Investor Presentation Fiscal 2024 – 3rd Quarter Update July 31, 2024 Exhibit 99

National Fuel Gas Company Company Overview (3) Why National Fuel? (7) Business Updates (12) Supplemental Information Segment Information (19) Rate Case Overview (45) Guidance & Other Financial Information (47)

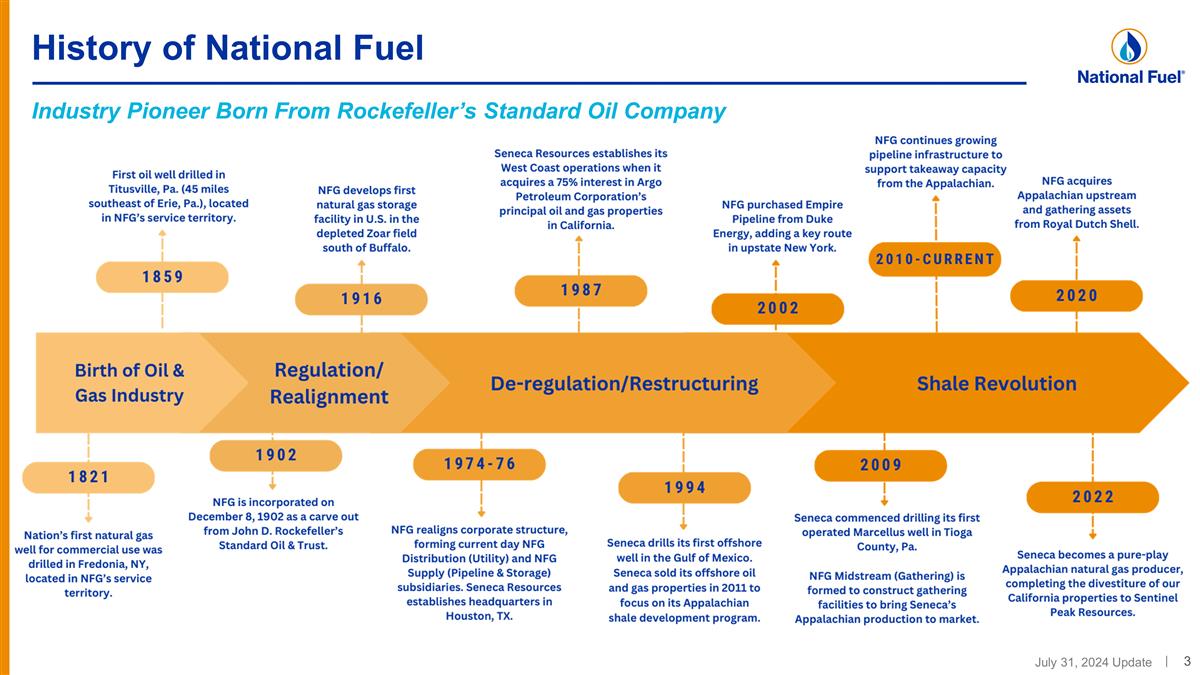

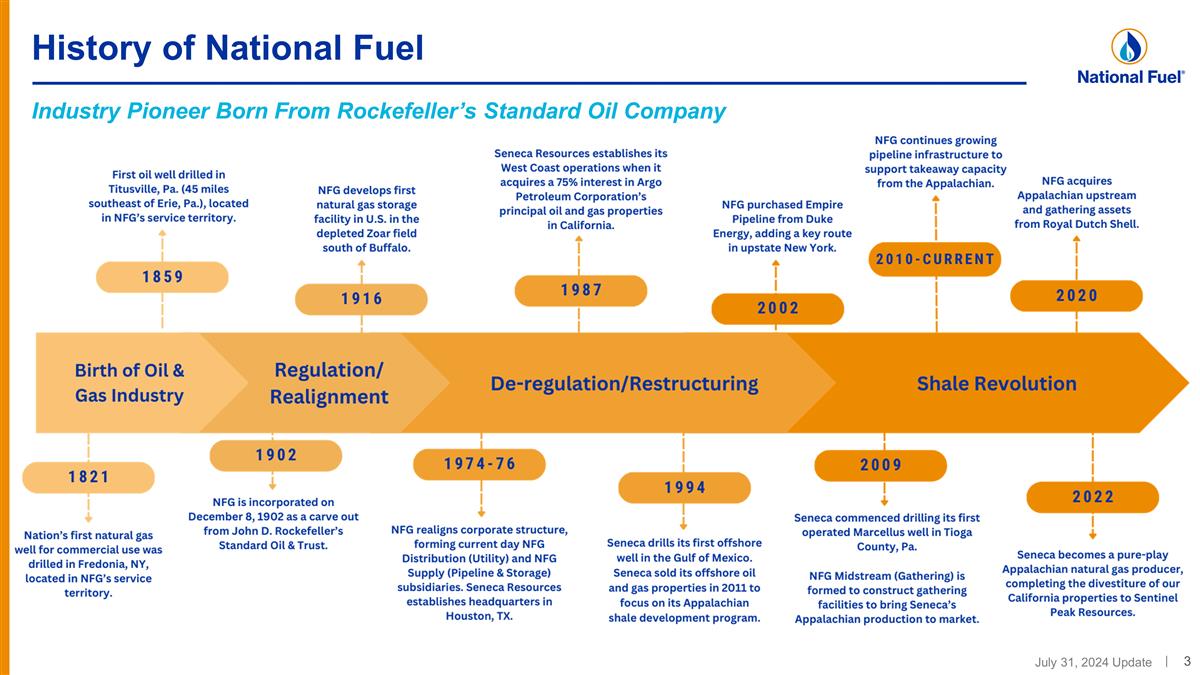

History of National Fuel Industry Pioneer Born From Rockefeller’s Standard Oil Company

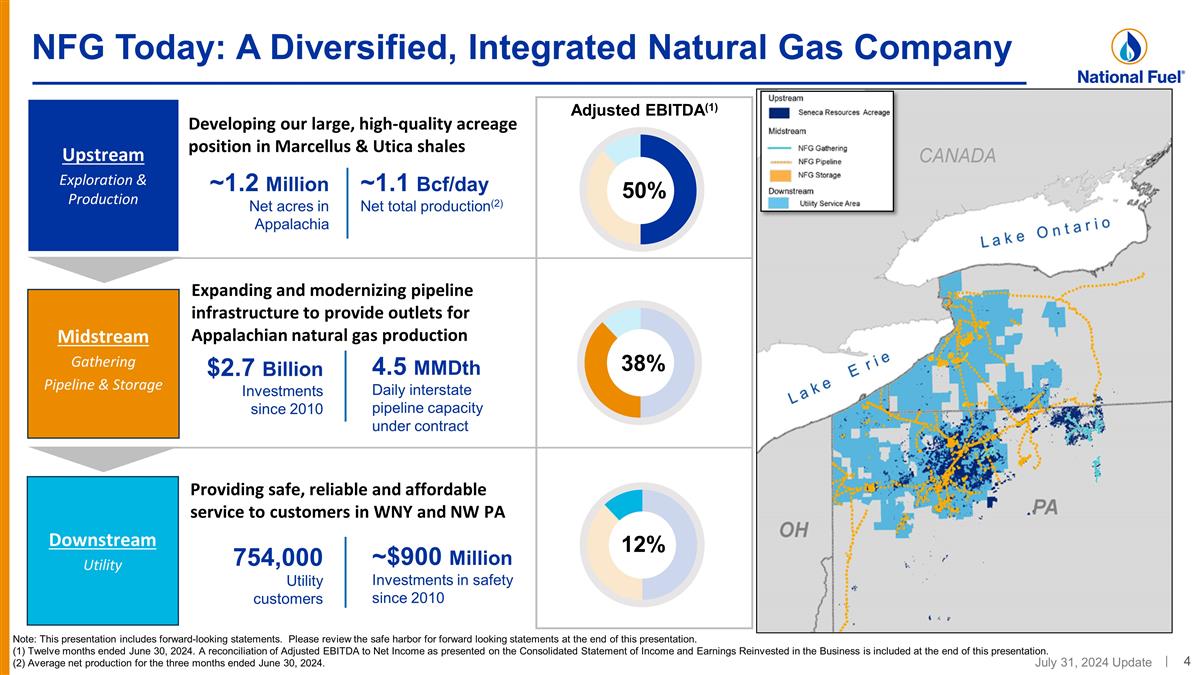

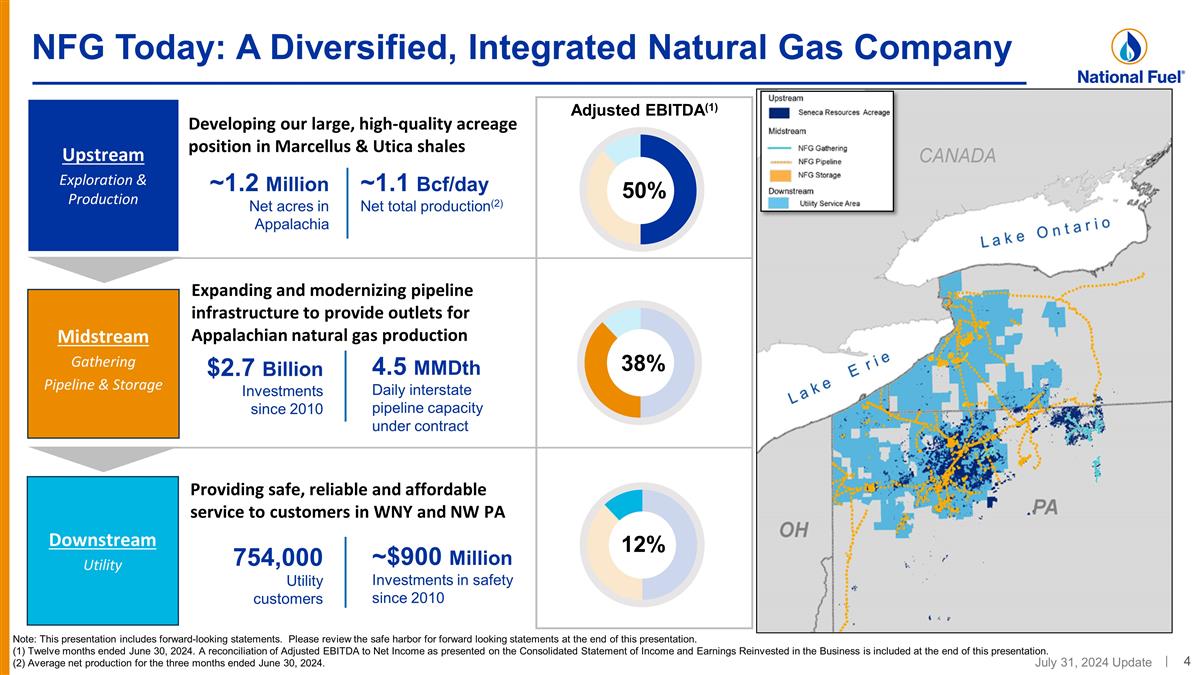

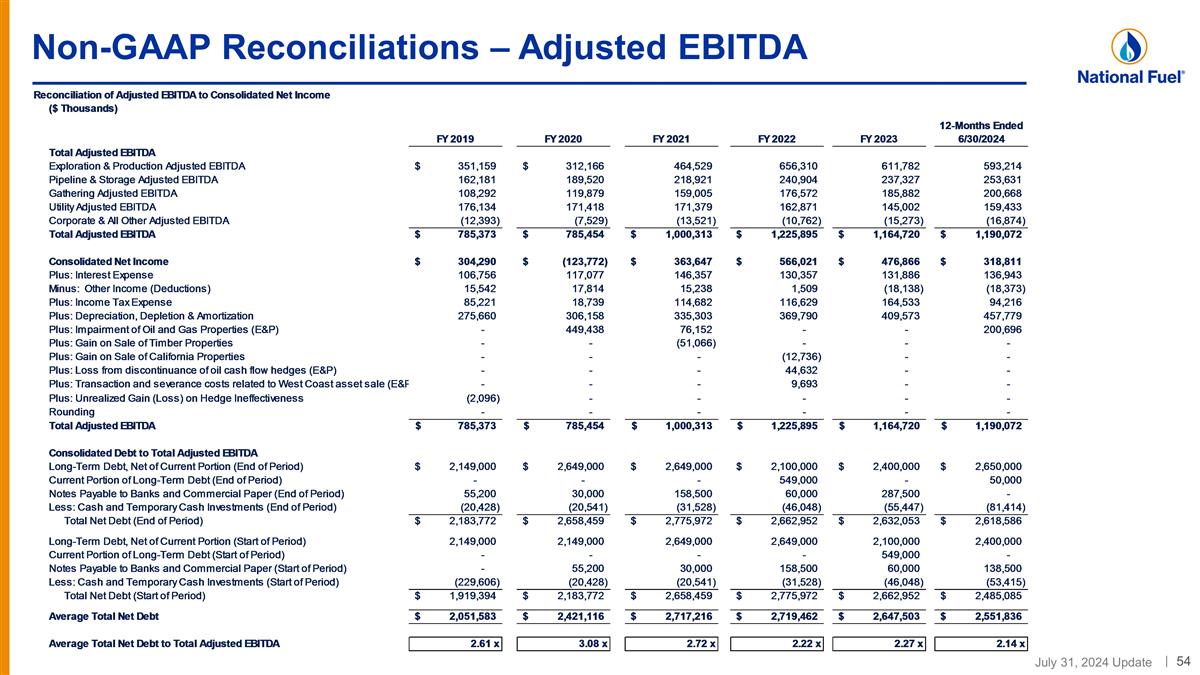

NFG Today: A Diversified, Integrated Natural Gas Company Developing our large, high-quality acreage position in Marcellus & Utica shales Providing safe, reliable and affordable service to customers in WNY and NW PA Upstream Exploration & Production Midstream Gathering Pipeline & Storage Downstream Utility Expanding and modernizing pipeline infrastructure to provide outlets for Appalachian natural gas production ~1.2 Million Net acres in Appalachia ~1.1 Bcf/day Net total production(2) $2.7 Billion Investments since 2010 4.5 MMDth Daily interstate pipeline capacity under contract 754,000 Utility customers ~$900 Million Investments in safety since 2010 Note: This presentation includes forward-looking statements. Please review the safe harbor for forward looking statements at the end of this presentation. (1) Twelve months ended June 30, 2024. A reconciliation of Adjusted EBITDA to Net Income as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end of this presentation. (2) Average net production for the three months ended June 30, 2024. 50% 38% 12% Adjusted EBITDA(1)

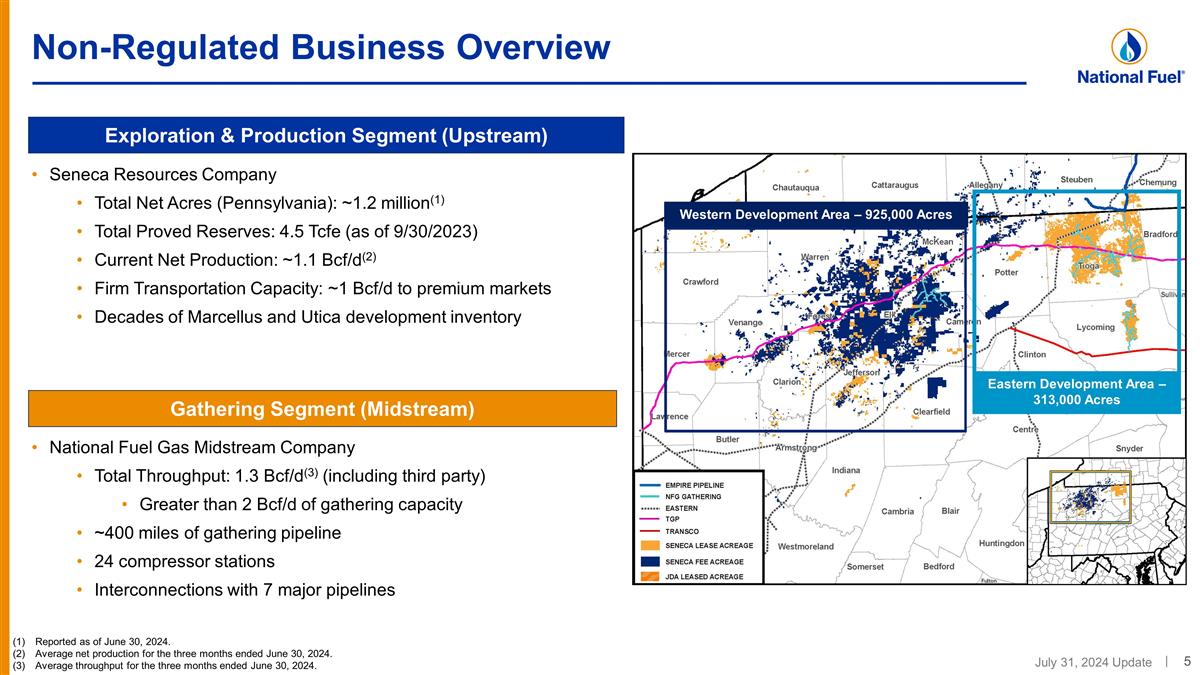

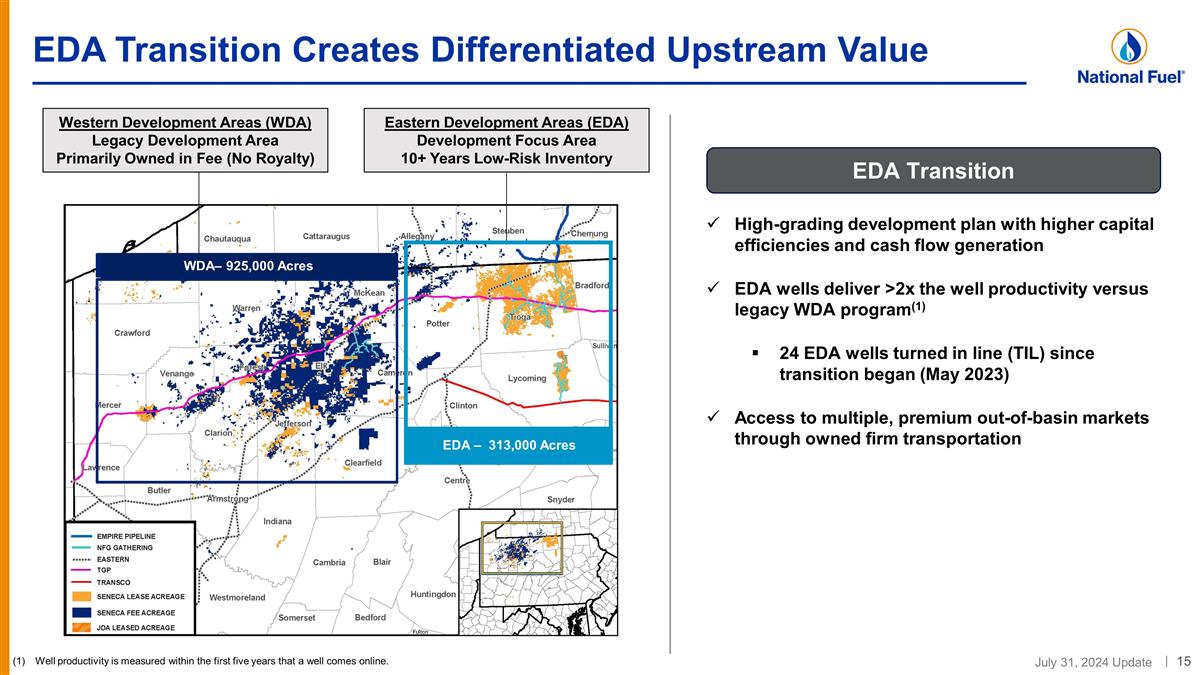

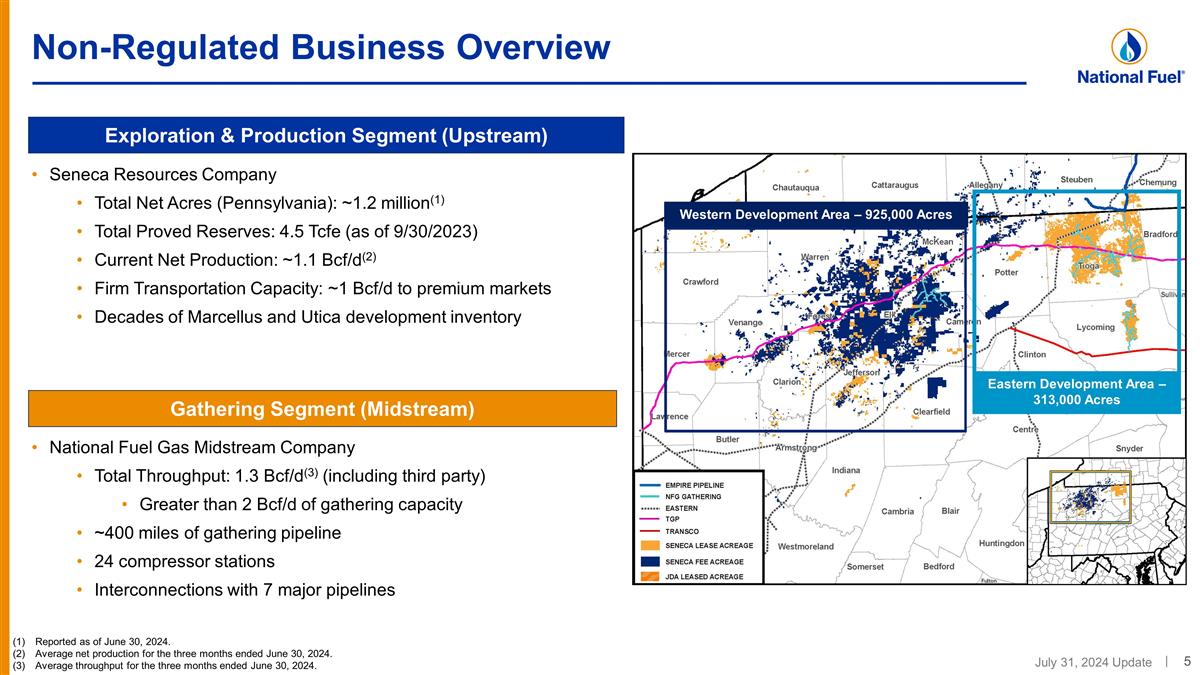

Non-Regulated Business Overview Exploration & Production Segment (Upstream) Gathering Segment (Midstream) Seneca Resources Company Total Net Acres (Pennsylvania): ~1.2 million(1) Total Proved Reserves: 4.5 Tcfe (as of 9/30/2023) Current Net Production: ~1.1 Bcf/d(2) Firm Transportation Capacity: ~1 Bcf/d to premium markets Decades of Marcellus and Utica development inventory National Fuel Gas Midstream Company Total Throughput: 1.3 Bcf/d(3) (including third party) Greater than 2 Bcf/d of gathering capacity ~400 miles of gathering pipeline 24 compressor stations Interconnections with 7 major pipelines Western Development Area – 925,000 Acres Eastern Development Area – 313,000 Acres Reported as of June 30, 2024. Average net production for the three months ended June 30, 2024. Average throughput for the three months ended June 30, 2024.

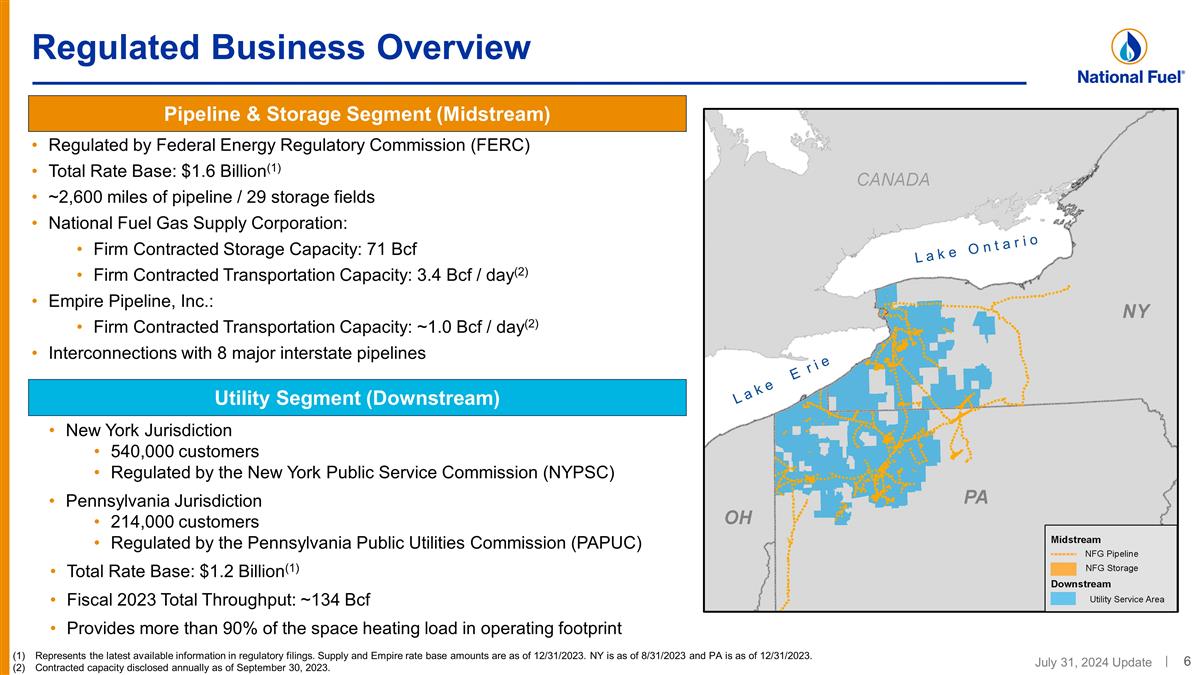

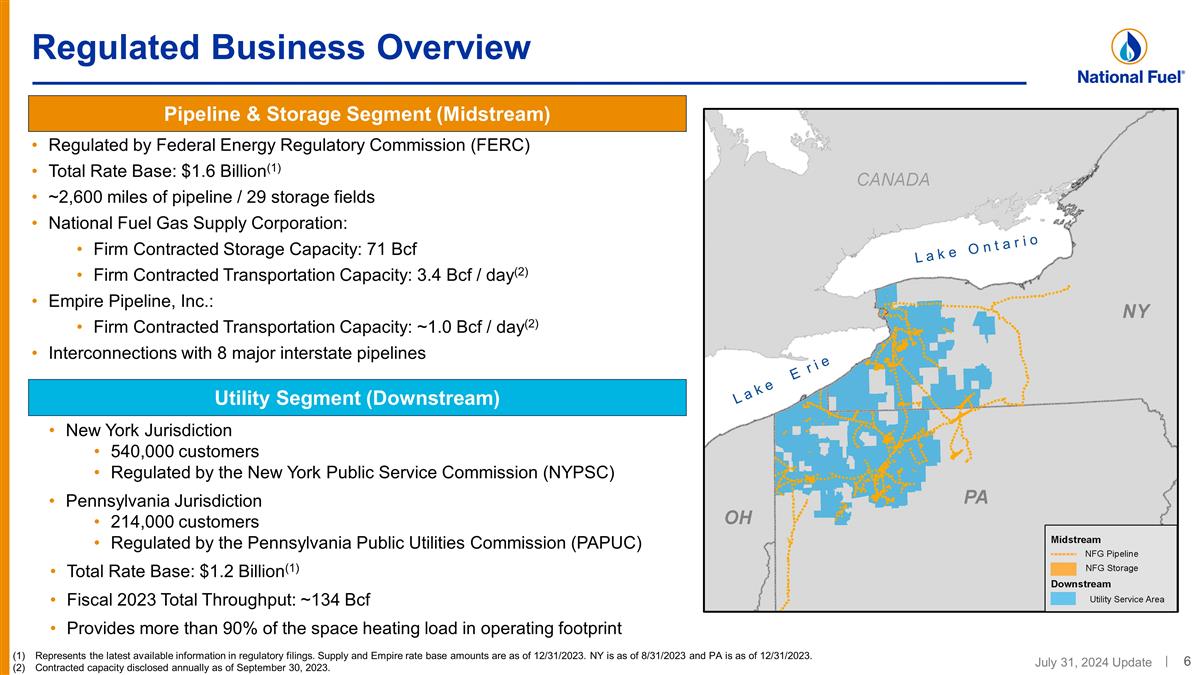

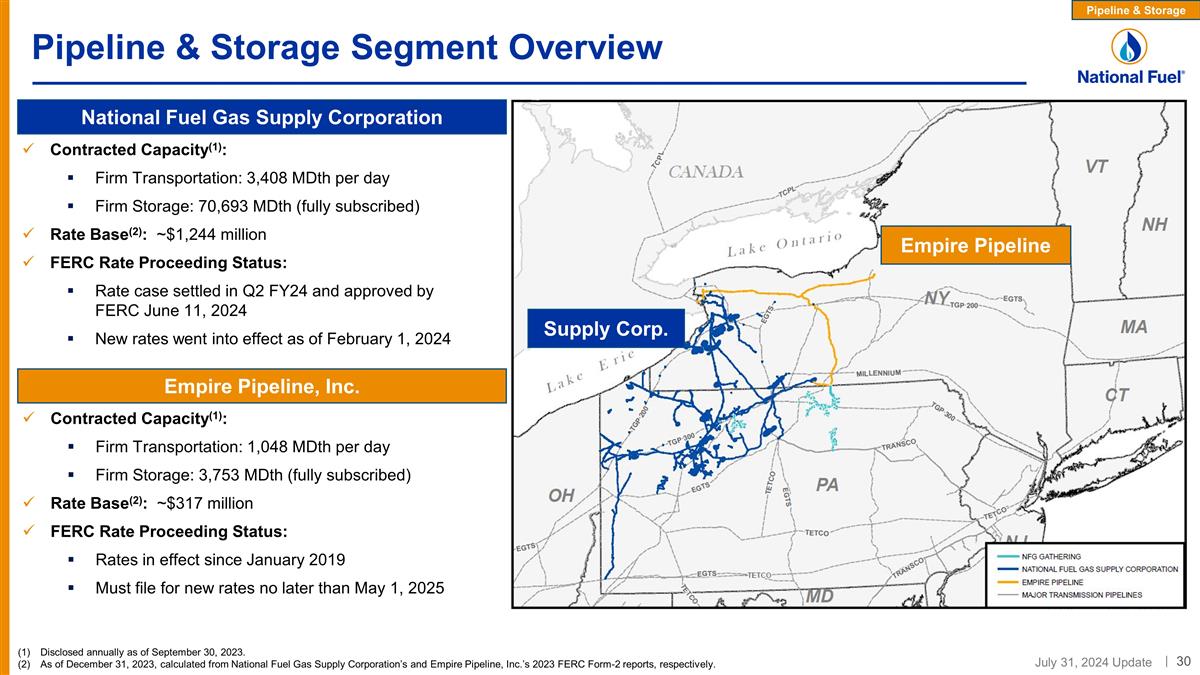

Regulated Business Overview Pipeline & Storage Segment (Midstream) Utility Segment (Downstream) Regulated by Federal Energy Regulatory Commission (FERC) Total Rate Base: $1.6 Billion(1) ~2,600 miles of pipeline / 29 storage fields National Fuel Gas Supply Corporation: Firm Contracted Storage Capacity: 71 Bcf Firm Contracted Transportation Capacity: 3.4 Bcf / day(2) Empire Pipeline, Inc.: Firm Contracted Transportation Capacity: ~1.0 Bcf / day(2) Interconnections with 8 major interstate pipelines New York Jurisdiction 540,000 customers Regulated by the New York Public Service Commission (NYPSC) Pennsylvania Jurisdiction 214,000 customers Regulated by the Pennsylvania Public Utilities Commission (PAPUC) Total Rate Base: $1.2 Billion(1) Fiscal 2023 Total Throughput: ~134 Bcf Provides more than 90% of the space heating load in operating footprint Represents the latest available information in regulatory filings. Supply and Empire rate base amounts are as of 12/31/2023. NY is as of 8/31/2023 and PA is as of 12/31/2023. Contracted capacity disclosed annually as of September 30, 2023.

