UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3455

North Carolina Capital Management Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, Massachusetts 02210

(Address of principal executive offices) (Zip code)

Scott C. Goebel, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code: 617-563-7000

Date of fiscal year end: | June 30 |

| |

Date of reporting period: | June 30, 2014 |

Item 1. Reports to Stockholders

(Fidelity Cover Art)

Cash Portfolio

Term Portfolio

Annual Report

June 30, 2014

NCX-ANN-0814

1.923759.104

Contents

THE NORTH CAROLINA CAPITAL MANAGEMENT TRUST |

Shareholder Expense Example | (Click Here) | An example of shareholder expenses. |

Cash Portfolio: | | |

Investment Changes/

Performance | (Click Here) | |

Investments | (Click Here) | A complete list of the fund's investments. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Term Portfolio: | | |

Performance | (Click Here) | How the fund has done over time. |

Management's Discussion

of Fund Performance | (Click Here) | The Portfolio Manager's review of fund performance and strategy. |

Investment Changes | (Click Here) | |

Investments | (Click Here) | A complete list of the fund's investments with their market values. |

Financial Statements | (Click Here) | Statements of assets and liabilities, operations, and changes in net assets, as well as financial highlights. |

Notes | (Click Here) | Notes to the financial statements. |

Report of Independent Registered Public Accounting Firm | (Click Here) | |

Trustees and Officers | (Click Here) | |

Distributions | (Click Here) | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov. You may also call 1-800-222-3232 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2014 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the funds. This report is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Forms N-Q are available on the SEC's website at http://www.sec.gov. A fund's Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

NOT FDIC INSURED • MAY LOSE VALUE • NO BANK GUARANTEE

Neither the funds nor Fidelity Distributors Corporation is a bank.

Annual Report

Shareholder Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2014 to June 30, 2014).

Actual Expenses

The first line of the accompanying table for each fund provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the first line for a fund under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the accompanying table for each fund provides information about hypothetical account values and hypothetical expenses based on a fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| Annualized

Expense Ratio B | Beginning

Account Value

January 1, 2014 | Ending

Account Value

June 30, 2014 | Expenses Paid

During Period*

January 1, 2014

to June 30, 2014 |

Cash Portfolio | .16% | | | |

Actual | | $ 1,000.00 | $ 1,000.05 | $ .79 |

Hypothetical A | | $ 1,000.00 | $ 1,024.00 | $ .80 |

Term Portfolio | .21% | | | |

Actual | | $ 1,000.00 | $ 1,000.50 | $ 1.04 |

Hypothetical A | | $ 1,000.00 | $ 1,023.75 | $ 1.05 |

A 5% return per year before expenses

B Annualized expense ratio reflects expenses net of applicable fee waivers.

* Expenses are equal to each Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

Annual Report

The North Carolina Capital Management Trust: Cash Portfolio

Investment Changes/Performance (Unaudited)

Effective Maturity Diversification |

Days | % of fund's investments 6/30/14 | % of fund's investments 12/31/13 | % of fund's

investments

6/30/13 |

1 - 7 | 30.8 | 29.4 | 25.4 |

8 - 30 | 16.8 | 15.2 | 19.3 |

31 - 60 | 15.7 | 20.8 | 19.1 |

61 - 90 | 22.8 | 19.6 | 15.4 |

91 - 180 | 10.7 | 12.9 | 16.8 |

> 180 | 3.2 | 2.1 | 4.0 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940. |

Weighted Average Maturity |

| 6/30/14 | 12/31/13 | 6/30/13 |

Cash Portfolio | 53 Days | 49 Days | 56 Days |

All Taxable Money Market Funds Average* | 44 Days | 47 Days | 50 Days |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Weighted Average Life |

| 6/30/14 | 12/31/13 | 6/30/13 |

Cash Portfolio | 88 Days | 86 Days | 91 Days |

Weighted Average Life (WAL) is the weighted average of the life of the securities held in a fund or portfolio and can be used as a measure of sensitivity to changes in liquidity and/or credit risk. Generally, the higher the value, the greater the sensitivity. WAL is based on the dollar-weighted average length of time until principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. The difference between WAM and WAL is that WAM takes into account interest rate resets and WAL does not. WAL for money market funds is not the same as WAL of a mortgage- or asset-backed security. |

Asset Allocation (% of fund's net assets) |

As of June 30, 2014 | As of December 31, 2013 |

| Commercial Paper 68.0% | |  | Commercial Paper 59.4% | |

| Variable Rate

Demand Notes

(VRDNs) 2.9% | |  | Variable Rate

Demand Notes

(VRDNs) 2.6% | |

| Treasury Debt 5.9% | |  | Treasury Debt 5.0% | |

| Government

Agency Debt 14.6% | |  | Government

Agency Debt 11.0% | |

| Repurchase

Agreements 8.9% | |  | Repurchase

Agreements 22.0% | |

| Net Other Assets

(Liabilities)** (0.3)% | |  | Net Other Assets

(Liabilities) 0.0% | |

* Source: iMoneyNet, Inc.

** Net Other Assets (Liabilities) are not included in the pie chart.

Annual Report

The North Carolina Capital Management Trust: Cash Portfolio

Investment Changes/Performance (Unaudited) - continued

Current and Historical Seven-Day Yields |

| 6/30/14 | 3/31/14 | 12/31/13 | 9/30/13 | 6/30/13 |

Cash Portfolio | .01% | .01% | .01% | .01% | .01% |

Yield refers to the income paid by the fund over a given period. Yields for money market funds are usually for seven-day periods, as they are here, though they are expressed as annual percentage rates. Past performance is no guarantee of future results. Yield will vary and its possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for period ending June 30, 2014 the most recent period shown in the table, would have been -0.07%.

Annual Report

The North Carolina Capital Management Trust: Cash Portfolio

Investments June 30, 2014

Showing Percentage of Net Assets

Financial Company Commercial Paper (c) - 58.6% |

| | Yield (a) | Principal Amount | Value |

Australia & New Zealand Banking Group Ltd. |

| 9/16/14 | 0.17% | $ 75,000,000 | $ 74,972,729 |

Bank of Nova Scotia |

| 7/7/14 to 9/30/14 | 0.20 to 0.27 | 105,000,000 | 104,960,796 |

Barclays Bank PLC/Barclays U.S. CCP Funding LLC |

| 7/16/14 to 9/26/14 | 0.23 to 0.25 | 168,000,000 | 167,919,675 |

BNP Paribas Finance, Inc. |

| 7/2/14 to 9/12/14 | 0.13 to 0.27 | 121,000,000 | 120,973,508 |

Commonwealth Bank of Australia |

| 10/1/14 to 2/23/15 | 0.18 to 0.22 (b) | 160,000,000 | 160,000,000 |

Credit Agricole North America |

| 7/1/14 to 9/3/14 | 0.09 to 0.26 | 147,000,000 | 146,963,649 |

Credit Suisse AG |

| 8/11/14 | 0.29 | 25,000,000 | 24,991,743 |

Deutsche Bank Financial LLC |

| 7/28/14 | 0.21 | 65,000,000 | 64,989,763 |

General Electric Capital Corp. |

| 11/10/14 | 0.20 | 15,000,000 | 14,989,000 |

JPMorgan Securities LLC |

| 9/3/14 to 11/25/14 | 0.22 to 0.27 (b) | 171,000,000 | 170,959,449 |

Mitsubishi UFJ Trust & Banking Corp. |

| 7/28/14 | 0.25 | 29,300,000 | 29,294,616 |

Natexis Banques Populaires U.S. Finance Co. LLC |

| 8/1/14 to 9/2/14 | 0.23 to 0.24 | 150,000,000 | 149,944,768 |

Nationwide Building Society |

| 9/18/14 | 0.22 | 51,000,000 | 50,975,378 |

Oversea-Chinese Banking Corp. Ltd. |

| 8/6/14 | 0.22 | 25,000,000 | 24,994,500 |

PNC Bank NA |

| 9/15/14 | 0.26 | 15,000,000 | 14,991,767 |

|

| | Yield (a) | Principal Amount | Value |

Skandinaviska Enskilda Banken AB |

| 8/1/14 to 8/19/14 | 0.24% | $ 76,000,000 | $ 75,980,580 |

Sumitomo Mitsui Banking Corp. |

| 7/3/14 to 11/5/14 | 0.22 to 0.24 | 155,000,000 | 154,956,413 |

Svenska Handelsbanken, Inc. |

| 9/16/14 to 9/25/14 | 0.22 | 132,000,000 | 131,935,687 |

Swedbank AB |

| 7/21/14 | 0.24 | 32,000,000 | 31,995,822 |

Toronto Dominion Holdings (U.S.A.) |

| 8/28/14 to 2/3/15 | 0.24 to 0.25 | 49,000,000 | 48,966,985 |

Toyota Motor Credit Corp. |

| 8/18/14 to 10/14/14 | 0.20 to 0.21 (b) | 128,000,000 | 127,979,000 |

TOTAL FINANCIAL COMPANY COMMERCIAL PAPER (Cost $1,893,735,828) | 1,893,735,828 |

Asset Backed Commercial Paper (c) - 5.3% |

|

Atlantic Asset Securitization Corp. (Liquidity Facility Credit Agricole CIB) |

| 7/7/14 | 0.13 | 29,179,000 | 29,178,368 |

Gotham Funding Corp. (Liquidity Facility Bank of Tokyo-Mitsubishi UFJ Ltd.) |

| 7/7/14 | 0.17 | 50,000,000 | 49,998,583 |

Northern Pines Funding LLC (Liquidity Facility Shanghai Bestway Marine Engineering Design Co. Ltd.) |

