Bond Index, which tracks investment-grade municipal securities, returned +4.18%.6 In comparison, the Barclays U.S. Treasury Index returned +0.57%.6 The tax-exempt nature of most municipal bond coupon payments included in the Barclays Municipal Bond Index further enhanced the relative strength of municipal bond performance for the six months under review.

In a September 13, 2012, news release, the Federal Open Market Committee (FOMC) cited continued elevated unemployment levels, slowing increases to business spending and sluggish home prices as reasons to augment its highly accommodative monetary policy. Beyond keeping the federal funds target rate extremely low, the FOMC stated its intention to buy $40 billion a month in mortgages for the foreseeable future. The FOMC also intended to continue its current program of buying long-term Treasury bonds and selling short-term Treasury bills and notes, commonly called Operation Twist, through the remainder of 2012. The Fed s actions during the period under review benefited the U.S. Treasury market and the municipal bond market.

Federal Reserve Board Chairman Ben Bernanke spoke on August 31, 2012, about state and local government austerity measures as a headwind to the pace of economic growth, adding that state and local governments had made real cuts to spending and employment. Spending cuts included reducing borrowing costs by issuing new debt at a lower rate and refinancing outstanding debt. New issuance increased during the first 11 months of 2012 compared with the same period in 2011, albeit from levels that were the lowest for new municipal bond issuance in a decade. Almost half of municipalities primary market issuance was for the purpose of refinancing outstanding debt. Year-to-date in 2012, the dollar amount of bonds issued for refinancing far outpaced the same period in 2011, but such bonds generally do not affect the total amount of outstanding municipal bonds. In contrast, bonds issued for new projects were more limited, resulting in low net supply of investment opportunities for municipal bond buyers. The scarcity of new bonds drove prices higher during the period.

At period-end, we maintained our positive view of the municipal bond market. We believe municipal bonds continue to be an attractive asset class among fixed income securities, and we intend to follow our solid discipline of investing to maximize income while seeking value in the municipal bond market.

6. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Semiannual Report | 7

Franklin New York Tax-Free Income Fund

Notes to Financial Statements (unaudited)

