UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-03445

The Merger Fund

(Exact name of registrant as specified in charter)

100 Summit Lake Drive

Valhalla, New York 10595

(Address of principal executive offices) (Zip code)

Roy Behren and Michael T. Shannon

100 Summit Lake Drive

Valhalla, New York 10595

(Name and address of agent for service)

1-800-343-8959

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2017

Date of reporting period: June 30, 2017

Item 1. Reports to Stockholders.

June 30, 2017

THE MERGER FUND

WCM ALTERNATIVES:

EVENT-DRIVEN FUND

DEAL COMPOSITION

The Merger Fund (Unaudited)

| Type of Buyer | | | | Deal Terms* | | |

| Strategic | 100.0% | | | | Cash & Stock | 38.0% | |

| Financial | 0.0% | | | | Cash | 35.4% | |

| | | | | | Stock and Stub(1) | 18.7% | |

| By Deal Type | | | | Stock with Fixed Exchange Ratio | 5.0% | |

| Friendly | 100.0% | | | | Undetermined(2) | 2.8% | |

| Hostile | 0.0% | | | | Stock with Flexible | | |

| | | | | | Exchange Ratio (Collar) | 0.1% | |

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of June 30, 2017. |

| 1 | “Stub” includes assets other than cash and stock (e.g., escrow notes). |

| 2 | The compensation is undetermined because the compensation to be received (e.g., stock, cash, escrow notes, other) will be determined at a later date, potentially at the option of the Fund’s investment adviser. |

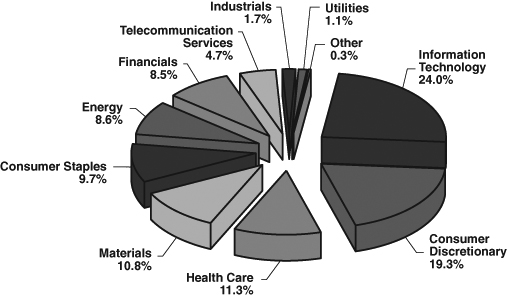

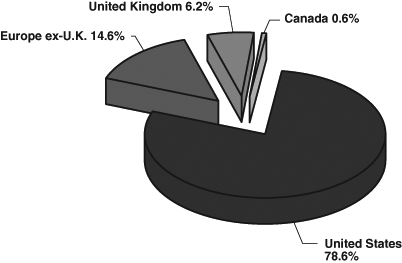

PORTFOLIO COMPOSITION*

The Merger Fund (Unaudited)

By Sector

By Region

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of June 30, 2017. Data expressed excludes short-term investments, short investments, written options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments, Schedule of Options Written, Schedule of Forward Currency Exchange Contracts and Schedule of Swap Contracts for more details on the Fund’s individual holdings. |

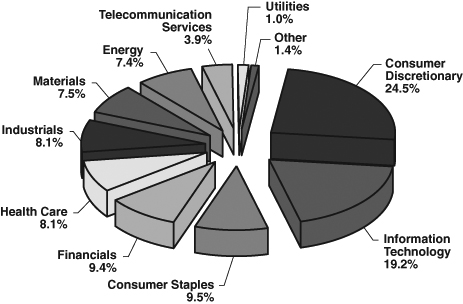

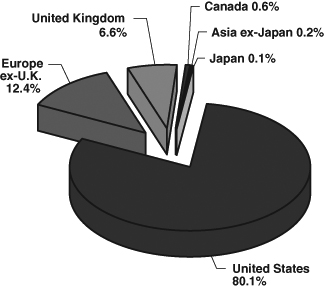

PORTFOLIO COMPOSITION*

WCM Alternatives: Event-Driven Fund (Unaudited)

By Sector

By Region

| * | Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of June 30, 2017. Data expressed excludes short-term investments, short investments, written options, forward currency exchange contracts and short total return swap contracts. Please refer to the Schedule of Investments, Schedule of Options Written, Schedule of Forward Currency Exchange Contracts and Schedule of Swap Contracts for more details on the Fund’s individual holdings. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The Merger Fund and WCM Alternatives: Event-Driven Fund

EXPENSE EXAMPLE

June 30, 2017 (Unaudited)

As a shareholder of The Merger Fund and/or WCM Alternatives: Event-Driven Fund (the “Funds”), you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, and other fund specific expenses. The expense example is intended to help a shareholder understand ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the most recent six-month period.

The Actual Expenses comparison provides information about actual account values and actual expenses. A shareholder may use the information in this line, together with the amount invested, to estimate the expenses paid over the period. A shareholder may divide his/her account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses paid on his/her account during this period. The example below includes, among other fees, management fees, fund accounting, custody and transfer agent fees. However, the example does not include portfolio trading commissions and related expenses or extraordinary expenses.

The Hypothetical Example for Comparison Purposes provides information about hypothetical account values and hypothetical expenses based on each Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid for the period. A shareholder may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, a shareholder would compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemptions fees, or exchange fees. Therefore, the Hypothetical Example for Comparison Purposes is useful in comparing ongoing costs only, and will not help to determine the relevant total costs of owning different funds. In addition, if these transactional costs were included, shareholder costs would have been higher.

The Merger Fund and WCM Alternatives: Event-Driven Fund

EXPENSE EXAMPLE (continued)

June 30, 2017 (Unaudited)

| | Annualized | Beginning | Ending | Expenses Paid |

| | Net Expense | Account | Account | During Period |

| | Ratio | Value | Value | 1/1/17- |

| | 6/30/17 | 1/1/17 | 6/30/17 | 6/30/17(1) |

| The Merger Fund |

| Investor Class | | | | |

Actual Expenses(2)(3) | 1.75% | $1,000.00 | $1,021.10 | $8.77 |

| Hypothetical Example for | | | | |

| Comparison Purposes | | | | |

| (5% return before | | | | |

expenses)(3) | 1.75% | $1,000.00 | $1,016.12 | $8.75 |

| Institutional Class | | | | |

Actual Expenses(2)(3) | 1.43% | $1,000.00 | $1,023.10 | $7.17 |

| Hypothetical Example for | | | | |

| Comparison Purposes | | | | |

| (5% return before | | | | |

expenses)(3) | 1.43% | $1,000.00 | $1,017.70 | $7.15 |

| | | | | |

| | Annualized | Beginning | Ending | Expenses Paid |

| | Net Expense | Account | Account | During Period |

| | Ratio | Value | Value | 3/23/17- |

| | 6/30/17 | 3/23/17 | 6/30/17 | 6/30/17(1) |

| WCM Alternatives: Event-Driven Fund |

| Investor Class | | | | |

Actual Expenses(2)(4) | 2.53% | $1,000.00 | $1,032.40 | $7.04 |

| Hypothetical Example for | | | | |

| Comparison Purposes | | | | |

| (5% return before | | | | |

expenses)(4) | 2.53% | $1,000.00 | $1,006.77 | $6.95 |

| | | | | |

| | Annualized | Beginning | Ending | Expenses Paid |

| | Net Expense | Account | Account | During Period |

| | Ratio | Value | Value | 1/1/17- |

| | 6/30/17 | 1/1/17 | 6/30/17 | 6/30/17(1) |

| WCM Alternatives: Event-Driven Fund |

| Institutional Class | | | | |

Actual Expenses(2)(4) | 2.22% | $1,000.00 | $1,041.80 | $11.24 |

| Hypothetical Example for | | | | |

| Comparison Purposes | | | | |

| (5% return before | | | | |

expenses)(4) | 2.22% | $1,000.00 | $1,013.79 | $11.08 |

The Merger Fund and WCM Alternatives: Event-Driven Fund

EXPENSE EXAMPLE (continued)

June 30, 2017 (Unaudited)

| (1) | Expenses are equal to the Fund’s annualized net expense ratio, multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period, with the exception of the WCM Alternatives: Event Driven Fund’s Investor Class which is multiplied by the average account value over the period, multiplied by 100/365 to reflect the period March 22, 2017 through June 30, 2017. |

| (2) | Based on the actual returns of 2.11%, 2.31%, and 4.18% for the six month-period ended June 30, 2017 for The Merger Fund Investor and Institutional Classes and WCM Alternatives: Event-Driven Fund Institutional Class, respectively. Based on the actual returns of 3.24% for the period March 22, 2017 through June 30, 2017 for WCM Alternatives: Event-Driven Fund Investor Class. |

| (3) | Excluding dividends and interest on short positions and borrowing expense on securities sold short, your actual cost of investment and your hypothetical cost of investment would have been $7.12 and $7.10, respectively in the The Merger Fund Investor Class and $5.52 and $5.51, respectively in The Merger Fund Institutional Class. |

| (4) | Excluding dividends and interest on short positions and borrowing expense on securities sold short, your actual cost of investment and your hypothetical cost of investment would have been $5.54 and $5.47, respectively in WCM Alternatives: Event-Driven Fund Investor Class and $8.81 and $8.70, respectively in WCM Alternatives: Event-Driven Fund Institutional Class. |