| 8/11/14 | 0.27 | 93,300,000 | 93,271,310 |

TOTAL ASSET BACKED COMMERCIAL PAPER (Cost $172,448,261) | 172,448,261 |

Other Commercial Paper (c) - 4.1% |

| | Yield (a) | Principal Amount | Value |

The Coca-Cola Co. |

| 10/10/14 to 1/28/15 | 0.20% | | |

| (Cost $130,900,272) | $ 131,000,000 | $ 130,900,272 |

Treasury Debt - 5.9% |

|

U.S. Treasury Inflation Protected Obligations - 1.0% |

U.S. Treasury Notes |

| 7/15/14 | 0.08 | 31,439,000 | 31,515,217 |

U.S. Treasury Obligations - 4.9% |

U.S. Treasury Bills |

| 8/14/14 to 6/25/15 | 0.11 | 95,000,000 | 94,939,103 |

U.S. Treasury Notes |

| 8/31/14 to 11/30/14 | 0.08 to 0.17 | 65,000,000 | 65,508,434 |

| | 160,447,537 |

TOTAL TREASURY DEBT (Cost $191,962,754) | 191,962,754 |

Variable Rate Demand Note - 2.9% |

|

North Carolina - 2.9% |

Charlotte Wtr. & Swr. Sys. Rev. Series 2002 C, (Liquidity Facility Bank of America NA), VRDN |

| 7/7/14 | 0.08 (b) | 26,060,000 | 26,060,000 |

Charlotte Wtr. & Swr. Sys. Rev. Series 2006 B, (Liquidity Facility Wells Fargo Bank NA), VRDN |

| 7/7/14 | 0.04 (b) | 100,000 | 100,000 |

North Carolina Cap. Facilities Fin. Agcy. Edl. Facilities Rev. (Campbell Univ. Proj.) Series 2009, LOC Branch Banking & Trust Co., VRDN |

| 7/7/14 | 0.06 (b) | 6,400,000 | 6,400,000 |

North Carolina Med. Care Commission Health Care Facilities Rev. (Cape Fear Valley Health Sys. Proj.) Series 2008 A1, LOC Branch Banking & Trust Co., VRDN |

| 7/7/14 | 0.05 (b) | 2,875,000 | 2,875,000 |

|

| | Yield (a) | Principal Amount | Value |

North Carolina Med. Care Commission Hosp. Rev. (CaroMont Health Proj.) Series 2003 B, LOC Wells Fargo Bank NA, VRDN |

| 7/7/14 | 0.05% (b) | $ 59,200,000 | $ 59,200,000 |

TOTAL VARIABLE RATE DEMAND NOTE (Cost $94,635,000) | 94,635,000 |

Government Agency Debt - 14.6% |

�� |

Federal Agencies - 14.6% |

Fannie Mae |

| 9/11/14 to 10/21/15 | 0.13 to 0.16 (a)(b) | 83,000,000 | 82,996,589 |

Federal Home Loan Bank |

| 7/16/14 to 9/14/15 | 0.07 to 0.20 (b) | 254,000,000 | 253,979,215 |

Freddie Mac |

| 12/5/14 to 7/17/15 | 0.14 to 0.15 (b) | 133,000,000 | 132,993,577 |

TOTAL GOVERNMENT AGENCY DEBT (Cost $469,969,381) | 469,969,381 |

Treasury Repurchase Agreement - 8.9% |

| Maturity

Amount | | Value |

In a joint trading account at 0.06% dated 6/30/14 due 7/1/14 (Collateralized by U.S. Treasury Obligations) # (Cost $287,647,000) | $ 287,647,511 | | $ 287,647,000 |

TOTAL INVESTMENT PORTFOLIO - 100.3% (Cost $3,241,298,496) | 3,241,298,496 |

NET OTHER ASSETS (LIABILITIES) - (0.3)% | | (9,008,779) |

NET ASSETS - 100% | $ 3,232,289,717 |

Security Type Abbreviations |

VRDN | - | VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly) |

Legend |

(a) Yield represents either the annualized yield at the date of purchase, or the stated coupon rate, or, for floating and adjustable rate securities, the rate at period end. |

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

(c) Cash Portfolio only purchases commercial paper with the highest possible ratings from at least one nationally recognized rating service. A substantial portion of Cash Portfolio's investments are in commercial paper of banks, finance companies and companies in the securities industry. |

# Additional information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value |

$287,647,000 due 7/01/14 at 0.06% |

BNP Paribas Securities Corp. | $ 42,000,000 |

Barclays Capital, Inc. | 27,000,000 |

Deutsche Bank Securities, Inc. | 37,647,000 |

HSBC Securities (USA), Inc. | 181,000,000 |

| $ 287,647,000 |

Other Information |

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets. |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

See accompanying notes which are an integral part of the financial statements.

Annual Report

The North Carolina Capital Management Trust: Cash Portfolio

Statement of Assets and Liabilities

| June 30, 2014 |

| | |

Assets | | |

Investment in securities, at value (including repurchase agreements of $287,647,000) - See accompanying schedule: Unaffiliated issuers (cost $3,241,298,496) | | $ 3,241,298,496 |

Cash | | 698 |

Receivable for fund shares sold | | 410,637 |

Interest receivable | | 531,106 |

Receivable from investment adviser for expense reductions | | 69,290 |

Total assets | | 3,242,310,227 |

| | |

Liabilities | | |

Payable for fund shares redeemed | $ 9,522,101 | |

Distributions payable | 1,922 | |

Accrued management fee | 473,670 | |

Deferred trustees' compensation | 22,817 | |

Total liabilities | | 10,020,510 |

| | |

Net Assets | | $ 3,232,289,717 |

Net Assets consist of: | | |

Paid in capital | | $ 3,232,290,869 |

Distributions in excess of net investment income | | (61,093) |

Accumulated undistributed net realized gain (loss) on investments | | 59,941 |

Net Assets, for 3,230,058,787 shares outstanding | | $ 3,232,289,717 |

Net Asset Value, offering price and redemption price per share ($3,232,289,717 ÷ 3,230,058,787 shares) | | $ 1.00 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended June 30, 2014 |

| | |

Investment Income | | |

Interest | | $ 6,190,334 |

| | |

Expenses | | |

Management fee | $ 8,321,476 | |

Independent trustees' compensation | 128,160 | |

Total expenses before reductions | 8,449,636 | |

Expense reductions | (2,619,628) | 5,830,008 |

Net investment income (loss) | | 360,326 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 109,956 |

Net increase in net assets resulting from operations | | $ 470,282 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

The North Carolina Capital Management Trust: Cash Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

June 30,

2014 | Year ended

June 30,

2013 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 360,326 | $ 1,756,280 |

Net realized gain (loss) | 109,956 | 174,933 |

Net increase in net assets resulting from operations | 470,282 | 1,931,213 |

Distributions to shareholders from net investment income | (360,963) | (1,756,242) |

Share transactions at net asset value of $1.00 per share

Proceeds from sales of shares | 9,668,663,045 | 10,611,503,020 |

Reinvestment of distributions | 333,009 | 1,611,561 |

Cost of shares redeemed | (9,943,882,967) | (10,811,063,463) |

Net increase (decrease) in net assets and shares resulting from share transactions | (274,886,913) | (197,948,882) |

Total increase (decrease) in net assets | (274,777,594) | (197,773,911) |

| | |

Net Assets | | |

Beginning of period | 3,507,067,311 | 3,704,841,222 |

End of period (including distributions in excess of net investment income of $61,093 and distributions in excess of net investment income of $60,456, respectively) | $ 3,232,289,717 | $ 3,507,067,311 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended June 30, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Income from Investment Operations | | | | | |

Net investment income (loss) | - C | - C | .001 | .001 | .002 |

Net realized and unrealized gain (loss) C | - | - | - | - | - |

Total from investment operations | - C | - C | .001 | .001 | .002 |

Distributions from net investment income | - C | - C | (.001) | (.001) | (.002) |

Distributions from net realized gain | - | - | - | - | - C |

Total distributions | - C | - C | (.001) | (.001) | (.002) |

Net asset value, end of period | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 | $ 1.00 |

