UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03479

Franklin New York Tax-Free Income Fund

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650 312-2000

Date of fiscal year end: 2/28

Date of reporting period: 8/31/24

Item 1. Reports to Stockholders.

| a.) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

|

| b.) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Not Applicable.

| | |

Franklin New York Tax-Free Income Fund | |

| Class A [FNYQX] |

| Semi-Annual Shareholder Report | August 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin New York Tax-Free Income Fund for the period March 1, 2024, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Class A | $40 | 0.78% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $2,797,288,102 |

Total Number of Portfolio Holdings* | 441 |

Portfolio Turnover Rate | 6.08% |

| * | Does not include derivatives, except purchased options, if any. |

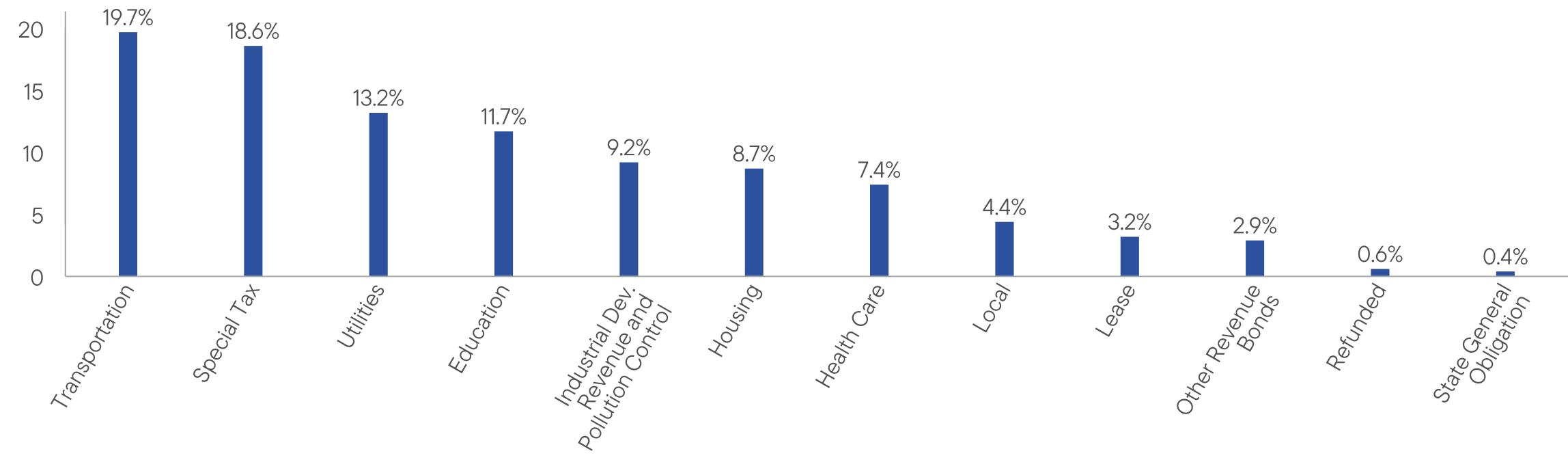

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

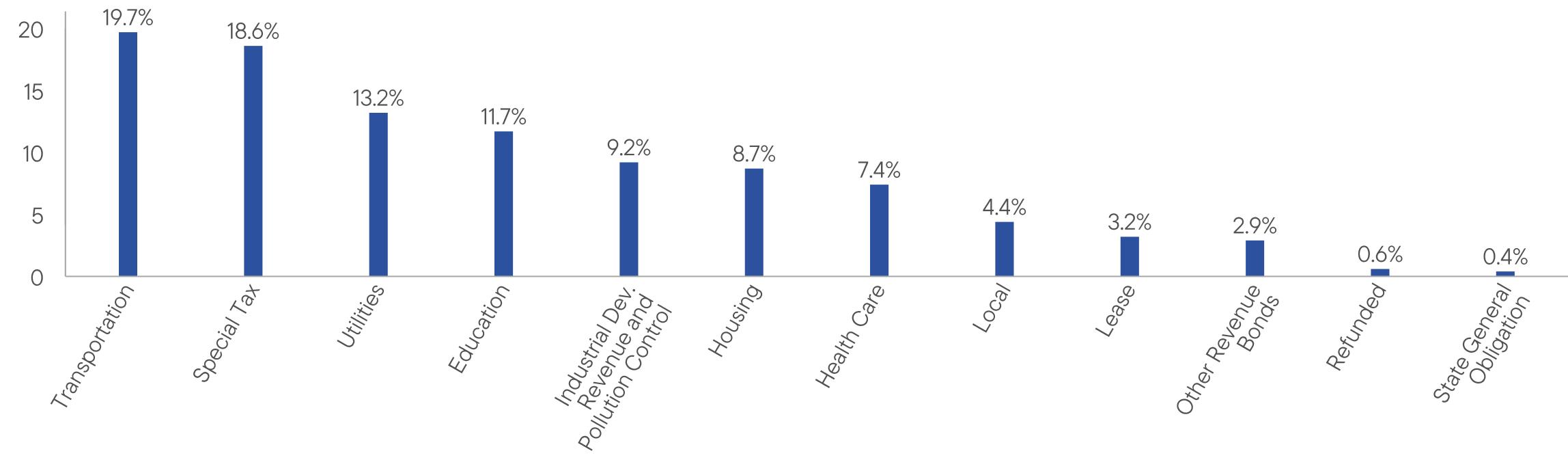

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin New York Tax-Free Income Fund | PAGE 1 | 1115-STSR-1024 |

19.718.613.211.79.28.77.44.43.22.90.60.4

| | |

Franklin New York Tax-Free Income Fund | |

| Class A1 [FNYTX] |

| Semi-Annual Shareholder Report | August 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin New York Tax-Free Income Fund for the period March 1, 2024, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Class A1 | $32 | 0.63% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $2,797,288,102 |

