UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3445

The Merger Fund

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Frederick W. Green

The Merger Fund

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: March 31, 2007

Item 1. Report to Stockholders.

THE

MERGER

FUND¨

SEMI-ANNUAL REPORT

MARCH 31, 2007

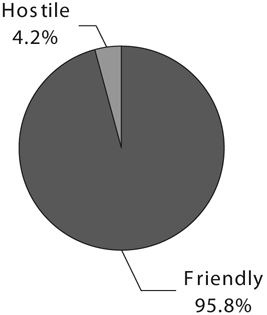

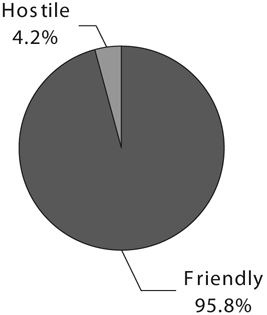

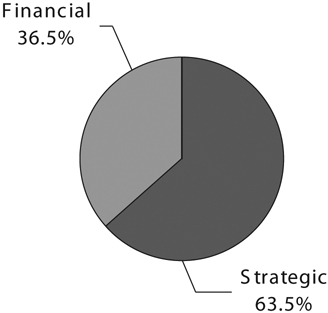

Chart 1 | Chart 2 |

| | |

PORTFOLIO COMPOSITION | PORTFOLIO COMPOSITION |

By Type of Deal* | By Type of Buyer* |

|  |

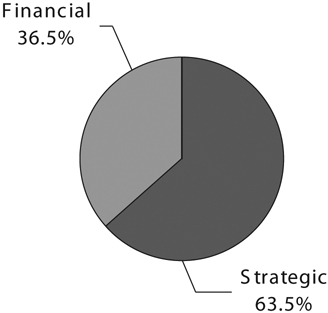

Chart 3

PORTFOLIO COMPOSITION

By Deal Terms*

* Data as of March 31, 2007

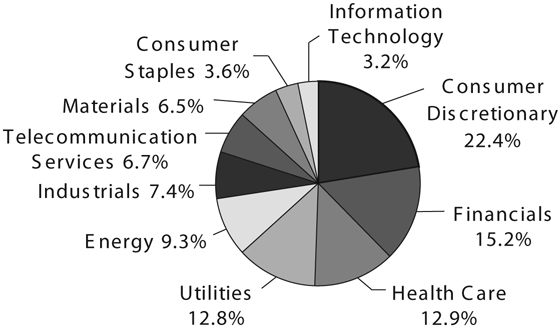

Chart 4

PORTFOLIO COMPOSITION

By Sector*

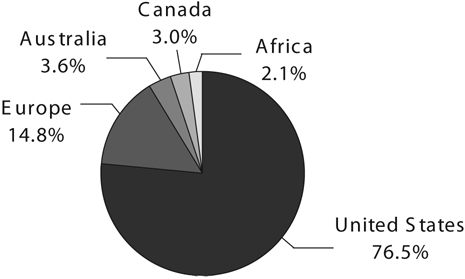

Chart 5

PORTFOLIO COMPOSITION

By Region*

* Data as of March 31, 2007

Chart 6

MERGER ACTIVITY

1991 - 2007

Source: Securities Data Corp.

The Merger Fund

EXPENSE EXAMPLE

March 31, 2007

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) redemption fees and (2) ongoing costs, including management fees; distribution and/or service fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 for the period 10/01/06 - 3/31/07.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. Although the Fund charges no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop-payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent. If you request that a redemption be made by wire transfer, a $15.00 fee will be charged by the Fund’s transfer agent. You will be charged a redemption fee equal to 2.00% of the net amount of the redemption if you redeem your shares less than 30 calendar days after you purchase them. IRA accounts will be charged a $15.00 annual maintenance fee. To the extent the Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the example below. The example below includes, but is not limited to, management fees, shareholder servicing fees, fund accounting, custody and transfer agent fees. However, the example below does not include portfolio trading commissions and related expenses, and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning Account | Ending Account | Expenses Paid During |

| Value 10/01/06 | Value 3/31/07 | Period 10/01/06-3/31/07* |

Actual+ (1) | $1,000.00 | $1,048.80 | $9.09 |

Hypothetical ++ (2) | $1,000.00 | $1,016.06 | $8.95 |

| + | Excluding dividends on short positions and interest expense, your actual cost of investment in the Fund would be $6.95. |

| ++ | Excluding dividends on short positions and interest expense, your hypothetical cost of investment in the Fund would be $6.84. |

| (1) | Ending account values and expenses paid during period based on a 4.88% return. This actual return is net of expenses. |

| (2) | Ending account values and expenses paid during period based on a 5.00% annual return before expenses. |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.78%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

The Merger Fund

SCHEDULE OF INVESTMENTS

March 31, 2007

(Unaudited)

Shares | | | | Value |

| COMMON STOCKS — 90.13% | | |

| | | AGRICULTURAL PRODUCTS — 2.47% | | |

| 1,039,525 | | Delta and Pine Land Company (e) | $ | 42,828,430 |

| | | AIRLINES — 0.12% | | |

| 492,400 | | Qantas Airways Limited | | 2,091,606 |

| | | ALUMINUM — 2.38% | | |

| 935,600 | | Novelis, Inc. (c) | | 41,269,316 |

| | | APPLICATION SOFTWARE — 0.55% | | |

| 106,600 | | Hyperion Solutions Corporation (a) | | 5,525,078 |

| 73,823 | | Kronos, Inc. (a) | | 3,949,531 |

| | | | | 9,474,609 |

| | | ASSET MANAGEMENT & CUSTODY BANKS — 1.65% | | |

| 383,450 | | The Bank of New York Company, Inc. (e) | | 15,548,898 |

| 225,000 | | Investors Financial Services Corp. (b) | | 13,083,750 |

| | | | | 28,632,648 |

| | | BROADCASTING & CABLE TV — 6.45% | | |

| 1,007,100 | | Alliance Atlantis Communications Inc. (a) (b) | | 44,453,717 |

| 1,919,800 | | Clear Channel Communications, Inc. (c) | | 67,269,792 |

| | | | | 111,723,509 |

| | | CASINOS & GAMING — 7.10% | | |

| 951,575 | | Harrah’s Entertainment (c) | | 80,360,509 |

| 492,300 | | Station Casinos, Inc. (c) | | 42,618,411 |

| | | | | 122,978,920 |

| | | COMMERCIAL PRINTING — 0.25% | | |

| 82,800 | | John H. Harland Company | | 4,241,844 |

| | | CONSTRUCTION & ENGINEERING — 1.52% | | |

| 859,500 | | Infrasource Services Inc. (a) | | 26,240,535 |

| | | CONSTRUCTION MATERIALS — 3.76% | | |

| 489,100 | | Florida Rock Industries, Inc. (b) | | 32,911,539 |

| 1,200 | | Rinker Group Limited — ADR | | 87,360 |

| 2,193,850 | | Rinker Group Limited ordinary (b) | | 32,039,575 |

| | | | | 65,038,474 |

| | | DATA PROCESSING & OUTSOURCED SERVICES — 0.06% | | |

| 66,500 | | TNS Inc. (a) | | 1,069,985 |

| | | DIVERSIFIED BANKS — 3.29% | | |

| 132,750 | | ABN AMRO Holding NV (c) | | 5,713,682 |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2007

(Unaudited)

