Schedule 14A Information

Proxy Statement Pursuant to Section 14(A) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[X] Preliminary Proxy Statement [ ] Confidential, for Use of the Commission

[ ] Definitive Proxy Statement Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Additional Materials

[ ] Soliciting Material under Section 240.14a-12

FRANKLIN TAX-FREE TRUST

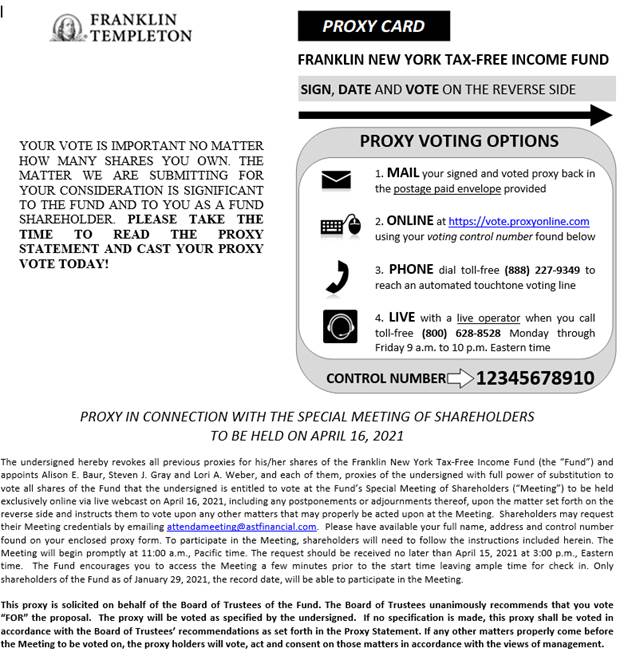

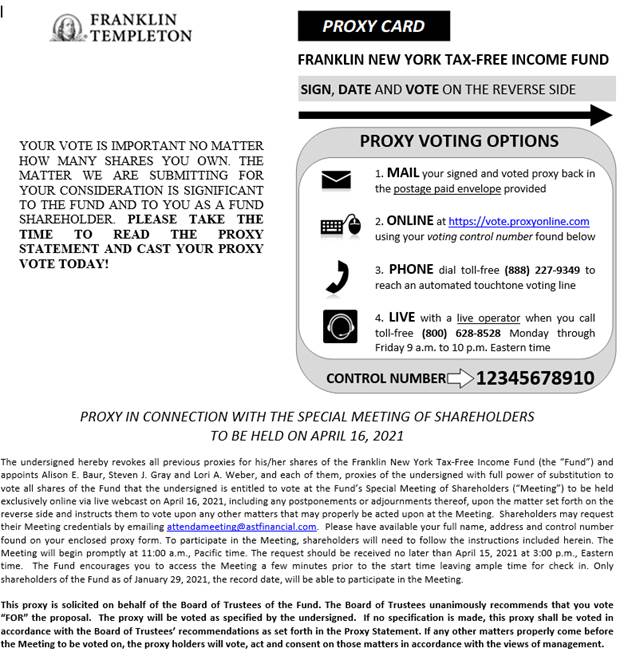

FRANKLIN NEW YORK TAX-FREE INCOME FUND

(Name of Registrant as Specified in its Charter)

_____________________________________________________________

(Name of Person(s) Filing Proxy Statement, other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

