| | | | | | | | | | | | | | | | | | | | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, DC 20549 |

| | | | | | | |

| Form 10-K |

| | | | | | | |

ý Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2024 |

| OR |

¨ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

| | | | | | | |

Commission File Number 1-7293 |

| | | | | | | |

| | | | | | | |

| TENET HEALTHCARE CORPORATION |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | |

| Nevada | | | 95-2557091 | |

| (State of Incorporation) | | | (IRS Employer Identification No.) | |

| | | | | | | |

| 14201 Dallas Parkway |

| Dallas, TX 75254 |

| (Address of principal executive offices, including zip code) |

| | | | | | | |

| (469) 893-2200 |

| (Registrant’s telephone number, including area code) |

| | | | | | | |

| | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered | |

| Common stock, $0.05 par value | | THC | | New York Stock Exchange | |

| 6.875% Senior Notes due 2031 | | THC31 | | New York Stock Exchange | |

| | | | | | | | | | | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(g) of the Act: None |

|

| | | | | | | |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨ |

| | | | | | | |

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý |

| | | | | | | |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨ |

| | | | | | | |

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes ý No ¨ |

| | | | | | | |

| Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company (each as defined in Exchange Act Rule 12b-2). |

| | | | | | | | | | | | | | |

Large accelerated filer ý | Accelerated filer ¨ | Non-accelerated filer ¨ |

| | | | | | | | | | | | | | |

| Smaller reporting company ☐ | | Emerging growth company ☐ | |

| | |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

|

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ý |

|

| If securities are registered pursuant to Section 12(b) of the Exchange Act, indicate by check mark whether the financial statements of the Registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐ |

|

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the Registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨ |

|

Indicate by check mark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No ý |

|

| As of June 30, 2024, the aggregate market value of the shares of common stock held by non-affiliates of the Registrant (treating directors, executive officers who were SEC reporting persons, and holders of 10% or more of the common stock outstanding as of that date, for this purpose, as affiliates) was approximately $9.97 billion based on the closing price of the Registrant’s shares on the New York Stock Exchange on Friday, June 28, 2024. As of January 31, 2025, there were 95,121 shares (in thousands) of common stock outstanding. |

|

DOCUMENTS INCORPORATED BY REFERENCE |

|

| Portions of the Registrant’s definitive proxy statement for the 2025 annual meeting of shareholders are incorporated by reference into Part III of this Form 10-K. |

PART I.

ITEM 1. BUSINESS

OVERVIEW

Tenet Healthcare Corporation (“Tenet”) is a diversified healthcare services company with its headquarters in Dallas, Texas, and a Global Business Center (“GBC”) in the Philippines, that supports various enterprise-wide administrative functions. We operate our expansive, nationwide care delivery network through direct and indirect subsidiaries, as well as downstream partnerships and joint ventures; the terms “we,” “our” and “us,” as used in this report and unless otherwise stated or indicated by the context, refer to Tenet and these entities. Our business is organized into two separate reporting segments – Hospital Operations and Services (“Hospital Operations”) and Ambulatory Care.

At December 31, 2024, our Hospital Operations segment was comprised of: (1) 49 acute care and specialty hospitals, a network of employed physicians, and 135 outpatient facilities, including urgent care centers (each, a “UCC”), imaging centers, off-campus hospital emergency departments (“EDs”) and micro‑hospitals; and (2) the revenue cycle management and value‑based care services we provide to hospitals, health systems, physician practices, employers and other clients through our Conifer Health Solutions, LLC joint venture (“Conifer JV”). Our Ambulatory Care segment, through our USPI Holding Company, Inc. subsidiary (“USPI”), held ownership interests in 518 ambulatory surgery centers (each, an “ASC”) and 25 surgical hospitals at December 31, 2024. Additional information about our reporting segments is provided below; statistical data for the segments can be found in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, of Part II of this report (“MD&A”).

OPERATIONS

HOSPITAL OPERATIONS AND SERVICES SEGMENT

In 2024, we continued to pursue advantageous opportunities to grow our portfolio of hospitals and other healthcare facilities. In July, we opened the newly constructed, 92‑bed Westover Hills Baptist Hospital in San Antonio, and, in September, we acquired a majority ownership interest in a 36‑bed rehabilitation hospital in El Paso. In addition, we continued construction in 2024 on a new medical campus located in Port St. Lucie, which will include the 54‑bed Florida Coast Surgical Hospital, as well as medical office space. We expect to complete construction of the Port St. Lucie medical campus in late 2025.

From time to time, we also capitalize on opportunities to refine our portfolio of hospitals and other healthcare facilities when we believe such refinements will help us improve profitability, allocate capital more effectively in areas where we have a stronger presence, deploy proceeds toward higher-return investments across our business, enhance cash flow generation or reduce our debt, among other things. To that end, we sold six hospitals in California and three hospitals in South Carolina, along with certain related operations, in 2024; in addition, we completed the sale of our majority ownership interests in several entities that owned or leased five hospitals and certain related operations in Alabama.

At December 31, 2024, our subsidiaries operated 49 acute care and specialty hospitals serving primarily urban and suburban communities in eight states. Our subsidiaries had sole ownership of 45 of these hospitals, two were owned by entities that are majority owned by a Tenet subsidiary, and two were owned by third parties and leased by our wholly owned subsidiaries.

Our general hospitals offer acute care services, operating and recovery rooms, radiology services, respiratory therapy services, clinical laboratories and pharmacies; in addition, most have: intensive care, critical care and/or coronary care units; cardiovascular, digestive disease, neurosciences, musculoskeletal and obstetrics services; and outpatient services, including physical therapy. Many of our hospitals provide tertiary care services, such as cardiothoracic surgery, complex spinal surgery, neonatal intensive care and neurosurgery, and our Children’s Hospital of Michigan also offers pediatric quaternary care through its heart, kidney and liver transplant programs. Moreover, a number of our hospitals offer advanced treatment options for patients, including limb‑salvaging vascular procedures, acute level 1 trauma services, comprehensive intravascular stroke care, minimally invasive cardiac valve replacement, cutting‑edge imaging technology, surgical robotic capabilities and telemedicine access for select medical specialties.

All of the hospitals in our Hospital Operations segment are licensed under appropriate state laws, and each is accredited by The Joint Commission or, in the case of The Hospitals of Providence Rehabilitation Hospital East, with the Center for Improvement in Healthcare Quality. With such accreditation, our hospitals are deemed to meet the Medicare Conditions of Participation and Conditions for Coverage, and they are eligible to participate in Medicare, Medicaid and other government‑sponsored provider programs.

The following table lists, by state, the hospitals wholly owned, operated as part of a joint venture, or leased and operated by our wholly owned subsidiaries at December 31, 2024:

| | | | | | | | | | | | | | | | | | | | |

| Hospital | | Location | | Licensed Beds | | Status |

| Arizona | | | | | | |

Abrazo Arizona Heart Hospital(1) | | Phoenix | | 59 | | Owned |

| Abrazo Arrowhead Campus | | Glendale | | 229 | | Owned |

| Abrazo Central Campus | | Phoenix | | 206 | | Owned |

| Abrazo Scottsdale Campus | | Phoenix | | 120 | | Owned |

| Abrazo West Campus | | Goodyear | | 216 | | Owned |

Holy Cross Hospital(2) | | Nogales | | 25 | | Owned |

| St. Joseph’s Hospital | | Tucson | | 451 | | Owned |

| St. Mary’s Hospital | | Tucson | | 400 | | Owned |

| | | | | | |

| California | | | | | | |

Desert Regional Medical Center(3) | | Palm Springs | | 385 | | Leased |

| Doctors Hospital of Manteca | | Manteca | | 73 | | Owned |

| Doctors Medical Center | | Modesto | | 461 | | Owned |

| Emanuel Medical Center | | Turlock | | 209 | | Owned |

Hi-Desert Medical Center(4) | | Joshua Tree | | 179 | | Leased |

| John F. Kennedy Memorial Hospital | | Indio | | 145 | | Owned |

San Ramon Regional Medical Center(5) | | San Ramon | | 123 | | JV/Owned |

| | | | | | |

| Florida | | | | | | |

| Delray Medical Center | | Delray Beach | | 536 | | Owned |

| Good Samaritan Medical Center | | West Palm Beach | | 333 | | Owned |

| Palm Beach Gardens Medical Center | | Palm Beach Gardens | | 199 | | Owned |

| St. Mary’s Medical Center | | West Palm Beach | | 420 | | Owned |

| West Boca Medical Center | | Boca Raton | | 195 | | Owned |

| | | | | | |

| Massachusetts | | | | | | |

| MetroWest Medical Center – Framingham Union Campus | | Framingham | | 136 | | Owned |

