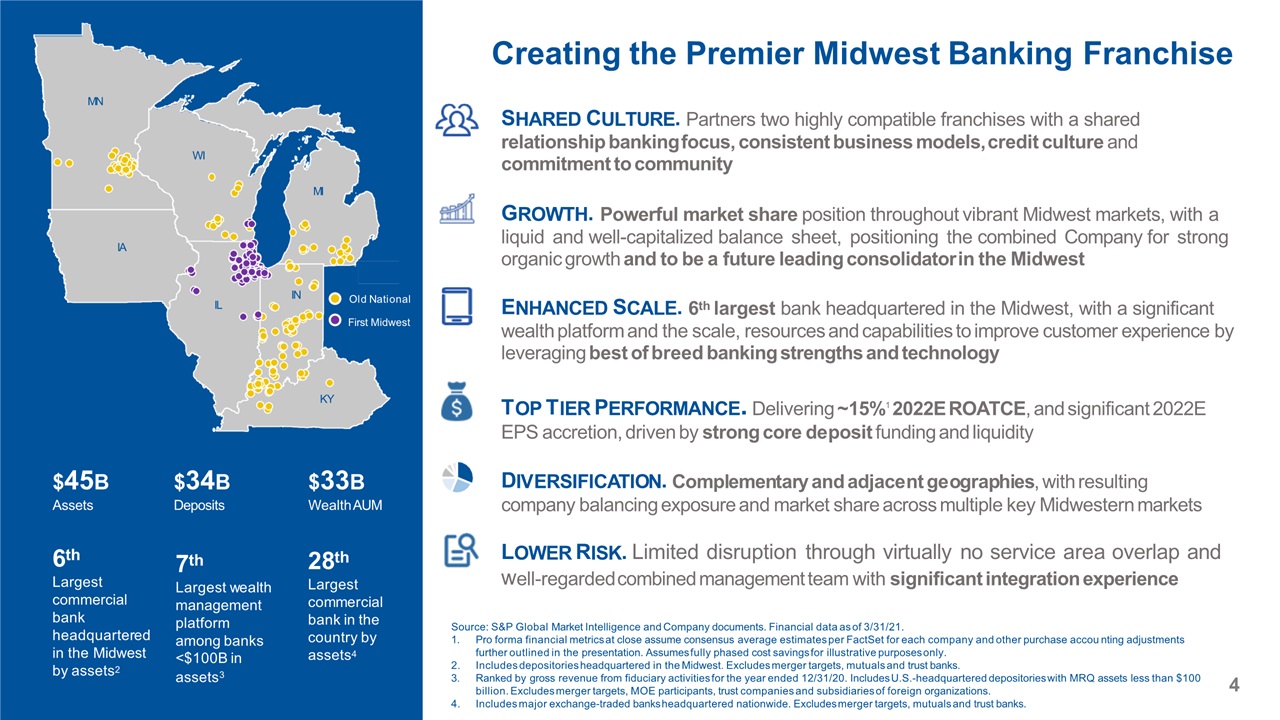

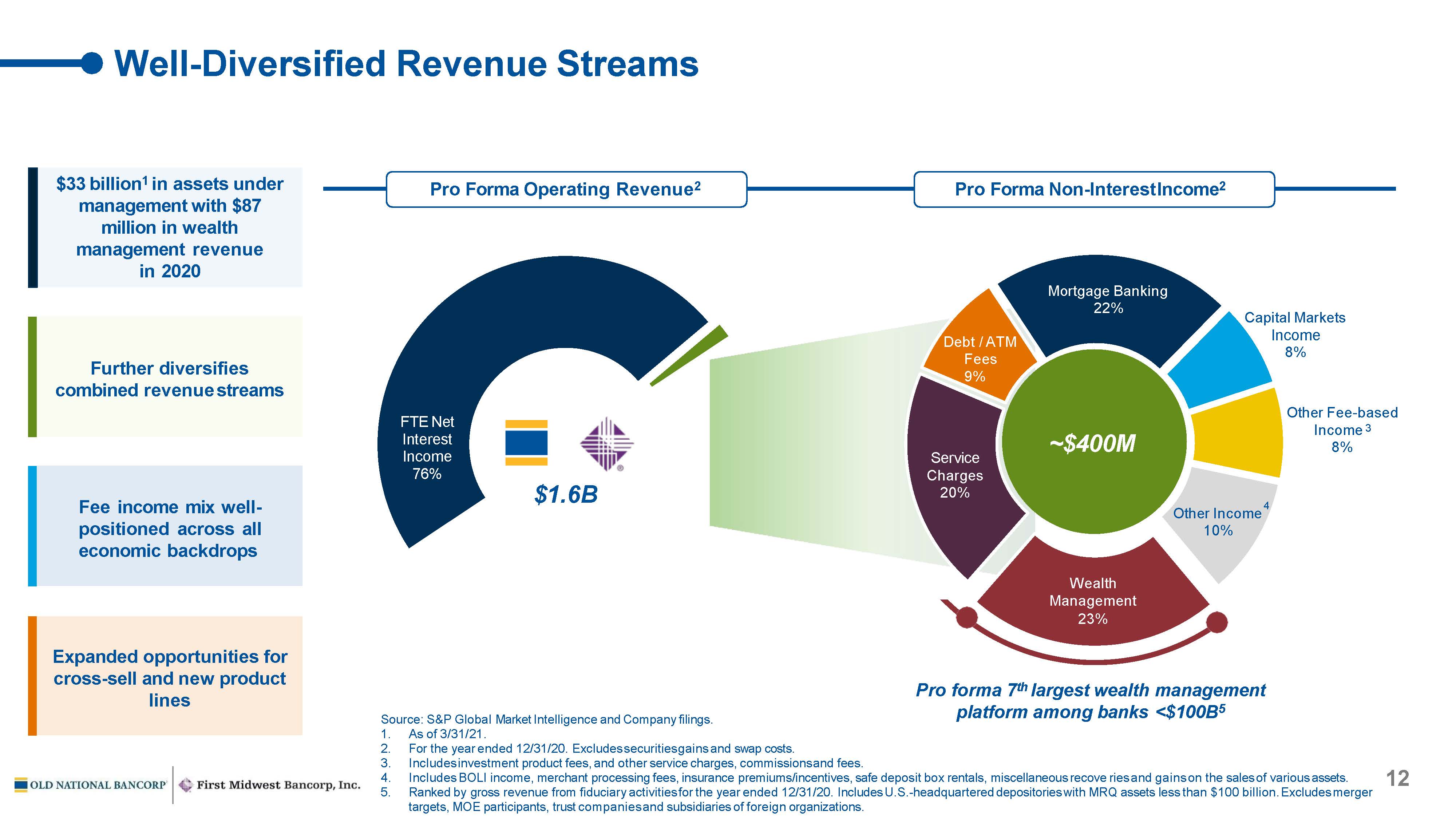

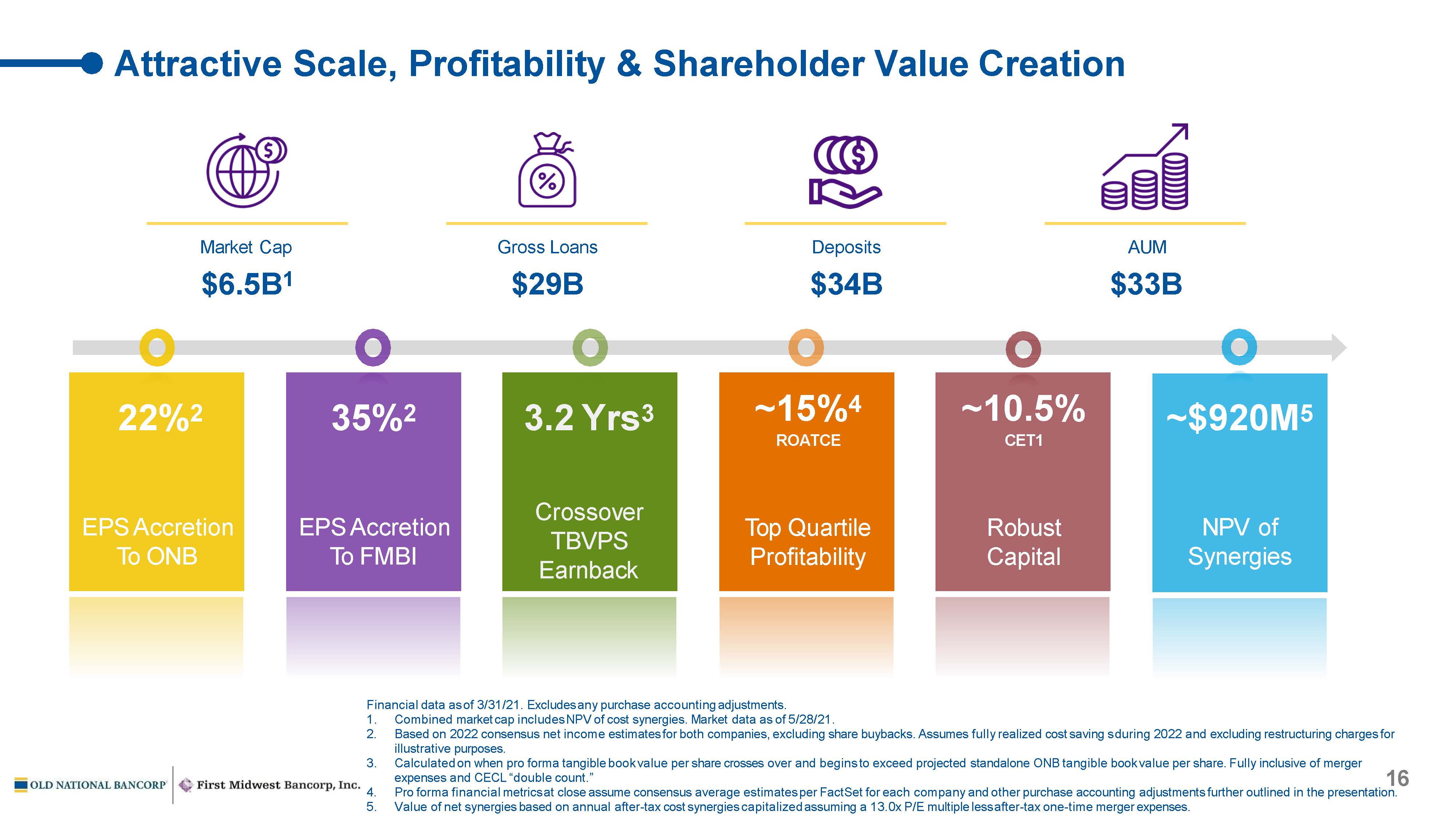

4 SHARED CULTURE. Partners two highly compatible franchises with a shared relationship banking focus, consistent business models, credit culture and commitment to community GROWTH. Powerful market share position throughout vibrant Midwest markets, with a liquid and well-capitalized balance sheet, positioning the combined Company for strong organic growth and to be a future leading consolidator in the Midwest ENHANCED SCALE. 6th largest bank headquartered in the Midwest, with a significant wealth platform and the scale, resources and capabilities to improve customer experience by leveraging best of breed banking strengths and technology TOP TIER