|

Exhibit 99.1

|

BancorpSouth, Inc.

Investor Presentation

August 2014

Forward Looking Information

The Company cautions you not to place undue reliance on the forward-looking statements contained in this this presentation and the accompanying slides in that actual results could differ materially from those indicated in such forward-looking statements because of a variety of factors. These factors may include, but are not limited to, the ability of the Company to resolve to the satisfaction of its federal bank regulators those identified concerns regarding the Company’s procedures, systems and processes related to certain of its compliance programs, including its Bank Secrecy Act and anti-money-laundering programs, the findings and results of the Consumer Financial Protection Bureau in its review of the Company’s fair lending practices, the ability of the Company, Ouachita Bancshares Corp. and Central Community Corporation to obtain regulatory approval of and close the proposed mergers, the potential impact upon the Company of the delay in the closings, if any, of these proposed mergers, the ability of the Company to retain key personnel after the closings, if any, of these proposed mergers and the Knox acquisition, the impact of the Company’s restructuring of its management, the conditions in the financial markets and economic conditions generally, the adequacy of the Company’s provision and allowance for credit losses to cover actual credit losses, the credit risk associated with real estate construction, acquisition and development loans, losses resulting from the significant amount of the Company’s other real estate owned, limitations on the Company’s ability to declare and pay dividends, the impact of legal or administrative proceedings, the availability of capital on favorable terms if and when needed, liquidity risk, governmental regulation, including the Dodd Frank Act, and supervision of the Company’s operations, the short-term and long-term impact of changes to banking capital standards on the Company’s regulatory capital and liquidity, the impact of regulations on service charges on the Company’s core deposit accounts, the susceptibility of the Company’s business to local economic or environmental conditions, the soundness of other financial institutions, changes in interest rates, the impact of monetary policies and economic factors on the Company’s ability to attract deposits or make loans, volatility in capital and credit markets, reputational risk, the impact of hurricanes or other adverse weather events, any requirement that the Company write down goodwill or other intangible assets, diversification in the types of financial services the Company offers, the Company’s ability to adapt its products and services to evolving industry standards and consumer preferences, competition with other financial services companies, risks in connection with completed or potential acquisitions, the Company’s growth strategy, interruptions or breaches in the Company’s information system security, the failure of certain third party vendors to perform, unfavorable ratings by rating agencies, dilution caused by the Company’s issuance of any additional shares of its common stock to raise capital or acquire other banks, bank holding companies, financial holding companies and insurance agencies, other factors generally understood to affect the assets, business, cash flows, financial condition, liquidity, prospects and/or results of operations of financial services companies and other factors detailed from time to time in the Company’s press releases and filings with the Securities and Exchange Commission. Forward-looking statements speak only as of the date that they were made, and, except as required by law, the Company does not undertake any obligation to update or revise forward-looking statements to reflect events or circumstances after the date of this this presentation and the accompanying slides. Unless otherwise noted, any quotes in this this presentation and the accompanying slides can be attributed to company management. 2

2

About BancorpSouth, Inc. (NYSE:BXS)

Total assets of $13.0 billion

Headquartered in Tupelo, MS

253 banking locations reaching throughout an 8-state footprint

Customer-focused business model with comprehensive line of financial products and banking services for individuals and small to mid-size businesses