Total Number of Portfolio Holdings* | 441 |

Portfolio Turnover Rate | 6.08% |

| * | Does not include derivatives, except purchased options, if any. |

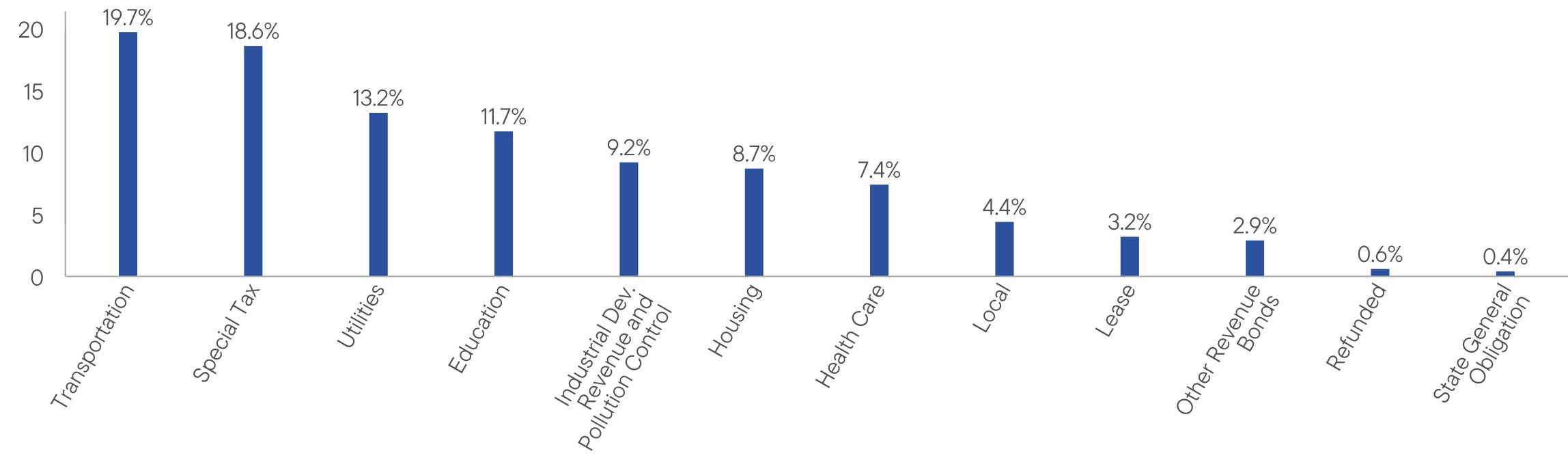

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin New York Tax-Free Income Fund | PAGE 1 | 115-STSR-1024 |

19.718.613.211.79.28.77.44.43.22.90.60.4

| | |

Franklin New York Tax-Free Income Fund | |

| Class C [FNYIX] |

| Semi-Annual Shareholder Report | August 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin New York Tax-Free Income Fund for the period March 1, 2024, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Class C | $60 | 1.18% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $2,797,288,102 |

Total Number of Portfolio Holdings* | 441 |

Portfolio Turnover Rate | 6.08% |

| * | Does not include derivatives, except purchased options, if any. |

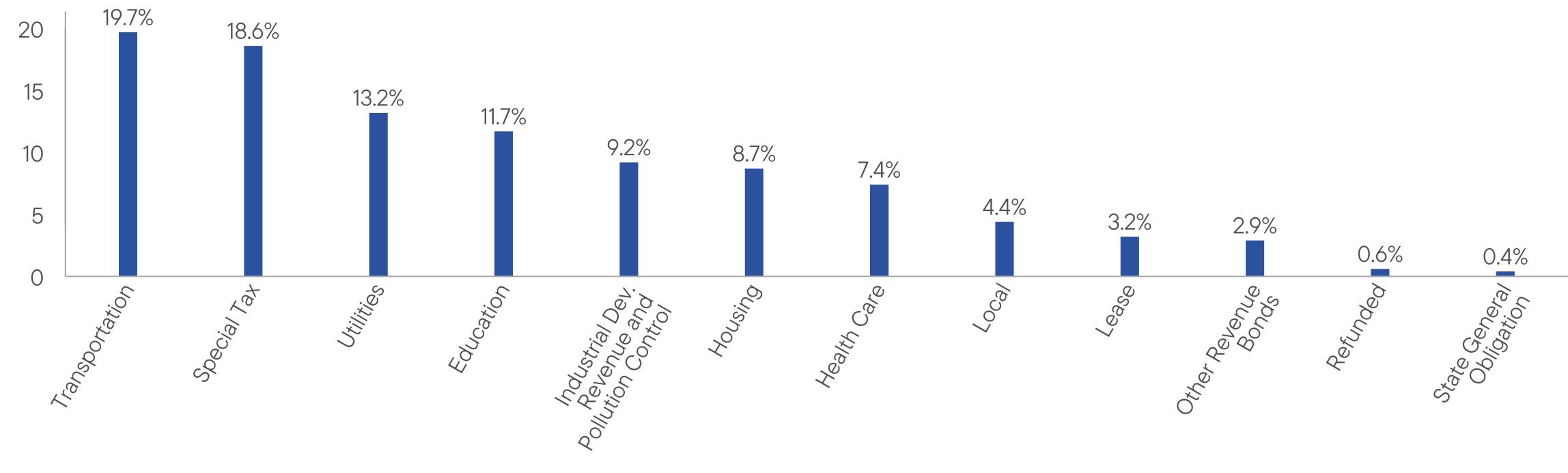

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin New York Tax-Free Income Fund | PAGE 1 | 215-STSR-1024 |

19.718.613.211.79.28.77.44.43.22.90.60.4

| | |

Franklin New York Tax-Free Income Fund | |

| Class R6 [FKTJX] |

| Semi-Annual Shareholder Report | August 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin New York Tax-Free Income Fund for the period March 1, 2024, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Class R6 | $25 | 0.49% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $2,797,288,102 |

Total Number of Portfolio Holdings* | 441 |

Portfolio Turnover Rate | 6.08% |

| * | Does not include derivatives, except purchased options, if any. |

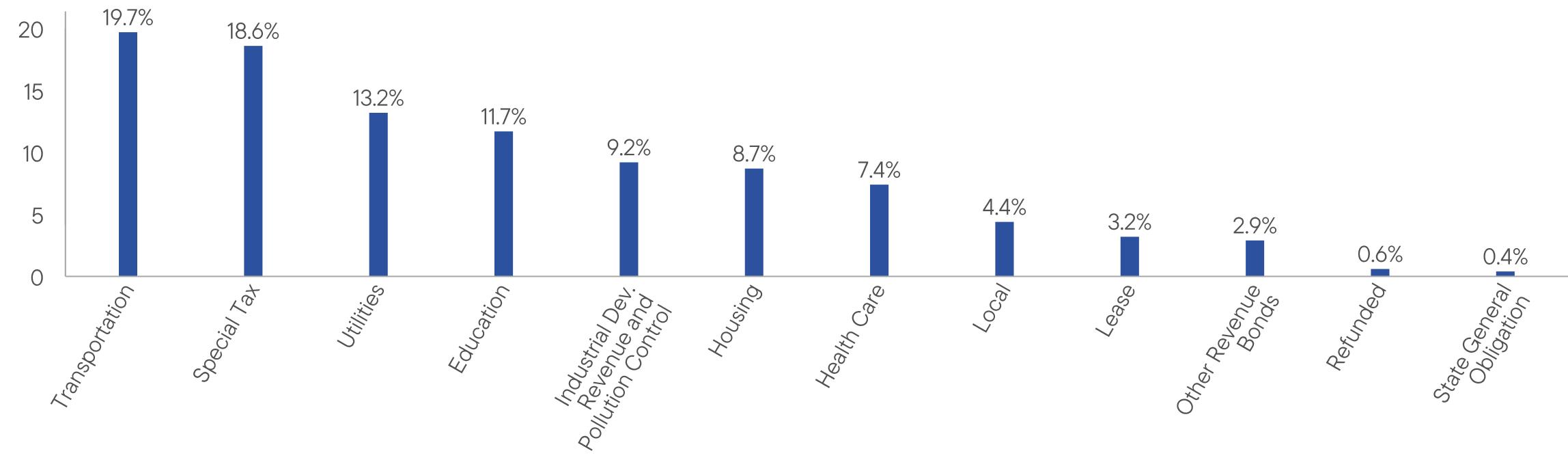

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin New York Tax-Free Income Fund | PAGE 1 | 8115-STSR-1024 |