Shares | | | | Value |

| | | DIVERSIFIED BANKS — 3.29% (CONTINUED) | | |

| 3,275,950 | | Banca Popolare Italiana Scrl (a) (b) | $ | 51,192,325 |

| | | | | 56,906,007 |

| | | DIVERSIFIED COMMERCIAL & PROFESSIONAL SERVICES — 2.17% | | |

| 1,228,600 | | PHH Corporation (a) | | 37,546,016 |

| | | EDUCATION SERVICES — 1.29% | | |

| 379,385 | | Laureate Education Inc. (a) (e) | | 22,372,333 |

| | | GENERAL MERCHANDISE STORES — 2.09% | | |

| 1,708,800 | | Dollar General Corporation (e) | | 36,141,120 |

| | | HEALTH CARE EQUIPMENT — 3.91% | | |

| 1,192,762 | | Biomet, Inc. (b) | | 50,680,457 |

| 679,400 | | IntraLase Corp. (a) | | 16,971,412 |

| | | | | 67,651,869 |

| | | HEALTH CARE FACILITIES — 4.05% | | |

| 684,900 | | Triad Hospitals, Inc. (a) (b) | | 35,786,025 |

| 1,117,000 | | United Surgical Partners International, Inc. (a) (b) | | 34,414,770 |

| | | | | 70,200,795 |

| | | HEALTH CARE TECHNOLOGY — 0.79% | | |

| 878,161 | | Dendrite International, Inc. (a) | | 13,752,001 |

| | | HYPERMARKETS & SUPER CENTERS — 0.24% | | |

| 313,000 | | Coles Group Limited (c) | | 4,115,289 |

| | | INDEPENDENT POWER PRODUCERS & ENERGY TRADERS — 4.67% | | |

| 1,261,600 | | TXU Corp. (c) | | 80,868,560 |

| | | INSURANCE BROKERS — 1.87% | | |

| 1,917,100 | | U.S.I. Holdings Corporation (a) (b) | | 32,303,135 |

| | | INTEGRATED TELECOMMUNICATION SERVICES — 1.03% | | |

| 1,327,816 | | Portugal Telecom, SGPS, S.A. (b) | | 17,790,773 |

| | | INTERNET SOFTWARE & SERVICES — 2.37% | | |

| 720,400 | | WebEx Communications, Inc. (a) (b) | | 40,961,944 |

| | | INVESTMENT BANKING & BROKERAGE — 1.40% | | |

| 4,773,944 | | Instinet Group Incorporated (a) | | 24,290,305 |

| | | MANAGED HEALTH CARE — 3.49% | | |

| 1,467,700 | | Sierra Health Services, Inc. (a) (d) | | 60,425,209 |

| | | MULTI-UTILITIES — 1.42% | | |

| 1,770,734 | | Alinta Limited (a) | | 20,802,836 |

| 90,500 | | KeySpan Corporation | | 3,724,075 |

| | | | | 24,526,911 |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2007

(Unaudited)

Shares | | | | Value |

| | | OIL & GAS DRILLING — 0.26% | | |

| 112,700 | | Todco (a) | $ | 4,545,191 |

| | | OIL & GAS EQUIPMENT & SERVICES — 1.43% | | |

| 149,800 | | Hydril (a) | | 14,416,752 |

| 157,200 | | Lone Star Technologies, Inc. (a) | | 10,379,916 |

| | | | | 24,796,668 |

| | | OIL & GAS EXPLORATION & PRODUCTION — 1.52% | | |

| 1,002,800 | | Energy Partners, Ltd. (a) | | 18,200,820 |

| 273,650 | | Stone Energy Corporation (a) | | 8,124,669 |

| | | | | 26,325,489 |

| | | OIL & GAS STORAGE & TRANSPORTATION — 5.58% | | |

| 677,105 | | Kinder Morgan, Inc. (d) | | 72,077,827 |

| 913,518 | | OMI Corporation (c) | | 24,537,094 |

| | | | | 96,614,921 |

| | | REGIONAL BANKS — 3.33% | | |

| 673,800 | | Compass Bancshares, Inc. (e) | | 46,357,440 |

| 212,200 | | First Republic Bank (e) | | 11,395,140 |

| | | | | 57,752,580 |

| | | RESIDENTIAL REITS — 0.25% | | |

| 302,300 | | Sunrise Senior Living REIT | | 4,409,469 |

| | | RETAIL REITS — 0.33% | | |

| 175,000 | | New Plan Excel Realty Trust | | 5,780,250 |

| | | SPECIALIZED CONSUMER SERVICES — 0.75% | | |

| 842,900 | | The ServiceMaster Company | | 12,972,231 |

| | | SPECIALIZED FINANCE — 7.16% | | |

| 1,029,611 | | Euronext NV (d) | | 123,984,095 |

| | | SPECIALTY STORES — 0.87% | | |

| 467,775 | | Claire’s Stores, Inc. | | 15,024,933 |

| | | TRUCKING — 2.96% | | |

| 1,480,107 | | Laidlaw International Inc. (e) | | 51,211,702 |

| | | WIRELESS TELECOMMUNICATION SERVICES — 5.30% | | |

| 4,472,698 | | Price Communications Corporation (e) (f) | | 91,779,763 |

| | | TOTAL COMMON STOCKS | | |

| | | (Cost $1,514,189,301) | | 1,560,639,435 |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2007

(Unaudited)

Contracts (100 shares per contract) | | Value |

| PUT OPTIONS PURCHASED — 0.26% | | |

| | | AMEX Natural Gas Index | | |

| 94 | | Expiration: April, 2007, Exercise Price: $480.00 | $ | 100,580 |

| | | Bloomberg US Lodging Index | | |

| 15,346 | | Expiration: June, 2007, Exercise Price: $425.00 | | 751,647 |

| 4,920 | | Expiration: June, 2007, Exercise Price: $425.00 | | 240,981 |

| | | Dow Jones EURO STOXX Telecommunications Index | | |

| 136 | | Expiration: May, 2007, Exercise Price: $470.00 | | 463,270 |

| | | Dow Jones EURO STOXX Utilities Index | | |

| 7,900 | | Expiration: April, 2007, Exercise Price: $545.00 | | 248,020 |

| | | Energy Select Sector SPDR Fund | | |

| 351,200 | | Expiration: April, 2007, Exercise Price: $61.00 | | 561,920 |

| | | PowerShares Dynamic Media | | |

| 3,155 | | Expiration: June, 2007, Exercise Price: $17.00 | | 347,050 |

| | | SPDR Trust Series 1 | | |

| 3,210 | | Expiration: May, 2007, Exercise Price: $144.00 | | 1,059,300 |

| | | streetTRACKS SPDR Homebuilders | | |

| 1,807 | | Expiration: June, 2007, Exercise Price: $37.00 | | 849,290 |

| | | TOTAL PURCHASED OPTIONS | | |

| | | (Cost $6,118,545) | | 4,622,058 |

| | | | | |

Principal Amount | | | | |

| CORPORATE BONDS — 0.19% | | |

| $3,500,000 | | Toys “R” Us, Inc. | | |

| | | 7.875%, 04/15/2013 | | 3,237,500 |

| | | TOTAL CORPORATE BONDS | | |

| | | (Cost $3,238,893) | | 3,237,500 |

| TAX ESCROW NOTES — 0.00% | | |

| 468,600 | | Telecorp PCS, Inc. Escrow Shares (a) | | 4,686 |

| | | TOTAL STRUCTURED NOTESS | | |

| | | (Cost $0) | | 4,686 |

| SHORT TERM INVESTMENTS — 6.77% | | |

| | | U.S. GOVERNMENT AGENCY ISSUES — 1.73% | | |

| | | Federal Home Loan Bank | | |

| 10,000,000 | | 4.802%, 4/2/2007 | | 9,996,000 |

| 10,000,000 | | 4.853%, 4/3/2007 | | 9,994,611 |

| 10,000,000 | | 4.853%, 4/4/2007 | | 9,993,264 |

| | | | | 29,983,875 |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

March 31, 2007

(Unaudited)

Principal Amount | | | | Value |

| | | VARIABLE RATE DEMAND NOTES — 5.04% | | |

| $45,994,191 | | American Family Financial Services, Inc., 4.943% | $ | 45,994,191 |

| 28,328,184 | | U.S. Bank, 5.070% | | 28,328,184 |

| 12,956,021 | | Wisconsin Corporate Central Credit Union, 4.990% | | 12,956,021 |

| | | | | 87,278,396 |

| | | TOTAL SHORT TERM INVESTMENTS | | |

| | | (Cost $117,262,271) | | 117,262,271 |

| | | TOTAL INVESTMENTS | | |

| | | (Cost $1,640,809,010) — 97.35% | $ | 1,685,765,950 |

Percentages are stated as a percent of net assets.