MetroWest Medical Center – Leonard Morse Campus(1) | | Natick | | 103 | | Owned |

| Saint Vincent Hospital | | Worcester | | 290 | | Owned |

| | | | | | |

| Michigan | | | | | | |

| Children’s Hospital of Michigan | | Detroit | | 228 | | Owned |

| Detroit Receiving Hospital | | Detroit | | 273 | | Owned |

| Harper University Hospital | | Detroit | | 470 | | Owned |

| Huron Valley-Sinai Hospital | | Commerce Township | | 158 | | Owned |

| Hutzel Women’s Hospital | | Detroit | | 114 | | Owned |

Rehabilitation Institute of Michigan(1) | | Detroit | | 69 | | Owned |

| Sinai-Grace Hospital | | Detroit | | 404 | | Owned |

| | | | | | |

| South Carolina | | | | | | |

| Piedmont Medical Center | | Rock Hill | | 294 | | Owned |

| Piedmont Medical Center Fort Mill | | Fort Mill | | 100 | | Owned |

| | | | | | |

| Tennessee | | | | | | |

| Saint Francis Hospital | | Memphis | | 479 | | Owned |

| Saint Francis Hospital – Bartlett | | Bartlett | | 196 | | Owned |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Hospital | | Location | | Licensed Beds | | Status |

| Texas | | | | | |

| Baptist Medical Center | | San Antonio | | 607 | | Owned |

| The Hospitals of Providence East Campus | | El Paso | | 218 | | Owned |

| The Hospitals of Providence Memorial Campus | | El Paso | | 480 | | Owned |

The Hospitals of Providence Rehabilitation Hospital East(1) | | El Paso | | 36 | | JV/Owned |

| The Hospitals of Providence Sierra Campus | | El Paso | | 306 | | Owned |

| The Hospitals of Providence Transmountain Campus | | El Paso | | 108 | | Owned |

| Mission Trail Baptist Hospital | | San Antonio | | 114 | | Owned |

| Nacogdoches Medical Center | | Nacogdoches | | 161 | | Owned |

| North Central Baptist Hospital | | San Antonio | | 443 | | Owned |

| Northeast Baptist Hospital | | San Antonio | | 351 | | Owned |

| Resolute Baptist Hospital | | New Braunfels | | 128 | | Owned |

| St. Luke’s Baptist Hospital | | San Antonio | | 287 | | Owned |

| Valley Baptist Medical Center | | Harlingen | | 586 | | Owned |

| Valley Baptist Medical Center – Brownsville | | Brownsville | | 240 | | Owned |

| Westover Hills Baptist Hospital | | Westover Hills | | 92 | | Owned |

| Total Licensed Beds | | | | 12,435 | | |

(1)Specialty hospital.

(2)Designated by the Centers for Medicare & Medicaid Services (“CMS”) as a critical access hospital.

(3)Current lease expires on May 30, 2027. In December 2024, we entered into a new lease-purchase agreement with a term of May 31, 2027 through May 30, 2057; in accordance with the provisions of the agreement, we will take ownership of the hospital at the end of the term.

(4)Lease expires in July 2045.

(5)Owned by a limited liability company formed as part of a joint venture with John Muir Health, a not‑for‑profit health system in the San Francisco Bay area; a Tenet subsidiary owned a 51% interest in the entity at December 31, 2024, and John Muir Health owned a 49% interest.

Information regarding the utilization of licensed beds and other operating statistics at December 31, 2024 and 2023 can be found in MD&A.

Our Hospital Operations segment also included 135 outpatient centers at December 31, 2024, primarily freestanding UCCs (nearly all of which are jointly owned with and managed by NextCare in Arizona), provider‑based and freestanding imaging centers, off-campus hospital EDs and micro‑hospitals. Approximately 72% of the outpatient centers in our Hospital Operations segment at December 31, 2024 were in Arizona and Texas. Strong concentrations of facilities within operating areas may help us expand our managed care payer network, reduce management, marketing and other expenses, and more efficiently utilize resources. However, these concentrations increase the risk that, should any adverse economic, regulatory, environmental, competitive or other condition (including an epidemic or outbreak of an infectious disease) occur in these areas, our overall business, financial condition, results of operations or cash flows could be materially adversely affected.

In addition to the hospitals and outpatient facilities discussed above, our Hospital Operations segment includes physician practices and other associated healthcare businesses, as well as our Conifer JV’s revenue cycle management and value‑based care service offerings. At December 31, 2024, we owned 76.2% of the Conifer JV, and CommonSpirit Health held a 23.8% ownership position. The term “Conifer,” as used in Part I of this report and unless otherwise stated or indicated by the context, refers to our Conifer JV and its direct or indirect wholly owned subsidiaries.

The revenue cycle management solutions we offer consist of: (1) patient services, including: centralized insurance and benefit verification; financial clearance, pre‑certification, registration and check‑in services; and financial counseling services, including reviews of eligibility for government healthcare or financial assistance programs, for both insured and uninsured patients, as well as qualified health plan coverage; (2) clinical revenue integrity solutions, including: clinical admission reviews; coding; clinical documentation improvement; coding compliance audits; charge description master management; and health information services; and (3) accounts receivable management solutions, including: third‑party billing and collections; denials management; and patient collections. All of these solutions include ongoing measurement and monitoring of key revenue cycle metrics, as well as productivity and quality improvement programs. In addition, we provide customized communications and engagement solutions to optimize the relationship between providers and patients. We also offer value‑based care services, including clinical integration, financial risk management and population health management, all of which aim to assist clients in improving the cost and quality of their healthcare delivery, as well as their patient outcomes.

At December 31, 2024, we provided one or more of the business process services described above to approximately 620 Tenet and non‑Tenet hospitals and other clients nationwide. Tenet and CommonSpirit Health facilities represented approximately 43% of these clients, and the remainder were unaffiliated health systems, hospitals, physician practices, self‑insured organizations, health plans and other entities.