Strong core capital base consisting of 100% common equity

Market capitalization of $2.0 billion

Market Capitalization as of July 31, 2014 3 All Other Data as of June 30, 2014

3

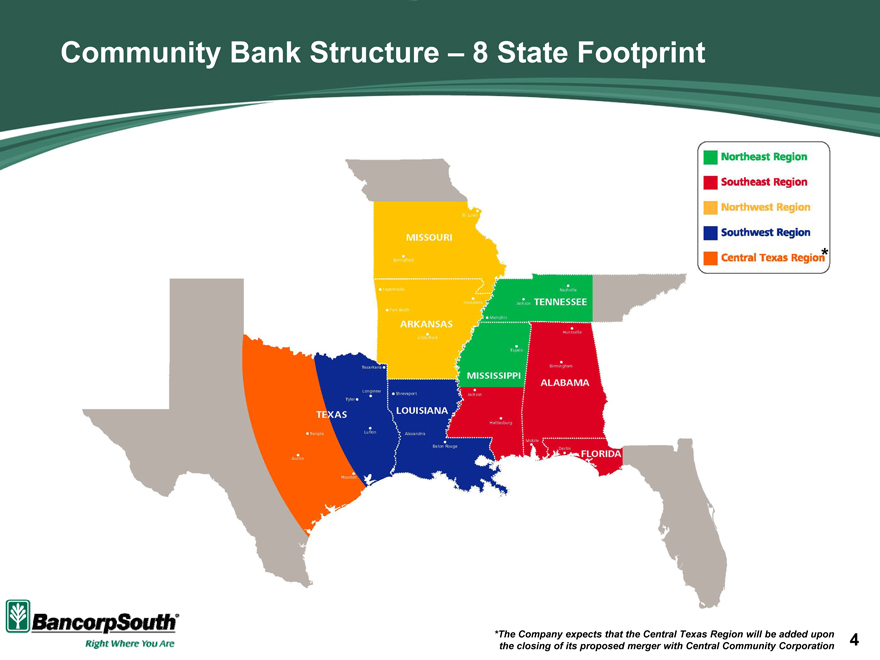

Community Bank Structure – 8 State Footprint

*Northeast Region

Southeast Region

Northwest Region

Southwest Region

Central Texas Region

*The Company expects that the Central Texas Region will be added upon 4 the closing of its proposed merger with Central Community Corporation

4

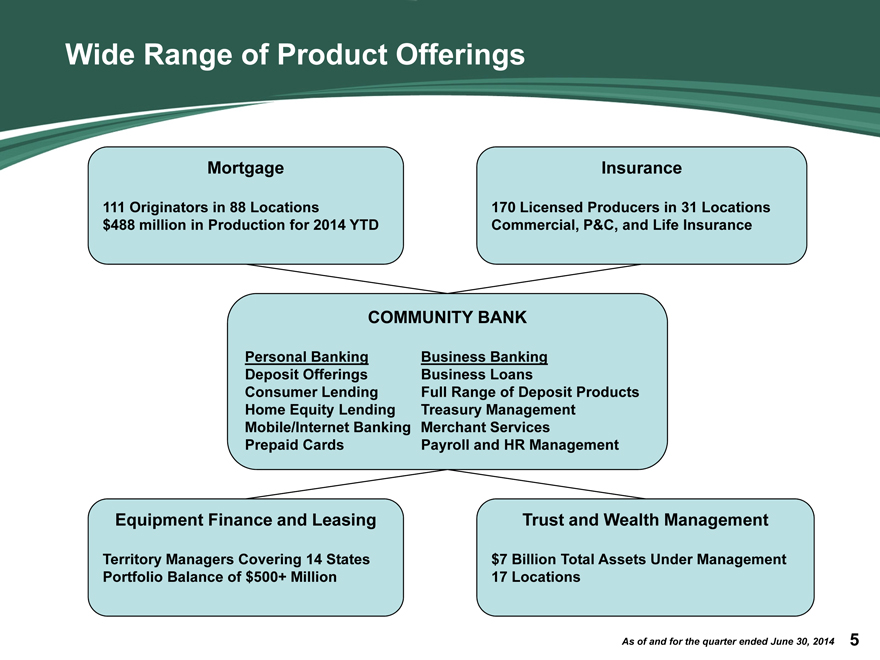

Wide Range of Product Offerings

Mortgage Insurance

111 Originators in 88 Locations 170 Licensed Producers in 31 Locations $488 million in Production for 2014 YTD Commercial, P&C, and Life Insurance

COMMUNITY BANK

Personal Banking Business Banking Deposit Offerings Business Loans

Consumer Lending Full Range of Deposit Products Home Equity Lending Treasury Management Mobile/Internet Banking Merchant Services Prepaid Cards Payroll and HR Management

Equipment Finance and Leasing Trust and Wealth Management

Territory Managers Covering 14 States $7 Billion Total Assets Under Management Portfolio Balance of $500+ Million 17 Locations

