- ONBPP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

First Midwest Bancorp (ONBPP) 8-KRegulation FD Disclosure

Filed: 19 May 10, 12:00am

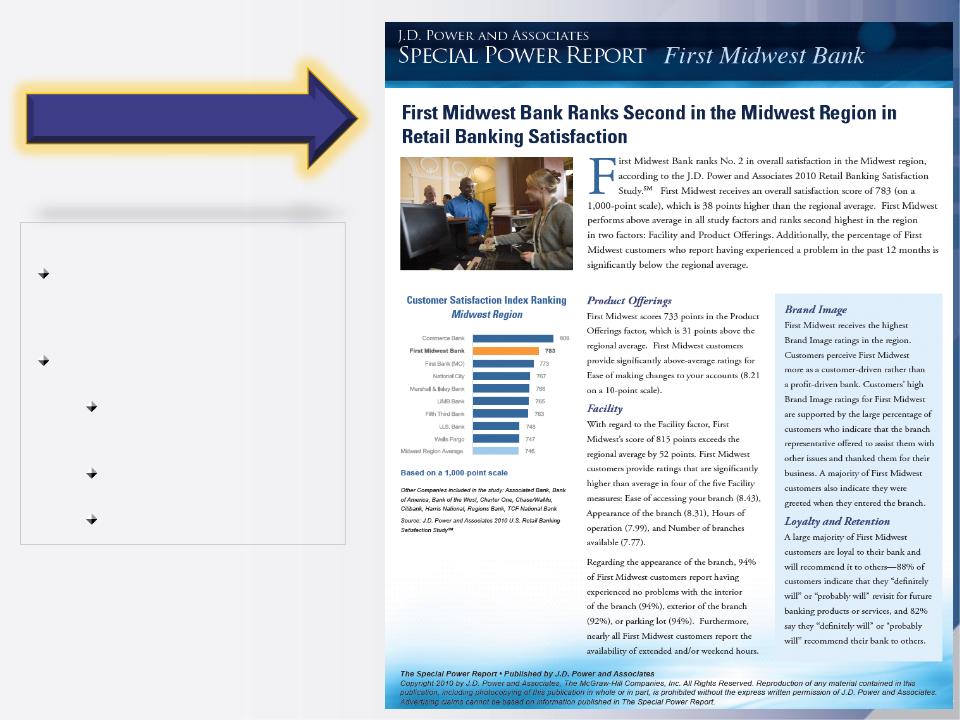

A Premier Bank | Premier Bank For Commercial | Premier Bank For Retail |

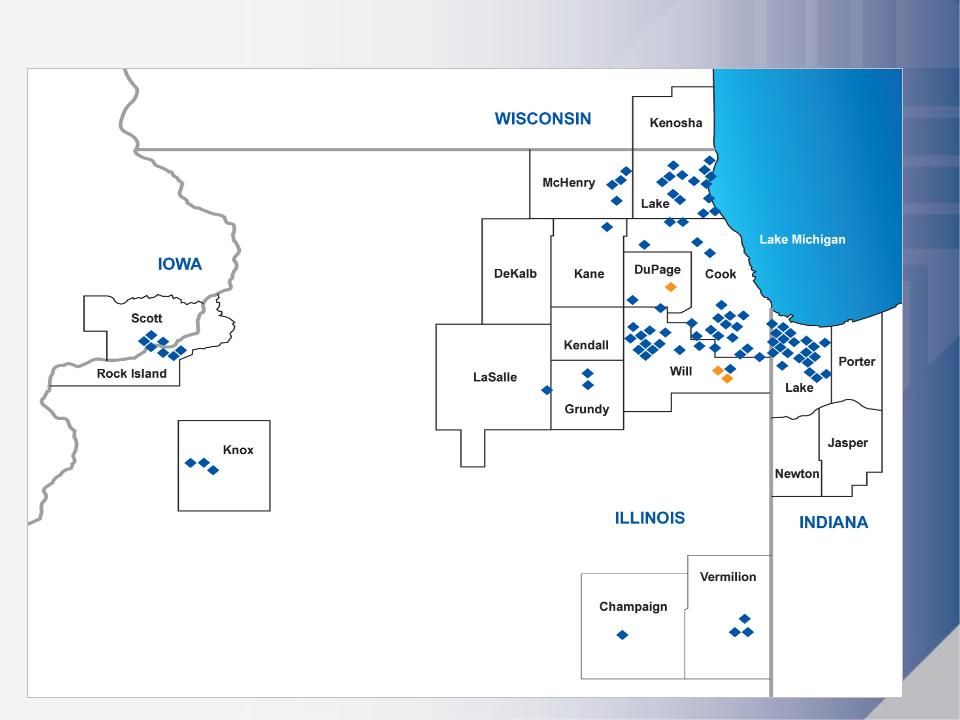

$7.6 Billion Assets $5.9 Billion Deposits $5.3 Billion Loans $3.9 Billion Trust/Investment AUM/C 90% Suburban Chicago | 7 Business Lines 25,000 Commercial Relationships 1,600 Trust Relationships 200 Relationship Managers Tenured Sales Force And Market Presence | 225,000 Retail Relationships 1,000 Bankers 96 Offices 8th Largest Distribution Network Suburban MSA* 9th In Suburban MSA Market Share* |