Why National Fuel? Optimized capital allocation Lower cost of capital Operational synergies Improved profitability Targeting significant rate base growth from system modernization and expansion High-grading upstream development and increasing capital efficiencies Responsibly Reduce Emissions Continued progress toward emissions reduction targets Enhanced GHG disclosures on sustainability initiatives 122 years of dividend payments 54 years of dividend increases New share repurchase program Long-Standing History of Shareholder Returns Responsibly Reducing Emissions Visibility on Long-Term EPS & FCF Growth Strong Integrated Returns

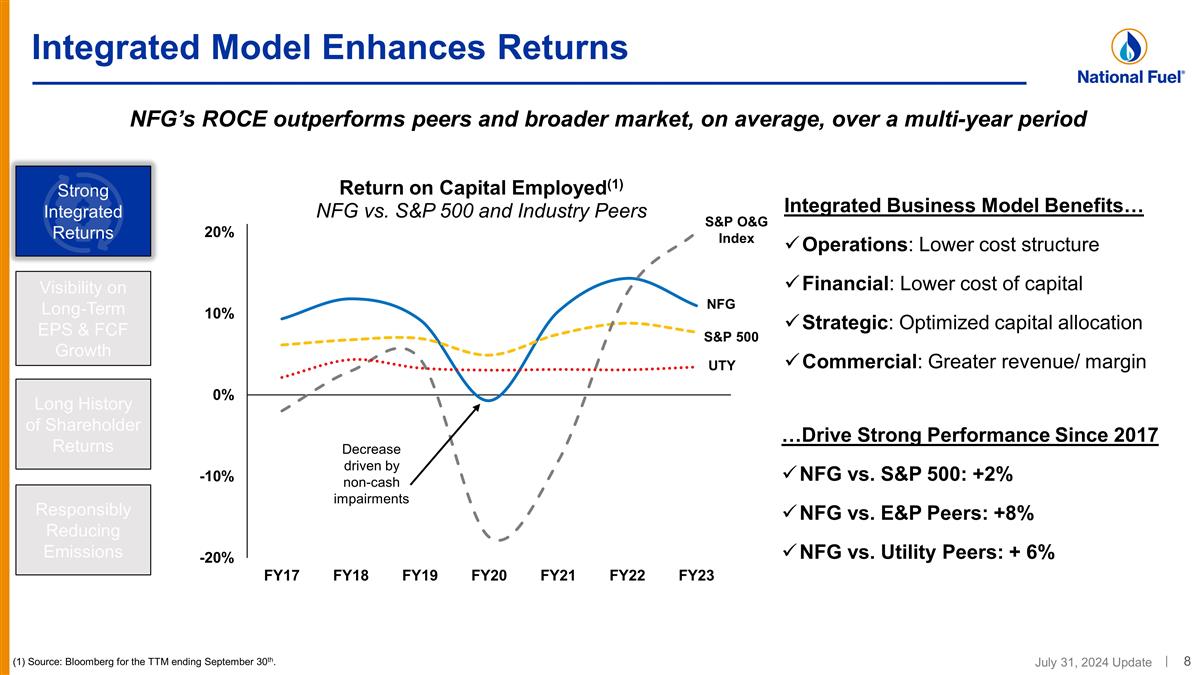

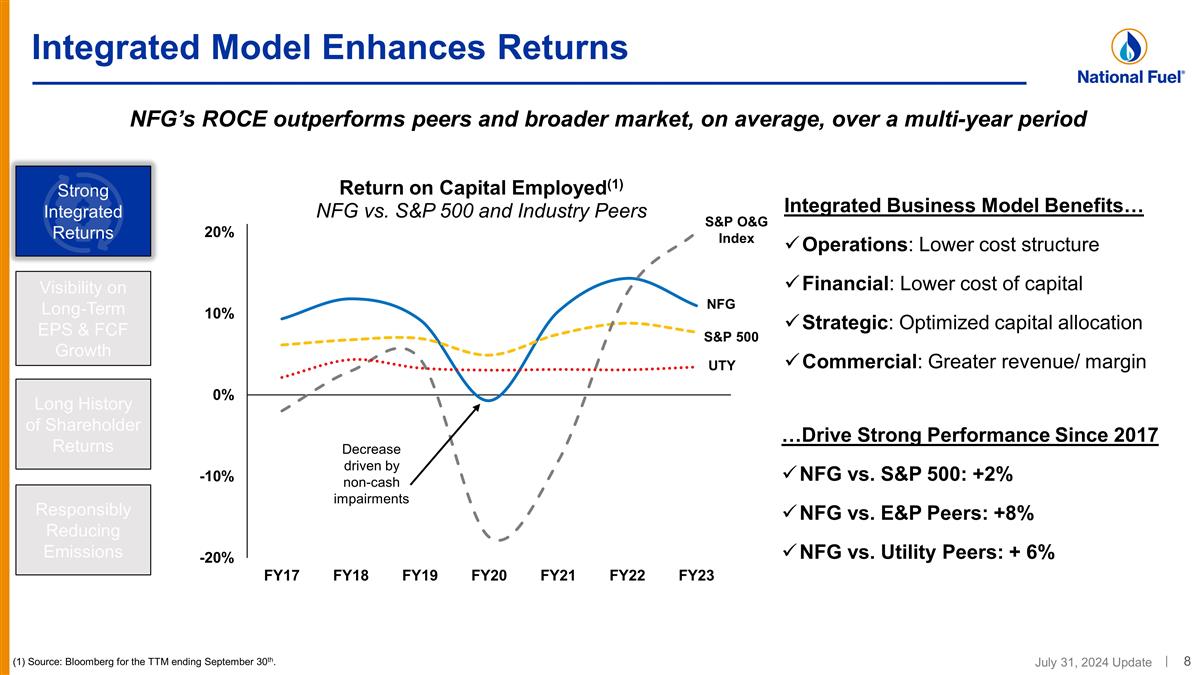

Integrated Model Enhances Returns Integrated Business Model Benefits… Operations: Lower cost structure Financial: Lower cost of capital Strategic: Optimized capital allocation Commercial: Greater revenue/ margin Strong Integrated Returns Visibility on Long-Term EPS & FCF Growth Responsibly Reducing Emissions Long History of Shareholder Returns (1) Source: Bloomberg for the TTM ending September 30th. …Drive Strong Performance Since 2017 NFG vs. S&P 500: +2% NFG vs. E&P Peers: +8% NFG vs. Utility Peers: + 6% NFG’s ROCE outperforms peers and broader market, on average, over a multi-year period Decrease driven by non-cash impairments S&P O&G Index NFG S&P 500 UTY

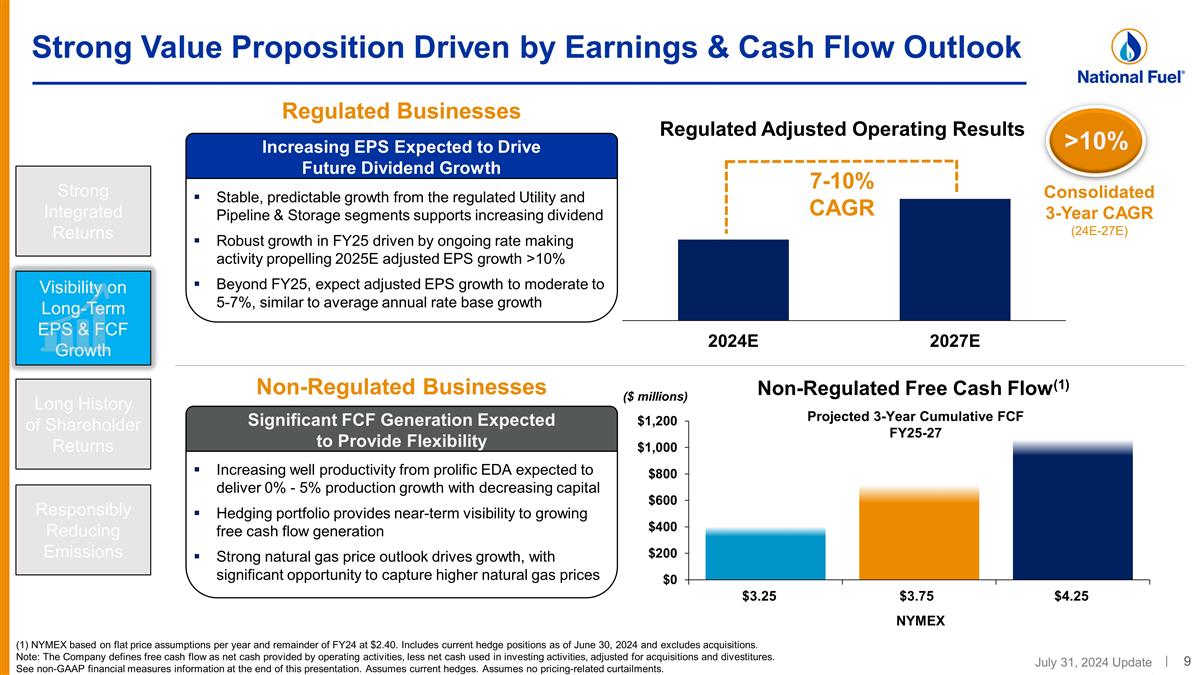

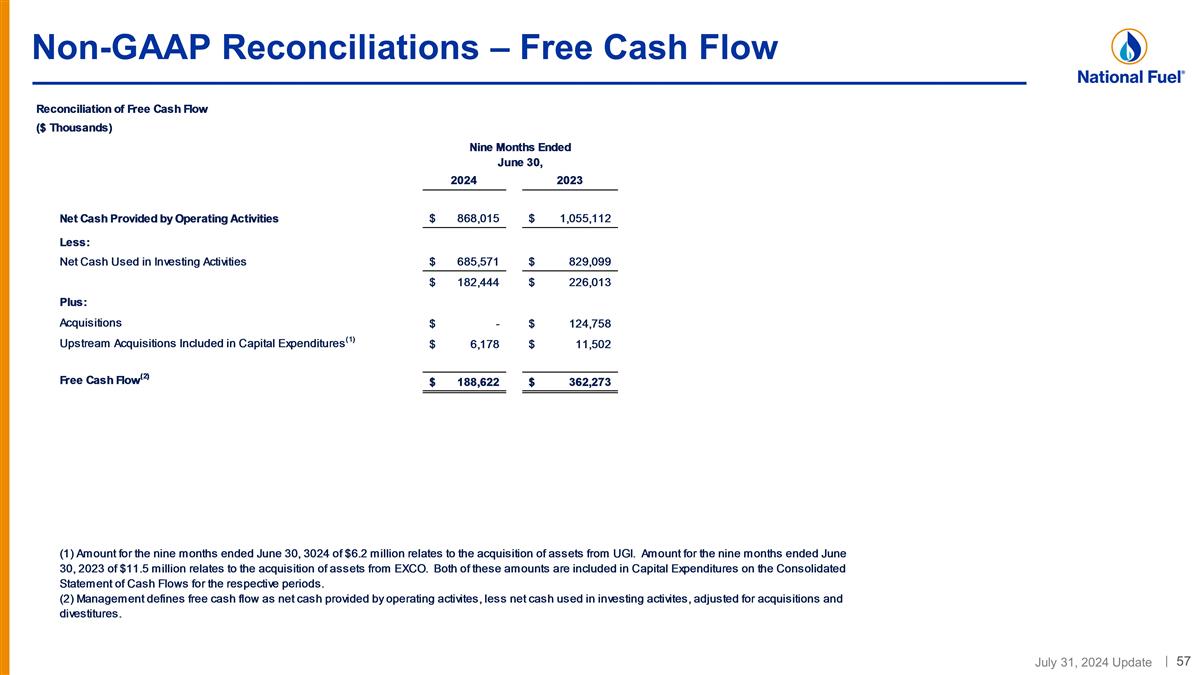

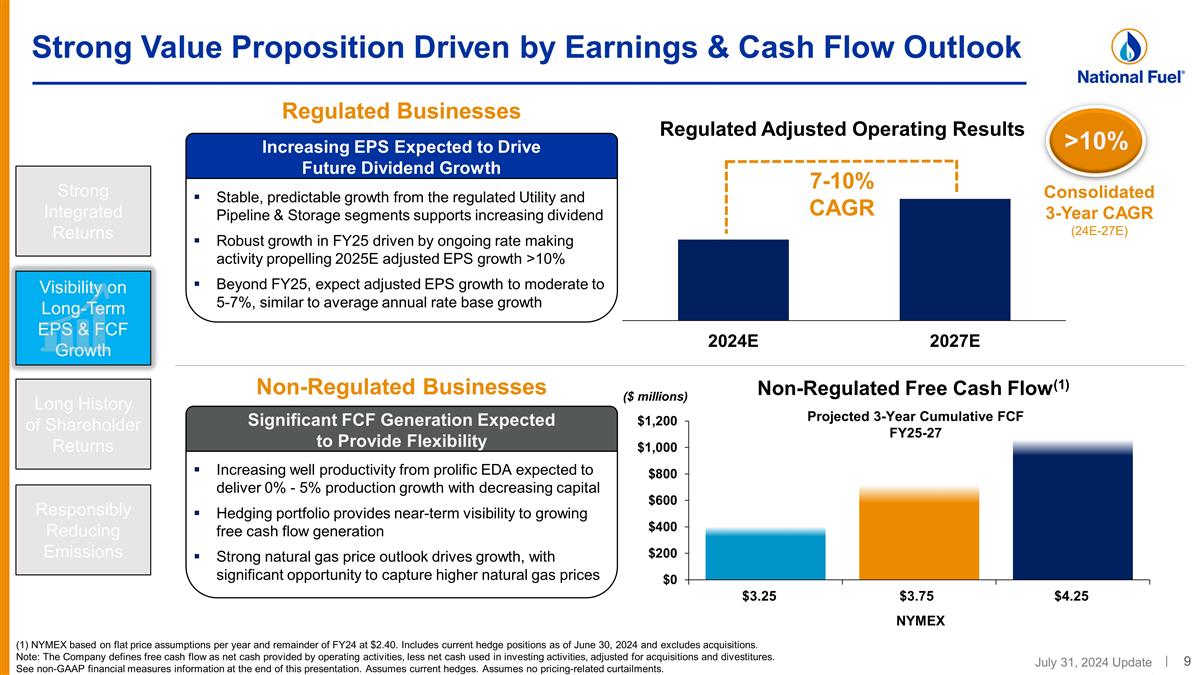

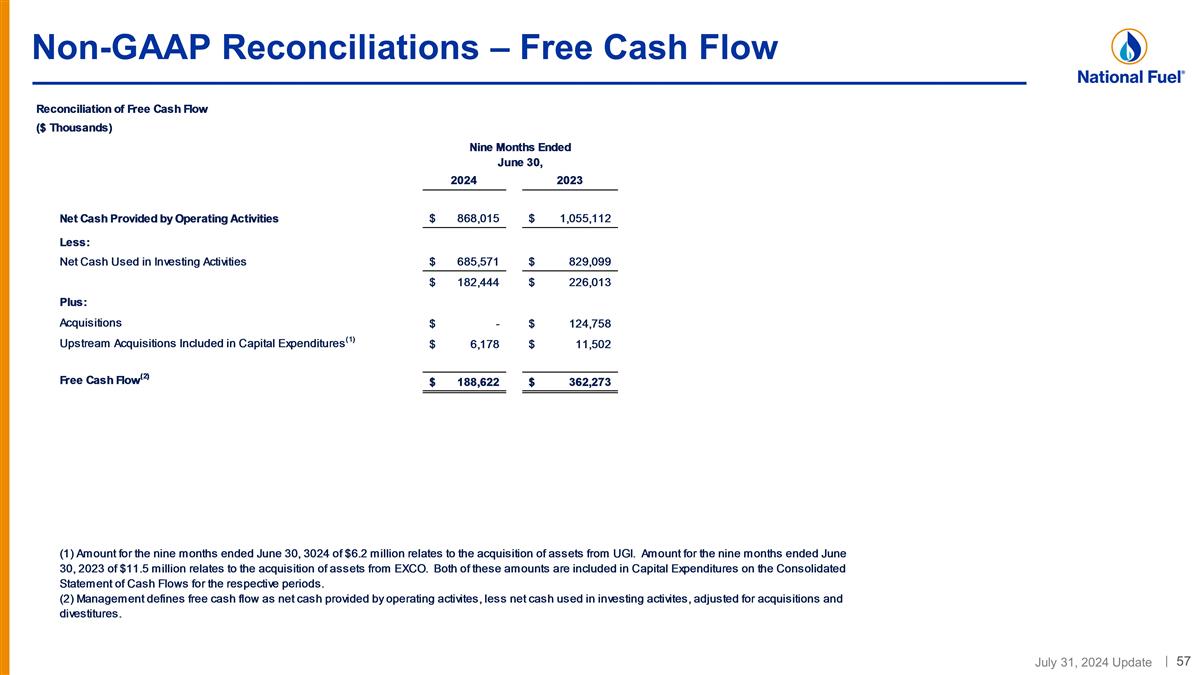

Strong Value Proposition Driven by Earnings & Cash Flow Outlook (1) NYMEX based on flat price assumptions per year and remainder of FY24 at $2.40. Includes current hedge positions as of June 30, 2024 and excludes acquisitions. Note: The Company defines free cash flow as net cash provided by operating activities, less net cash used in investing activities, adjusted for acquisitions and divestitures. See non-GAAP financial measures information at the end of this presentation. Assumes current hedges. Assumes no pricing-related curtailments. Non-Regulated Free Cash Flow(1) Strong Integrated Returns Visibility on Long-Term EPS & FCF Growth Responsibly Reducing Emissions Long History of Shareholder Returns 7-10% CAGR Regulated Adjusted Operating Results Increasing well productivity from prolific EDA expected to deliver 0% - 5% production growth with decreasing capital Hedging portfolio provides near-term visibility to growing free cash flow generation Strong natural gas price outlook drives growth, with significant opportunity to capture higher natural gas prices Significant FCF Generation Expected to Provide Flexibility Stable, predictable growth from the regulated Utility and Pipeline & Storage segments supports increasing dividend Robust growth in FY25 driven by ongoing rate making activity propelling 2025E adjusted EPS growth >10% Beyond FY25, expect adjusted EPS growth to moderate to 5-7%, similar to average annual rate base growth Increasing EPS Expected to Drive Future Dividend Growth Regulated Businesses Non-Regulated Businesses >10% NYMEX $3.25 $3.75 $4.25 ($ millions) Consolidated 3-Year CAGR (24E-27E)

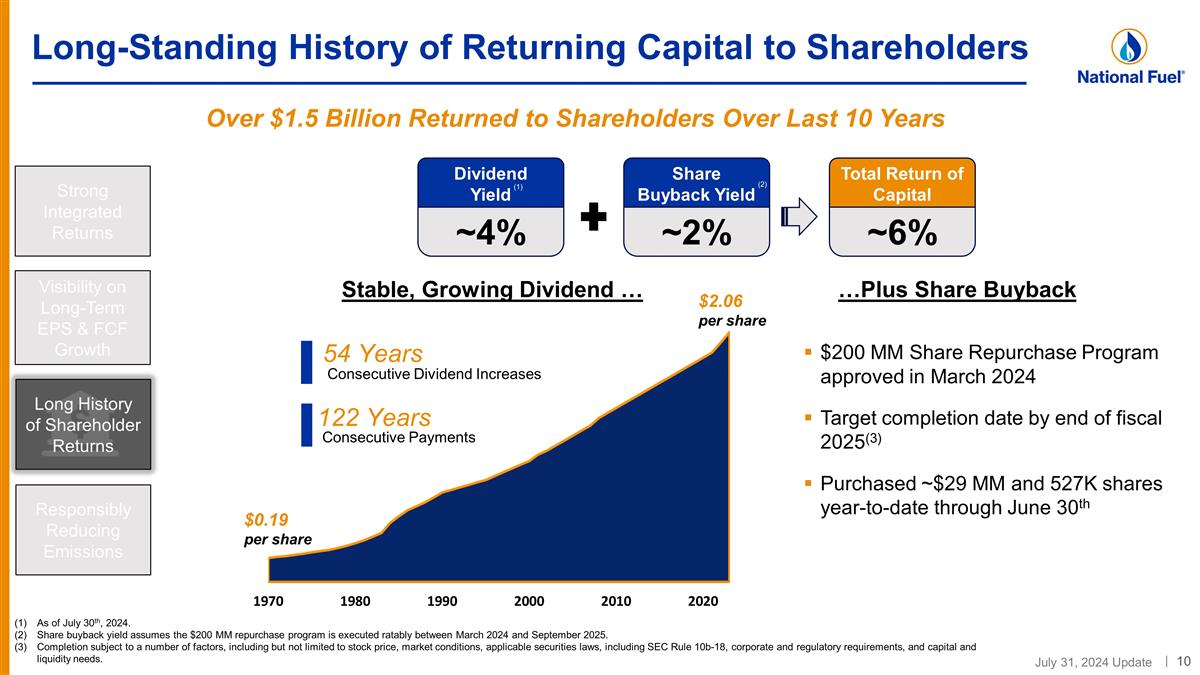

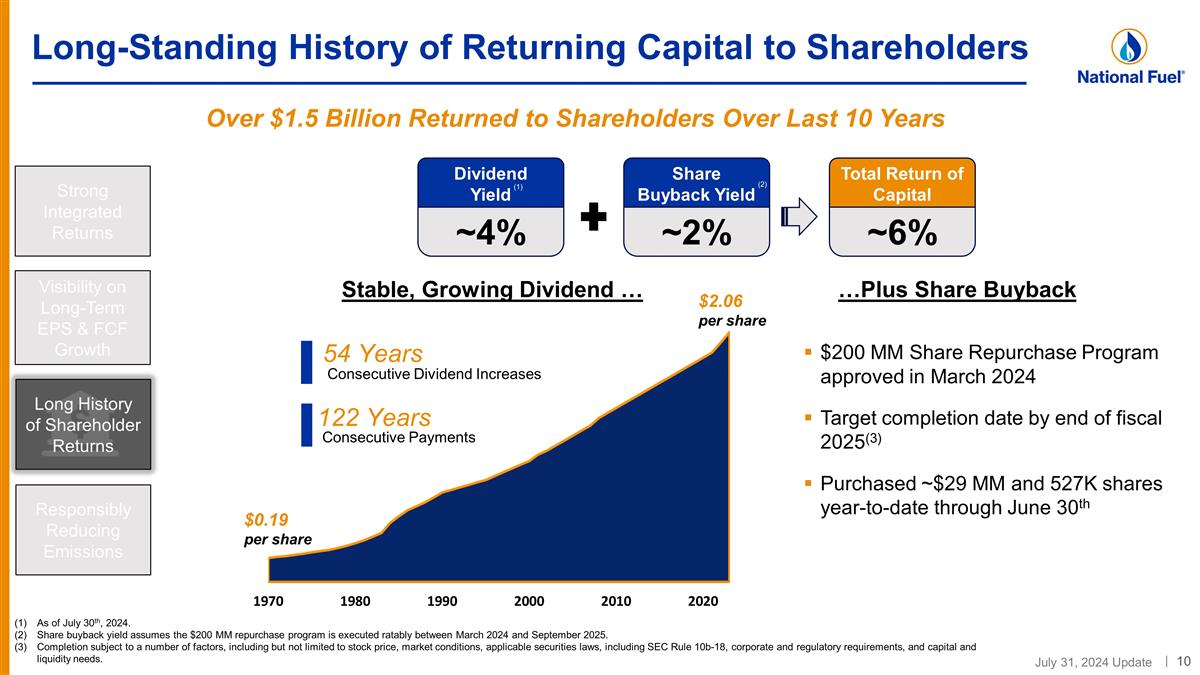

Long-Standing History of Returning Capital to Shareholders ~4% Dividend Yield ~2% Share Buyback Yield ~6% Total Return of Capital 54 Years Consecutive Dividend Increases 122 Years Consecutive Payments $2.06 per share $0.19 per share Stable, Growing Dividend … …Plus Share Buyback $200 MM Share Repurchase Program approved in March 2024 Target completion date by end of fiscal 2025(3) Purchased ~$29 MM and 527K shares year-to-date through June 30th Over $1.5 Billion Returned to Shareholders Over Last 10 Years (1) Strong Integrated Returns Visibility on Long-Term EPS & FCF Growth Responsibly Reducing Emissions Long History of Shareholder Returns (2) As of July 30th, 2024. Share buyback yield assumes the $200 MM repurchase program is executed ratably between March 2024 and September 2025. Completion subject to a number of factors, including but not limited to stock price, market conditions, applicable securities laws, including SEC Rule 10b-18, corporate and regulatory requirements, and capital and liquidity needs.

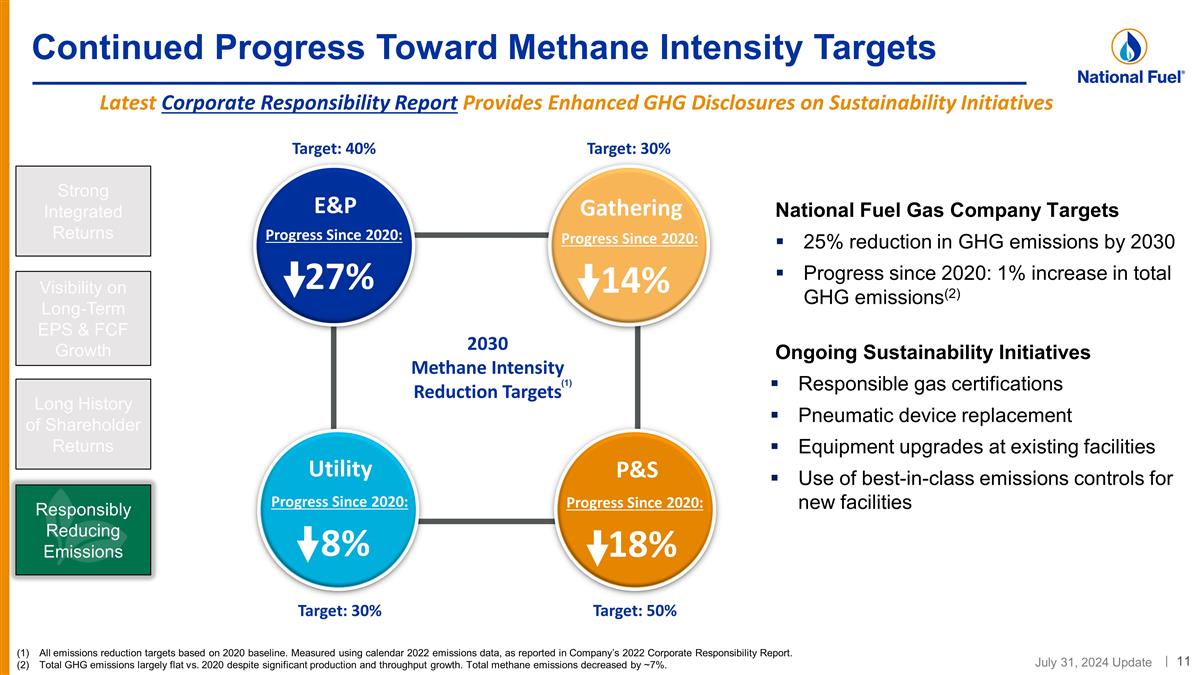

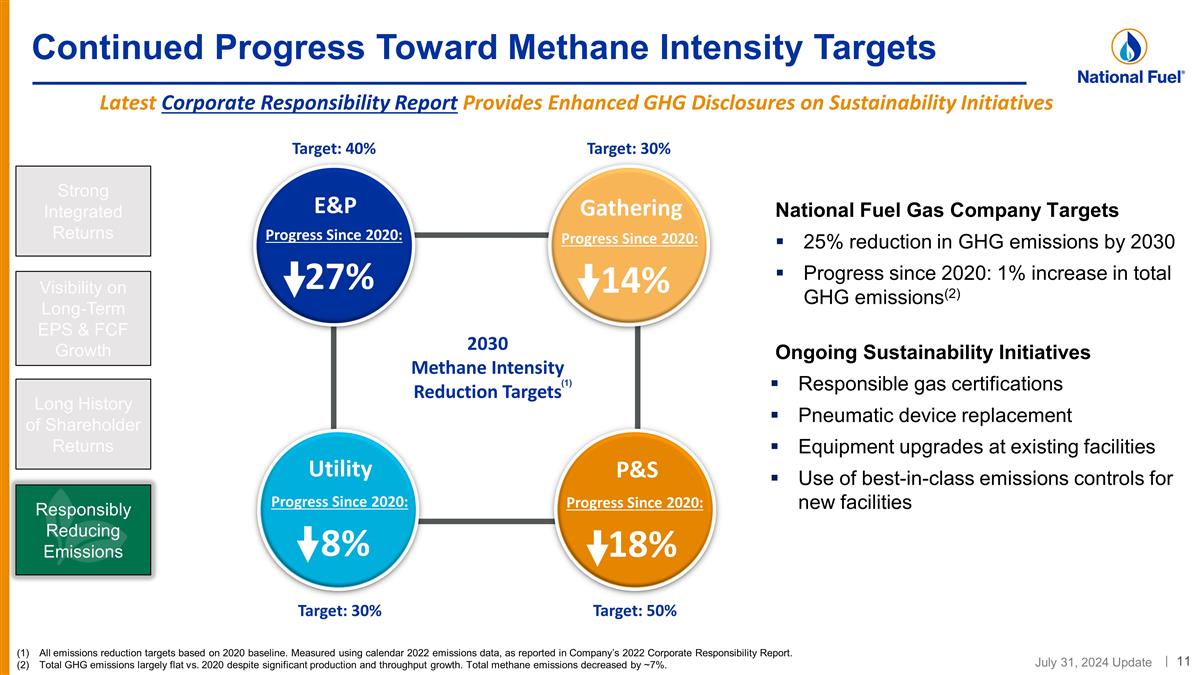

Continued Progress Toward Methane Intensity Targets Latest Corporate Responsibility Report Provides Enhanced GHG Disclosures on Sustainability Initiatives All emissions reduction targets based on 2020 baseline. Measured using calendar 2022 emissions data, as reported in Company’s 2022 Corporate Responsibility Report. Total GHG emissions largely flat vs. 2020 despite significant production and throughput growth. Total methane emissions decreased by ~7%. Target: 40% Progress Since 2020: 27% E&P Progress Since 2020: 14% Gathering Progress Since 2020: 18% P&S Progress Since 2020: 8% Utility 2030 Methane Intensity Reduction Targets Target: 30% Target: 50% Target: 30% National Fuel Gas Company Targets 25% reduction in GHG emissions by 2030 Progress since 2020: 1% increase in total GHG emissions(2) Ongoing Sustainability Initiatives Responsible gas certifications Pneumatic device replacement Equipment upgrades at existing facilities Use of best-in-class emissions controls for new facilities (1) Strong Integrated Returns Visibility on Long-Term EPS & FCF Growth Responsibly Reducing Emissions Long History of Shareholder Returns

Business Updates

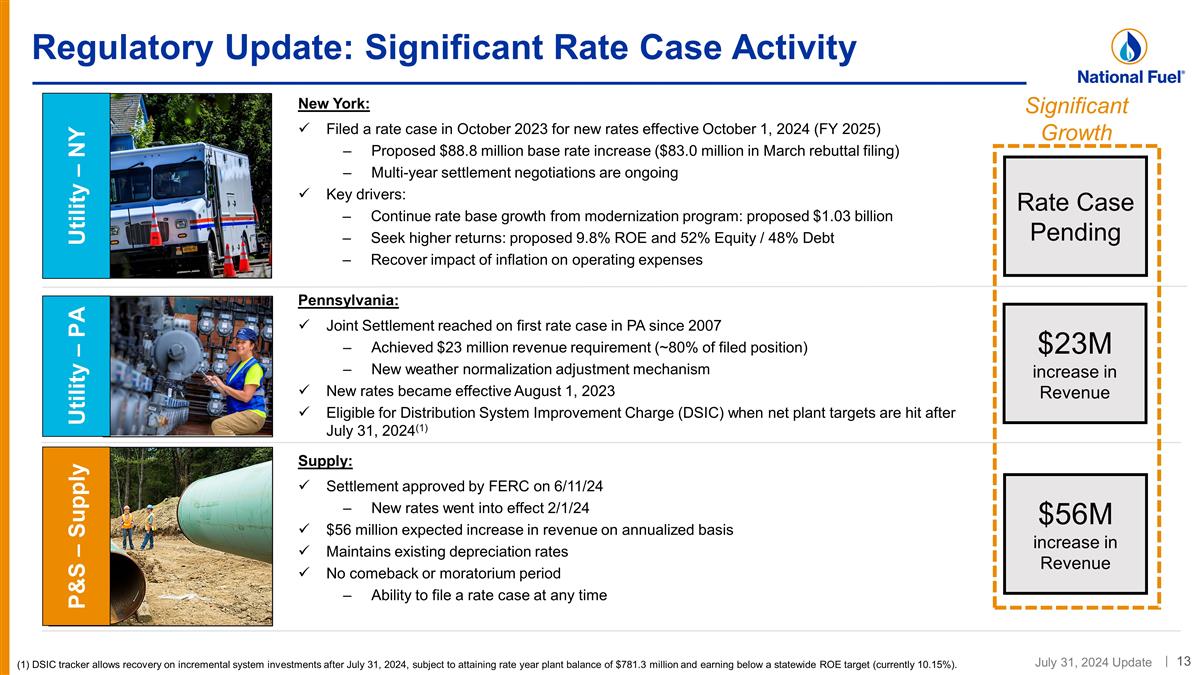

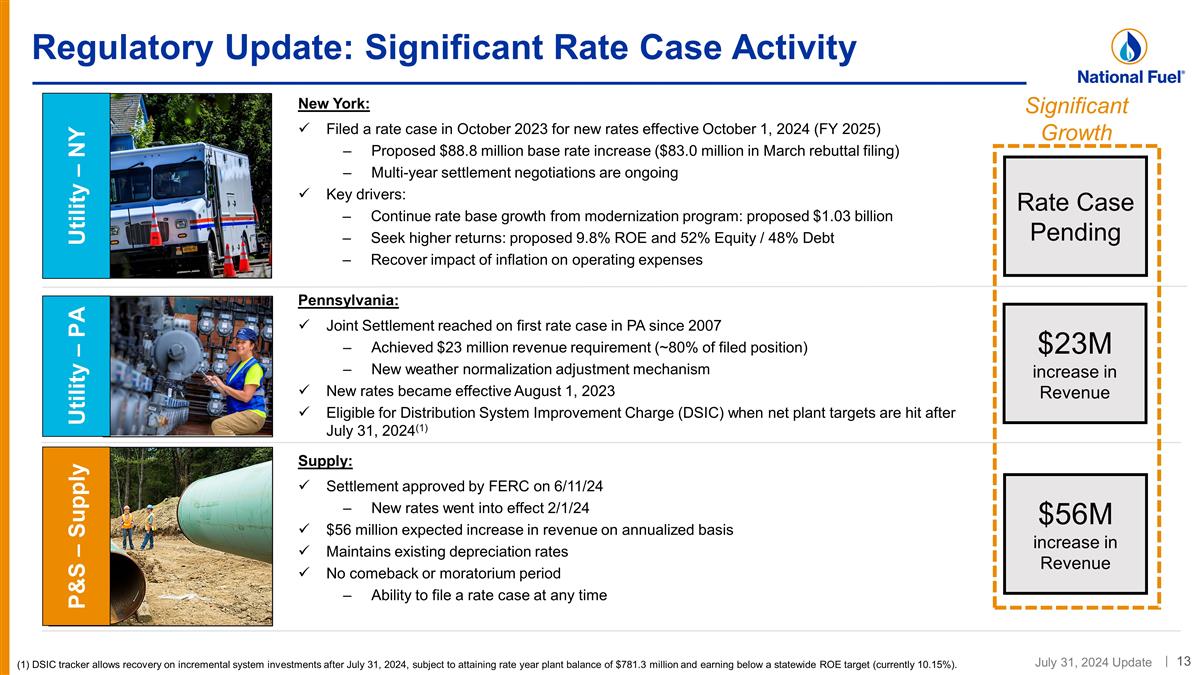

(1) DSIC tracker allows recovery on incremental system investments after July 31, 2024, subject to attaining rate year plant balance of $781.3 million and earning below a statewide ROE target (currently 10.15%). Regulatory Update: Significant Rate Case Activity New York: Filed a rate case in October 2023 for new rates effective October 1, 2024 (FY 2025) Proposed $88.8 million base rate increase ($83.0 million in March rebuttal filing) Multi-year settlement negotiations are ongoing Key drivers: Continue rate base growth from modernization program: proposed $1.03 billion Seek higher returns: proposed 9.8% ROE and 52% Equity / 48% Debt Recover impact of inflation on operating expenses Utility – NY Supply: Settlement approved by FERC on 6/11/24 New rates went into effect 2/1/24 $56 million expected increase in revenue on annualized basis Maintains existing depreciation rates No comeback or moratorium period Ability to file a rate case at any time P&S – Supply Pennsylvania: Joint Settlement reached on first rate case in PA since 2007 Achieved $23 million revenue requirement (~80% of filed position) New weather normalization adjustment mechanism New rates became effective August 1, 2023 Eligible for Distribution System Improvement Charge (DSIC) when net plant targets are hit after July 31, 2024(1) Utility – PA Rate Case Pending $23M increase in Revenue $56M increase in Revenue Significant Growth