Total ReturnA | .01% | .05% | .06% | .12% | .19% |

Ratios to Average Net Assets B | | | | | |

Expenses before reductions | .24% | .24% | .24% | .24% | .24% |

Expenses net of fee waivers, if any | .17% | .19% | .20% | .20% | .23% |

Expenses net of all reductions | .17% | .19% | .20% | .20% | .23% |

Net investment income (loss) | .01% | .05% | .06% | .12% | .19% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $3,232,290 | $ 3,507,067 | $ 3,704,841 | $ 3,991,384 | $ 4,199,259 |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed or waived or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements, waivers or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement and waivers but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

C Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

The North Carolina Capital Management Trust: Term Portfolio

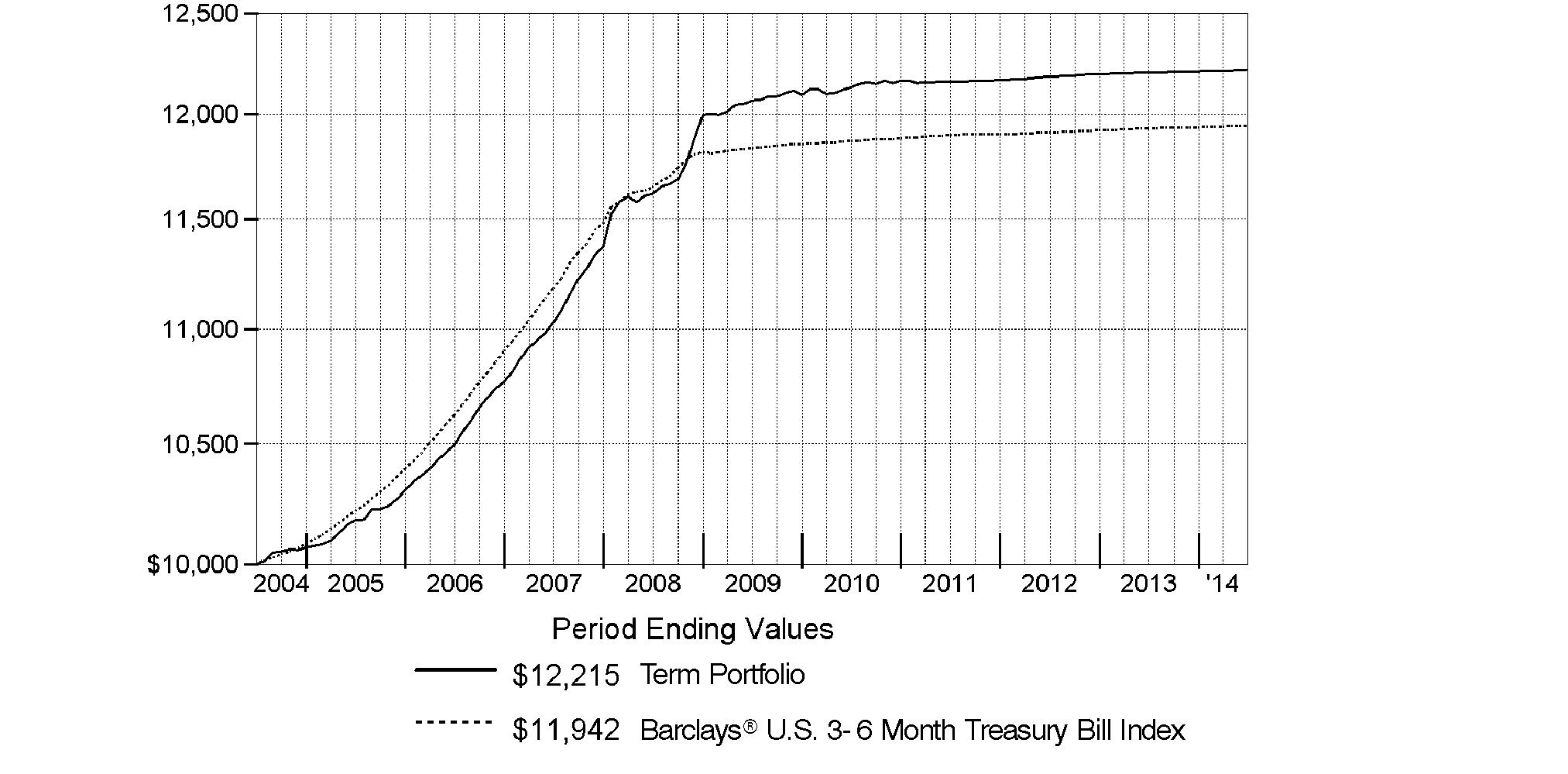

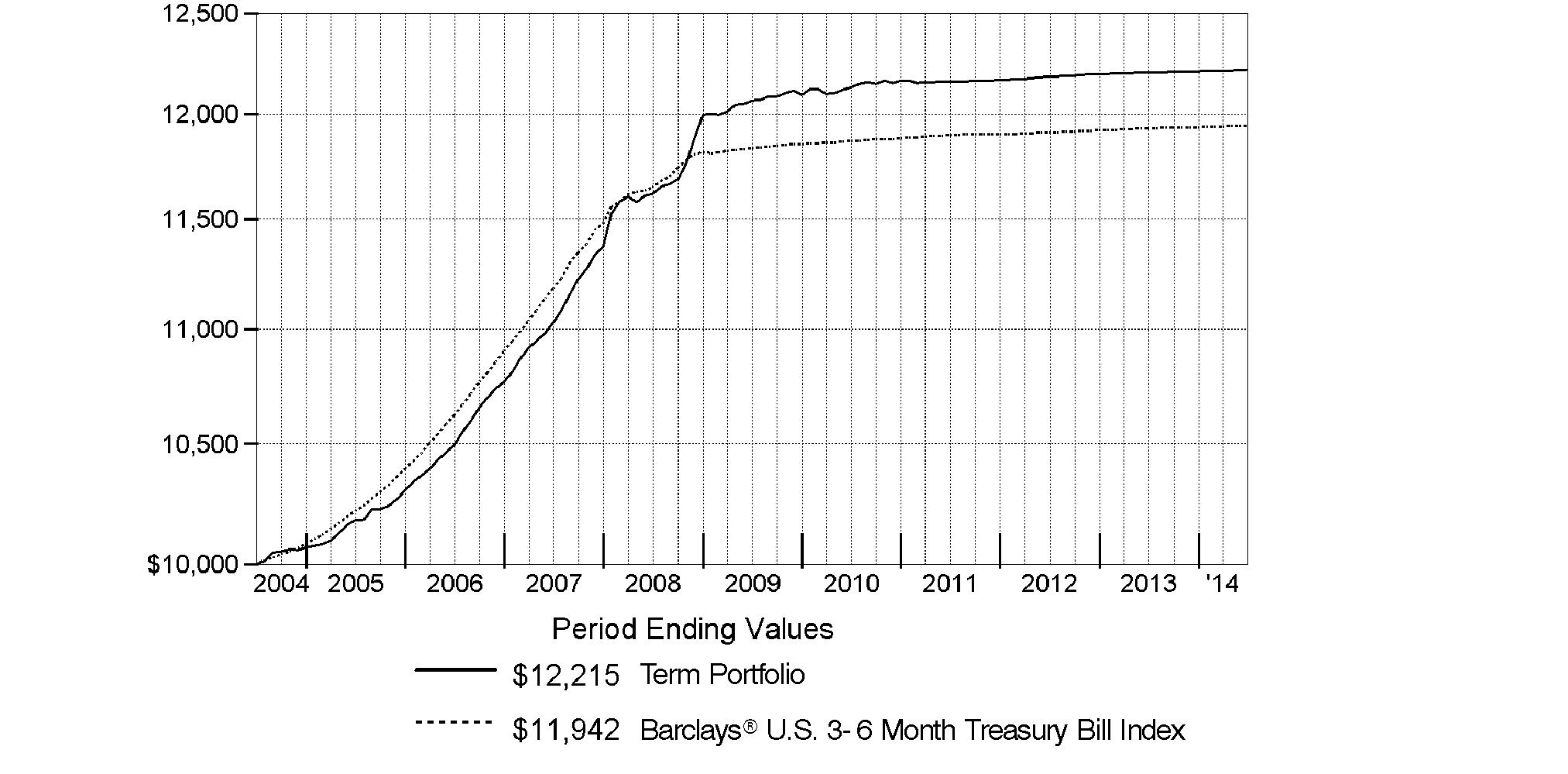

Performance: The Bottom Line

Average annual total return reflects the change in the value of an investment, assuming reinvestment of the fund's distributions from dividend income and capital gains (the profits earned upon the sale of securities that have grown in value, if any) and assuming a constant rate of performance each year. The $10,000 table and the fund's returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. During periods of reimbursement by Fidelity, a fund's total return will be greater than it would be had the reimbursement not occurred. How a fund did yesterday is no guarantee of how it will do tomorrow.