As of and for the quarter ended June 30, 2014 5

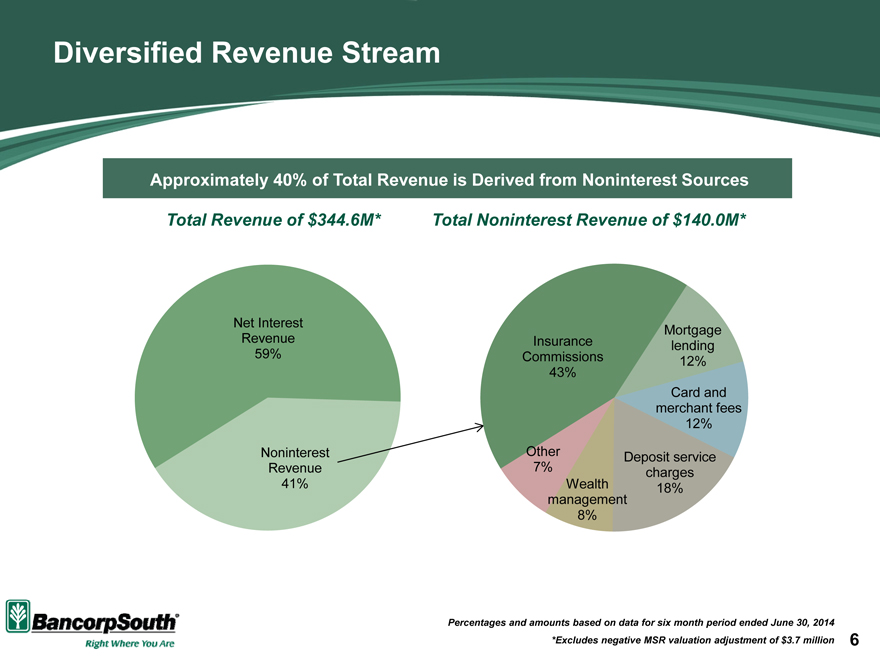

Diversified Revenue Stream

Approximately 40% of Total Revenue is Derived from Noninterest Sources

Total Revenue of $344.6M* Total Noninterest Revenue of $140.0M*

Net Interest Mortgage

Revenue Insurance lending

59% Commissions 12%

43%

Card and

merchant fees

12%

Noninterest Other Deposit service

Revenue 7% charges

41% Wealth 18%

management

8%

Percentages and amounts based on data for six month period ended June 30, 2014 *Excludes negative MSR valuation adjustment of $3.7 million 6

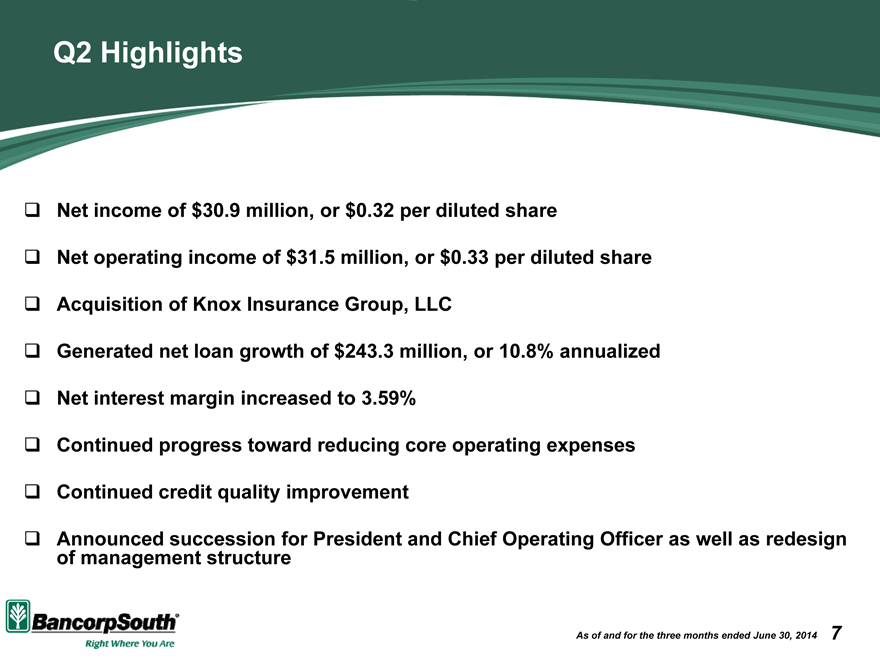

Q2 Highlights

Net income of $30.9 million, or $0.32 per diluted share

Net operating income of $31.5 million, or $0.33 per diluted share

Acquisition of Knox Insurance Group, LLC

Generated net loan growth of $243.3 million, or 10.8% annualized Net interest margin increased to 3.59% Continued progress toward reducing core operating expenses Continued credit quality improvement

Announced succession for President and Chief Operating Officer as well as redesign of management structure

