UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

TENET HEALTHCARE CORPORATION

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

This filing consists of a Tenet Healthcare Corporation Presentation to Investors and the related Script for Tenet Healthcare Corporation Investor Call, both dated January 11, 2011.

Trevor Fetter President and Chief Executive Officer January 11, 2011 Tenet Healthcare Corporation Presentation To Investors Exhibit 99.1 |

2 Forward-looking statements Forward-looking statements Certain statements contained in this presentation constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements are based on management's current expectations and involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results to be materially different from those expressed or implied by such forward-looking statements. Such factors include, among others, the following: the passage of heath care reform legislation and the enactment of additional federal and state health care reform; other changes in federal, state, or local laws and regulations affecting the health care industry; general economic and business conditions, both nationally and regionally; demographic changes; changes in, or the failure to comply with, laws and governmental regulations; the ability to enter into managed care provider arrangements on acceptable terms; changes in Medicare and Medicaid payments or reimbursement; liability and other claims asserted against the Company; competition, including the Company’s ability to attract patients to its hospitals; technological and pharmaceutical improvements that increase the cost of providing, or reduce the demand for, health care; changes in business strategy or development plans; the ability to attract and retain qualified personnel, including physicians, nurses and other health care professionals, and the impact on the Company’s labor expenses resulting from a shortage of nurses or other health care professionals; the significant indebtedness of the Company; the Company's ability to integrate new businesses with its existing operations; the availability and terms of capital to fund the expansion of the Company's business, including the acquisition of additional facilities; the creditworthiness of counterparties to the Company’s business transactions; adverse fluctuations in interest rates and other risks related to interest rate swaps or any other hedging activities the Company undertakes; the ability to continue to expand and realize earnings contributions from the Company’s Conifer revenue cycle management and patient communication businesses; and its ability to identify and execute on measures designed to save or control costs or streamline operations. Such factors also include the positive and negative effects of health reform legislation on reimbursement and utilization and the future designs of provider networks and insurance plans, including pricing, provider participation, coverage and co-pays and deductibles, all of which contain significant uncertainty, and for which multiple models exist which may differ materially from the Company's expectations. Certain additional risks and uncertainties are discussed in the Company’s filings with the Securities and Exchange Commission, including the Company’s annual report on Form 10-K and quarterly reports on Form 10-Q. The Company specifically disclaims any obligation to update any forward-looking statement, whether as a result of changes in underlying factors, new information, future events or otherwise. Non-GAAP Information This document includes certain financial measures such as Adjusted EBITDA, which are not calculated in accordancewith generally accepted accounting principles (GAAP). Management recommends that you focus on the GAAP numbers as the best indicator of financial performance. These alternative measures are provided only as a supplement to aid in analysis of the Company. Reconciliation between non-GAAP measures and related GAAP measures can be found in Appendix D. Additional Information Tenet Healthcare Corporation ("Tenet") will file with the Securities and Exchange Commission ("SEC") a proxy statement in connection with its 2011 annual meeting of stockholders. Any definitive proxy statement will be mailed to stockholders of Tenet. INVESTORS AND SECURITYHOLDERS OF TENET ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and securityholders will be able to obtain free copies of these documents (when available) and other documents filed with the SEC by Tenet through the website maintained by the SEC at http://www.sec.gov. Certain Information Regarding Participants Tenet and certain of its respective directors and executive officers are deemed to be participants under the rules of the SEC. Information regarding these participants is contained in a filing under Rule 14a-12 filed by Tenet with the SEC on January 7, 2011. This filing and other documents can be obtained free of charge from the sources indicated above. Additional information regarding the interests of these participants in any proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC if and when they become available. |

3 The hospital industry: a compelling investment The hospital industry: a compelling investment Strong demographic changes driving growth The growth rate of the over 65 population will more than double to over 3.0% between 2010 and 2012 Per capita spending on healthcare nearly doubles between age 50 and age 65 Affordable Care Act Expands insurance coverage to 32 million uninsured Americans (2014) Insurance “reforms” increase interim coverage (2010) Newly covered population likely to utilize hospital services at increased rate Recession has suppressed volume growth and increased bad debt expense Returning to pre-recession levels expected to expand margins and growth rates |

4 Tenet at a glance Tenet at a glance Acute Care Hospitals (1) Beds (1) Employees US Coverage (1) Inpatient Admissions (2) Outpatient Visits (2) November 2010 EBITDA Outlook: - Including CA Provider Fee - Excluding CA Provider Fee Current 2010 EBITDA Estimate (5) (Excluding CA Provider Fee) 2011 EBITDA Outlook Range (5) - Represents an increase of $100mm - $200m over the 2010 estimate ___________________________ 1. Continuing operations as of December 31, 2010. 2. LTM continuing operations as of December 31, 2010. 3. Based on THC share price of $6.69 as of December 31, 2010. 4. $3.7 billion equity value (includes mandatory convertible) plus $4.1 billion in debt less $0.4 billion in cash, as of September 30, 2010. 5. Assumes California Provider Fee is recognized in 2011 as opposed to 2010. Actual 2010 EBITDA results may vary when 2010 results are released in February. 2010E Revenue (2) Equity Market Value (3) Enterprise Value (4) Net Debt $9.2 bn $3.7 bn $7.4 bn $3.7 bn Corporate Governance Independent Chairman of the Board 9 out of 10 board members are independent Diversified experience in public sector, healthcare, manufacturing Substantial experience with major corporate actions $1,050 - $1,100 mm $986 - $1,036 mm $1,050 mm $1,150 - $1,250 mm 49 13,430 57,000 11 states 513,000 3.9mm |

Q4 2010 preliminary performance highlights and EBITDA outlook (1) Q4 2010 preliminary performance highlights and EBITDA outlook (1) Inpatient and outpatient year-over-year volume trends both improved relative to Q3 Inpatient admissions declined by 2.0% (compares to a 3.5% decline in Q3) Outpatient visits increased by 2.9% (compares to a 2.0% decline in Q3) Commercial volume trends improved compared to Q3 2010’s results, but statistic will no longer be disclosed Preliminary EBITDA (excluding California Provider Fee) of $1.050 billion exceeds previous outlook Excluding $64 million California Provider Fee, previous outlook was for $986 million to $1.036 billion Q4 Preliminary EBITDA is $281 million, previous outlook, excluding the California Provider Fee, was $217 million to $267 million Requirements for California Provider Fee to be recognized in 2010 were not met by year end Recognition is now expected in 2011 Expected amount remains $64 million New EBITDA Outlook for 2011 established from $1.150 billion to $1.250 billion (including California Provider Fee) 5 Solid results in 2010 and poised for further growth and value creation in 2011 ___________________________ 1. Actual Q4 2010 volume trends and 2010 EBITDA may vary when 2010 results are released in February. |

6 Our national hospital and outpatient center footprint Our national hospital and outpatient center footprint Acute Care Hospitals Diagnostic Imaging Centers (DICs) Ambulatory Surgery Centers (ASCs) DIC in development 49 acute care hospitals 81 free-standing OP centers $9.2 billion in revenues Focus on high growth markets Well-positioned in attractive growth markets |

7 Tenet Healthcare: A compelling investment Tenet Healthcare: A compelling investment Continued Strong Organic Growth Continued Strong Organic Growth in Earnings in Earnings Operating Integrity, Growth and Operating Integrity, Growth and Infrastructure Investments Reduce Future Risks Infrastructure Investments Reduce Future Risks Consistent Strategy Driven by Innovative, Consistent Strategy Driven by Innovative, High Margin, Capital Efficient Initiatives High Margin, Capital Efficient Initiatives |

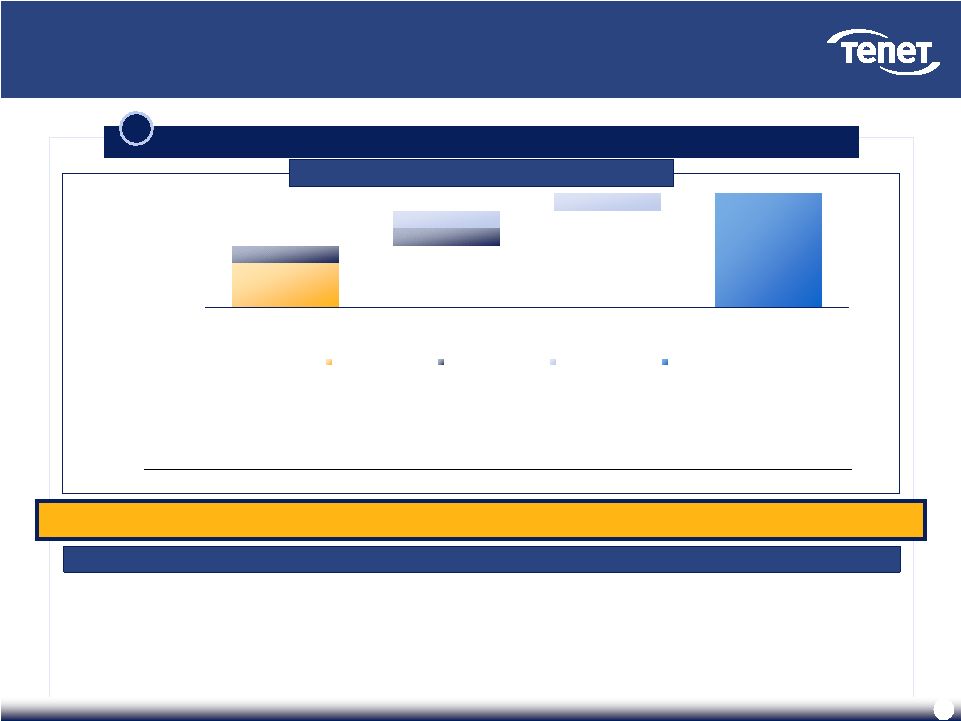

8 Significant positive momentum – multiple value drivers Significant positive momentum – multiple value drivers ___________________________ 1. Data reflects the results of our existing 49 hospitals. 2. Actual 2010 results may vary when 2010 results are released in February. 3. Return on capital is defined as income from continuing operations excluding impairments and debt gains/losses, net of tax, plus after-tax interest expense net of investment income, and 1/3 of rent expense after-tax divided by invested capital, which is defined as total debt including our former government settlement obligation less cash plus average equity over the most recent five quarters excluding impairments in the period recorded plus 8 times rent expense. The reversal of our deferred tax asset valuation allowance in 2010 has been excluded from the 2010 computation. Return on Invested Capital (1)(3) De-levered Balance Sheet Superior EBITDA Growth and Margin Expansion (1) ($ millions) Estimate (2) ($ millions) Estimate (2) Estimate (2) Strong Net Revenue Growth (1) ($ millions) Estimate (2) $7,669 $7,557 $7,676 $8,083 $8,585 $9,014 $9,200 2004 2005 2006 2007 2008 2009 2010 6.9% 9.2% 12.1% 12.0% (3.3%) 2006 2007 2008 2009 2010 Return on Invested Capital $422 $543 $631 $658 $739 $982 $1,050 2004 2005 2006 2007 2008 2009 2010 0% 2% 4% 6% 8% 10% 12% 14% EBITDA EBITDA Margin $4,436 $4,803 $5,088 $5,039 $5,088 $4,950 $4,059 2004 2005 2006 2007 2008 2009 2010 Debt DOJ Liability |