Average Annual Total Returns

Periods ended June 30, 2014 | Past 1

year | Past 5

years | Past 10

years |

Term Portfolio A | 0.10% | 0.25% | 2.02% |

A Prior to November 1, 2010, Term Portfolio operated under certain different investment policies and, prior to August 1, 2011, compared its performance to a different benchmark. The fund's historical performance may not represent its current investment policies.

$10,000 Over 10 Years

Let's say hypothetically that $10,000 was invested in Term Portfolio on June 30, 2004. The chart shows how the value of your investment would have changed, and also shows how the Barclays® U.S. 3-6 Month Treasury Bill Index performed over the same period.

Annual Report

The North Carolina Capital Management Trust: Term Portfolio

Management's Discussion of Fund Performance

Market Recap: A combination of strong investor demand and a limited amount of new Treasury issuance helped U.S. investment-grade bonds post gains for the 12 months ending June 30, 2014, with the Barclays® U.S. Aggregate Bond Index advancing 4.37%. The U.S. economy posted steady gains until the first quarter of 2014, when it unexpectedly contracted due to severe winter weather that suppressed spending. This backdrop attracted investors, who shrugged of fears that interest rates could keep rising as they sought the relative safety of the fixed-income markets. The U.S. Federal Reserve kept the benchmark federal funds rate in a target range of zero to 0.25%, but began to wind down quantitative easing, its stimulative asset-purchase program. Longer-term bonds outperformed shorter-dated securities, while intermediate-term bonds lagged. Lower-quality bonds attracted strong buying interest, especially in the latter part of the period. Worldwide, bonds were buoyed by concern arising from slowing economic growth in China, uncertainty in the emerging markets and tension due to the Russia/Ukraine conflict. Investment-grade corporate debt - bolstered by solid corporate balance sheets and investors hungry for higher-yielding alternatives to government bonds - posted a strong gain of 7.44%, eclipsing the other sectors that make up the Barclays index. By contrast, safe-haven Treasury securities rose only 2.04%, while municipal bonds appreciated 6.14%. High-yield bonds, as measured by The BofA Merrill LynchSM US High Yield Constrained Index, rose 11.79%; many investors continued to accept greater risk in exchange for higher income.

Comments from Timothy Huyck, Portfolio Manager of The North Carolina Capital Management Trust: Term Portfolio: For the 12 months ending June 30, 2014, the fund returned 0.10%, compared with 0.09% for the Barclays® U.S. 3-6 Month Treasury Bill Index. We aimed to provide a yield slightly higher than that of The North Carolina Capital Management Trust: Cash Portfolio while minimizing net asset value volatility. We achieved this goal by investing in the same high-quality issuers as the Cash portfolio, looking to achieve incrementally higher returns by purchasing securities with slightly longer final maturities. We maintained a conservative approach, including the management of our eurozone bank exposure; we invested selectively in the highest-quality banks located in core eurozone countries with the best sovereign-debt backdrop, including Germany, the Netherlands and France. The fund's weighted average maturity was shorter than the duration of its benchmark, and was lengthened when the market offered good investment opportunities, particularly in the eurozone, in the six- to nine-month maturity range.

The views expressed above reflect those of the portfolio manager(s) only through the end of the period as stated on the cover of this report and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity fund.

Annual Report

Semiannual Report

The North Carolina Capital Management Trust: Term Portfolio

Investment Changes (Unaudited)

Weighted Average Maturity as of June 30, 2014 |

| | 6 months ago |

Years | 0.2 | 0.2 |

This is a weighted average of all the maturities of the securities held in a fund. Weighted Average Maturity (WAM) can be used as a measure of sensitivity to interest rate changes and market changes. Generally, the longer the maturity, the greater the sensitivity to such changes. WAM is based on the dollar-weighted average length of time until principal payments must be paid. Depending on the types of securities held in a fund, certain maturity shortening devices (e.g., demand features, interest rate resets, and call options) may be taken into account when calculating the WAM. |

Duration as of June 30, 2014 |

| | 6 months ago |

Years | 0.2 | 0.2 |

Duration is a measure of a security's price sensitivity to changes in interest rates. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity shortening features (e.g., demand features, interest rate resets, and call options) when applicable. Securities with longer durations generally tend to be more sensitive to interest rate changes than securities with shorter durations. A fund with a longer average duration generally can be expected to be more sensitive to interest rate changes than a fund with a shorter average duration. |

Asset Allocation (% of fund's net assets) |

As of June 30, 2014 | As of December 31, 2013 |

| Commercial

Paper 101.8% | |  | Commercial

Paper 93.8% | |

| U.S. Government

and Government

Agency Obligations 0.6% | |  | U.S. Government

and Government

Agency Obligations 0.0% | |

| Other Short-Term

Investments and

Net Other Assets

(Liabilities)* (2.4)% | |  | Other Short-Term

Investments and

Net Other Assets

(Liabilities) 6.2% | |

* Other Short-Term Investments and Net Other Assets (Liabilities) are not included in the pie chart.

Annual Report

The North Carolina Capital Management Trust: Term Portfolio

Investments June 30, 2014

Showing Percentage of Net Assets

U.S. Government and Government Agency Obligations - 0.6% |

| Principal Amount | | Value |

U.S. Government Agency Obligations - 0.6% |

Federal Farm Credit Bank 0.182% 9/12/16 (b)

(Cost $8,848,858) | | $ 8,850,000 | | $ 8,855,832 |

Commercial Paper - 101.8% |

|

ABN AMRO Funding U.S.A. LLC: | | | | |

0.27% 8/22/14 | | 16,425,000 | | 16,421,107 |

0.28% 8/22/14 | | 12,575,000 | | 12,572,020 |

0.31% 10/2/14 | | 8,720,000 | | 8,715,560 |

0.34% 7/22/14 | | 25,000,000 | | 24,998,153 |

0.34% 7/22/14 | | 6,500,000 | | 6,499,520 |

0.48% 7/3/14 | | 10,000,000 | | 9,999,917 |

Bank of Nova Scotia yankee 0.27% 9/30/14 | | 25,000,000 | | 24,989,670 |

Barclays Bank PLC/Barclays U.S. CCP Funding LLC yankee: | | | | |

0.37% 11/14/14 | | 22,000,000 | | 21,982,558 |

0.42% 8/1/14 | | 10,000,000 | | 9,998,930 |

Barclays U.S. Funding Corp. yankee: | | | | |

0.38% 9/26/14 | | 15,000,000 | | 14,993,070 |

0.38% 10/21/14 | | 20,000,000 | | 19,986,126 |

BNP Paribas Finance, Inc. yankee: | | | | |

0.33% 9/8/14 | | 40,000,000 | | 39,986,232 |

0.44% 12/1/14 | | 37,000,000 | | 36,958,057 |

BPCE SA yankee 0.45% 8/1/14 | | 6,500,000 | | 6,499,100 |

Ciesco LP: | | | | |

0.25% 8/5/14 (a) | | 50,000,000 | | 49,991,800 |

0.25% 8/6/14 (a) | | 19,000,000 | | 18,996,778 |

Commonwealth Bank of Australia 0.181% 10/7/14 (b) | | 25,000,000 | | 24,998,700 |

|

| Principal Amount | | Value |

Credit Agricole North America yankee: | | | | |

0.335% 9/19/14 | | $ 6,977,000 | | $ 6,974,112 |

0.34% 7/28/14 | | 6,500,000 | | 6,499,353 |

0.34% 9/2/14 | | 10,000,000 | | 9,996,924 |

0.34% 9/4/14 | | 45,000,000 | | 44,985,645 |

Credit Suisse AG: | | | | |

yankee: | | | | |

0.32% 7/25/14 | | 5,000,000 | | 4,999,469 |

0.33% 7/31/14 | | 20,000,000 | | 19,997,066 |

0.35% 10/28/14 | | 19,000,000 | | 18,982,900 |

0.2515% 11/7/14 (b) | | 25,000,000 | | 24,999,900 |

DNB Bank ASA yankee: | | | | |

0.23% 9/9/14 | | 25,000,000 | | 24,993,195 |

0.255% 2/6/15 | | 31,000,000 | | 30,951,724 |

0.255% 2/19/15 | | 19,000,000 | | 18,968,137 |

ING U.S. Funding LLC yankee: | | | | |

0.23% 9/2/14 | | 25,000,000 | | 24,992,310 |

0.235% 8/11/14 | | 5,000,000 | | 4,999,149 |

0.28% 8/1/14 | | 30,000,000 | | 29,996,454 |

0.3% 10/7/14 | | 7,000,000 | | 6,996,112 |

JPMorgan Securities LLC: | | | | |

0.32% 7/1/14 | | 10,000,000 | | 9,999,953 |

0.33% 12/1/14 | | 17,000,000 | | 16,985,383 |

0.35% 10/24/14 | | 50,000,000 | | 49,969,550 |

Lloyds Bank PLC yankee: | | | | |

0.24% 9/4/14 | | 20,000,000 | | 19,994,646 |

0.28% 1/26/15 | | 32,000,000 | | 31,945,866 |

0.415% 7/1/14 | | 20,000,000 | | 19,999,956 |

Mitsubishi UFJ Trust & Banking Corp. yankee 0.23% 11/4/14 | | 19,000,000 | | 18,984,270 |

