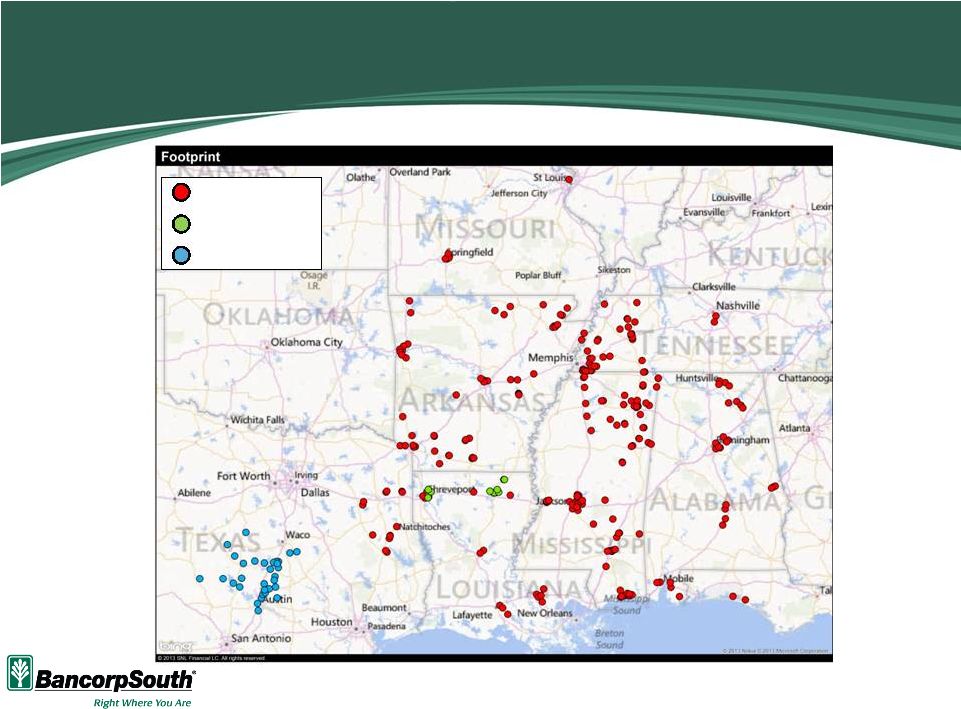

Forward Looking Information 2 Certain statements contained in this presentation and the accompanying slides may not be based on historical facts and are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by reference to a future period or by the use of forward-looking terminology, such as “anticipate,” “believe,” “estimate,” “expect,” “foresee,” “may,” “might,” “will,” “intend,” “could,” “would” or “plan,” or future or conditional verb tenses, and variations or negatives of such terms. These forward-looking statements include, without limitation, statements relating to revenue estimates for the Company’s operations in Houston, Texas following the closing of the transaction with GEM Insurance Agencies, LP and the potential for expansion of the Company’s business in Houston, the terms and closing of the proposed transactions with Ouachita Bancshares Corp. and Central Community Corp., acceptance by customers of Ouachita Bancshares Corp. and Central Community Corp. of the Company’s products and services, the opportunities to enhance market share in certain markets and market acceptance of the Company generally in new markets, pro forma loan, deposit and market share information, the impact of and the Company’s ability to implement cost-saving initiatives, our ability to improve efficiency, and future growth, expansion, and consolidation opportunities. We caution you not to place undue reliance on the forward-looking statements contained in this news release in that actual results could differ materially from those indicated in such forward-looking statements because of a variety of factors. These factors may include, but are not limited to, the ability to obtain required shareholder and regulatory approvals of the mergers, the ability of the Company, Ouachita Bancshares Corp. and Central Community Corp. to close the mergers, the ability of the Company to expand its insurance operations in Houston, conditions in the financial markets and economic conditions generally, the adequacy of the Company’s provision and allowance for credit losses to cover actual credit losses, the credit risk associated with real estate construction, acquisition and development loans, losses resulting from the significant amount of the Company’s other real estate owned, limitations on the Company’s ability to declare and pay dividends, the impact of legal or administrative proceedings, the availability of capital on favorable terms if and when needed, liquidity risk, governmental regulation, including the Dodd Frank Act, and supervision of the Company’s operations, the short-term and long-term impact of changes to banking capital standards on the Company’s regulatory capital and liquidity, the impact of regulations on service charges on the Company’s core deposit accounts, the susceptibility of the Company’s business to local economic or environmental conditions, the soundness of other financial institutions, changes in interest rates, the impact of monetary policies and economic factors on the Company’s ability to attract deposits or make loans, volatility in capital and credit markets, reputational risk, the impact of hurricanes or other adverse weather events, any requirement that the Company write down goodwill or other intangible assets, diversification in the types of financial services the Company offers, the Company’s ability to adapt its products and services to evolving industry standards and consumer preferences, competition with other financial services companies, risks in connection with completed or potential acquisitions, the Company’s growth strategy, interruptions or breaches in the Company’s information system security, the failure of certain third party vendors to perform, unfavorable ratings by rating agencies, dilution caused by the Company’s issuance of any additional shares of its common stock to raise capital or acquire other banks, bank holding companies, financial holding companies and insurance agencies, other factors generally understood to affect the financial results of financial services companies and other factors detailed from time to time in the Company’s press releases and filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they were made, and, except as required by law, we do not undertake any obligation to update or revise forward-looking statements to reflect events or circumstances after the date of this presentation. Certain tabular presentations may not reconcile because of rounding. Unless otherwise noted, any quotes in this presentation can be attributed to company management. In connection with the proposed merger of Central Community Corporation with and into BancopSouth, BancorpSouth will file a registration statement on Form S-4 with the Securities and Exchange Commission. Shareholders of BancorpSouth and Central Community Corporation are encouraged to read the registration statement, including the proxy statement/prospectus that will be a part of the registration statement, because it will contain important information about the merger, BancorpSouth and Central Community Corporation. After the registration statement is filed with the SEC, the proxy statement/prospectus and other relevant documents will be available for free on the SEC’s web site (www.sec.gov), and the proxy statement/prospectus will also be made available for free from the Corporate Secretary of each of BancorpSouth and Central Community Corporation. In connection with the proposed merger of Ouachita Bancshares Corp. with and into BancorpSouth, BancorpSouth has filed a registration statement on Form S-4 with the Securities and Exchange Commission. Shareholders of BancorpSouth and Ouachita Bancshares Corp. are encouraged to read the registration statement, including the proxy statement/prospectus that is a part of the registration statement, because it contains important information about the merger, BancorpSouth and Ouachita Bancshares Corp. The proxy statement/prospectus and other relevant documents are available for free o the SEC’s web site (www.sec.gov), and the proxy statement/prospectus is available for free from the Corporate Secretary of each of BancorpSouth and Ouachita Bancshares Corp. |