An Important Update for All Shareholders Creating Shareholder Value Enhancing Performance Implementing Efficiency Improvements Providing Superior Customer Service Executing on Our Strategy

Leading the Norfolk Southern team is an incredible honor, particularly at this time of near all-time best service levels. Our 30,000 employees and I are committed to doing everything we can to deliver superior value to our shareholders. Meet Your Company’s New Management Team: Strong Leadership and Fresh Perspectives Jim Squires Chairman, President and CEO Jim, a 23-year railroad veteran, was appointed Chairman of NS in October 2015 and CEO in March 2015. In his fi rst eight months as CEO, Jim has overseen the return of service to near all-time best performance levels. Looking forward, he has instituted a strategic plan to drive profi tability and accelerate growth, with projected annual savings of more than $650 million by 2020. One line, infi nite possibilities.

Jim and his team are already successfully implementing the new plan to drive growth and deliver enhanced value to shareholders Restored NS service to approach all-time best service levels On track to achieve more than $650 million of cost savings and an operating ratio of less than 65 over the next fi ve years Mike Wheeler Executive Vice President and COO A 30-year railroad veteran, Mike became the new EVP and COO on February 1, 2016. Maximizing Operational Efficiencies While leading NS’ transportation, mechanical and engineering groups, Mike has worked to align NS’ service to customer needs and tailored capital expenditures to meet current market dynamics, while continuing to streamline operations and reduce expenses. Marta Stewart Executive Vice President and CFO A 32-year railroad veteran, Marta was appointed EVP and CFO in November 2013. Promoting a Sound Financial Platform In the past two years, Marta has prudently managed NS’ balance sheet, positioning NS for fi nancial fl exibility and success. She also championed our strategy to emphasize capital allocation and signifi cant shareholder returns. Alan Shaw Executive Vice President and CMO A 21-year railroad veteran, Alan was appointed EVP and CMO in May 2015. Securing Profi table Business In the past nine months, Alan has positioned NS to capitalize on service sensitive traffi c, to maximize profi t through disciplined pricing increases, and to grow volume opportunistically. In addition, he oversaw the restructuring of Triple Crown.

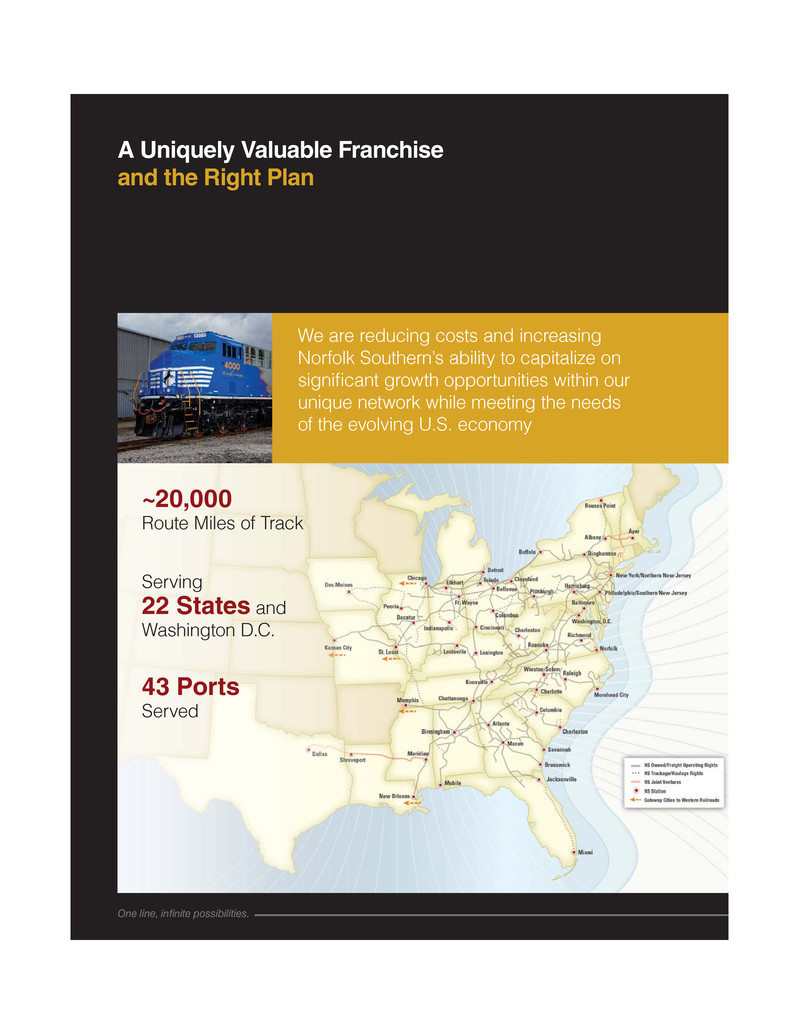

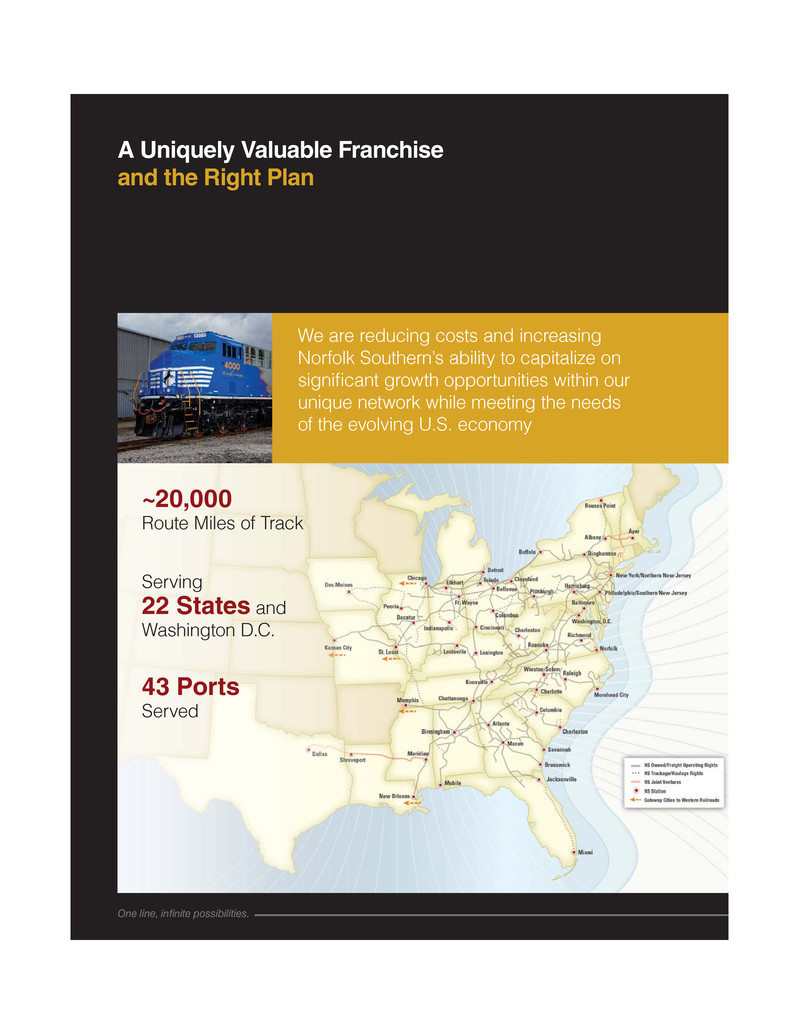

A Uniquely Valuable Franchise and the Right Plan We are reducing costs and increasing Norfolk Southern’s ability to capitalize on signifi cant growth opportunities within our unique network while meeting the needs of the evolving U.S. economy ~20,000 Route Miles of Track Serving 22 States and Washington D.C. 43 Ports Served One line, infi nite possibilities.

Provide superior service and increase value to customers • Increasing consistency, reliability, and availability that customers value and for which they are willing to pay Grow key merchandise and intermodal markets • Capitalizing on signifi cant truckload conversion opportunity • Dominating premium intermodal space Continue to improve network performance • Accelerating train speeds • Reducing dwell times • Increasing train length to reduce crew and locomotive requirements Integrate technological innovations • Maximizing fuel effi ciency • Enhancing track usage and improving network velocity • Further reducing terminal dwell and optimizing local network We’re on the Right Track: Driving Signifi cant Revenue Growth Our new management team has been executing on a comprehensive strategic plan to streamline operations, drive profi tability, and accelerate growth to increase revenue and earnings per share

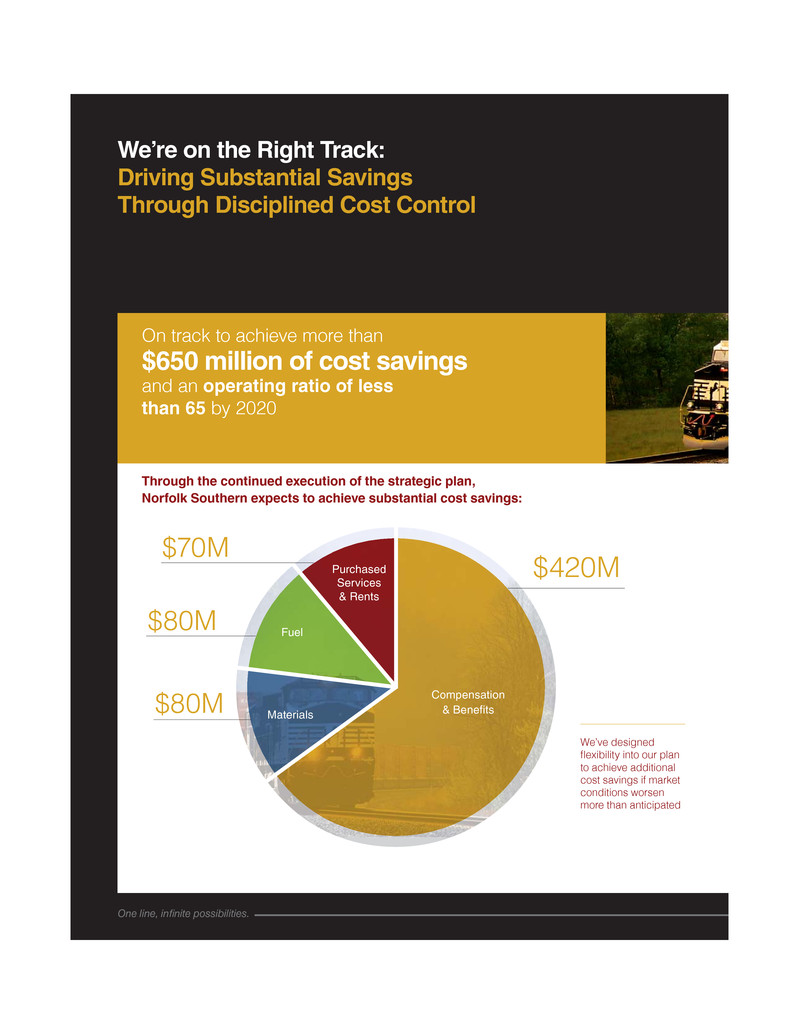

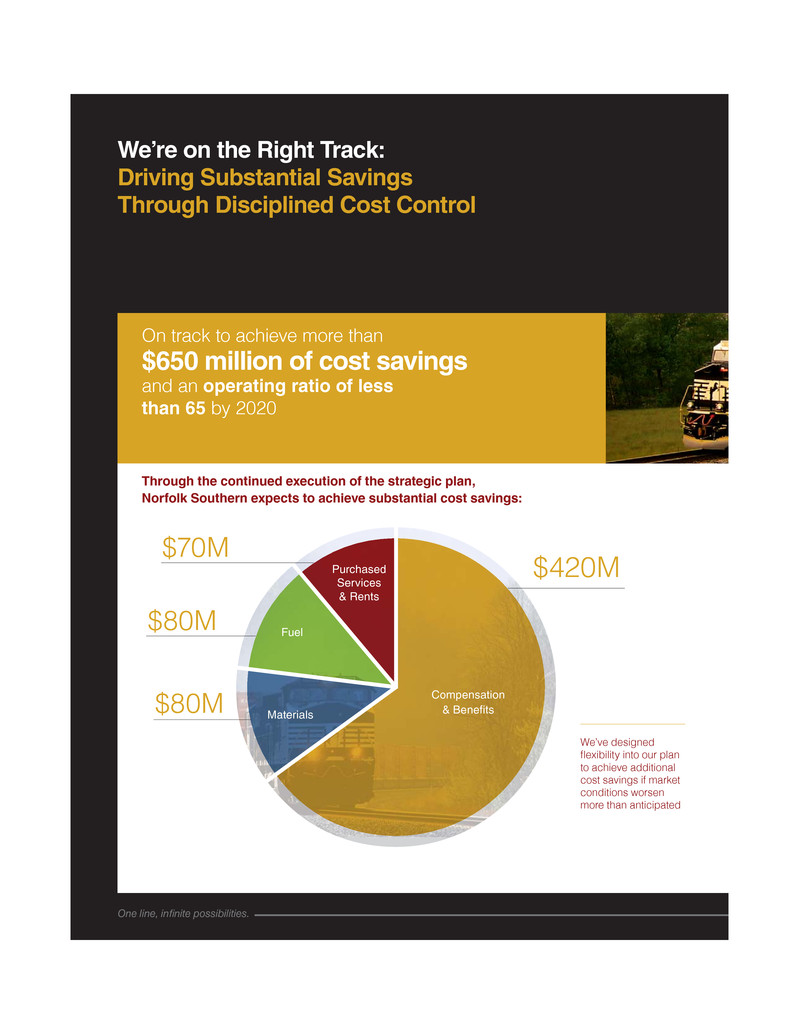

We’re on the Right Track: Driving Substantial Savings Through Disciplined Cost Control Through the continued execution of the strategic plan, Norfolk Southern expects to achieve substantial cost savings: On track to achieve more than $650 million of cost savings and an operating ratio of less than 65 by 2020 One line, infi nite possibilities. $420M $80M $80M $70M Compensation & Benefi tsMaterials Fuel Purchased Services & Rents We’ve designed fl exibility into our plan to achieve additional cost savings if market conditions worsen more than anticipated

A Strong Record of Returning Capital to Shareholders, Including Dividend Growth Norfolk Southern is vital to the U.S. economy. We’re focused on creating value for our shareholders, our customers, and our country. 134 consecutive quarters of paying dividends on our common stock Steadily increasing dividend with a 10 year compound annual growth rate of 17% Average of approximately $1 billion in share repurchases per year We are committed to a capital allocation strategy that allows for signifi cant return of capital to shareholders. Over the past 10 years Norfolk Southern has returned approximately $15 billion in share repurchases and dividends to shareholders. We’re proud of our:

Forward-Looking Statements Certain statements in this communication are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements relate to future events or the Company’s future fi nancial performance and involve known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance or achievements of the Company or its industry to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements can be identifi ed by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “project,” “consider,” “predict,” “potential” or other comparable terminology. The Company has based these forward- looking statements on management’s current expectations, assumptions, estimates, beliefs and projections. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control. These and other important factors, including those discussed under “Risk Factors” in the Company’s Form 10-K for the year ended December 31, 2014, as well as the Company’s subsequent fi lings with the Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this communication are made only as of the date they were fi rst issued, and unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Copies of Norfolk Southern Corporation’s communication and additional information about the Company are available at www.norfolksouthern.com or you can contact the Norfolk Southern Corporation Investor Relations Department by calling 757-629-2861. Important Additional Information and Where to Find It Norfolk Southern Corporation (the “Company”), its directors and certain of its executive offi cers and employees may be deemed to be participants in the solicitation of proxies from shareholders in connection with the Company’s 2016 Annual Meeting of Shareholders (the “2016 Annual Meeting”). The Company plans to fi le a proxy statement with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the 2016 Annual Meeting (the “2016 Proxy Statement”). Additional information regarding the identity of these potential participants, none of whom owns in excess of 1 percent of the Company’s shares of Common Stock, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the 2016 Proxy Statement and other materials to be fi led with the SEC in connection with the 2016 Annual Meeting. This information can also be found in the Company’s defi nitive proxy statement for its 2015 Annual Meeting of Shareholders (the “2015 Proxy Statement”), fi led with the SEC on March 25, 2015, or the Annual Report on Form 10-K for the year ended December 31, 2014, fi led with the SEC on February 11, 2015 (the “Form 10-K”). To the extent holdings of the Company’s securities by such potential participants have changed since the amounts printed in the 2015 Proxy Statement, such changes have been or will be refl ected on Statements of Ownership and Change in Ownership on Forms 3 and 4 fi led with the SEC. SHAREHOLDERS ARE URGED TO READ THE 2016 PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE ACCOMPANYING WHITE PROXY CARD AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY HAS FILED OR WILL FILE WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain, free of charge, copies of the 2016 Proxy Statement (when fi led), and any other documents (including the WHITE proxy card) fi led or to be fi led by the Company with the SEC in connection with the 2016 Annual Meeting at the SEC’s website (http://www.sec.gov) or at the Company’s website (http://www.norfolksouthern.com) or by writing to Denise Hutson, Corporate Secretary, Norfolk Southern Corporation, Three Commercial Place, Norfolk, Virginia 23510. www.norfolksouthern.com