19.718.613.211.79.28.77.44.43.22.90.60.4

| | |

Franklin New York Tax-Free Income Fund | |

| Advisor Class [FNYAX] |

| Semi-Annual Shareholder Report | August 31, 2024 |

|

This semi-annual shareholder report contains important information about Franklin New York Tax-Free Income Fund for the period March 1, 2024, to August 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment† |

| Advisor Class | $27 | 0.53% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Total Net Assets | $2,797,288,102 |

Total Number of Portfolio Holdings* | 441 |

Portfolio Turnover Rate | 6.08% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin New York Tax-Free Income Fund | PAGE 1 | 615-STSR-1024 |

19.718.613.211.79.28.77.44.43.22.90.60.4

Item 2. Code of Ethics. N/A

Item 3. Audit Committee Financial Expert. N/A

Item 4. Principal Accountant Fees and Services. N/A

Item 5. Audit Committee of Listed Registrants. N/A

Item 6. Schedule of Investments.

(a) Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR.

(b) N/A

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Franklin

New

York

Tax-Free

Income

Fund

Financial

Statements

and

Other

Important

Information

Semiannual

|

August

31,

2024

Financial

Statements

and

Other

Important

Information—Semiannual

Financial

Highlights

and

Schedule

of

Investments

2

Financial

Statements

19

Notes

to

Financial

Statements

(unaudited)

23

Changes

In

and

Disagreements

with

Accountants

30

Results

of

Meeting(s)

of

Shareholders

30

Remuneration

Paid

to

Directors,

Officers

and

Others

30

Board

Approval

of

Management

and

Subadvisory

Agreements

30

Franklin

New

York

Tax-Free

Income

Fund

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

August

31,

2024

(unaudited)

Year

Ended

February

28,

Year

Ended

February

28,

2022

b

Year

Ended

May

31,

Year

Ended

May

31,

2019

c

2024

a

2023

2021

2020

Class

A

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

..............

$10.02

$9.72

$10.83

$11.38

$11.09

$11.10

$10.75

Income

from

investment

operations

d

:

Net

investment

income

e

.

0.16

0.30

0.27

0.19

0.28

0.29

0.24

Net

realized

and

unrealized

gains

(losses)

0.03

0.30

(1.11)

(0.55)

0.29

(0.01)

0.34

Total

from

investment

operations

.............

0.19

0.60

(0.84)

(0.36)

0.57

0.28

0.58

Less

distributions

from:

Net

investment

income

..

(0.16)

(0.30)

(0.27)

(0.19)

(0.28)

(0.29)

(0.23)

Net

asset

value,

end

of

period

................

$10.05

$10.02

$9.72

$10.83

$11.38

$11.09

$11.10

Total

return

f

............

1.89%

6.29%

(7.77)%

(3.25)%

5.15%

2.51%

5.46%

Ratios

to

average

net

assets

g

Expenses

h

............

0.78%

0.75%

0.81%

0.82%

0.78%

0.78%

0.78%

Net

investment

income

...

3.10%

3.08%

2.74%

2.21%

2.48%

2.59%

3.09%

Supplemental

data

Net

assets,

end

of

period

(000’s)

...............

$354,551

$361,554

$351,002

$409,409

$367,358

$291,562

$177,982

Portfolio

turnover

rate

....

6.08%

15.99%

22.81%

11.94%

12.15%

21.27%

19.78%

a

For

the

year

ended

February

29.

b

For

the

period

June

1,

2021

to

February

28,

2022.

c

For

the

period

September

10,

2018

(effective

date)

to

May

31,

2019.

d

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

e

Based

on

average

daily

shares

outstanding.

f

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

g

Ratios

are

annualized

for

periods

less

than

one

year.

h

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

New

York

Tax-Free

Income

Fund

Financial

Highlights

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

Six

Months

Ended

August

31,

2024

(unaudited)

Year

Ended

February

28,

Year

Ended

February

28,

2022

b

Year

Ended

May

31,

2024

a

2023

2021

2020

2019

Class

A1

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

..............

$10.03

$9.73

$10.84

$11.39

$11.10

$11.10

$10.86

Income

from

investment

operations

c

:

Net

investment

income

d

.

0.16

0.32

0.29

0.20

0.30

0.31

0.35

Net

realized

and

unrealized

gains

(losses)

0.02

0.29

(1.12)

(0.55)

0.28

(0.01)

0.25

Total

from

investment

operations

.............

0.18

0.61

(0.83)

(0.35)

0.58

0.30

0.60

Less

distributions

from:

Net

investment

income

..

(0.16)

(0.31)

(0.28)

(0.20)

(0.29)

(0.30)

(0.36)

Net

asset

value,

end

of

period

................

$10.05

$10.03

$9.73

$10.84

$11.39

$11.10

$11.10

Total

return

e

...........

1.87%

6.44%

(7.63)%

(3.13)%

5.31%

2.75%

5.67%

Ratios

to

average

net

assets

f

Expenses

g

............

0.63%

0.60%

0.66%

0.67%

0.63%

0.63%

0.63%

Net

investment

income

...

3.25%

3.23%

2.89%

2.36%

2.63%

2.74%

3.24%

Supplemental

data

Net

assets,

end

of

period

(000’s)

...............

$1,799,531

$1,891,646

$2,010,712

$2,514,275

$2,775,454

$2,902,606

$3,192,168

Portfolio

turnover

rate

....

6.08%

15.99%

22.81%

11.94%

12.15%

21.27%

19.78%

a

For

the

year

ended

February

29.

b

For

the

period

June

1,

2021

to

February

28,

2022.

c

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

d

Based

on

average

daily

shares

outstanding.

e

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

f

Ratios

are

annualized

for

periods

less

than

one

year.

g

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

New

York

Tax-Free

Income

Fund

Financial

Highlights

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

August

31,

2024

(unaudited)

Year

Ended

February

28,

Year

Ended

February

28,

2022

b

Year

Ended

May

31,

2024

a

2023

2021

2020

2019

Class

C

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

..............

$10.02

$9.72

$10.82

$11.38

$11.08

$11.09

$10.85

Income

from

investment

operations

c

:

Net

investment

income

d

.

0.14

0.26

0.23

0.15

0.24

0.24

0.29

Net

realized

and

unrealized

gains

(losses)

0.02

0.30

(1.10)

(0.56)

0.29

(0.01)

0.25

Total

from

investment

operations

.............

