- NSC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Norfolk Southern (NSC) 8-KCurrent report

Filed: 12 Feb 03, 12:00am

Section 1 An Introduction to Norfolk Southern

Section 5 Corporate Information

Forward-Looking Statements

Some or all the documents in this book contain or are based in whole or in part on "forward-looking statements," as that term is defined in the Private Securities Litigation Reform Act of 1995. Such statements (which usually are introduced with words such as "expect," "anticipate," "plan," "believe" and other words having a similar meaning and used in connection with future events) are founded on expectations, estimates and projections that reflect Management's good-faith evaluation of information available at the time the statements were made. As such, they are based upon, and will be influenced by, a number of external variables -- more particularly described and identified in our most recent annual report and quarterly report to the Securities and Exchange Commission (SEC) on Form 10-K and Form 10-Q -- over which the Corporation may have no, or incomplete, control: for example, (1) changes in the economic or credit environment in the United States and abroad; (2) competitive conditions and pricing leve ls; (3) legislative and regulatory developments; (4) changes in tax laws; and (5) other risks and uncertainties not now identified. Accordingly, actual outcomes and results already or eventually may differ materially from those indicated in such forward-looking statements.

We undertake no obligation publicly to correct or update any forward-looking statement; should we elect to update one or more such statements, we undertake no obligation to make further updates, with respect either to the updated statement(s) or to any other statement. Corrections and updates may appear in our public filings with the Securities and Exchange Commission, which you are advised to consult.

Be the safest, most customer- focused and successful transportation company in the world

Norfolk Southern Corporation (NYSE:NSC) is a Virginia-based holding company with headquarters in Norfolk. It controls a major freight railroad, Norfolk Southern Railway Company, and owns a natural resources company, Pocahontas Land Corp., and a telecommunications company, Thoroughbred Technology and Telecommunications, Inc.

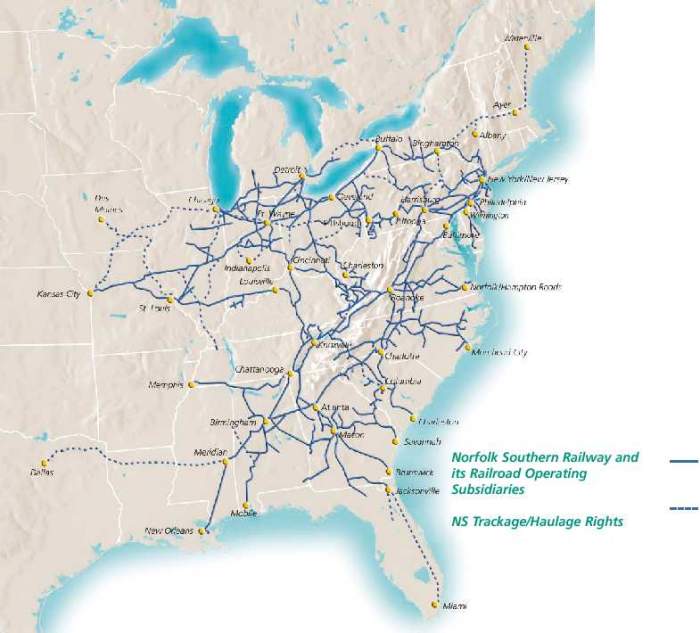

Norfolk Southern links customers to worldwide markets. The Railway operates 21,500 route miles in 22 eastern states, the District of Columbia and the province of Ontario, Canada, serves 20 seaports and lake ports and connects with rail partners in the West and Canada. Norfolk Southern provides comprehensive logistics services and offers the most extensive intermodal network in the East.

Pocahontas Land Corp. manages more than a million acres of coal resources in Alabama, Illinois, Kentucky, Tennessee, Virginia and West Virginia.

Thoroughbred Technology and Telecommunications, or "T-Cubed," installs and markets telecommunications facilities and provides related services.

Norfolk Southern Corporation's policy is to comply with all applicable laws, regulations and executive orders concerning equal opportunity and nondiscrimination and to offer employment on the basis of qualification and performance, regardless of race, religion, color, national origin, sex, age, veteran status, the presence of a disability or any other legally protected status.

Norfolk Southern's environmental policy requires every employee to understand and comply with environmental requirements on the job. Public agencies and the affected public are to be informed of any incident with the potential to cause environmental harm. Wastes are to be minimized through recycling, reduced consumption and use of environmentally preferred materials, and non-polluting technologies. Cooperation is to be given all governmental/environmental authorities. All laws and regulations related to protecting the environment and transporting environmentally sensitive materials are to be complied with in full.

Norfolk Southern's mission is to enhance the value of our stockholders' investment over time by providing quality freight transportation services and by undertaking any other related businesses in which our resources, particularly our people, give the company an advantage.

We are responsible to our stockholders, customers, employees and the communities we serve.

For all our constituencies, we will make safety our highest priority.

For our customers, we will provide quality service, always trying to reduce our costs in order to offer competitive prices.

For our stockholders, we will strive to earn a return on their equity investment that will increase the value of their ownership. By generating a reasonable return on invested capital, we will provide the security of a financially strong company to our customers, employees, stockholders and communities.

For our employees, our greatest asset, we will provide fair and dignified treatment with equal opportunity at every level. We will seek a talented, diverse work force and management with the highest standards of honesty and fairness.

For the communities we serve, we will be good corporate citizens, seeking to enhance their quality of life through service, jobs, investment, and the energies and good will of our employees.

Norfolk Southern's management team is committed to high standards of corporate governance.

Norfolk Southern raised the bar in the Thoroughbred Quality process by introducing Six Sigma problem-solving methodology. In only the second year of using Six Sigma, NS employee teams managed several efforts to improve operations and service. Six Sigma is a fact-based methodology to study problems that cause variation in the quality of service. By adopting Six Sigma methods, Norfolk Southern demonstrates commitment to continuous quality improvement, a requirement in maintaining ISO 9002 registrations. ISO is the internationally recognized quality measurement certifying that processes are continually improved. The company's transportation operations, major mechanical shops and a number of other areas already are certified to ISO 9002:1994 standards. They will be registered to reflect more recent ISO 9002:2000 standards, which require reflecting the voice of the customer in addition to a continuous improvement process. Six Sigma is that process.

Using Six Sigma methods, Norfolk Southern changed its freight car suspension design, which led to smoother ride quality and eliminated a source of freight damage for customers. In addition, NS installed ride quality detectors on rail cars to improve ride quality for customers' freight and reduce safety risks. Customer benefits include fewer service disruptions, greater equipment availability and reduced lading damage. Also, a locomotive-mounted track lubrication system reduces friction between wheels and rail. Expected benefits include reduced fuel consumption, less equipment and track wear and fewer track-related service disruptions.

Norfolk Southern employees earned in 2002 an unprecedented thirteenth consecutive award for the best safety record among the nation's largest railroads. The Harriman is awarded in May based on the prior year's safety performance.

With continuous improvement in safety practices, NS' people will not be satisfied until they have achieved the ultimate goal: an accident- and injury-free workplace.

NS' focus on employee safety has translated into train and community safety, with the Thoroughbred consistently leading major U.S. railroads with the lowest ratio fo cars derailed per billion car-miles.