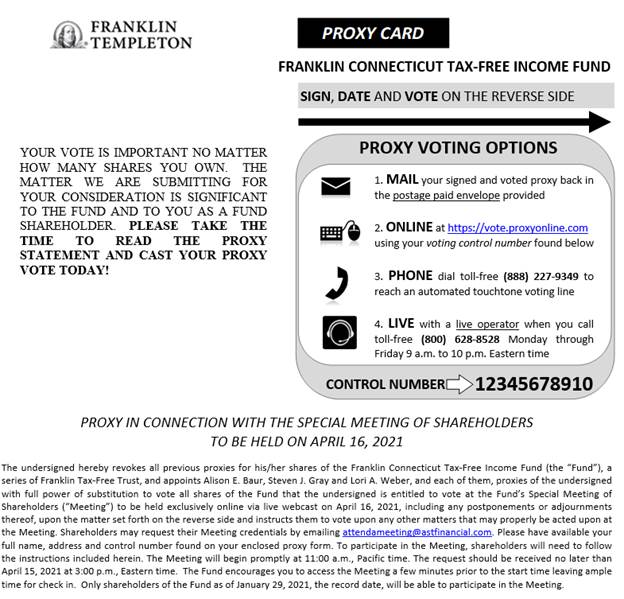

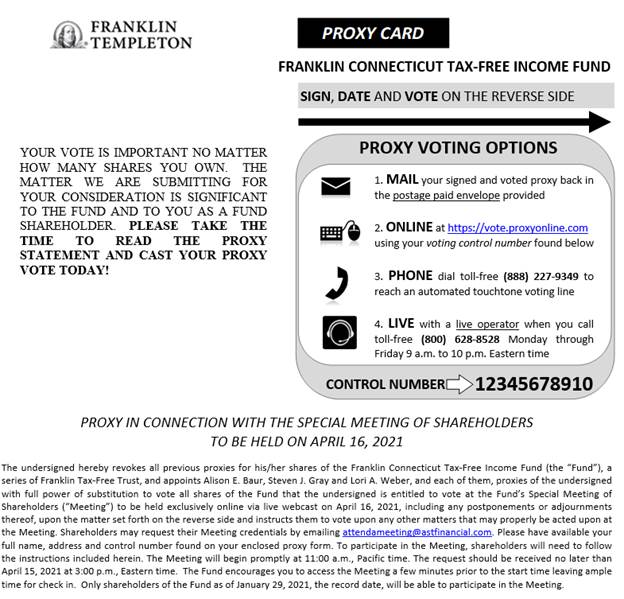

Franklin CONNECTICUT TAX-FREE INCOME fund

(a series of Franklin Tax-Free Trust)

FRANKLIN NEW YORK TAX-FREE INCOME FUND

IMPORTANT SHAREHOLDER INFORMATION

These materials are for a Special Joint Meeting of Shareholders of Franklin Connecticut Tax-Free Income Fund (the “Connecticut Fund”), a series of Franklin Tax-Free Trust (“FTFT”), and Franklin New York Tax-Free Income Fund (the “New York Fund,” and together with the Connecticut Fund, the “Funds,” and each individually, a “Fund”), scheduled for April 16, 2021, at 11:00 a.m., Pacific time, which will be conducted exclusively online via live webcast (the “Meeting”). The enclosed materials discuss an important proposal (the “Proposal”) to be voted on separately by the shareholders of each Fund at the Meeting, and contain the Notice of Special Joint Meeting of Shareholders, proxy statement and proxy card(s) and/or voting instruction form(s). A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how you wish to vote on important issues relating to the Fund(s) in which you are invested. If you specify a vote on the Proposal, your proxy will be voted as you indicate. If you simply sign, date and return the proxy card(s), but do not specify a vote on the Proposal, your proxy will be voted FOR the Proposal in accordance with the Trustees’ recommendation beginning on page 1 of the proxy statement.

We urge you to spend a few minutes reviewing the Proposal in the proxy statement. Then, please fill out and sign the proxy card(s) or voting instruction form(s) and return it (them) prior to the Meeting on April 16, 2021, so that your vote will be counted. When shareholders return their proxies promptly, the Funds may be able to save money by not having to conduct additional solicitations, including other mailings. PLEASE COMPLETE, SIGN AND RETURN each proxy card or voting instruction form you receive.

We welcome your comments. If you have any questions or would like to quickly vote your shares, call AST Fund Solutions, LLC, our proxy solicitor, toll free at (800) 628-8528. Agents are available 9:00 a.m. – 10:00 p.m., Eastern time, Monday through Friday.

TELEPHONE AND INTERNET VOTING

For your convenience, you may vote by telephone or through the Internet, 24 hours a day.

Separate instructions are listed on the enclosed voting instruction form(s) or proxy card(s).

Franklin CONNECTICUT TAX-FREE INCOME fund

(a series of Franklin Tax-Free Trust)

FRANKLIN NEW YORK TAX-FREE INCOME FUND

NOTICE OF SPECIAL JOINT MEETING OF SHAREHOLDERS

The Boards of Trustees of Franklin Tax-Free Trust (“FTFT”), on behalf of its series Franklin Connecticut Tax-Free Income Fund (the “Connecticut Fund”), and Franklin New York Tax-Free Income Fund (the “New York Fund,” and together with the Connecticut Fund, the “Funds,” and each individually, a “Fund”), have called a Special Joint Meeting of Shareholders of the Funds, which will be conducted exclusively online via live webcast on April 16, 2021, at 11:00 a.m., Pacific time (the “Meeting”).

During the Meeting, shareholders of each Fund will be asked to vote on the following Proposal:

1. To approve a change in the Fund’s classification from a diversified to a non-diversified fund.

By Order of the Boards of Trustees,

Steven J. Gray

Co-Secretary and Vice President

[March 2], 2021

Please sign and promptly return all of the proxy card(s) or voting instruction form(s) in the enclosed self-addressed envelope, or vote your shares by telephone or through the Internet, regardless of the number of shares you own, prior to the Meeting on April 16, 2021, so that your vote will be counted.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL JOINT MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 16, 2021

The Notice of Special Joint Meeting of Shareholders, proxy statement and form of proxy card are available on the Internet at https://vote.proxyonline.com/Franklin/docs/ FranklinNYandCT2021.pdf. The form of proxy card on the Internet site cannot be used to cast your vote.

If you have any questions, would like to vote your shares, or wish to obtain instructions on how to attend the Meeting and vote in person, please call AST Fund Solutions, LLC, our proxy solicitor, toll free at (800) 628-8528.

Franklin CONNECTICUT TAX-FREE INCOME fund

(a series of Franklin Tax-Free Trust)

FRANKLIN NEW YORK TAX-FREE INCOME FUND

A Special Joint Meeting of Shareholders of the of Franklin Connecticut Tax-Free Income Fund (the “Connecticut Fund”), a series of Franklin Tax-Free Trust (“FTFT”), and Franklin New York Tax-Free Income Fund (the “New York Fund,” and together with the Connecticut Fund, the “Funds,” and each individually, a “Fund”) will be conducted exclusively online via live webcast on April 16, 2021 (the “Meeting”) to vote on an important proposal that affects each Fund. Please read the enclosed materials and cast your vote on the proxy cards(s) or voting instruction form(s).