0.16

0.56

(0.87)

(0.41)

0.53

0.23

0.54

Less

distributions

from:

Net

investment

income

..

(0.14)

(0.26)

(0.23)

(0.15)

(0.23)

(0.24)

(0.30)

Net

asset

value,

end

of

period

................

$10.04

$10.02

$9.72

$10.82

$11.38

$11.08

$11.09

Total

return

e

...........

1.59%

5.86%

(8.06)%

(3.62)%

4.83%

2.10%

5.10%

Ratios

to

average

net

assets

f

Expenses

g

............

1.18%

1.15%

1.21%

1.22%

1.18%

1.18%

1.18%

Net

investment

income

...

2.70%

2.67%

2.33%

1.82%

2.10%

2.19%

2.69%

Supplemental

data

Net

assets,

end

of

period

(000’s)

...............

$55,149

$64,099

$89,134

$129,772

$202,215

$257,275

$332,093

Portfolio

turnover

rate

....

6.08%

15.99%

22.81%

11.94%

12.15%

21.27%

19.78%

a

For

the

year

ended

February

29.

b

For

the

period

June

1,

2021

to

February

28,

2022.

c

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

d

Based

on

average

daily

shares

outstanding.

e

Total

return

does

not

reflect

sales

commissions

or

contingent

deferred

sales

charges,

if

applicable,

and

is

not

annualized

for

periods

less

than

one

year.

f

Ratios

are

annualized

for

periods

less

than

one

year.

g

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

New

York

Tax-Free

Income

Fund

Financial

Highlights

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

Six

Months

Ended

August

31,

2024

(unaudited)

Year

Ended

February

28,

Year

Ended

February

28,

2022

b

Year

Ended

May

31,

2024

a

2023

2021

2020

2019

Class

R6

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

..............

$10.04

$9.74

$10.85

$11.41

$11.11

$11.12

$10.88

Income

from

investment

operations

c

:

Net

investment

income

d

.

0.17

0.33

0.30

0.21

0.31

0.32

0.36

Net

realized

and

unrealized

gains

(losses)

0.03

0.30

(1.11)

(0.55)

0.30

(0.01)

0.25

Total

from

investment

operations

.............

0.20

0.63

(0.81)

(0.34)

0.61

0.31

0.61

Less

distributions

from:

Net

investment

income

..

(0.17)

(0.33)

(0.30)

(0.22)

(0.31)

(0.32)

(0.37)

Net

asset

value,

end

of

period

................

$10.07

$10.04

$9.74

$10.85

$11.41

$11.11

$11.12

Total

return

e

...........

2.04%

6.55%

(7.48)%

(3.10)%

5.54%

2.80%

5.80%

Ratios

to

average

net

assets

f

Expenses

g

............

0.49%

0.49%

0.51%

0.50%

0.50%

0.50%

0.50%

h

Net

investment

income

...

3.39%

3.34%

3.04%

2.52%

2.76%

2.87%

3.37%

Supplemental

data

Net

assets,

end

of

period

(000’s)

...............

$106,154

$98,748

$86,891

$97,268

$89,785

$71,991

$62,689

Portfolio

turnover

rate

....

6.08%

15.99%

22.81%

11.94%

12.15%

21.27%

19.78%

a

For

the

year

ended

February

29.

b

For

the

period

June

1,

2021

to

February

28,

2022.

c

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

d

Based

on

average

daily

shares

outstanding.

e

Total

return

is

not

annualized

for

periods

less

than

one

year.

f

Ratios

are

annualized

for

periods

less

than

one

year.

g

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

h

Benefit

of

waiver

and

payments

by

affiliates

rounds

to

less

than

0.01%.

Franklin

New

York

Tax-Free

Income

Fund

Financial

Highlights

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

August

31,

2024

(unaudited)

Year

Ended

February

28,

Year

Ended

February

28,

2022

b

Year

Ended

May

31,

2024

a

2023

2021

2020

2019

Advisor

Class

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

..............

$10.04

$9.74

$10.84

$11.40

$11.10

$11.11

$10.87

Income

from

investment

operations

c

:

Net

investment

income

d

.

0.17

0.33

0.30

0.21

0.31

0.32

0.36

Net

realized

and

unrealized

gains

(losses)

0.02

0.29

(1.11)

(0.56)

0.29

(0.02)

0.25

Total

from

investment

operations

.............

0.19

0.62

(0.81)

(0.35)

0.60

0.30

0.61

Less

distributions

from:

Net

investment

income

..

(0.17)

(0.32)

(0.29)

(0.21)

(0.30)

(0.31)

(0.37)

Net

asset

value,

end

of

period

................

$10.06

$10.04

$9.74

$10.84

$11.40

$11.10

$11.11

Total

return

e

...........

1.92%

6.54%

(7.44)%

(3.15)%

5.50%

2.76%

5.77%

Ratios

to

average

net

assets

f

Expenses

g

............

0.53%

0.50%

0.57%

0.57%

0.53%

0.53%

0.53%

Net

investment

income

...

3.35%

3.35%

3.01%

2.46%

2.73%

2.84%

3.34%

Supplemental

data

Net

assets,

end

of

period

(000’s)

...............

$481,902

$489,421

$328,181

$277,600

$287,411

$266,050

$220,727

Portfolio

turnover

rate

....

6.08%

15.99%

22.81%

11.94%

12.15%

21.27%

19.78%

a

For

the

year

ended

February

29.

b

For

the

period

June

1,

2021

to

February

28,

2022.

c

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchas-

es

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

d

Based

on

average

daily

shares

outstanding.

e

Total

return

is

not

annualized

for

periods

less

than

one

year.

f

Ratios

are

annualized

for

periods

less

than

one

year.

g

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

New

York

Tax-Free

Income

Fund

Schedule

of

Investments

(unaudited),

August

31,

2024

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Principal

Amount

a

Value

a

a

a

a

a

Corporate

Bonds

0.2%

Software

0.2%

a

Haven

at

Elgin

LLC

,

5.25

%

,

12/31/53

....................................

$

6,700,000

$

6,887,395

Total

Corporate

Bonds

(Cost

$

6,700,000

)

.......................................

6,887,395

Municipal

Bonds

98.2%

California

0.2%

California

Municipal

Finance

Authority

,

Integrity

Housing

Obligated

Group

,

Revenue

,

2022

A-1

,

4.25

%

,

12/01/37

...........................................

5,800,000

5,138,966

Florida

1.9%

Capital

Trust

Agency,

Inc.

,

Kingdom

Development

West

Palm

Beach

Portfolio

Obligated

Group

,

Revenue

,

2021

A-1

,

3.75

%

,

12/01/36

.............................................

18,760,000

16,758,019

Kingdom

Development

West

Palm

Beach

Portfolio

Obligated

Group

,

Revenue

,

2021

A-2

,

5.5

%

,

12/01/30

..............................................

2,770,000

2,510,617

b

SHI

-

Lake

Osborne

LLC

,

Revenue

,

144A,

2021

A-1

,

3.68

%

,

1/01/57

...........

