UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED JANUARY 31, 2011

COMMISSION FILE NUMBER 1 – 34795

MENTOR GRAPHICS CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Oregon | | 93-0786033 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

| | |

8005 SW Boeckman Road Wilsonville, Oregon | | 97070-7777 |

| (Address of principal executive offices) | | (Zip Code) |

(503) 685-7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange on which Registered |

| Common Stock, without par value | | NASDAQ Global Select Market |

| Incentive Stock Purchase Rights | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or in any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large Accelerated Filer | | x | | Accelerated Filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $1,051,159,266 on July 31, 2010 based upon the last price of the Common Stock on that date reported in The NASDAQ Global Select Market. On March 11, 2011, there were 112,357,843 shares of the Registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

| | |

Document | | Part of Form 10-K into which incorporated |

Portions of the 2011 Proxy Statement | | Part III |

Table of Contents

2

Part I

This Form 10-K contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those set forth under Part I, Item 1A. “Risk Factors.”

GENERAL

Mentor Graphics Corporation is a technology leader in electronic design automation (EDA). We provide software and hardware design solutions that enable our customers to develop better electronic products faster and more cost effectively. We market our products and services worldwide, primarily to large companies in the military/aerospace, communications, computer, consumer electronics, semiconductor, networking, multimedia, and transportation industries.

The electronic components and systems that our customers create with our products include printed circuit boards (PCBs), integrated circuits (ICs), field programmable gate arrays (FPGAs), embedded software solutions, wire harness systems, and computers. Our products are used in the design and development of a diverse set of electronic products, including automotive electronics, video game consoles, digital cameras, cellular telephones, medical devices, smart phones, and e-book readers. As silicon manufacturing process geometries shrink, our customers are creating entire electronic systems on a single IC. These are called system-on-chip (SoC) devices. This trend becomes apparent to the everyday consumer as consumer electronics become smaller and more sophisticated. This trend also poses significant opportunities and challenges for the EDA industry.

We were incorporated in Oregon in 1981, and our common stock is traded on The NASDAQ Global Select Market under the symbol “MENT.” Our executive offices are located at 8005 S.W. Boeckman Road, Wilsonville, Oregon 97070-7777. The telephone number at that address is (503) 685-7000. Our website address iswww.mentor.com. Electronic copies of our reports filed with the Securities and Exchange Commission (SEC) are available through our website as soon as reasonably practicable after the reports are filed with the SEC. Our Director Code of Ethics, Standards of Business Conduct, Guidelines for Corporate Disclosure, Corporate Governance Guidelines, and our Audit, Compensation, and Nominating and Corporate Governance Committee Charters are also posted on our website.

PRODUCTS

We design our products to enable engineers to overcome increasingly complex electronic design challenges by improving the accuracy of complex designs and shrinking product time-to-market schedules. A hardware design process is typically as follows:

| | • | | Electrical engineers begin the design process by describing and specifying the architectural, behavioral, functional, and structural characteristics of an IC, PCB, or electronic system and components. |

| | • | | Engineers then create the component designs according to stated specifications. |

| | • | | Engineers verify the design to reveal defects and then modify the component’s design until it is correct and meets the previously stated specifications. |

| | • | | Engineers assemble components and test the components and the entire system. |

| | • | | The system then goes to production. During the manufacturing process, engineers work to identify defective parts and improve yields. “Yields” refer to the percentage of working ICs on a silicon wafer or PCBs working compared to the total of those manufactured. |

Scalable Verification

The Mentor Graphics® Scalable Verification™ tools allow engineers to verify that their complex IC designs function as intended. Functional errors are a leading cause of design revisions that slow down an electronic system’s time-to-market and reduce its profitability. We offer the following digital simulation products:

| | • | | The ModelSim® software tool is a leading hardware description language (HDL) mixed-language digital simulator that helps hardware designers verify that their IC design functions correctly before the design is completed, and is used for application-specific integrated circuits (ASICs), SoCs, FPGAs, and other IC design verification, as well as verification of entire systems. |

3

| | • | | The Questa® scalable verification platform includes support for HDLs, including System Verilog, simulation, and new verification methodologies including assertions and formal methods. The Questa platform is used for more extended verification of systems and ICs including ASICs, SoCs, and FPGAs. |

Along with digital simulation products, we offer analog/mixed-signal simulators. Complex electronic designs often require different types of circuits, such as analog and digital, to work together. An example is a CD or DVD player which uses a digital input and produces an analog output of sounds or images. Our analog/mixed signal simulation products include the Eldo®, ADVance MSTM, and ADiT™ tools.

We provide hardware emulation systems, such as our Veloce® product, which allow users to create functional and logical equivalent models of actual electronic circuits to verify the function and timing of those circuits. Hardware emulation systems typically allow faster verification of complex electronic circuits when compared to software simulation tools. Our Veloce product allows customers to verify complex designs containing up to 512 million logic gates.

IC Design to Silicon

Shrinking geometries and increasing design size in the nanometer era have enabled ever increasing functionality on a single IC. Feature sizes of today’s advanced ICs are typically less than 50 nanometers (nm). Nanometer process geometries cause design challenges in the creation of ICs which are not present at larger geometries. As a result, nanometer process technologies, used to deliver the majority of today’s ICs, are the product of careful design and precision manufacturing. The increasing complexity and smaller size of designs have changed how those responsible for the physical layout of an IC design deliver their design to the IC manufacturer or foundry. In older technologies, this handoff was a relatively simple layout database check when the design went to manufacturing. Now it is a multi-step process where the layout database is checked and modified so the design can be manufactured with cost-effective yields of ICs.

To address these challenges, we offer the Calibre® tool family, which is a standard for most of the world’s largest integrated device manufacturers and foundries:

| | • | | The Calibre physical verification tool suite, Calibre DRCTM and Calibre LVSTM, helps ensure that a particular IC layout accurately corresponds to the original schematic or circuit diagram of the design and conforms to stringent manufacturing rules at wafer fabs where ICs are manufactured. |

| | • | | The Calibre xRC™ and xACT products, transistor-level extraction and device modeling tools, compute the values of detailed circuit parameters including interconnect resistances, capacitances, and inductances to enable customers to more accurately simulate the performance of a design before it is manufactured. |

| | • | | The Calibre lithography tools allow engineers to model, enhance, and verify layouts using lithography resolution enhancement techniques, including optical and process correction, phase-shift mask, scattering bars, and off-axis illumination. Use of these tools substantially increases the yields of ICs and is required at the lower geometries to achieve any yield at all. |

| | • | | In the Design For Manufacturing (DFM) area, the Calibre LFD™ product can help customers produce higher yields at nanometer process geometries where variations in manufacturing can cause yield reductions. The Calibre CMPAnalyzer tool allows customers to model the expected planarity (i.e., thickness variation) of ICs and identify where modifications to the layout will improve a chip’s flatness. This helps prevent manufacturing defects and reduces variations in performance from one chip to the next. |

| | • | | The Calibre PERC is a tool for checking the electrical design of an IC. It is useful in verifying the completeness of electrostatic discharge protection circuitry which affects both manufacturing yield and long-term reliability of an IC. |

We also offer the Olympus-SoC™ place and route product targeted at customers designing ICs using geometries of 65 nm and below. The Olympus-SoC product addresses IC design challenges such as manufacturing variability, design size and complexity, and low power requirements. The Olympus-SoC place and route solution addresses these issues with technology such as Design Rule Checkers-, DFM-, power-aware routing, lithography-friendly layout, and multi-corner multi-mode timing analysis, which concurrently optimizes for timing, power, and signal integrity across multiple process corners and design modes. In 2010 we introduced the Calibre InRoute design and verification platform which enables designers to increase their productivity by invoking Calibre tools within the Olympus-SoC place and route tool.