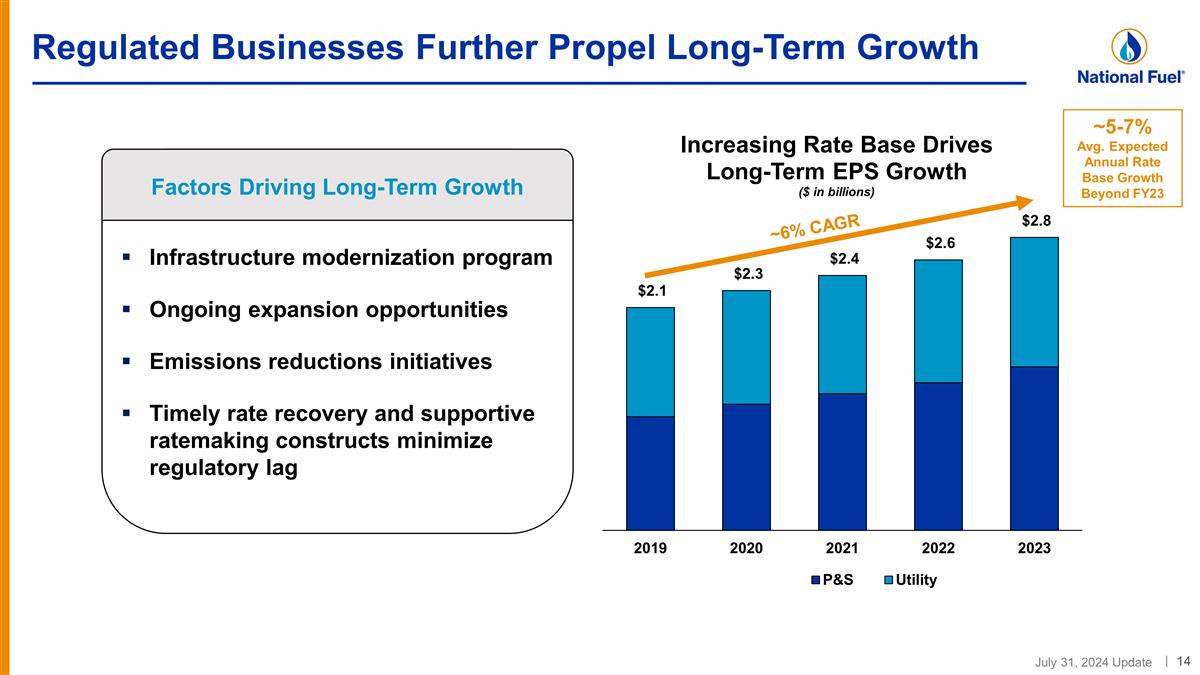

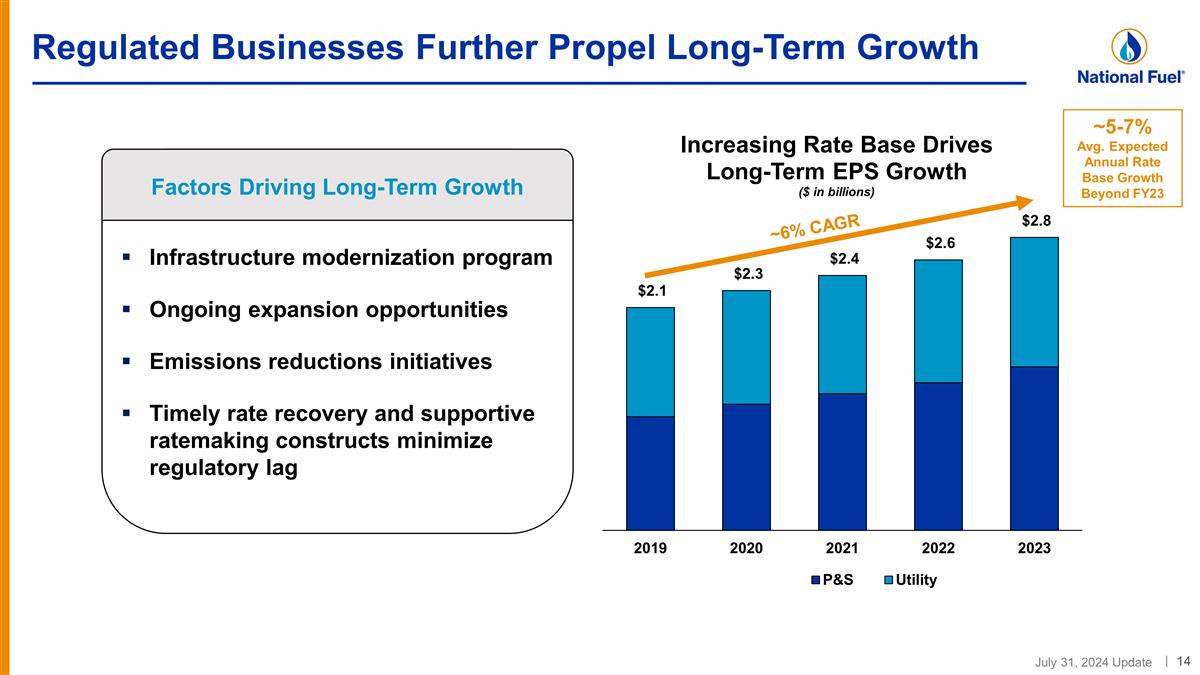

Regulated Businesses Further Propel Long-Term Growth Infrastructure modernization program Ongoing expansion opportunities Emissions reductions initiatives Timely rate recovery and supportive ratemaking constructs minimize regulatory lag Factors Driving Long-Term Growth ~6% CAGR ~5-7% Avg. Expected Annual Rate Base Growth Beyond FY23

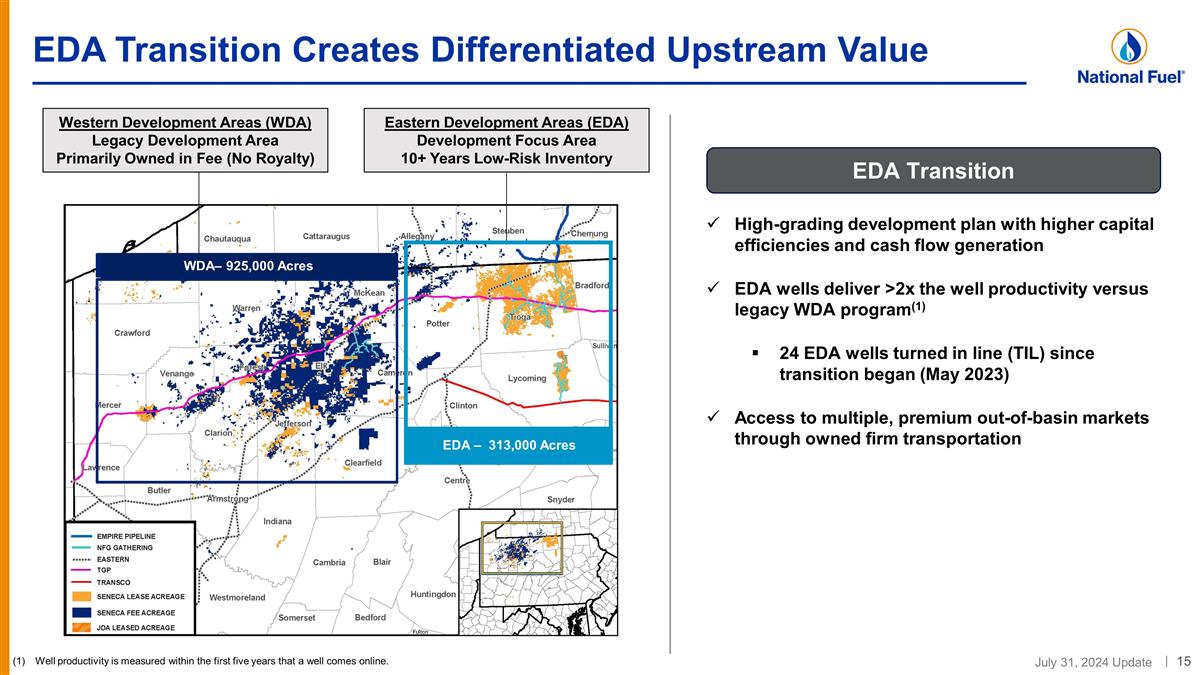

EDA Transition Creates Differentiated Upstream Value EDA Transition High-grading development plan with higher capital efficiencies and cash flow generation EDA wells deliver >2x the well productivity versus legacy WDA program(1) 24 EDA wells turned in line (TIL) since transition began (May 2023) Access to multiple, premium out-of-basin markets through owned firm transportation Well productivity is measured within the first five years that a well comes online. Western Development Areas (WDA) Legacy Development Area Primarily Owned in Fee (No Royalty) Eastern Development Areas (EDA) Development Focus Area 10+ Years Low-Risk Inventory EDA – 313,000 Acres WDA– 925,000 Acres

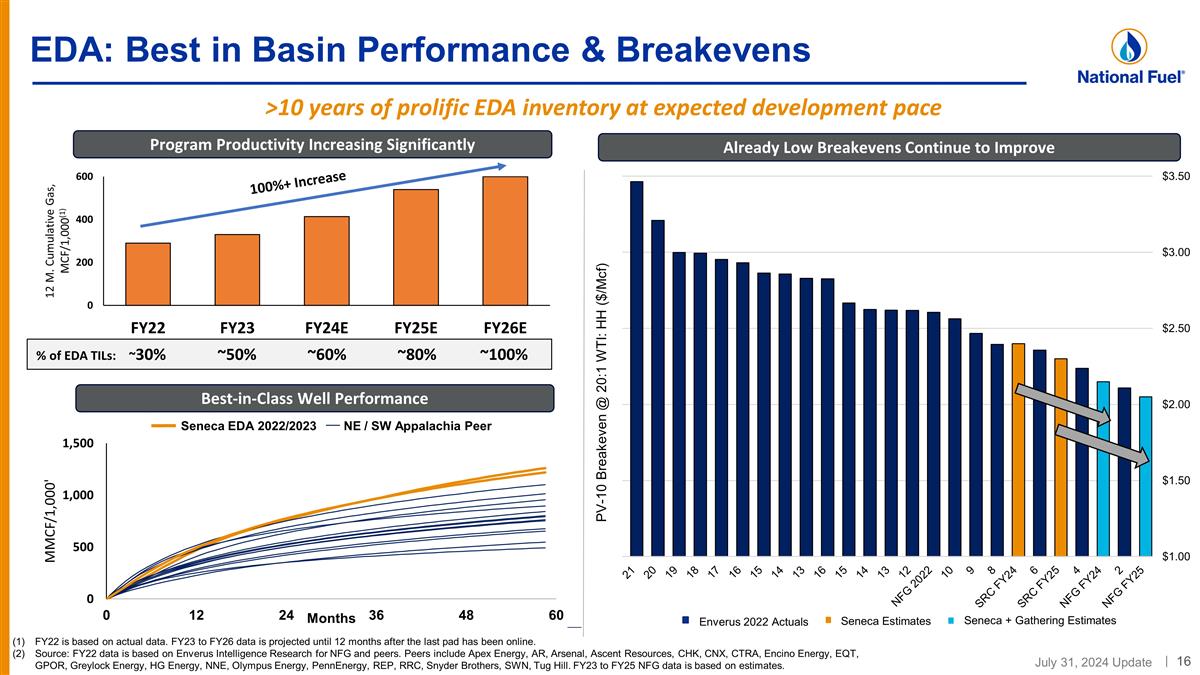

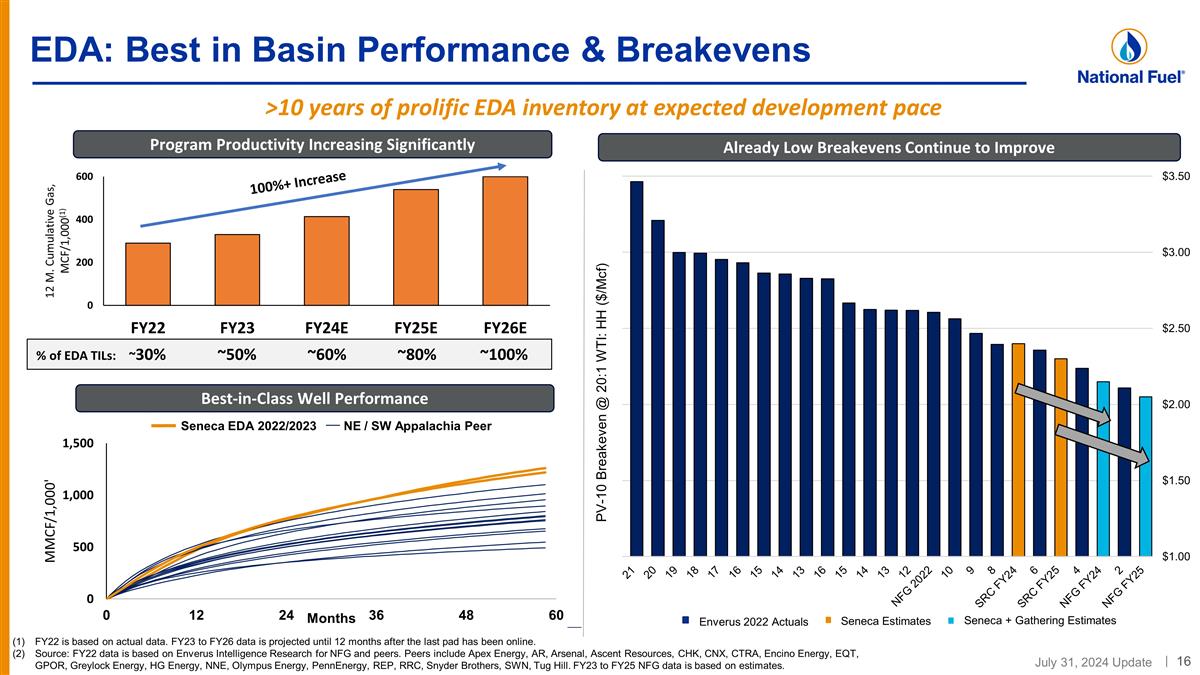

Enverus 2022 Actuals Enverus 2022 Actuals Seneca Estimates Seneca + Gathering Estimates EDA: Best in Basin Performance & Breakevens FY22 is based on actual data. FY23 to FY26 data is projected until 12 months after the last pad has been online. Source: FY22 data is based on Enverus Intelligence Research for NFG and peers. Peers include Apex Energy, AR, Arsenal, Ascent Resources, CHK, CNX, CTRA, Encino Energy, EQT, GPOR, Greylock Energy, HG Energy, NNE, Olympus Energy, PennEnergy, REP, RRC, Snyder Brothers, SWN, Tug Hill. FY23 to FY25 NFG data is based on estimates. >10 years of prolific EDA inventory at expected development pace % of EDA TILs: ~30% ~50% ~60% ~80% ~100% Seneca EDA 2022/2023 NE / SW Appalachia Peer Program Productivity Increasing Significantly Best-in-Class Well Performance Already Low Breakevens Continue to Improve

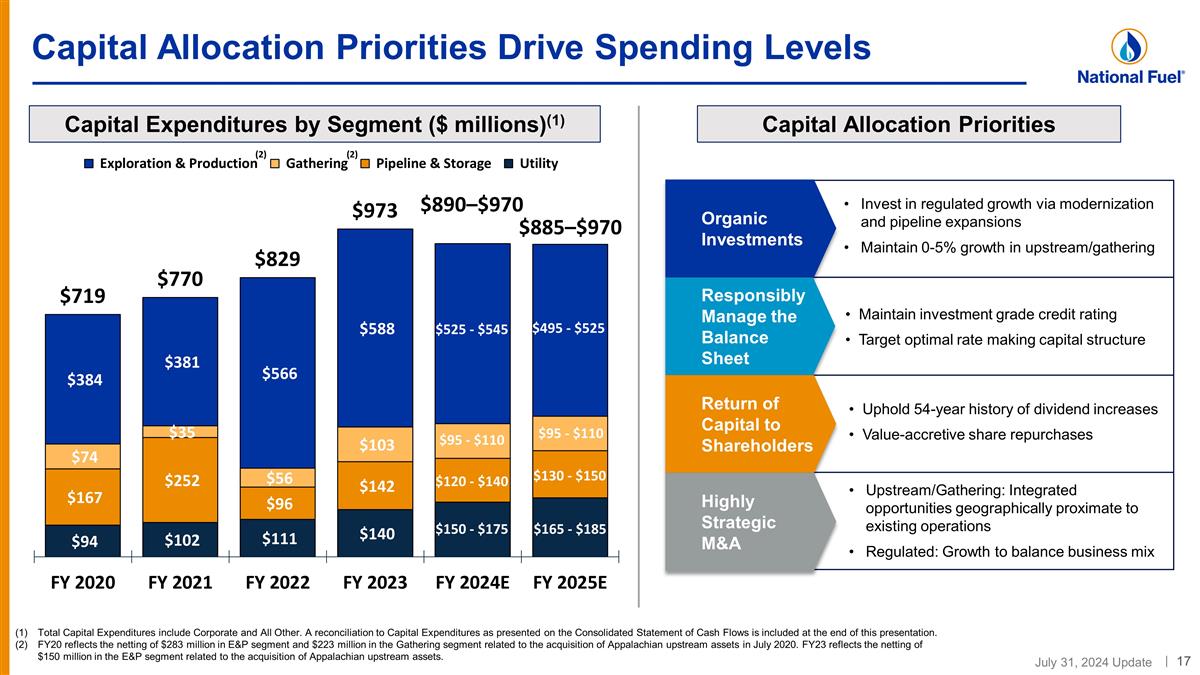

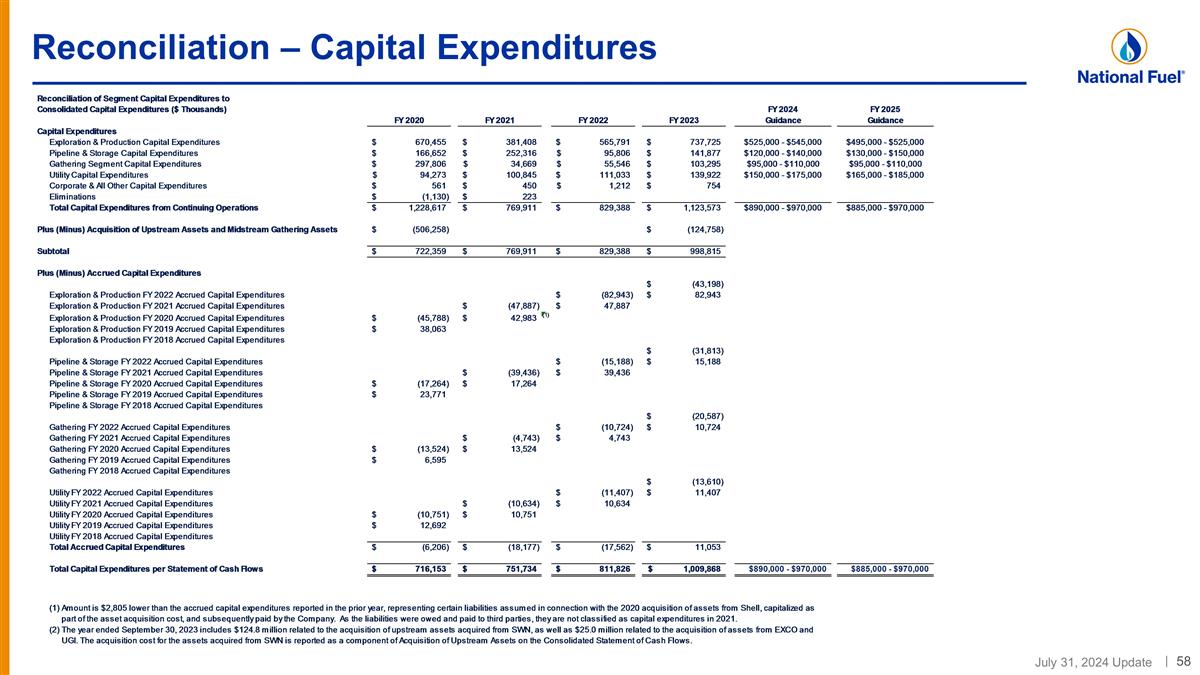

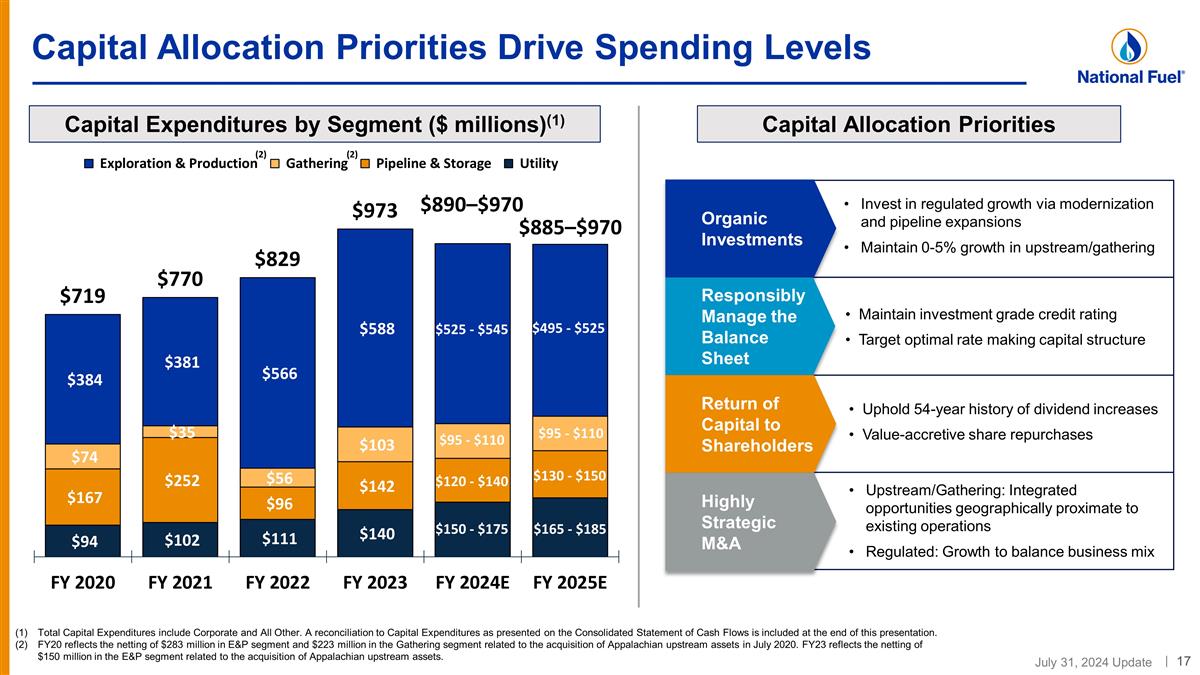

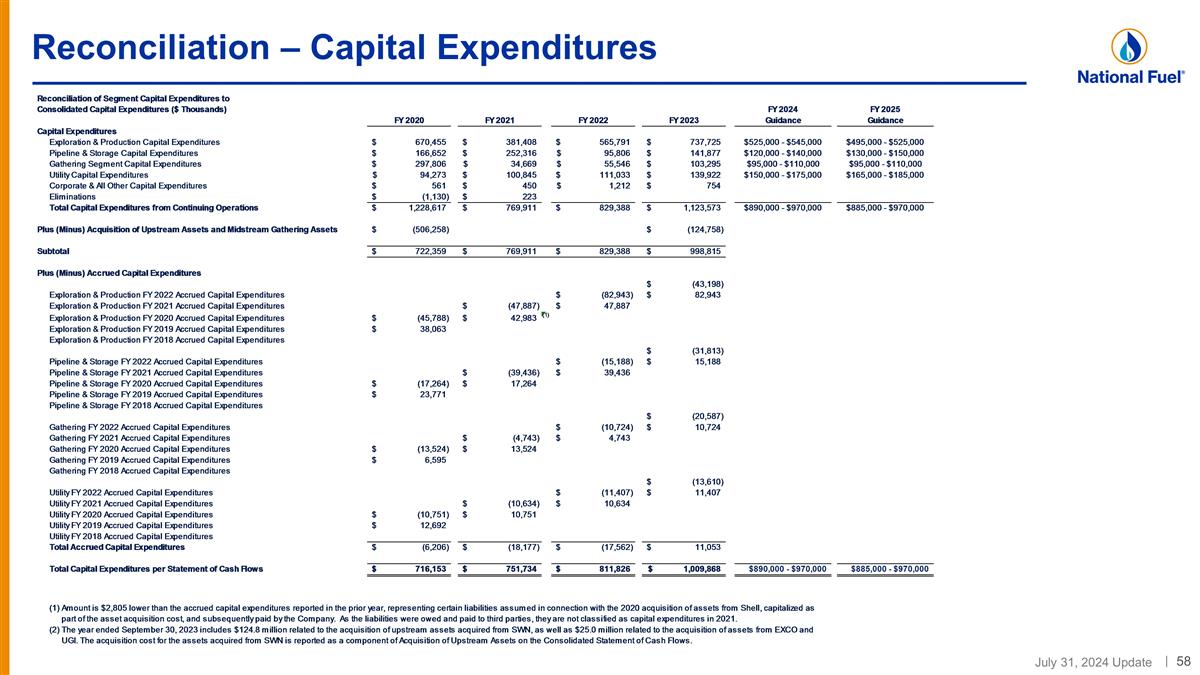

Capital Allocation Priorities Drive Spending Levels (2) Total Capital Expenditures include Corporate and All Other. A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY20 reflects the netting of $283 million in E&P segment and $223 million in the Gathering segment related to the acquisition of Appalachian upstream assets in July 2020. FY23 reflects the netting of $150 million in the E&P segment related to the acquisition of Appalachian upstream assets. Capital Expenditures by Segment ($ millions)(1) Capital Allocation Priorities $120 - $140 $95 - $110 $150 - $175 Organic Investments Responsibly Manage the Balance Sheet Return of Capital to Shareholders Highly Strategic M&A Invest in regulated growth via modernization and pipeline expansions Maintain 0-5% growth in upstream/gathering Maintain investment grade credit rating Target optimal rate making capital structure Uphold 54-year history of dividend increases Value-accretive share repurchases Upstream/Gathering: Integrated opportunities geographically proximate to existing operations Regulated: Growth to balance business mix (2) $495 - $525 $95 - $110

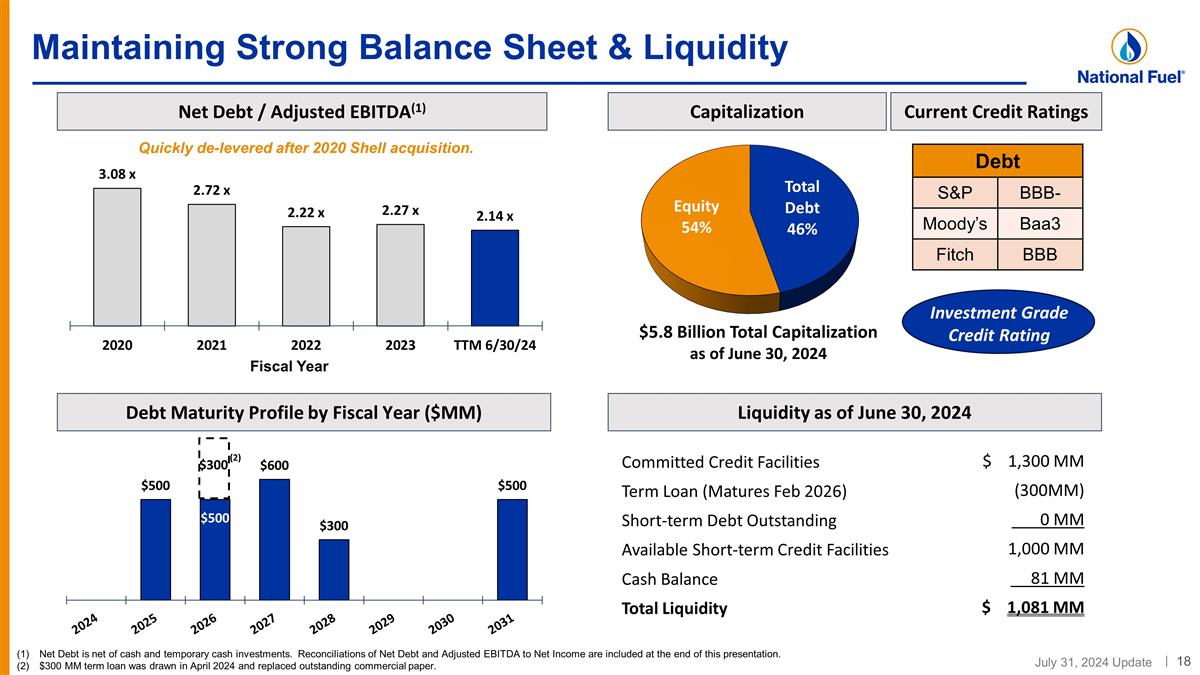

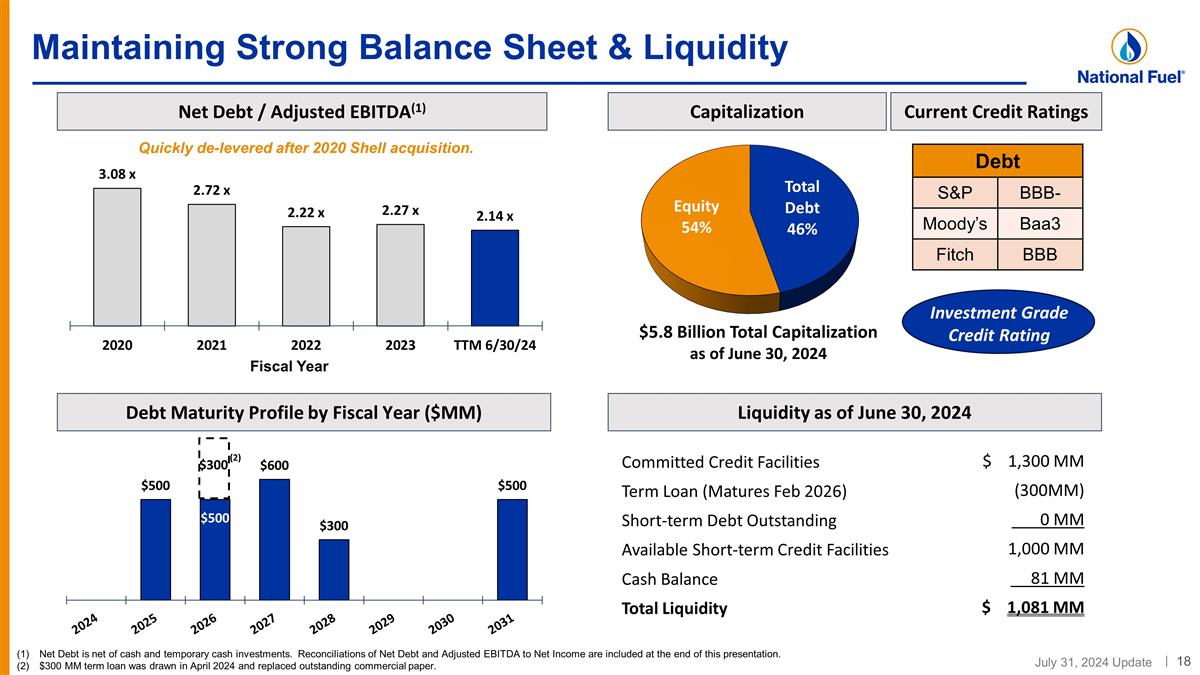

Maintaining Strong Balance Sheet & Liquidity $5.8 Billion Total Capitalization as of June 30, 2024 Net Debt / Adjusted EBITDA(1) Capitalization Debt Maturity Profile by Fiscal Year ($MM) Liquidity as of June 30, 2024 Net Debt is net of cash and temporary cash investments. Reconciliations of Net Debt and Adjusted EBITDA to Net Income are included at the end of this presentation. $300 MM term loan was drawn in April 2024 and replaced outstanding commercial paper. Committed Credit Facilities Term Loan (Matures Feb 2026) Short-term Debt Outstanding Available Short-term Credit Facilities Cash Balance Total Liquidity $ 1,300 MM (300MM) 0 MM 1,000 MM 81 MM $ 1,081 MM Current Credit Ratings Debt S&P BBB- Moody’s Baa3 Fitch BBB Investment Grade Credit Rating Quickly de-levered after 2020 Shell acquisition. $300 (2)

Exploration & Production & Gathering Overview Seneca Resources Company, LLC National Fuel Gas Midstream Company, LLC Supplemental Information: Segment Overview

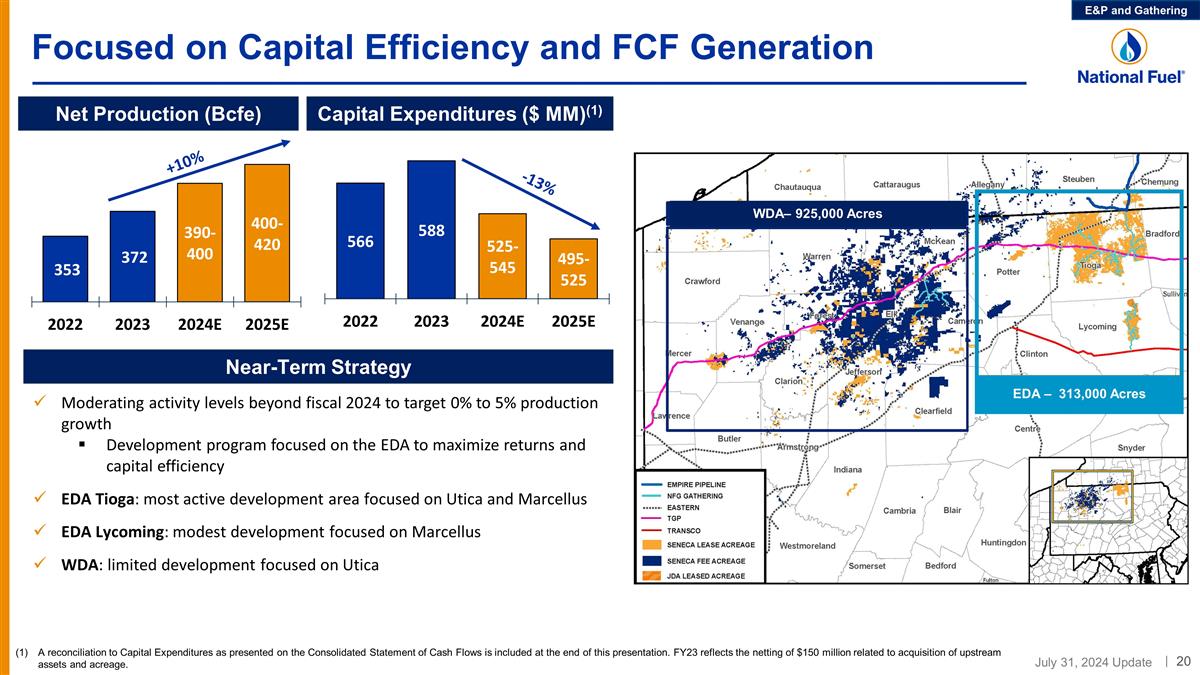

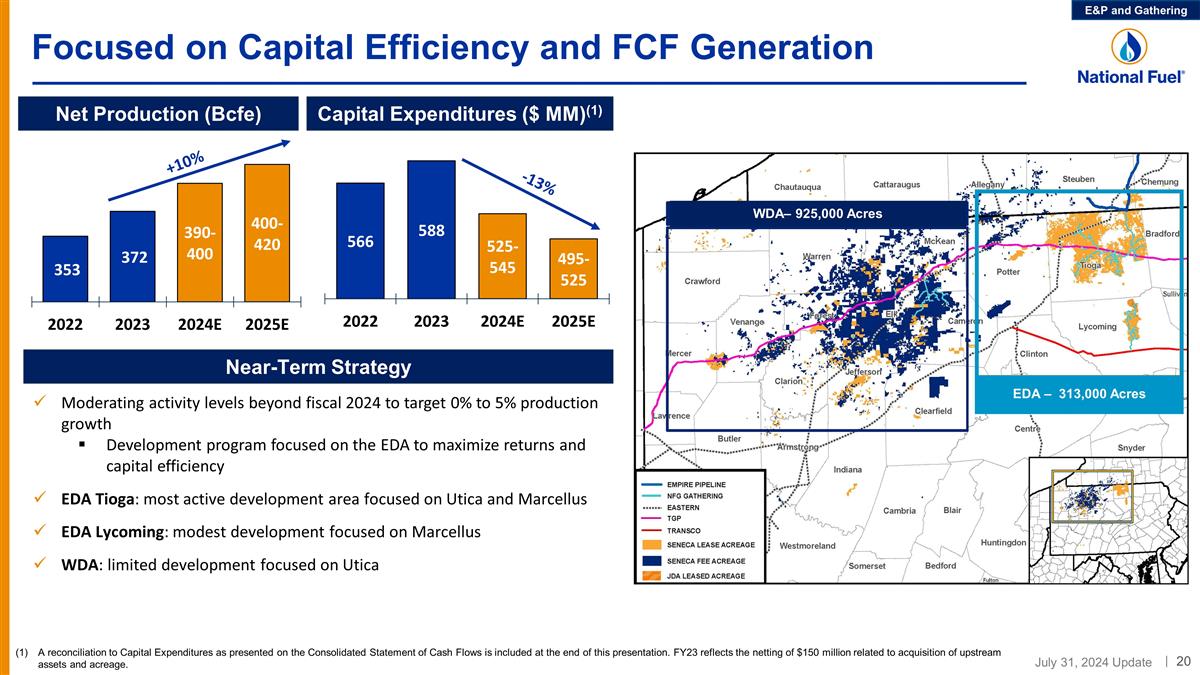

Focused on Capital Efficiency and FCF Generation Near-Term Strategy Capital Expenditures ($ MM)(1) Net Production (Bcfe) Moderating activity levels beyond fiscal 2024 to target 0% to 5% production growth Development program focused on the EDA to maximize returns and capital efficiency EDA Tioga: most active development area focused on Utica and Marcellus EDA Lycoming: modest development focused on Marcellus WDA: limited development focused on Utica A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY23 reflects the netting of $150 million related to acquisition of upstream assets and acreage. E&P and Gathering +10% -13% EDA – 313,000 Acres WDA– 925,000 Acres