ADR - American Depository Receipt

| (a) | Non-income producing security. |

| (b) | All or a portion of the shares have been committed as collateral for open short positions. |

| (c) | All or a portion of the shares have been committed as collateral for written option contracts. |

| (d) | All or a portion of the shares have been committed as collateral for swap contracts. |

| (e) | All or a portion of the shares have been committed as collateral for foreign currency contracts. |

| (f) | Affiliated company. See Note 12 in Notes to the Financial Statements. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF SECURITIES SOLD SHORT

March 31, 2007

(Unaudited)

Shares | | | | Value |

| 1,596,300 | | Babcock & Brown Infrastructure Group | $ | 2,363,569 |

| 897,800 | | Banco Bilbao Vizcaya Argentaria, S.A. | | 22,041,008 |

| 83,300 | | Banco Bilbao Vizcaya Argentaria — ADR | | 2,045,015 |

| 1,408,700 | | Banco Popolare di Verona e Novara Scrl | | 43,789,590 |

| 110,400 | | Hercules Offshore, Inc. | | 2,899,104 |

| 978,755 | | Iberdrola S.A. | | 46,271,176 |

| 362,442 | | Mellon Financial Corporation | | 15,635,748 |

| 999,019 | | NYSE Group Inc. | | 93,658,031 |

| 1,051,400 | | Quanta Services, Inc. | | 26,516,308 |

| 203,900 | | State Street Corporation | | 13,202,525 |

| 2,325,680 | | Verizon Communications Inc. | | 88,189,785 |

| 92,225 | | Vulcan Materials Company | | 10,742,368 |

| | | TOTAL SECURITIES SOLD SHORT | | |

| | | (Proceeds $336,479,581) | $ | 367,354,227 |

ADR - American Depository Receipt

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN

March 31, 2007

(Unaudited)

Contracts (100 shares per contract) | | Value |

| CALL OPTIONS | | |

| | | ABN AMRO Holding NV | | |

| 9,248 | | Expiration: May, 2007, Exercise Price: $28.00 | $ | 5,559,250 |

| | | Clear Channel Communications, Inc. | | |

| 7,471 | | Expiration: July, 2007, Exercise Price: $35.00 | | 1,158,005 |

| | | Coles Group Limited | | |

| 3,130 | | Expiration: June, 2007, Exercise Price: $15.00 | | 364,676 |

| | | Harrah’s Entertainment | | |

| 250 | | Expiration: April, 2007, Exercise Price: $85.00 | | 7,500 |

| | | Novelis, Inc. | | |

| 3,187 | | Expiration: June, 2007, Exercise Price: $35.00 | | 2,995,780 |

| 6,169 | | Expiration: June, 2007, Exercise Price: $45.00 | | 154,225 |

| | | OMI Corporation | | |

| 5,438 | | Expiration: April, 2007, Exercise Price: $25.00 | | 1,087,600 |

| | | Station Casinos, Inc. | | |

| 4,072 | | Expiration: January, 2008, Exercise Price: $90.00 | | 122,160 |

| | | TXU Corp. | | |

| 5,532 | | Expiration: April, 2007, Exercise Price: $60.00 | | 2,406,420 |

| 6,121 | | Expiration: April, 2007, Exercise Price: $65.00 | | 550,890 |

| | | TOTAL OPTIONS WRITTEN | | |

| | | (Premiums received $9,890,572) | $ | 14,406,506 |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF ASSETS AND LIABILITIES

March 31, 2007

(Unaudited)

| ASSETS: | | | | | |

| Investments, at value | | | | | |

| Unaffiliated issuers (cost $1,573,345,080) | | | | | $ | 1,593,986,187 | |

| Affiliated issuers (cost $67,463,930) | | | | | | 91,779,763 | |

| Deposit at brokers for short sales | | | | | | 78,064,038 | |

| Receivable from brokers for proceeds on securities sold short | | | | | | 321,614,752 | |

| Receivable for securities sold, short sales and written options | | | | | | 52,918,326 | |

| Receivable for fund shares issued | | | | | | 5,537,531 | |

| Dividends and interest receivable | | | | | | 1,618,127 | |

| Receivable for swap contracts (including up front fees of $2,480,332) | | | | | | 10,947,853 | |

| Prepaid expenses | | | | | | 141,060 | |

| Total Assets | | | | | | 2,156,607,637 | |

| LIABILITIES: | | | | | | | |

| Securities sold short, at value (proceeds of $336,479,581) | | $ | 367,354,227 | | | | |

| Options written, at value (premiums received $9,890,572) | | | 14,406,506 | | | | |

| Payable to custodian | | | 1,993,636 | | | | |

| Payable for forward currency exchange contracts | | | 3,346,328 | | | | |

| Payable for short dividends | | | 42,819 | | | | |

| Payable for securities purchased, short positions and written options | | | 33,311,969 | | | | |

| Payable for fund shares redeemed | | | 729,942 | | | | |

| Investment advisory fee payable | | | 1,426,565 | | | | |

| Distribution fees payable | | | 524,081 | | | | |

| Accrued expenses and other liabilities | | | 1,852,366 | | | | |

| Total Liabilities | | | | | | 424,988,439 | |

| NET ASSETS | | | | | $ | 1,731,619,198 | |

| NET ASSETS Consist Of: | | | | | | | |

| Accumulated undistributed net investment income | | | | | $ | 11,853,773 | |

| Accumulated undistributed net realized gain on investments | | | | | | | |

| sold, foreign currency translation, forward currency exchange | | | | | | | |

| contracts, securities sold short, swap contracts, | | | | | | | |

| and written option contracts expired or closed | | | | | | (7,455,946 | ) |

| Net unrealized appreciation (depreciation) on: | | | | | | | |

| Investments | | $ | 44,956,940 | | | | |

| Securities sold short | | | (30,874,646 | ) | | | |

| Written option contracts | | | (4,515,934 | ) | | | |

| Swap contracts | | | 13,428,185 | | | | |

| Foreign currency translations | | | 4,920 | | | | |

| Forward currency exchange contracts | | | (2,427,052 | ) | | | |

| Net unrealized appreciation | | | | | | 20,572,413 | |

| Paid-in capital | | | | | | 1,706,648,958 | |

| Total Net Assets | | | | | $ | 1,731,619,198 | |

| NET ASSET VALUE, offering price and redemption price per share | | | | | | | |

| ($1,731,619,198 / 107,925,343 shares of beneficial interest outstanding) | | | | | $ | 16.04 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF OPERATIONS

For the Six Months Ended March 31, 2007

(Unaudited)

| INVESTMENT INCOME: | | | | | |

| Interest | | | | | $ | 7,885,321 | |

| Dividend income on long positions | | | | | | | |

| Unaffiliated issuers (net of foreign withholding taxes of $63,464) | | | | | | 14,279,141 | |

| Affiliated issuers | | | | | | 3,440,747 | |

| Total investment income | | | | | | 25,605,209 | |

| EXPENSES: | | | | | | | |

| Investment advisory fee | | $ | 7,978,150 | | | | |

| Distribution fees | | | 1,666,944 | | | | |

| Transfer agent and shareholder servicing agent fees | | | 105,676 | | | | |

| Federal and state registration fees | | | 48,211 | | | | |

| Professional fees | | | 144,767 | | | | |

| Trustees’ fees and expenses | | | 28,911 | | | | |

| Custody fees | | | 201,459 | | | | |

| Administration fee | | | 336,284 | | | | |

| Fund accounting expense | | | 105,398 | | | | |

| Reports to shareholders | | | 172,473 | | | | |

| Dividends on short positions | | | 3,339,465 | | | | |

| Interest | | | 49,360 | | | | |

| Other | | | 92,441 | | | | |

| Total expenses before expense reimbursement by adviser | | | | | | 14,269,539 | |