The Merger Fund

SCHEDULE OF INVESTMENTS

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| | | | | | | |

| LONG INVESTMENTS — 103.44% | | | | | | |

| | | | | | | |

| COMMON STOCKS — 66.16% | | | | | | |

| | | | | | | |

| AEROSPACE & DEFENSE — 0.29% | | | | | | |

| DigitalGlobe, Inc. (a) | | | 243,806 | | | $ | 8,118,740 | |

| | | | | | | | | |

| ALTERNATIVE CARRIERS — 3.35% | | | | | | | | |

| Level 3 Communications, Inc. (a)(e) | | | 1,601,552 | | | | 94,972,034 | |

| | | | | | | | | |

| APPLICATION SOFTWARE — 3.42% | | | | | | | | |

| Mobileye NV (a)(b) | | | 1,545,483 | | | | 97,056,332 | |

| | | | | | | | | |

| ASSET MANAGEMENT & CUSTODY BANKS — 1.69% | | | | | | | | |

| Fortress Investment Group LLC Class A | | | 6,001,753 | | | | 47,954,006 | |

| | | | | | | | | |

| BIOTECHNOLOGY — 0.00% | | | | | | | | |

| Mersana Therapeutics, Inc. (a) | | | 413 | | | | 5,770 | |

| | | | | | | | | |

| COMMODITY CHEMICALS — 0.54% | | | | | | | | |

| Valvoline, Inc. | | | 640,647 | | | | 15,196,145 | |

| | | | | | | | | |

| DIVERSIFIED CHEMICALS — 5.42% | | | | | | | | |

| The Dow Chemical Company | | | 2,394 | | | | 150,990 | |

| E. I. du Pont de Nemours and Company | | | 991,103 | | | | 79,991,923 | |

| Huntsman Corporation | | | 2,846,200 | | | | 73,545,808 | |

| | | | | | | | 153,688,721 | |

| | | | | | | | | |

| DRUG RETAIL — 0.18% | | | | | | | | |

| Rite Aid Corporation (a)(e) | | | 1,751,455 | | | | 5,166,792 | |

| | | | | | | | | |

| FERTILIZERS & AGRICULTURAL CHEMICALS — 1.02% | | | | | | | | |

| Monsanto Company | | | 243,600 | | | | 28,832,496 | |

| | | | | | | | | |

| FOOD RETAIL — 0.13% | | | | | | | | |

| Whole Foods Market, Inc. | | | 86,243 | | | | 3,631,693 | |

| | | | | | | | | |

| HEALTH CARE EQUIPMENT — 5.06% | | | | | | | | |

| C.R. Bard, Inc. (e) | | | 453,428 | | | | 143,333,125 | |

| | | | | | | | | |

| HEALTH CARE FACILITIES — 1.35% | | | | | | | | |

| VCA, Inc. (a) | | | 413,996 | | | | 38,215,971 | |

| | | | | | | | | |

| HEALTH CARE SUPPLIES — 1.79% | | | | | | | | |

| Alere, Inc. (a) | | | 1,010,532 | | | | 50,718,601 | |

| | | | | | | | | |

| HOUSEWARES & SPECIALTIES — 4.49% | | | | | | | | |

| Jarden Corporation (a)(d)(g)(j) | | | 2,025,678 | | | | 127,374,430 | |

| | | | | | | | | |

| INVESTMENT COMPANIES — 0.28% | | | | | | | | |

| Forum Merger Corporation (a) | | | 284,888 | | | | 2,903,009 | |

| Modern Media Acquisition Corporation (a) | | | 477,701 | | | | 4,901,212 | |

| | | | | | | | 7,804,221 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| MOVIES & ENTERTAINMENT — 6.78% | | | | | | |

| Time Warner, Inc. (e) | | | 1,914,297 | | | $ | 192,214,562 | |

| | | | | | | | | |

| MULTI-LINE INSURANCE — 2.52% | | | | | | | | |

| American International Group, Inc. (e) | | | 1,143,700 | | | | 71,504,124 | |

| | | | | | | | | |

| OIL & GAS EQUIPMENT & SERVICES — 2.14% | | | | | | | | |

| Baker Hughes, Inc. (e) | | | 1,111,831 | | | | 60,605,908 | |

| | | | | | | | | |

| OIL & GAS EXPLORATION & PRODUCTION — 1.08% | | | | | | | | |

| Rice Energy, Inc. (a) | | | 1,155,240 | | | | 30,764,041 | |

| | | | | | | | | |

| OIL & GAS REFINING & MARKETING — 0.03% | | | | | | | | |

| Showa Shell Sekiyu K.K. (b) | | | 93,792 | | | | 868,915 | |

| | | | | | | | | |

| OIL & GAS STORAGE & TRANSPORTATION — 3.41% | | | | | | | | |

| Columbia Pipeline Group, Inc. (a)(d)(g)(j) | | | 2,276,354 | | | | 58,561,551 | |

| ONEOK Partners LP | | | 497,036 | | | | 25,383,628 | |

| Veresen, Inc. (b) | | | 309,131 | | | | 4,371,887 | |

| VTTI Energy Partners LP (b) | | | 424,341 | | | | 8,338,301 | |

| | | | | | | | 96,655,367 | |

| | | | | | | | | |

| PAPER PACKAGING — 1.36% | | | | | | | | |

| Sealed Air Corporation | | | 859,000 | | | | 38,448,840 | |

| | | | | | | | | |

| REGIONAL BANKS — 0.07% | | | | | | | | |

| Stonegate Bank | | | 43,244 | | | | 1,997,008 | |

| | | | | | | | | |

| REITs — 0.97% | | | | | | | | |

| Care Capital Properties, Inc. | | | 8,341 | | | | 222,705 | |

| FelCor Lodging Trust, Inc. | | | 2,465,280 | | | | 17,774,669 | |

| Starwood Property Trust, Inc. (e) | | | 424,863 | | | | 9,512,682 | |

| | | | | | | | 27,510,056 | |

| | | | | | | | | |

| SEMICONDUCTORS — 7.57% | | | | | | | | |

| NXP Semiconductors NV (a)(b)(e) | | | 1,961,239 | | | | 214,657,608 | |

| | | | | | | | | |

| SPECIALTY CHEMICALS — 1.37% | | | | | | | | |

| Ashland Global Holdings, Inc. (e) | | | 590,600 | | | | 38,926,446 | |

| | | | | | | | | |

| TECHNOLOGY HARDWARE, | | | | | | | | |

| STORAGE & PERIPHERALS — 2.50% | | | | | | | | |

| Hewlett Packard Enterprise Company (e) | | | 4,276,300 | | | | 70,943,817 | |

| | | | | | | | | |

| TOBACCO — 7.19% | | | | | | | | |

| Reynolds American, Inc. (e) | | | 3,133,047 | | | | 203,773,377 | |

| | | | | | | | | |

| TRUCKING — 0.16% | | | | | | | | |

| Swift Transportation Company (a) | | | 172,551 | | | | 4,572,602 | |

| TOTAL COMMON STOCKS (Cost $1,809,473,960) | | | | | | | 1,875,511,748 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| CLOSED-END FUNDS — 8.11% | | | | | | |

| Altaba, Inc. (a)(e) | | | 4,223,009 | | | $ | 230,069,530 | |

| TOTAL CLOSED-END FUNDS (Cost $189,937,335) | | | | | | | 230,069,530 | |

| | | | | | | | | |

| CONTINGENT VALUE RIGHTS — 0.09% (a)(g) | | | | | | | | |

| Casa Ley, S.A. de C.V. | | | 1,713,496 | | | | 831,046 | |

| Media General, Inc. | | | 891,153 | | | | 1,804,585 | |

| Property Development Centers LLC | | | 1,713,496 | | | | 25,702 | |

| TOTAL CONTINGENT VALUE RIGHTS (Cost $431,892) | | | | | | | 2,661,333 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| BANK LOANS — 0.55% (f) | | | | | | | | |

| Bass Pro Group LLC | | | | | | | | |

| 6.274%, 12/16/2023 (k) | | $ | 16,112,000 | | | | 15,683,018 | |

| TOTAL BANK LOANS (Cost $16,011,300) | | | | | | | 15,683,018 | |

| | | | | | | | | |

| CORPORATE BONDS — 6.38% (f) | | | | | | | | |

| Alere, Inc. | | | | | | | | |

| 6.500%, 6/15/2020 | | | 17,951,000 | | | | 18,287,581 | |

| Caesars Growth Properties Holdings LLC | | | | | | | | |

| 9.375%, 5/1/2022 | | | 6,372,000 | | | | 6,929,550 | |

| CST Brands, Inc. | | | | | | | | |

| 5.000%, 5/1/2023 (e) | | | 4,667,000 | | | | 4,924,618 | |

| Energy Future Intermediate Holding Company LLC | | | | | | | | |

| 11.000%, 10/1/2021 (h) | | | 2,012,922 | | | | 2,616,799 | |

| FairPoint Communications, Inc. | | | | | | | | |

| 8.750%, 8/15/2019 (i) | | | 13,596,000 | | | | 13,984,846 | |

| IASIS Healthcare LLC | | | | | | | | |

| 8.375%, 5/15/2019 | | | 22,303,000 | | | | 22,425,666 | |

| Level 3 Financing, Inc. | | | | | | | | |

| 4.939%, 1/15/2018 (e)(k) | | | 11,870,000 | | | | 11,925,789 | |

| Lloyds Bank plc | | | | | | | | |

| 6.850%, 7/17/2027 (b)(k) | | | 19,784,000 | | | | 20,110,040 | |

| Rice Energy, Inc. | | | | | | | | |

| 6.250%, 5/1/2022 | | | 20,040,000 | | | | 20,966,850 | |

| Rite Aid Corporation | | | | | | | | |

| 6.125%, 4/1/2023 (i) | | | 3,991,000 | | | | 3,941,113 | |

| Terraform Global Operating, LLC | | | | | | | | |

| 9.750%, 8/15/2022 (i) | | | 22,076,000 | | | | 24,835,500 | |

| Tribune Media Company | | | | | | | | |

| 5.875%, 7/15/2022 | | | 2,033,000 | | | | 2,139,733 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| West Corporation | | | | | | |

| 5.375%, 7/15/2022 (i) | | $ | 27,320,000 | | | $ | 27,661,500 | |

| TOTAL CORPORATE BONDS (Cost $181,139,005) | | | | | | | 180,749,585 | |

| | | | | | | | | |

| | | Contracts | | | | | |

| | | (100 shares | | | | | |

| | | per contract) | | | | | |

| PURCHASED CALL OPTIONS — 0.01% | | | | | | | | |

| Mead Johnson Nutrition Company | | | | | | | | |

| Expiration: January 2019, Exercise Price: $90.00 (f) | | | 480 | | | | — | |

| SPDR S&P 500 ETF Trust | | | | | | | | |

| Expiration: August 2017, Exercise Price: $248.00 | | | 2,398 | | | | 158,268 | |

| | | | | | | | 158,268 | |

| PURCHASED PUT OPTIONS — 0.19% | | | | | | | | |

| American International Group, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $57.50 | | | 343 | | | | 2,401 | |

| Expiration: August 2017, Exercise Price: $55.00 | | | 7,936 | | | | 134,912 | |

| Ashland Global Holdings, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $105.00 (l) | | | 2,324 | | | | 87,150 | |

| Expiration: October 2017, Exercise Price: $55.00 | | | 3,222 | | | | 185,265 | |

| AT&T, Inc. | | | | | | | | |

| Expiration: October 2017, Exercise Price: $37.00 | | | 15,589 | | | | 2,151,282 | |

| Baker Hughes, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $52.50 | | | 10,588 | | | | 518,812 | |

| Expiration: August 2017, Exercise Price: $45.00 | | | 530 | | | | 7,178 | |

| The Dow Chemical Company | | | | | | | | |

| Expiration: September 2017, Exercise Price: $52.50 | | | 3,446 | | | | 96,488 | |

| Expiration: September 2017, Exercise Price: $57.50 | | | 74 | | | | 4,884 | |

| E. I. du Pont de Nemours and Company | | | | | | | | |

| Expiration: July 2017, Exercise Price: $72.50 | | | 2,878 | | | | 31,658 | |

| Hewlett Packard Enterprise Company | | | | | | | | |

| Expiration: August 2017, Exercise Price: $15.00 | | | 22,383 | | | | 223,830 | |

