UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

Eight Tower Bridge

161 Washington Street, Suite 1111

Conshohocken, PA 19428

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Penn Series Funds, Inc.

Aggressive Allocation Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Aggressive Allocation Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Aggressive Allocation Fund | $17 | 0.33% |

| Fund net assets | $59,424,384% |

| Total number of portfolio holdings | $21% |

| Total advisory fee paid | $35,764% |

| Portfolio turnover rate | $7% |

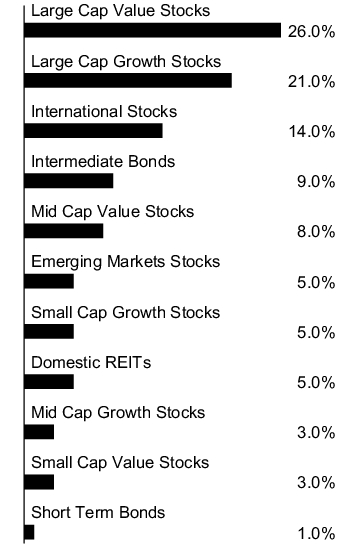

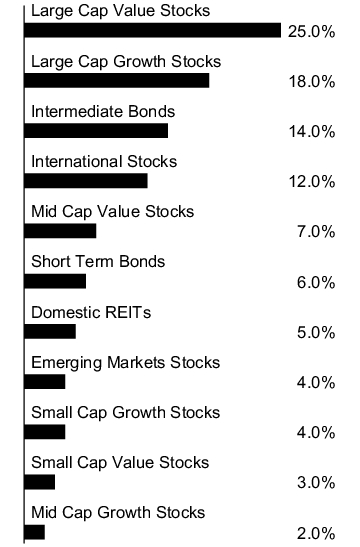

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Penn Series Index 500 Fund | 25.0% |

| Penn Series Flexibly Managed Fund | 9.0% |

| Penn Series International Equity Fund | 8.9% |

| Penn Series Large Cap Value Fund | 6.1% |

| Penn Series Quality Bond Fund | 5.9% |

| Penn Series Real Estate Securities Fund | 5.0% |

| Penn Series Mid Core Value Fund | 5.0% |

| Penn Series Emerging Markets Equity Fund | 5.0% |

| Penn Series Large Core Value Fund | 5.0% |

| Penn Series Developed International Index Fund | 5.0% |

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Balanced Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Balanced Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Balanced Fund | $10 | 0.20% |

| Fund net assets | $79,535,457% |

| Total number of portfolio holdings | $2% |

| Total advisory fee paid | $N/A |

| Portfolio turnover rate | $5% |

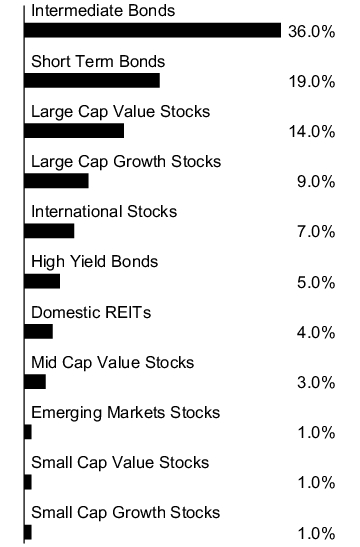

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Penn Series Index 500 Fund | 60.2% |

| Penn Series Quality Bond Fund | 39.8% |

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Conservative Allocation Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Conservative Allocation Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Conservative Allocation Fund | $18 | 0.35% |

| Fund net assets | $45,665,477% |

| Total number of portfolio holdings | $10% |

| Total advisory fee paid | $27,171% |

| Portfolio turnover rate | $6% |

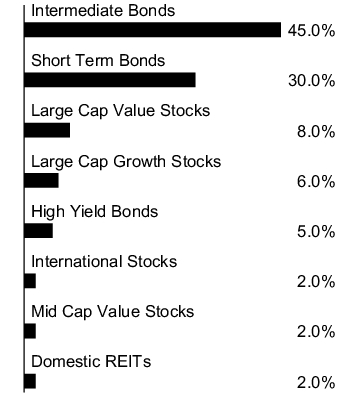

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Penn Series Quality Bond Fund | 41.8% |

| Penn Series Limited Maturity Bond Fund | 30.0% |

| Penn Series Flexibly Managed Fund | 8.1% |

| Penn Series Index 500 Fund | 7.0% |

| Penn Series High Yield Bond Fund | 5.0% |

| Penn Series Real Estate Securities Fund | 2.0% |

| Penn Series Mid Core Value Fund | 2.0% |

| Penn Series Large Core Value Fund | 2.0% |

| Penn Series Developed International Index Fund | 2.0% |

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Developed International Index Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Developed International Index Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Developed International Index Fund | $47 | 0.93% |

| Fund net assets | $81,989,064% |

| Total number of portfolio holdings | $754% |

| Total advisory fee paid | $126,922% |

| Portfolio turnover rate | $1% |

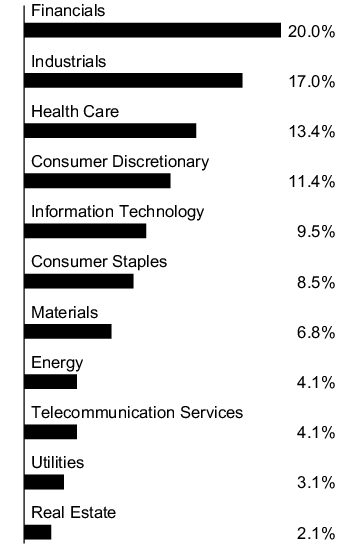

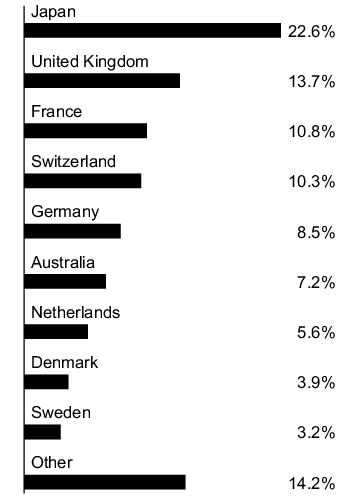

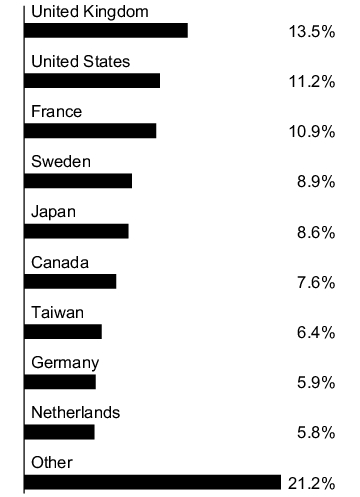

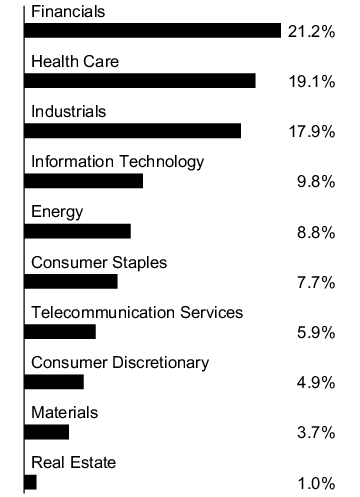

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Novo Nordisk A/S, Class B | 2.7% |