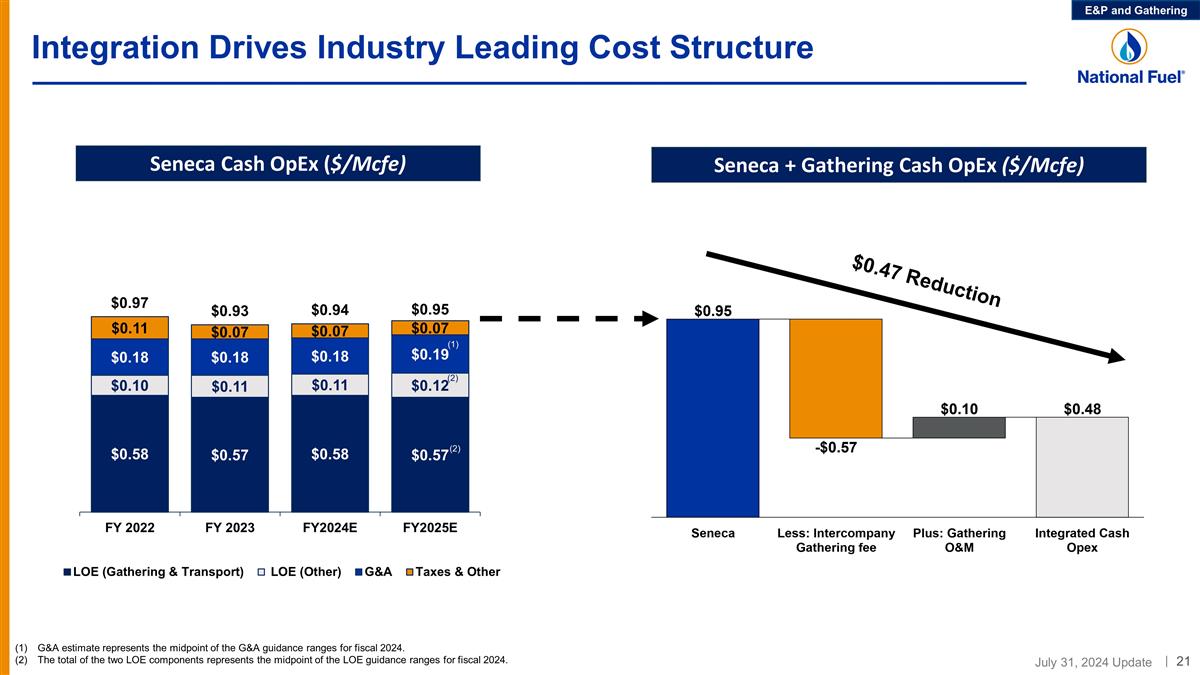

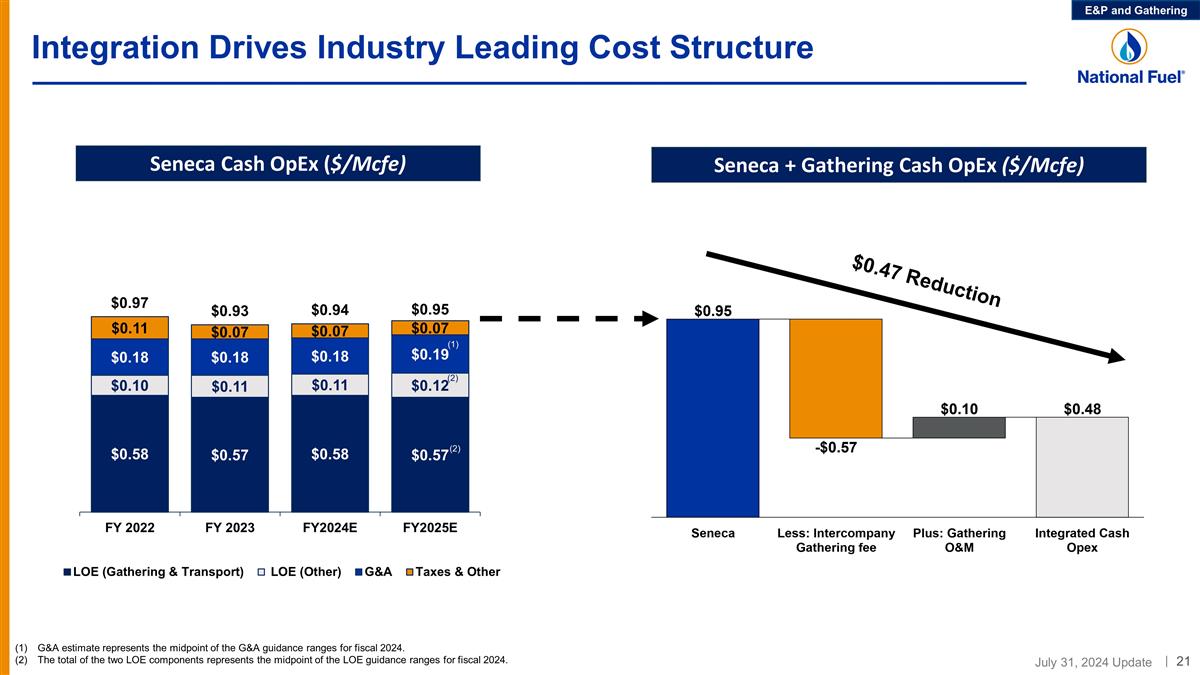

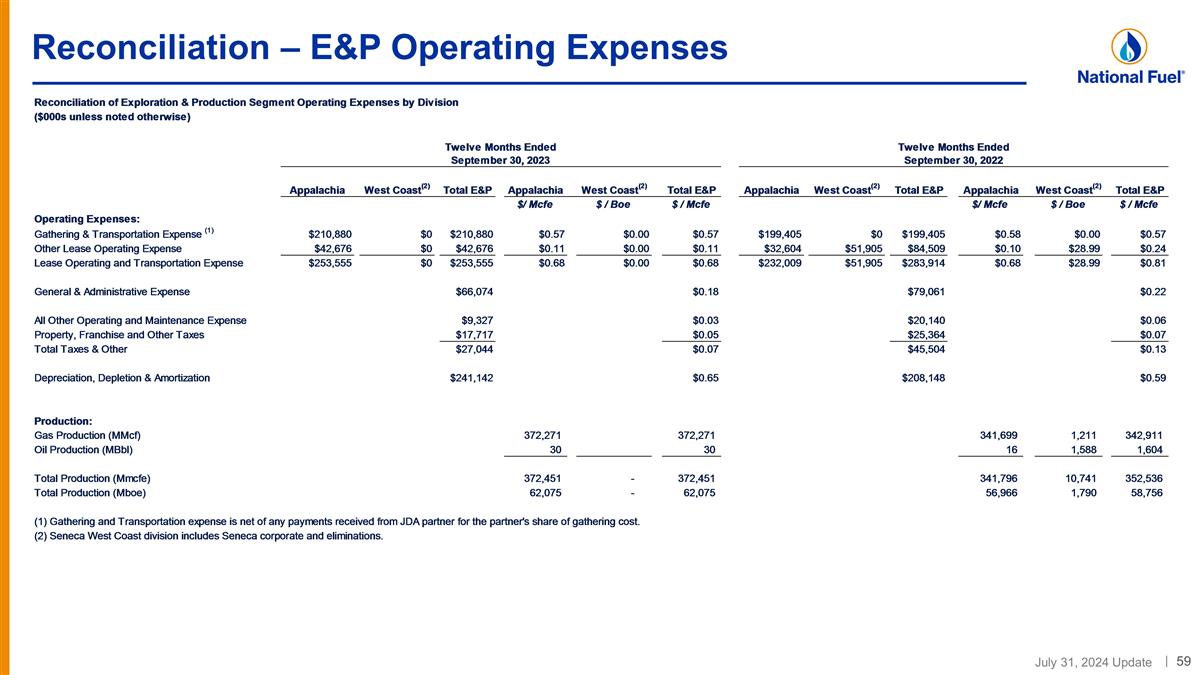

Integration Drives Industry Leading Cost Structure Seneca Cash OpEx ($/Mcfe) G&A estimate represents the midpoint of the G&A guidance ranges for fiscal 2024. The total of the two LOE components represents the midpoint of the LOE guidance ranges for fiscal 2024. (2) E&P and Gathering (2) Seneca + Gathering Cash OpEx ($/Mcfe) $0.47 Reduction

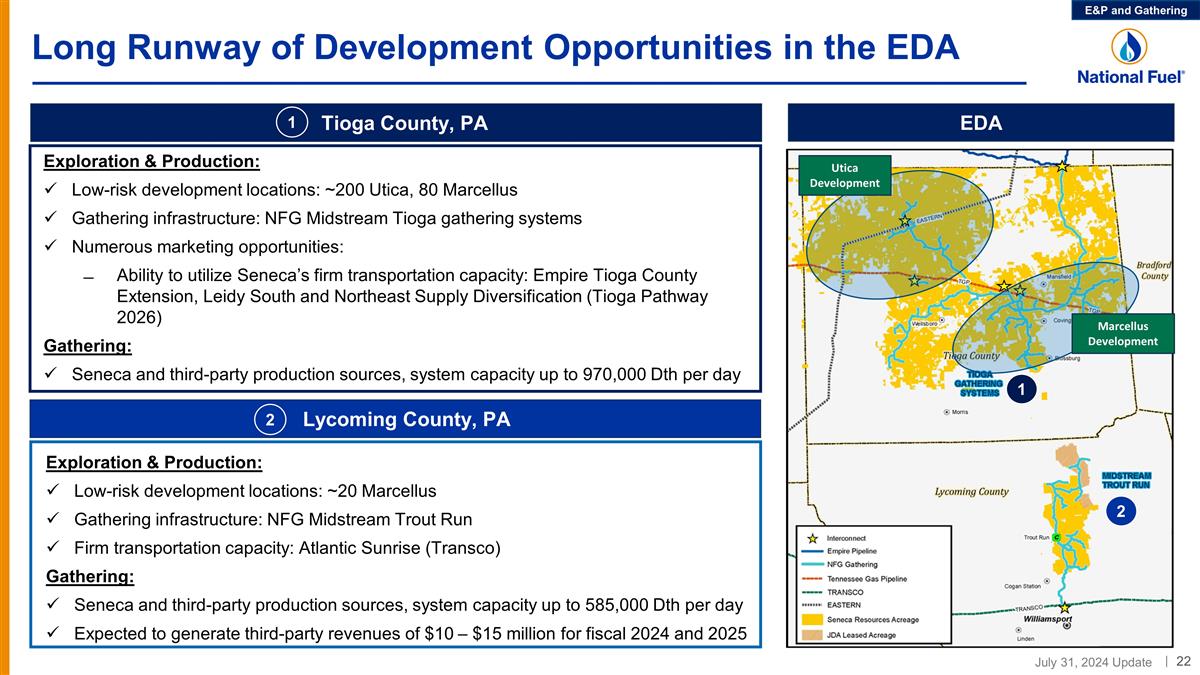

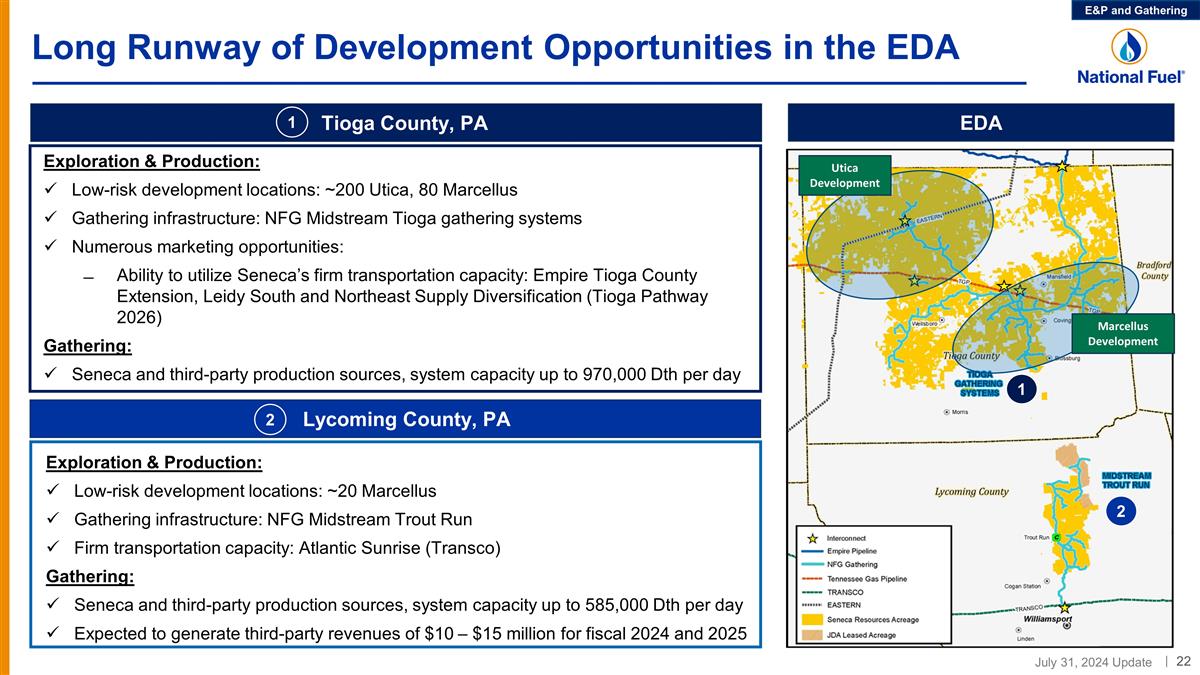

Long Runway of Development Opportunities in the EDA 1 2 Utica Development Marcellus Development Exploration & Production: Low-risk development locations: ~200 Utica, 80 Marcellus Gathering infrastructure: NFG Midstream Tioga gathering systems Numerous marketing opportunities: Ability to utilize Seneca’s firm transportation capacity: Empire Tioga County Extension, Leidy South and Northeast Supply Diversification (Tioga Pathway 2026) Gathering: Seneca and third-party production sources, system capacity up to 970,000 Dth per day Exploration & Production: Low-risk development locations: ~20 Marcellus Gathering infrastructure: NFG Midstream Trout Run Firm transportation capacity: Atlantic Sunrise (Transco) Gathering: Seneca and third-party production sources, system capacity up to 585,000 Dth per day Expected to generate third-party revenues of $10 – $15 million for fiscal 2024 and 2025 Tioga County, PA Lycoming County, PA 1 2 EDA E&P and Gathering

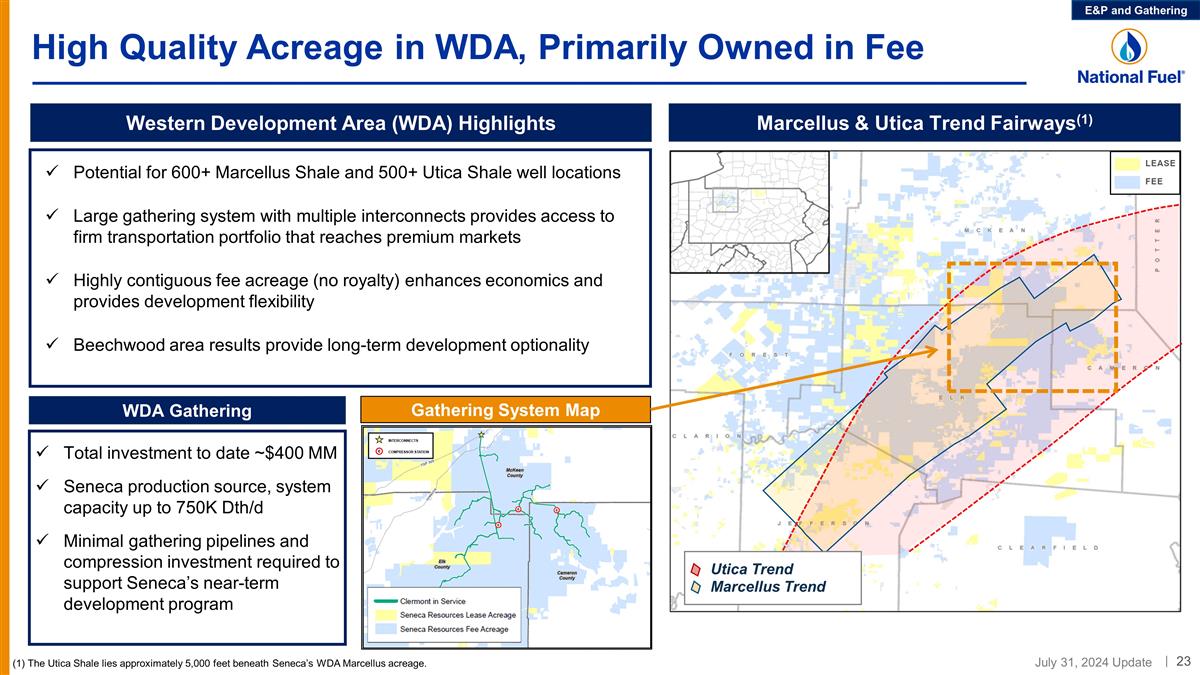

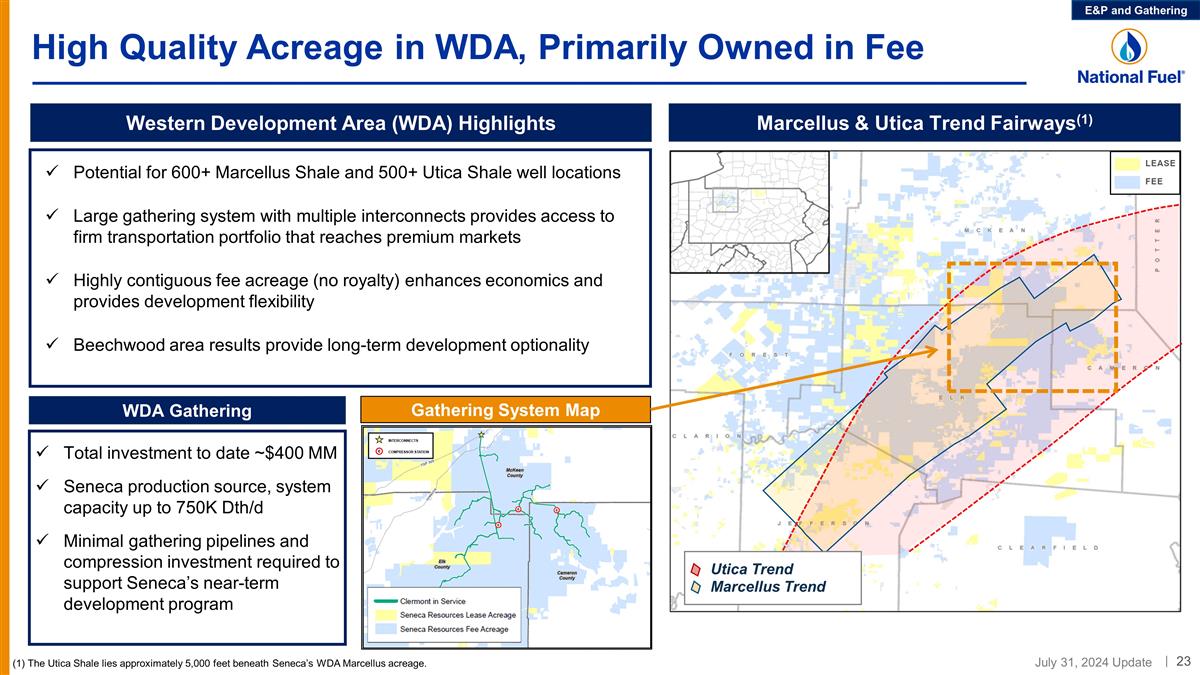

High Quality Acreage in WDA, Primarily Owned in Fee Potential for 600+ Marcellus Shale and 500+ Utica Shale well locations Large gathering system with multiple interconnects provides access to firm transportation portfolio that reaches premium markets Highly contiguous fee acreage (no royalty) enhances economics and provides development flexibility Beechwood area results provide long-term development optionality Western Development Area (WDA) Highlights Marcellus & Utica Trend Fairways(1) (1) The Utica Shale lies approximately 5,000 feet beneath Seneca’s WDA Marcellus acreage. Gathering System Map WDA Gathering Total investment to date ~$400 MM Seneca production source, system capacity up to 750K Dth/d Minimal gathering pipelines and compression investment required to support Seneca’s near-term development program Utica Trend Marcellus Trend E&P and Gathering

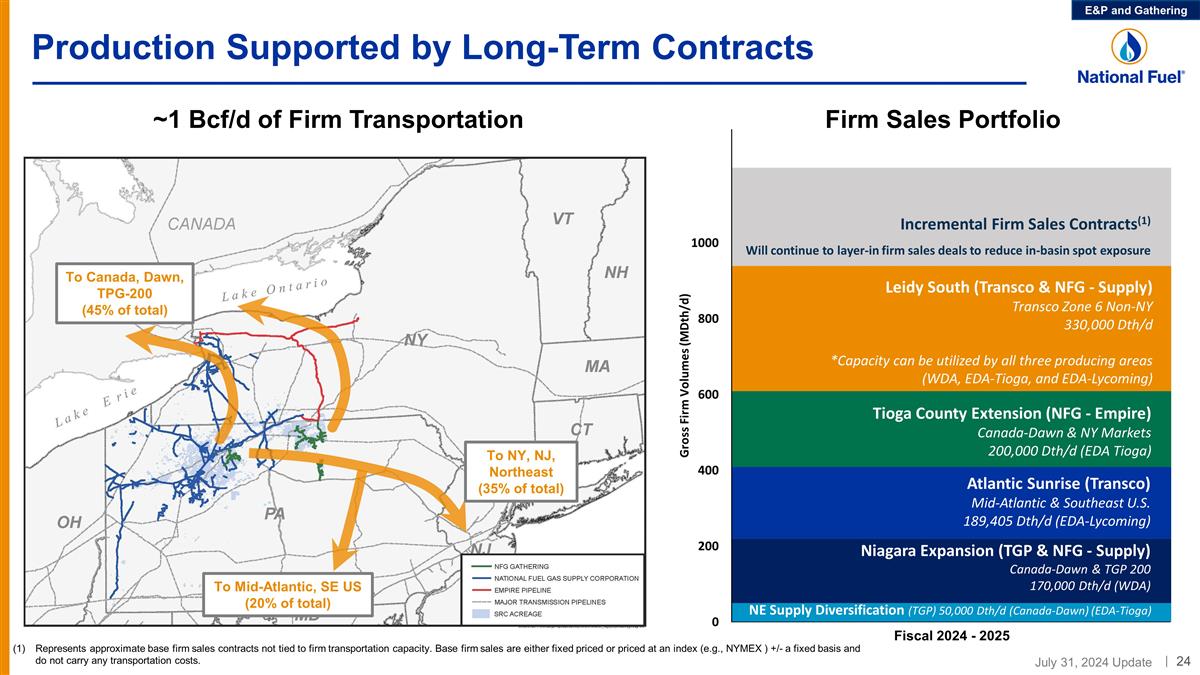

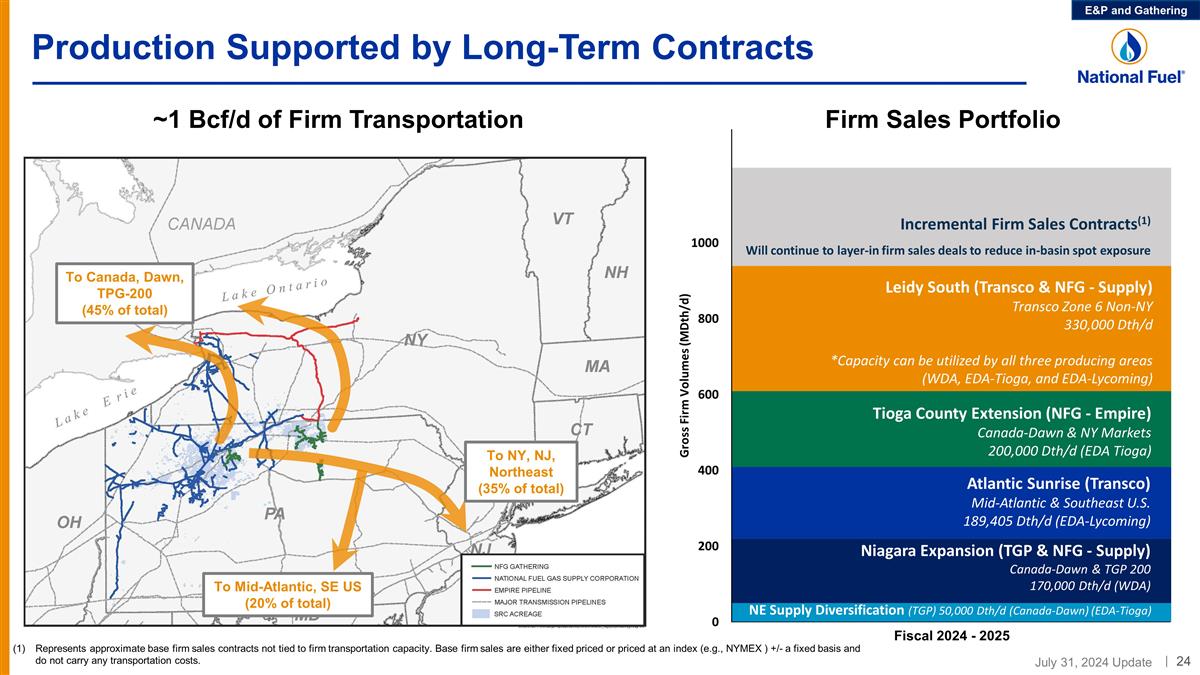

E&P and Gathering Production Supported by Long-Term Contracts To Canada, Dawn, TPG-200 (45% of total) To Mid-Atlantic, SE US (20% of total) To NY, NJ, Northeast (35% of total) ~1 Bcf/d of Firm Transportation NE Supply Diversification (TGP) 50,000 Dth/d (Canada-Dawn) (EDA-Tioga) Niagara Expansion (TGP & NFG - Supply) Canada-Dawn & TGP 200 170,000 Dth/d (WDA) Atlantic Sunrise (Transco) Mid-Atlantic & Southeast U.S. 189,405 Dth/d (EDA-Lycoming) Incremental Firm Sales Contracts(1) Will continue to layer-in firm sales deals to reduce in-basin spot exposure Leidy South (Transco & NFG - Supply) Transco Zone 6 Non-NY 330,000 Dth/d *Capacity can be utilized by all three producing areas (WDA, EDA-Tioga, and EDA-Lycoming) Tioga County Extension (NFG - Empire) Canada-Dawn & NY Markets 200,000 Dth/d (EDA Tioga) Firm Sales Portfolio Fiscal 2024 - 2025 Represents approximate base firm sales contracts not tied to firm transportation capacity. Base firm sales are either fixed priced or priced at an index (e.g., NYMEX ) +/- a fixed basis and do not carry any transportation costs.

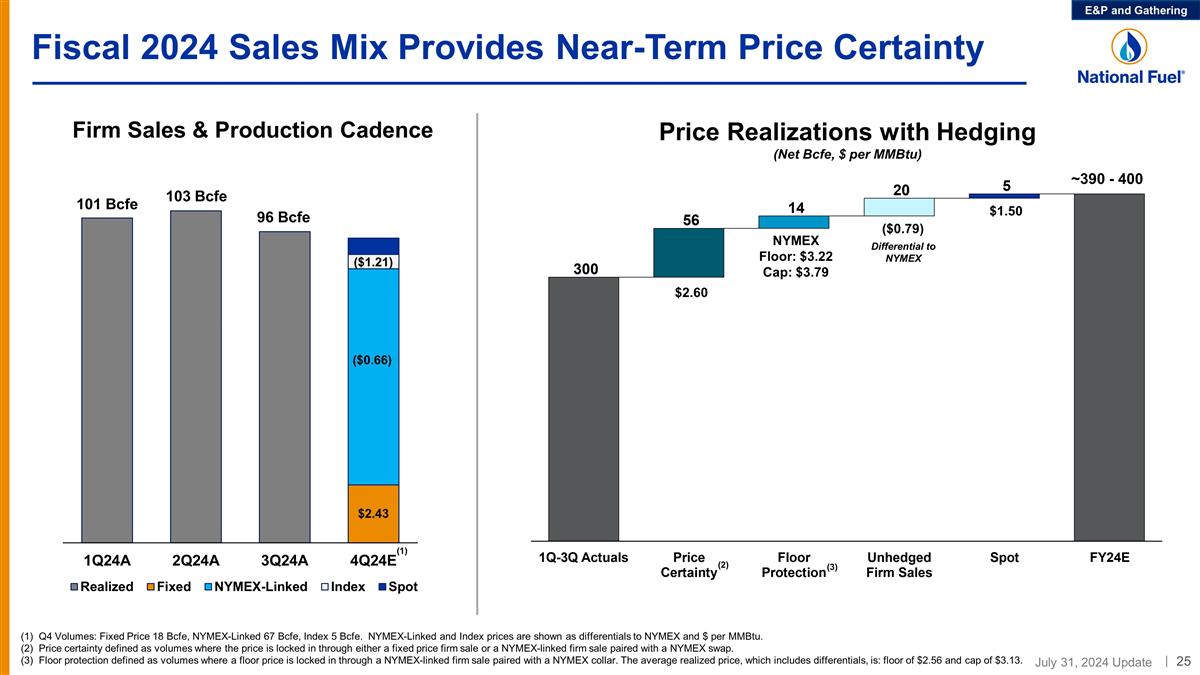

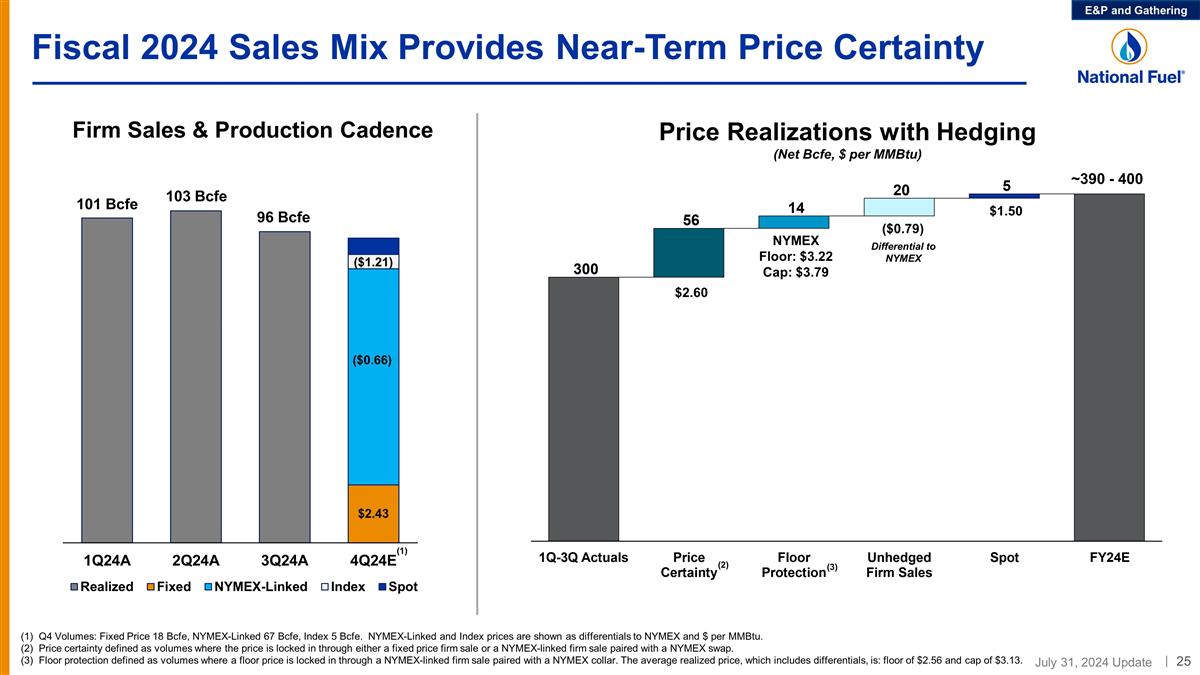

Fiscal 2024 Sales Mix Provides Near-Term Price Certainty Q4 Volumes: Fixed Price 18 Bcfe, NYMEX-Linked 67 Bcfe, Index 5 Bcfe. NYMEX-Linked and Index prices are shown as differentials to NYMEX and $ per MMBtu. Price certainty defined as volumes where the price is locked in through either a fixed price firm sale or a NYMEX-linked firm sale paired with a NYMEX swap. Floor protection defined as volumes where a floor price is locked in through a NYMEX-linked firm sale paired with a NYMEX collar. The average realized price, which includes differentials, is: floor of $2.56 and cap of $3.13. E&P and Gathering ($1.21) ($0.66) $2.43 $2.60 103 Bcfe Firm Sales & Production Cadence Price Realizations with Hedging (Net Bcfe, $ per MMBtu) ~390 - 400 NYMEX Floor: $3.22 Cap: $3.79 ($0.79) $1.50 (2) (3) (1) Differential to NYMEX 96 Bcfe