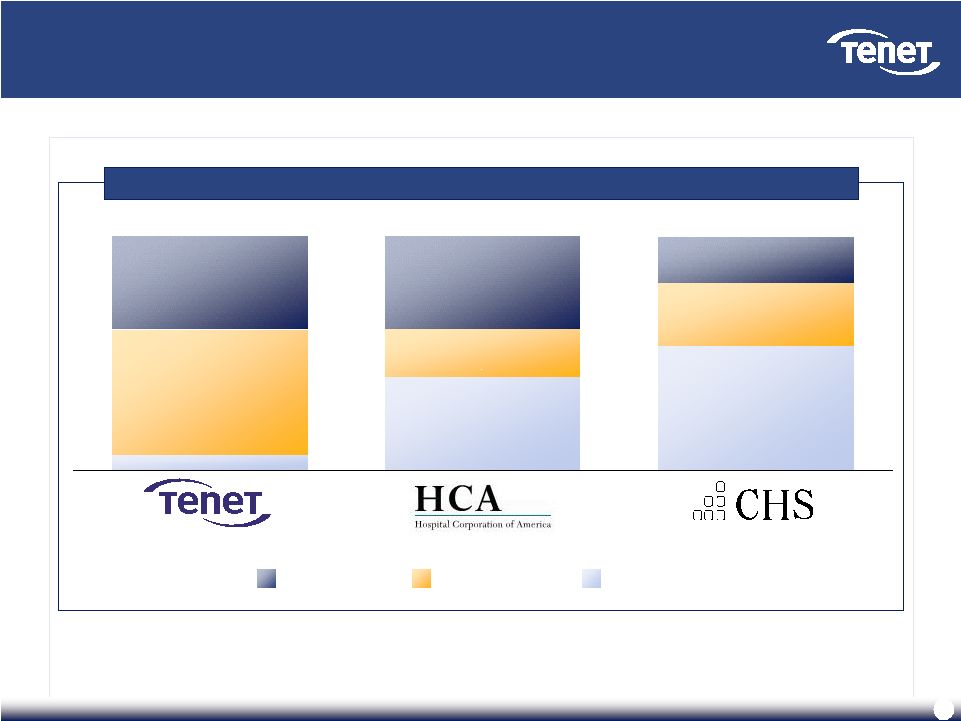

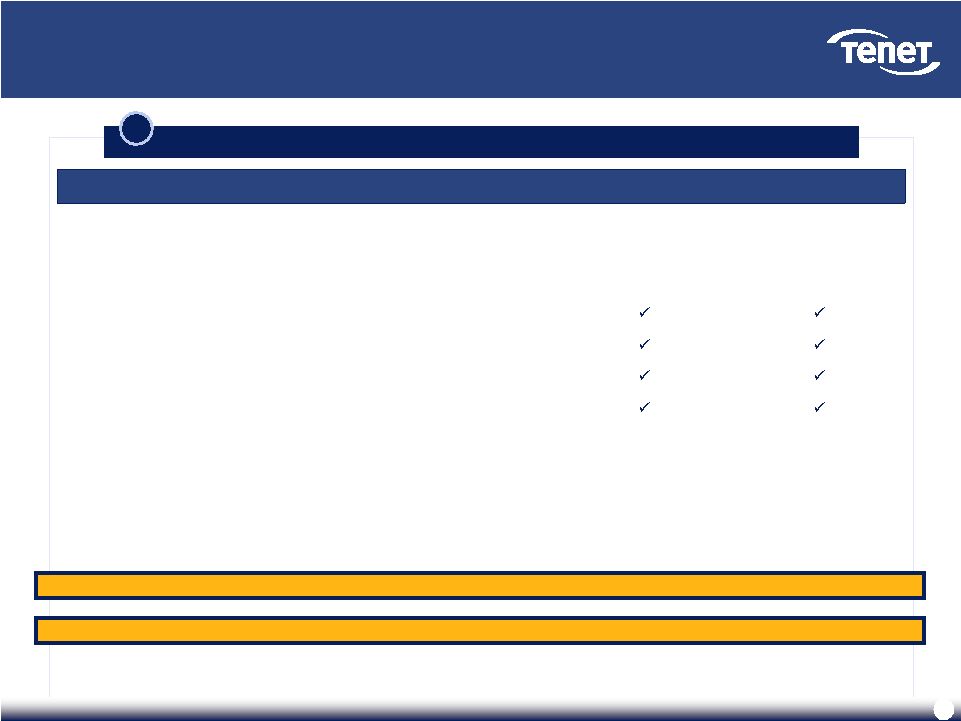

1 6 8 8 3 4 6 6 3 9 Tenet has led same-hospital admissions growth over the last 15 quarters Tenet has led same-hospital admissions growth over the last 15 quarters Same-Hospital Admissions Growth (1) Ranking (2) Over Last 15 Quarters ___________________________ 1. Data for Tenet reflects the results of our existing 49 hospitals. 2. Metric records number of quarters in which the Company ranked #1, #2 or #3 among the three companies in the 15 quarters from Q1’07 to Q3’10. Ranked 1 st Ranked 2 nd Ranked 3 rd |

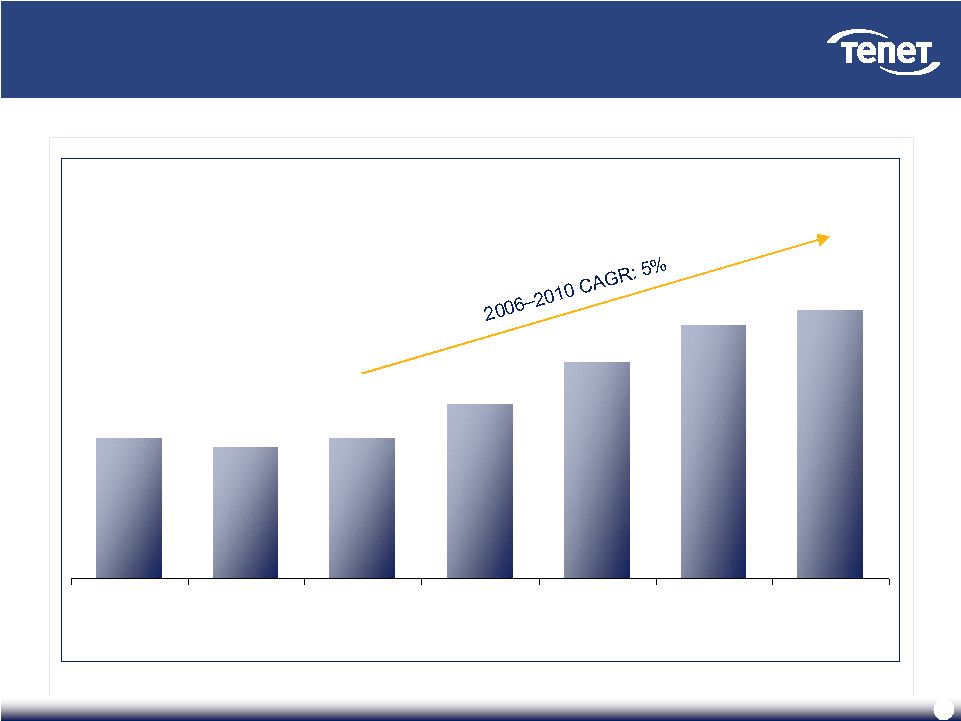

10 Strong organic net revenue growth (1) Strong organic net revenue growth (1) ($ millions) Estimate (2) ___________________________ 1. Data reflects the results of our existing 49 hospitals. 2. Actual 2010 results may vary when they are released in February. $7,669 $7,557 $7,676 $8,083 $8,585 $9,014 $9,200 2004 2005 2006 2007 2008 2009 2010 |

11 Consistent improvement of operating metrics has driven solid organic EBITDA growth Tenet’s same-hospital EBITDA growth has outpaced its largest peers in eight out of the last 15 quarters Tenet’s same-hospital EBITDA growth has outpaced its largest peers in eight out of the last 15 quarters EBITDA Growth (1) Ranking (2) Over Last 15 Quarters ___________________________ 1. Data for Tenet reflects the results of our existing 49 hospitals. Community’s same-store year-over-year EBITDA growth calculated using reported same-store income from operations, same-store depreciation and amortization, and same-store minority interest in earnings for each quarter. HCA year-over-year EBITDA growth based on reported consolidated EBITDA. 2. Metric records number of quarters in which the Company ranked #1, #2 or #3 among the three companies in the 15 quarters from Q1’07 to Q3’10. Ranked 1 st Ranked 2 nd Ranked 3 rd 4 5 6 3 7 5 8 3 4 |

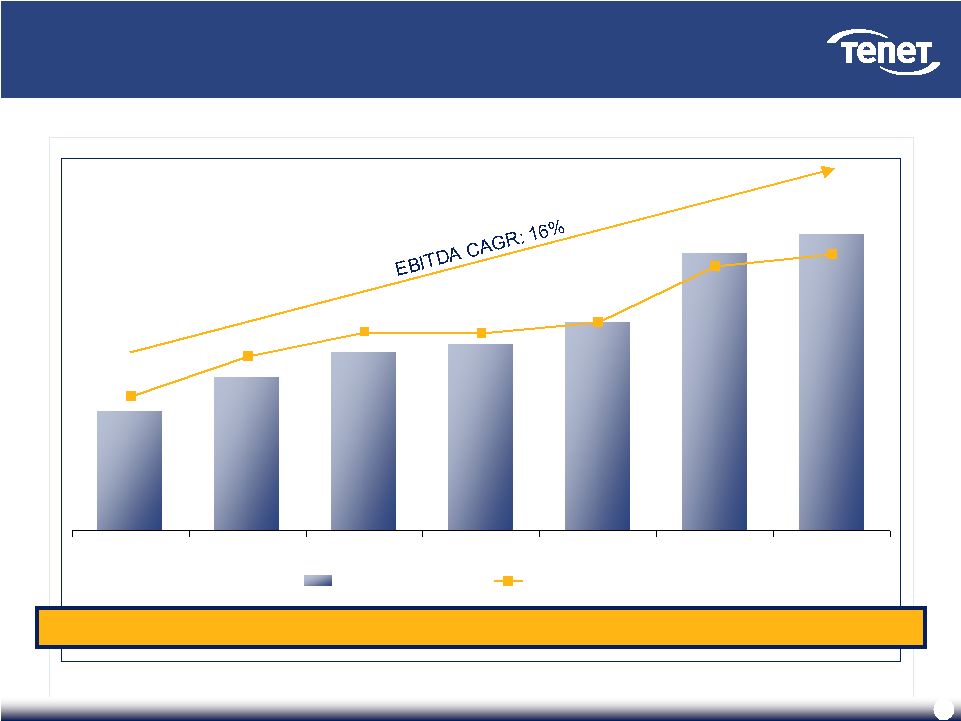

12 Tenet’s EBITDA margins have expanded 590 basis points since 2004 (1) Tenet’s EBITDA margins have expanded 590 basis points since 2004 (1) ($ millions) Estimate (2) Cost control initiatives coupled with improved pricing has yielded significant margin expansion ___________________________ 1. Data reflects the results of our existing 49 hospitals. 2. Actual 2010 EBITDA may vary when results are released in February. $739 $982 $1,050 $658 $631 $543 $422 11.4% 10.9% 8.6% 8.1% 8.2% 7.2% 5.5% 2004 2005 2006 2007 2008 2009 2010 EBITDA EBITDA Margin |