3,990,000

2,888,523

b

Capital

Trust

Authority

,

Gulf

Coast

Portfolio

Obligated

Group

,

Revenue

,

144A,

2024

,

Refunding

,

Zero

Cpn.,

3/01/29

........................................

23,200,000

18,410,520

b

Leon

County

Housing

Finance

Authority

,

Revenue

,

144A,

2022

A

,

Zero

Cpn.,

5/01/57

15,500,000

13,775,625

54,343,304

Georgia

0.3%

b

Development

Authority

of

Rockdale

County

,

AHPC

Terraces

at

Fieldstone

LLC

,

Revenue

,

144A,

2021

A-1

,

3.5

%

,

12/01/36

...............................

11,550,000

9,777,930

Illinois

1.0%

Metropolitan

Pier

&

Exposition

Authority

,

State

of

Illinois

McCormick

Place

Expansion

Project

Fund

,

Revenue

,

2022

A

,

Refunding

,

4

%

,

12/15/42

...........................................

6,970,000

6,887,777

State

of

Illinois

McCormick

Place

Expansion

Project

Fund

,

Revenue

,

2022

A

,

Refunding

,

4

%

,

6/15/52

............................................

10,310,000

9,598,834

State

of

Illinois

,

GO

,

2003

,

5.1

%

,

6/01/33

............................................

4,705,882

4,737,160

GO

,

2020

B

,

5

%

,

10/01/29

...........................................

1,000,000

1,096,730

GO

,

2021

A

,

5

%

,

3/01/31

............................................

650,000

723,731

GO

,

2021

A

,

5

%

,

3/01/32

............................................

500,000

553,941

GO

,

2021

A

,

5

%

,

3/01/34

............................................

2,000,000

2,202,386

GO

,

2021

A

,

4

%

,

3/01/38

............................................

2,600,000

2,586,289

28,386,848

Kentucky

0.2%

b

Louisville/Jefferson

County

Metropolitan

Government

,

PSG

Vesta

Derby

Oaks

LLC

,

Revenue

,

144A,

2022

A

,

Zero

Cpn.,

5/01/52

..............................

7,600,000

6,071,780

New

Jersey

0.5%

New

Jersey

Economic

Development

Authority

,

State

of

New

Jersey

,

Revenue

,

2021

QQQ

,

4

%

,

6/15/50

.................................................

1,500,000

1,443,315

New

Jersey

Transportation

Trust

Fund

Authority

,

State

of

New

Jersey

,

Revenue

,

2020

AA

,

5

%

,

6/15/50

......................

4,750,000

4,994,244

State

of

New

Jersey

,

Revenue

,

2022

A

,

4

%

,

6/15/41

........................

1,500,000

1,496,173

State

of

New

Jersey

,

Revenue

,

2022

BB

,

4

%

,

6/15/46

......................

5,000,000

4,831,574

12,765,306

New

York

89.7%

Albany

Capital

Resource

Corp.

,

Albany

College

of

Pharmacy

and

Health

Sciences

,

Revenue

,

2022

A

,

Refunding

,

5.25

%

,

12/01/38

.................................................

6,505,000

6,846,723

Equitable

School

Revolving

Fund

LLC

Obligated

Group

,

Revenue

,

2021

D

,

4

%

,

11/01/51

.......................................................

2,000,000

1,934,464

Franklin

New

York

Tax-Free

Income

Fund

Schedule

of

Investments

(unaudited)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Principal

Amount

a

Value

a

a

a

a

a

Municipal

Bonds

(continued)

New

York

(continued)

Albany

Capital

Resource

Corp.,

(continued)

KIPP

Capital

Region

Public

Charter

Schools

,

Revenue

,

2024

,

4.75

%

,

6/01/54

....

$

1,200,000

$

1,202,291

KIPP

Capital

Region

Public

Charter

Schools

,

Revenue

,

2024

,

5

%

,

6/01/64

.......

2,250,000

2,272,288

Allegany

County

Capital

Resource

Corp.

,

Alfred

University

,

Revenue

,

2024

,

5.25

%

,

4/01/49

..........................

1,700,000

1,784,087

Alfred

University

,

Revenue

,

2024

,

5.25

%

,

4/01/54

..........................

3,000,000

3,124,980

Battery

Park

City

Authority

,

Revenue,

Senior

Lien

,

2019

A

,

5

%

,

11/01/49

.............................

6,130,000

6,556,653

Revenue,

Senior

Lien

,

2023

A

,

5

%

,

11/01/48

.............................

20,000,000

22,175,846

Brookhaven

Local

Development

Corp.

,

Active

Retirement

Community,

Inc.

Obligated

Group

,

Revenue

,

2020

A

,

4

%

,

11/01/45

1,500,000

1,427,789

Active

Retirement

Community,

Inc.

Obligated

Group

,

Revenue

,

2020

A

,

4

%

,

11/01/55

8,000,000

7,209,061

Broome

County

Local

Development

Corp.

,

Good

Shepherd

Village

at

Endwell

Obligated

Group

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/36

........................................................

1,600,000

1,544,260

Good

Shepherd

Village

at

Endwell

Obligated

Group

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/41

........................................................

1,530,000

1,407,998

Good

Shepherd

Village

at

Endwell

Obligated

Group

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/47

........................................................

1,160,000

1,008,789

United

Health

Services

Hospitals

Obligated

Group

,

Revenue

,

2020

,

Refunding

,

AGMC

Insured

,

3

%

,

4/01/45

........................................

7,045,000

5,531,249

Buffalo

&

Erie

County

Industrial

Land

Development

Corp.

,

Catholic

Health

System

Obligated

Group

,

Revenue

,

2015

,

5.25

%

,

7/01/35

.......

1,000,000

987,744

Catholic

Health

System

Obligated

Group

,

Revenue

,

2015

,

5

%

,

7/01/40

.........

1,000,000

954,650

D'Youville

University

,

Revenue

,

2020

A

,

Refunding

,

4

%

,

11/01/50

..............

2,500,000

2,094,464

Build

NYC

Resource

Corp.

,

Academic

Leadership

Charter

School

,

Revenue

,

2021

,

4

%

,

6/15/36

............

400,000

385,367

Classical

Charter

School,

Inc.

,

Revenue

,

2023

A

,

4.5

%

,

6/15/43

...............

700,000

698,469

Classical

Charter

School,

Inc.

,

Revenue

,

2023

A

,

4.75

%

,

6/15/53

..............

850,000

844,185

Classical

Charter

School,

Inc.

,

Revenue

,

2023

A

,

4.75

%

,

6/15/58

..............

725,000

713,785

Grand

Concourse

Academy

Charter

School

,

Revenue

,

2022

A

,

5

%

,

7/01/42

......

600,000

616,992

Grand

Concourse

Academy

Charter

School

,

Revenue

,

2022

A

,

5

%

,

7/01/52

......

