- NFG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

National Fuel Gas (NFG) 8-KRegulation FD Disclosure

Filed: 6 Aug 20, 5:22pm

Investor Presentation Q3 Fiscal 2020 Update August 6, 2020 Exhibit 99

National Fuel is committed to the safe and environmentally conscious development, transportation, storage, and distribution of natural gas and oil resources. For additional information, please visit our corporate responsibility website at https://responsibility.natfuel.com

A message from David Bauer, President and CEO of National Fuel Gas Company, on NFG’s COVID-19 response “During these unprecedented times, the safety and well-being of our workforce, customers, and communities in which we operate is our top priority. We continue to support our employees through a number of initiatives, including providing a safe work environment, offering flexible work arrangements to meet the child care needs of our employees, and the avoidance of workforce reductions and furloughs. While National Fuel, like so many companies across the globe, has encountered new challenges in connection with the COVID-19 pandemic, I am proud to say that, to date, the Company has not experienced significant operational or financial impacts during this crisis – a testament to the diligence and commitment of our approximately 2,100 employees, who continue to meet and exceed the challenges of this ‘new normal’. Furthermore, with operations that span the entirety of the natural gas value chain, we see firsthand the critical role that our business, and the energy industry, plays in meeting the daily needs of our communities – producing, gathering, transporting, and ultimately delivering critical low-cost energy supplies to the homes that have become our offices, schools, and gyms, and the manufacturing facilities that produce our food, supplies, and personal protective equipment.”

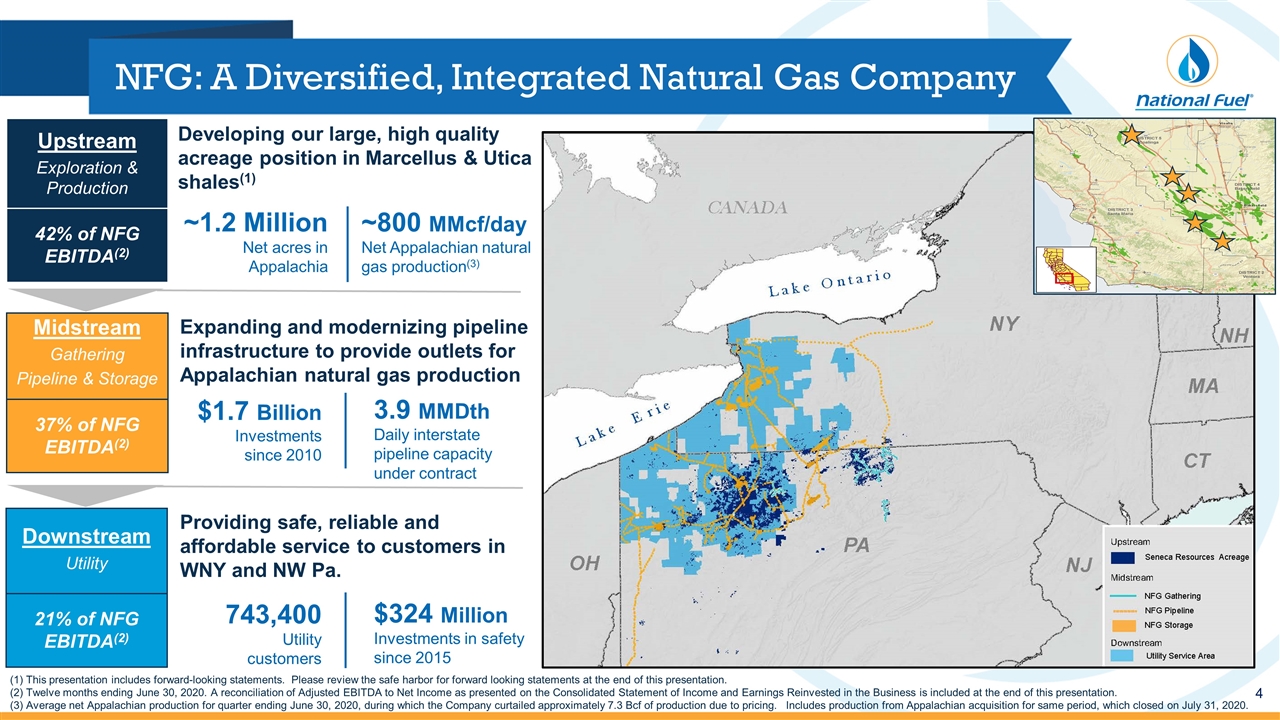

Developing our large, high quality acreage position in Marcellus & Utica shales(1) NFG: A Diversified, Integrated Natural Gas Company Providing safe, reliable and affordable service to customers in WNY and NW Pa. Upstream Exploration & Production Midstream Gathering Pipeline & Storage 38% of NFG EBITDA(1) Downstream Utility % of NFG 20EBITDA(1) Expanding and modernizing pipeline infrastructure to provide outlets for Appalachian natural gas production ~1.2 Million Net acres in Appalachia ~800 MMcf/day Net Appalachian natural gas production(3) $1.7 Billion Investments since 2010 3.9 MMDth Daily interstate pipeline capacity under contract 743,400 Utility customers $324 Million Investments in safety since 2015 (1) This presentation includes forward-looking statements. Please review the safe harbor for forward looking statements at the end of this presentation. (2) Twelve months ending June 30, 2020. A reconciliation of Adjusted EBITDA to Net Income as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end of this presentation. (3) Average net Appalachian production for quarter ending June 30, 2020, during which the Company curtailed approximately 7.3 Bcf of production due to pricing. Includes production from Appalachian acquisition for same period, which closed on July 31, 2020. 42% of NFG EBITDA(2) 37% of NFG EBITDA(2) 21% of NFG EBITDA(2)

Why National Fuel? Diversified Assets Provide Stability and Long-Term Growth Opportunities

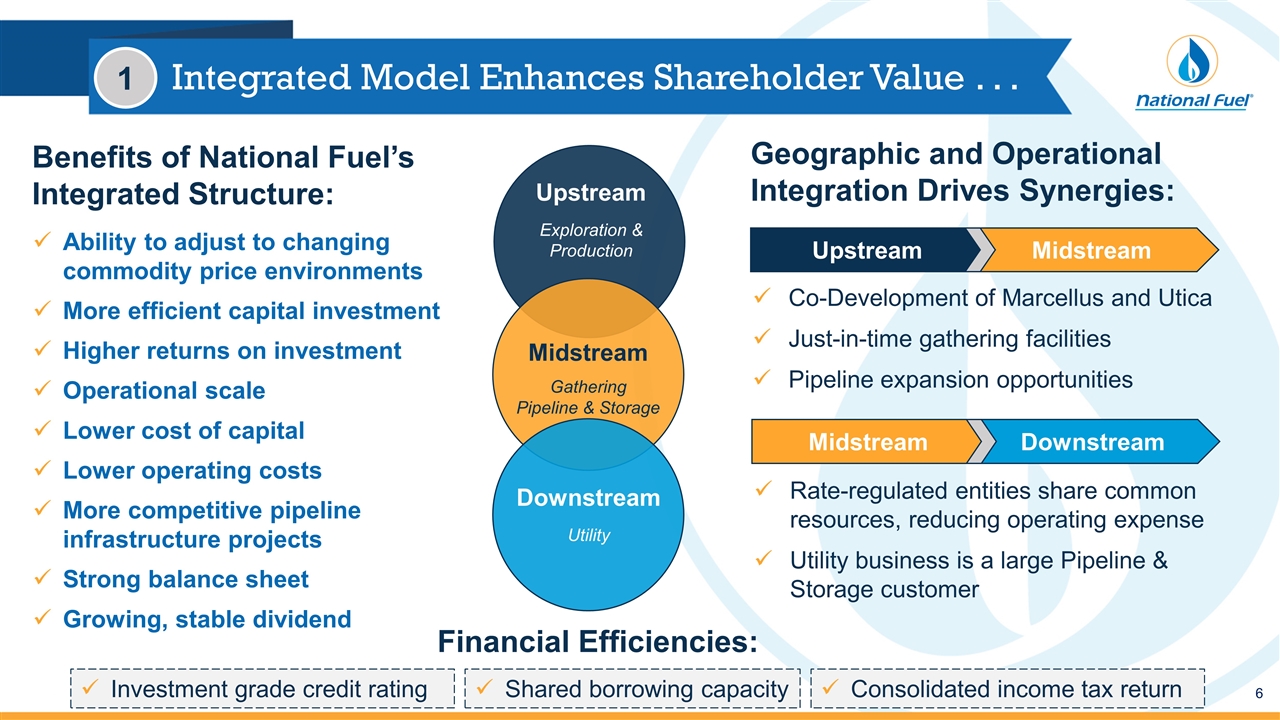

Midstream Integrated Model Enhances Shareholder Value . . . Ability to adjust to changing commodity price environments More efficient capital investment Higher returns on investment Operational scale Lower cost of capital Lower operating costs More competitive pipeline infrastructure projects Strong balance sheet Growing, stable dividend Geographic and Operational Integration Drives Synergies: Benefits of National Fuel’s Integrated Structure: Financial Efficiencies: Investment grade credit rating Shared borrowing capacity Consolidated income tax return Downstream Utility Midstream Gathering Pipeline & Storage Upstream Exploration & Production Co-Development of Marcellus and Utica Just-in-time gathering facilities Pipeline expansion opportunities Upstream Rate-regulated entities share common resources, reducing operating expense Utility business is a large Pipeline & Storage customer Downstream Midstream 1

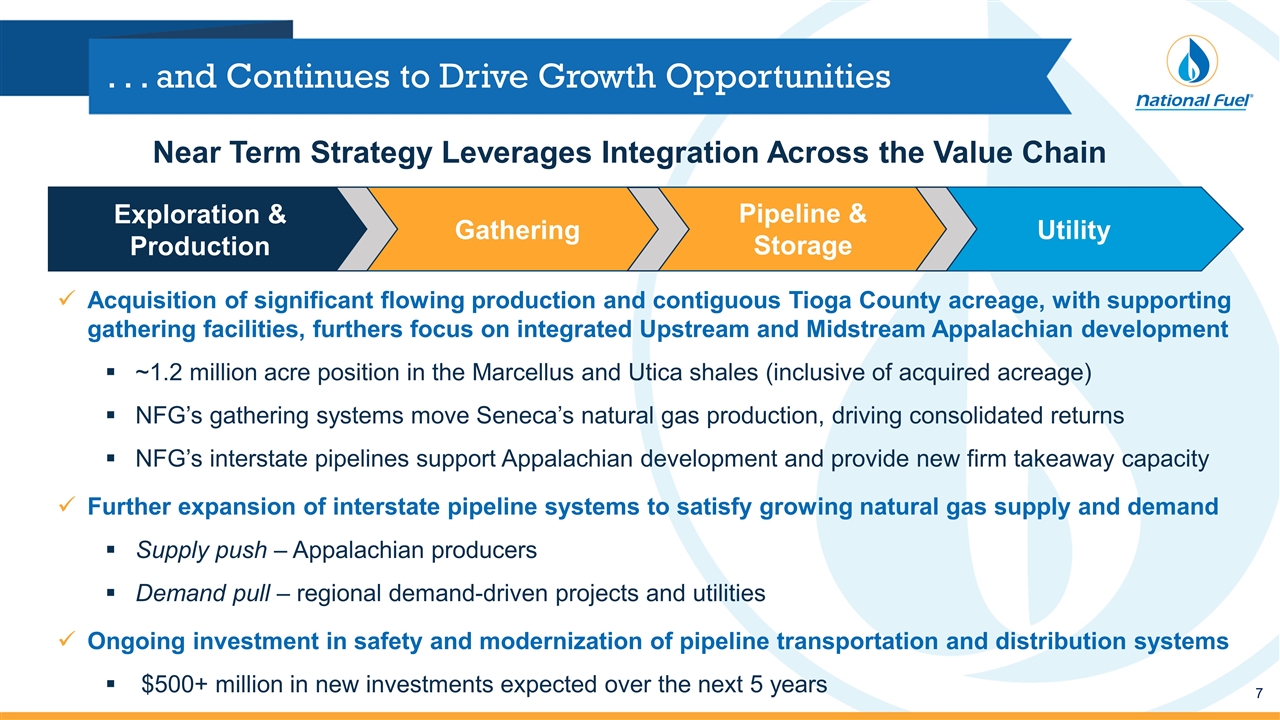

Acquisition of significant flowing production and contiguous Tioga County acreage, with supporting gathering facilities, furthers focus on integrated Upstream and Midstream Appalachian development ~1.2 million acre position in the Marcellus and Utica shales (inclusive of acquired acreage) NFG’s gathering systems move Seneca’s natural gas production, driving consolidated returns NFG’s interstate pipelines support Appalachian development and provide new firm takeaway capacity Further expansion of interstate pipeline systems to satisfy growing natural gas supply and demand Supply push – Appalachian producers Demand pull – regional demand-driven projects and utilities Ongoing investment in safety and modernization of pipeline transportation and distribution systems $500+ million in new investments expected over the next 5 years . . . and Continues to Drive Growth Opportunities Near Term Strategy Leverages Integration Across the Value Chain Utility Gathering Pipeline & Storage Exploration & Production

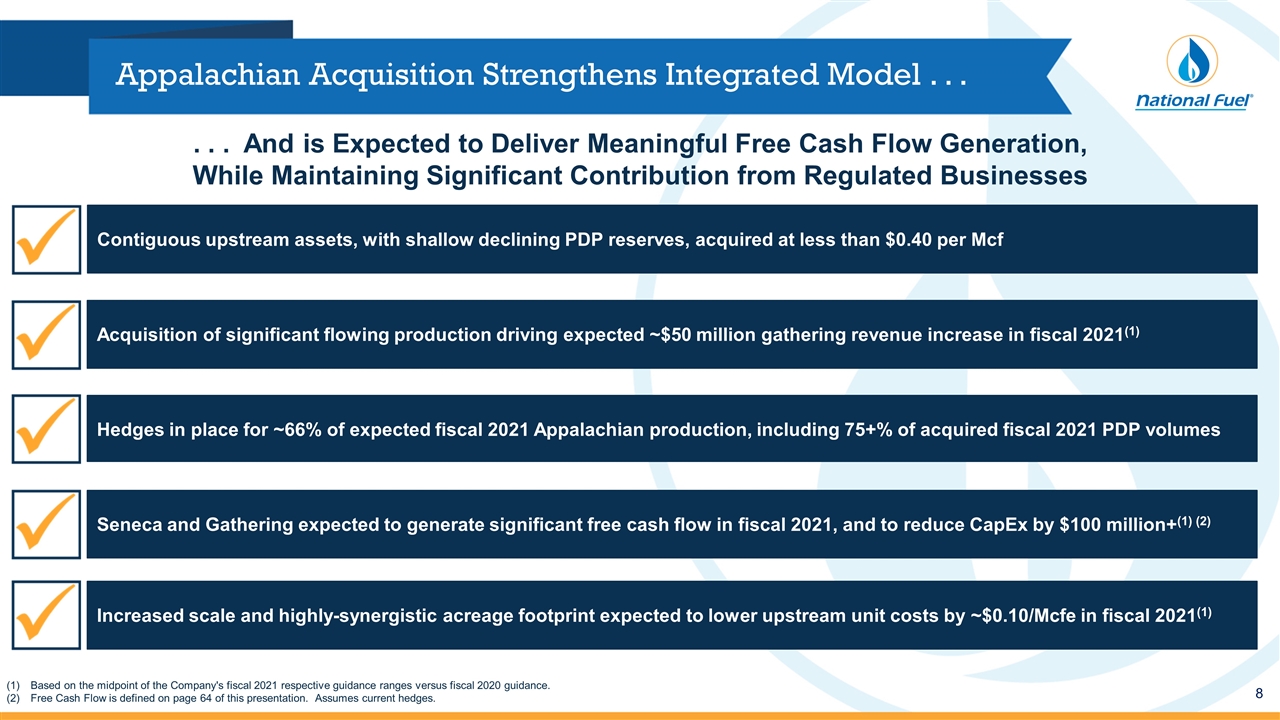

Appalachian Acquisition Strengthens Integrated Model . . . . . . And is Expected to Deliver Meaningful Free Cash Flow Generation, While Maintaining Significant Contribution from Regulated Businesses Contiguous upstream assets, with shallow declining PDP reserves, acquired at less than $0.40 per Mcf Seneca and Gathering expected to generate significant free cash flow in fiscal 2021, and to reduce CapEx by $100 million+(1) (2) Increased scale and highly-synergistic acreage footprint expected to lower upstream unit costs by ~$0.10/Mcfe in fiscal 2021(1) Hedges in place for ~66% of expected fiscal 2021 Appalachian production, including 75+% of acquired fiscal 2021 PDP volumes Based on the midpoint of the Company's fiscal 2021 respective guidance ranges versus fiscal 2020 guidance. Free Cash Flow is defined on page 64 of this presentation. Assumes current hedges. Acquisition of significant flowing production driving expected ~$50 million gathering revenue increase in fiscal 2021(1)

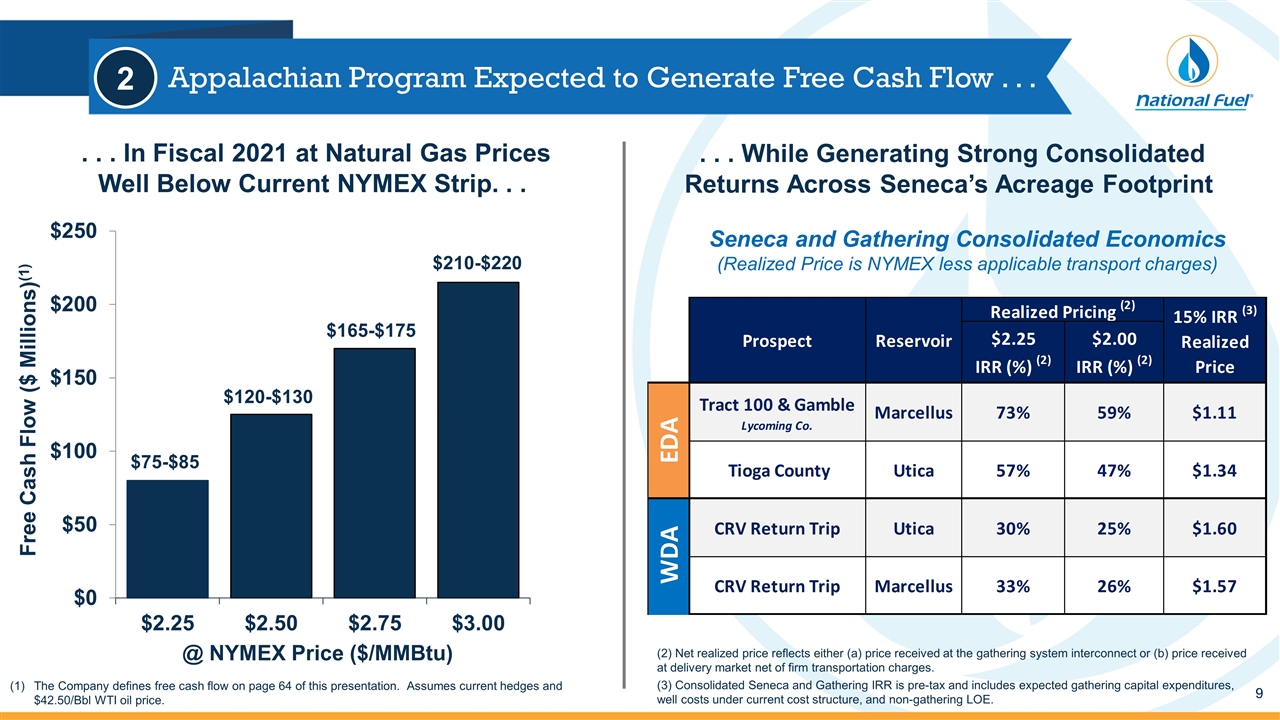

Appalachian Program Expected to Generate Free Cash Flow . . . The Company defines free cash flow on page 64 of this presentation. Assumes current hedges and $42.50/Bbl WTI oil price. 2 . . . In Fiscal 2021 at Natural Gas Prices Well Below Current NYMEX Strip. . . . . . While Generating Strong Consolidated Returns Across Seneca’s Acreage Footprint (2) Net realized price reflects either (a) price received at the gathering system interconnect or (b) price received at delivery market net of firm transportation charges. (3) Consolidated Seneca and Gathering IRR is pre-tax and includes expected gathering capital expenditures, well costs under current cost structure, and non-gathering LOE. @ NYMEX Price ($/MMBtu) $210-$220 Seneca and Gathering Consolidated Economics (Realized Price is NYMEX less applicable transport charges)

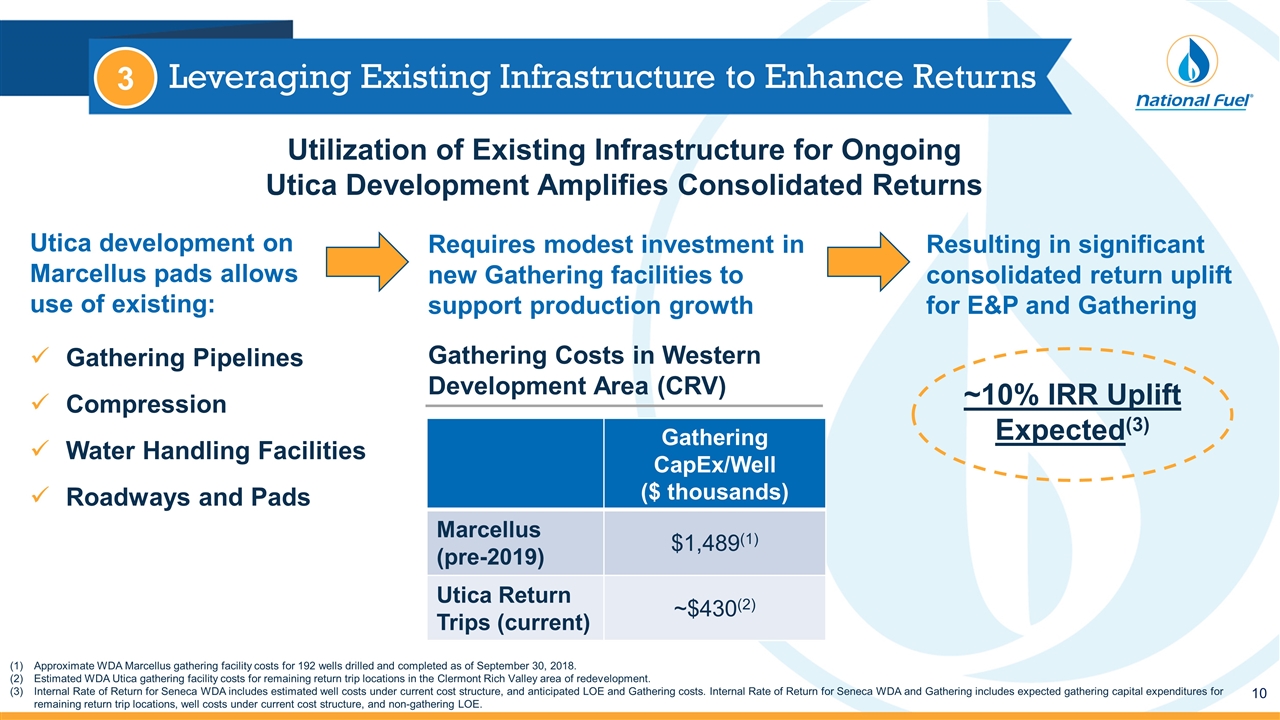

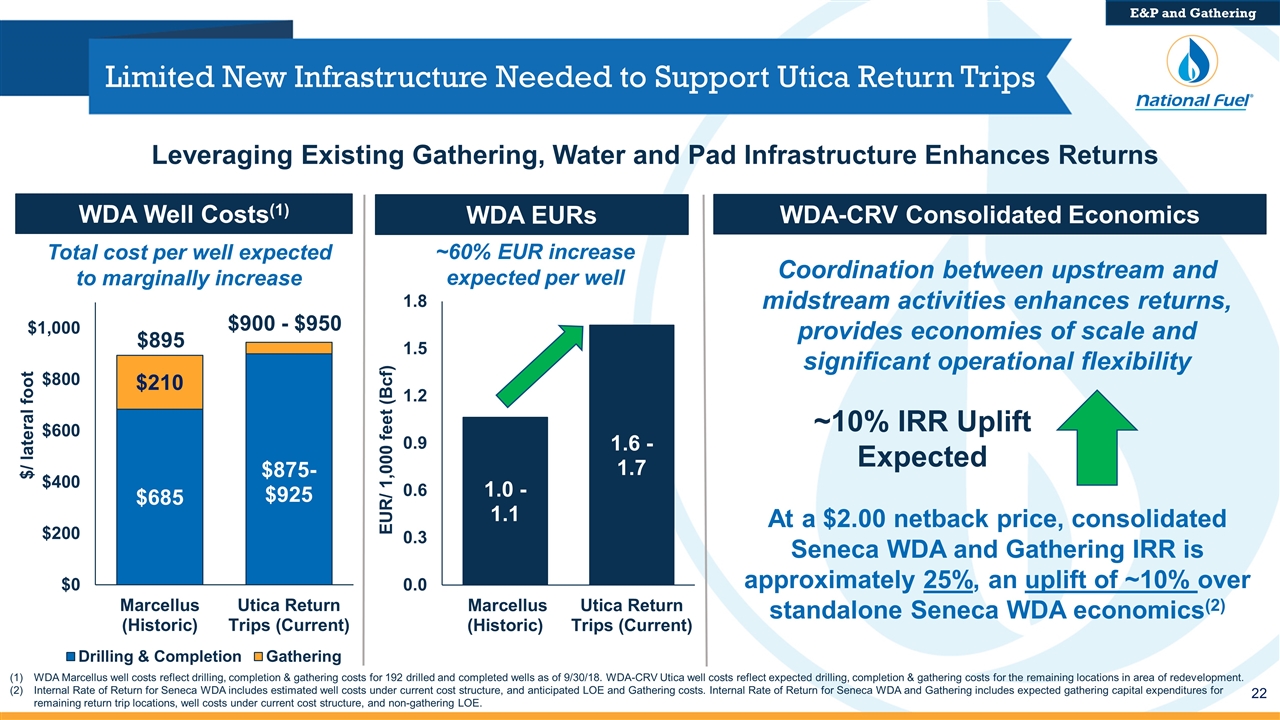

Utilization of Existing Infrastructure for Ongoing Utica Development Amplifies Consolidated Returns L Leveraging Existing Infrastructure to Enhance Returns Approximate WDA Marcellus gathering facility costs for 192 wells drilled and completed as of September 30, 2018. Estimated WDA Utica gathering facility costs for remaining return trip locations in the Clermont Rich Valley area of redevelopment. Internal Rate of Return for Seneca WDA includes estimated well costs under current cost structure, and anticipated LOE and Gathering costs. Internal Rate of Return for Seneca WDA and Gathering includes expected gathering capital expenditures for remaining return trip locations, well costs under current cost structure, and non-gathering LOE. Gathering CapEx/Well ($ thousands) Marcellus (pre-2019) $1,489(1) Utica Return Trips (current) ~$430(2) Gathering Pipelines Compression Water Handling Facilities Roadways and Pads Gathering Costs in Western Development Area (CRV) ~10% IRR Uplift Expected(3) Requires modest investment in new Gathering facilities to support production growth Utica development on Marcellus pads allows use of existing: Resulting in significant consolidated return uplift for E&P and Gathering 3

