1 Credit Suisse 3rd Annual Industrials Conference December 2, 2015 Alan H. Shaw Executive Vice President and Chief Marketing Officer

Guiding Principles Committed to Advancing Shareholder Interests 2 Advance shareholder interests through operating performance and financial strategy Deliver safe, reliable, efficient service Maximize incremental margin Reinvest in the core franchise Return capital to shareholders

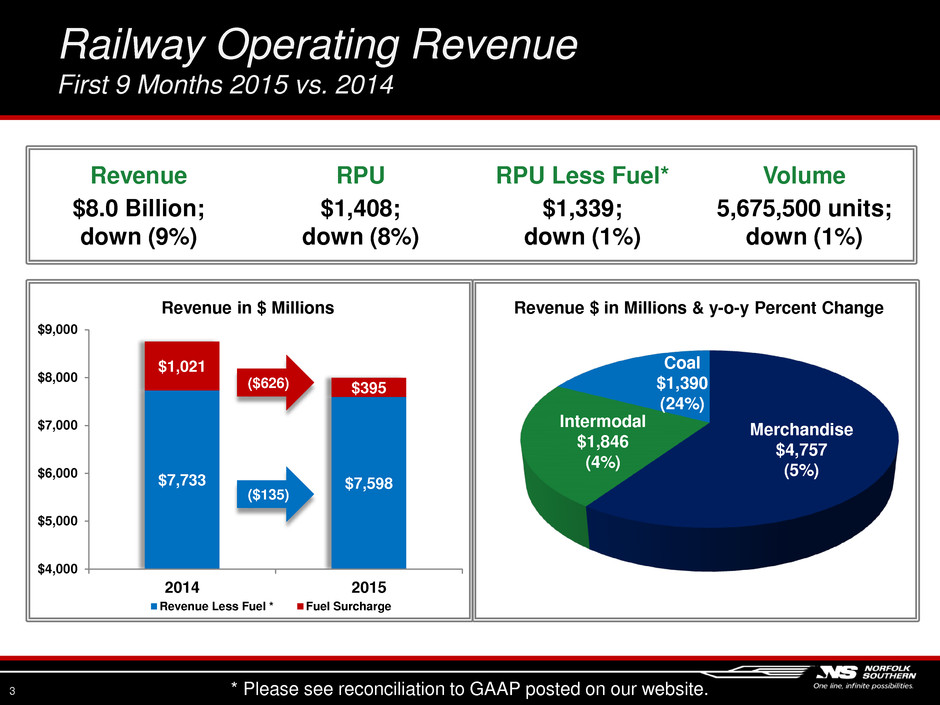

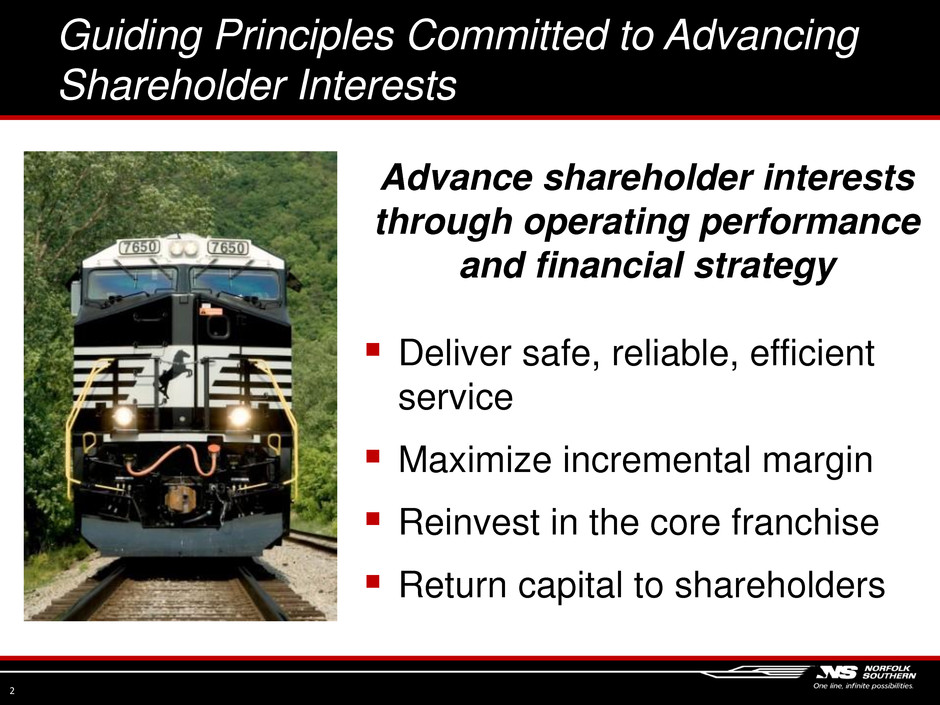

Revenue $ in Millions & y-o-y Percent Change Revenue in $ Millions Railway Operating Revenue First 9 Months 2015 vs. 2014 Merchandise $4,757 (5%) Coal $1,390 (24%) Intermodal $1,846 (4%) $7,733 $7,598 $1,021 $395 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 2014 2015 Revenue Less Fuel * Fuel Surcharge ($626) ($135) 3 Revenue RPU RPU Less Fuel* Volume $8.0 Billion; $1,408; $1,339; 5,675,500 units; down (9%) down (8%) down (1%) down (1%) * Please see reconciliation to GAAP posted on our website.

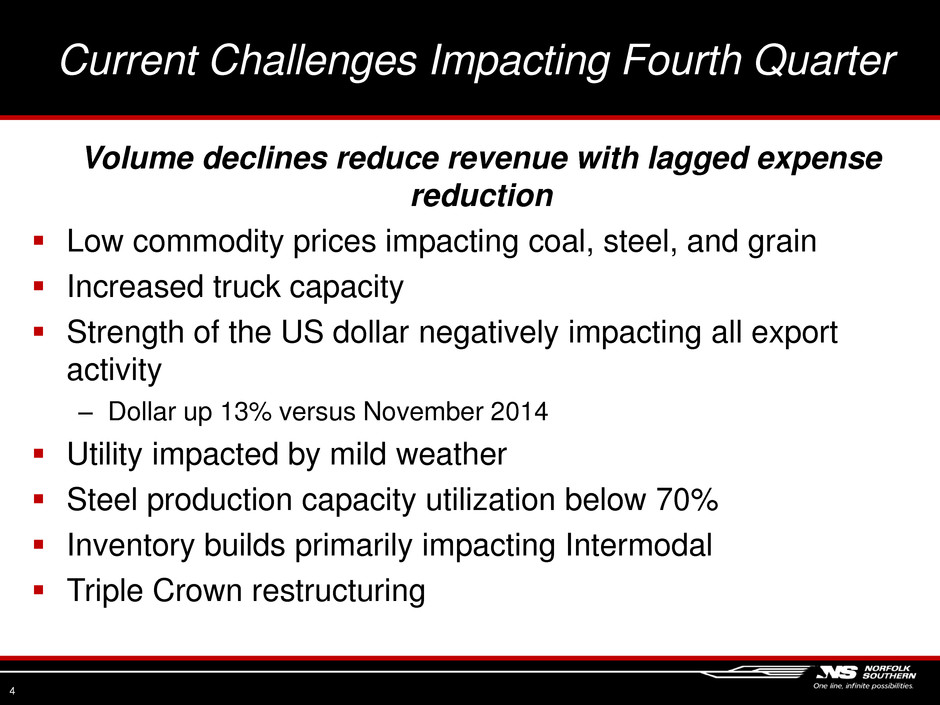

Volume declines reduce revenue with lagged expense reduction Low commodity prices impacting coal, steel, and grain Increased truck capacity Strength of the US dollar negatively impacting all export activity ‒ Dollar up 13% versus November 2014 Utility impacted by mild weather Steel production capacity utilization below 70% Inventory builds primarily impacting Intermodal Triple Crown restructuring Current Challenges Impacting Fourth Quarter 4