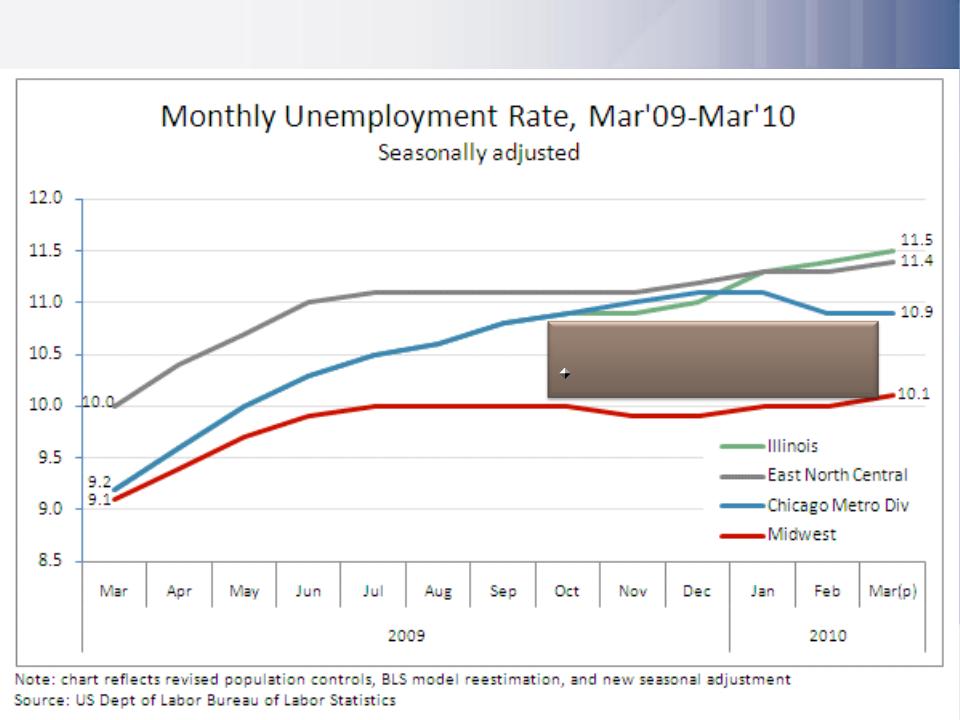

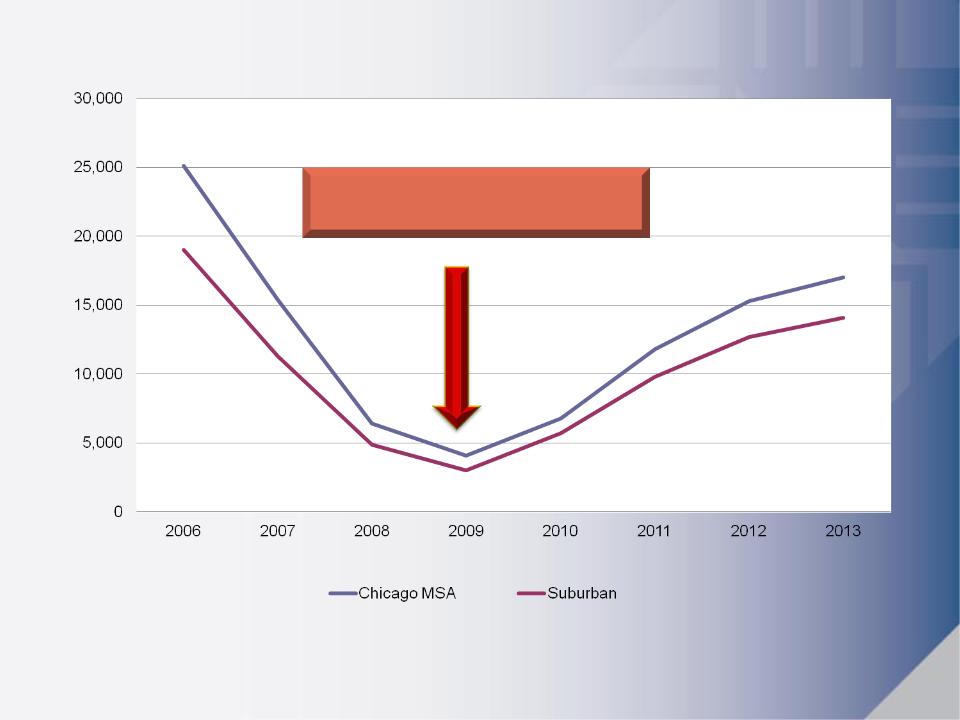

Employment | Single Family Starts | Housing Prices | Industrial Production | |

12/2007 | 0.6% | (41.1%) | (4.5%) | 1.53% |

12/2008 | (2.1%) | (62.8%) | (14.3%) | (5.84%) |

3/2009 | (3.3%) | (63.6%) | (18.6%) | (11.53%) |

6/2009 | (4.5%) | (60.0%) | (16.73%) | (13.38%) |

9/2009 | (4.9%) | (50.4%) | (10.6%) | (10.8%) |

12/2009 | (4.4%) | (21.6%) | (7.2%) | (6.4%) |