4

Integrated System Design

As ICs grow in complexity and function and PCB fabrication technology advances to include embedded components and high-density interconnect layers within the PCB, the design of PCBs is becoming increasingly complex. This complexity can be a source of design bottlenecks.

Our PCB-FPGA Systems Design software products support the PCB design process from schematic entry, where the electronic circuit is defined by engineers, through physical layout of the PCB, to providing digital output data for manufacturing, assembly, and test. Most types of designs, including analog, radio frequency, and high-speed digital and mixed signal, are supported by our PCB design tools. We have specific integrated software tool flows for process management, component library creation, simulation, and verification of the PCB design:

| | • | | The Expedition Series® product line is our principal PCB design family of products used by larger enterprise customers. |

| | • | | We also offer the “ready to use” PADS® product line which provides a lower cost Windows-based PCB design and layout solution. |

| | • | | Our I/O Designer TM product integrates FPGA input/output planning with our PCB design tools to help improve routing in large complex designs. |

| | • | | The XtremePCBTM tool offers a method for simultaneous design where multiple designers can edit the same design at the same time and view each others’ edits in real-time. |

| | • | | Our XtremeAR product is a PCB routing product that improves the routing time of large designs. This product allows improved designs by running more simultaneous routing iterations during the design cycle. |

Our AutoActiveTM place and route technology is available on both UNIX and Windows platforms and is used to replace older generation routers in PCB design flows. The AutoActive technology, which is incorporated into the Expedition product line, is intended to help improve design quality, shorten design cycles, and increase manufacturability. Our Hyperlynx® high-speed design technology tools address signal integrity and timing challenges of complex, high-speed PCB designs.

Our Precision® Synthesis product family allows a designer to use HDL descriptions of functionality to efficiently program an FPGA to perform a specific set of functions.

Our Mechanical Analysis Division offers a line of products that provide simulation of mechanical engineering design processes involving heat transfer and fluid flow which help reduce costs, eliminate design mistakes, and accelerate design cycle time. The FloEFD TM product is embedded in a range of commercial mechanical computer aided design software products and enables design engineers to conduct computational fluid dynamics analysis throughout the product’s lifecycle. The FloTHERM® 3D computational fluid dynamics software provides bottleneck and shortcut fields so engineers can identify where and why heat flow congestion occurs in an electronic design.

Our Valor® Division offers a line of products for printed circuit board, design for manufacturing, and manufacturing execution systems. Valor’s solutions target three key segments in the PCB manufacturing market: design of the physical layout of the PCB, fabrication of the bare PCB, and assembly of PCB components.

New and Emerging Products

Engineers are trying to reduce the design and verification complexity associated with next generation applications found in technologies such as broadband wireless, image/video processing, and military products. One response to this trend is leading designers toward methodologies based on ANSI C/C++ language which can offer a more abstract and efficient way to create and verify designs. Our Catapult® C Synthesis tool can help engineering teams produce ASIC or FPGA hardware that can be smaller in size, use less power, reduce overall design cycle time, and reduce overall verification effort.

Our Integrated Electrical Systems Division provides specialized software for design, analysis, manufacture, and data management of complex wire harness systems used by automotive, aerospace, and other industries. We also offer a variety of software tools targeting the automotive market that focus on the functional design of the electronic components of cars.

5

We offer a suite of products for companies developing embedded software for products such as smart phones and medical devices. Our offerings in this area are real-time operating systems, Linux and Android (Google TM) products and services, middleware, and associated development and debugging tools.

We also offer tools to test IC designs. Our Tessent™ suite of integrated silicon test products are used to test a design’s logic and memories after manufacturing to ensure that a manufactured IC is functioning correctly. Our suite of tools includes scan insertion, automatic test pattern generation, logic and memory built-in self-test, and our patented Tessent TestKompress® product for the EDT™ (Embedded Deterministic Test). A suite of test analysis products is also available that leverages test data and layout-aware diagnosis capabilities for silicon debug and yield analysis.

PLATFORMS

Our software products are available on UNIX, Windows, and LINUX platforms in a broad range of price and performance levels. Customers purchase platforms from leading workstation and personal computer suppliers.

MARKETING AND CUSTOMERS

Our sales and marketing emphasizes large corporate account penetration in the military/aerospace, communications, computer, consumer electronics, semiconductor, networking, multimedia, and transportation industries. We license our products worldwide through our direct sales force, distributors, and sales representatives. During the year ended January 31, 2011, revenues outside of North America accounted for 56% of total revenues compared to 57% for fiscal 2010 and 61% for fiscal 2009. See “Geographic Revenues Information” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the footnotes to our financial statements included in Part II, Item 8. “Financial Statements and Supplementary Data” for more information. We enter into foreign currency exchange contracts in an effort to mitigate the impact of foreign currency fluctuations.

We segregate revenues into five categories of similar products and services. These categories include IC Design to Silicon, Integrated System Design, Scalable Verification, New and Emerging Products, and Services and Other. Each category includes both product and support revenues. See the discussion in Note 21. “Segment Reporting” in Part II, Item 8. “Financial Statements and Supplementary Data” for further detail of revenue by product and service category.

Over time, no material portion of our business is dependent on a single or a few customers. We do not believe that the competitive loss of one or more product lines at one or more of our customers would have a material adverse effect on our revenues. We have traditionally experienced some seasonal fluctuations of orders, with orders typically stronger in the fourth quarter of each year. Due to the complexity of our products, the selling cycle can be six months or longer. During the selling cycle our account managers, application engineers, and technical specialists make technical presentations and product demonstrations to the customer. At some point during the selling cycle, our products may also be loaned to customers for short-term on-site evaluation. We generally ship our products to customers within 180 days after receipt of an order and a substantial portion of quarterly shipments tend to be made in the last month of each quarter. We license our products and some third-party products pursuant to end-user license agreements.

BACKLOG

Our backlog of firm orders was approximately $129 million as of January 31, 2011 compared to $71 million as of January 31, 2010. This backlog includes products requested for delivery within six months and unfulfilled professional services and training requested for delivery within one year. We do not track backlog for support services. The January 31, 2011 backlog of orders is expected to ship before the end of our fiscal year ending January 31, 2012.

MANUFACTURING OPERATIONS

Our manufacturing operations primarily consist of reproduction of our software and documentation. In North America, manufacturing is substantially outsourced with distribution to North American and Japanese customers occurring primarily from Wilsonville, Oregon. Our line of emulation products, which has a large hardware component, is manufactured in the United States and France on an outsourced basis. Mentor Graphics (Ireland)

6

Limited, a wholly owned subsidiary of Mentor Graphics Corporation, manufactures, or contracts with third-parties to manufacture, our products and distributes these products to markets outside North America and Japan through our established sales channels. See the discussion in Note 21. “Segment Reporting” in Part II, Item 8. “Financial Statements and Supplementary Data” for further detail of the location of property, plant, and equipment.