As of and for the three months ended June 30, 2014 7

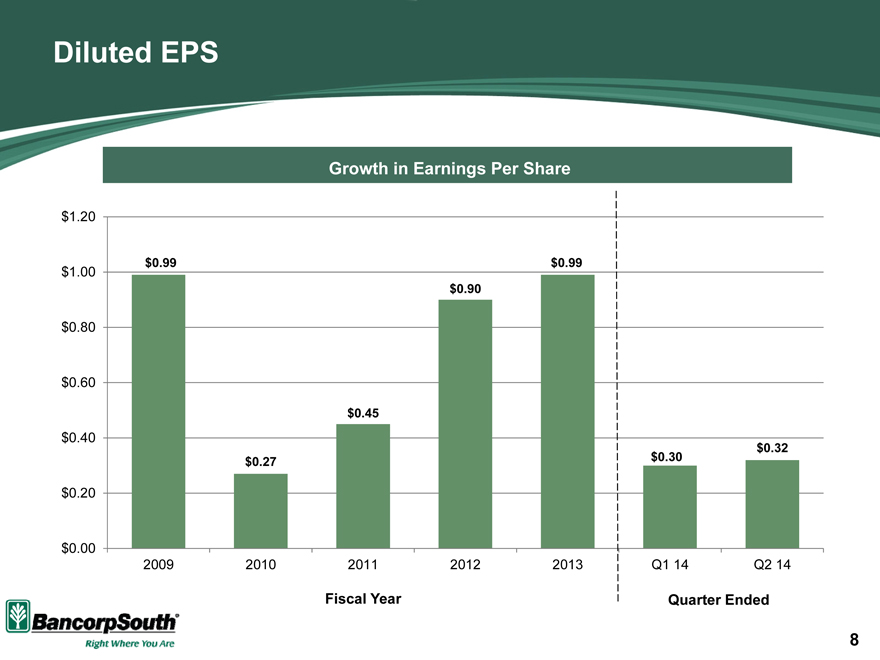

Diluted EPS

Growth in Earnings Per Share

$ 1.20

$ 0.99 $0.99

$ 1.00

$0.90

$ 0.80

$ 0.60

$ 0.45

$ 0.40

$ 0.32

$0.27 $0.30

$ 0.20

$ 0.00

2009 2010 2011 2012 2013 Q1 14 Q2 14

Fiscal Year Quarter Ended

8

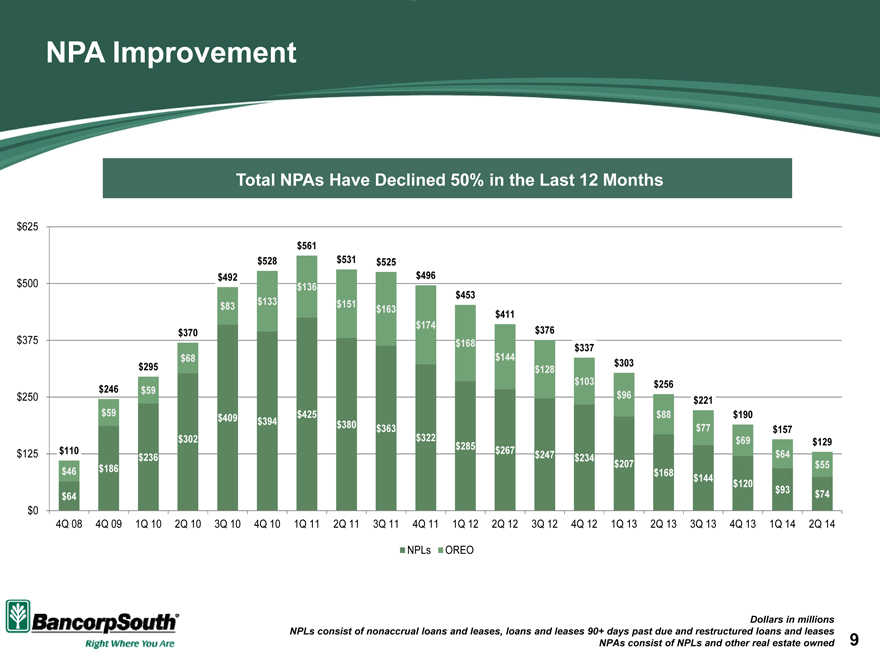

NPA Improvement

Total NPAs Have Declined 50% in the Last 12 Months

$625

$ 561

$ 528 $ 531 $ 525

$492 $ 496

$500 $ 136

$ 133 $ 453

$83 $ 151 $ 163 $ 411

$ 174

$370 $ 376

$375 $ 168

$ 337

$68 $ 144

$295 $ 128 $303

$246 $59 $ 103 $256

$250 $96 $221

$59 $409 $ 425 $88 $190

$ 394

$ 380 $ 363 $77 $157

$302 $ 322 $ 285 $69 $129

$125 $110 $236 $ 267 $ 247 $ 234 $64

$46 $186 $207 $168 $55

$144 $120

$64 $93 $74

$0

4Q 08 4Q 09 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 3Q 12 4Q 12 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14

NPLs OREO

Dollars in millions NPLs consist of nonaccrual loans and leases, loans and leases 90+ days past due and restructured loans and leases 9 NPAs consist of NPLs and other real estate owned

