Exhibit 99.A

| 2006 Annual Information Form |

| For the year ended December 31, 2006 |

| |

| Annual Information Form |  |

Attached to this Annual Information Form is the Annual Report to shareholders for the year ended December 31, 2006 of Shell Canada Limited (Annual Report). Copies of this Annual Information Form and the Annual Report can also be found on the Corporation’s website at www.shell.ca and under Shell Canada’s profile at www.sedar.com.

Those sections of the Annual Report referenced herein are specifically incorporated by reference into this Annual Information Form. Any sections of the Annual Report not referenced herein do not form part of this Annual Information Form.

Unless the contents indicate otherwise, the terms “Shell,” “Shell Canada,” “Shell Canada Limited,” “Corporation” and “Company” are used interchangeably in this Annual Information Form to refer to Shell Canada Limited and its consolidated subsidiaries.

INDEX

| | | | | |

| | | 1 | |

| |

| |

| | | 1 | |

| | | 1 | |

| | | 1 | |

| | | 2 | |

| |

| |

| | | 2 | |

| | | 2 | |

| | | 3 | |

| |

| |

| | | 3 | |

| | | 9 | |

| | | 12 | |

| | | 14 | |

| | | 15 | |

| | | 15 | |

| | | 16 | |

| | | 16 | |

| | | 16 | |

| | | 17 | |

| |

| |

| | | 17 | |

| | | 18 | |

| | | 19 | |

| | | 20 | |

| |

| |

| | | 20 | |

| |

| |

| | | 20 | |

| |

| |

| | | 21 | |

| |

| |

| | | 21 | |

| |

| |

| | | 22 | |

| |

| |

| | | 23 | |

| |

| |

| | | 25 | |

| |

| |

| | | 36 | |

| |

| |

| | | 38 | |

| |

| |

| | | 40 | |

| |

| |

| | | 41 | |

| |

| |

| | | 43 | |

| |

| |

| | | 53 | |

| |

| |

| | | 66 | |

| |

| |

| | | 84 | |

| |

| |

| | | 91 | |

| |

| |

| | | 92 | |

| |

| |

| | | 93 | |

| |

| |

| | | | | |

| |

| Corporate Structure |  |

NAME AND INCORPORATION

Shell Canada Limited was incorporated under the laws of Canada in 1925 as the successor to The Shell Company of Canada, Limited, incorporated in 1911, and was continued under theCanada Business Corporations Acton May 1, 1978.

The Corporation’s articles or other establishing documents have been subject to the following material amendments: (i) Supplementary Letters Patent effective May 14, 1973 subdividing the Class “A” and Class “B” common shares of the Corporation on athree-for-one basis; (ii) Articles of Amalgamation effective January 1, 1986 reflecting the Corporation’s amalgamation with a wholly owned subsidiary, Shell Canada Resources Limited; (iii) Articles of Amendment effective June 1, 1989 converting the Class “B” common shares to Class “A” common shares on afour-for-one basis and deleting the Series “A” preferred shares; (iv) Articles of Amendment effective May 20, 1997 splitting the Class “A” common shares on athree-for-one basis; (v) Articles of Amalgamation effective July 1, 1998 reflecting the Corporation’s amalgamation with a wholly owned subsidiary, 177487 Canada Ltd.; (vi) Articles of Amendment dated May 2, 2000 redesignating the Class “A” common shares of the Corporation to common shares and deleting all references to Class “B” common shares; (vii) Restated Articles of Incorporation effective May 18, 2000 consolidating prior amendments; and (viii) Articles of Amendment effective June 6, 2005 subdividing the common shares on athree-for-one basis as of June 21, 2005.

The head and registered office of the Corporation is located at400-4th Avenue S.W., Calgary, Alberta, T2P 0J4.

INTERCORPORATE RELATIONSHIPS

The Corporation’s principal subsidiary, Shell Canada Products Limited, is wholly owned and was incorporated under theCanada Business Corporations Actin 1982. Shell Canada Products Limited owns 99.99 per cent of the partnership units and is the managing partner of Shell Canada Products, an Alberta partnership. The balance of the partnership units are held by a wholly owned subsidiary of the Corporation. Shell Canada Products is engaged in the manufacture, distribution and marketing of refined petroleum products.

Effective January 1, 2007, the Corporation transferred the principal assets of its Exploration & Production and Oil Sands business units to Shell Canada Energy, an Alberta partnership. Shell Canada Limited is the principal holder of the partnership units and is the managing partner of Shell Canada Energy. The balance of the partnership units are held by two wholly owned subsidiaries of the Corporation, BlackRock Ventures Inc. and 6581528 Canada Ltd.

The total revenues and total assets of the Corporation’s other operating subsidiaries, in the aggregate, represent less than 20 per cent of Shell’s total consolidated revenues and total consolidated assets, respectively.

CAPITAL STRUCTURE

The Corporation is authorized to issue an unlimited number of common shares, an unlimited number of four per cent cumulative redeemable preference shares and an unlimited number of preferred shares.

| |

| General Development of the Business |  |

Shell Canada, a large integrated petroleum company in Canada, operates principally in three industry segments: Exploration & Production (E&P), Oil Sands and Oil Products. E&P explores for, produces and markets natural gas and natural gas liquids. Oil Sands is responsible for an integrated bitumen mining and upgrading operation and Shell Canada’s in situ bitumen business in Alberta. Oil Products manufactures, distributes and markets refined petroleum products across Canada.

THREE-YEAR HISTORY

20041 Shell Canada reported earnings of $1,283 million or $1.55 per common share compared with earnings of $810 million or $0.98 per share in 2003. The return on average capital employed (ROACE) of 19.9 per cent was an improvement over the previous year’s 13.1 per cent. E&P earnings in 2004 were $450 million compared with $619 million in 2003. The decline in earnings was primarily attributed to lower production volumes, higher exploration expenses due to increased activity, higher depreciation charges for the Sable Offshore Energy Project (SOEP) and previously reported charges related to the expensing of Mackenzie Gas Project costs and changes in the Company’s Long Term Incentive Plan (LTIP). E&P capital and predevelopment expenditures were $435 million compared with $385 million in 2003. Oil Products’ earnings were $449 million in 2004, up from $344 million in 2003. The improvement was due to strong refining margins, higher prices for benzene and improved feedstock volumes from the integrated Oil Sands operations. Good refinery reliability throughout 2004 also contributed to the results. Oil Products’ capital expenditures were $313 million compared with $194 million in 2003. Oil Sands generated earnings of $376 million in 2004 versus a loss of $142 million in 2003 when the Athabasca Oil Sands Project (AOSP) was instart-up mode. Higher prices and volumes and lower unit costs were the main contributors to the earnings increase as AOSP production ramped up to design levels over the first nine months of 2004. However, production volumes decreased over the final three months of the year as a result of repair and maintenance activities at the Muskeg River Mine and the Scotford Upgrader. Oil Sands capital and predevelopment expenditures were $195 million compared with $123 million in 2003.

20051 Shell Canada reported earnings of $2,001 million in 2005, or $2.43 per common share, compared with $1,283 million or $1.55, respectively, in 2004. An increased contribution from the Oil Sands business was the main reason for the 56 per cent increase over the previous year. ROACE of 26.7 per cent was an improvement over the previous year’s 19.9 per cent. E&P earnings in 2005 were $665 million compared with $450 million in 2004. The improvement was mainly due to strong commodity prices, and new production from basin-centred gas (BCG). E&P capital and predevelopment expenditures were $796 million compared with $435 million in 2004. Oil Products’ earnings were $434 million in 2005, slightly down from $449 million in 2004. The small decrease was due to the increase in expenses resulted from higher refinery maintenance costs, increased costs for purchased product and higher LTIP charges. Oil Products’ capital expenditures in 2005 were $484 million compared with $313 million in 2004. In its second full year of integrated operations, Oil Sands reported earnings of $783 million compared with $376 million in 2004 due to increased volumes at Athabasca Oil Sands Project (AOSP) and higher prices. This represented 39 per cent of the Company’s overall earnings, a significant contribution from this relatively new business. The earnings increase also reflected higher proceeds from insurance settlements and use ofnon-capital losses in 2005, offset by higher LTIP charges. The 2005 earnings included insurance proceeds of $82 million for the final settlement on a loss of profit claim related to the January 2003 fire at the Muskeg River Mine. In December 2004, Shell Canada acquirednon-capital losses with the acquisition of a related party, Coral Resources Canada ULC, and in 2005 this resulted in a benefit of $164 million. Oil Sands capital and predevelopment expenditures were $420 million compared with $195 million in 2004.

2006 For highlights of 2006, reference is made to the business sections in the “Management’s Discussion and Analysis” section of the Annual Report found on pages 7 to 48.