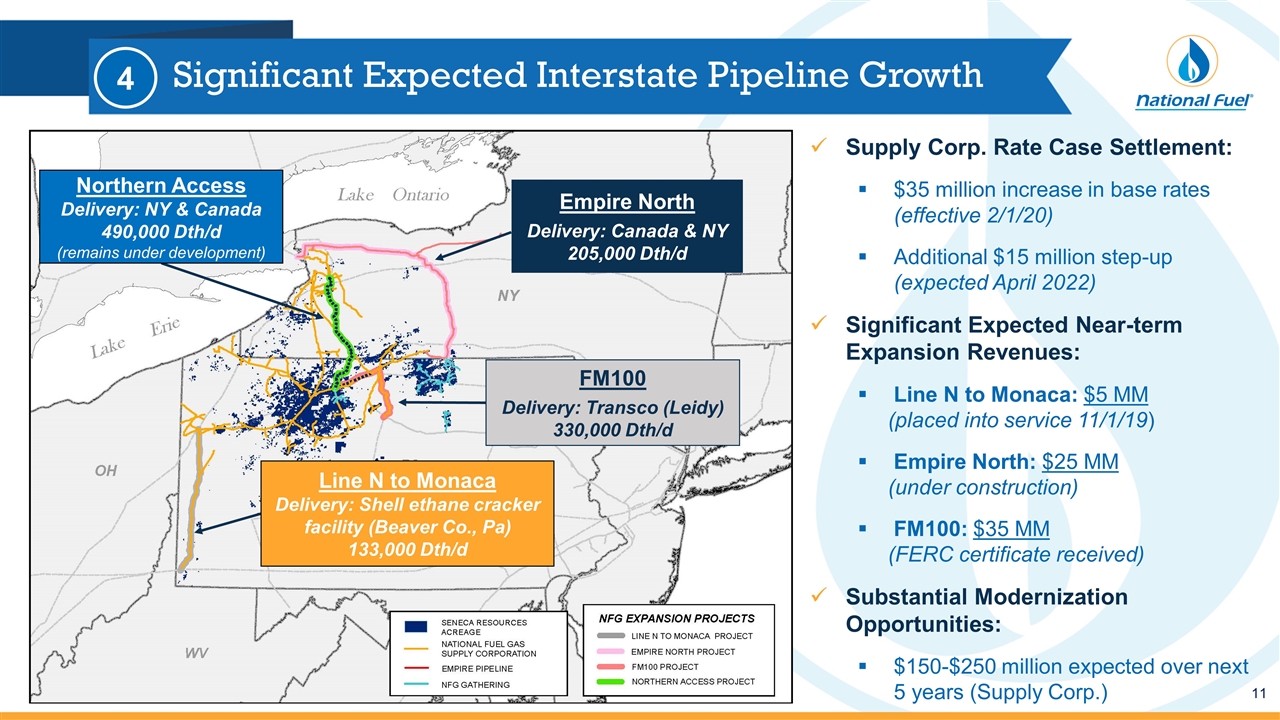

Significant Expected Interstate Pipeline Growth Northern Access Delivery: NY & Canada 490,000 Dth/d (remains under development) Line N to Monaca Delivery: Shell ethane cracker facility (Beaver Co., Pa) 133,000 Dth/d FM100 Delivery: Transco (Leidy) 330,000 Dth/d Empire North Delivery: Canada & NY 205,000 Dth/d Supply Corp. Rate Case Settlement: $35 million increase in base rates (effective 2/1/20) Additional $15 million step-up (expected April 2022) Significant Expected Near-term Expansion Revenues: Line N to Monaca: $5 MM (placed into service 11/1/19) Empire North: $25 MM (under construction) FM100: $35 MM (FERC certificate received) Substantial Modernization Opportunities: $150-$250 million expected over next 5 years (Supply Corp.) 4

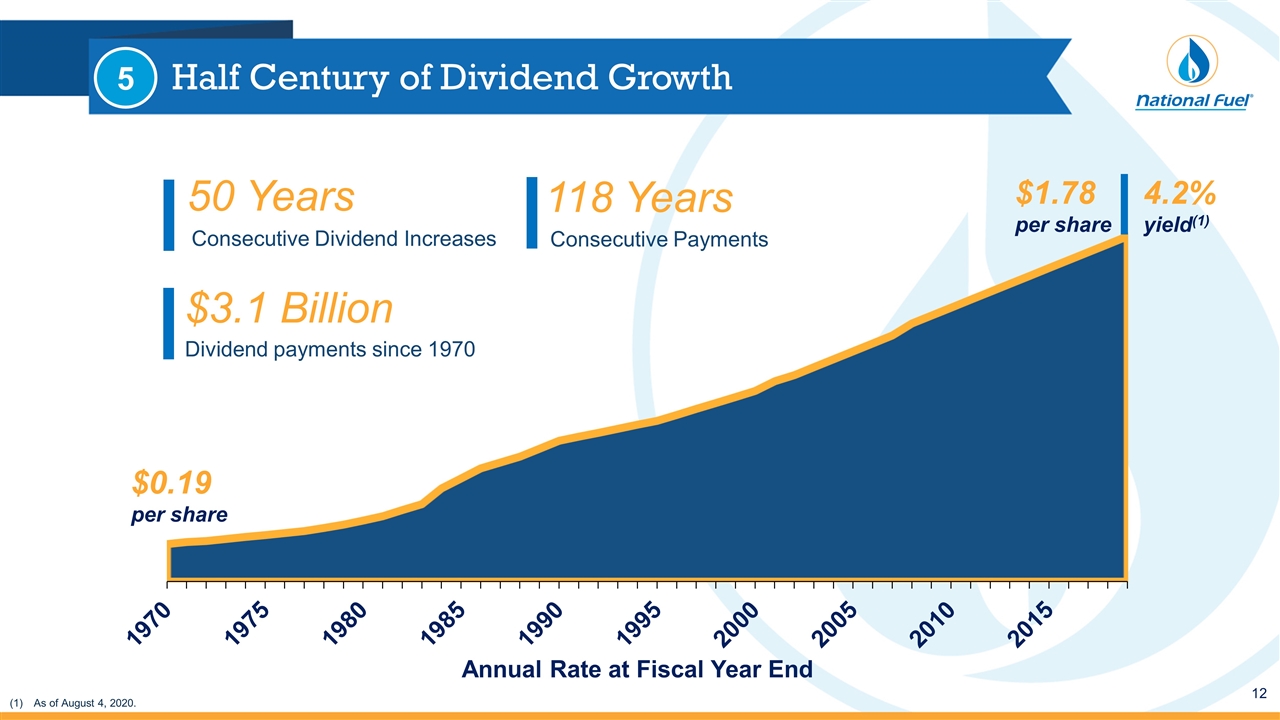

Half Century of Dividend Growth $3.1 Billion Dividend payments since 1970 $1.78 per share 50 Years Consecutive Dividend Increases $0.19 per share 118 Years Consecutive Payments 4.2% yield(1) As of August 4, 2020. 5

Financial Highlights Third Quarter Fiscal 2020

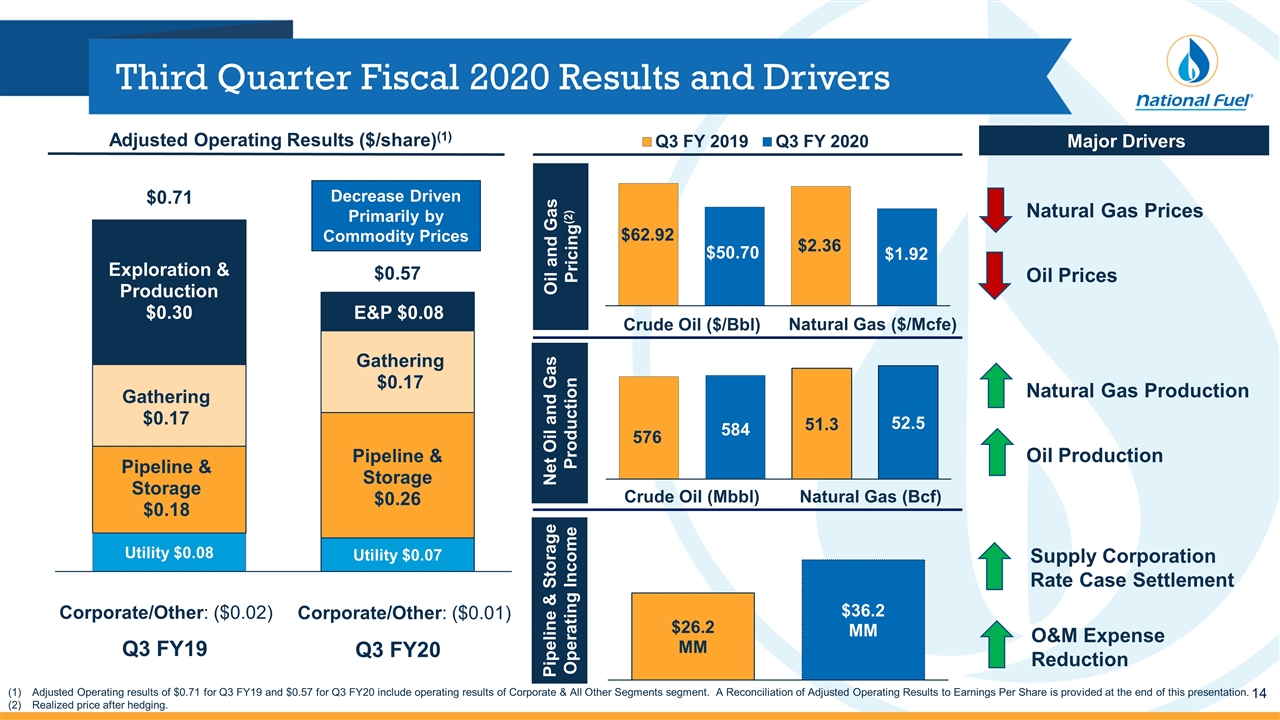

Net Oil and Gas Production Third Quarter Fiscal 2020 Results and Drivers Adjusted Operating results of $0.71 for Q3 FY19 and $0.57 for Q3 FY20 include operating results of Corporate & All Other Segments segment. A Reconciliation of Adjusted Operating Results to Earnings Per Share is provided at the end of this presentation. Realized price after hedging. Oil and Gas Pricing(2) Natural Gas ($/Mcfe) Crude Oil ($/Bbl) Oil Prices Natural Gas Prices Pipeline & Storage Operating Income Supply Corporation Rate Case Settlement Major Drivers Natural Gas Production Oil Production Crude Oil (Mbbl) Natural Gas (Bcf) Adjusted Operating Results ($/share)(1) O&M Expense Reduction

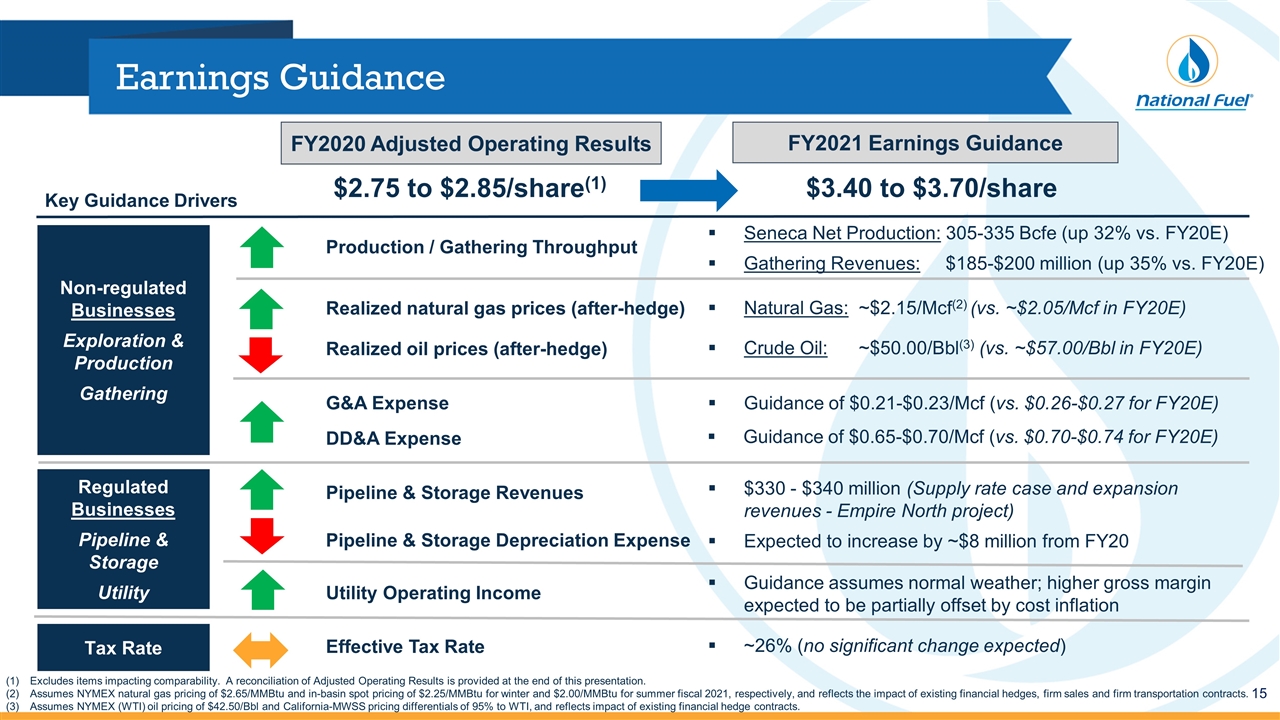

Earnings Guidance FY2020 Adjusted Operating Results Non-regulated Businesses Exploration & Production Gathering $2.75 to $2.85/share(1) $3.40 to $3.70/share FY2021 Earnings Guidance Seneca Net Production: 305-335 Bcfe (up 32% vs. FY20E) Gathering Revenues: $185-$200 million (up 35% vs. FY20E) Natural Gas: ~$2.15/Mcf(2) (vs. ~$2.05/Mcf in FY20E) Crude Oil: ~$50.00/Bbl(3) (vs. ~$57.00/Bbl in FY20E) Key Guidance Drivers Excludes items impacting comparability. A reconciliation of Adjusted Operating Results is provided at the end of this presentation. Assumes NYMEX natural gas pricing of $2.65/MMBtu and in-basin spot pricing of $2.25/MMBtu for winter and $2.00/MMBtu for summer fiscal 2021, respectively, and reflects the impact of existing financial hedges, firm sales and firm transportation contracts. Assumes NYMEX (WTI) oil pricing of $42.50/Bbl and California-MWSS pricing differentials of 95% to WTI, and reflects impact of existing financial hedge contracts. Production / Gathering Throughput Realized natural gas prices (after-hedge) Utility Operating Income Regulated Businesses Pipeline & Storage Utility Guidance assumes normal weather; higher gross margin expected to be partially offset by cost inflation $330 - $340 million (Supply rate case and expansion revenues - Empire North project) Pipeline & Storage Revenues Tax Rate Realized oil prices (after-hedge) Effective Tax Rate ~26% (no significant change expected) Pipeline & Storage Depreciation Expense Expected to increase by ~$8 million from FY20 G&A Expense Guidance of $0.21-$0.23/Mcf (vs. $0.26-$0.27 for FY20E) DD&A Expense Guidance of $0.65-$0.70/Mcf (vs. $0.70-$0.74 for FY20E)

Exploration & Production and Gathering Overview Seneca Resources Company, LLC ~ National Fuel Gas Midstream Company, LLC

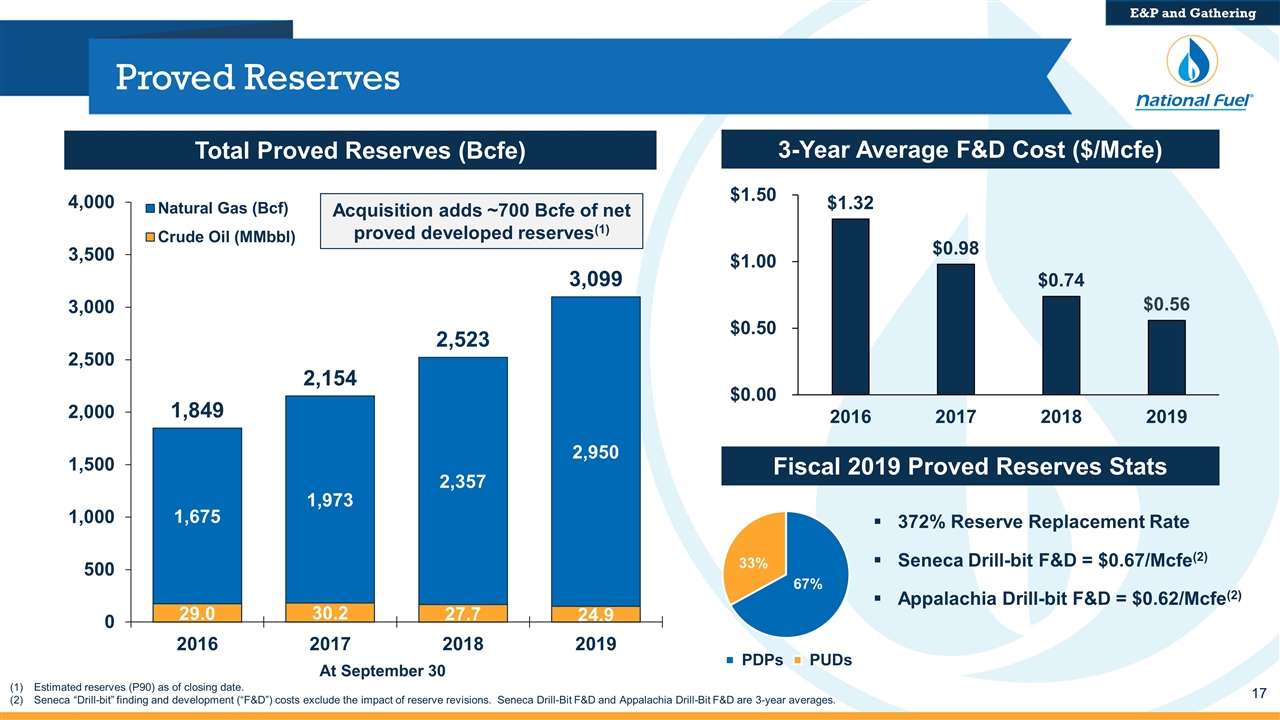

Proved Reserves 372% Reserve Replacement Rate Seneca Drill-bit F&D = $0.67/Mcfe(2) Appalachia Drill-bit F&D = $0.62/Mcfe(2) Estimated reserves (P90) as of closing date. Seneca “Drill-bit” finding and development (“F&D”) costs exclude the impact of reserve revisions. Seneca Drill-Bit F&D and Appalachia Drill-Bit F&D are 3-year averages. Total Proved Reserves (Bcfe) Fiscal 2019 Proved Reserves Stats 3-Year Average F&D Cost ($/Mcfe) E&P and Gathering Acquisition adds ~700 Bcfe of net proved developed reserves(1)

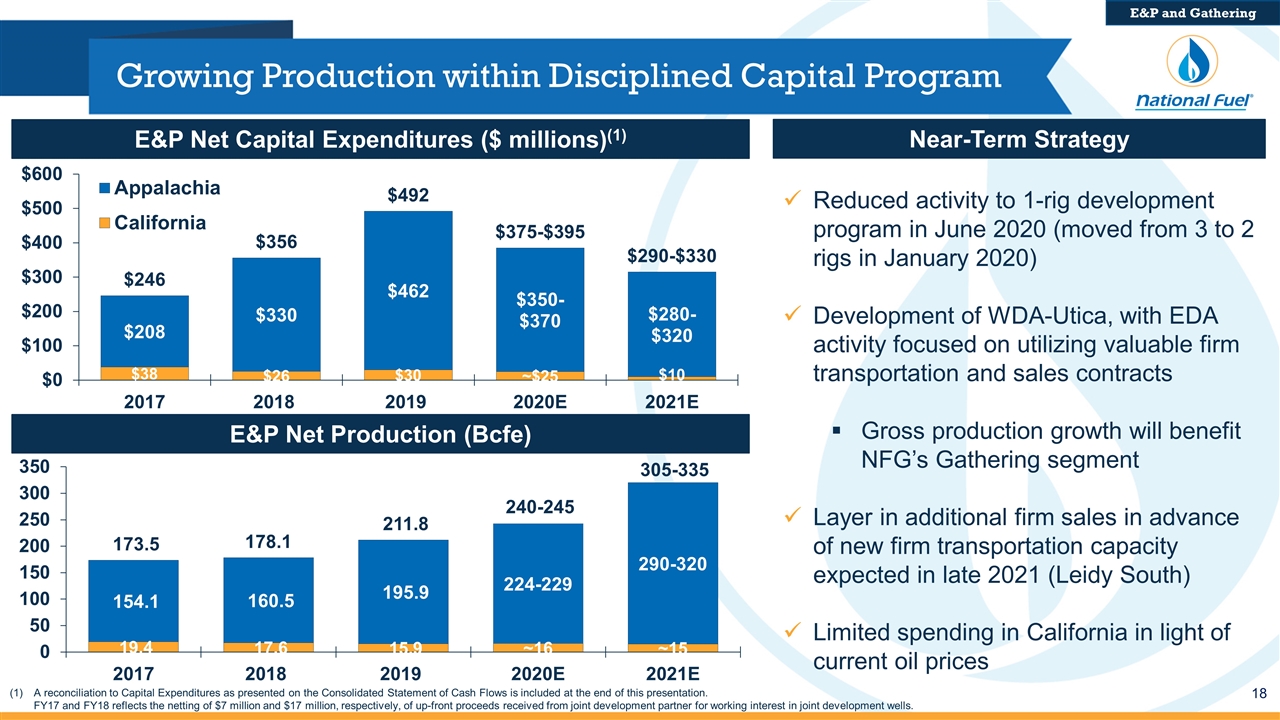

Reduced activity to 1-rig development program in June 2020 (moved from 3 to 2 rigs in January 2020) Development of WDA-Utica, with EDA activity focused on utilizing valuable firm transportation and sales contracts Gross production growth will benefit NFG’s Gathering segment Layer in additional firm sales in advance of new firm transportation capacity expected in late 2021 (Leidy South) Limited spending in California in light of current oil prices Growing Production within Disciplined Capital Program Near-Term Strategy E&P Net Capital Expenditures ($ millions)(1) E&P Net Production (Bcfe) E&P and Gathering A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY17 and FY18 reflects the netting of $7 million and $17 million, respectively, of up-front proceeds received from joint development partner for working interest in joint development wells.