| Expense reimbursement by adviser (Note 3) | | | | | | (50,123 | ) |

| Net Expenses | | | | | | 14,219,416 | |

| NET INVESTMENT INCOME | | | | | | 11,385,793 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | | | |

| Realized gain (loss) on: | | | | | | | |

| Investments in unaffiliated issuers | | | 72,854,075 | | | | |

| Securities sold short | | | (20,508,146 | ) | | | |

| Written option contracts expired or closed | | | 7,908,829 | | | | |

| Swap contracts | | | (3,623,058 | ) | | | |

| Foreign currency translations | | | 444,035 | | | | |

| Forward currency exchange contracts | | | (4,028,235 | ) | | | |

| Net realized gain | | | | | | 53,047,500 | |

| Change in unrealized appreciation / depreciation on: | | | | | | | |

| Investments | | | 11,543,260 | | | | |

| Securities sold short | | | (5,249,831 | ) | | | |

| Written option contracts | | | (7,207,492 | ) | | | |

| Swap contracts | | | 14,858,232 | | | | |

| Foreign currency translations | | | 4,983 | | | | |

| Forward currency exchange contracts | | | (2,943,977 | ) | | | |

| Net unrealized gain | | | | | | 11,005,175 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | | | 64,052,675 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | | $ | 75,438,468 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENT OF CASH FLOWS

For the Period Ended March 31, 2007

(Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase in net assets resulting from operations | | $ | 75,438,468 | |

| Adjustments to reconcile net increase in net assets resulting from | | | | |

| operations to net cash provided (used) by operating activities: | | | | |

| Net realized (gain) loss on: | | | | |

| Long transactions | | | (72,854,075 | ) |

| Short transactions | | | 20,508,146 | |

| Written options | | | (7,908,829 | ) |

| Change in unrealized appreciation on long transactions, | | | | |

| short transactions, and written options | | | 914,063 | |

| Amortization and accretion of premium and discount | | | (2,371,318 | ) |

| Changes in assets and liabilities: | | | | |

| Deposit at broker for short sales | | | (6,468,878 | ) |

| Receivable from brokers for proceeds on securities sold short | | | 15,443,922 | |

| Receivable for investments sold, short sales and written options | | | 13,843,158 | |

| Receivable for fund shares sold | | | (762,883 | ) |

| Dividends and interest receivable | | | (158,715 | ) |

| Prepaid expenses | | | (48,398 | ) |

| Receivable/Payable for forward foreign currency exchange contracts | | | 3,863,253 | |

| Payable for swap contracts | | | (9,088,220 | ) |

| Payable for short dividends | | | (255,497 | ) |

| Investment advisory fees payable | | | 164,957 | |

| Distribution fees payable | | | 58,369 | |

| Payable for securities purchased, short positions and written options | | | (55,384,763 | ) |

| Payable for fund shares redeemed | | | (1,432,487 | ) |

| Accrued expenses and other liabilities | | | 461,076 | |

| Purchases of investments | | | (6,453,856,361 | ) |

| Proceeds from sale of investments | | | 6,408,478,666 | |

| Proceeds from short transactions | | | 715,641,740 | |

| Cover short transactions | | | (747,212,333 | ) |

| Premiums received on written options | | | 31,841,466 | |

| Written options closed or exercised | | | (24,220,605 | ) |

| NET CASH PROVIDED BY OPERATING ACTIVITIES | | | (95,366,078 | ) |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from shares issued | | | 397,527,888 | |

| Payment on shares redeemed less redemption fees | | | (301,500,229 | ) |

| Cash distributions paid | | | (2,891,997 | ) |

| NET CASH PROVIDED BY FINANCING ACTIVITIES | | | 93,135,662 | |

| NET CHANGE IN CASH FOR THE PERIOD | | | (2,230,416 | ) |

| CASH, BEGINNING OF PERIOD | | | 236,780 | |

| CASH, END OF PERIOD | | $ | (1,993,636 | ) |

| SUPPLEMENTAL INFORMATION: | | | | |

| Cash paid for interest on loan outstanding | | $ | 49,360 | |

| Noncash financing activities consisting of reinvestments of distributions | | | 59,240,023 | |

| | | | | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

STATEMENTS OF CHANGES IN NET ASSETS

| | | Six Months Ended | | Year Ended | |

| | March 31, 2007 | | September 30, 2006 | |

| | (Unaudited) | | | |

| | | | | | |

| Net investment income | | $ | 11,385,793 | | $ | 6,021,550 | |

| Net realized gain on investments, securities sold | | | | | | | |

| short, written option contracts, swap contracts, | | | | | | | |

| foreign currency translations and forward | | | | | | | |

| currency exchange contracts | | | 53,047,500 | | | 63,035,453 | |

| Change in unrealized appreciation / depreciation on | | | | | | | |

| investments, securities sold short, written option | | | | | | | |

| contracts, swap contracts, foreign currency translations | | | | | | | |

| and forward currency exchange contracts | | | 11,005,175 | | | 21,559,388 | |

| Net increase in net assets resulting from operations | | | 75,438,468 | | | 90,616,391 | |

| Distributions to shareholders from: | | | | | | | |

| Net investment income | | | (10,472,366 | ) | | (743,486 | ) |

| Net realized gains | | | (51,659,654 | ) | | (69,756,711 | ) |

| Total dividends and distributions | | | (62,132,020 | ) | | (70,500,197 | ) |

| Net increase (decrease) in net assets from | | | | | | | |

| capital share transactions (Note 4) | | | 155,267,682 | | | 58,254,258 | |

| Net increase (decrease) in net assets | | | 168,574,130 | | | 78,370,452 | |

| | | | | | | | |

| NET ASSETS: | | | | | | | |

| Beginning of period | | | 1,563,045,068 | | | 1,484,674,616 | |

| End of period (including accumulated undistributed | | | | | | | |

| net investment income of $11,853,773 | | | | | | | |

| and $10,940,346 respectively) | | $ | 1,731,619,198 | | $ | 1,563,045,068 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS

Selected per share data is based on a share of beneficial interest outstanding throughout each period.

| | | Six Months | | Year | | Year | | Year | | Year | | Year | |

| | Ended | | Ended | | Ended | | Ended | | Ended | | Ended | |

| | March 31, | | Sept. 30, | | Sept. 30, | | Sept. 30, | | Sept. 30, | | Sept. 30, | |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| | (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Net Asset Value, beginning of period | | $ | 15.95 | | $ | 15.78 | | $ | 15.10 | | $ | 14.84 | | $ | 13.46 | | $ | 15.74 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | 0.11 | (2) | | 0.06 | (2) | | (0.06 | )(2) | | (0.08 | )(3) | | 0.05 | (2) | | 0.22 | (3) |

| Net realized and unrealized | | | | | | | | | | | | | | | | | | | |

| gain (loss) on investments | | | 0.64 | | | 0.99 | | | 0.94 | | | 0.38 | | | 1.53 | | | (1.44 | ) |

| Total from investment operations | | | 0.75 | | | 1.05 | | | 0.88 | | | 0.30 | | | 1.58 | | | (1.22 | ) |

| Redemption fees | | | 0.00 | (5) | | 0.00 | (5) | | 0.00 | (5) | | 0.00 | (5) | | — | | | — | |

| Less distributions: | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.11 | ) | | (0.01 | ) | | 0.00 | (5) | | (0.04 | ) | | (0.20 | ) | | (0.21 | ) |

| Distributions from net realized gains | | | (0.55 | ) | | (0.87 | ) | | (0.20 | ) | | — | | | — | | | (0.85 | ) |

| Total distributions | | | (0.66 | ) | | (0.88 | ) | | (0.20 | ) | | (0.04 | ) | | (0.20 | ) | | (1.06 | ) |

| Net Asset Value, end of period | | $ | 16.04 | | $ | 15.95 | | $ | 15.78 | | $ | 15.10 | | $ | 14.84 | | $ | 13.46 | |