| Expiration: August 2017, Exercise Price: $16.00 | | | 18,078 | | | | 451,950 | |

| Huntsman Corporation | | | | | | | | |

| Expiration: August 2017, Exercise Price: $17.00 | | | 3,140 | | | | 7,850 | |

| Expiration: August 2017, Exercise Price: $20.00 | | | 13,869 | | | | 69,345 | |

| Expiration: August 2017, Exercise Price: $21.00 | | | 13,996 | | | | 104,970 | |

| MetLife, Inc. | | | | | | | | |

| Expiration: August 2017, Exercise Price: $50.00 | | | 1,237 | | | | 55,665 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Contracts | | | | |

| | | (100 shares | | | | |

| | | per contract) | | | Value | |

| Sealed Air Corporation | | | | | | |

| Expiration: July 2017, Exercise Price: $38.00 | | | 8,590 | | | $ | 21,475 | |

| SPDR S&P 500 ETF Trust | | | | | | | | |

| Expiration: July 2017, Exercise Price: $239.50 | | | 2,109 | | | | 263,625 | |

| Expiration: July 2017, Exercise Price: $242.00 | | | 2,866 | | | | 573,200 | |

| VanEck Vectors Semiconductor ETF | | | | | | | | |

| Expiration: August 2017, Exercise Price: $86.00 | | | 808 | | | | 412,080 | |

| | | | | | | | 5,404,020 | |

| TOTAL PURCHASED OPTIONS (Cost $7,799,272) | | | | | | | 5,562,288 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| ESCROW NOTES — 0.07% | | | | | | | | |

| AMR Corporation (a)(d)(g) | | $ | 1,243,406 | | | | 1,927,279 | |

| TOTAL ESCROW NOTES (Cost $679,555) | | | | | | | 1,927,279 | |

| | | | | | | | | |

| | | Shares | | | | | |

| SHORT-TERM INVESTMENTS — 21.88% | | | | | | | | |

| MONEY MARKET FUNDS — 18.25% | | | | | | | | |

| First American Government Obligations Fund, | | | | | | | | |

| Institutional Share Class, 0.84% (c) | | | 58,586,118 | | | | 58,586,118 | |

| The Government & Agency Portfolio, | | | | | | | | |

| Institutional Share Class, 0.89% (c) | | | 138,808,000 | | | | 138,808,000 | |

| JPMorgan Prime Money Market Fund, | | | | | | | | |

| Institutional Share Class, 1.20% (c) | | | 42,479,256 | | | | 42,496,028 | |

| JPMorgan U.S. Government Money Market Fund, | | | | | | | | |

| Institutional Share Class, 0.88% (c) | | | 138,808,000 | | | | 138,808,000 | |

| Morgan Stanley Institutional Liquidity Funds — | | | | | | | | |

| Government Portfolio, Institutional | | | | | | | | |

| Share Class, 0.84% (c) | | | 138,808,000 | | | | 138,808,000 | |

| | | | | | | | 517,506,146 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| U.S. TREASURY BILLS — 3.63% (f) | | | | | | | | |

| United States Treasury Bill | | | | | | | | |

| 0.78%, 7/27/2017 | | $ | 15,000,000 | | | | 14,991,855 | |

| 0.83%, 8/24/2017 | | | 15,000,000 | | | | 14,980,395 | |

| 0.88%, 9/28/2017 | | | 15,000,000 | | | | 14,963,565 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Principal | | | | |

| | | Amount | | | Value | |

| 0.94%, 10/26/2017 | | $ | 24,210,000 | | | $ | 24,131,318 | |

| 0.95%, 11/02/2017 | | | 100,000 | | | | 99,653 | |

| 0.94%, 11/09/2017 | | | 4,500,000 | | | | 4,483,291 | |

| 1.00%, 11/24/2017 | | | 14,200,000 | | | | 14,139,849 | |

| 1.00%, 11/30/2017 | | | 1,600,000 | | | | 1,592,978 | |

| 1.03%, 12/7/2017 | | | 2,900,000 | | | | 2,886,529 | |

| 1.02%, 12/21/2017 | | | 8,000,000 | | | | 7,959,304 | |

| 1.07%, 12/28/2017 | | | 2,600,000 | | | | 2,585,697 | |

| | | | | | | | 102,814,434 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $620,337,554) | | | | | | | 620,320,580 | |

| TOTAL LONG INVESTMENTS | | | | | | | | |

| (Cost $2,825,809,873) — 103.44% | | | | | | | 2,932,485,361 | |

| | | | | | | | | |

| | | Shares | | | | | |

| SHORT INVESTMENTS — (13.82)% | | | | | | | | |

| COMMON STOCKS — (13.82)% | | | | | | | | |

| AEROSPACE & DEFENSE — (0.14)% | | | | | | | | |

| MacDonald, Dettwiler and Associates Ltd. (b)(f) | | | (76,360 | ) | | | (3,955,448 | ) |

| | | | | | | | | |

| AIRLINES — (0.12)% | | | | | | | | |

| American Airlines Group, Inc. | | | (65,211 | ) | | | (3,281,418 | ) |

| | | | | | | | | |

| DIVERSIFIED BANKS — (0.00)% | | | | | | | | |

| Canadian Imperial Bank of Commerce | | | (1 | ) | | | (81 | ) |

| | | | | | | | | |

| HEALTH CARE EQUIPMENT — (1.58)% | | | | | | | | |

| Becton, Dickinson and Company | | | (230,197 | ) | | | (44,913,737 | ) |

| | | | | | | | | |

| INTEGRATED TELECOMMUNICATION SERVICES — (1.59)% | | | | | | | | |

| AT&T, Inc. | | | (282,199 | ) | | | (10,647,368 | ) |

| CenturyLink, Inc. | | | (1,446,033 | ) | | | (34,531,268 | ) |

| | | | | | | | (45,178,636 | ) |

| INTERNET SOFTWARE & SERVICES — (7.26)% | | | | | | | | |

| Alibaba Group Holding Ltd. — ADR | | | (1,461,568 | ) | | | (205,934,931 | ) |

| | | | | | | | | |

| OIL & GAS EXPLORATION & PRODUCTION — (0.88)% | | | | | | | | |

| EQT Corporation | | | (427,439 | ) | | | (25,043,651 | ) |

| | | | | | | | | |

| OIL & GAS REFINING & MARKETING — (0.05)% | | | | | | | | |

| Idemitsu Kosan Company Ltd. (b) | | | (46,809 | ) | | | (1,327,590 | ) |

| | | | | | | | | |

| OIL & GAS STORAGE & TRANSPORTATION — (1.02)% | | | | | | | | |

| ONEOK, Inc. | | | (489,509 | ) | | | (25,532,789 | ) |

| Pembina Pipeline Corporation (b) | | | (98,057 | ) | | | (3,247,648 | ) |

| | | | | | | | (28,780,437 | ) |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| REGIONAL BANKS — (0.03)% | | | | | | |

| Home BancShares, Inc. | | | (28,587 | ) | | $ | (711,816 | ) |

| | | | | | | | | |

| REITs — (0.63)% | | | | | | | | |

| RLJ Lodging Trust | | | (892,431 | ) | | | (17,732,604 | ) |

| Sabra Health Care REIT, Inc. | | | (9,377 | ) | | | (225,986 | ) |

| | | | | | | | (17,958,590 | ) |

| TOBACCO — (0.36)% | | | | | | | | |

| British American Tobacco plc — ADR | | | (149,139 | ) | | | (10,221,987 | ) |

| | | | | | | | | |

| TRUCKING — (0.16)% | | | | | | | | |

| Knight Transportation, Inc. | | | (124,237 | ) | | | (4,602,981 | ) |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Proceeds $314,012,471) | | | | | | | (391,911,303 | ) |

| TOTAL SHORT INVESTMENTS | | | | | | | | |

| (Proceeds $314,012,471) — (13.82)% | | | | | | | (391,911,303 | ) |

| TOTAL NET INVESTMENTS | | | | | | | | |

| (Cost $2,511,797,402) — 89.62% | | | | | | | 2,540,574,058 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 10.38% | | | | | | | 294,414,040 | |

| TOTAL NET ASSETS — 100.00% | | | | | | $ | 2,834,988,098 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

plc – Public Limited Company

REIT – Real Estate Investment Trust

| (a) | Non-income producing security. |

| (b) | Foreign security. |

| (c) | The rate quoted is the annualized seven-day yield as of June 30, 2017. |

| (d) | Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short, written option contracts, swap contacts, and forward currency exchange contracts. |

| (f) | Level 2 Security. Please see Note 2 in the Notes to the Financial Statements for more information. |

| (g) | Level 3 Security. Please see Note 2 in the Notes to the Financial Statements for more information. |

| (h) | Default or other conditions exist and the security is not presently accruing income. |

| (i) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of June 30, 2017, these securities represent 2.48% of total net assets. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| (j) | Restricted security. Please see Note 2 in the Notes to the Financial Statements for more information. As of June 30, 2017, these securities represent 6.56% of total net assets. |

| (k) | The coupon rate shown on variable rate securities represents the rates as of June 30, 2017. |

| (l) | As the result of a corporate action on the underlying holding, the option’s underlying security is 100 shares of Ashland Global Holding, Inc., 274 shares of Valvoline, Inc. and cash in lieu of fractional shares. |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| LONG INVESTMENTS — 103.89% | | | | | | |