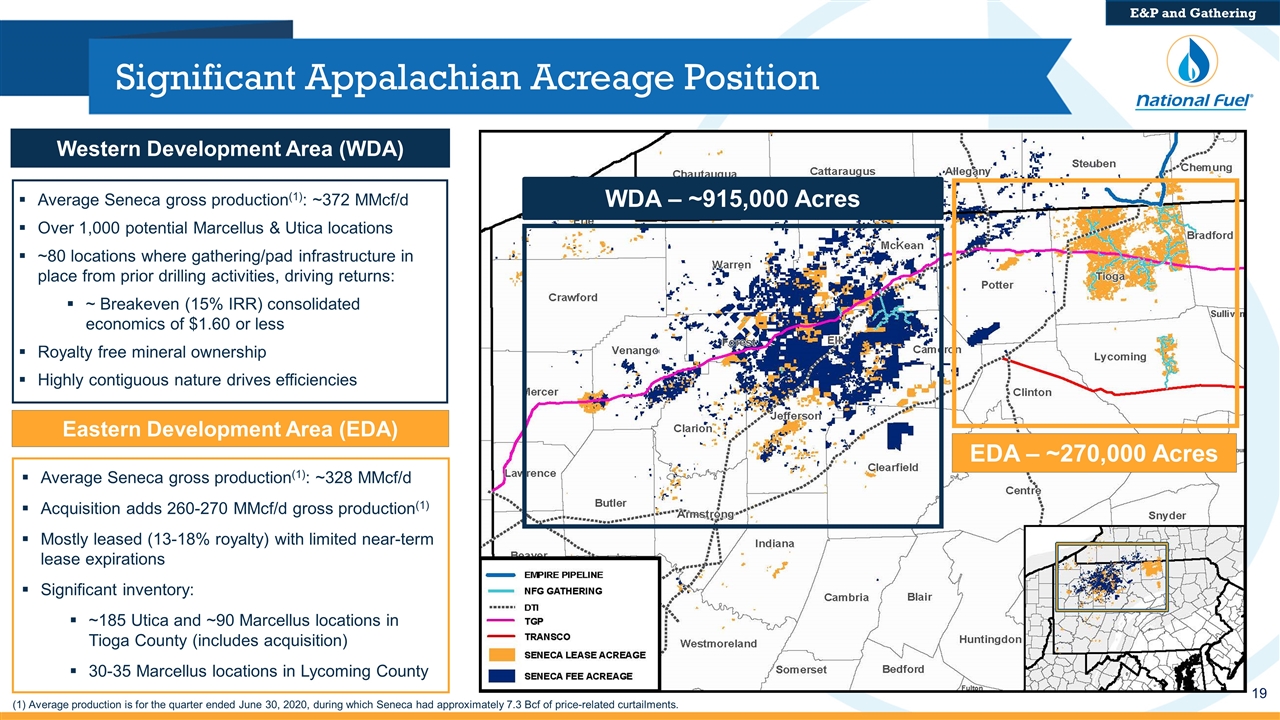

Significant Appalachian Acreage Position Average Seneca gross production(1): ~328 MMcf/d Acquisition adds 260-270 MMcf/d gross production(1) Mostly leased (13-18% royalty) with limited near-term lease expirations Significant inventory: ~185 Utica and ~90 Marcellus locations in Tioga County (includes acquisition) 30-35 Marcellus locations in Lycoming County Eastern Development Area (EDA) Western Development Area (WDA) Average Seneca gross production(1): ~372 MMcf/d Over 1,000 potential Marcellus & Utica locations ~80 locations where gathering/pad infrastructure in place from prior drilling activities, driving returns: ~ Breakeven (15% IRR) consolidated economics of $1.60 or less Royalty free mineral ownership Highly contiguous nature drives efficiencies E&P and Gathering (1) Average production is for the quarter ended June 30, 2020, during which Seneca had approximately 7.3 Bcf of price-related curtailments. WDA – ~915,000 Acres EDA – ~270,000 Acres

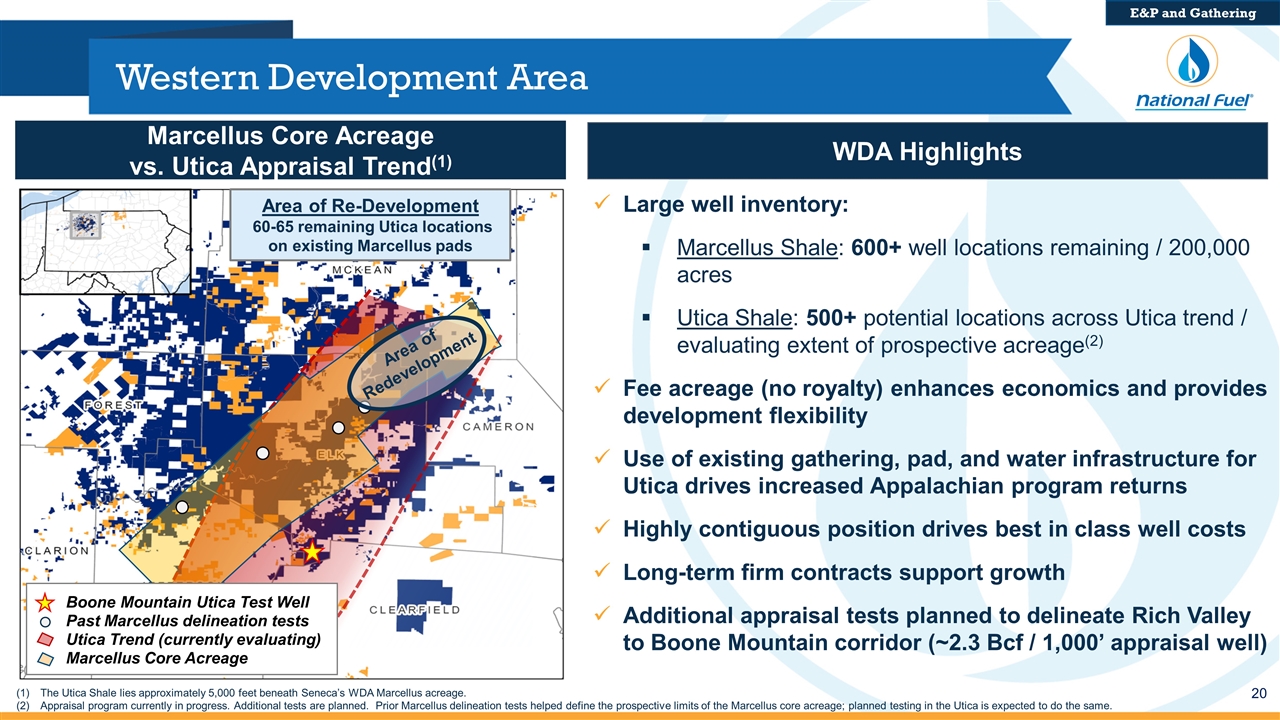

Western Development Area Marcellus Core Acreage vs. Utica Appraisal Trend(1) The Utica Shale lies approximately 5,000 feet beneath Seneca’s WDA Marcellus acreage. Appraisal program currently in progress. Additional tests are planned. Prior Marcellus delineation tests helped define the prospective limits of the Marcellus core acreage; planned testing in the Utica is expected to do the same. Large well inventory: Marcellus Shale: 600+ well locations remaining / 200,000 acres Utica Shale: 500+ potential locations across Utica trend / evaluating extent of prospective acreage(2) Fee acreage (no royalty) enhances economics and provides development flexibility Use of existing gathering, pad, and water infrastructure for Utica drives increased Appalachian program returns Highly contiguous position drives best in class well costs Long-term firm contracts support growth Additional appraisal tests planned to delineate Rich Valley to Boone Mountain corridor (~2.3 Bcf / 1,000’ appraisal well) E&P and Gathering WDA Highlights Area of Re-Development 60-65 remaining Utica locations on existing Marcellus pads ? Boone Mountain Utica Test Well Past Marcellus delineation tests Utica Trend (currently evaluating) Marcellus Core Acreage Area of Redevelopment

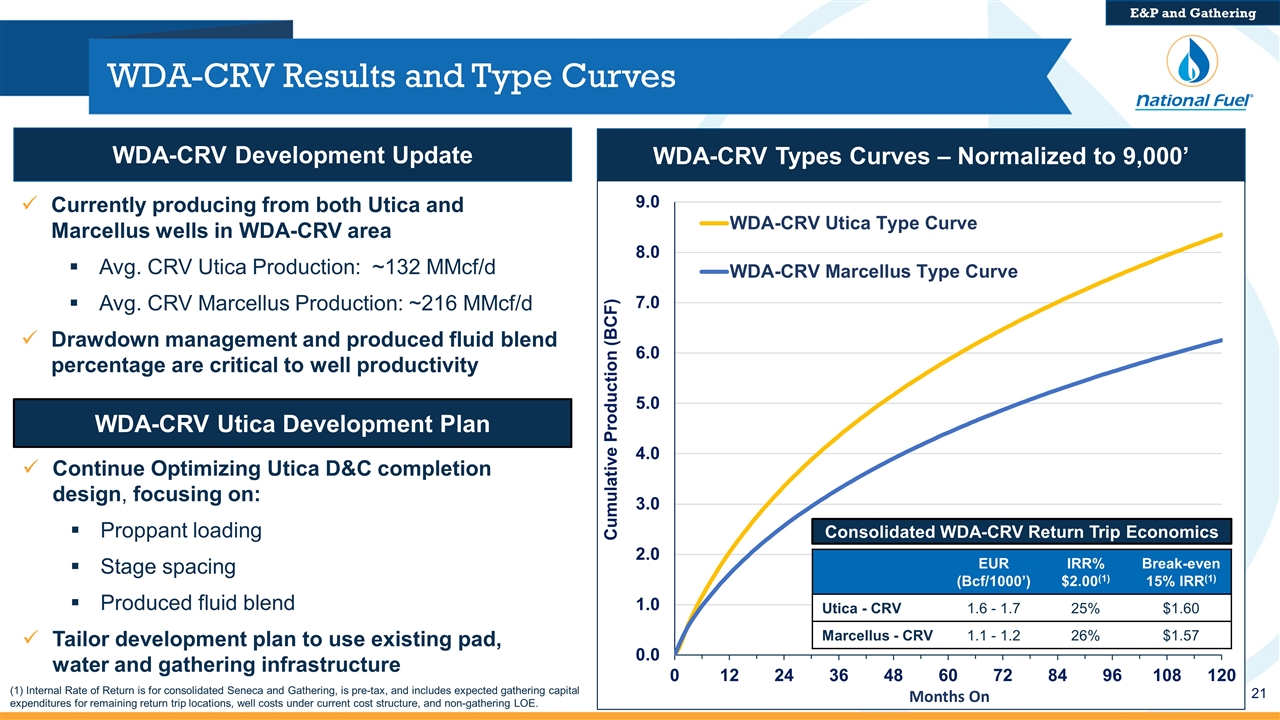

WDA-CRV Results and Type Curves Currently producing from both Utica and Marcellus wells in WDA-CRV area Avg. CRV Utica Production: ~132 MMcf/d Avg. CRV Marcellus Production: ~216 MMcf/d Drawdown management and produced fluid blend percentage are critical to well productivity WDA-CRV Development Update E&P and Gathering WDA-CRV Types Curves – Normalized to 9,000’ WDA-CRV Utica Development Plan Continue Optimizing Utica D&C completion design, focusing on: Proppant loading Stage spacing Produced fluid blend Tailor development plan to use existing pad, water and gathering infrastructure EUR (Bcf/1000’) IRR% $2.00(1) Break-even 15% IRR(1) Utica - CRV 1.6 - 1.7 25% $1.60 Marcellus - CRV 1.1 - 1.2 26% $1.57 (1) Internal Rate of Return is for consolidated Seneca and Gathering, is pre-tax, and includes expected gathering capital expenditures for remaining return trip locations, well costs under current cost structure, and non-gathering LOE. Consolidated WDA-CRV Return Trip Economics

Leveraging Existing Gathering, Water and Pad Infrastructure Enhances Returns Limited New Infrastructure Needed to Support Utica Return Trips WDA Well Costs(1) WDA-CRV Consolidated Economics Coordination between upstream and midstream activities enhances returns, provides economies of scale and significant operational flexibility WDA Marcellus well costs reflect drilling, completion & gathering costs for 192 drilled and completed wells as of 9/30/18. WDA-CRV Utica well costs reflect expected drilling, completion & gathering costs for the remaining locations in area of redevelopment. Internal Rate of Return for Seneca WDA includes estimated well costs under current cost structure, and anticipated LOE and Gathering costs. Internal Rate of Return for Seneca WDA and Gathering includes expected gathering capital expenditures for remaining return trip locations, well costs under current cost structure, and non-gathering LOE. Total cost per well expected to marginally increase WDA EURs At a $2.00 netback price, consolidated Seneca WDA and Gathering IRR is approximately 25%, an uplift of ~10% over standalone Seneca WDA economics(2) ~10% IRR Uplift Expected E&P and Gathering

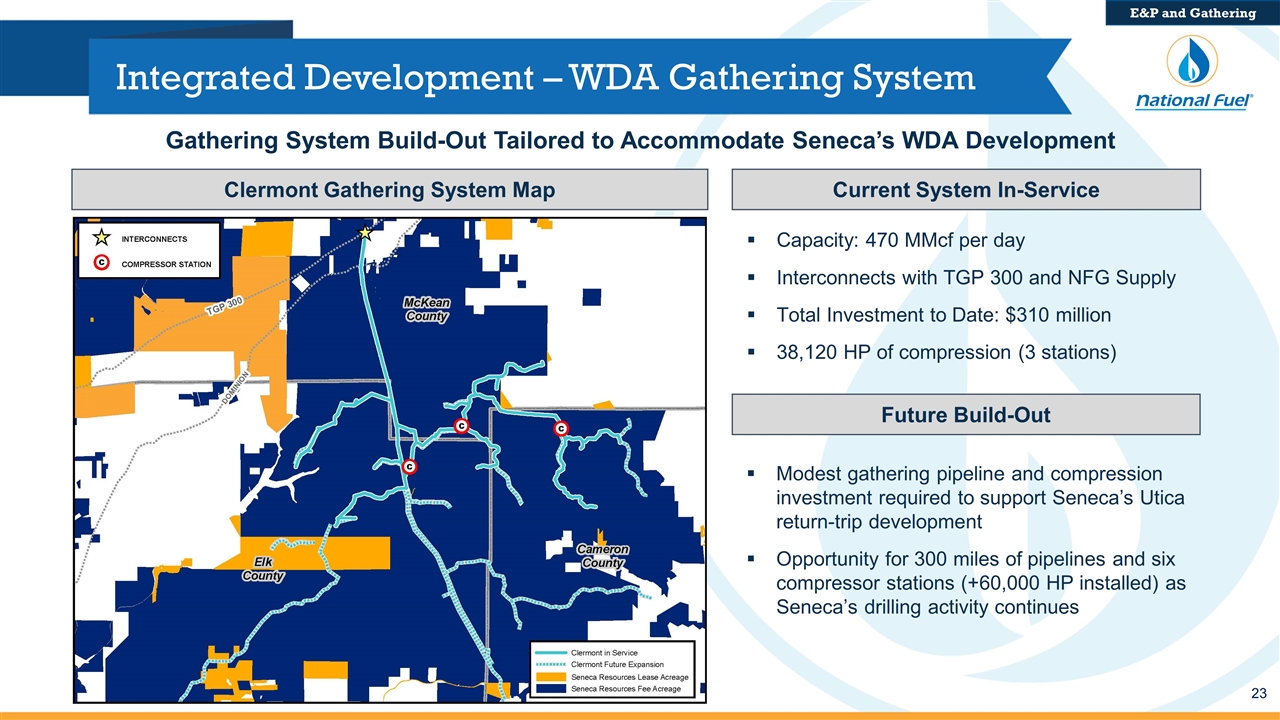

Integrated Development – WDA Gathering System Current System In-Service Capacity: 470 MMcf per day Interconnects with TGP 300 and NFG Supply Total Investment to Date: $310 million 38,120 HP of compression (3 stations) Future Build-Out Modest gathering pipeline and compression investment required to support Seneca’s Utica return-trip development Opportunity for 300 miles of pipelines and six compressor stations (+60,000 HP installed) as Seneca’s drilling activity continues Gathering System Build-Out Tailored to Accommodate Seneca’s WDA Development Clermont Gathering System Map E&P and Gathering

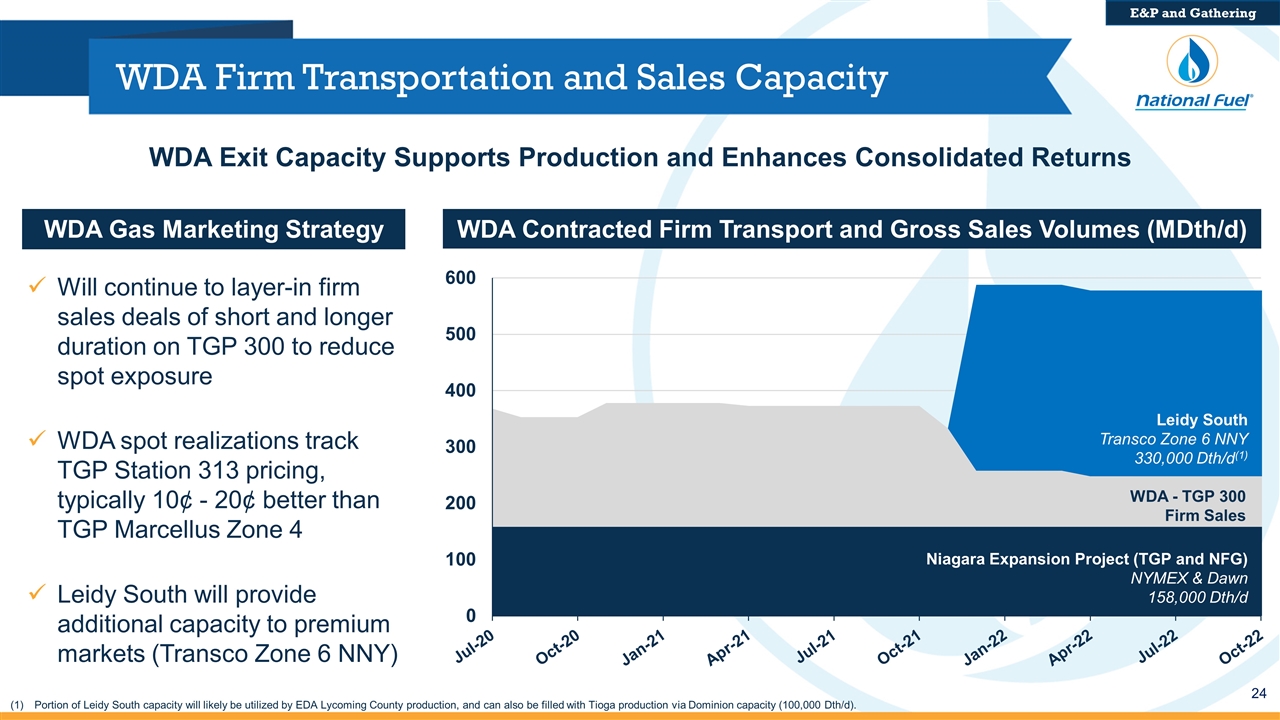

WDA Firm Transportation and Sales Capacity Will continue to layer-in firm sales deals of short and longer duration on TGP 300 to reduce spot exposure WDA spot realizations track TGP Station 313 pricing, typically 10¢ - 20¢ better than TGP Marcellus Zone 4 Leidy South will provide additional capacity to premium markets (Transco Zone 6 NNY) WDA Exit Capacity Supports Production and Enhances Consolidated Returns WDA Contracted Firm Transport and Gross Sales Volumes (MDth/d) E&P and Gathering Niagara Expansion Project (TGP and NFG) NYMEX & Dawn 158,000 Dth/d WDA - TGP 300 Firm Sales Leidy South Transco Zone 6 NNY 330,000 Dth/d(1) Portion of Leidy South capacity will likely be utilized by EDA Lycoming County production, and can also be filled with Tioga production via Dominion capacity (100,000 Dth/d). WDA Gas Marketing Strategy

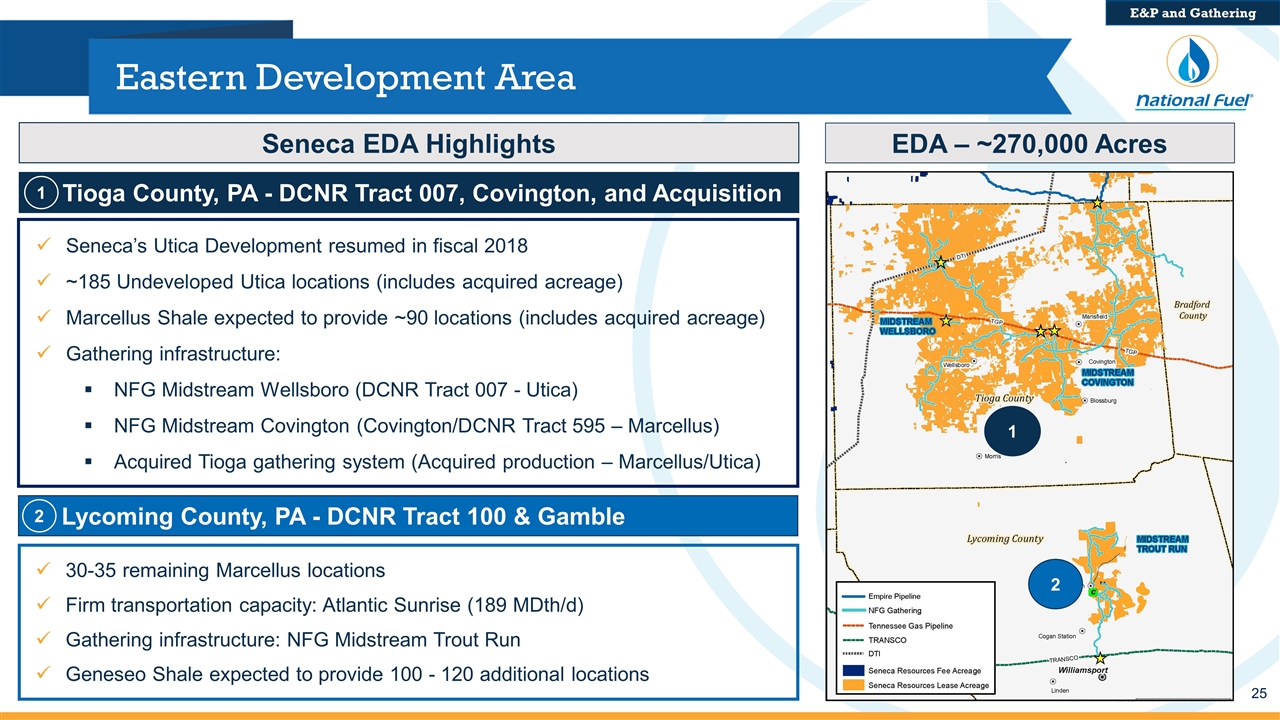

Eastern Development Area EDA – ~270,000 Acres Seneca EDA Highlights Seneca’s Utica Development resumed in fiscal 2018 ~185 Undeveloped Utica locations (includes acquired acreage) Marcellus Shale expected to provide ~90 locations (includes acquired acreage) Gathering infrastructure: NFG Midstream Wellsboro (DCNR Tract 007 - Utica) NFG Midstream Covington (Covington/DCNR Tract 595 – Marcellus) Acquired Tioga gathering system (Acquired production – Marcellus/Utica) E&P and Gathering 30-35 remaining Marcellus locations Firm transportation capacity: Atlantic Sunrise (189 MDth/d) Gathering infrastructure: NFG Midstream Trout Run Geneseo Shale expected to provide 100 - 120 additional locations 2 1 Tioga County, PA - DCNR Tract 007, Covington, and Acquisition Lycoming County, PA - DCNR Tract 100 & Gamble 1 2

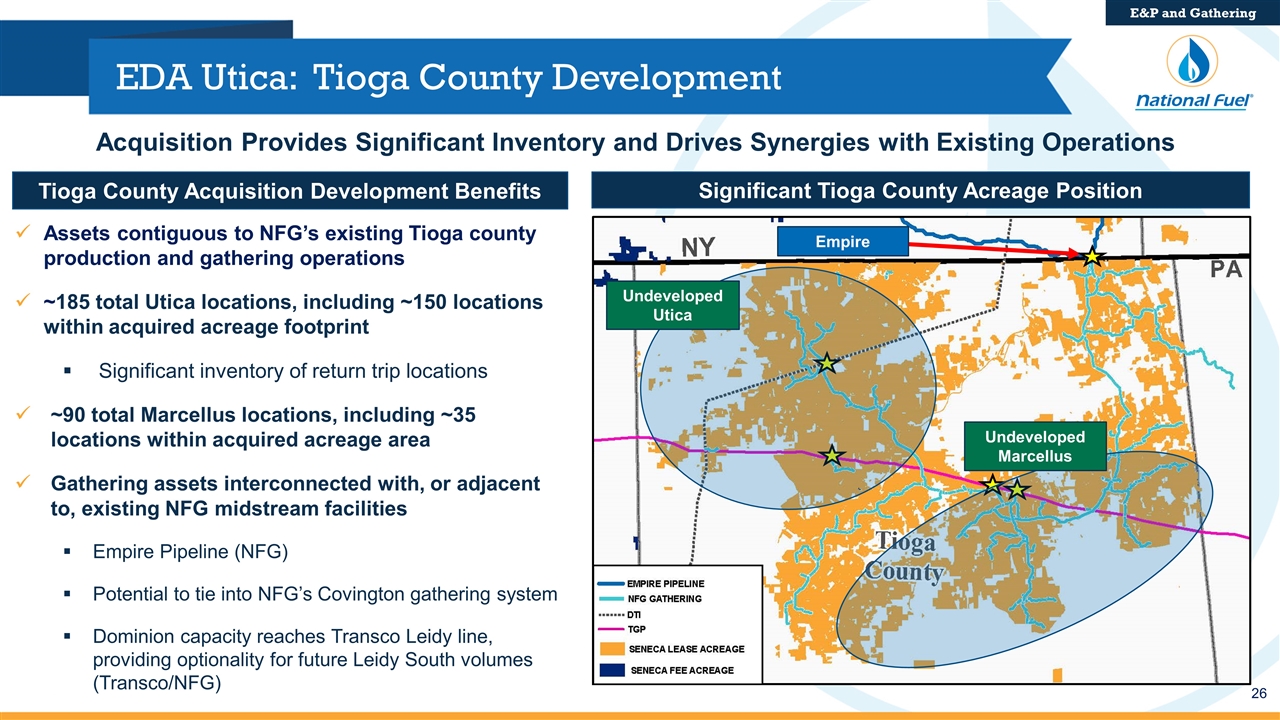

EDA Utica: Tioga County Development Acquisition Provides Significant Inventory and Drives Synergies with Existing Operations Assets contiguous to NFG’s existing Tioga county production and gathering operations ~185 total Utica locations, including ~150 locations within acquired acreage footprint Significant inventory of return trip locations ~90 total Marcellus locations, including ~35 locations within acquired acreage area Gathering assets interconnected with, or adjacent to, existing NFG midstream facilities Empire Pipeline (NFG) Potential to tie into NFG’s Covington gathering system Dominion capacity reaches Transco Leidy line, providing optionality for future Leidy South volumes (Transco/NFG) E&P and Gathering Tioga County Acquisition Development Benefits (1) Significant Tioga County Acreage Position Empire Undeveloped Utica Undeveloped Marcellus