TRENDS

2007 For a discussion of the significant initiatives planned by the Company for 2007, reference is made to the business sections in the “Management’s Discussion and Analysis” section of the Annual Report found on pages 7 to 48.

| |

| 1 | 2004 and 2005 earnings have been restated to reflect that effective January 1, 2006, the Peace River business, which operates an in situ bitumen facility near Peace River, was transferred from Shell Canada’s E&P to Oil Sands business and the retroactive adoption of Emerging Issues Committee (EIC) Abstract 162 “Stock-Based Compensation For Employees Eligible to Retire Before The Vesting Date” with prior period restatement as required. Reference is made to Note 1 of the Consolidated Financial Statements on pages 57 to 59 of the Annual Report. |

2 GENERAL DEVELOPMENT OF THE BUSINESS

| |

| Narrative Description of the Business |  |

EXPLORATION & PRODUCTION

Shell Canada has been engaged in the exploration and production of crude oil and natural gas in Canada since 1939. From 1976 to 1985, Shell Canada’s exploration and production operations were managed and operated through a wholly owned subsidiary of the Corporation, Shell Canada Resources Limited (Shell Resources). Shell Canada Limited was amalgamated with Shell Resources on January 1, 1986, and the Resources business of Shell Canada, renamed in 2004 as Exploration & Production (E&P), became part of the operations of Shell Canada Limited. In 1999, Shell Canada sold its conventional crude oil producing interests. Effective January 1, 2006, the Peace River business, which operates an in situ bitumen facility near Peace River, was transferred from E&P to Shell Canada’s Oil Sands business.

E&P explores for, produces and markets natural gas, natural gas liquids (NGLs), and sulphur. This upstream business operates four natural gas processing facilities in the Foothills of Alberta. The Company also has a 31.3 per cent share of the SOEP, which produces natural gas and natural gas liquids off the coast of Nova Scotia.

The Corporation’s conventional oil and gas reserves disclosure and related information have been prepared in reliance on a decision of the applicable Canadian securities regulatory authorities under National Instrument51-101 —Standards of Disclosure for Oil and Gas Activities(NI51-101), which permits the Corporation to present its reserves disclosure in accordance with the applicable requirements of the United States Financial Accounting Standards Board (FASB) and the United States Securities and Exchange Commission (SEC). This disclosure differs from the corresponding information required by NI51-101. If Shell Canada had not received the decision, it would be required to disclose proved plus probable oil and gas reserves estimates based on forecasted prices and costs and information relating to future net revenue using forecasted prices and costs.

Additional information related to E&P may be found on pages 18 to 25 of the Annual Report and in Schedule I and Schedule IIIA on pages 23 and 24 and pages 36 and 37, respectively, of this Annual Information Form.

Principal Products

Shell Canada’s E&P segment is a major producer of natural gas, natural gas liquids and sulphur in Canada.

Principal Markets and Methods of Distribution

Natural Gas Shell Canada sells the majority of its Western Canada natural gas production to 3095381 Nova Scotia Company, an affiliated company that operates as part of the Royal Dutch Shell plc global trading organization, at Alberta market-based prices (AECO reference price).

The SOEP started up late in December 1999. It is owned jointly by Shell Canada, ExxonMobil Canada Properties, Imperial Oil Resources, Pengrowth Corporation and Mosbacher Operating Ltd. Shell’s equity share of natural gas production from SOEP is 31.3 per cent and is marketed both directly to end use customers in North America and to an affiliate, Coral Energy Canada Inc.

Natural Gas Liquids Shell Canada is a major producer and marketer of natural gas liquids (ethane, propane, butane and condensate) in Canada. NGLs are used in a variety of petrochemical, refining, and diluent applications, with propane also being consumed by the transportation and space-heating sectors.

Shell Canada has investments in shared infrastructure near major market centres in Edmonton, Alberta; Sarnia, Ontario; and Point Tupper, Nova Scotia; for the processing, storage and delivery of natural gas liquids to meet customer requirements.

NARRATIVE DESCRIPTION OF THE BUSINESS 3

Natural gas liquids production from these facilities, as well as from Foothills gas plants, is sold to both Canadian and U.S. markets. SOEP condensate production is shipped by marine tanker to North American markets.

Sulphur Shell Canada is one of the world’s largest sulphur producers and marketers with 38 per cent of Canadian sulphur sales, and approximately 16 per cent of world traded sulphur. Shell markets sulphur primarily to export markets. China, United States (U.S.), Australia and Brazil represent Shell’s four largest export markets. Most of Shell’s sulphur customers are in the fertilizer industry. Sulphur is shipped by rail to the United States in liquid form and, for markets outside North America, it is moved in solid form by rail to the Port of Vancouver, British Columbia, for shipping in dry bulk cargo vessels to overseas markets.

Revenues by Product

Reference is made to Note 2 “Segmented Information” of the Consolidated Financial Statements on pages 60 to 63 of the Annual Report.

The following tables set out the percentage of revenue by type of customer:

| | | | | | | | | | | | | |

| Natural Gas(%) | | 2006 | | | 2005 | | | 2004 | |

| |

| |

| Inter-segment sales | | | 3 | | | | 2 | | | | 2 | |

| Sales to third parties | | | 9 | | | | 14 | | | | 13 | |

| Sales to related parties | | | 88 | | | | 84 | | | | 85 | |

|

| Total natural gas sales | | | 100 | | | | 100 | | | | 100 | |

|

| | | | | | | | | | | | | |

| Natural Gas Liquids(%) | | 2006 | | | 2005 | | | 2004 | |

| |

| |

| Inter-segment sales | | | 11 | | | | 4 | | | | 2 | |

| Sales to third parties | | | 81 | | | | 93 | | | | 96 | |

| Sales to related parties | | | 8 | | | | 3 | | | | 2 | |

|

| Total natural gas liquids sales | | | 100 | | | | 100 | | | | 100 | |

|

Source and Availability of Raw Materials

The source and availability of natural gas and natural gas liquids reserves depends upon the success of Shell’s exploration and development programs. Shell’s development programs are focused in three areas: gas fields in the deep foothills, the deep basin region of Western Canada and the gas fields near Sable Island, offshore Nova Scotia. Shell’s exploration program continues to focus on exploring for new reserves in the Western Canada Sedimentary Basin (WCSB), and maintains exploration interests off the East and West coasts of Canada and in Northern Canada. In 2006, the Company continued to acquire additional land positions in northeast British Columbia, the deep basin region of Western Canada, and in the Beaufort Sea.

In 2006,follow-up activities to Shell’s 2004 Tay River discovery were conducted, with the drilling of two more wells, one to delineate the original discovery and the other to test a new structure. Both were unsuccessful.

In northeast British Columbia, major activity occurred in 2006 and into 2007 to tie in five wells, three of which were drilled in 2006. This activity includes construction of a major gathering system and dehydration facility at Wolverine River. Limitations in the main gathering system and processing facility will restrict gas sales from this region in the near term.

The basin-centred gas (BCG) business progressed in its drilling program and its first full year of production from the Chinook Ridge field. Investment in infrastructure was made and construction commenced to build a new pipeline and expand local gas processing capacity in the region to accommodate future production growth. This program of exploration and development will be accelerated in 2007. These facilities are expected to be completed and operating by late 2007.

4 NARRATIVE DESCRIPTION OF THE BUSINESS

In the Orphan Basin, offshore Newfoundland and Labrador, the first deep water exploration well, in which Shell has a 20 per cent interest, was spudded in August and continued drilling into the first quarter 2007. Further drilling and seismic acquisition is planned for 2007.

Seasonality

Historically, natural gas sales prices have been higher in the first and fourth quarters of the year as a result of increased heating demand during the winter months. However, in 2006 prices for natural gas came under pressure over the first quarter due to mild temperatures and record levels of gas in North American storage. Prices dropped to five-year lows at the end of the third quarter as the anticipated repeat of the 2005 hurricane season failed to materialize. Fourth quarter prices recovered to first quarter levels due to weather-related demand, although well below the levels experienced in the fourth quarter of 2005.

Drilling Activity

Reference is made to the “Exploration and Development Wells Drilled” table and as well the “Productive Wells” table on page 79 of the Annual Report.

Present Activity

Reference is made to the “Exploration and Development Wells Drilled” table on page 79 of the Annual Report.

Location of Production

Shell Canada operates and has substantial interests in natural gas plants in Alberta and has substantial interests in natural gas plants in Nova Scotia, which process approximately 71 per cent of its current sales volumes. The remaining sales volumes are processed in other natural gas processing plants in Alberta, in which Shell Canada has varying interests or to which it has access under processing agreements.