13 Tenet’s consistent EBITDA improvement relative to peers has narrowed the margin gap Tenet’s consistent EBITDA improvement relative to peers has narrowed the margin gap Tenet is on track to exceed current industry average margins ___________________________ 1. Peer Average EBITDA margin of Community Health Systems, Hospital Corporation of America, Health Management Associates, LifePoint, Universal Health Services and Vanguard Health Systems. Vanguard 2010 EBITDA margin reflects last twelve months financials as of September 30, 2010 and the remaining peers reflect 2010E Wall Street research estimates. Peer Avg: (230bps) Tenet: 590bps 2004–2010E Change 10.8% 2.6% THC EBITDA Margin Peer Average Margin (1) 0% 5% 10% 15% 20% 2004 2005 2006 2007 2008 2009 2010E |

14 Tenet has one of the lowest leverage ratios and longest maturity profiles in the industry Tenet has one of the lowest leverage ratios and longest maturity profiles in the industry Active management of capital structure has significantly improved Tenet’s debt profile ___________________________ 1. As of September 30, 2010. Total Debt less Cash and Cash Equivalents/LTM EBITDA. 2. Includes $1.525 billion issuance announced on November 9, 2010. 3. Pro forma for Detroit Medical Center acquisition. Assumes $120 million of EBITDA at Detroit Medical Center as per Wall Street research. 4. Pro forma for announced acquisition of Psychiatric Solutions. 5. $216 million due February 1, 2013. 6. Borrowing availability under our revolving credit facility was $460 million at September 30, 2010. Becomes $500 million under the new agreement, as of September 30, 2010. No significant debt maturities prior to 2015 (5) No significant maintenance covenants Ample liquidity with $398 million of cash as of 9/30/2010; $800 million undrawn credit line (6) provides flexibility Weighted Average Debt Maturity (years) Leverage Ratio (1) Leverage Ratio Years (2) (3) (4) 4.0 4.0 5.0 5.0 6.0 6.0 8.0 HMA Community UHS LifePoint Vanguard HCA Tenet 4.8x 4.7x 4.3x 3.9x 3.8x 3.7x 2.7x HCA CommunityVanguard UHS HMA Tenet LifePoint |

15 Well-defined growth strategy Well-defined growth strategy High margin businesses Growth in EBITDA, cash flow, ROIC Organic growth Outpatient Capacity utilization & operating leverage through physician alignment Revenue cycle business Financial Objectives Growth Drivers Integrated clinical systems driving the capture of incentives, improved clinical quality, provider integration and cost efficiencies Greater than average benefit from new federal law Operating Foundation |

Current HIT investments necessary to achieve government’s “meaningful use” will capture government incentives and contribute positive benefit to earnings beginning in 2012, while also improving clinical outcomes and operational efficiency 16 Improve outpatient/inpatient mix High growth/high margin revenue cycle management business focused on acute care providers Significant cost savings extracted from productivity and other efficiency initiatives Outpatient Conifer MPI (1) Health IT Significant reductions in uncompensated care and increased paying volumes due to Affordable Care Act Available capacity and increasing volumes position Company for substantial margin expansion Economic recovery and reduced unemployment expected to decrease bad debt expense and drive margin expansion Affordable Care Act Operating Leverage Bad Debt Seven key drivers of a 16 –18% EBITDA margin Seven key drivers of a 16 –18% EBITDA margin Tenet-specific Macroeconomic Industry ___________________________ 1. MPI = Medicare Performance Initiative. 1 2 3 4 6 5 7 |

17 Targeted acquisitions and organic growth will drive meaningful EBITDA margin expansion Targeted acquisitions and organic growth will drive meaningful EBITDA margin expansion ___________________________ 1. Acquisitions closed in 2010. Full year impact reflected in 2011 metrics. 2. Acquisitions expected to be negotiated and closed in 2011. Metrics represent partial year impacts (except for purchase price). 3. Percentage growth based on 2010 Outlook of 3.9mm OP visits, which includes OP visits associated with newly acquired centers. ($ millions) EBITDA Impact Outpatient 1 Tenet physician alignment and targeted growth initiatives expected to drive further outpatient growth Outpatient Acquisition Strategy 2010 Acquisitions (1) 2011 Acquisitions (2) Total 2011 Impact Centers Acquired 24 15–25 40–50 Purchase Price ($mm) $65 $100 $165 2011 Outpatient Visits (000s) 215 50–60 265–275 Impact on 2011 Visits (3) (% increase) 5% 1%–2% 6%–7% 2011 2012 2013 Run-Rate 2013 $65 $65 $55 $35 Total 20 20 10 -- 2012 20 20 20 10 2011 $25 $25 $25 $25 2010 EBITDA contribution from acquisitions completed in: $10 $10 $10 $25 $10 $65 2010 Acquisitions 2011 Acquisitions 2012 Acquisitions 2013 Run-Rate |

18 Conifer ranks among revenue cycle industry leaders Conifer ranks among revenue cycle industry leaders ___________________________ Source: Tenet and Accretive Health as of September 30, 2010 10-Q filing. Wall Street research. Note: Market data as of December 31, 2010. Conifer 2 Strong momentum with meaningful provider penetration and a substantial pipeline for continued growth Conifer Accretive # Client Hospitals 79 64 Client Net Patient Revenue $13.4bn $14.0bn # Employees 2,600 2,100 Solution Spans Entire Revenue Cycle Value Proposition = Increasing Client Yield Margin Expansion Inherent in Business Model Provides Long-Term Contracts 2011E EBITDA Multiple N/A 16.8x Enterprise Value N/A $1.5bn 2011 Revenue N/A $885 2011 EBITDA N/A $88 Substantial embedded value within Tenet |

19 Medicare Performance Initiative will continue to deliver significant cost savings Medicare Performance Initiative will continue to deliver significant cost savings MPI 3 MPI’s Goal: Cost reduction captured through physician adoption of best practices $30 million in 2010 cost savings achieved $50 million incremental savings in 2011 and subsequent years as MPI is rolled out to more hospitals and more DRGs; augmented by other supply and productivity initiatives MPI cost savings are cumulative 2011 2012 2013 2014 2015 Run-Rate Savings Incremental Savings $100 $150 $200 $250 $50 $50 $50 $100 $50 $150 $50 $200 $50 ($ millions) |

2009 2010 (1) 2011 2012 2013 2014 2015 2016 Healthcare IT (HIT) Program Expense (2) $12 $21 $50 $60 $40 $15 – – Federal HIT Incentives – – $15 $70 $97 $81 $44 $13 EBITDA Impact ($12) ($21) ($35) $10 $57 $66 $44 $13 HIT Capital Expenditures $49 $69 $106 $115 $69 $14 – – Foundation Systems (# Go-Live) – 8 12 20 9 – – – CPOE Systems (# Go-Live) – – 9 17 14 9 – – 20 HIT investments improve clinical outcomes and operational efficiencies HIT investments improve clinical outcomes and operational efficiencies ___________________________ 1. Estimate pending final close. Actual results may vary when results are released in February. 2. Excludes recurring clinical support operating expenses and HIT benefits to operating performance. Health IT 4 Federal HIT incentives contribute positive benefit to earnings starting in 2012 Clinical systems are critical to physician alignment and integration, reduction of medication errors, standardization of clinical practice and reduction of cost ($ in millions) Penalties avoided by achieving “Meaningful Use” (Net present value of $315mm) |

21 Reduced bad debt expense expected to contribute to EBITDA growth Reduced bad debt expense expected to contribute to EBITDA growth ___________________________ 1. Data reflects the results of our existing 49 hospitals. 2. Collection rates from self-pay accounts. The increase in bad debt expense includes factors in addition to the decline in collection rates. Key Takeaways Recession Has Driven Increase in Bad Debt Expense Bad Debt 5 Economic recovery expected to moderate bad debt expense and drive EBITDA margin expansion Prior to the recession, Conifer drove self- pay collections from 32% to 36% Tenet has executed its plan throughout the recession AR days declined from 54 days in Q1’08 to 46 days in Q3’10 Point of service collections increased from 34.5% in 2008 to 39.4% YTD 2010 Billing cycle times reduced by 19% from Q1’08 Right Care, Right Place initiative 53% increase in Medicaid qualifications in 2010 compared to 2008 Expense reductions expected from improved collections in the future 2007 collection rate of 36% declined to 29% in 2010 (2) Economic recovery alone expected to improve collections back to 36% Conifer expected to drive improved collections beyond 36% (1) Pre-Recession Recession 7.2% 6.3% 6.9% 7.3% 7.7% 8.0% 2005 2006 2007 2008 2009 2010 YTD Sept Bad Debt as % of Net Revenue |

22 Increase in capacity utilization provides significant upside opportunity Increase in capacity utilization provides significant upside opportunity ___________________________ 1. Utilization defined as daily census divided by number of licensed beds. 2. Actual 2010 utilization may vary when results are released in February. Utilization of Licensed Beds (1) Operating Leverage 6 Adjusted fixed expenses to right-size cost structure during economic downturn while also maintaining capacity to increase volumes in near term $40 million incremental EBITDA for every one percent increase in total volumes, assuming current mix $80 million incremental EBITDA from a one percent increase in capacity utilization No significant near-term capacity constraints (2) 54% 50% 52% Tenet 5-Yr High Utilization Tenet 2010E Utilization Tenet Projected 2015 Utilization |

23 Affordable Care Act expected to increase volumes Affordable Care Act expected to increase volumes ___________________________ Assumptions: Conversions of uninsured to Medicaid and exchanges use Congressional Budget Office assumptions (57% conversion) evenly split between Medicaid and exchanges. Existing volumes convert at existing case mix. Exchange pricing is slightly lower than projected commercial pricing. Note: Volume growth estimate assumes the same market share of newly insured as Tenet presently has of Medicaid and commercial patients and that utilization of hospital services are consistent with current Medicaid and commercial populations. Ultimate outcomes of the new law will vary, potentially significantly, depending on actual pricing of the exchanges, migration of lives (including to Medicaid and exchanges from commercial coverage), case mix and utilization of hospital and outpatient services by the newly insured, exchange copays and deductibles and other variables. Affordable Care Act 7 The Affordable Care Act is expected to be negative to earnings through 2013 due to Market Basket reductions (reducing positive annual market basket adjustments) However, expected to be positive in 2014 and 2015 due to: Migration of existing charity care to an insured status (revenue, bad debt and income increase) Migration of uninsured volumes to an insured status (revenue and bad debt decrease, income increases) Increased utilization of healthcare by the newly insured (revenue, bad debt and income increase) Expected to result in 7.5% inpatient and 5.0% outpatient volume growth Our 2015 estimated EBITDA range provides for substantial variation Tenet is positioned to benefit more from coverage of the newly insured due to our concentration in areas of high uninsured populations |