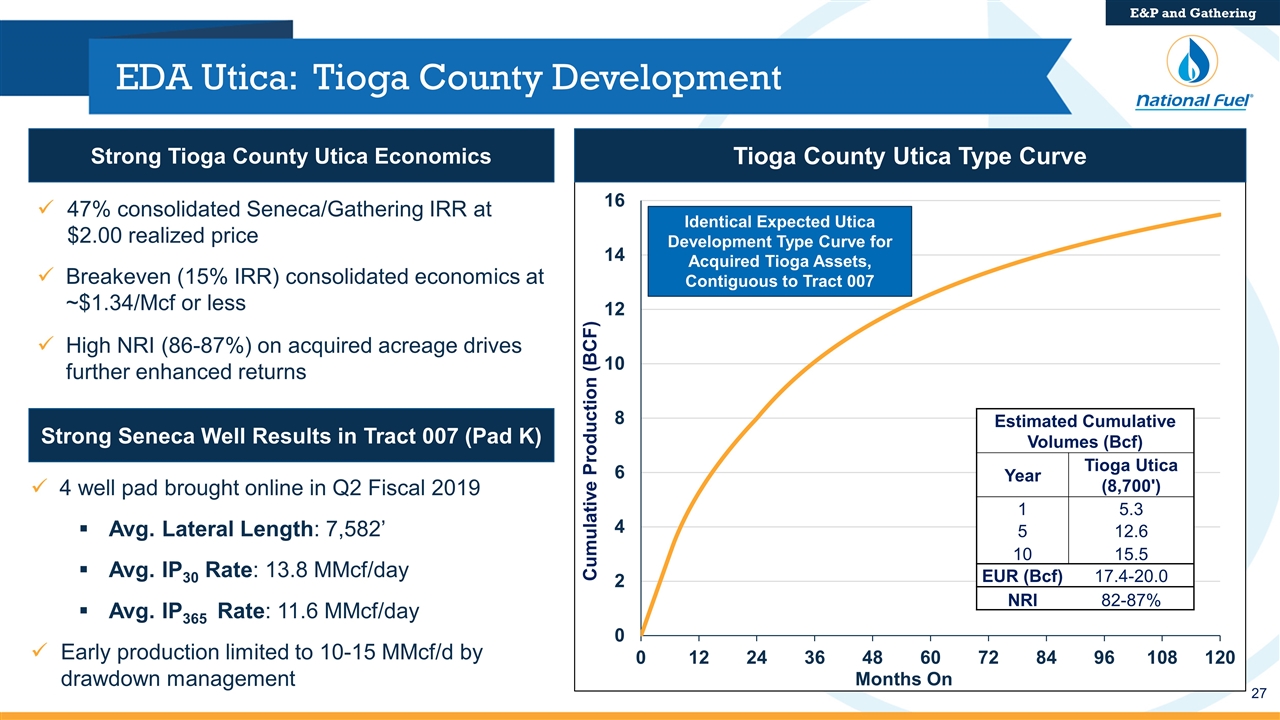

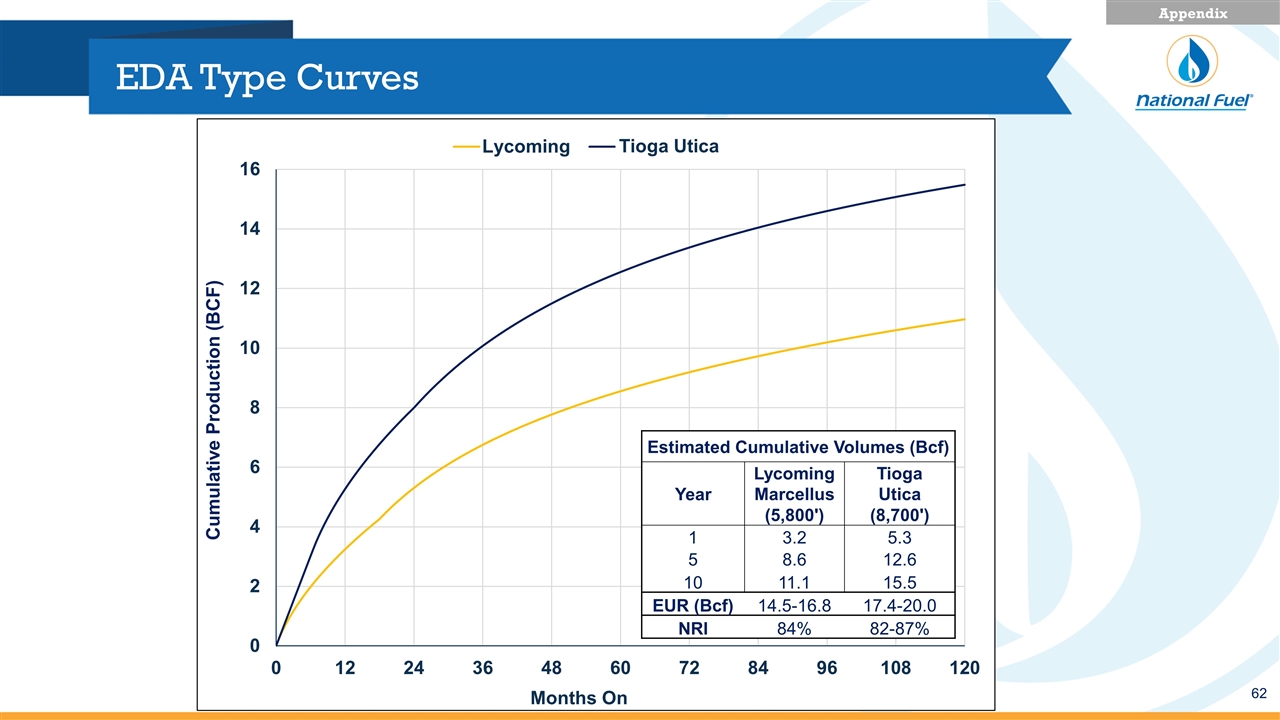

EDA Utica: Tioga County Development E&P and Gathering Strong Seneca Well Results in Tract 007 (Pad K) 4 well pad brought online in Q2 Fiscal 2019 Avg. Lateral Length: 7,582’ Avg. IP30 Rate: 13.8 MMcf/day Avg. IP365 Rate: 11.6 MMcf/day Early production limited to 10-15 MMcf/d by drawdown management Estimated Cumulative Volumes (Bcf) Year Tioga Utica (8,700') 1 5.3 5 12.6 10 15.5 EUR (Bcf) 17.4-20.0 NRI 82-87% Tioga County Utica Type Curve Strong Tioga County Utica Economics 47% consolidated Seneca/Gathering IRR at $2.00 realized price Breakeven (15% IRR) consolidated economics at ~$1.34/Mcf or less High NRI (86-87%) on acquired acreage drives further enhanced returns Identical Expected Utica Development Type Curve for Acquired Tioga Assets, Contiguous to Tract 007

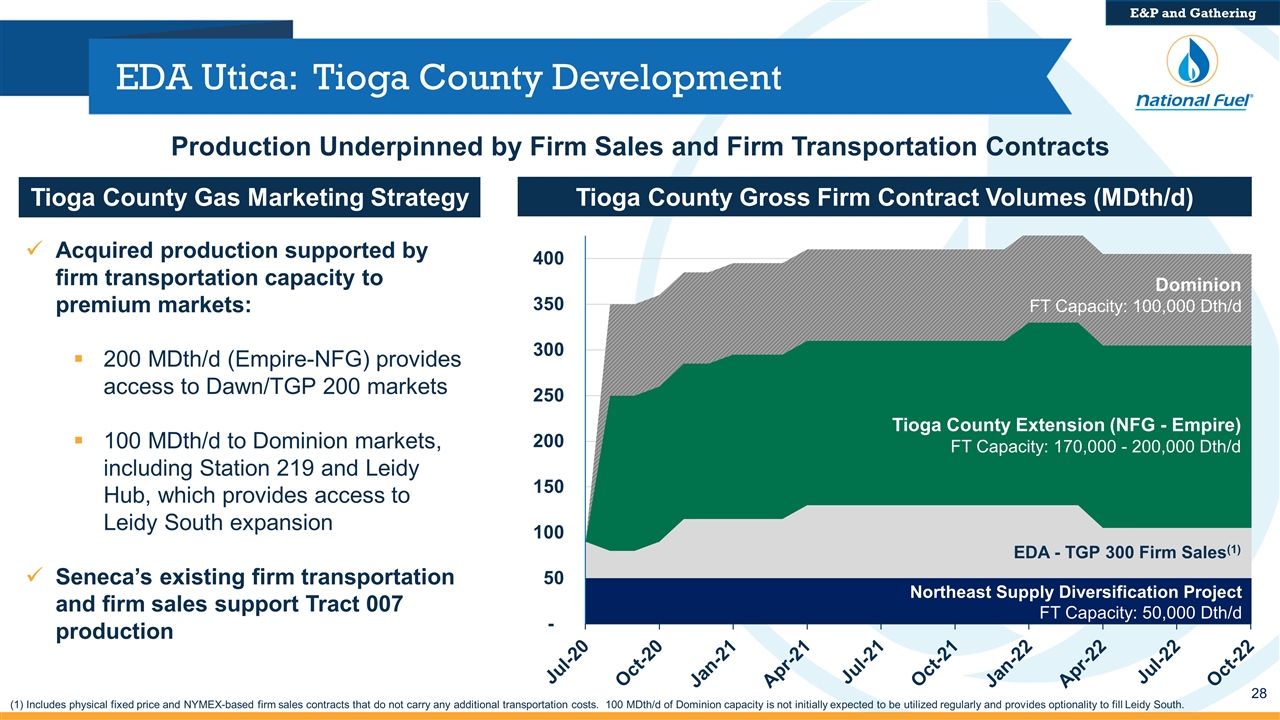

EDA Utica: Tioga County Development Production Underpinned by Firm Sales and Firm Transportation Contracts (1) Includes physical fixed price and NYMEX-based firm sales contracts that do not carry any additional transportation costs. 100 MDth/d of Dominion capacity is not initially expected to be utilized regularly and provides optionality to fill Leidy South. E&P and Gathering Acquired production supported by firm transportation capacity to premium markets: 200 MDth/d (Empire-NFG) provides access to Dawn/TGP 200 markets 100 MDth/d to Dominion markets, including Station 219 and Leidy Hub, which provides access to Leidy South expansion Seneca’s existing firm transportation and firm sales support Tract 007 production Tioga County Gas Marketing Strategy Tioga County Gross Firm Contract Volumes (MDth/d) EDA - TGP 300 Firm Sales(1) Northeast Supply Diversification Project FT Capacity: 50,000 Dth/d Tioga County Extension (NFG - Empire) FT Capacity: 170,000 - 200,000 Dth/d FT Capacity: 100,000 Dth/d Dominion

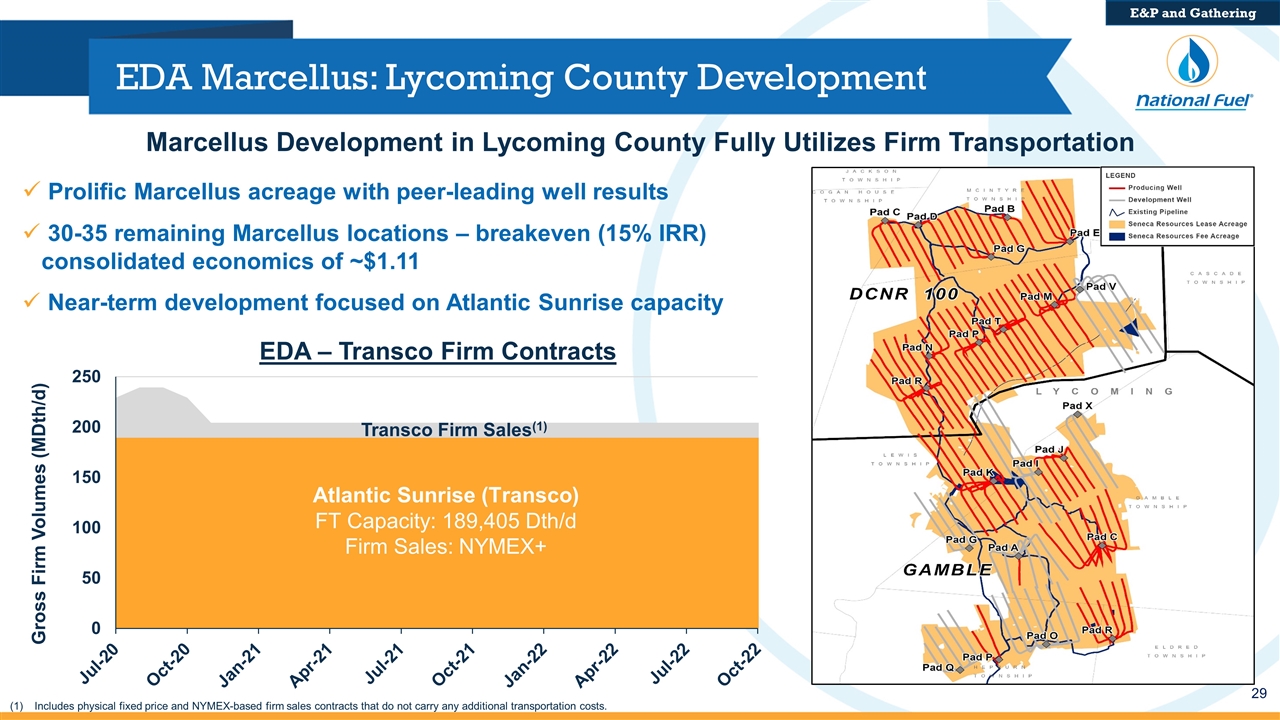

EDA Marcellus: Lycoming County Development Marcellus Development in Lycoming County Fully Utilizes Firm Transportation Includes physical fixed price and NYMEX-based firm sales contracts that do not carry any additional transportation costs. E&P and Gathering Prolific Marcellus acreage with peer-leading well results 30-35 remaining Marcellus locations – breakeven (15% IRR) consolidated economics of ~$1.11 Near-term development focused on Atlantic Sunrise capacity Transco Firm Sales(1)

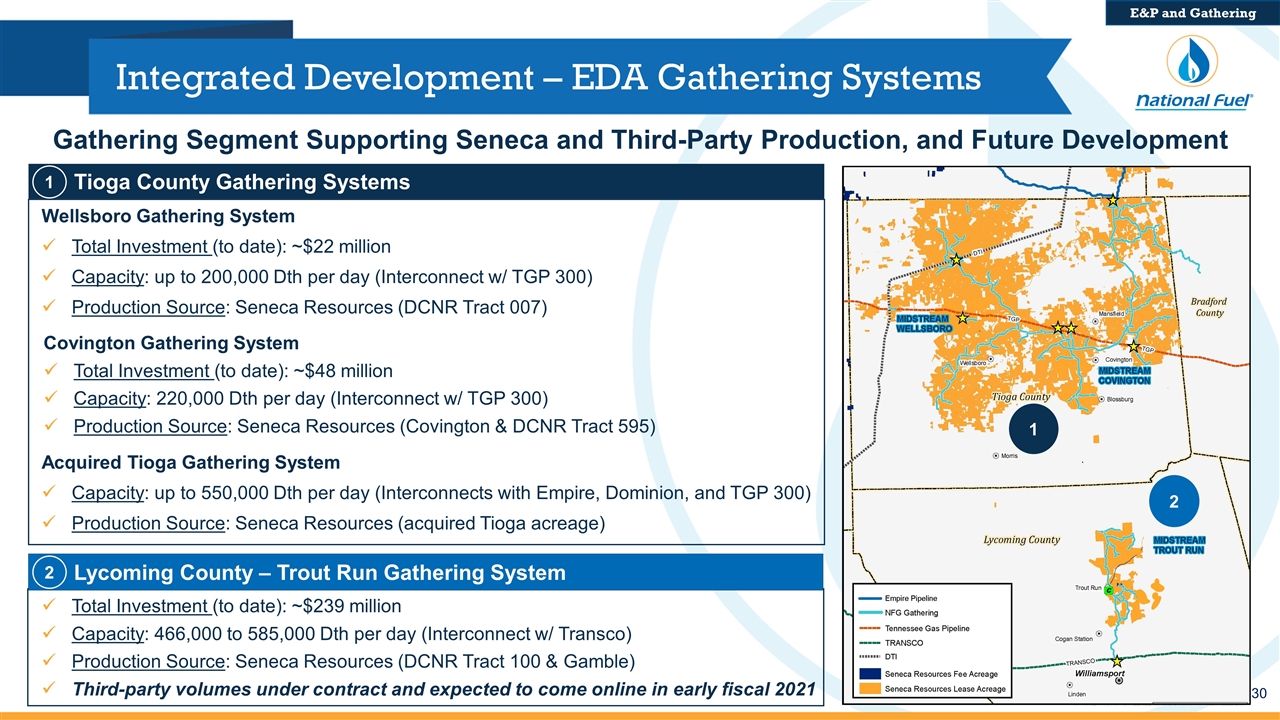

v v Integrated Development – EDA Gathering Systems Covington Gathering System Total Investment (to date): ~$48 million Capacity: 220,000 Dth per day (Interconnect w/ TGP 300) Production Source: Seneca Resources (Covington & DCNR Tract 595) Gathering Segment Supporting Seneca and Third-Party Production, and Future Development Tioga County Gathering Systems Wellsboro Gathering System Total Investment (to date): ~$22 million Capacity: up to 200,000 Dth per day (Interconnect w/ TGP 300) Production Source: Seneca Resources (DCNR Tract 007) E&P and Gathering 1 2 Acquired Tioga Gathering System Capacity: up to 550,000 Dth per day (Interconnects with Empire, Dominion, and TGP 300) Production Source: Seneca Resources (acquired Tioga acreage) Total Investment (to date): ~$239 million Capacity: 466,000 to 585,000 Dth per day (Interconnect w/ Transco) Production Source: Seneca Resources (DCNR Tract 100 & Gamble) Third-party volumes under contract and expected to come online in early fiscal 2021 Lycoming County – Trout Run Gathering System 1 2

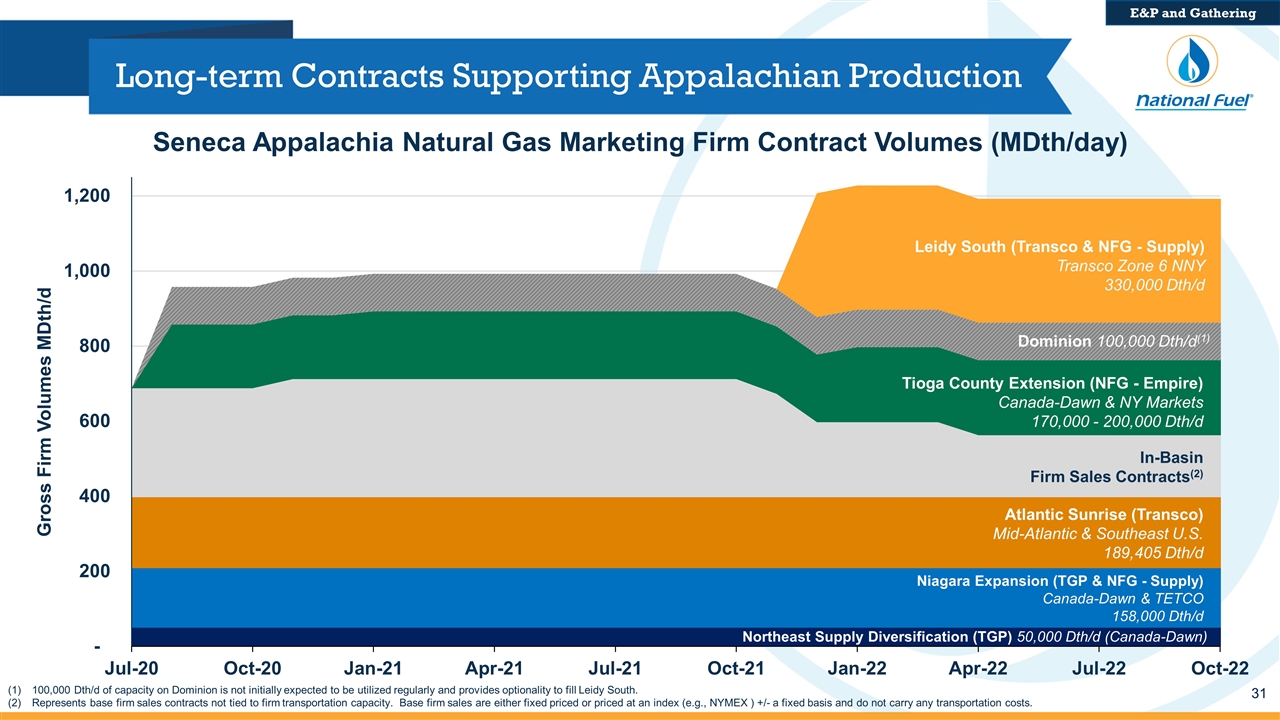

Long-term Contracts Supporting Appalachian Production E&P and Gathering 100,000 Dth/d of capacity on Dominion is not initially expected to be utilized regularly and provides optionality to fill Leidy South. Represents base firm sales contracts not tied to firm transportation capacity. Base firm sales are either fixed priced or priced at an index (e.g., NYMEX ) +/- a fixed basis and do not carry any transportation costs. Northeast Supply Diversification (TGP) 50,000 Dth/d (Canada-Dawn) Niagara Expansion (TGP & NFG - Supply) Canada-Dawn & TETCO 158,000 Dth/d Atlantic Sunrise (Transco) Mid-Atlantic & Southeast U.S. 189,405 Dth/d In-Basin Firm Sales Contracts(2) Leidy South (Transco & NFG - Supply) Transco Zone 6 NNY 330,000 Dth/d Tioga County Extension (NFG - Empire) Canada-Dawn & NY Markets 170,000 - 200,000 Dth/d Seneca Appalachia Natural Gas Marketing Firm Contract Volumes (MDth/day) Dominion 100,000 Dth/d(1)

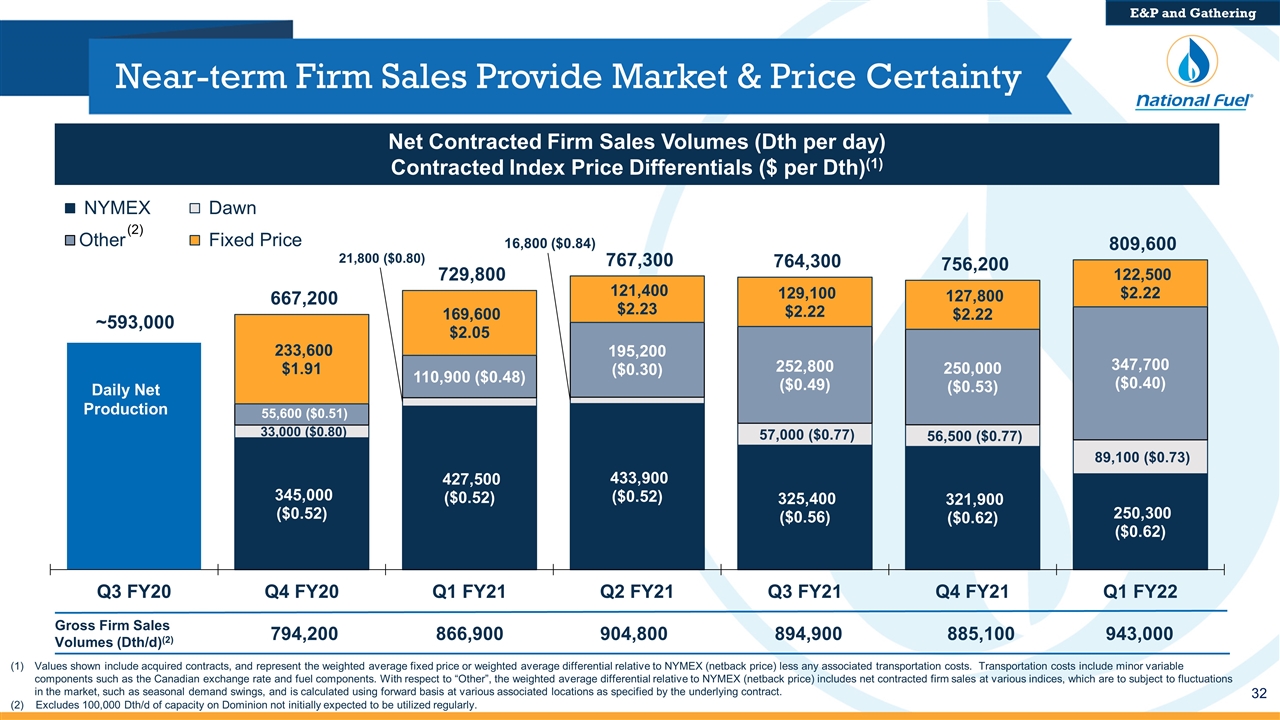

Near-term Firm Sales Provide Market & Price Certainty Net Contracted Firm Sales Volumes (Dth per day) Contracted Index Price Differentials ($ per Dth)(1) Daily Net Production 794,200 866,900 904,800 894,900 885,100 943,000 Gross Firm Sales Volumes (Dth/d)(2) E&P and Gathering Values shown include acquired contracts, and represent the weighted average fixed price or weighted average differential relative to NYMEX (netback price) less any associated transportation costs. Transportation costs include minor variable components such as the Canadian exchange rate and fuel components. With respect to “Other”, the weighted average differential relative to NYMEX (netback price) includes net contracted firm sales at various indices, which are to subject to fluctuations in the market, such as seasonal demand swings, and is calculated using forward basis at various associated locations as specified by the underlying contract. (2) Excludes 100,000 Dth/d of capacity on Dominion not initially expected to be utilized regularly. (2)

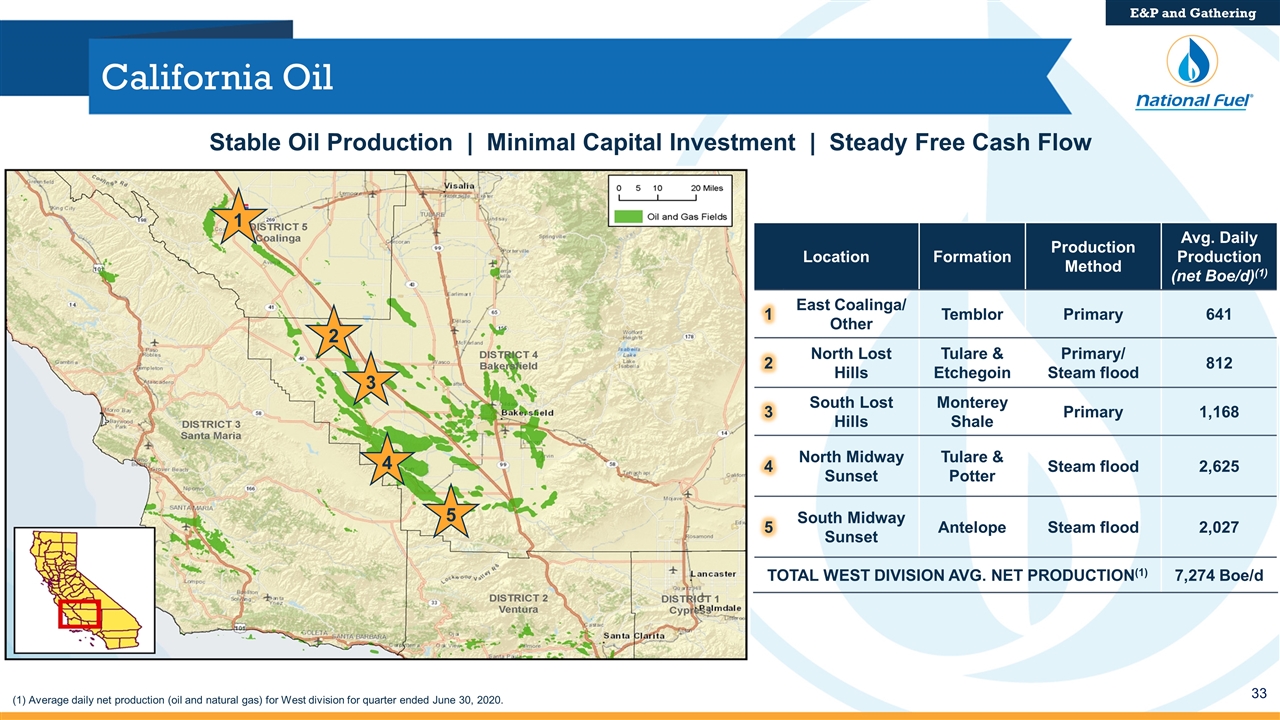

California Oil Stable Oil Production | Minimal Capital Investment | Steady Free Cash Flow 1 2 3 4 5 Location Formation Production Method Avg. Daily Production (net Boe/d)(1) 1 East Coalinga/ Other Temblor Primary 641 2 North Lost Hills Tulare & Etchegoin Primary/ Steam flood 812 3 South Lost Hills Monterey Shale Primary 1,168 4 North Midway Sunset Tulare & Potter Steam flood 2,625 5 South Midway Sunset Antelope Steam flood 2,027 TOTAL WEST DIVISION AVG. NET PRODUCTION(1) 7,274 Boe/d E&P and Gathering (1) Average daily net production (oil and natural gas) for West division for quarter ended June 30, 2020.