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

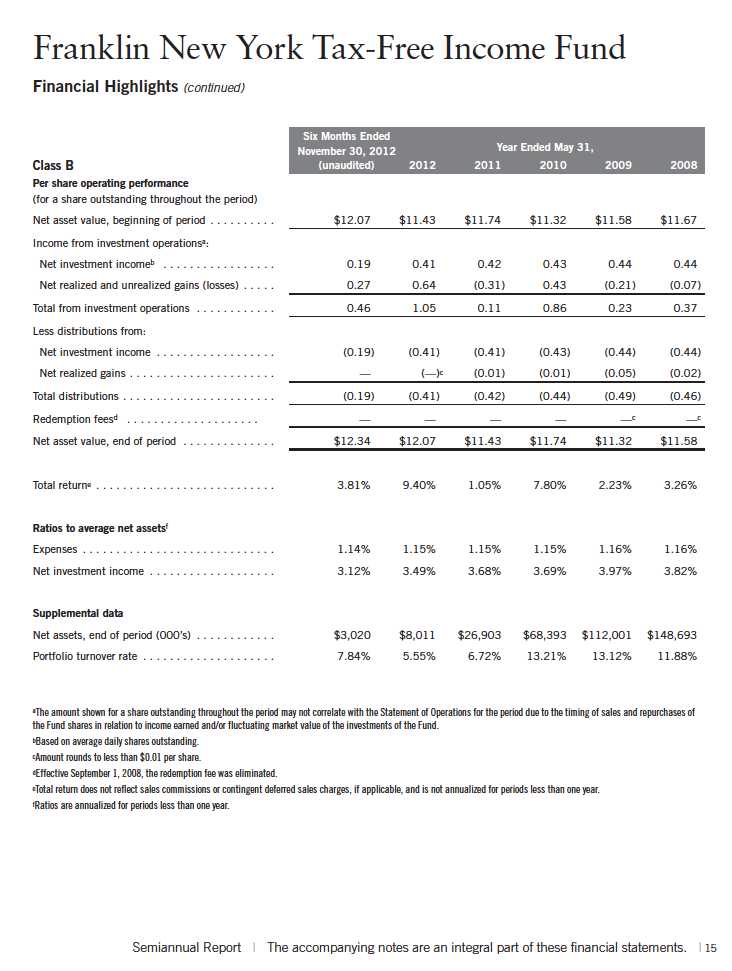

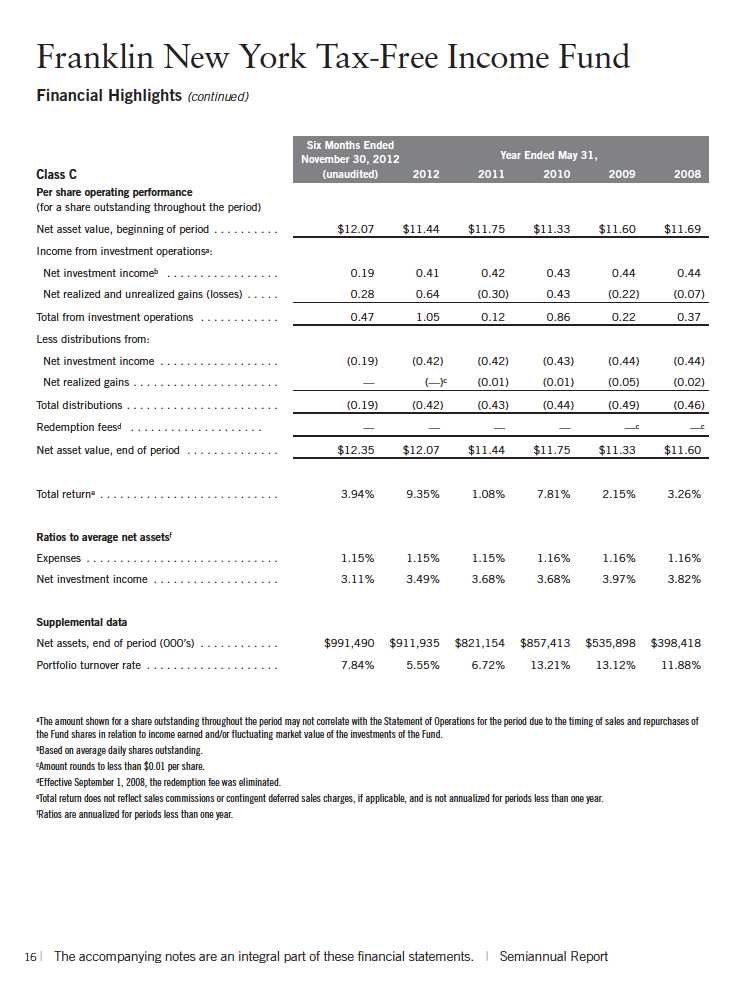

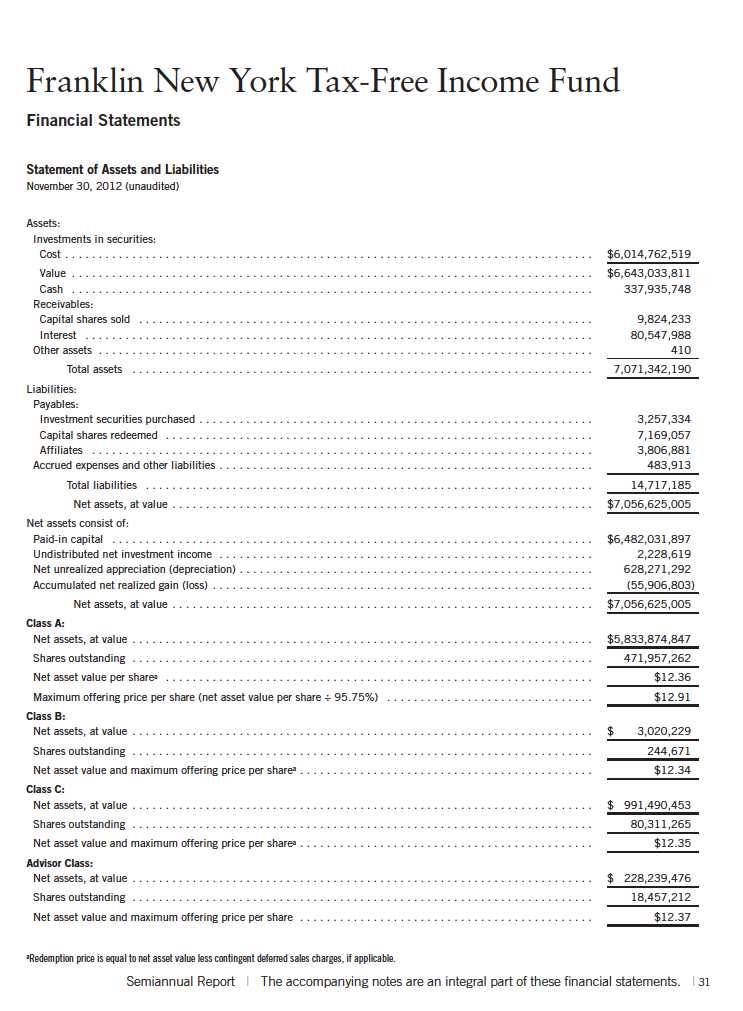

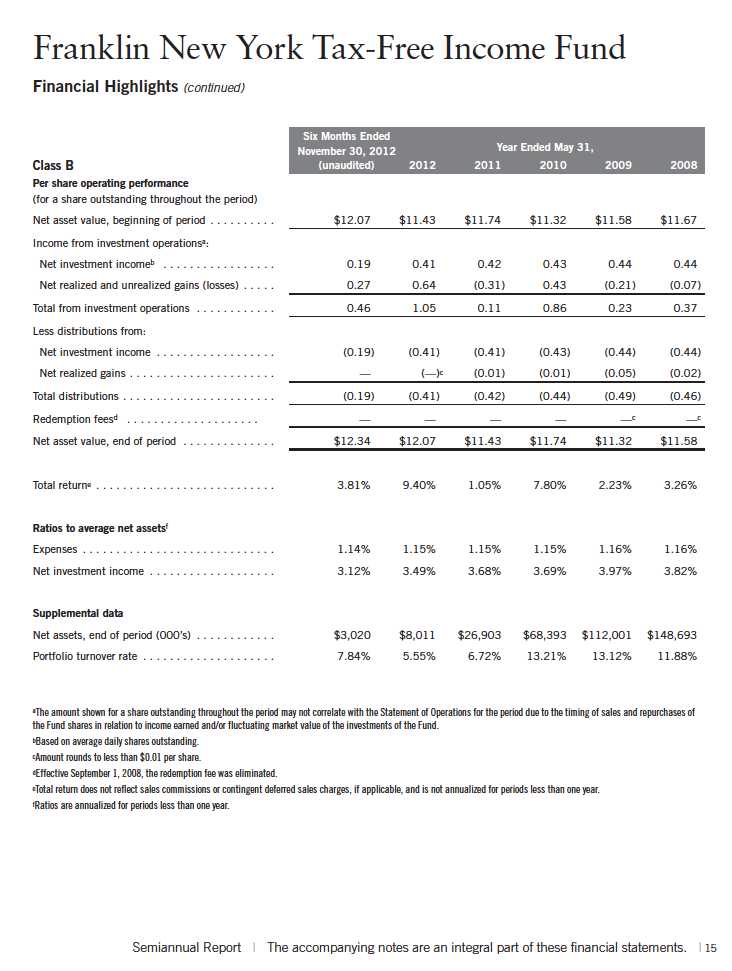

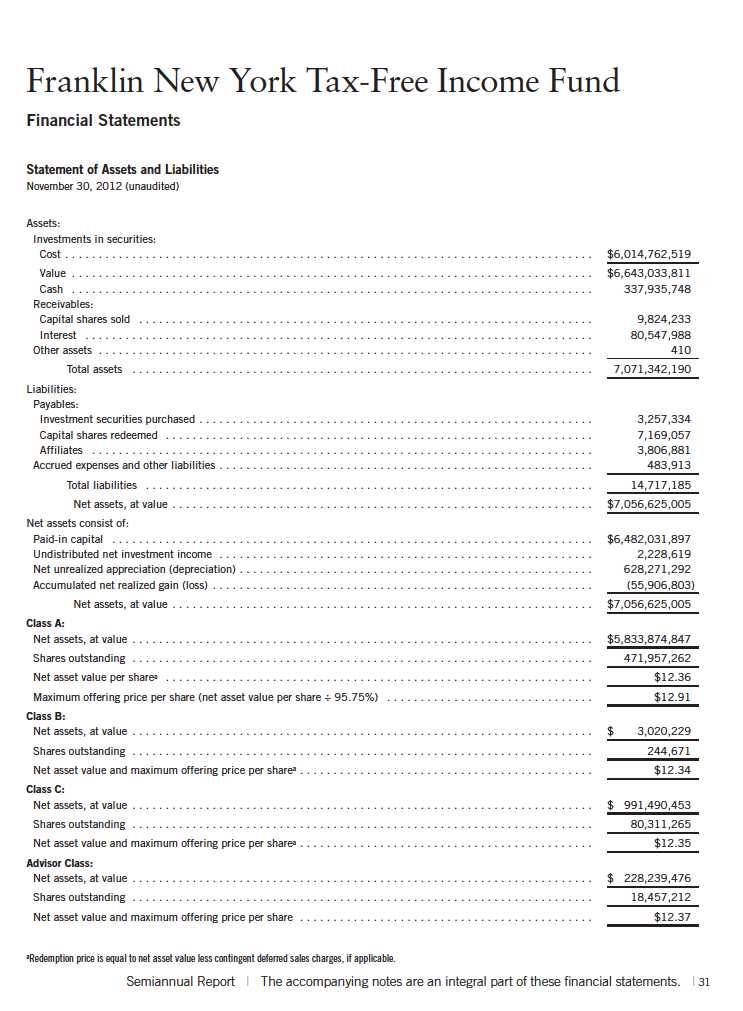

Franklin New York Tax-Free Income Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end investment company. The Fund offers four classes of shares: Class A, Class B, Class C, and Advisor Class. Effective March 1, 2005, the Fund no longer offered Class B for purchase. As disclosed in the fund prospectus Class B shares convert to Class A shares after eight years of investment, therefore all Class B shares will convert to Class A by March 2013. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund s significant accounting policies.

a. Financial Instrument Valuation

The Fund s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Fund s Board of Trustees (the Board), the Fund s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund s evaluation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair

34 | Semiannual Report

Franklin New York Tax-Free Income Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

b. Securities Purchased on a When-Issued Basis

The Fund purchases securities on a when-issued basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Fund will generally purchase these securities with the intention of holding the securities, it may sell the securities before the settlement date. Sufficient assets have been segregated for these securities.

c. Income Taxes

It is the Fund s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of November 30, 2012, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

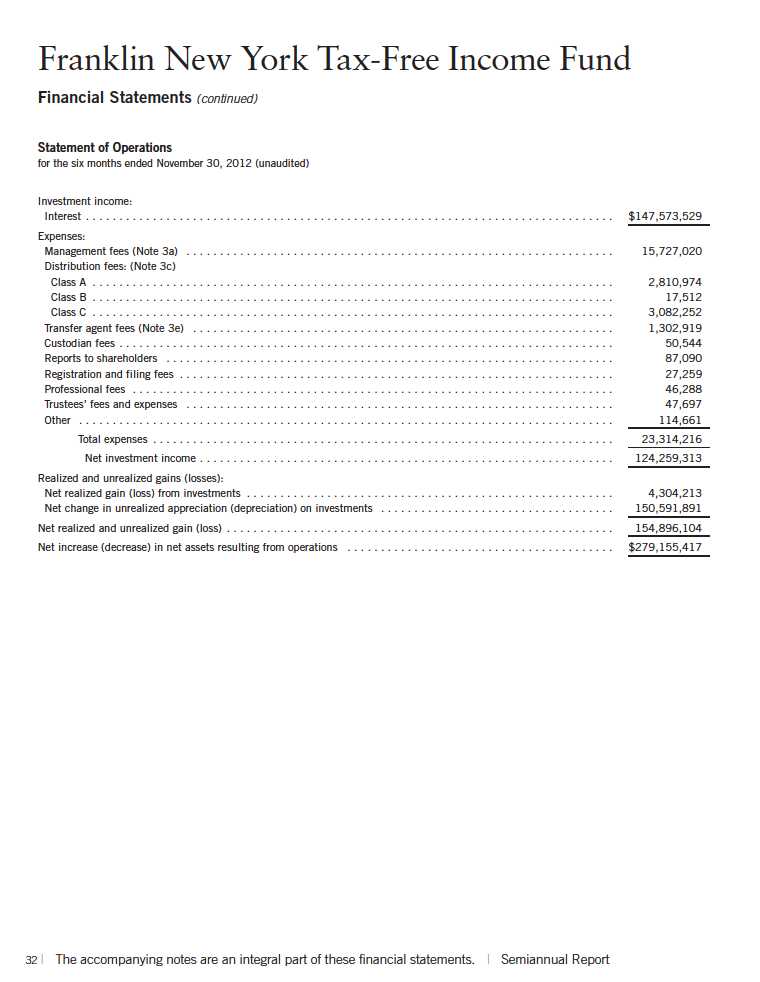

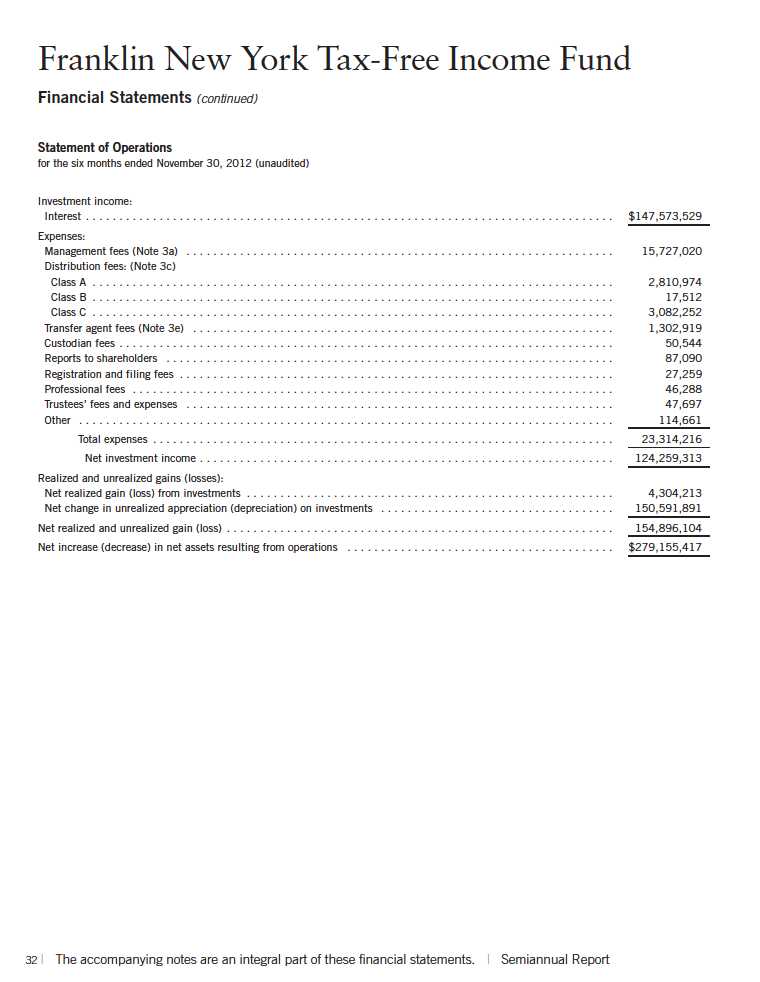

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Semiannual Report | 35

Franklin New York Tax-Free Income Fund

Notes to Financial Statements (unaudited) (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| d. | Security Transactions, Investment Income, Expenses and Distributions (continued) |

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

e. Insurance

The scheduled payments of interest and principal for each insured municipal security in the Fund are insured by either a new issue insurance policy or a secondary insurance policy. Some municipal securities in the Fund are secured by collateral guaranteed by an agency of the U.S. government. Depending on the type of coverage, premiums for insurance are either added to the cost basis of the security or paid by a third party.