24 EBITDA outlook for 2010 and 2011 EBITDA outlook for 2010 and 2011 EBITDA Guidance Range Commentary 2010 Estimate (1) $1,050mm $64 million California provider fee extracted from 2010 and moved to 2011 Cash balance at December 31, 2010 is approximately $400 million with favorable EBITDA performance offset by higher capital spending (approximately $460 million), the deferral of the California Provider Fee, and working capital and other liability changes 2011 $1,150mm– $1,250mm Conservative macroeconomic assumptions Admissions decline of 1% to flat Adverse payer mix shift of $25 million Bad debt remains an elevated 7.4% to 8.4% HIT expense, net of incentives, expected to increase $14 million to $35 million $50 million in MPI and other cost savings Outpatient acquisitions adding $30 to $40 million Follow-on provider fees of $40 million expected, guidance range allows for variability ___________________________ 1. Actual 2010 EBITDA results may vary when 2010 results are released in February. |

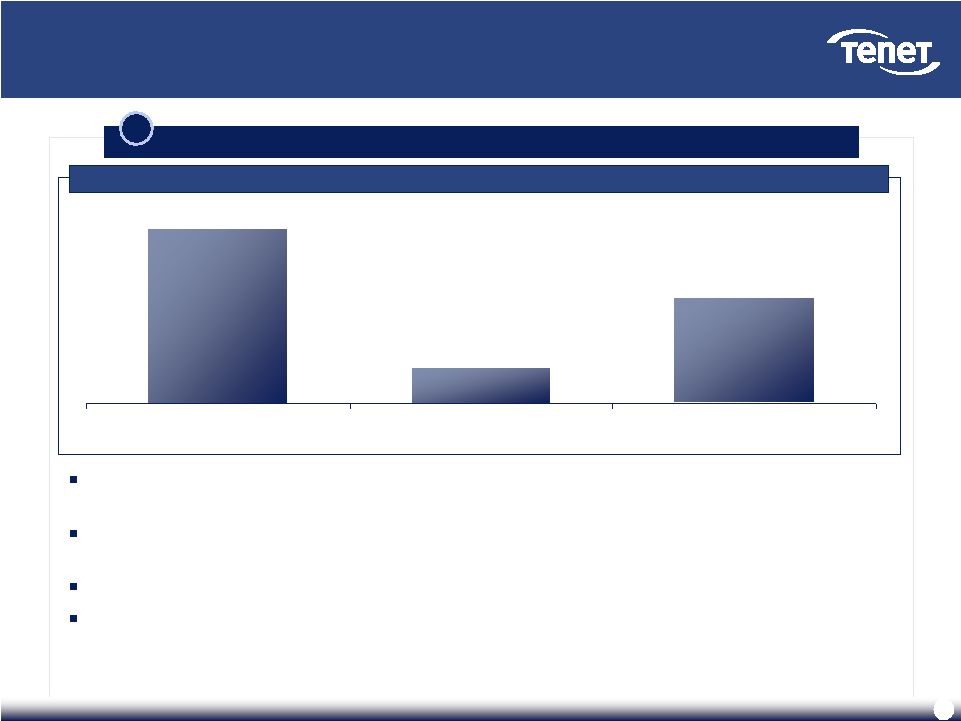

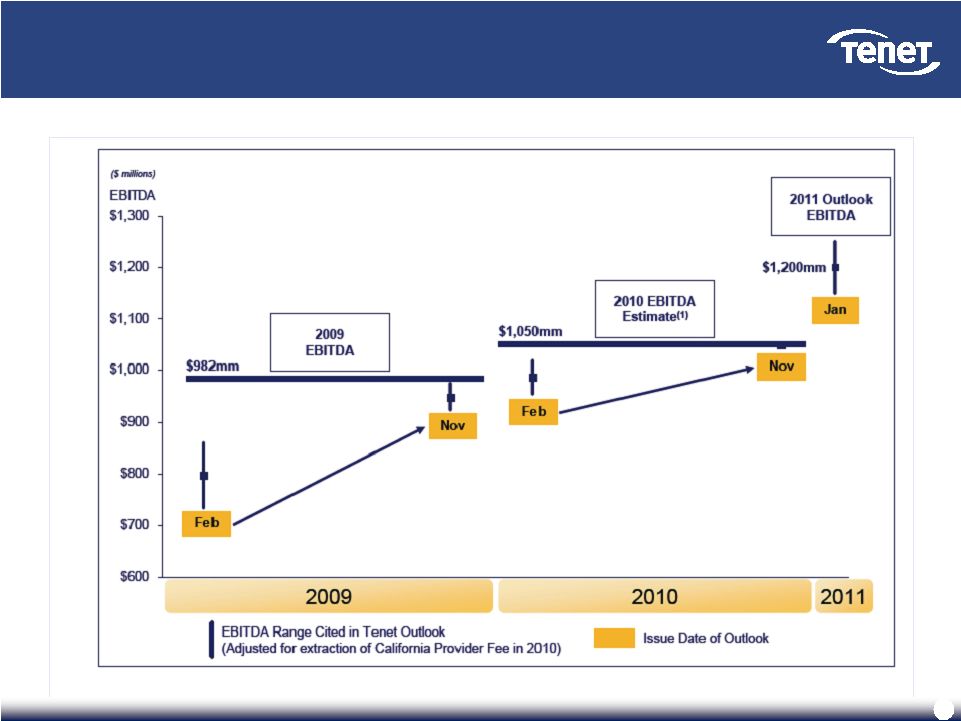

25 Tenet has exceeded initial annual outlook in 2009 and 2010 Tenet has exceeded initial annual outlook in 2009 and 2010 1. Actual 2010 EBITDA may vary when results are released in February. |

26 Long-term outlook: 2010–2015 Long-term outlook: 2010–2015 Guidance Range Drivers Revenue Growth 4%–6% CAGR Continued pricing improvement balanced by modest volume growth (1) Government pricing pressure as measures from the “Affordable Care Act” are implemented Improving outpatient mix 36% of net patient revenue Flat to positive admissions growth Strong growth from Conifer and outpatient acquisitions EBITDA Growth 11%–16% CAGR Reduction in bad debt expense Economic recovery Affordable Care Act Growth in high margin business Conifer Outpatient services Increased operating leverage MPI Health IT incentives EBITDA Target Margin 16%–18% by end of 2015 Capital Expenditures $450mm–$550mm per annum Seismic requirements met as of Q4 2010 EPS Growth 37%–50% CAGR Continued trend of deleveraging and improving the capital structure NOL $2 billion NOL (December 2010) Expected to be fully realized by 2014 or 2015 NPV of $550mm–$600mm ___________________________ 1. Commercial pricing negotiated; 90% of 2011, 60% of 2012, at contractual price increases consistent with 2010. |

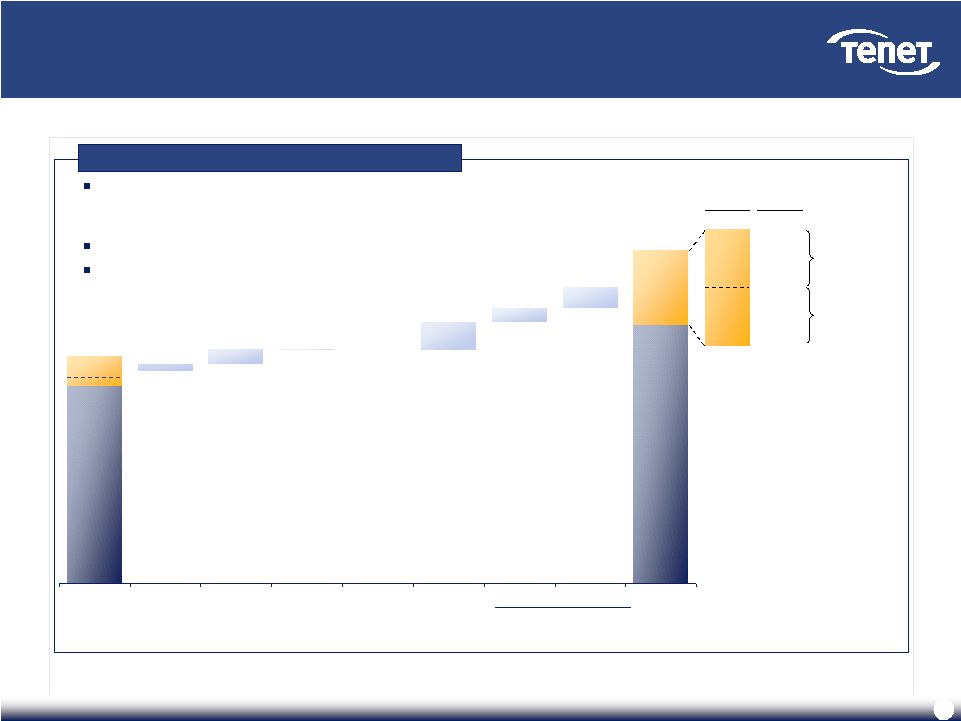

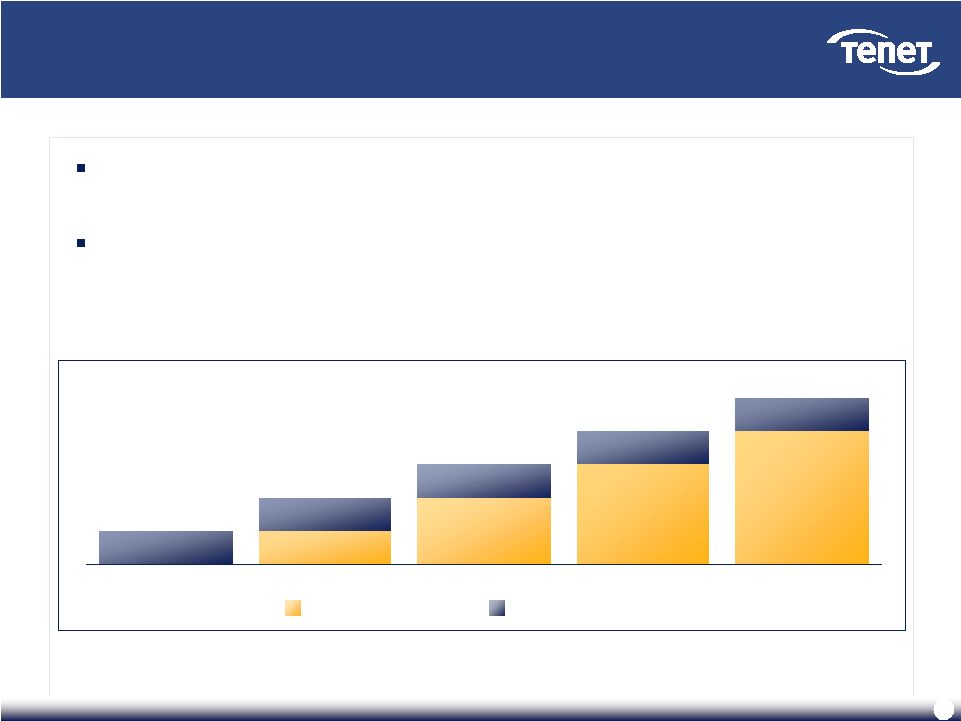

Tenet’s EBITDA growth Tenet’s EBITDA growth ($ millions) Projected EBITDA growth is more modest than historical growth rates $1,250 $1,535 $2,250 27 ___________________________ 1. 2010 – 2015 CAGR based on mid-point of projected range. 2. Actual 2010 EBITDA may vary when results are released in February. Estimate (2) $422 $1,050 $1,150 $1,335 $1,750 $0 $500 $1,000 $1,500 $2,000 $2,500 2004 2010 2011 2013 2015 Lower End of EBITDA Range Upper End of EBITDA Range |