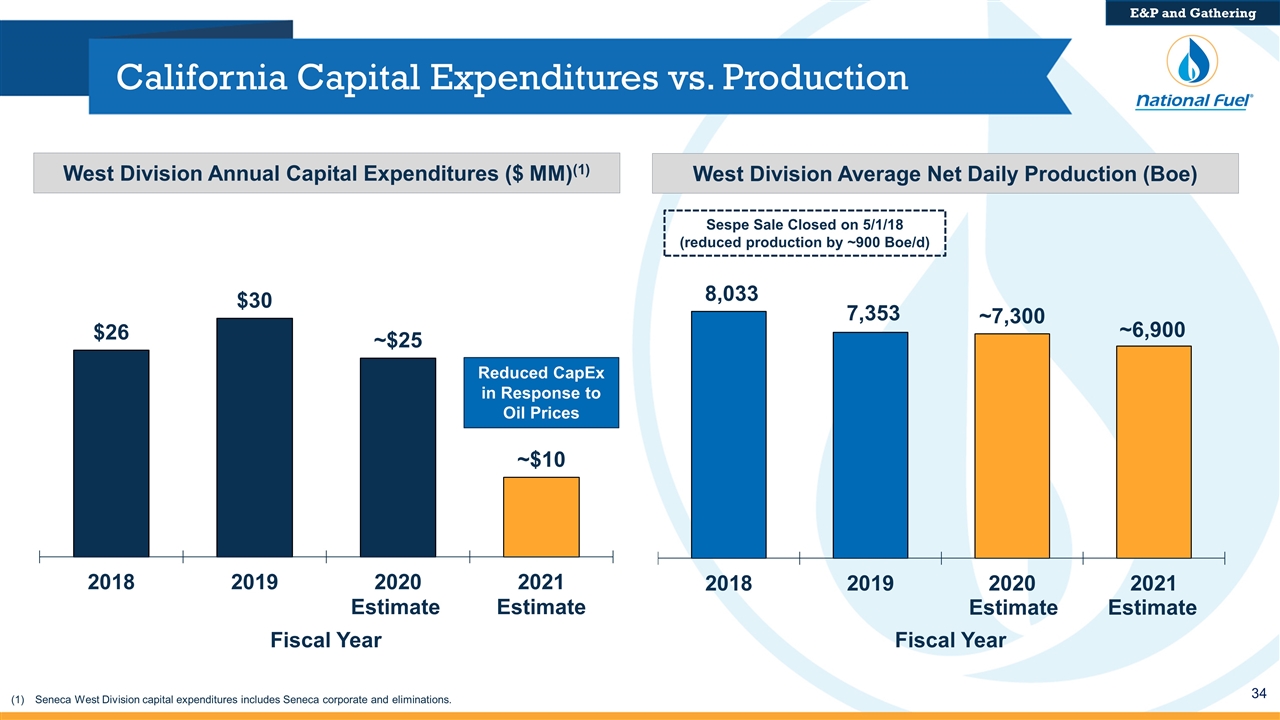

California Capital Expenditures vs. Production West Division Average Net Daily Production (Boe) West Division Annual Capital Expenditures ($ MM)(1) Estimate Seneca West Division capital expenditures includes Seneca corporate and eliminations. E&P and Gathering Sespe Sale Closed on 5/1/18 (reduced production by ~900 Boe/d) Estimate Estimate Estimate

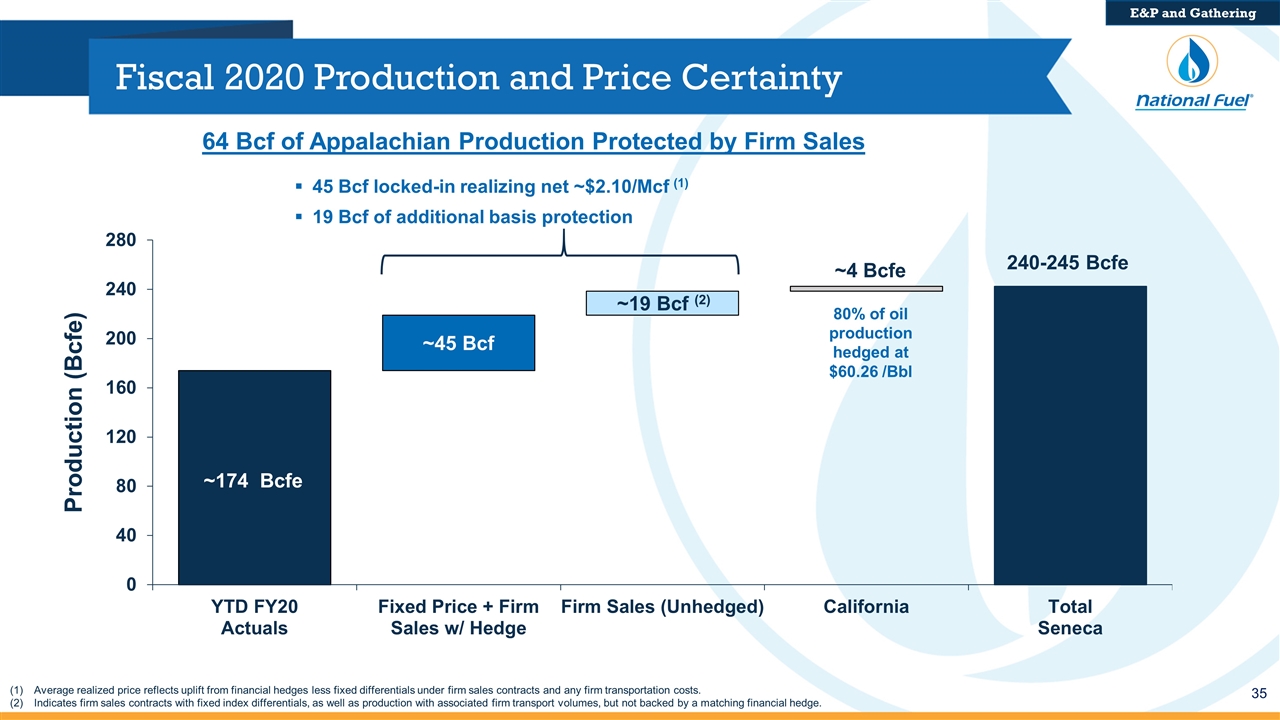

Fiscal 2020 Production and Price Certainty Average realized price reflects uplift from financial hedges less fixed differentials under firm sales contracts and any firm transportation costs. Indicates firm sales contracts with fixed index differentials, as well as production with associated firm transport volumes, but not backed by a matching financial hedge. 45 Bcf locked-in realizing net ~$2.10/Mcf (1) 19 Bcf of additional basis protection 64 Bcf of Appalachian Production Protected by Firm Sales 80% of oil production hedged at $60.26 /Bbl E&P and Gathering

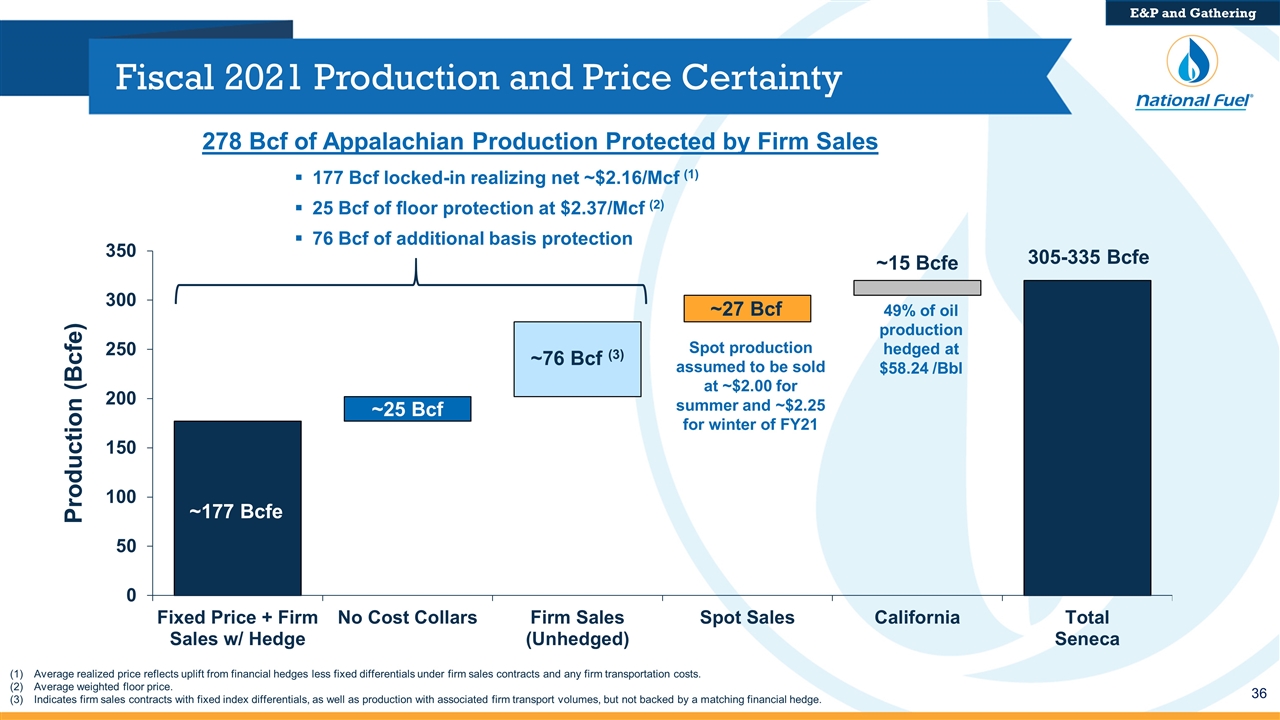

Fiscal 2021 Production and Price Certainty Average realized price reflects uplift from financial hedges less fixed differentials under firm sales contracts and any firm transportation costs. Average weighted floor price. Indicates firm sales contracts with fixed index differentials, as well as production with associated firm transport volumes, but not backed by a matching financial hedge. 177 Bcf locked-in realizing net ~$2.16/Mcf (1) 25 Bcf of floor protection at $2.37/Mcf (2) 76 Bcf of additional basis protection Spot production assumed to be sold at ~$2.00 for summer and ~$2.25 for winter of FY21 278 Bcf of Appalachian Production Protected by Firm Sales 49% of oil production hedged at $58.24 /Bbl E&P and Gathering

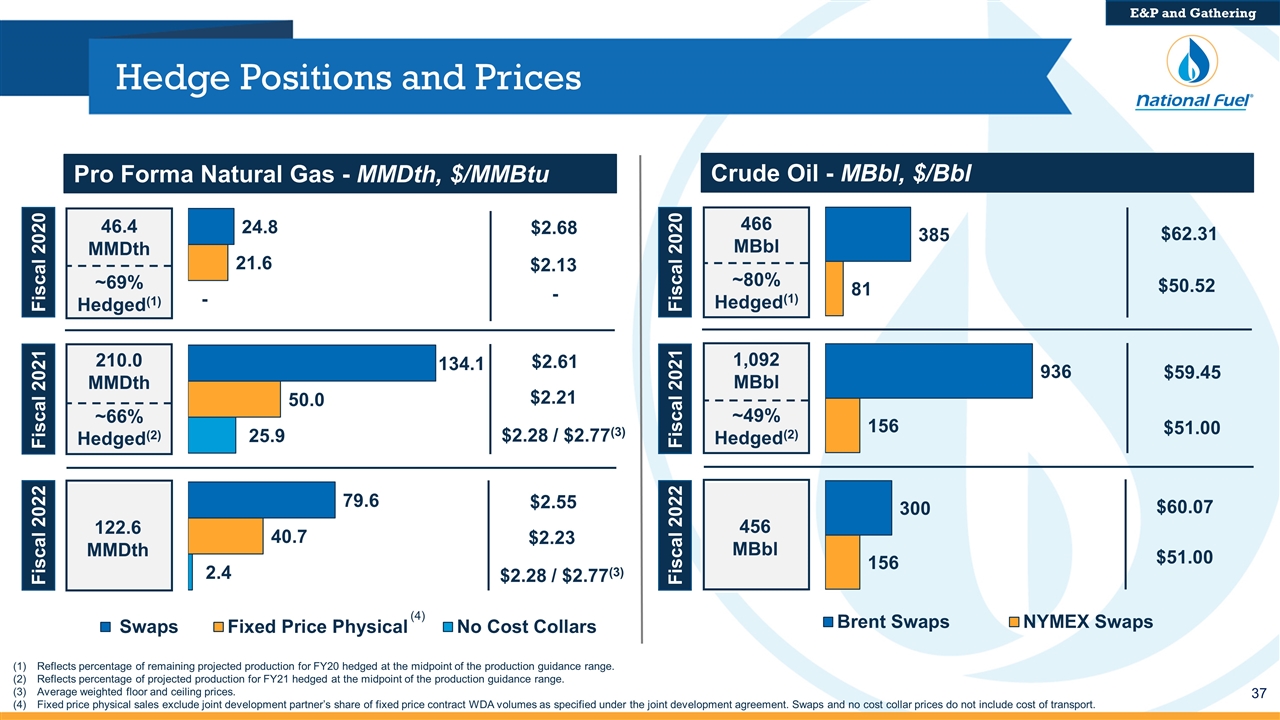

Hedge Positions and Prices Reflects percentage of remaining projected production for FY20 hedged at the midpoint of the production guidance range. Reflects percentage of projected production for FY21 hedged at the midpoint of the production guidance range. Average weighted floor and ceiling prices. Fixed price physical sales exclude joint development partner’s share of fixed price contract WDA volumes as specified under the joint development agreement. Swaps and no cost collar prices do not include cost of transport. E&P and Gathering Pro Forma Natural Gas - MMDth, $/MMBtu 122.6 MMDth 210.0 MMDth ~66% Hedged(2) 46.4 MMDth ~69% Hedged(1) $2.68 $2.13 $2.61 $2.21 - $2.28 / $2.77(3) $2.55 $2.23 $2.28 / $2.77(3) Crude Oil - MBbl, $/Bbl 456 MBbl 1,092 MBbl ~49% Hedged(2) 466 MBbl ~80% Hedged(1) $62.31 $50.52 $59.45 $51.00 $60.07 $51.00 Fiscal 2020 Fiscal 2021 Fiscal 2022 Fiscal 2020 Fiscal 2021 Fiscal 2022

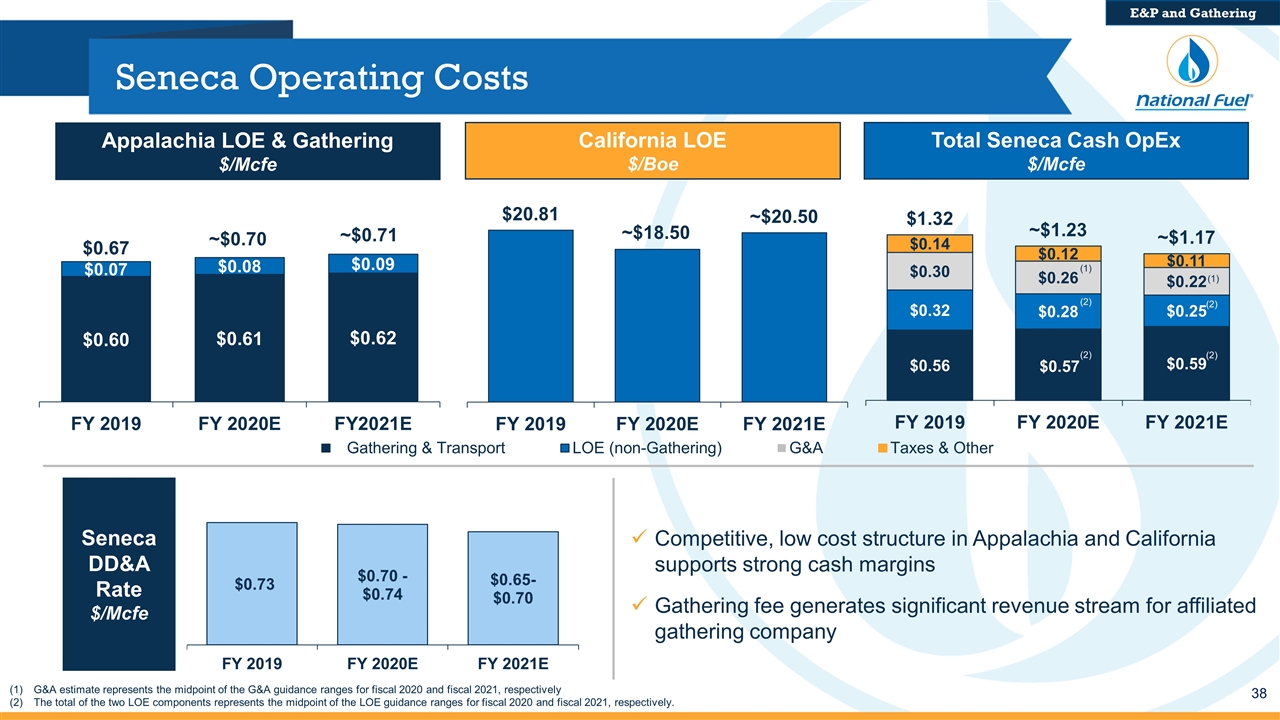

Seneca Operating Costs Competitive, low cost structure in Appalachia and California supports strong cash margins Gathering fee generates significant revenue stream for affiliated gathering company Seneca DD&A Rate $/Mcfe Appalachia LOE & Gathering $/Mcfe California LOE $/Boe Total Seneca Cash OpEx $/Mcfe G&A estimate represents the midpoint of the G&A guidance ranges for fiscal 2020 and fiscal 2021, respectively The total of the two LOE components represents the midpoint of the LOE guidance ranges for fiscal 2020 and fiscal 2021, respectively. E&P and Gathering (2) (2) (2) (2)

Pipeline and Storage Overview National Fuel Gas Supply Corporation ~ Empire Pipeline, Inc.

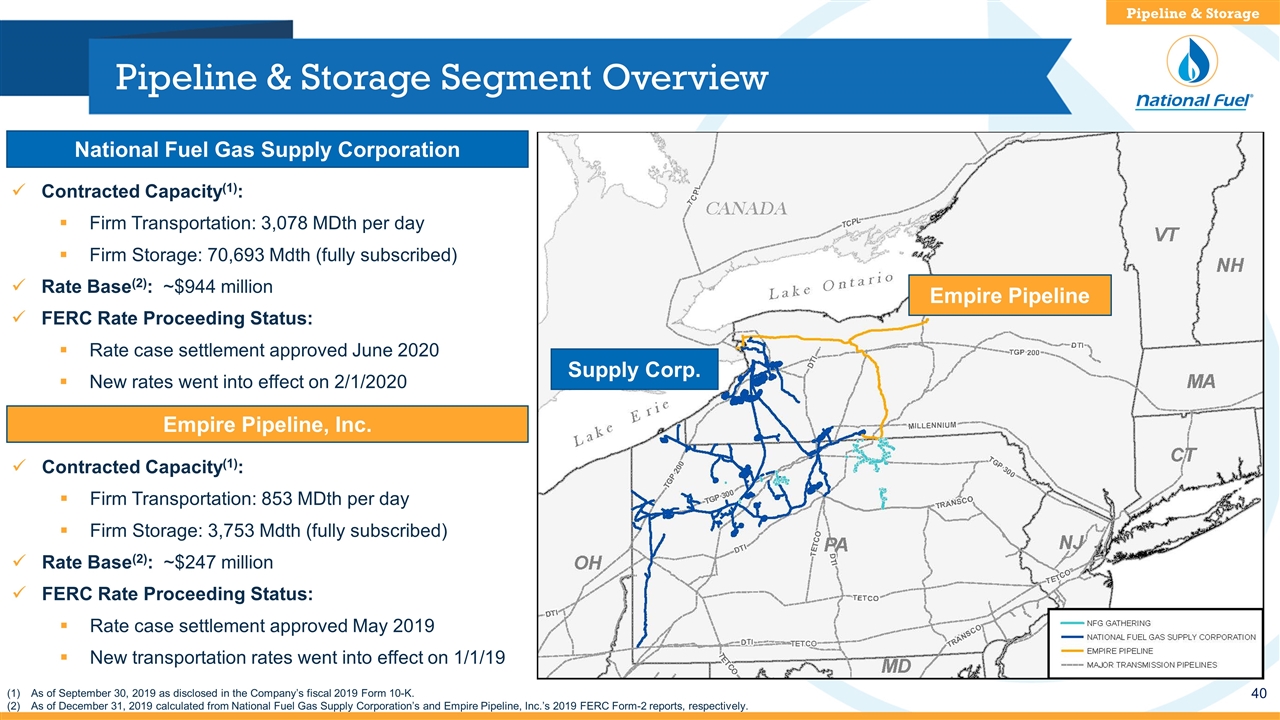

Pipeline & Storage Segment Overview As of September 30, 2019 as disclosed in the Company’s fiscal 2019 Form 10-K. As of December 31, 2019 calculated from National Fuel Gas Supply Corporation’s and Empire Pipeline, Inc.’s 2019 FERC Form-2 reports, respectively. Empire Pipeline, Inc. National Fuel Gas Supply Corporation Empire Pipeline Supply Corp. Contracted Capacity(1): Firm Transportation: 3,078 MDth per day Firm Storage: 70,693 Mdth (fully subscribed) Rate Base(2): ~$944 million FERC Rate Proceeding Status: Rate case settlement approved June 2020 New rates went into effect on 2/1/2020 Contracted Capacity(1): Firm Transportation: 853 MDth per day Firm Storage: 3,753 Mdth (fully subscribed) Rate Base(2): ~$247 million FERC Rate Proceeding Status: Rate case settlement approved May 2019 New transportation rates went into effect on 1/1/19 Pipeline & Storage

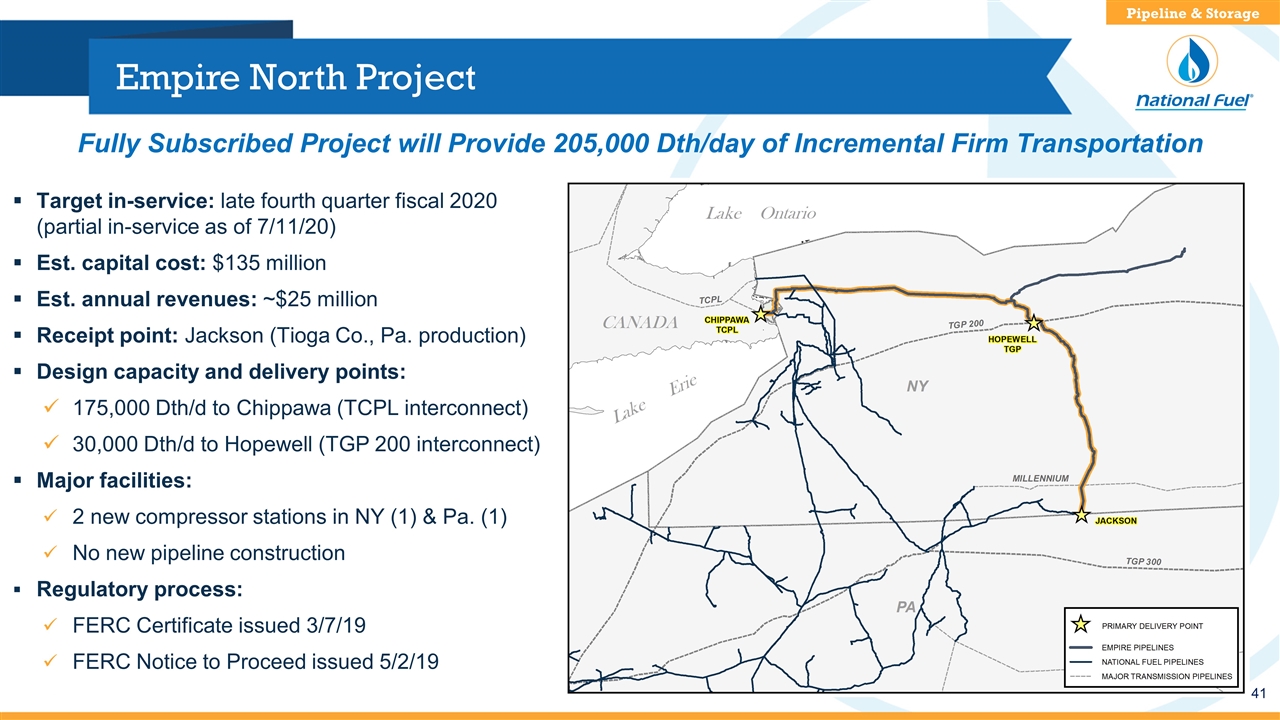

Empire North Project Target in-service: late fourth quarter fiscal 2020 (partial in-service as of 7/11/20) Est. capital cost: $135 million Est. annual revenues: ~$25 million Receipt point: Jackson (Tioga Co., Pa. production) Design capacity and delivery points: 175,000 Dth/d to Chippawa (TCPL interconnect) 30,000 Dth/d to Hopewell (TGP 200 interconnect) Major facilities: 2 new compressor stations in NY (1) & Pa. (1) No new pipeline construction Regulatory process: FERC Certificate issued 3/7/19 FERC Notice to Proceed issued 5/2/19 Pipeline & Storage Fully Subscribed Project will Provide 205,000 Dth/day of Incremental Firm Transportation

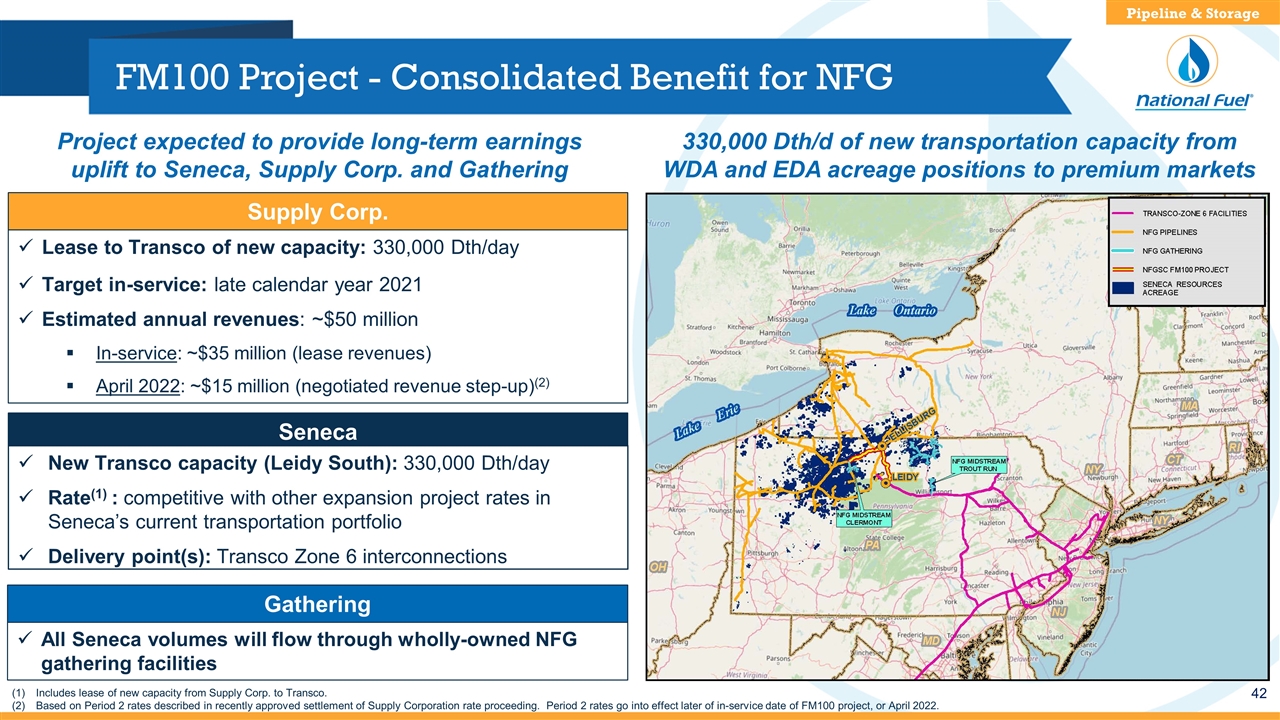

All Seneca volumes will flow through wholly-owned NFG gathering facilities FM100 Project - Consolidated Benefit for NFG 330,000 Dth/d of new transportation capacity from WDA and EDA acreage positions to premium markets New Transco capacity (Leidy South): 330,000 Dth/day Rate(1) : competitive with other expansion project rates in Seneca’s current transportation portfolio Delivery point(s): Transco Zone 6 interconnections Seneca Lease to Transco of new capacity: 330,000 Dth/day Target in-service: late calendar year 2021 Estimated annual revenues: ~$50 million In-service: ~$35 million (lease revenues) April 2022: ~$15 million (negotiated revenue step-up)(2) Supply Corp. Project expected to provide long-term earnings uplift to Seneca, Supply Corp. and Gathering Pipeline & Storage Gathering Includes lease of new capacity from Supply Corp. to Transco. Based on Period 2 rates described in recently approved settlement of Supply Corporation rate proceeding. Period 2 rates go into effect later of in-service date of FM100 project, or April 2022.

