UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3455

North Carolina Capital Management Trust

(Exact name of registrant as specified in charter)

82 Devonshire St., Boston, Massachusetts 02109

(Address of principal executive offices) (Zip code)

Eric D. Roiter, Secretary

82 Devonshire St.

Boston, Massachusetts 02109

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | June 30 |

| |

Date of reporting period: | December 31, 2005 |

Item 1. Reports to Stockholders

Cash Portfolio

Term Portfolio

|

Semiannual Report December 31, 2005

|

| Contents | | | | |

| |

| THE NORTH CAROLINA CAPITAL MANAGEMENT TRUST |

| Shareholder Expense Example | | 3 | | An example of shareholder expenses. |

| Cash Portfolio: | | | | |

| Investment Changes | | 4 | | |

| Investments | | 5 | | A complete list of the fund’s investments. |

| Financial Statements | | 10 | | Statements of assets and liabilities, operations, and changes |

| | | | | in net assets, as well as financial highlights. |

| Term Portfolio: | | | | |

| Investment Changes | | 14 | | |

| Investments | | 15 | | A complete list of the fund’s investments with their |

| | | | | market values. |

| Financial Statements | | 16 | | Statements of assets and liabilities, operations, and changes |

| | | | | in net assets, as well as financial highlights. |

| Notes | | 20 | | Notes to the financial statements. |

| Proxy Voting Results | | 23 | | |

| Board Approval of Investment | | 24 | | |

| Advisory Contracts and | | | | |

| Management Fees | | | | |

| | NOT FDIC INSURED · MAY LOSE VALUE · NO BANK GUARANTEE

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N Q. Forms

N Q are available on the SEC’s website at http://www.sec.gov. A fund’s Forms N Q may be reviewed and copied at the SEC’s Public Reference

Room in Washington, DC. Information regarding the operation of the SEC’s Public Reference Room may be obtained by calling

1-800-SEC-0330.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This

report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

Neither the funds nor Fidelity Distributors Corporation is a bank.

|

Semiannual Report 2

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2005 to December 31, 2005).

Actual Expenses

The first line of the table below for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below for each fund provides information about hypothetical account values and hypothetical expenses based on a fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | Expenses Paid |

| | | | | | | | | | | During Period* |

| | | Beginning | | Ending | | | | July 1, 2005 |

| | | Account Value | | Account Value | | | | to December 31, |

| | | July 1, 2005 | | December 31, 2005 | | | | 2005 |

| Cash Portfolio | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ 1,018.10 | | | | $ 1.17 |

| HypotheticalA | | $ 1,000.00 | | $ 1,024.05 | | | | $ 1.17 |

| Term Portfolio | | | | | | | | | | |

| Actual | | $ 1,000.00 | | $ 1,012.30 | | | | $ 1.37 |

| HypotheticalA | | $ 1,000.00 | | $ 1,023.84 | | | | $ 1.38 |

| | A 5% return per year before expenses

* Expenses are equal to each Fund’s annualized expense ratio (shown in the table below); multiplied by the average ac

count value over the period, multiplied by 184/365 (to reflect the one-half year period).

|

| | | Annualized |

| | | Expense Ratio |

| Cash Portfolio | | 23% |

| Term Portfolio | | 27% |

3 Semiannual Report

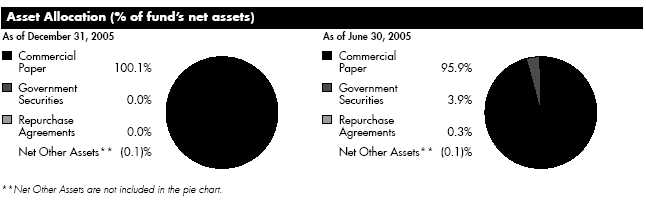

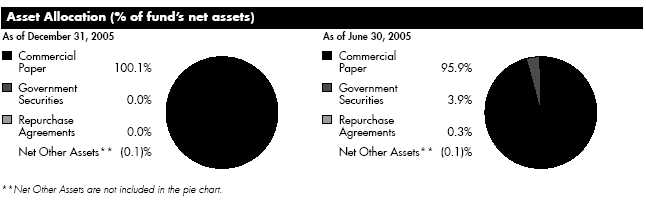

| The North Carolina Capital Management Trust: Cash Portfolio | | | | | | |

| Investment Changes | | | | | | |

| |

| Maturity Diversification | | | | | | |

| Days | | % of fund’s | | % of fund’s | | % of fund’s |

| | | investments | | investments | | investments |

| | | 12/31/05 | | 6/30/05 | | 12/31/04 |

| 0 – 30 | | 65.0 | | 58.8 | | 47.4 |

| 31 – 90 | | 30.2 | | 41.2 | | 46.7 |

| 91 – 180 | | 3.0 | | 0.0 | | 5.9 |

| 181 – 397 | | 1.8 | | 0.0 | | 0.0 |

| Weighted Average Maturity | | | | | | |

| | | 12/31/05 | | 6/30/05 | | 12/31/04 |

| Cash Portfolio | | 33 Days | | 29 Days | | 38 Days |

| All Taxable Money Market Funds Average* | | 36 Days | | 36 Days | | 38 Days |

*Source: iMoneyNet, Inc.

Semiannual Report 4

| The North Carolina Capital Management Trust: Cash Portfolio | | | | | | |

| Investments December 31, 2005 (Unaudited) | | | | | | |

| Showing Percentage of Net Assets | | | | | | |

| |

| Commercial Paper (c) 100.1% | | | | | | |

| Due Date | | Annualized | | | | Principal | | Value |

| | | Yield at Time of | | | | Amount | | Note 1) |

| | | Purchase | | | | | | |

| Alliance & Leicester PLC | | | | | | | | |

| 2/28/06 | | 4.38% | | $ | | 7,000,000 | | $ 6,951,167 |

| Bank of America Corp. | | | | | | | | |

| 2/1/06 | | 4.31 | | | | 50,000,000 | | 49,815,722 |

| Bank of Ireland | | | | | | | | |

| 1/23/06 | | 4.25 | | | | 75,000,000 | | 74,806,583 |

| 7/19/06 | | 4.02 | | | | 75,000,000 | | 73,400,384 |

| Barclays U.S. Funding Corp. | | | | | | | | |

| 1/25/06 | | 4.27 | | | | 90,000,000 | | 89,745,600 |

| 1/30/06 | | 4.31 | | | | 100,000,000 | | 99,654,819 |

| Bear Stearns Companies, Inc. | | | | | | | | |

| 1/3/06 | | 4.29 | | | | 200,000,000 | | 199,952,332 |

| BMW U.S. Capital Corp. | | | | | | | | |

| 1/3/06 | | 4.13 | | | | 10,200,000 | | 10,197,663 |

| Capital One Multi Asset Execution Trust | | | | | | | | |

| 1/12/06 | | 4.35 | | | | 26,900,000 | | 26,864,410 |

| 2/1/06 | | 4.25 | | | | 15,000,000 | | 14,945,750 |

| Charta LLC | | | | | | | | |

| 1/3/06 | | 4.17 | | | | 160,000,000 | | 159,962,933 |

| 1/20/06 | | 4.25 | | | | 10,000,000 | | 9,977,728 |

| 1/24/06 | | 4.25 | | | | 30,000,000 | | 29,919,117 |

| CIT Group, Inc. | | | | | | | | |

| 2/8/06 | | 4.27 | | | | 47,500,000 | | 47,288,414 |

| Citibank Credit Card Master Trust I (Dakota Certificate Program) | | | | | | | | |

| 1/19/06 | | 4.27 | | | | 5,000,000 | | 4,989,400 |

| 1/23/06 | | 4.28 | | | | 20,000,000 | | 19,948,056 |

| 1/24/06 | | 4.30 | | | | 15,000,000 | | 14,959,079 |

| 2/1/06 | | 4.28 | | | | 15,000,000 | | 14,945,169 |

| 2/1/06 | | 4.33 | | | | 10,000,000 | | 9,962,972 |

| 2/2/06 | | 4.35 | | | | 20,000,000 | | 19,923,200 |

| Citigroup Funding, Inc. | | | | | | | | |

| 1/19/06 | | 4.35 | | | | 100,000,000 | | 99,783,500 |

| 1/23/06 | | 4.28 | | | | 5,000,000 | | 4,987,014 |

| 1/24/06 | | 4.28 | | | | 15,000,000 | | 14,959,271 |

| 1/25/06 | | 4.28 | | | | 5,000,000 | | 4,985,833 |

| 1/26/06 | | 4.30 | | | | 10,000,000 | | 9,970,347 |

| 1/31/06 | | 4.30 | | | | 15,000,000 | | 14,946,625 |

| 3/14/06 | | 4.45 | | | | 50,000,000 | | 49,560,000 |

See accompanying notes which are an integral part of the financial statements. | | | | | | |