| COMMON STOCKS — 55.69% | | | | | | |

| AEROSPACE & DEFENSE — 0.30% | | | | | | |

| DigitalGlobe, Inc. (a)(e) | | | 10,080 | | | $ | 335,664 | |

| | | | | | | | | |

| ALTERNATIVE CARRIERS — 4.44% | | | | | | | | |

| Level 3 Communications, Inc. (a)(e) | | | 83,614 | | | | 4,958,310 | |

| | | | | | | | | |

| AUTOMOBILE MANUFACTURERS — 1.54% | | | | | | | | |

| General Motors Company (e) | | | 49,200 | | | | 1,718,556 | |

| | | | | | | | | |

| BIOTECHNOLOGY — 0.00% | | | | | | | | |

| Mersana Therapeutics, Inc. (a) | | | 16 | | | | 223 | |

| | | | | | | | | |

| BROADCASTING — 2.32% | | | | | | | | |

| CBS Corporation Class B | | | 40,700 | | | | 2,595,846 | |

| | | | | | | | | |

| BUILDING PRODUCTS — 1.02% | | | | | | | | |

| Johnson Controls International plc (b)(e) | | | 26,200 | | | | 1,136,032 | |

| | | | | | | | | |

| CABLE & SATELLITE — 2.07% | | | | | | | | |

| Liberty Media Corporation-Liberty | | | | | | | | |

| SiriusXM Class A (a)(e) | | | 55,034 | | | | 2,310,327 | |

| | | | | | | | | |

| COMMODITY CHEMICALS — 1.45% | | | | | | | | |

| Valvoline, Inc. (e) | | | 68,403 | | | | 1,622,525 | |

| | | | | | | | | |

| CONSTRUCTION & ENGINEERING — 2.90% | | | | | | | | |

| Chicago Bridge & Iron Company N.V. (b)(e) | | | 164,300 | | | | 3,241,639 | |

| | | | | | | | | |

| DATA PROCESSING & OUTSOURCED SERVICES — 0.55% | | | | | | | | |

| MoneyGram International, Inc. (a) | | | 35,340 | | | | 609,615 | |

| | | | | | | | | |

| DIVERSIFIED CHEMICALS — 4.05% | | | | | | | | |

| The Dow Chemical Company | | | 118 | | | | 7,442 | |

| E. I. du Pont de Nemours and Company (e) | | | 48,972 | | | | 3,952,530 | |

| Huntsman Corporation | | | 22,100 | | | | 571,064 | |

| | | | | | | | 4,531,036 | |

| DRUG RETAIL — 2.06% | | | | | | | | |

| Rite Aid Corporation (a) | | | 779,072 | | | | 2,298,262 | |

| | | | | | | | | |

| FERTILIZERS & AGRICULTURAL CHEMICALS — 1.97% | | | | | | | | |

| Monsanto Company (e) | | | 18,600 | | | | 2,201,496 | |

| | | | | | | | | |

| FOOD PRODUCTS — 0.44% | | | | | | | | |

| Pinnacle Foods, Inc. | | | 8,300 | | | | 493,020 | |

| | | | | | | | | |

| HOTELS, RESORTS & CRUISE LINES — 0.98% | | | | | | | | |

| ILG, Inc. | | | 40,031 | | | | 1,100,452 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| HOUSEHOLD DURABLES — 0.01% | | | | | | |

| Lennar Corporation Class B | | | 173 | | | $ | 7,780 | |

| | | | | | | | | |

| HOUSEWARES & SPECIALTIES — 3.47% | | | | | | | | |

| Jarden Corporation (a)(d)(g)(j) | | | 61,683 | | | | 3,878,621 | |

| | | | | | | | | |

| INDUSTRIAL CONGLOMERATES — 3.21% | | | | | | | | |

| General Electric Company (e) | | | 132,900 | | | | 3,589,629 | |

| | | | | | | | | |

| INVESTMENT COMPANIES — 1.94% | | | | | | | | |

| Bison Capital Acquisition Corporation (a)(b) | | | 35,538 | | | | 362,488 | |

| Forum Merger Corporation (a) | | | 105,675 | | | | 1,076,828 | |

| Modern Media Acquisition Corporation (a) | | | 71,497 | | | | 733,559 | |

| | | | | | | | 2,172,875 | |

| MEDIA — 1.09% | | | | | | | | |

| DISH Network Corporation Class A (a)(e) | | | 19,500 | | | | 1,223,820 | |

| | | | | | | | | |

| MOVIES & ENTERTAINMENT — 3.27% | | | | | | | | |

| News Corporation Class A (e) | | | 47,456 | | | | 650,147 | |

| Time Warner, Inc. (e) | | | 29,907 | | | | 3,002,962 | |

| | | | | | | | 3,653,109 | |

| MULTI-LINE INSURANCE — 2.11% | | | | | | | | |

| American International Group, Inc. (e) | | | 37,800 | | | | 2,363,256 | |

| | | | | | | | | |

| OIL & GAS EXPLORATION & PRODUCTION — 1.08% | | | | | | | | |

| Rice Energy, Inc. (a)(e) | | | 45,280 | | | | 1,205,806 | |

| | | | | | | | | |

| OIL & GAS REFINING & MARKETING — 0.09% | | | | | | | | |

| Showa Shell Sekiyu K.K. (b) | | | 10,508 | | | | 97,349 | |

| | | | | | | | | |

| OIL & GAS STORAGE & TRANSPORTATION — 2.02% | | | | | | | | |

| Columbia Pipeline Group, Inc. (a)(d)(g)(j) | | | 38,718 | | | | 996,061 | |

| Veresen, Inc. (b) | | | 12,176 | | | | 172,199 | |

| VTTI Energy Partners LP (b) | | | 55,160 | | | | 1,083,894 | |

| | | | | | | | 2,252,154 | |

| OIL, GAS & CONSUMABLE FUELS — 1.61% | | | | | | | | |

| Marathon Petroleum Corporation (e) | | | 34,400 | | | | 1,800,152 | |

| | | | | | | | | |

| REITs — 2.80% | | | | | | | | |

| Care Capital Properties, Inc. | | | 318 | | | | 8,491 | |

| Colony NorthStar, Inc. Class A (e) | | | 119,310 | | | | 1,681,078 | |

| FelCor Lodging Trust, Inc. | | | 92,874 | | | | 669,622 | |

| Starwood Property Trust, Inc. (e) | | | 34,314 | | | | 768,290 | |

| | | | | | | | 3,127,481 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| ROAD & RAIL — 1.10% | | | | | | |

| CSX Corporation (e) | | | 20,500 | | | $ | 1,118,480 | |

| Hertz Global Holdings, Inc. (a) | | | 9,800 | | | | 112,700 | |

| | | | | | | | 1,231,180 | |

| SPECIALTY CHEMICALS — 2.96% | | | | | | | | |

| Ashland Global Holdings, Inc. (e) | | | 50,200 | | | | 3,308,682 | |

| | | | | | | | | |

| SYSTEMS SOFTWARE — 0.83% | | | | | | | | |

| Dell Technologies, Inc. Class V (a)(e) | | | 15,172 | | | | 927,161 | |

| | | | | | | | | |

| TECHNOLOGY HARDWARE, | | | | | | | | |

| STORAGE & PERIPHERALS — 1.77% | | | | | | | | |

| Hewlett Packard Enterprise Company (e) | | | 119,364 | | | | 1,980,249 | |

| | | | | | | | | |

| TOBACCO — 0.24% | | | | | | | | |

| Reynolds American, Inc. | | | 4,126 | | | | 268,355 | |

| TOTAL COMMON STOCKS (Cost $60,566,793) | | | | | | | 62,240,662 | |

| | | | | | | | | |

| CLOSED-END FUNDS — 8.52% (e) | | | | | | | | |

| Altaba, Inc. (a) | | | 138,951 | | | | 7,570,050 | |

| BlackRock Debt Strategies Fund, Inc. | | | 82,764 | | | | 955,097 | |

| Western Asset High Income Opportunity Fund, Inc. | | | 195,533 | | | | 991,352 | |

| TOTAL CLOSED-END FUNDS (Cost $9,170,808) | | | | | | | 9,516,499 | |

| | | | | | | | | |

| PREFERRED STOCKS — 1.26% | | | | | | | | |

| Colony NorthStar, Inc. Series B (e) | | | 32,071 | | | | 818,773 | |

| Colony NorthStar, Inc. Series E (e) | | | 21,830 | | | | 589,410 | |

| TOTAL PREFERRED STOCKS (Cost $1,365,927) | | | | | | | 1,408,183 | |

| | | | | | | | | |

| CONTINGENT VALUE RIGHTS — 0.08% (a)(g) | | | | | | | | |

| Casa Ley, S.A. de C.V. | | | 5,338 | | | | 2,589 | |

| Media General, Inc. | | | 42,852 | | | | 86,775 | |

| Property Development Centers LLC | | | 5,338 | | | | 80 | |

| TOTAL CONTINGENT VALUE RIGHTS (Cost $20,805) | | | | | | | 89,444 | |

| | | | | | | | | |

| RIGHTS — 0.02% (a)(b)(f) | | | | | | | | |

| Pacific Special Acquisition Corporation | | | 35,377 | | | | 20,873 | |

| TOTAL RIGHTS (Cost $8,171) | | | | | | | 20,873 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| WARRANTS — 0.02% (a)(b)(f) | | | | | | |

| Pacific Special Acquisition Corporation | | | 35,377 | | | $ | 18,396 | |

| TOTAL WARRANTS (Cost $3,112) | | | | | | | 18,396 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| BANK LOANS — 1.09% (f) | | | | | | | | |

| Bass Pro Group LLC | | | | | | | | |

| 6.274%, 12/16/2023 (k) | | $ | 1,246,000 | | | | 1,212,825 | |

| TOTAL BANK LOANS (Cost $1,238,212) | | | | | | | 1,212,825 | |

| | | | | | | | | |

| CORPORATE BONDS — 13.80% (f) | | | | | | | | |

| Alere, Inc. | | | | | | | | |

| 6.500%, 6/15/2020 | | | 633,000 | | | | 644,869 | |

| Caesars Entertainment Operating Company, Inc. | | | | | | | | |

| 10.750%, 2/1/2016 (h) | | | 1,030,000 | | | | 1,442,000 | |

| Caesars Growth Properties Holdings LLC | | | | | | | | |

| 9.375%, 5/1/2022 (e) | | | 2,919,000 | | | | 3,174,413 | |

| Energy Future Intermediate Holding Company LLC | | | | | | | | |

| 11.000%, 10/1/2021 (h) | | | 85,690 | | | | 111,397 | |

| FairPoint Communications, Inc. | | | | | | | | |

| 8.750%, 8/15/2019 (e)(i) | | | 1,104,000 | | | | 1,135,574 | |

| IASIS Healthcare LLC | | | | | | | | |

| 8.375%, 5/15/2019 | | | 1,173,000 | | | | 1,179,451 | |

| Rice Energy, Inc. | | | | | | | | |

| 6.250%, 5/1/2022 | | | 1,055,000 | | | | 1,103,794 | |

| Rite Aid Corporation | | | | | | | | |

| 6.750%, 6/15/2021 (e) | | | 747,000 | | | | 770,904 | |

| 6.125%, 4/1/2023 (e)(i) | | | 126,000 | | | | 124,425 | |

| Sinclair Television Group, Inc. | | | | | | | | |

| 6.125%, 10/1/2022 (e) | | | 1,000,000 | | | | 1,043,750 | |

| Terraform Global Operating, LLC | | | | | | | | |

| 9.750%, 8/15/2022 (e)(i) | | | 1,292,000 | | | | 1,453,500 | |

| Tribune Media Company | | | | | | | | |

| 5.875%, 7/15/2022 | | | 77,000 | | | | 81,043 | |

| West Corporation | | | | | | | | |

| 5.375%, 7/15/2022 (e)(i) | | | 3,124,000 | | | | 3,163,050 | |

| TOTAL CORPORATE BONDS (Cost $14,804,800) | | | | | | | 15,428,170 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Contracts | | | | |