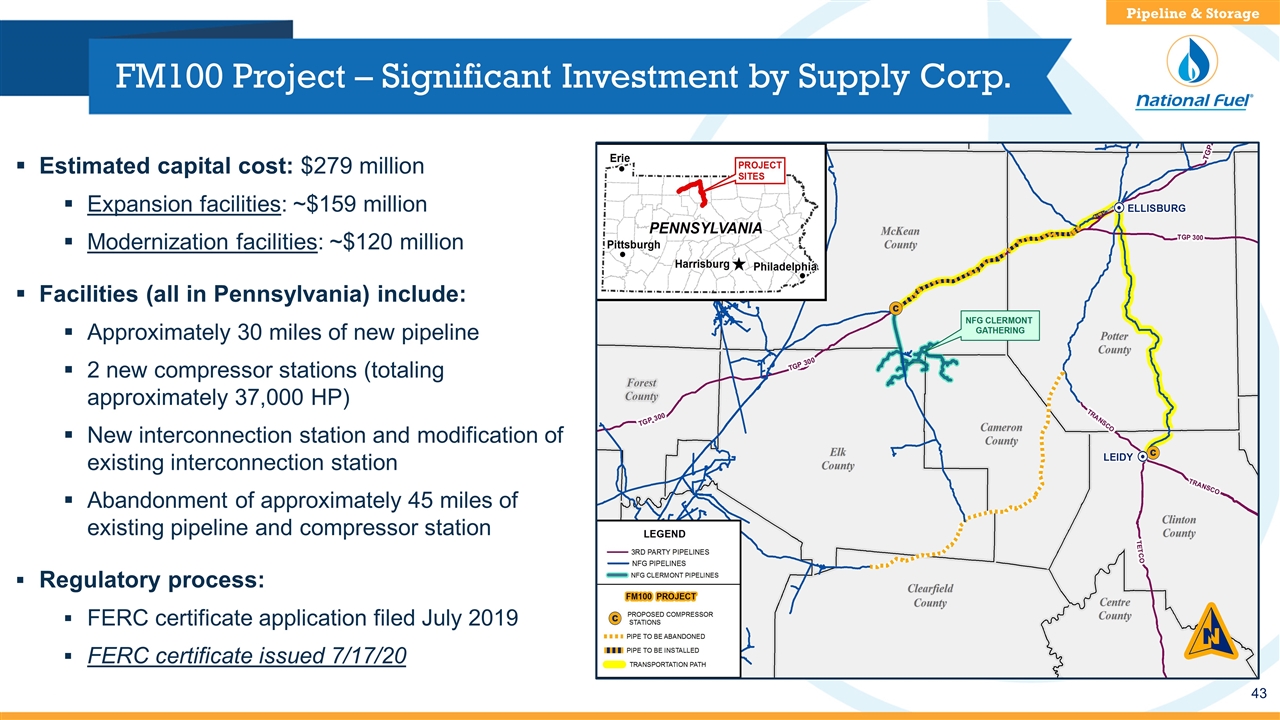

FM100 Project – Significant Investment by Supply Corp. Pipeline & Storage Estimated capital cost: $279 million Expansion facilities: ~$159 million Modernization facilities: ~$120 million Facilities (all in Pennsylvania) include: Approximately 30 miles of new pipeline 2 new compressor stations (totaling approximately 37,000 HP) New interconnection station and modification of existing interconnection station Abandonment of approximately 45 miles of existing pipeline and compressor station Regulatory process: FERC certificate application filed July 2019 FERC certificate issued 7/17/20

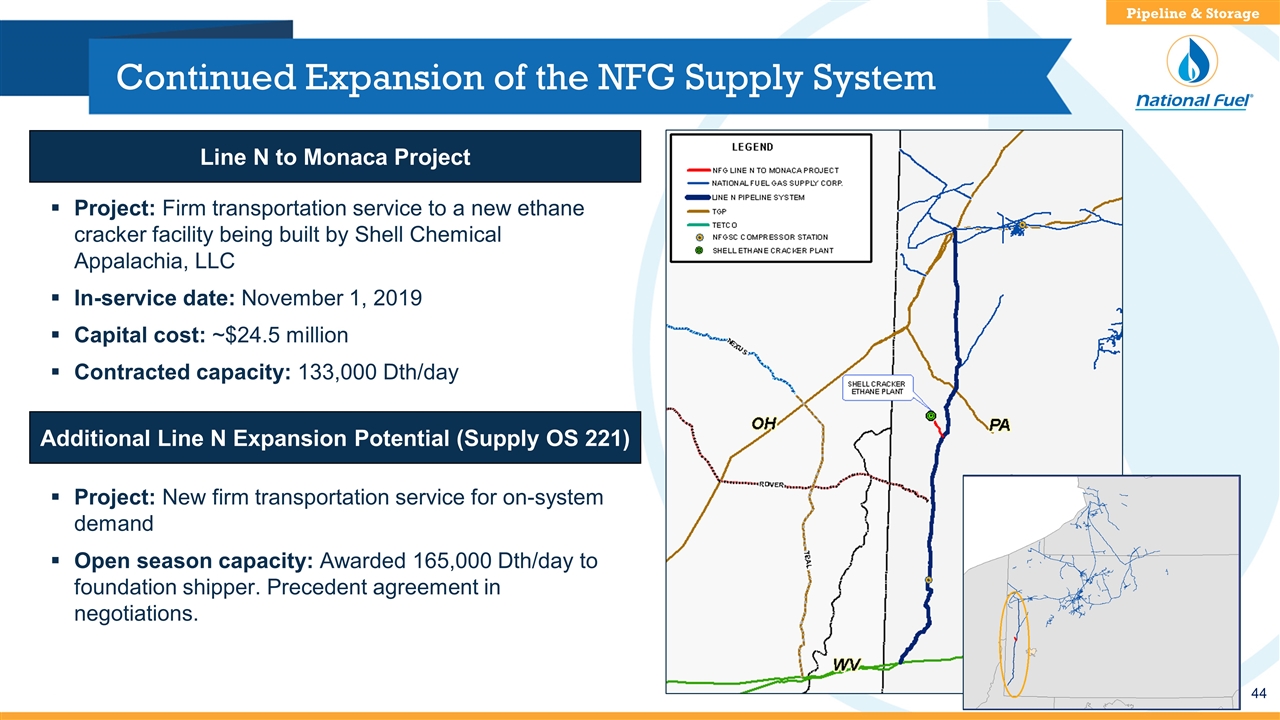

Continued Expansion of the NFG Supply System Line N to Monaca Project Project: Firm transportation service to a new ethane cracker facility being built by Shell Chemical Appalachia, LLC In-service date: November 1, 2019 Capital cost: ~$24.5 million Contracted capacity: 133,000 Dth/day Project: New firm transportation service for on-system demand Open season capacity: Awarded 165,000 Dth/day to foundation shipper. Precedent agreement in negotiations. Pipeline & Storage Additional Line N Expansion Potential (Supply OS 221)

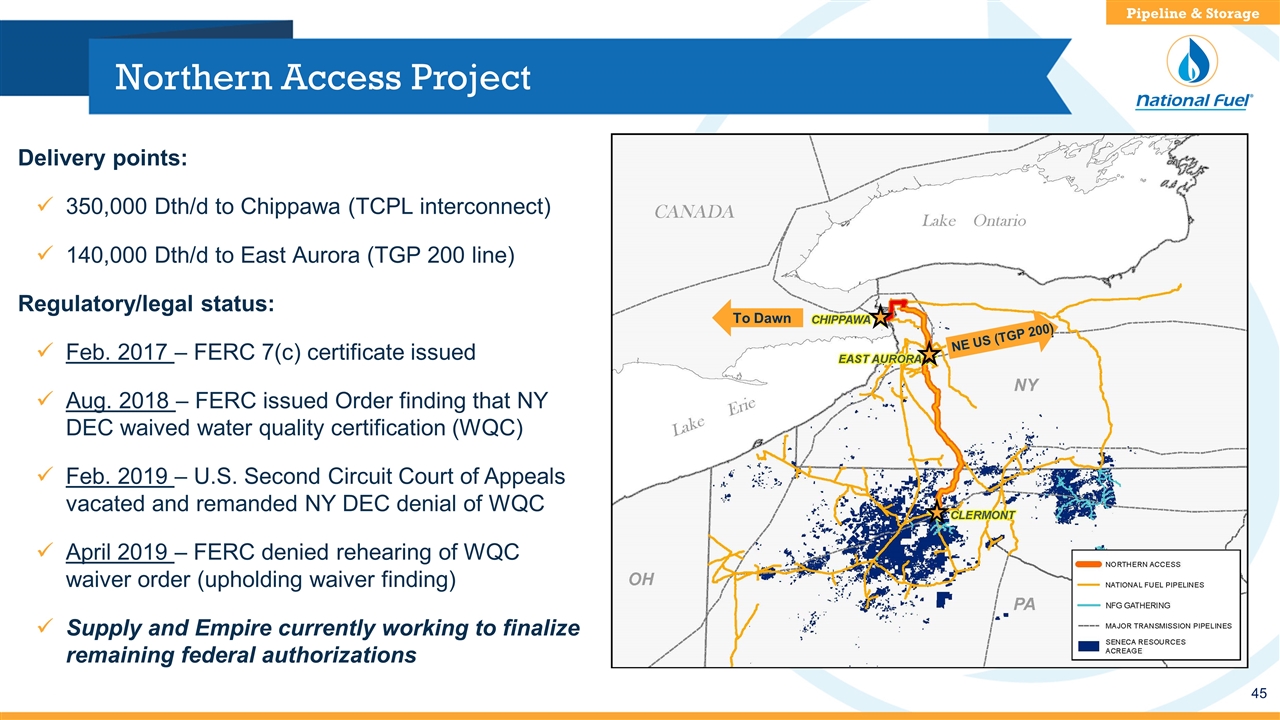

Northern Access Project Delivery points: 350,000 Dth/d to Chippawa (TCPL interconnect) 140,000 Dth/d to East Aurora (TGP 200 line) Regulatory/legal status: Feb. 2017 – FERC 7(c) certificate issued Aug. 2018 – FERC issued Order finding that NY DEC waived water quality certification (WQC) Feb. 2019 – U.S. Second Circuit Court of Appeals vacated and remanded NY DEC denial of WQC April 2019 – FERC denied rehearing of WQC waiver order (upholding waiver finding) Supply and Empire currently working to finalize remaining federal authorizations Pipeline & Storage To Dawn NE US (TGP 200)

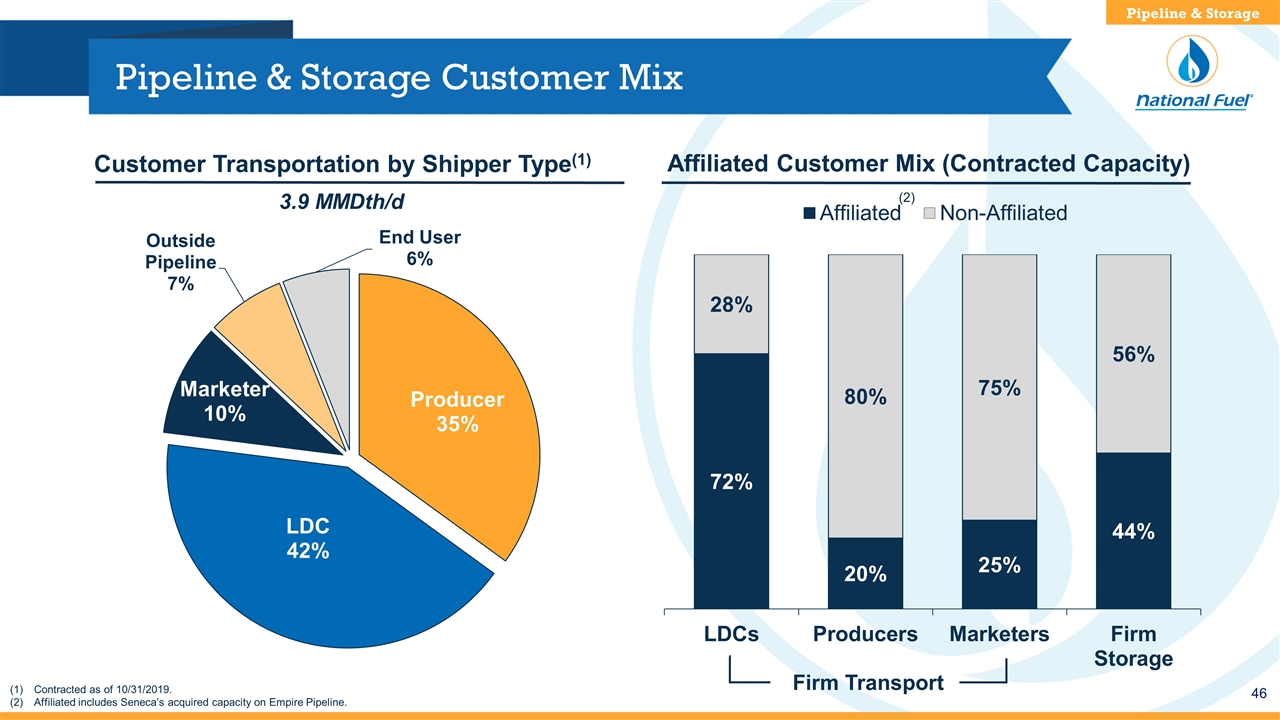

Pipeline & Storage Customer Mix 3.9 MMDth/d Contracted as of 10/31/2019. Affiliated includes Seneca’s acquired capacity on Empire Pipeline. Customer Transportation by Shipper Type(1) Affiliated Customer Mix (Contracted Capacity) Firm Transport Pipeline & Storage (2)

Utility Overview National Fuel Gas Distribution Corporation

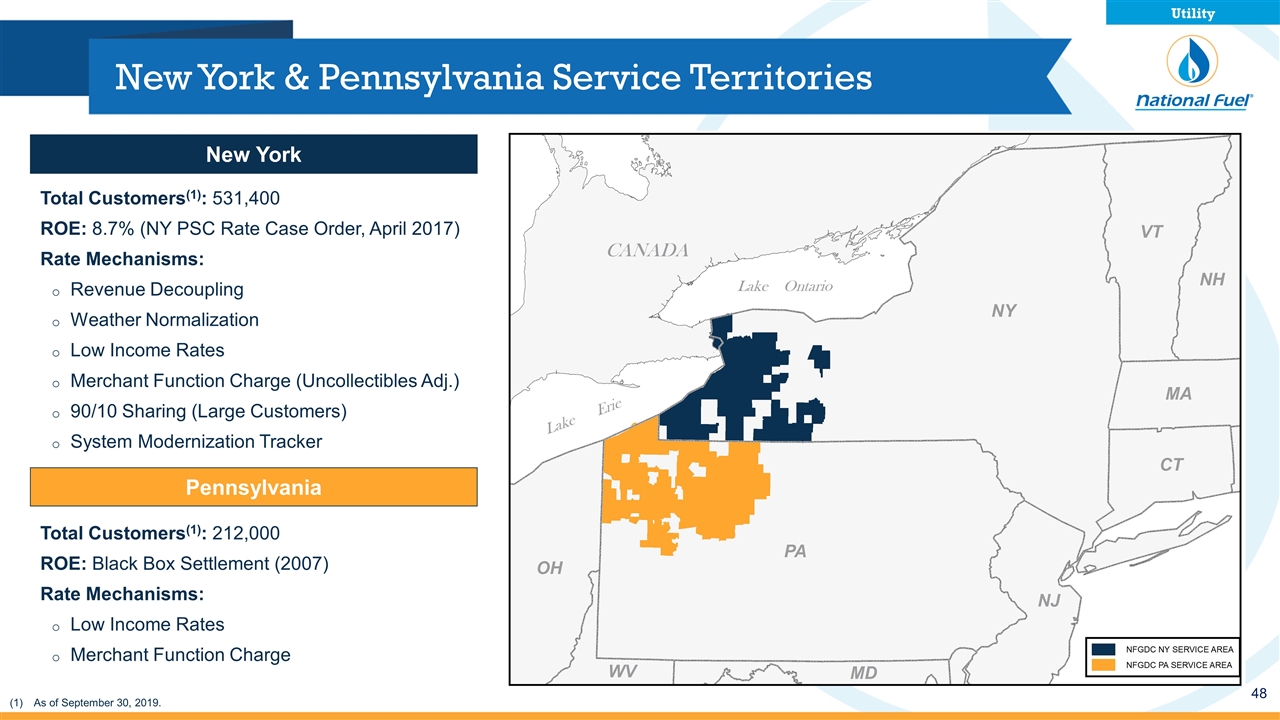

New York & Pennsylvania Service Territories New York Total Customers(1): 531,400 ROE: 8.7% (NY PSC Rate Case Order, April 2017) Rate Mechanisms: Revenue Decoupling Weather Normalization Low Income Rates Merchant Function Charge (Uncollectibles Adj.) 90/10 Sharing (Large Customers) System Modernization Tracker Pennsylvania Total Customers(1): 212,000 ROE: Black Box Settlement (2007) Rate Mechanisms: Low Income Rates Merchant Function Charge As of September 30, 2019. Utility

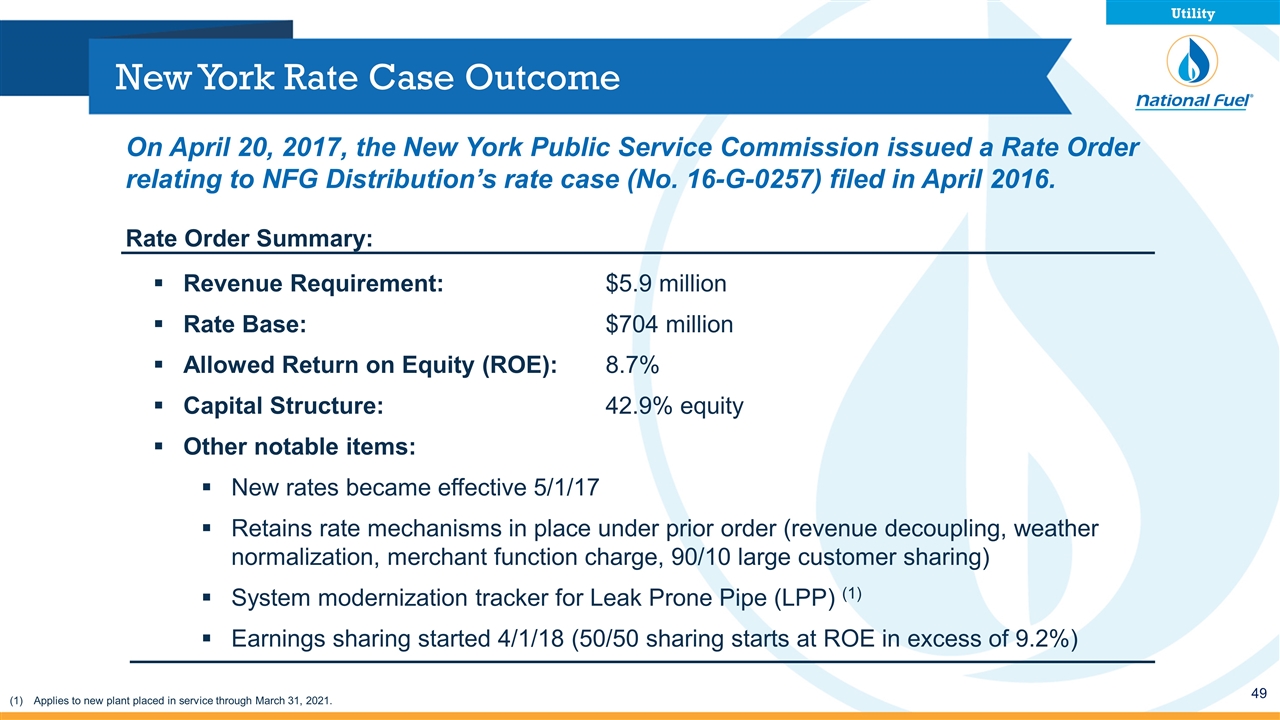

New York Rate Case Outcome Rate Order Summary: Revenue Requirement:$5.9 million Rate Base:$704 million Allowed Return on Equity (ROE):8.7% Capital Structure:42.9% equity Other notable items: New rates became effective 5/1/17 Retains rate mechanisms in place under prior order (revenue decoupling, weather normalization, merchant function charge, 90/10 large customer sharing) System modernization tracker for Leak Prone Pipe (LPP) (1) Earnings sharing started 4/1/18 (50/50 sharing starts at ROE in excess of 9.2%) On April 20, 2017, the New York Public Service Commission issued a Rate Order relating to NFG Distribution’s rate case (No. 16-G-0257) filed in April 2016. Utility Applies to new plant placed in service through March 31, 2021.