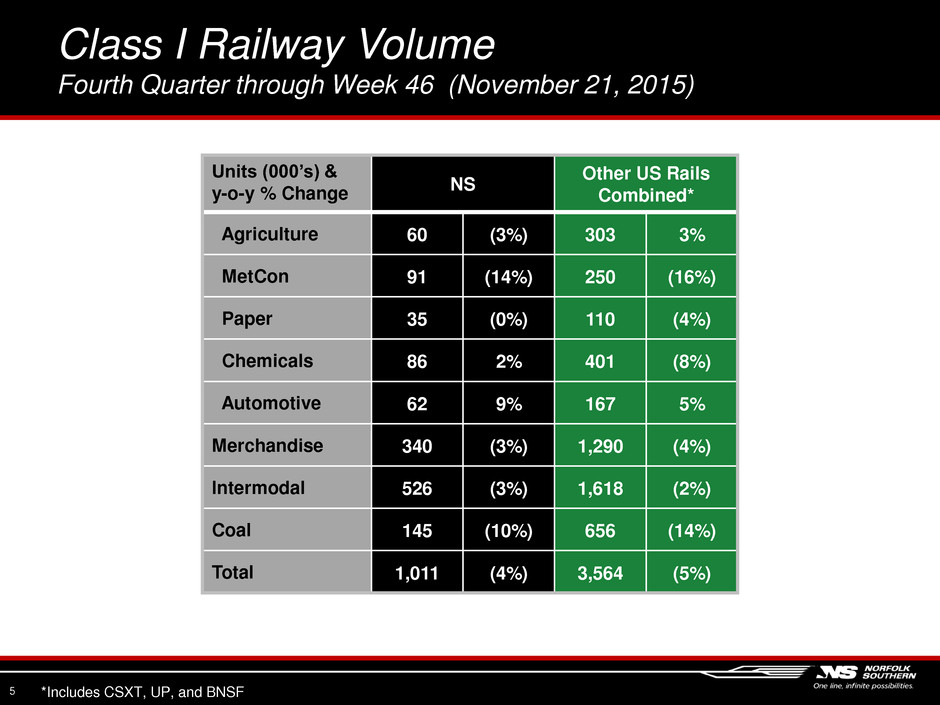

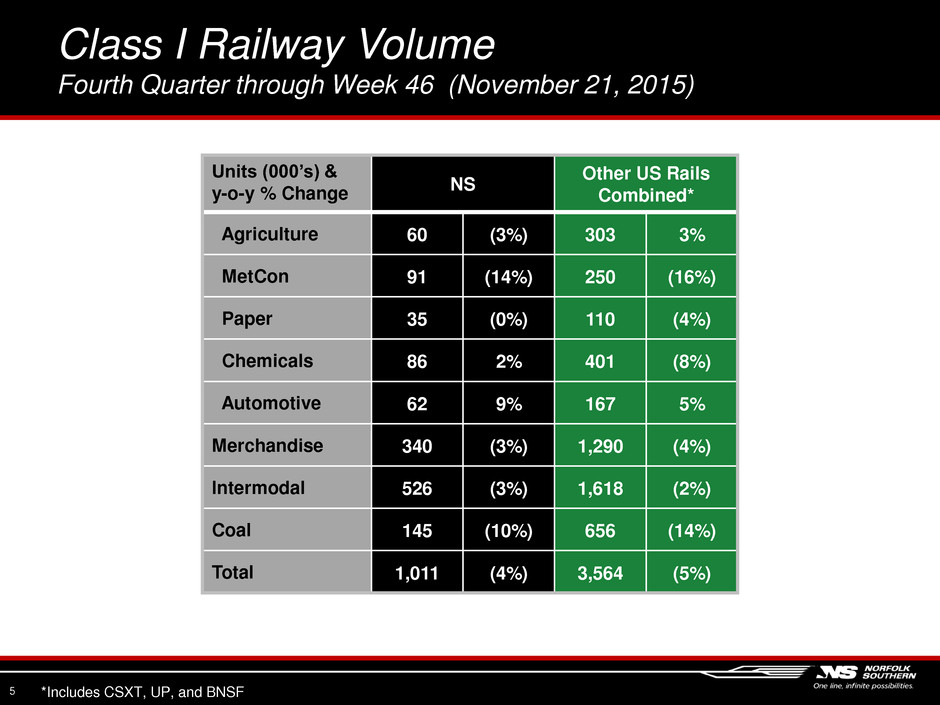

Class I Railway Volume Fourth Quarter through Week 46 (November 21, 2015) 5 *Includes CSXT, UP, and BNSF Units (000’s) & y-o-y % Change NS Other US Rails Combined* Agriculture 60 (3%) 303 3% MetCon 91 (14%) 250 (16%) Paper 35 (0%) 110 (4%) Chemicals 86 2% 401 (8%) Automotive 62 9% 167 5% Merchandise 340 (3%) 1,290 (4%) Intermodal 526 (3%) 1,618 (2%) Coal 145 (10%) 656 (14%) Total 1,011 (4%) 3,564 (5%)