| | | (100 shares | | | | |

| | | per contract) | | | Value | |

| PURCHASED CALL OPTIONS — 0.01% | | | | | | |

| Mead Johnson Nutrition Company | | | | | | |

| Expiration: January 2019, Exercise Price: $90.00 (f) | | | 20 | | | $ | — | |

| SPDR S&P 500 ETF Trust | | | | | | | | |

| Expiration: August 2017, Exercise Price: $248.00 | | | 127 | | | | 8,382 | |

| | | | | | | | 8,382 | |

| PURCHASED PUT OPTIONS — 0.63% | | | | | | | | |

| American International Group, Inc. | | | | | | | | |

| Expiration: August 2017, Exercise Price: $55.00 | | | 452 | | | | 7,684 | |

| Expiration: August 2017, Exercise Price: $57.50 | | | 119 | | | | 4,284 | |

| Ashland Global Holdings, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $100.00 (l) | | | 98 | | | | 4,165 | |

| Expiration: July 2017, Exercise Price: $105.00 (l) | | | 32 | | | | 1,200 | |

| Expiration: July 2017, Exercise Price: $110.00 (l) | | | 116 | | | | 4,930 | |

| Expiration: October 2017, Exercise Price: $55.00 | | | 226 | | | | 12,995 | |

| AT&T, Inc. | | | | | | | | |

| Expiration: October 2017, Exercise Price: $37.00 | | | 362 | | | | 49,956 | |

| Baker Hughes, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $52.50 | | | 544 | | | | 26,656 | |

| Expiration: August 2017, Exercise Price: $45.00 | | | 20 | | | | 271 | |

| CBS Corporation Class B | | | | | | | | |

| Expiration: August 2017, Exercise Price: $55.00 | | | 87 | | | | 2,349 | |

| Expiration: August 2017, Exercise Price: $57.50 | | | 185 | | | | 9,157 | |

| Chicago Bridge & Iron Company N.V. | | | | | | | | |

| Expiration: August 2017, Exercise Price: $15.00 | | | 1,643 | | | | 82,150 | |

| CSX Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $45.00 | | | 64 | | | | 512 | |

| Expiration: July 2017, Exercise Price: $50.00 | | | 205 | | | | 6,765 | |

| Delphi Automotive plc | | | | | | | | |

| Expiration: August 2017, Exercise Price: $75.00 | | | 438 | | | | 16,425 | |

| DISH Network Corporation Class A | | | | | | | | |

| Expiration: July 2017, Exercise Price: $57.50 | | | 169 | | | | 4,225 | |

| Expiration: September 2017, Exercise Price: $57.50 | | | 185 | | | | 30,987 | |

| The Dow Chemical Company | | | | | | | | |

| Expiration: September 2017, Exercise Price: $52.50 | | | 147 | | | | 4,116 | |

| E. I. du Pont de Nemours and Company | | | | | | | | |

| Expiration: July 2017, Exercise Price: $72.50 | | | 199 | | | | 2,189 | |

| General Electric Company | | | | | | | | |

| Expiration: July 2017, Exercise Price: $26.00 | | | 330 | | | | 4,620 | |

| Expiration: September 2017, Exercise Price: $26.00 | | | 306 | | | | 14,382 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Contracts | | | | |

| | | (100 shares | | | | |

| | | per contract) | | | Value | |

| Hertz Global Holdings, Inc. | | | | | | |

| Expiration: July 2017, Exercise Price: $17.50 | | | 154 | | | $ | 93,170 | |

| Hewlett Packard Enterprise Company | | | | | | | | |

| Expiration: August 2017, Exercise Price: $15.00 | | | 229 | | | | 2,290 | |

| Expiration: August 2017, Exercise Price: $16.00 | | | 264 | | | | 6,600 | |

| Expiration: August 2017, Exercise Price: $17.00 | | | 2,264 | | | | 160,744 | |

| Huntsman Corporation | | | | | | | | |

| Expiration: August 2017, Exercise Price: $17.00 | | | 221 | | | | 552 | |

| �� Expiration: August 2017, Exercise Price: $18.00 | | | 343 | | | | 1,715 | |

| Expiration: August 2017, Exercise Price: $19.00 | | | 570 | | | | 2,850 | |

| Expiration: August 2017, Exercise Price: $20.00 | | | 415 | | | | 2,075 | |

| Expiration: August 2017, Exercise Price: $22.00 | | | 221 | | | | 3,315 | |

| ILG, Inc. | | | | | | | | |

| Expiration: August 2017, Exercise Price: $24.00 | | | 363 | | | | 9,982 | |

| Johnson Controls International plc | | | | | | | | |

| Expiration: August 2017, Exercise Price: $38.00 | | | 262 | | | | 4,061 | |

| Magna International, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $40.00 | | | 487 | | | | 1,218 | |

| Marathon Petroleum Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $42.50 | | | 43 | | | | 108 | |

| Expiration: July 2017, Exercise Price: $45.00 | | | 281 | | | | 1,405 | |

| Expiration: July 2017, Exercise Price: $47.50 | | | 695 | | | | 6,950 | |

| Expiration: August 2017, Exercise Price: $47.50 | | | 42 | | | | 2,310 | |

| MetLife, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $45.00 | | | 106 | | | | 106 | |

| Expiration: August 2017, Exercise Price: $50.00 | | | 19 | | | | 855 | |

| Expiration: September 2017, Exercise Price: $47.50 | | | 736 | | | | 27,232 | |

| MGM Resorts International | | | | | | | | |

| Expiration: July 2017, Exercise Price: $27.00 | | | 87 | | | | 1,392 | |

| Pinnacle Foods, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $57.50 | | | 83 | | | | 5,810 | |

| Sealed Air Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $38.00 | | | 976 | | | | 2,440 | |

| SPDR S&P 500 ETF Trust | | | | | | | | |

| Expiration: July 2017, Exercise Price: $239.50 | | | 79 | | | | 9,875 | |

| Expiration: July 2017, Exercise Price: $242.00 | | | 241 | | | | 48,200 | |

| VanEck Vectors Semiconductor ETF | | | | | | | | |

| Expiration: August 2017, Exercise Price: $86.00 | | | 36 | | | | 18,360 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Contracts | | | | |

| | | (100 shares | | | | |

| | | per contract) | | | Value | |

| Wyndham Worldwide Corporation | | | | | | |

| Expiration: July 2017, Exercise Price: $87.50 | | | 225 | | | $ | 1,688 | |

| | | | | | | | 705,321 | |

| TOTAL PURCHASED OPTIONS (Cost $958,798) | | | | | | | 713,703 | |

| | | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| ESCROW NOTES — 0.23% (a)(d)(g) | | | | | | | | |

| AMR Corporation | | $ | 28,850 | | | | 44,717 | |

| Winthrop Realty Trust | | | 26,484 | | | | 215,183 | |

| TOTAL ESCROW NOTES (Cost $294,386) | | | | | | | 259,900 | |

| | | | | | | | | |

| | | Shares | | | | | |

| SHORT-TERM INVESTMENTS — 22.54% (e) | | | | | | | | |

| MONEY MARKET FUNDS — 6.11% | | | | | | | | |

| JPMorgan Prime Money Market Fund, | | | | | | | | |

| Institutional Share Class, 1.20% (c) | | | 1,376,585 | | | | 1,376,998 | |

| JPMorgan U.S. Government Money Market Fund, | | | | | | | | |

| Institutional Share Class, 0.88% (c) | | | 5,455,000 | | | | 5,455,000 | |

| | | | | | | | 6,831,998 | |

| | | | | | | | |

| | | Principal | | | | | |

| | | Amount | | | | | |

| U.S. TREASURY BILLS — 16.43% (e)(f) | | | | | | | | |

| United States Treasury Bills | | | | | | | | |

| 0.77%, 7/27/2017 | | $ | 2,000,000 | | | | 1,998,914 | |

| 0.83%, 8/24/2017 | | | 2,000,000 | | | | 1,997,386 | |

| 0.88%, 9/28/2017 | | | 2,000,000 | | | | 1,995,142 | |

| 0.94%, 10/26/2017 | | | 8,820,000 | | | | 8,791,335 | |

| 0.93%, 11/9/2017 | | | 300,000 | | | | 298,886 | |

| 1.00%, 11/24/2017 | | | 1,600,000 | | | | 1,593,222 | |

| 0.99%, 11/30/2017 | | | 600,000 | | | | 597,367 | |

| 1.05%, 12/7/2017 | | | 700,000 | | | | 696,749 | |

| 1.00%, 12/21/2017 | | | 100,000 | | | | 99,491 | |

| 1.07%, 12/28/2017 | | | 300,000 | | | | 298,350 | |

| | | | | | | | 18,366,842 | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | |

| (Cost $25,202,095) | | | | | | | 25,198,840 | |

| TOTAL LONG INVESTMENTS | | | | | | | | |

| (Cost $113,633,907) — 103.89% | | | | | | | 116,107,495 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| SHORT INVESTMENTS — (11.64)% | | | | | | |

| COMMON STOCKS — (11.64)% | | | | | | |

| AEROSPACE & DEFENSE — (0.15)% | | | | | | |

| MacDonald, Dettwiler and Associates Ltd. (b)(f) | | | (3,157 | ) | | $ | (163,533 | ) |