PRODUCT DEVELOPMENT

Our research and development is focused on continued improvement of our existing products and the development of new products. During the year ended January 31, 2011, we expensed $285 million related to product research and development compared to $256 million for fiscal 2010 and $260 million for fiscal 2009. We also seek to expand existing product offerings and pursue new lines of business through acquisitions. During fiscal 2011, we amortized purchased technology of $14 million compared to $12 million for fiscal 2010 and $12 million for fiscal 2009. During fiscal 2009 we expensed in-process research and development of $22 million. Our future success depends on our ability to develop or acquire competitive new products that satisfy customer requirements.

CUSTOMER SUPPORT AND CONSULTING

We have a worldwide support organization to meet our customers’ needs for software support, hardware support, and customer training. Most of our customers enter into support contracts that deliver regular software updates with the latest improvements, technical assistance from experienced experts, access to a self-service support site, and participation in Mentor’s interactive communities. Hardware support is available for emulation products. Mentor Graphics Education Services offers a wide range of learning solutions developed specifically for electronics designers and engineers.

Mentor Consulting, our professional services division, is comprised of a worldwide team of consulting professionals. The services provided to customers are concentrated around our products. In addition, Mentor Consulting provides methodology development and refinement services that help customers improve their product development processes.

COMPETITION

The markets for our products are characterized by price competition, rapid technological advances in application software, and new market entrants. The EDA industry tends to be labor intensive rather than capital intensive. This means that the number of actual and potential competitors is significant. While our two principal competitors are large companies with extensive capital and marketing resources, we also compete with small companies with little capital but innovative ideas. Our principal competitors are Cadence Design Systems, Inc. and Synopsys, Inc.

We believe the main competitive factors affecting our business are breadth and quality of application software, product integration, ability to respond to technological change, quality of a company’s sales force, price, size of the installed base, level of customer support, and professional services. We can give no assurance, however, that we will have financial resources, marketing, distribution and service capability, depth of key personnel, or technological knowledge to compete successfully in our markets.

EMPLOYEES

We employed approximately 4,700 people full time as of January 31, 2011. Our future success will depend in part on our ability to attract and retain employees. None of our United States (U.S.) employees are covered by collective bargaining agreements. Employees in some jurisdictions outside the U.S. are represented by local or national union organizations. We continue to have satisfactory employee relations.

PATENTS AND LICENSES

We regard our products as proprietary and protect our rights in our products and technology in a variety of ways. We currently hold approximately 500 U.S. and 30 non-U.S. patents on inventions embodied in our products or that are otherwise relevant to EDA technology. In addition, we hold approximately 460 patent applications pending in the U.S. and abroad. While we believe the patent applications relate to patentable technology, we cannot predict whether any patent will issue on a pending application, nor can we assure that any patent can be successfully defended.

7

We also rely on contractual and technical safeguards to protect our proprietary rights in our products. We typically include restrictions on disclosure, use, and transferability in our agreements with customers and other parties. In addition, we use our trademark, copyright, and trade secret rights to protect our interests in our products and technology.

Some of our products include software or other intellectual property licensed from other parties. We also license software from other parties for internal use. We may have to seek new licenses or renew these licenses in the future.

The forward-looking statements contained under “Outlook for Fiscal 2012” in Part II, Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and all other statements contained in this report that are not statements of historical fact, including without limitation, statements containing the words “believes,” “expects,” “projections,” and words of similar meaning, constitute forward-looking statements that involve a number of risks and uncertainties that are difficult to predict. Moreover, from time to time, we may issue other forward-looking statements. Forward-looking statements regarding financial performance in future periods, including the statements under “Outlook for Fiscal 2012,” do not reflect potential impacts of mergers or acquisitions or other significant transactions or events that have not been announced as of the time the statements are made. Actual outcomes and results may differ materially from what is expressed or forecast in forward-looking statements. We disclaim any obligation to update forward-looking statements to reflect future events or revised expectations. Our business faces many risks, and set forth below are some of the factors that could cause actual results to differ materially from the results expressed or implied by our forward-looking statements. Forward-looking statements should be considered in light of these factors.

Weakness in the United States (U.S.) and international economies may harm our business.

Our revenue levels are generally dependent on the level of technology capital spending, which includes worldwide expenditures for electronic design automation (EDA) software, hardware, and consulting services. Periods of economic uncertainty, such as the recession experienced in 2008 and much of 2009, can adversely affect our customers and postpone decisions to license or purchase our products, decrease our customers’ spending, and jeopardize or delay our customers’ ability or willingness to make payment obligations, any of which could adversely affect our business.

Our forecasts of our revenues and earnings outlook may be inaccurate.

Our revenues, particularly new software license revenues, are difficult to forecast. We use a “pipeline” system, a common industry practice, to forecast revenues and trends in our business. Sales personnel monitor the status of potential business and estimate when a customer will make a purchase decision, the dollar amount of the sale, and the products or services to be sold. These estimates are aggregated periodically to generate a sales pipeline. Our pipeline estimates may prove to be unreliable either in a particular quarter or over a longer period of time, in part because the “conversion rate” of the pipeline into contracts can be very difficult to estimate and requires management judgment. A variation in the conversion rate could cause us to plan or budget incorrectly and materially adversely impact our business or our planned results of operations. In particular, a slowdown in customer spending or weak economic conditions generally can reduce the conversion rate in a particular quarter as purchasing decisions are delayed, reduced in amount, or cancelled. The conversion rate can also be affected by the tendency of some of our customers to wait until the end of a fiscal quarter attempting to obtain more favorable terms. This may result in failure to agree to terms within the fiscal quarter and cause expected revenue to slip into a subsequent quarter.

Our business could be impacted by fluctuations in quarterly results of operations due to customer seasonal purchasing patterns, the timing of significant orders, and the mix of licenses and products purchased by our customers.

We have experienced, and may continue to experience, varied quarterly operating results. Various factors affect our quarterly operating results and some of these are not within our control, including customer demand and the timing of significant orders. We typically experience seasonality in demand for our products, due to the purchasing cycles of our customers, with revenues in the fourth quarter generally being the highest. If planned contract renewals are delayed or the average size of renewed contracts do not increase as we anticipate, we could fail to meet our and investors’ expectations, which could have a material adverse impact on our stock price.

8

Our revenues are also affected by the mix of licenses entered into where we recognize software revenues as payments become due and payable, on a cash basis, or ratably over the license term as compared to revenues recognized at the beginning of the license term. We recognize revenues ratably over the license term, for instance, when the customer is provided with rights to unspecified or unreleased future products. A shift in the license mix toward increased ratable, due and payable, and/or cash-based revenue recognition could result in increased deferral of software revenues to future periods and would decrease current revenues, which could result in us not meeting near-term revenue expectations.

The gross margin on our software is greater than that for our emulation hardware systems, software support, and professional services. Therefore, our gross margin may vary as a result of the mix of products and services sold. We also have a significant amount of fixed or relatively fixed costs, such as employee costs and purchased technology amortization, and costs which are committed in advance and can only be adjusted periodically. As a result, a small failure to reach planned revenues would likely have a relatively large negative effect on resulting earnings. If anticipated revenues do not materialize as expected, our gross margins and operating results could be materially adversely impacted.

We face intense price competition in the EDA industry.