That record is especially important with regard to NS' hazardous materials transportation services. By 2002, the railroad was moving some 340,000 hazmat loads annually. Safety outreach includes training state and local emergency responders as part of the Transportation Community Awareness Emergency Response (TRANSCAER) initiatiave to assist communities in developing their hazmat emergency response plans.

Norfolk Southern continued providing benefits for employee reservists activated for Operation Enduring Freedom, the war on terrorism declared by President George W. Bush. International tensions escalated as 2003 began, and additional reservists were called up for active duty.

Air Force Secretary James Roche commended NS, saying "your company's support continues to be critical to our ongoing efforts and makes a real difference in our country."

NS military leave benefits are designed to help provide support for employees and their families during the deployments. They include a monthly income supplement of $1,500 and continuation of health care and life insurance benefits. NS began the enhanced benefits program in October 2001, following the Sept. 11 terrorist attacks.

Norfolk Southern's system extends over 21,500 route miles, serving 22 states, the District of Columbia and the province of Ontario, Canada.

Norfolk Southern offers the East's most extensive intermodal network and provides comprehensive transportation logistics services supported by innovative data systems and technology.

Norfolk Southern's network is comprised of three regions: 1) Eastern, 2) Western and 3) Northern and blankets much of the eastern U.S.

For international business, NS serves 20 seaports and lake ports and connects with western and Canadian partners. Norfolk Southern is focused on capitalizing on the advantages associated with its expanded system.

Pocahontas Land Corporation (PLC) is Norfolk Southern's natural resource subsidiary and a vital contributor to its core rail business. PLC owns and/or manages a million acres of land containing coal in Alabama, Illinois, Kentucky, Tennessee, Virginia and West Virginia.

Coal mining lessees produced a total of 35.2 million tons of coal in 2002, most of which was hauled by NS. To date, more than 2.2 billion tons of coal has been mined from PLC and affiliated properties. The company is constantly seeking coal lands to ensure abundant supplies of coal tributary to NS' rail lines to serve the markets of the 21st century. PLC estimates its remaining coal reserves to be 1.8 billion tons, categorized as follows:

PLC has interests in joint ventures involving a state-of-the-art lumber manufacturing plant near Charleston, W.Va.; a crosstie production facility near Justice, W.Va.; and another lumber and crosstie mill near Duffield, Va. Both crosstie mills supply crossties to Norfolk Southern.

PLC continues to pursue profitable growth opportunities and strives to achieve its vision to be the most responsible, innovative and successful owner and manager of natural resource properties.

In cooperation with its partners in the telecommunications industry, Thoroughbred Technology and Telecommunications, Inc., or T-Cubed, is building an eastern fiber optic conduit and dark fiber network along Norfolk Southern's right-of-way.

T-Cubed is Norfolk Southern's telecom infrastructure provider and seeks to leverage the physical assets of Norfolk Southern's network to create added value.

With more than 21,500 miles of right-of-way and some 375 microwave towers at its disposal, T-Cubed offers network builders access to major metropolitan areas as well as other eastern U.S. markets.

While the telecommunications industry slowdown continued in 2002, T-Cubed remains focused on providing fiber-optic conduit and wireless infrastructures to a variety of telecommunications companies and will pursue additional transactions in 2003.

In addition, T-Cubed continues to explore ways in which its assets can be used to enhance the current Norfolk Southern telecommunications infrastructure, along with opportunities to leverage existing Norfolk Southern telecom assets for commercial purposes.

The East Carolina Business Unit (ECBU) is Norfolk Southern's internal "short-line railroad" unit. It is linked to NS' centralized dispatching, customer service and operating systems and has the flexibility and speed of a small railroad backed by the industrial development and technological resources of a major carrier. Norfolk Southern created the marketing and operating unit in eastern North Carolina to develop new business, improve customer service and increase operating efficiency.

The ECBU reflects Norfolk Southern's renewed focus on eastern North Carolina and its rail customers. The business unit has headquarters in Raleigh, N.C., and includes 485 miles of Norfolk Southern-operated railroad track that runs east and south from Raleigh. The ECBU, first of its kind within Norfolk Southern, is designed to bring the railroad closer to its local customers to better meet their needs, while improving the use of rail assets.

The ECBU is providing intense local focus on eastern North Carolina and looks to improve NS' profitability by stimulating revenue growth and controlling costs. In the first three full quarters, ECBU has improved per unit margin from ($19.51) to $9.73. This has primarily been accomplished through improved asset utilization and a streamlining of the operation resulting in an overall reduction of $2.1 million in annual expenses. The local locomotive pool has been reduced by 29% resulting in the use of four fewer locomotives. Local train starts have been reduced by 17% resulting in an average of 10 fewer train starts per week. While these reductions were implemented, NS' overall customer approval rating from ECBU customers improved.

Norfolk Southern's balanced traffic portfolio reduces dependence on any one sector of the economy.

In 2002, general merchandise traffic accounted for 58% of total Norfolk Southern revenues, while coal accounted for 23% and intermodal 19%. Norfolk Southern will continue to focus on increasing revenues and profitability in each market group to realize the potential of its expanded network.

Changes in traffic mix, pricing strategies and improvement in operating efficiency during 2002 enabled Norfolk Southern to produce record high railway operating revenues, which resulted in a $100 million increase year-over-year. Substantial growth in merchandise and intermodal traffic was offset in part by declines in coal; however, a greater emphasis on merchandise traffic in the changing mix of NS' traffic base enabled the company to post gains despite weakness in the coal market.

Norfolk Southern Corporation is one of the nation's largest transporters of coal for utilities, steel producers, industrial users and for export to 17 countries around the world.

Norfolk Southern Corporation serves coalfields in Virginia, West Virginia, Kentucky, Pennsylvania, Indiana, Illinois, Ohio, Alabama and Tennessee. These coalfields contain some of the world's best low-sulfur, high-Btu steam coals, and high-quality metallurgical coals. NS also transports western, low-sulfur, Powder River Basin coal to eastern and mid-western utilities.

In 2002, NS utility coal tonnage decreased 3% compared with 2001, due primarily to high coal stockpile levels, relatively mild temperatures, moderate natural gas prices and reduced demand caused by a downturn in the economy. In addition, licensing requirements for new gas-fired plants caused those plants to be dispatched ahead of other, more cost-efficient plants during parts of the summer when demand was high.

In 2003, utility shipments are expected to improve. Coal-fired generation remains the most affordable marginal source of electricity, after nuclear power. With coal plant capacity factors hovering near 70% on Norfolk Southern, increased demand for coal in this market is anticipated as utilities increasingly ramp up coal-fired plants to meet electricity demand increases. Weather swings will play an important role in overall utility coal consumption.

Two newly completed projects are expected to result in market gains in 2003. The first is First Energy's Sammis Power Plant at Stratton, Ohio, where new rail access could generate approximately 20,000 annual coal carloads. Prior to this change, this plant was served exclusively by barge. The second project is a new shuttle train that serves two Ohio mines (one of which is new ) and delivers coal to an Ohio River transload facility, which is expected to generate 30,000 annual carloads.