725,000

735,046

Grand

Concourse

Academy

Charter

School

,

Revenue

,

2022

A

,

5

%

,

7/01/56

......

570,000

575,898

KIPP

NYC

Public

Charter

Schools

,

Revenue

,

2022

,

5.25

%

,

7/01/52

............

4,000,000

4,173,328

KIPP

NYC

Public

Charter

Schools

,

Revenue

,

2022

,

5.25

%

,

7/01/57

............

1,000,000

1,040,720

KIPP

NYC

Public

Charter

Schools

,

Revenue

,

2022

,

5.25

%

,

7/01/62

............

1,500,000

1,556,091

c

Chautauqua

County

Capital

Resource

Corp.

,

NRG

Energy,

Inc.

,

Revenue

,

2020

,

Refunding

,

Mandatory

Put

,

4.25

%

,

4/03/28

...............................

2,000,000

2,048,838

City

of

Long

Beach

,

GO

,

2022

B

,

BAM

Insured

,

5.25

%

,

7/15/42

.................

1,010,000

1,095,055

City

of

New

Rochelle

,

Iona

College

,

Revenue

,

2015

A

,

Refunding

,

5

%

,

7/01/45

.....

2,675,000

2,684,490

City

of

New

York

,

GO

,

2017

B

,

5

%

,

12/01/41

...........................................

7,000,000

7,218,559

GO

,

2018

B-1

,

5

%

,

10/01/38

.........................................

6,250,000

6,549,514

GO

,

2018

E-1

,

5

%

,

3/01/40

..........................................

14,330,000

15,053,165

GO

,

2018

E-1

,

5

%

,

3/01/44

..........................................

12,500,000

13,046,305

GO

,

2018

F-1

,

5

%

,

4/01/40

..........................................

16,210,000

17,045,959

GO

,

2018

F-1

,

5

%

,

4/01/45

..........................................

10,000,000

10,431,427

GO

,

2019

D-1

,

4

%

,

12/01/43

.........................................

10,000,000

9,858,235

GO

,

2022

D-1

,

5.25

%

,

5/01/41

........................................

1,500,000

1,678,032

GO

,

2023

A-1

,

4

%

,

9/01/46

..........................................

5,000,000

4,927,770

GO

,

2023

E-1

,

4

%

,

4/01/45

..........................................

3,000,000

2,962,376

GO

,

2023

E-1

,

5.25

%

,

4/01/47

........................................

10,000,000

11,046,494

GO

,

2024

C

,

5.25

%

,

3/01/53

.........................................

7,750,000

8,558,261

GO

,

2024

D

,

5.25

%

,

4/01/54

.........................................

2,000,000

2,208,448

d

GO

,

2025

C-1

,

5.25

%

,

9/01/50

........................................

1,000,000

1,111,246

Dutchess

County

Local

Development

Corp.

,

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

5

%

,

7/01/32

......

175,000

188,855

Franklin

New

York

Tax-Free

Income

Fund

Schedule

of

Investments

(unaudited)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Principal

Amount

a

Value

a

a

a

a

a

Municipal

Bonds

(continued)

New

York

(continued)

Dutchess

County

Local

Development

Corp.,

(continued)

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

5

%

,

7/01/33

......

$

185,000

$

198,891

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

5

%

,

7/01/34

......

500,000

537,345

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/35

......

200,000

200,016

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/36

......

200,000

198,613

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/37

......

250,000

246,301

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/38

......

250,000

242,264

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/39

......

100,000

95,616

Culinary

Institute

of

America

(The)

,

Revenue

,

2021

,

Refunding

,

4

%

,

7/01/40

......

100,000

94,764

Nuvance

Health

Obligated

Group

,

Revenue

,

2016

B

,

5

%

,

7/01/31

.............

10,550,000

10,779,214

Nuvance

Health

Obligated

Group

,

Revenue

,

2019

B

,

Refunding

,

4

%

,

7/01/44

.....

1,900,000

1,822,839

Nuvance

Health

Obligated

Group

,

Revenue

,

2019

B

,

Refunding

,

4

%

,

7/01/49

.....

4,425,000

4,234,692

Vassar

College

,

Revenue

,

2017

,

Refunding

,

5

%

,

7/01/42

....................

5,000,000

5,162,058

Vassar

College

,

Revenue

,

2017

,

Refunding

,

4

%

,

7/01/46

....................

5,715,000

5,651,478

Genesee

County

Funding

Corp.

(The)

,

Rochester

Regional

Health

Obligated

Group

,

Revenue

,

2022

A

,

Refunding

,

5.25

%

,

12/01/52

............................

4,250,000

4,436,300

Hempstead

Town

Local

Development

Corp.

,

Hofstra

University

,

Revenue

,

2017

,

Refunding

,

5

%

,

7/01/42

..................

1,250,000

1,288,993

Hofstra

University

,

Revenue

,

2017

,

Refunding

,

5

%

,

7/01/47

..................

5,250,000

5,380,038

Hofstra

University

,

Revenue

,

2021

A

,

Refunding

,

4

%

,

7/01/39

.................

575,000

579,427

Hofstra

University

,

Revenue

,

2021

A

,

Refunding

,

4

%

,

7/01/40

.................

715,000

716,602

Hofstra

University

,

Revenue

,

2021

A

,

Refunding

,

4

%

,

7/01/41

.................

625,000

621,267

Hofstra

University

,

Revenue

,

2021

A

,

Refunding

,

3

%

,

7/01/51

.................

3,000,000

2,239,592

Hudson

Yards

Infrastructure

Corp.

,

Revenue

,

2017

A

,

Refunding

,

5

%

,

2/15/42

...............................

15,000,000

15,494,423

Revenue

,

2017

A

,

Refunding

,

AGMC

Insured

,

4

%

,

2/15/47

...................

13,680,000

13,414,947

Long

Island

Power

Authority

,

Revenue

,

2016

B

,

Refunding

,

5

%

,

9/01/41

...............................

15,250,000

15,710,350

Revenue

,

2018

,

5

%

,

9/01/39

.........................................

5,000,000

5,299,220

Revenue

,

2021

A

,

Refunding

,

4

%

,

9/01/42

...............................

1,500,000

1,526,392

Revenue

,

2022

A

,

Refunding

,

5

%

,

9/01/44

...............................

3,000,000

3,310,064

Revenue

,

2023

E

,

5

%

,

9/01/53

........................................

3,500,000

3,808,078

Revenue

,

2024

A

,

Refunding

,

5

%

,

9/01/54

...............................

8,000,000

8,755,149

Revenue

,

2024

A

,

Refunding

,

5.25

%

,

9/01/54

.............................

2,500,000

2,794,022

Metropolitan

Transportation

Authority

,

Revenue

,

2015

C-1

,

Refunding

,

5

%

,

11/15/35

............................

5,000,000

5,093,201

Revenue

,

2016

B

,

Refunding

,

5

%

,

11/15/33

..............................