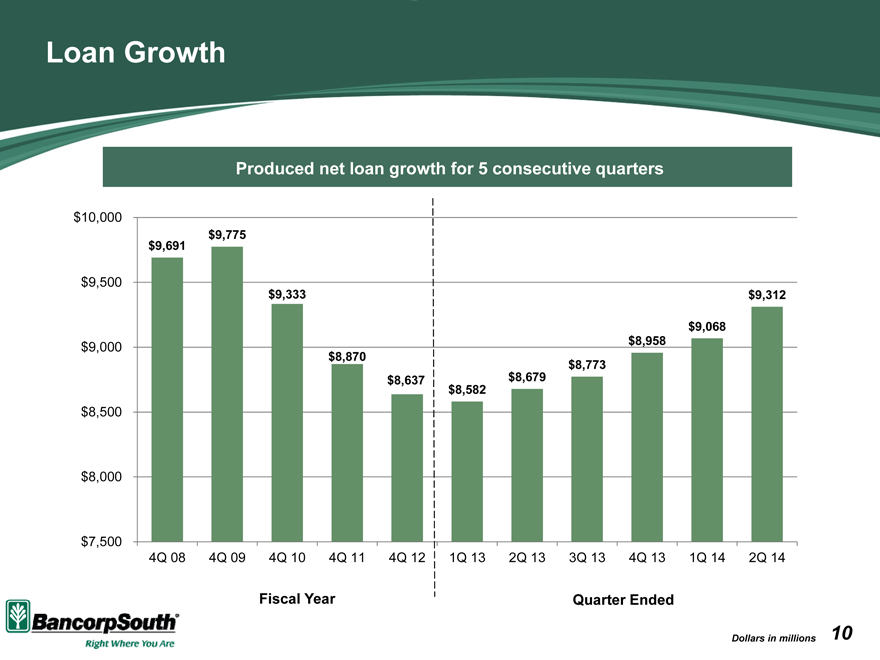

Loan Growth

Produced net loan growth for 5 consecutive quarters

$10,000

$9,775

$9,691

$9,500

$9,333 $9,312

$9,068

$9,000 $8,958

$8,870 $8,773

$8,637 $8,679

$8,582

$8,500

$8,000

$7,500

4Q 08 4Q 09 4Q 10 4Q 11 4Q 12 1Q 13 2Q 13 3Q 13 4Q 13 1Q 14 2Q 14

Fiscal Year Quarter Ended

Dollars in millions 10

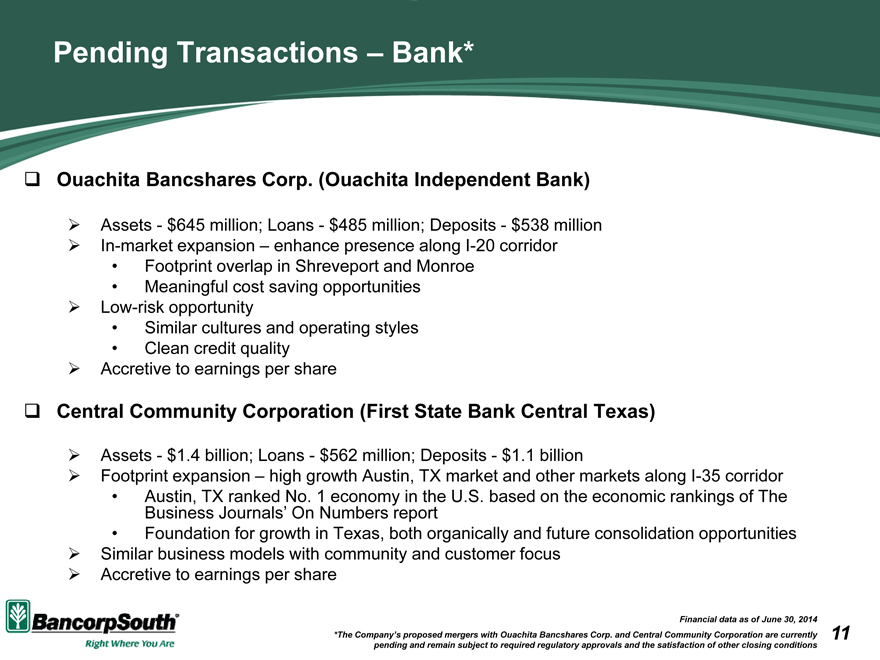

Pending Transactions – Bank*

Ouachita Bancshares Corp. (Ouachita Independent Bank)

Assets—$645 million; Loans—$485 million; Deposits—$538 million??In-market expansion – enhance presence along I-20 corridor

Footprint overlap in Shreveport and Monroe

Meaningful cost saving opportunities Low-risk opportunity

Similar cultures and operating styles

Clean credit quality Accretive to earnings per share

Central Community Corporation (First State Bank Central Texas)

Assets—$1.4 billion; Loans—$562 million; Deposits—$1.1 billion

Footprint expansion – high growth Austin, TX market and other markets along I-35 corridor

