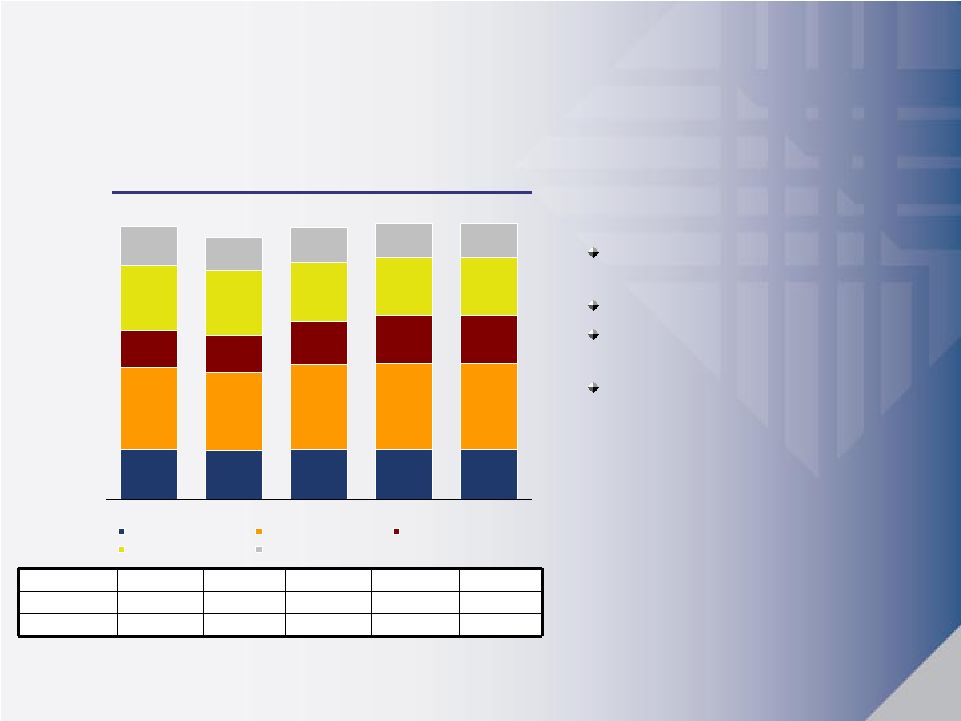

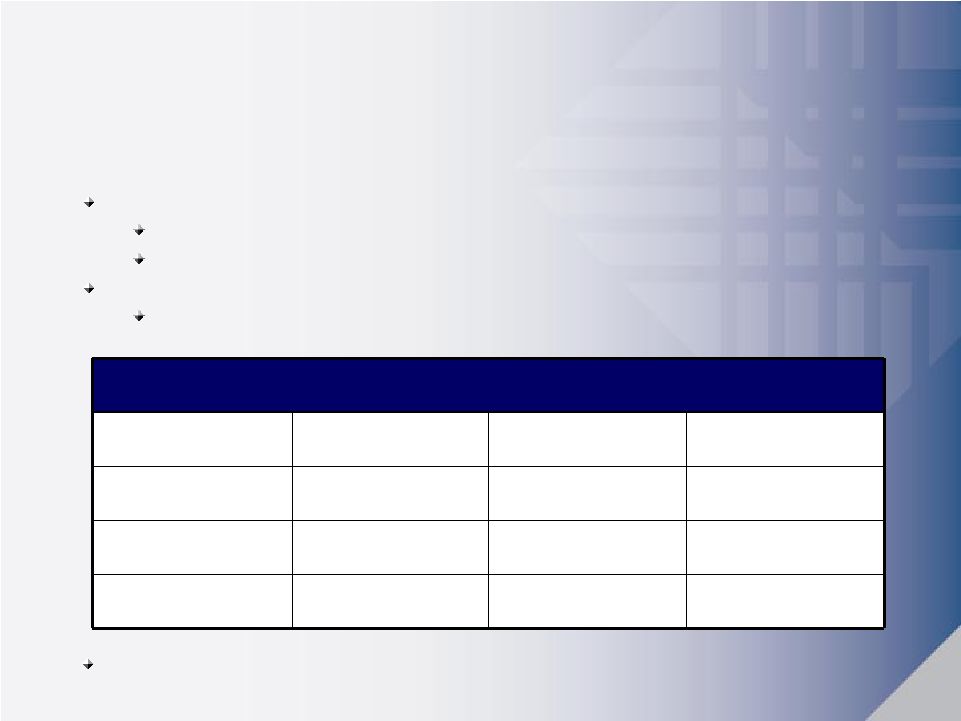

28 28 Reconciliation of Non-GAAP Measures Reconciliation of Non-GAAP Measures ($ in 000s) ($ in 000s) Note: The Company’s accounting and reporting policies conform to U.S. generally accepted accounting principles (GAAP) and general practice within the banking industry. As a supplement to GAAP, the Company has provided this non-GAAP performance result. The Company believes that this non-GAAP financial measure is useful because it allows investors to assess the Company’s operating performance. Although this non-GAAP financial measure is intended to enhance investors’ understanding of the Company’s business and performance, this non-GAAP financial measure should not be considered an alternative to GAAP. For the 3-Months Ended 2006 2007 2008 31-Mar-09 30-Jun-09 30-Sep-09 31-Dec-09 Income (Loss) Before Taxes $ 152,298 $ 94,012 $ 36,045 $(3,814) $(3,710) $(2,569) $(65,833) Provision for Loan Losses 10,229 7,233 70,254 48,410 36,262 38,000 93,000 Pre-Tax, Pre-Provision Earnings (Loss) $ 162,527 $ 101,245 $ 106,299 $ 44,596 $ 32,552 $ 35,431 $ 27,167 Non-Operating Items Securities Gains (Losses), net $ 4,269 $(50,801) $(35,611) $ 8,222 $ 6,635 $(6,975) $(5,772) Gain on FDIC-Assisted Transaction - - - - - - 13,071 Gains on Early Extinguishment of Debt - - - - - 13,991 1,267 Write-Downs of Bank-Owned Life Insurance (412) (699) (10,360) - - - - Losses Realized on Other Real Estate Owned 304 514 (1,566) (315) (2,387) (1,801) (14,051) FDIC Special Assessment - - - - (3,500) - - Total Non Operating Items $ 4,161 $(50,986) $(47,537) $ 7,907 $ 748 $ 5,215 $(5,485) Pre-Tax, Pre-Provision Core Operating Earnings $ 158,366 $ 152,231 $ 153,836 $ 36,689 $ 31,804 $ 30,216 $ 32,652 Risk-Weighted Assets $ 6,259,983 $ 6,340,614 $ 6,609,359 $ 6,600,684 $ 6,335,010 $ 6,234,283 $ 6,262,883 Pre-Tax, Pre-Provision Earnings / RWA 2.53 % 2.40 % 2.33 % 2.22 % 2.01 % 1.94 % 2.09 % |