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to call you to solicit your vote.

The proposal for each Fund has been carefully reviewed by such Fund’s Board of Trustees (the “Board”). The Trustees of FTFT and the Trustees of the New York Fund, most of whom are not affiliated with Franklin Templeton, are responsible for looking after your interests as a shareholder of the Connecticut Fund and the New York Fund, respectively. Each Fund’s Board believes the proposal is in the best interests of the Fund’s shareholders. Each Fund’s Board unanimously recommends that you vote FOR the proposal.

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card(s) or voting instruction form(s) enclosed in this package. Be sure to complete, sign and return the card/form before mailing it in the postage-paid envelope. You may also vote your shares by touch-tone telephone or through the Internet. Simply call the toll-free number or visit the web site indicated on your proxy card(s) or voting instruction form(s) and follow the instructions.

We welcome your comments. If you have any questions or would like to quickly vote your shares, please call AST Fund Solutions, LLC, our proxy solicitor, toll-free at (800) 628-8528. Agents are available 9:00 a.m. – 10:00 p.m., Eastern time, Monday through Friday. Thank you for your participation in this important initiative.

The following Q&A is provided to assist you in understanding the proposal. The proposal is described in greater detail in the proxy statement. We appreciate your trust in Franklin Templeton and look forward to continuing to help you achieve your financial goals.

Important information to help you understand and vote on the proposal

Below is a brief overview of the proposal to be voted upon by each Fund’s shareholders. Your vote is important, no matter how large or small your holdings may be.

What proposal am I being asked to vote on?

Shareholders of each Fund are being asked to vote on the following proposal:

1. To approve a change in the Fund’s classification from a diversified to a non-diversified fund.

Has each Fund’s Board approved the proposal for the Fund?

Each Fund’s Board has unanimously approved the proposal for the Fund and recommends that you vote to approve the proposal.

Why is each Fund’s Board proposing to change the Fund’s diversification status?

Each Fund currently is classified as a diversified fund and has declared a fundamental policy of being diversified, which may not be changed or eliminated without shareholder approval. A diversified fund must limit all investments greater than 5% of its assets in any one issuer to no more than, in the aggregate, 25% of the fund’s assets. The municipal securities markets in Connecticut and New York have become increasingly concentrated in a more limited number of issuers, which has presented challenges to the Funds’ investment manager to effectively manage the Funds’ portfolios with a limited supply of higher quality issuances and continue to meet the investment requirements of a diversified fund. Currently, each Fund’s portfolio has reached the maximum investment limitations of a diversified fund, which limits the ability of the Funds to take full advantage of certain investment opportunities. The Funds’ investment manager believes that the Connecticut and New York municipal securities markets will remain concentrated for the foreseeable future. In addition, the Funds’ investment manager has found that many of the Fund’s peers are classified as non-diversified, which the investment manager believes is reflective of the more recent concentrated nature of these municipal securities markets.

As a non-diversified fund, each Fund could invest a greater portion of its assets in any one issuer and could invest overall in a smaller number of issuers than a diversified fund. Each Fund’s investment manager believes that this added flexibility will enable the Fund to operate its investment program in a more effective manner by increasing investments in securities that the investment manager believes to be most attractive, and more closely align the Fund with its peers.

What effect will changing a Fund’s status from “diversified” to “non-diversified” have on the Fund?

As a non-diversified fund, each Fund would be able to increase its investments in single issuers above the limits discussed above, which may subject the Fund to additional risks. Non-diversified funds are more sensitive to economic, business, political or other changes affecting such or similar issuers or securities, which may result in greater fluctuation in the value of the fund’s shares.

Who is AST Fund Solutions, LLC?

AST Fund Solutions, LLC (the “Solicitor”) is a company that has been engaged by FTFT, on behalf of the Connecticut Fund, and the New York Fund to assist in the solicitation of proxies. The Solicitor is not affiliated with the Funds or with Franklin Templeton. In order to hold a shareholder meeting for a Fund, a certain percentage of such Fund’s shares (often referred to as “quorum”) must be represented at the Meeting. If a quorum is not attained, the Meeting may be adjourned to a future date. The Funds may attempt to reach shareholders through multiple mailings to remind the shareholders to cast their votes. As the Meeting approaches, phone calls may be made to shareholders who have not yet voted their shares so that the Meeting does not have to be adjourned or postponed.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each share (and a proportionate fractional vote for each fractional share) you own of a Fund on the record date. The record date is January 29, 2021 (the “Record Date”).

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy card(s) or voting instruction form(s) and mailing it (them) in the enclosed postage-paid envelope. You may also vote using a touch-tone telephone by calling the toll-free number printed on your proxy card(s) or voting instruction form(s) and following the recorded instructions, or through the Internet by visiting the web site printed on your proxy card(s) or voting instruction form(s) and following the on-line instructions. You can also vote your shares in person at the Meeting, which is being conducted exclusively online via live webcast. If you need any assistance, or have any questions regarding the proposals or how to vote your shares, please call the Solicitor toll-free at (800) 628-8528.