EBITDA walk forward (2010–2013) EBITDA walk forward (2010–2013) Key Drivers Initial benefits from Medicare Performance Initiative Run-rate impact of near-term outpatient acquisitions Return on Health IT investments through incentives Moderate reduction in bad debt expense as a result of economic recovery $1,535 $1,050 ___________________________ 1. Operating Leverage is driven by the combination of assumptions on volumes, pricing and cost drivers. $100mm cushion $100mm upside opportunity (1) 28 2013 EBITDA 2013 EBITDA Margin $1,535 14-15% $1,435 13-14% $1,335 12-13% $65 $35 $150 $80 $40 $80 $25 ($90) 2010 Outpatient Conifer MPI Health IT Medicaid Funding Bad Debt Expense Operating Leverage Affordable Care Act 2013 $1,335 |

EBITDA walk forward (2013–2015) EBITDA walk forward (2013–2015) Key Drivers $1,535 $2,250 Improvement in capacity utilization from new federal law, demographics and other factors drive operating leverage Full impact of Medicare Performance Initiative Additional third party revenues and benefits from utilization of Conifer’s capabilities Affordable Care Act Recovery of Losses Through ‘13 Gains During ’14-’15 29 (1) ___________________________ 1. Operating Leverage is driven by the combination of assumptions on volumes, pricing and cost drivers. $250mm cushion $250mm upside opportunity 2015 EBITDA 2015 EBITDA Margin $2,250 18-19% $2,000 16-18% $1,750 15-16% $50 $100 $5 $190 $90 ($10) $140 $1,750 $1,335 2013 Conifer MPI Health IT Bad Debt Expense Operating Leverage 2015 $1,435 |

30 Tenet Healthcare: a compelling investment Tenet Healthcare: a compelling investment Positive Industry Trends Strong demographic changes driving growth Growth rate of Americans over 65 will more than double from 2010 to 2012 Recession has suppressed volume growth and increased bad debt expense New federal law expands insurance coverage to 32 million uninsured Americans (2014) Delivering Consistent Performance Superior EBITDA growth and margin expansion Accelerated Adjusted Free Cash Flow De-levered balance sheet Same-hospital admission and EBITDA growth has outpaced peer group Positioned to Outperform Continued strong organic growth in earnings and cash flow Consistent strategy driven by innovative, high margin, capital efficient initiatives Operating integrity, past growth and infrastructure investments reduce future risks |

Appendix A: Selected Q4’10 Disclosures 31 |

32 Selected Q4’10 Disclosures Selected Q4’10 Disclosures 0.1 99,513 99,645 Uninsured + Charity OP Visits 0.0 8,392 8,394 Uninsured + Charity Admissions (3.1) 628,438 608,890 Patient days 3.2 872,228 900,182 Paying OP Visits 2.9 971,741 999,827 OP Visits (2.2) 121,239 118,583 Paying Admissions 129,631 Q4’09 Q4’10E (1) Change (%) Admissions 126,977 (2.0) ___________________________ 1. Actual Q4’10 results may vary when Q4’10 results are released in February. |

Appendix B: Medicare Performance Initiative 33 |

34 Medicare Performance Initiative (MPI) Overview What is MPI? MPI is a program with the goal of creating a sustained, standardized approach following nationally recognized best practices to improve clinical outcomes and reduce variable costs This program is built on a unique foundation of information system capabilities and allows us to improve the way we treat disease and perform procedures on Medicare patients Any benefits of the initiative should also have a “halo” effect on other payers This is critical given the direction of health care reform to a more “value based purchasing model” involving the delivery of higher quality at lower pricing near Medicare payment levels MPI encompasses many different initiatives: 1) Physician behavior change 2) Labor management 3) Supply chain initiatives 4) Case management program MPI initiatives are identified, tracked, measured and shared |

35 1. Physician Behavior Change How are savings achieved through different methods of treating disease and performing procedures? An analysis is performed on 5 MS-DRG groups at each hospital where total costs exceed revenues to identify variable costs that can be reduced Physician champions are enlisted to support the changes in behavior that will reduce the variability of how different physicians treat the same disease Customized prescriptive work plans are developed to reduce the variable costs using local, national, and acceptable best practices for standards of care Repeatable process is hardwired to address more MS-DRGs in the future What’s in it for the physician? High cost/ low quality physicians are already being excluded by health plans in certain markets Hospital and physician incentives will be more aligned, creating greater opportunity for success under health reform based payment models Improving profitability and quality enhances the hospital’s ability to attract the best employees and fund investments in capital equipment and facilities |

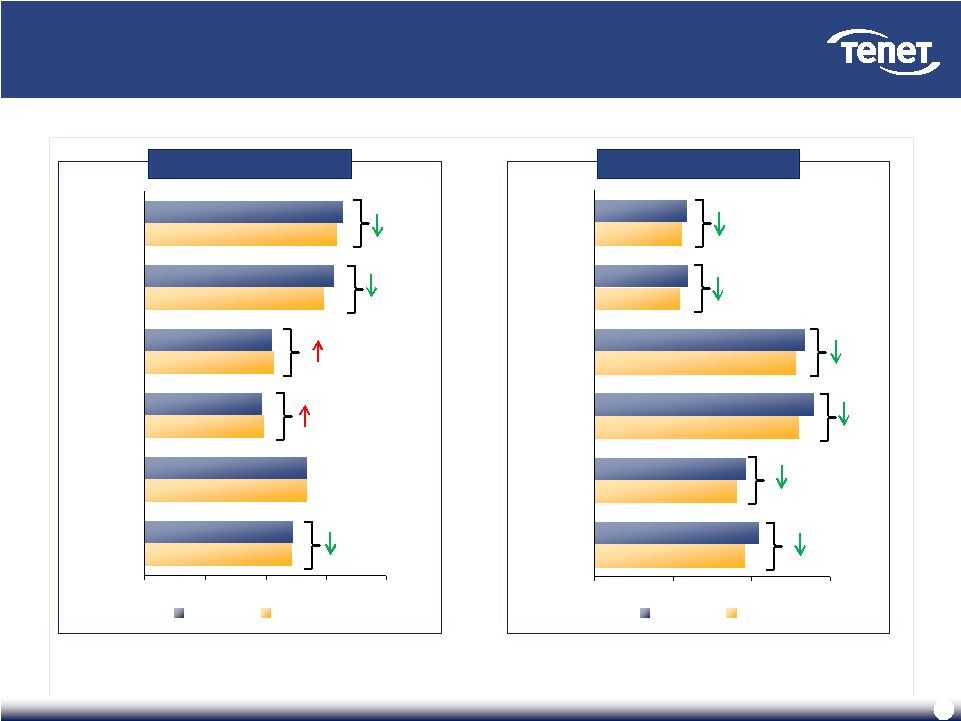

36 Physicians championing behavior change have led to reduced ALOS and variable cost 5% 2% 1% 1% Average Length of Stay 3% 9% Variable Cost per Case (unadjusted for inflation) 5% 7% 4% 6% ___________________________ Note: Data includes first 16 Wave 1 MPI hospitals, and each hospital’s unique base period represents the six months proceeding the formal launch of Wave 1 of MPI. Source: Internal company data. Pre-MPI Post-MPI Pre-MPI Post-MPI 9% 0 2 4 6 8 All Payer - Combined Medicare - Combined All Payer - Procedural Medicare - Procedural All Payer - Medical Medicare - Medical $0 $5,000 $10,000 $15,000 All Payer - Combined Medicare - Combined All Payer - Procedural Medicare - Procedural All Payer - Medical Medicare - Medical |

37 2. Labor Management Labor Management Specialists are assigned to each Region Each hospital is provided an array of labor productivity tools – Position Control, Staffing Grids, Visionware Labor Management Specialists make site visits to work with hospital teams to improve use of tools and understanding of program New Labor Management Reporting System (LMRS) has been developed Replaces previous bi-weekly labor reports Reflects both paid and productive FTEs and dollars Departmental drill downs available Future enhancements to include more meaningful department-level drill down |

38 Better labor management has resulted in lower labor expense Paid FTEs per AADC Contract Labor per APD ___________________________ Source: Internal company data. 1. 2010E based on November YTD results plus December forecast. Core hospitals only. Estimate (1) Estimate (1) $41 $44 $37 $20 $16 2006 2007 2008 2009 2010 4.31 4.32 4.26 4.18 4.12 2006 2007 2008 2009 2010 |

39 CMI-adjusted Supply Cost per Adjusted Patient Day (1) 3. Supply Chain Initiatives 3. Supply Chain Initiatives Numerous supply chain initiatives have been identified and implemented These require significant work with physicians and staff to change behavior, but can result in significant savings Supply chain initiatives that have been most effective include: High cost drugs – medication utilization management Cardiac Rhythm Management (CRM) devices Drug eluting stents Ortho and spine implants High cost supplies – custom procedure tray utilization Purchased services – Food and Nutritional Services and Environmental Services Blood product sourcing and improved utilization ___________________________ 1. Core hospital supply cost only. 2.8% 2.6% 3.5% 3.5% 3.2% 2.4% 1.2% 3.2% 1.6% (0.1%) (1%) 0% 1% 2% 3% 4% 5% Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Percent Change - MedSurg PPI Percent Change - Supply Expense per CMI-Adjusted Patient Day |

Cumulative Cardiac Rhythm Management Contracting Savings: 2009 – 2011 (2) 40 Many supply chain initiatives have controlled or decreased supply expense Many supply chain initiatives have controlled or decreased supply expense Pharmacy Spend Per Adjusted Patient Admission (1) Estimate ___________________________ 1. Source: Internal company data. 2. Source: Internal company data. Savings for 2009 through 2011 on this initiative projected to be in excess of $20 million. Region Impact % California (28.8%) Central (28.3%) Florida (24.7%) Philadelphia (24.1%) Southern States (19.6%) Total (25.2%) $397 $397 $401 $411 2007 2008 2009 2010 |