| Total Return | | | 4.88 | %(7) | | 7.10 | % | | 5.88 | % | | 1.99 | % | | 11.88 | % | | (8.39 | )% |

| Supplemental Data and Ratios: | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000’s) | | $ | 1,731,619 | | $ | 1,563,045 | | $ | 1,484,675 | | $ | 1,681,281 | | $ | 1,149,990 | | $ | 853,957 | |

| Ratio of operating expenses | | | | | | | | | | | | | | | | | | | |

| to average net assets | | | 1.78 | %(8) | | 2.08 | % | | 1.77 | % | | 1.87 | % | | 1.86 | % | | 1.60 | % |

| Ratio of interest expense and | | | | | | | | | | | | | | | | | | | |

| dividends on short positions to | | | | | | | | | | | | | | | | | | | |

| average net assets | | | 0.42 | %(8) | | 0.71 | % | | 0.41 | % | | 0.50 | % | | 0.49 | % | | 0.22 | % |

| Ratio of operating expense to | | | | | | | | | | | | | | | | | | | |

| average net assets excluding | | | | | | | | | | | | | | | | | | | |

| interest expense and dividends | | | | | | | | | | | | | | | | | | | |

on short positions(6) | | | 1.36 | %(8) | | 1.37 | % | | 1.36 | % | | 1.37 | % | | 1.37 | % | | 1.38 | % |

| Ratio of net investment income | | | | | | | | | | | | | | | | | | | |

to average net assets(6) | | | 1.43 | %(8) | | 0.43 | % | | (0.35 | )% | | (0.68 | )% | | 0.22 | % | | 1.31 | % |

Portfolio turnover rate(4) | | | 203.52 | % | | 369.47 | % | | 312.04 | % | | 256.88 | % | | 309.18 | % | | 258.37 | % |

Footnotes To Financial Highlights On Following Page

The accompanying notes are an integral part of these financial statements.

The Merger Fund

FINANCIAL HIGHLIGHTS (continued)

| (1) | Net investment income before interest expense and dividends on short positions for the six months ended March 31, 2007 and for the years ended September 30, 2006, 2005, 2004, 2003 and 2002, was $0.15, $0.18, $0.01, $0.00, $0.01 and $0.16, respectively. |

| (2) | Net investment income per share is calculated using ending balances prior to consideration of adjustments for permanent book and tax differences. |

| (3) | Net investment income per share represents net investment income for the respective period divided by the monthly average shares of beneficial interest outstanding throughout each period. |

| (4) | The numerator for the portfolio turnover rate includes the lesser of purchases or sales (excluding short positions). The denominator includes the average long positions throughout the period. |

| (5) | Amount less than $0.005 per share. |

| (6) | Ratio was not impacted by the expense waiver. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS

March 31, 2007 (Unaudited)

Note 1 — ORGANIZATION

The Merger Fund (the “Fund”) is a no-load, open-end, non-diversified investment company organized as a trust under the laws of the Commonwealth of Massachusetts on April 12, 1982, and registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund was formerly known as the Risk Portfolio of The Ayco Fund. In January of 1989, the Fund’s fundamental policies were amended to permit the Fund to engage exclusively in merger arbitrage. At the same time, Westchester Capital Management, Inc. became the Fund’s investment adviser, and the Fund began to do business as The Merger Fund. Merger arbitrage is a highly specialized investment approach generally designed to profit from the successful completion of proposed mergers, takeovers, tender offers, leveraged buyouts, liquidations and other types of corporate reorganizations.

Note 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles.

Securities listed on the NASDAQ Global Market and the NASDAQ Global Select Market are valued at the NASDAQ Official Closing Price (“NOCP”). Other listed securities are valued at the last sales price on the exchange on which such securities are primarily traded or, in the case of options, at the higher of the intrinsic value of the option or the last reported composite sales price. Securities not listed on an exchange and securities for which there are no transactions are valued at the average of the closing bid and asked prices. When pricing options, if no sales are reported or if the last sale is outside the bid and asked parameters, the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices will be used. Securities for which there are no such valuations are valued at fair value as determined in good faith by management under the supervision of the Board of Trustees. The Adviser (as defined herein) reserves the right to value securities, including options, at prices other than last-sale prices, intrinsic value prices, or the average of closing bid and asked prices when such prices are believed unrepresentative of fair market value as determined in good faith by the Adviser. When fair-valued pricing is employed, the prices of securities used by the Fund to calculate its NAV may differ from quoted or published prices for the same securities. In addition, due to the subjective and variable nature of fair value pricing, it is possible that the value determined for a particular asset may be materially different from the value realized upon such asset’s sale. At March 31, 2007, there were no fair-valued securities. Investments in United States government securities (other than short-term securities) are valued at the average of the quoted bid and asked prices in the over-the-counter market. Short-term investments are carried at amortized cost, which approximates market value.

The Fund may sell securities or currencies short for hedging purposes. For financial statement purposes, an amount equal to the settlement amount is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

market to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities or currencies sold, but not yet purchased, may require purchasing the securities or currencies at prices which may differ from the market value reflected on the Statement of Assets and Liabilities.

The Fund is liable for any dividends payable on securities while those securities are in a short position. As collateral for its short positions, the Fund is required under the 1940 Act to maintain assets consisting of cash, cash equivalents or liquid securities. These assets are required to be adjusted daily to reflect changes in the value of the securities or currencies sold short.

| C. | Transactions with Brokers for Short Sales |

The Fund’s receivable from brokers for proceeds on securities sold short and deposit at brokers for short sales are with three major securities dealers. The Fund does not require the brokers to maintain collateral in support of the receivable from the broker for proceeds on securities sold short.

No provision for federal income taxes has been made since the Fund has complied to date with the provisions of the Internal Revenue Code applicable to regulated investment companies and intends to continue to so comply in future years and to distribute investment company net taxable income and net capital gains to shareholders. Additionally, the Fund intends to make all required distributions to avoid federal excise tax.

| E. | Written Option Accounting |

The Fund writes (sells) covered call options to hedge portfolio investments. Uncovered put options can also be written by the Fund as part of a merger arbitrage strategy involving a pending corporate reorganization. When the Fund writes (sells) an option, an amount equal to the premium received by the Fund is included in the Statement of Assets and Liabilities as an asset and an equivalent liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the option written. By writing an option, the Fund may become obligated during the term of the option to deliver or purchase the securities underlying the option at the exercise price if the option is exercised. Option contracts are valued at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract written is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When an option expires on its stipulated expiration date or the Fund enters into a closing purchase transaction, the Fund realizes a gain or loss if the cost of the closing purchase transaction differs from the premium received when the option was sold without regard to any unrealized gain or loss on the underlying security, and the liability related to such option is eliminated. When an option is exercised, the premium originally received decreases the cost basis of the security (or increases the proceeds on a sale of the security), and the Fund realizes a gain or loss from the sale of the underlying security.

| F. | Purchased Option Accounting |

The Fund purchases put options to hedge portfolio investments. Call options may be purchased only for the purpose of closing out previously written covered call options. Premiums paid for option

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

contracts purchased are included in the Statement of Assets and Liabilities as an asset. Option contracts are valued at the higher of the intrinsic value of the option or the last sales price reported on the date of valuation. If no sale is reported or if the last sale is outside the parameters of the closing bid and asked prices, the option contract purchased is valued at the higher of the intrinsic value of the option or the mean between the last reported bid and asked prices on the day of valuation. When option contracts expire or are closed, realized gains or losses are recognized without regard to any unrealized gains or losses on the underlying securities.

| G. | Forward Currency Exchange Contracts |

The Fund may enter into forward currency exchange contracts obligating the Fund to deliver and receive a currency at a specified future date. Forward contracts are valued daily, and unrealized appreciation or depreciation is recorded daily as the difference between the contract exchange rate and the closing forward rate applied to the face amount of the contract. A realized gain or loss is recorded at the time the forward contract is closed.