Austin, TX ranked No. 1 economy in the U.S. based on the economic rankings of The Business Journals’ On Numbers report

Foundation for growth in Texas, both organically and future consolidation opportunities Similar business models with community and customer focus Accretive to earnings per share

Financial data as of June 30, 2014 *The Company’s proposed mergers with Ouachita Bancshares Corp. and Central Community Corporation are currently 11 pending and remain subject to required regulatory approvals and the satisfaction of other closing conditions

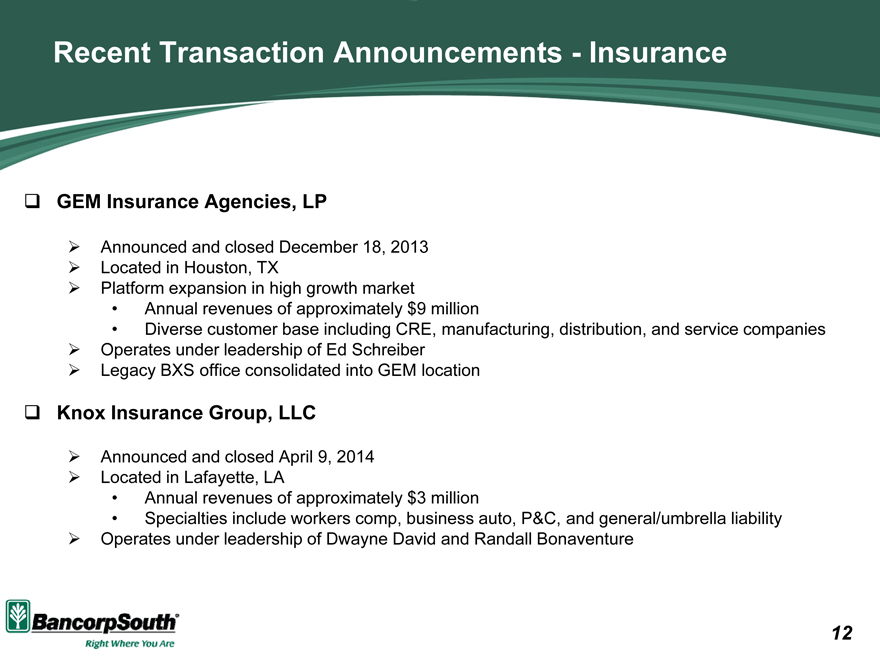

Recent Transaction Announcements—Insurance

GEM Insurance Agencies, LP

Announced and closed December 18, 2013 Located in Houston, TX

Platform expansion in high growth market

Annual revenues of approximately $9 million

Diverse customer base including CRE, manufacturing, distribution, and service companies Operates under leadership of Ed Schreiber Legacy BXS office consolidated into GEM location

Knox Insurance Group, LLC

Announced and closed April 9, 2014 Located in Lafayette, LA

Annual revenues of approximately $3 million

Specialties include workers comp, business auto, P&C, and general/umbrella liability Operates under leadership of Dwayne David and Randall Bonaventure

12

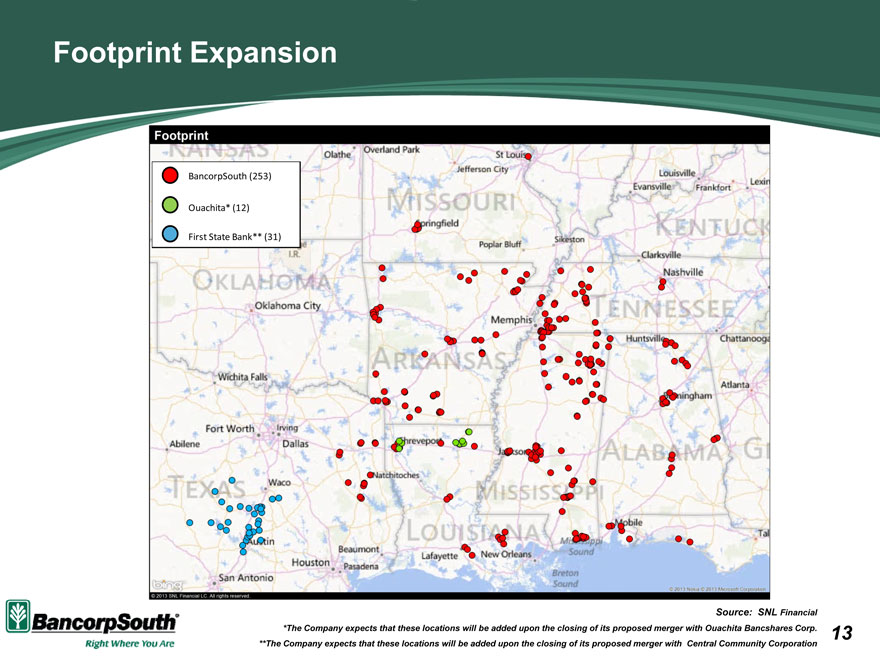

Footprint Expansion

BancorpSouth (253) Ouachita* (12) First State Bank** (31)