| |

| | | 5 | | | | Semiannual Report |

| The North Carolina Capital Management Trust: Cash Portfolio | | | | | | |

| Investments (Unaudited) - continued | | | | | | | | |

| |

| |

| Due Date | | | | Annualized | | Principal | | Value |

| | | | | Yield at Time of | | Amount | | (Note 1) |

| | | | | Purchase | | | | |

| Credit Suisse First Boston New York Branch | | | | | | | | |

| 1/17/06 | | | | 4.33% | | $ 150,000,000 | | $149,712,533 |

| Dresdner U.S. Finance, Inc. | | | | | | | | |

| 3/6/06 | | | | 4.43 | | 10,000,000 | | 9,922,116 |

| Emerald (MBNA Credit Card Master Note Trust) | | | | | | | | |

| 1/5/06 | | | | 4.08 | | 10,000,000 | | 9,995,511 |

| 1/24/06 | | | | 4.26 | | 5,000,000 | | 4,986,519 |

| 1/24/06 | | | | 4.35 | | 5,000,000 | | 4,986,200 |

| 1/25/06 | | | | 4.27 | | 10,000,000 | | 9,971,800 |

| 1/26/06 | | | | 4.28 | | 10,000,000 | | 9,970,556 |

| 1/26/06 | | | | 4.35 | | 5,000,000 | | 4,985,000 |

| 2/1/06 | | | | 4.30 | | 5,000,000 | | 4,981,658 |

| 2/1/06 | | | | 4.35 | | 5,000,000 | | 4,981,400 |

| 2/2/06 | | | | 4.36 | | 95,000,000 | | 94,634,356 |

| 2/7/06 | | | | 4.33 | | 10,000,000 | | 9,955,908 |

| 2/9/06 | | | | 4.38 | | 10,000,000 | | 9,952,875 |

| FCAR Owner Trust | | | | | | | | |

| 1/17/06 | | | | 4.29 | | 5,000,000 | | 4,990,511 |

| 1/17/06 | | | | 4.33 | | 15,000,000 | | 14,971,267 |

| 1/24/06 | | | | 4.33 | | 44,050,000 | | 43,928,703 |

| 3/15/06 | | | | 4.46 | | 65,000,000 | | 64,418,738 |

| 4/4/06 | | | | 4.52 | | 15,000,000 | | 14,827,175 |

| General Electric Capital Corp. | | | | | | | | |

| 1/31/06 | | | | 4.28 | | 50,000,000 | | 49,822,917 |

| 2/1/06 | | | | 4.30 | | 50,000,000 | | 49,816,153 |

| Giro Funding US Corp. | | | | | | | | |

| 1/24/06 | | | | 4.34 | | 15,000,000 | | 14,958,600 |

| 1/27/06 | | | | 4.35 | | 50,000,000 | | 49,843,639 |

| 2/8/06 | | | | 4.28 | | 65,640,000 | | 65,346,917 |

| Goldman Sachs Group, Inc. | | | | | | | | |

| 1/6/06 | | | | 4.29 (a)(b) | | 50,000,000 | | 50,000,000 |

| 3/6/06 | | | | 4.41 (a)(b) | | 100,000,000 | | 100,000,000 |

| Grampian Funding LLC | | | | | | | | |

| 3/28/06 | | | | 4.42 | | 35,000,000 | | 34,636,292 |

| 5/19/06 | | | | 4.54 | | 35,000,000 | | 34,403,629 |

| Greenwich Capital Holdings, Inc. | | | | | | | | |

| 1/3/06 | | | | 4.18 | | 18,470,000 | | 18,465,711 |

| 1/5/06 | | | | 4.27 (b) | | 100,000,000 | | 100,000,000 |

See accompanying notes which are an integral part of the financial statements. | | | | | | |

| |

| Semiannual Report | | 6 | | | | | | |

| Commercial Paper (c) continued | | | | | | | | |

| Due | | Annualized | | | | Principal | | Value |

| Date | | Yield at Time of | | | | Amount | | (Note 1) |

| | | Purchase | | | | | | |

| HSBC Finance Corp. | | | | | | | | |

| 1/31/06 | | 4.31% | | $ | | 5,000,000 | | $ 4,982,167 |

| 5/15/06 | | 4.52 | | | | 75,000,000 | | 73,766,083 |

| Market Street Funding Corp. | | | | | | | | |

| 1/26/06 | | 4.35 | | | | 10,000,000 | | 9,970,000 |

| 1/27/06 | | 4.33 | | | | 156,444,000 | | 155,958,154 |

| 2/27/06 | | 4.38 | | | | 10,000,000 | | 9,931,442 |

| Morgan Stanley | | | | | | | | |

| 1/3/06 | | 4.32 (b) | | | | 80,000,000 | | 80,000,000 |

| 1/3/06 | | 4.33 (b) | | | | 50,000,000 | | 50,000,000 |

| Motown Notes Program | | | | | | | | |

| 1/3/06 | | 4.06 | | | | 15,000,000 | | 14,996,650 |

| 1/4/06 | | 4.08 | | | | 8,000,000 | | 7,997,307 |

| 1/17/06 | | 4.34 | | | | 5,000,000 | | 4,990,411 |

| 1/18/06 | | 4.37 | | | | 5,000,000 | | 4,989,729 |

| 2/1/06 | | 4.28 | | | | 5,000,000 | | 4,981,788 |

| 2/2/06 | | 4.28 | | | | 15,000,000 | | 14,943,600 |

| 2/3/06 | | 4.27 | | | | 7,000,000 | | 6,972,858 |

| 2/6/06 | | 4.29 | | | | 5,000,000 | | 4,978,800 |

| 2/6/06 | | 4.31 | | | | 5,000,000 | | 4,978,700 |

| 2/6/06 | | 4.39 | | | | 10,000,000 | | 9,956,400 |

| 2/9/06 | | 4.31 | | | | 5,000,000 | | 4,976,871 |

| Nationwide Building Society | | | | | | | | |

| 2/1/06 | | 4.31 | | | | 10,000,000 | | 9,963,144 |

| Northern Rock PLC | | | | | | | | |

| 2/17/06 | | 4.35 | | | | 35,000,000 | | 34,803,514 |

| Paradigm Funding LLC | | | | | | | | |

| 1/9/06 | | 4.30 (b) | | | | 100,000,000 | | 100,000,000 |

| 1/20/06 | | 4.25 | | | | 20,000,000 | | 19,955,456 |

| 1/31/06 | | 4.30 | | | | 20,000,000 | | 19,928,833 |

| Park Granada LLC | | | | | | | | |

| 1/23/06 | | 4.20 | | | | 50,000,000 | | 49,873,042 |

| 1/24/06 | | 4.20 | | | | 5,000,000 | | 4,986,727 |

| 1/24/06 | | 4.22 | | | | 10,000,000 | | 9,973,326 |

| 1/25/06 | | 4.22 | | | | 20,000,000 | | 19,944,267 |

| 1/26/06 | | 4.22 | | | | 10,000,000 | | 9,970,972 |

| 1/26/06 | | 4.35 | | | | 10,000,000 | | 9,970,000 |

| 1/30/06 | | 4.23 | | | | 30,000,000 | | 29,898,742 |

| |

| See accompanying notes which are an integral part of the financial statements. | | | | | | | | |

| |

| 7 | | | | | | Semiannual Report |

| The North Carolina Capital Management Trust: Cash Portfolio | | | | | | | | | | |