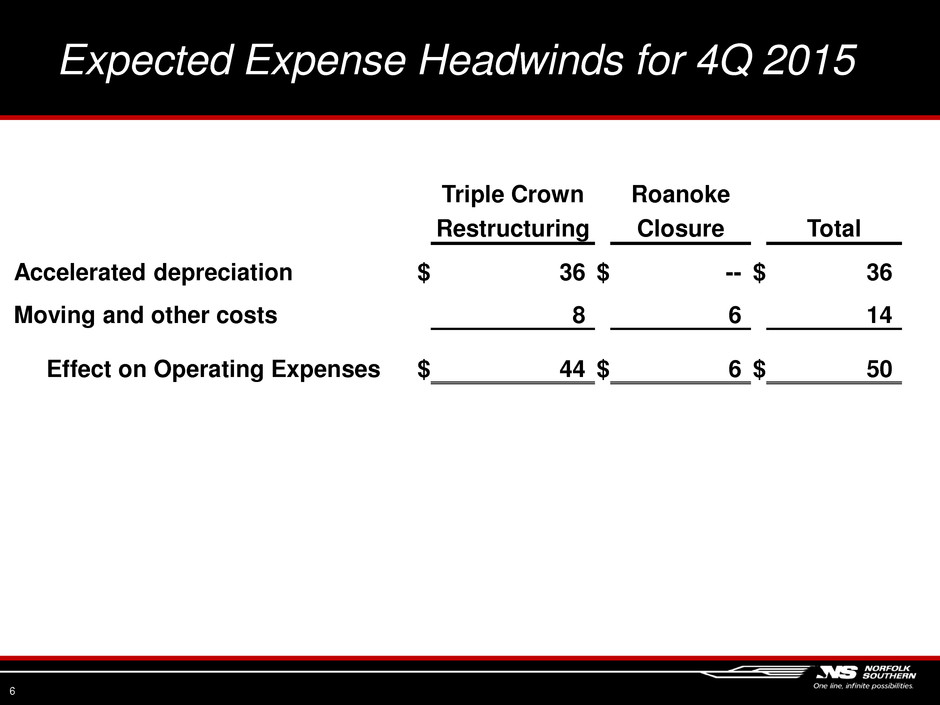

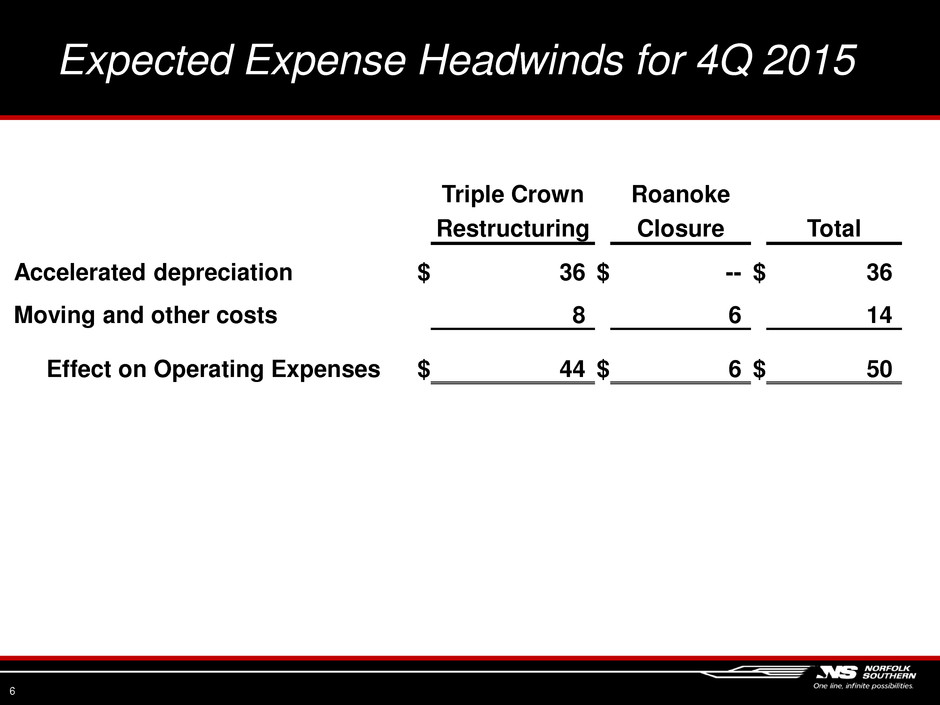

Triple Crown Roanoke Restructuring Closure Total Accelerated depreciation $ 36 $ -- $ 36 Moving and other costs 8 6 14 Effect on Operating Expenses $ 44 $ 6 $ 50 6 Expected Expense Headwinds for 4Q 2015

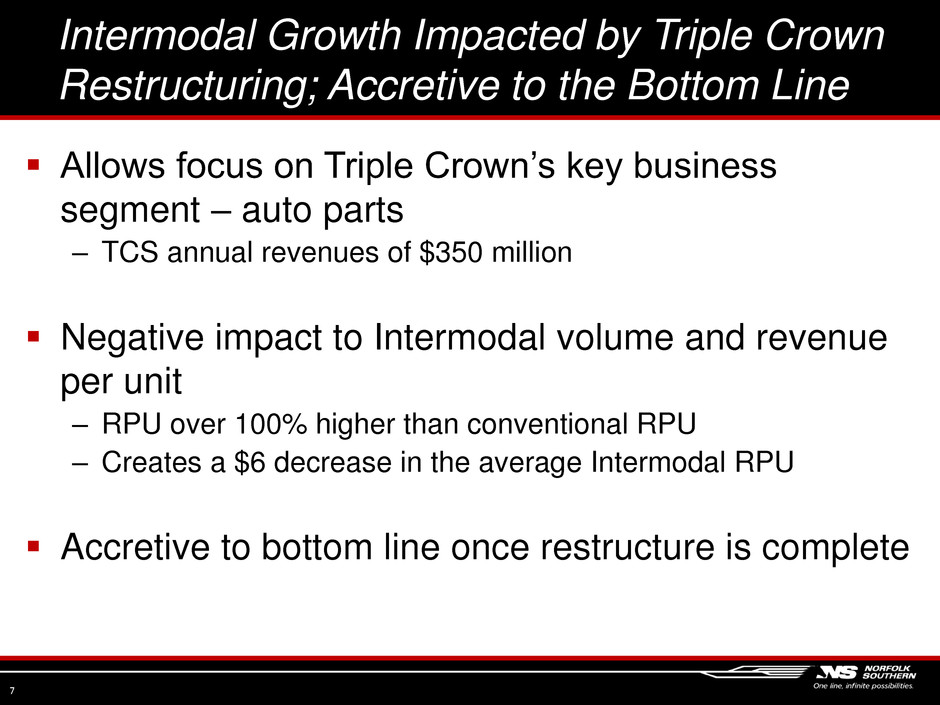

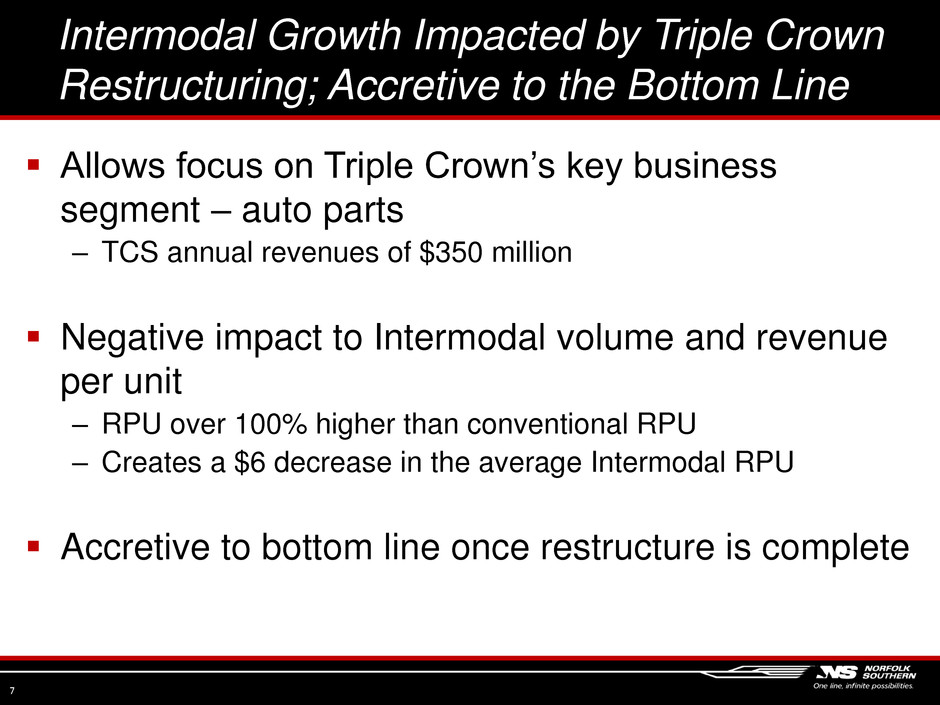

Allows focus on Triple Crown’s key business segment – auto parts – TCS annual revenues of $350 million Negative impact to Intermodal volume and revenue per unit – RPU over 100% higher than conventional RPU – Creates a $6 decrease in the average Intermodal RPU Accretive to bottom line once restructure is complete 7 Intermodal Growth Impacted by Triple Crown Restructuring; Accretive to the Bottom Line