PERFORMANCE. Delivering ~15%1 2022E ROATCE, and significant 2022E EPS accretion, driven by strong core deposit funding and liquidity DIVERSIFICATION. Complementary and adjacent geographies, with resulting company balancing exposure and market share across multiple key Midwestern markets LOWER RISK. Limited disruption through virtually no service area overlap and well-regarded combined management team with significant integration experience Creating the Premier Midwest Banking Franchise 28thLargest commercial bank in the country by assets4 6thLargest commercial bank headquartered in the Midwest by assets2 Old National First Midwest MN IA WI MI KY IL IN $45BAssets $34BDeposits $33BWealth AUM Source: S&P Global Market Intelligence and Company documents. Financial data as of 3/31/21. Pro forma financial metrics at close assume consensus average estimates per FactSet for each company and other purchase accou nting adjustmentsfurther outlined in the presentation. Assumes fully phased cost savings for illustrative purposes only.Includes depositories headquartered in the Midwest. Excludes merger targets, mutuals and trust banks.Ranked by gross revenue from fiduciary activities for the year ended 12/31/20. Includes U.S.-headquartered depositories with MRQ assets less than $100billion. Excludes merger targets, MOE participants, trust companies and subsidiaries of foreign organizations.Includes major exchange-traded banks headquartered nationwide. Excludes merger targets, mutuals and trust banks. 7thLargest wealth management platform among banks<$100B in assets 3