Commercial Paper - continued |

| Principal Amount | | Value |

Natexis Banques Populaires U.S. Finance Co. LLC yankee: | | | | |

0.33% 9/10/14 | | $ 10,000,000 | | $ 9,996,440 |

0.35% 7/16/14 | | 22,700,000 | | 22,698,870 |

0.48% 8/1/14 | | 38,000,000 | | 37,995,508 |

Nationwide Building Society yankee: | | | | |

0.27% 12/8/14 | | 19,000,000 | | 18,976,632 |

0.28% 9/8/14 | | 40,000,000 | | 39,986,232 |

Northern Pines Funding LLC: | | | | |

0.3% 8/11/14 (Liquidity Facility Shanghai Bestway Marine Engineering Design Co. Ltd.) | | 30,000,000 | | 29,994,891 |

0.33% 9/26/14 (Liquidity Facility Shanghai Bestway Marine Engineering Design Co. Ltd.) | | 46,500,000 | | 46,478,517 |

Oversea-Chinese Banking Corp. Ltd. 0.235% 9/3/14 | | 50,000,000 | | 49,986,190 |

PNC Bank NA 0.26% 9/15/14 | | 10,000,000 | | 9,996,129 |

Rabobank U.S.A. Financial Corp. yankee 0.24% 2/2/15 | | 55,000,000 | | 54,918,880 |

Skandinaviska Enskilda Banken AB yankee: | | | | |

0.25% 9/23/14 | | 14,000,000 | | 13,994,315 |

0.25% 10/31/14 | | 6,000,000 | | 5,996,023 |

0.26% 9/23/14 | | 15,000,000 | | 14,993,909 |

0.26% 10/31/14 | | 8,000,000 | | 7,994,698 |

0.27% 10/31/14 | | 13,000,000 | | 12,991,384 |

0.275% 7/10/14 | | 15,000,000 | | 14,999,790 |

|

| Principal Amount | | Value |

Societe Generale North America, Inc. yankee: | | | | |

0.32% 9/29/14 | | $ 35,000,000 | | $ 34,983,102 |

0.35% 7/31/14 | | 24,000,000 | | 23,997,293 |

Sumitomo Mitsui Banking Corp. yankee 0.25% 11/4/14 | | 46,000,000 | | 45,960,675 |

Swedbank AB yankee: | | | | |

0.25% 8/5/14 | | 25,000,000 | | 24,997,400 |

0.255% 11/3/14 | | 21,000,000 | | 20,986,182 |

0.265% 2/13/15 | | 17,000,000 | | 16,973,514 |

Toronto Dominion Holdings (U.S.A.) yankee: | | | | |

0.24% 8/28/14 | | 30,000,000 | | 29,994,117 |

0.25% 10/3/14 | | 25,000,000 | | 24,990,633 |

United Overseas Bank Ltd. 0.24% 7/22/14 | | 5,095,000 | | 5,094,717 |

Westpac Banking Corp. yankee 0.3% 10/31/14 | | 25,000,000 | | 24,984,540 |

TOTAL COMMERCIAL PAPER (Cost $1,440,476,948) | 1,440,759,953 |

Cash Equivalents - 0.9% |

| Maturity Amount | | Value |

Investments in repurchase agreements in a joint trading account at 0.05%, dated 6/30/14 due 7/1/14 (Collateralized by U.S. Treasury Obligations) #

(Cost $12,766,000) | $ 12,766,018 | | $ 12,766,000 |

TOTAL INVESTMENT PORTFOLIO - 103.3% (Cost $1,462,091,806) | 1,462,381,785 |

NET OTHER ASSETS (LIABILITIES) - (3.3)% | | (46,911,332) |

NET ASSETS - 100% | $ 1,415,470,453 |

Legend |

(a) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $68,988,578 or 4.9% of net assets. |

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end. |

# Additional information on each counterparty to the repurchase agreement is as follows: |

Repurchase Agreement / Counterparty | Value |

$12,766,000 due 7/01/14 at 0.05% |

Deutsche Bank Securities, Inc. | $ 12,766,000 |

Other Information |

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements. |

Distribution of investments by country or territory of incorporation, as a percentage of total net assets, is as follows (Unaudited): |

United States of America | 63.0% |

Sweden | 9.6% |

United Kingdom | 9.1% |

Norway | 5.3% |

Singapore | 3.9% |

Australia | 3.6% |

Japan | 3.2% |

Canada | 1.8% |

Others (Individually Less Than 1%) | 0.5% |

| 100.0% |

See accompanying notes which are an integral part of the financial statements.

Annual Report

The North Carolina Capital Management Trust: Term Portfolio

Statement of Assets and Liabilities

| June 30, 2014 |

| | |

Assets | | |

Investment in securities, at value (including repurchase agreements of $12,766,000)

- See accompanying schedule: Unaffiliated issuers (cost $1,462,091,806) | | $ 1,462,381,785 |

Cash | | 476 |

Receivable for fund shares sold | | 7,253,756 |

Interest receivable | | 13,975 |

Receivable from investment adviser for expense reductions | | 27,232 |

Total assets | | 1,469,677,224 |

| | |

Liabilities | | |

Payable for fund shares redeemed | $ 53,922,803 | |

Distributions payable | 2,719 | |

Accrued management fee | 280,320 | |

Deferred trustee's compensation | 929 | |

Total liabilities | | 54,206,771 |

| | |

Net Assets | | $ 1,415,470,453 |

Net Assets consist of: | | |

Paid in capital | | $ 1,415,151,161 |

Undistributed net investment income | | 12,757 |

Accumulated undistributed net realized gain (loss) on investments | | 16,556 |

Net unrealized appreciation (depreciation) on investments | | 289,979 |

Net Assets, for 146,195,061 shares outstanding | | $ 1,415,470,453 |

Net Asset Value, offering price and redemption price per share ($1,415,470,453 ÷ 146,195,061 shares) | | $ 9.68 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Statement of Operations

| Year ended June 30, 2014 |

| | |

Investment Income | | |

Interest | | $ 4,523,471 |

| | |

Expenses | | |

Management fee | $ 3,830,298 | |

Independent trustees' compensation | 51,779 | |

Total expenses before reductions | 3,882,077 | |

Expense reductions | (838,056) | 3,044,021 |

Net investment income (loss) | | 1,479,450 |

Realized and Unrealized Gain (Loss) Net realized gain (loss) on: | | |

Investment securities: | | |

Unaffiliated issuers | | 19,313 |

Change in net unrealized appreciation (depreciation) on investment securities | | 96,740 |

Net gain (loss) | | 116,053 |

Net increase (decrease) in net assets resulting from operations | | $ 1,595,503 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

The North Carolina Capital Management Trust: Term Portfolio

Financial Statements - continued

Statement of Changes in Net Assets

| Year ended

June 30,

2014 | Year ended

June 30,

2013 |

Increase (Decrease) in Net Assets | | |

Operations | | |

Net investment income (loss) | $ 1,479,450 | $ 2,440,804 |

Net realized gain (loss) | 19,313 | 15,105 |

Change in net unrealized appreciation (depreciation) | 96,740 | 13,924 |

Net increase (decrease) in net assets resulting from operations | 1,595,503 | 2,469,833 |

Distributions to shareholders from net investment income | (1,486,068) | (2,438,195) |

Share transactions

Proceeds from sales of shares | 1,231,263,749 | 1,413,254,020 |

Reinvestment of distributions | 1,449,348 | 2,392,175 |

Cost of shares redeemed | (1,213,766,928) | (943,530,813) |

Net increase (decrease) in net assets resulting from share transactions | 18,946,169 | 472,115,382 |

Total increase (decrease) in net assets | 19,055,604 | 472,147,020 |

| | |

Net Assets | | |

Beginning of period | 1,396,414,849 | 924,267,829 |

End of period (including undistributed net investment income of $12,757 and undistributed net investment income of $8,688, respectively) | $ 1,415,470,453 | $ 1,396,414,849 |

Other Information Shares | | |

Sold | 127,196,668 | 145,997,316 |

Issued in reinvestment of distributions | 149,726 | 247,126 |

Redeemed | (125,389,145) | (97,472,191) |

Net increase (decrease) | 1,957,249 | 48,772,251 |

See accompanying notes which are an integral part of the financial statements.