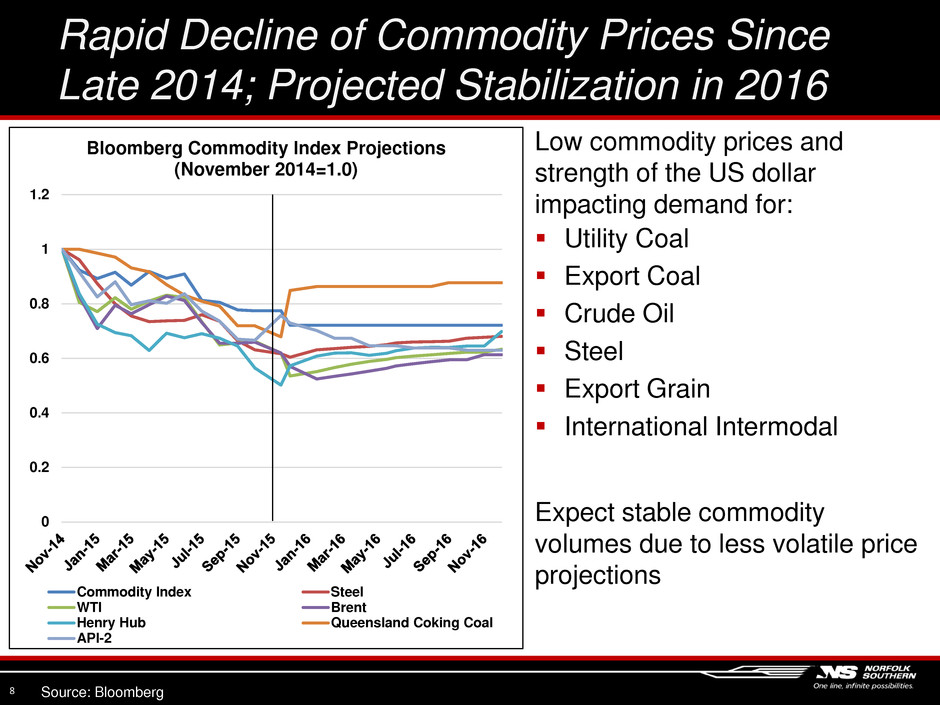

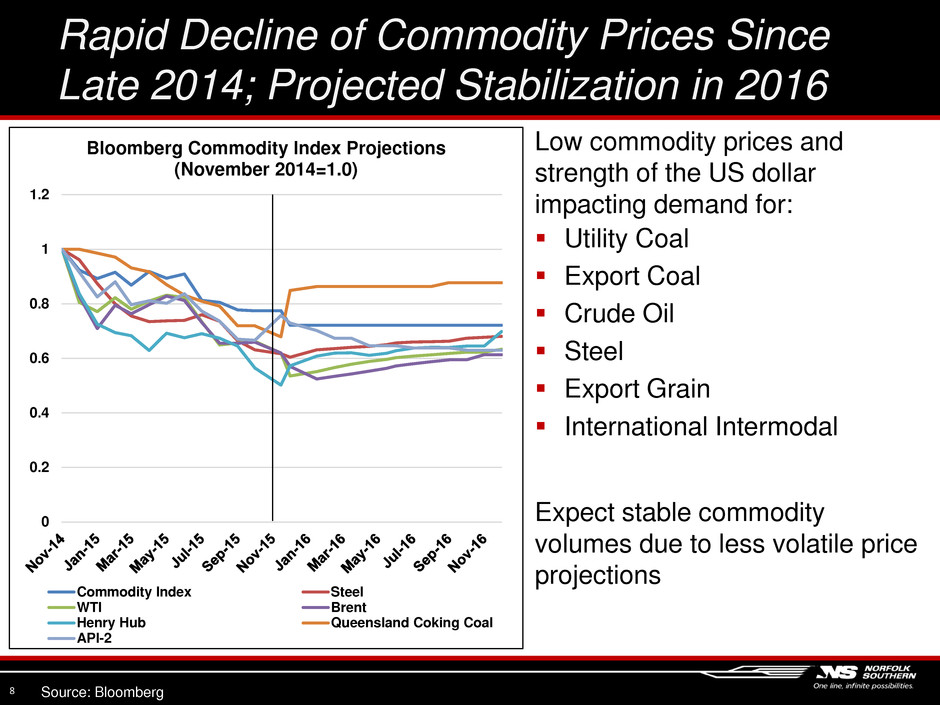

Rapid Decline of Commodity Prices Since Late 2014; Projected Stabilization in 2016 8 Source: Bloomberg Low commodity prices and strength of the US dollar impacting demand for: Utility Coal Export Coal Crude Oil Steel Export Grain International Intermodal Expect stable commodity volumes due to less volatile price projections 0 0.2 0.4 0.6 0.8 1 1.2 Bloomberg Commodity Index Projections (November 2014=1.0) Commodity Index Steel WTI Brent Henry Hub Queensland Coking Coal API-2