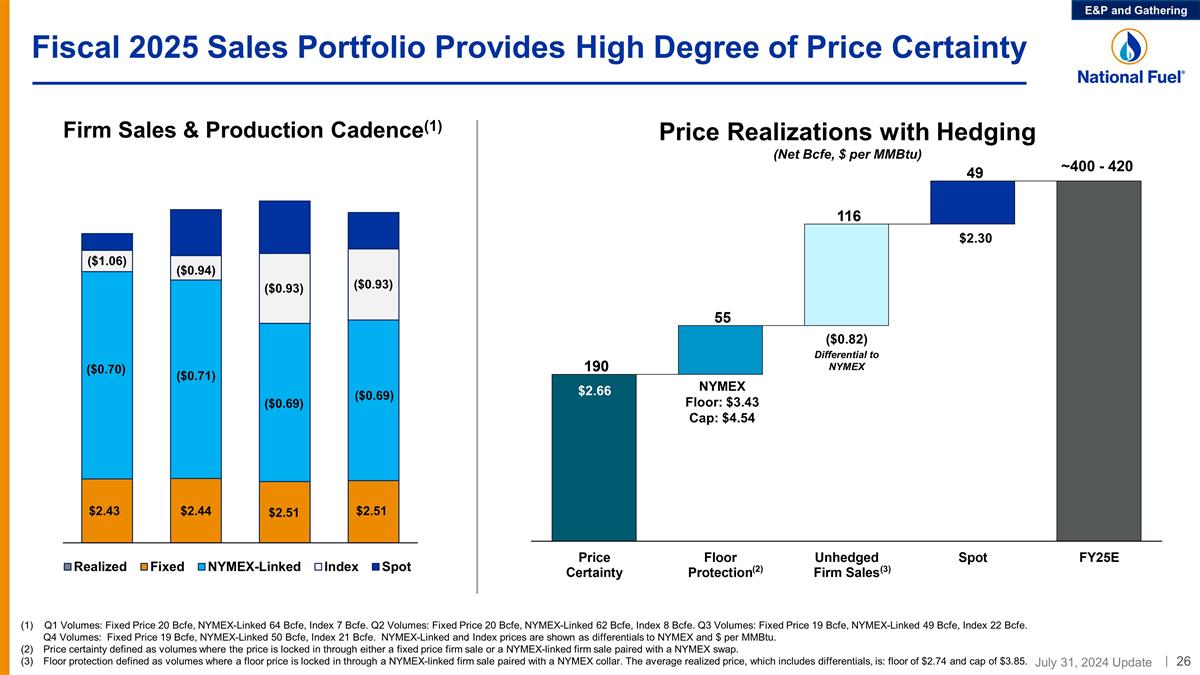

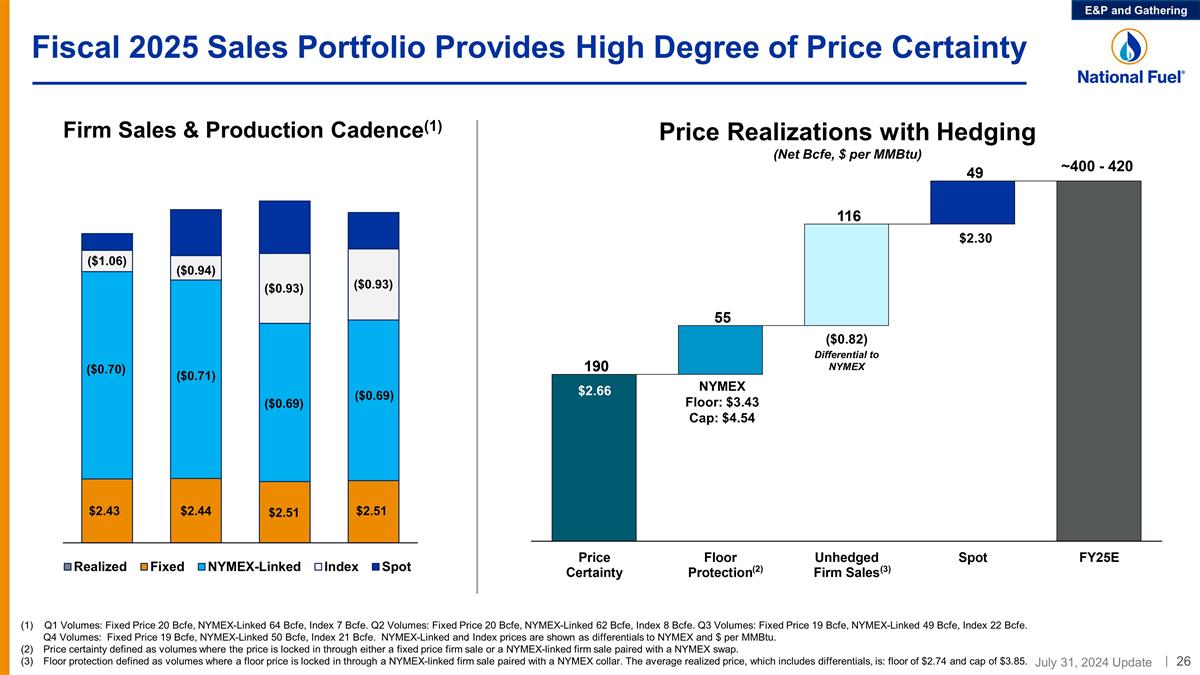

Fiscal 2025 Sales Portfolio Provides High Degree of Price Certainty Q1 Volumes: Fixed Price 20 Bcfe, NYMEX-Linked 64 Bcfe, Index 7 Bcfe. Q2 Volumes: Fixed Price 20 Bcfe, NYMEX-Linked 62 Bcfe, Index 8 Bcfe. Q3 Volumes: Fixed Price 19 Bcfe, NYMEX-Linked 49 Bcfe, Index 22 Bcfe. Q4 Volumes: Fixed Price 19 Bcfe, NYMEX-Linked 50 Bcfe, Index 21 Bcfe. NYMEX-Linked and Index prices are shown as differentials to NYMEX and $ per MMBtu. Price certainty defined as volumes where the price is locked in through either a fixed price firm sale or a NYMEX-linked firm sale paired with a NYMEX swap. Floor protection defined as volumes where a floor price is locked in through a NYMEX-linked firm sale paired with a NYMEX collar. The average realized price, which includes differentials, is: floor of $2.74 and cap of $3.85. E&P and Gathering ($0.93) ($0.93) ($0.69) ($0.69) $2.51 $2.51 $2.66 Firm Sales & Production Cadence(1) Price Realizations with Hedging (Net Bcfe, $ per MMBtu) ~400 - 420 NYMEX Floor: $3.43 Cap: $4.54 ($0.82) $2.30 (2) (3) Differential to NYMEX ($0.94) ($0.71) $2.44 ($1.06) ($0.70) $2.43

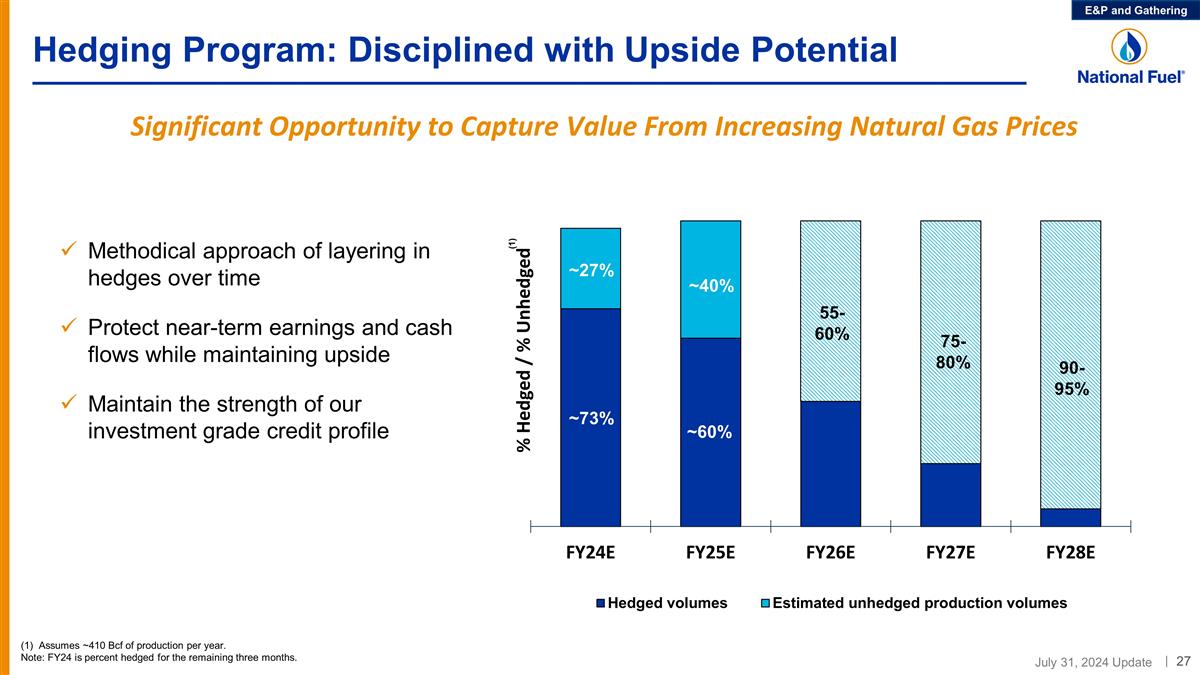

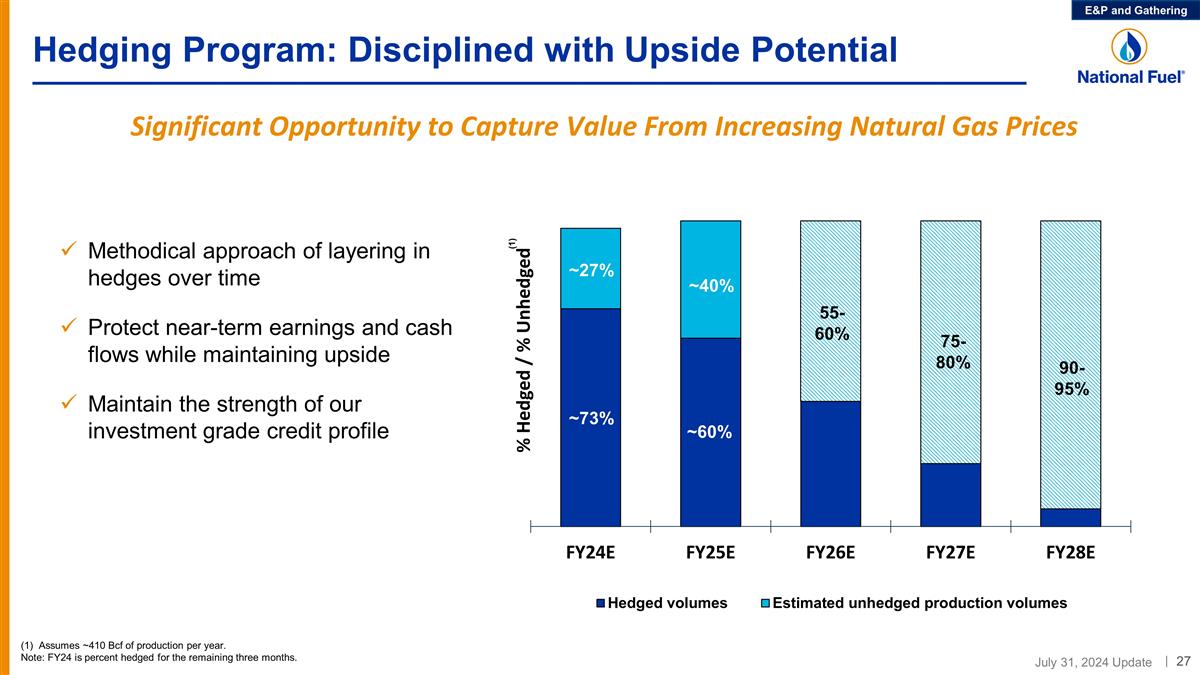

Hedging Program: Disciplined with Upside Potential Significant Opportunity to Capture Value From Increasing Natural Gas Prices Methodical approach of layering in hedges over time Protect near-term earnings and cash flows while maintaining upside Maintain the strength of our investment grade credit profile E&P and Gathering 75- 80% 55- 60% ~40% ~27% Assumes ~410 Bcf of production per year. Note: FY24 is percent hedged for the remaining three months. (1) ~73% ~60%

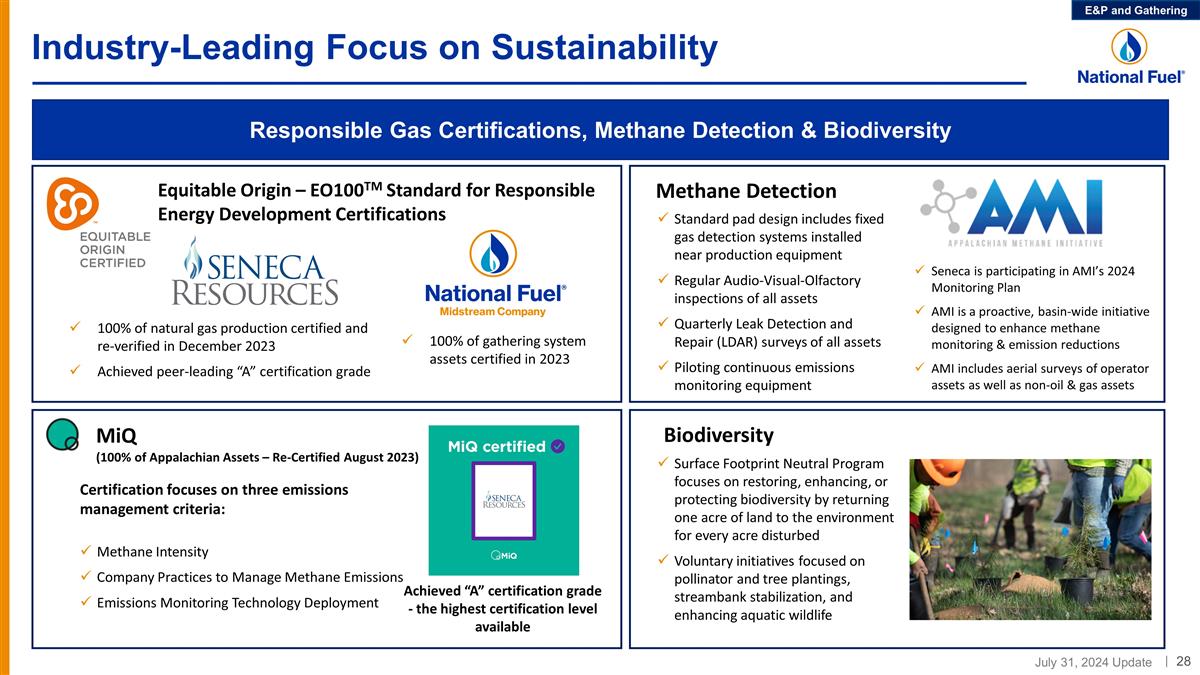

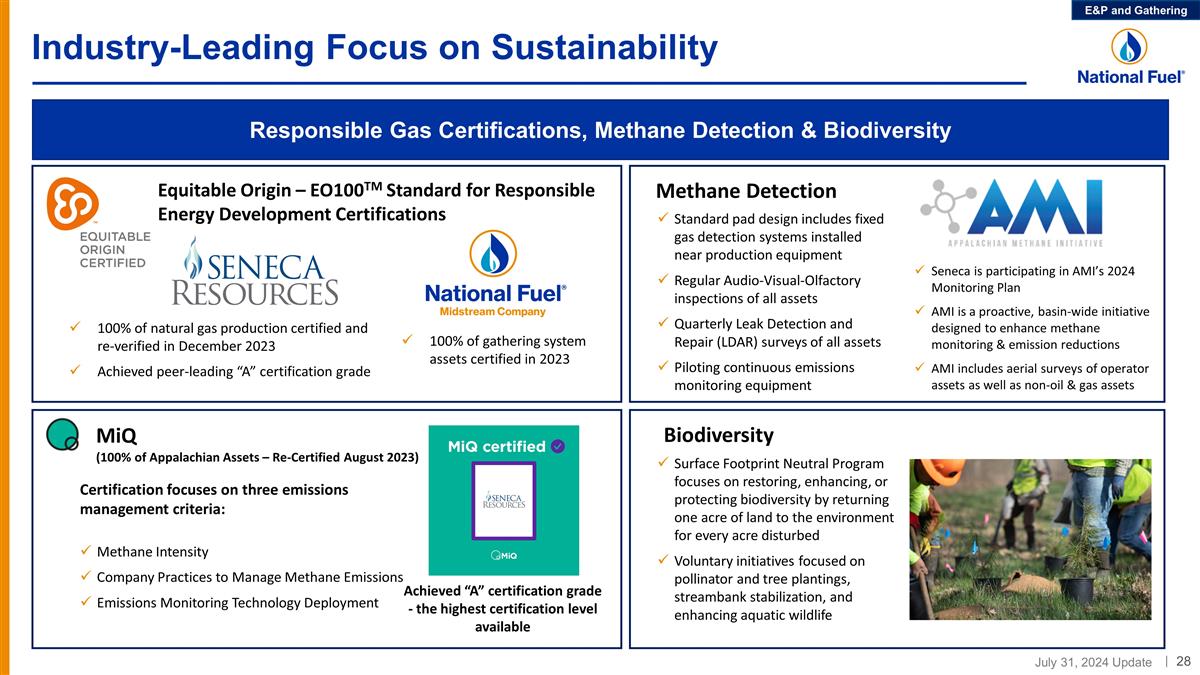

Industry-Leading Focus on Sustainability E&P and Gathering Responsible Gas Certifications, Methane Detection & Biodiversity Equitable Origin – EO100TM Standard for Responsible Energy Development Certifications Certification focuses on three emissions management criteria: Methane Intensity Company Practices to Manage Methane Emissions Emissions Monitoring Technology Deployment MiQ (100% of Appalachian Assets – Re-Certified August 2023) 100% of natural gas production certified and re-verified in December 2023 Achieved peer-leading “A” certification grade Methane Detection Standard pad design includes fixed gas detection systems installed near production equipment Regular Audio-Visual-Olfactory inspections of all assets Quarterly Leak Detection and Repair (LDAR) surveys of all assets Piloting continuous emissions monitoring equipment Achieved “A” certification grade - the highest certification level available Biodiversity Surface Footprint Neutral Program focuses on restoring, enhancing, or protecting biodiversity by returning one acre of land to the environment for every acre disturbed Voluntary initiatives focused on pollinator and tree plantings, streambank stabilization, and enhancing aquatic wildlife 100% of gathering system assets certified in 2023 Seneca is participating in AMI’s 2024 Monitoring Plan AMI is a proactive, basin-wide initiative designed to enhance methane monitoring & emission reductions AMI includes aerial surveys of operator assets as well as non-oil & gas assets

Pipeline & Storage Overview National Fuel Gas Supply Corporation Empire Pipeline, Inc. Supplemental Information: Segment Overview

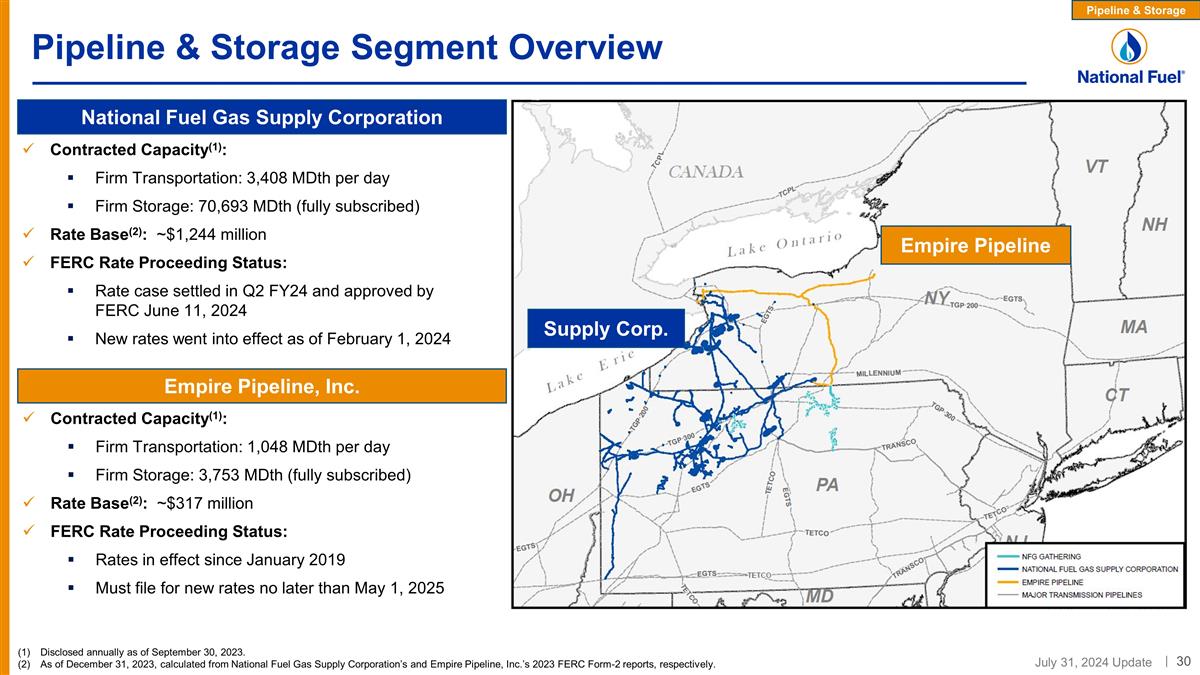

Pipeline & Storage Segment Overview Disclosed annually as of September 30, 2023. As of December 31, 2023, calculated from National Fuel Gas Supply Corporation’s and Empire Pipeline, Inc.’s 2023 FERC Form-2 reports, respectively. Empire Pipeline, Inc. National Fuel Gas Supply Corporation Empire Pipeline Supply Corp. Contracted Capacity(1): Firm Transportation: 3,408 MDth per day Firm Storage: 70,693 MDth (fully subscribed) Rate Base(2): ~$1,244 million FERC Rate Proceeding Status: Rate case settled in Q2 FY24 and approved by FERC June 11, 2024 New rates went into effect as of February 1, 2024 Contracted Capacity(1): Firm Transportation: 1,048 MDth per day Firm Storage: 3,753 MDth (fully subscribed) Rate Base(2): ~$317 million FERC Rate Proceeding Status: Rates in effect since January 2019 Must file for new rates no later than May 1, 2025 Pipeline & Storage

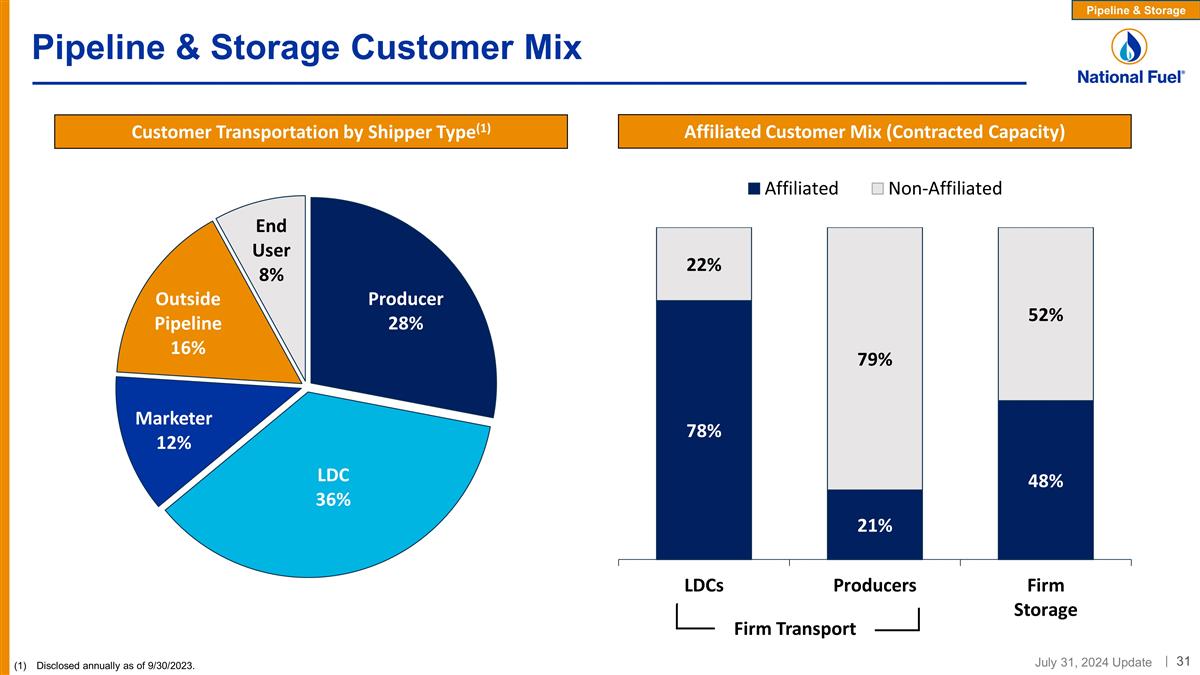

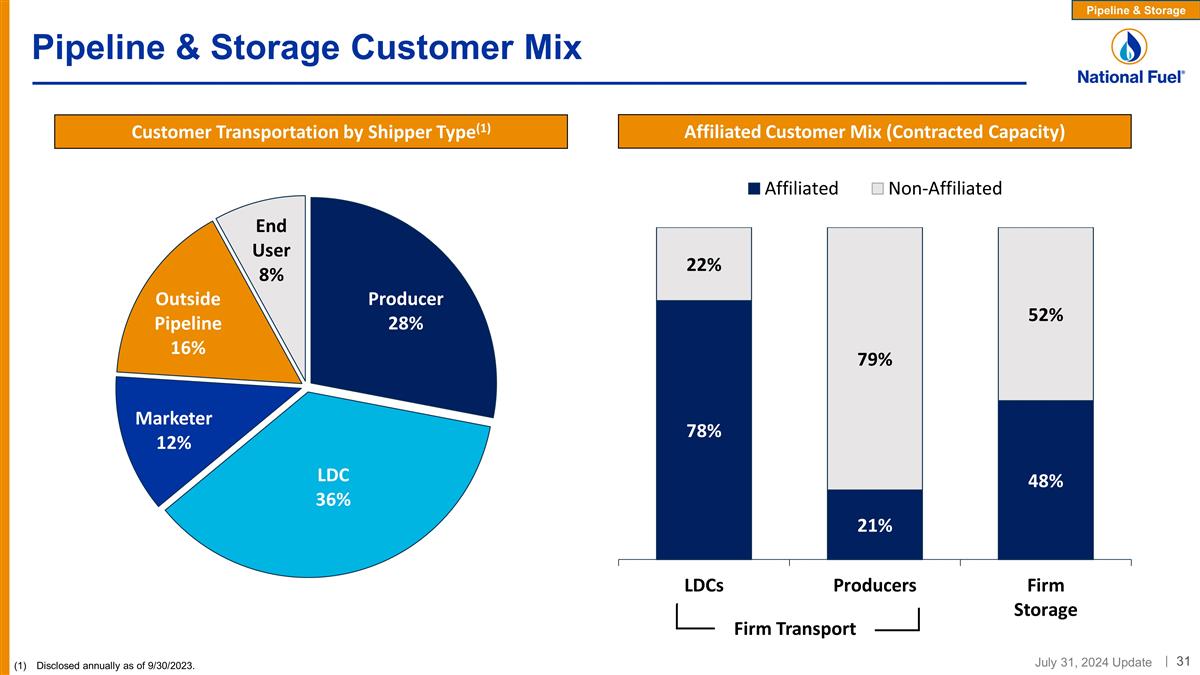

Pipeline & Storage Customer Mix Firm Transport Customer Transportation by Shipper Type(1) Affiliated Customer Mix (Contracted Capacity) Disclosed annually as of 9/30/2023. Pipeline & Storage

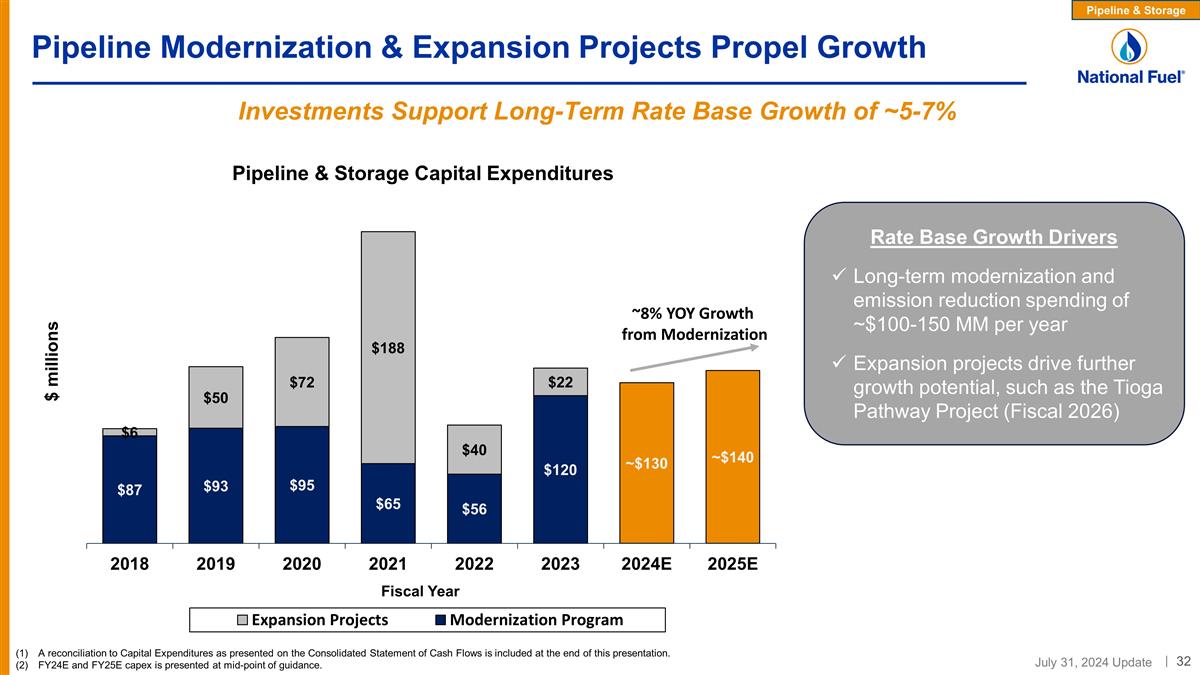

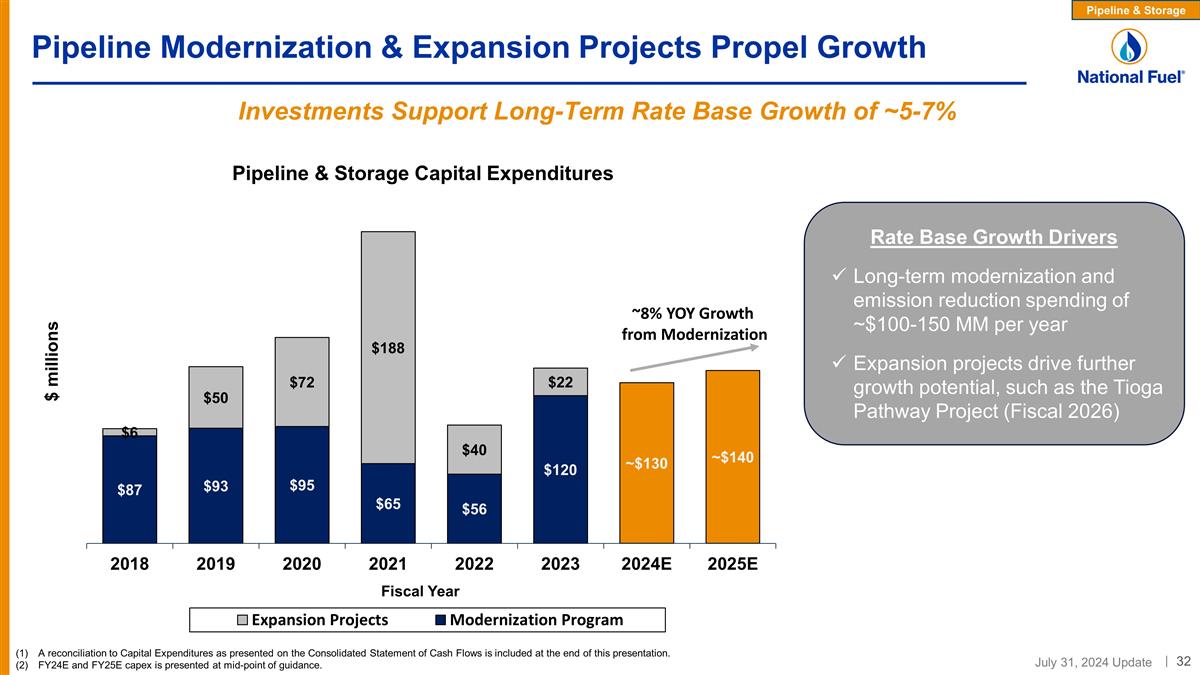

Pipeline Modernization & Expansion Projects Propel Growth A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY24E and FY25E capex is presented at mid-point of guidance. Investments Support Long-Term Rate Base Growth of ~5-7% Pipeline & Storage ~8% YOY Growth from Modernization Rate Base Growth Drivers Long-term modernization and emission reduction spending of ~$100-150 MM per year Expansion projects drive further growth potential, such as the Tioga Pathway Project (Fiscal 2026)

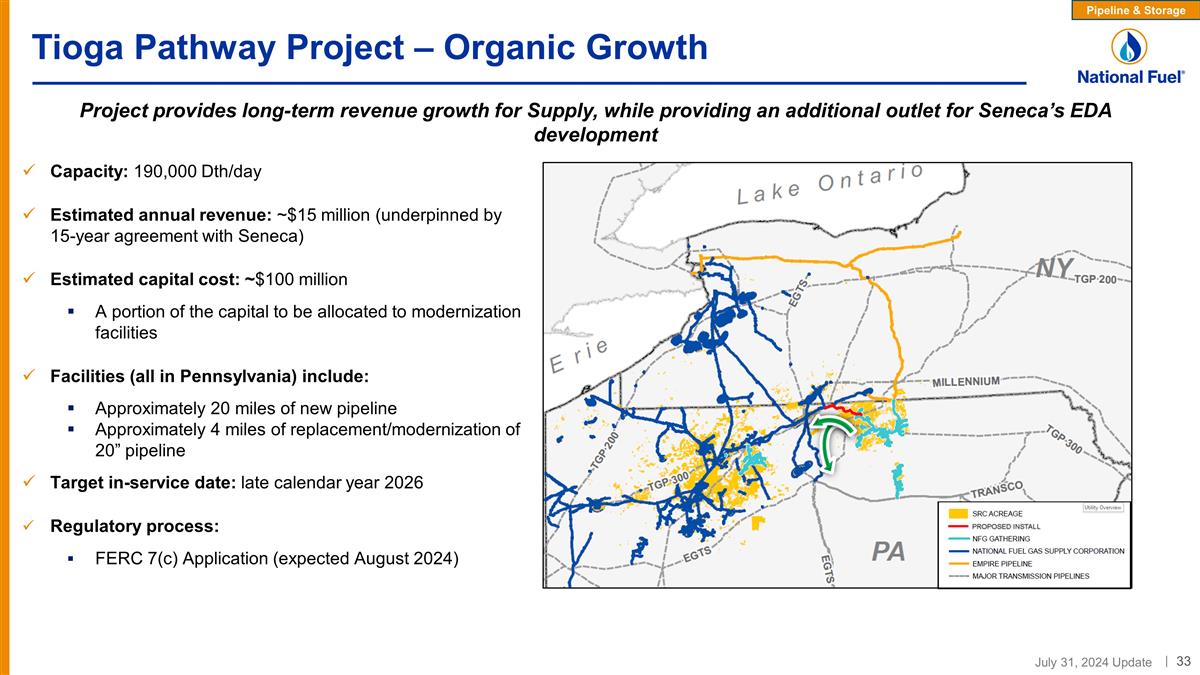

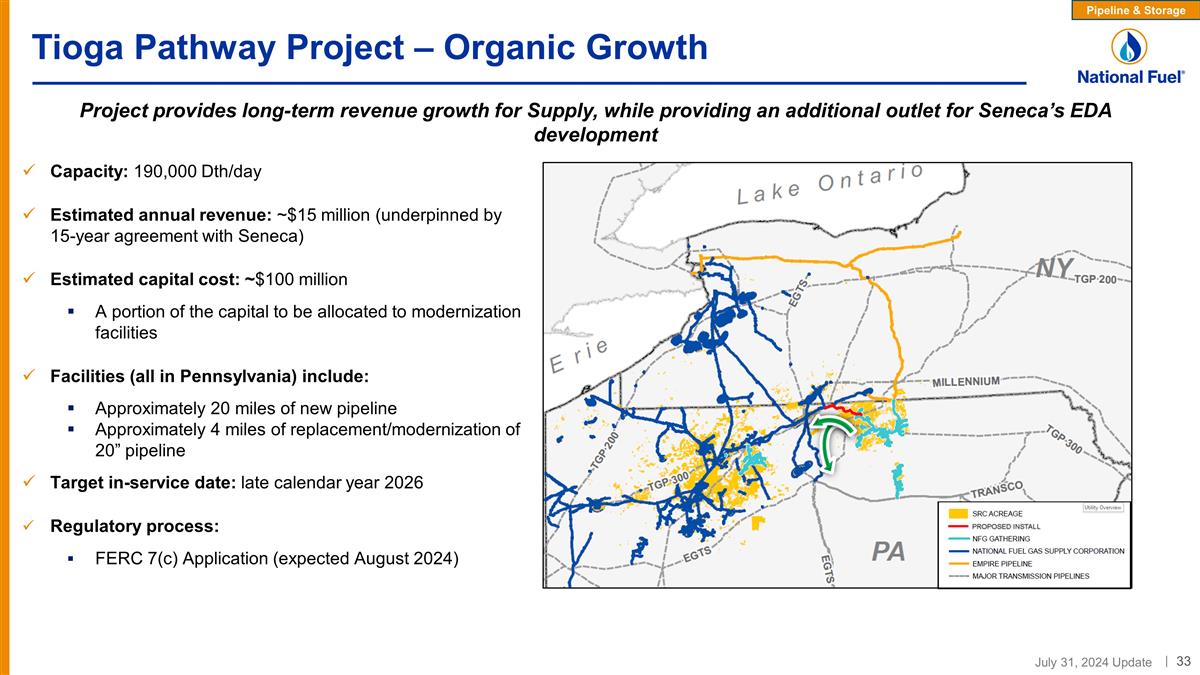

Tioga Pathway Project – Organic Growth Capacity: 190,000 Dth/day Estimated annual revenue: ~$15 million (underpinned by 15-year agreement with Seneca) Estimated capital cost: ~$100 million A portion of the capital to be allocated to modernization facilities Facilities (all in Pennsylvania) include: Approximately 20 miles of new pipeline Approximately 4 miles of replacement/modernization of 20” pipeline Target in-service date: late calendar year 2026 Regulatory process: FERC 7(c) Application (expected August 2024) Pipeline & Storage Project provides long-term revenue growth for Supply, while providing an additional outlet for Seneca’s EDA development