Price competition in the EDA industry is intense, which can lead to, among other things, price reductions, longer selling cycles, lower product margins, loss of market share, and additional working capital requirements. If our competitors offer significant discounts on certain products, we may need to lower our prices or offer other favorable terms to compete successfully. Any such changes would likely reduce margins and could materially adversely impact our operating results. Any broad-based changes to our prices and pricing policies could cause new software license and service revenues to decline or be delayed as the sales force implements and our customers adjust to the new pricing policies. Some of our competitors may bundle certain software products at low prices for promotional purposes or as a long-term pricing strategy. These practices could significantly reduce demand for our products or limit prices we can charge.

We currently compete primarily with two large companies: Synopsys, Inc. and Cadence Design Systems, Inc. We also compete with smaller companies and compete with manufacturers of electronic devices that have developed their own EDA products internally. Some large customers may also develop internal tools, thereby reducing demand for our products.

Our international operations and the effects of foreign currency fluctuations expose us to additional risks.

We typically generate about half of our revenues from customers outside the U.S. and we generate approximately one-third of our expenses outside the U.S. Significant changes in currency exchange rates, particularly in the Japanese yen, euro, and the British pound, could have an adverse impact on us. In addition, international operations subject us to other risks including longer receivables collection periods, changes in a specific country’s or region’s economic or political conditions, trade protection measures, local labor laws, import or export licensing requirements, loss or modification of exemptions for taxes and tariffs, limitations on repatriation of earnings, and difficulties with licensing and protecting our intellectual property rights.

We derive a substantial portion of our revenues from relatively few product groups.

We derive a substantial portion of our revenues from sales of relatively few product groups and related support services. As a result, any factor adversely affecting sales of these products, including the product release cycles, market acceptance, product competition, performance and reliability, reputation, price competition, and economic and market conditions, could harm our operating results.

We are subject to the cyclical nature of the integrated circuit (IC) and electronics systems industries.

Purchases of our products and services are highly dependent upon new design projects initiated by customers in the IC and electronics systems industries. These industries are highly cyclical and are subject to constant and rapid technological change, rapid product obsolescence, price erosion, evolving standards, short product life cycles, and wide fluctuations in product supply and demand. The increasing complexity of ICs and resulting increase in costs to

9

design and manufacture ICs have in recent years led to fewer design starts, which could cause a reduced demand for our products. In addition, the IC and electronics systems industries regularly experience significant downturns, often connected with, or in anticipation of, maturing product cycles within such companies or decline in general economic conditions. These downturns could cause diminished demand for our products and services.

Shortages of components for our hardware products may delay or reduce our sales and increase our costs.

The inability to obtain sufficient quantities of components and other materials necessary for the production of our hardware products could result in reduced or delayed sales or lost orders. Any delay in or loss of sales could adversely impact our operating results. From time to time, materials and components used in our production or in other aspects of our customers’ products may become subject to allocation because of shortages of these materials and components. Future shortages of materials and components, including potential supply constraints of silicon, could cause delayed shipments, customer dissatisfaction, and lower revenue.

Customer payment defaults could adversely affect our timing of revenue recognition.

We use fixed-term license agreements as standard business practices with customers we believe are creditworthy. These multi-year, multi-element term license agreements have payments spread over the license term and are typically about three years in length for semiconductor companies and about four years in length for military and aerospace companies. The complexity of these agreements tends to increase the risk associated with collectibility from customers that can arise for a variety of reasons including ability to pay, product dissatisfaction, and disputes. If we are unable to collect under these agreements, our results of operations could be materially adversely impacted. We use these fixed-term license agreements as a standard business practice and have a history of successfully collecting under the original payment terms without making concessions on payments, products, or services. If we no longer had a history of collecting without providing concessions on the terms of the agreements, then revenue would be required to be recognized under U.S. generally accepted accounting principles as the payments become due and payable over the license term. This change could have a material adverse impact on our near-term results.

IC and printed circuit board (PCB) technology evolves rapidly.

The complexity of ICs and PCBs continues to rapidly increase. In response to this increasing complexity, new design tools and methodologies must be invented or acquired quickly to remain competitive. If we fail to quickly respond to new technological developments, our products could become obsolete or uncompetitive, which could materially adversely impact our business.

Errors or defects in our products and services could expose us to liability and harm our reputation.

Our customers use our products and services in designing and developing products that involve a high degree of technological complexity and have unique specifications. Due to the complexity of the systems and products with which we work, some of our products and designs can be adequately tested only when put to full use in the marketplace. As a result, our customers or their end users may discover errors or defects in our software, or the products or systems designed with or manufactured using tools that may not operate as expected. Errors or defects could result in:

| | • | | Loss of current customers and loss of, or delay in, revenue and loss of market share; |

| | • | | Failure to attract new customers or achieve market acceptance; |

| | • | | Diversion of development resources to resolve the problems resulting from errors or defects; and |

| | • | | Increased support or service costs. |

In addition, we include limited amounts of third-party technology in our products and we rely on those third parties to provide support services to us. Failure of those third parties to provide necessary support services could materially adversely impact our business.

10

Long sales cycles and delay in customer completion of projects make the timing of our revenues difficult to predict.

We have a lengthy sales cycle. A lengthy customer evaluation and approval process is generally required due to the complexity and expense associated with our products and services. Consequently, we may incur substantial expenses and devote significant management effort and expense to develop potential relationships that do not result in agreements or revenues and may prevent us from pursuing other opportunities. In addition, sales of our products and services is sometimes discretionary and may be delayed if customers delay approval or commencement of projects due to budgetary constraints, internal acceptance review procedures, timing of budget cycles, or timing of competitive evaluation processes.

Any loss of our leadership position in certain segments of the EDA market could harm our business.

The industry in which we compete is characterized by very strong leadership positions in specific segments of the EDA market. For example, one company may have a large percentage of sales in the physical verification segment of the market while another may have a similarly strong position in mixed-signal simulation. These strong leadership positions can be maintained for significant periods of time as the software is difficult to master and customers are disinclined to make changes once their employees, as well as others in the industry, have developed familiarity with a particular software product. For these reasons, much of our profitability arises from niche areas in which we are the leader. Conversely, it is difficult for us to achieve significant profits in niche areas where other companies are the leaders. If for any reason we lose our leadership position in a niche, we could be materially adversely impacted.

Accounting rules governing revenue recognition are complex and may change.

The accounting rules governing software revenue recognition are complex and have been subject to authoritative interpretations that have generally made it more difficult to recognize software revenues at the beginning of the license period.

We may have additional tax liabilities.

Significant judgments and estimates are required in determining the provision for income taxes and other tax liabilities. Our tax expense may be impacted if our intercompany transactions, which are required to be computed on an arm’s-length basis, are challenged and successfully disputed by the tax authorities. Also, our tax expense could be impacted depending on the applicability of withholding taxes on software licenses and related intercompany transactions in certain jurisdictions. In determining the adequacy of income taxes, we assess the likelihood of adverse outcomes resulting from the Internal Revenue Service (IRS) and other tax authorities’ examinations. The IRS and tax authorities in countries where we do business regularly examine our tax returns. The ultimate outcome of these examinations cannot be predicted with certainty. Should the IRS or other tax authorities assess additional taxes as a result of examinations, we may be required to record charges to operations that could have a material impact on the results of operations, financial position, or cash flows.

Forecasting our income tax rate is complex and subject to uncertainty.