May I attend the Meeting?

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of each Fund’s shareholders, employees and community, the Meeting will be conducted exclusively online via live webcast. Shareholders of each Fund may request the Meeting credentials by emailing attendameeting@astfinancial.com. The request should be received no later than April 15, 2021 at 3:00 p.m., Eastern time. Please include your full name, address and the control number found on your enclosed proxy form. The Meeting will begin promptly at 11:00 a.m., Pacific time. Each Fund encourages you to access the Meeting a few minutes prior to the start time leaving ample time for the check in. Only shareholders of the Funds as of the Record Date will be able to participate in the Meeting.

What if my shares are held in a brokerage account?

If you hold your shares through an intermediary, such as a bank, broker or other custodian (i.e., in “street name”), you must register in advance to access your individual control number in order to attend the Meeting online via live webcast. To register and receive your individual control number to attend the Meeting online, you must email proof of your proxy power (“Legal Proxy”) from your broker, bank or other nominee indicating that you are the beneficial owner of the shares in the Fund(s) on the Record Date, and authorizing you to vote along with your name and email address to attendameeting@astfinancial.com (forward the email from your broker, bank or other nominee or attach an image of your Legal Proxy). The email must also state whether before the Meeting you authorized a proxy to vote for you, and if so, how you instructed such proxy to vote. Requests for registration must be labeled as “Legal Proxy” and be received no later than April 15, 2021 at 3:00 p.m., Eastern time. You will receive a confirmation of your registration and your individual control number by email after the Solicitor receives your registration information.

How do I sign the proxy card?

Individual Accounts: Shareholders should sign exactly as their names appear on the account registration shown on the proxy card(s) or voting instruction form(s).

Joint Accounts: Either owner may sign, but the name of the person signing should conform exactly to a name appearing on the account registration as shown on the proxy card(s) or voting instruction form(s).

All Other Accounts: The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, “Ann B. Collins, Trustee.”

Franklin CONNECTICUT TAX-FREE INCOME fund

(a series of Franklin Tax-Free Trust)

FRANKLIN NEW YORK TAX-FREE INCOME FUND

PROXY STATEMENT

¿ INFORMATION ABOUT VOTING

Who is asking for my vote?

The Boards of Trustees of Franklin Tax-Free Trust (“FTFT”), on behalf of Franklin Connecticut Tax-Free Income Fund (the “Connecticut Fund”), and Franklin New York Tax-Free Income Fund (the “New York Fund,” and together with the Connecticut Fund, the “Funds,” and each individually, a “Fund”), in connection with a Special Joint Meeting of Shareholders of the Funds to be conducted exclusively online via live webcast on April 16, 2021 (the “Meeting”), has requested your vote on an important proposal (the “Proposal”).

Who is eligible to vote?

Shareholders of record at the close of business on January 29, 2021 (the “Record Date”) are entitled to be present and to vote at the Meeting or any adjourned Meeting. Each share of record of a Fund as of the Record Date is entitled to one vote (and a proportionate fractional vote for each fractional share) on each matter presented at the Meeting. The Notice of Special Joint Meeting of Shareholders, the proxy statement and the proxy card(s) and/or voting instruction form(s) were first mailed to shareholders of record on or about March 2, 2021.

On what issues am I being asked to vote?

Shareholders of each Fund are being asked to vote on the following Proposal:

1. To approve a change in the Fund’s classification from a diversified to a non-diversified fund.

How does the Board of Trustees of my Fund recommend that I vote?

The Board of Trustees of FTFT, on behalf of the Connecticut Fund, and the Board of Trustees of the New York Fund (each, a “Board,” and together, the “Boards”) unanimously recommend that you vote:

1. FOR the approval to change the Fund’s classification from a diversified to a non-diversified fund.

How do I ensure that my vote is accurately recorded?

You may submit your proxy card(s) or voting instruction form(s) in one of four ways.

- By Internet. The web address and instructions for voting can be found on the enclosed proxy card(s) or voting instruction form(s). You will be required to provide your control number located on the proxy card(s) or voting instruction form(s).

- By Telephone. The toll-free number for telephone voting can be found on the enclosed proxy card(s) or voting instruction form(s). You will be required to provide your control number located on the proxy card(s) or voting instruction form(s).

- By Mail. Mark the enclosed proxy card(s) or voting instruction form(s), sign and date it (them) and return it (them) in the postage-paid envelope we provided. A proxy card with respect to shares held by joint owners may be signed by just one of them, unless, at or prior to exercise of such proxy, the appropriate Fund receives a specific written notice to the contrary from any one of the joint owners.

- In Person at the Meeting. You can vote your shares in person at the Meeting.

If you require additional information regarding the Meeting you may contact AST Fund Solutions, LLC (the “Solicitor”), the proxy solicitor, toll-free at (800) 628-8528. Please see the section entitled “FURTHER INFORMATION ABOUT VOTING AND THE MEETING” for more information on the Solicitor.