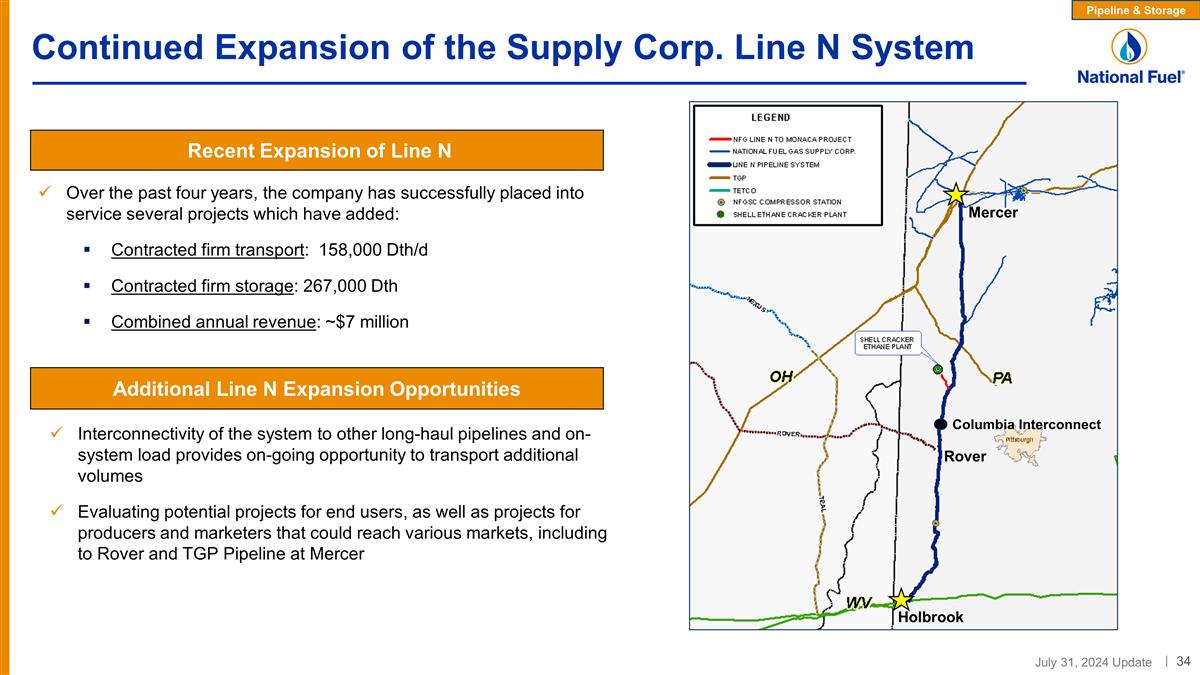

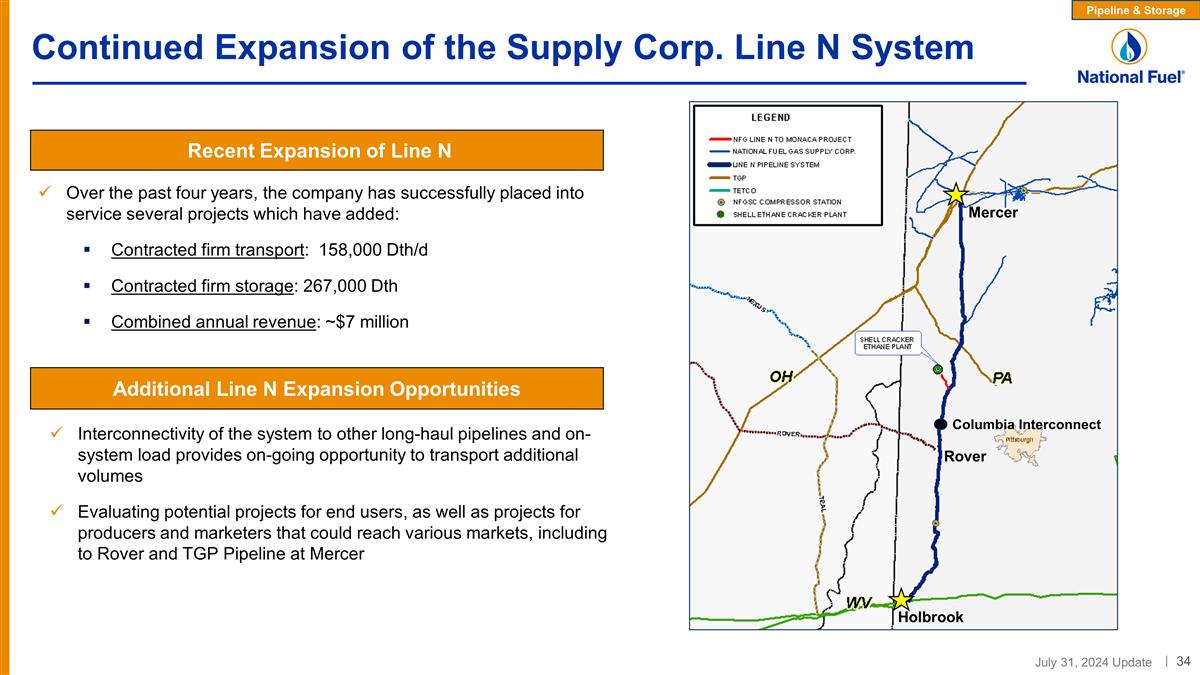

Continued Expansion of the Supply Corp. Line N System Over the past four years, the company has successfully placed into service several projects which have added: Contracted firm transport: 158,000 Dth/d Contracted firm storage: 267,000 Dth Combined annual revenue: ~$7 million Pipeline & Storage Mercer Rover Holbrook Columbia Interconnect Recent Expansion of Line N Additional Line N Expansion Opportunities Interconnectivity of the system to other long-haul pipelines and on-system load provides on-going opportunity to transport additional volumes Evaluating potential projects for end users, as well as projects for producers and marketers that could reach various markets, including to Rover and TGP Pipeline at Mercer

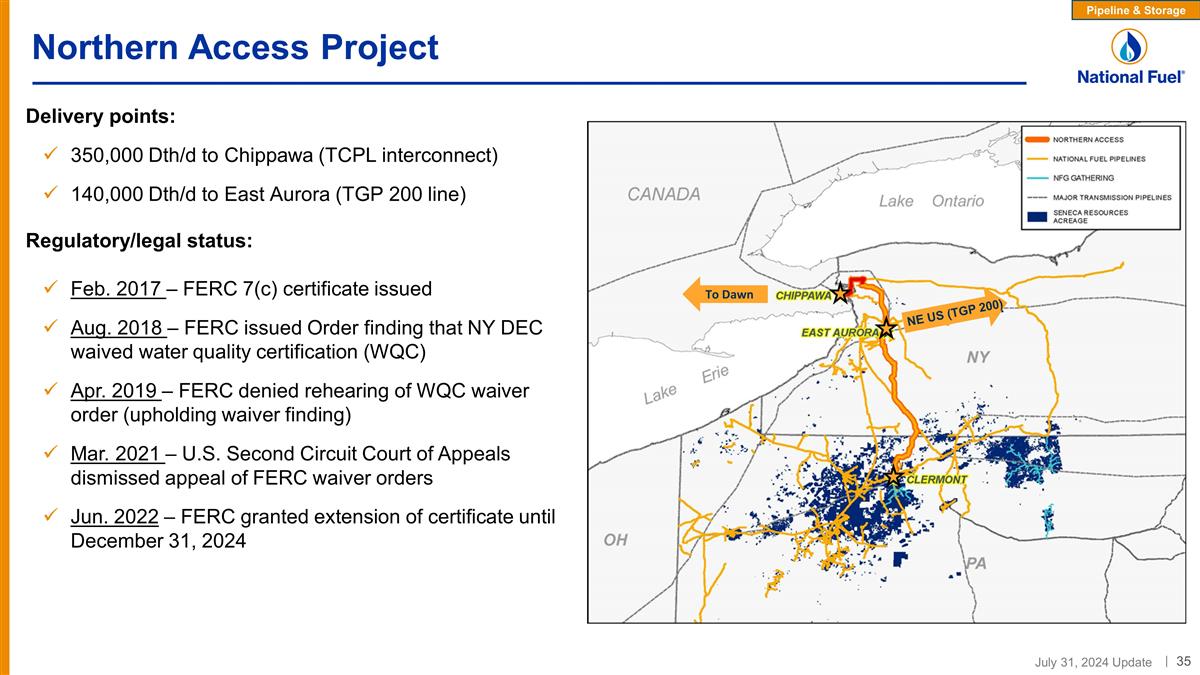

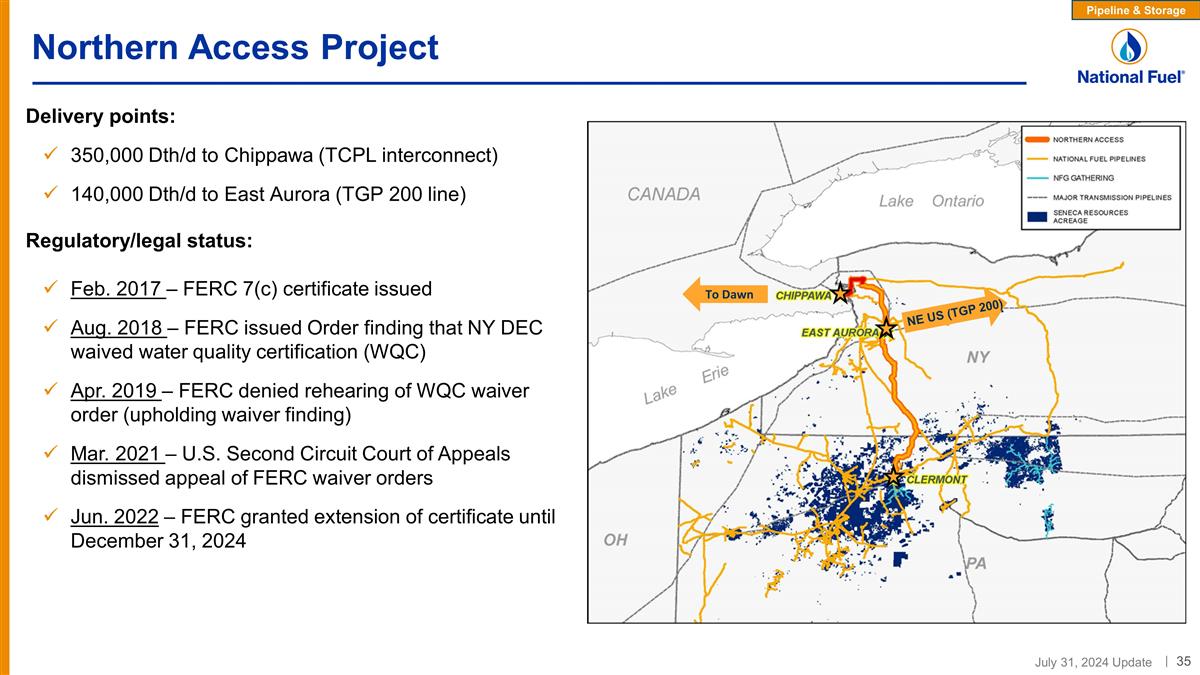

Northern Access Project Delivery points: 350,000 Dth/d to Chippawa (TCPL interconnect) 140,000 Dth/d to East Aurora (TGP 200 line) Regulatory/legal status: Feb. 2017 – FERC 7(c) certificate issued Aug. 2018 – FERC issued Order finding that NY DEC waived water quality certification (WQC) Apr. 2019 – FERC denied rehearing of WQC waiver order (upholding waiver finding) Mar. 2021 – U.S. Second Circuit Court of Appeals dismissed appeal of FERC waiver orders Jun. 2022 – FERC granted extension of certificate until December 31, 2024 To Dawn NE US (TGP 200) Pipeline & Storage

Utility Overview National Fuel Gas Distribution Corporation Supplemental Information: Segment Overview

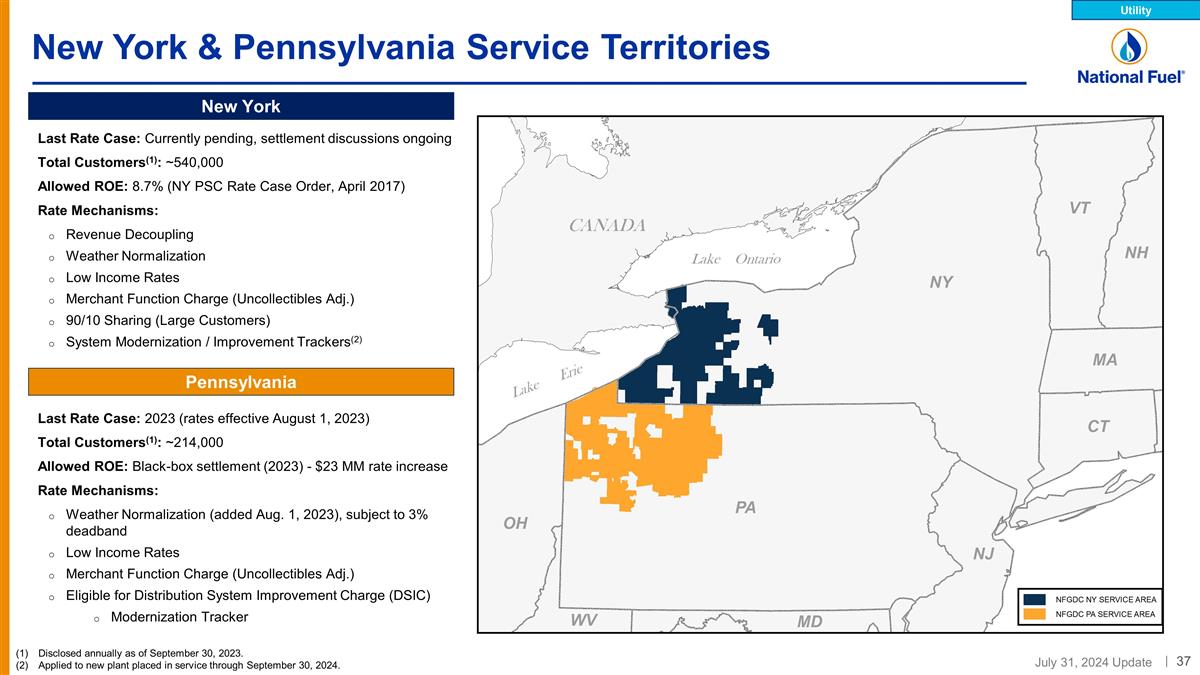

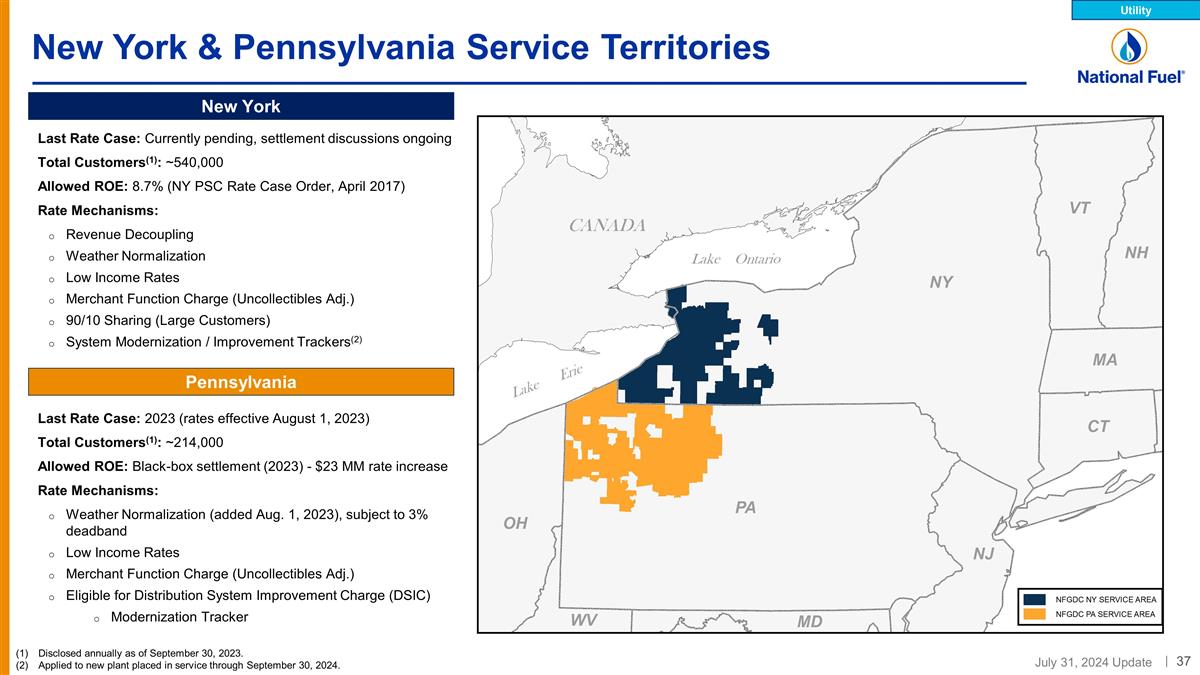

New York & Pennsylvania Service Territories New York Last Rate Case: Currently pending, settlement discussions ongoing Total Customers(1): ~540,000 Allowed ROE: 8.7% (NY PSC Rate Case Order, April 2017) Rate Mechanisms: Revenue Decoupling Weather Normalization Low Income Rates Merchant Function Charge (Uncollectibles Adj.) 90/10 Sharing (Large Customers) System Modernization / Improvement Trackers(2) Pennsylvania Last Rate Case: 2023 (rates effective August 1, 2023) Total Customers(1): ~214,000 Allowed ROE: Black-box settlement (2023) - $23 MM rate increase Rate Mechanisms: Weather Normalization (added Aug. 1, 2023), subject to 3% deadband Low Income Rates Merchant Function Charge (Uncollectibles Adj.) Eligible for Distribution System Improvement Charge (DSIC) Modernization Tracker Disclosed annually as of September 30, 2023. Applied to new plant placed in service through September 30, 2024. Utility

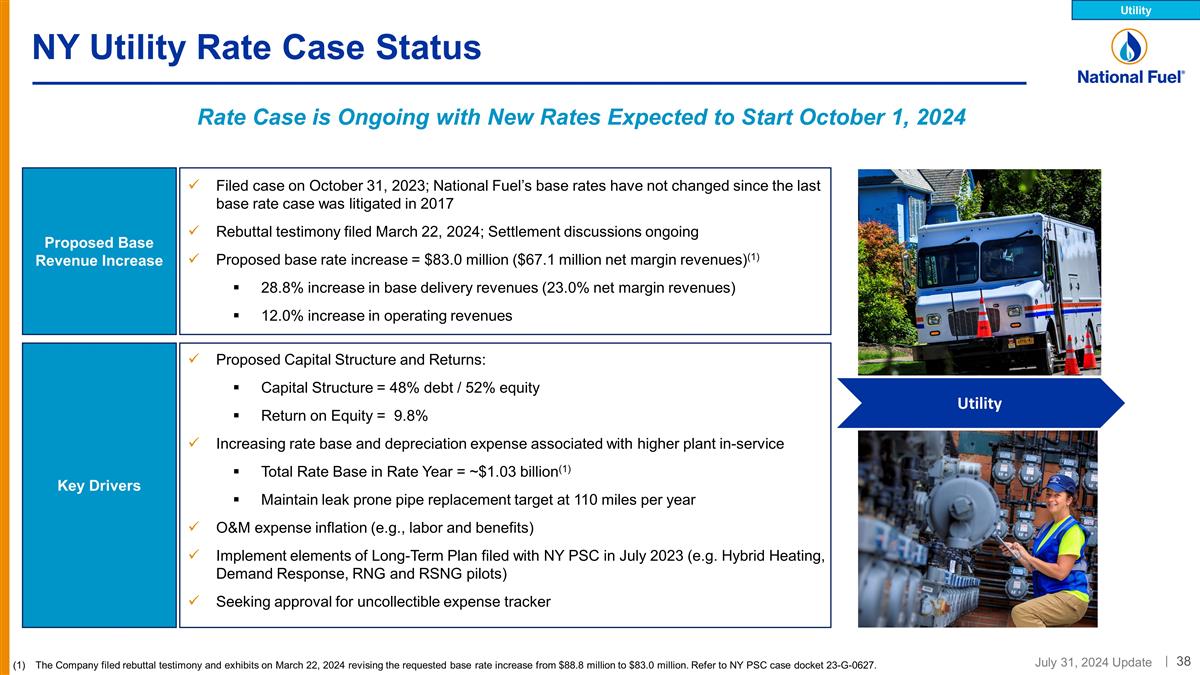

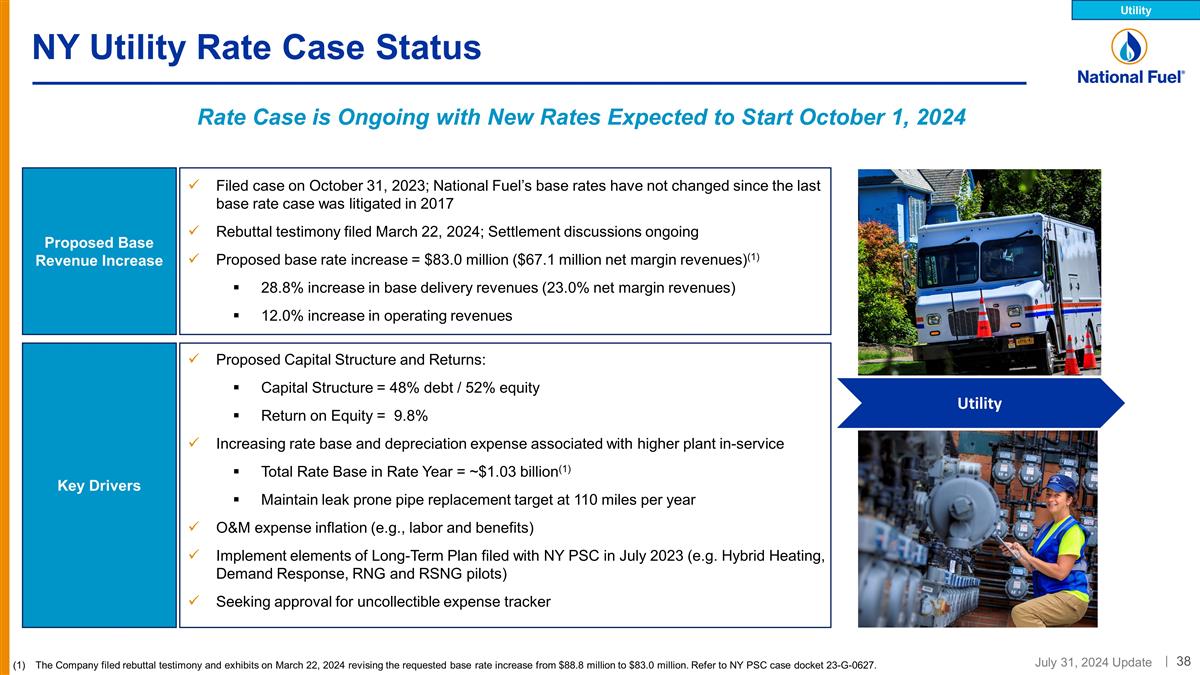

NY Utility Rate Case Status Rate Case is Ongoing with New Rates Expected to Start October 1, 2024 Utility Filed case on October 31, 2023; National Fuel’s base rates have not changed since the last base rate case was litigated in 2017 Rebuttal testimony filed March 22, 2024; Settlement discussions ongoing Proposed base rate increase = $83.0 million ($67.1 million net margin revenues)(1) 28.8% increase in base delivery revenues (23.0% net margin revenues) 12.0% increase in operating revenues Proposed Base Revenue Increase Key Drivers Proposed Capital Structure and Returns: Capital Structure = 48% debt / 52% equity Return on Equity = 9.8% Increasing rate base and depreciation expense associated with higher plant in-service Total Rate Base in Rate Year = ~$1.03 billion(1) Maintain leak prone pipe replacement target at 110 miles per year O&M expense inflation (e.g., labor and benefits) Implement elements of Long-Term Plan filed with NY PSC in July 2023 (e.g. Hybrid Heating, Demand Response, RNG and RSNG pilots) Seeking approval for uncollectible expense tracker The Company filed rebuttal testimony and exhibits on March 22, 2024 revising the requested base rate increase from $88.8 million to $83.0 million. Refer to NY PSC case docket 23-G-0627. Utility

First utility in the state to submit a LTP (Long-Term Plan) NY PSC implemented NFG’s LTP with modifications in December 2023 Includes an “All-of-the-Above Pathway” for an affordable and practical way to meet the State’s climate goals LTP includes Hybrid Heating, Demand Response, RNG and RSNG pilots System modernization NFG continues to receive support for accelerated and proactive investments in the replacement of leak prone pipe Current modernization tracker reduces regulatory lag on rate base growth Supportive rate mechanisms include: Weather normalization – Adjusts billings based on temperature variances compared to average weather Revenue Decoupling – Separates usage from revenue for initiatives such as energy conservation Industrial 90/10 – Symmetrical sharing for large commercial and industrial customer margin NY Regulatory Environment Continues to Prioritize Access to Safe, Reliable and Affordable Energy NY Utility Regulated Environment Utility

Customer Affordability New York Pennsylvania Based on 2023 average monthly residential bill data posted on company websites required by the NYPSC. Based on analysis of 2024 PAPUC Annual Rate Comparison Report, which includes data for average monthly residential bills for 2023. Utility #3 Out of 9 Gas Utilities(1) #1 Out of 6 Gas Utilities(2)

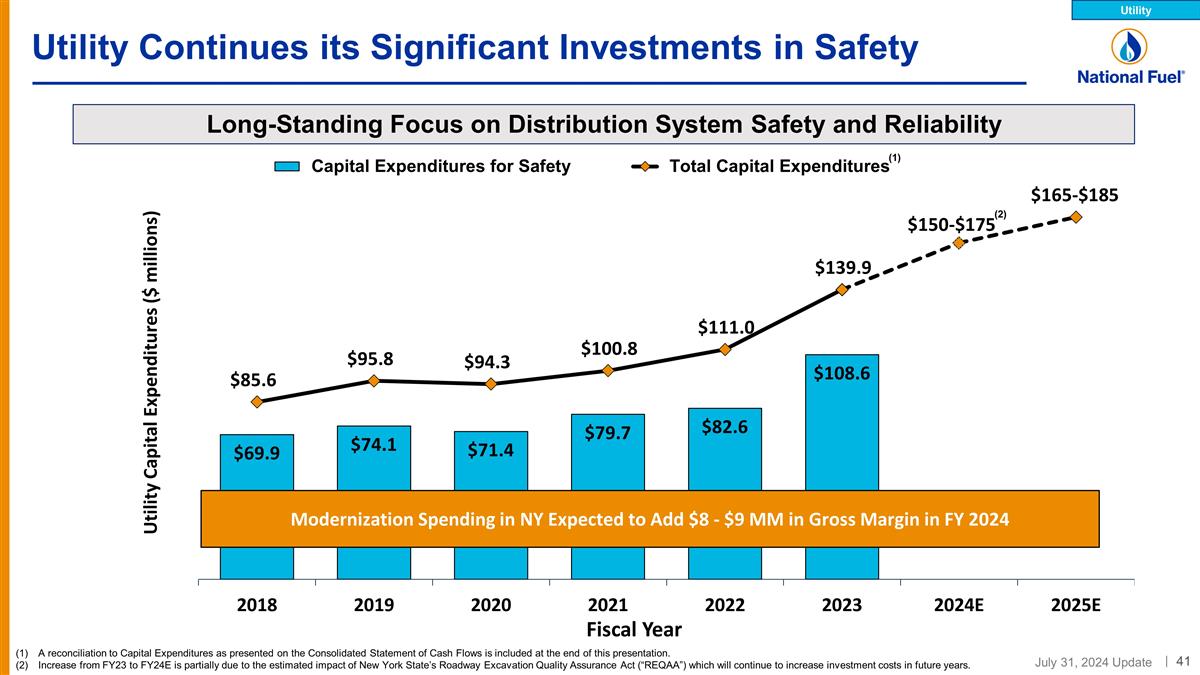

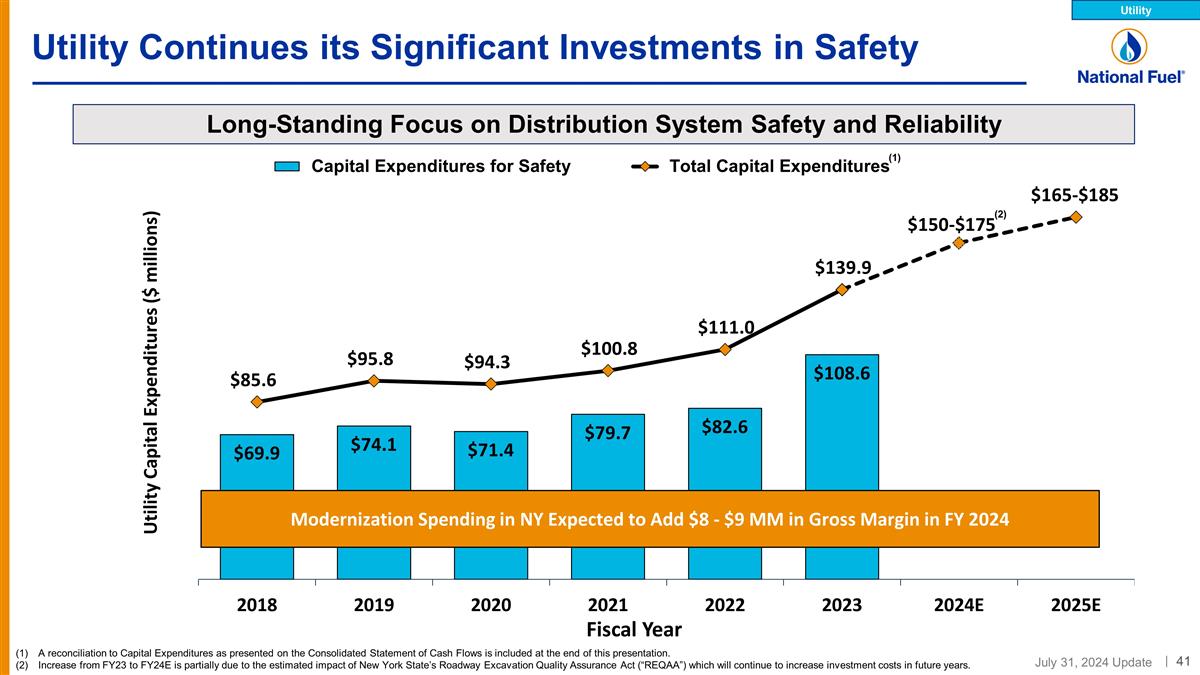

Utility Continues its Significant Investments in Safety (1) A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. Increase from FY23 to FY24E is partially due to the estimated impact of New York State’s Roadway Excavation Quality Assurance Act (“REQAA”) which will continue to increase investment costs in future years. Long-Standing Focus on Distribution System Safety and Reliability Utility Modernization Spending in NY Expected to Add $8 - $9 MM in Gross Margin in FY 2024 (2)

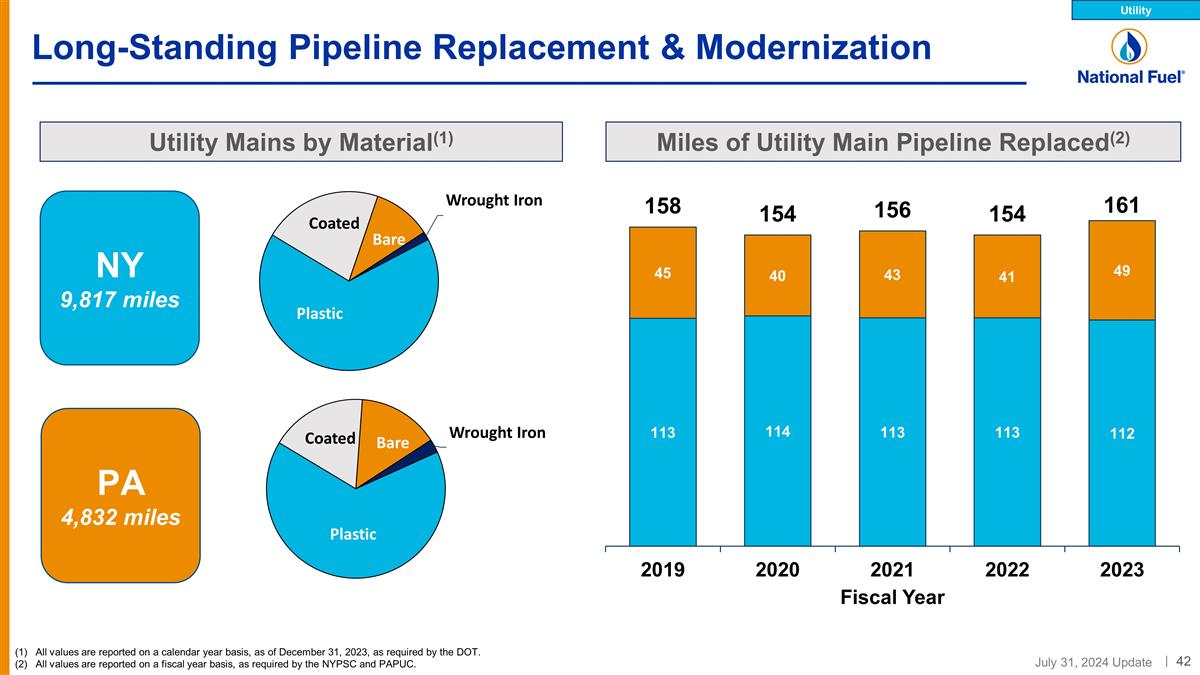

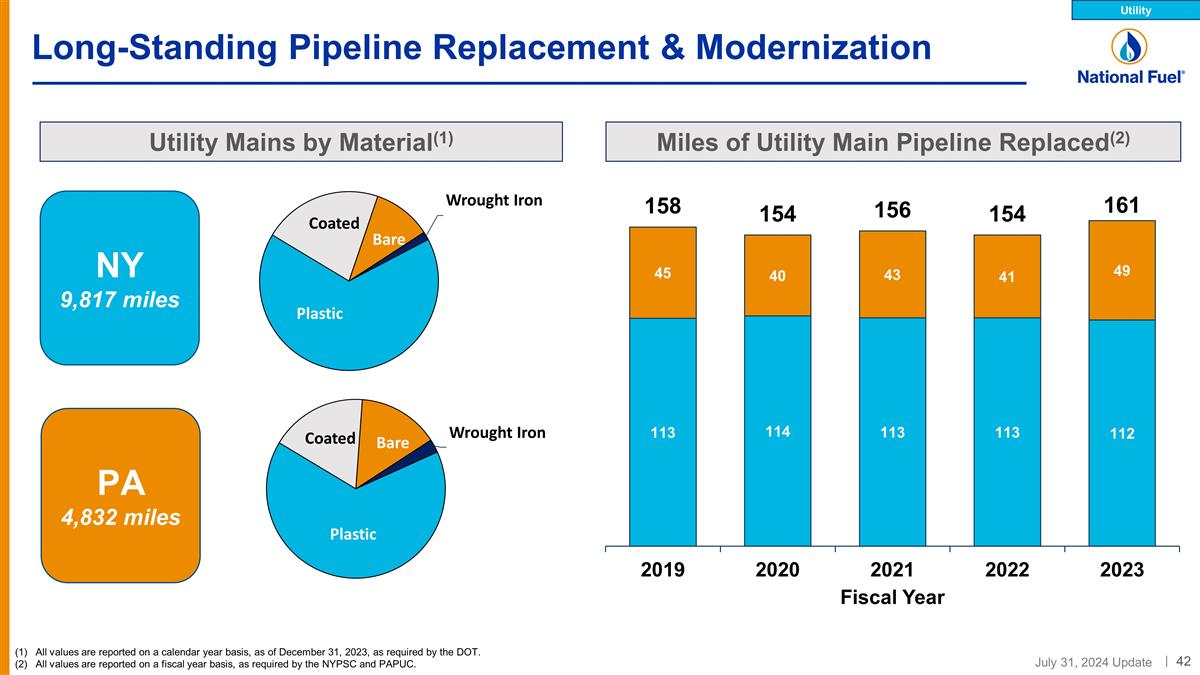

Long-Standing Pipeline Replacement & Modernization NY 9,817 miles PA 4,832 miles Miles of Utility Main Pipeline Replaced(2) Utility Mains by Material(1) (1) All values are reported on a calendar year basis, as of December 31, 2023, as required by the DOT. (2) All values are reported on a fiscal year basis, as required by the NYPSC and PAPUC. Utility