| | | | | | | | | |

| AIRLINES — (0.06)% | | | | | | | | |

| American Airlines Group, Inc. | | | (1,443 | ) | | | (72,612 | ) |

| | | | | | | | | |

| CABLE & SATELLITE — (2.52)% | | | | | | | | |

| Sirius XM Holdings, Inc. | | | (514,633 | ) | | | (2,815,043 | ) |

| | | | | | | | | |

| HEALTH CARE EQUIPMENT — (1.73)% | | | | | | | | |

| Becton, Dickinson and Company | | | (9,918 | ) | | | (1,935,101 | ) |

| | | | | | | | | |

| HOUSEHOLD DURABLES — (0.01)% | | | | | | | | |

| Lennar Corporation Class A | | | (138 | ) | | | (7,358 | ) |

| | | | | | | | | |

| INTEGRATED TELECOMMUNICATION | | | | | | | | |

| SERVICES — (2.13)% | | | | | | | | |

| AT&T, Inc. | | | (15,966 | ) | | | (602,397 | ) |

| CenturyLink, Inc. | | | (74,506 | ) | | | (1,779,203 | ) |

| | | | | | | | (2,381,600 | ) |

| INTERNET SOFTWARE & SERVICES — (0.19)% | | | | | | | | |

| Alibaba Group Holding Ltd. — ADR | | | (1,514 | ) | | | (213,323 | ) |

| | | | | | | | | |

| MOVIES & ENTERTAINMENT — (0.60)% | | | | | | | | |

| News Corporation Class B | | | (47,456 | ) | | | (671,502 | ) |

| | | | | | | | | |

| OIL & GAS EXPLORATION & PRODUCTION — (0.88)% | | | | | | | | |

| EQT Corporation | | | (16,755 | ) | | | (981,675 | ) |

| | | | | | | | | |

| OIL & GAS REFINING & MARKETING — (0.13)% | | | | | | | | |

| Idemitsu Kosan Company Ltd. (b) | | | (5,154 | ) | | | (146,177 | ) |

| | | | | | | | | |

| OIL & GAS STORAGE & TRANSPORTATION — (1.24)% | | | | | | | | |

| ONEOK, Inc. | | | (24,051 | ) | | | (1,254,500 | ) |

| Pembina Pipeline Corporation (b) | | | (3,862 | ) | | | (127,910 | ) |

| | | | | | | | (1,382,410 | ) |

| REITs — (0.61)% | | | | | | | | |

| RLJ Lodging Trust | | | (33,622 | ) | | | (668,069 | ) |

| Sabra Health Care REIT, Inc. | | | (357 | ) | | | (8,604 | ) |

| | | | | | | | (676,673 | ) |

| SOFTWARE — (1.06)% | | | | | | | | |

| VMware, Inc. Class A | | | (13,610 | ) | | | (1,189,922 | ) |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2017 (Unaudited)

| | | Shares | | | Value | |

| TOBACCO — (0.33)% | | | | | | |

| British American Tobacco plc — ADR | | | (5,413 | ) | | $ | (371,007 | ) |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Proceeds $11,420,522) | | | | | | | (13,007,936 | ) |

| TOTAL SHORT INVESTMENTS | | | | | | | | |

| (Proceeds $11,420,522) — (11.64)% | | | | | | | (13,007,936 | ) |

| TOTAL NET INVESTMENTS | | | | | | | | |

| (Cost $102,213,385) — 92.25% | | | | | | | 103,099,559 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 7.75% | | | | | | | 8,659,961 | |

| TOTAL NET ASSETS — 100.00% | | | | | | $ | 111,759,520 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

plc – Public Limited Company

REIT – Real Estate Investment Trust

| (a) | Non-income producing security. |

| (b) | Foreign security. |

| (c) | The rate quoted is the annualized seven-day yield as of June 30, 2017. |

| (d) | Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees. |

| (e) | All or a portion of the shares have been committed as collateral for open securities sold short, written option contracts, swap contacts, and forward currency exchange contracts. |

| (f) | Level 2 Security. Please see Note 2 in the Notes to the Financial Statements for more information. |

| (g) | Level 3 Security. Please see Note 2 in the Notes to the Financial Statements for more information. |

| (h) | Default or other conditions exist and the security is not presently accruing income. |

| (i) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of June 30, 2017, these securities represent 5.26% of total net assets. |

| (j) | Restricted security. Please see Note 2 in the Notes to the Financial Statements for more information. As of June 30, 2017, these securities represent 4.36% of total net assets. |

| (k) | The coupon rate shown on variable rate securities represents the rates as of June 30, 2017. |

| (l) | As the result of a corporate action on the underlying holding, the option’s underlying security is 100 shares of Ashland Global Holding, Inc., 274 shares of Valvoline, Inc. and cash in lieu of fractional shares. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN

June 30, 2017 (Unaudited)

| | | Contracts | | | | |

| | | (100 shares | | | | |

| | | per contract) | | | Value | |

| CALL OPTIONS WRITTEN | | | | | | |

| American International Group, Inc. | | | | | | |

| Expiration: July 2017, Exercise Price: $62.50 | | | 2,276 | | | $ | 195,736 | |

| Expiration: July 2017, Exercise Price: $65.00 | | | 343 | | | | 4,116 | |

| Expiration: August 2017, Exercise Price: $62.50 | | | 8,818 | | | | 1,516,696 | |

| Ashland Global Holdings, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $120.00 (a) | | | 2,326 | | | | 2,686,530 | |

| Expiration: October 2017, Exercise Price: $65.00 | | | 3,580 | | | | 1,396,200 | |

| AT&T, Inc. | | | | | | | | |

| Expiration: October 2017, Exercise Price: $41.00 | | | 21,602 | | | | 367,234 | |

| Baker Hughes, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $57.50 | | | 10,588 | | | | 232,936 | |

| Expiration: August 2017, Exercise Price: $52.50 | | | 530 | | | | 161,359 | |

| CenturyLink, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $24.00 | | | 6,228 | | | | 342,540 | |

| Expiration: September 2017, Exercise Price: $24.00 | | | 2,190 | | | | 229,950 | |

| The Dow Chemical Company | | | | | | | | |

| Expiration: September 2017, Exercise Price: $60.00 | | | 3,446 | | | | 1,533,470 | |

| Expiration: September 2017, Exercise Price: $65.00 | | | 147 | | | | 22,050 | |

| E. I. du Pont de Nemours and Company | | | | | | | | |

| Expiration: July 2017, Exercise Price: $77.50 | | | 718 | | | | 280,020 | |

| Expiration: July 2017, Exercise Price: $80.00 | | | 2,267 | | | | 396,725 | |

| Expiration: September 2017, Exercise Price: $82.50 | | | 758 | | | | 147,810 | |

| Hewlett Packard Enterprise Company | | | | | | | | |

| Expiration: August 2017, Exercise Price: $18.00 | | | 41,833 | | | | 313,747 | |

| Huntsman Corporation | | | | | | | | |

| Expiration: August 2017, Exercise Price: $23.00 | | | 11,326 | | | | 3,624,320 | |

| Expiration: August 2017, Exercise Price: $24.00 | | | 17,136 | | | | 4,026,960 | |

| Monsanto Company | | | | | | | | |

| Expiration: July 2017, Exercise Price: $115.00 | | | 2,436 | | | | 901,320 | |

| Sealed Air Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $42.00 | | | 8,590 | | | | 2,512,575 | |

| SPDR S&P 500 ETF Trust | | | | | | | | |

| Expiration: August 2017, Exercise Price: $242.00 | | | 2,398 | | | | 832,106 | |

| Whole Foods Market, Inc. | | | | | | | | |

| Expiration: August 2017, Exercise Price: $42.00 | | | 862 | | | | 38,790 | |

| | | | | | | | 21,763,190 | |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

June 30, 2017 (Unaudited)

| | | Contracts | | | | |

| | | (100 shares | | | | |

| | | per contract) | | | Value | |

| PUT OPTIONS WRITTEN | | | | | | |

| MetLife, Inc. | | | | | | |

| Expiration: August 2017, Exercise Price: $52.50 | | | 1,375 | | | $ | 132,000 | |

| SPDR S&P 500 ETF Trust | | | | | | | | |

| Expiration: July 2017, Exercise Price: $234.00 | | | 2,190 | | | | 111,690 | |

| VanEck Vectors Semiconductor ETF | | | | | | | | |

| Expiration: August 2017, Exercise Price: $78.00 | | | 808 | | | | 122,008 | |

| | | | | | | | 365,698 | |

| TOTAL OPTIONS WRITTEN | | | | | | | | |

| (Premiums received $30,162,982) | | | | | | $ | 22,128,888 | |

ETF – Exchange-Traded Fund

| (a) | As the result of a corporate action on the underlying holding, the option’s underlying security is 100 shares of Ashland Global Holding, Inc., 274 shares of Valvoline, Inc. and cash in lieu of fractional shares. |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF OPTIONS WRITTEN

June 30, 2017 (Unaudited)

| | Contracts | | | | |

| | | (100 shares | | | | |

| | | per contract) | | | Value | |

| CALL OPTIONS WRITTEN | | | | | | |

| American International Group, Inc. | | | | | | |

| Expiration: July 2017, Exercise Price: $62.50 | | | 69 | | | $ | 5,934 | |

| Expiration: August 2017, Exercise Price: $62.50 | | | 502 | | | | 86,344 | |

| Expiration: August 2017, Exercise Price: $65.00 | | | 121 | | | | 8,349 | |

| Ashland Global Holdings, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $125.00 (a) | | | 151 | | | | 99,660 | |

| Expiration: July 2017, Exercise Price: $130.00 (a) | | | 98 | | | | 32,830 | |

| Expiration: October 2017, Exercise Price: $65.00 | | | 253 | | | | 98,670 | |

| AT&T, Inc. | | | | | | | | |

| Expiration: October 2017, Exercise Price: $41.00 | | | 863 | | | | 14,671 | |

| Baker Hughes, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $57.50 | | | 35 | | | | 770 | |

| Expiration: July 2017, Exercise Price: $60.00 | | | 509 | | | | 7,635 | |

| Expiration: August 2017, Exercise Price: $52.50 | | | 20 | | | | 6,089 | |

| CBS Corporation Class B | | | | | | | | |

| Expiration: August 2017, Exercise Price: $60.00 | | | 87 | | | | 41,977 | |

| Expiration: August 2017, Exercise Price: $62.50 | | | 205 | | | | 62,833 | |

| Expiration: August 2017, Exercise Price: $65.00 | | | 148 | | | | 26,640 | |

| CenturyLink, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $24.00 | | | 450 | | | | 24,750 | |

| Chicago Bridge & Iron Company N.V. | | | | | | | | |

| Expiration: August 2017, Exercise Price: $17.50 | | | 1,643 | | | | 566,835 | |

| CSX Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $52.50 | | | 205 | | | | 60,885 | |

| DISH Network Corporation Class A | | | | | | | | |

| Expiration: September 2017, Exercise Price: $62.50 | | | 185 | | | | 72,150 | |

| The Dow Chemical Company | | | | | | | | |

| Expiration: September 2017, Exercise Price: $60.00 | | | 97 | | | | 43,165 | |

| Expiration: September 2017, Exercise Price: $62.50 | | | 50 | | | | 13,000 | |

| E. I. du Pont de Nemours and Company | | | | | | | | |

| Expiration: July 2017, Exercise Price: $80.00 | | | 203 | | | | 35,525 | |

| Expiration: September 2017, Exercise Price: $82.50 | | | 31 | | | | 6,045 | |

| General Electric Company | | | | | | | | |

| Expiration: September 2017, Exercise Price: $28.00 | | | 306 | | | | 14,076 | |

| Expiration: September 2017, Exercise Price: $30.00 | | | 164 | | | | 1,476 | |

| General Motors Company | | | | | | | | |

| Expiration: August 2017, Exercise Price: $35.00 | | | 245 | | | | 26,460 | |

| Huntsman Corporation | | | | | | | | |

| Expiration: August 2017, Exercise Price: $25.00 | | | 221 | | | | 34,697 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