2/2010 | (4.5%) | 15.16% | (3.0%) | (1.1%) |

($ in mm’s) | 2009 | 2008 | Change |

PTPP Core Operating Earnings(1) | $131.4 | $153.8 | -15% |

PTPP Return to RWA Average Assets | 2.10% | 2.33% | -10% |

Net Interest Margin | 3.72% | 3.61% | +3% |

Average Earning Assets | $7,282 | $7,440 | -2% |

Loans | $5,203 | $5,360 | -3% |

Average Transactional Deposits | $3,734 | $3,559 | +5% |

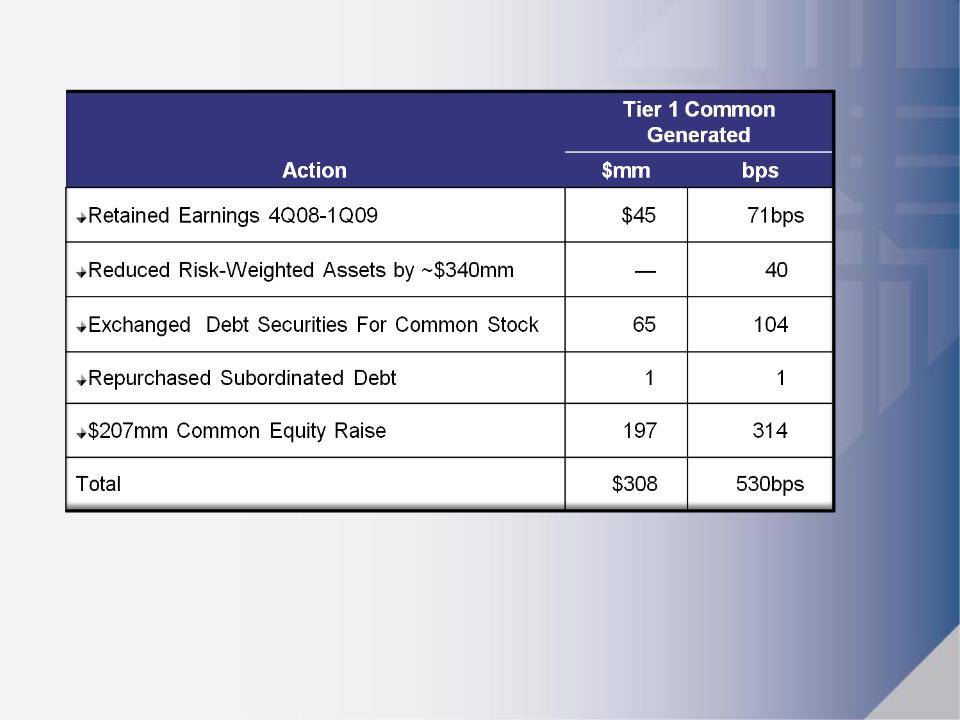

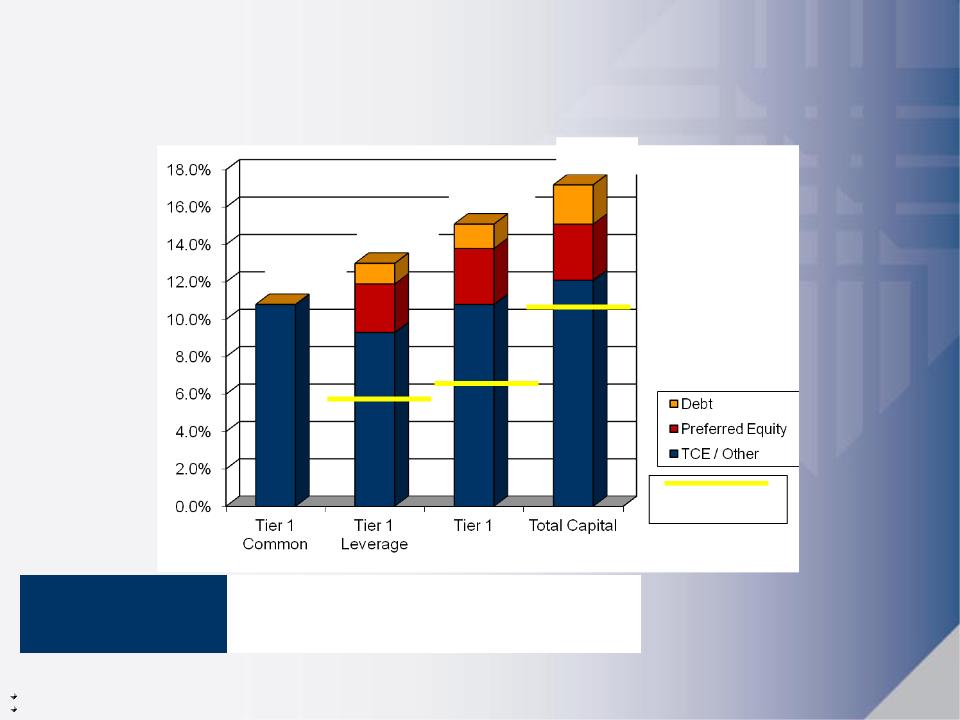