The price of natural gas has a significant impact on the outlook for coal in this market segment. The volatility of natural gas prices improves the long-term competitive position of coal-fired generation, as electric plant developers look to hedge the gas price risks with steady coal prices and output.

Norfolk Southern is well positioned for Phase II of the Clean Air Act that began on Jan. 1, 2000. Many NS-served mines are able to produce Phase II compliance coal. In addition, many NS-served utilities have built substantial banks of sulfur dioxide credits, which should allow NS-served utilities to continue to maintain flexibility in coal sourcing.

Challenges are ahead for utility coal. Downward pressure on coal demand in 2003 could come from a variety of sources, including an uncertain economy; improved nuclear generation due to up-rating at certain plants; considerable downtime for SCR installation and NOX reduction equipment at a few very large plants; new gas units running at high levels; and continued stockpile drawdowns. Upward pressure on coal demand could come from a war with Iraq, an event that could have a potentially negative impact on oil price and/or availability. This could lead to higher demand for natural gas in the residential and industrial markets, thereby reducing its availability for electricity generation while increasing demand for coal.

The Bush administration reversed some EPA interpretive rulings involving New Source Review on older coal plants. This rule change, which has been a top priority of the White House, will encourage emissions reductions by allowing companies to implement projects to increase energy efficiency and reduce air pollution intensity. Along with other Administration Clear Skies initiatives, this rule change allows coal-fired power plant owners to renew investments in some of their older plants. This will help retain and increase coal production and deliveries to these plants and will help keep the cost of electricity low.

Export coal tonnage declined 18% in 2002, which was characterized as a year of turmoil in the export coal market. During the first half of the year, demand for U.S. coal weakened as international buyers were purchasing coal from other world sources. In addition, late contract settlements severely disrupted shipping schedules.

In late 2002, the international market for blast furnace raw materials underwent another shift. The supply of Chinese coke tightened dramatically and prices nearly doubled, while the quality of the remaining tons declined sharply. European coke makers worked to help offset the shortage by running their coke batteries harder. Shortened coking times cause coke makers to begin to alter coal blends to emphasize higher quality coals. Simultaneously, the coal supply market saw some shifts, as China and Poland's coking coal exports declined. Australian coal remained tight as well.

These events combined to cause an increase in demand for U.S. coking coals, which increased volumes at Lamberts Point late in the year.

Looking ahead, the stage appears to be set for some recovery of U.S. coal export volumes. The balance of supply and demand favors the U.S. The growth in demand for higher quality coals as a means of increasing coke yield and strength favors the U.S. Ocean freight rates also impact this market.

Domestic metallurgical coal, coke and iron ore traffic increased 5% in 2002. This increase was due primarily to the U. S. Presidential Tariff Program, which positively influenced U. S. raw steel production, which increased 8.1% in 2002. U. S. steel companies are proceeding to restructure, invest and strengthen their competitive position. With change, frequently there is opportunity, and NS' competitive response to the new environment has resulted in increased volumes, particularly in coke and iron ore.

In 2003, domestic metallurgical coal, coke and iron ore traffic is expected to continue to experience modest gains, at least for the remaining two-year life of the import tariffs. While long-term demand is expected to decline due to consolidations and coal supply constraints, this could allow NS to increase yields on the available production of metallurgical coal that NS will handle.

In 2002, other coal traffic, principally steam coal shipped to manufacturing plants, decreased 14%. This sector experienced considerable downward pressure exerted by the weak domestic economy. A recovery in this sector in 2003 depends in large part upon the health of the U.S. economy. The rebound of this sector will likely trail that of the U. S. economy as production of finished goods will increase using existing inventories. Once coal inventories are sufficiently reduced, shipments will be restored. Also, the volatility in the price of natural gas will influence higher coal consumption as customers with dual-firing capability have the option to switch from gas to coal.

Intermodal shipments involve the transportation of shipping containers or truck trailers by rail. Norfolk Southern segments its intermodal business into four groups: 1) International, 2) Premium, 3) Domestic and 4) Triple Crown Services.

1) International: Traffic in this segment is generated from a large number of Atlantic and Gulf Coast ports served by NS, as well as interline mini-landbridge Pacific trade business generated through the West Coast ports.

2) Premium: This is the most demanding segment in terms of service, and NS' share of this traffic is expected to increase with service improvements. Customers in this group include UPS, United States Postal Service and select LTL carriers.

3) Domestic: This segment is also very service sensitive and will provide a considerable source of traffic growth as service continues to improve and as product offerings expand. Customers in this group include JB Hunt, Hub Group, Alliance and other motor carriers and Intermodal Marketing Companies (IMCs).

4) Triple Crown Services: Triple Crown Services (TCS) provides very high quality, retail, door-to-door intermodal services that directly compete with over-the-road motor carriers in medium-haul lanes as well as select long-haul lanes. TCS maintains its own network of 12 terminals and a 5,600-unit fleet of high-cube "RoadRailer" intermodal equipment.

Facilities: All of the terminals shown on NS' intermodal map are dedicated to handling intermodal business. NS directly or through strategic agreements serves 52 facilities extending from Maine to Louisiana and from Miami to Chicago. NS has the most comprehensive intermodal network east of the Mississippi.

In 2002, intermodal traffic on NS grew 6%, more than on any other major U.S. railroad. New services enabled conversions from truck to rail, and service improvements yielded competitive advantages over other intermodal carriers. On-time reliability and service speed enhanced NS' position as a partner for premium customers, such as UPS and less-than-truckload carriers. Reliability also made possible an increase in guaranteed services from four lanes in 2001 to nine lanes in 2002. NS moved more than 2,500 loads of guaranteed business.

In partnership with Union Pacific, NS introduced new expedited intermodal train service from the Northeast and the Southeast to Mexico.

More than 7,300 loads were converted from truck to rail from Dockside, at Port Elizabeth, N.J., to Canada, for an annual conversion rate of 15,000 units.

In a marketing alliance with Florida East Coast Railway, called the Hurricane Service, 6,000 loads between Atlanta and Miami were converted from truck to rail. Also, new Southeast-Northeast train service converted some 26,000 loads.

In its full year of operation, the John W. Whitaker intermodal facility at Austell, Ga., near Atlanta, contributed more than 61,000 truck-to-rail conversions. At Cleveland, Ohio, the Maple Heights facility contributed more than 22,000 conversions, with 80% growth in international traffic to and from Cleveland. The Savannah, Ga., facility contributed more than 15,000 conversions, with a 34% growth in international traffic to and from Savannah.

Although the industrial economy remained soft throughout much of the year, 2002 proved to be a modest, consumer-driven economy that provided at least some fuel for growth of NS' intermodal base business. Business was impacted, however, as a result of a lockout of West Coast ports in the fourth quarter. This resulted in a disruption of flow of international freight into and out of the West, which impacted NS' intermodal business. Recovery from the lockout was slower than expected and resulted in some short-term losses of freight, directly impacting October and November freight volume levels, contributing to a weaker fourth quarter. Despite the West Coast port situation, intermodal volume for the year grew faster than the economy, benefiting from truck-to-rail conversions.

April: NS and BNSF announce a new, coast-to-coast guaranteed service for domestic container, private truckload, and international container shipments moving between southern California and the Northeast.