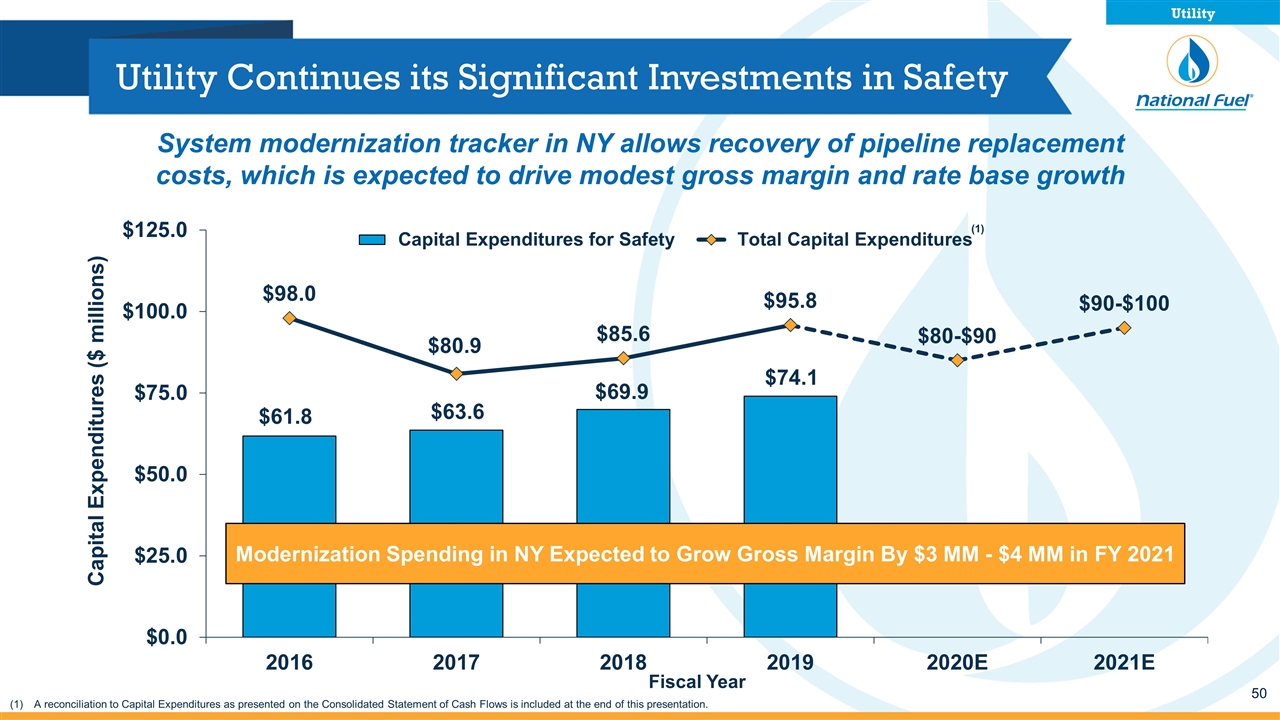

Utility Continues its Significant Investments in Safety Modernization Spending in NY Expected to Grow Gross Margin By $3 MM - $4 MM in FY 2021 (1) A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. Utility System modernization tracker in NY allows recovery of pipeline replacement costs, which is expected to drive modest gross margin and rate base growth

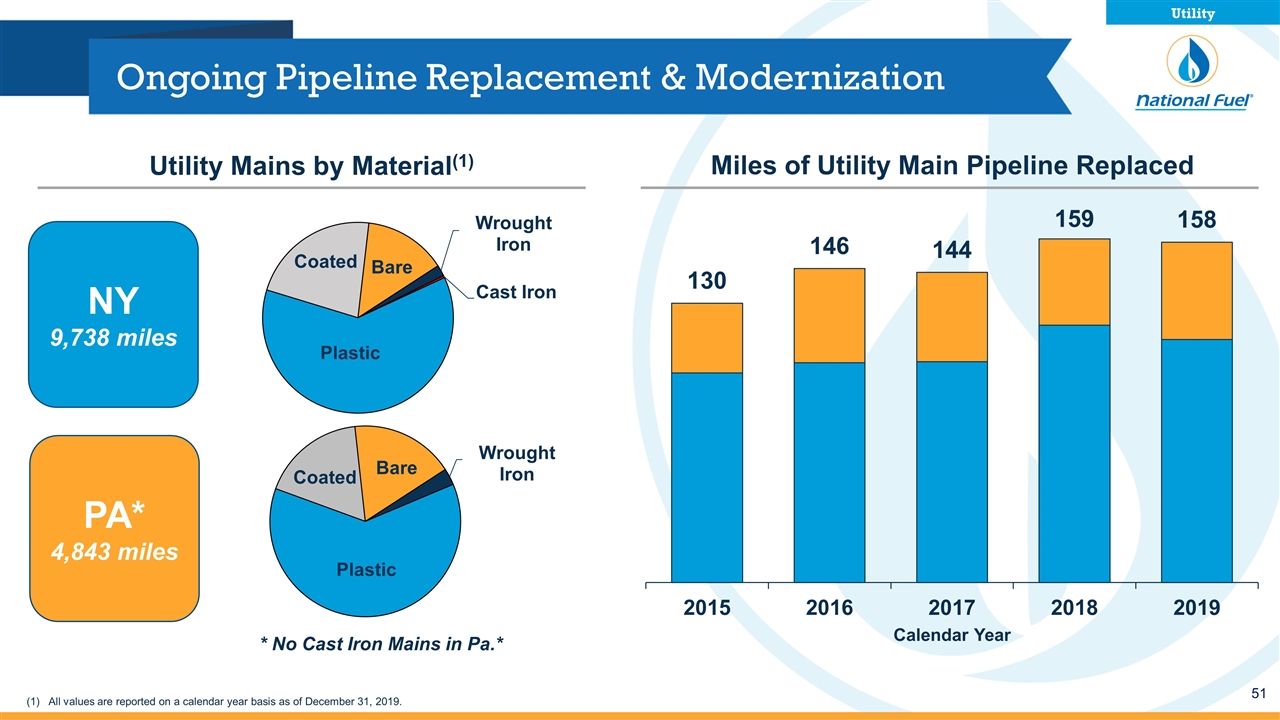

Ongoing Pipeline Replacement & Modernization NY 9,738 miles PA* 4,843 miles * No Cast Iron Mains in Pa.* Miles of Utility Main Pipeline Replaced Utility Mains by Material(1) Utility (1) All values are reported on a calendar year basis as of December 31, 2019.

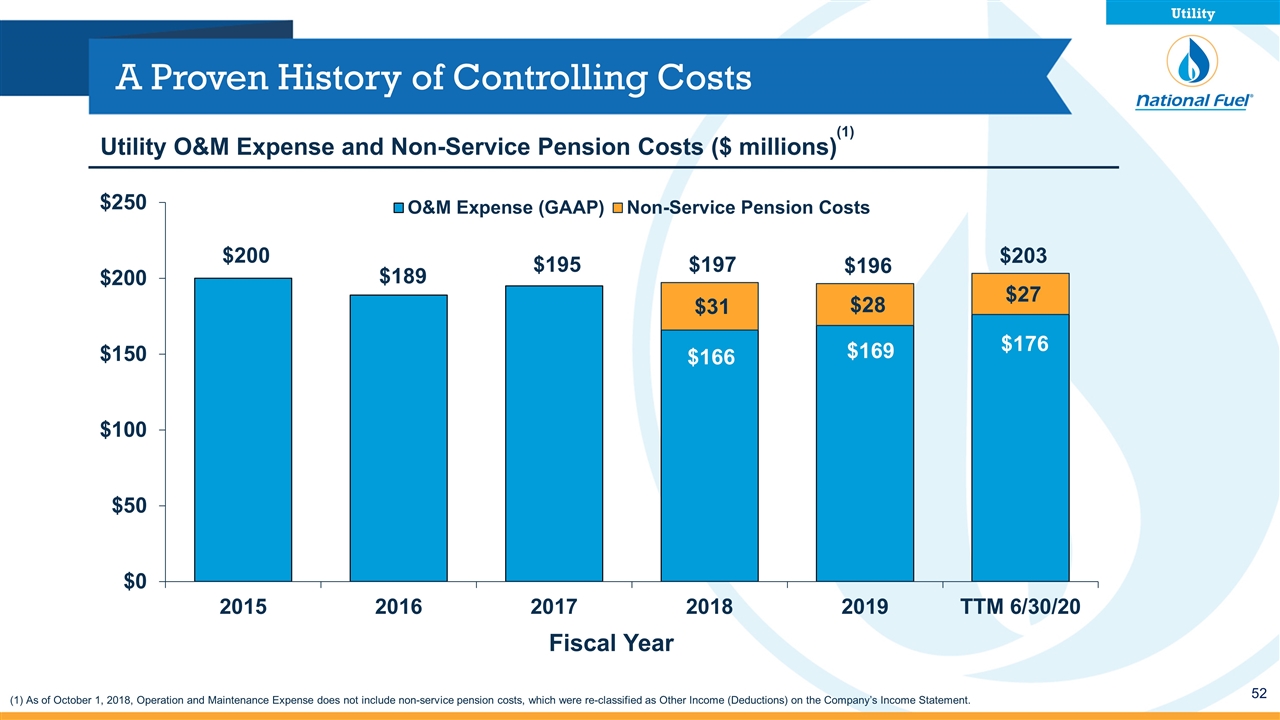

A Proven History of Controlling Costs Utility O&M Expense and Non-Service Pension Costs ($ millions) Utility (1) (1) As of October 1, 2018, Operation and Maintenance Expense does not include non-service pension costs, which were re-classified as Other Income (Deductions) on the Company’s Income Statement.

Consolidated Financial Overview Upstream I Midstream I Downstream

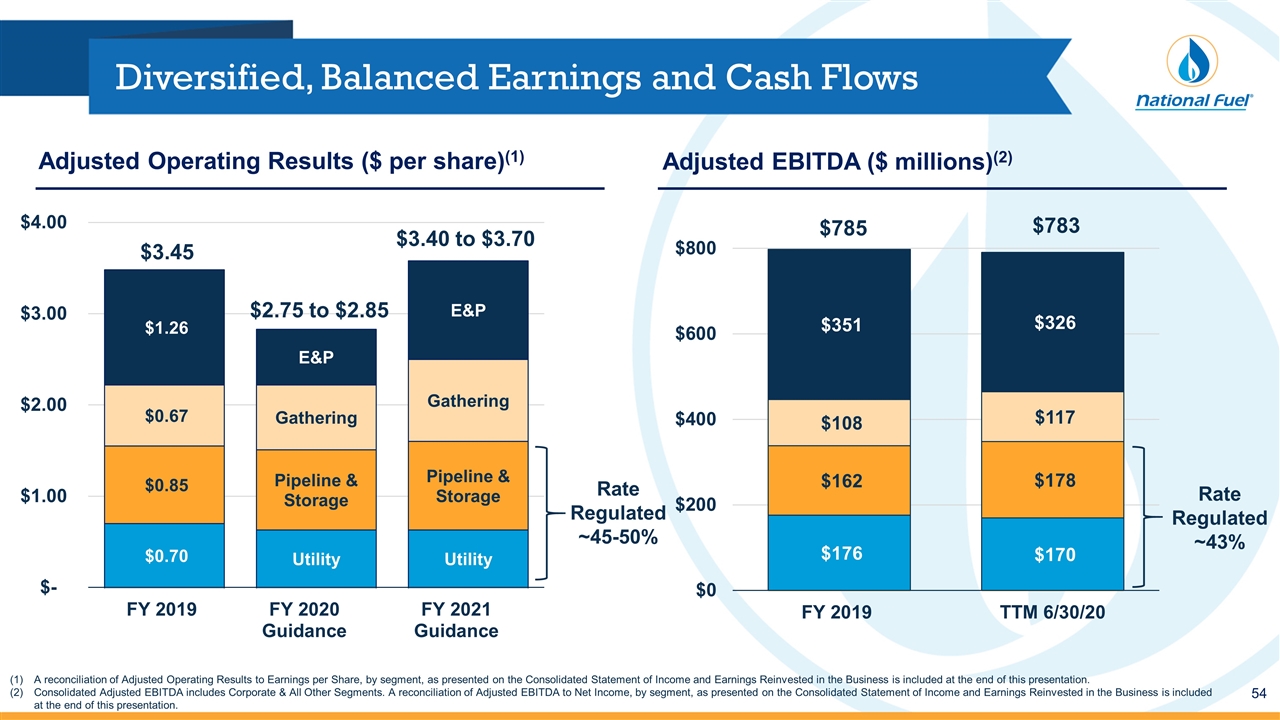

Adjusted Operating Results ($ per share)(1) Diversified, Balanced Earnings and Cash Flows A reconciliation of Adjusted Operating Results to Earnings per Share, by segment, as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end of this presentation. Consolidated Adjusted EBITDA includes Corporate & All Other Segments. A reconciliation of Adjusted EBITDA to Net Income, by segment, as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end of this presentation. Adjusted EBITDA ($ millions)(2) Rate Regulated ~45-50% Rate Regulated ~43%

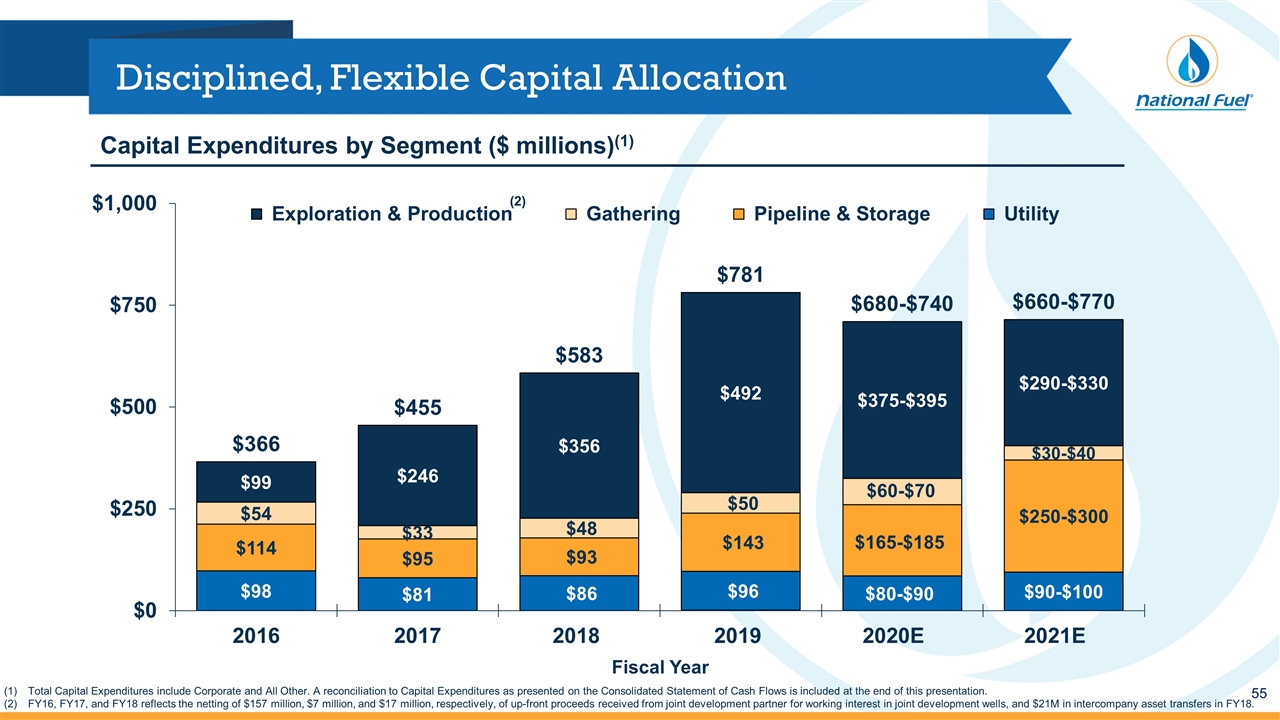

Disciplined, Flexible Capital Allocation (2) Total Capital Expenditures include Corporate and All Other. A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY16, FY17, and FY18 reflects the netting of $157 million, $7 million, and $17 million, respectively, of up-front proceeds received from joint development partner for working interest in joint development wells, and $21M in intercompany asset transfers in FY18. Capital Expenditures by Segment ($ millions)(1)

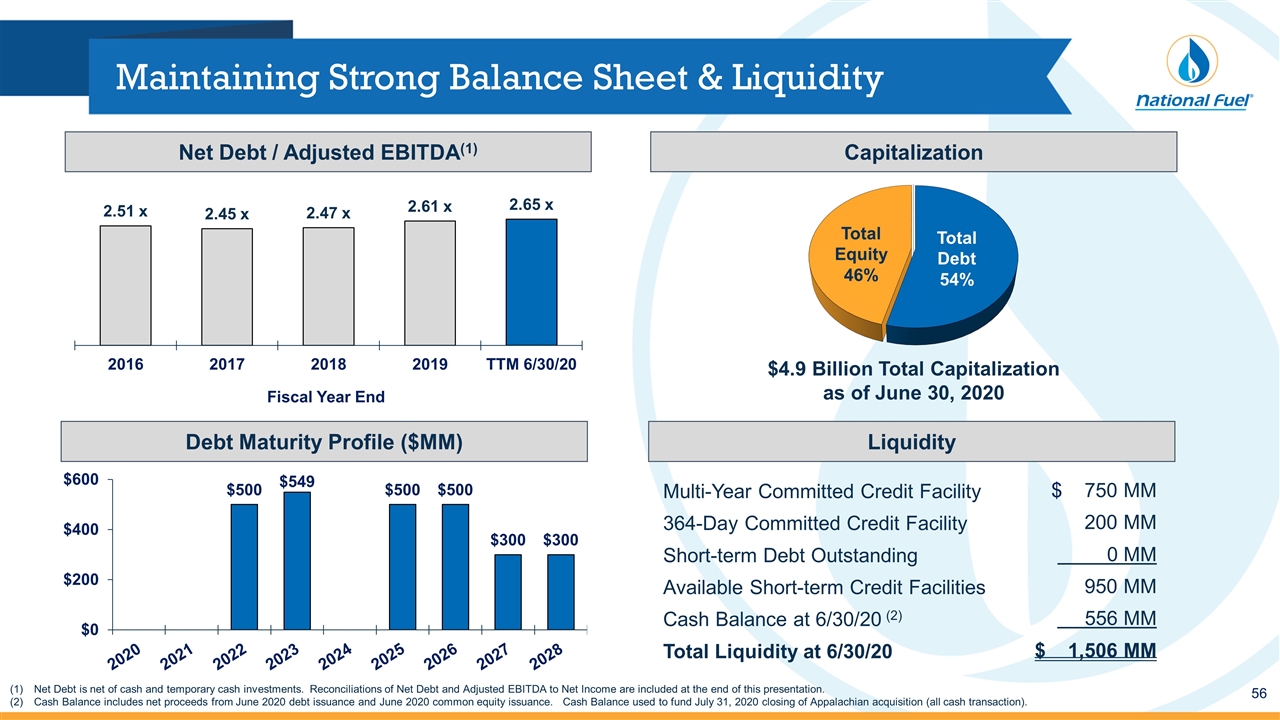

Maintaining Strong Balance Sheet & Liquidity Total Debt 54% $4.9 Billion Total Capitalization as of June 30, 2020 Net Debt / Adjusted EBITDA(1) Capitalization Debt Maturity Profile ($MM) Liquidity Multi-Year Committed Credit Facility 364-Day Committed Credit Facility Short-term Debt Outstanding Available Short-term Credit Facilities Cash Balance at 6/30/20 (2) Total Liquidity at 6/30/20 $ 750 MM 200 MM 0 MM 950 MM 556 MM $ 1,506 MM Net Debt is net of cash and temporary cash investments. Reconciliations of Net Debt and Adjusted EBITDA to Net Income are included at the end of this presentation. Cash Balance includes net proceeds from June 2020 debt issuance and June 2020 common equity issuance. Cash Balance used to fund July 31, 2020 closing of Appalachian acquisition (all cash transaction). Total Equity 46%

Appendix

Safe Harbor For Forward Looking Statements This presentation may contain “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, including statements regarding future prospects, plans, objectives, goals, projections, estimates of oil and gas quantities, strategies, future events or performance and underlying assumptions, capital structure, anticipated capital expenditures, completion of construction projects, projections for pension and other post-retirement benefit obligations, impacts of the adoption of new accounting rules, and possible outcomes of litigation or regulatory proceedings, as well as statements that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may,” and similar expressions. Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. The Company’s expectations, beliefs and projections are expressed in good faith and are believed by the Company to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors, the following are important factors that could cause actual results to differ materially from those discussed in the forward-looking statements: the Company’s ability to successfully integrate acquired assets, including Shell’s upstream assets and midstream gathering assets in Pennsylvania, and achieve expected cost synergies; impairments under the SEC’s full cost ceiling test for natural gas and oil reserves; changes in the price of natural gas or oil; the length and severity of the COVID-19 pandemic, including its impacts across our businesses on demand, operations, global supply chains and liquidity; changes in economic conditions, including global, national or regional recessions, and their effect on the demand for, and customers’ ability to pay for, the Company’s products and services; the creditworthiness or performance of the Company’s key suppliers, customers and counterparties; financial and economic conditions, including the availability of credit, and occurrences affecting the Company’s ability to obtain financing on acceptable terms for working capital, capital expenditures and other investments, including any downgrades in the Company’s credit ratings and changes in interest rates and other capital market conditions; changes in laws, regulations or judicial interpretations to which the Company is subject, including those involving derivatives, taxes, safety, employment, climate change, other environmental matters, real property, and exploration and production activities such as hydraulic fracturing; delays or changes in costs or plans with respect to Company projects or related projects of other companies, including disruptions due to the COVID-19 pandemic, as well as difficulties or delays in obtaining necessary governmental approvals, permits or orders or in obtaining the cooperation of interconnecting facility operators; the Company’s ability to complete planned strategic transactions; governmental/regulatory actions, initiatives and proceedings, including those involving rate cases (which address, among other things, target rates of return, rate design and retained natural gas), environmental/safety requirements, affiliate relationships, industry structure, and franchise renewal; changes in price differentials between similar quantities of natural gas or oil sold at different geographic locations, and the effect of such changes on commodity production, revenues and demand for pipeline transportation capacity to or from such locations; the impact of information technology disruptions, cybersecurity or data security breaches; factors affecting the Company’s ability to successfully identify, drill for and produce economically viable natural gas and oil reserves, including among others geology, lease availability, title disputes, weather conditions, shortages, delays or unavailability of equipment and services required in drilling operations, insufficient gathering, processing and transportation capacity, the need to obtain governmental approvals and permits, and compliance with environmental laws and regulations; increasing health care costs and the resulting effect on health insurance premiums and on the obligation to provide other post-retirement benefits; other changes in price differentials between similar quantities of natural gas or oil having different quality, heating value, hydrocarbon mix or delivery date; the cost and effects of legal and administrative claims against the Company or activist shareholder campaigns to effect changes at the Company; uncertainty of oil and gas reserve estimates; significant differences between the Company’s projected and actual production levels for natural gas or oil; changes in demographic patterns and weather conditions; changes in the availability, price or accounting treatment of derivative financial instruments; changes in laws, actuarial assumptions, the interest rate environment and the return on plan/trust assets related to the Company’s pension and other post-retirement benefits, which can affect future funding obligations and costs and plan liabilities; economic disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural disasters, terrorist activities or acts of war; significant differences between the Company’s projected and actual capital expenditures and operating expenses; or increasing costs of insurance, changes in coverage and the ability to obtain insurance. Forward-looking statements include estimates of oil and gas quantities. Proved oil and gas reserves are those quantities of oil and gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible under existing economic conditions, operating methods and government regulations. Other estimates of oil and gas quantities, including estimates of probable reserves, possible reserves, and resource potential, are by their nature more speculative than estimates of proved reserves. Accordingly, estimates other than proved reserves are subject to substantially greater risk of being actually realized. Investors are urged to consider closely the disclosure in our Form 10-K available at www.nationalfuel.com. You can also obtain this form on the SEC’s website at www.sec.gov. For a discussion of the risks set forth above and other factors that could cause actual results to differ materially from results referred to in the forward-looking statements, see “Risk Factors” in the Company’s Form 10-K for the fiscal year ended September 30, 2019 and the Forms 10-Q for the quarters ended December 31, 2019, March 31, 2020, and June 30, 2020. The Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date thereof or to reflect the occurrence of unanticipated events. Appendix

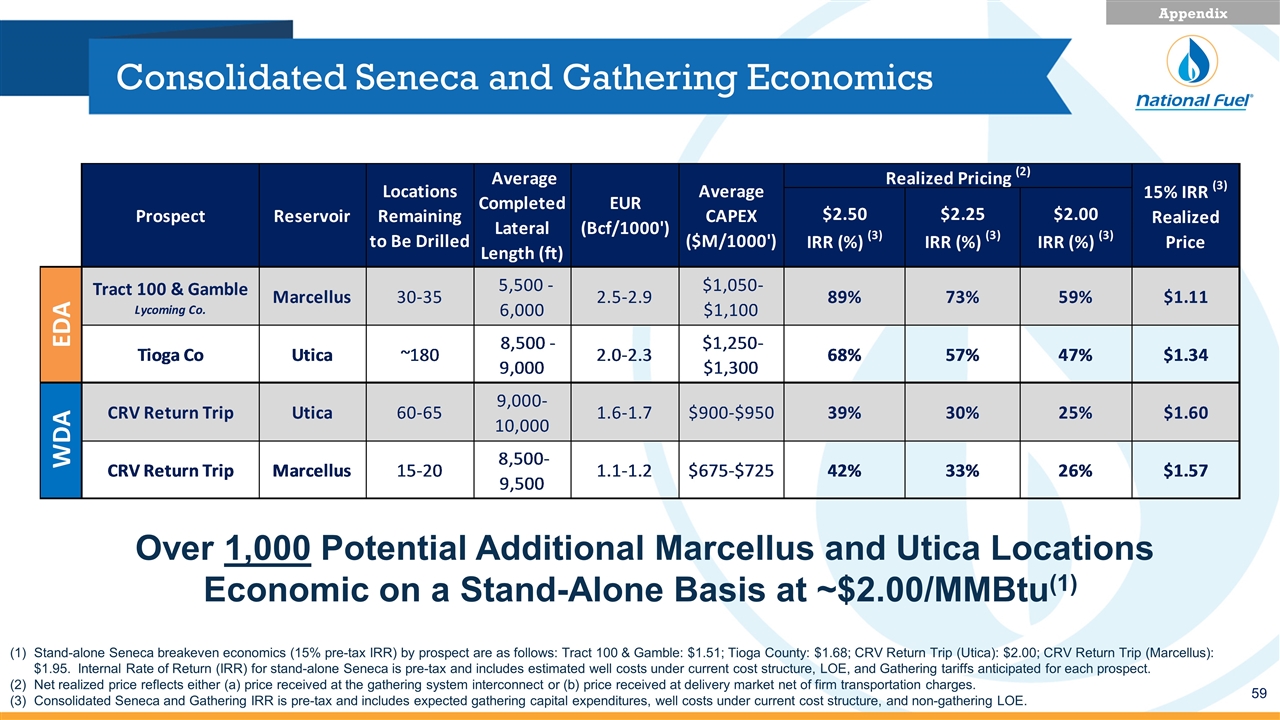

Consolidated Seneca and Gathering Economics Stand-alone Seneca breakeven economics (15% pre-tax IRR) by prospect are as follows: Tract 100 & Gamble: $1.51; Tioga County: $1.68; CRV Return Trip (Utica): $2.00; CRV Return Trip (Marcellus): $1.95. Internal Rate of Return (IRR) for stand-alone Seneca is pre-tax and includes estimated well costs under current cost structure, LOE, and Gathering tariffs anticipated for each prospect. Net realized price reflects either (a) price received at the gathering system interconnect or (b) price received at delivery market net of firm transportation charges. Consolidated Seneca and Gathering IRR is pre-tax and includes expected gathering capital expenditures, well costs under current cost structure, and non-gathering LOE. Over 1,000 Potential Additional Marcellus and Utica Locations Economic on a Stand-Alone Basis at ~$2.00/MMBtu(1) Appendix

