Exhibit 99.1

23 rd Annual Insurance Conference CFA Society of NY and Raymond James THE IHC GROUP: JOSH DAU AND DAVE KELLER MARCH 19, 2019

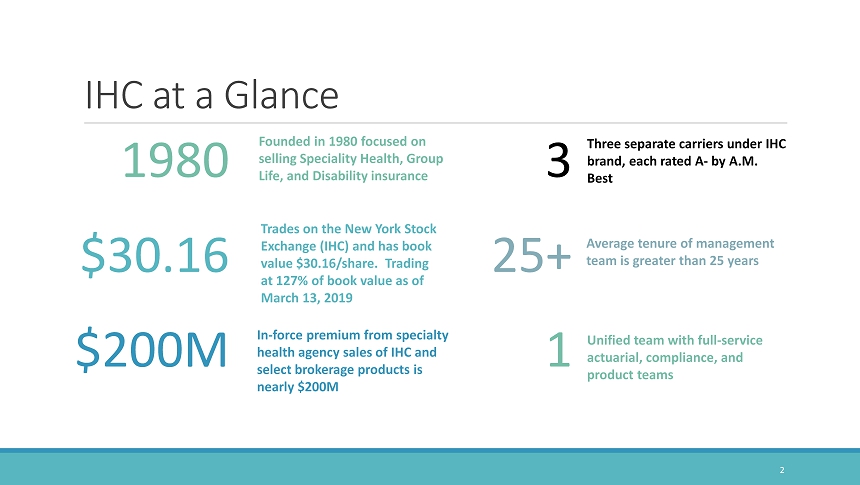

IHC at a Glance 2 Founded in 1980 focused on selling Speciality Health, Group Life, and Disability insurance $30.16 1980 3 $200M 25+ 1 Trades on the New York Stock Exchange (IHC) and has book value $30.16/share. Trading at 127% of book value as of March 13, 2019 In - force premium from specialty health agency sales of IHC and select brokerage products is nearly $200M Three separate carriers under IHC brand, each rated A - by A.M. Best Average tenure of management team is greater than 25 years Unified team with full - service actuarial, compliance, and product teams

IHC Corporate Structure Two Primary Business Segments: Focus In Select Niches Specialty Health DBL/PFL and Group Life/LTD 1 2 Standard Security Life Insurance Company (NY) Top 6 writer of DBL and PFL in NY Madison National Life Insurance Company, Inc. (WI) Top writer of Long - Term Disability for school districts in the Upper Midwest Independence American Insurance Company (DE) Top 3 writer of Short - Term Limited Duration Insurance (STM) and top 6 writer of Pet Insurance 3