6,000,000

6,213,505

Revenue

,

2016

B

,

Refunding

,

5

%

,

11/15/35

..............................

4,000,000

4,131,158

Revenue

,

2016

B

,

Refunding

,

5

%

,

11/15/37

..............................

18,500,000

19,059,033

Revenue

,

2016

D

,

Refunding

,

5

%

,

11/15/30

..............................

10,305,000

10,713,964

Revenue

,

2017

A-1

,

Refunding

,

5

%

,

11/15/51

.............................

2,505,000

2,570,299

Revenue

,

2017

C-1

,

Refunding

,

5

%

,

11/15/30

............................

6,215,000

6,668,844

Revenue

,

2017

D

,

Refunding

,

4

%

,

11/15/42

..............................

20,000,000

19,746,522

Revenue

,

2017

D

,

Refunding

,

4

%

,

11/15/46

..............................

5,000,000

4,838,398

Revenue

,

2019

C

,

AGMC

Insured

,

4

%

,

11/15/45

...........................

8,000,000

7,864,750

Revenue

,

2020

A-1

,

5

%

,

11/15/48

.....................................

17,000,000

17,795,236

Revenue

,

2020

C-1

,

4.75

%

,

11/15/45

...................................

2,950,000

3,025,926

Revenue

,

2020

C-1

,

5

%

,

11/15/50

.....................................

9,150,000

9,554,694

Revenue

,

2020

D

,

5

%

,

11/15/44

.......................................

15,000,000

15,910,307

Revenue

,

2020

D

,

4

%

,

11/15/50

.......................................

10,000,000

9,576,483

Revenue

,

2021

A-2

,

4

%

,

11/15/42

.....................................

5,000,000

4,955,633

Revenue

,

2024

A

,

Refunding

,

4

%

,

11/15/43

..............................

6,220,000

6,126,834

Revenue

,

2024

A

,

Refunding

,

5.25

%

,

11/15/49

............................

6,000,000

6,547,681

Dedicated

Tax

Fund

,

Revenue

,

2012

A

,

Refunding

,

Zero

Cpn.,

11/15/32

.........

10,000,000

7,564,938

Dedicated

Tax

Fund

,

Revenue

,

2017

A

,

5

%

,

11/15/47

.......................

30,375,000

31,230,867

Dedicated

Tax

Fund

,

Revenue

,

2017

B-1

,

Refunding

,

5

%

,

11/15/42

............

5,000,000

5,199,617

Dedicated

Tax

Fund

,

Revenue

,

2017

B-1

,

Refunding

,

5

%

,

11/15/47

............

13,505,000

13,961,628

Franklin

New

York

Tax-Free

Income

Fund

Schedule

of

Investments

(unaudited)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Principal

Amount

a

Value

a

a

a

a

a

Municipal

Bonds

(continued)

New

York

(continued)

Metropolitan

Transportation

Authority,

(continued)

Dedicated

Tax

Fund

,

Special

Tax

,

2024

A

,

5

%

,

11/15/49

.....................

$

2,500,000

$

2,744,921

Dedicated

Tax

Fund

,

Special

Tax

,

2024

A

,

5.25

%

,

11/15/54

...................

7,500,000

8,371,688

Monroe

County

Industrial

Development

Corp.

,

Rochester

Regional

Health

Obligated

Group

,

Revenue

,

2017

,

5

%

,

12/01/46

......

17,000,000

17,142,132

Rochester

Regional

Health

Obligated

Group

,

Revenue

,

2020

A

,

Refunding

,

5

%

,

12/01/31

.......................................................

1,500,000

1,581,336

Rochester

Regional

Health

Obligated

Group

,

Revenue

,

2020

A

,

Refunding

,

5

%

,

12/01/32

.......................................................

4,200,000

4,417,078

Rochester

Regional

Health

Obligated

Group

,

Revenue

,

2020

A

,

Refunding

,

5

%

,

12/01/33

.......................................................

1,000,000

1,049,783

Rochester

Regional

Health

Obligated

Group

,

Revenue

,

2020

A

,

Refunding

,

5

%

,

12/01/34

.......................................................

2,510,000

2,629,235

Rochester

Regional

Health

Obligated

Group

,

Revenue

,

2020

A

,

Refunding

,

4

%

,

12/01/35

.......................................................

1,100,000

1,103,765

Rochester

Regional

Health

Obligated

Group

,

Revenue

,

2020

A

,

Refunding

,

4

%

,

12/01/46

.......................................................

8,560,000

7,871,044

St.

John

Fisher

University

,

Revenue

,

2024

,

Refunding

,

5.25

%

,

6/01/49

..........

635,000

697,914

St.

John

Fisher

University

,

Revenue

,

2024

,

Refunding

,

5.25

%

,

6/01/54

..........

1,670,000

1,813,351

b

True

North

Rochester

Prep

Charter

School

,

Revenue

,

144A,

2020

A

,

5

%

,

6/01/50

.

2,360,000

2,394,935

b

True

North

Rochester

Prep

Charter

School

,

Revenue

,

144A,

2020

A

,

5

%

,

6/01/59

.

2,345,000

2,370,890

University

of

Rochester

,

Revenue

,

2015

A

,

Refunding

,

5

%

,

7/01/37

............

1,780,000

1,805,435

University

of

Rochester

,

Revenue

,

2017

C

,

Refunding

,

4

%

,

7/01/43

............

22,895,000

22,936,783

University

of

Rochester

,

Revenue

,

2017

D

,

Refunding

,

4

%

,

7/01/43

............

21,550,000

21,589,329

University

of

Rochester

,

Revenue

,

2023

A

,

5

%

,

7/01/53

.....................

10,000,000

10,905,146

Nassau

County

Local

Economic

Assistance

Corp.

,

Roosevelt

Children's

Academy

Charter

School

,

Revenue

,

2023

A

,

5

%

,

7/01/43

....

1,440,000

1,507,179

Roosevelt

Children's

Academy

Charter

School

,

Revenue

,

2023

A

,

5

%

,

7/01/55

....

2,605,000

2,662,080

New

York

City

Health

and

Hospitals

Corp.

,

Revenue

,

2020

A

,

Refunding

,

3

%

,

2/15/45

...............................

1,250,000

1,009,923

Revenue

,

2020

A

,

Refunding

,

4

%

,

2/15/45

...............................

1,800,000

1,768,469

Revenue

,

2020

A

,

Refunding

,

4

%

,

2/15/48

...............................

880,000

846,785

New

York

City

Housing

Development

Corp.

,

Revenue

,

2018

K

,

4

%

,

11/01/48

.......................................

36,505,000

34,984,125

Revenue

,

2019

G-1-B

,

Refunding

,

3

%

,

11/01/44

...........................

9,405,000

7,632,896

Revenue

,

2019

J

,

3

%

,

11/01/44

.......................................

4,935,000

4,059,557

Revenue

,

2020

C

,

FNMA

Insured

,

2.75

%

,

2/01/51

.........................