The computation of income tax expense (benefit) is complex as it is based on the laws of numerous taxing jurisdictions and requires significant judgment on the application of complicated rules governing accounting for tax provision under U.S. generally accepted accounting principles. Income tax expense (benefit) for interim quarters is based on a forecast of our global tax rate for the year, which includes forward looking financial projections, including the expectations of profit and loss by jurisdiction, and contains numerous assumptions. Various items cannot be accurately forecasted, and may be treated as discrete accounting. Examples of items which could cause variability in the rate include tax deductions for stock option expense, application of transfer pricing rules, and changes in our valuation allowance for deferred tax assets. Future events, such as changes in our business and the tax law in the jurisdictions where we do business, could also affect our rate. For these reasons, our global tax rate may be materially different than our forecast.

There are limitations on the effectiveness of controls.

We do not expect that disclosure controls or internal control over financial reporting will prevent all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. Failure of our control systems to prevent error or fraud could materially adversely impact us.

11

We may not realize revenues as a result of our investments in research and development.

We incur substantial expense to develop new software products. Research and development activities are often performed over long periods of time. This effort may not result in a successful product offering. As a result, we could realize little or no revenues related to our investment in research and development.

We may acquire other companies and may not successfully integrate them.

The industry in which we compete has experienced significant consolidation in recent years. During this period, we have acquired numerous businesses and have frequently been in discussions with potential acquisition candidates, and we may acquire other businesses in the future. While we expect to carefully analyze all potential transactions before committing to them, we cannot assure that any completed transaction will result in long-term benefits to us or our shareholders or that we will be able to manage the acquired businesses effectively. In addition, growth through acquisition involves a number of risks. If any of the following events occurs after we acquire another business, it could materially adversely impact us:

| | • | | Difficulties in combining previously separate businesses into a single unit; |

| | • | | The substantial diversion of management’s attention from ongoing business when integrating the acquired business; |

| | • | | The failure to realize anticipated benefits, such as cost savings and increases in revenues; |

| | • | | The failure to retain key personnel of the acquired business; |

| | • | | Difficulties related to assimilating the products of an acquired business in, for example, distribution, engineering, and customer support areas; |

| | • | | Unanticipated liabilities or litigation in connection with or as a result of an acquisition, including claims from terminated employees, customers, or third parties; |

| | • | | Adverse impacts on existing relationships with suppliers and customers; and |

| | • | | Failure to understand and compete effectively in markets in which we have limited experience. |

Acquired businesses may not perform as projected, which could result in impairment of acquisition-related intangible assets. Additional challenges include integration of sales channels, training and education of the sales force for new product offerings, integration of product development efforts, integration of systems of internal controls, and integration of information systems. Accordingly, in any acquisition there will be uncertainty as to the achievement and timing of projected synergies, cost savings, and sales levels for acquired products. All of these factors could impair our ability to forecast, meet revenues and earnings targets, and manage effectively our business for long-term growth. We cannot assure that we can effectively meet these challenges.

We may not adequately protect our proprietary rights or we may fail to obtain software or other intellectual property licenses.

Our success depends, in large part, upon our proprietary technology. We generally rely on patents, copyrights, trademarks, trade secret laws, licenses, and restrictive agreements to establish and protect our proprietary rights in technology and products. Despite precautions we may take to protect our intellectual property, we cannot assure that third parties will not try to challenge, invalidate, or circumvent these protections. The companies in the EDA industry, as well as entities and persons outside the industry, are obtaining patents at a rapid rate. We cannot predict if any of these patents will cover any of our products. In addition, many of these entities have substantially larger patent portfolios than we have. As a result, we may on occasion be forced to engage in costly patent litigation to protect our rights or defend our customers’ rights. We may also need to settle these claims on terms that are unfavorable; such settlements could result in the payment of significant damages or royalties, or force us to stop selling or redesign one or more products. We cannot assure that the rights granted under our patents will provide us with any competitive advantage, that patents will be issued on any of our pending applications, or that future patents will be sufficiently broad to protect our technology. Furthermore, the laws of foreign countries may not protect our proprietary rights in those countries to the same extent as U.S. law protects these rights in the U.S.

12

Some of our products include software or other intellectual property licensed from third parties, and we may have to seek new licenses or renew existing licenses for software and other intellectual property in the future. Failure to obtain software or other intellectual property licenses or rights from third parties on favorable terms could materially adversely impact us.

Our use of open source software could negatively impact our ability to sell our products and may subject us to unanticipated obligations.

The products, services or technologies we acquire, license, provide or develop may incorporate or use open source software. We monitor our use of open source software in an effort to avoid unintended consequences, such as reciprocal license grants, patent retaliation clauses, and the requirement to license our products at no cost. Nevertheless, we may be subject to unanticipated obligations regarding our products which incorporate open source software.

Our failure to attract and retain key employees may harm us.

We depend on the efforts and abilities of our senior management, our research and development staff, and a number of other key management, sales, support, technical, and services personnel. Competition for experienced, high-quality personnel is intense, and we cannot assure that we can continue to recruit and retain such personnel. Our failure to hire and retain such personnel could impair our ability to develop new products and manage our business effectively.

We have global sales and research and development offices in parts of the world that are not as politically stable as the United States.

We have global sales and research and development offices, some of which are in parts of the world that are not as politically stable as the United States. In particular our offices in Egypt and Pakistan may be subject to disruption or closure from time to time. As a result, we may face a greater risk of business interruption as a result of potential unrest, terrorist acts, or military conflicts than businesses located domestically.

Oregon law and our shareholder rights plan may have anti-takeover effects.

The Oregon Control Share Act and the Business Combination Act limit the ability of parties who acquire a significant amount of voting stock to exercise control over us. These provisions may have the effect of lengthening the time required to acquire control of us through a proxy contest or the election of a majority of the Board of Directors. In June 2010, we adopted a shareholder rights plan, which has the effect of making it more difficult for a person to acquire control of us in a transaction not approved by our board of directors. The provisions of the Oregon Control Share Act and the Business Combination Act and our shareholder rights plan could have the effect of delaying, deferring, or preventing a change of control of us, could discourage bids for our common stock at a premium over the market price of our common stock and could materially adversely impact the market price of, and the voting and other rights of the holders of, our common stock.

Our revolving credit facility has financial and non-financial covenants, and default of any covenant could materially adversely impact us.

Our bank revolving credit facility imposes operating restrictions on us in the form of financial and non-financial covenants. Financial covenants include adjusted quick ratio, minimum tangible net worth, leverage ratio, senior leverage ratio, and minimum cash and accounts receivable ratio. If we were to fail to comply with the financial covenants and did not obtain a waiver from our lenders, we would be in default under the revolving credit facility and our lenders could terminate the facility and demand immediate repayment of all outstanding loans under the revolving credit facility. The declaration of an event of default could have a material adverse effect on our financial condition. We could also find it difficult to obtain other bank lines or credit facilities on comparable terms.

Our bank revolving credit facility terminates June 1, 2011. We could find it difficult to obtain comparable terms on a new revolving credit facility.

13

We have a substantial level of indebtedness.

