Laura E. Flores

Partner

+1.202.373.6101

laura.flores@morganlewis.com

VIA EDGAR

April 24, 2023

Mr. David Orlic

Division of Investment Management

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

| Re: | Penn Series Funds, Inc.; File Nos. 002-77284 and 811-03459 |

Dear Mr. Orlic:

This letter responds to the comment conveyed to us telephonically on April 13, 2023 relating to the Penn Series Funds, Inc. (the “Registrant”) Post-Effective Amendment No. 96 (the “Registration Statement”), which was filed with the U.S. Securities and Exchange Commission (“SEC”) on February 27, 2023, for the purpose of revising (i) the investment objective and principal investment strategy for the Large Growth Stock Fund, (ii) the investment objective and principal investment strategy for the Large Core Growth Fund, and (iii) the principal investment strategy for the Flexibly Managed Fund (each a “Fund” and collectively, the “Funds”). For ease of reference, we have set forth below your comment followed by the Registrant’s response to the comment. Unless otherwise noted, capitalized terms have the same meaning as contained in the prospectus.

Comment. Please provide the Staff with a completed fee table, Example information and performance information for each Fund in correspondence at least five (5) days prior to the effective date of the Registration Statement.

Response. Each Fund’s completed fee table, Example information and performance information are set forth in Appendix A hereto.

If you have any additional questions or comments, please do not hesitate to contact me 202.373.6101.

Sincerely yours,

/s/ Laura E. Flores

Laura E. Flores

cc:

Philip K.W. Smith, Esq.

Victoria Robinson

Appendix A

FLEXIBLY MANAGED FUND

Fund Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below. Additional fees and expenses will be applied at the variable contract level. Those fees and expenses are described in your variable contract prospectus. If the information below were to reflect the deduction of variable contract charges, fees and expenses would be higher.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | |

Investment Advisory Fees | | | 0.69% | |

Distribution (12b-1) Fees | | | None | |

Other Expenses | | | 0.19% | |

Total Annual Fund Operating Expenses | | | 0.88% | |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example does not reflect expenses and charges which are, or may be, imposed under your variable contract. If the examples were to reflect the deduction of such charges, the costs shown would be greater. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs and returns might be higher or lower, based on these assumptions your costs would be:

| | | | | | |

| 1 Year | | 3 Years | | 5 Years | | 10 Years |

| $90 | | $281 | | $488 | | $1,804 |

Performance Information

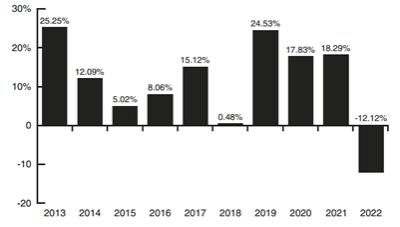

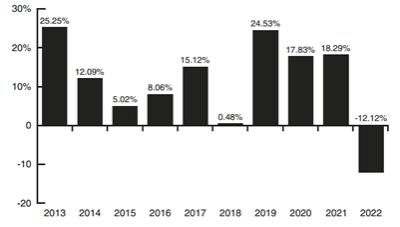

The bar chart and table below show the performance of the Fund both year-by-year and as an average over different periods of time. Since March 7, 2022, T. Rowe Price Associates, Inc., sub-adviser to the Fund, has delegated the day-to-day portfolio management of the Fund to its affiliate, T. Rowe Price Investment Management, Inc. The delegation did not result in a change to the Fund’s principal investment strategy or its portfolio managers. The performance and average annual total returns shown for periods prior to March 7, 2022 may have differed had T. Rowe Price Investment Management, Inc. been responsible for the day-to-day portfolio management during those periods. The bar chart and table demonstrate the variability of performance over time and provide an indication of the risks and volatility of an investment in the Fund by showing how the Fund’s average annual total returns for various periods compare with those of a broad-based securities market index. Past performance does not necessarily indicate how the Fund will perform in the future. This performance information does not include the impact of any charges deducted under your variable contract. If it did, returns would be lower.

| | | | | | |

| | Best Quarter | | Worst Quarter | | |

| | 13.70% | | -12.22% | | |

| | 06/30/2020 | | 03/31/2020 | | |

| | | | | | |

| Average Annual Total Return (for Periods Ended December 31, 2022) |

| | | 1 Year | | 5 Years | | 10 Years |

| Flexibly Managed Fund | | (12.12)% | | 8.91% | | 10.62% |

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | | (18.11)% | | 9.42% | | 12.56% |

LARGE GROWTH STOCK FUND

Fund Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below. Additional fees and expenses will be applied at the variable contract level. Those fees and expenses are described in your variable contract prospectus. If the information below were to reflect the deduction of variable contract charges, fees and expenses would be higher.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | |

Investment Advisory Fees | | | 0.71% | |

Distribution (12b-1) Fees | | | None | |

Other Expenses | | | 0.26% | |

Total Annual Fund Operating Expenses | | | 0.97% | |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example does not reflect expenses and charges which are, or may be, imposed under your variable contract. If the examples were to reflect the deduction of such charges, the costs shown would be greater. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your

investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs and returns might be higher or lower, based on these assumptions your costs would be:

| | | | | | |

| 1 Year | | 3 Years | | 5 Years | | 10 Years |

| $99 | | $309 | | $536 | | $1,190 |

Performance Information

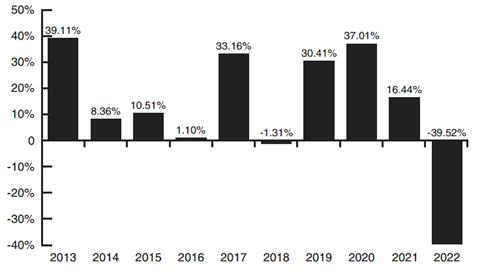

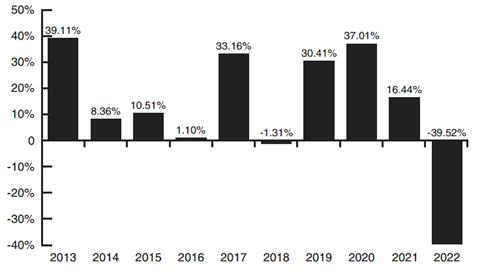

The bar chart and table below show the performance of the Fund both year-by-year and as an average over different periods of time. The bar chart and table demonstrate the variability of performance over time and provide an indication of the risks and volatility of an investment in the Fund by showing how the Fund’s average annual total returns for various periods compare with those of a broad-based securities market index. Past performance does not necessarily indicate how the Fund will perform in the future. This performance information does not include the impact of any charges deducted under your variable contract. If it did, returns would be lower.

| | | | | | |

| | Best Quarter | | Worst Quarter | | |

| | 27.61% | | -25.82% | | |

| | 06/30/2020 | | 06/30/2022 | | |

| | | | | | |

| Average Annual Total Return (for Periods Ended December 31, 2022) |

| | | 1 Year | | 5 Years | | 10 Years |

| Large Growth Stock Fund | | (39.52)% | | 4.43% | | 10.79% |

Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) | | (29.14)% | | 10.96% | | 14.10% |

LARGE CORE GROWTH FUND

Fund Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below. Additional fees and expenses will be applied at the variable contract level. Those fees and expenses are described in your variable contract prospectus. If the information below were to reflect the deduction of variable contract charges, fees and expenses would be higher.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | |

Investment Advisory Fees | | | 0.58% | |

Distribution (12b-1) Fees | | | None | |

Other Expenses | | | 0.28% | |

Acquired Fund Fees and Expenses | | | 0.01% | |

Total Annual Fund Operating Expenses* | | | 0.87% | |

| | * | The Fund’s Investment Advisory Fees were reduced effective May 1, 2023. The Investment Advisory Fees and Total Annual Fund Operating Expenses line items in the table above have been restated to reflect the new reduced Investment Advisory Fee. As a result, the Total Annual Fund Operating Expenses in this fee table may not correlate to the expense ratios in the Fund’s financial highlights and financial statements which (i) reflect the prior Investment Advisory Fee rate and (ii) reflect only the operating expenses of the Fund and do not include Acquired Fund Fees and Expenses, which are fees and expenses incurred indirectly by the Fund through its investments in certain underlying investment companies. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example does not reflect expenses and charges which are, or may be, imposed under your variable contract. If the examples were to reflect the deduction of such charges, the costs shown would be greater. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs and returns might be higher or lower, based on these assumptions your costs would be:

| | | | | | |

| 1 Year | | 3 Years | | 5 Years | | 10 Years |

| $89 | | $278 | | $482 | | $1,073 |

Performance Information

The bar chart and table below show the performance of the Fund both year-by-year and as an average over different periods of time. Performance prior to December 1, 2016 reflects the Fund’s investment performance when managed by a previous sub-adviser, and performance between December 1, 2016 and May 1, 2023 reflects the Fund’s investment performance when managed by a different previous sub-adviser, both pursuant to similar principal investment strategies. Since May 1, 2023, Delaware Investments Fund Advisers has been responsible for the Fund’s day-to-day portfolio management. Therefore, the performance and average annual total returns shown for periods prior to May 1, 2023 may have differed had Delaware Investments Fund Advisers been responsible for the day-to-day portfolio management during those periods. The bar chart and table demonstrate the variability of performance over time and provide an indication of the risks and volatility of an investment in the Fund by showing how the Fund’s average

annual total returns for various periods compare with those of a broad-based securities market index. Past performance does not necessarily indicate how the Fund will perform in the future. This performance information does not include the impact of any charges deducted under your variable contract. If it did, returns would be lower.

| | | | | | |

| | Best Quarter | | Worst Quarter | | |

| | 47.15% | | -36.58% | | |

| | 06//30/2020 | | 06/30/2022 | | |

| | | | | | |

| Average Annual Total Return (for Periods Ended December 31, 2022) |

| | | 1 Year | | 5 Years | | 10 Years |

| Large Core Growth Fund | | (53.49)% | | 0.63% | | 7.56% |

Russell 1000® Growth Index (reflects no deduction for fees, expenses or taxes) | | (29.14)% | | 10.96% | | 14.10% |