Insurance companies typically insure municipal bonds that tend to be of very high quality, with the majority of underlying municipal bonds rated A or better. However, an event involving an insurer could have an adverse effect on the value of the securities insured by that insurance company. There is no guarantee the insurer will be able to fulfill its obligations under the terms of the policy.

f. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

g. Guarantees and Indemnifications

Under the Fund s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

36 | Semiannual Report

Franklin New York Tax-Free Income Fund

Notes to Financial Statements (unaudited) (continued)

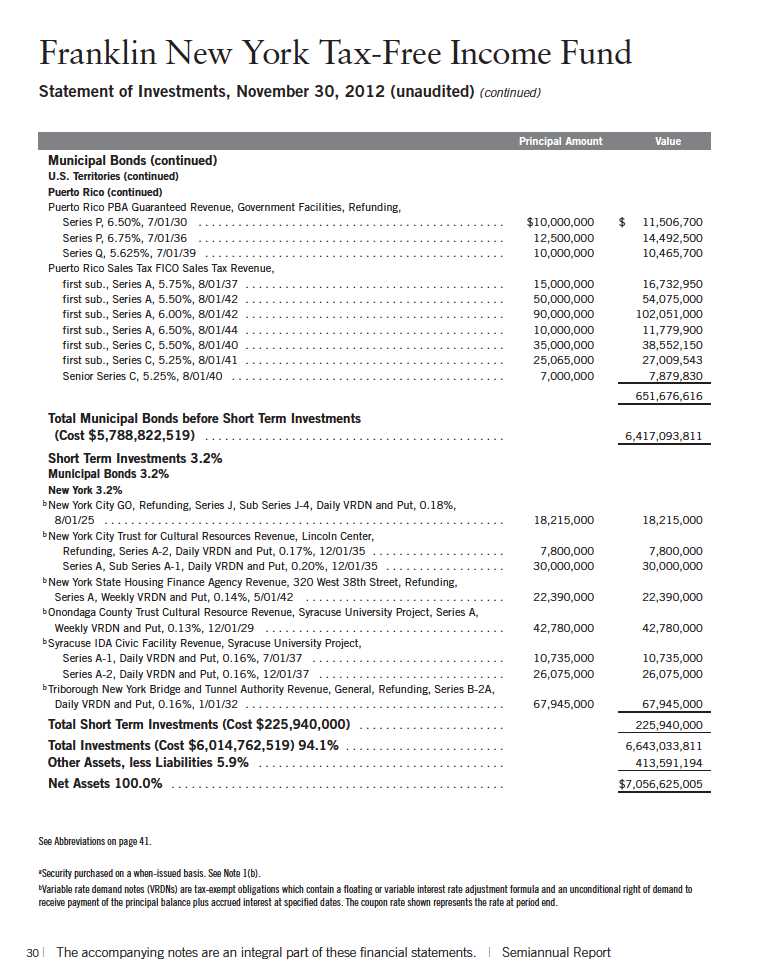

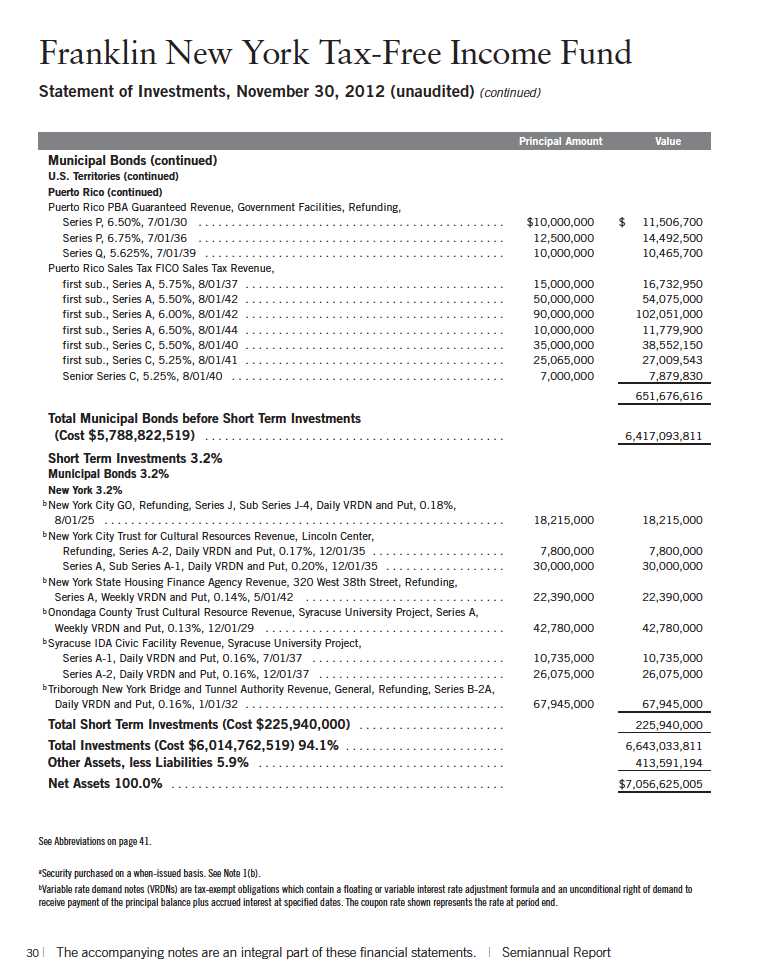

5. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities) for the period ended November 30, 2012, aggregated $510,822,389 and $684,785,311, respectively.