41 4. Case Management Program 4. Case Management Program Case Management Specialists are assigned to each Region and perform on-site visits to hospitals Medical Necessity screening is performed using Interqual guidelines prior to, or as soon as possible after, bed placement Clinical rationale for decision is clearly documented Goals of an effective case management program are: Correct use of observation status Ensure length of stay is appropriate Reduce managed care denials Tactics used to reach these goals are: All clinical departments, nursing departments, and the Utilization Management (UM) committee share in ownership Implement multidisciplinary patient care conferences Adequate & effective Physician Advisor coverage with UM knowledge Physician education and support |

42 Hospitals have direct access to MPI-level variable cost analytics, updated on a monthly basis MPI analytics and reporting now on intranet Best Practices are shared regularly throughout the company It is expected that every hospital management team is implementing those applicable Quick Wins |

43 MPI Summary MPI is a program that delivers higher quality at lower costs and positions Tenet well for the country’s move to value based purchasing MPI is sustainable: $30mm in savings were captured in 2010 and $50mm in savings are targeted for 2011 and beyond 2011 2012 2013 2014 2015 Run-Rate Savings Incremental Savings $100 $150 $200 $250 $50 $50 $50 $100 $50 $150 $50 $200 $50 ($ millions) |

Appendix C: Tenet Board of Directors 44 |

45 Tenet’s Board of Directors is aligned with shareholder interests Tenet’s Board of Directors is aligned with shareholder interests Substantial Wealth of Directorship Knowledge Executive Leadership Experience Independent Board of Directors Independent Chairman of the Board Separation of Chairman and CEO roles 9 out of 10 independent board members No two directors can serve on another public company board together (prevents interlocking directorates) Each of the directors has served in a leadership role within a large, complex organization Diversified experience with leaders in public sector, healthcare, accounting and finance, technology and manufacturing 1 former Chairman and CEO of an S&P 500 corporation 2 former CEOs and/or Presidents of a major business unit of S&P 500 corporations 1 former Chairman and CEO of an international public accounting firm 2 former Governors of U.S. States, of which one was a former member of the U.S. Senate and former President of a major university Healthcare: Allscripts, Athersys, CorMatrix Cardiovascular, Eclipsys*, EndoGastric Solutions, IMS Health*, Intuitive Surgical, MAKO Surgical Selected Corporations: Deloitte*, Electronic Data Systems*, GreenPoint Financial*, Hovnanian, Intuit, North Fork Bancorp*, Office Depot, Prudential Financial, Qwest Communications, Unisys*, United Technologies Other: Allina Hospitals and Clinics*, The Cleveland Clinic Foundation* Board members have experience with major corporate actions: Eclipsys*, Electronic Data Systems*, IMS Health*, North Fork Bancorp* * - Indicates prior Directorship affiliation |

46 Tenet’s Board of Directors is aligned with shareholder interests (cont’d) Tenet’s Board of Directors is aligned with shareholder interests (cont’d) Government Experience Provider Experience Operating and Financial Expertise Edward A. Kangas, Non-Executive Chairman Global Chairman and CEO, Deloitte Touche (1989-2000) Member of Tenet Board since 2003 Other Directorships: Allscripts Healthcare Solutions, Hovnanian Enterprises, Intuit, United Technologies, Eclipsys*, EDS* Governor Jeb Bush Governor of Florida (1999-2007) Member of Tenet Board since 2007 Other Directorships: Rayonier, Swisher International, Angelica Trevor Fetter, President and CEO (Since 2003) President, Tenet (2002-2003) CEO, Broadlane (2000-2002) CFO, Tenet (1995-1999) Other Directorships: Hartford Financial Services Group Karen Garrison President, Pitney Bowes Business Services (1999-2004) Member of Tenet Board since 2005 Other Directorships: Kaman Corporation, Standard Parking, North Fork Bancorp* Floyd D. Loop, M.D. Chairman and CEO, The Cleveland Clinic Foundation (1989- 2004) Member of Tenet Board since 1999 Other Directorships: Athersys, Intuitive Surgical Ronald A. Rittenmeyer Chairman, President and CEO, Electronic Data Systems Corporation (2005-2008) Member of Tenet Board since 2010 Other Directorships: AIG, Electronic Data Systems*, R.H. Donnelley*, Safety-Kleen Systems*, RailTex* Brenda Gaines President and CEO, Diners Club North America (2002-2004) Member of Tenet Board since 2005 Other Directorships: Fannie Mae, NICOR, Office Depot, CNA Financial Corp* Senator J. Robert Kerrey President, New School University (2001-2010) Former U.S. Senator (1989-2000) Former Governor (1982-1987) Member of Tenet Board since 2001 Other Directorships: Genworth Financial, Jones Apparel Group, Scientific Games Corporation Richard R. Pettingill President and CEO, Allina Hospitals and Clinics (2002-2009) VP and COO, Kaiser Foundation Health Plans and Hospitals (1996-2002) Member of Tenet Board since 2004 Other Directorships: Mako Surgical James A. Unruh Chairman and CEO, Unisys (1990-1997) Member of Tenet Board since 2004 Other Directorships: Prudential Financial, Qwest Communications, CSG Systems International * - Indicates prior Directorship affiliation |

Appendix D: Adjusted EBITDA Reconciliation 47 |

Reconciliation of EBITDA Reconciliation of EBITDA Adjusted EBITDA, a non-GAAP term, is defined by the Company as net income (loss) attributable to Tenet Healthcare Corporation common shareholders before (1) cumulative effect of changes in accounting principle, net of tax, (2) net income attributable to noncontrolling interests, (3) preferred stock dividends, (4) income (loss) from discontinued operations, net of tax, (5) income tax (expense) benefit, (6) investment earnings (loss), (7) gain (loss) from early extinguishment of debt, (8) net gain (loss) on sales of investments, (9) interest expense, (10) litigation and investigation (costs) benefit, net of insurance recoveries, (11) hurricane insurance recoveries, net of costs, (12) impairment of long-lived assets and goodwill and restructuring charges, net of insurance recoveries, and (13) depreciation and amortization. The Company’s Adjusted EBITDA may not be comparable to EBITDA reported by other companies. The Company provides this information as a supplement to GAAP information to assist itself and investors in understanding the impact of various items on its financial statements, some of which are recurring or involve cash payments. The Company uses this information in its analysis of the performance of its business excluding items that it does not consider as relevant in the performance of its hospitals in continuing operations. Adjusted EBITDA is not a measure of liquidity, but is a measure of operating performance that management uses in its business as an alternative to net income (loss) attributable to Tenet Healthcare Corporation common shareholders. Because Adjusted EBITDA excludes many items that are included in our financial statements, it does not provide a complete measure of our operating performance. Accordingly, investors are encouraged to use GAAP measures when evaluating the Company’s financial performance. Future period high range estimates assume excess cash is used to early retire debt. Actual use of cash may vary and therefore interest expense and other elements of earnings may vary significantly. The reconciliation of net income (loss) attributable to Tenet Healthcare Corporation common shareholders, the most comparable GAAP term, to Adjusted EBITDA, is set forth below. 48 |

Exhibit 99.2

Trevor Fetter

Investor Call

January 11, 2011

7:30 AM (CT) / 8:30 AM (ET)

[Tom Rice reads Safe harbor Language]

Slide 1: Tenet Healthcare Corporation Presentation to Investors

Thank you, Tom, and good morning everyone, and thanks for joining us. We decided to hold this call, instead of attending the JP Morgan conference, in order to have sufficient time to cover more topics. We also wanted to allow the analyst community to ask questions. To those of you on the west coast, I’m sorry to hold the call so early, but since we’re issuing preliminary results for 2010 and an EBITDA Outlook for 2011 and beyond, we wanted to complete the call before the market opens.

Before I start with our results and Outlook, I want to briefly address the unsolicited proposal we received in November from Community Health.

As you know, in December our Board of Directors unanimously determined that the Community Health proposal of $6.00 per share in cash and stock grossly undervalued Tenet and was not in the best interests of Tenet or its stockholders. The Tenet Board believes that Community Health’s proposal does not reflect the value of our compelling growth prospects, and thatTenet’s stockholders – not Community’s stockholders – deserve to benefit from Tenet’s growth.

[PAUSE]

At the conclusion of my prepared remarks today my colleagues and I are happy to take your questions. Let’s now turn to the presentation. The slides we’re using are at both tenethealth.com and streetevents.com.

Slide 2: Forward-Looking Statements

Slide 3: The Hospital Industry: A Compelling Investment

Many of you know us very well. But for those of you who are new to the Tenet story, let me take just a minute to provide some background.

I’d like to start with some brief comments about our industry, so please turn to Slide 3.

With large barriers to entry, a lack of foreign competition, and limited risk of substitution, this has always been viewed as a stable industry. The industry has suffered a bit during the recession, but is now at a positive inflection point as we begin the New Year: 2011 is when the baby boomers begin to enter the Medicare program, and they do so at the rate of a new beneficiary every eight seconds.

The growth rate of the population 65 and over will double, from 1.5% to more than 3%, between 2010 and 2012. And per-capita spending on healthcare nearly doubles between age 50 and age 65.

| Investor Call – January 11, 2011 | 2 |

In addition to aging, the population is becoming increasingly obese. While this poses challenges for our country, these are secular trends that will drive higher growth in demand for hospital services compared with the last decade.

The Affordable Care Act, enacted last year, also changes the landscape for our industry in a positive way.

In addition to these powerful forces, as the economy pulls out of the recession, we should see positive cyclical trends as well. Rising unemployment has contributed to a cyclical decrease in utilization and an increase in bad debt expense. These factors have put recent pressure on hospital industry margins and growth rates.

Slide 4: Tenet at a Glance

Slide 4 provides a brief overview of Tenet. The Company consists of 49 acute care hospitals and 81 freestanding outpatient centers in 11 states. We also provide services, mainly in the revenue cycle, to hospitals outside of Tenet.

In 2010, these three businesses, inpatient, outpatient and services, together generated more than $9 billion in annual revenue and approximately one billion fifty million dollars of EBITDA. We anticipate EBITDA will increase in 2011 to a range between one billion one hundred fifty million to one billion two hundred fifty million dollars.

In terms of corporate governance, we believe we have one of the finest boards in the industry. Collectively, our directors have an impressive professional history with personal accomplishments in healthcare, government, or in corporate management. I am the only insider on the board, and no two board members serve together on any other boards or have any other interlocks. Please refer to Appendix C for a more complete description of our board.

Slide 5: Q42010 Preliminary Performance Highlights and EBITDA Outlook

While it would be premature to provide a “pre-release” of Q4 results, we do know enough about our performance in the quarter to make some preliminary statements. The information on Slide 5 and Appendix A provides the highlights and a starting point for the longer term Outlook I’ll discuss in a moment.