As of January 31, 2011, we had $231.9 million of outstanding indebtedness, which includes $196.5 million of 6.25% Convertible Subordinated Debentures (6.25% Debentures) due 2026, $18.5 million under a term loan, $15.6 million in short-term borrowings, and $1.3 million in other notes payable. This level of indebtedness among other things could:

| | • | | Make it difficult for us to satisfy our payment obligations on our debt; |

| | • | | Make it difficult for us to incur additional indebtedness or obtain any necessary financing in the future for working capital, capital expenditures, debt service, acquisitions, or general corporate purposes; |

| | • | | Limit our flexibility in planning for or reacting to changes in our business; |

| | • | | Reduce funds available for use in our operations; |

| | • | | Make us more vulnerable in the event of a downturn in our business; |

| | • | | Make us more vulnerable in the event of an increase in interest rates if we must incur new debt to satisfy our obligations under the 6.25% Debentures and term loan; and |

| | • | | Place us at a possible competitive disadvantage relative to less leveraged competitors and competitors that have greater access to capital resources. |

We may also be unable to borrow funds as a result of an inability of financial institutions to lend due to restrictive lending policies and/or institutional liquidity concerns.

If we experience a decline in revenues, we could have difficulty paying amounts due on our indebtedness. Any default under our indebtedness could have a material adverse impact on our business, operating results, and financial condition.

Our stock price could become more volatile, and your investment could lose value.

All of the factors discussed in this “Risk Factors” section could affect our stock price. The timing of announcements in the public market regarding new products, product enhancements, or technological advances by our competitors or us, and any announcements by us of acquisitions, major transactions, or management changes could also affect our stock price. Our stock price is subject to speculation in the press and the analyst community, changes in recommendations or earnings estimates by financial analysts, changes in investors’ or analysts’ valuation measures for our stock, our credit ratings, and market trends unrelated to our performance. A significant drop in our stock price could also expose us to the risk of securities class actions lawsuits, which could result in substantial costs and divert management’s attention and resources, which could adversely affect our business.

Our business could be negatively affected as a result of a proxy fight and the actions of activist shareholders.

We recently received a notice from Icahn Partners LP and certain of its affiliates that announces their intent to nominate three individuals for election to our Board of Directors and to propose to amend our bylaws. Subsequently, we received an unsolicited conditional proposal from Carl Icahn and certain of his affiliated entities to purchase all of the outstanding shares of our company. If a proxy contest results from this notice or proposal or if other activist activities continue, our business could be adversely affected because:

| | • | | Responding to proxy contests and other actions by activist shareholders can be costly and time-consuming, disrupting our operations and diverting the attention of management and our employees; |

| | • | | Perceived uncertainties as to our future direction may result in the loss of potential business opportunities, and may make it more difficult to attract and retain qualified personnel and business partners; and |

| | • | | If individuals are elected to our Board of Directors with a specific agenda, it may adversely affect our ability to effectively and timely implement our strategic plans. |

14

| Item 1B. | Unresolved Staff Comments |

None.

We own six buildings on 43 acres of land in Wilsonville, Oregon. We occupy approximately 405,000 square feet in four of those buildings, as our corporate headquarters. We also own an additional 69 acres of undeveloped land adjacent to our headquarters. Most administrative functions and a significant amount of our domestic research and development operations are located at the Wilsonville site. We also own three buildings totaling 196,000 square feet in Fremont, California which house research and development, sales and administrative staff.

We lease additional space in Longmont, Colorado; Redmond, Washington; Huntsville and Mobile, Alabama; and Marlboro and Waltham, Massachusetts where some of our domestic research and development takes place; and in various locations throughout the United States and in other countries, primarily for sales and customer service operations. Additional research and development is done in locations outside the United States including locations in Armenia, Egypt, France, India, Israel, Pakistan, Poland, Sweden, Finland, Germany, Russia, Hungary, Austria, Taiwan, and the United Kingdom. We believe that we will be able to renew or replace our existing leases as they expire and that our current facilities will be adequate through at least the year ending January 31, 2012.

From time to time, we are involved in various disputes and litigation matters that arise from the ordinary course of business. These include disputes and lawsuits relating to intellectual property rights, licensing, contracts, and employee relations matters.

The Company is currently engaged in patent litigation in Japan and federal court in the U.S. with EVE SA (EVE), a provider of emulation products and services. The Company is the plaintiff in these legal actions and seeks injunctions and damages from EVE. There can be no assurance that this litigation will be successful or result in a positive outcome for the Company.

We believe that the outcome of current litigation, individually and in the aggregate, will not have a material effect on our financial position or results of operations.

15

| Item 4. | (Removed and Reserved) |

EXECUTIVE OFFICERS OF THE REGISTRANT

The following are the executive officers of Mentor Graphics Corporation:

| | | | |

Name | | Position | | Age |

| Walden C. Rhines | | Chairman of the Board and Chief Executive Officer | | 64 |

| Gregory K. Hinckley | | President and Director | | 64 |

| L. Don Maulsby | | Senior Vice President, World Trade | | 59 |

| Brian Derrick | | Vice President, Corporate Marketing | | 47 |

| Dean Freed | | Vice President, General Counsel and Secretary | | 52 |

| Alan J. Friedman | | Vice President, Human Resources | | 63 |

The executive officers are elected by our Board of Directors annually. Officers hold their positions until they resign, are terminated, or their successors are elected. There are no arrangements or understandings between the officers or any other person pursuant to which officers were elected. There are no family relationships among any of our executive officers or directors.

Dr. Rhines has served as our Chairman of the Board and Chief Executive Officer since 2000. Dr. Rhines served as our Director, President, and Chief Executive Officer from 1993 to 2000. Dr. Rhines is currently a director of Triquint Semiconductor, Inc., a semiconductor manufacturer, and served as director of Cirrus Logic, Inc., also a semiconductor manufacturer, from 1995 to 2009.

Mr. Hinckley has served as our President, Chief Operating Officer, and Director since 2000. Mr. Hinckley has served as our Chief Financial Officer since 2008. He has primary responsibility for the operations of our corporate centers, sales, and research and development divisions. Mr. Hinckley is a director of Intermec Inc., a provider of integrated systems solutions, Super Micro Computer, Inc., a server board, chassis, and server systems supplier, and SI Bone, Inc., a privately held medical device company, and served as a director of Amkor Technology, Inc., a provider of semiconductor packaging and test services, from 1997 to 2007.

Mr. Maulsby has served as our Senior Vice President, World Trade since 1999.

Mr. Derrick has served as our Vice President, Corporate Marketing since 2002. From 2000 to 2001 he was Vice President and General Manager of our Physical Verification Division. Since 2008, Mr. Derrick has served as a director of Calypto Design Systems, Inc., a sequential analysis technology company.

Mr. Freed has served as our Vice President, General Counsel, and Secretary since 1995.

Mr. Friedman has served as our Vice President, Human Resources since 2009. From 2001 to 2009, Mr. Friedman was the Senior Vice President, People for Novell, Inc., an integrated IT management software company.