| ASML Holding N.V. | 2.4% |

| Nestle S.A. | 1.6% |

| AstraZeneca PLC | 1.4% |

| Shell PLC | 1.3% |

| Toyota Motor Corp. | 1.3% |

| LVMH Moet Hennessy Louis Vuitton S.E. | 1.2% |

| Novartis AG | 1.2% |

| SAP S.E. | 1.2% |

| Roche Holding AG | 1.1% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Emerging Markets Equity Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Emerging Markets Equity Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Emerging Markets Equity Fund | $67 | 1.35% |

| Fund net assets | $83,208,851% |

| Total number of portfolio holdings | $62% |

| Total advisory fee paid | $357,595% |

| Portfolio turnover rate | $39% |

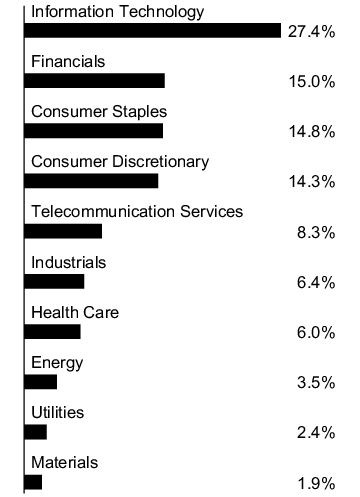

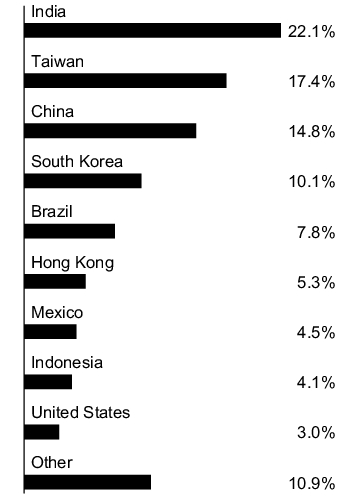

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Taiwan Semiconductor Manufacturing Co., Ltd. | 9.5% |

| Tencent Holdings Ltd. | 6.8% |

| Samsung Electronics Co., Ltd. | 4.3% |

| Reliance Industries Ltd. | 3.4% |

| NU Holdings Ltd., Class A | 2.7% |

| Cipla Ltd. | 2.6% |

| Eicher Motors Ltd. | 2.6% |

| Raia Drogasil S.A. | 2.6% |

| Accton Technology Corp. | 2.6% |

| President Chain Store Corp. | 2.6% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.83% of the Fund’s average daily net assets. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.87% of the Fund’s average daily net assets.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Flexibly Managed Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Flexibly Managed Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Flexibly Managed Fund | $45 | 0.87% |

| Fund net assets | $5,244,332,488% |

| Total number of portfolio holdings | $306% |

| Total advisory fee paid | $17,661,018% |

| Portfolio turnover rate | $34% |

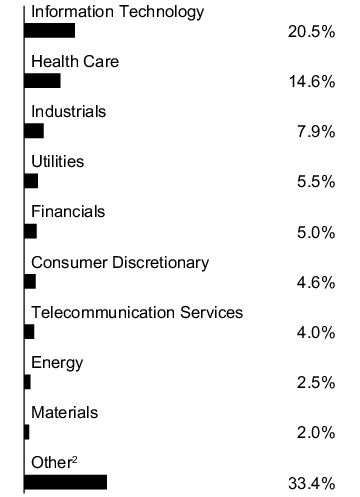

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Microsoft Corp. | 5.4% |

U.S. Treasury Notes

4.500%, 11/15/33 | 3.7% |

U.S. Treasury Notes

4.000%, 02/15/34 | 3.5% |

| Alphabet, Inc., Class A | 2.7% |

| Amazon.com, Inc. | 2.7% |

| UnitedHealth Group, Inc. | 2.6% |

| NVIDIA Corp. | 2.6% |

| Danaher Corp. | 2.1% |

U.S. Treasury Notes

4.375%, 05/15/34 | 2.0% |

| Intuit, Inc. | 2.0% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

2 Includes non-equity investments.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

High Yield Bond Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series High Yield Bond Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| High Yield Bond Fund | $37 | 0.73% |

| Fund net assets | $129,847,948% |

| Total number of portfolio holdings | $127% |

| Total advisory fee paid | $299,012% |

| Portfolio turnover rate | $41% |

| Weighted Average Maturity | 4.2 Years |

| Effective Duration | 2.5 Years |

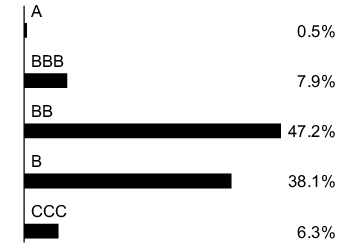

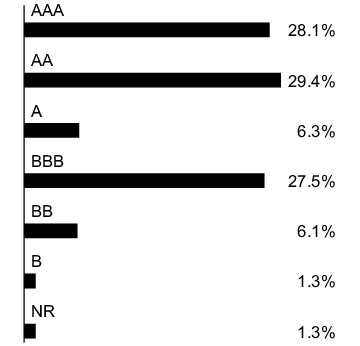

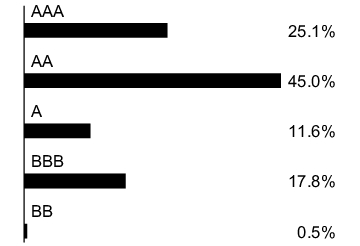

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Corporate Bonds | 90.5% |

| Loan Agreements | 5.4% |

| Money Market Funds | 3.6% |

| Asset Backed Securities | 0.5% |

1 Source: Independent Rating Agencies such as Moody’s, S&P, Fitch, etc.

Note: When a security is rated differently by three rating agencies, the median rating is used; when rated differently by two rating agencies, the lower rating is used.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Index 500 Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Index 500 Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Index 500 Fund | $18 | 0.34% |