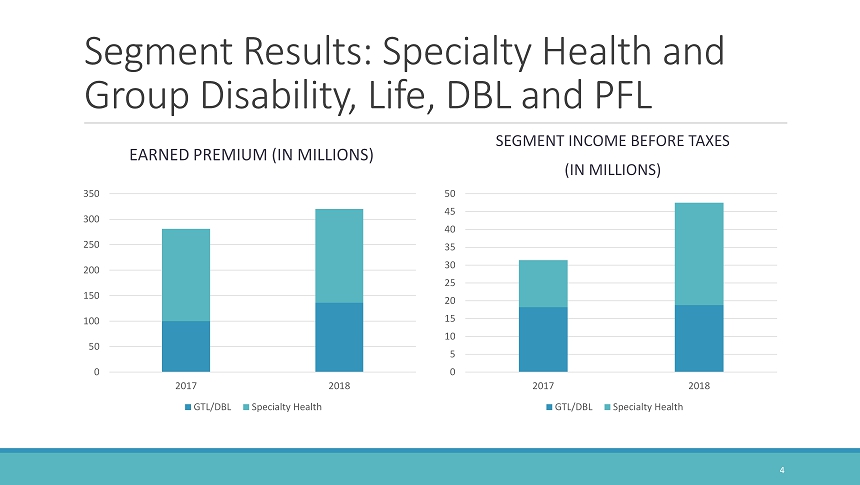

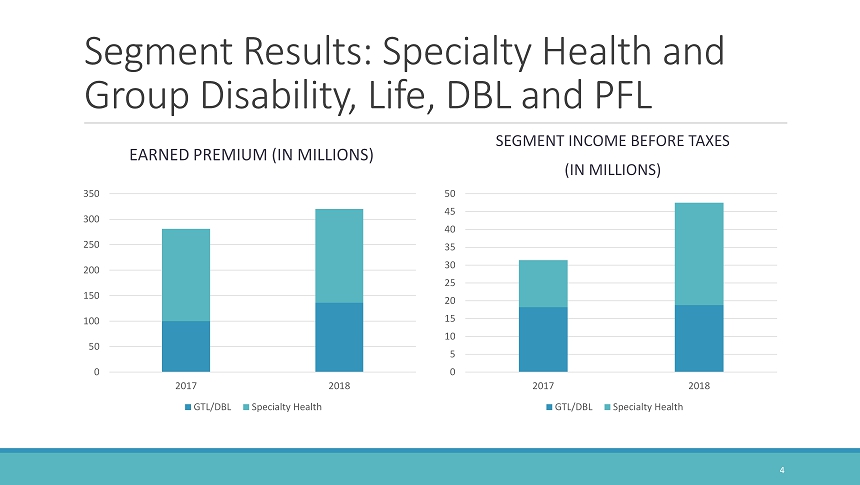

Segment Results: Specialty Health and Group Disability, Life, DBL and PFL EARNED PREMIUM (IN MILLIONS) 0 50 100 150 200 250 300 350 2017 2018 GTL/DBL Specialty Health SEGMENT INCOME BEFORE TAXES (IN MILLIONS) 0 5 10 15 20 25 30 35 40 45 50 2017 2018 GTL/DBL Specialty Health 4

▪ Offer longer duration Short Term Medical Insurance (STM); up to 36 months in certain states ▪ Continue to Enhance lead analytic capabilities for company - owned call centers ▪ Tap into the growing market for Ancillary Plans to supplement ACA coverage ▪ Achieve continued growth of NY DBL and PFL ▪ Expand Pet Insurance distribution Short Term Medical Group Life and Disability Hospital Indemnity Pet Insurance Top Growth Opportunities 5

Differentiating Through Technology ▪ Current quoting and enrollment platform facilitates cross - selling, top performing distributions including our call centers averaging of 2.5 policies per enrolled member ▪ Recently acquired Web - Based Entity (WBE) My1HR to provide agency more access to ACA plans ▪ Comparison tools enable producers to determine if individual ACA (with HRA), or employer - sponsored ACA is the best avenue for the employer ▪ Launching on - line enrollment service for small employer groups 6 Individual Products Employer Groups