| Investments (Unaudited) - continued | | | | | | | | | | | | |

| |

| |

| Due Date | | | | Annualized | | | | Principal | | | | Value |

| | | | | Yield at Time of | | | | Amount | | | | (Note 1) |

| | | | | Purchase | | | | | | | | |

| Park Sienna LLC | | | | | | | | | | | | |

| 1/3/06 | | | | 4.34% | | $ | | 31,000,000 | | $ | | 30,992,526 |

| Preferred Receivables Funding Corp. | | | | | | | | | | | | |

| 1/3/06 | | | | 4.19 | | | | 30,200,000 | | | | 30,192,970 |

| Royal Bank of Scotland PLC | | | | | | | | | | | | |

| 1/31/06 | | | | 4.28 | | | | 50,000,000 | | | | 49,822,917 |

| Santander Finance, Inc. | | | | | | | | | | | | |

| 2/21/06 | | | | 4.33 | | | | 75,000,000 | | | | 74,544,719 |

| Sheffield Receivables Corp. | | | | | | | | | | | | |

| 1/17/06 | | | | 4.32 | | | | 101,416,000 | | | | 101,222,183 |

| Sigma Finance, Inc. | | | | | | | | | | | | |

| 1/17/06 | | | | 4.32 (b) | | | | 50,000,000 | | | | 49,992,852 |

| Skandinaviska Enskilda Banken AB | | | | | | | | | | | | |

| 1/12/06 | | | | 4.32 (b) | | | | 75,000,000 | | | | 75,000,000 |

| 1/30/06 | | | | 4.35 (b) | | | | 75,000,000 | | | | 75,000,000 |

| Strand Capital LLC | | | | | | | | | | | | |

| 1/17/06 | | | | 3.91 | | | | 15,000,000 | | | | 14,974,267 |

| 2/2/06 | | | | 4.28 | | | | 5,000,000 | | | | 4,981,200 |

| 2/2/06 | | | | 4.29 | | | | 5,000,000 | | | | 4,981,111 |

| 2/14/06 | | | | 4.35 | | | | 15,000,000 | | | | 14,921,167 |

| 3/14/06 | | | | 4.26 | | | | 5,000,000 | | | | 4,958,200 |

| Stratford Receivables Co. LLC | | | | | | | | | | | | |

| 1/13/06 | | | | 4.30 | | | | 5,000,000 | | | | 4,992,867 |

| 1/17/06 | | | | 4.24 | | | | 20,000,000 | | | | 19,962,622 |

| 1/19/06 | | | | 4.28 | | | | 10,000,000 | | | | 9,978,750 |

| 1/20/06 | | | | 4.25 | | | | 25,000,000 | | | | 24,944,385 |

| 1/24/06 | | | | 4.29 | | | | 5,000,000 | | | | 4,986,408 |

| 1/25/06 | | | | 4.28 | | | | 15,000,000 | | | | 14,957,500 |

| 1/26/06 | | | | 4.37 | | | | 50,000,000 | | | | 49,848,958 |

| 1/30/06 | | | | 4.35 | | | | 15,000,000 | | | | 14,947,800 |

| 2/2/06 | | | | 4.37 | | | | 5,000,000 | | | | 4,980,733 |

| 2/7/06 | | | | 4.40 | | | | 10,000,000 | | | | 9,955,086 |

| 2/8/06 | | | | 4.39 | | | | 10,000,000 | | | | 9,953,978 |

| 2/9/06 | | | | 4.40 | | | | 10,000,000 | | | | 9,952,658 |

| 2/14/06 | | | | 4.42 | | | | 5,000,000 | | | | 4,973,203 |

| 2/15/06 | | | | 4.41 | | | | 30,000,000 | | | | 29,835,750 |

| 2/17/06 | | | | 4.42 | | | | 110,264,000 | | | | 109,632,034 |

| |

| See accompanying notes which are an integral part of the financial statements. | | | | | | | | | | |

| |

| Semiannual Report | | 8 | | | | | | | | | | |

| Commercial Paper (c) continued | | | | | | |

| Due | | Annualized | | | | Principal | | Value |

| Date | | Yield at Time of | | | | Amount | | (Note 1) |

| | | Purchase | | | | | | |

| Thames Asset Global Securities No. 1, Inc. | | | | | | |

| 1/18/06 | | 4.35% | | | | $ 25,000,000 | | $ 24,948,882 |

| Toyota Motor Credit Corp. | | | | | | | | |

| 1/31/06 | | 4.30 | | | | 50,000,000 | | 49,822,083 |

| White Pine Finance LLC | | | | | | | | |

| 1/20/06 | | 4.32 (a)(b) | | | | 97,000,000 | | 96,999,031 |

| 1/23/06 | | 4.32 (a)(b) | | | | 44,000,000 | | 43,997,193 |

| 1/25/06 | | 4.33 (b) | | | | 38,000,000 | | 37,999,502 |

| |

| TOTAL COMMERCIAL PAPER | | | | | | | | 4,114,762,290 |

| |

| Repurchase Agreements 0.0% | | | | | | |

| | | | | | | Maturity | | |

| | | | | | | Amount | | |

| In a joint trading account (Collateralized by U.S. Treasury Obligations dated 12/30/05 due 1/3/06 | | | | | | | | |

| At 3.52%) | | | | | | $ 369,144 | | 369,000 |

| |

| TOTAL INVESTMENT | | | | | | | | |

| PORTFOLIO 100.1% | | | | | | | | |

| (Cost $4,115,131,290) | | | | | | | | 4,115,131,290 |

| |

| NET OTHER ASSETS (0.1)% | | | | | | | | (4,148,990) |

| NET ASSETS 100% | | | | | | | | $ 4,110,982,300 |

Legend

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt

from registration, normally to qualified institutional buyers. At the period end, the value of these securities amounted to $290,996,224 or

7.1% of net assets.

(b) The coupon rate shown on floating or adjustable rate securities represents the rate at period end. The due dates on these types of securities

reflect the next interest rate reset date or, when applicable, the final maturity date.

(c) Cash Portfolio only purchases commercial paper with the highest possible ratings from at least one nationally recognized rating service. A

substantial portion of Cash Portfolio’s investments are in commercial paper of banks, finance companies and companies in the securities

industry.

|

Income Tax Information

At June 30, 2005, the fund had a capital loss carryforward of approximately $218,711 of which $82,853 and $135,858 will expire on June 30, 2012 and 2013, respectively.

See accompanying notes which are an integral part of the financial statements.

9 Semiannual Report

| The North Carolina Capital Management Trust: Cash Portfolio | | | | |

| |

| Financial Statements | | | | |

| |

| Statement of Assets and Liabilities | | | | |

| |

| | | December 31, 2005 (Unaudited) |

| |

| Assets | | | | |

| Investment in securities, at value (including repurchase agreements of $369,000) — | | | | |

| See accompanying schedule: | | | | |

| Unaffiliated issuers (cost $4,115,131,290) | | $4,115,131,290 |

| Receivable for fund shares sold | | | | 2,649,501 |

| Interest receivable | | | | 1,813,906 |

| Receivable from investment adviser for expense reductions | | | | 26,303 |

| Total assets | | | | 4,119,621,000 |

| |

| Liabilities | | | | |

| Payable to custodian bank | | $ 499,453 | | |

| Payable for fund shares redeemed | | 5,604,998 | | |

| Distributions payable | | 1,063,786 | | |

| Accrued management fee | | 781,856 | | |

| Deferred trustees’ compensation | | 688,607 | | |

| Total liabilities | | | | 8,638,700 |

| |

| Net Assets | | $ 4,110,982,300 |

| Net Assets consist of: | | | | |

| Paid in capital | | $4,111,333,009 |

| Distributions in excess of net investment income | | | | (176,351) |

| Accumulated undistributed net realized gain (loss) on investments | | | | (174,358) |

| Net Assets, for 4,111,218,806 shares outstanding | | $ 4,110,982,300 |

| Net Asset Value, offering price and redemption price per share | | | | |

| ($4,110,982,300 ÷ 4,111,218,806 shares) | | | | $ 1.00 |

See accompanying notes which are an integral part of the financial statements.

| Statement of Operations | | | | | | |

| |

| | | Six months ended December 31, 2005 (Unaudited) |

| |

| Investment Income | | | | | | |

| Interest | | | | $ | | 71,027,036 |

| |

| Expenses | | | | | | |

| Management fee | | $ | | 4,345,441 | | |

| Independent trustees’ compensation | | | | 82,687 | | |

| Total expenses before reductions | | | | 4,428,128 | | |

| Expense reductions | | | | (78,822) | | 4,349,306 |

| |

| Net investment income | | | | | | 66,677,730 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | | | 44,353 |

| Net increase in net assets resulting from operations | | | | $ | | 66,722,083 |

See accompanying notes which are an integral part of the financial statements.