| Fund net assets | $812,175,806% |

| Total number of portfolio holdings | $505% |

| Total advisory fee paid | $483,593% |

| Portfolio turnover rate | $1% |

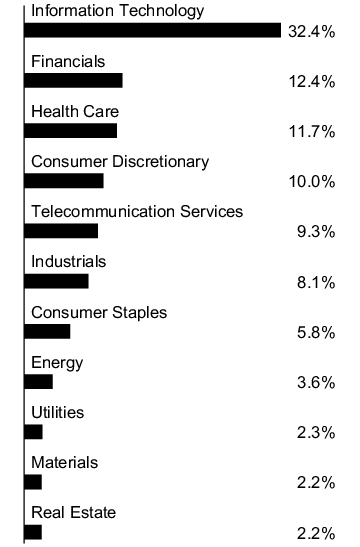

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Microsoft Corp. | 7.2% |

| NVIDIA Corp. | 6.6% |

| Apple, Inc. | 6.6% |

| Amazon.com, Inc. | 3.8% |

| Meta Platforms, Inc., Class A | 2.4% |

| Alphabet, Inc., Class A | 2.3% |

| Alphabet, Inc., Class C | 1.9% |

| Berkshire Hathaway, Inc., Class B | 1.6% |

| Eli Lilly & Co. | 1.6% |

| Broadcom, Inc. | 1.5% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

International Equity Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series International Equity Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| International Equity Fund | $55 | 1.09% |

| Fund net assets | $241,156,582% |

| Total number of portfolio holdings | $43% |

| Total advisory fee paid | $1,006,356% |

| Portfolio turnover rate | $62% |

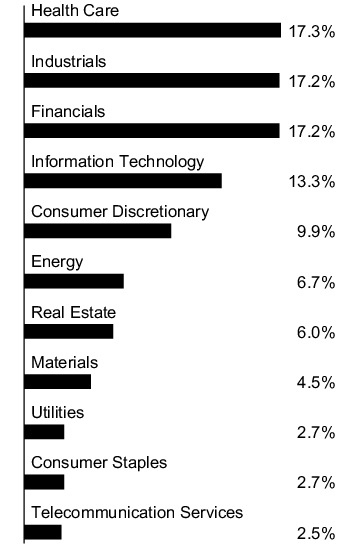

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Taiwan Semiconductor Manufacturing Co., Ltd., ADR | 6.4% |

| Constellation Software, Inc. | 6.1% |

| Wolters Kluwer N.V. | 5.5% |

| RELX PLC | 4.9% |

| SAP S.E. | 4.6% |

| Alcon, Inc. | 4.5% |

| Halma PLC | 3.6% |

| Experian PLC | 3.6% |

| London Stock Exchange Group PLC | 3.4% |

| Schneider Electric S.E. | 3.4% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.81% of the Fund’s average daily net assets up to $200 million, and 0.61% of the Fund’s average daily net assets over $200 million. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.83% of the Fund’s average daily net assets up to $227 million, and 0.63% of the Fund’s average daily net assets over $227 million.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Large Cap Growth Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Large Cap Growth Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Large Cap Growth Fund | $46 | 0.87% |

| Fund net assets | $70,238,991% |

| Total number of portfolio holdings | $57% |

| Total advisory fee paid | $187,300% |

| Portfolio turnover rate | $12% |

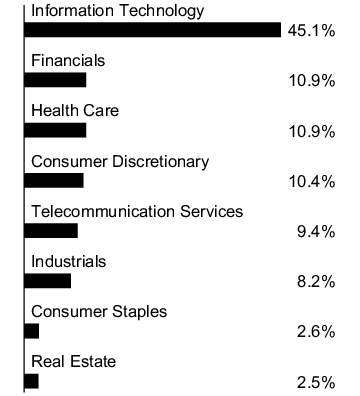

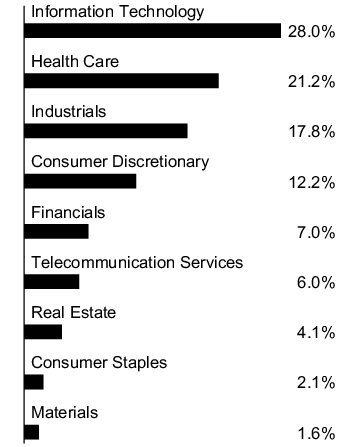

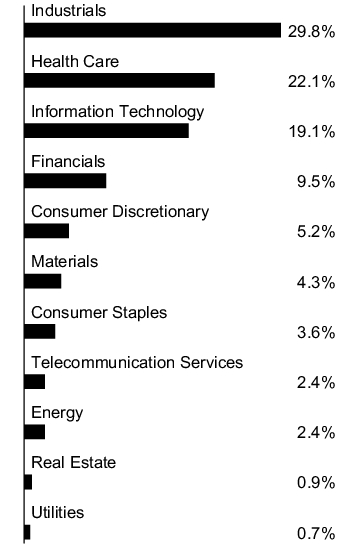

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Microsoft Corp. | 14.5% |

| Alphabet, Inc., Class A | 6.1% |

| Apple, Inc. | 5.7% |

| NVIDIA Corp. | 5.3% |

| Visa, Inc., Class A | 4.1% |

| Accenture PLC, Class A | 3.1% |

| Church & Dwight Co., Inc. | 2.3% |

| Taiwan Semiconductor Manufacturing Co., Ltd., ADR | 2.2% |

| Aon PLC, Class A | 2.1% |

| Agilent Technologies, Inc. | 2.0% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.53% of the Fund’s average daily net assets. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.55% of the Fund’s average daily net assets.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Large Cap Value Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Large Cap Value Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Large Cap Value Fund | $48 | 0.93% |

| Fund net assets | $168,725,210% |

| Total number of portfolio holdings | $69% |

| Total advisory fee paid | $564,075% |

| Portfolio turnover rate | $28% |

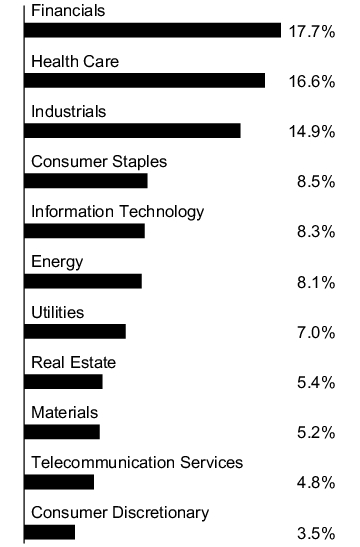

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| JPMorgan Chase & Co. | 3.7% |