AMBULATORY CARE SEGMENT

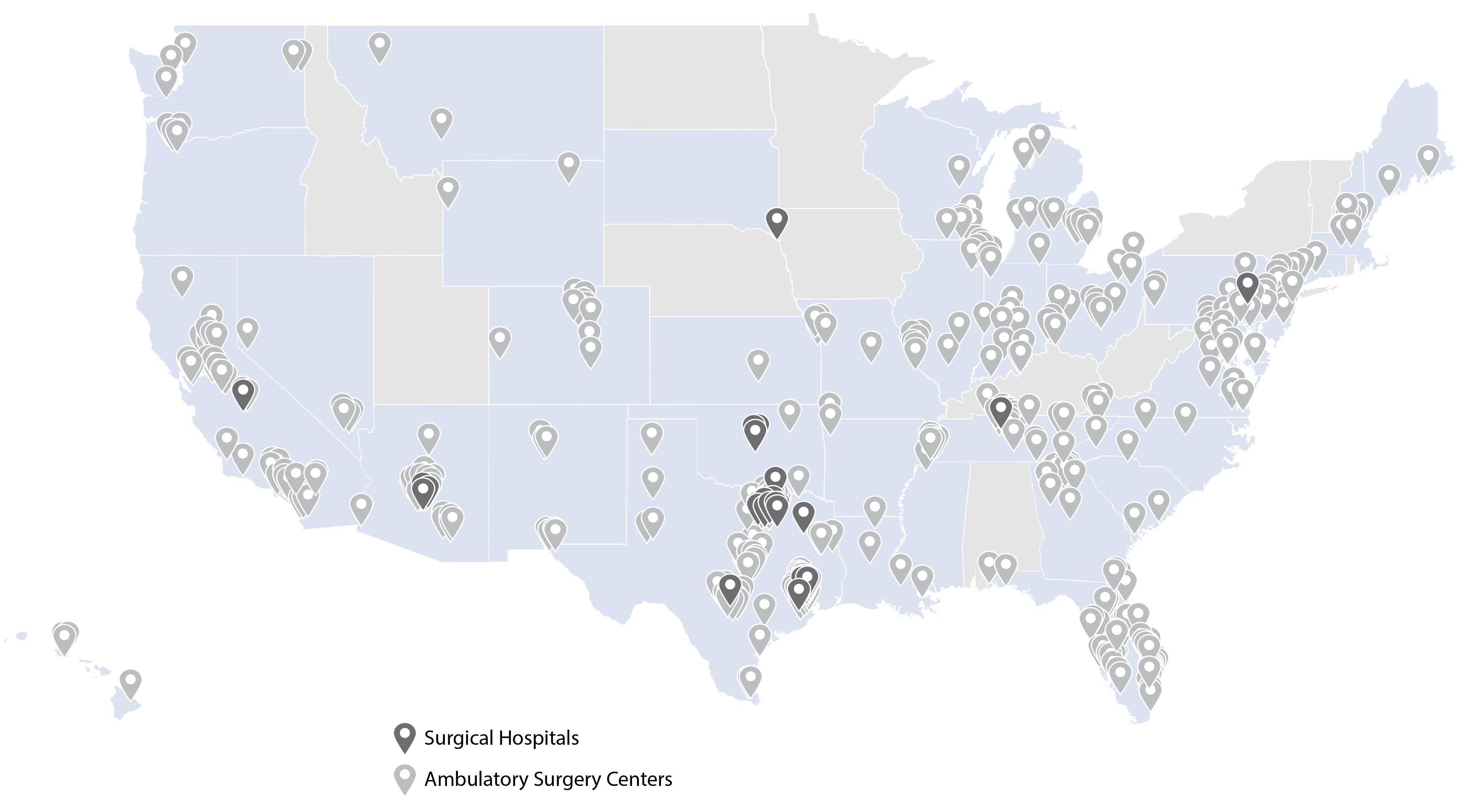

At December 31, 2024, USPI held indirect ownership interests in 518 ASCs and 25 surgical hospitals in 37 states.

USPI’s facilities offer a range of procedures and service lines, including, among other specialties: orthopedics, total joint replacement, and spinal and other musculoskeletal procedures; gastroenterology; pain management; otolaryngology (ear, nose and throat); ophthalmology; and urology.

We believe USPI’s ASCs and surgical hospitals offer many advantages to patients and physicians, including greater affordability, predictability, flexibility and convenience. Moreover, due in part to advancements in surgical techniques, medical technology and anesthesia, as well as the lower cost structure and greater efficiencies that are attainable at a specialized outpatient site, we believe the volume and complexity of surgical cases performed in the outpatient setting will continue to increase over time. For these reasons, we remain focused on opportunities to expand our Ambulatory Care segment through acquisitions, organic growth in physician relationships and service lines, construction of new outpatient centers and strategic partnerships. Detailed information about our Ambulatory Care acquisition and development activity in the year ended December 31, 2024 can be found in MD&A.

Operations of USPI—USPI acquires and develops its facilities primarily through the formation of joint ventures with physicians and/or health system partners. USPI’s subsidiaries hold ownership interests in the facilities directly or indirectly, and we operate the facilities on a day‑to‑day basis through management services contracts. We structure our joint ventures and adopt staffing, scheduling, and clinical systems and protocols with the goals of increasing physician productivity and satisfaction.

REAL PROPERTY

The locations of our acute care and specialty hospitals and the number of licensed beds at each at December 31, 2024 are set forth in the table beginning on page 2. The locations of USPI’s surgical hospitals and ASCs are reflected on the map above. We lease the majority of our outpatient facilities in both our Hospital Operations segment and our Ambulatory Care segment, and our physician practices also lease space in medical office buildings. These leases typically have initial terms ranging from five to 10 years, and most of the leases contain options to extend the lease periods. In addition, our subsidiaries own some medical office buildings located on, or nearby, our hospital campuses. We typically lease our office space under operating lease agreements. Our corporate headquarters are in Dallas, Texas. In addition, we maintain administrative offices in regions where we operate hospitals and other businesses, as well as our GBC

in the Philippines. We believe that all of our properties are suitable for their respective uses and are, in general, adequate for our present needs.

HUMAN CAPITAL RESOURCES

PHYSICIANS

Our operations depend in large part on the number, quality, specialties, and admitting and scheduling practices of the licensed physicians who are members of the medical staffs of our hospitals and other facilities, as well as physicians who affiliate with us and use our facilities as an extension of their practices. Under state laws and other licensing standards, medical staffs are generally self‑governing organizations subject to ultimate oversight by the facility’s local governing board. Members of the medical staffs of our facilities also often serve on the medical staffs of facilities we do not operate, and they are free to terminate their association with our facilities or admit their patients to competing facilities at any time. It is essential to our ongoing business and clinical program development that we attract an appropriate number of quality physicians in the specialties required to support our services and that we maintain good relations with those physicians.

Although we have no contractual relationship with most of the physicians who practice at our hospitals and outpatient centers, at December 31, 2024, we owned over 650 physician practices, and our subsidiaries employed (where permitted by state law) or were otherwise affiliated with nearly 1,135 physicians. Our ability to employ physicians is closely regulated, with a number of states prohibiting the corporate practice of medicine or otherwise regulating what types of entities may employ physicians, and we structure our arrangements with healthcare providers to comply with these state laws.

In 2024, we continued to experience challenges in recruiting and retaining physicians. In some of the regions where we operate, physician recruitment and retention are affected by a shortage of qualified physicians in certain higher-demand clinical service lines and specialties. Moreover, we continue to refine our physician base and provider programs to focus on experienced, high-quality and collaborative specialists.

EMPLOYEES

We believe each employee across our network has a role integral to our mission, which is to provide quality, compassionate care in the communities we serve. At December 31, 2024, we employed approximately 98,000 people (of which approximately 24% were part‑time and on-call employees) in our two reporting segments, as follows:

| | | | | |

| Hospital Operations | 73,000 | |

| Ambulatory Care | 25,000 | |

| |

| Total | 98,000 | |

At December 31, 2024, our overall employee headcount was approximately 8% lower than at December 31, 2023, primarily due to the divestiture of 14 hospitals and related operations during 2024, partially offset by an increase in our Ambulatory Care employees as a result of acquisition and development activity. We had employees in all 50 U.S. states and the District of Columbia, as well as approximately 4,000 GBC employees providing support across our entire network, at December 31, 2024. Approximately 32% of our employees are nurses.