Proxy cards that are properly signed, dated and received at or prior to the Meeting will be voted as specified. If you specify a vote on the Proposal, your proxy will be voted as you indicate. If you simply sign, date and return the proxy card, but do not specify a vote on the Proposal, your proxy will be voted FOR the Proposal in accordance in accordance with the Trustees’ recommendations beginning on page 1 of this proxy statement.

May I revoke my proxy?

You may revoke your proxy at any time before it is voted by forwarding a written revocation or a later-dated proxy card to the appropriate Fund that is received by the Fund at or prior to the Meeting, or by attending the Meeting and voting in person.

May I attend the Meeting?

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of each Fund’s shareholders, employees and community, the Meeting will be conducted exclusively online via live webcast. Shareholders may request the Meeting credentials by emailing attendameeting@astfinancial.com. The request should be received no later than April 15, 2021 at 3:00 p.m., Eastern time. Please include your full name, address and the control number found on your enclosed proxy form. The Meeting will begin promptly at 11:00 a.m., Pacific time. The Funds encourage you to access the Meeting a few minutes prior to the start time leaving ample time for the check in. Only shareholders of the Funds as of the Record Date will be able to participate in the Meeting.

What if my shares are held in a brokerage account?

If you hold your shares through an intermediary, such as a bank, broker or other custodian (i.e., in “street name”), you must register in advance to access your individual control number in order to attend the Meeting online via live webcast. To register and receive your individual control number to attend the Meeting online, you must email proof of your proxy power (“Legal Proxy”) from your broker, bank or other nominee indicating that you are the beneficial owner of the shares in the Fund(s), on the Record Date, and authorizing you to vote along with your name and email address to attendameeting@astfinancial.com (forward the email from your broker, bank or other nominee or attach an image of your Legal Proxy). The email must also state whether before the meeting you authorized a proxy to vote for you, and if so, how you instructed such proxy to vote. Requests for registration must be labeled as “Legal Proxy” and be received no later than April 15, 2021 at 3:00 p.m., Eastern time. You will receive a confirmation of your registration and your individual control number by email after the Solicitor receives your registration information.

Who will pay proxy solicitation costs?

The costs of soliciting proxies, including the fees of a proxy soliciting agent, will be borne by the Funds, regardless of whether shareholders approve the Proposal. For more information, please see “FURTHER INFORMATION ABOUT VOTING AND THE MEETING – Solicitation of Proxies.”

¿ PROPOSAL: TO approve a change in the fund’s classification from a diversified to non-diversified fund

Background

The Investment Company Act of 1940 (“1940 Act”) requires each investment company to classify itself as either a “diversified” or “non-diversified” fund and recite in its registration statement its classification. If a fund is “diversified,” it may not purchase the securities of any one issuer if, at the time of purchase, with respect to 75% of the fund’s total assets, more than 5% of its total assets (calculated at the time of purchase) would be invested in the securities of that issuer, or the fund would own or hold more than 10% of the outstanding voting securities of that issuer. Up to 25% of a fund’s total assets may be invested without regard to these limitations. Under the 1940 Act, these limitations do not apply to securities issued or guaranteed as to principal or interest by the U.S. government or any of its agencies or instrumentalities, or to the securities of other investment companies. A non-diversified fund is any fund that does not meet the diversification requirements of the 1940 Act described above.

Each Fund is currently classified as a “diversified” fund under the 1940 Act and has adopted the following fundamental investment policy regarding diversification:

[The Fund may not:] Purchase the securities of any one issuer (other than the U.S. government or any of its agencies or instrumentalities or securities of other investment companies, whether registered or excluded from registration under Section 3(c) of the 1940 Act) if immediately after such investment (a) more than 5% of the value of the Fund’s total assets would be invested in such issuer or (b) more than 10% of the outstanding voting securities of such issuer would be owned by the Fund, except that up to 25% of the value of the Fund’s total assets may be invested without regard to such 5% and 10% limitations.

Each Fund’s classification as “diversified” and its current fundamental investment policy on diversification set forth above may not be changed or eliminated without the approval of such Fund’s shareholders.

The New York Fund has been classified and operated as a diversified fund since its inception in 1982. The Connecticut Fund was originally classified as a non-diversified fund from its inception in 1984 until 2007, at which point the Fund became reclassified as a diversified fund and the Fund’s shareholders approved the Fund’s current fundamental investment policy on diversification. According to the rules under the 1940 Act, a non-diversified fund that operates as a diversified fund for a continuous three-year period is automatically reclassified as a diversified fund notwithstanding its original classification as a non-diversified fund. In such case, shareholder approval is required to change a fund’s classification from diversified to non-diversified.