The following table sets out the capacity and utilization of Shell Canada’s major plants:

| | | | | | | | | | | | | |

| Gas Plants | | | | | | |

|

| | | | | Current

| | Utilization

|

| | | Shell Canada’s

| | Sales Gas

| | of Current

|

| | | Interest

| | Capacity1

| | Capacity2

|

| | | (%) | | (millions of cubic feet per day) | | (%) |

|

| |

| Waterton | | | 100 | | | | 165 | | | | 58 | |

|

| Jumping Pound | | | 100 | | | | 151 | | | | 81 | |

|

| Burnt Timber | | | 82 | | | | 86 | | | | 85 | |

|

| Caroline | | | 72 | | | | 129 | | | | 66 | |

|

| Wildcat Hills (outside operated) | | | 34 | | | | 113 | | | | 75 | |

|

| Goldboro (outside operated) | | | 31 | | | | 565 | | | | 60 | |

|

| | |

| | 1 | Based on inlet gas composition, the current volume of sales gas that can be processed with all equipment running and feed gas optimized based on product prices. |

2 Based on average daily sales relative to current capacity in 2006.

NARRATIVE DESCRIPTION OF THE BUSINESS 5

Shell also has interests in four major outside operated natural gas liquids fractionation and storage facilities.

| | | | | | | | | | | | | |

|

| NGL Fractionation/Storage | | | | | | |

| | | Shell Canada’s

| | Shell Share

| | Shell Share

|

| | | Interest

| | Capacity

| | Utilization1

|

| | | (%) | | (thousands of barrels per day) | | (%) |

|

| |

| Fort Saskatchewan, Alberta | | | | | | | | | | | | |

|

| De-ethanizer | | | 44 | | | | 31 | | | | 68 | |

|

| Fractionator | | | 42 | | | | 13 | | | | 47 | |

|

| Sarnia, Ontario | | | | | | | | | | | | |

|

| Fractionator | | | 13 | | | | 15 | | | | 95 | |

|

| Point Tupper, Nova Scotia | | | | | | | | | | | | |

|

| Fractionator | | | 31 | | | | 10 | | | | 57 | |

|

| Empress Wolcott Facility, Alberta | | | | | | | | | | | | |

|

| Straddle Plant | | | 6 | | | | 2 | | | | 100 | |

|

1 Based on average daily throughput relative to available capacity.

The significant fields in which Shell owns varying interests are:

| | | | | |

|

| Natural Gas, Natural Gas Liquids and Sulphur Production |

| |

Alberta | | British Columbia | | Nova Scotia |

|

| Burnt Timber | | Northeast B.C. | | Alma |

|

| Clearwater | | | | Thebaud |

|

| Limestone | | | | South Venture |

|

| Panther River | | | | North Triumph |

|

| Wildcat Hills | | | | Venture |

|

| Chinook Ridge | | | | |

|

| Caroline | | | | |

|

| Jumping Pound | | | | |

|

| Moose/Whiskey | | | | |

|

| Waterton | | | | |

|

| Tay River | | | | |

|

A large quantity of the natural gas production comes from fields with natural gas containing significant amounts of liquids and hydrogen sulphide. Production from these fields requires complex treatment, which yields substantial volumes of natural gas liquids and sulphur, as well as marketable natural gas.

Location of Wells

Reference is made to the “Productive Wells” table on page 79 of the Annual Report.

Interest in Material Properties

Reference is made to the “Landholdings” table on page 86 of the Annual Report.

6 NARRATIVE DESCRIPTION OF THE BUSINESS

Reserves Estimates

Reference is made to the “Reserves” section on pages 80 and 81 of the Annual Report and to Schedule I on pages 23 and 24 of this Annual Information Form.

Source of Reserves Estimates

Reserves estimates are prepared by the Corporation’s internal qualified reserves evaluators. No independent qualified reserves evaluator or auditor was involved in the preparation of the Corporation’s conventional oil and gas reserves data. An external, independent petroleum consulting firm audited 100 per cent of the proved conventional oil and gas estimates prepared by the Corporation’s internal reserves evaluators and verified compliance with applicable FASB and SEC requirements.

Shell’s Chief Reservoir Engineer is a qualified reserves evaluator, as defined by NI51-101, and together with the Company’s internal team of reservoir engineers, evaluates the Company’s conventional oil and gas reserves data. The conventional oil and gas reserves estimates prepared by the Chief Reservoir Engineer are reviewed by the Chief Executive Officer, members of senior management in the E&P segment and the Reserves Committee prior to submission of the estimates to the Board of Directors for approval.

The Reserves Committee has been delegated the responsibility by the Board of Directors to review the Corporation’s processes and related procedures for the disclosure of conventional oil and gas reserves data as permitted by NI51-101. All members of the Reserves Committee are independent, outside directors and are not related to the Corporation or to its majority shareholder.

Reference is made to Schedule IIIA on pages 36 and 37 and Schedule V on pages 41 and 42, respectively, of this Annual Information Form.

Reconciliation of Reserves

Reference is made to the “Reserves” section on pages 80 and 81 of the Annual Report.

History

Reference is made to the “Production” table on page 78 of the Annual Report.

Revenue

| | | | | | | | | | | | | |

|

| Natural Gas($/mcf)1 | | | | | | |

| | | 2006 | | 2005 | | 2004 |

| | | | | (restated)2 | | (restated)2 |

|

| |

| Average Plant Gate Price | | | 6.79 | | | | 8.23 | | | | 6.49 | |

| Royalties | | | 1.34 | | | | 1.70 | | | | 1.19 | |

| Operating Expenses | | | | | | | | | | | | |

| Plant and Field | | | 1.11 | | | | 1.04 | | | | 0.80 | |

| Head Office | | | 0.47 | | | | 0.60 | | | | 0.42 | |

|

| Total Operating Expenses | | | 1.58 | | | | 1.64 | | | | 1.22 | |

|

| Netback | | | 3.87 | | | | 4.89 | | | | 4.08 | |

|

1 Dollars per thousand cubic feet.

2 Adjusted to exclude costs due to transfer of the Corporation’s in situ business from E&P to Oil Sands.

NARRATIVE DESCRIPTION OF THE BUSINESS 7

| | | | | | | | | | | | | |

|

| Ethane, Propane and Butane($/bbl)1 | | | | | | |

| | | 2006 | | 2005 | | 2004 |

| | | | | (restated)2 | | (restated)2 |

|

| |

| Average Plant Gate Price | | | 33.94 | | | | 34.79 | | | | 28.71 | |

| Royalties | | | 6.78 | | | | 6.98 | | | | 5.41 | |

| Operating Expenses | | | | | | | | | | | | |

| Plant and Field | | | 6.66 | | | | 6.26 | | | | 4.77 | |

| Head Office | | | 2.83 | | | | 3.59 | | | | 2.53 | |

|

| Total Operating Expenses | | | 9.49 | | | | 9.85 | | | | 7.30 | |

|

| Netback | | | 17.67 | | | | 17.96 | | | | 16.00 | |

|

| | | | | | | | | | | | | |

|

| Condensate($/bbl)1 | | | | | | |

| | | 2006 | | 2005 | | 2004 |

| | | | | (restated)2 | | (restated)2 |

|

| |

| Average Plant Gate Price | | | 71.63 | | | | 66.76 | | | | 50.46 | |

| Royalties | | | 15.76 | | | | 15.22 | | | | 11.07 | |

| Operating Expenses | | | | | | | | | | | | |

| Plant and Field | | | 6.66 | | | | 6.26 | | | | 4.77 | |

| Head Office | | | 2.83 | | | | 3.59 | | | | 2.53 | |

|

| Total Operating Expenses | | | 9.49 | | | | 9.85 | | | | 7.30 | |

|

| Netback | | | 46.38 | | | | 41.69 | | | | 32.09 | |

|

1 Dollars per barrel.

2 Adjusted to exclude costs due to transfer of the Corporation’s in situ business from E&P to Oil Sands.

Sales Commitments

| | | |

| Volume(millions of BOE1) | | Source of Production |

|

| |

| 139 | | Western Canada Sedimentary Basin |

| 15 | | Sable Offshore Energy Project |

|

| | |

| | 1 | Barrels of oil equivalent (BOE) may be misleading, particularly if used in isolation. A BOE conversion of six thousand cubic feet of natural gas to one barrel of oil, as used in this Annual Information Form, is based on the energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

The sales commitments consist of long-term natural gas contracts.

Exploration and Development

Expenditures on exploration and development appear in Schedule I on pages 23 and 24 of this Annual Information Form.

Additional information related to exploration and development activities may be found on pages 18 to 25 of the Annual Report.

8 NARRATIVE DESCRIPTION OF THE BUSINESS

OIL SANDS

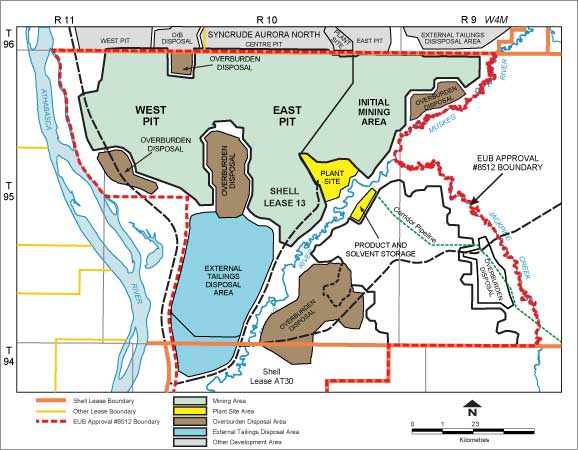

Mining

In 2006, AOSP completed its third full year of integrated operations. Under a joint venture agreement, Shell Canada has a 60 per cent interest in the project while Chevron Canada Limited and Western Oil Sands L.P. each hold 20 per cent.

The AOSP joint venture includes the Muskeg River Mine and the Scotford Upgrader.

The Muskeg River Mine, on Lease 13, is located 75 kilometres north of Fort McMurray, Alberta. The Muskeg River Mine uses trucks and shovels to excavate the oil sands, as well as advanced extraction technologies to separate the bitumen from the sands. Albian Sands Energy Inc. operates the mine and extraction plant.

The Scotford Upgrader is adjacent to Shell’s existing Scotford Refinery north of Fort Saskatchewan, Alberta. The Scotford Upgrader uses hydrogen-addition technology to process the bitumen from the Muskeg River Mine into a range of synthetic crude oils. Shell Canada operates the upgrader.

AOSP production of 137,500 barrels per day (bbls/d) was achieved in 2006 (2005 — 159,900; 2004 — 135,500). Shell Canada’s share of bitumen production for 2006 was approximately 30 million barrels (2005 — 35 million barrels; 2004 — 30 million barrels).

In Situ

Shell Canada has operated in situ assets since 1979, when the Company began production at its Peace River Complex in northern Alberta. Effective January 2006, the Peace River business was transferred from Shell Canada’s E&P business to its Oil Sands business unit. In 2006, Shell Canada also gained significant new in situ resources and additional production through its acquisition of BlackRock Ventures Inc. (BlackRock). Synergies between the Company’s in situ, mining, upgrading and BlackRock’s oil sands operations are expected to provide opportunities for reduced costs and larger-scale heavy oil integration.

Shell Canada achieved record production rates in excess of 25,000 bbls/d of bitumen from its in situ operations in the month of November, and now has the capacity for 30,000 bbls/d. However, in situ production was negatively impacted in 2006 by a facility turnaround at Peace River, a fire at the Seal battery in June and more recently the apportionment on the Rainbow Pipeline, which transports bitumen to market.

Growth

In 2006, Shell Canada received the regulatory approvals needed to proceed with AOSP Expansion 1, a fully integrated 100,000 barrel per day (bpd) expansion of oil sands mining and upgrader facilities. The first bitumen recovery from AOSP Expansion 1 is expected in the fourth quarter of 2009 with synthetic crude production from the Scotford Upgrader Expansion 1 following in late 2010.

In July 2006, the Company announced its intention to build on its expanded in situ portfolio, using a variety of production techniques to obtain its long term potential of 150,000 bbls/d in situ production.

Construction on the 10,000 bpd first phase of the Orion steam-assisted gravity drainage (SAGD) project at Cold Lake continued in 2006. At Peace River, regulatory applications were filed to increase production from the existing capacity of 12,000 bbls/d to more than 100,000 bbls/d in the long term. Shell Canada intends to increase bitumen production across its Peace River leases using cold (primary) production followed by thermal (horizontal cyclic steam) techniques to increase bitumen recovery. Drilling for the initial phase of cold production is expected to begin in early 2007, with a final investment decision on the first 50,000 bpd thermal phase expected post regulatory approval in 2008.

NARRATIVE DESCRIPTION OF THE BUSINESS 9

Shell Canada has options to participate in additional in situ development with Chevron Canada Limited and Western Oil Sands L.P. In 2006, the Company exercised its right to acquire a 20 per cent working interest in Chevron Canada’s Ells River in situ leases, located approximately 50 kilometres northwest of Fort McMurray. Delineation drilling commenced during the winter of2006/2007.

Shell has planned capital expenditures for 2007 of $2,450 million for Oil Sands base business and growth initiatives. The 2007 program includes $170 million for predevelopment expenses related to future growth projects in Athabasca and Peace River. Planned investment includes $220 million for profitability and production optimization projects as well as sustaining capital. Capital spending on growth initiatives, primarily the 100,000 bpd AOSP expansion project, will be about $1,570 million. The 2007 program also provides capital spending of approximately $490 million on in situ projects.

The Corporation’s minable bitumen reserves disclosure and related information has been prepared in reliance on a decision of the applicable Canadian securities regulatory authorities under NI51-101, which permits the Corporation to present this disclosure in accordance with the applicable requirements of FASB and the SEC. This disclosure differs from the corresponding information required by NI51-101. If Shell Canada had not received the decision, the Corporation would be required to disclose proved and probable reserves estimates based on forecasted prices and costs and information relating to future net revenue using constant and forecasted prices and costs.

Additional information related to Oil Sands may be found on pages 26 to 33 of the Annual Report and in Schedule I, Schedule II and Schedule IV on pages 23 and 24, pages 25 to 35 and page 40, respectively, of this Annual Information Form.

Principal Products

Shell Canada’s Oils Sands segment is a major producer of minable and in situ bitumen, and synthetic crude in Canada.

Principal Markets and Methods of Distribution

The AOSP is a fully integrated operation with the Corridor Pipeline carrying diluted bitumen from the Muskeg River Mine to the Scotford Upgrader where it is processed into synthetic crude oil products. The majority of the synthetic crude produced at the upgrader is supplied to Shell Canada’s Scotford Refinery, with the remainder moved by pipeline to markets throughout Canada and the United States.

In situ bitumen production is shipped through a number of pipelines from Shell’s producing locations to refineries primarily in the U.S. market.

Revenues by Product

Reference is made to Note 2 “Segmented Information” of the Consolidated Financial Statements on pages 60 to 63 of the Annual Report.

The following table sets out the percentage of revenues by customer:

| | | | | | | | | | | | | |

|

| Synthetic Crude Sales(%) | | 2006 | | 2005 | | 2004 |

|

| |

| Inter-segment sales | | | 46 | | | | 54 | | | | 54 | |

| Sales to third parties | | | 49 | | | | 41 | | | | 44 | |

| Sales to related parties | | | 5 | | | | 5 | | | | 2 | |

|

| Total synthetic crude oil sales | | | 100 | | | | 100 | | | | 100 | |

|

Source and Availability of Raw Materials

The source and availability of bitumen reserves depends upon the success of Shell’s exploration and development programs. Shell’s development programs are focused on the Athabasca and Peace River Bitumen deposits, and the Seal and Orion asset areas.

10 NARRATIVE DESCRIPTION OF THE BUSINESS

Shell Canada’s crude oil requirements were supplied from three major sources as shown in the table below. The majority of purchases were done through an affiliated company of Royal Dutch Shell plc. The definition of crude oil includes Muskeg River Mine diluted bitumen produced by the AOSP.

| | | | | | | | | | | | | |

|

| Crude Oil Requirements(%) | | 2006 | | 2005 | | 2004 |

|

| |

| Domestic industry production | | | 21 | | | | 21 | | | | 22 | |

| Shell Canada’s own production | | | 78 | | | | 78 | | | | 77 | |

| Imported production | | | 1 | | | | 1 | | | | 1 | |

|

| Total crude oil requirements | | | 100 | | | | 100 | | | | 100 | |

|

Seasonality

There were no significant seasonal fluctuations in the overall Oil Sands business in 2006. However, production rates may be lower during extremely cold weather conditions.

Drilling Activity

Reference is made to the “Exploration and Development Wells Drilled” table and as well the “Productive Wells” table on page 83 of the Annual Report.

Present Activity

Reference is made to the “Exploration and Development Wells Drilled” table on page 83 of the Annual Report.

Location of Production

Shell Canada operates and has substantial interests in bitumen production in Alberta. The significant fields in which Shell owns varying interests are:

| | | |

|

| Minable Bitumen Production | | In Situ Bitumen Production |

|

| |

Alberta | | Alberta |

| Athabasca Region | | Peace River |

| | | Seal |

| | | Orion |

|

Location of Wells

Reference is made to the “Productive Wells” table on page 83 of the Annual Report.

Interest in Material Properties

Reference is made to the “Landholdings” table on page 86 of the Annual Report.

Reserves Estimates

Reference is made to the “Reserves” section on pages 83 to 85 of the Annual Report.

NARRATIVE DESCRIPTION OF THE BUSINESS 11

Source of Reserves Estimates

Minable and in situ bitumen reserves estimates are prepared by the Corporation’s internal qualified reserves evaluators. For 2006, reserves estimates associated with the BlackRock properties were prepared by an independent qualified reserves evaluator. With the exception of the BlackRock properties, no independent qualified reserves evaluator or auditor was involved in the preparation of the Company’s minable and in situ bitumen reserves data.

Shell’s Chief Mining Engineer and Chief Reservoir Engineer are both qualified reserves evaluators, as defined by NI51-101, and together with the Company’s internal team of geological and mining professionals and reservoir engineers evaluate the Company’s minable and in situ bitumen reserves data. The reserves estimates prepared by the Chief Mining Engineer and the Chief Reservoir Engineer are reviewed by the Chief Executive Officer and members of senior management in the Oil Sands segment and the Reserves Committee prior to submission of the estimates to the Board of Directors for approval.

The Reserves Committee has been delegated the responsibility by the Board of Directors to review the Corporation’s processes and related procedures for the disclosure of reserves data as permitted by NI51-101. All members of the Reserves Committee are independent, outside directors and are not related to the Corporation or to its significant shareholder.

Reference is also made to Schedule IIIB, Schedule IV and Schedule V on pages 38 and 39, page 40 and pages 41 and 42, respectively, of this Annual Information Form.

Reconciliation of Reserves

Reference is made to the “Reserves” section on pages 83 to 85 of the Annual Report.

History

Reference is made to the “Production” table on page 82 of the Annual Report.

Gross production includes all production attributable to Shell’s interest before deduction of royalties.

OIL PRODUCTS

Shell Canada’s oil refining, supply, distribution and marketing businesses are managed and operated through Shell Canada Products, a partnership wholly owned indirectly by the Corporation. Shell manufactures, distributes and markets a full range of refined petroleum products, including automotive gasoline, diesel fuel, aviation fuels, lubricating oils and greases, heavy fuel oils, solvents and asphalts. The Company’s Canada-wide network of retail sites includes convenience food stores and car wash facilities.

In September 2006, Shell Canada and Flying J Canada Inc. amalgamated their Canadian commercial road transportation businesses through an incorporated joint venture, SFJ Inc. Shell and Flying J announced a$200-million growth plan to create a Canadian network of travel plazas offeringShell-branded fuels and highway hospitality services to long-distance truck drivers, recreational vehicle users and local customers. Shell also sold its heating oil business, Thermoshell, in 2006.

Additional information related to Oil Products may be found on pages 34 to 41 of the Annual Report.

Methods of Distribution

Shell Canada uses various modes of transportation, including marine, pipeline, rail and truck, to transport crude oil and refined products. Shell arranges marine transportation, principally by charter, to transport petroleum products in the Great Lakes, the Gulf of St. Lawrence,

12 NARRATIVE DESCRIPTION OF THE BUSINESS

the Arctic and the West Coast. Shell has minority ownership interests in various crude oil and refined product pipelines. Shell Canada’s transportation system for refined products also includes leased railway tank cars and contracted delivery services.

Principal Markets

Refined petroleum products, as well as specialty items for the automotive, commercial, farm and home markets, are marketed nationally, principally under Shell trademarks. Shell Canada is also a major supplier of aviation fuels and lubricants to international and domestic airlines, and of marine fuels and lubricants to ships in Canadian ports. The Shell Pecten trademark, which is owned in Canada by the Corporation, and related trademarks and brand names constitute a cornerstone of the Oil Products business. Shell’s retail market share for large urban markets in Canada was 17 per cent in 2006 (2005 — 17 per cent; 2004 — 17 per cent).

The number of Shell sites at December 31, 2006 was 1,635 (2005 — 1,681; 2004 — 1,762).

Revenues by Product

Reference is made to Note 2 “Segmented Information” of the Consolidated Financial Statements on pages 60 to 63 of the Annual Report.

Shell Canada sells 98 per cent of gasoline and middle distillates volumes to third parties and two per cent to SFJ Inc., which is considered a related party.

Source and Availability of Raw Materials

Shell Canada’s crude oil requirements were supplied from three major sources as shown in the table below. The majority of purchases were done through an affiliated company of Royal Dutch Shell plc. The definition of crude oil includes Scotford Upgrader feedstocks from the AOSP.

| | | | | | | | | | | | | |

|

| Crude Oil Requirements(%) | | 2006 | | 2005 | | 2004 |

|

| |

| Domestic industry production | | | 31 | | | | 25 | | | | 36 | |

| Shell Canada’s own production | | | 27 | | | | 30 | | | | 27 | |

| Imported production | | | 42 | | | | 45 | | | | 37 | |

|

| Total crude oil requirements | | | 100 | | | | 100 | | | | 100 | |

|

Seasonality

There were no significant seasonal fluctuations in the overall Oil Products business over the year and historically there have been no multi-year cycles.

Manufacturing

Shell Canada’s three operating refineries located at Sarnia, Ontario; Montreal, Quebec; and Fort Saskatchewan, Alberta, achieved average utilization rates of 86 per cent in 2006 (2005 — 87 per cent; 2004 — 89 per cent). In 2006, the construction of the$400-million ultra-low sulphur diesel projects at the Montreal and Scotford refineries was completed and commissioned safely, within budget and ahead of new federal regulations that took effect in June.

NARRATIVE DESCRIPTION OF THE BUSINESS 13

Shell Canada’s refineries continue to account for approximately 16 per cent (2005 — 16 per cent; 2004 — 16 per cent) of Canada’s operating refinery capacity in 2006. The location and rated capacity of each of Shell’s refineries at December 31, 2006 are shown below.

| | | | | | | | | |

|

| | | Daily Rated Capacity1 |

| Refinery | | (cubic metres) | | (barrels) |

|

| |

| Montreal East (Quebec) | | | 20 700 | | | | 130 000 | |

| Sarnia (Ontario) | | | 12 200 | | | | 77 000 | |

| Scotford (Alberta) | | | 19 000 | | | | 119 000 | |

|

| Total | | | 51 900 | | | | 326 000 | |

|

| | |

| | 1 | Rated capacity is based on definite specifications as to types of crude oil and Scotford Upgrader feedstocks, the products to be obtained and the refinery processes, taking into consideration an estimated allowance for normal annual maintenance shutdowns. Accordingly, capacity under actual operating conditions may be higher or lower than rated capacity. |

In 2006, Shell’s lubricant blending and packaging plant in Brockville, Ontario produced 173 million litres of lubricants, a two per cent decrease from 2005 volumes. 2006 also saw the facility embark on a$20-million capital expansion to allow for growth and flexibility to address current and future market demands.

The Calgary grease manufacturing facility produced approximately four million kilograms of soap-based and microgel-based greases in 2006. This represents an increase of nine per cent over 2005 volumes and the second consecutive year of record production volumes.

COMPETITIVE CONDITIONS

The oil and gas industry in Canada operates under federal, provincial and municipal legislation and regulations governing land tenure, royalties, production rates, environmental protection, exports, income and other matters.

The Canadian petroleum industry is highly competitive in all its aspects, including the exploration for and development of new sources of supply; the acquisition of oil and gas interests; the construction and operation of crude oil, natural gas and refined products pipelines; and the refining, distributing and marketing of petroleum products.

In the E&P and Oil Sands segments, acquisitions of exploration rights on Crown-owned lands in Canada are acquired through a competitive bidding process. Company-held exploration seismic and drilling data are generally considered trade secrets. Prices of all products are set by the Company based on market conditions and are subject to international competition.

In the Oil Sands segment, the Company has extensive minable leaseholdings adjacent to the initial Muskeg River Mine development. The other joint venture participants with interests in the initial Muskeg River Mine development have the option to participate in the future development of these other Shell Canada existing Athabasca oil sands leases. Shell Canada, in turn, has the option to participate in leases purchased in the region by the other AOSP joint venture participants.

TheInvestment Canada Actrequires Shell Canada, a statutory non-Canadian and World Trade Organization investor, to notify Industry Canada of all investments resulting in acquisition of control of an existing Canadian business, or the establishment of a new Canadian business where the transaction is not a reviewable transaction. Any direct investment in excess of $265 million in 2006 was reviewable (2007 — $281 million), and an indirect acquisition is reviewable if the value of the assets of the business located in Canada amounts to more than 50 per cent of the asset value of the transaction. Additional thresholds apply for the acquisition or establishment of particular types of Canadian businesses. In 2006, Shell Canada’s offer to purchase all of the outstanding common shares of BlackRock (including common shares issuable upon the exercise or surrender of options or convertible debentures) was a “reviewable transaction” under theInvestment Canada Act. Shell Canada filed an application for review with the Investment Review Division of Industry Canada and was granted the requisite approval to proceed with the acquisition. In granting the approval, the Minister of Industry determined that the transaction is likely to be of “net benefit to Canada” for the purposes of theInvestment Canada Act.

14 NARRATIVE DESCRIPTION OF THE BUSINESS

The BlackRock acquisition was also a “notifiable transaction” under theCompetition Act(Canada). Shell Canada requested the Commissioner of Competition to issue an advance ruling certificate and waive the obligation to submit a pre-merger notification for the transaction. The Commissioner of Competition granted the Company the requested relief, which constituted compliance with the requirements of the Competition Act(Canada).

In the Oil Products segment, market conditions and site economics of retail outlets support a continued asset rationalization program by the Company to improve operating efficiencies within its network.

RESEARCH AND DEVELOPMENT

Research and development expense was $44 million in 2006 (2005 — $41 million; 2004 — $28 million).

ENVIRONMENTAL PROTECTION

Shell Canada has a systematic approach to health, safety and environmental (HSE) management designed to ensure compliance with the law and to achieve continuous performance improvement. The HSE management system provides for identification and control of HSE-related hazards arising from the Company’s operationsand/or from the areas in which it operates. The Company’s E&P business has met the criteria for multi-site registration of its facilities and operations to International Standards Organization (ISO) 14001. In addition, all major facilities in the Oil Products manufacturing business and the operations in the Oil Sands business are ISO 14001 registered.

Total environmental expenditures for Shell Canada in 2006 and the previous two years are shown in the following table:

| | | | | | | | | | | | | |

| Environmental Expenditures($ millions) | | 2006 | | 2005 | | 2004 |

|

| |

| Operating costs | | | 94 | | | | 89 | | | | 70 | |

| Capital costs | | | 209 | | | | 313 | | | | 168 | |

| Restoration and reclamation | | | 69 | | | | 37 | | | | 40 | |

|

| | | | | | | | | | | | | |

| Total | | | 372 | | | | 439 | | | | 278 | |

|

Operating costs These include waste disposal, environmental operating costs (such as cost of energy and chemicals for environmental systems), maintenance (of plant systems to ensure continued environmentally sound performance), studies to determine environmental impact, monitoring and reporting requirements, salaries, environmental association fees, hearings, and legal costs and fines. Total health, safety and environmental fines and penalties paid in 2006 were approximately $11,000.

Capital costs These include the cost of new equipment and associated construction costs for pollution prevention and controlling air emissions, water discharges and waste management. A significant portion of the capital spent in 2006 ($60 million) was on a closed-loop cooling tower at the Muskeg River Mine. This tower is expected to improve the energy efficiency of the Solvent Recovery Unit heat exchangers and reduce greenhouse gas emissions from mining operations. The completion of the ultra-low-sulphur diesel project at Shell’s refineries resulted in a capital expenditure of $42 million.

Restoration and reclamation This includes the costs of spill cleanup, decommissioning and restoration and the protection or restoration of wildlife and habitat.

Environmental expenditures related to operating cost are expected to continue to increase over the next three years as Shell implements incremental programs initiated by the Federal, Provincial and Regional governments. Operating costs related to air emissions, emergency preparedness, the Chemicals Management Plan and fuel reformulations like ultra-low sulphur fuels are some of the more recent added operating costs. Environmental capital cost expenditures will likely be similar to 2006 levels with costs related to flare emission reduction, and refinery emission reductions necessitating further investments.

NARRATIVE DESCRIPTION OF THE BUSINESS 15

NUMBER OF EMPLOYEES

The number of employees at the end of 2006 was 4,793 compared with 4,564 at the end of 2005. The number of employees in each segment is as follows:

| | | | | | | | | | | | | |

| Number of Employees |

| As at December 31 | | 2006 | | 20051 | | 20041 |

| | | | | (restated) | | (restated) |

|

| |

| E&P | | | 950 | | | | 1 000 | | | | 805 | |

| Oil Products | | | 1 954 | | | | 2 078 | | | | 1 921 | |

| Oil Sands | | | 999 | | | | 665 | | | | 604 | |

| Corporate | | | 890 | | | | 821 | | | | 673 | |

|

| Total | | | 4 793 | | | | 4 564 | | | | 4 003 | |

|

| | |

| | 1 | 2004 and 2005 numbers were restated to reflect that effective January 1, 2006, the Peace River business, which operates an in situ bitumen facility near Peace River, was transferred from Shell Canada’s E&P to Oil Sands business and resulted in a reclassification of 99 employees from E&P to Oil Sands business. |

FOREIGN OPERATIONS

None of the Corporation’s segments depend upon foreign operations.

RISK FACTORS

Reference is made to the “Risk Management” sections on pages 15, 25, 33, 41, and 48 of the Annual Report.

16 NARRATIVE DESCRIPTION OF THE BUSINESS

| |

| Selected Consolidated Financial Information |  |

ANNUAL INFORMATION

Total Revenue

Reference is made to the “Consolidated Statement of Earnings and Retained Earnings” table, “Revenues” section on page 54 of the Annual Report.

Earnings in Total and on a Per Equity Share and Diluted Equity Share Basis

Reference is made to the “Consolidated Statement of Earnings and Retained Earnings” table on page 54 and the “Data Per Common Share” table on page 87 of the Annual Report.

Total Assets

Reference is made to the “Consolidated Balance Sheet” table on page 56 of the Annual Report.

Long-Term Financial Liabilities

Reference is made to the “Consolidated Balance Sheet” table on page 56 of the Annual Report.

Cash Dividends Declared Per Share

Reference is made to the “Data Per Common Share” table on page 87 of the Annual Report.

Factors Affecting Comparability

20041 Shell Canada’s modification to the existing options under the Long-term Incentive Plan (LTIP) resulted in an $85 million charge to earnings where share appreciation rights were attached. In its first full year of production, Oil Sands contributed $376 million to income. Due to the degree of uncertainty in terms of timing and realization of future benefits, the Company wrote off $32 million after-tax of front-end expenditures related to the Mackenzie Gas Project. The Company’s earnings were impacted by a number of significant dry hole write-offs, which included the Weymouth well for $28 million and the Onondaga well for $15 million. Oil Products earnings included a provision of $25 million for increased liability associated with the AIR MILES® Reward Miles program.

20051 The impact of the Company’s LTIP resulted in a$186-million charge to earnings due to strong appreciation in the share price during the year. The use of non-capital tax losses increased earnings by $164 million in 2005 and, along with proceeds from insurance settlements of $94 million, outweighed the effect of the higher LTIP charge. Physical damage claims related to the fire were previously settled with insurers. The Company also recorded a favourable tax settlement of $64 million related to prior year returns.

2006 The first major scheduled turnaround of Athabasca Oil Sands Project (AOSP) resulted in higher maintenance costs and lower production which, together with lower natural gas prices, created lower earnings. These were offset by higher oil prices and refining light oil margins, and a favourable adjustment in the second quarter of $222 million primarily resulting from changes to federal and Alberta corporate tax rates. LTIP charges were $44 million in 2006. The Company gained significant new in situ resources and additional production through its acquisition of BlackRock Ventures Inc. (BlackRock.)

| |

| ® | Trademark of AIR MILES International Trading B.V. Used under license by Loyalty Management Group Canada Inc. and Shell Canada Products. |

| |

| 1 | 2004 and 2005 earnings have been restated to reflect the retroactive adoption of Emerging Issues Committee (EIC) Abstract 162 “Stock-Based Compensation For Employees Eligible to Retire Before The Vesting Date” with prior period restatement as required. Reference is made to Note 1 of the Consolidated Financial Statements on pages 57 to 59 of the Annual Report. |

SELECTED CONSOLIDATED FINANCIAL INFORMATION 17

Trading Price and Volume

Reference is made to the “Stock-Trading Information” table on page 87 of the Annual Report.

The monthly financial and stock-trading information as quoted on the Toronto Stock Exchange (TSX) for 2006 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Share Price($) | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

| | | Jan | | Feb | | Mar | | Apr | | May | | Jun | | Jul | | Aug | | Sep | | Oct | | Nov | | Dec | | Total |

|

| |

| High | | | 47.19 | | | | 45.83 | | | | 41.92 | | | | 45.99 | | | | 42.65 | | | | 41.70 | | | | 42.50 | | | | 40.98 | | | | 36.71 | | | | 43.07 | | | | 43.71 | | | | 43.85 | | | | 47.19 | |

| Low | | | 39.59 | | | | 37.33 | | | | 37.69 | | | | 41.07 | | | | 37.50 | | | | 37.15 | | | | 38.28 | | | | 35.60 | | | | 29.51 | | | | 28.90 | | | | 42.62 | | | | 43.00 | | | | 28.90 | |

| Close | | | 44.50 | | | | 38.20 | | | | 41.05 | | | | 41.95 | | | | 40.03 | | | | 41.50 | | | | 39.43 | | | | 35.90 | | | | 31.35 | | | | 42.80 | | | | 43.35 | | | | 43.51 | | | | 43.51 | |

Volume(000) | | | 10 156 | | | | 10 353 | | | | 7 490 | | | | 7 610 | | | | 9 860 | | | | 6 841 | | | | 8 301 | | | | 10 004 | | | | 11 956 | | | | 49 219 | | | | 25 637 | | | | 10 722 | | | | 168 151 | |

|

Credit Ratings

Reference is made to page 44 of the Annual Report.

The credit ratings assigned to the Corporation are not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the rating organization.

DIVIDENDS

Dividends are declared at the discretion of the Board of Directors of the Corporation. In 2006, dividends declared and paid for the year totalled $0.440 per common share, up from $0.367 per common share in 2005.

Under the terms of the support agreement between Shell Investments Limited and the Company in connection with the offer by Royal Dutch Shell plc to acquire the minority shares of Shell Canada for cash consideration of $45.00 per common share, the Company has agreed to neither declare nor pay any dividend (other than quarterly cash dividends of $0.110 per common share in accordance with the Company’s past practice).

Reference is made to the “Summary of Quarterly Results” table and to the “Selected Annual Financial Information” table on page 8 of the Annual Report.

18 SELECTED CONSOLIDATED FINANCIAL INFORMATION

UNITED STATES GENERALLY ACCEPTED ACCOUNTING PRINCIPLES

Oil and Gas Disclosure

Disclosure, in accordance with Statement No. 69 of the United States Financial Accounting Standards Board (FASB), appears in Schedule I on pages 23 and 24 of this Annual Information Form.

United States Generally Accepted Accounting Principles

The significant differences between Canadian and United States generally accepted accounting principles (GAAP) are identified in Note 14 of the Consolidated Financial Statements on pages 74 to 76 of the Annual Report.

Accounting Policy

Exchange Transactions The Corporation enters into exchange transactions for inventory held for sale in the ordinary course of its business to balance regional supply and demand, increase transportation efficiencies and reduce overall cost of acquiring inventory. These transactions are accounted for using Accounting Principles Board Opinion No. 29Accounting for Nonmonetary Transactionsand are netted in cost of goods sold. These transactions do not have a material impact on the Corporation’s earnings.

The Emerging Issues Task Force (EITF) reached a consensus regarding EITF IssueNo. 04-13Accounting for Purchases and Sales of Inventory with the Same Counterpartythat a nonmonetary exchange whereby an entity transfers (a) raw materials or work in process (WIP) for raw materials or WIP or (b) finished goods inventory for finished goods inventory, should not be recognized at fair value. This EITF does not impact the Corporation’s current accounting treatment for nonmonetary exchange transactions.

Exploratory Drilling Costs

Pursuant to FASB Statement No. 19Financial Accounting Reporting by Oil and Gas Producing Companies, the Company’s exploratory drilling costs related to exploratory wells in an area that requires major capital expenditures are carried as an asset, provided that (a) there have been sufficient oil and gas reserves found to justify completion as a producing well if the required capital expenditure is made, and (b) drilling of additional exploratory wells is underway or firmly planned for the near future. The determination of whether or not reserves are sufficient is subject to establishing, through a well test, the volume of hydrocarbons that can be economically produced.

The following table provides the net change in capitalized exploration well costs:

| | | | | | | | | | | | | |

|

| ($ thousands) | | 2006 | | 2005 | | 2004 |

|

| |

Beginning balance at January 11 | | | 37 710 | | | | 44 106 | | | | 68 102 | |

| Additions to exploratory well costs pending the determination of proved well reserves | | | 180 149 | | | | 57 977 | | | | 101 790 | |

| Reclassification to well, facilities, and equipment based on the determination of proved reserves | | | (29 136 | ) | | | (29 777 | ) | | | (11 157 | ) |

| Exploratory well costs charged to expense | | | (23 931 | ) | | | (34 596 | ) | | | (114 629 | ) |

|

| Ending balance at December 31 | | | 164 792 | | | | 37 710 | | | | 44 106 | |

|

1 This table includes in situ costs.

SELECTED CONSOLIDATED FINANCIAL INFORMATION 19

New United States Generally Accepted Accounting Principles

New United States GAAP is identified on page 46 of the Annual Report.

Management’s Discussion and Analysis

Reference is made to pages 7 to 48 of the Annual Report.

Market for Securities and Transfer Agent

Reference is made to “Investor Information” on page 97 of the Annual Report.

Directors and Officers

Reference is made to the “Corporate Directory and Board of Directors” table on pages 88 to 92 of the Annual Report, the “Corporate Governance Practices” section on pages 93 to 96 of the Annual Report and Schedules VI, VII and VIII on pages 43 to 52, pages 53 to 65 and pages 66 to 83, respectively, of this Annual Information Form.

The following were officers of the Corporation as at December 31, 2006:

| | | |

|

| Name and Municipality of Residence | | Position and Office 1 |

|

| |

Clive Mather

Calgary, Alberta, Canada | | President and Chief Executive Officer |

|

David C. Aldous

Calgary, Alberta, Canada | | Senior Vice President, Oil Products |

|

| H. Ian Kilgour | | Senior Vice President, Exploration & Production |

| Calgary, Alberta, Canada | | |

|

Brian E. Straub

Calgary, Alberta, Canada | | Senior Vice President, Oil Sands |

|

Cathy L. Williams

Calgary, Alberta, Canada | | Chief Financial Officer |

|

Timothy J. Bancroft

Calgary, Alberta, Canada | | Vice President, Sustainable Development, Technology and Public Affairs |

|

Graham Bojé

Calgary, Alberta, Canada | | Vice President, Manufacturing and Supply |

|

David R. Brinley

Calgary, Alberta, Canada | | Vice President, General Counsel & Secretary |

|

David R. Collyer

Calgary, Alberta, Canada | | Vice President, Frontier |

|

| Ramzi Fawaz | | Vice President, Projects, Oil Sands |

| Calgary, Alberta, Canada | | |

|

R. David Fulton

Calgary, Alberta, Canada | | Vice President, Human Resources |

|

| | |

| | 1 | All of these officers of the Corporation have, for the past five years, been actively engaged in executive or employee capacities with the Corporation or its affiliates, except for David Stanford who was previously employed during this period as a partner with the law firm of McCarthy Tetrault LLP. |

20 SELECTED CONSOLIDATED FINANCIAL INFORMATION

| | | |

|

| Name and Municipality of Residence | | Position and Office 1 |

|

| |

Rob W.P. Symonds

Calgary, Alberta, Canada | | Vice President, Foothills |

|

Thomas G. Zengerly

Calgary, Alberta, Canada | | Vice President, Operations, Oil Sands |

|

Matthew B. Haney

Calgary, Alberta, Canada | | Treasurer |

|

Donna Tarka

Calgary, Alberta, Canada | | Controller |

|

Susan S. Boughs

Calgary, Alberta, Canada | | Chief Compliance Officer, Associate General Counsel, Regulatory & Compliance and Assistant Secretary |

|

Shannon L. Cosmescu

Calgary, Alberta, Canada | | Associate General Counsel, Corporate and Assistant Secretary |

|

John T.D. Courtright

Calgary, Alberta, Canada | | Associate General Counsel, Oil Sands and Assistant Secretary |

|

Richard W. Riegert

Calgary, Alberta, Canada | | Associate General Counsel, E&P and Assistant Secretary |

|

David Stanford

Calgary, Alberta, Canada | | Associate General Counsel, Oil Products and Assistant Secretary |

|

| | |

| | 1 | All of these officers of the Corporation have, for the past five years, been actively engaged in executive or employee capacities with the Corporation or its affiliates, except for David Stanford who was previously employed during this period as a partner with the law firm of McCarthy Tetrault LLP. |

The percentage of common shares of the Corporation owned beneficially, directly or indirectly, or over which control or direction is exercised by the directors, senior officers and any expert whose report is contained in this Annual Information Form (namely Bruce Roberts, Chief Reservoir Engineer of the Corporation, Allen G. Vanderputten, Chief Mining Engineer of the Corporation, Sproule Associates Limited and Pricewaterhouse Coopers LLP), as a group, is less than one per cent.

The Corporation has five committees of the Board of Directors. Reference is made to Schedule IX on pages 84 to 90 of this Annual Information Form for the Report of the Audit Committee. Reference is also made to pages 93 to 96 of the Annual Report for a discussion of the Corporation’s corporate governance practices.

Reference is made to “Interest of Informed Persons in Material Transactions” in Schedule X on page 91 of this Annual Information Form and Schedule VI on pages 43 to 52 of this Annual Information Form for identification of other entities that transact business with the Corporation of which a director of the Corporation also serves as a director or officer.

Auditors

Reference is made to Schedule XI on page 92 of this Annual Information Form for information pertaining to the Corporation’s auditors.

Majority Shareholder

Until July 20, 2005, Royal Dutch, a Netherlands company, and The “Shell” Transport and Trading Company, plc (Shell T&T), an English company, (together referred to as Royal Dutch/Shell) held, indirectly, approximately 78 per cent of the Corporation’s common shares. On July 20, 2005, Royal Dutch and Shell T&T were unified following receipt of shareholder approval and the satisfaction of applicable legal conditions. The unified entity, Royal Dutch Shell plc, holds, indirectly, approximately 78 per cent of the Corporation’s common shares. Royal Dutch Shell plc is an English company with headquarters in the Netherlands.

On July 29, 2004, Royal Dutch/Shell reached agreements in principle with the United Kingdom’s Financial Services Authority (FSA) and the staff of the United States Securities and Exchange Commission (SEC) to resolve their pending inquiries related to Royal Dutch/Shell’s reserves recategorization.

In connection with the agreement in principle with the FSA, Royal Dutch/Shell agreed, without admitting or denying the FSA’s findings or conclusions, to the entry of a Final Notice by the FSA finding that Royal Dutch/Shell breached market abuse provisions of the United Kingdom’s Financial Services and Markets Act 2000 and the Listing Rules made thereunder. In connection with the proposed settlement, Royal Dutch/Shell paid a penalty of £17 million.

In connection with the agreement in principle with the SEC, Royal Dutch/Shell consented, without admitting or denying the SEC’s findings or conclusions, to an administrative order finding that Royal Dutch/Shell violated, and requiring Royal Dutch/Shell to cease and desist from future violations of, the antifraud, reporting, record-keeping and internal control provisions of the U.S. Federal securities laws and related SEC rules. In connection with the proposed settlement, Royal Dutch/Shell paid a US$120 million civil penalty and undertook to spend an additional US$5 million developing a comprehensive internal compliance program.

Additional Information

AVAILABILITY OF DOCUMENTS

Copies of the following documents are available upon request from the Corporation’s Secretary: the Annual Information Form for 2006, together with the documents incorporated by reference therein; the Proxy Circular for the most recent annual meeting of shareholders; the Corporation’s Annual Report containing comparative financial statements for 2006, together with the Auditors’ Report thereon; and the Management’s Discussion and Analysis and interim financial statements filed subsequent to December 31, 2006.

When securities of the Corporation are in the course of a distribution pursuant to a short form prospectus, or a preliminary short form prospectus, copies of the foregoing documents and any other documents that are incorporated by reference into a preliminary short form prospectus, or short form prospectus, may also be obtained from the Corporation’s Secretary upon request.

Additional information including directors’ and officers’ remuneration and indebtedness, principal holders of the Corporation’s securities and options to purchase securities is contained in Schedules VIII and XII on pages 66 to 83 and page 93, respectively, of this Annual Information Form. Additional financial information is provided in the Corporation’s Consolidated Financial Statements and Management’s Discussion and Analysis for its most recently completed financial year.

Additional information relating to Shell Canada filed with Canadian and U.S. securities regulatory authorities, including this Annual Information Form and theForm 40-F, can be found online under Shell Canada’s profile atwww.sedar.comandwww.sec.gov.