May-July: NS implements the 2002 Summer Network Improvement Plan, the largest set of improvements to the network since the opening of John W. Whitaker intermodal facility in Austell, Ga. The plan reduced operational costs, increased service reliability and frequency, and improved transit times across the NS system. Major service areas that benefited include: New Jersey; Atlanta; Dallas; Jacksonville, Fla.; Charlotte, N.C.; Greensboro, N.C.; St. Louis, Mo.; and New Orleans.

August: NS, in conjunction with Union Pacific, launches a new, dedicated service to Mexico from points in the Northeast and Southeast.

October: West Coast ports lock out on Sept. 30, and NS responds by suspending international container services to West Coast port destinations. The restrictions on westbound international containers were lifted on Oct. 14, ending a two-week port shutdown that affected all areas of intermodal transportation and network traffic.

December: NS and UP expand the successful Blue Streak guaranteed service between northern California and the Northeast. This expansion results in nine lanes where NS offers service guarantees.

With expectations for modest economic growth in 2003, intermodal anticipates that it will outpace the economy in both volume and revenue growth. With most infrastructure spending complete and network capacity in place to support growth opportunities, attention will turn to improving yield. Emphasis on increasing train length, car utilization and rail equipment utilization are expected to improve intermodal's profitability.

In addition, NS expects to expand its portfolio of guaranteed services that generate higher revenue per shipment. Along with an emphasis on yield, NS will continue to grow its profitable international and premium sectors.

The Agriculture, Consumer Products and Government team has marketing and sales responsibility for the transportation of corn, wheat, soybeans, fertilizer, sweeteners, animal and poultry feeds, beverages, canned goods, consumer products and military equipment. The Agriculture group has a strong core traffic base that includes corn from the Midwest to the poultry industry in the Southeast; corn and soybeans to processors; fertilizer to industrial and agricultural customers; wheat to millers; flour from millers to bakeries; and sweeteners and food oils from processors to food and beverage manufacturers.

In 2002, agriculture, consumer products and government traffic volume remained consistent with last year, and revenue increased approximately 3% compared with 2001 results. While traffic volumes declined for soybeans, feed, food oils and military/miscellaneous transportation, the strength of corn, fertilizer, food products, beverages, canned goods and sweeteners offset those volume losses and helped improve revenue and revenue per car.

Corn, a key agricultural commodity for Norfolk Southern, generated a 4% increase in volume and a 10.5% increase in revenue. Due to the drought of 2002, there was a significant increase in demand for corn from NS' Southeast feed mill customers and from poultry producers in eastern Pennsylvania, Maryland, and Delaware, which resulted in increased long-haul movements from NS' Midwest suppliers to these drought-stricken areas.

NS continued to reap benefits from the continued development of its 75-car shuttle program from Midwest suppliers to Southeast feed markets, resulting in improved service and utilization of rail equipment.

As a result of improving fertilizer markets, aggressive marketing strategies and a diversification of NS' customer base, the company's fertilizer carloads and revenue increased 1.3% and 2%, respectively. 2002 produced the first year-over-year increase since 1999. The overall increase in food products is attributed primarily to a 37% increase in frozen potato carloads from Pacific Northwest origins to the Southeast. Revenue was up 47% over 2001. This increase also was due to aggressive marketing strategies and an extended customer base.

Conversely, NS experienced a significant decline in soybean volumes in 2002, primarily attributable to reduced production as a result of the high cost of beans and a weak export demand for soybean meal. Also, feed volumes were down due to lower export demand for soybean meal and a decline in feed shipments to the Southwest and central Virginia due to an avian flu, which resulted in a significant loss of poultry.

Overall, 2003 agriculture, consumer products and government traffic is expected to exceed 2002 volume levels due primarily to projected increases in corn, fertilizer and food products. Long-haul corn business from the Midwest to poultry producers in eastern markets and to the Southeast feed markets is expected to remain strong through the fall harvest of 2003. Also, continued success and expansion of NS' 75-car shuttle train program to the Southeast is expected to continue to improve car utilization and capacity.

For the past two years, the idling of the PCS phosphate fertilizer plant in Occidental, Fla., has had a significant impact on NS fertilizer shipments. In the fall of 2002, however, PCS announced the reopening of this facility, which is expected in early 2003. The addition of this facility is expected to increase fertilizer traffic volume.

Burlington Northern and Santa Fe Railway Company and Norfolk Southern have introduced a new coast-to-coast carload service assurance program for temperature-controlled commodities, primarily fresh and frozen produce, moving from selected cities in the Pacific Northwest to the Midwest, Northeast and Southeast. The service became available in December 2002 and is expected to result in increased business for the food products commodity group.

Norfolk Southern's Automotive Group covers the transportation of finished vehicles as well as auto parts destined to assembly plants.

North American automotive production rose 5.8% to 16.4 million units in 2002. Norfolk Southern's automotive group produced its best year ever, with $961 million in revenues, which was an increase of 9%, or $76 million, over 2001. During 2002, Norfolk Southern continued to boost automotive revenues through the refinement of its mixing center network design with extended hauls. Restructuring the Ford mixing center network enabled NS to extend hauls, improve reliability and velocity and reduce equipment handling. These improvements resulted not only in better service but also in reduced costs and less damage to vehicles.

NS secured 3,800 annual carloads of finished H2 Hummers from Mishawaka, Ind., and inbound frames from St. Thomas, Ontario. A retooled and reopened General Motors plant in Oklahoma City awarded NS its entire inbound rail parts business of 8,800 annual carloads.

Assembly plant expansions on NS include Mitsubishi in Normal, Ill., Toyota in Princeton, Ind., and Mercedes-Benz in Vance, Ala. GM's new inbound vehicle distribution facility in Moraine, Ohio, received more than 5,000 new carloads of vehicles. Additionally, GM recognized NS' performance with its All Star Quality Award for damage-free rail delivery.

Light vehicle production in 2003 is expected to mirror 2002 production levels. Despite Ford's announcement of a 5% decline in first-quarter production and downtime associated with the model changeover at the F-150 series plants in Norfolk, Va., and Kansas City, Mo., automotive revenue growth is anticipated to be sustained through the following initiatives:

1) the opening of a second Toyota plant in Princeton, Ind.,

2) the addition of the Honda assembly plant at Lincoln, Ala.,

3) the increase in production of Mitsubishi's new assembly line in Normal, Ill., and 4) additional volume at Toyota's new Southeast vehicle processing and distribution facility on NS at Westlake, Fla.

The Chemicals Market Group serves shippers and receivers of petroleum products, plastics, sulphur, chlorine and bleaching compounds, industrial chemicals, as well as hazardous and nonhazardous wastes.

In 2002, Norfolk Southern's chemical carloads were relatively flat, while revenues increased 2% compared with 2001. Strong plastics and miscellaneous chemical segments offset weakness in petroleum and industrial intermediates. Overall, reduced inventories, low plant operating rates, weak demand and a cautious economy in 2002 resulted in flat carloads. Revenues increased slightly as a result of improved pricing to meet market conditions, as well as improving plastics demand driven largely by housing starts and automotive production.