| H. | Distributions to Shareholders |

Dividends from net investment income and net realized capital gains, if any, are declared and paid at least annually. Income and capital gain distributions are determined in accordance with income tax regulations which may differ from generally accepted accounting principles. These differences are due primarily to wash-loss deferrals, constructive sales, straddle-loss deferrals, adjustments on swap contracts, and unrealized gains or losses on Section 1256 contracts, which were realized, for tax purposes, at September 30, 2006. Accordingly, reclassifications are made within the net asset accounts for such amounts, as well as amounts related to permanent differences in the character of certain income and expense items for income tax and financial reporting purposes. At September 30, 2006, the Fund decreased accumulated net investment loss by $6,104,311, reduced realized accumulated gains by $13,112,241, and increased paid-in capital by $7,007,930. The Fund may utilize earnings and profits deemed distributed to shareholders on redemption of shares as part of the dividends-paid deduction.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Investing in securities of foreign companies involves special risks and considerations not typically associated with investing in U.S. companies. These risks include revaluation of currencies and adverse political and economic developments. Moreover, securities of many foreign companies and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. companies.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 2 — SIGNIFICANT ACCOUNTING POLICIES (continued)

| K. | Foreign Currency Translations |

The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities. However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gain or loss from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences.

The Fund may sell securities on a when-issued or delayed-delivery basis. Although the payment and interest terms of these securities are established at the time the Fund enters into the agreement, these securities may be delivered for cash proceeds at a future date. The Fund records sales of when-issued securities and reflects the values of such securities in determining net asset value in the same manner as other open short-sale positions. The Fund segregates and maintains at all times cash, cash equivalents or other liquid securities in an amount at least equal to the market value for when-issued securities.

The Fund considers highly liquid temporary cash investments purchased with an original maturity of less than three months to be cash equivalents. Cash equivalents are included in short-term investments on the Schedule of Investments as well as in the investments on the Statement of Assets and Liabilities.

| N. | Guarantees and Indemnifications |

In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

Investment and shareholder transactions are recorded on the trade date. Realized gains and losses from security transactions are recorded on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Interest is accounted for on the accrual basis. Investment income includes $3,457,215 of interest earned on receivables from brokers for proceeds on securities sold short and deposits. The Fund may utilize derivative instruments such as options, forward currency exchange contracts and other instruments with similar characteristics to the extent that they are consistent with the Fund’s investment objectives and limitations. The use of these instruments may involve additional investment risks, including the possibility of illiquid markets or imperfect correlation between the value of the instruments and the underlying securities.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 3 — AGREEMENTS

The Fund’s investment adviser is Westchester Capital Management, Inc. (the “Adviser”) pursuant to an investment advisory agreement dated January 31, 1989. Under the terms of this agreement, the Adviser is entitled to receive a fee, calculated daily and payable monthly, at the annual rate of 1.00% of the Fund’s average daily net assets. Effective August 1, 2004, the Adviser agreed to waive 0.10% of its fee at net asset levels between $1.5 billion through $2 billion. When net assets of the Fund exceed $2 billion, the Adviser has agreed to waive 0.20% of its fee. Investment adviser fees waived by the Adviser for the period ended March 31, 2007 were $50,123. Certain officers of the Fund are also officers of the Adviser.

U.S. Bancorp Fund Services, LLC, a subsidiary of U.S. Bancorp, a publicly held bank holding company, serves as transfer agent, administrator and accounting services agent for the Fund. U.S. Bank, N.A. serves as custodian for the Fund.

Distribution services are performed pursuant to distribution contracts with broker-dealers and other qualified institutions.

Note 4 — SHARES OF BENEFICIAL INTEREST

The Trustees have the authority to issue an unlimited amount of shares of beneficial interest without par value.

Changes in shares of beneficial interest were as follows:

| | | Six Months Ended | | Year Ended | |

| | March 31, 2007 | | September 30, 2006 | |

| | Shares | | Amount | | Shares | | Amount | |

| Issued | | | 25,015,300 | | $ | 397,527,888 | | | 45,422,154 | | $ | 697,120,869 | |

| Issued as reinvestment | | | | | | | | | | | | | |

| of dividends | | | 3,795,005 | | | 59,240,023 | | | 4,637,847 | | | 68,036,847 | |

| Redemption fee | | | — | | | 45,064 | | | — | | | 65,213 | |

| Redeemed | | | (18,884,734 | ) | | (301,545,293 | ) | | (46,170,138 | ) | | (706,968,671 | ) |

| Net increase (decrease) | | | 9,925,571 | | $ | 155,267,682 | | | 3,889,863 | | $ | 58,254,258 | |

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 5 — INVESTMENT TRANSACTIONS

Purchases and sales of securities for the six months ended March 31, 2007 (excluding short-term investments, options and short positions) aggregated $3,062,351,222 and $2,895,242,058, respectively. There were no purchases or sales of U.S. Government Securities.

At September 30, 2006, the components of accumulated losses on a tax basis were as follows:

| Cost of Investments | | $ | 1,529,717,484 | |

| Gross unrealized appreciation | | | 55,331,689 | |

| Gross unrealized depreciation | | | (31,429,571 | ) |

| Net unrealized appreciation | | $ | 23,902,118 | |

| Undistributed ordinary income | | $ | 62,186,463 | |

| Undistributed long-term capital gain | | | — | |

| Total distributable earnings | | $ | 62,186,463 | |

| Other accumulated losses | | | (74,424,789 | ) |

| Total accumulated gains | | $ | 11,663,792 | |

The tax components of dividends paid during the six months ended March 31, 2007 and the fiscal year ended September 30, 2006 were as follows:

| | | 2007 | | 2006 | |

| Ordinary Income | | $ | 62,132,020 | | $ | 70,500,197 | |

Long-Term Capital Gains | | $ | — | | $ | — | |

The Fund incurred a post-October capital loss of $47,401,581, which is deferred for tax purposes until the next fiscal year.

For the fiscal year ended September 30, 2006 certain dividends paid by the Fund may be subject to a maximum tax rate of 15% as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from net investment income designated as qualified dividend income was 9.04% for the Fund (unaudited).

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends-received deduction for the fiscal year ended September 30, 2006 was 5.20% for the Fund (unaudited).

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 6 — OPTION CONTRACTS WRITTEN

The premium amount and the number of option contracts written during the six months ended March 31, 2007, were as follows:

| | | Premium Amount | | Number of Contracts | |

| Options outstanding at September 30, 2006 | | $ | 10,178,540 | | | 42,610 | |

| Options written | | | 31,841,466 | | | 148,460 | |

| Options closed | | | (6,019,257 | ) | | (26,763 | ) |

| Options exercised | | | (22,236,120 | ) | | (90,044 | ) |

| Options expired | | | (3,874,057 | ) | | (23,645 | ) |

| Options outstanding at March 31, 2007 | | $ | 9,890,572 | | | 50,618 | |

Note 7 — DISTRIBUTION PLAN

The Fund has adopted an Amended and Restated Plan of Distribution (the “Plan”) dated July 19, 2005, pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Fund will compensate broker-dealers or qualified institutions with whom the Fund has entered into a contract to distribute Fund shares (“Dealers”). Under the Plan, the amount of such compensation paid in any one year shall not exceed 0.25% annually of the average daily net assets of the Fund, which may be payable as a service fee for providing recordkeeping, subaccounting, subtransfer agency and/or shareholder liaison services. For the six months ended March 31, 2007, the Fund incurred $1,666,944 pursuant to the Plan.

The Plan will remain in effect from year to year provided such continuance is approved at least annually by a vote either of a majority of the Trustees, including a majority of the non-interested Trustees, or a majority of the Fund’s outstanding shares.

Note 8 — CREDIT FACILITY

Custodial Trust Company has made available to the Fund a $400 million credit facility (subject to increase under certain conditions) pursuant to a Loan and Security Agreement (“Agreement”) dated March 18, 1992 (subsequent amended) for the purpose of purchasing portfolio securities. The Agreement can be terminated by either the Fund or Custodial Trust Company with three months’ prior notice. For the period October 1, 2006 to March 31, 2007, the interest rate on the outstanding principal amount was the Federal Funds Rate plus 0.75% (weighted average rate of 6.094% was paid on the loan during the period ended March 31, 2007). Advances are collateralized by securities owned by the Fund and held separately in a special custody account pursuant to a Special Custody Agreement dated March 31, 1994. During the six months ended March 31, 2007, the Fund had an outstanding average daily balance of $1,720,077. The maximum amount outstanding during the six months ended March 31, 2007, was $60,714,000. At March 31, 2007, the Fund had a loan payable balance of $0. As collateral for the loan, the Fund is required under the 1940 Act to maintain assets consisting of cash, cash equivalents or liquid securities. The assets are required to be adjusted daily to reflect changes in the amount of the loan outstanding.

The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 9 — FORWARD CURRENCY EXCHANGE CONTRACTS

At March 31, 2007, the Fund had entered into “position hedge” forward currency exchange contracts that obligated the Fund to deliver or receive currencies at a specified future date. The net unrealized depreciation of $2,427,052 is included in the net unrealized appreciation (depreciation) section of the Statement of Assets and Liabilities. The terms of the open contracts are as follows:

| | | U.S. $ Value at March 31, 2007 | Currency to be Received | | U.S. $ Value at March 31, 2007 |

| 4/30/07 | 2,690,050 | | Australian Dollars | $ | 2,174,194 | 2,115,890 | | U.S. Dollars | $ | 2,115,890 |

| 5/18/07 | 37,289,697 | | Australian Dollars | | 30,118,274 | 30,055,027 | | U.S. Dollars | | 30,055,027 |

| 6/22/07 | 23,019,542 | | Australian Dollars | | 18,575,853 | 18,092,142 | | U.S. Dollars | | 18,092,142 |

| 6/28/07 | 4,695,000 | | Australian Dollars | | 3,787,115 | 3,688,392 | | U.S. Dollars | | 3,688,392 |

| 4/30/07 | 53,376,300 | | Canadian Dollars | | 46,288,820 | 45,598,369 | | U.S. Dollars | | 45,598,369 |

| 5/18/07 | 5,137,400 | | Canadian Dollars | | 4,457,722 | 4,436,193 | | U.S. Dollars | | 4,436,193 |

| 4/27/07 | 13,278,120 | | Euros | | 17,755,347 | 17,452,536 | | U.S. Dollars | | 17,452,536 |

| 5/22/07 | 29,732,400 | | Euros | | 39,802,286 | 39,642,620 | | U.S. Dollars | | 39,642,620 |

| 6/28/07 | 7,108,811 | | Euros | | 9,528,599 | 9,280,446 | | U.S. Dollars | | 9,280,446 |

| 4/20/07 | 7,276,999 | | British Pounds | | 14,318,097 | 14,265,694 | | U.S. Dollars | | 14,265,694 |

| 4/30/07 | 26,577,128 | | British Pounds | | 52,289,081 | 52,170,902 | | U.S. Dollars | | 52,170,902 |

| 6/18/07 | 5,696,160 | | British Pounds | | 11,203,504 | 11,159,201 | | U.S. Dollars | | 11,159,201 |

| 9/21/07 | 6,608,700 | | British Pounds | | 12,983,255 | 12,878,285 | | U.S. Dollars | | 12,878,285 |

| 5/15/07 | 259,589,408 | | South African Rand | | 35,654,888 | 35,674,286 | | U.S. Dollars | | 35,674,286 |

| | | | | $ | 298,937,035 | | | | $ | 296,509,983 |

Note 10 — SWAP CONTRACTS

Equity Swaps

The Fund has entered into both long and short equity swap contracts with multiple broker-dealers. A long equity swap contract entitles the Fund to receive from the counterparty any appreciation and dividends paid on an individual security, while obligating the Fund to pay the counterparty any depreciation on the security as well as interest on the notional amount of the contract at a rate equal to LIBOR plus 25 to 100 basis points. A short equity swap contract obligates the Fund to pay the counterparty any appreciation and dividends paid on an individual security, while entitling the Fund to receive from the counterparty any depreciation on the security as well as interest on the notional value of the contract at a rate equal to LIBOR less 25 to 100 basis points.

The Fund may also enter into equity swap contracts whose value is determined by the spread between a long equity position and a short equity position. This type of swap contract obligates the Fund to pay the counterparty an amount tied to any increase in the spread between the two securities over the term of the contract. The Fund is also obligated to pay the counterparty any dividends paid on the short equity holding as well as any net financing costs. This type of swap contract entitles the Fund to receive from the counterparty any gains based on a decrease in the spread as well as any dividends paid on the long equity holding and any net interest income. The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 10 — SWAP CONTRACTS (Continued)

Fluctuations in the value of an open contract are recorded daily as a net unrealized gain or loss. The Fund will realize a gain or loss upon termination or reset of the contract. Either party, under certain conditions, may terminate the contract prior to the contract’s expiration date.

Credit risk may arise as a result of the failure of the counterparty to comply with the terms of the contract. The Fund considers the creditworthiness of each counterparty to a contract in evaluating potential credit risk. The counterparty risk to the Fund is limited to the net unrealized gain, if any, on the contract, along with dividends receivable on long equity contracts and interest receivable on short equity contracts. Additionally, risk may arise from unanticipated movements in interest rates or in the value of the underlying securities. At March 31, 2007, the Fund had the following open equity swap contracts:

| | | | | Unrealized Appreciation |

Termination Date | Security | Shares | | | (Depreciation) |

| 5/19/07 | ABM AMRO Holding NV | 924,800 | | $ | 3,283,410 |

| 7/10/07 | Alliance Boots Plc | 629,400 | | | 226,549 |

| 4/11/07 | Corus Group Plc | 1,199,500 | | | 362,673 |

| 5/15/07 | Edgars Swap | 5,643,248 | | | 695,269 |

| 6/16/07 | EMI Group June Call | (500,000) | | | 104,513 |

| 6/16/07 | EMI Group June Call | (1,773,400) | | | 339,954 |

| 6/16/07 | EMI Group Plc | 2,374,114 | | | (646,786) |

| 4/27/07 | Scottish Power Plc | 6,644,282 | | | 7,225,274 |

| | | | | $ | 11,590,856 |

Credit Default Swaps

The Fund may enter into credit default swaps. In a credit default swap, one party makes a stream of payments to another party in exchange for the right to receive a specified return in the event of a default by a referenced entity, typically corporate issues, on its obligation. The Fund may use the swaps as part of a merger arbitrage strategy involving pending corporate reorganizations. The Fund may purchase credit protection on the referenced entity of the credit default swap (‘‘Buy Contract’’) or provide credit protection on the referenced entity of the credit default swap (‘‘Sale Contract’’).

Swap contracts involve, to varying degrees, elements of market risk and exposure to loss in excess of the amount reflected in the Statement of Assets and Liabilities. The notional amounts reflect the extent of the total investment exposure that the Fund has under the swap contract. The primary risks associated with the use of swap agreements are imperfect correlation between movements in the notional amount and the price of the underlying securities and the inability of counterparties to perform. The Fund bears the risk of loss of the amount expected to be received under a swap contract in the event of default or bankruptcy of the swap contract counterparty. The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 10 — SWAP CONTRACTS (Continued)

| | | | | | Unrealized |

Expiration | | Buy/Sell | Pay/Receive | Notional | Appreciation |

Date | Security | Protection | Fixed Rate | Amount | (Depreciation) |

| 6/20/11 | Dow Jones CDX | Buy | 0.40% | $649,497,289 | $1,837,329 |

| | North American | | | | |

| | Investment Grade | | | | |

Note 11 — NEW ACCOUNTING STANDARDS

On July 13, 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the affirmative evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is more likely than not (i.e., greater than 50%) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. A tax position that meets the more-likely-than-not recognition threshold is measured to determine the amount of benefit to recognize in the financial statements. Differences between tax positions taken in a tax return and amounts recognized in the financial statements will generally result in an increase in a liability for taxes payable (or a reduction of a tax refund receivable) and an increase in a deferred tax liability (or a reduction in a deferred tax asset). Adoption of FIN 48 is required as of the date of the last Net Asset Value (”NAV”) calculation in the first required financial statement reporting period for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. On December 22, 2006, the SEC granted a six-month delay in the required implementation of FIN 48 for mutual funds. At this time, management is evaluating the implications of FIN 48. Its impact on the financial statements has not yet been determined.