In recent years, the municipal securities markets in New York and Connecticut have become increasingly concentrated in a more limited number of issuers, which has presents challenges for the Funds’ investment manager (the “Investment Manager”) to effectively manage the Funds’ portfolios with a limited supply of higher quality issuances (including long-term bonds) available and continue to meet the investment requirements of a diversified fund. Due to the concentrated nature of each Fund’s investment universe, the Funds are not able to take as large of positions in certain issuances that the Investment Manager believes are beneficial for the Fund’s portfolio because it is limited in doing so to maintain its diversified status. Currently, each Fund’s portfolio has reached the maximum investment limitations as a diversified fund, which limits the ability of the Funds to take full advantage of certain investment opportunities. The Funds’ Investment Manager believes that the Connecticut and New York municipal securities markets will remain concentrated for the foreseeable future. The Investment Manager also has found that many of the Funds’ peers are classified as non-diversified, which the Investment Manager believes reflects the more recent concentrated nature of the relevant municipal bond market. The Investment Manager believes that changing each Fund’s classification from diversified to non-diversified will provide added flexibility that will enable the Fund to operate its investment program in a more effective manner by increasing investments in securities that the investment manager believes to be most attractive, and more closely align the Fund with its peers. As a non-diversified fund, each Fund could invest a greater portion of its assets in any one issuer and could invest overall in a smaller number of issuers than a diversified fund.

Therefore, shareholders of each Fund are being asked to approve the Proposal to change the Fund’s classification from “diversified” to “non-diversified,” which includes eliminating its current fundamental investment restriction regarding diversification.

What effect will changing a Fund’s status from “diversified” to “non-diversified” have on the Fund?

If the Proposal is approved by a Fund’s shareholders, such Fund would maintain a portfolio that complies with non-diversification status under the 1940 Act. However, each Fund would be required to limit its investments greater than 5% in any one issuer to no more than 50% of its assets (rather than the 25% limit imposed upon diversified funds) to continue to comply with the tax diversification requirements of Subchapter M of the Internal Revenue Code. The 1940 Act diversification requirements are similar to, but are separate and apart from, the diversification requirements that each Fund complies with to quality for special tax treatment as set forth in Subchapter M of the Internal Revenue Code. The Proposal does not in any way affect either Fund’s ability to comply with Subchapter M.

Because a non-diversified fund generally invests a greater portion of its assets in the securities of one or more issuers and/or invests overall in a smaller number of issuers than a diversified fund, a non-diversified fund may be subject to additional risks. Specifically, each Fund may be more sensitive to a single economic, business, political, regulatory or other occurrence or to the financial results of a single issuer than a more diversified fund might be, which may result in greater fluctuation in the value of the Fund’s shares.

What is the required vote on the Proposal?

The Proposal will be voted on separately by shareholders of each Fund. For each Fund, the Proposal must be approved by the affirmative vote of a “majority of the outstanding voting securities” of such Fund, which is defined in the 1940 Act as the lesser of: (A) 67% or more of the voting securities of the Fund present at the Meeting, if the holders of more than 50% of the outstanding voting securities of the Fund are present or represented by proxy; or (B) more than 50% of the outstanding voting securities of the Fund. If the Proposal is approved by a Fund’s shareholders, it is anticipated that the Fund’s diversification status will change and the related fundamental investment policy will be eliminated shortly after the Meeting.

If the Proposal is not approved by a Fund’s shareholders, such Fund’s classification as a diversified fund and its related fundamental investment restriction will remain in effect.

THE BOARD OF EACH FUND UNANIMOUSLY RECOMMENDS that

shareholders VOTE “FOR” THE PROPOSAL.

¿ ADDITIONAL INFORMATION ABOUT THE FUNDS

The Investment Manager. The principal address of Franklin Advisers, Inc., each Fund’s Investment Manager, is One Franklin Parkway, San Mateo, CA 94403-1906. Pursuant to an investment management agreement with each Fund, the Investment Manager manages the investment and reinvestment of the Fund’s assets. The Investment Manager is a wholly owned subsidiary of Franklin Resources, Inc. (“Franklin Resources”).

The Administrator. Pursuant to a subcontract for fund administration services with each Fund’s Investment Manager, Franklin Templeton Services, LLC (“FT Services”) provides certain administrative services and facilities for the Funds. FT Services, with its principal address at One Franklin Parkway, San Mateo, California 94403-1906, is an indirect, wholly owned subsidiary of Franklin Resources and an affiliate of the Investment Manager and the Fund’s principal underwriter. JPMorgan Chase & Co., 270 Park Avenue, New York, NY 10017, has an agreement with FT Services to provide certain sub-administrative services for the Funds.

The Underwriter. The principal underwriter for each Fund is Franklin Templeton Distributors, Inc. (“FT Distributors”), with its principal address at One Franklin Parkway, San Mateo, California 94403-1906. As principal underwriter, FT Distributors receives (i) underwriting commissions in connection with the sale or redemption of Fund shares and (ii) 12b-1 fees pursuant to separate Rule 12b-1 plans adopted by each Fund’s Board, which fees are used for, among other things, advertising expenses and the costs of printing sales material and prospectuses used to offer shares.

The Transfer Agent. The transfer agent and shareholder servicing agent for each Fund is Franklin Templeton Investor Services, LLC, located at 3344 Quality Drive, Rancho Cordova, California 95670-7313.

The Custodian. The custodian for each Fund is The Bank of New York Mellon, Mutual Funds Division, 100 Church Street, New York, NY 10286.

Other Matters. Each Fund’s audited financial statements and annual report for its last completed fiscal year, and any subsequent semi-annual report to shareholders, are available free of charge. To obtain a free copy, please contact your financial advisor, call (800) DIAL BEN® ((800) 342-5236) or forward a written request to Franklin Templeton Investor Services, LLC, P.O. Box 33030, St. Petersburg, Florida 33733-8030.