11 Semiannual Report

| The North Carolina Capital Management Trust: Cash Portfolio | | | | |

| Financial Statements continued | | | | |

| |

| Statement of Changes in Net Assets | | | | |

| |

| | | Six months ended | | Year ended |

| | | December 31, 2005 | | June 30, |

| | | (Unaudited) | | 2005 |

| Increase (Decrease) in Net Assets | | | | |

| Operations | | | | |

| Net investment income | | $ 66,677,730 | | $ 78,121,201 |

| Net realized gain (loss) | | 44,353 | | 15,671 |

| Net increase in net assets resulting from operations | | 66,722,083 | | 78,136,872 |

| Distributions to shareholders from net investment income | | (66,640,655) | | (78,161,140) |

| Distributions to shareholders from net realized gain | | — | | (392,679) |

| Total distributions | | (66,640,655) | | (78,553,819) |

| Share transactions at net asset value of $1.00 per share | | | | |

| Proceeds from sales of shares | | 5,142,881,276 | | 10,232,114,627 |

| Reinvestment of distributions | | 59,442,364 | | 68,292,296 |

| Cost of shares redeemed | | (4,793,659,772) | | (10,216,277,349) |

| Net increase (decrease) in net assets and shares resulting from share transactions | | 408,663,868 | | 84,129,574 |

| Total increase (decrease) in net assets | | 408,745,296 | | 83,712,627 |

| |

| Net Assets | | | | |

| Beginning of period | | 3,702,237,004 | | 3,618,524,377 |

| End of period (including distributions in excess of net investment income of $176,351 and | | | | |

| distributions in excess of net investment income of $213,426, respectively) | | $ 4,110,982,300 | | $ 3,702,237,004 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Six months ended | | | | | | | | | | | | | | | | | | | | |

| | | December 31, | | | | | | | | | | | | | | | | | | | | |

| | | 2005 | | Years ended June 30, |

| | | (Unaudited) | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | | 1.00 | | $ | | 1.00 | | $ | | 1.00 | | $ | | 1.00 | | $ | | 1.00 | | $ | | 1.00 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | 018 | | | | .020 | | | | .009 | | | | .013 | | | | .024 | | | | .057 |

| Net realized and unrealized gain (loss)E | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — |

| Total from investment operations | | | | 018 | | | | .020 | | | | .009 | | | | .013 | | | | .024 | | | | .057 |

| Distributions from net investment income | | | | (.018) | | | | (.020) | | | | (.009) | | | | (.013) | | | | (.024) | | | | (.057) |

| Distributions from net realized gain | | | | — | | | | —E | | | | — | | | | — | | | | — | | | | — |

| Total distributions | | | | (.018) | | | | (.020) | | | | (.009) | | | | (.013) | | | | (.024) | | | | (.057) |

| Net asset value, end of period | | $ | | 1.00 | | $ | | 1.00 | | $ | | 1.00 | | $ | | 1.00 | | $ | | 1.00 | | $ | | 1.00 |

| Total ReturnB,C | | | | 1.81% | | | | 2.05% | | | | .89% | | | | 1.32% | | | | 2.39% | | | | 5.90% |

| Ratios to Average Net AssetsD | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | | | 24%A | | | | .24% | | | | .24% | | | | .24% | | | | .24% | | | | .24% |

| Expenses net of fee waivers, if any | | | | 23%A | | | | .23% | | | | .22% | | | | .23% | | | | .23% | | | | .24% |

| Expenses net of all reductions | | | | 23%A | | | | .23% | | | | .22% | | | | .23% | | | | .23% | | | | .24% |

| Net investment income | | | | 3.58%A | | | | 2.04% | | | | .89% | | | | 1.29% | | | | 2.32% | | | | 5.62% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ | | 4,111 | | $ | | 3,702 | | $ | | 3,619 | | $ | | 4,025 | | $ | | 3,947 | | $ | | 4,092 |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by

the fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements.

Expenses net of all reductions represent the net expenses paid by the fund.

E Amount represents less than $.001 per share.

|

See accompanying notes which are an integral part of the financial statements.

13 Semiannual Report

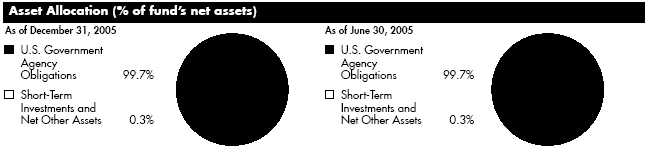

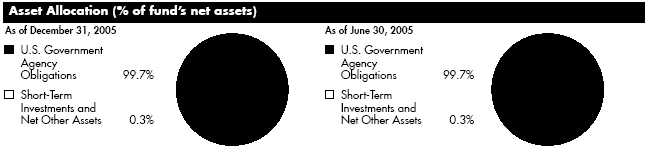

| The North Carolina Capital Management Trust: Term Portfolio | | | | |

| Investment Changes | | | | |

| Average Years to Maturity as of December 31, 2005 | | | | |

| | | | | 6 months ago |

| Years | | 0.8 | | 0.9 |

Average years to maturity is based on the average time remaining until principal payments are expected from each of the fund’s bonds, weighted by dollar amount.

| Duration as of December 31, 2005 | | | | |

| | | | | | | 6 months ago |

| Years | | | | 0.8 | | 0.9 |

Duration shows how much a bond fund’s price fluctuates with changes in comparable interest rates. If rates rise 1%, for example, a fund with a five year duration is likely to lose about 5% of its value. Other factors also can influence a bond fund’s performance and share price. Accordingly, a bond fund’s actual performance may differ from this example.

Semiannual Report 14

The North Carolina Capital Management Trust: Term Portfolio

Investments December 31, 2005 (Unaudited)

Showing Percentage of Net Assets

|

| U.S. Government and | | |

| Government Agency Obligations 99.7% | | | | |

| | | Principal | | Value |

| | | Amount | | (Note 1) |

| U.S. Government Agency Obligations 99.7% | | | | |

| Fannie Mae: | | | | |

| 0% 12/1/06 | | $ 5,000,000 | | $ 4,785,585 |

| 2.07% 9/29/06 | | 4,800,000 | | 4,709,592 |

| Federal Home Loan Bank 2.1% | | | | |

| 10/13/06 | | 12,000,000 | | 11,763,804 |

| Freddie Mac: | | | | |

| 0% 8/15/06 | | 4,347,000 | | 4,223,389 |

| 0% 10/17/06 | | 15,700,000 | | 15,122,993 |

| 0% 11/14/06 | | 5,490,000 | | 5,267,589 |

| 3.625% 2/15/07 | | 6,850,000 | | 6,765,067 |

| 5.5% 7/15/06 | | 3,525,000 | | 3,541,839 |

| TOTAL U.S. GOVERNMENT AND | | | | |

| GOVERNMENT AGENCY | | | | |

| OBLIGATIONS | | | | |

| (Cost $56,374,459) | | | | 56,179,858 |

| | | | | |

| Cash Equivalents 0.0% | | | | |

| | | Maturity | | |

| | | Amount | | |

| Investments in repurchase | | | | |

| agreements (Collateralized | | | | |

| by U.S. Treasury Obligations, | | | | |

| in a joint trading account at | | | | |

| 3.52%, dated 12/30/05 | | | | |

| due 1/3/06) | | | | |

| (Cost $20,000) | | $ 20,008 | | 20,000 |

| | | | | |

| TOTAL INVESTMENT | | | | |

| PORTFOLIO 99.7% | | | | |

| (Cost $56,394,459) | | | | 56,199,858 |

| | | | | |

| NET OTHER ASSETS 0.3% | | | | 176,487 |

| NET ASSETS 100% | | | | $ 56,376,345 |

Income Tax Information

At June 30, 2005, the fund had a capital loss carryforward of approximately $3,857,917 of which $703,016, $837,001, $1,662,860, $600,863 and $54,177 will expire on June 30, 2006, 2007, 2008, 2009 and 2013, respectively.

See accompanying notes which are an integral part of the financial statements.