First, it’s important to note that we now expect to recognize in 2011 the $64 million from the California Provider Fee program that we had expected to recognize in 2010. The conditions necessary to record that income in 2010 were not met, and as of yesterday, official approval of the program from CMS had yet to be granted, although it is expected within days. Setting aside this item, our operations performedvery well in 2010.

For the full year 2010, we estimate that we will achieve EBITDA of one billion fifty million dollars, approximately $280 million of which we generated in the fourth quarter. As you can see from the slide, these core operating results exceeded the high end of the relevant range reflected in our November Outlook.

| Investor Call – January 11, 2011 | 3 |

This performance was supported by improving statistics in both inpatient and outpatient volumes in the fourth quarter, during which time both total and commercial volumes, while still negative, were better than the trend in Q3.

Outpatient visits grew by approximately 2.9%, driven by our recent outpatient acquisitions.

In addition to improving volume trends, we continued to be very effective in managing costs. We had favorable malpractice trends, and we benefitted from the impact of rising interest rates on malpractice expense.

Slide 6: Our National Hospital and Outpatient Center Footprint

Slide 6 shows our geographic footprint. You can see our presence is primarily in the southern half of the U.S., with market concentrations in California, Texas, and Florida. We operate primarily urban or suburban hospitals serving fast growing metropolitan markets. Our hospitals tend to be large. We have four academic medical centers.

Although the markets we serve have had above-average population growth in the past decade, certain markets have had higher-than-average levels of uninsured populations and unemployment. But we believe we’re in good markets for the future, and that we’re well positioned within those markets. Under the Affordable Care Act, the historic disadvantage of being in states with high numbers of uninsured people is mitigated as many of these people gain insurance.

Slide 7: Tenet Healthcare: A Compelling Investment

[PAUSE]

Slide 7 demonstrates that like the industry itself, Tenet represents a compelling value to investors. Tenet has continued to deliver strong growth in earnings. We have established a consistent strategy driven by innovative, high margin, capital efficient initiatives that have significant runway in front of them. And we’ve run our Company with a high degree of integrity, providing extensive transparency and emphasizing clinical quality and regulatory compliance.

With these key initiatives in place along with continued industry trends, we expect to exceed current industry margins within the period of the Outlook we’re providing today.

Slide 8: Significant Positive Momentum – Multiple Value Drivers

Slide 8 provides a summary view of the primary drivers of economic value. As you can see, each of these drivers is moving in the right direction, and those positive trends are well-established.

Let’s start with the chart in the upper left. Despite difficult headwinds, since 2006 we’ve grown revenues steadily at an annual rate of 5%, which is consistent with our long-term Outlook. This growth has been fueled by our improved managed care pricing, which reflects our superior value proposition. This is an organic story; not one driven by acquisitions.

The EBITDA and margin chart in the upper right illustrates powerful growth over the last seven years. We’ve more than doubled EBITDA and margin since 2004—and this is presented on the same base of 49 hospitals we have today.

| Investor Call – January 11, 2011 | 4 |

On the lower left, you can see the significant reductions in debt, which along with improved earnings, has produced one of the more solid balance sheets in the industry.

The chart on the lower right shows how we’ve dramatically increased Return on Invested Capital. As this is one of the most fundamental measures of value creation, we are proud of our track record and expect to continue achieving growth in ROIC.

Slide 9: Tenet Has Led Same-Hospital Admissions Growth over the Last 15 Quarters

Slide 9 compares Tenet’s volume growth at our 49 hospitals to that of our largest peers for the period Q1 2007, the first year following our 2006 settlement with the Department of Justice, to Q3 2010, the most recent quarter for which comparable statistics are available.

What this chart shows is that in six of those 15 quarters, Tenet reported the strongest admissions growth compared to our largest competitors. In 14 out of the 15 quarters, we ranked first or second among these three companies.

[PAUSE]

Slide 10: Strong Organic Net Revenue Growth

The revenue growth you see on Slide 10 is organic, and as I mentioned earlier, has grown at a steady and consistent rate of 5% since 2006.

[PAUSE]

Slide 11: Tenet’s Same-Hospital EBITDA Growth Has Outpaced Its Largest Peers in Eight out Of the Last 15 Quarters

Slide 11 compares Tenet’s EBITDA growth at our 49 hospitals to our largest peers since the beginning of 2007. In eight of these 15 quarters, or more than half of the time, Tenet ranked first in same-hospital EBITDA growth.

Slide 12: Tenet’s EBITDA Margins Have Expanded 590 Basis Points Since 2004

Slide 12 provides a closer look at Tenet’s strong growth in EBITDA and EBITDA margin since 2004.

EBITDA growth has averaged a compound annual increase of 16% during this seven-year period. This track record clearly demonstrates our long-term ability to produce superior and sustained earnings growth. Of course, this is the most fundamental of value drivers. It’s also important to note that this seven-year period of sustained growth included the most significant recession in 70 years.

Again, I want to remind you that this growth is virtually all organic. This is not an acquisition story. We have grown through cost control and quality initiatives coupled with improved pricing. We did it against strong headwinds. And we accomplished this growth while significantly de-leveraging and de-risking the Company.

| Investor Call – January 11, 2011 | 5 |

Slide 13: Tenet’s Consistent EBITDA Improvement Relative to Peers Has Narrowed the Margin Gap

Slide 13 puts our margin growth in context. Tenet has grown margins at the same time peer margins havedeclined. To be specific: Tenet expanded margins by 590 basis points while the industry, excluding Tenet, suffered marginerosion of 230 basis points.

This margin differential is now just 260 basis points and we expect to more than close this gap over the next few years. In just a moment, I’ll discuss the specific initiatives we are using to close the remaining margin gap.

Slide 14: Tenet Has One of the Lowest Leverage Ratios and Longest Maturity Profiles in the Industry

Slide 14 provides a more detailed look at our risk profile. I showed you earlier how we reduced debt and repaid our obligation to the government. On this chart you can see that whether you look at our leverage ratio compared to our industry peers, or the weighted average debt maturities, Tenet has one of the better risk profiles in the industry.

[PAUSE]

Slide 15: Well-Defined Growth Strategy

Beginning with slide 15, I’d like to transition from our past performance to our future.

We are focusing on organic growth, building high margin businesses, and growing EBITDA, free cash flow and ROIC. This is reinforced and incentivized throughout the organization.

To this end, we increased our focus on growing outpatient volumes, we significantly expanded our high-growth revenue cycle business, and emphasized physician alignment as a way to build our service lines and capture the benefits of the operating leverage inherent in our business.

The foundation for these growth strategies includes integrated clinical systems that are driving quality and efficiency and providing an enhanced value proposition to our physicians. And, as in the past, we maintain high standards of clinical quality and regulatory compliance.

Slide 16: Seven Key Drivers of a 16-18% EBITDA Margin

On Slide 16, we’ve translated these strategies into the seven key drivers toward a 16% - 18% EBITDA margin. This list should look very familiar to anyone who has seen our investor presentations over the past year.

Let’s take a closer look at each of these drivers.

Slide 17: Targeted Acquisitions and Organic Growth Will Drive Meaningful EBITDA Margin Expansion

Slide 17 illustrates our first initiative: significant expansion of our outpatient services business. The current market remains uniquely attractive for outpatient acquisitions. We closed on 24 outpatient acquisitions in 2010 for a total outlay of $65 million. We expect these acquisitions will contribute an additional $25 million to EBITDA in 2011 and more in subsequent years.

| Investor Call – January 11, 2011 | 6 |

Our pipeline is strong, so we anticipate our 2011 acquisition program will continue at a similar pace to last year’s. We expect the partial year contribution from 2011 acquisitions to generate an additional $10 million of EBITDA. We should achieve full contribution from the 2010 and 2011 acquisitions by 2013, when we will have a $65 million run-rate from that point forward.

Even though we expect to continue making outpatient acquisitions, as a practice we do not include unidentified acquisitions in our earnings Outlook. Therefore our earnings Outlook through 2015 includes only the $65 million run rate from outpatient acquisitions we have completed or for which we have visibility today.

[PAUSE]

Slide 18: Conifer Ranks among Revenue Cycle Industry Leaders

Our revenue cycle business, which you’ll see highlighted on Slide 18, operates under the brand name ‘Conifer’. Although we’ve talked about Conifer at investor meetings over the past few years, and many of you have met the leaders of Conifer, I believe that some investors may not fully appreciate the potential of this business.

This slide compares Conifer’s key metrics to the only comparable publicly-traded company, Accretive Health. This side-by-side comparison demonstrates that these two businesses, Conifer and Accretive, are similar in magnitude.

Given the comparable size of its business, please note that Accretive, which went public in 2010, has a current enterprise value of approximately $1.5 billion. As Conifer gains momentum and becomes a greater contributor to our earnings, we expect this will become a more visible source of value in our shares.

Conifer is highly strategic to driving superior performance for Tenet in the revenue cycle. Over the past five years, it has driven Tenet’s reduction in Accounts Receivable days from 58 days to 46 days today, an improvement that has unlocked approximately $300 million in cash. Conifer has also reduced our billing cycle times by almost 35%. We achieved almost 40% of our self-pay collections at the point of service in 2010, up 12 points from five years ago.

Conifer has also contributed to our cash generation by assisting otherwise uninsured patients in qualifying for government programs. Last year, Conifer enabled 100,000 of our patients who were otherwise uninsured to qualify for state Medicaid programs.

As most of you know, the sales cycle on outsourcing services can be very long, but Conifer has already made significant penetration in the market and built a substantial pipeline for future sales, so we have a high degree of confidence in the $85 million of incremental EBITDA contribution we’ve incorporated into our 2015 earnings Outlook.

| Investor Call – January 11, 2011 | 7 |

Slide 19: Medicare Performance Initiative Will Continue To Deliver Significant Cost Savings

Slide 19 describes the growing earnings contribution we expect from our “Medicare Performance Initiative”, or “MPI”.

MPI is built on a unique foundation of information systems capabilities and analytic tools we developed at Tenet. These systems and tools give us excellent insights into our business, and enable us to work with physicians to improve quality and reduce variation in resource utilization.

MPI was launched in early 2009. In the first year, we launched the program with an examination of the Top 5 DRGs, or “Diagnostic Related Groups” at each of our hospitals. For those new to our industry, DRG is a Medicare term that has become a common language for describing specific services.

The concept driving MPI is to identify best practices among our physicians for these targeted DRGs. We then identify physician champions to lead the adoption of those practices by other physicians. The goal is safer, better care at a lower cost.

In MPI, we can identify not only the profitability of each physician for each DRG, but also the specific reasons why the clinical practices of individual physicians might make or lose money for the hospital.

While physicians generally like to think their procedures are profitable for hospitals, if they use overly expensive supplies or keep patients in the hospital too long, those thin Medicare margins evaporate. While today there are no consequences to the physician within Medicare, there can be consequences in managed care. We help the physicians understand when their clinical practices could cause them to be dropped from a managed care network. We can help the physicians remain in network, reduce costs, improve profitability, and increase clinical quality. Everyone wins.