Board Oversight—Our board of directors and its committees oversee human capital matters through regular reports from management and advisors. The board’s human resources committee (“HR Committee”) is responsible for establishing general compensation policies that (1) support our overall business strategies and objectives, (2) enhance our efforts to attract and retain skilled employees, (3) link compensation with our business objectives and organizational performance, and (4) provide competitive compensation opportunities for key executives. The HR Committee also provides, among other things, its perspectives regarding performance management, succession planning, leadership development, equality of opportunity, recruiting, retention and employee training. The board’s environmental, social and governance (“ESG”) committee provides oversight with respect to our ESG strategy and guidance on ESG matters that are relevant to our business.

Human Resources Practices—We have established – and continue to enhance and refine – a comprehensive set of practices for recruiting, managing and optimizing the human resources of our organization. We seek to recruit and retain qualified employees across all demographics; to conduct fair and open competition; and to select and advance employees based on their knowledge, skills, abilities and performance. In many cases, we utilize objective benchmarking and other tools in our efforts in such areas as organizational effectiveness, engagement, voluntary turnover and staffing efficiencies.

Compensation and Benefits—In general, we seek to attract, develop and retain a qualified, diverse, resilient and engaged workforce and to cultivate a performance‑oriented culture that embraces data‑driven decision‑making. To that end, we offer:

•a competitive range of compensation and benefit programs (which vary by location and other factors) designed to reward performance and promote well‑being, including an employee stock purchase plan, a 401(k) plan, health care and insurance benefits, health savings and flexible spending accounts, and paid time off;

•opportunities for continuing education and advancement through a broad range of clinical training and leadership development experiences, including in‑person and online courses and mentoring opportunities;

•a supportive, inclusive and patient‑centered culture aligned with our values and based on respect for others;

•company‑sponsored efforts encouraging and recognizing volunteerism and community service; and

•a code of conduct that promotes integrity, accountability and transparency, among other high ethical standards.

Employee Safety and Welfare—We place a high priority on maintaining a secure and healthy workplace. We promote a culture of well‑being and reporting by connecting employee safety policies with patient safety policies, and we review and refine the policies regularly. At our hospitals, outpatient facilities and other care sites, we align staffing to need in our nursing units, and we invest in appropriate training to improve the competency of our caregivers. In addition, we maintain up‑to‑date infection-prevention protocols and availability of personal protective equipment and disinfection supplies.

We also offer resources to help employees manage challenging circumstances, including a comprehensive employee assistance program comprised of counseling services, financial guidance and legal aid. The Tenet Care Fund (the “Care Fund”) is a 501(c)(3) public charity that provides financial assistance to our employees who have experienced hardship due to, among other things, fires, natural disasters, catastrophic injuries and extended illnesses.

Culture—We continue to focus on fostering an engaging culture through the hiring, advancement and retention of a workforce and leadership teams that represent the communities we serve. We have a Community Healthcare Engagement Council, which consists of leaders representing different facets of our enterprise, to support our efforts in the areas of recruiting, talent development, new‑hire mentoring, community partnerships, and educational opportunities. The Council works to provide tools, guidelines and training with respect to best practices in these areas.

Competition; Staffing and Labor Trends—Our operations are dependent on the availability, efforts, abilities and experience of management and medical support personnel, including nurses, therapists, pharmacists and lab technicians, among others. We compete with other healthcare providers in recruiting and retaining qualified personnel responsible for the operation of our facilities. There is limited availability of experienced medical support personnel nationwide, which drives up the wages and benefits required to recruit and retain employees. In particular, like others in the healthcare industry, we continue to experience shortages of advanced practice providers and critical‑care nurses in certain disciplines and geographic areas. At times, we have to pay premiums above standard compensation for essential workers and rely on higher-cost contract labor, which we compete with other healthcare providers to secure.

We also depend on the general labor pool of available workers in the areas where we operate. In some of our communities, employers across various industries have increased their minimum wage, which has created more competition and, in some cases, higher labor costs for this sector of employees. Furthermore, state-mandated minimum wage increases in California became effective for healthcare workers in October 2024, with further annual increases anticipated through 2028. The current and expected future increases will result in higher compensation costs for certain of our employees and vendors.

As a result of the aforementioned challenges, as well as inflationary pressures, we have been, and we may continue to be, required to enhance wages and benefits to recruit and retain experienced employees, pay premiums above standard compensation for essential workers, or hire more expensive temporary or contract employees, which we also compete with other healthcare providers to secure. We have also made greater investments in education and training for newly licensed medical support personnel. We continue to work within our communities to increase access to healthcare programs and careers, including at our Baptist School of Health Professions in San Antonio and through our nationwide nursing extern and immersion program, which provides students with relevant hands-on training prior to graduation. Through these efforts, we have streamlined onboarding and training time of some of our new nurses, and we have reduced certain of our expenses related to new-hire training.

Union Activity and Labor Relations—At December 31, 2024, approximately 21% of the employees in our Hospital Operations segment were represented by labor unions. None of the employees in our Ambulatory Care segment belong to a

union. Unionized employees – primarily registered nurses and service, technical and maintenance workers – are located at 27 of our hospitals, the majority of which are in California, Florida and Michigan. Organizing activities by labor unions could increase our level of union representation in future periods, which could impact our labor costs.

When we are negotiating collective bargaining agreements with unions (whether such agreements are renewals or first contracts), work stoppages and strikes may be threatened or occur. Although relatively uncommon, extended strikes have had, and could in the future have, an adverse effect on our patient volumes, net operating revenues and labor costs at individual hospitals or in local markets.

Staffing Ratio Requirements—Our acute care hospitals in California are required to maintain minimum nurse‑to‑patient staffing ratios, which impacts our labor costs. Moreover, from time to time, we are required to limit admissions if we do not have the necessary number of nurses available to meet the required ratios, which has a corresponding adverse effect on our revenues.

ESG Report—Additional information on matters relating to human capital resources can be found in our most recent ESG Report, which is available on our website. The information found on our website, including the information in our ESG Reports, is not incorporated by reference into nor part of this or any other report or document we file with or furnish to the U.S. Securities and Exchange Commission (“SEC”).

COMPETITION

We believe our hospitals and outpatient facilities compete within local areas and regions on the basis of many factors, including: quality of care; location and ease of access; the scope and breadth of services offered; reputation; and the caliber of the facilities, equipment and employees. Trends toward clinical and pricing transparency may also impact a healthcare facility’s competitive position in ways that are difficult to predict. In addition, the competitive positions of hospitals and outpatient facilities depend in part on the number, quality, specialties, and admitting and scheduling practices of the licensed physicians who are members of the medical staffs of those facilities, as well as physicians who affiliate with and use outpatient centers as an extension of their practices. Physicians often serve on the medical staffs of more than one facility, and they are typically free to terminate their association with such facilities or admit their patients to competing facilities at any time.

Some competing healthcare facilities are owned by tax‑supported government agencies, and many others are owned by not‑for‑profit organizations that may have financial advantages not available to our facilities, including (1) support through endowments, charitable contributions and tax revenues, (2) access to tax‑exempt financing, (3) exemptions from sales, property and income taxes, and (4) discounted prescription drug pricing. In addition, in certain areas where we operate, large teaching hospitals provide highly specialized facilities, equipment and services that may not be available at most of our hospitals.

The existence or absence of state laws that require findings of need for construction and expansion of healthcare facilities or services (as described in the Healthcare Regulation and Licensing – Certificate of Need Requirements subsection below) may also impact competition. In recent years, the number of freestanding specialty hospitals, surgery centers, EDs, imaging centers and UCCs in the geographic areas where we operate has increased significantly. Some of these facilities are physician‑owned. Moreover, we expect to encounter additional competition from system‑affiliated hospitals and healthcare companies, as well as health insurers and private equity companies seeking to acquire providers, in certain regions in the future.