June 30, 2017 (Unaudited)

| | | Contracts | | | | |

| | | (100 shares | | | | |

| | �� | per contract) | | | Value | |

| ILG, Inc. | | | | | | |

| Expiration: August 2017, Exercise Price: $27.00 | | | 363 | | | $ | 63,525 | |

| Johnson Controls International plc | | | | | | | | |

| Expiration: August 2017, Exercise Price: $43.00 | | | 262 | | | | 38,645 | |

| Marathon Petroleum Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $52.50 | | | 302 | | | | 31,710 | |

| Expiration: August 2017, Exercise Price: $52.50 | | | 34 | | | | 6,630 | |

| Monsanto Company | | | | | | | | |

| Expiration: July 2017, Exercise Price: $115.00 | | | 186 | | | | 68,820 | |

| Pinnacle Foods, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $70.00 | | | 41 | | | | 615 | |

| Rite Aid Corporation | | | | | | | | |

| Expiration: August 2017, Exercise Price: $3.00 | | | 7,479 | | | | 201,933 | |

| SPDR S&P 500 ETF Trust | | | | | | | | |

| Expiration: August 2017, Exercise Price: $242.00 | | | 127 | | | | 44,069 | |

| | | | | | | | 1,847,413 | |

| | | | | | | | | |

| PUT OPTIONS WRITTEN | | | | | | | | |

| American International Group, Inc | | | | | | | | |

| Expiration: July 2017, Exercise Price: $65.00 | | | 88 | | | | 21,956 | |

| CSX Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $49.00 | | | 64 | | | | 1,536 | |

| Delphi Automotive plc | | | | | | | | |

| Expiration: August 2017, Exercise Price: $82.50 | | | 216 | | | | 29,700 | |

| Expiration: August 2017, Exercise Price: $85.00 | | | 222 | | | | 46,620 | |

| DISH Network Corporation Class A | | | | | | | | |

| Expiration: July 2017, Exercise Price: $62.50 | | | 188 | | | | 31,020 | |

| Hertz Global Holdings, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $20.00 | | | 56 | | | | 47,600 | |

| Hewlett Packard Enterprise Company | | | | | | | | |

| Expiration: August 2017, Exercise Price: $18.00 | | | 164 | | | | 23,780 | |

| Huntsman Corporation | | | | | | | | |

| Expiration: August 2017, Exercise Price: $21.00 | | | 111 | | | | 833 | |

| Expiration: August 2017, Exercise Price: $23.00 | | | 439 | | | | 10,975 | |

| Expiration: August 2017, Exercise Price: $24.00 | | | 1,050 | | | | 44,625 | |

| Magna International, Inc. | | | | | | | | |

| Expiration: July 2017, Exercise Price: $45.00 | | | 487 | | | | 23,376 | |

| Marathon Petroleum Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $50.00 | | | 281 | | | | 11,240 | |

| Expiration: July 2017, Exercise Price: $52.50 | | | 393 | | | | 47,160 | |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF OPTIONS WRITTEN (continued)

June 30, 2017 (Unaudited)

| | | Contracts | | | | |

| | | (100 shares | | | | |

| | | per contract) | | | Value | |

| MetLife, Inc. | | | | | | |

| Expiration: August 2017, Exercise Price: $52.50 | | | 21 | | | $ | 2,016 | |

| Expiration: September 2017, Exercise Price: $52.50 | | | 864 | | | | 113,616 | |

| Sealed Air Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $43.00 | | | 124 | | | | 2,170 | |

| Expiration: July 2017, Exercise Price: $45.00 | | | 852 | | | | 66,030 | |

| SPDR S&P 500 ETF Trust | | | | | | | | |

| Expiration: July 2017, Exercise Price: $234.00 | | | 171 | | | | 8,721 | |

| VanEck Vectors Semiconductor ETF | | | | | | | | |

| Expiration: August 2017, Exercise Price: $78.00 | | | 36 | | | | 5,436 | |

| Wyndham Worldwide Corporation | | | | | | | | |

| Expiration: July 2017, Exercise Price: $95.00 | | | 225 | | | | 10,125 | |

| | | | | | | | 548,535 | |

| TOTAL OPTIONS WRITTEN | | | | | | | | |

| (Premiums received $3,383,122) | | | | | | $ | 2,395,948 | |

ETF – Exchange-Traded Fund

plc – Public Limited Company

| (a) | As the result of a corporate action on the underlying holding, the option’s underlying security is 100 shares of Ashland Global Holding, Inc., 274 shares of Valvoline, Inc. and cash in lieu of fractional shares. |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF FORWARD CURRENCY EXCHANGE CONTRACTS*

June 30, 2017 (Unaudited)

| | | | | | | USD Value at | | | | | | | USD Value at | | | Unrealized | |

| Settlement | | Currency to | | June 30, | | | Currency to | | June 30, | | | Appreciation | |

| Date | | be Delivered | | 2017 | | | be Received | | 2017 | | | (Depreciation)** | |

| 8/15/17 | | | 37,319,578 | | CAD | | $ | 28,802,015 | | | | 27,880,995 | | USD | | $ | 27,880,995 | | | $ | (921,020 | ) |

| 8/15/17 | | | 19,442,990 | | USD | | | 19,442,990 | | | | 25,707,694 | | CAD | | | 19,840,348 | | | | 397,358 | |

| 8/24/17 | | | 5,125,677 | | CAD | | | 3,956,295 | | | | 3,891,032 | | USD | | | 3,891,032 | | | | (65,263 | ) |

| 7/27/17 | | | 6,600,500 | | EUR | | | 7,550,185 | | | | 7,210,930 | | USD | | | 7,210,930 | | | | (339,255 | ) |

| 12/20/17 | | | 109,954,023 | | GBP | | | 143,973,413 | | | | 137,878,490 | | USD | | | 137,878,490 | | | | (6,094,923 | ) |

| 12/20/17 | | | 3,109,275 | | USD | | | 3,109,275 | | | | 2,381,491 | | GBP | | | 3,118,316 | | | | 9,041 | |

| 12/27/17 | | | 3,796,323 | | GBP | | | 4,971,937 | | | | 4,838,454 | | USD | | | 4,838,454 | | | | (133,483 | ) |

| | | | | | | | $ | 211,806,110 | | | | | | | | $ | 204,658,565 | | | $ | (7,147,545 | ) |

CAD – Canadian Dollar

EUR – Euro

GBP – British Pound

USD – U.S. Dollar

| * | JPMorgan Chase & Co., Inc. is the counterparty for all open forward currency exchange contracts held by the Fund as of June 30, 2017. |

| ** | Net unrealized appreciation (depreciation) is a receivable (payable). |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF FORWARD CURRENCY EXCHANGE CONTRACTS*

June 30, 2017 (Unaudited)

| | | | | | | USD Value at | | | | | | | USD Value at | | | Unrealized | |

| Settlement | | Currency to | | June 30, | | | Currency to | | June 30, | | | Appreciation | |

| Date | | be Delivered | | 2017 | | | be Received | | 2017 | | | (Depreciation)** | |

| 8/15/17 | | | 1,343,590 | | CAD | | $ | 1,036,938 | | | | 1,003,736 | | USD | | $ | 1,003,736 | | | $ | (33,202 | ) |

| 8/15/17 | | | 706,478 | | USD | | | 706,478 | | | | 934,111 | | CAD | | | 720,916 | | | | 14,438 | |

| 8/24/17 | | | 303,351 | | CAD | | | 234,144 | | | | 229,891 | | USD | | | 229,891 | | | | (4,253 | ) |

| 7/27/17 | | | 619,716 | | EUR | | | 708,881 | | | | 677,364 | | USD | | | 677,364 | | | | (31,517 | ) |

| 12/13/17 | | | 339,933 | | GBP | | | 445,014 | | | | 436,731 | | USD | | | 436,731 | | | | (8,283 | ) |

| 12/20/17 | | | 6,076,143 | | GBP | | | 7,956,080 | | | | 7,680,902 | | USD | | | 7,680,902 | | | | (275,178 | ) |

| 12/20/17 | | | 122,387 | | USD | | | 122,387 | | | | 93,740 | | GBP | | | 122,743 | | | | 356 | |

| 12/27/17 | | | 223,205 | | GBP | | | 292,325 | | | | 284,477 | | USD | | | 284,477 | | | | (7,848 | ) |

| | | | | | | | $ | 11,502,247 | | | | | | | | $ | 11,156,760 | | | $ | (345,487 | ) |

CAD – Canadian Dollar

EUR – Euro

GBP – British Pound

USD – U.S. Dollar

| * | JPMorgan Chase & Co., Inc. is the counterparty for all open forward currency exchange contracts held by the Fund as of June 30, 2017. |

| ** | Net unrealized appreciation (depreciation) is a receivable (payable). |

The accompanying notes are an integral part of these financial statements.

The Merger Fund

SCHEDULE OF SWAP CONTRACTS

June 30, 2017 (Unaudited)

| | | | | | | | | | | Unrealized | | |

| Termination | | | | | | | Notional | | | Appreciation | | Counter- |

| Date | | Security | | Shares | | | Amount | | | (Depreciation)* | | party |

| LONG TOTAL RETURN SWAP CONTRACTS |

| 4/21/18 | | Allied World Assurance | | | | | | | | | | |

| | | Company Holdings AG | | | 918,078 | | | $ | 48,569,892 | | | $ | (28,761 | ) | BAML |

| 6/21/18 | | Booker Group plc | | | 8,398,944 | | | | 19,526,369 | | | | 837,279 | | JPM |

| 4/27/18 | | Christian Dior SE | | | 38,375 | | | | 10,562,363 | | | | 402,776 | | JPM |

| 6/16/18 | | Idorsia Ltd. | | | 26,715 | | | | — | | | | 504,267 | | JPM |

| 5/10/18 | | Luxottica Group S.p.A | | | 2,804 | | | | 163,420 | | | | (1,328 | ) | JPM |

| 4/21/18 | | Reynolds American, Inc. | | | 155,800 | | | | 9,907,322 | | | | 220,786 | | BAML |

| 12/12/17 | | Sky plc | | | 10,006,747 | | | | 122,843,868 | | | | 6,622,086 | | JPM |

| 4/21/18 | | VCA, Inc. | | | 157,718 | | | | 14,440,660 | | | | 110,820 | | BAML |

| 6/21/18 | | Veresen, Inc. | | | 717,761 | | | | 9,896,213 | | | | 253,505 | | BAML |

| | | | | | | | | | | | | | | | |

| SHORT TOTAL RETURN SWAP CONTRACTS |

| 1/18/18 | | British American | | | | | | | | | | | | | |

| | | Tobacco plc (a) | | | (1,151,693 | ) | | | (69,693,093 | ) | | | (8,848,201 | ) | JPM |

| 4/21/18 | | British American | | | | | | | | | | | | | |

| | | Tobacco plc (a) | | | (347,157 | ) | | | (23,059,001 | ) | | | (619,191 | ) | BAML |

| 4/21/18 | | British American | | | | | | | | | | | | | |

| | | Tobacco plc — ADR | | | (81,951 | ) | | | (5,457,937 | ) | | | (164,167 | ) | BAML |

| 5/10/18 | | Essilor International SA | | | (1,292 | ) | | | (168,251 | ) | | | 3,925 | | JPM |

| 4/21/18 | | Fairfax Financial | | | | | | | | | | | | | |

| | | Holdings Ltd. | | | (53,191 | ) | | | (23,483,979 | ) | | | 436,657 | | BAML |

| 4/27/18 | | Hermes International | | | (7,367 | ) | | | (3,542,244 | ) | | | (96,844 | ) | JPM |

| 6/21/18 | | Pembina Pipeline | | | | | | | | | | | | | |

| | | Corporation | | | (227,674 | ) | | | (7,349,128 | ) | | | (190,974 | ) | BAML |

| 6/21/18 | | Tesco plc | | | (7,228,836 | ) | | | (15,366,359 | ) | | | (524,132 | ) | JPM |

| | | | | | | | | | | | | $ | (1,081,497 | ) | |

ADR – American Depository Receipt

BAML – Bank of America Merrill Lynch & Co., Inc.