16

PART II

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities |

Our common stock trades on The NASDAQ Global Select Market under the symbol “MENT.” The following table sets forth for the periods indicated the high and low sales prices for our common stock, as reported by The NASDAQ Global Select Market:

| | | | | | | | | | | | | | | | |

Quarter ended | | April 30 | | | July 31 | | | October 31 | | | January 31 | |

Fiscal 2011 | | | | | | | | | | | | | | | | |

High | | $ | 9.59 | | | $ | 9.95 | | | $ | 11.09 | | | $ | 12.85 | |

Low | | $ | 7.60 | | | $ | 7.81 | | | $ | 8.76 | | | $ | 10.42 | |

| | | | |

Quarter ended | | April 30 | | | July 31 | | | October 31 | | | January 31 | |

Fiscal 2010 | | | | | | | | | | | | | | | | |

High | | $ | 6.86 | | | $ | 7.34 | | | $ | 9.55 | | | $ | 9.25 | |

Low | | $ | 3.44 | | | $ | 5.09 | | | $ | 7.26 | | | $ | 7.16 | |

As of March 11, 2011, we had 556 stockholders of record.

No dividends were paid in fiscal 2011 or fiscal 2010. Our revolving credit facility prohibits the payment of dividends.

17

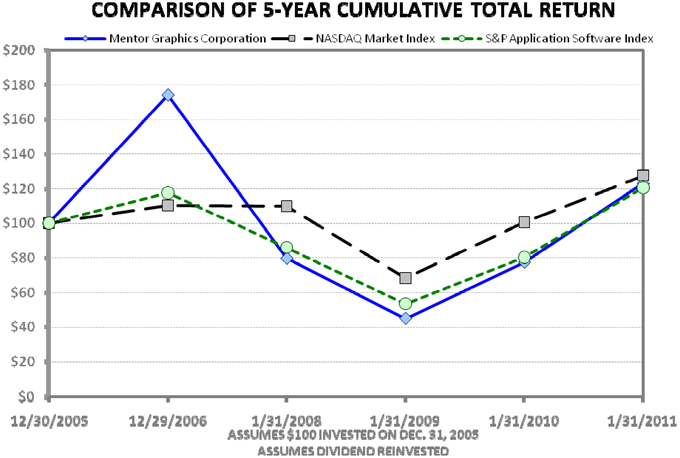

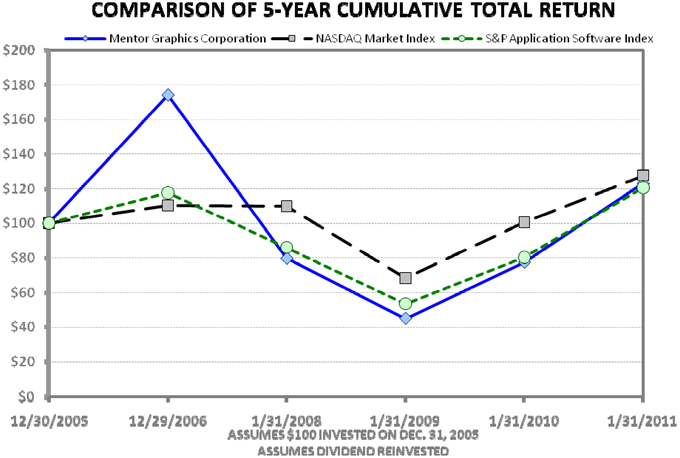

The following graph compares the cumulative 5-year total stockholder return on our common stock relative to the cumulative total return of the S&P Application Software index, and the NASDAQ Market index.

Note: the stock price shown on the above graph is not necessarily indicative of future performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Period Ending | | | | |

Company/Market/Peer Group | | 12/30/2005 | | | 12/29/2006 | | | 1/31/2008 | | | 1/31/2009 | | | 1/31/2010 | | | 1/31/2011 | |

Mentor Graphics Corporation | | $ | 100.00 | | | $ | 174.37 | | | $ | 79.79 | | | $ | 45.07 | | | $ | 77.56 | | | $ | 123.16 | |

NASDAQ Market Index | | $ | 100.00 | | | $ | 110.26 | | | $ | 109.86 | | | $ | 68.46 | | | $ | 100.56 | | | $ | 127.64 | |

S&P Application Software Index | | $ | 100.00 | | | $ | 117.52 | | | $ | 86.17 | | | $ | 53.58 | | | $ | 80.45 | | | $ | 120.58 | |

18

| Item 6. | Selected Consolidated Financial Data |

In thousands, except percentages and per share data

| | | | | | | | | | | | | | | | | | | | |

Year ended | | January 31,

2011 | | | January 31,

2010 | | | January 31,

2009 | | | January 31,

2008(1) | | | December 31,

2006 | |

Statement of Operations Data | | | | | | | | | | | | | | | | | | | | |

Total revenues | | $ | 914,753 | | | $ | 802,727 | | | $ | 789,101 | | | $ | 879,732 | | | $ | 802,839 | |

Operating income (loss) | | $ | 52,539 | | | $ | (1,167 | ) | | $ | (65,558 | ) | | $ | 72,366 | | | $ | 62,290 | |

Net income (loss) | | $ | 28,584 | | | $ | (21,889 | ) | | $ | (91,252 | ) | | $ | 24,309 | | | $ | 25,131 | |

Gross margin percent | | | 85 | % | | | 85 | % | | | 84 | % | | | 85 | % | | | 86 | % |

Operating income (loss) as a percent of revenues | | | 6 | % | | | 0 | % | | | (8 | %) | | | 8 | % | | | 8 | % |

| | | | | |

Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net income (loss) per share – basic | | $ | 0.27 | | | $ | (0.23 | ) | | $ | (0.99 | ) | | $ | 0.28 | | | $ | 0.31 | |

Net income (loss) per share – diluted | | $ | 0.26 | | | $ | (0.23 | ) | | $ | (0.99 | ) | | $ | 0.27 | | | $ | 0.30 | |

Weighted average number of shares outstanding – basic | | | 107,743 | | | | 96,474 | | | | 91,829 | | | | 88,086 | | | | 81,303 | |

Weighted average number of shares outstanding – diluted | | | 109,861 | | | | 96,474 | | | | 91,829 | | | | 89,981 | | | | 82,825 | |

| | | | | |

As of | | January 31,

2011 | | | January 31,

2010 | | | January 31,

2009 | | | January 31,

2008(1) | | | December 31,

2006 | |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | |

Cash, cash equivalents, and short-term investments | | $ | 133,113 | | | $ | 99,343 | | | $ | 95,639 | | | $ | 126,215 | | | $ | 129,857 | |

Working capital | | $ | 178,898 | | | $ | 71,416 | | | $ | 101,680 | | | $ | 187,082 | | | $ | 111,692 | |

Property, plant, and equipment, net | | $ | 139,340 | | | $ | 121,795 | | | $ | 100,991 | | | $ | 100,421 | | | $ | 86,100 | |

Total assets | | $ | 1,427,798 | | | $ | 1,223,041 | | | $ | 1,186,070 | | | $ | 1,237,656 | | | $ | 1,125,566 | |

Short-term borrowings and current portion of notes payable | | $ | 17,544 | | | $ | 70,146 | | | $ | 36,998 | | | $ | 14,178 | | | $ | 7,181 | |

Long-term portion of notes payable, deferred revenue, and other noncurrent liabilities | | $ | 291,377 | | | $ | 223,827 | | | $ | 283,505 | | | $ | 264,165 | | | $ | 247,950 | |

Stockholders’ equity | | $ | 776,714 | | | $ | 640,017 | | | $ | 586,445 | | | $ | 654,182 | | | $ | 554,206 | |

| (1) | On July 19, 2006, we changed our fiscal year to January 31 from December 31, effective for the year ended January 31, 2008. We believe that the twelve months ended December 31, 2006 provides a meaningful comparison to the years ended January 31, 2011, 2010, 2009, and 2008. There are no factors, of which we are aware, seasonal or otherwise, that would impact the comparability of information or trends, if results for the twelve months ended January 31, 2007 were presented in lieu of the results for the twelve months ended December 31, 2006. |

19

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Unless otherwise indicated, numerical references are in millions, except for percentages and per share data.