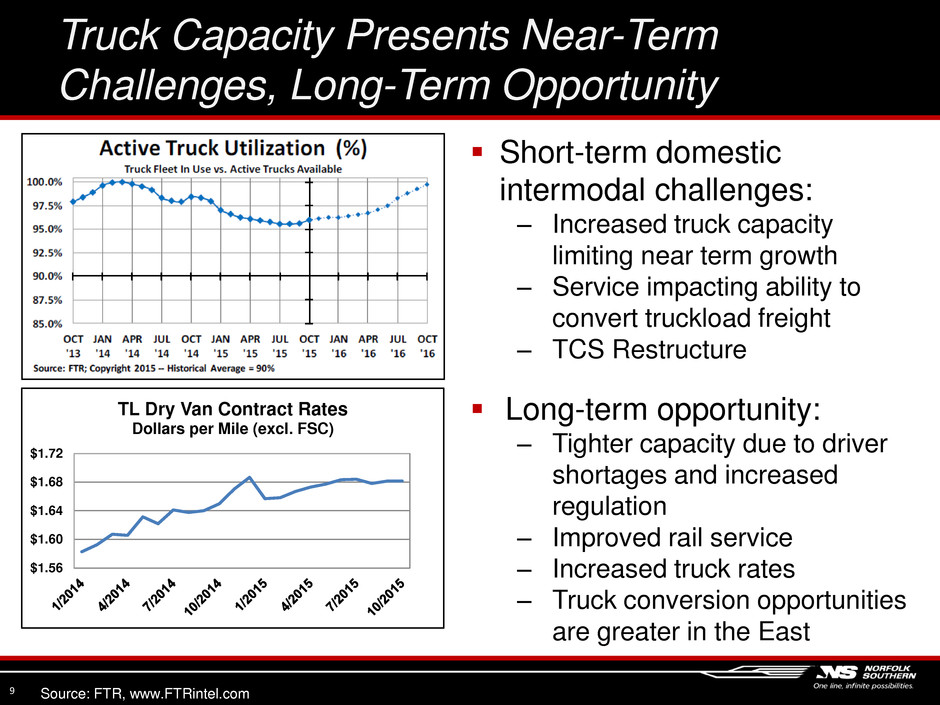

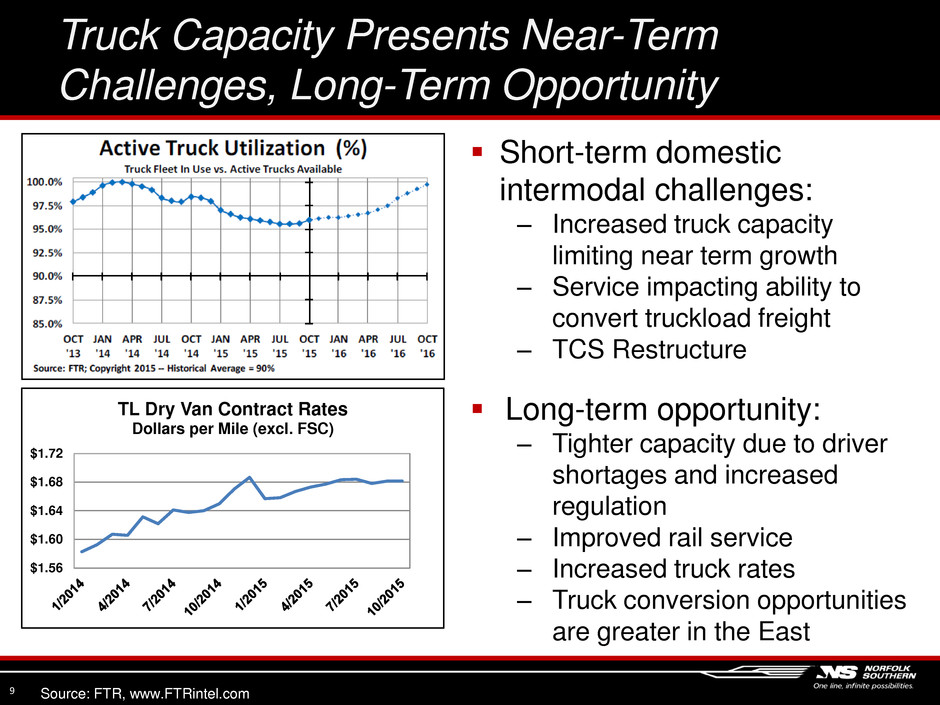

Truck Capacity Presents Near-Term Challenges, Long-Term Opportunity 9 Short-term domestic intermodal challenges: ‒ Increased truck capacity limiting near term growth ‒ Service impacting ability to convert truckload freight ‒ TCS Restructure Long-term opportunity: ‒ Tighter capacity due to driver shortages and increased regulation ‒ Improved rail service ‒ Increased truck rates ‒ Truck conversion opportunities are greater in the East Source: FTR, www.FTRintel.com $1.56 $1.60 $1.64 $1.68 $1.72 TL Dry Van Contract Rates Dollars per Mile (excl. FSC)

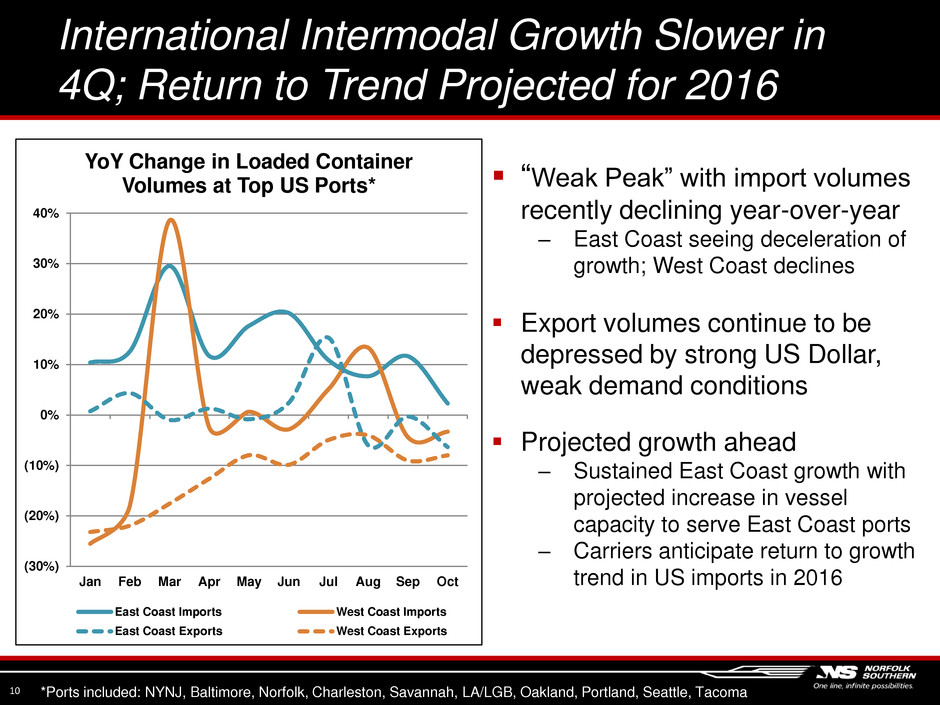

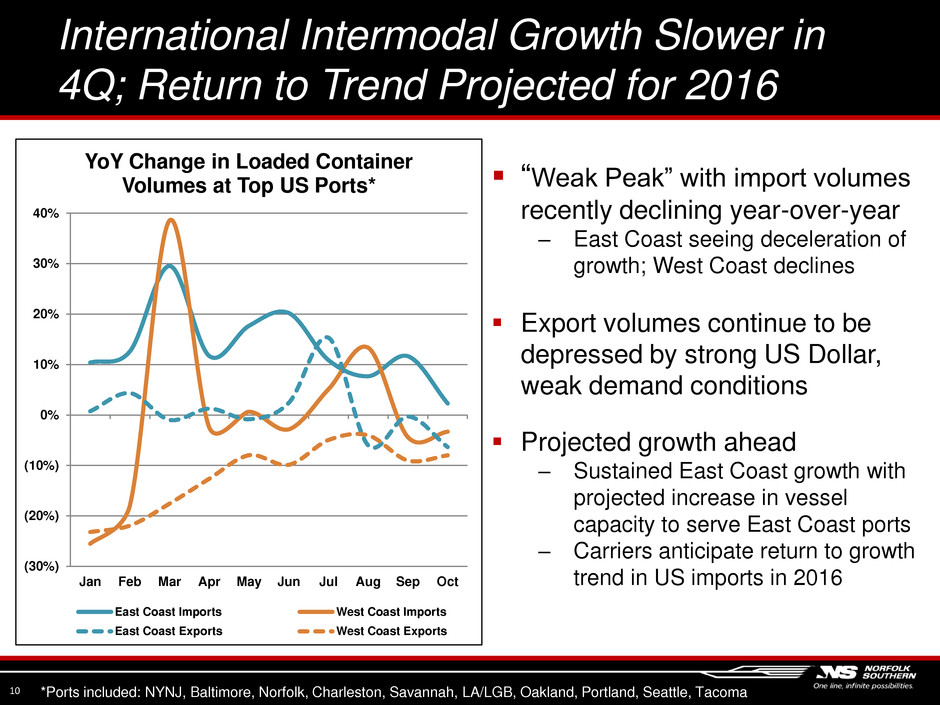

International Intermodal Growth Slower in 4Q; Return to Trend Projected for 2016 10 “Weak Peak” with import volumes recently declining year-over-year ‒ East Coast seeing deceleration of growth; West Coast declines Export volumes continue to be depressed by strong US Dollar, weak demand conditions Projected growth ahead ‒ Sustained East Coast growth with projected increase in vessel capacity to serve East Coast ports ‒ Carriers anticipate return to growth trend in US imports in 2016 *Ports included: NYNJ, Baltimore, Norfolk, Charleston, Savannah, LA/LGB, Oakland, Portland, Seattle, Tacoma (30%) (20%) (10%) 0% 10% 20% 30% 40% Jan Feb Mar Apr May Jun Jul Aug Sep Oct YoY Change in Loaded Container Volumes at Top US Ports* East Coast Imports West Coast Imports East Coast Exports West Coast Exports

Opportunities: ‒ Consumer-driven markets • Automotive • Housing and Construction related commodities • Basic Chemicals ‒ International and domestic intermodal gains long-term Strategies to Drive Growth: ‒ Continued focus on pricing improvement ‒ Improving productivity and efficiency ‒ Network reach ‒ Strategic structuring Primary objective is contribution to the bottom line Emphasis on Contribution Growth Ahead 11

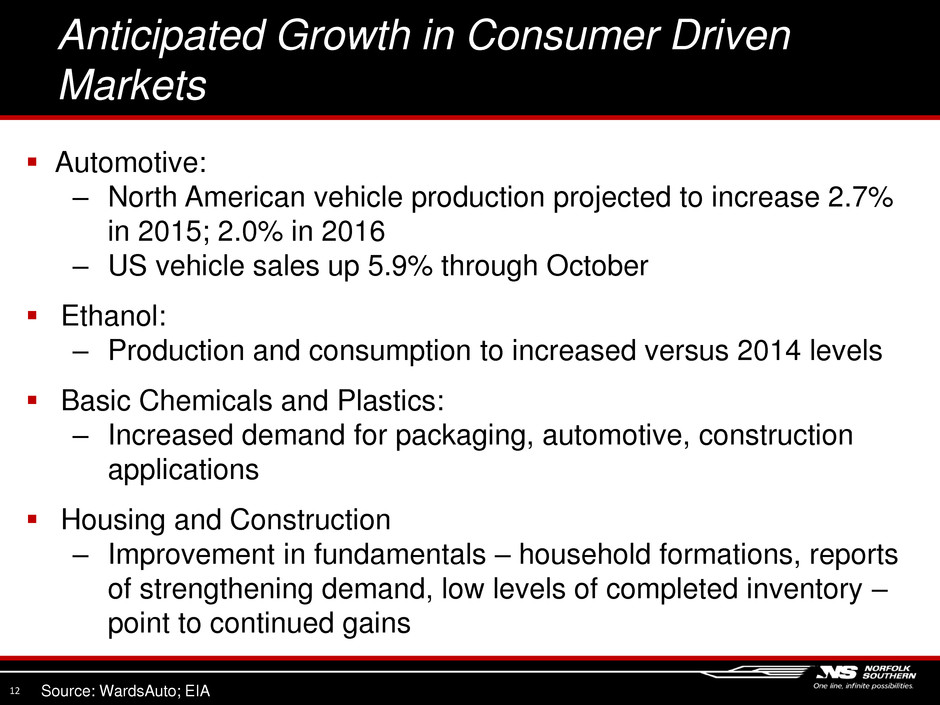

Anticipated Growth in Consumer Driven Markets 12 Source: WardsAuto; EIA Automotive: ‒ North American vehicle production projected to increase 2.7% in 2015; 2.0% in 2016 ‒ US vehicle sales up 5.9% through October Ethanol: ‒ Production and consumption to increased versus 2014 levels Basic Chemicals and Plastics: ‒ Increased demand for packaging, automotive, construction applications Housing and Construction ‒ Improvement in fundamentals – household formations, reports of strengthening demand, low levels of completed inventory – point to continued gains

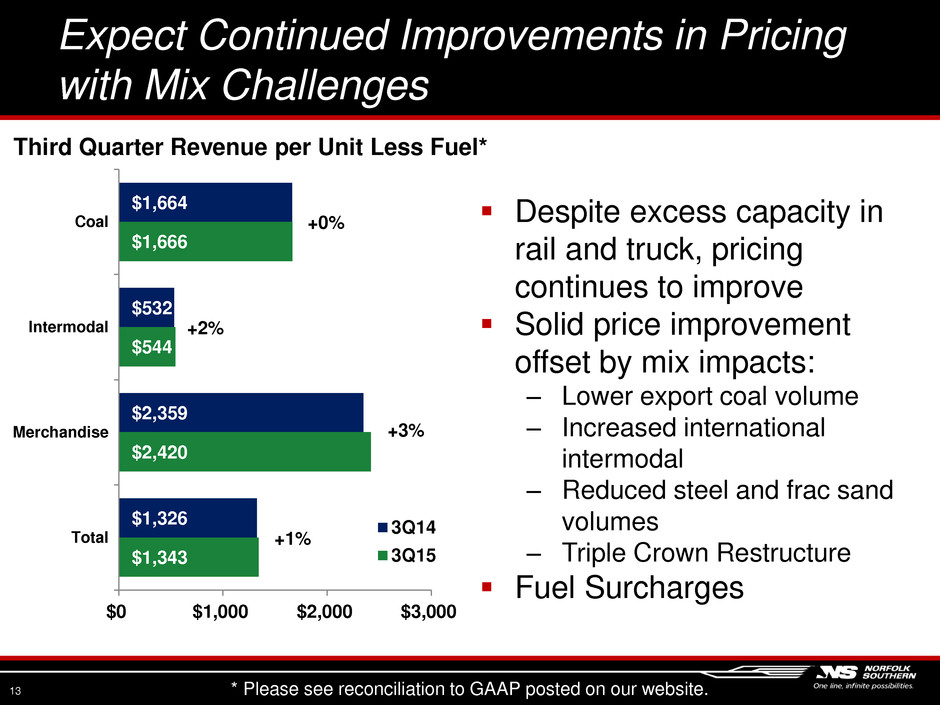

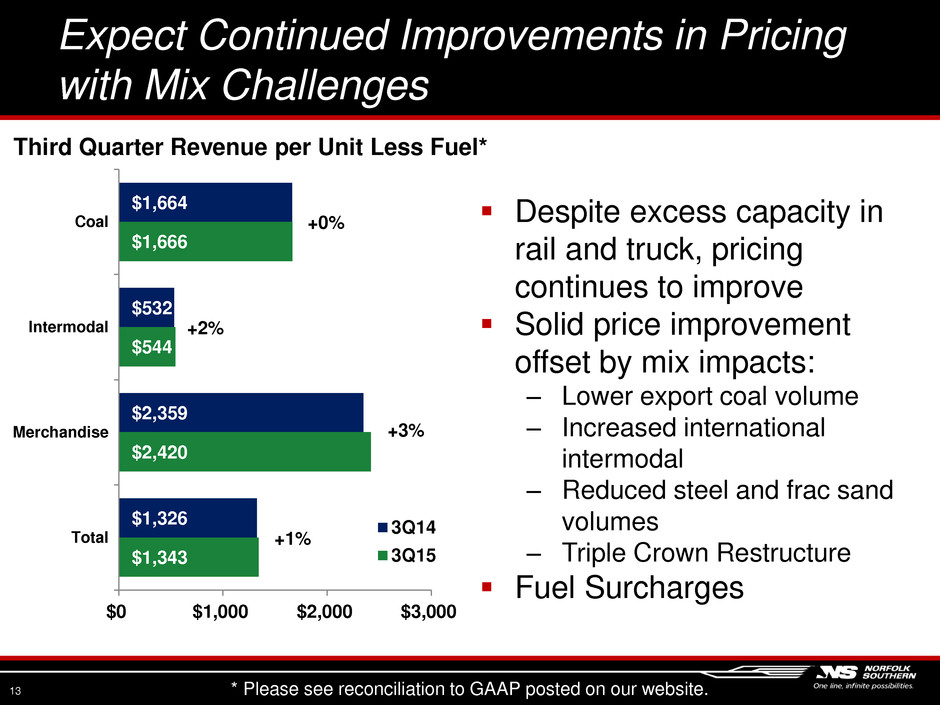

13 Expect Continued Improvements in Pricing with Mix Challenges $1,664 $532 $2,359 $1,326 $1,666 $544 $2,420 $1,343 $0 $1,000 $2,000 $3,000 Coal Intermodal Merchandise Total 3Q14 3Q15 +1% +3% +2% +0% Third Quarter Revenue per Unit Less Fuel* Despite excess capacity in rail and truck, pricing continues to improve Solid price improvement offset by mix impacts: ‒ Lower export coal volume ‒ Increased international intermodal ‒ Reduced steel and frac sand volumes ‒ Triple Crown Restructure Fuel Surcharges * Please see reconciliation to GAAP posted on our website.

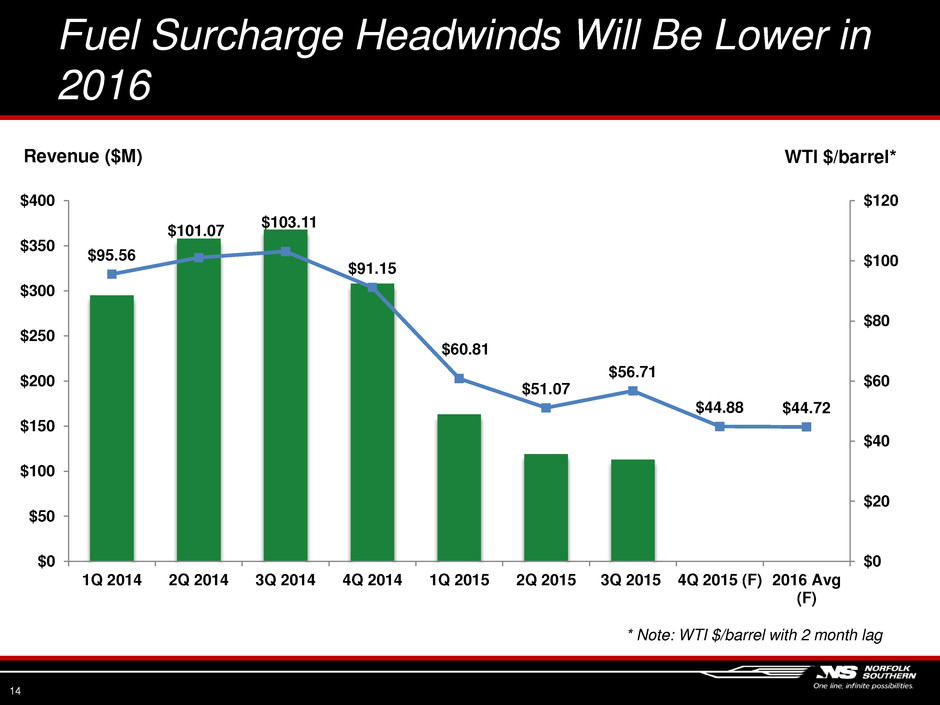

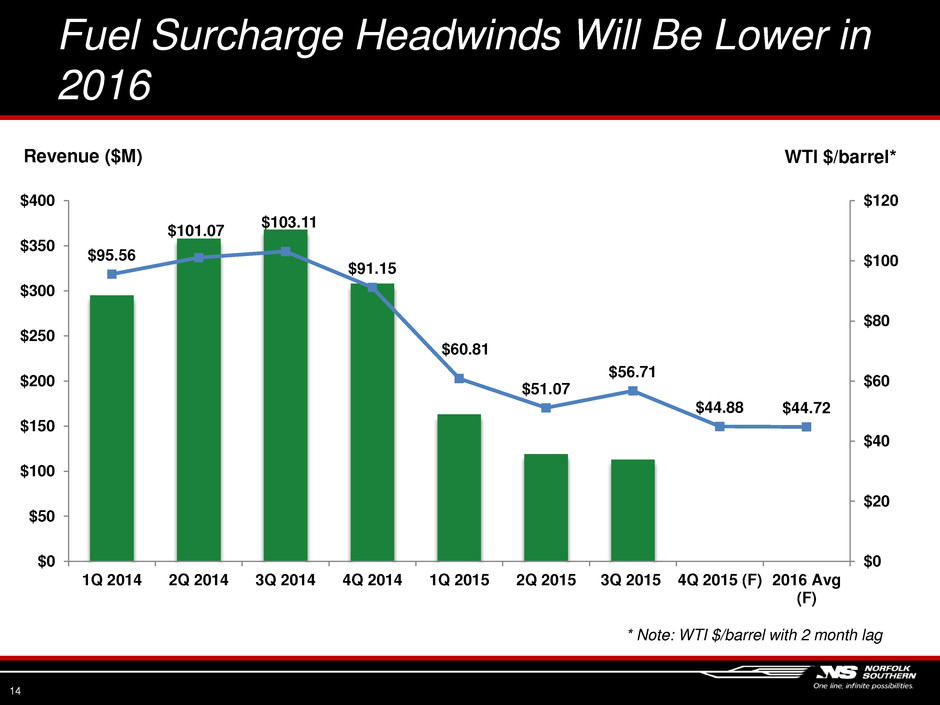

Fuel Surcharge Headwinds Will Be Lower in 2016 $95.56 $101.07 $103.11 $91.15 $60.81 $51.07 $56.71 $44.88 $44.72 $0 $20 $40 $60 $80 $100 $120 $0 $50 $100 $150 $200 $250 $300 $350 $400 1Q 2014 2Q 2014 3Q 2014 4Q 2014 1Q 2015 2Q 2015 3Q 2015 4Q 2015 (F) 2016 Avg (F) WTI $/barrel* Revenue ($M) 14 * Note: WTI $/barrel with 2 month lag

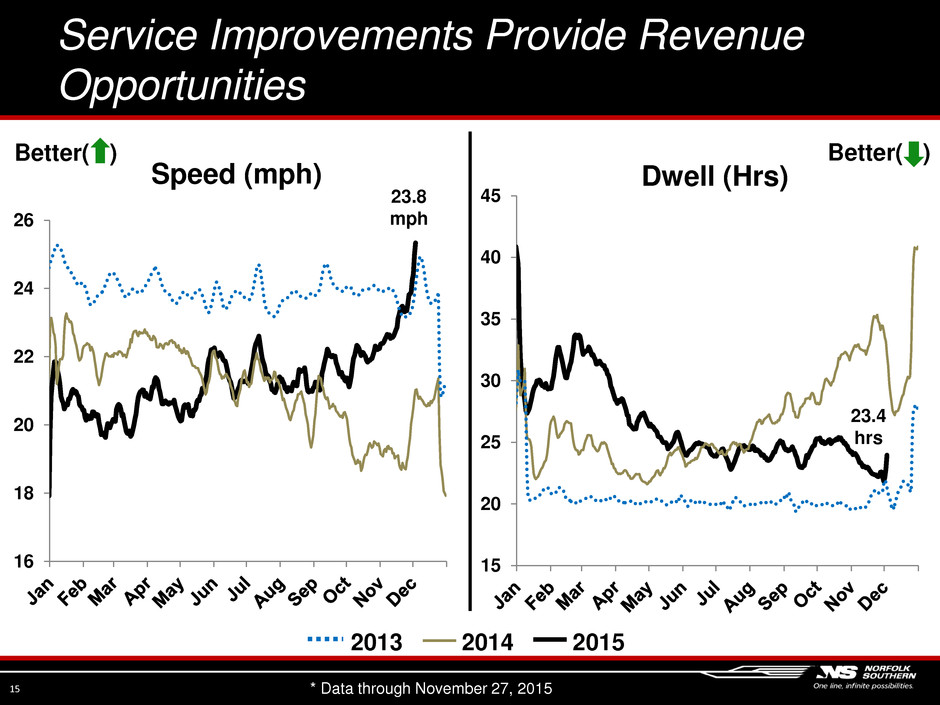

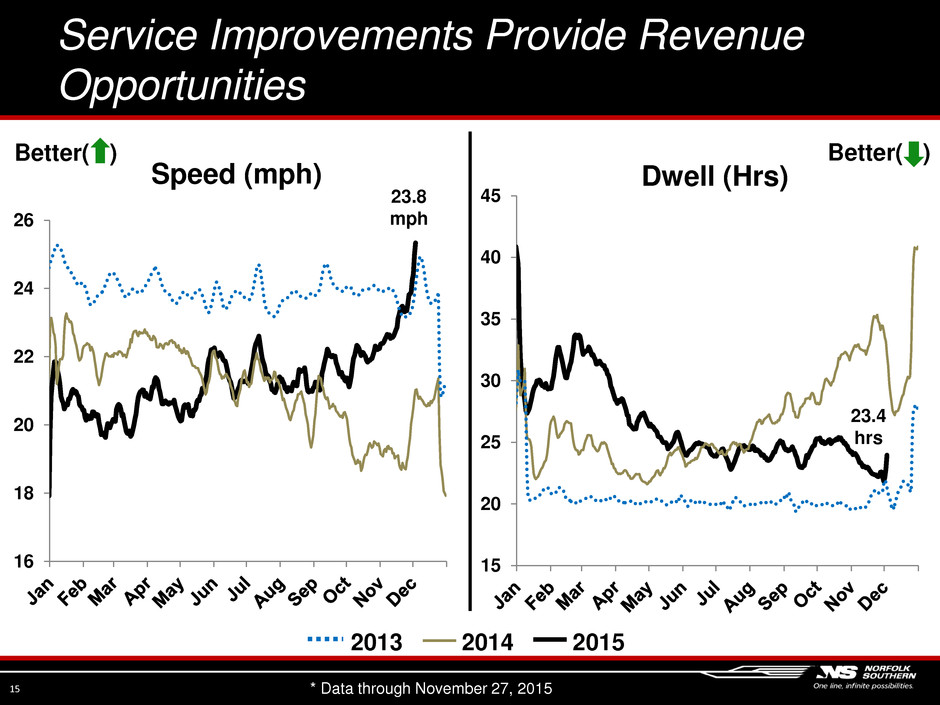

15 20 25 30 35 40 45 Dwell (Hrs) 15 * Data through November 27, 2015 23.4 hrs 2013 2014 2015 16 18 20 22 24 26 Speed (mph) 23.8 mph Service Improvements Provide Revenue Opportunities Better( ) Better( )

Recent initiatives set the stage for better performance in 2016 and will produce long term results Service improvements distinguish our product Coal ‒ No impact from environmental regulations in the near term in our Utility franchise ‒ Less exposure in the Export Thermal market Intermodal ‒ Robust Domestic franchise ‒ International franchise better aligned with shipping lines adding capacity between Far East and East Coast Truck conversion opportunities are greater in the East Pricing improvement throughout the year Drivers of Future Success 16

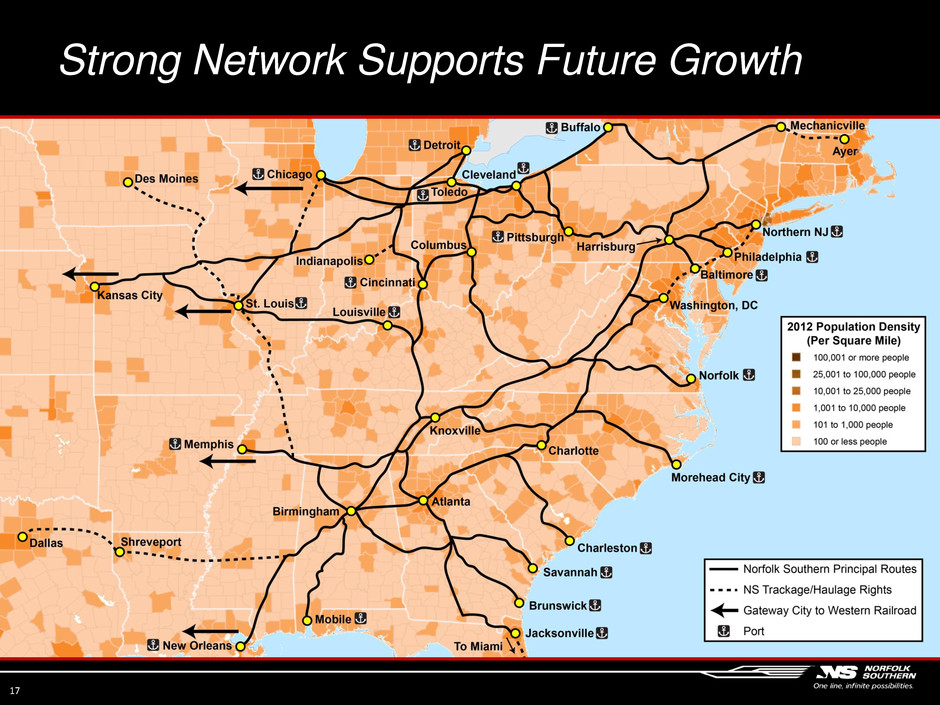

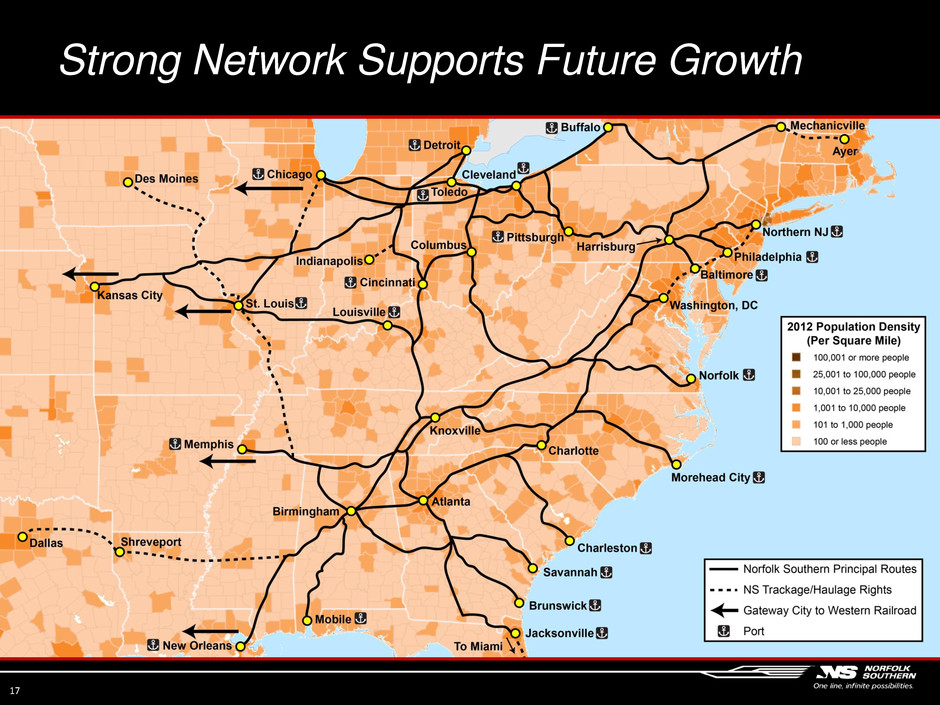

Strong Network Supports Future Growth 17

Committed to Driving Growth to the Bottom Line Asset Utilization and Resource Sizing Continued Service Initiatives Pricing Volume Our Focus 18

Thank You 19