Source: SNL Financial

*The Company expects that these locations will be added upon the closing of its proposed merger with Ouachita Bancshares Corp. 13 **The Company expects that these locations will be added upon the closing of its proposed merger with Central Community Corporation

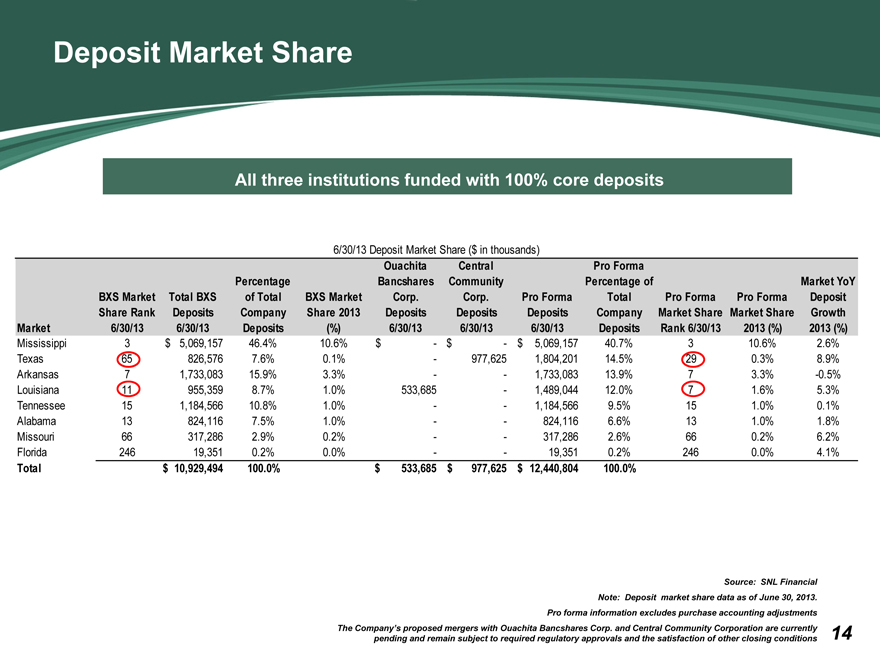

Deposit Market Share

All three institutions funded with 100% core deposits

6/30/13 Deposit Market Share ($ in thousands)

Ouachita Central Pro Forma

Percentage Bancshares Community Percentage of Market YoY

BXS Market Total BXS of Total BXS Market Corp. Corp. Pro Forma Total Pro Forma Pro Forma Deposit

Share Rank Deposits Company Share 2013 Deposits Deposits Deposits Company Market Share Market Share Growth

Market 6/30/13 6/30/13 Deposits (%) 6/30/13 6/30/13 6/30/13 Deposits Rank 6/30/13 2013 (%) 2013 (%)

Mississippi 3 $ 5,069,157 46.4% 10.6% $ — $ — $ 5,069,157 40.7% 3 10.6% 2.6%

Texas 65 826,576 7.6% 0.1% — 977,625 1,804,201 14.5% 29 0.3% 8.9%

Arkansas 7 1,733,083 15.9% 3.3% — — 1,733,083 13.9% 7 3.3% -0.5%

Louisiana 11 955,359 8.7% 1.0% 533,685 — 1,489,044 12.0% 7 1.6% 5.3%

Tennessee 15 1,184,566 10.8% 1.0% — — 1,184,566 9.5% 15 1.0% 0.1%

Alabama 13 824,116 7.5% 1.0% — — 824,116 6.6% 13 1.0% 1.8%

Missouri 66 317,286 2.9% 0.2% — — 317,286 2.6% 66 0.2% 6.2%

Florida 246 19,351 0.2% 0.0% — — 19,351 0.2% 246 0.0% 4.1%

Total $ 10,929,494 100.0% $ 533,685 $ 977,625 $ 12,440,804 100.0%

Source: SNL Financial Note: Deposit market share data as of June 30, 2013.