OVERVIEW

The following discussion should be read in conjunction with the consolidated financial statements and notes included elsewhere in this Form 10-K. Certain of the statements below contain forward-looking statements. These statements are predictions based upon our current expectations about future trends and events. Actual results could vary materially as a result of certain factors, including but not limited to, those expressed in these statements. In particular, we refer you to the risks discussed in Part I, Item 1A. “Risk Factors” and in our other Securities and Exchange Commission filings, which identify important risks and uncertainties that could cause our actual results to differ materially from those contained in the forward-looking statements.

We urge you to consider these factors carefully in evaluating the forward-looking statements contained in this Form 10-K. All subsequent written or spoken forward-looking statements attributable to our company or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The forward-looking statements included in this Form 10-K are made only as of the date of this Form 10-K. We do not intend, and undertake no obligation, to update these forward-looking statements.

THE COMPANY

We are a supplier of electronic design automation (EDA) systems — advanced computer software and emulation hardware systems used to automate the design, analysis, and testing of electronic hardware and embedded systems software in electronic systems and components. We market our products and services worldwide, primarily to large companies in the military/aerospace, communications, computer, consumer electronics, semiconductor, networking, multimedia, and transportation industries. Through the diversification of our customer base among these various customer markets, we attempt to reduce our exposure to fluctuations within each market. We sell and license our products through our direct sales force and a channel of distributors and sales representatives. In addition to our corporate offices in Wilsonville, Oregon, we have sales, support, software development, and professional service offices worldwide.

We focus on products and design platforms where we have leading market share, enabling us to spend more effort to cause adoption of our technology in new applications, especially for new markets in which EDA companies have not participated. We believe this strategy leads to a more diversified product and customer mix and can help reduce the volatility of our business and our credit risk while increasing our potential for growth. System customers make up a much larger percentage of our business than that of most of our EDA competitors.

We derive system and software revenues primarily from the sale of term software license contracts, which are typically three to four years in length. We generally recognize revenue for these arrangements upon product delivery at the beginning of the license term. Larger enterprise-wide customer contracts, which typically represent as much as 50% of our system and software revenue, drive the majority of our period-to-period revenue variances. We identify term licenses where collectibility is not probable and recognize revenue on those licenses when cash is received. Ratable license revenues also include short-term term licenses as well as other term licenses where we provide the customer with rights to unspecified or unreleased future products. For these reasons, the timing of large contract renewals, customer circumstances, and license terms are the primary drivers of revenue changes from period to period, with revenue changes also being driven by new contracts and increases in the capacity of existing contracts, to a lesser extent.

The EDA industry is competitive and is characterized by very strong leadership positions in specific segments of the EDA market. These strong leadership positions can be maintained for significant periods of time as the software can be difficult to master and customers are disinclined to make changes once their employees, as well as others in the industry, have developed familiarity with a particular software product. For these reasons, much of our profitability arises from areas in which we are the leader. We will continue our strategy of developing high quality tools with number one market share potential, rather than being a broad-line supplier with undifferentiated product offerings. This strategy allows us to focus investment in areas where customer needs are greatest and where we have the opportunity to build significant market share.

20

Our products and services are dependent to a large degree on new design projects initiated by customers in the integrated circuit and electronics system industries. These industries can be cyclical and are subject to constant and rapid technological change, rapid product obsolescence, price erosion, evolving standards, short product life cycles, and wide fluctuations in product supply and demand. Furthermore, extended economic downturns can result in reduced funding for development due to downsizing and other business restructurings. These pressures are offset by the need for the development and introduction of next generation products once an economic recovery occurs.

Our revenue has historically fluctuated quarterly and has generally been the highest in the fourth quarter of our fiscal year due to our customers’ corporate calendar year-end spending trends and the timing of contract renewals.

Known Trends and Uncertainties Impacting Future Results of Operations

Our top ten accounts make up approximately 40% of our receivables, including both short and long-term balances and we have not experienced and do not presently expect to experience collection issues with these customers. Net of reserves, we have no receivables greater than 60 days past due, and continue to experience no difficulty in factoring our higher quality receivables.

Bad debt expense recorded for the year ended January 31, 2011 was not material. However, we do have exposures within our receivables portfolio to customers with weak credit ratings. These receivables balances do not represent a material portion of our portfolio but could have a material adverse effect on earnings in any given quarter, should additional allowances for doubtful accounts be necessary.

A multi-quarter increase or decrease in service and support revenue can be an early indicator that our business is either strengthening or weakening. Our experience is that customers will scale back on the purchase of outsourcing services in times of economic decline or weakness. For the year ended January 31, 2011 and the last six months of fiscal 2010, we noted an increase in software maintenance revenues.

Bookings during the year ended January 31, 2011 increased by approximately 30% compared to fiscal 2010. Bookings are the value of executed orders during a period for which revenue has been or will be recognized within six months for products and within twelve months for professional services and training. The ten largest transactions for fiscal 2011 and fiscal 2010 accounted for approximately 40% of total system and software bookings. The number of new customers for fiscal 2011, excluding PADS (our ready to use printed circuit board design tools) increased approximately 10% from the levels experienced during fiscal 2010.

We are focused on continued expense control in the operation of our business. We have plans to reduce sales, general, and administrative expenses as a percentage of revenue over the next three fiscal years.

Product Developments

During the year ended January 31, 2011, we continued to execute our strategy of focusing on challenges encountered by customers, as well as building upon our well-established product families. We believe that customers, faced with leading-edge design challenges in creating new products, generally choose the best EDA products in each category to build their design environment. Through both internal development and strategic acquisitions, we have focused on areas where we believe we can build a leading market position or extend an existing leading market position.

We believe that the development and commercialization of EDA software tools is generally a three to five year process with limited customer adoption and sales in the first years of tool availability. Once tools are adopted, however, their life spans tend to be long. We introduced new products and upgrades to existing products during fiscal 2011, including solutions acquired as a result of the Valor Computerized Systems, Ltd. (Valor) acquisition which target the printed circuit board manufacturing market. During the year ended January 31, 2011, we did not have any significant products reaching the end of their useful economic life.

CRITICAL ACCOUNTING POLICIES

We base our discussion and analysis of our financial condition and results of operations upon our financial statements which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, and contingencies as of the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. We evaluate our estimates on an on-going basis. We base our estimates on historical experience, current facts, and on various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the recording of revenue, costs, and expenses that are not readily apparent from other sources. As future events and their effects cannot be determined with precision, actual results could differ from those estimates.

21

We believe that the accounting for revenue recognition, valuation of trade accounts receivable, valuation of deferred tax assets, income tax reserves, goodwill, intangible assets, long-lived assets, special charges, and accounting for stock-based compensation are the critical accounting estimates and judgments used in the preparation of our consolidated financial statements. For further information on our significant accounting policies, see Note 2. “Summary of Significant Accounting Policies” in Part II, Item 8. “Financial Statements and Supplementary Data.”

Revenue Recognition