| Regeneron Pharmaceuticals, Inc. | 3.7% |

| Walmart, Inc. | 3.6% |

| Berkshire Hathaway, Inc., Class B | 3.6% |

| Wells Fargo & Co. | 3.5% |

| Elevance Health, Inc. | 3.4% |

| QUALCOMM, Inc. | 3.0% |

| Philip Morris International, Inc. | 3.0% |

| Cencora, Inc. | 2.9% |

| Fiserv, Inc. | 2.7% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Large Core Growth Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Large Core Growth Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Large Core Growth Fund | $45 | 0.85% |

| Fund net assets | $133,383,809% |

| Total number of portfolio holdings | $38% |

| Total advisory fee paid | $361,311% |

| Portfolio turnover rate | $9% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Microsoft Corp. | 12.6% |

| NVIDIA Corp. | 10.3% |

| Apple, Inc. | 6.6% |

| Alphabet, Inc., Class A | 6.4% |

| Amazon.com, Inc. | 5.3% |

| Visa, Inc., Class A | 4.3% |

| UnitedHealth Group, Inc. | 3.8% |

| Motorola Solutions, Inc. | 3.4% |

| Intuit, Inc. | 3.3% |

| Intercontinental Exchange, Inc. | 2.9% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Large Core Value Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Large Core Value Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Large Core Value Fund | $48 | 0.93% |

| Fund net assets | $135,367,253% |

| Total number of portfolio holdings | $58% |

| Total advisory fee paid | $452,805% |

| Portfolio turnover rate | $23% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| The Charles Schwab Corp. | 3.5% |

| Chevron Corp. | 3.2% |

| NextEra Energy, Inc. | 3.0% |

| Micron Technology, Inc. | 3.0% |

| Thermo Fisher Scientific, Inc. | 2.8% |

| Reinsurance Group of America, Inc. | 2.7% |

| Wells Fargo & Co. | 2.6% |

| Hasbro, Inc. | 2.6% |

| Mid-America Apartment Communities, Inc. | 2.6% |

| BJ's Wholesale Club Holdings, Inc. | 2.4% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.64% of the Fund’s average daily net assets up to $150 million, 0.62% of the Fund’s average daily net assets on the next $250 million, and 0.60% of the Fund’s average daily net assets over $400 million. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.67% of the Fund’s average daily net assets up to $150 million, 0.65% of the Fund’s average daily net assets on the next $250 million, and 0.60% of the Fund’s average daily net assets over $400 million.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Large Growth Stock Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Large Growth Stock Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Large Growth Stock Fund | $50 | 0.92% |

| Fund net assets | $358,368,903% |

| Total number of portfolio holdings | $69% |

| Total advisory fee paid | $1,138,765% |

| Portfolio turnover rate | $16% |

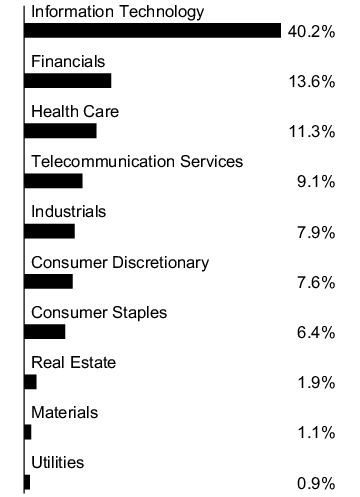

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Microsoft Corp. | 13.6% |

| NVIDIA Corp. | 12.5% |

| Apple, Inc. | 8.5% |

| Amazon.com, Inc. | 7.7% |

| Alphabet, Inc., Class A | 5.7% |

| Meta Platforms, Inc., Class A | 4.9% |

| Eli Lilly & Co. | 3.7% |

| Visa, Inc., Class A | 2.5% |

| Mastercard, Inc., Class A | 2.1% |

| Netflix, Inc. | 1.8% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Limited Maturity Bond Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Limited Maturity Bond Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Limited Maturity Bond Fund | $36 | 0.71% |

| Fund net assets | $189,191,123% |

| Total number of portfolio holdings | $123% |

| Total advisory fee paid | $427,258% |

| Portfolio turnover rate | $25% |

| Weighted Average Maturity | 3.5 Years |

| Effective Duration | 1.8 Years |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Corporate Bonds | 38.2% |

| Asset Backed Securities | 23.4% |

| Commercial Mortgage Backed Securities | 16.7% |

| Residential Mortgage Backed Securities | 14.9% |

| U.S. Treasury Obligations | 6.3% |

| Money Market Funds | 0.5% |

1 Source: Independent Rating Agencies such as Moody’s, S&P, Fitch, etc.

Note: When a security is rated differently by three rating agencies, the median rating is used; when rated differently by two rating agencies, the lower rating is used.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Mid Cap Growth Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Mid Cap Growth Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Mid Cap Growth Fund | $48 | 0.97% |

| Fund net assets | $138,563,153% |

| Total number of portfolio holdings | $68% |

| Total advisory fee paid | $504,428% |

| Portfolio turnover rate | $14% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| CoStar Group, Inc. | 4.0% |

| Pinterest, Inc., Class A | 3.4% |

| Monolithic Power Systems, Inc. | 3.0% |

| The Trade Desk, Inc., Class A | 2.5% |

| Teradyne, Inc. | 2.4% |

| Universal Display Corp. | 2.3% |

| Dexcom, Inc. | 2.2% |

| Tyler Technologies, Inc. | 2.2% |

| HEICO Corp., Class A | 2.2% |

| Floor & Decor Holdings, Inc., Class A | 2.1% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.68% of the Fund’s average daily net assets. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.70% of the Fund’s average daily net assets.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Mid Cap Value Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Mid Cap Value Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Mid Cap Value Fund | $43 | 0.83% |

| Fund net assets | $89,523,296% |

| Total number of portfolio holdings | $71% |

| Total advisory fee paid | $245,781% |

| Portfolio turnover rate | $18% |

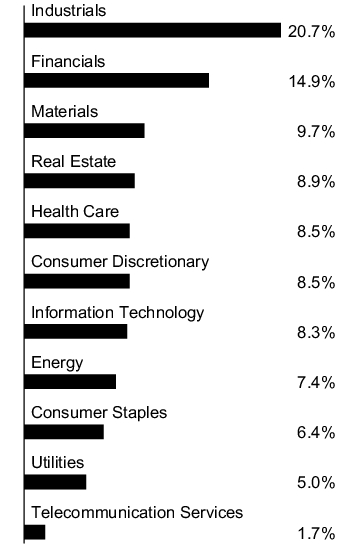

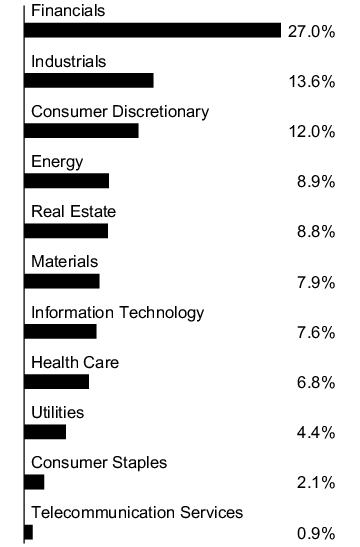

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Casey's General Stores, Inc. | 2.9% |

| Entergy Corp. | 2.5% |

| Freeport-McMoRan, Inc. | 2.4% |

| Alliant Energy Corp. | 2.4% |

| Fidelity National Information Services, Inc. | 2.3% |

| Marathon Oil Corp. | 2.3% |

| Chesapeake Energy Corp. | 2.3% |

| Globus Medical, Inc., Class A | 2.2% |

| Lamar Advertising Co., Class A | 2.1% |

| The Hartford Financial Services Group, Inc. | 2.0% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.54% of the Fund’s average daily net assets up to $250 million, 0.525% of the Fund’s average daily net assets on the next $250 million, 0.50% of the Fund’s average daily net assets on the next $250 million, 0.475% of the Fund’s average daily net assets on the next $250 million, 0.45% of the Fund’s average daily net assets on the next $500 million, and 0.425% of the Fund’s average daily net assets over $1.5 billion. Prior to June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.55% of the Fund’s average daily net assets up to $250 million, 0.525% of the Fund’s average daily net assets on the next $250 million, 0.50% of the Fund’s average daily net assets on the next $250 million, 0.475% of the Fund’s average daily net assets on the next $250 million, 0.45% of the Fund’s average daily net assets on the next $500 million, and 0.425% of the Fund’s average daily net assets over $1.5 billion.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Mid Core Value Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Mid Core Value Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Mid Core Value Fund | $52 | 1.04% |

| Fund net assets | $77,622,563% |

| Total number of portfolio holdings | $109% |

| Total advisory fee paid | $273,021% |

| Portfolio turnover rate | $28% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Zimmer Biomet Holdings, Inc. | 3.0% |

| The Bank of New York Mellon Corp. | 2.2% |

| Conagra Brands, Inc. | 2.1% |

| Enterprise Products Partners LP | 2.0% |

| Henry Schein, Inc. | 1.9% |

| Northern Trust Corp. | 1.9% |

| Koninklijke Ahold Delhaize N.V. | 1.9% |

| Willis Towers Watson PLC | 1.9% |

| Edison International | 1.8% |

| Quest Diagnostics, Inc. | 1.8% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.68% of the Fund’s average daily net assets. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.69% of the Fund’s average daily net assets.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Moderate Allocation Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Moderate Allocation Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Moderate Allocation Fund | $15 | 0.30% |

| Fund net assets | $207,590,390% |

| Total number of portfolio holdings | $18% |

| Total advisory fee paid | $125,711% |

| Portfolio turnover rate | $3% |

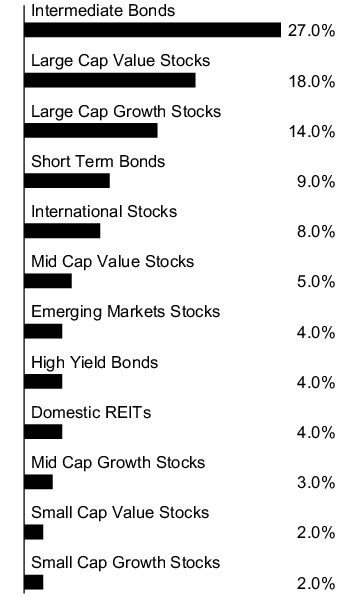

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Penn Series Quality Bond Fund | 23.8% |

| Penn Series Index 500 Fund | 18.1% |

| Penn Series Flexibly Managed Fund | 9.0% |

| Penn Series Limited Maturity Bond Fund | 9.0% |

| Penn Series Mid Core Value Fund | 5.0% |

| Penn Series Real Estate Securities Fund | 4.0% |

| Penn Series Emerging Markets Equity Fund | 4.0% |

| Penn Series Developed International Index Fund | 4.0% |

| Penn Series High Yield Bond Fund | 4.0% |

| Penn Series International Equity Fund | 4.0% |

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Moderately Aggressive Allocation Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Moderately Aggressive Allocation Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Moderately Aggressive Allocation Fund | $15 | 0.30% |

| Fund net assets | $202,596,371% |

| Total number of portfolio holdings | $20% |

| Total advisory fee paid | $120,803% |

| Portfolio turnover rate | $5% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Penn Series Index 500 Fund | 22.0% |

| Penn Series Quality Bond Fund | 10.9% |

| Penn Series Flexibly Managed Fund | 9.0% |

| Penn Series International Equity Fund | 6.9% |

| Penn Series Large Cap Value Fund | 6.1% |

| Penn Series Limited Maturity Bond Fund | 6.0% |

| Penn Series Real Estate Securities Fund | 5.0% |

| Penn Series Mid Core Value Fund | 5.0% |

| Penn Series Large Core Value Fund | 5.0% |

| Penn Series Developed International Index Fund | 5.0% |

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Moderately Conservative Allocation Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Moderately Conservative Allocation Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Moderately Conservative Allocation Fund | $16 | 0.32% |

| Fund net assets | $78,318,629% |

| Total number of portfolio holdings | $16% |

| Total advisory fee paid | $47,175% |

| Portfolio turnover rate | $7% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Penn Series Quality Bond Fund | 32.8% |

| Penn Series Limited Maturity Bond Fund | 19.0% |

| Penn Series Index 500 Fund | 11.1% |

| Penn Series Flexibly Managed Fund | 8.0% |

| Penn Series High Yield Bond Fund | 5.0% |

| Penn Series Real Estate Securities Fund | 4.1% |

| Penn Series International Equity Fund | 4.0% |

| Penn Series Large Cap Value Fund | 3.0% |

| Penn Series Mid Core Value Fund | 3.0% |

| Penn Series Large Core Value Fund | 3.0% |

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Money Market Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Money Market Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Money Market Fund | $29 | 0.58% |

| Fund net assets | $137,719,977 |

| Total number of portfolio holdings | $14 |

| Total advisory fee paid | $235,541 |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

Federal Home Loan Mortgage Corp.