Norfolk Southern's Thoroughbred Operating Plan, or TOP, resulted in 6,273 annual carloads of new traffic, including conversion from truck to rail of 277 carloads to a Bridgestone-Firestone plant in Graniteville, S.C.

Looking ahead, Norfolk Southern secured 500 annual carloads from a new asphalt terminal in Perry, Ga.; 200 additional annual carloads from an expanded shingle plant in Tuscaloosa, Ala.; and 400 new carloads from new plastics plants.

Growth at Thoroughbred Bulk Transfer terminals yielded 1,600 carloads, and truck diversions yielded 900 new carloads. As the economy recovers, stronger carloads are expected. NS' focus will remain on improving revenue yield and remaining competitive in the marketplace.

Overall, Norfolk Southern expects chemical volume to improve in 2003, primarily due to expectations of a stronger economy, improved plant operating rates and increased capital spending for plant maintenance by chemical companies.

The Metals and Construction Team serves producers, suppliers and distributors of metals products, metallic ores, scrap metal, machinery, cement, brick, sand and gravel, and miscellaneous construction materials. Norfolk Southern is the nation's largest transporter of steel.

Metals shipments increased 6.9% during 2002 compared with 2001. Growth was generated by a moderate increase in domestic steel demand, which helped support the restarting of mills idled during 2001. Steel industry consolidations and restarted mills included International Steel Groups (ISG) purchasing LTV facilities and operating the former LTV mills at Hennepin, Ill.; Indiana Harbor, Ind.; and Cleveland, Ohio. ISG also purchased the former Acme Steel facility in Riverdale, Ill. Nucor Steel purchased Trico at Millard, Ala., and Birmingham Steel. The restarting of these mills resulted in more than 6,000 carloads of increased business during 2002. Import slab volumes increased to support the demand for domestic finished steel. NS handled more than 29,000 carloads of import slabs during 2002, which was a 46% increase over 2001.

Increased production from new steel mills located on NS include: Chaparral Steel at Petersburg, Va.; Ipsco Steel at Lemoyne, Ala.; and Steel Dynamics at Columbia City, Ind. Incremental volumes from these mills exceeded 4,300 carloads during 2002. Growth in new scrap steel business generated a 6.9% increase in carloads over 2001. Construction shipments declined 4.9% during 2002 due to reductions in regional highway projects and sourcing changes, which adversely impacted stone and general construction commodities.

Metals and construction volumes are expected to grow moderately in 2003. Growth is based on a full year of restarted steel mills. Further consolidation in the steel industry is expected, with a continued trend toward imported semi-finished steel to meet orders and demands of domestic processing. Continued growth also is projected from new mills, including Steel Dynamics at Columbia City, Ind.; Ipsco at LeMoyne, Ala.; and Chaparral Steel, Petersburg, Va. Construction markets are expected to benefit from new NS access to stone quarries and cement terminals in the Southeast.

Norfolk Southern's Paper, Clay and Forest Products group is responsible for the marketing of all commodities involved with the paper and forest products transportation supply chain. This cycle begins with shipments of raw materials that feed the paper making process for the production of outbound finished products. The group also handles marketing for the uses of kaolin clay, such as filler for paper and a coated finish for printed materials. NS serves many paper distribution centers, sawmills and panel facilities and handles a variety of lumber products to reload centers and end users.

Carloads decreased 3% and revenues decreased 1% as a result of continued soft demand for paper, clay and forest products in the U.S. and global markets. The industry generally did not experience sustained price and production gains, but it did show signs of recovery in the second half of 2002. NS paper, clay and forest products traffic volumes and revenue followed the industry trend and strengthened as the year progressed, particularly in pulp, pulpboard and printing paper markets. NS embarked on numerous commercial initiatives with large paper shippers to attract and secure new business.

NS secured more than 5,000 carloads in truck-to-rail conversions during 2002. Scrap paper traffic increased during the fourth quarter for the first time in three years as NS began handling a new move to Coosa Pines, Ala., with Bowater in late 2002. The pulp market benefited from more shipments to toilet tissue/paper towel producers, including a 25% increase in carloads to Procter and Gamble at Mehoopany, Pa. NS-originated lumber carloads increased 10% due to the robust market for residential construction and increased import lumber traffic through eastern ports.

The pulp and paper industry is expected to mirror the general economic outlook and experience slight production growth in 2003. In recent years, pulp, paper and forest products mergers and acquisitions have been rampant. In 2003, the industry is expected to see fewer company consolidations, while focusing on cost and debt reduction.

NS has numerous marketing projects under way to grow this segment of business, including initiatives to divert business from truck to rail. NS has worked closely with large paper manufacturers to identify supply chain cost savings opportunities and optimize flows from their mills. These supply chain efforts with companies such as Bowater, International Paper, Smurfit Stone and MeadWestvaco will continue into 2003.

In addition, NS anticipates its lumber traffic volume to improve as the company aggressively targets import business to help offset losses as a result of the Canadian tariff imposed in mid-2002. Wood fiber business is expected to benefit from the addition of several new export moves from the Southeast for the fiber fuel market in Europe. Kaolin domestic and export traffic is expected to show modest improvement, which is consistent with printing paper production increases that are expected to rebound from weak levels in most of 2002. NS also expects to see some new clay business from newsprint mills that are being converted to coated ground wood mills, such as Bowater at Calhoun, Tenn.

MODALGISTICSSM is a supply chain services group that provides comprehensive logistical solutions by integrating management resources and supply chain technology. MODALGISTICS plans, develops and implements supply chain solutions for rail- and nonrail-served customers. The aim is to lower customers' total cost by providing more modal choices, shipment management and better visibility of inventories, while leveraging NS' rail infrastructure, access to distribution facilities and transportation services.

MODALGISTICS' second year as a business unit was successful with the introduction of new technology and services, new supply chain initiatives with customers and implementation of key revenue generating projects. A suite of services was developed to provide shipment, inventory and fleet management, and performance tracking tools in a single package for customers. Customized supply chain projects led to more than 9,000 annualized new carloads for NS.

For example, MODALGISTICS worked closely with Bowater to optimize its network of newsprint shipments from various mills and to implement MODALGISTICS' shipment and transportation management services, which are expected to generate 700 newsprint carloads annually for NS. Additionally, more than 450 carloads were awarded to NS for Eaglebrook, a company specializing in water treatment, after MODALGISTICS provided supply chain consulting services to improve Eaglebrook's inventory management.

In 2002, MODALGISTICS opened several new distribution facilities to grow its transload business. The Thoroughbred Bulk Transfer (TBT) network grew with the addition of two new terminals in Chicago, Ill., and Augusta, Ga. The TBT network terminal capacity increased 23% and overall utilization increased 8%. MODALGISTICS and Collier Metals LLC opened a SteelNet® operation in Atlanta, Ga., to provide coil processing capacity, warehousing and storage for customers. Additionally, a new lumber reload facility was opened with Raven Logistics in Columbus, Ohio.

Norfolk Southern's extensive distribution network includes:

In 2003, MODALGISTICS will continue to develop multimodal business for NS, develop new products and services, and form strategic partnerships with customers to achieve optimal supply chain solutions. MODALGISTICS is expected to generate supply chain revenue through freight transportation, shipment management transaction fees, professional services and consulting fees, and gain sharing with customers.