In September 2006, FASB issued its new Standard No. 157, Fair Value Measurements (“FAS 157”). FAS 157 is designed to unify guidance for the measurement of fair value of all types of assets, including financial instruments, and certain liabilities, throughout a number of accounting standards. FAS 157 also establishes a hierarchy for measuring fair value in generally accepted accounting principles and expands financial statement disclosures about fair value measurements that are relevant to mutual funds. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and earlier adoption is permitted. At this time, management is evaluating the implications of FAS 157 and its impact on the financial statements has not yet been determined.

Note 12 — TRANSACTIONS WITH AFFILIATES

Pursuant to Section (2)(a)(3) of the 1940 Act, if the Fund owns 5% or more of the outstanding voting securities of an issuer, the issuer is deemed to be an affiliate of the Fund. During the period October 1, 2006 - March 31, 2007 the Fund owned the following positions in such companies for investment purposes only: The Merger Fund

NOTES TO THE FINANCIAL STATEMENTS (continued)

March 31, 2007 (Unaudited)

Note 12 — TRANSACTIONS WITH AFFILIATES (Continued)

| | Purchases | Sales | | | | |

| Price Communications | | | | | | | |

Corporation | 4,450,698 | 22,000 | — | 4,472,698 | $91,779,763 | $3,440,747 | — |

The Merger Fund

APPROVAL OF ADVISORY CONTRACT

On January 16, 2007, at a meeting called for the purpose of voting on such approval, the Board of Trustees, including all of the Trustees who are not parties to the Advisory Contract or interested persons of any such party (the non-interested Trustees), approved the continuance of the Advisory Contract for the Fund. In so doing, the Board studied materials specifically relating to the Advisory Contract provided by the Adviser, counsel to the non-interested Trustees and counsel to the Fund. The Board considered a variety of factors, including the following:

The Board considered the nature, extent and quality of the services to be provided by the Adviser to the Fund pursuant to the Advisory Contract, including the Adviser’s competence and integrity; research capabilities; implementation and enforcement of compliance procedures and financial-reporting controls; and adherence to the Fund’s investment objectives, policies and restrictions. The Board also reviewed the Adviser’s methodology, research and analysis that it employs in selecting investments for the Fund. The Board considered the non-traditional nature of the Fund’s investment approach, the specialized expertise and experience of the Fund’s portfolio managers and the difficulty, were it warranted, of selecting an alternative adviser. The Board concluded that the Adviser fulfilled all of the foregoing factors and responsibilities in accordance with its obligations under the Advisory Contract.

The Board also evaluated the investment performance of the Fund relative to the S&P 500 Index over the last year, three years, five years and 10 years, and relative to the performance of alternative-investment mutual funds, including those that engage in merger arbitrage.

Additionally, the Board reviewed information on the fee structure of the Advisory Contract, including the costs of the services to be provided and the profits to be realized by the Adviser and its affiliate from their relationship with the Fund, as evidenced by the Adviser’s profitability analysis. The profitability analysis consisted of income and expenses by category for calendar years 2006 and 2005, less expenses allocated to other funds managed by the Adviser’s affiliate, adjusted total expenses, net income, pre-tax profit margin and pre-tax profit margin before payments to fund supermarkets. The Board also reviewed comparisons of the rates of compensation paid to managers of funds in its peer group, Lipper data relating to average expenses and advisory fees for comparable funds and the benefit to the Adviser of the Fund’s soft-dollar arrangements. Based on the information provided, the Board determined that the Fund’s fee structure is competitive with funds with similar investment goals and strategies.

The Board considered the Fund’s total expense ratio, contractual investment advisory fees, 12b-1 distribution expense and service-provider fee ratio compared to the industry average by quartile, within the appropriate Lipper benchmark category and Lipper category range. The Board also considered the amount and nature of fees paid by shareholders. The Board considered the fact that the Adviser has agreed to waive a portion of its fees and noted that the fee waiver could be discontinued at any time after January 31, 2008.

The Adviser provided information on peer-group comparisons consisting of alternative-investment mutual funds, including those that engage in merger arbitrage. The materials compared each fund’s investment strategies; management fee; expense ratio; total assets; whether a fund has a breakpoint, charges a sales load and is open to new investors; returns for the one year, three years, five years and

The Merger Fund

APPROVAL OF ADVISORY CONTRACT (continued)

10 years ended December 31, 2006; and risk as measured by beta and standard deviation. It was noted that the Fund’s management fees and expense ratio are within the average range compared to its peer funds.

The Board considered the extent to which economies of scale would be realized with respect to operational costs as the Fund grows in the number of shareholders and assets under management, the existence of breakpoints previously established by the Adviser, and whether fee levels to be charged by the Adviser reflect these economies of scale for the benefit of Fund investors and are fair under the circumstances, which the Board, including all of the non-interested Trustees, believed to be the case.

Based on its evaluation, in consultation with independent counsel, of all material aspects of the Advisory Contract, including the foregoing factors and such other information believed to be reasonably necessary to evaluate the terms of the Advisory Contract, the Board, including all of the non-interested Trustees voting separately, concluded that the continuation of the Advisory Contract would be in the best interest of the Fund’s shareholders, and determined that the compensation to the Adviser provided for in the Advisory Contract is fair and reasonable.

The Merger Fund

AVAILABILITY OF PROXY VOTING INFORMATION

Information regarding how the Fund generally votes proxies relating to portfolio securities may be obtained without charge by calling the Fund’s Transfer Agent at 1-800-343-8959 or by visiting the SEC’s website at www.sec.gov. Information regarding how the Fund voted proxies during the period ended June 30, 2006 is available on the SEC’s website or by calling the toll-free number listed above.

AVAILABILITY OF QUARTERLY PORTFOLIO SCHEDULE

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Investment Adviser

Westchester Capital Management, Inc.

100 Summit Lake Drive

Valhalla, NY 10595

(914) 741-5600

Administrator, Transfer Agent, Dividend Paying

Agent and Shareholder Servicing Agent

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

P.O. Box 701

Milwaukee, WI 53201-0701

(800) 343-8959

Custodian

U.S. Bank, N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, WI 53212

(800) 343-8959

Trustees

Frederick W. Green

Michael J. Downey

James P. Logan, III

Barry Hamerling

Executive Officers

Frederick W. Green, President

Bonnie L. Smith, Vice President,

Treasurer and Secretary

Roy D. Behren, Chief Compliance Officer

Counsel

Fulbright & Jaworski L.L.P.

666 Fifth Avenue

New York, NY 10103

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

100 East Wisconsin Avenue

Milwaukee, WI 53202

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end management investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end management investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s board of trustees.

Item 11. Controls and Procedures.

(a) The Registrant’s President/Principal Executive Officer and Treasurer/Principal Financial Officer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider.

(b) There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 12. Exhibits.

(a) (1) Any code of ethics, or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy the Item 2 requirements through filing of an exhibit. Not Applicable.

(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end management investment companies.

(b) Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) The Merger Fund

By (Signature and Title)* /s/ Frederick W. Green

Frederick W. Green, President

Date 05/22/2007

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)* /s/ Frederick W. Green

Frederick W. Green, President

Date 05/22/2007

By (Signature and Title)* /s/ Bonnie L. Smith

Bonnie L. Smith, Treasurer

Date 05/22/2007

* Print the name and title of each signing officer under his or her signature.