5.256%, 07/03/24 | 7.3% |

Federal National Mortgage

5.260%, 07/10/24 | 7.3% |

Federal Farm Credit Banks

5.297%, 07/11/24 | 7.3% |

Federal Home Loan Mortgage Corp.

5.259%, 07/12/24 | 7.2% |

Federal Home Loan Banks

5.292%, 07/18/24 | 7.2% |

Tennessee Valley Authority

5.272%, 07/24/24 | 7.2% |

U.S. Treasury Bills

5.317%, 07/30/24 | 7.2% |

Federal Farm Credit Banks

5.299%, 07/31/24 | 7.2% |

U.S. Treasury Bills

5.267%, 08/13/24 | 7.2% |

U.S. Treasury Bills

5.266%, 08/20/24 | 7.2% |

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Quality Bond Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Quality Bond Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Quality Bond Fund | $34 | 0.68% |

| Fund net assets | $388,628,983% |

| Total number of portfolio holdings | $131% |

| Total advisory fee paid | $863,740% |

| Portfolio turnover rate | $16% |

| Weighted Average Maturity | 8.7 Years |

| Effective Duration | 5.6 Years |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Residential Mortgage Backed Securities | 38.5% |

| Corporate Bonds | 24.1% |

| Commercial Mortgage Backed Securities | 15.0% |

| Asset Backed Securities | 11.3% |

| U.S. Treasury Obligations | 9.9% |

| Municipal Bonds | 0.7% |

| Money Market Funds | 0.5% |

1 Source: Independent Rating Agencies such as Moody’s, S&P, Fitch, etc.

Note: When a security is rated differently by three rating agencies, the median rating is used; when rated differently by two rating agencies, the lower rating is used.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Real Estate Securities Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Real Estate Securities Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Real Estate Securities Fund | $48 | 0.97% |

| Fund net assets | $106,499,665% |

| Total number of portfolio holdings | $34% |

| Total advisory fee paid | $367,504% |

| Portfolio turnover rate | $14% |

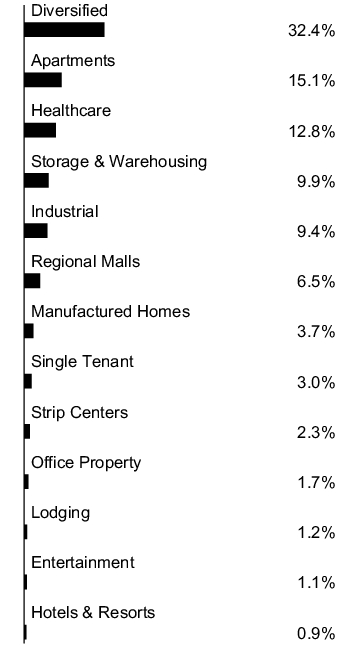

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Welltower, Inc. | 7.7% |

| Digital Realty Trust, Inc. | 7.6% |

| Prologis, Inc. | 7.1% |

| Simon Property Group, Inc. | 6.4% |

| American Tower Corp. | 5.1% |

| Invitation Homes, Inc. | 5.0% |

| Crown Castle, Inc. | 4.9% |

| Iron Mountain, Inc. | 4.8% |

| Equinix, Inc. | 4.1% |

| VICI Properties, Inc. | 4.1% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Small Cap Growth Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Small Cap Growth Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Small Cap Growth Fund | $52 | 1.02% |

| Fund net assets | $100,214,017% |

| Total number of portfolio holdings | $126% |

| Total advisory fee paid | $366,894% |

| Portfolio turnover rate | $10% |

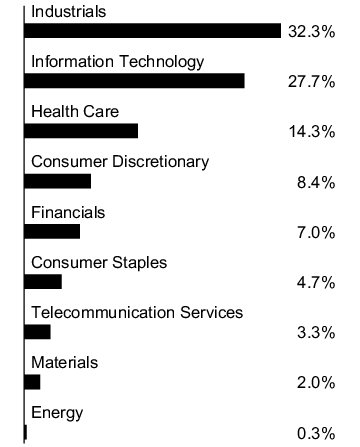

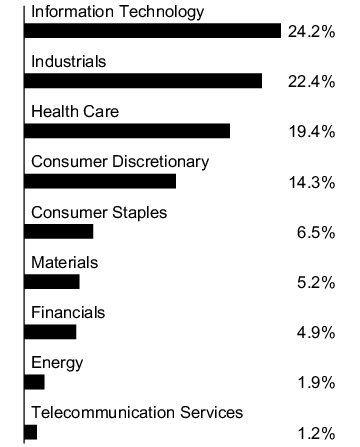

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| SS&C Technologies Holdings, Inc. | 2.2% |

| Rentokil Initial PLC, ADR | 2.0% |

| Stride, Inc. | 1.8% |

| The Descartes Systems Group, Inc. | 1.8% |

| Globus Medical, Inc., Class A | 1.7% |

| LPL Financial Holdings, Inc. | 1.7% |

| Blackbaud, Inc. | 1.7% |

| Broadridge Financial Solutions, Inc. | 1.6% |

| CSW Industrials, Inc. | 1.6% |

| Crown Holdings, Inc. | 1.5% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.75% of the Fund’s average daily net assets up to $25 million, 0.70% of the Fund’s average daily net assets on the next $25 million, and 0.65% of the Fund’s average daily net assets over $50 million. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.80% of the Fund’s average daily net assets up to $25 million, 0.75% of the Fund’s average daily net assets on the next $25 million, and 0.70% of the Fund’s average daily net assets over $50 million.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Small Cap Index Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Small Cap Index Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Small Cap Index Fund | $36 | 0.71% |