Another factor in the competitive position of a hospital or outpatient facility is the scope and terms of its relationships with managed care plans. Health maintenance organizations (“HMOs”), preferred provider organizations (“PPOs”), third‑party administrators and other third‑party payers use managed care contracts to encourage patients to use certain facilities in exchange for discounts from the facilities’ established charges. Our ability to enter into, maintain and renew favorable contracts with HMOs, insurers offering preferred provider arrangements and other managed care plans, as well as add new facilities to our existing agreements at contracted rates, significantly affects our revenues and operating results. Generally, we compete for managed care contracts on the basis of price, market reputation, geographic location, quality and range of services, caliber of the medical staff and convenience. Other healthcare providers may affect our ability to enter into acceptable managed care contractual arrangements or negotiate commercial rate increases. For example, some of our competitors may negotiate exclusivity provisions with managed care plans or otherwise restrict the ability of managed care companies to contract with us through the formation of narrow networks or other similar structures. Vertical integration efforts involving third‑party payers and healthcare providers, among other factors, may increase competitive challenges.

Our strategies are designed to help our hospitals and outpatient facilities remain competitive, to attract and retain an appropriate number of physicians of distinction in various specialties, as well as skilled clinical personnel and other healthcare professionals, and to increase patient volumes. To that end, we have made significant investments in equipment, technology,

education and operational strategies designed to improve clinical quality at our facilities. In addition, we continually collaborate with physicians to implement the most current evidence‑based medicine techniques to improve the way we provide care, while using labor management tools and supply‑chain initiatives to reduce variable costs. Moreover, we participate in various value‑based programs to improve quality and cost of care. We believe the use of these practices will promote the most effective and efficient utilization of resources and result in more appropriate lengths of stay, as well as reductions in readmissions for hospitalized patients. In general, we believe that quality of care improvements may have the effects of: (1) reducing costs; (2) increasing payments from Medicare and certain managed care payers for our services; and (3) increasing physician and patient satisfaction, which may improve our volumes. Other competing health systems may implement similar strategies.

In addition, we have significantly increased our focus on operating our outpatient centers with improved accessibility and more convenient service for patients, increased predictability and efficiency for physicians, and (for most services) lower costs for payers and patients than would be incurred with a hospital visit. We believe that emphasis on higher‑demand clinical service lines (including outpatient services), focus on expanding our ambulatory care business, cultivation of our culture of service and participation in Medicare Advantage health plans that have been experiencing higher growth rates than traditional Medicare, among other strategies, will help us address competitive challenges.

We also recognize that our future success depends, in part, on our ability to maintain and renew our existing managed care contracts and enter into new managed care contracts on competitive terms. To bolster our competitive position, we have sought to include all of our hospitals, outpatient centers and physician practices in the related geographic area or nationally when negotiating new managed care contracts, which may result in additional volumes at facilities that were not previously a part of such managed care networks. We also continue to engage in contracting strategies that create shared value with payers and patients.

The market for our revenue cycle management services is also competitive. To be successful, we must respond more quickly and effectively than our competitors to new or changing opportunities, technologies, standards, regulations and client requirements.

HEALTHCARE REGULATION AND LICENSING

OVERVIEW

Like others in the healthcare industry, we are subject to an extensive and complex framework of government regulation at the federal, state and local levels. These legal and regulatory standards relate to, among other topics: ownership and operation of facilities and physician practices; licensure, certification and enrollment in government programs; the necessity and adequacy of medical care; quality of medical equipment and services; relationships with and qualifications of physicians and employees; operating conduct, policies and procedures; screening, stabilization and transfer of individuals who have emergency medical conditions; rate-setting, billing and coding for services; the preparation and filing of cost reports; the handling of overpayments; contractual arrangements; relationships with referral sources and referral recipients; privacy and security; maintenance of adequate records; construction, acquisition, expansion and closure of healthcare facilities or services; environmental protection; compliance with fire prevention and building codes; debt collection; and communications with patients and consumers. In addition, various permits are required to dispense narcotics, operate pharmacies, handle radioactive materials and operate certain equipment. Our facilities are also subject to periodic inspection by governmental and other authorities to determine their compliance with applicable regulations, as well as the standards necessary for licensing and accreditation.

We believe that our healthcare facilities hold all required governmental approvals, licenses and permits material to the operation of their business. Furthermore, we have extensive policies and procedures in place to facilitate compliance with applicable laws, rules and regulations; however, these policies and procedures cannot ensure compliance in every case. Moreover, as discussed in greater detail below, government regulations often change, and we may have to make adjustments to our facilities, equipment, personnel and services to remain in compliance.

The potential consequences for failing to comply with applicable laws, rules and regulations include (1) required refunds of previously received government program payments, (2) the assessment of civil monetary penalties, including treble damages, (3) fines, which could be significant, (4) exclusion from participation in federal healthcare programs and (5) criminal sanctions, including sanctions against current or former employees. Our Medicare and Medicaid payments may be suspended pending even an investigation of what the government determines to be a credible allegation of fraud. Any of the aforementioned consequences could have a material adverse effect on our business, financial condition, results of operations or cash flows.

POTENTIAL CHANGES IN HEALTHCARE POLICY

The Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010 (the “Affordable Care Act”), extended health coverage to millions of uninsured legal U.S. residents through a combination of private sector health insurance reforms and public program expansion. The expansion of health insurance coverage under the Affordable Care Act resulted in an increase in the number of patients using our facilities with either private or public program coverage and a decrease in uninsured and charity care admissions, along with reductions in Medicare and Medicaid reimbursement to healthcare providers, including us. Of the eight states in which we operate hospitals, four have taken action in accordance with the Affordable Care Act to expand their Medicaid programs; however, over half of our licensed beds at December 31, 2024 were located in four states, namely Florida, South Carolina, Tennessee and Texas, that have not expanded Medicaid under the law.

Over the past several years, various laws and regulations lengthened the enrollment period, expanded income eligibility, and reduced premium caps for subsidies for individuals purchasing Affordable Care Act coverage through state and federal marketplaces – all of which led to increased enrollment numbers, particularly in states that have not expanded Medicaid. Certain of these provisions are set to expire at the end of 2025; if they are not extended, it could result in significant increases in premiums, potentially leading to decreased enrollment and a corresponding rise in the number of uninsured Americans or a shift of individuals from commercial coverage to government program coverage beginning in 2026. We cannot predict whether or how the new Congress may extend or modify provisions of or relating to the Affordable Care Act or other laws affecting the healthcare industry generally, nor can we predict how the new administration will influence, promulgate or implement rules, regulations or executive orders that affect the healthcare industry directly or indirectly. We may also experience potential impacts on our business, in ways we cannot anticipate, from healthcare-related policy changes at the state level. Some federal and state changes, initiatives and requirements could, among other things, negatively impact our patient volumes, case mix and revenue mix, increase our operating costs, adversely affect the reimbursement we receive for our services, impact our competitive position or require us to expend resources to modify certain aspects of our operations.

More specifically, we are also unable to predict the effect of future government healthcare funding policy changes on our business. The Medicare and Medicaid programs are subject to:

•statutory and regulatory changes, administrative and judicial rulings, executive orders, interpretations and determinations concerning eligibility requirements, funding levels and the method of calculating reimbursements, among other things;

•requirements for utilization review; and

•federal and state funding restrictions.

Any of these factors could materially increase or decrease payments from government programs in the future, as well as affect the cost of providing services to our patients and the timing of payments to our facilities. If the rates paid by governmental payers are reduced, if the scope of services covered by governmental payers is limited, if eligibility or enrollment is further restricted, if there are changes to align payment rates for certain procedures across various care settings, or if we or one or more of our hospitals are excluded from participation in the Medicare or Medicaid program or any other government healthcare program, there could be a material adverse effect on our business, financial condition, results of operations or cash flows. Furthermore, we cannot predict the impact healthcare policy risks and uncertainties may have on the trading price of our common stock.