15 Semiannual Report

| The North Carolina Capital Management Trust: Term Portfolio | | | | | | |

| |

| Financial Statements | | | | | | |

| |

| Statement of Assets and Liabilities | | | | | | |

| |

| | | | | December 31, 2005 (Unaudited) |

| |

| Assets | | | | �� | | |

| Investment in securities, at value (including repurchase agreements of $20,000) — | | | | | | |

| See accompanying schedule: | | | | | | |

| Unaffiliated issuers (cost $56,394,459) | | | | | $ | 56,199,858 |

| Cash | | | | | | 2 |

| Interest receivable | | | | | | 262,538 |

| Total assets | | | | | | 56,462,398 |

| |

| Liabilities | | | | | | |

| Distributions payable | | | $ | 51,227 | | |

| Accrued management fee | | | | 12,891 | | |

| Deferred trustees’ compensation | | | | 21,935 | | |

| Total liabilities | | | | | | 86,053 |

| |

| Net Assets | | | | | $ | 56,376,345 |

| Net Assets consist of: | | | | | | |

| Paid in capital | | | | | $ | 60,669,159 |

| Undistributed net investment income | | | | | | 252,961 |

| Accumulated undistributed net realized gain (loss) on investments | | | | | | (4,351,174) |

| Net unrealized appreciation (depreciation) on investments | | | | | | (194,601) |

| Net Assets, for 6,010,821 shares outstanding | | | | | $ | 56,376,345 |

| Net Asset Value, offering price and redemption price per share ($56,376,345 ÷ 6,010,821 shares) | | | | | $ | 9.38 |

See accompanying notes which are an integral part of the financial statements.

| Statement of Operations | | | | | | |

| |

| | | Six months ended December 31, 2005 (Unaudited) |

| |

| Investment Income | | | | | | |

| Interest | | | | | $ | 1,192,331 |

| |

| Expenses | | | | | | |

| Management fee | | | $ | 83,921 | | |

| Independent trustees’ compensation | | | | 1,606 | | |

| Total expenses before reductions | | | | 85,527 | | |

| Expense reductions | | | | (1,132) | | 84,395 |

| |

| Net investment income | | | | | | 1,107,936 |

| Realized and Unrealized Gain (Loss) | | | | | | |

| Net realized gain (loss) on: | | | | | | |

| Investment securities: | | | | | | |

| Unaffiliated issuers | | | | | | (289,434) |

| Change in net unrealized appreciation (depreciation) on investment securities | | | | | | (57,632) |

| Net gain (loss) | | | | | | (347,066) |

| Net increase (decrease) in net assets resulting from operations | | | | | $ | 760,870 |

See accompanying notes which are an integral part of the financial statements.

17 Semiannual Report

| The North Carolina Capital Management Trust: Term Portfolio | | | | | | | | |

| Financial Statements continued | | | | | | | | |

| |

| Statement of Changes in Net Assets | | | | | | | | |

| |

| | | Six months ended | | | | Year ended |

| | | December 31, 2005 | | | | June 30, |

| | | (Unaudited) | | | | 2005 |

| Increase (Decrease) in Net Assets | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | | 1,107,936 | | | $ | 1,258,442 |

| Net realized gain (loss) | | | | (289,434) | | | | (297,083) |

| Change in net unrealized appreciation (depreciation) | | | | (57,632) | | | | 46,039 |

| Net increase (decrease) in net assets resulting from operations | | | | 760,870 | | | | 1,007,398 |

| Distributions to shareholders from net investment income | | | | (886,414) | | | | (1,191,458) |

| Share transactions | | | | | | | | |

| Proceeds from sales of shares | | | | 6,500,000 | | | | 6,530,149 |

| Reinvestment of distributions | | | | 524,781 | | | | 748,340 |

| Cost of shares redeemed | | | | (13,239,079) | | | | (4,040,889) |

| Net increase (decrease) in net assets resulting from share transactions | | | | (6,214,298) | | | | 3,237,600 |

| Total increase (decrease) in net assets | | | | (6,339,842) | | | | 3,053,540 |

| |

| Net Assets | | | | | | | | |

| Beginning of period | | | | 62,716,187 | | | | 59,662,647 |

| End of period (including undistributed net investment income of $252,961 and undistributed net | | | | | | | | |

| investment income of $31,439, respectively) | | $ | | 56,376,345 | | | $ | 62,716,187 |

| |

| Other Information | | | | | | | | |

| Shares | | | | | | | | |

| Sold | | | | 692,850 | | | | 694,685 |

| Issued in reinvestment of distributions | | | | 55,951 | | | | 79,542 |

| Redeemed | | | | (1,411,416) | | | | (428,015) |

| Net increase (decrease) | | | | (662,615) | | | | 346,212 |

See accompanying notes which are an integral part of the financial statements.

| Financial Highlights | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Six months ended | | | | | | | | | | | | | | | | | | | | |

| | | December 31, | | | | | | | | | | | | | | | | | | | | |

| | | 2005 | | Years ended June 30, |

| | | (Unaudited) | | | | 2005 | | | | 2004 | | | | 2003 | | | | 2002 | | | | 2001 |

| Selected Per Share Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | | 9.40 | | $ | | 9.43 | | $ | | 9.47 | | $ | | 9.48 | | $ | | 9.35 | | $ | | 9.28 |

| Income from Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment incomeD | | | | 167 | | | | .209 | | | | .107 | | | | .166 | | | | .262F | | | | .532 |

| Net realized and unrealized gain (loss) | | | | (.052) | | | | (.041) | | | | (.042) | | | | .027 | | | | .116F | | | | .097 |

| Total from investment operations | | | | 115 | | | | .168 | | | | .065 | | | | .193 | | | | .378 | | | | .629 |

| Distributions from net investment income | | | | (.135) | | | | (.198) | | | | (.105) | | | | (.203) | | | | (.248) | | | | (.559) |

| Net asset value, end of period | | $ | | 9.38 | | $ | | 9.40 | | $ | | 9.43 | | $ | | 9.47 | | $ | | 9.48 | | $ | | 9.35 |

| Total ReturnB,C | | | | 1.23% | | | | 1.80% | | | | .69% | | | | 2.05% | | | | 4.09% | | | | 6.98% |

| Ratios to Average Net AssetsE | | | | | | | | | | | | | | | | | | | | | | | | |

| Expenses before reductions | | | | 28%A | | | | .28% | | | | .28% | | | | .28% | | | | .28% | | | | .28% |

| Expenses net of fee waivers, if any | | | | 27%A | | | | .27% | | | | .27% | | | | .27% | | | | .27% | | | | .28% |

| Expenses net of all reductions | | | | 27%A | | | | .27% | | | | .27% | | | | .27% | | | | .27% | | | | .28% |

| Net investment income | | | | 3.54%A | | | | 2.22% | | | | 1.13% | | | | 1.78% | | | | 2.78%F | | | | 5.72% |

| Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in millions) | | $ | | 56 | | $ | | 63 | | $ | | 60 | | $ | | 74 | | $ | | 71 | | $ | | 74 |

| Portfolio turnover rate | | | | 112%A | | | | 130% | | | | 200% | | | | 83% | | | | 157% | | | | 0% |

A Annualized

B Total returns for periods of less than one year are not annualized.

C Total returns would have been lower had certain expenses not been reduced during the periods shown.

D Calculated based on average shares outstanding during the period.

E Expense ratios reflect operating expenses of the fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or expense offset arrangements and do not represent the amount paid by

the fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements.

Expenses net of all reductions represent the net expenses paid by the fund.

F Effective July 1, 2001, the fund adopted the provisions of the AICPA Audit and Accounting Guide for Investment Companies and began amortizing premium and discount on all debt securities. Per share data and ratios

for periods prior to adoption have not been restated to reflect this change.

|

See accompanying notes which are an integral part of the financial statements.

19 Semiannual Report

Notes to Financial Statements

For the period ended December 31, 2005 (Unaudited)

1. Significant Accounting Policies.

|

Cash Portfolio and Term Portfolio (the funds) are funds of The North Carolina Capital Management Trust (the trust). The trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open end management investment company organized as a Massachusetts business trust. Shares of the trust are offered exclusively to local government and public authorities of the state of North Carolina. Each fund is authorized to issue an unlimited number of shares. The financial state ments have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. The following summarizes the significant accounting policies of the funds:

Security Valuation. Investments are valued and net asset value per share is calculated (NAV calculation) as of the close of business of the New York Stock Exchange, normally 4:00 p.m. Eastern time. Wherever possible, each fund uses independent pricing services approved by the Board of Trustees to value their investments. Debt securities, including restricted securities, for which quotations are readily available, are valued by independent pricing services or by dealers who make markets in such securities. Pricing services consider yield or price of bonds of comparable quality, coupon, maturity and type as well as dealer supplied prices.