Annual Report

Financial Highlights

Years ended June 30, | 2014 | 2013 | 2012 | 2011 | 2010 |

Selected Per-Share Data | | | | | |

Net asset value, beginning of period | $ 9.68 | $ 9.68 | $ 9.68 | $ 9.70 | $ 9.69 |

Income from Investment Operations | | | | | |

Net investment income (loss) B | .010 | .017 | .024 | .019 | .019 |

Net realized and unrealized gain (loss) | - D | .001 | (.006) | .004 | .033 |

Total from investment operations | .010 | .018 | .018 | .023 | .052 |

Distributions from net investment income | (.010) | (.018) | (.018) | (.022) | (.018) |

Distributions from net realized gain | - | - | - | (.021) | (.024) |

Total distributions | (.010) | (.018) | (.018) | (.043) | (.042) |

Net asset value, end of period | $ 9.68 | $ 9.68 | $ 9.68 | $ 9.68 | $ 9.70 |

Total ReturnA | .10% | .18% | .19% | .23% | .54% |

Ratios to Average Net Assets C | | | | | |

Expenses before reductions | .27% | .27% | .28% | .28% | .28% |

Expenses net of fee waivers, if any | .21% | .22% | .20% | .27% | .27% |

Expenses net of all reductions | .21% | .22% | .20% | .27% | .27% |

Net investment income (loss) | .10% | .18% | .25% | .20% | .19% |

Supplemental Data | | | | | |

Net assets, end of period (000 omitted) | $ 1,415,470 | $ 1,396,415 | $ 924,268 | $ 60,398 | $ 70,652 |

Portfolio turnover rate | 0% | 0% | 0% | 71% | 202% |

A Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

B Calculated based on average shares outstanding during the period.

C Expense ratios reflect operating expenses of the Fund. Expenses before reductions do not reflect amounts reimbursed by the investment adviser or reductions from expense offset arrangements and do not represent the amount paid by the Fund during periods when reimbursements or reductions occur. Expenses net of fee waivers reflect expenses after reimbursement by the investment adviser but prior to reductions from expense offset arrangements. Expenses net of all reductions represent the net expenses paid by the Fund.

D Amount represents less than $.001 per share.

See accompanying notes which are an integral part of the financial statements.

Annual Report

Notes to Financial Statements

For the period ended June 30, 2014

1. Organization.

Cash Portfolio and Term Portfolio (the Funds) are funds of The North Carolina Capital Management Trust (the Trust). The Trust is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company organized as a Massachusetts business trust. Shares of the Trust are offered exclusively to local government and public authorities of the state of North Carolina. Each Fund is authorized to issue an unlimited number of shares.

2. Significant Accounting Policies.

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (GAAP), which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Subsequent events, if any, through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Funds:

Investment Valuation. Investments are valued as of 4:00 p.m. Eastern time on the last calendar day of the period. In accordance with valuation policies and procedures approved by the Board of Trustees (the Board), the Term Fund attempts to obtain prices from one or more third party pricing vendors or brokers to value its investments. When current market prices, quotations or currency exchange rates are not readily available or reliable, investments will be fair valued in good faith by the Fidelity Management & Research Company (FMR) Fair Value Committee (the Committee), in accordance with procedures adopted by the Board. Factors used in determining fair value vary by investment type and may include market or investment specific events, changes in interest rates and credit quality. The frequency with which these procedures are used cannot be predicted and they may be utilized to a significant extent. The Committee oversees the Term Fund's valuation policies and procedures and is responsible for approving and reporting to the Board all fair value determinations.

Each Fund categorizes the inputs to valuation techniques used to value its investments into a disclosure hierarchy consisting of three levels as shown below:

Level 1 - quoted prices in active markets for identical investments

Level 2 - other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, etc.)

Level 3 - unobservable inputs (including the Fund's own assumptions based on the best information available)

Valuation techniques used to value each Fund's investments by major category are as follows:

For the Term Portfolio, debt securities, including restricted securities, are valued based on evaluated prices received from third party pricing vendors or from brokers who make markets in such securities. U.S. government and government agency obligations and commercial paper are valued by pricing vendors who utilize matrix pricing which considers yield or price of bonds of comparable quality, coupon, maturity and type or by broker-supplied prices. When independent prices are unavailable or unreliable, debt securities may be valued utilizing pricing methodologies which consider similar factors that would be used by third party pricing vendors. Debt securities are generally categorized as Level 2 in the hierarchy but may be Level 3 depending on the circumstances.

Short-term securities with remaining maturities of sixty days or less may be valued at amortized cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

Annual Report

Notes to Financial Statements - continued

2. Significant Accounting Policies - continued

Investment Valuation - continued

For the Cash Portfolio, as permitted by compliance with certain conditions under Rule 2a-7 of the 1940 Act, securities are valued at amortized cost, which approximates fair value. The amortized cost of an instrument is determined by valuing it at its original cost and thereafter amortizing any discount or premium from its face value at a constant rate until maturity. Securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

For the Term Fund, changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy.

Investment Transactions and Income. For financial reporting purposes, the Funds' investment holdings and NAV include trades executed through the end of the last business day of the period. The NAV per share for processing shareholder transactions is calculated as of the close of business of the New York Stock Exchange (NYSE), normally 4:00 p.m. Eastern time and includes trades executed through the end of the prior business day for the Term Portfolio and trades executed through the end of the current business day for the Cash Portfolio. Gains and losses on securities sold are determined on the basis of identified cost. Interest income is accrued as earned and includes coupon interest and amortization of premium and accretion of discount on debt securities as applicable. The principal amount on inflation-indexed securities is periodically adjusted to the rate of inflation and interest is accrued based on the principal amount. The adjustments to principal due to inflation are reflected as increases or decreases to Interest in the accompanying Statement of Operations.

Expenses. Expenses directly attributable to a fund are charged to that fund. Expenses attributable to more than one fund are allocated among the respective funds on the basis of relative net assets or other appropriate methods. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Deferred Trustee Compensation. The independent Trustees may elect to defer receipt of all or a portion of their annual fees under the Trustees' Deferred Compensation Plan ("the Plan"). Interest is accrued on amounts deferred under the Plan based on the prevailing 90 day Treasury Bill rate.

Income Tax Information and Distributions to Shareholders. Each year, each Fund intends to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code, including distributing substantially all of its taxable income and realized gains. As a result, no provision for U.S. Federal income taxes is required. As of June 30, 2014, each Fund did not have any unrecognized tax benefits in the financial statements; nor is each Fund aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Each Fund files a U.S. federal tax return, in addition to state and local tax returns as required. Each Fund's federal income tax returns are subject to examination by the Internal Revenue Service (IRS) for a period of three fiscal years after they are filed. State and local tax returns may be subject to examination for an additional fiscal year depending on the jurisdiction.

Dividends are declared and recorded daily and paid monthly from net investment income. Distributions from realized gains, if any, are declared and recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. In addition, the Fund claimed a portion of the payment made to redeeming shareholders as a distribution for income tax purposes.

Annual Report

2. Significant Accounting Policies - continued

Income Tax Information and Distributions to Shareholders - continued

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Capital accounts are not adjusted for temporary book-tax differences which will reverse in a subsequent period.

Book-tax differences are primarily due to deferred trustee compensation.

The federal tax cost of investment securities and unrealized appreciation (depreciation) as of period end were as follows for each Fund:

| Tax cost | Gross unrealized

appreciation | Gross unrealized

depreciation | Net unrealized

appreciation

(depreciation) on

securities and other investments |

Cash Portfolio | 3,241,298,496 | - | - | - |

Term Portfolio | 1,462,091,806 | 297,013 | (7,034) | 289,979 |

The tax-based components of distributable earnings as of period end were as follows for each Fund:

| Undistributed

ordinary income | Undistributed

long-term

capital gain | Capital loss

carryforward | Net unrealized

appreciation

(depreciation) |

Cash Portfolio | $ 37,829 | $ 6,638 | $ - | $ - |

Term Portfolio | 30,707 | - | - | 289,979 |

The tax character of distributions paid was as follows:

June 30, 2014 | Ordinary Income | Long-term

Capital Gains | Tax Return

of Capital | Total |

Cash Portfolio | $ 360,963 | $ - | $ - | $ 360,963 |

Term Portfolio | 1,486,068 | - | - | 1,486,068 |

June 30, 2013 | Ordinary Income | Long-term

Capital Gains | Tax Return

of Capital | Total |

Cash Portfolio | $ 1,756,242 | $ - | $ - | $ 1,756,242 |

Term Portfolio | 2,438,195 | - | - | 2,438,195 |

Repurchase Agreements. Pursuant to an Exemptive Order issued by the Securities and Exchange Commission (the SEC), the Funds along with other registered investment companies having management contracts with Fidelity Management & Research Company (FMR), or other affiliated entities of FMR, are permitted to transfer uninvested cash balances into joint trading accounts which are then invested in repurchase agreements. The Funds may also invest directly with institutions in repurchase agreements. Repurchase agreements may be collateralized by government or non-government securities. Upon settlement date, collateral is held in segregated accounts with custodian banks and may be obtained in the event of a default of the counterparty. Each applicable Fund monitors, on a daily basis, the value of the collateral to ensure it is at least equal to the principal amount of the repurchase agreement (including accrued interest). In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the value of the collateral may decline.