2003 will mark the premier of Thoroughbred EXTRA, a customized supply chain service for shippers and receivers of paper products. Thoroughbred EXTRA is a value-added service that includes rail transportation, shipment tracking, inventory management, warehouse management and truck delivery to final destination. MODALGISTICS will continue to provide its customers a competitive advantage through multimodal logistics solutions resulting in superior supply chain networks.

To promote strategic growth, Norfolk Southern employs a highly sophisticated industrial development program to attract new and expanding businesses to its service territory.

In 2002, NS assisted with the location of 93 new industries and the expansion of another 33. This represents planned investment of nearly $4 billion by NS customers and is expected to create more than 4,700 jobs in the 21 states where the plants and expansions are located. NS expects these industrial development efforts to generate more than 91,000 carloads annually.

Eight of the top 10 projects in 2002 were either auto- or steel-related.

The largest auto projects included Southeast Toyota Distributor's new vehicle processing and distribution facility at Jacksonville, Fla., General Motors Corporation's $355 million expansion at Moraine, Ohio, and Mitsubishi Corporation's plant expansion at Normal, Ill. The largest steel projects included Steel Dynamic's new $310 million structural steel mill at Columbia City, Ind., and International Steel Group's steel mill at Hennepin, Ill.

The success of Norfolk Southern's plastics initiative continued in 2002 with 11 new and expanded plastics industries. Food-related projects also were strong, with 17 new and expanded industries. Other projects included facilities involved in the production or handling of autos, agriculture products, scrap metal, steel, chemicals, paper, cement, lumber and construction materials.

NS works with state and local economic development authorities on projects involving site location and development of infrastructure to connect customers to its rail system. NS provides free and confidential plant location services, including site layout, engineering and logistics assistance.

New projects under construction for completion in 2003 and 2004 include additional auto assembly plants for Toyota at Princeton, Ind., Mercedes-Benz at Vance, Ala., and Honda at Lincoln, Ala.

The development of new and expanding businesses on NS' network helps to ensure that the traffic is renewed, modernized and continues to expand.

The Industrial Development department maintains a computer database of highly detailed site profiles that allows for quick and comprehensive responses to new business opportunities - usually within 24 hours. What puts NS ahead of the competition is the ability to provide full, in-house engineering and consulting services to new business prospects.

NS maintains Industrial Development offices in Atlanta, Ga.; Binghamton, N.Y.; Birmingham, Ala.; Columbia, S.C.; Columbus, Ohio; Detroit, Mich.; Harrisburg, Pa.; Indianapolis, Ind.; Nashville, Tenn.; Norfolk, Va.; Philadelphia, Pa.; Raleigh, N.C.; Roanoke, Va.; and St., Louis, Mo.

| ($ millions) | 1998 | 1999 | 2000 | 2001 | 2002 |

|---|---|---|---|---|---|

| Projects (new and expanded) | 101 | 124 | 117 | 109 | 126 |

| Estimated investment by industries | $3,344 | $2,841 | $2,367 | $2,981 | $3,964 |

| Estimated future annual system revenues | $272 | $132 | $138 | $105 | $125 |

| Estimated future annual system carloads | 476,056 | 113,759 | 100,208 | 95,051 | 91,135 |

| 1982 |

|

| 1985 |

|

| 1986 |

|

| 1987 |

|

| 1989 |

|

| 1990 |

|

| 1991 |

|

| 1993 |

|

| 1995 |

|

| 1996 |

|

| 1997 |

|

| 1998 |

|

| 1999 |

|

| 2000 |

|

| 2001 |

|

| 2002 |

|

Norfolk Southern has led the rail industry in safety performance since 1989, winning an unprecedented thirteenth consecutive E. H. Harriman Gold Medal Awards for employee safety (1989-2001). The important role safety plays is evident in its inclusion in NS' vision statement.

Employee commitment to safety remained a priority at NS during a time of change and challenge. In 2002, NS continued to set the pace for the railroad industry by finishing with a ratio of 1.2 personal injuries per 200,000 employee hours, which is well below the industry average. The success of NS' safety process can be attributed to the personal commitment of each employee.

Maintaining the enviable position as the safest railroad in the industry allows NS to offer customers a competitive transportation package while also serving the interests of its employees and shareholders. NS looks forward to 2003 as it strives to achieve continuous improvement in safety toward its ultimate goal of zero incidents and zero injuries.

A new, fully implemented operating plan, augmented by computer systems that monitor performance in unprecedented detail and make it easier to do business with NS, enables NS to increase the value of its services to customers.

Norfolk Southern completed rollout in the first quarter of 2002 of its redesigned service network, called the Thoroughbred Operating Plan, or TOP, which is a combined effort of Marketing, Transportation, Strategic Planning and field operations employees.

TOP optimizes Norfolk Southern's operations by minimizing the complexity of merchandise train blocking, reducing car handling and avoiding circuitous routes. TOP improved service consistency and reliability, which helped attract new business.

Operating efficiencies also drove higher-value service. Principle measurements of rail network performance - system average train speed, terminal dwell time and the number of cars on line - all set record bests. TOP contributed to the improvement in those metrics and in on-time performance.

Transit time variability was reduced by up to 50%. On-time arrivals for merchandise trains hit 90% and continue to improve.

Transit times improved in key merchandise traffic lanes. For example, in the Chicago-Piedmont lane, transit time improved 36% westbound and 49% eastbound. Transit time on the Gulf States-Northeast lane improved 40% in each direction. About 75% of Norfolk Southern's merchandise customers experienced transit times reductions.

TOP-driven performance improvement became an integral marketing tool. NS' sales force moved traffic off the highway and onto the rails. Truck-to-carload diversions for merchandise traffic reached $35 million in 2002.

Faster, more reliable performance also enables NS to offer premium services for which shippers are willing to pay, an important factor in improving the company's revenues. TOP enhancements during 2003 and 2004 will provide reliable dock-to-dock tracking of customer shipments.

Interline service also has improved. Traffic is being handed off faster and more reliably with other rail carriers, making possible the creation of new premium services in partnership with other railroads. For example, in a joint venture with Burlington Northern Santa Fe, NS offers coast-to-coast carload service for perishable products. Interline service is important for intermodal business as well. More than 60% of NS' total intermodal volume involves interline shipments.

Integral to TOP are investments NS made in computer and communications technologies that give customers the tools to plan, monitor and make adjustments to shipments.

Service reliability plus visibility equal ease of doing business. The entire process is simpler, from rendering a bill of lading, to getting a rate, to final payment. These service and technology initiatives reduce opportunities for errors and lower back-office costs for both NS and customers. Providing ready access to real-time information and support enables NS to address concerns before they become problems.

A new operating plan, innovative service options, better data systems and more interline partnerships all were put in place in 2002. What made them work was the commitment of Norfolk Southern employees systemwide to create extra value for customers. Customer teams, including employees who operate trains as well as sales and marketing employees, improved customer communications and provided personal service. NS office employees who routinely handle customer inquiries by phone made more than 3,000 on-site customer visits to learn about service needs firsthand.