10,000,000

6,942,619

New

York

City

Industrial

Development

Agency

,

Queens

Ballpark

Co.

LLC

,

Revenue

,

2021

A

,

Refunding

,

AGMC

Insured

,

3

%

,

1/01/46

5,000,000

4,074,011

Yankee

Stadium

LLC

,

Revenue

,

2020

A

,

Refunding

,

AGMC

Insured

,

3

%

,

3/01/49

..

10,000,000

7,782,442

New

York

City

Municipal

Water

Finance

Authority

,

New

York

City

Water

&

Sewer

System

,

Revenue

,

2024

CC-1

,

4.25

%

,

6/15/54

.....

2,500,000

2,521,582

Water

&

Sewer

System

,

Revenue

,

2017

AA

,

4

%

,

6/15/46

....................

24,290,000

24,290,794

Water

&

Sewer

System

,

Revenue

,

2017

DD

,

5

%

,

6/15/47

....................

33,800,000

34,924,678

Water

&

Sewer

System

,

Revenue

,

2018

BB-1

,

5

%

,

6/15/46

..................

36,375,000

37,612,470

Water

&

Sewer

System

,

Revenue

,

2018

CC-1

,

5

%

,

6/15/48

..................

11,225,000

11,590,444

Water

&

Sewer

System

,

Revenue

,

2018

FF

,

Refunding

,

5

%

,

6/15/40

............

15,000,000

15,852,117

Water

&

Sewer

System

,

Revenue

,

2019

DD-1

,

5

%

,

6/15/49

..................

19,000,000

19,836,857

Water

&

Sewer

System

,

Revenue

,

2020

AA

,

Refunding

,

5

%

,

6/15/40

...........

10,000,000

10,800,223

Water

&

Sewer

System

,

Revenue

,

2022

AA-1

,

5

%

,

6/15/48

..................

8,825,000

9,459,384

Water

&

Sewer

System

,

Revenue

,

2023

AA-1

,

5.25

%

,

6/15/52

................

16,750,000

18,456,249

New

York

City

Transitional

Finance

Authority

,

Future

Tax

Secured

,

Revenue

,

2016

A-1

,

5

%

,

8/01/36

......................

10,000,000

10,159,080

Future

Tax

Secured

,

Revenue

,

2017

E-1

,

5

%

,

2/01/33

......................

6,500,000

6,786,289

Future

Tax

Secured

,

Revenue

,

2017

F-1

,

5

%

,

5/01/42

......................

17,500,000

18,128,254

Future

Tax

Secured

,

Revenue

,

2018

A-3

,

5

%

,

8/01/40

......................

3,270,000

3,409,655

Future

Tax

Secured

,

Revenue

,

2018

C-3

,

4

%

,

5/01/42

......................

7,410,000

7,420,034

Franklin

New

York

Tax-Free

Income

Fund

Schedule

of

Investments

(unaudited)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Principal

Amount

a

Value

a

a

a

a

a

Municipal

Bonds

(continued)

New

York

(continued)

New

York

City

Transitional

Finance

Authority,

(continued)

Future

Tax

Secured

,

Revenue

,

2019

A-1

,

5

%

,

8/01/40

......................

$

9,340,000

$

9,848,624

Future

Tax

Secured

,

Revenue

,

2020

B-1

,

4

%

,

11/01/41

.....................

7,205,000

7,240,269

Future

Tax

Secured

,

Revenue

,

2021

C-1

,

4

%

,

5/01/43

......................

5,000,000

5,003,712

Future

Tax

Secured

,

Revenue

,

2023

D-1

,

5

%

,

11/01/46

.....................

10,000,000

10,893,132

Future

Tax

Secured

,

Revenue

,

2024

A-1

,

4

%

,

5/01/53

......................

3,000,000

2,919,731

Future

Tax

Secured

,

Revenue

,

2024

G-1

,

4.125

%

,

5/01/52

...................

6,500,000

6,455,056

Future

Tax

Secured

,

Revenue

,

2024

G-1

,

5

%

,

5/01/52

......................

4,000,000

4,353,207

State

of

New

York

,

Revenue

,

2018

S-3

,

5

%

,

7/15/43

........................

10,000,000

10,493,311

State

of

New

York

,

Revenue

,

2019

S-1

,

5

%

,

7/15/43

........................

22,230,000

23,326,630

State

of

New

York

,

Revenue

,

2020

S-1

,

4

%

,

7/15/41

........................

8,465,000

8,512,207

State

of

New

York

,

Revenue

,

2020

S-1B

,

4

%

,

7/15/41

......................

2,465,000

2,486,405

New

York

Convention

Center

Development

Corp.

,

New

York

City

Hotel

Unit

Fee

,

Revenue,

Senior

Lien

,

2016

A

,

5

%

,

11/15/46

.............................

5,000,000

5,106,091

New

York

Liberty

Development

Corp.

,

Revenue

,

2021

A

,

Refunding

,

3

%

,

11/15/51

..............................

18,000,000

13,408,047

Goldman

Sachs

Headquarters

LLC

,

Revenue

,

2005

,

Refunding

,

5.25

%

,

10/01/35

..

91,360,000

106,820,433

Goldman

Sachs

Headquarters

LLC

,

Revenue

,

2007

,

5.5

%

,

10/01/37

...........

27,000,000

32,399,490

Port

Authority

of

New

York

&

New

Jersey

,

Revenue

,

1WTC

2021

,

Refunding

,

3

%

,

2/15/42

........................................................

5,000,000

4,253,693

Port

Authority

of

New

York

&

New

Jersey

,

Revenue

,

1WTC-2021

,

Refunding

,

4

%

,

2/15/43

........................................................

5,000,000

4,946,630

New

York

Power

Authority

,

Revenue

,

2020

A

,

Refunding

,

4

%

,

11/15/60

..............................

11,455,000

11,148,546

SFP

Transmission

Project

,

Revenue

,

2023

A

,

AGMC

Insured

,

5

%

,

11/15/53

......

3,000,000

3,314,487

New

York

State

Dormitory

Authority

,

Revenue

,

2008

A-1

,

5

%

,

6/01/38

......................................

3,970,000

3,974,429

Revenue

,

2009

A

,

AGMC

Insured

,

5.625

%

,

10/01/29

.......................

300,000

300,600

Revenue

,

2009

C

,

AGMC

Insured

,

5

%

,

10/01/31

..........................

45,000

45,067

Revenue

,

2009

C

,

AGMC

Insured

,

5.125

%

,

10/01/36

.......................

60,000

60,100

Revenue

,

2010

A

,

AGMC

Insured

,

5

%

,

10/01/24

...........................

710,000

710,950

Catholic

Health

System

Obligated

Group

,

Revenue

,

2019

A

,

Refunding

,

4

%

,

7/01/37

1,705,000

1,478,855

Catholic

Health

System

Obligated

Group

,

Revenue

,

2019

A

,

Refunding

,

4

%

,

7/01/38

2,200,000

1,888,974