Annual Report

Notes to Financial Statements - continued

3. Fees and Other Transactions with Affiliates.

Management Fee. Fidelity Management & Research Company (the investment adviser) and its affiliates provides the Funds with investment management related services for which the Funds pay a monthly management fee based upon a graduated series of annual rates ranging between ..195% and .275% of each Fund's average net assets. The investment adviser pays all other expenses, except the compensation of the independent Trustees and certain exceptions such as interest expense. The management fee paid to the investment adviser by the Funds is reduced by an amount equal to the fees and expenses paid by the Funds to the independent Trustees. For the reporting period each Fund's annual management fee rate, expressed as a percentage of each Fund's average net assets, was as follows:

Cash Portfolio | .24% |

Term Portfolio | .26% |

Distribution and Service Plan Fees. In accordance with Rule 12b-1 of the 1940 Act, each Fund has adopted a separate Distribution and Service plan. The Funds do not pay any fees for these services. The investment adviser pays Fidelity Distributors Corporation (FDC), an affiliate of the investment adviser, a Distribution and Service fee from the management fee paid by each fund based on a graduated series of rates ranging from ..06% to .08% of each Fund's average net assets. For the period, the investment adviser paid FDC $1,780,043 and $394,828 on behalf of Cash and Term Portfolios, respectively, all of which was paid to the Capital Management of the Carolinas LLC.

4. Expense Reductions.

The investment adviser or its affiliates voluntarily agreed to waive a portion of each Fund's management fee during the period. The amount of the waiver for each Fund was as follows:

Cash Portfolio | $ 2,619,628 |

Term Portfolio | 838,056 |

5. Other.

The Funds' organizational documents provide former and current trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Funds. In the normal course of business, the Funds may also enter into contracts that provide general indemnifications. The Funds' maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Funds. The risk of material loss from such claims is considered remote.

Annual Report

Report of Independent Registered Public Accounting Firm

To the Trustees of North Carolina Capital Management Trust and the Shareholders of Cash Portfolio and Term Portfolio:

In our opinion, the accompanying statements of assets and liabilities, including the schedules of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial positions of Cash Portfolio and Term Portfolio (funds of North Carolina Capital Management Trust) at June 30, 2014, the results of each of their operations for the year then ended, the changes in each of their net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the North Carolina Capital Management Trust's management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at June 30, 2014 by correspondence with the custodian, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

August 15, 2014

Annual Report

The Trustees and officers of the trust and funds, as applicable, are listed below. The Board of Trustees governs each fund and is responsible for protecting the interests of shareholders. The Trustees are experienced executives who meet periodically throughout the year to oversee each fund's activities, review contractual arrangements with companies that provide services to each fund, oversee management of the risks associated with such activities and contractual arrangements, and review each fund's performance. Each of the Trustees oversees two funds.

The Trustees hold office without limit in time except that (a) any Trustee may resign; (b) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (c) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (d) any Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the trust. In any event, each Trustee who is not an interested person (as defined in the 1940 Act) of the trust and the funds (Independent Trustee), shall retire not later than the last day of the calendar year in which his or her 75th birthday occurs. The officers hold office without limit in time, except that any officer may resign or may be removed by a vote of a majority of the Trustees at any regular meeting or any special meeting of the Trustees. Except as indicated, each individual has held the office shown or other offices in the same company for the past five years.

Experience, Skills, Attributes, and Qualifications of the Trustees. The Board of Trustees has adopted a statement of policy that describes the experience, qualifications, attributes and skills that are necessary and desirable for potential Independent Trustee candidates (Statement of Policy). With respect to the criteria for selecting Independent Trustees, it is expected that all candidates will possess the following minimum qualifications: (i) unquestioned personal integrity; (ii) not an interested person of FMR or its affiliates within the meaning of the 1940 Act; (iii) does not have a material relationship (e.g., commercial, banking, consulting, legal, or accounting) that could create an appearance of lack of independence in respect of FMR and its affiliates; (iv) has the disposition to act independently in respect of FMR and its affiliates and others in order to protect the interests of the funds and all shareholders; (v) ability to attend regularly scheduled meetings during the year; (vi) demonstrates sound business judgment gained through broad experience in significant positions where the candidate has dealt with management, technical, financial, or regulatory issues; (vii) sufficient financial or accounting knowledge to add value in the complex financial environment of the funds; (viii) experience on corporate or other institutional oversight bodies having similar responsibilities, but which board memberships or other relationships could not result in business or regulatory conflicts with the funds; (ix) capacity for the hard work and attention to detail that is required to be an effective Independent Trustee in light of the funds' complex regulatory, operational, and marketing setting; and (x) understanding of the economy of North Carolina and the financing needs of North Carolina counties and municipalities. The Board may determine that a candidate who does not have the type of previous experience or knowledge referred to above should nevertheless be considered as a nominee if the Board finds that the candidate has additional qualifications such that his or her qualifications, taken as a whole, demonstrate the same level of fitness to serve as an Independent Trustee. The Board believes that each Trustee satisfied at the time he was initially elected or appointed a Trustee, and continues to satisfy, the standards contemplated by the Statement of Policy. The Board of Trustees may also engage professional search firms to help identify potential Independent Trustee candidates with experience, qualifications, attributes and skills consistent with the Statement of Policy. Additional criteria based on the composition and skills of the current Independent Trustees as well as experience or skills that may be appropriate in light of future changes to board composition, business conditions, and regulatory or other developments may be considered by a professional search firm and the Board of Trustees. In addition, the Board takes into account the Trustees' commitment and participation in Board and committee meetings, as well as their leadership of standing and ad hoc committees throughout their tenure.

In determining that a particular Trustee was and continues to be qualified to serve as a Trustee, the Board has considered a variety of criteria, none of which, in isolation, was controlling. The Board believes that, collectively, the Trustees have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing each fund and protecting the interests of shareholders. Information about the specific experience, skills, attributes, and qualifications of each Trustee, which in each case led to the Board's conclusion that the Trustee should serve (or continue to serve) as a trustee of the funds, is provided below.

Annual Report

Trustees and Officers - continued

Board Structure and Oversight Function. Thomas P. Hollowell is an Independent Trustee and currently serves as Chairman. The Trustees have determined that an independent Chairman is appropriate and benefits shareholders. In his capacity as Chairman, Mr. Hollowell (i) acts as a liaison between the Independent Trustees and management with respect to matters important to the Independent Trustees; and (ii) with management, prepares agendas for Board meetings. The Independent Trustees also meet regularly in executive session.

The Trustees oversee two funds that are offered exclusively to certain governmental entities of the State of North Carolina. The Trustees primarily operate as a full Board, but have also established one standing committee, the Audit Committee, to facilitate the timely and efficient consideration of all matters of importance to the Trustees, each fund, and fund shareholders and to facilitate compliance with legal and regulatory requirements and oversight of the funds' activities and associated risks. The Board has charged FMR and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrably adverse effects on the funds' business and/or reputation; (ii) implementing processes and controls to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously business and market conditions in order to facilitate the identification and implementation processes described in (i) and (ii) above. Because the day-to-day operations and activities of the funds are carried out by or through FMR, its affiliates and other service providers, the funds' exposure to risks is mitigated but not eliminated by the processes overseen by the Trustees. Board oversight of different aspects of the funds' activities is exercised primarily through the full Board, but also through the Audit Committee. Appropriate personnel, including but not limited to the funds' Chief Compliance Officer (CCO), FMR's internal auditor, the independent accountants, and the funds' Treasurer and portfolio management personnel, make periodic reports to the Board and Audit Committee, as appropriate. The responsibilities of the Audit Committee, including its oversight responsibilities, are described further under "Audit Committee."

The funds' Statement of Additional Information (SAI) includes more information about the Trustees. To request a free copy, call Capital Management of the Carolinas, L.L.C. (CMC) at 1-800-222-3232.

Interested Trustee*:

Correspondence intended for the Trustee who is an interested person (as defined in the 1940 Act) may be sent to Fidelity Investments, 245 Summer Street, Boston, Massachusetts 02210.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+ |

Don Haile (1941) |

Year of Election or Appointment: 2012 Trustee |

| Mr. Haile serves as a member of the Board of Directors of St. Vincent College and MCNC (non-profit operator of the North Carolina Research and Education Network), and as an Advisory Board Member for the Penn State College of Information Services and Technology. Prior to his retirement, Mr. Haile was a Venture Partner for Volition Capital LLC (formerly, Fidelity Ventures) (2005-2011) and was Chief Information Officer (1999-2005) and Senior Vice President and General Manager (2005-2007) for FMR Corp. |

* Trustee has been determined to be an "Interested Trustee" by virtue of, among other things, his affiliation with the trust, CMC, or various entities under common control with FMR.