JPM – JPMorgan Chase & Co., Inc.

plc – Public Limited Company

| * | Based on the net swap value held at each counterparty, unrealized appreciation is a receivable and unrealized depreciation is a payable. |

| (a) | Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees. |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF SWAP CONTRACTS

June 30, 2017 (Unaudited)

| | | | | | | | | | | Unrealized | | |

| Termination | | | | | | | Notional | | | Appreciation | | Counter- |

| Date | | Security | | Shares | | | Amount | | | (Depreciation)* | | party |

| LONG TOTAL RETURN SWAP CONTRACTS |

| 5/19/18 | | Alere, Inc. | | | 57,863 | | | $ | 2,784,637 | | | $ | 118,493 | | BAML |

| 4/21/18 | | Allied World Assurance | | | | | | | | | | | | | |

| | | Company Holdings AG | | | 25,229 | | | | 1,335,613 | | | | (1,598 | ) | BAML |

| 6/19/18 | | Altaba, Inc. | | | 36,346 | | | | 1,841,165 | | | | 138,079 | | JPM |

| 8/26/17 | | American International | | | | | | | | | | | | | |

| | | Group, Inc. | | | 31,400 | | | | 1,842,057 | | | | 112,803 | | JPM |

| 4/21/18 | | Baker Hughes, Inc. | | | 56,481 | | | | 3,347,045 | | | | (269,732 | ) | BAML |

| 6/21/18 | | Booker Group plc | | | 493,817 | | | | 1,148,055 | | | | 49,228 | | JPM |

| 6/27/18 | | C.R. Bard, Inc. | | | 19,532 | | | | 6,181,241 | | | | (6,981 | ) | JPM |

| 4/21/18 | | CBS Corporation Class B | | | 3,300 | | | | 226,281 | | | | (15,909 | ) | BAML |

| 4/27/18 | | Christian Dior SE | | | 3,603 | | | | 990,970 | | | | 36,806 | | JPM |

| 2/16/18 | | Fortress Investment | | | | | | | | | | | | | |

| | | Group LLC Class A | | | 199,280 | | | | 1,572,758 | | | | 11,346 | | JPM |

| 4/21/18 | | Hewlett Packard | | | | | | | | | | | | | |

| | | Enterprise Company | | | 198,079 | | | | 3,596,615 | | | | (312,098 | ) | BAML |

| 6/16/18 | | Idorsia Ltd. | | | 1,336 | | | | — | | | | 25,218 | | JPM |

| 5/24/18 | | ILG, Inc. | | | 53,542 | | | | 1,438,251 | | | | 31,955 | | JPM |

| 6/26/18 | | Kennedy Wilson | | | | | | | | | | | | | |

| | | Europe Real Estate plc | | | 60,197 | | | | 851,904 | | | | 18,305 | | JPM |

| 5/10/18 | | Luxottica Group S.p.A | | | 106 | | | | 6,178 | | | | (59 | ) | JPM |

| 4/21/18 | | Mobileye N.V. | | | 78,337 | | | | 4,852,830 | | | | 64,728 | | BAML |

| 4/5/18 | | Monsanto Company | | | 1,827 | | | | 211,422 | | | | 4,113 | | JPM |

| 4/13/18 | | NXP Semiconductors NV | | | 82,177 | | | | 8,619,961 | | | | 370,473 | | BAML |

| 4/21/18 | | ONEOK Partners LP | | | 24,633 | | | | 1,279,931 | | | | (22,543 | ) | BAML |

| 4/26/18 | | ONEOK Partners LP | | | 3,328 | | | | 175,769 | | | | (6,364 | ) | JPM |

| 5/18/18 | | PAREXEL International | | | | | | | | | | | | | |

| | | Corporation | | | 3,444 | | | | 275,758 | | | | 23,253 | | JPM |

| 4/21/18 | | Reynolds American, Inc. | | | 148,005 | | | | 9,411,638 | | | | 210,384 | | BAML |

| 4/21/18 | | Rite Aid Corporation | | | 59,239 | | | | 241,695 | | | | (67,057 | ) | BAML |

| 12/12/17 | | Sky plc | | | 556,503 | | | | 6,900,130 | | | | 279,644 | | JPM |

| 4/21/18 | | Time Warner, Inc. | | | 51,128 | | | | 5,112,800 | | | | 18,668 | | BAML |

| 4/21/18 | | VCA, Inc. | | | 15,846 | | | | 1,450,860 | | | | 11,233 | | BAML |

| 6/23/18 | | Veresen, Inc. | | | 48,598 | | | | 671,709 | | | | 15,526 | | BAML |

| | | | | | | | | | | | | | | | |

| SHORT TOTAL RETURN SWAP CONTRACTS |

| 1/5/18 | | Alibaba Group | | | | | | | | | | | | | |

| | | Holding Ltd. — ADR | | | (59,306 | ) | | | (5,974,281 | ) | | | (2,373,753 | ) | JPM |

| 1/18/18 | | British American | | | | | | | | | | | | | |

| | | Tobacco plc (a) | | | (52,637 | ) | | | (3,193,043 | ) | | | (390,252 | ) | JPM |

| 4/21/18 | | British American | | | | | | | | | | | | | |

| | | Tobacco plc (a) | | | (19,753 | ) | | | (1,312,042 | ) | | | (35,238 | ) | BAML |

The accompanying notes are an integral part of these financial statements.

WCM Alternatives: Event-Driven Fund

SCHEDULE OF SWAP CONTRACTS (continued)

June 30, 2017 (Unaudited)

| | | | | | | | | | | Unrealized | | |

| Termination | | | | | | | Notional | | | Appreciation | | Counter- |

| Date | | Security | | Shares | | | Amount | | | (Depreciation)* | | party |

| 4/21/18 | | British American | | | | | | | | | | |

| | | Tobacco plc — ADR | | | (2,262 | ) | | $ | (150,649 | ) | | $ | (4,505 | ) | BAML |

| 5/10/18 | | Essilor International SA | | | (49 | ) | | | (6,381 | ) | | | 153 | | JPM |

| 4/21/18 | | Fairfax Financial | | | | | | | | | | | | | |

| | | Holdings Ltd. | | | (1,462 | ) | | | (646,698 | ) | | | 13,217 | | BAML |

| 4/27/18 | | Hermes International | | | (691 | ) | | | (331,582 | ) | | | (9,461 | ) | JPM |

| 6/30/18 | | Kennedy-Wilson | | | | | | | | | | | | | |

| | | Holdings, Inc. | | | (23,200 | ) | | | (440,652 | ) | | | — | | JPM |

| 4/21/18 | | ONEOK, Inc. | | | (211 | ) | | | (11,377 | ) | | | 374 | | BAML |

| 4/21/18 | | ONEOK, Inc. | | | (3,275 | ) | | | (179,084 | ) | | | 8,438 | | JPM |

| 6/23/18 | | Pembina Pipeline | | | | | | | | | | | | | |

| | | Corporation | | | (15,416 | ) | | | (499,723 | ) | | | (10,831 | ) | BAML |

| 6/21/18 | | Tesco plc | | | (425,021 | ) | | | (903,468 | ) | | | (30,817 | ) | JPM |

| | | | | | | | | | | | | $ | (1,994,761 | ) | |

ADR – American Depository Receipt

BAML – Bank of America Merrill Lynch & Co., Inc.

JPM – JPMorgan Chase & Co., Inc.

plc – Public Limited Company

| * | Based on the net swap value held at each counterparty, unrealized appreciation is a receivable and unrealized depreciation is a payable. |

| (a) | Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees. |

The accompanying notes are an integral part of these financial statements.

(This Page Intentionally Left Blank.)

The Merger Fund and WCM Alternatives: Event-Driven Fund

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2017 (Unaudited)

| | | | | WCM Alternatives: | |

| | | The Merger Fund | | | Event-Driven Fund | |

| ASSETS: | | | | | | |

| Investments, at value (Cost $2,825,809,873 and | | | | | | |

| $113,633,907, respectively) | | $ | 2,932,485,361 | | | $ | 116,107,495 | |

| Cash held in foreign currency (Cost 8,818,344 | | | | | | | | |

| and $337,414, respectively) | | | 9,024,962 | | | | 342,749 | |

| Receivable at brokers | | | 311,768,209 | | | | 11,420,522 | |

| Deposits at brokers | | | — | | | | 7,715,834 | |

| Receivable for swap contracts | | | 18,675 | | | | 83,585 | |

| Receivable for investments sold | | | 10,439,131 | | | | 1,334,770 | |

| Dividends and interest receivable | | | 10,344,419 | | | | 528,636 | |

| Receivable for fund shares issued | | | 4,739,807 | | | | 325,158 | |

| Prepaid expenses and other receivables | | | 212,849 | | | | 32,226 | |

| Total Assets | | | 3,279,033,413 | | | | 137,890,975 | |

| LIABILITIES: | | | | | | | | |

| Securities sold short, at value (Proceeds of | | | | | | | | |

| $314,012,471 and $11,420,522, respectively) | | | 391,911,303 | | | | 13,007,936 | |

| Written option contracts, at value | | | | | | | | |