To better equip employees to serve customers and to help the company meet increasing business demands, NS implemented significant work force initiatives in 2002. The initiatives collectively are named Forging Our Future Together. Following are highlights:

NS' financial results improved despite a difficult economic environment. Net income increased 23% as strong operating results led to a 15% gain in income from railway operations. Cash flow improved, which allowed NS to repay $303 million of debt (excluding borrowings from Conrail) and to reduce the amount of accounts receivable sold by $270 million. The quarterly dividend was increased midyear from 6 cents to 7 cents a share, a 17% increase.

Railway operating revenues were $6.3 billion, up 2% compared with 2001. General merchandise revenues increased $122 million, or 3%, supported by a $76 million, or 9%, gain in automotive revenues.

Intermodal revenues increased $58 million, or 5%, on a 6% rise in traffic volume. Coal revenues were $80 million, or 5% lower, as traffic was down 4%.

Railway operating expenses were $5.1 billion, down $51 million, or 1%, despite a 1% increase in overall carloadings.

Income from railway operations was $1.2 billion, an increase of $151 million, or 15%, resulting from the $100 million gain in revenues and the $51 million decline in expenses.

The railway operating ratio improved to 81.5%, compared with 83.7% in 2001. The improvement reflected efficiency gains achieved after implementation of the Thoroughbred Operating Plan.

Net income for 2002 was $460 million, or $1.18 per diluted share, up $85 million, or 23%, compared with 2001.

Although the cost of diesel fuel declined in 2002, prices remain high. Spot diesel fuel prices began the year at low levels and climbed throughout the year as anxieties over a war with Iraq and a strike at a major Venezuelan oil producer drove up prices by year-end.

Because fluctuations in fuel prices have a direct impact on NS' financial results, as shown below, Norfolk Southern began a program in 2001 to hedge a portion of its diesel fuel consumption. The intent of the program is to assist in the management of NS' aggregate risk exposure to fuel price fluctuations, which can significantly affect operating margins and profitability. NS' fuel hedging program in 2002 helped produce more stable and predictable adjusted fuel prices throughout the year.

Diesel fuel costs represented approximately 7% of NS' operating expenses for 2002. The program provides that NS will not enter into any fuel hedges with a duration of more than 36 months, and that no more than 80% of NS' average monthly fuel consumption will be hedge for each month within any 36-month period.

As of Dec. 31, 2002, through swap transactions, NS has hedged approximately 62% of its expected 2003 diesel fuel requirements. The effect of the hedges is to yield an average cost of 73 cents per hedged gallon, including federal taxes and transportation.

Historically, NS has maintained a debt-to-total capital ratio well below today's levels. However, in order to finance its purchase of 58% of Conrail's stock, long-term debt has increased. Nevertheless, NS continues to maintain one of the highest credit ratings among major U.S. railroads with senior unsecured debt ratings of: Moody's: Baa1 and S&P - BBB. As free cash flow strengthens, a primary use of the cash will be to pay back debt.

NS has maintained these ratings despite a relatively high debt-to-total capitalization ratio because of the limited amount of lease obligations it has compared to other railroads. Also, NS' balance sheet reflects well-maintained modern assets, which are largely owned.

Norfolk Southern reduced long-term debt by $695 million since the beginning of 2000, and NS' share of Conrail's long-term debt declined $256 million. The total reduction in debt obligations was $951 million, and year-end cash and short-term investments totaled $184 million.

NS initiated three new debt offerings in 2002 to take advantage of an attractive interest rate environment and to provide more financial flexibility. The offerings helped the company to refinance a portion of its outstanding debt maturities.

Norfolk Southern, historically a rail industry leader in financial performance, focused on strengthening its financial position during 2002.

The company's improvement during the year helped to produce higher earnings per share as compared with each of the previous two years. The price of NS stock rose in 2002 despite widespread weakness in equity prices. NS outperformed the S&P 500 index in 2002 by 32.5 percentage points.

NS also has a long history of paying a dividend to shareholders. Until recently, NS paid a dividend at a rate well above the average of other dividend-paying companies in the S&P 500. In July 2002, NS announced an increase in its dividend to $0.07 per share, an increase from the recent dividend level of $0.06 per share.

NS maintains its roadway and equipment in superior condition - an important element of NS' long-term competitive advantage. Through continuous investment in its assets, NS expects to achieve greater efficiencies and the highest levels of safety and customer service for its growing markets.

NS' capital expenditures from 1998 through its planned spending for 2003 reflect not only its high standard in maintaining its plant and equipment, but also spending in connection with the 1999 expansion of the network. Such spending involved capacity enhancement projects that will facilitate the future growth expected on the system.

In 2003, NS plans to spend $798 million on capital improvements.

Anticipated spending includes $499 million for roadway projects and $246 million for equipment.

In roadway improvements, the largest expenditure will be $383 million for rail, crosstie, ballast and bridge programs. In addition, there is $29 million provided for communications, signal and electrical projects and $20 million for environmental projects and public improvements, such as grade crossing separations and crossing signal upgrades.

Other roadway projects include $36 million for marketing and industrial development initiatives, including increasing track capacity and access to coal receivers and vehicle production and distribution facilities, and continuing investments in intermodal infrastructure.

Equipment spending includes $183 million to purchase 100 six-axle locomotives, upgrade existing locomotives and certify and rebuild multi-level automobile racks. Equipment spending also includes $47 million for projects related to computers and information technology, including allocations for additional security and backup systems.

Norfolk Southern's network of more than 21,500 route miles blankets much of the eastern United States. This extensive coverage allows NS to better serve customers and to compete in today's marketplace. NS is focused on making the best use of its resources to serve these customers and its shareholders. With the change in markets and business demands, NS is making targeted investments in specific growth areas and reallocating resources to maximize NS' growth potential.

NS maintains its roadway to high standards. A well-maintained system is a safer system and results in fewer derailments and better service.

NS continuously pursues maximizing returns on investment in its locomotive fleet. Locomotive utilization teams are focused on the task of achieving the highest levels of efficiency from NS' locomotive fleet while simultaneously satisfying customer needs. As part of a steady program of locomotive replacement, NS announced in its 2003 capital budget that it plans to take delivery of 100 new six-axle high adhesion locomotives. The new locomotives are much more efficient and reliable than the locomotives being retired. This will allow NS to reduce fleet maintenance costs and improve fuel efficiency. New transportation systems that optimize traffic flows will be instrumental to NS' utilization improvement efforts.

NS also strives to attain the highest levels of utilization from its fleet of freight cars, and those of its customers and other railroads. Moving cars expeditiously on the network not only improves returns on invested capital and saves on car hire costs, but also results in improved customer service.

Installation of the Thoroughbred Operating Plan, or TOP, was successfully completed in 2002 and is an integral part of NS' business growth. TOP continues to position the company to improve service consistency, reliability and productivity. TOP provides metrics to better understand root-cause problems associated with variation in train performance. These measurements are the focus of the Operating Plan Adherence (OPA) project, which is expected to improve blocking compliance, connection performance and provide additional data displays to assist the field operations work force. In the coming year, the ability to measure shipment performance against the operating plan will be implemented and distributed to customers.