Annual Report

+ The information above includes the Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to the Trustee's qualifications to serve as a Trustee, which led to the conclusion that the Trustee should serve as a Trustee for each fund.

Independent Trustees:

Correspondence intended for each Independent Trustee (that is, the Trustees other than the Interested Trustee) may be sent to Fidelity Investments, P.O. Box 55235, Boston, Massachusetts 02205-5235.

Name, Year of Birth; Principal Occupations and Other Relevant Experience+ |

Thomas P. Hollowell (1943) |

Year of Election or Appointment: 2003 Trustee Chairman of the Independent Trustees |

| Mr. Hollowell is a member of the Board of Faison Enterprises Inc. (real estate development), and Advisory Director of Fidus Partners (investment banking, 2008-present). Previously, Mr. Hollowell served as Senior Managing Director of Fidus Partners (2004-2008) and Chairman of the College of William and Mary Foundation (2003-2005). |

Anna Spangler Nelson (1962) |

Year of Election or Appointment: 2012 Trustee |

| Ms. Nelson is Chairman and Executive Vice President of the Spangler Companies, Inc. (private investment company, 2005-present) and is a general partner of Wakefield Group (venture capital firm, 1988-present). She is a member of the board of directors of Ruddick Corporation (holding company, 1998-present) and a Director and Vice President of C. D. Spangler Foundation, Inc. (1998-present). Ms. Nelson serves on the board of trustees of Champions for Education (2002-present), the Fidelity Charitable Gift Fund (2005-present), Trinity Episcopal School (2010-present), and the John S. and James L. Knight Foundation (2011-present), and is the Co-Chair of the Governance Board of the Charlotte Mecklenburg Schools - Project L.I.F.T. (2011-present). Previously, Ms. Nelson served as Chairman and Executive Vice President of Golden Eagle Industries, Inc. (private investments company, 2005-2010) and on the Board of Trustees of The Carolina Thread Trail (2007-2011). |

E. Norris Tolson (1939) |

Year of Election or Appointment: 2008 Trustee |

| Mr. Tolson serves as President and Chief Executive Officer (2007-present), a Director (1997-present), and an Executive Committee member (2000-present) of the North Carolina Biotechnology Center. Mr. Tolson also serves as a member of the North Carolina State University Board of Trustees (2009-present), as well as the North Carolina State University Alumni Association Board (2007-present), and the North Carolina State University College of Agriculture and Life Sciences Alumni and Friends Society Board (1998-present). |

+ The information above includes each Trustee's principal occupation during the last five years and other information relating to the experience, attributes, and skills relevant to each Trustee's qualifications to serve as a Trustee, which led to the conclusion that each Trustee should serve as a Trustee for each fund.

Annual Report

Trustees and Officers - continued

Officers:

Correspondence intended for each officer may be sent to 245 Summer Street, Boston, Massachusetts 02210. Officers appear below in alphabetical order.

Name, Year of Birth; Principal Occupation |

Elizabeth Paige Baumann (1968) |

Year of Election or Appointment: 2012 Anti-Money Laundering (AML) Officer |

| Ms. Baumann also serves as AML Officer of other funds. She is Chief AML Officer of FMR LLC (2012-present) and is an employee of Fidelity Investments. Previously, Ms. Baumann served as Vice President and Deputy Anti-Money Laundering Officer (2007-2012). |

Jonathan Davis (1968) |

Year of Election or Appointment: 2014 Assistant Treasurer |

| Mr. Davis also serves as Assistant Treasurer of other funds. Mr. Davis is an employee of Fidelity Investments. Previously, Mr. Davis served as Vice President and Associate General Counsel of FMR LLC (2003-2010). |

Stephanie J. Dorsey (1969) |

Year of Election or Appointment: 2014 President and Treasurer |

| Ms. Dorsey also serves as an officer of other funds. She is an employee of Fidelity Investments (2008-present) and has served in other fund officer roles. Prior to joining Fidelity Investments, Ms. Dorsey served as Treasurer (2004-2008) of the JPMorgan Mutual Funds and Vice President (2004-2008) of JPMorgan Chase Bank. |

Scott C. Goebel (1968) |

Year of Election or Appointment: 2008 Secretary and Chief Legal Officer (CLO) |

| Mr. Goebel serves as Secretary and CLO of other funds. Mr. Goebel also serves as Secretary of Fidelity SelectCo, LLC (2013-present), Fidelity Investments Money Management, Inc. (FIMM) (2010-present) and Fidelity Research and Analysis Company (FRAC) (2010-present); General Counsel, Secretary, and Senior Vice President of FMR (2008-present) and FMR Co., Inc. (2008-present); Chief Legal Officer of Fidelity Management & Research (Hong Kong) Limited (2008-present); and Assistant Secretary of Fidelity Management & Research (Japan) Inc. (2008-present) and Fidelity Management & Research (U.K.) Inc. (2008-present). Previously, Mr. Goebel served as Secretary and CLO of other Fidelity funds (2008-2013), Assistant Secretary of FIMM (2008-2010), FRAC (2008-2010), and certain funds (2007-2008); and as Vice President and Secretary of Fidelity Distributors Corporation (FDC) (2005-2007). Mr. Goebel has been employed by FMR LLC or an affiliate since 2001. |

Kimberley H. Monasterio (1963) |

Year of Election or Appointment: 2014 Chief Financial Officer (CFO) |

| Ms. Monasterio also serves as Senior Vice President of Fund Administration for Fidelity Pricing and Cash Management Services (FPCMS) (2010-present) and is an employee of Fidelity Investments (2004-present). Previously, Ms. Monasterio served as President and Chief Executive Officer of The North Carolina Capital Management Trust: Cash and Term Portfolios (2013-2014). |

Jason P. Pogorelec (1975) |

Year of Election or Appointment: 2013 Assistant Secretary |

| Mr. Pogorelec also serves as Vice President, Associate General Counsel (2010-present) and is an employee of Fidelity Investments (2006-present). |

J. Calvin Rivers, Jr. (1945) |

Year of Election or Appointment: 2001 Vice President |

| Mr. Rivers also serves as President of Capital Management of the Carolinas, L.L.C. Previously, Mr. Rivers served as a Director of Bojangle's Inc. (fast-food restaurant chain, 2001-2007) and a Director of the Board of Trustees of the Teachers' and State Employees' Retirement System (2002-2005). |

Michael H. Whitaker (1967) |

Year of Election or Appointment: 2008 Chief Compliance Officer |

| Mr. Whitaker also serves as Chief Compliance Officer of other funds. Mr. Whitaker is an employee of Fidelity Investments (2007-present). Prior to joining Fidelity Investments, Mr. Whitaker worked at MFS Investment Management where he served as Senior Vice President and Chief Compliance Officer (2004-2006), and Assistant General Counsel. |

Annual Report

The funds hereby designate as capital gain dividend the amounts noted below for the taxable year ended June 30, 2014, or, if subsequently determined to be different, the net capital gain of such year.

North Carolina (NCCMT): Cash Portfolio | $6,638 |

The funds will notify shareholders in January 2015 of amounts for use in preparing 2014 income tax returns.

Annual Report

Investment Adviser

Fidelity Management & Research Company

Boston, MA

Sub-Advisers

Fidelity Investments Money Management, Inc.

Fidelity Management & Research

(U.K.) Inc.

Fidelity Management & Research

(Hong Kong) Limited

Fidelity Management & Research

(Japan) Inc.

Distribution Agent

Capital Management of the Carolinas, L.L.C.

Charlotte, NC

Transfer and Service Agents

Fidelity Investments Institutional Operations Company, Inc.

Boston, MA

Fidelity Service Company, Inc.

Boston, MA

Custodian

Wells Fargo Bank

San Francisco, CA

Item 2. Code of Ethics

As of the end of the period, June 30, 2014, North Carolina Capital Management Trust (the trust) has adopted a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President, Treasurer and Chief Financial Officer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3. Audit Committee Financial Expert

The Board of Trustees of the trust has determined that Thomas Hollowell is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Hollowell is independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services

Fees and Services

The following table presents fees billed by PricewaterhouseCoopers LLP ("PwC") in each of the last two fiscal years for services rendered to the Cash Portfolio and Term Portfolio (the "Funds"):

Services Billed by PwC

June 30, 2014 FeesA

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Cash Portfolio | $39,000 | $- | $1,900 | $- |

Term Portfolio | $41,000 | $- | $1,900 | $- |

June 30, 2013 FeesA

| Audit Fees | Audit-Related Fees | Tax Fees | All Other Fees |

Cash Portfolio | $40,000 | $- | $1,800 | $6,300 |

Term Portfolio | $42,000 | $- | $1,800 | $6,700 |

A Amounts may reflect rounding.