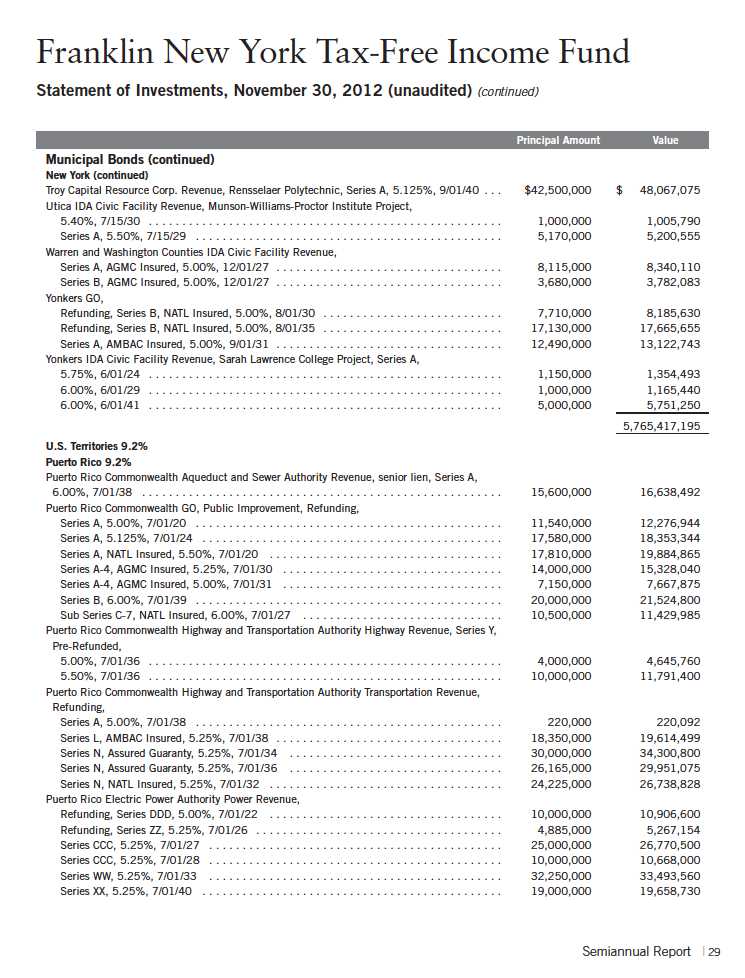

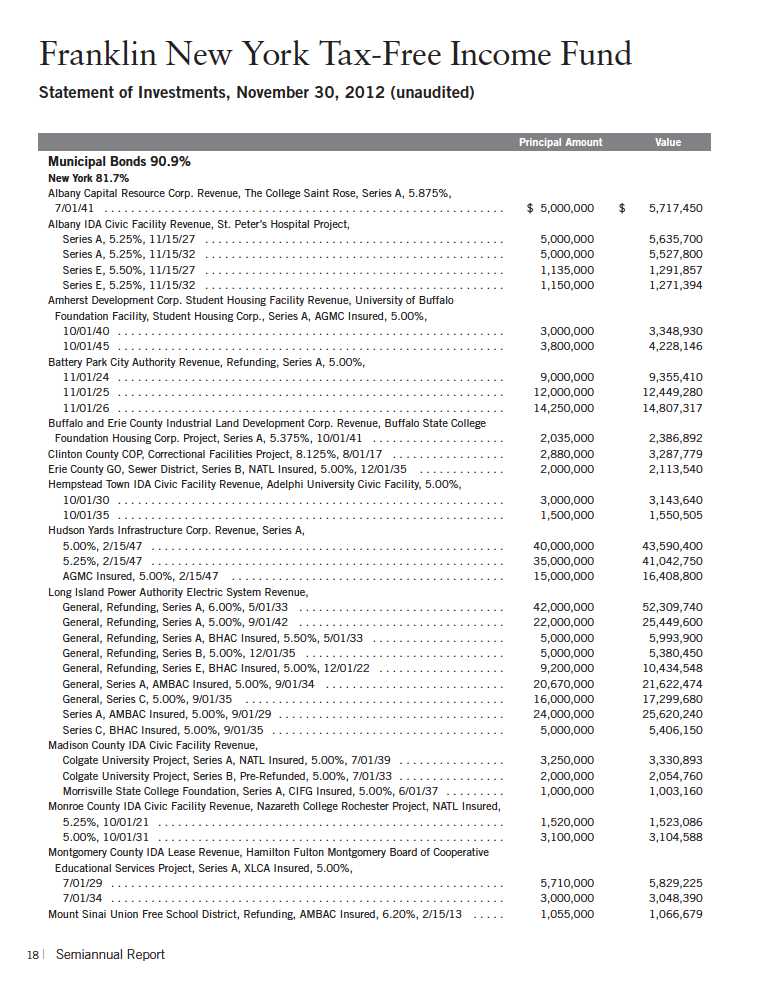

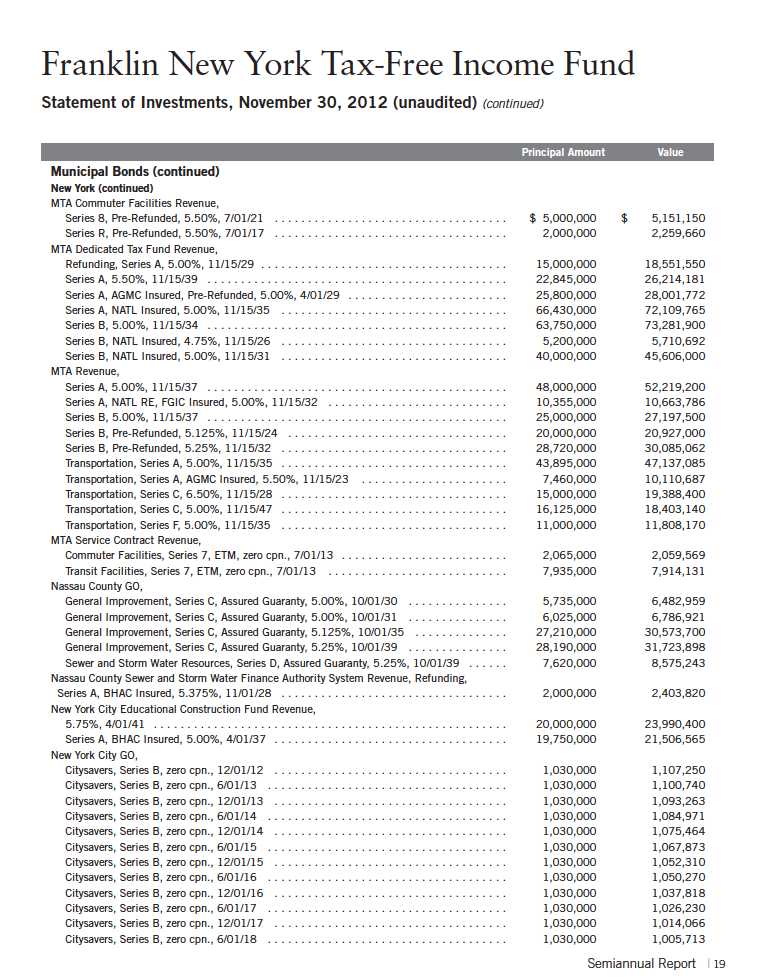

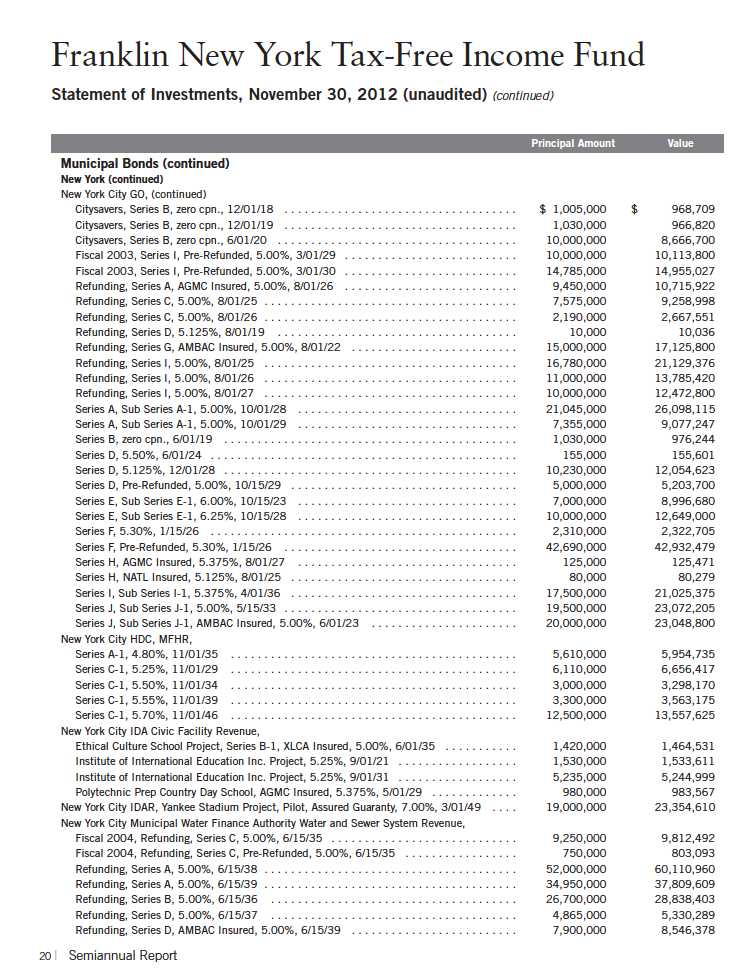

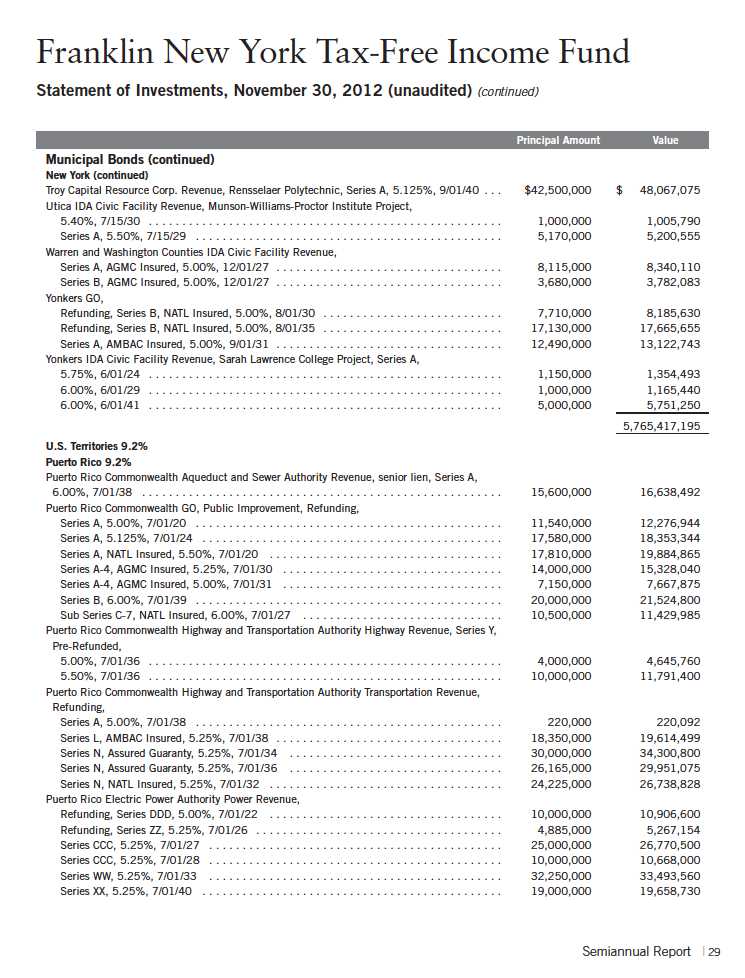

6. CONCENTRATION OF RISK

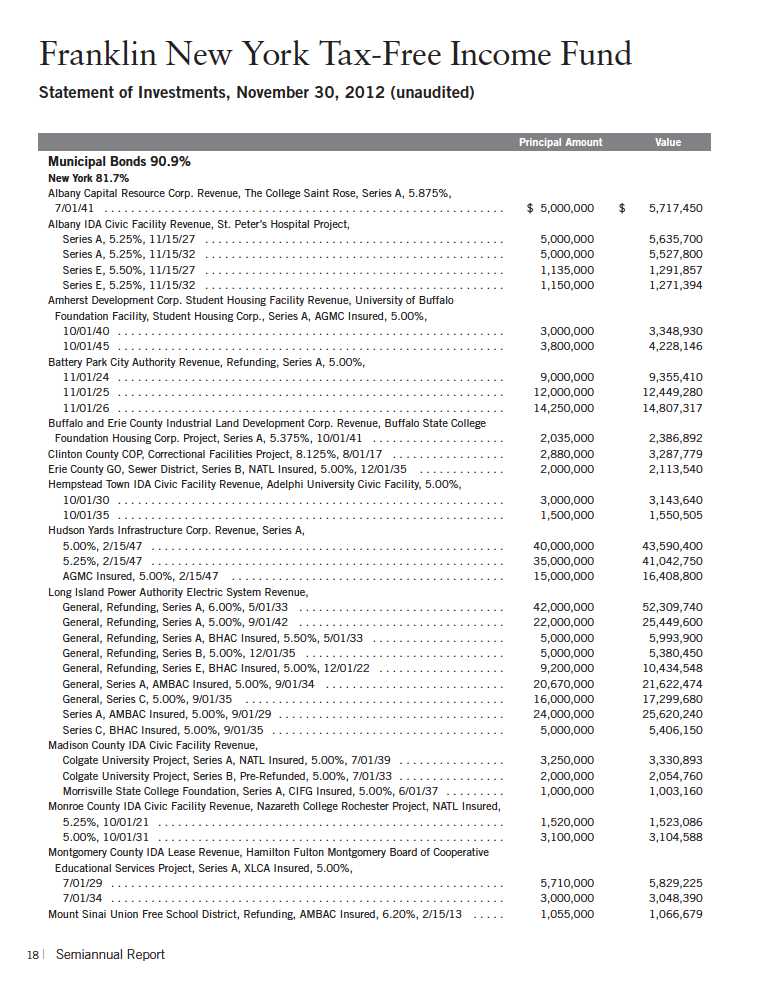

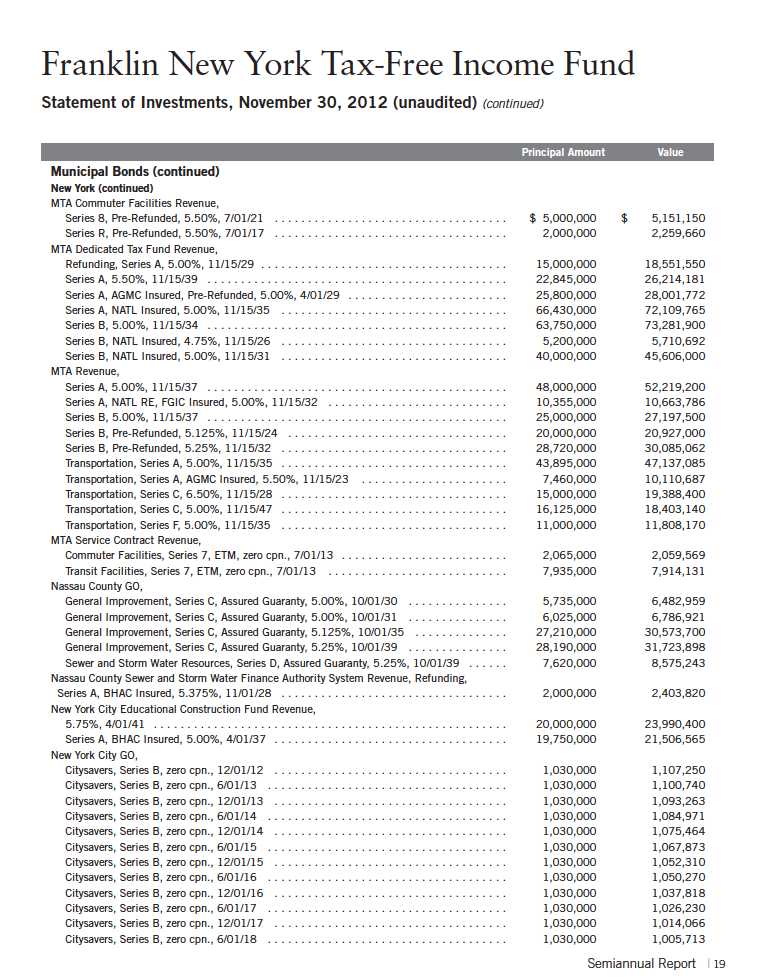

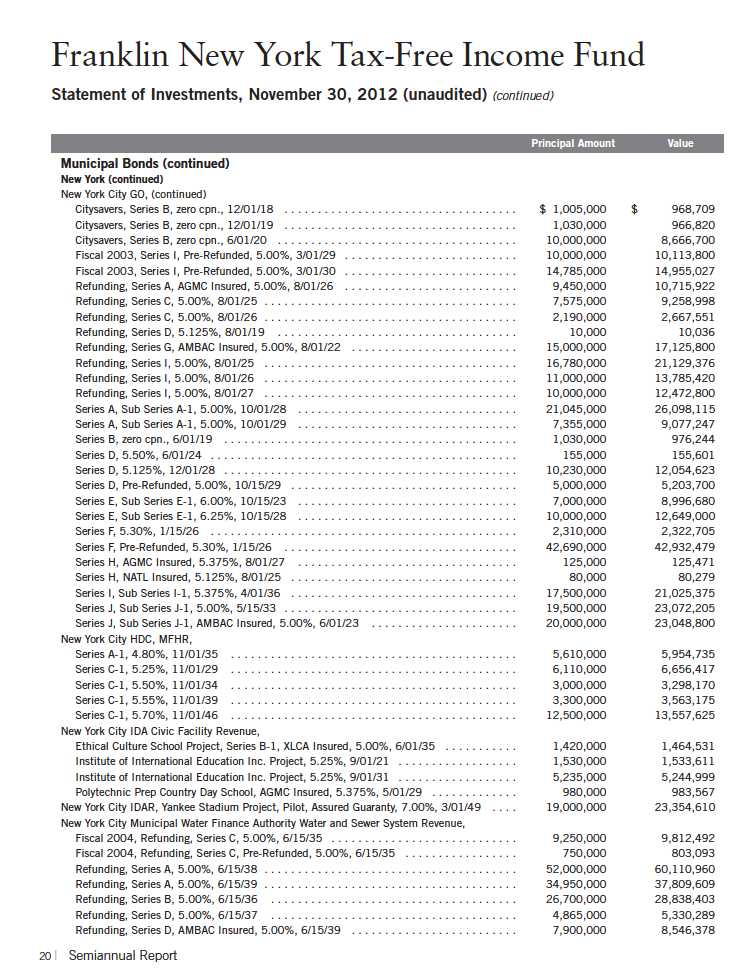

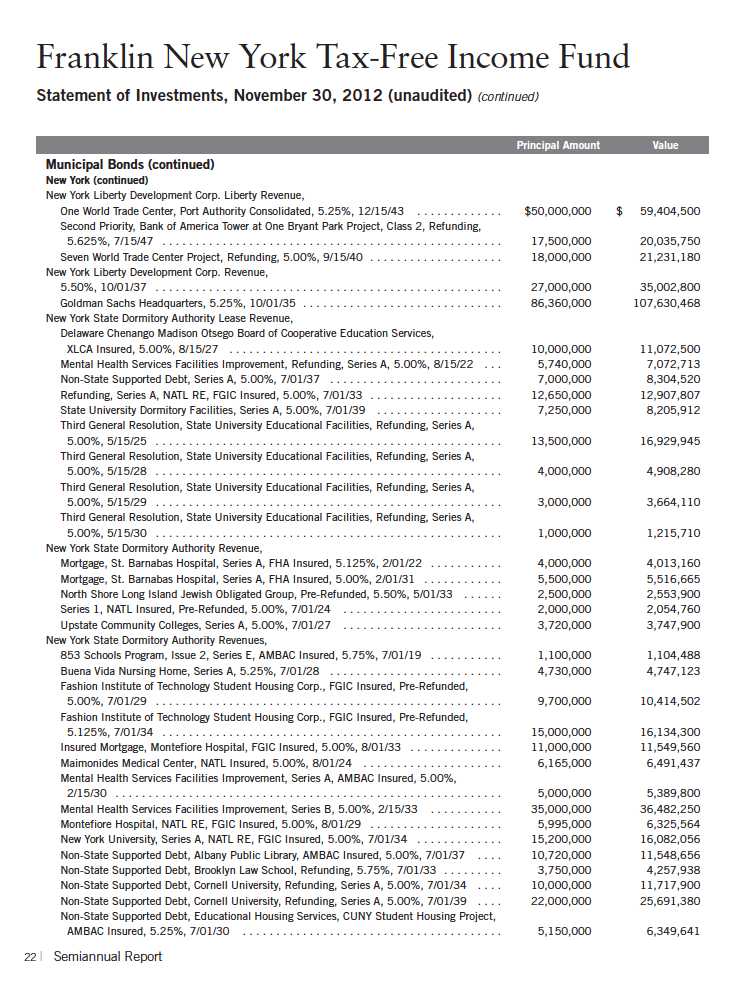

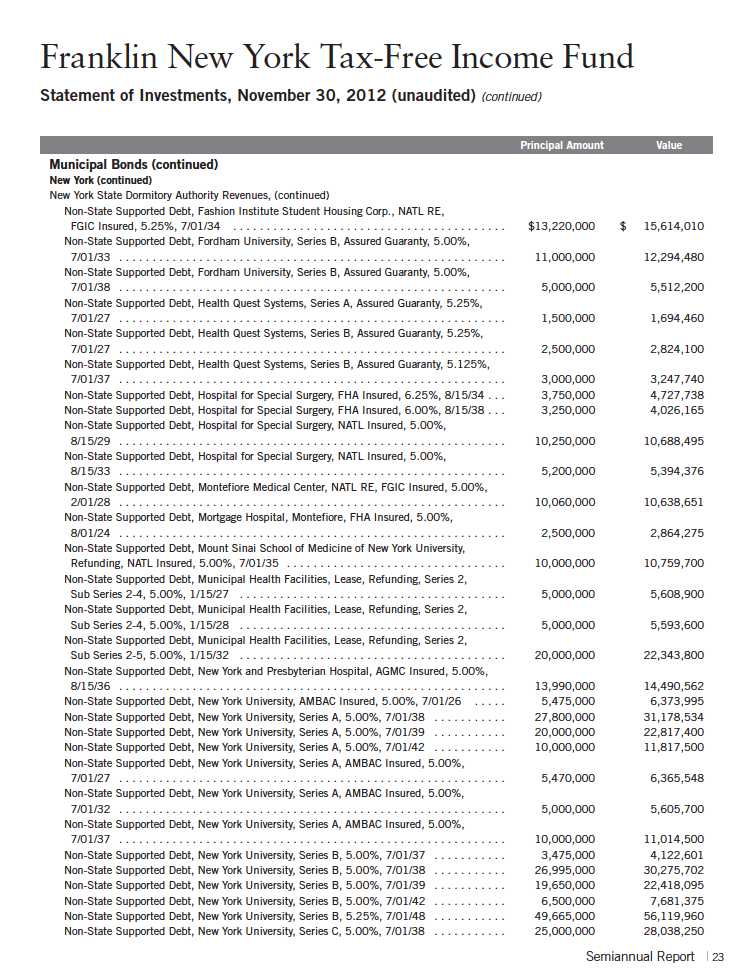

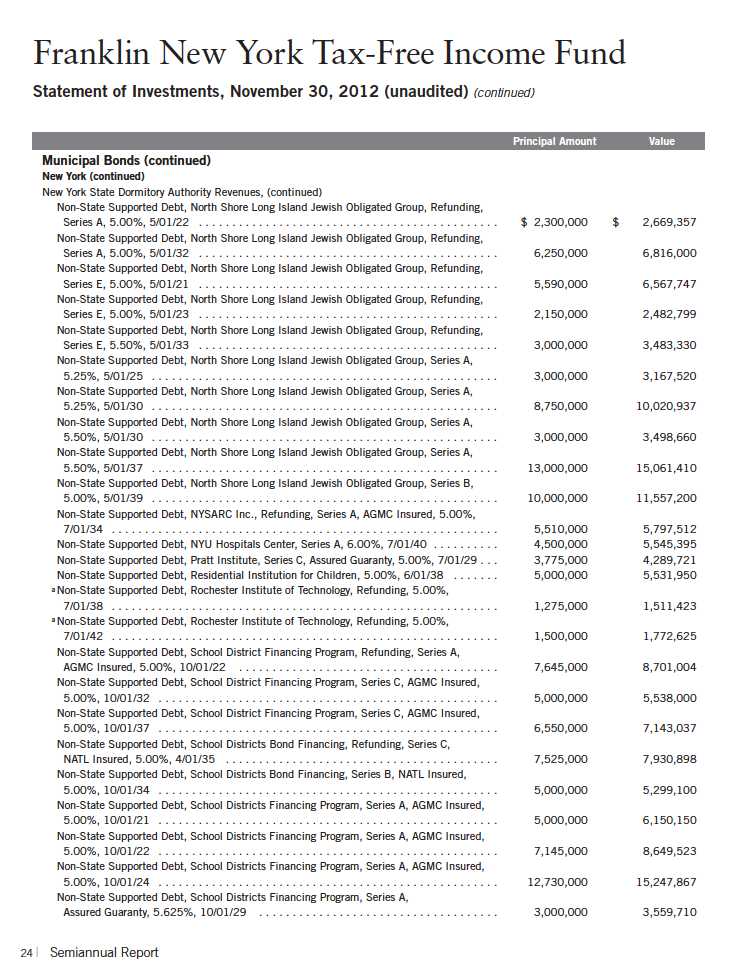

The Fund invests a large percentage of its total assets in obligations of issuers within New York and U.S. territories. Such concentration may subject the Funds to risks associated with industrial or regional matters, and economic, political or legal developments occurring within New York and U.S. territories. In addition, investments in these securities are sensitive to interest rate changes and credit risk of the issuer and may subject the funds to increased market volatility. The market for these investments may be limited, which may make them difficult to buy or sell.