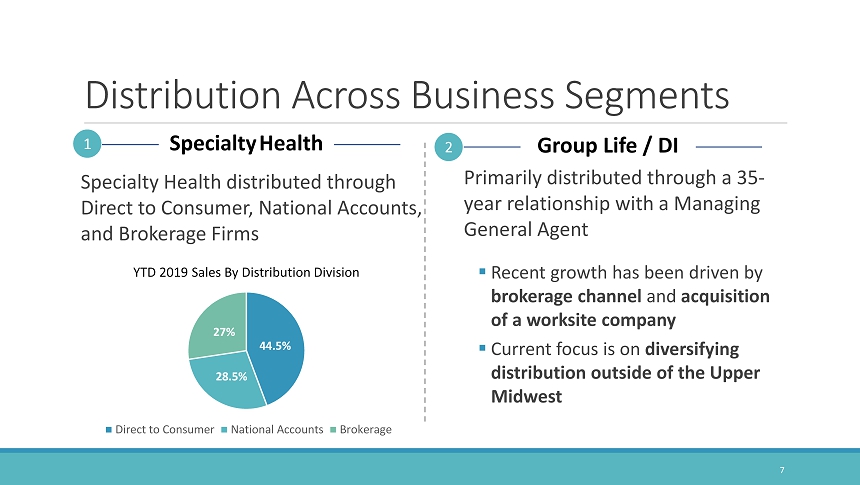

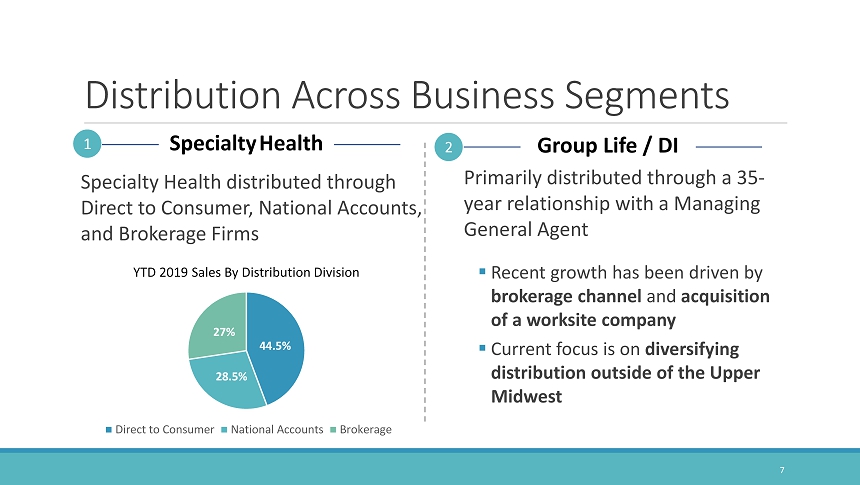

Distribution Across Business Segments Specialty Health distributed through Direct to Consumer, National Accounts, and Brokerage Firms 44.5% 28.5% 27% YTD 2019 Sales By Distribution Division Direct to Consumer National Accounts Brokerage Primarily distributed through a 35 - year relationship with a Managing General Agent ▪ Recent growth has been driven by brokerage channel and acquisition of a worksite company ▪ Current focus is on diversifying distribution outside of the Upper Midwest 1 2 Specialty Health Group Life / DI 7

Specialty Benefits Distribution : Direct to Consumer ▪ Call center has expanded from 10 seats to approximately 50 seats by growing relationships with insurance carriers, financial services firms, P&C agents, and affinity groups who want IHC to manage their health sales ▪ Moving into the over 65 and small group ACA market in Q3 2019 ▪ Leveraging My1HR to improve on cross - sell opportunities with IHC carriers and best in class partners ▪ Over half of our leads are organic/affinity groups which drives down the cost of customer acquisition ▪ Career agency focused on individual and family insurance products 8