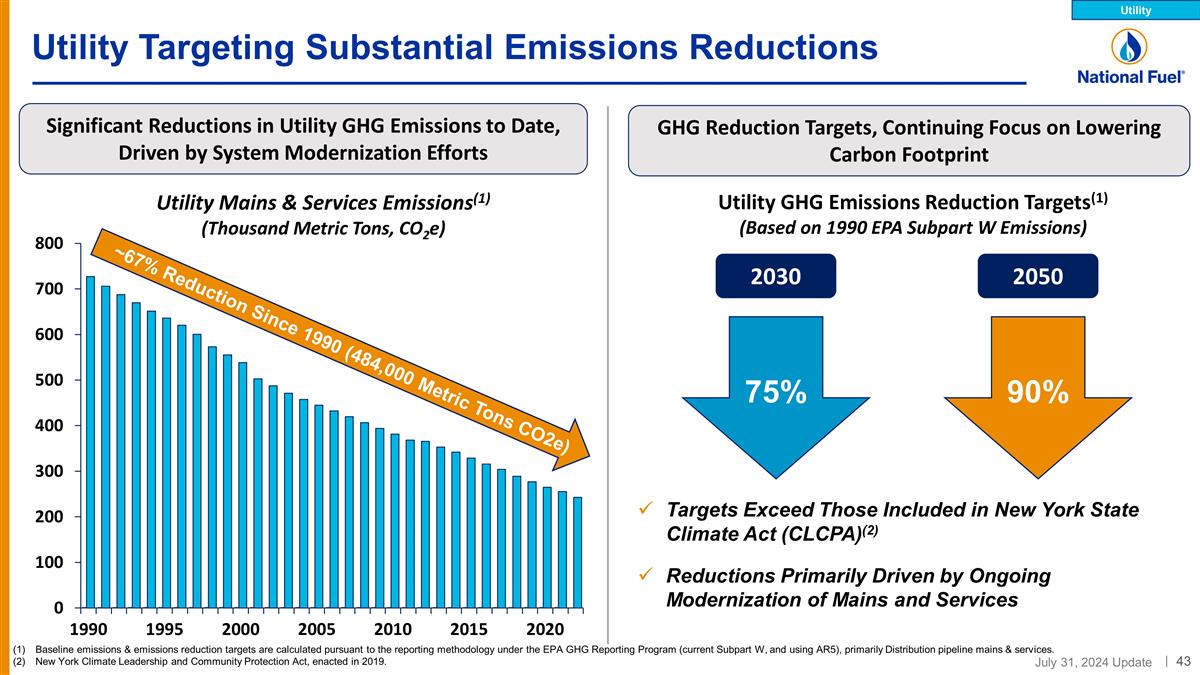

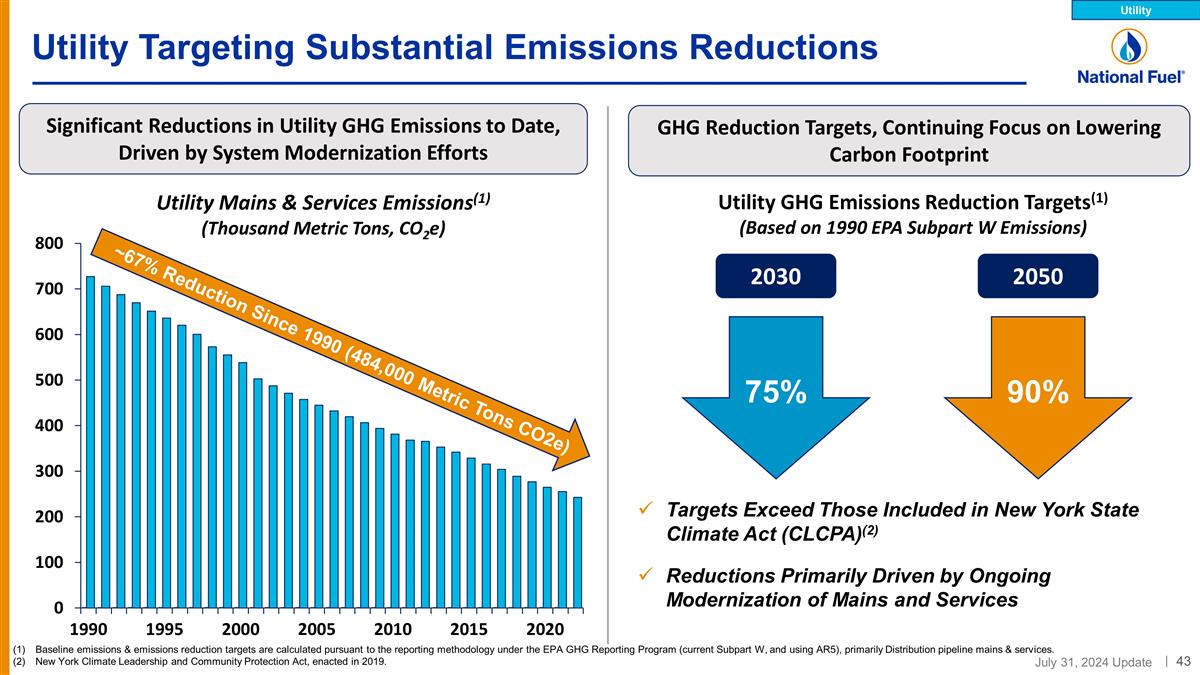

Baseline emissions & emissions reduction targets are calculated pursuant to the reporting methodology under the EPA GHG Reporting Program (current Subpart W, and using AR5), primarily Distribution pipeline mains & services. New York Climate Leadership and Community Protection Act, enacted in 2019. Targets Exceed Those Included in New York State Climate Act (CLCPA)(2) Reductions Primarily Driven by Ongoing Modernization of Mains and Services Utility Targeting Substantial Emissions Reductions 2030 75% Significant Reductions in Utility GHG Emissions to Date, Driven by System Modernization Efforts GHG Reduction Targets, Continuing Focus on Lowering Carbon Footprint ~67% Reduction Since 1990 (484,000 Metric Tons CO2e) Utility GHG Emissions Reduction Targets(1) (Based on 1990 EPA Subpart W Emissions) 90% 2050 Utility

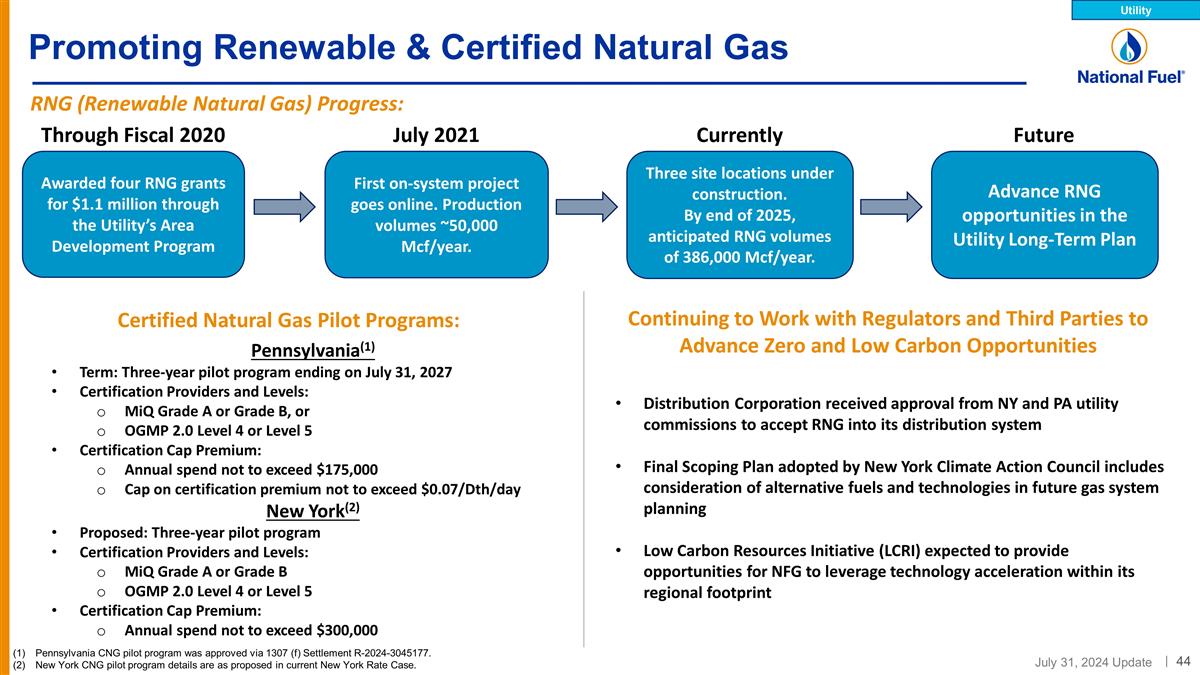

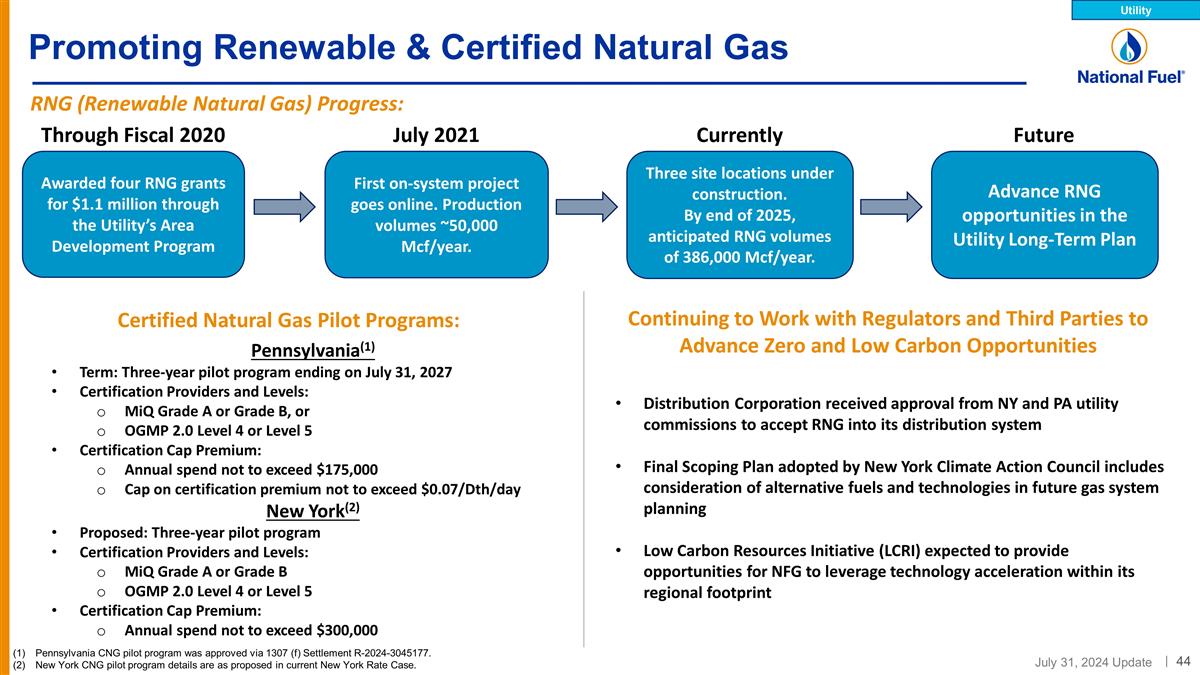

Promoting Renewable & Certified Natural Gas Awarded four RNG grants for $1.1 million through the Utility’s Area Development Program First on-system project goes online. Production volumes ~50,000 Mcf/year. Through Fiscal 2020 Future Distribution Corporation received approval from NY and PA utility commissions to accept RNG into its distribution system Final Scoping Plan adopted by New York Climate Action Council includes consideration of alternative fuels and technologies in future gas system planning Low Carbon Resources Initiative (LCRI) expected to provide opportunities for NFG to leverage technology acceleration within its regional footprint Continuing to Work with Regulators and Third Parties to Advance Zero and Low Carbon Opportunities Utility Advance RNG opportunities in the Utility Long-Term Plan July 2021 Currently Three site locations under construction. By end of 2025, anticipated RNG volumes of 386,000 Mcf/year. Certified Natural Gas Pilot Programs: Pennsylvania(1) Term: Three-year pilot program ending on July 31, 2027 Certification Providers and Levels: MiQ Grade A or Grade B, or OGMP 2.0 Level 4 or Level 5 Certification Cap Premium: Annual spend not to exceed $175,000 Cap on certification premium not to exceed $0.07/Dth/day New York(2) Proposed: Three-year pilot program Certification Providers and Levels: MiQ Grade A or Grade B OGMP 2.0 Level 4 or Level 5 Certification Cap Premium: Annual spend not to exceed $300,000 Pennsylvania CNG pilot program was approved via 1307 (f) Settlement R-2024-3045177. New York CNG pilot program details are as proposed in current New York Rate Case. RNG (Renewable Natural Gas) Progress:

Rate Case Overview Supplemental Information

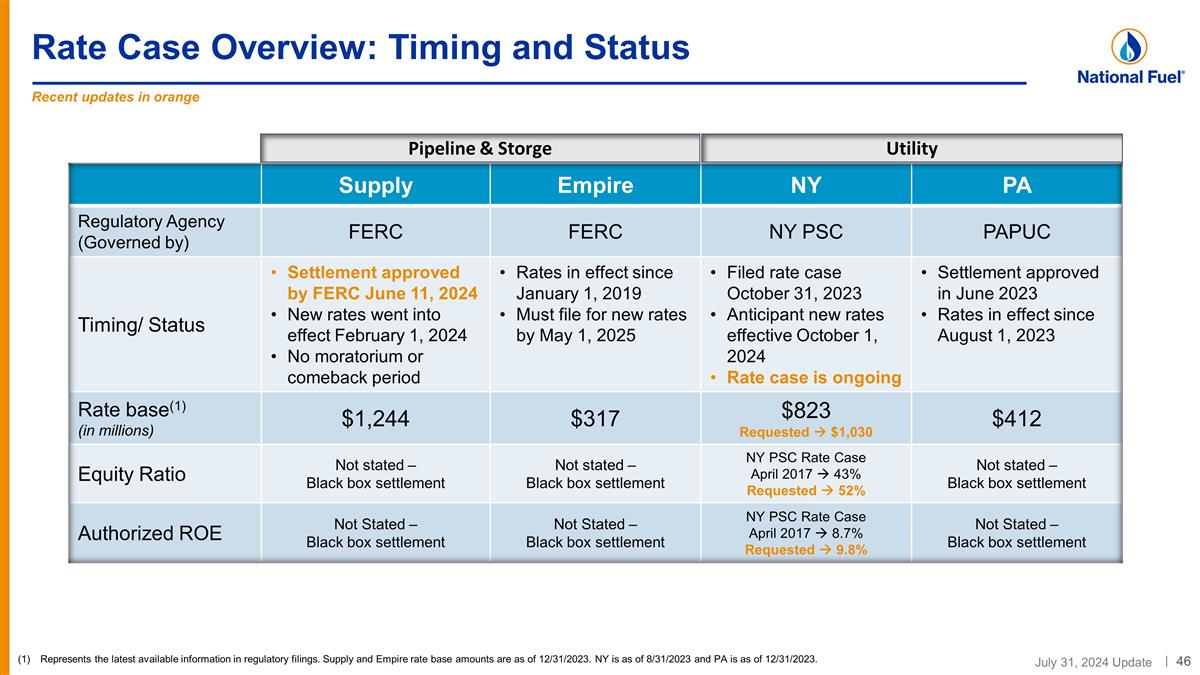

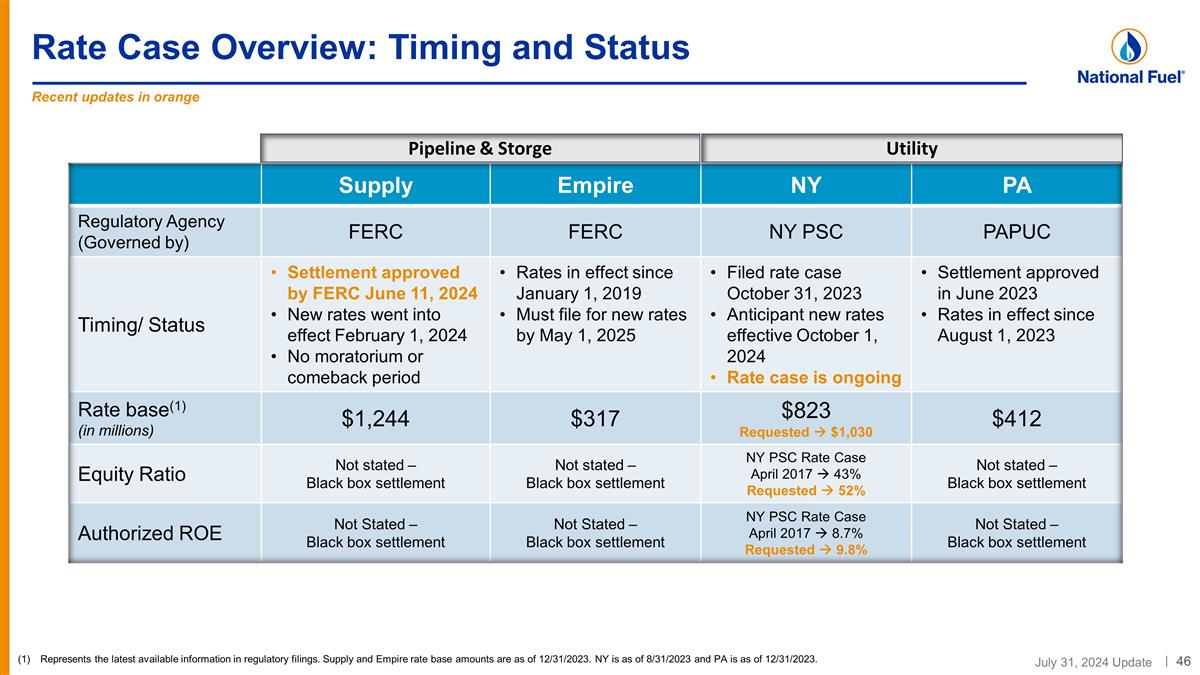

Rate Case Overview: Timing and Status Supply Empire NY PA Regulatory Agency (Governed by) FERC FERC NY PSC PAPUC Timing/ Status Settlement approved by FERC June 11, 2024 New rates went into effect February 1, 2024 No moratorium or comeback period Rates in effect since January 1, 2019 Must file for new rates by May 1, 2025 Filed rate case October 31, 2023 Anticipant new rates effective October 1, 2024 Rate case is ongoing Settlement approved in June 2023 Rates in effect since August 1, 2023 Rate base(1) (in millions) $1,244 $317 $823 Requested à $1,030 $412 Equity Ratio Not stated – Black box settlement Not stated – Black box settlement NY PSC Rate Case April 2017 à 43% Requested à 52% Not stated – Black box settlement Authorized ROE Not Stated – Black box settlement Not Stated – Black box settlement NY PSC Rate Case April 2017 à 8.7% Requested à 9.8% Not Stated – Black box settlement Pipeline & Storge Utility Represents the latest available information in regulatory filings. Supply and Empire rate base amounts are as of 12/31/2023. NY is as of 8/31/2023 and PA is as of 12/31/2023. Recent updates in orange

Guidance & Other Financial Information Supplemental Information

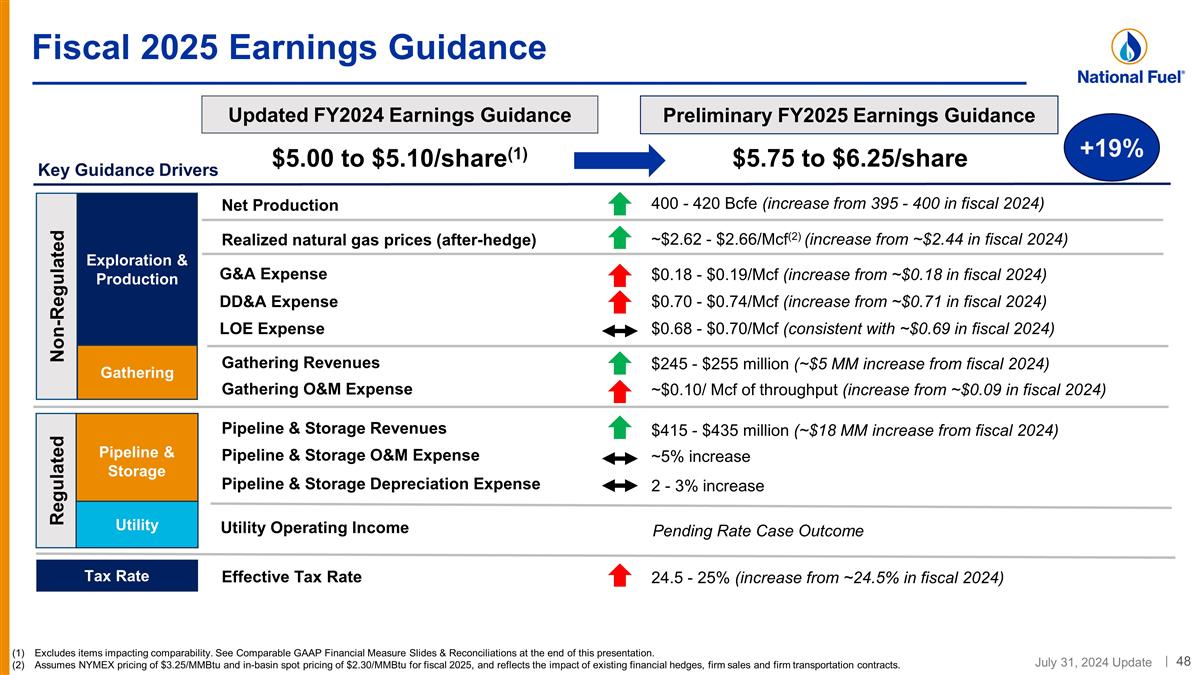

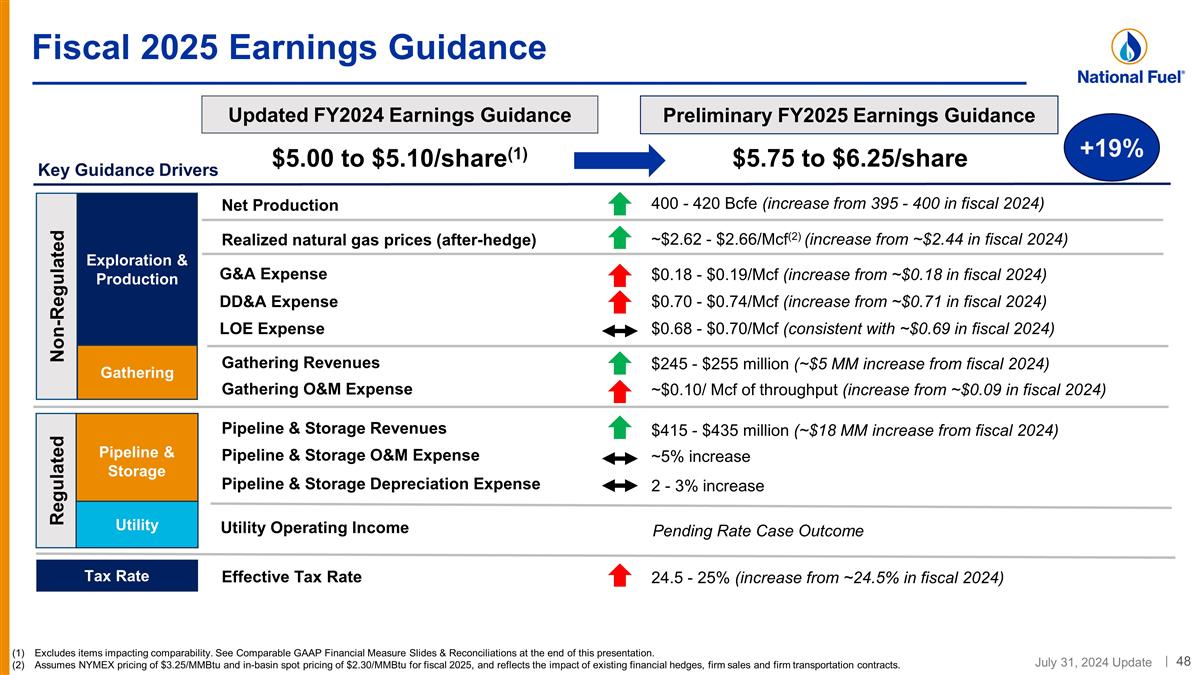

Fiscal 2025 Earnings Guidance Updated FY2024 Earnings Guidance $5.00 to $5.10/share(1) $5.75 to $6.25/share Preliminary FY2025 Earnings Guidance 400 - 420 Bcfe (increase from 395 - 400 in fiscal 2024) ~$2.62 - $2.66/Mcf(2) (increase from ~$2.44 in fiscal 2024) Key Guidance Drivers Net Production Realized natural gas prices (after-hedge) Pipeline & Storage Utility Pending Rate Case Outcome $415 - $435 million (~$18 MM increase from fiscal 2024) Pipeline & Storage Revenues Tax Rate Effective Tax Rate 24.5 - 25% (increase from ~24.5% in fiscal 2024) Pipeline & Storage Depreciation Expense 2 - 3% increase G&A Expense $0.18 - $0.19/Mcf (increase from ~$0.18 in fiscal 2024) DD&A Expense $0.70 - $0.74/Mcf (increase from ~$0.71 in fiscal 2024) ~5% increase Pipeline & Storage O&M Expense Non-Regulated Regulated $245 - $255 million (~$5 MM increase from fiscal 2024) Gathering Revenues Gathering O&M Expense ~$0.10/ Mcf of throughput (increase from ~$0.09 in fiscal 2024) Exploration & Production Gathering Pipeline & Storage Utility LOE Expense $0.68 - $0.70/Mcf (consistent with ~$0.69 in fiscal 2024) Utility Operating Income Excludes items impacting comparability. See Comparable GAAP Financial Measure Slides & Reconciliations at the end of this presentation. Assumes NYMEX pricing of $3.25/MMBtu and in-basin spot pricing of $2.30/MMBtu for fiscal 2025, and reflects the impact of existing financial hedges, firm sales and firm transportation contracts. +19%

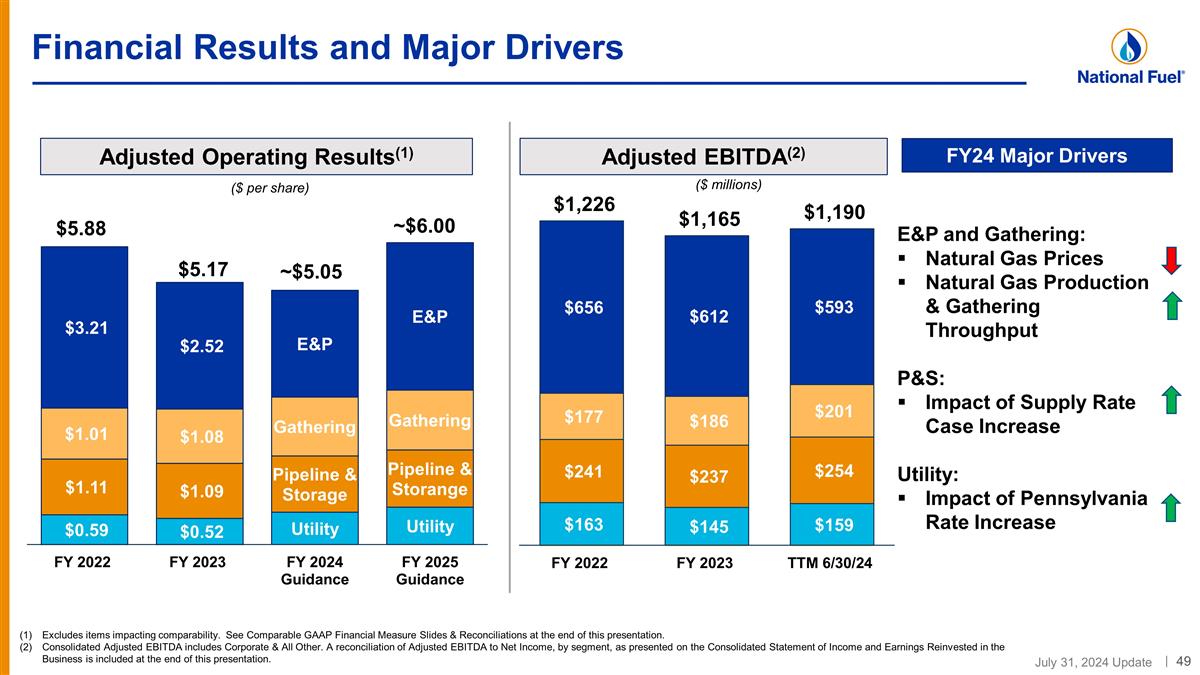

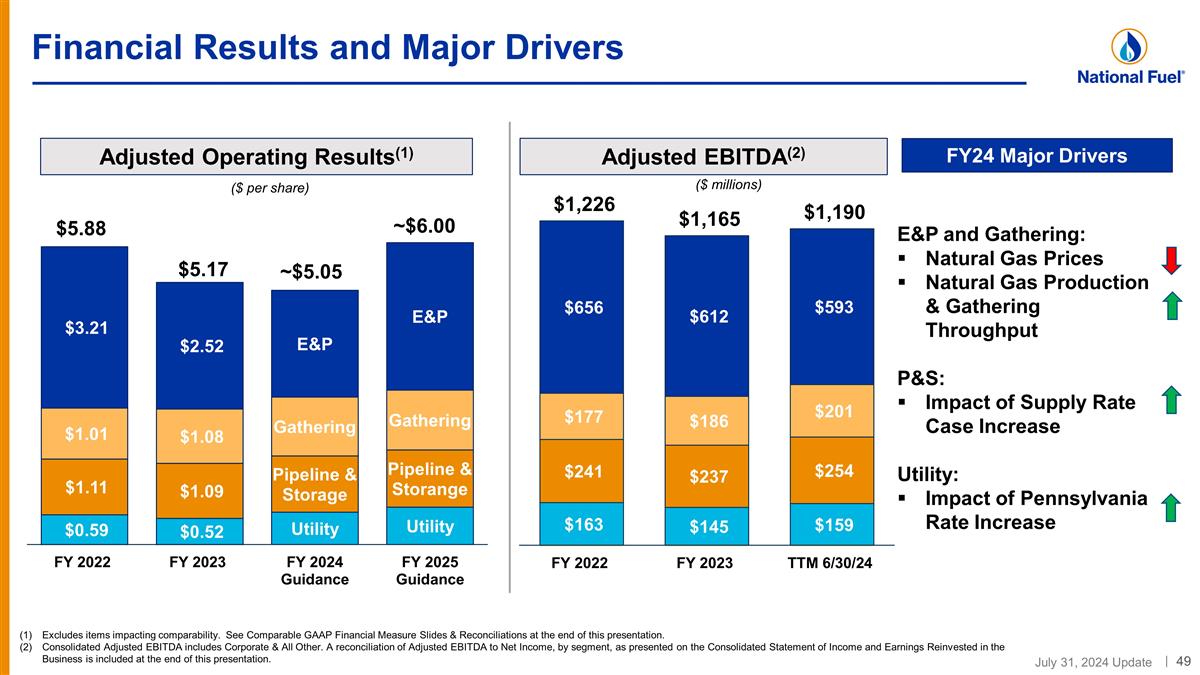

Financial Results and Major Drivers Adjusted Operating Results(1) Excludes items impacting comparability. See Comparable GAAP Financial Measure Slides & Reconciliations at the end of this presentation. Consolidated Adjusted EBITDA includes Corporate & All Other. A reconciliation of Adjusted EBITDA to Net Income, by segment, as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end of this presentation. Adjusted EBITDA(2) ($ per share) FY24 Major Drivers E&P and Gathering: Natural Gas Prices Natural Gas Production & Gathering Throughput P&S: Impact of Supply Rate Case Increase Utility: Impact of Pennsylvania Rate Increase ($ millions)

Safe Harbor For Forward Looking Statements This presentation may contain “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, including statements regarding future prospects, plans, objectives, goals, projections, estimates of gas quantities, strategies, future events or performance and underlying assumptions, capital structure, anticipated capital expenditures, completion of construction projects, projections for pension and other post-retirement benefit obligations, impacts of the adoption of new accounting rules, and possible outcomes of litigation or regulatory proceedings, as well as statements that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may,” and similar expressions. Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. The Company’s expectations, beliefs and projections are expressed in good faith and are believed by the Company to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors, the following are important factors that could cause actual results to differ materially from those discussed in the forward-looking statements: impairments under the SEC's full cost ceiling test for natural gas reserves; changes in the price of natural gas; changes in laws, regulations or judicial interpretations to which the Company is subject, including those involving derivatives, taxes, safety, employment, climate change, other environmental matters, real property, and exploration and production activities such as hydraulic fracturing; governmental/regulatory actions, initiatives and proceedings, including those involving rate cases (which address, among other things, target rates of return, rate design, retained natural gas and system modernization), environmental/safety requirements, affiliate relationships, industry structure, and franchise renewal; the Company’s ability to estimate accurately the time and resources necessary to meet emissions targets; governmental/regulatory actions and/or market pressures to reduce or eliminate reliance on natural gas; increased costs or delays or changes in plans with respect to Company projects or related projects of other companies, as well as difficulties or delays in obtaining necessary governmental approvals, permits or orders or in obtaining the cooperation of interconnecting facility operators; changes in economic conditions, including inflationary pressures, supply chain issues, liquidity challenges, and global, national or regional recessions, and their effect on the demand for, and customers’ ability to pay for, the Company’s products and services; the creditworthiness or performance of the Company’s key suppliers, customers and counterparties; financial and economic conditions, including the availability of credit, and occurrences affecting the Company’s ability to obtain financing on acceptable terms for working capital, capital expenditures and other investments, including any downgrades in the Company’s credit ratings and changes in interest rates and other capital market conditions; changes in price differentials between similar quantities of natural gas sold at different geographic locations, and the effect of such changes on commodity production, revenues and demand for pipeline transportation capacity to or from such locations; the impact of information technology disruptions, cybersecurity or data security breaches; factors affecting the Company’s ability to successfully identify, drill for and produce economically viable natural gas reserves, including among others geology, lease availability and costs, title disputes, weather conditions, water availability and disposal or recycling opportunities of used water, shortages, delays or unavailability of equipment and services required in drilling operations, insufficient gathering, processing and transportation capacity, the need to obtain governmental approvals and permits, and compliance with environmental laws and regulations; the Company's ability to complete strategic transactions; increasing health care costs and the resulting effect on health insurance premiums and on the obligation to provide other post-retirement benefits; other changes in price differentials between similar quantities of natural gas having different quality, heating value, hydrocarbon mix or delivery date; the cost and effects of legal and administrative claims against the Company or activist shareholder campaigns to effect changes at the Company; negotiations with the collective bargaining units representing the Company's workforce, including potential work stoppages during negotiations; uncertainty of natural gas reserve estimates; significant differences between the Company’s projected and actual production levels for natural gas; changes in demographic patterns and weather conditions (including those related to climate change); changes in the availability, price or accounting treatment of derivative financial instruments; changes in laws, actuarial assumptions, the interest rate environment and the return on plan/trust assets related to the Company’s pension and other post-retirement benefits, which can affect future funding obligations and costs and plan liabilities; economic disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural disasters, terrorist activities or acts of war, as well as economic and operational disruptions due to third-party outages; significant differences between the Company’s projected and actual capital expenditures and operating expenses; or increasing costs of insurance, changes in coverage and the ability to obtain insurance. Forward-looking statements include estimates of gas quantities. Proved gas reserves are those quantities of gas which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible under existing economic conditions, operating methods and government regulations. Other estimates of gas quantities, including estimates of probable reserves, possible reserves, and resource potential, are by their nature more speculative than estimates of proved reserves. Accordingly, estimates other than proved reserves are subject to substantially greater risk of being actually realized. Investors are urged to consider closely the disclosure in our Form 10-K available at www.nationalfuel.com. You can also obtain this form on the SEC’s website at www.sec.gov. Forward-looking and other statements in this presentation regarding methane and greenhouse gas reduction plans and goals are not an indication that these statements are necessarily material to investor or required to be disclosed in our filings with the SEC. In addition, historical, current and forward-looking statements regarding methane and greenhouse gas emissions may be based on standards for measuring progress that are still developing, internal controls, and processes that continue to evolve and assumptions that are subject to change in the future. For a discussion of the risks set forth above and other factors that could cause actual results to differ materially from results referred to in the forward-looking statements, see “Risk Factors” in the Company’s Form 10-K for the fiscal year ended September 30, 2023, and the Forms 10-Q for the quarter ended December 31, 2023, March 31, 2024, and June 30, 2024. The Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date thereof or to reflect the occurrence of unanticipated events.

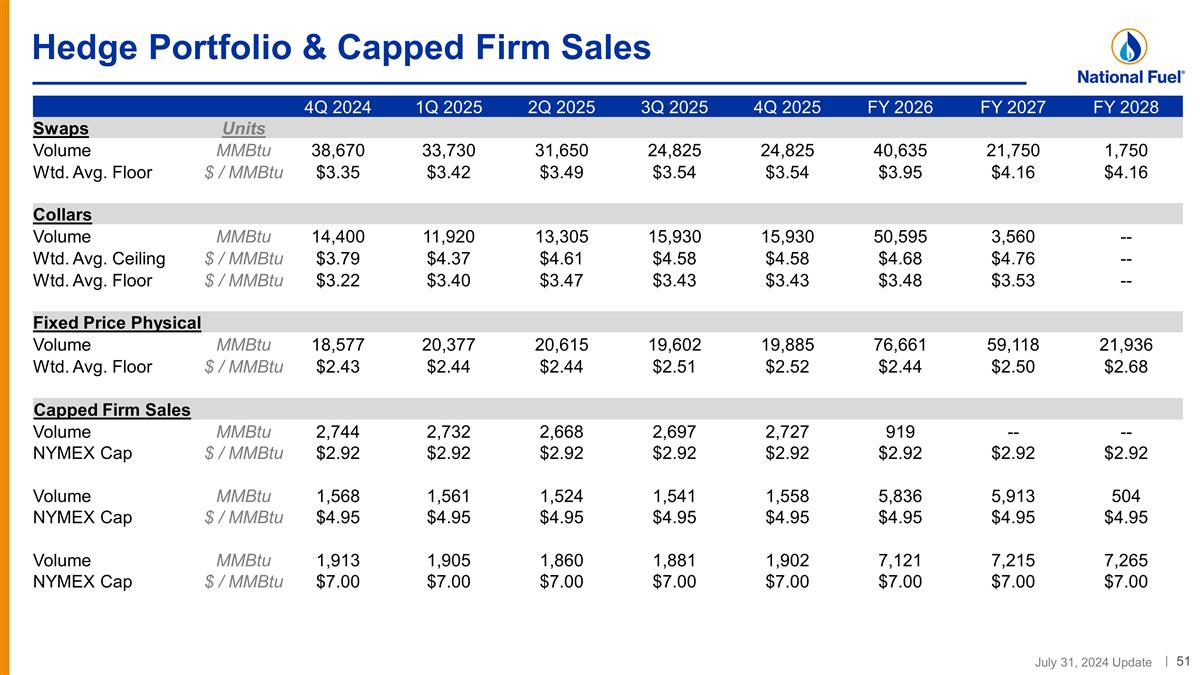

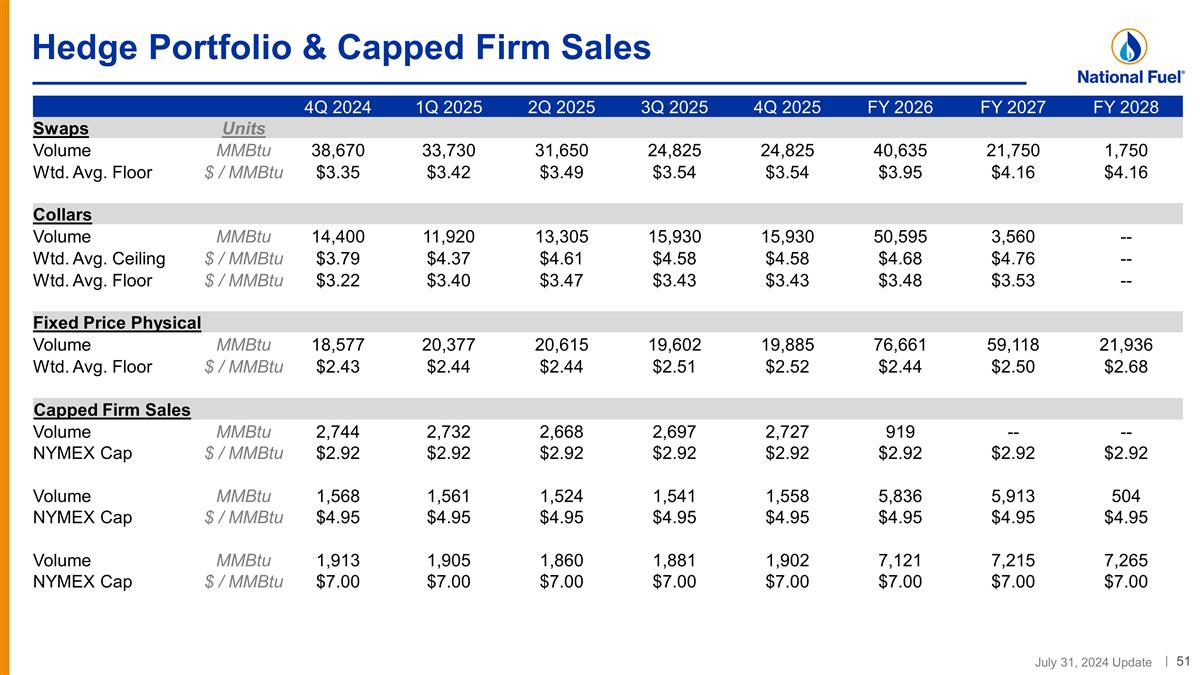

Hedge Portfolio & Capped Firm Sales 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 FY 2026 FY 2027 FY 2028 Swaps Units Volume MMBtu 38,670 33,730 31,650 24,825 24,825 40,635 21,750 1,750 Wtd. Avg. Floor $ / MMBtu $3.35 $3.42 $3.49 $3.54 $3.54 $3.95 $4.16 $4.16 Collars Volume MMBtu 14,400 11,920 13,305 15,930 15,930 50,595 3,560 -- Wtd. Avg. Ceiling $ / MMBtu $3.79 $4.37 $4.61 $4.58 $4.58 $4.68 $4.76 -- Wtd. Avg. Floor $ / MMBtu $3.22 $3.40 $3.47 $3.43 $3.43 $3.48 $3.53 -- Fixed Price Physical Volume MMBtu 18,577 20,377 20,615 19,602 19,885 76,661 59,118 21,936 Wtd. Avg. Floor $ / MMBtu $2.43 $2.44 $2.44 $2.51 $2.52 $2.44 $2.50 $2.68 Capped Firm Sales Volume MMBtu 2,744 2,732 2,668 2,697 2,727 919 -- -- NYMEX Cap $ / MMBtu $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 Volume MMBtu 1,568 1,561 1,524 1,541 1,558 5,836 5,913 504 NYMEX Cap $ / MMBtu $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 Volume MMBtu 1,913 1,905 1,860 1,881 1,902 7,121 7,215 7,265 NYMEX Cap $ / MMBtu $7.00 $7.00 $7.00 $7.00 $7.00 $7.00 $7.00 $7.00

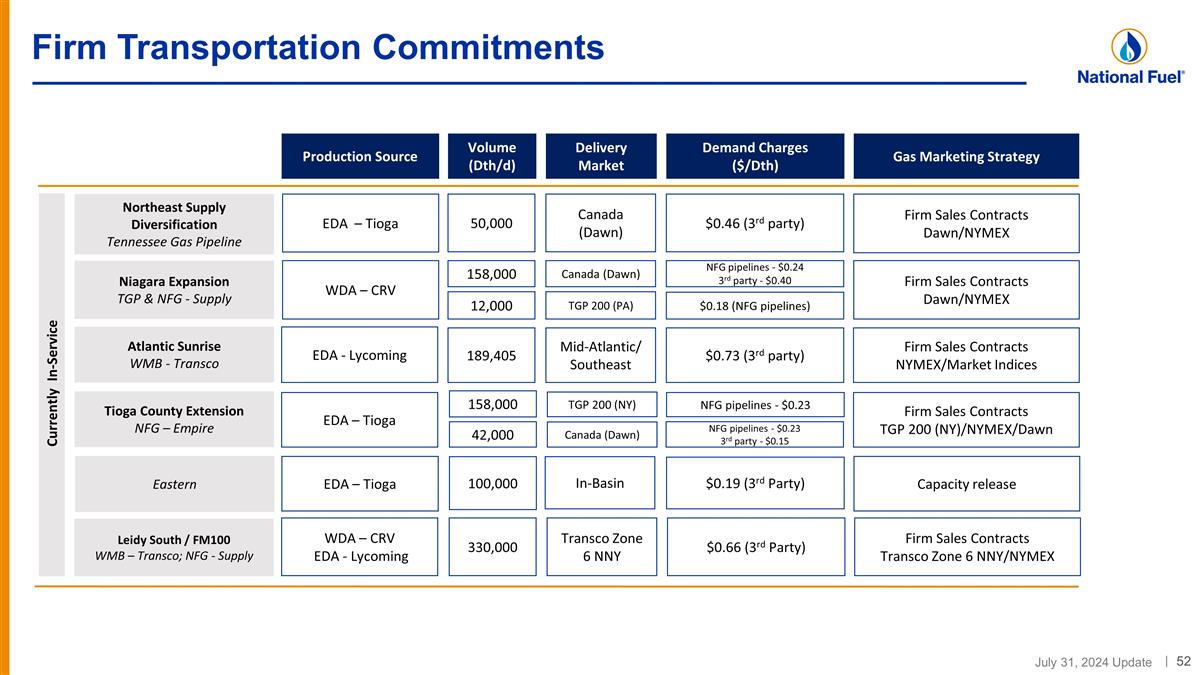

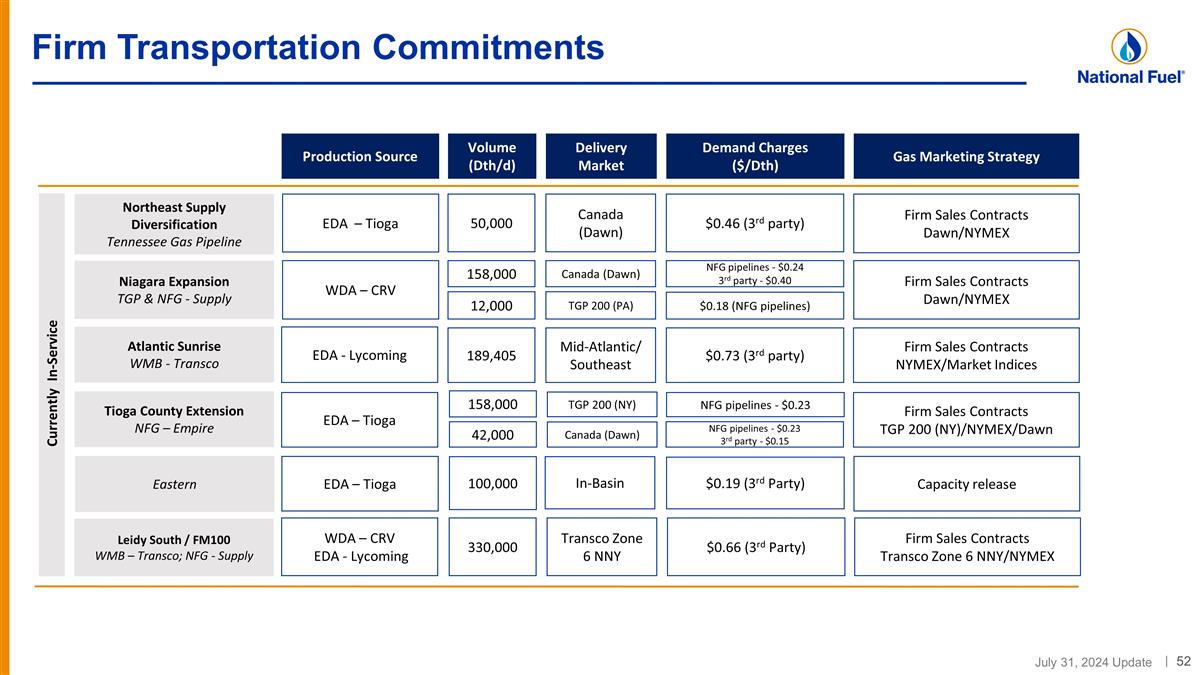

Firm Transportation Commitments Volume (Dth/d) Production Source Delivery Market Demand Charges ($/Dth) Gas Marketing Strategy Northeast Supply Diversification Tennessee Gas Pipeline Niagara Expansion TGP & NFG - Supply Leidy South / FM100 WMB – Transco; NFG - Supply 50,000 158,000 EDA – Tioga WDA – CRV WDA – CRV EDA - Lycoming 12,000 Canada (Dawn) Canada (Dawn) TGP 200 (PA) $0.46 (3rd party) NFG pipelines - $0.24 3rd party - $0.40 $0.18 (NFG pipelines) Firm Sales Contracts Dawn/NYMEX Currently In-Service Firm Sales Contracts Dawn/NYMEX Atlantic Sunrise WMB - Transco 189,405 EDA - Lycoming Mid-Atlantic/ Southeast $0.73 (3rd party) Firm Sales Contracts NYMEX/Market Indices 330,000 Transco Zone 6 NNY $0.66 (3rd Party) Firm Sales Contracts Transco Zone 6 NNY/NYMEX Tioga County Extension NFG – Empire EDA – Tioga Firm Sales Contracts TGP 200 (NY)/NYMEX/Dawn Eastern EDA – Tioga Capacity release $0.19 (3rd Party) 100,000 In-Basin 158,000 42,000 TGP 200 (NY) Canada (Dawn) NFG pipelines - $0.23 NFG pipelines - $0.23 3rd party - $0.15

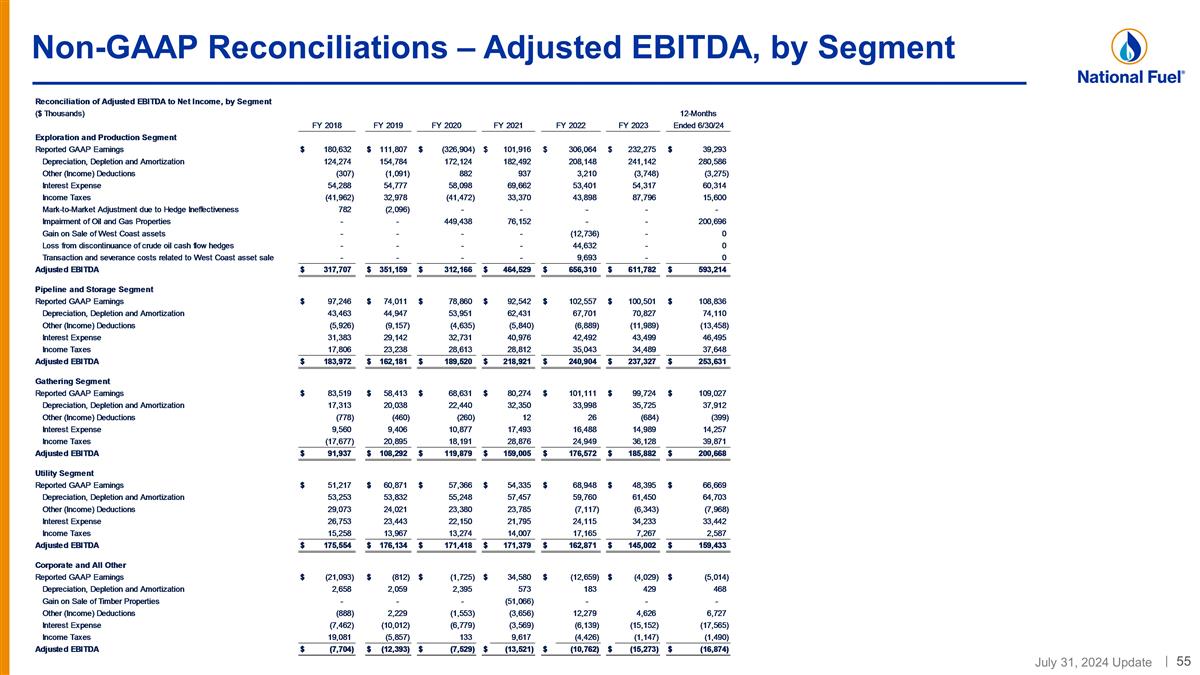

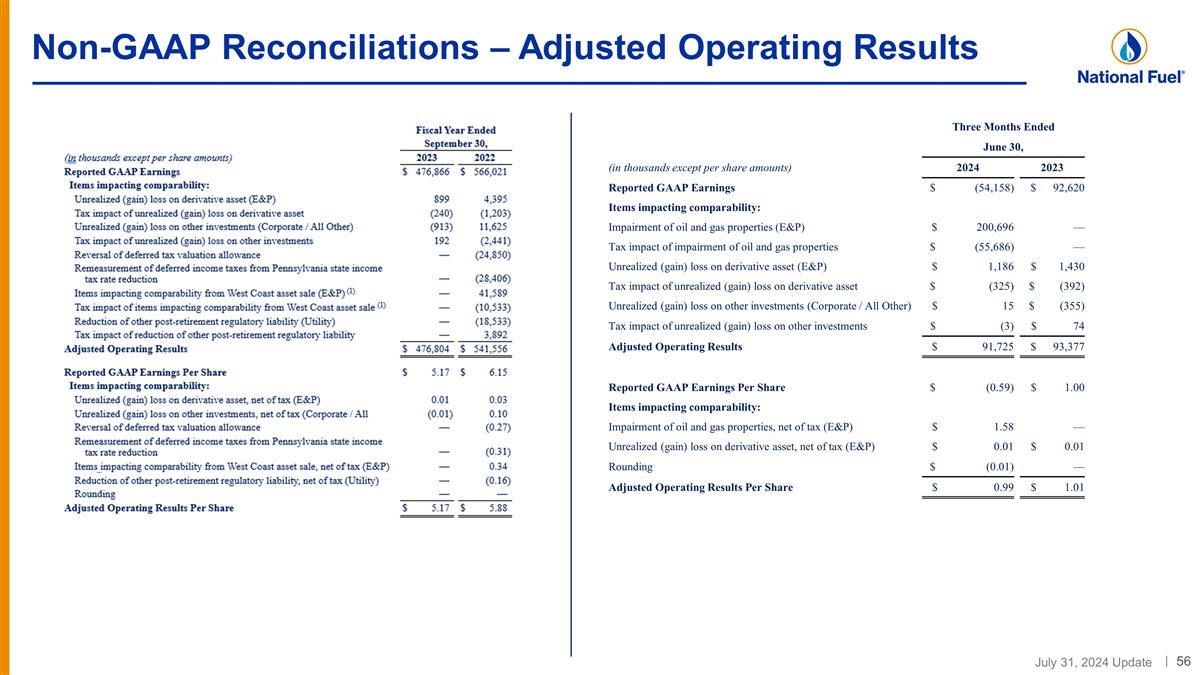

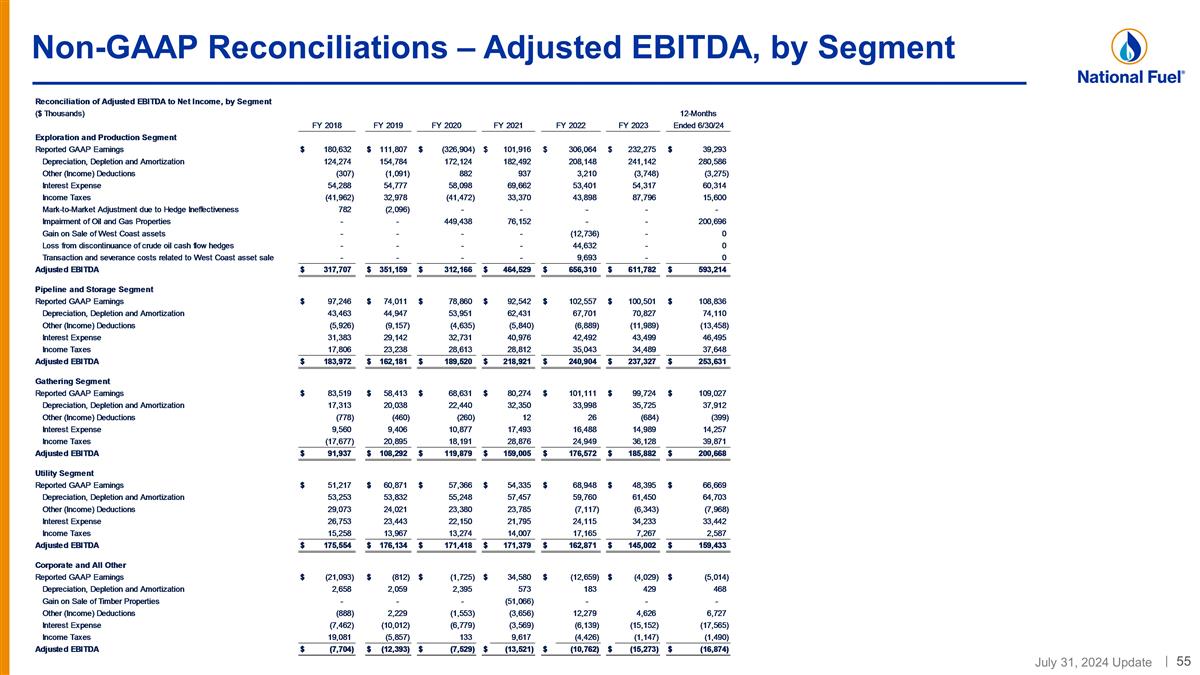

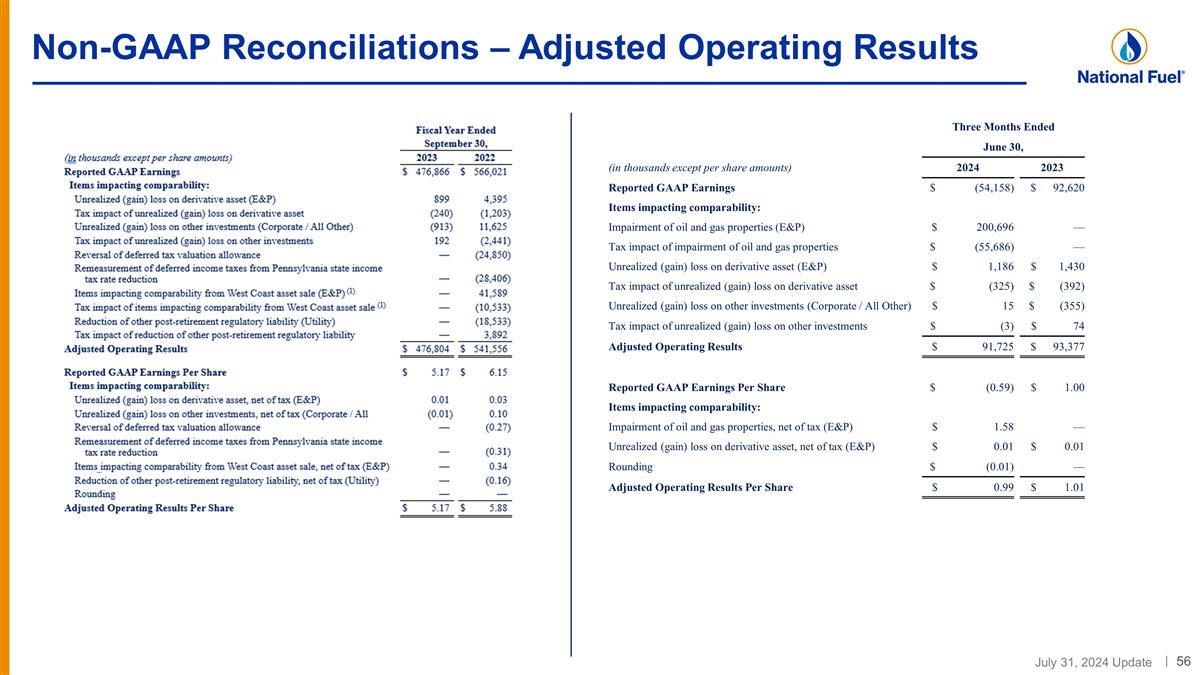

Comparable GAAP Financial Measure Slides & Reconciliations This presentation contains certain non-GAAP financial measures. For pages that contain non-GAAP financial measures, pages containing the most directly comparable GAAP financial measures and reconciliations are provided in the slides that follow. The Company believes that its non-GAAP financial measures are useful to investors because they provide an alternative method for assessing the Company’s ongoing operating results or liquidity and for comparing the Company’s financial performance to other companies. The Company’s management uses these non-GAAP financial measures for the same purpose, and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not meant to be a substitute for financial measures prepared in accordance with GAAP. Management defines adjusted operating results as reported GAAP earnings before items impacting comparability. Management defines adjusted EBITDA as reported GAAP earnings before the following items: interest expense, income taxes, depreciation, depletion and amortization, other income and deductions, impairments, and other items reflected in operating income that impact comparability. The revised earnings guidance range does not include the impact of certain items that impacted the comparability of earnings during the nine months ended June 30, 2024, including: (1) the after tax impairment of oil and gas properties, which reduced earnings by $1.57 per share; (2) after-tax unrealized losses on a derivative asset, which reduced earnings by $0.04 per share; and (3) after-tax unrealized gains on other investments, which increased earnings by $0.02 per share. While the Company expects to record certain adjustments to unrealized gain or loss on a derivative asset and unrealized gain or loss on investments during the three months ending September 30, 2024, the amounts of these and other potential adjustments and charges, including ceiling test impairments, are not reasonably determinable at this time. As such, the Company is unable to provide earnings guidance other than on a non-GAAP basis. Management defines free cash flow as net cash provided by operating activities, less net cash used in investing activities, adjusted for acquisitions and divestitures. The Company is unable to provide a reconciliation of projected free cash flow as described in this presentation to its respective comparable financial measure calculated in accordance with GAAP without unreasonable efforts. This is due to our inability to reliably predict the comparable GAAP projected metrics, including operating income and total production costs, given the unknown effect, timing, and potential significance of certain income statement items.

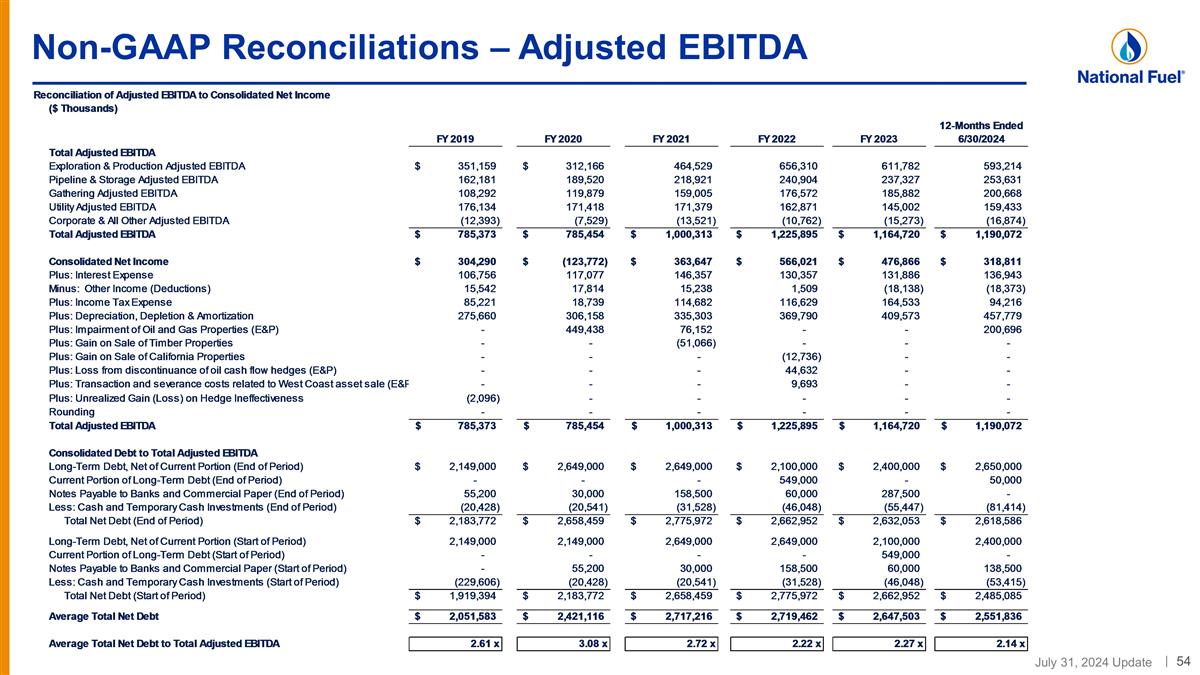

Non-GAAP Reconciliations – Adjusted EBITDA

Non-GAAP Reconciliations – Adjusted EBITDA, by Segment

Non-GAAP Reconciliations – Adjusted Operating Results Three Months Ended June 30, (in thousands except per share amounts) 2024 2023 Reported GAAP Earnings $ (54,158) $ 92,620 Items impacting comparability: Impairment of oil and gas properties (E&P) $ 200,696 — Tax impact of impairment of oil and gas properties $ (55,686) — Unrealized (gain) loss on derivative asset (E&P) $ 1,186 $ 1,430 Tax impact of unrealized (gain) loss on derivative asset $ (325) $ (392) Unrealized (gain) loss on other investments (Corporate / All Other) $ 15 $ (355) Tax impact of unrealized (gain) loss on other investments $ (3) $ 74 Adjusted Operating Results $ 91,725 $ 93,377 Reported GAAP Earnings Per Share $ (0.59) $ 1.00 Items impacting comparability: Impairment of oil and gas properties, net of tax (E&P) $ 1.58 — Unrealized (gain) loss on derivative asset, net of tax (E&P) $ 0.01 $ 0.01 Rounding $ (0.01) — Adjusted Operating Results Per Share $ 0.99 $ 1.01

Non-GAAP Reconciliations – Free Cash Flow

Reconciliation – Capital Expenditures

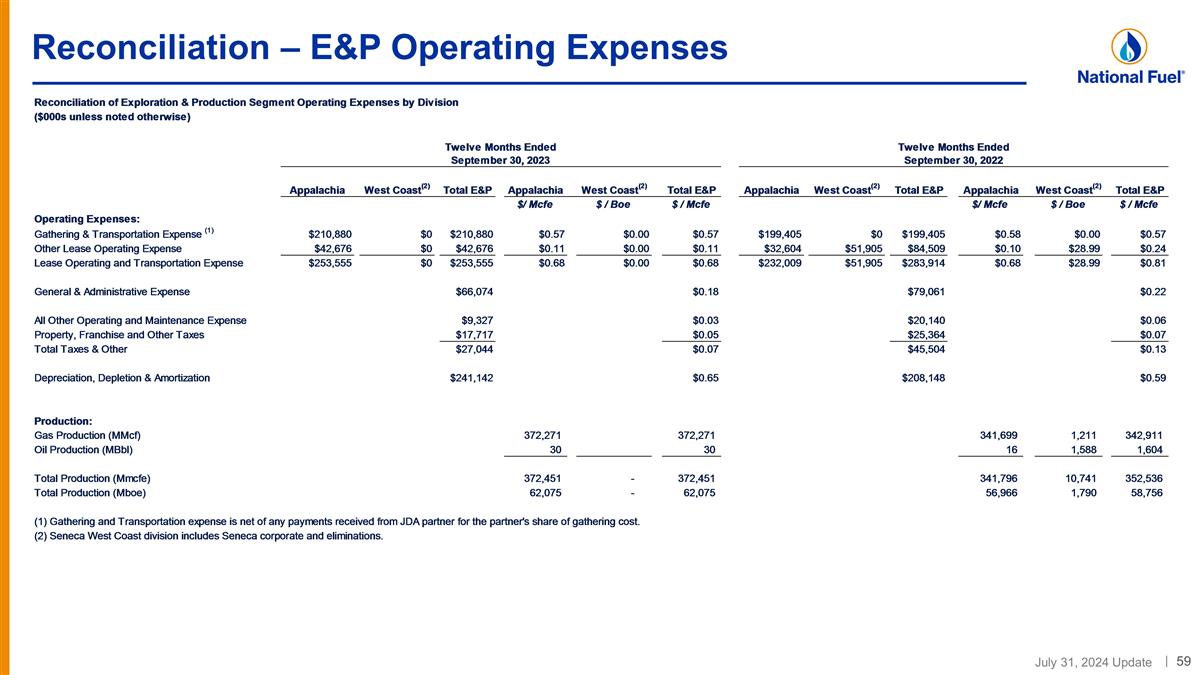

Reconciliation – E&P Operating Expenses