When current market prices or quotations are not readily available or do not accurately reflect fair value, valuations may be determined in accordance with procedures adopted by the Board of Trustees. The frequency of when fair value pricing is used is unpredictable. The value of securities used for NAV calculation under fair value pricing may differ from published prices for the same securities. Investments in open end mutual funds are valued at their closing net asset value each business day. Short term securities with remaining maturities of sixty days or less for which quotations are not readily available are valued at amortized cost, which approximates value.

As permitted by compliance with certain conditions under Rule 2a 7 of the 1940 Act, securities owned by the Cash Portfolio are valued at amortized cost which approximates value.

Investment Transactions and Income. Security transactions are accounted for as of trade date. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned. Interest income includes coupon interest and amortization of premium and accretion of discount on debt securities.

Expenses. Most expenses of the trust can be directly attributed to a fund. Expenses which cannot be directly attributed are apportioned among each fund in the trust.

Deferred Trustee Compensation. The independent Trustees may elect to defer receipt of all or a portion of their annual fees under the Trustees’ Deferred Compensation Plan (“the Plan”). Interest is accrued on amounts deferred under the Plan based on the prevailing 90 day Treasury Bill rate.

Income Tax Information and Distributions to Shareholders. Each year, each fund intends to qualify as a regulated invest ment company by distributing all of its taxable income and realized gains under Subchapter M of the Internal Revenue Code. As a result, no provision for income taxes is required in the accompanying financial statements.

Dividends are declared daily and paid monthly from net investment income. Distributions from realized gains, if any, are recorded on the ex dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

Capital accounts within the financial statements are adjusted for permanent book tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book tax differences will reverse in a subsequent period.

1. Significant Accounting Policies continued

Income Tax Information and Distributions to Shareholders continued

Book tax differences are primarily due to deferred trustees compensation and capital loss carryforwards for Cash Portfolio.

Book tax differences are primarily due to market discount, deferred trustees compensation, capital loss carryforwards and losses deferred due to excise tax regulations for Term Portfolio.

The federal tax cost of investments and unrealized appreciation (depreciation) as of period end were as follows for each fund:

| | | | | | | | | | | | | | | Net Unrealized |

| | | Cost for Federal | | | | Unrealized | | | | Unrealized | | | | Appreciation/ |

| | | Income Tax Purposes | | | | Appreciation | | | | Depreciation | | | | (Depreciation) |

| Cash Portfolio | | $ | | 4,115,131,290 | | | $ | — | | | $ | — | | | $ | — |

| Term Portfolio | | 56,198,938 | | | | 70,962 | | | | (70,042) | | | | 920 |

| |

| 2. Operating Policies. | | | | | | | | | | | | | | |

Repurchase Agreements. Fidelity Management & Research Company (FMR) has received an Exemptive Order from the Securi ties and Exchange Commission (the SEC) which permits certain funds and other affiliated entities of FMR to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. Certain funds may also invest directly with institutions in repurchase agreements. Repurchase agreements are collateralized by government or non government securities. Collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. Each applicable fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Restricted Securities. Certain funds may invest in securities that are subject to legal or contractual restrictions on resale. These securities generally may be resold in transactions exempt from registration or to the public if the securities are registered. Disposal of these securities may involve time consuming negotiations and expense, and prompt sale at an acceptable price may be difficult. Information regarding restricted securities is included at the end of each applicable fund’s Schedule of Investments.

3. Fees and Other Transactions with Affiliates.

Management Fee. FMR and its affiliates provides the funds with investment management related services for which the funds pay a monthly management fee based upon a graduated series of annual rates ranging between .215% and .275% of each fund’s average net assets. FMR pays all other expenses, except the compensation of the independent Trustees and certain exceptions such as interest expense. The management fee paid to FMR by the funds is reduced by an amount equal to the fees and expenses paid by the funds to the independent Trustees. For the period each fund’s annualized management fee rate, expressed as a per centage of each fund’s average net assets, was as follows:

| Cash Portfolio | | 23% |

| Term Portfolio | | 27% |

21 Semiannual Report

| Notes to Financial Statements (Unaudited) continued |

3. Fees and Other Transactions with Affiliates continued |

Distribution and Service Plan. In accordance with Rule 12b 1 of the 1940 Act each fund has adopted a separate Distribution and Service Plan. FMR pays Fidelity Distributors Corporation (FDC), an affiliate of FMR, a Distribution and Service fee from the management fee paid by each fund based on a graduated series of rates ranging from .07% to .08% of each fund’s average net assets. For the period, FMR paid FDC $1,205,070 and $21,939 on behalf of Cash and Term Portfolios, respectively, all of which was paid to the Capital Management of the Carolinas LLC.

FMR voluntarily agreed to waive a portion of each fund’s management fee during the period. The amount of the waiver for each fund was as follows:

| | | Reimbursement |

| | | from adviser |

| Cash Portfolio | | $ | | 78,822 |

| Term Portfolio | | $ | | 1,132 |

| |

| 5. Other. | | | | |

The funds’ organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the funds. In the normal course of business, the funds may also enter into contracts that provide general indemnifications. The funds’ maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the funds. The risk of material loss from such claims is considered remote.

A special meeting of each fund’s shareholders was held on October 28, 2005. The results of votes taken among shareholders on proposals before them are reported below. Each vote reported represents a single share held on the record date for the meeting.

| PROPOSAL 1 | | | | |

| To elect a Board of Trustees.A | | |

| | | # of | | % of |

| | | Votes | | Votes |

| Boyce I. Greer | | | | |

| Affirmative | | 2,140,123,341.059 | | 98.124 |

| Withheld | | 40,924,113.490 | | 1.876 |

| TOTAL | | 2,181,047,454.549 | | 100.000 |

| Thomas P. Hollowell | | | | |

| Affirmative | | 2,140,123,341.059 | | 98.124 |

| Withheld | | 40,924,113,490 | | 1.876 |

| TOTAL | | 2,181,047,454.549 | | 100.000 |

| James Grubbs Martin | | | | |

| Affirmative | | 2,144,405,473.009 | | 98.320 |

| Withheld | | 36,641,981.540 | | 1.680 |

| TOTAL | | 2,181,047,454.549 | | 100.000 |

| William M. McCoy | | | | |

| Affirmative | | 2,138,921,525.889 | | 98.069 |

| Withheld | | 42,125,928.660 | | 1.931 |

| TOTAL | | 2,181,047,454.549 | | 100.000 |

| A Denotes trust-wide proposals and voting results. | | |

23 Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees

Each year, typically in July, the Board of Trustees, including the independent Trustees (together, the Board), votes on the renewal of the management contract and sub advisory agreements (together, the Advisory Contracts) for each fund. The Board, assisted by the advice of fund counsel and independent Trustees’ counsel, requests and considers a broad range of information throughout the year.

The Board meets each quarter and takes into account throughout the year matters bearing on Advisory Contracts. The Board, acting directly and through its separate committees, considers at each of its meetings factors that are relevant to the annual renewal of each fund’s Advisory Contracts, including the services and support provided to each fund and its shareholders by Fidelity. At the time of the renewal, the Board had one standing Audit Committee, composed of independent Trustees with varying backgrounds, to which the Board has assigned specific subject matter responsibilities in order to enhance effective decision making by the Board. The Audit Committee has adopted a written charter outlining the structure and purposes of the committee, which includes meeting quarterly and as necessary to consider matters specifically related to the annual renewal of Advisory Contracts. The committee requests and receives information on, and makes recommendations to the independent Trustees concerning, the approval and annual review of the Advisory Contracts.

At its July 2005 meeting, the Board of Trustees, including the independent Trustees, unanimously determined to renew the Advisory Contracts for each fund. In reaching its determination, the Board considered all factors it believed relevant, including (1) the nature, extent, and quality of the services to be provided to each fund and its shareholders by Fidelity (including the investment performance of each fund); (2) the competitiveness of the management fee and total expenses of each fund; (3) the total costs of the services to be provided by and the profits to be realized by the investment adviser and its affiliates from the relationship with each fund; (4) the extent to which economies of scale would be realized as each fund grows; and (5) whether fee levels reflect these economies of scale, if any, for the benefit of fund shareholders.