Shareholders Sharing the Same Address. If two or more shareholders share the same address, only one copy of this proxy statement is being delivered to that address, unless the Fund(s) has/have received contrary instructions from one or more of the shareholders at that shared address. Upon written or oral request, the Funds will deliver promptly a separate copy of this proxy statement to a shareholder at a shared address. Please call (800) DIAL BEN® ((800) 342-5236) or forward a written request to Franklin Templeton Investor Services, LLC, P.O. Box 33030, St. Petersburg, Florida 33733-8030, if you would like to: (1) receive a separate copy of this proxy statement; (2) receive your annual reports or proxy statements separately in the future; or (3) request delivery of a single copy of annual reports or proxy statements if you are currently receiving multiple copies at a shared address.

Outstanding Shares and Principal Shareholders. The outstanding shares and classes of each Fund as of the Record Date were as follows:

Fund/Class | Number of Outstanding Shares |

Franklin Connecticut Tax-Free Income Fund | |

Class A Shares | |

Class A1 Shares | |

Class C Shares | |

Class R6 Shares | |

Advisor Class Shares | |

Total Shares | |

| |

Franklin New York Tax-Free Income Fund | |

Class A Shares | |

Class A1 Shares | |

Class C Shares | |

Class R6 Shares | |

Advisor Class Shares | |

Total Shares | |

The names and addresses of shareholders that owned beneficially 5% or more of the outstanding shares of any class of a Fund are set forth in Exhibit A. From time to time, the number of shares held in “street name” accounts of various securities dealers for the benefit of their clients may exceed 5% of the total shares outstanding of any class of a Fund. To the knowledge of each Fund’s management, as of the Record Date, there were no other entities, except as set forth in Exhibit A, owning beneficially more than 5% of the outstanding shares of any class of the Fund.

Contacting the Board. If a shareholder wishes to send a communication to the Board of a Fund, such correspondence should be in writing and addressed to the Board of that Fund at the Fund’s offices at One Franklin Parkway, San Mateo, California 94403-1906, Attention: Secretary. The correspondence will be given to the Board for review and consideration.

¿ FURTHER INFORMATION ABOUT VOTING AND THE MEETING

Solicitation of Proxies. Your vote is being solicited by the Boards. AST Fund Solutions, LLC (the “Solicitor”) has been engaged to assist in the solicitation of proxies. The cost of soliciting proxies, including the fees of a proxy soliciting agent, is estimated to be approximately $35,000 for the Connecticut Fund, and approximately $337,500 for the New York Fund, which in each case will be borne by the Fund.

As the date of the Meeting approaches, certain Fund shareholders may receive a telephone call from a representative of the Solicitor if their votes have not yet been received. Each Fund reimburses brokerage firms and others for their expenses in forwarding proxy materials to the beneficial owners of shares of the Fund and soliciting them to execute voting instructions. The Funds expect that the solicitation will be primarily by mail, but may also include telephone, facsimile, electronic or other means of communication. Trustees and officers of a Fund, and regular employees and agents of FT or its affiliates, involved in the solicitation of the proxies are not reimbursed.

Authorization to permit the Solicitor to execute proxies may be obtained by telephonic instructions from eligible shareholders of the Funds. Proxies that are obtained telephonically will be recorded in accordance with the procedures set forth below. The Funds believe that these procedures are reasonably designed to ensure that both the identity of the shareholder casting the vote and the voting instructions of the shareholder are accurately determined.

In all cases where a telephonic proxy is solicited, the Solicitor representative is required to ask for each shareholder’s full name and address and to confirm that the shareholder has received the proxy materials in the mail or by other acceptable means. If the shareholder is a corporation or other entity, the Solicitor representative is required to ask for the person’s title and confirmation that the person is authorized to direct the voting of the shares. If the information elicited accords with the information provided to the Solicitor, then the Solicitor may ask for the shareholder’s instructions on the Proposal. Although the Solicitor representative is permitted to answer questions about the process, he or she is not permitted to recommend to the shareholder how to vote, other than to read any recommendation set forth in this proxy statement. The Solicitor will record the shareholder’s instructions on the proxy card. Within 72 hours, the shareholder will be sent a letter to confirm his or her vote and asking the shareholder to call the Solicitor immediately if his or her instructions are not correctly reflected in the confirmation.

A shareholder may also vote by submitting the proxy card(s) or voting instruction form(s) originally sent with this proxy statement by mail, via telephone, via the Internet or by attending the Meeting.

Voting by Broker-Dealers. The Funds expect that, before the Meeting, broker-dealer firms holding shares of the Funds in “street name” for the broker-dealer firms’ customers will request voting instructions from their customers and beneficial owners. Certain broker-dealers may exercise discretion over shares held in the broker-dealer firms’ names for which no instructions are received by voting these shares in the same proportion as the broker-dealer firms vote shares for which they received instructions.