Tier 1 Common to RWA | 7.56% | 6.79% | +11% |

($ in mm’s) | 1Q10 | 1Q09 | Change |

Net Income | $8.1 | $5.7 | +41% |

PTPP Core Operating Earnings(1) | $31.6 | $36.7 | -14% |

Net Interest Margin | 4.28% | 3.67% | +61% |

Loan Loss Provision | $18.4 | $48.4 | -62% |

Loans | $5,196 | $5,387 | -4% |

Average Transactional Deposits | $3,917 | $3,439 | +14% |

Tier 1 Common to RWA | 10.81% | 7.04% | +54% |

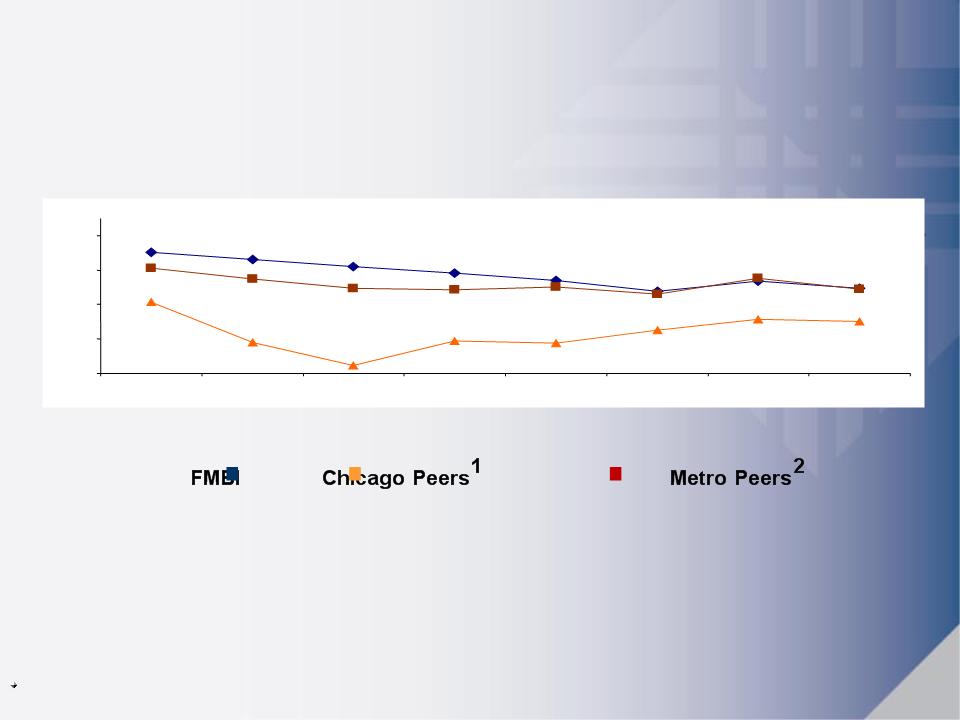

Stock Price Increase | ||

YTD | 1 Yr | |