ANTIFRAUD AND ABUSE LAWS

A number of federal statutes, and the regulations implementing them, govern our participation in the Medicare and Medicaid payment programs, including:

•the anti‑kickback and antifraud and abuse amendments codified under Section 1128B(b) of the Social Security Act (the “Anti‑kickback Statute”), which prohibit the knowing and willful remuneration of anything of value intended to induce or reward patient referrals or the generation of business involving any item or service payable by federal healthcare programs, subject to certain government-established “safe harbor” exceptions;

•the False Claims Act (“FCA”), which prohibits the submission of claims for payment to government programs that are known to be, or should be known to be, fraudulent;

•the Stark law, which generally restricts physician referrals of Medicare or Medicaid patients to entities the physician or an immediate family member has a financial relationship with, regardless of any intent to violate the law, unless one of several exceptions applies; and

•the Civil Monetary Penalties Law, which authorizes the Secretary of the U.S. Department of Health and Human Services (“HHS”) to impose civil penalties for various forms of fraud and abuse involving the Medicare and Medicaid programs.

States in which we operate have adopted laws that prohibit payments in exchange for patient referrals, similar to the federal Anti‑kickback Statute, or that otherwise prohibit fraud and abuse activities. Many states have also passed self‑referral legislation similar to the Stark law. Often these state laws are broader in scope in terms of the providers and services regulated, and certain of the laws apply regardless of the source of payment for care. These statutes typically provide for criminal and civil penalties, as well as loss of licensure.

Application to Our Operations—We regularly enter into financial arrangements with physicians and other providers in a manner we believe complies with the Anti‑kickback Statute, the Stark law, and other applicable antifraud and abuse laws. At December 31, 2024, the majority of the surgical hospitals and ASCs in our Ambulatory Care segment were owned by joint ventures with physicians and/or health systems. In addition, we have contracts with physicians and non‑physician referral sources providing for a variety of financial arrangements, including employment agreements, leases and professional service contracts, such as medical director agreements. We also provide financial incentives to recruit physicians to relocate to communities served by our hospitals, including income and collection guarantees and reimbursement of relocation costs.

As described below, the primary focus of our quality, compliance and ethics program is compliance with the requirements of Medicare, Medicaid and other federally funded healthcare programs. However, if our arrangements are found to fail to comply with applicable antifraud and abuse laws, our operations could be adversely affected. In addition, any determination by a federal or state agency or court that we or one of our subsidiaries has violated any of these laws could give certain of our joint venture partners or business process solutions clients a right to terminate their relationships with us. Moreover, any violations by and resulting penalties or exclusions imposed upon USPI’s joint venture partners could adversely affect their financial condition and, in turn, have a material adverse effect on our business and results of operations.

Government Enforcement Efforts and Qui Tam Lawsuits—The healthcare industry is subject to heightened and coordinated civil and criminal enforcement efforts from both federal and state government agencies. The U.S. Office of Inspector General, which is an independent and objective oversight unit of HHS, conducts audits, evaluations and investigations relating to HHS programs and operations and, when appropriate, imposes civil monetary penalties, assessments and administrative sanctions.

Healthcare providers are also subject to qui tam or “whistleblower” lawsuits under the FCA, which allows private individuals to bring actions on behalf of the government, alleging that a hospital or healthcare provider has defrauded a government program, such as Medicare or Medicaid. If the government intervenes in the action and prevails, the defendant may be required to pay three times the damages sustained by the government, plus mandatory civil penalties for each false claim submitted to the government. As part of the resolution of a qui tam case, the qui tam plaintiff may share in a portion of any settlement or judgment. If the government does not intervene in the action, the qui tam plaintiff may continue to pursue the action independently. Qui tam actions can also be filed under certain state false claims laws if the fraud involves Medicaid funds or funding from state and local agencies.

We have paid significant amounts to resolve government investigations and qui tam matters brought against us in the past, and we are unable to predict the impact of any future actions on our business, financial condition, results of operations or cash flows.

HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) requires administrative, physical and technical safeguards to protect the confidentiality, integrity and availability of protected health information (“PHI”) and sets forth the rights of patients to understand and control how their information is used and disclosed. We have developed an expansive set of policies and procedures in our efforts to comply with HIPAA, and similar state privacy laws, under the guidance of our ethics and compliance department. Our compliance officers and information security officers are responsible for implementing and monitoring enterprise‑wide compliance with our HIPAA privacy and security policies and procedures. We have also created an internal web‑based HIPAA training program, which is mandatory for all employees.

Under HIPAA, we are required to report breaches of unsecured PHI to affected individuals without unreasonable delay, but not longer than 60 days following discovery of the breach. We are also required to notify HHS and, in certain situations involving large breaches, the media. All non-permitted uses or disclosures of unsecured PHI are presumed to be breaches unless it can be established that there is a low probability the information has been compromised. Various state laws

and regulations may also require us to notify the applicable state agency and affected individuals in the event of a data breach involving personally identifiable information (“PII”).

Violations of the HIPAA privacy and security regulations may result in criminal penalties and in substantial civil penalties per violation. In addition to enforcement by HHS, state attorneys general are authorized to bring civil actions seeking either injunction or damages in response to violations of HIPAA privacy and security regulations that threaten the privacy of state residents. HHS may resolve HIPAA violations through informal means, such as allowing a company to implement a corrective action plan, but HHS has the discretion to move directly to impose monetary penalties and is required to impose penalties for violations resulting from willful neglect. We are also subject to any federal or state privacy-related laws that are more restrictive than the privacy regulations issued under HIPAA. These laws vary and could impose additional penalties and subject us to additional privacy and security restrictions. In addition, various states have enacted, and other states are considering, new laws and regulations concerning the privacy and security of consumer and other personal information. To the extent we are subject to such requirements, these laws and regulations often have far-reaching effects, are subject to amendments, changing requirements and updates to regulators’ enforcement priorities, may require us to modify our data processing practices and policies, may require us to incur substantial costs and expenses to comply, and may subject our business to a risk of increased potential liability. These laws and regulations often provide for civil penalties for violations, as well as a private right of action for data breaches, which may increase the likelihood or impact of data breach litigation.

UTILIZATION REVIEW COMPLIANCE AND HOSPITAL GOVERNANCE

The Social Security Act and Medicare regulations generally require that services that may be paid for under the Medicare program or state healthcare programs are (1) provided economically and only when, and to the extent, they are medically reasonable and necessary, (2) of a quality that meets professionally recognized standards of healthcare, and (3) supported by appropriate evidence of medical necessity and quality. The Quality Improvement Organization program established under the Social Security Act seeks: to improve the effectiveness, efficiency, economy and quality of services delivered to Medicare beneficiaries; to use data to track healthcare quality improvements at the local level; to preserve the Medicare Trust Fund by ensuring that Medicare pays only for services that are reasonable and necessary and that are provided in the most appropriate setting; and to protect Medicare beneficiaries by expeditiously addressing complaints, violations under the Emergency Medical Treatment and Active Labor Act, and other quality‑related issues.

Medical and surgical services and practices are extensively supervised by committees of staff physicians at each of our healthcare facilities, are overseen by each facility’s local governing board, the members of which primarily are community members and physicians, and are reviewed by our clinical quality personnel. The local governing board also helps maintain standards for quality care, develop short‑term and long‑range plans, and establish, review and enforce practices and procedures, as well as approves the credentials, disciplining and, if necessary, the termination of privileges of medical staff members.

CERTIFICATE OF NEED REQUIREMENTS

Some states require state approval for construction, acquisition and closure of healthcare facilities, including findings of need for additional or expanded healthcare facilities or services. Certificates or determinations of need, which are issued by governmental agencies with jurisdiction over healthcare facilities, are at times required for capital expenditures exceeding a prescribed amount, changes in bed capacity or services, and certain other matters. Approximately 27% of our licensed hospital beds are located in four states (namely, Massachusetts, Michigan, South Carolina and Tennessee) that currently require a form of state approval under certificate of need programs applicable to acute care hospitals. (In 2023, South Carolina enacted a law that sunsets its hospital certificate of need program effective January 1, 2027.) Certificate of need programs apply to ASCs in 10 states where we have such facilities.

Failure to obtain necessary state approval can result in the inability to expand facilities, add services, acquire a facility or change ownership. Further, violation of such laws may result in the imposition of civil sanctions or the revocation of a facility’s license. We are unable to predict whether we will be required or able to obtain any additional certificates of need in any jurisdiction where they are required, or if any jurisdiction will eliminate or alter its certificate of need requirements in a manner that will increase competition and, thereby, affect our competitive position. In those states that do not have certificate of need requirements or that do not require review of healthcare capital expenditure amounts below a relatively high threshold, competition in the form of new services, facilities and capital spending may be more prevalent.

ENVIRONMENTAL MATTERS

Our healthcare operations are subject to a number of federal, state and local environmental laws, rules and regulations that govern, among other things, our disposal of solid waste, as well as our use, storage, transportation and disposal of hazardous and toxic materials (including radiological materials). Our operations also generate medical waste that must be

discarded in compliance with statutes and regulations that vary from state to state. In addition, our operating expenses could be adversely affected if legal and regulatory developments related to climate change or other initiatives result in increased energy or other costs. Moreover, we could be affected by climate change and other environmental issues to the extent such issues adversely affect the general economy or result in severe weather or natural disasters affecting the communities in which our facilities are located. At this time, we do not believe that the costs of complying with environmental laws, including regulations relating to climate change issues, will have a material adverse effect on our future capital expenditures, results of operations or cash flows. There were no material capital expenditures for environmental matters in the year ended December 31, 2024.

ANTITRUST LAWS

The federal government and most states have enacted antitrust laws that prohibit specific types of anti‑competitive conduct, including price fixing, wage fixing, anticompetitive hiring practices, restrictive covenants, concerted refusals to deal, price discrimination and tying arrangements, as well as monopolization and acquisitions of competitors that have, or may have, a substantial adverse effect on competition. Violations of federal or state antitrust laws can result in various sanctions, including criminal and civil penalties.

Antitrust enforcement in the healthcare industry is a priority of the U.S. Federal Trade Commission (“FTC”) and analogous state regulatory agencies. In recent years, the FTC has filed multiple administrative complaints and public comments challenging hospital and other healthcare transactions in several states. The FTC has focused its enforcement efforts on preventing hospital transactions that may, in the government’s view, leave insufficient local options for patient services, which could result in higher costs to consumers. In addition, the FTC has given increased attention to the effect of combinations involving other healthcare providers, including physician practices, as well as to the use of restrictive covenants that limit the ability of owners, employees and others to engage in certain competitive activities. The FTC has also entered into numerous consent decrees in the past several years settling allegations of price‑fixing among providers. Moreover, a number of states, including California and Massachusetts, have enacted antitrust laws requiring state agency notification and review of proposed healthcare industry transactions that are below federal reporting thresholds. We cannot predict the impact of these laws on our ability to complete transactions in the related states.

LAWS AND REGULATIONS AFFECTING REVENUE CYCLE MANAGEMENT SERVICES

Conifer is subject to civil and criminal statutes and regulations governing consumer finance, medical billing, coding, collections and other operations. In connection with these laws and regulations, Conifer has been and may continue to be party to various lawsuits, claims, and federal and state regulatory investigations from time to time. Some of these actions may involve large demands, as well as substantial defense costs. We cannot predict the outcome of current or future legal actions against Conifer or the effect that judgments, penalties or settlements in such matters may have.

The federal Fair Debt Collection Practices Act (“FDCPA”) regulates persons who regularly collect or attempt to collect, directly or indirectly, consumer debts owed or asserted to be owed to another person. Certain of the accounts receivable handled by Conifer’s third‑party debt collection vendors are subject to the FDCPA, which establishes specific guidelines and procedures that debt collectors must follow in communicating with consumer debtors, including the time, place and manner of such communications. We audit and monitor our vendors for compliance, but there can be no assurance that such audits and monitoring will detect all instances of potential non‑compliance.

Many states also regulate the billing and collection practices of creditors who collect their own debt, as well as the companies a creditor engages to bill and collect from consumers on the creditor’s behalf. These state regulations may be more stringent than the FDCPA. In addition, state regulations may be specific to medical billing and collections or the same or similar to state regulations applicable to third‑party collectors. Certain of the accounts receivable Conifer or its billing, servicing and collections subsidiary, PSS Patient Solution Services, LLC, manages for its clients are subject to these state regulations.

Conifer is also subject to laws under which both federal and state regulatory agencies have the authority to investigate consumer complaints relating to unfair, deceptive and abusive acts and practices, as well as a variety of consumer protection laws, including but not limited to the Telephone Consumer Protection Act and all applicable state equivalents. These agencies may initiate enforcement actions, including actions to seek restitution and monetary penalties from, or to require changes in business practices of, regulated entities. In addition, affected consumers may bring lawsuits, including class action suits, to seek monetary remedies (including statutory damages) for violations of the federal and state provisions discussed above.

LAWS, REGULATIONS AND OTHER MATTERS AFFECTING OUR GBC

Our GBC operations in the Philippines are subject to certain U.S. healthcare industry-specific requirements, as well as U.S. and foreign laws applicable to businesses generally, including anti-corruption laws. One such law, the Foreign Corrupt

Practices Act (“FCPA”), regulates U.S. companies in their dealings with foreign officials, prohibiting bribes and similar practices, and requires that they maintain records that fairly and accurately reflect transactions and appropriate internal accounting controls. FCPA enforcement actions continue to be a high priority for the SEC and the U.S. Department of Justice. Our failure to comply with the FCPA could result in the imposition of fines and other civil and criminal penalties, which could be significant. Moreover, our offshore operations could expose us to foreign political and economic instability, compliance and regulatory challenges, and natural disasters not typically experienced in the United States, such as volcanic activity and tsunamis.

COMPLIANCE AND ETHICS

General—Our ethics and compliance department maintains our values‑based ethics and compliance program, which is designed to: (1) help staff in our corporate and USPI offices, hospitals, outpatient centers and physician practices meet or exceed applicable standards established by federal and state statutes and regulations, as well as industry practice; (2) monitor and raise awareness of ethical issues among employees and others, and stress the importance of understanding and complying with our Code of Conduct; and (3) provide a channel for employees to make confidential ethics and compliance‑related reports, anonymously if they choose. The ethics and compliance department operates independently – it has its own operating budget; it has the authority to hire outside counsel, access any company document and interview any of our personnel; and our chief compliance officer reports directly to our chief executive officer, as well as to the quality, compliance and ethics committee of our board of directors.

Program Charter—Our Quality, Compliance and Ethics Program Charter is the governing document for our ethics and compliance program. Our adherence to the charter is intended to:

•support and maintain our present and future responsibilities with regard to participation in federal healthcare programs; and

•further our goals of operating an organization that (1) fosters and maintains the highest ethical standards among all employees, officers and directors, physicians practicing at our facilities, and contractors that furnish healthcare items or services, (2) values compliance with all state and federal statutes and regulations as a foundation of its corporate philosophy, and (3) aligns its behaviors and decisions with Tenet’s core values.