7. CREDIT FACILITY

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $1.5 billion (Global Credit Facility) which matures on January 18, 2013. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.08% based upon the unused portion of the Global Credit Facility, which is reflected in other expenses on the Statement of Operations. During the period ended November 30, 2012, the Fund did not use the Global Credit Facility.

8. FAIR VALUE MEASUREMENTS

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund s financial instruments and are summarized in the following fair value hierarchy:

- Level 1 quoted prices in active markets for identical financial instruments

- Level 2 other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 significant unobservable inputs (including the Fund s own assumptions in determining the fair value of financial instruments)

40 | Semiannual Report

Franklin New York Tax-Free Income Fund

Notes to Financial Statements (unaudited) (continued)

8. FAIR VALUE MEASUREMENTS (continued)

The inputs or methodology used for valuing financial instruments are not an indication of the risk associated with investing in those financial instruments.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At November 30, 2012, all of the Fund s investments in financial instruments carried at fair value were valued using Level 2 inputs.

9. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

| | | |

| ABBREVIATIONS | | |

| |

| Selected Portfolio | | |

| |

| AGMC | - Assured Guaranty Municipal Corp. | IDA | -IndustrialDevelopment Authority/Agency |

| AMBAC | - American Municipal Bond Assurance Corp. | IDAR | -IndustrialDevelopment Authority Revenue |

| BHAC | - Berkshire Hathaway Assurance Corp. | MFH | - Multi-Family Housing |

| CIFG | - CDC IXIS Financial Guaranty | MFHR | - Multi-Family Housing Revenue |

| COP | - Certificate of Participation | MTA | - Metropolitan Transit Authority |

| CSD | -CentralSchool District | NATL | - National Public Financial Guarantee Corp. |

| ETM | - Escrow to Maturity | NATL RE | - National Public Financial Guarantee Corp. |

| FGIC | -FinancialGuaranty Insurance Co. | | Reinsured |

| FHA | - Federal Housing Authority/Agency | PBA | - Public Building Authority |

| FICO | -FinancingCorp. | PCR | - Pollution Control Revenue |

| GNMA | - Government National Mortgage Association | XLCA | - XL Capital Assurance |

| GO | -GeneralObligation | | |

| HDC | - Housing Development Corp. | | |

| HFA | - Housing Finance Authority/Agency | | |

| HFAR | - Housing Finance Authority Revenue | | |

Semiannual Report | 41

Franklin New York Tax-Free Income Fund

Shareholder Information

Proxy Voting Policies and Procedures

The Fund s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission s website at sec.gov. The filed form may also be viewed and copied at the Commission s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

42 | Semiannual Report

This page intentionally left blank.

This page intentionally left blank.