Quorum. For each Fund, the holders of 40% of the outstanding shares of the Fund entitled to vote at the Meeting, present in person or represented by proxy, constitutes a quorum at the Meeting for purposes of acting upon the Proposal. The shares over which broker-dealers have discretionary voting power, the shares that represent “broker non-votes” (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote, and (ii) the broker or nominee does not have discretionary voting power on matters other than election of board members) and the shares whose proxies reflect an abstention on any item will all be counted as shares present and entitled to vote for purposes of determining whether the required quorum of shares exists.

Method of Tabulation. The vote required to approve the Proposal is set forth in the discussion of the Proposal above.

An “abstention” occurs when a shareholder has affirmatively designated to abstain from voting on the Proposal. Generally, abstentions and broker non-votes will be treated as votes present at the Meeting, but will not be treated as votes cast. Therefore, abstentions and broker non-votes may have the same effect as a vote “against” the Proposal.

Simultaneous Meetings. The Meeting is to be held at the same time for both Funds. If any shareholder at the Meeting objects to the holding of simultaneous meetings and moves for an adjournment of the Meeting to a time promptly after the simultaneous meetings, the persons designated as proxies will vote in favor of such adjournment.

Adjournment. The Meeting as to either Fund may be adjourned from time to time for any reason whatsoever by vote of the holders of a majority of the shares present (in person or by proxy and entitled to vote at the Meeting), or by the Chairman of the Board or certain officers, whether or not a quorum is present. Such authority to adjourn the Meeting may be used in the event that a quorum is not present at the Meeting, or in the event that a quorum is present but sufficient votes have not been received to approve the Proposal, or for any other reason consistent with applicable state law and the applicable Fund’s By-Laws, including to allow for the further solicitation of proxies. Any adjournment may be made with respect to any business which might have been transacted at the Meeting, and any adjournment will not delay or otherwise affect the effectiveness and validity of any business transacted at the Meeting prior to adjournment. Unless otherwise instructed by a shareholder granting a proxy, the persons designated as proxies may use their discretionary authority to vote as instructed by management of the Funds on questions of adjournment and on any other proposals raised at the Meeting to the extent permitted by applicable federal securities laws, state law, and the applicable Fund’s governing instruments. If the Meeting is adjourned to another time or place, written notice need not be given of the adjourned meeting if the time and place is announced at the Meeting, unless a new record date is fixed for the adjourned meeting, or unless the adjournment is for more than 180 days from the record date set for the original meeting.

Shareholder Proposals. The Funds are not required and do not intend to hold regular annual meetings of shareholders. A shareholder who wishes to submit a proposal for consideration for inclusion in a Fund’s proxy statement for the next meeting of shareholders of such Fund should send his or her written proposal to the Fund’s offices: One Franklin Parkway, San Mateo, California 94403-1906, Attention: Secretary, so that it is received within a reasonable time before the Fund begins to print and send its proxy materials for such meeting. A shareholder proposal may be presented at a meeting of shareholders only if such proposal concerns a matter that may be properly brought before the meeting under applicable federal securities laws, state law and the applicable Fund’s governing instruments. Submission of a proposal by a shareholder does not guarantee that the proposal will be included in the Fund’s proxy statement or presented at the meeting.

No business other than the matters described above is expected to come before the Meeting, but should any other matter requiring a vote of shareholders properly come before the Meeting, including any questions as to an adjournment or postponement of the Meeting, the persons designated as proxies named on the enclosed proxy card will vote on such matters in accordance with the views of management, to the extent permitted under applicable federal securities laws, state law and the applicable Fund’s governing instruments, including proposals for which management of the Fund did not have timely notice, as set forth in the U.S. Securities and Exchange Commission’s proxy rules.

By Order of the Boards of Trustees,

Steven J. Gray

Co-Secretary and Vice President

[March 2], 2021

EXHIBIT A

PRINCIPAL HOLDERS OF FUND SHARES AS OF JANUARY 29, 2021**

As of January 29, 2021, the following shareholders owned beneficially 5% or more of the outstanding shares of any class of a Fund. [For purposes of the 1940 Act, any person who owns, directly or through one or more controlled companies, more than 25% of the voting securities of a company is presumed to “control” such company. Accordingly, to the extent that a shareholder identified in the following table as the beneficial owner and holder of record of more than 25% of the outstanding voting securities of a Fund and has voting and/or investment power, the shareholder may be presumed to control such Fund.]

Fund Name/Class | Name and Address of Account | Share Amount | Percentage of Class (%) |

Franklin Connecticut Tax-Free Income Fund | | | |

Class A Shares | | | |

| | | |

| | | |

Class A1 Shares | | | |

| | | |

| | | |

Class C Shares | | | |

| | | |

| | | |

Class R6 Shares | | | |

| | | |

| | | |

Advisor Class Shares | | | |

| | | |

| | | |

Franklin New York Tax-Free Income Fund | | | |

Class A Shares | | | |

| | | |

| | | |

Class A1 Shares | | | |

| | | |

| | | |

Class C Shares | | | |

| | | |

| | | |

Class R6 Shares | | | |

| | | |

| | | |

Advisor Class Shares | | | |

| | | |

* For the benefit of its customer(s).

** In addition, to the knowledge of each Fund’s management, as of the Record Date, the Trustees and officers of the Fund owned, as a group, less than 1% of the outstanding shares of the Fund and each class thereof.