In determining whether to renew the Advisory Contracts for each fund, the Board ultimately reached a determination, with the assistance of fund counsel and independent Trustees’ counsel, that the renewal of the Advisory Contracts and the compensation to be received by Fidelity under the management contracts is consistent with Fidelity’s fiduciary duty under applicable law. In addition to evaluating the specific factors noted above, the Board, in reaching its determination, is aware that shareholders in each fund have a broad range of investment choices available to them, and that each fund’s shareholders, with the opportunity to review and weigh the disclosure provided by the fund in its prospectus and other public disclosures, have chosen to invest in that fund, managed by Fidelity.

Nature, Extent, and Quality of Services Provided by Fidelity. The Board considered staffing within the investment adviser, FMR, and the sub advisers (together, the Investment Advisers), including the backgrounds of the funds’ portfolio managers and the funds’ investment objectives and disciplines. The independent Trustees also had discussions with senior management of Fidelity’s investment operations and investment groups. The Board considered the structure of the portfolio manager compensa tion program and whether this structure provides appropriate incentives.

Fidelity Resources Dedicated to Investment Management and Support Services. The Board reviewed the size, education, and experience of the Investment Advisers’ investment staff, their use of technology, and the Investment Advisers’ approach to recruit ing, training, and retaining portfolio managers and other research, advisory, and management personnel. The Board considered Fidelity’s extensive global research capabilities that enable the Investment Advisers to aggregate data from various sources in an effort to produce positive investment results. The Board noted that Fidelity’s analysts have access to a variety of technological tools that enable them to perform both fundamental and quantitative analysis and to specialize in various disciplines. The Board also considered that Fidelity’s portfolio managers and analysts have access to daily portfolio attribution that allows for monitoring of a

fund’s portfolio, as well as an electronic communication system that provides immediate real time access to research concerning issuers and credit enhancers.

Shareholder and Administrative Services. The Board considered the nature, extent, quality, and cost of administrative, distribu tion, and shareholder services performed by the Investment Advisers and their affiliates under the Advisory Contracts and under separate agreements covering transfer agency and pricing and bookkeeping services for each fund. The Board also considered the nature and extent of the Investment Advisers’ supervision of third party service providers, principally Capital Management of Carolinas, the Portfolios’ regional distributor, as well as the third parties acting as the Portfolios’ custodians and subcustodians. The Board reviewed the allocation of fund brokerage, including allocations to brokers affiliated with the Investment Advisers. The Board also considered the resources devoted to, and the record of compliance with, each fund’s compliance policies and procedures.

The Board noted that the growth of fund assets across the complex allows Fidelity to reinvest in the development of services designed to enhance the value or convenience of the Fidelity funds as investment vehicles. These services include 24 hour access to account information and market information through phone representatives and over the Internet, and various investor educa tion materials.

Investment in a Large Fund Family. The Board considered the benefits to shareholders of investing in a Fidelity fund, including the benefits of investing in a fund that is part of a large family of funds offering a variety of investment disciplines and providing for a large variety of mutual fund investor services.

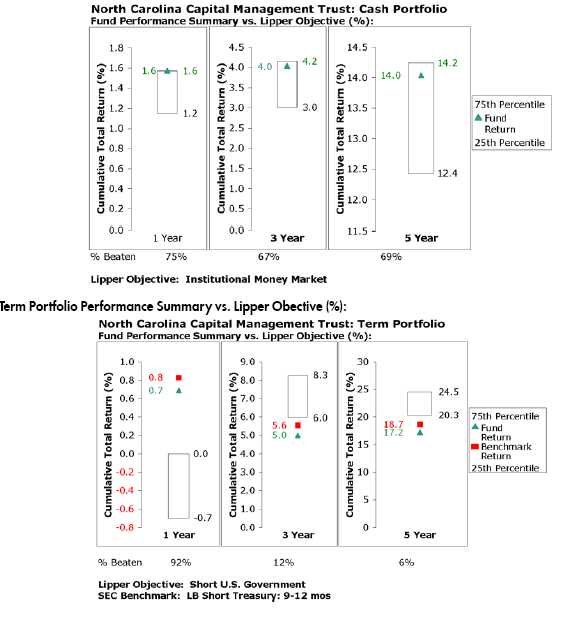

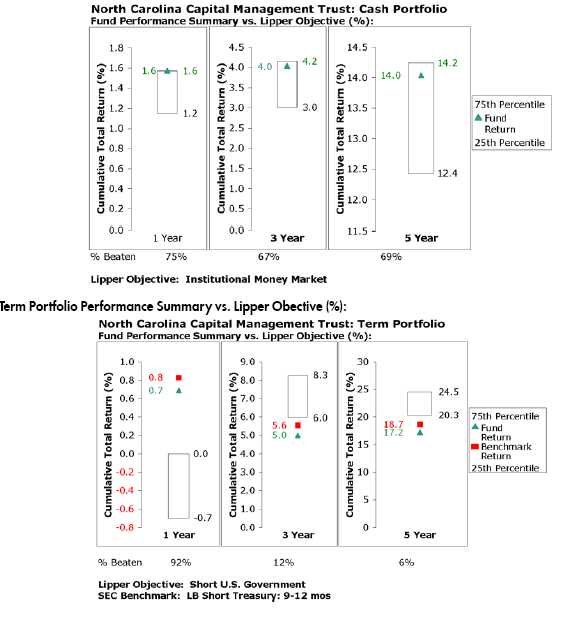

Investment Performance. The Board considered whether each fund has operated within its investment objective, as well as its record of compliance with its investment restrictions. It also reviewed each fund’s absolute investment performance, as well as each fund’s relative investment performance measured against (i) a broad based securities market index (bond fund only , as money market funds are typically not compared against a market index), and (ii) a peer group of mutual funds deemed appropriate by the Board over multiple periods. For each fund, the following charts considered by the Board show, over the one , three , and five year periods ended December 31, 2004, the fund’s returns, the returns of a broad based securities market index (“benchmark”) (bond fund only), and a range of returns of a peer group of mutual funds identified by Lipper Inc. as having an investment objective similar to that of the fund. The box within each chart shows the 25th percentile return (bottom of box) and the 75th percentile return (top of box) of the Lipper peer group. The percentage beaten number noted below each chart corre sponds to the percentile box and represents the percentage of funds in the Lipper peer group whose performance was equal to or lower than that of the fund.

25 Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees - continued

Cash Portfolio Performance vs. Lipper Obective (%):

Semiannual Report 26

The Board noted that the relative investment performance of Cash Portfolio has compared favorably to its Lipper peer group over time, and that the relative investment performance of Term Portfolio has improved over time and compares favorably to its Lipper peer group. The Board also noted that the relative investment performance of Term Portfolio was lower than its benchmark over time. The Board noted that each Portfolio’s performance is also influenced by the investment parameters imposed by the laws of North Carolina, which restrict the flexibility of the Portfolios when compared to other funds in their respective Lipper universes. For example, unlike other Institutional Money Market Funds, Cash Portfolio does not engage in reverse repurchase agreements, the use of which might increase yield. The Board also considered that, because Term Portfolio maintains a shorter duration than most other funds in its competitive universe, its performance may lag that of its competitors during periods of declining interest rates.

Based on its review, and giving particular weight to the nature and quality of the resources dedicated by the Investment Advisers to maintain and improve relative performance, the Board concluded that the nature, extent, and quality of the services provided by Fidelity will benefit each fund’s shareholders.

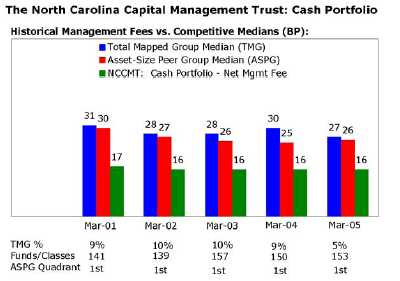

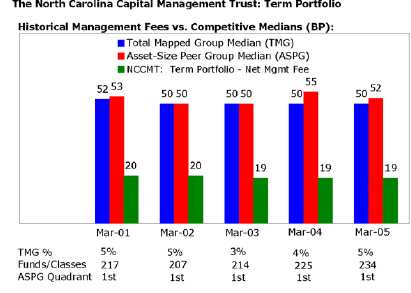

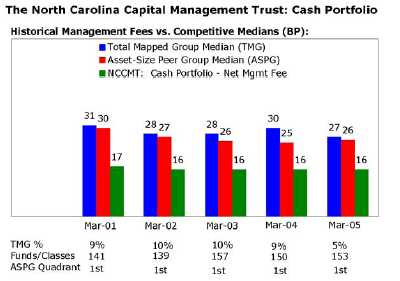

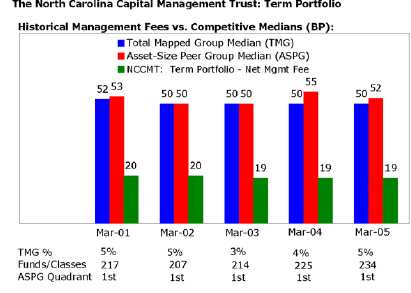

Competitiveness of Management Fee and Total Fund Expenses. The Board considered each fund’s management fee and total expenses compared to “mapped groups” of competitive funds and classes. Fidelity creates “mapped groups” by combining similar Lipper investment objective categories that have comparable management fee characteristics. Combining Lipper invest ment objective categories aids the Board’s management fee and total expense comparisons by broadening the competitive group used for comparison and by reducing the number of universes to which various Fidelity funds are compared.

The Board considered two proprietary management fee comparisons for the 12 month periods shown in the charts below. The group of Lipper funds used by the Board for management fee comparisons is referred to below as the “Total Mapped Group” and, for the reasons explained above, is broader than the Lipper peer group used by the Board for performance comparisons. The Total Mapped Group comparison focuses on a fund’s standing relative to the total universe of comparable funds available to investors, in terms of gross management fees before expense reimbursements or caps. The “Asset Size Peer Group” (ASPG) comparison focuses on a fund’s standing relative to non Fidelity funds similar in size to the fund within the Total Mapped Group. The ASPG represents at least 15% of the funds in the Total Mapped Group with comparable asset size and management fee characteristics, subject to a minimum of 50 funds (or all funds in the Total Mapped Group if fewer than 50). Additional information is also included in the charts and considered by the Board.

27 Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees - continued

Cash Portfolio Historical Management Fees vs. Competitive Medians:

Term Portfolio Historical Management Fees vs. Competitive Medians:

Semiannual Report 28

The Board noted that each fund’s management fee ranked below the median of its Total Mapped Group and below the median of its ASPG for calendar 2004. Based on its review, the Board concluded that each fund’s management fee was fair and reasonable in light of the services that the fund receives and the other factors considered.

In its review of each fund’s total expenses, the Board considered the fund’s management fee as well as other fund expenses, such as transfer agent fees, pricing and bookkeeping fees, and custodial, legal, and audit fees. The Board also considered the benefits of the Trust’s all inclusive fee structure. As part of its review, the Board also considered current and historical total expenses of each fund compared to competitive fund median expenses. Each fund is compared to those funds and classes in the Total Mapped Group (used by the Board for management fee comparisons) that have a similar sales load structure.

The Board noted that each fund’s total expenses ranked below its competitive median for calendar 2004.

In its review of total expenses, the Board also considered Fidelity fee structures and other information on clients that FMR and its affiliates service in other competitive markets, such as other mutual funds advised or subadvised by FMR or its affiliates, pension plan clients, and other institutional clients. The Board noted that the management fees charged by Fidelity to the funds are among the lowest in the Fidelity complex for each of their respective disciplines.

Based on its review, the Board concluded that each fund’s total expenses were reasonable in light of the services that the fund and its shareholders receive and the other factors considered.

Costs of the Services and Profitability. The Board considered the revenues earned and the expenses incurred by Fidelity in conducting the business of developing, marketing, distributing, managing, administering and servicing each fund and its share holders. The Board also considered the level of Fidelity’s profits in respect of the funds.

On an annual basis, FMR presents to the Board Fidelity’s profitability for each fund. Fidelity calculates the profitability for each fund using a series of detailed revenue and cost allocation methodologies which originate with the audited books and records of Fidelity. The Audit Committee of the Board reviews any significant changes from the prior year’s methodologies.

PricewaterhouseCoopers LLP (PwC), independent registered accounting firm and auditor to Fidelity and certain Fidelity funds, has been engaged annually by the Board as part of the Board’s assessment of the results of Fidelity’s profitability analysis. PwC’s engagement includes the review and assessment of Fidelity’s methodologies used in determining the revenues and expenses attributable to Fidelity’s mutual fund business, and completion of agreed upon procedures surrounding the mathematical accuracy of fund profitability and its conformity to allocation methodologies. After considering PwC’s reports issued under the engagement and information provided by Fidelity, the Board believes that while other allocation methods may also be reasonable, Fidelity’s profitability methodologies are reasonable in all material respects.

The Board considered the costs of the services provided by and the profits realized by Fidelity in connection with the operation of each fund and determined that the amount of profit is a fair entrepreneurial profit for the management of each fund.

Economies of Scale. The Board considered whether there have been economies of scale in respect of the management of the funds, whether the funds (including each fund) have appropriately benefited from any such economies of scale, and whether there is potential for realization of any further economies of scale. The Board considered the extent to which each fund will benefit from economies of scale through increased services to the fund, through waivers or reimbursements, or through fee or expense reductions.

The Board concluded that any potential economies of scale are being shared between fund shareholders and Fidelity in an appropriate manner.

29 Semiannual Report

Board Approval of Investment Advisory Contracts and Management Fees - continued

Additional Information Requested by the Board. In order to develop fully the factual basis for consideration of the Advisory Contracts, the Board requested additional information regarding (i) Fidelity’s fund profitability methodology, including additional detail on various cost allocations; and (ii) competitive performance of the funds against Certificates of Deposit of varying dura tions, and, for Term Portfolio, against the Lehman Brothers 9 12 Month Treasury Index, and for Cash Portfolio, against the iMoneyNet All Taxable Money Market Index.

Based on its evaluation of all of the conclusions noted above, and after considering all material factors, the Board ultimately concluded that the existing advisory fee structures are fair and reasonable, and that each fund’s existing Advisory Contracts should be renewed.

31 Semiannual Report

Custodian

Wachovia Corporation

Charlotte, NC

Distribution Agent

Capital Management of the Carolinas, L.L.C.

Charlotte, NC

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Sub Advisers

Fidelity Investments Money Management, Inc.

Fidelity International Investment Advisors

Fidelity International Investment Advisors (U.K.) Limited

Transfer and Service Agents

Fidelity Investments Institutional Operations Company, Inc.

Boston, MA

Fidelity Service Company, Inc.

Boston, MA

|

Item 2. Code of Ethics

Not applicable.

Item 3. Audit Committee Financial Expert

Not applicable.

Item 4. Principal Accountant Fees and Services

Not applicable.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9. Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders

There were no material changes to the procedures by which shareholders may recommend nominees to the North Carolina Capital Management Trust 's Board of Trustees.

Item 11. Controls and Procedures

(a)(i) The President and the Treasurer and Chief Financial Officer have concluded that the North Carolina Capital Management Trust 's (the "Trust") disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act) provide reasonable assurances that material information relating to the Trust is made known to them by the appropriate persons, based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report.

(a)(ii) There was no change in the Trust's internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.

Item 12. Exhibits

(a) | (1) | Not applicable. |

(a) | (2) | Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)) is filed and attached hereto as Exhibit 99.CERT. |

(a) | (3) | Not applicable. |

(b) | | Certification pursuant to Rule 30a-2(b) under the Investment Company Act of 1940 (17 CFR 270.30a-2(b)) is furnished and attached hereto as Exhibit 99.906CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

North Carolina Capital Management Trust

By: | /s/Boyce I. Greer |

| Boyce I. Greer |

| President |

| |

Date: | February 17, 2006 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/Boyce I. Greer |

| Boyce I. Greer |

| President |

| |

Date: | February 17, 2006 |

By: | /s/John Hebble |

| John Hebble |

| Treasurer and Chief Financial Officer |

| |

Date: | February 17, 2006 |