Pro forma information excludes purchase accounting adjustments

The Company’s proposed mergers with Ouachita Bancshares Corp. and Central Community Corporation are currently 14 pending and remain subject to required regulatory approvals and the satisfaction of other closing conditions 14

Summary

Non-Financial Highlights

Extension of merger agreements President and COO succession Management restructure

Financial Highlights

Improvement in GAAP and operating earnings Meaningful loan growth Steady net interest margin Progress toward reducing expenses Continued credit quality improvement

Current Focus

Attract quality producers and continue to grow Continue to drive expenses out of the system

Remediate regulatory concerns regarding Bank Secrecy Act and anti-money laundering processes

15

Appendix

16

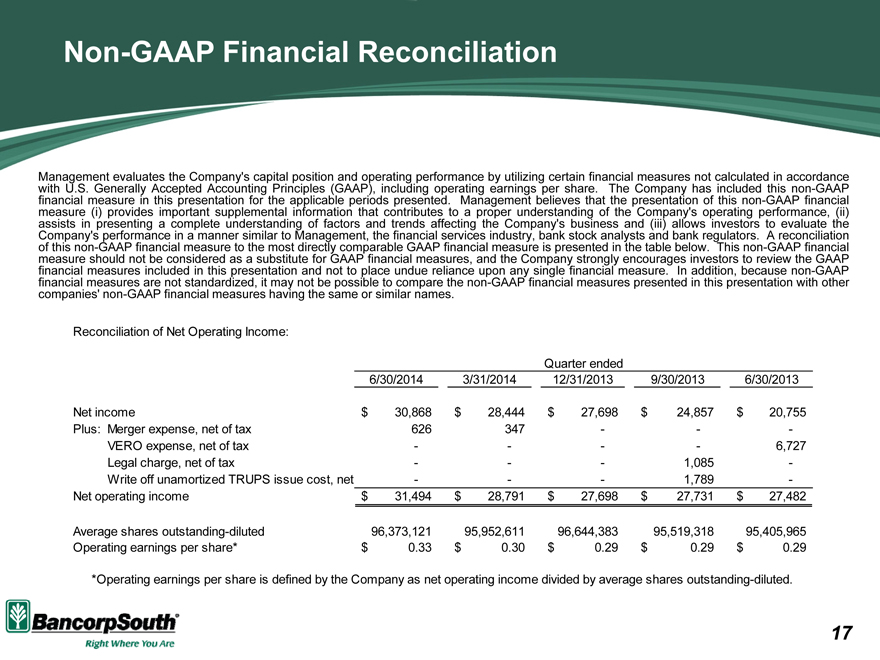

Non-GAAP Financial Reconciliation

Management evaluates the Company’s capital position and operating performance by utilizing certain financial measures not calculated in accordance with U.S. Generally Accepted Accounting Principles (GAAP), including operating earnings per share. The Company has included this non-GAAP financial measure in this presentation for the applicable periods presented. Management believes that the presentation of this non-GAAP financial measure (i) provides important supplemental information that contributes to a proper understanding of the Company’s operating performance, (ii) assists in presenting a complete understanding of factors and trends affecting the Company’s business and (iii) allows investors to evaluate the Company’s performance in a manner similar to Management, the financial services industry, bank stock analysts and bank regulators. A reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure is presented in the table below. This non-GAAP financial measure should not be considered as a substitute for GAAP financial measures, and the Company strongly encourages investors to review the GAAP financial measures included in this presentation and not to place undue reliance upon any single financial measure. In addition, because non-GAAP financial measures are not standardized, it may not be possible to compare the non-GAAP financial measures presented in this presentation with other companies’ non-GAAP financial measures having the same or similar names.

Reconciliation of Net Operating Income:

Quarter ended

6/30/2014 3/31/2014 12/31/2013 9/30/2013 6/30/2013

Net income $ 30,868 $ 28,444 $ 27,698 $ 24,857 $ 20,755

Plus: Merger expense, net of tax 626 347 — — -

VERO expense, net of tax — — — — 6,727

Legal charge, net of tax — — — 1,085 -

Write off unamortized TRUPS issue cost, net — — — 1,789 -

Net operating income $ 31,494 $ 28,791 $ 27,698 $ 27,731 $ 27,482

Average shares outstanding-diluted 96,373,121 95,952,611 96,644,383 95,519,318 95,405,965

Operating earnings per share* $ 0.33 $ 0.30 $ 0.29 $ 0.29 $ 0.29

*Operating earnings per share is defined by the Company as net operating income divided by average shares outstanding-diluted.

17

BancorpSouth’s common stock is listed on the New York Stock Exchange under the symbol BXS. Additional information can be found at www.bancorpsouth.com.*

Investor Inquiries:

Will Fisackerly

Director of Corporate Finance BancorpSouth, Inc.

662-680-2475 will.fisackerly@bxs.com

*Reference to BancorpSouth’s website does not constitute incorporation by reference of the information contained on the website and is not, and should not, be deemed a part of this presentation