First Midwest | 40% | 72% |

SNL Bank Index (1) | 22% | 24% |

NASDAQ Bank Index | 25% | 20% |

Peer Rank | Chicago (1) | 1/6 | 1/6 | 1/6 | 1/6 |

Metro (2) | 5/14 | 1/14 | 2/14 | 2/14 |

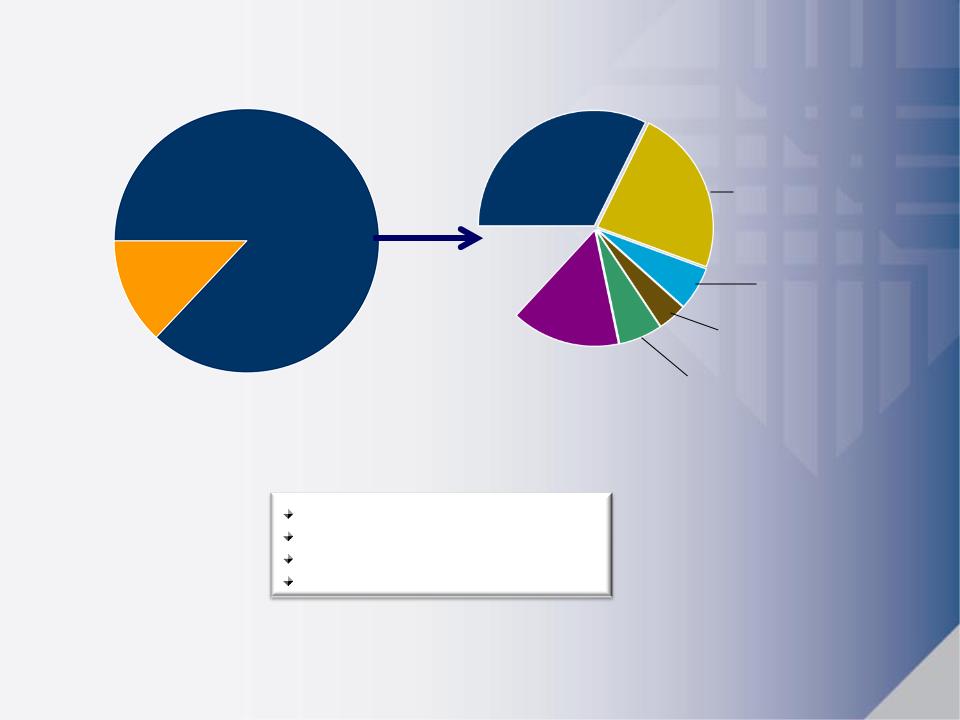

Acquisition | Date Acq. | Dep | % Core (1) | Lns | Loss Share | # Loc | Pre Tax Gain |

First DuPage | 4Q09 | $229 | 26% | $226 | 80/20 | 1 | $13 |

Peotone Bank And Trust | 2Q10 | $84 | 49% | $56 | 80/20 | 2 | $3 |

Total | $313 | $282 | 3 | $16 |