Making sure cars are routed in the most efficient manner on NS' network is critical to optimizing utilization. The more trips cars can make on the system during a given time period, the fewer cars NS and its customers need. This results in lower investment costs, lower maintenance costs and higher customer satisfaction. E-cars, the NS Internet-based car ordering system, has enhanced equipment demand forecasting. Cross-departmental teams dedicate considerable attention to coordinating the complex effort of maximizing freight car utilization. Achieving such efficiencies is the primary goal of NS' information systems, such as its Thoroughbred Yard Enterprise System (TYES), Algorithmic Blocking and Classification (ABC), Commodity Transportation Management System (CTMS), Strategic Intermodal Management System (SIMS), and Integrated Transportation Management System (ITMS).

Gerald L. Baliles, 62, of Richmond, Va., is a partner in the law firm of Hunton & Williams, a business law firm with offices in several major U.S. cities and international offices in Bangkok, Brussels, London, Warsaw and Hong Kong. His board service began in 1990; his current term expires in 2005.

Gene R. Carter, 63, of Alexandria, Va., is executive director and chief executive officer of the Association for Supervision and Curriculum Development, among the world's largest international education associations. His board service began in 1992; his current term expires in 2005.

Alston D. Correll, 61, of Atlanta, Ga., is chairman, chief executive officer and president of Georgia-Pacific Corporation. His board service began in 2000; his current term expires in 2004.

David R. Goode, 62, of Norfolk, Va., is chairman, president and chief executive officer of Norfolk Southern Corporation. He joined Norfolk and Western Railway in 1965 and was named CEO of Norfolk Southern in 1992. His board service began in 1992; his current term expires in 2003.

Landon Hilliard, 63, of New York City, is a partner in Brown Brothers Harriman & Co., a private bank in New York City. His board service began in 1992; his current term expires in 2004.

Steven F. Leer, 50, of St. Louis, is president and chief executive officer of Arch Coal, Inc., the nation's second largest coal producer. His board service began in 1999; his current term expires in 2005.

Jane Margaret O'Brien, 49, of St. Mary's City, Md., is president of St. Mary's College of Maryland. Her board service began in 1994; her current term expires in 2004.

Harold W. Pote, 56, of New York City, is regional banking group executive of J.P. Morgan Chase & Co. His board service began in 1988; his current term expires in 2003.

J. Paul Reason, 62, Admiral, USN, retired, of Norfolk, Va., is president and chief operating officer of Metro Machine Corporation, a ship repair company. His board service began 2002; his current term expires in 2005.

Carroll A. Campbell Jr. retired from the board of directors of Norfolk Southern effective Nov. 29, 2002.

The board expressed "heartfelt appreciation for his effective and dedicated service" and his "judgment, wise counsel and long-standing commitment to fiscal responsibility."

Campbell was elected to the board in July 1996. He served on the Executive and Governance, Finance and Audit committees, and he helped guide the company during a time of significant growth and expansion. Prior to joining the board, Campbell served two terms as South Carolina's governor and was U.S. representative from the state's 4th Congressional District. He served successively as a state representative and as a state senator before his congressional term.

Executive and Governance

L. Hilliard, chair

G.L. Baliles

A.D. Correll

D.R. Goode

S.F. Leer

Audit

H.W. Pote, chair

G.R. Carter

J.M. O'Brien

J.P. Reason

Compensation and Nominating

G.R. Carter, chair

L. Hilliard

J.M. O'Brien

H.W. Pote

Finance

G.L. Baliles, chair

A.D. Correll

S.F. Leer

J.P. Reason

Performance-Based Compensation

G.R. Carter, chair

J.M. O'Brien

H.W. Pote

David R. Goode, chairman, president and chief executive officer

L.I. Prillaman, vice chairman and chief marketing officer

Stephen C. Tobias, vice chairman and chief operating officer

Henry C. Wolf, vice chairman and chief financial officer

John F. Corcoran, senior vice president public affairs

John W. Fox Jr., senior vice president coal services

James A. Hixon, senior vice president administration

Henry D. Light, senior vice president law

James W. McClellan, senior vice president planning

Kathryn B. McQuade, senior vice president financial planning

Charles W. Moorman, senior vice president corporate services

John P. Rathbone, senior vice president and controller

Stephen P. Renken, senior vice president and chief information officer

John M. Samuels, senior vice president operations planning and support

Donald W. Seale, senior vice president merchandise marketing

Deborah H. Butler, vice president customer service

James E. Carter Jr., vice president internal audit

Joseph C. Dimino, senior general counsel

Cindy C. Earhart, vice president information technology

Terry N. Evans, vice president operations planning and budget

Robert C. Fort, vice president public relations

William A. Galanko, vice president taxation

Robert E. Huffman, vice president intermodal operations

Tony L. Ingram, vice president transportation operations

H. Craig Lewis, vice president corporate affairs

Mark R. MacMahon, vice president labor relations

Bruno Maestri, vice president public affairs

Mark D. Manion, vice president transportation services and mechanical

Robert E. Martinez, vice president marketing services and international

Michael R. McClellan, vice president intermodal marketing

Thomas H. Mullenix Jr., vice president human resources

Richard W. Parker, vice president real estate

William J. Romig, vice president and treasurer

Daniel D. Smith, president NS development

James A. Squires, senior general counsel

Charles J. Wehrmeister, vice president safety and environmental

F. Blair Wimbush, senior general counsel

Gary W. Woods, vice president engineering

Dezora M. Martin, corporate secretary

Stock symbol: NSC on the New York Stock Exchange (NYSE)

Newspaper listings: NorflkSo

For assistance with lost certificates, transfer requirements and the Dividend Reinvestment Plan, contact:

Registrar and Transfer Agent

The Bank of New York

101 Barclay St. - 11E

New York, N.Y. 10286

(866) 272-9472

At its January 2003 meeting, the Corporation's Board of Directors declared a quarterly dividend of 7 cents per share on its common stock, payable March 10, 2003, to stockholders of record on Feb. 7, 2003.

Norfolk Southern Corporation pays quarterly dividends on its common stock, usually on or about March 10, June 10, Sept. 10, and Dec. 10. The Corporation has paid 82 consecutive quarterly dividends since its inception in 1982.

Stockholders whose names appear on their stock certificates (not a street or broker name) are eligible to participate in the Dividend Reinvestment Plan.

The Plan provides a convenient, economical and systematic method of acquiring additional shares of the Corporation's common stock by permitting eligible stockholders of record to reinvest dividends.

The Plan's administrator is The Bank of New York. For additional information, dial (866) 272-9472.

May 8, 2003, at 10 a.m. CDT

Pan American Life Conference Center

601 Poydras St.

New Orleans, La.

Portfolio managers, registered representatives and security analysts are invited to direct their financial questions to:

Henry C. Wolf

Vice Chairman and CFO

Norfolk Southern Corporation

Three Commercial Place

Norfolk, Va. 23510-9215

757/629-2650

Financial materials also are available by calling 800/531-6757.

(at the same address):

William J. Romig

Vice President and Treasurer

757/629-2780

Leanne D. McGruder

Director, Investor Relations

757/629-2861

e-mail: leanne.mcgruder@nscorp.com

Please visit Norfolk Southern's web site (Investing in the Thoroughbred) for such useful online information as: