Cautionary Statement on Forward-Looking Statements

Certain statements in this communication are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. These statements relate to future events or our future financial performance, including statements relating to our ability to execute on our strategic plan and our 2024 Annual Meeting and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or our achievements or those of our industry to be materially different from those expressed or implied by any forward-looking statements. In some cases, forward-looking statements may be identified by the use of words like “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “project,” “consider,” “predict,” “potential,” “feel,” or other comparable terminology. The Company has based these forward-looking statements on its current expectations, assumptions, estimates, beliefs, and projections. While the Company believes these expectations, assumptions, estimates, and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which involve factors or circumstances that are beyond the Company’s control. These and other important factors, including those discussed under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as well as the Company’s subsequent filings with the SEC, may cause actual results, performance, or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements herein are made only as of the date they were first issued, and unless otherwise required by applicable securities laws, the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measures

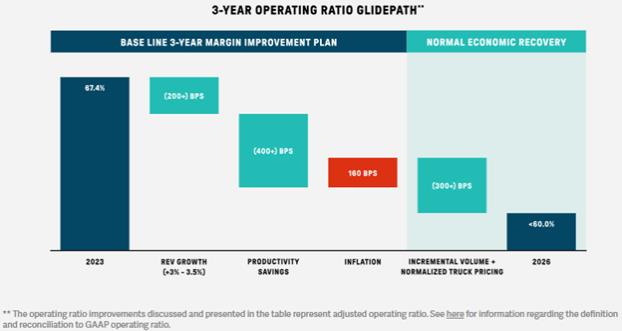

This document includes the presentation and discussion of adjusted operating ratio. This figure adjusts our GAAP financial results to exclude the effects of the direct costs resulting from the East Palestine incident. We use this non-GAAP financial measure internally and believe this information provides useful supplemental information to investors to facilitate making period to period comparisons by excluding the costs arising from the East Palestine incident, and in 2024, also excluding other charges relating to restructuring efforts, shareholder matters and a deferred tax adjustment. While we believe that this non-GAAP financial measure is useful in evaluating our business, this information should be considered as supplemental in nature and is not meant to be considered in isolation from, or as a substitute for, the related financial information prepared in accordance with GAAP. In addition, this non-GAAP financial measure may not be the same as similar measures presented by other companies. See below for a reconciliation of the 2023 non-GAAP operating ratio figures provided in this document to GAAP operating ratio. With respect to projections and estimates for future non-GAAP operating ratio, including full year 2024 adjusted operating ratio guidance and our longer term adjusted operating ratio target, the Company is unable to predict or estimate with reasonable certainty the ultimate outcome of certain items required for the GAAP measure without unreasonable effort. Information about the adjustments that are not currently available to the Company could have a potentially unpredictable and significant impact on future GAAP results.

The following table adjusts our 2023 GAAP financial results to exclude the effects of the East Palestine incident. The income tax effects of this non-GAAP adjustment were calculated based on the applicable tax rates to which the non-GAAP adjustment related:

| | | | | | | | | | | | |

| | | Non-GAAP Reconciliation for 2023 | |

| | Reported (GAAP) | | | East Palestine

Incident | | | Adjusted

(non-GAAP) | |

| | ($ in millions, except per share amounts) | |

Income from railway operations | | $ | 2,851 | | | $ | 1,116 | | | $ | 3,967 | |

Income taxes | | $ | 493 | | | $ | 270 | | | $ | 763 | |

Net income | | $ | 1,827 | | | $ | 846 | | | $ | 2,673 | |

Diluted earnings per share | | $ | 8.02 | | | $ | 3.72 | | | $ | 11.74 | |

Railway operating ratio (percent) | | | 76.5 | | | | (9.1 | ) | | | 67.4 | |