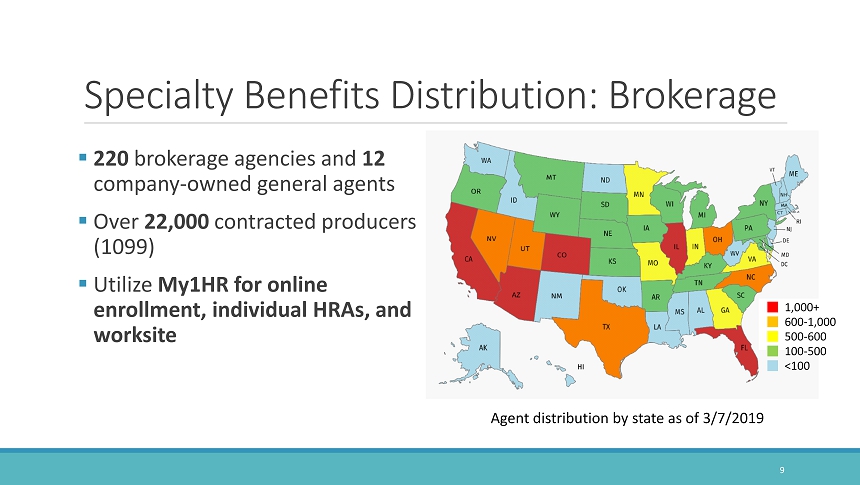

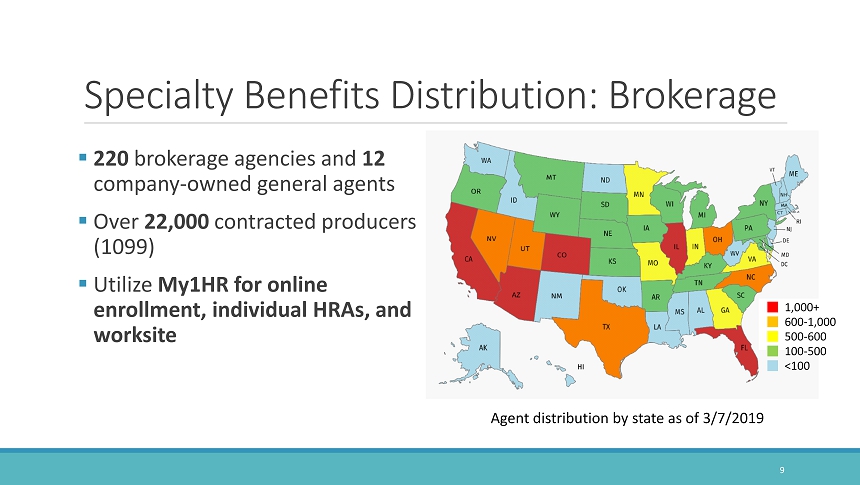

Specialty Benefits Distribution : Brokerage ▪ 220 brokerage agencies and 12 company - owned general agents ▪ Over 22,000 contracted producers (1099) ▪ Utilize My1HR for online enrollment, individual HRAs, and worksite 9 Agent distribution by state as of 3/7/2019 1,000+ 600 - 1,000 500 - 600 100 - 500 <100

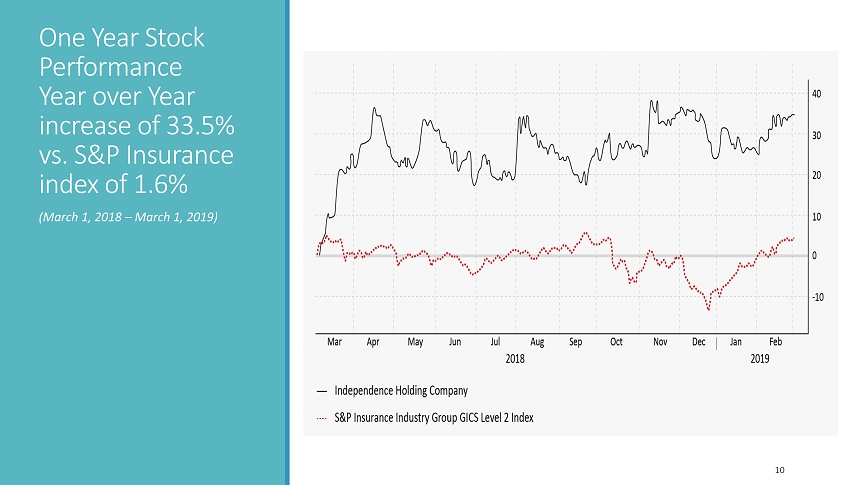

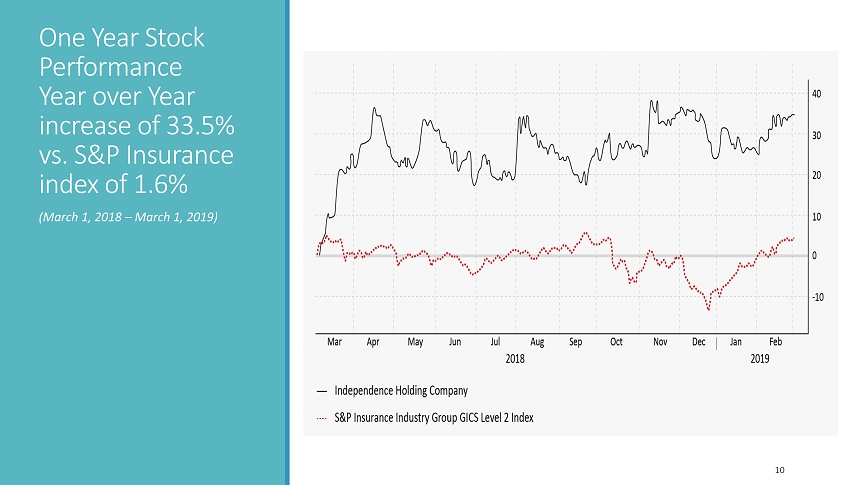

One Year Stock Performance Year over Year increase of 33.5% vs. S&P Insurance index of 1.6% (March 1, 2018 – March 1, 2019) 10

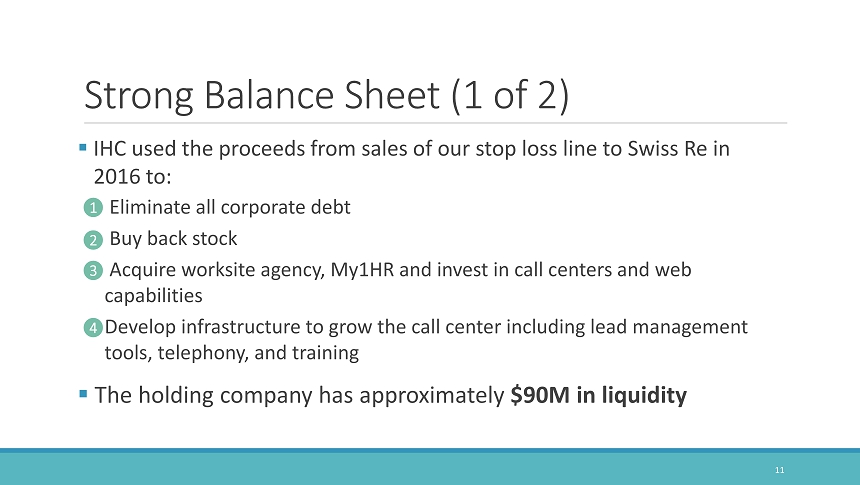

Strong Balance Sheet (1 of 2) ▪ IHC used the proceeds from sales of our stop loss line to Swiss Re in 2016 to: ▪ Eliminate all corporate debt ▪ Buy back stock ▪ Acquire worksite agency, My1HR and invest in call centers and web capabilities ▪ Develop infrastructure to grow the call center including lead management tools, telephony, and training ▪ The holding company has approximately $90M in liquidity 11 1 2 3 4

Strong Balance Sheet (2 of 2) ▪ Market capitalization of $ 574M as of March 13, 2019 ▪ All three carriers have capital well in excess of what is required to support expected growth ▪ RBC Level ▪ SSL: 4,119% ▪ MNL: 798% ▪ IAIC: 685% ▪ No debt at any level within the organization 12

13 FORWARD - LOOKING STATEMENTS Certain statements in this presentation are “forward - looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, cash flows, plans, objectives, future performance and business of IHC. Forward - looking statements by their nature address matters that are, to differing degrees, uncertain. With respect to IHC, particular uncertainties that could adversely or positively affect our future result s include, but are not limited to, economic conditions in the markets in which we operate, new federal or state governmental regulation, our ability to effectively operate, integrate and leverage any past or future strategic acquisition, and other fa cto rs which can be found in our news releases and filings with the Securities and Exchange Commission. These uncertainties may cause IHC’s actual future results to be materially different than those expressed in this presentatio n. IHC does not undertake to update its forward - looking statements.