| Fund net assets | $81,997,382% |

| Total number of portfolio holdings | $1,965% |

| Total advisory fee paid | $122,443% |

| Portfolio turnover rate | $14% |

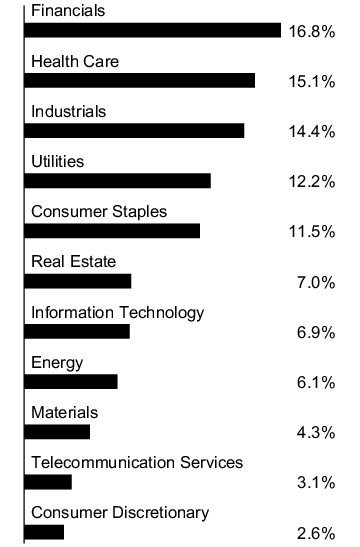

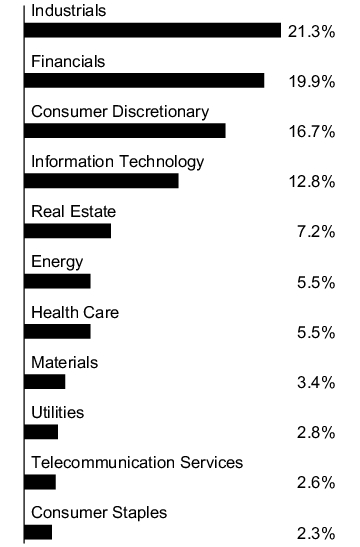

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Insmed, Inc. | 0.4% |

| FTAI Aviation Ltd. | 0.4% |

| Abercrombie & Fitch Co., Class A | 0.4% |

| Fabrinet | 0.4% |

| Sprouts Farmers Market, Inc. | 0.3% |

| Vaxcyte, Inc. | 0.3% |

| Fluor Corp. | 0.3% |

| Applied Industrial Technologies, Inc. | 0.3% |

| HealthEquity, Inc. | 0.3% |

| SPS Commerce, Inc. | 0.3% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

Small Cap Value Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series Small Cap Value Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| Small Cap Value Fund | $51 | 1.02% |

| Fund net assets | $147,224,249% |

| Total number of portfolio holdings | $191% |

| Total advisory fee paid | $534,576% |

| Portfolio turnover rate | $48% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| Meritage Homes Corp. | 1.5% |

| SITE Centers Corp. | 1.4% |

| Gates Industrial Corp. PLC | 1.3% |

| Ameris Bancorp | 1.3% |

| Home BancShares, Inc. | 1.2% |

| Acadia Realty Trust | 1.2% |

| ASGN, Inc. | 1.1% |

| Commercial Metals Co. | 1.1% |

| SouthState Corp. | 1.0% |

| MGIC Investment Corp. | 1.0% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.71% of the Fund’s average daily net assets up to $50 million, 0.68% of the Fund’s average daily net assets on the next $50 million, and 0.66% of the Fund’s average daily net assets over $100 million. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.75% of the Fund’s average daily net assets up to $50 million, 0.725% of the Fund’s average daily net assets on the next $50 million, and 0.70% of the Fund’s average daily net assets over $100 million.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

SMID Cap Growth Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series SMID Cap Growth Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| SMID Cap Growth Fund | $54 | 1.04% |

| Fund net assets | $70,594,433% |

| Total number of portfolio holdings | $99% |

| Total advisory fee paid | $273,004% |

| Portfolio turnover rate | $31% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| BJ's Wholesale Club Holdings, Inc. | 2.0% |

| Natera, Inc. | 2.0% |

| Manhattan Associates, Inc. | 2.0% |

| AAON, Inc. | 2.0% |

| Texas Roadhouse, Inc. | 1.9% |

| Wingstop, Inc. | 1.9% |

| MACOM Technology Solutions Holdings, Inc. | 1.9% |

| Domino's Pizza, Inc. | 1.8% |

| Ashland, Inc. | 1.7% |

| Tetra Tech, Inc. | 1.7% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.73% of the Fund’s average daily net assets. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.75% of the Fund’s average daily net assets.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Penn Series Funds, Inc.

SMID Cap Value Fund

semi-annual Shareholder Report | June 30, 2024

This semi-annual shareholder report contains important information about the Penn Series SMID Cap Value Fund (“Fund”) for the period of January 01, 2024 to June 30, 2024. You can find additional information about the Fund at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1-800-523-0650.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

Based on a hypothetical $10,000 investment

| Fund | Cost of $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

| SMID Cap Value Fund | $60 | 1.20% |

| Fund net assets | $48,649,923% |

| Total number of portfolio holdings | $95% |

| Total advisory fee paid | $205,822% |

| Portfolio turnover rate | $27% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, with each category representing a percentage of the Fund's total investments.

| First Citizens BancShares, Inc., Class A | 1.6% |

| MasTec, Inc. | 1.6% |

| Jones Lang LaSalle, Inc. | 1.6% |

| ArcBest Corp. | 1.5% |

| ADT, Inc. | 1.4% |

| Cameco Corp. | 1.4% |

| Nexstar Media Group, Inc. | 1.4% |

| BorgWarner, Inc. | 1.4% |

| AutoNation, Inc. | 1.4% |

| Fluor Corp. | 1.3% |

1 Sector allocation is presented as a percentage of total investments before short-term investments.

Material Fund Changes

Effective June 1, 2024, the Fund’s investment advisory fee was reduced and calculated daily at the annual rate of 0.80% of the Fund’s average daily net assets. Prior to June 1, 2024, the Fund’s investment advisory fee was calculated daily at the annual rate of 0.84% of the Fund’s average daily net assets.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund’s such as the prospectus, financial information, fund holdings and proxy voting information at www.pennmutual.com/FundLiterature. You can also request this information by contacting us at 1‑800‑523‑0650.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.pennmutual.com/FundLiterature.

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | The full Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the report to shareholders filed under Item 1(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

The semi-annual financial statements, and the Financial Highlights are attached herewith.

Penn Series Funds, Inc.

⬛ 2024 Semi-Annual Financials and Other Information

Available through Penn Mutual Variable Products

[THIS PAGE INTENTIONALLY LEFT BLANK]

Table of Contents

1

Penn Series Funds, Inc.

Schedule of Investments — June 30, 2024 (Unaudited)

Money Market Fund

| | | | | | | | |

| | | Number of

Shares | | | Value† | |

SHORT-TERM INVESTMENTS — 100.0% | |

| | |

MONEY MARKET FUNDS — 14.6% | | | | | |

Goldman Sachs Financial Square Funds - Government Fund Institutional Shares (seven-day effective yield 5.211%)