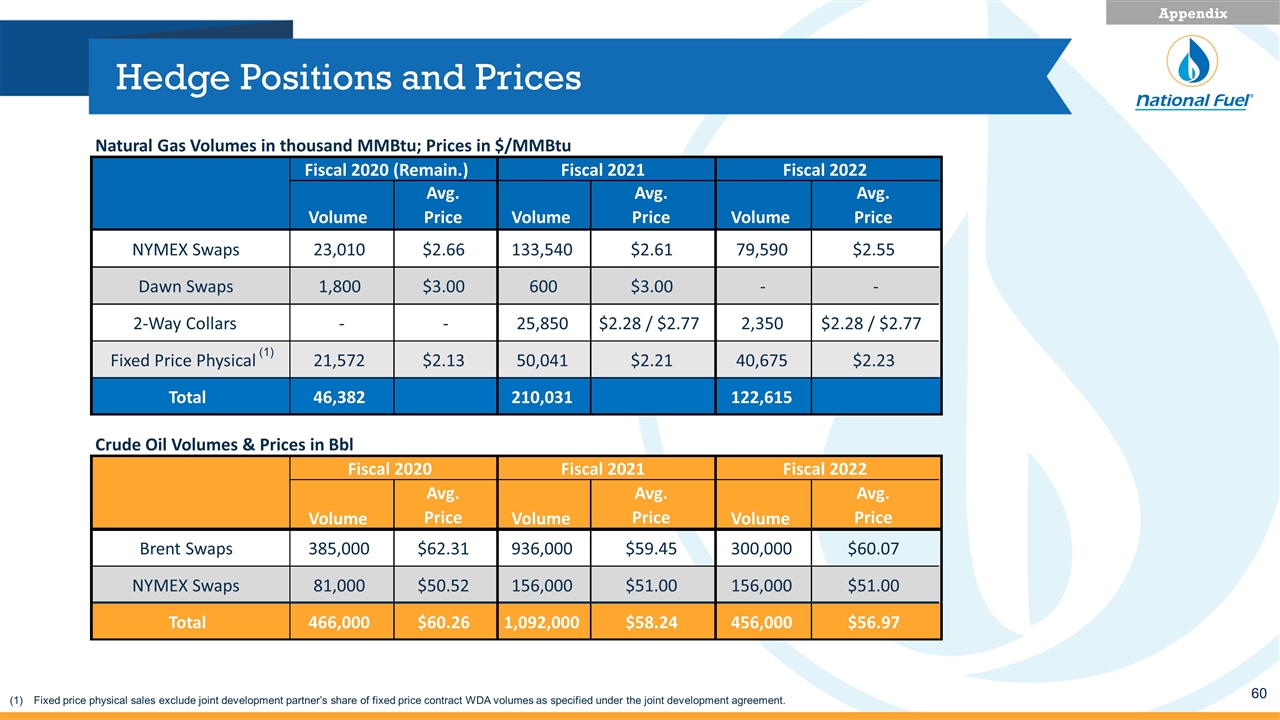

Natural Gas Volumes in thousand MMBtu; Prices in $/MMBtu Volume Avg. Price Volume Avg. Price Volume Avg. Price NYMEX Swaps 23,010 $2.66 133,540 $2.61 79,590 $2.55 Dawn Swaps 1,800 $3.00 600 $3.00 - - 2-Way Collars - - 25,850 $2.28 / $2.77 2,350 $2.28 / $2.77 Fixed Price Physical 21,572 $2.13 50,041 $2.21 40,675 $2.23 Total 46,382 210,031 122,615 Crude Oil Volumes & Prices in Bbl Avg. Avg. Avg. Price Price Price Brent Swaps 385,000 $62.31 936,000 $59.45 300,000 $60.07 NYMEX Swaps 81,000 $50.52 156,000 $51.00 156,000 $51.00 Total 466,000 $60.26 1,092,000 $58.24 456,000 $56.97 Fiscal 2022 Fiscal 2020 (Remain.) Fiscal 2021 Fiscal 2020 Volume Fiscal 2021 Volume Fiscal 2022 Volume Hedge Positions and Prices Fixed price physical sales exclude joint development partner’s share of fixed price contract WDA volumes as specified under the joint development agreement. Appendix (1)

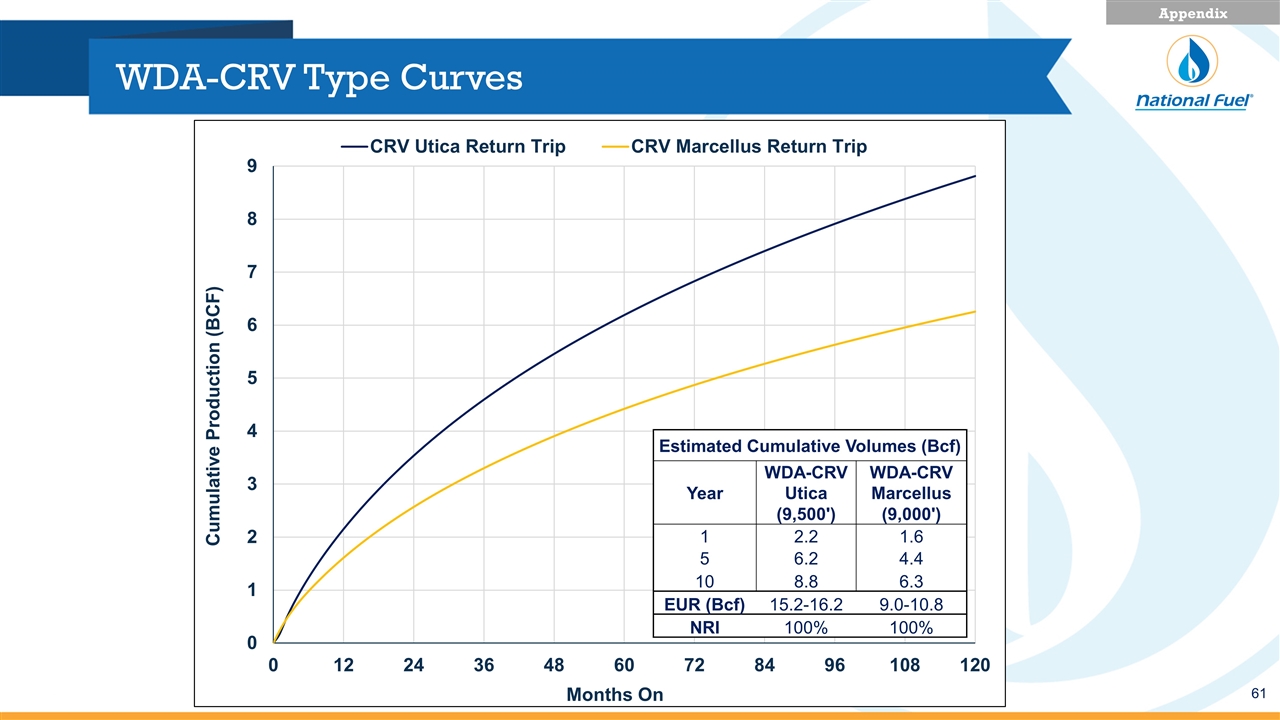

WDA-CRV Type Curves Estimated Cumulative Volumes (Bcf) Year WDA-CRV Utica (9,500') WDA-CRV Marcellus (9,000') 1 2.2 1.6 5 6.2 4.4 10 8.8 6.3 EUR (Bcf) 15.2-16.2 9.0-10.8 NRI 100% 100% Appendix

EDA Type Curves Appendix Estimated Cumulative Volumes (Bcf) Year Lycoming Marcellus (5,800') Tioga Utica (8,700') 1 3.2 5.3 5 8.6 12.6 10 11.1 15.5 EUR (Bcf) 14.5-16.8 17.4-20.0 NRI 84% 82-87%

Firm Transportation Commitments Volume (Dth/d) Production Source Delivery Market Demand Charges ($/Dth) Gas Marketing Strategy Northeast Supply Diversification Tennessee Gas Pipeline Niagara Expansion TGP & NFG - Supply Leidy South / FM100 WMB – Transco; NFG - Supply Target in-service: late 2021 50,000 158,000 EDA – Tioga WDA – CRV WDA – CRV EDA - Lycoming 12,000 Canada (Dawn) Canada (Dawn) TETCO (SE Pa.) $0.50 (3rd party) NFG pipelines = $0.24 3rd party = $0.43 $0.12 (NFG pipelines) Firm Sales Contracts Dawn/NYMEX+ 10 years Currently In-Service(1) Future Capacity Firm Sales Contracts Dawn/NYMEX+ 8 to 15 years Atlantic Sunrise WMB - Transco 189,405 EDA - Lycoming Mid-Atlantic/ Southeast $0.73 (3rd party) Firm Sales Contracts NYMEX+ First 5 years 330,000 Transco Zone 6 Competitive with other expansion project rates in Seneca’s portfolio Seneca to pursue firm sales contracts as project development progresses Appendix Tioga County Extension NFG - Empire EDA – Tioga Utilize acquired firm sales and pursue additional firm sales as needed 200,000 TGP 200 (NY) / Canada (Dawn) $0.23 (NFG pipelines) Dominion EDA – Tioga Utilize acquired firm sales and pursue additional firm sales as needed Station 219 $0.14 (3rd Party) Northern Access NFG – Supply and Empire WDA – CRV 350,000 140,000 Canada (Dawn) TGP 200 (NY) NFG pipelines = $0.50 3rd party = $0.21 $0.38 (NFG pipelines) Seneca to pursue firm sales contracts as project development progresses (1) 100,000 Dth/d of capacity on Dominion is not initially expected to be utilized regularly and provides optionality to fill Leidy South. 25,000 75,000(1) In-Basin $0.14 (3rd Party)

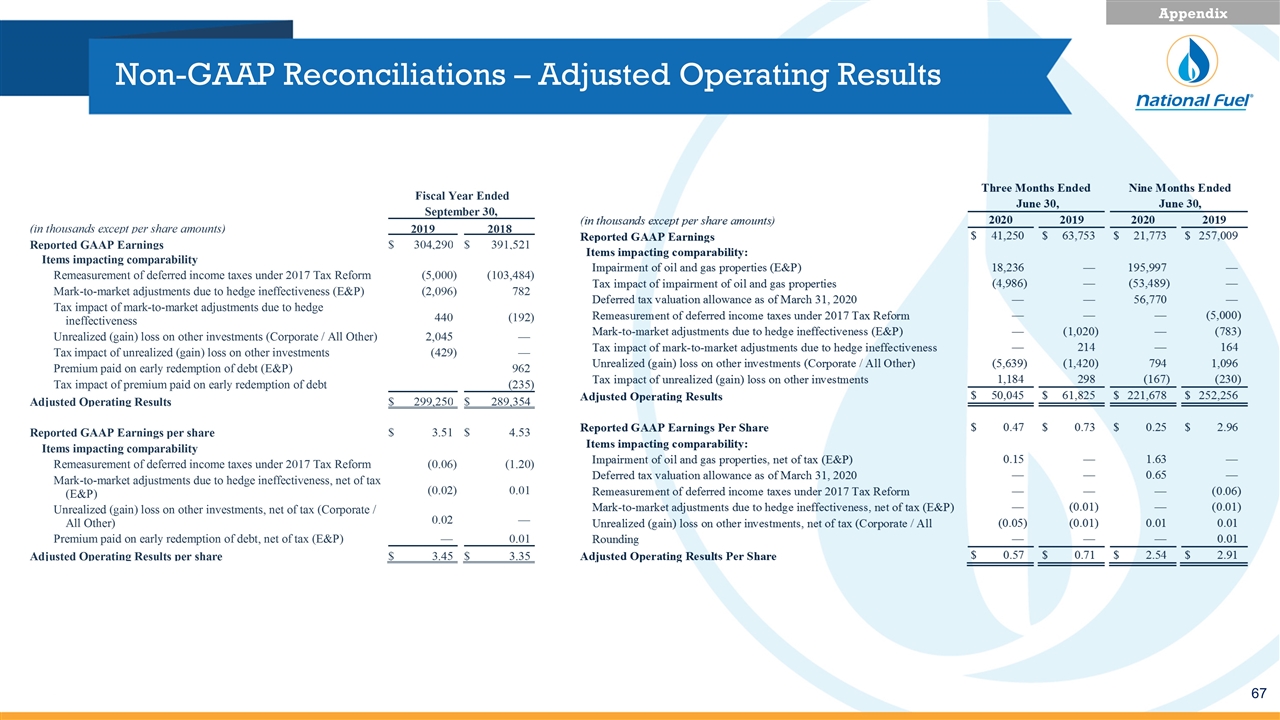

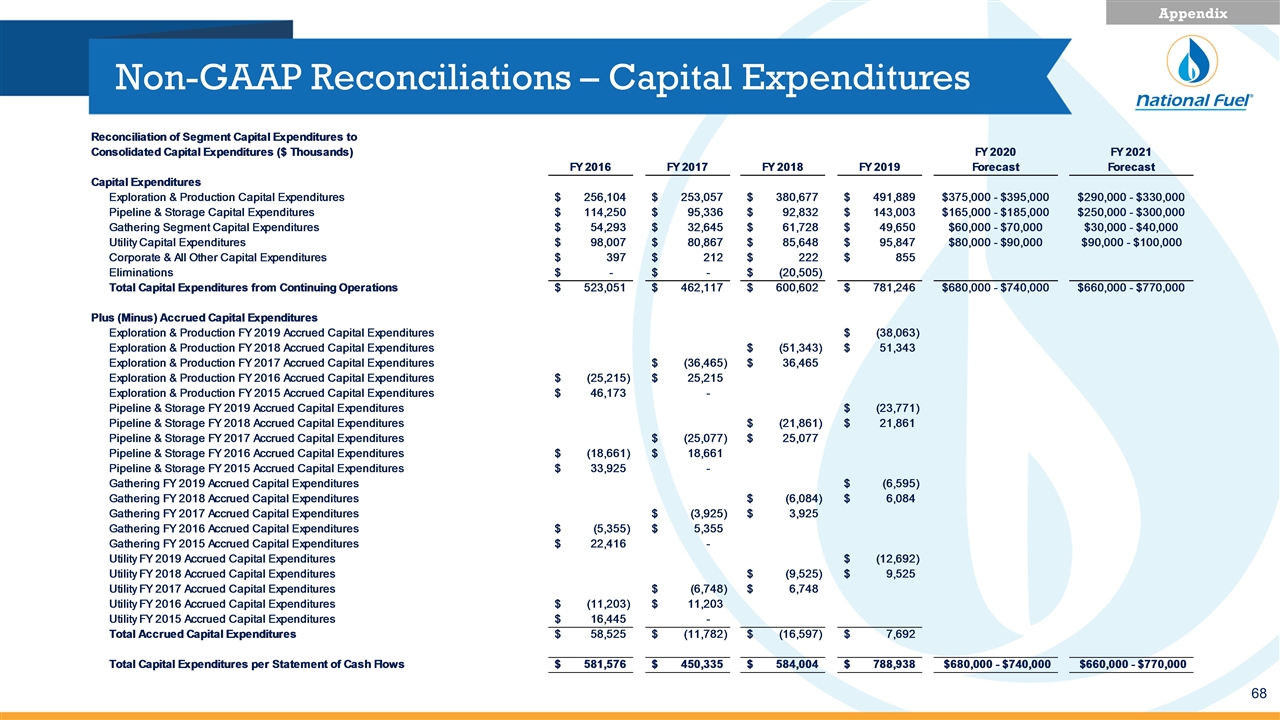

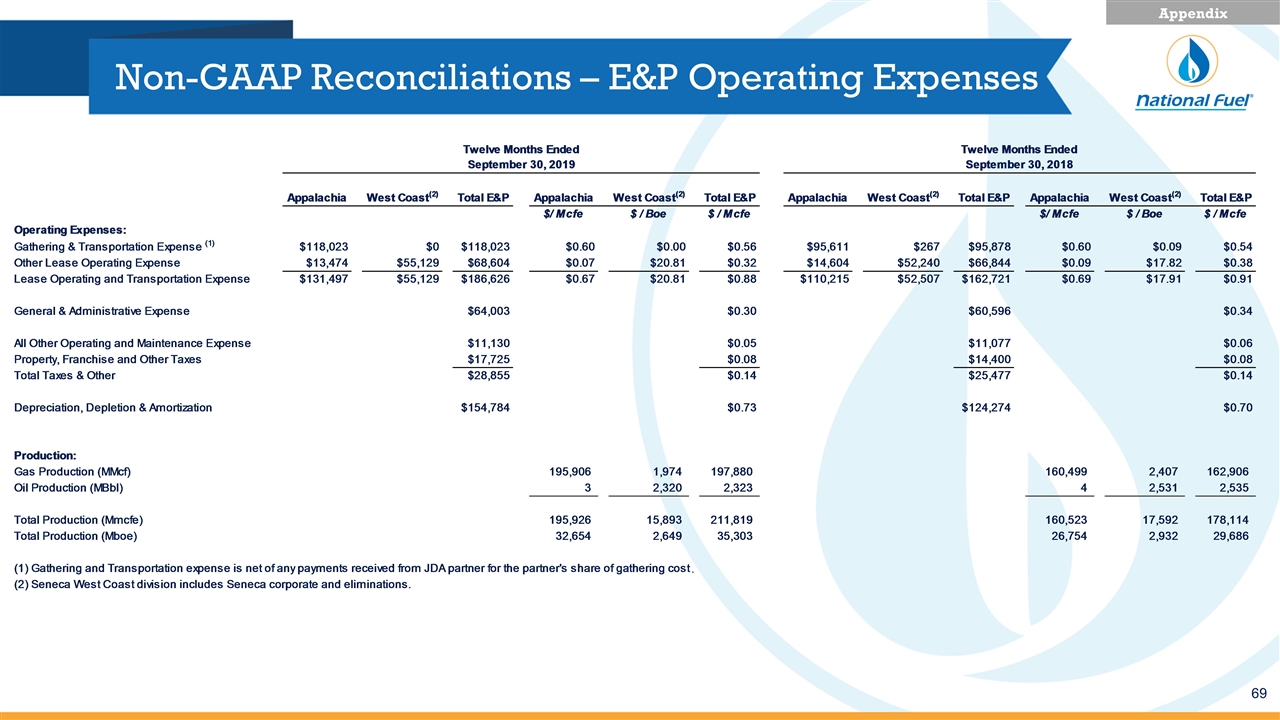

Comparable GAAP Financial Measure Slides & Reconciliations This presentation contains certain non-GAAP financial measures. For pages that contain non-GAAP financial measures, pages containing the most directly comparable GAAP financial measures and reconciliations are provided in the slides that follow. The Company believes that its non-GAAP financial measures are useful to investors because they provide an alternative method for assessing the Company’s ongoing operating results and for comparing the Company’s financial performance to other companies. The Company’s management uses these non-GAAP financial measures for the same purpose, and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not meant to be a substitute for financial measures prepared in accordance with GAAP. Management defines Adjusted Operating Results as reported GAAP earnings before items impacting comparability. Management, defines Adjusted EBITDA as reported GAAP earnings before the following items: interest expense, income taxes, depreciation, depletion and amortization interest and other income, impairments, and other items reflected in operating income that impact comparability. Management defines Free Cash Flow as Funds from Operations less Capital Expenditures. The Company is unable to provide a reconciliation of projected Free Cash Flow as described in this presentation to their respective comparable financial measure calculated in accordance with GAAP without unreasonable efforts. This is due to our inability to calculate the comparable GAAP projected metrics, including operating income and total production costs, given the unknown effect, timing, and potential significance of certain income statement items. The Company’s fiscal 2020 earnings guidance range does not include the impact of certain items that impacted the comparability of earnings during the nine months ended June 30, 2020. While the Company expects to incur additional ceiling test impairment charges in the last quarter of fiscal 2020, the amount of these charges is not reasonably determinable at this time. The amount of any ceiling test charge is determined at the end of the applicable quarter and will depend on many factors, including additions to or subtractions from proved reserves, fluctuations in oil and gas prices, and income tax effects related to the differences between the book and tax basis of the Company’s oil and gas properties. Some or all of these factors are likely to be significant. Because the expected ceiling test impairment charges and other potential items impacting comparability are not reasonably determinable at this time, the Company is unable to provide earnings guidance other than on a non-GAAP basis that excludes these items. Appendix

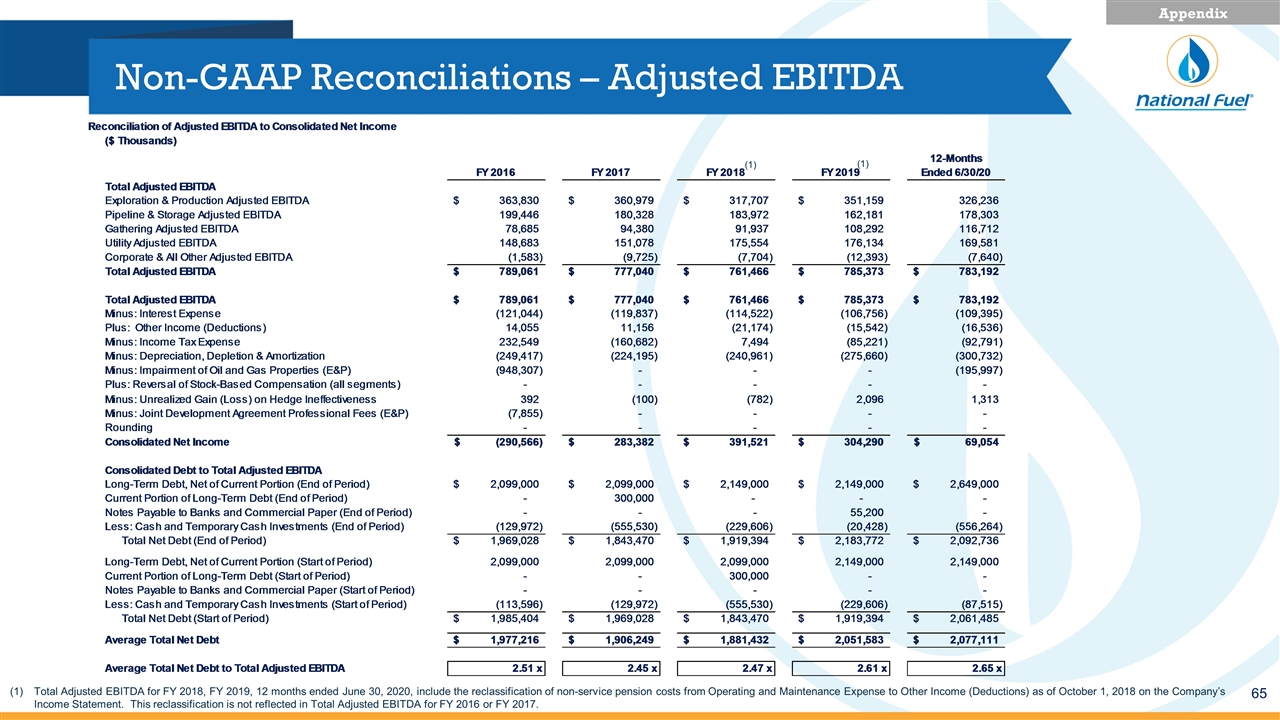

Non-GAAP Reconciliations – Adjusted EBITDA Appendix Total Adjusted EBITDA for FY 2018, FY 2019, 12 months ended June 30, 2020, include the reclassification of non-service pension costs from Operating and Maintenance Expense to Other Income (Deductions) as of October 1, 2018 on the Company’s Income Statement. This reclassification is not reflected in Total Adjusted EBITDA for FY 2016 or FY 2017. (1) (1)

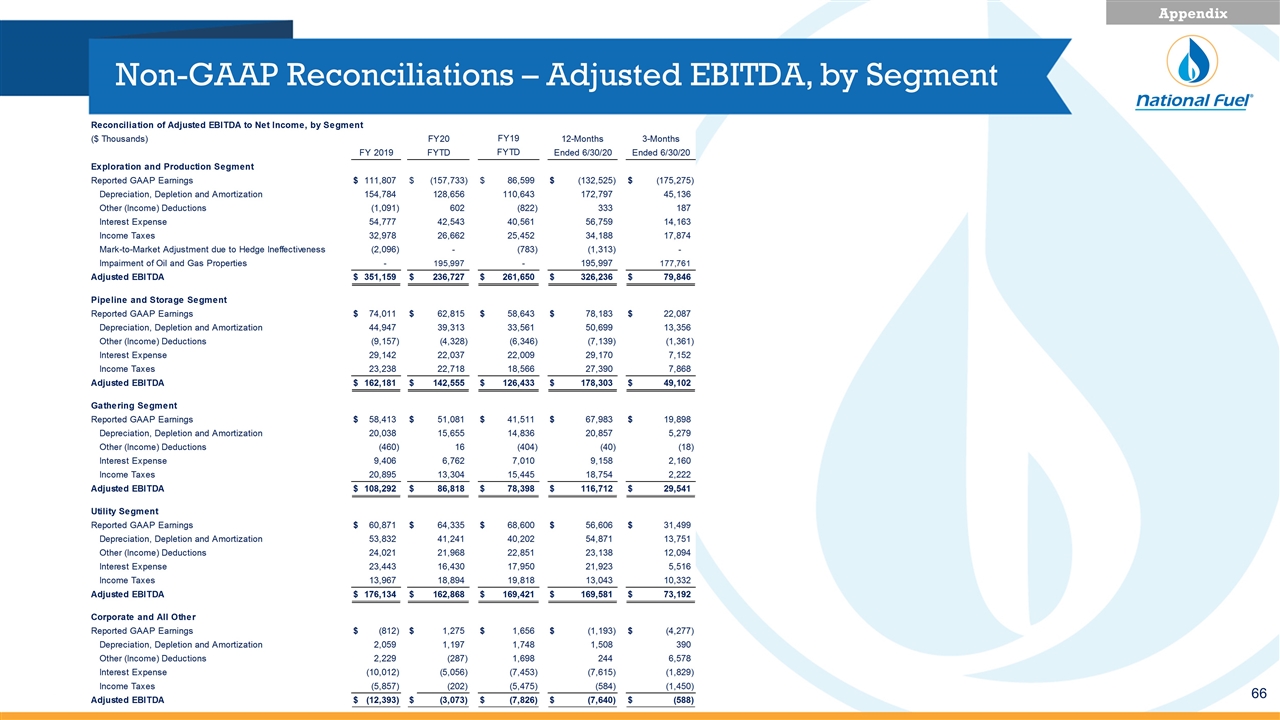

Non-GAAP Reconciliations – Adjusted EBITDA, by Segment Appendix

Non-GAAP Reconciliations – Adjusted Operating Results Appendix

Non-GAAP Reconciliations – Capital Expenditures Appendix

Non-GAAP Reconciliations – E&P Operating Expenses Appendix .