The primary focus of our quality, compliance and ethics program is compliance with the requirements of Medicare, Medicaid and other federally funded healthcare programs. Pursuant to the terms of the charter, our ethics and compliance department is responsible for, among other things, the following activities: (1) assessing, critiquing, and (as appropriate) drafting and distributing company policies and procedures; (2) developing, providing, and tracking ethics and compliance training and other training programs, including job‑specific training to those who work in clinical quality, coding, billing, cost reporting and referral source arrangements, in collaboration with the respective department responsible for oversight of each of these areas; (3) creating and disseminating our Code of Conduct and obtaining certifications of adherence to the Code of Conduct as a condition of employment; (4) maintaining and promoting our Ethics Action Line, a 24‑hour, toll‑free hotline that allows for confidential reporting of issues on an anonymous basis and emphasizes our no‑retaliation policy; and (5) responding to and resolving all compliance‑related issues that arise from the Ethics Action Line and compliance reports received from facilities and compliance officers (utilizing any compliance reporting software that we may employ for this purpose) or any other source that results in a report to the ethics and compliance department.

Code of Conduct—All of our employees and officers, including our chief executive officer, chief financial officer and principal accounting officer, are required to abide by our Code of Conduct to advance our mission that our business be conducted in a legal and ethical manner. The members of our board of directors and all of our contractors having functional roles similar to our employees are also required to abide by our Code of Conduct. The standards therein reflect our basic values and form the foundation of a comprehensive process that includes compliance with all corporate policies, procedures and practices. Our Code of Conduct covers such areas as quality patient care, compliance with all applicable statutes and regulations, appropriate use of our assets, protection of patient information and avoidance of conflicts of interest.

As part of the program, we provide compliance training at least annually to every employee and officer, as well as our board of directors and certain physicians and contractors. All such persons are required to report incidents that they believe in good faith may be in violation of the Code of Conduct or our policies, and all are encouraged to contact our Ethics Action Line when they have questions about any aspect of our Code of Conduct or any ethics concerns. All reports to the Ethics Action Line are kept confidential to the extent allowed by law, and any individual who makes a report has the option to remain anonymous. Incidents of alleged financial improprieties reported to the Ethics Action Line or the ethics and compliance department are communicated to the audit committee of our board of directors. Reported cases that involve a possible violation of the law or regulatory policies and procedures are referred to the ethics and compliance department for investigation, although certain matters may be referred to the law or human resources department. Retaliation against anyone in connection with reporting

ethical concerns is considered a serious violation of our Code of Conduct, and, if it occurs, it will result in discipline, up to and including termination of employment.

Availability of Documents—The full text of our Quality, Compliance and Ethics Program Charter, our Code of Conduct, and a number of our ethics and compliance policies and procedures are published on our website, at www.tenethealth.com, under the “Our Commitment to Compliance” caption in the “About” section. Amendments to the Code of Conduct and any grant of a waiver from a provision of the Code of Conduct requiring disclosure under applicable SEC rules will be disclosed at the same location as the Code of Conduct on our website.

INSURANCE

We maintain captive insurance companies to self‑insure for the majority of our professional and general liability claims, and we purchase insurance from third parties to cover catastrophic claims. Commercial insurance we purchase is subject to per‑claim and policy period aggregate limits. If the policy period aggregate limit of any of these policies is exhausted, in whole or in part, it could deplete or reduce the limits available to pay other material claims applicable to that policy period. Any losses not covered by or in excess of the amounts maintained under our professional and general liability insurance policies will be funded from our working capital or other sources of liquidity.

In addition to the reserves recorded by our captive insurance subsidiaries, we maintain reserves, including reserves for incurred but not reported claims, for our self‑insured professional liability retentions and claims in excess of the policies’ aggregate limits, based on modeled estimates of losses and related expenses. We provide standby letters of credit to some of our insurers, which can be drawn upon under certain circumstances, to collateralize the deductible and self‑insured retentions under a select number of our professional and general liability insurance programs.

We also purchase property, business interruption, cyber-liability and other insurance coverage from third parties. Our commercial insurance does not cover all claims against us and may not offset the financial impact of a material loss event. The rise in the number and severity of hurricanes, wildfires, tornadoes and other events has led to higher insurance premiums and reductions in coverage for property owners. Commercial insurance may not continue to be available at a reasonable cost for us to maintain at adequate levels in the future. In addition, our insurance against cybersecurity risks and cyber-attacks may not provide the coverage we anticipate or offset the financial impact of a material loss event. Moreover, the occurrence of cybersecurity incidents and the continued and elevated risk of attacks (including ransomware), system and data breaches, and other disruptions to information technology systems in the current environment has caused increases in our cyber insurance premiums and lower coverage limits. For further information regarding our insurance coverage, see Note 16 to our Consolidated Financial Statements.

COMPANY INFORMATION

We file annual, quarterly and current reports, proxy statements and other documents with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our reports, proxy statements and other documents filed electronically with the SEC are available at the website maintained by the SEC at www.sec.gov.

Our website, www.tenethealth.com, also offers, free of charge, access to our annual, quarterly and current reports (and amendments to such reports), and other filings made with, or furnished to, the SEC as soon as reasonably practicable after such documents are submitted to the SEC. The information found on our website is not incorporated by reference into nor part of this or any other report or document we file with or furnish to the SEC.

FORWARD-LOOKING STATEMENTS

This report includes “forward‑looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act, each as amended. All statements, other than statements of historical or present facts, that address activities, events, outcomes, business strategies and other matters that we plan, expect, intend, assume, believe, budget, predict, forecast, project, target, estimate or anticipate (and other similar expressions) will, should or may occur in the future are forward‑looking statements, including (but not limited to) disclosures regarding (1) our future earnings, financial position, and operational and strategic initiatives, (2) developments in the healthcare industry, and (3) the anticipated impacts of economic and public health conditions on our business. Forward‑looking statements represent management’s expectations, based on currently available information, as to the outcome and timing of future events, but, by their nature, address matters that are indeterminate. They involve known and unknown risks, uncertainties and other factors, many of which we are unable to predict

or control, that may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward‑looking statements. Such factors include, but are not limited to, the following:

•Our ability to enter into or renew managed care provider arrangements on acceptable terms; changes in service mix, revenue mix and surgical volumes, including potential declines in the population covered under managed care agreements; and the impact of alternative payment models and value-based purchasing initiatives;

•The impacts on our business from the enactment, amendment or expiration of statutes and regulations affecting the healthcare industry, and potential reductions to Medicare and Medicaid payment rates, changes in reimbursement practices or funding levels, or modification of Medicaid supplemental payment programs;

•Our success in recruiting and retaining physicians, nurses and other healthcare professionals;

•The effect of competition generally, and clinical and price transparency regulations, on our business;

•The timing, outcome and impact of: government investigations and litigation; changes in federal tax laws, regulations and policies (including those related to tariffs and trade restrictions); and future tax audits, disputes and litigation associated with our tax positions;

•The potential emergence and effects of a future pandemic, epidemic or outbreak of an infectious disease on our operations, financial condition and liquidity;

•Security threats, catastrophic events and other disruptions that affect our information technology and related information systems and confidential business data;

•Our ability to achieve operating and financial targets, attain expected levels of patient volumes, and identify and execute on measures designed to save or control costs or streamline operations;

•Operational and other risks associated with acquisitions, divestitures and joint venture arrangements, including the integration of newly acquired businesses and the risk that transactions may not receive necessary government clearances;

•The impact of our indebtedness; the availability and terms of capital, if needed, to refinance existing debt, fund our operations and expand our business; and our ability to comply with our debt covenants and effectively manage our capital structure and leverage ratio;

•The effect that inflation, consumer behavior and other economic factors have on our volumes and our ability to collect outstanding receivables on a timely basis, among other things; and increases in the number of uninsured accounts, as well as deductibles, co‑insurance amounts and co‑pays for insured accounts; and

•Other factors and risks referenced in this report and our other public filings.