(Cost $20,096,989) | | | 20,096,989 | | | $ | 20,096,989 | |

| | | | | |

| | |

| | | Par (000) | | | | |

U.S. TREASURY OBLIGATIONS — 21.6% | |

U.S. Treasury Bills | | | | | |

5.317%, 07/30/24 | | $ | 10,000 | | | $ | 9,957,519 | |

5.267%, 08/13/24 | | | 10,000 | | | | 9,937,577 | |

5.266%, 08/20/24 | | | 10,000 | | | | 9,927,472 | |

| | | | | |

TOTAL U.S. TREASURY OBLIGATIONS (Cost $29,822,568) | | | | 29,822,568 | |

| | | | | |

| | | | | |

AGENCY OBLIGATIONS — 63.8% | | | | | |

Federal Farm Credit Banks | | | | | |

5.297%, 07/11/24 | | $ | 10,000 | | | $ | 9,985,389 | |

1.850%, 07/26/24 | | | 3,000 | | | | 2,992,776 | |

5.299%, 07/31/24 | | | 10,000 | | | | 9,956,167 | |

Federal Home Loan Banks | | | | | |

5.292%, 07/18/24 | | | 10,000 | | | | 9,975,161 | |

5.308%, 07/22/24 | | | 8,000 | | | | 7,975,407 | |

Federal Home Loan Mortgage Corp. | | | | | |

5.256%, 07/03/24 | | | 10,000 | | | | 9,997,092 | |

5.259%, 07/12/24 | | | 10,000 | | | | 9,983,989 | |

Federal National Mortgage | | | | | |

5.260%, 07/10/24 | | | 10,000 | | | | 9,986,912 | |

Tennessee Valley Authority | | | | | |

5.291%, 07/10/24 | | | 7,000 | | | | 6,990,777 | |

5.272%, 07/24/24 | | | 10,000 | | | | 9,966,458 | |

| | | | | | | | |

TOTAL AGENCY OBLIGATIONS

(Cost $87,810,128) | | | | 87,810,128 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $137,729,685) | | | | 137,729,685 | |

| | | | | | | | |

TOTAL INVESTMENTS — 100.0%

(Cost $137,729,685) | | | $ | 137,729,685 | |

Other Assets & Liabilities — (0.0)% | | | | (9,708 | ) |

| | | | | | | | |

TOTAL NET ASSETS — 100.0% | | | $ | 137,719,977 | |

| | | | | | | | |

| † | See Security Valuation Note. |

Summary of inputs used to value the Fund’s investments as of 6/30/2024 are as follows (See Security Valuation Note):

| | | | | | | | | | | | | | | | |

ASSETS TABLE | |

Description | | Total

Market

Value at

6/30/2024 | | | Level 1

Quoted

Price | | | Level 2

Significant

Observable

Input | | | Level 3

Significant

Unobservable

Input | |

Short-Term Investments | | $ | 137,729,685 | | | $ | — | | | $ | 137,729,685 | | | $ | — | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 137,729,685 | | | $ | — | | | $ | 137,729,685 | | | $ | — | |

| | | | | | | | | | | | | | | | |

It is the Fund’s practice to recognize transfers into and transfers out of Level 3 at the fair value hierarchy as of the beginning of period. The Fund did not have any transfers into and transfers out of Level 3 fair value hierarchy during the reporting period.

The accompanying notes are an integral part of these financial statements.

2

Penn Series Funds, Inc.

Schedule of Investments — June 30, 2024 (Unaudited)

Limited Maturity Bond Fund

| | | | | | | | |

| | | Par

(000) | | | Value† | |

ASSET BACKED SECURITIES — 23.1% | |

Barings CLO Ltd., Series 2017-1A Class B1 (3 M SOFR + 1.962%), 144A 7.289%, 07/18/29@,• | | $ | 1,500 | | | $ | 1,500,471 | |

Catskill Park CLO Ltd., Series 2017-1A Class A2 (3 M SOFR + 1.962%, Floor 1.700%), 144A 7.286%, 04/20/29@,• | | | 1,140 | | | | 1,141,257 | |

Crestline Denali CLO XVI Ltd., Series 2018-1A Class A (3 M SOFR + 1.382%, Floor 1.382%), 144A 6.706%, 01/20/30@,• | | | 1,622 | | | | 1,624,066 | |

ECMC Group Student Loan Trust, | | | | | | | | |

Series 2018-2A Class A (30 Day Average SOFR + 0.914%, Floor 0.800%), 144A 6.250%, 09/25/68@,• | | | 2,316 | | | | 2,289,252 | |

Series 2019-1A Class A1A, 144A 2.720%, 07/25/69@ | | | 1,130 | | | | 1,026,617 | |

Elevation CLO Ltd., Series 2017-6A Class B (3 M SOFR + 2.112%, Floor 2.112%), 144A 7.440%, 07/15/29@,• | | | 750 | | | | 750,601 | |

Exeter Automobile Receivables Trust, Series 2022-4A Class B, 4.570%, 01/15/27 | | | 1,866 | | | | 1,863,546 | |

First Eagle BSL CLO Ltd., Series 2019-1A Class B (3 M SOFR + 3.512%, Floor 3.250%), 144A 8.836%, 01/20/33@,• | | | 1,500 | | | | 1,501,696 | |

Navient Private Education Loan Trust, | | | | | | | | |

Series 2015-AA Class A3 (1 M SOFR + 1.814%), 144A 7.143%, 11/15/30@,• | | | 787 | | | | 789,730 | |

Series 2014-AA Class A3 (1 M SOFR + 1.714%), 144A 7.043%, 10/15/31@,• | | | 1,001 | | | | 1,003,734 | |

Series 2015-BA Class A3 (1 M SOFR + 1.564%), 144A 6.893%, 07/16/40@,• | | | 1,104 | | | | 1,107,914 | |

Navient Private Education Refi Loan Trust, | | | | | | | | |

Series 2020-EA Class A, 144A 1.690%, 05/15/69@ | | | 1,277 | | | | 1,168,254 | |

Series 2021-EA Class A, 144A 0.970%, 12/16/69@ | | | 2,617 | | | | 2,275,879 | |

Navient Student Loan Trust, | | | | | | | | |

Series 2016-5A Class A (30 Day Average SOFR + 1.364%), 144A 6.700%, 06/25/65@,• | | | 3,461 | | | | 3,479,764 | |

Series 2023-BA Class A1A, 144A 6.480%, 03/15/72@ | | | 1,784 | | | | 1,808,893 | |

Nelnet Student Loan Trust, Series 2004-4 Class B (90 Day Average SOFR + 0.562%), 5.909%, 01/25/41• | | | 2,285 | | | | 2,257,748 | |

| | | | | | | | |

| | | Par

(000) | | | Value† | |

| | | | | | | | | |

OCP CLO Ltd., Series 2014-5A Class A2R (3 M SOFR + 1.662%, Floor 1.400%), 144A 6.986%, 04/26/31@,• | | $ | 1,000 | | | $ | 999,967 | |

OZLM XI Ltd., Series 2015-11A Class A2R (3 M SOFR + 2.012%), 144A 7.341%, 10/30/30@,• | | | 2,300 | | | | 2,303,420 | |

Palmer Square Loan Funding Ltd., Series 2021-1A Class B (3 M SOFR + 2.062%, Floor 2.062%), 144A 7.386%, 04/20/29@,• | | | 1,610 | | | | 1,611,520 | |