22 ADDITIONAL INFORMATION

| |

| Schedule I |  |

(UNAUDITED)

OIL AND GAS AND IN SITU BITUMEN DISCLOSURE

The following conventional oil and gas reserves and in situ bitumen disclosure has been prepared in reliance on a decision of the applicable Canadian securities regulatory authorities under National Instrument51-101 —Standards of Disclosure for Oil and Gas Activities(NI51-101), which permits the Corporation to present this disclosure in accordance with the applicable requirements of FASB Statement No. 69 (FAS 69) Disclosures about Oil and Gas Producing Activities. The United States Securities and Exchange Commission (SEC) has adopted this standard as a comprehensive set of disclosure requirements for conventional oil and gas producing activities. The format of this disclosure adheres to the requirements outlined in paragraphs 10 to 34 of FAS 69. This information differs from the corresponding information required by NI51-101. Reference is made to Exploration & Production on page 3 of this Annual Information Form for a discussion of these differences.

This disclosure is unaudited and includes in situ bitumen but excludes minable bitumen. No independent qualified reserves evaluator or auditor has been involved in the preparation of this disclosure, with the exception of the disclosure relative to the properties acquired by the Corporation through its acquisition of BlackRock Ventures Inc. (BlackRock) in 2006 which has been prepared by an independent qualified reserves evaluator.

| | | | | | | | | | | | | |

| As at December 31 ($ millions) | | 2006 | | 2005 | | 2004 |

|

| |

CAPITALIZED COSTS | | | | | | | | | | | | |

| Unproved oil and gas reserves | | | 3 014 | | | | 426 | | | | 209 | |

| Proved oil and gas reserves | | | 6 739 | | | | 5 442 | | | | 4 877 | |

|

| | | | 9 753 | | | | 5 868 | | | | 5 086 | |

| Accumulated depreciation, depletion and amortization | | | 3 517 | | | | 3 231 | | | | 3 016 | |

|

Net capitalized costs | | | 6 236 | | | | 2 637 | | | | 2 070 | |

|

| | | | | | | | | | | | | |

| Year ended December 31 ($ millions) | | 2006 | �� | 2005 | | 2004 |

|

| |

COSTS INCURRED | | | | | | | | | | | | |

| Property acquisition | | | 93 | | | | 260 | | | | 26 | |

| Exploration costs | | | 288 | | | | 146 | | | | 171 | |

| Development costs | | | 966 | | | | 542 | | | | 323 | |

|

Total costs incurred | | | 1 347 | | | | 948 | | | | 520 | |

|

| | | | | | | | | | | | | |

| Year ended December 31 ($ millions) | | 2006 | | 2005 | | 2004 |

|

RESULTS OF OPERATIONS FROM PRODUCING ACTIVITIES | | | | | | | | | | | | |

| Revenues | | | 2 447 | | | | 2 799 | | | | 2 361 | |

| Operating expenses | | | 841 | | | | 961 | | | | 749 | |

| Transportation expenses | | | 306 | | | | 331 | | | | 309 | |

| Exploration and predevelopment expenses | | | 176 | | | | 156 | | | | 221 | |

| Depreciation, depletion, amortization and retirements | | | 415 | | | | 366 | | | | 353 | |

| Income tax | | | 182 | | | | 336 | | | | 275 | |

|

Results of operations from producing activities | | | 527 | | | | 649 | | | | 454 | |

|

Standardized Measure of Discounted Future Net Cash Flows

The following future net revenue information, in management’s view, does not purport to represent an accurate or fair estimate of the value of the Corporation’s conventional oil and gas and in situ operations. The information should be interpreted with considerable caution since actual future cash flows will differ from future net cash flows presented because, among other things:

| | |

| | (a) | future cash flows will be derived not only from proved reserves but also from probable and potential reserves that ultimately become proved; |

| |

| | (b) | future-year rather than current-year costs and prices will apply; |

| | |

| | (c) | economic, regulatory and operating conditions will change; and |

| | |

| | (d) | this computation excludes cash flows from minable bitumen activities. |

The information includes cash flows related to the in situ bitumen operations but does not include minable bitumen.

| | | | | | | | | | | | | |

| As at December 31 ($ millions) | | 2006 | | 2005 | | 2004 |

|

| |

| | | | | | | | | | | | | |

FUTURE NET CASH FLOWS | | | | | | | | | | | | |

| Future cash inflow | | | 11 700 | | | | 15 281 | | | | 10 776 | |

| Future operating and development costs | | | 6 542 | | | | 4 596 | | | | 4 029 | |

| Future income taxes | | | 1 396 | | | | 3 392 | | | | 2 045 | |

|

Future net cash flows 1 | | | 3 762 | | | | 7 293 | | | | 4 702 | |

| 10% annual discount for estimated timing of cash flows | | | 1 193 | | | | 2 624 | | | | 1 720 | |

|

Standardized measure of discounted future net cash flows

from proved oil and gas reserves | | | 2 569 | | | | 4 669 | | | | 2 982 | |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

CHANGES IN FUTURE NET CASH FLOWS | | | | | | | | | | | | |

| Balance at beginning of year | | | 4 669 | | | | 2 982 | | | | 3 209 | |

| Changes resulting from: | | | | | | | | | | | | |

| Sales, net of operating costs | | | (876 | ) | | | (1 528 | ) | | | (1 016 | ) |

| Net changes in prices, development and operating costs | | | (4 620 | ) | | | 2 212 | | | | (226 | ) |

| Extensions, discoveries and improved recoveries, less related costs | | | 210 | | | | 1 065 | | | | 597 | |

| Development costs incurred during the period | | | 927 | | | | 509 | | | | 319 | |

| Revisions of previous quantity estimates | | | (89 | ) | | | (101 | ) | | | (265 | ) |

| Purchases (sales) of reserves in place | | | 600 | | | | 53 | | | | (173 | ) |

| Accretion of discount | | | 562 | | | | 348 | | | | 382 | |

| Net changes in income taxes | | | 1 186 | | | | (871 | ) | | | 155 | |

|

| Net increase (decrease) for the year | | | (2 100 | ) | | | 1 687 | | | | (227 | ) |

|

Balance at end of year | | | 2 569 | | | | 4 669 | | | | 2 982 | |

|

| | |

| | 1 | Future net cash flows were computed using year-end prices and costs, and year-end statutory tax rates that relate to existing proved developed and undeveloped oil and gas reserves. |

Since the beginning of the Company’s 2006 fiscal year, the Company has not filed or furnished reserves estimates with any authority or agency of the United States other than the U.S. SEC.

| |

| Schedule II |  |

OIL SANDS MINING DISCLOSURE

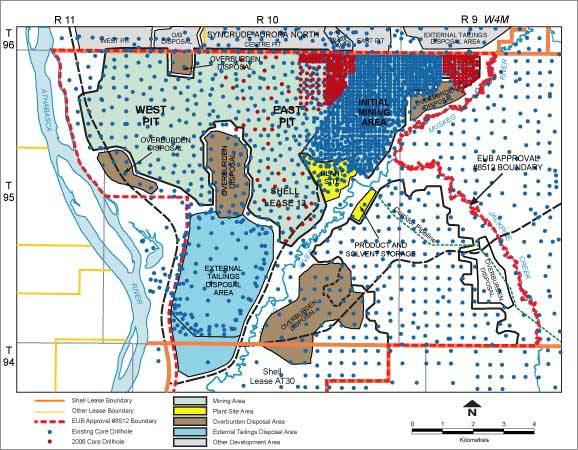

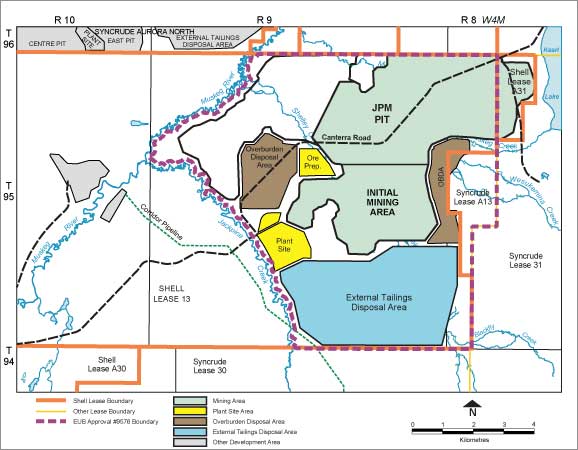

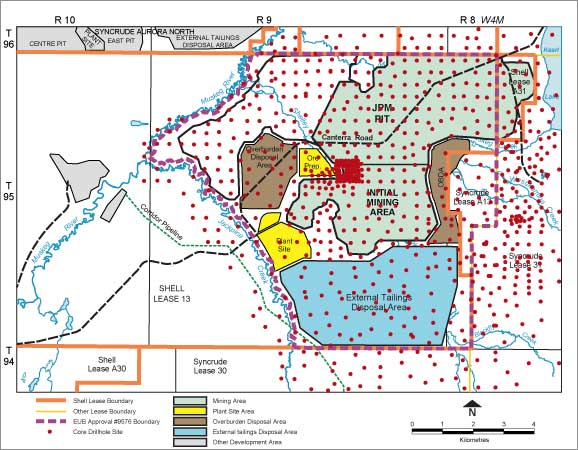

Shell Surface Minable Development History