Those of you who have followed Tenet closely may remember a slide with bubble charts for DRG 871 and a certain Doctor #6. His costs per case had improved significantly in the 12 months post-MPI implementation, but were still at a level which lost money for the hospital. In preparing this presentation, we checked on Doctor #6 and found that for the last six months both the variable costs per case and average length of stay for his patients have declined. Thanks to MPI, his cases in DRG 871 are now solidly profitable for the hospital.

[PAUSE]

Alongside MPI, we have had other related programs to help reduce costs. These include standardization and purchasing initiatives related to supplies, length of stay and case management initiatives, labor productivity initiatives and standardization of clinical care. Some of these are more mature than others, but all are expected to achieve significant benefit going forward and are included in the aggregate savings we target as part of MPI.

As we expand MPI to a larger number of hospitals in 2011, we expect to build on the savings achieved in 2010 and add an incremental $50 million in savings, annually, to that base. Since these annual savings are cumulative, by 2015, we expect MPI to achieve a $250 million reduction in our cost base.

Because MPI, our Medicare Performance Initiative, is so important, we’ve included supplemental slides on the topic in Appendix B of this presentation.

| Investor Call – January 11, 2011 | 8 |

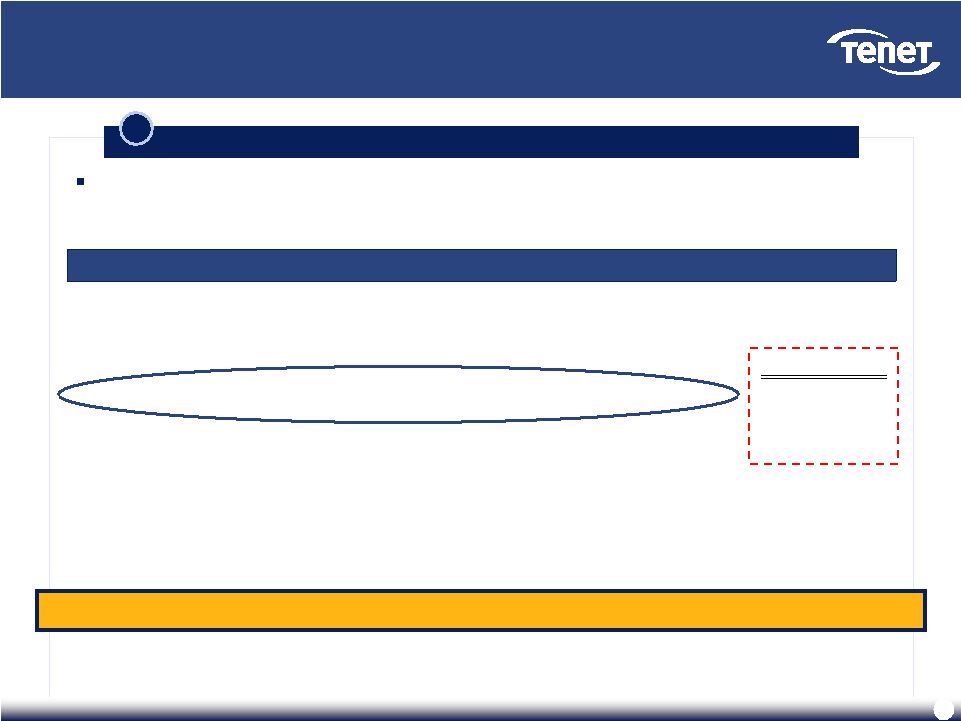

Slide 20: HIT Investments Improve Clinical Outcomes and Operational Efficiencies

Slide 20 provides some important insights into our substantial investments in Health IT. We are spending $620 million on advanced clinical systems from 2009 to 2014, which is offset in large part by aggregate federal incentives of $320 million. These investments suppressed our earnings growth in 2010 and will do so again in 2011. But the impact on earnings turns positive next year, in 2012, as we expect federal incentive payments to exceed our implementation costs by $10 million. It’s important to remember that we would have made these investments over time in any event, but the federal incentives motivated us to accelerate the program.

There are two important things not to miss on this slide. The first is the line with a circle around it. That’s the effect on EBITDA, assuming zero operating benefits, but just netting the cost against the incentive payments. The second important point is off to the right. The penalties fornot implementing these systems are significant: there are penalties in perpetuity which have a net present value of approximately $315 million.

It makes sense to invest in these systems, and even more sense to maximize the incentives and minimize the penalties, because advanced clinical systems are essential to patient care, the competitiveness of our hospitals, and the satisfaction of our physicians.

Slide 21: Reduced Bad Debt Expense Expected To Contribute To EBITDA Growth

Turning to Slide 21, an economic recovery should help us reduce bad debt expense. Conifer is also expected to contribute to a decline in bad debt. From 2006 to the second quarter of 2008, Conifer drove our self-pay collection rate from 32% to 36%.

Since then, recessionary pressures have driven collection rates back down to 29%. An economic recovery alone should drive these collection rates back toward our pre-recession level of 36%, and we believe Conifer will improve our collection rate to a level above that.

Slide 22: Increase in Capacity Utilization Provides Significant Upside Opportunity

As you can see on Slide 22, we have plenty of available inpatient capacity, and our long range outlook is to improve modestly in comparison to our peak capacity utilization in the past five years. Like the impact from reduced bad debt, we assume a major portion of this contribution will be driven by the economic recovery, as economic and job growth drives volume growth.

Tenet is currently operating at a 50% utilization rate for licensed beds, which means that we have no near-term capacity constraints, but rather, significant upside potential for earnings. We estimate that incremental inpatient volume has roughly a 40% margin. The operating leverage in our business model provides upside coming out of the recession. Of course it’s more than just a macroeconomic story. We have a series of volume-building initiatives to augment industry-average volume growth.

Slide 23: Affordable Care Act Expected To Increase Volumes

Slide 23 outlines the impact on profitability from the Affordable Care Act, otherwise known as healthcare reform. The Act is negative to earnings in the near-team, but distinctly positive beginning in 2014.

| Investor Call – January 11, 2011 | 9 |

Of course, there are many uncertainties in projecting the ultimate impact of recent legislation post-2014. One of the most difficult parts is estimating the changes in utilization of healthcare services by today’s uninsured and charity patients as they become insured. It’s safe to assume that newly insured people will consume more healthcare services, on which we expect good margins as a result of the operating leverage I spoke about earlier. It is very subjective at this point as to what the pricing, payer and case mix will be. Our best estimate is that the net impact on earnings will be positive as you will see in our earnings walk forward.

In 2014, we anticipate that inpatient volumes could surge by as much as 7 and one-half percent, and outpatient visits could grow by 5%.

The most important take-away from this discussion is that while uncertainties make it difficult to predict the precise impact of the law on the profitability of the industry, there is no question that our geographic presence and business model will position Tenet to capture substantial net benefits from this new law.

Slide 24: EBITDA Outlook for 2010 & 2011

Putting this all together, I’d like now to turn to our near-term and long-term Outlooks for our financial performance, which you can see on Slide 24.

We won’t release our final results for 2010 until mid- to late-February, but our preliminary estimate for 2010 EBITDA is approximately one billion fifty million dollars.

Our initial Outlook for 2011 EBITDA is a range of one billion one hundred fifty million to one billion two hundred fifty million dollars, or 10-20% growth over 2010. Since the California Provider Fee is now expected to be recorded in 2011 and will not be recorded in 2010, if you set aside that item entirely, the growth range is expected to be from 3-13%.

Our cash balance at December 31, 2010 was approximately $400 million, reflecting favorable EBITDA performance offset by capital spending of approximately $460 million, and working capital and other liability changes.

The assumptions underlying our 2011 Outlook are appropriately conservative, reflecting the uncertain strength of the economic recovery. More specifically, we are assuming total admissions will be flat to down one percent. The adverse payer shift we have experienced in recent years is assumed to continue into 2011, with an unfavorable impact of approximately $25 million.

We are assuming the headwinds from bad debt expense will continue. And while we also included $35 million of negative EBITDA associated with the Health IT expenses in the year, I want to remind you that that this is the last year in which our Health IT program will be a net financial drag on our reported earnings.

| Investor Call – January 11, 2011 | 10 |

Slide 25: Tenet Has Consistently Exceeded Initial Annual Outlook in 2009 and 2010

Slide 25 is intended to place our 2011 Outlook in context. This graph compares our initial Outlooks to our ultimate performance in 2009 and 2010. It shows we have ‘under-promised and over-delivered’. While we strive to be as accurate as possible in issuing our Outlooks, we also try to avoid unwarranted optimism. Since we explicitly identified the California Provider Fee each time we issued our 2010 Outlook, we have excluded it from 2010 for this purpose.

Slide 26: Long-Term Outlook: 2010-2015

Slide 26 summarizes our high-level overview of the Outlook for the next five years.

We are expecting revenue growth to stay in the same, well-established 4-6% range we achieved over the last five years. This revenue growth reflects continued pricing improvement balanced by modest volume growth through 2013, enhanced by the volumes expected as a result of the Affordable Care Act in 2014 and 2015. While it fully reflects pricing pressure from the federal health legislation, this is offset by an improving outpatient mix and strong growth from Conifer.

In the middle of our range, annual EBITDA growth is expected to average 14%, slightly lower than the 16% compound annual growth we’ve generated over the last six years.

By 2015, we expect our margin in the middle of the EBITDA range to be 16-18%, exceeding today’s industry average.

Meeting these objectives corresponds to annual EPS growth of 37-50%.

EPS growth will be accelerated by our utilization of our two billion dollar NOL. Based on these assumptions, we expect the NOL to be fully utilized by 2014 or 2015.

Throughout this period, we expect to continue to invest in our hospitals. We reflected those investments by including annual capital expenditures in a range of 450 million to 550 million dollars.

Slide 27: Tenet’s EBITDA Growth

Slide 27 provides an illustration of the EBITDA generated under this Outlook. What’s most notable about this growth trajectory is that it’s actually 200 basis pointslower than our track record for EBITDA growth going back to 2004. At the high end of the 2015 range, the growth rate is actually equal to that of the past six years.

Slide 28: EBITDA Walk-Forward 2010-2013

We thought it would be helpful to disaggregate our 2015 Outlook into two segments: looking first at the period prior to the implementation of the most significant pieces of the Affordable Care Act in 2014, and next at our expectation for the first two years after full implementation of the Act – namely 2014 and 2015.

| Investor Call – January 11, 2011 | 11 |

Slide 28 summarizes our Outlook for the first of these two time periods. This slide provides detail on the contributions to EBITDA growth from 2010 to 2013 from our seven primary growth drivers. Note that while outpatient, Conifer, MPI and Health IT are making significant contributions, aggregating $330 million by 2013, our assumption on the impact from reduced bad debt is modest, at $25 million. And, we include a $90 millionadverse impact from healthcare reform. This $90 million is primarily the impact of the Medicare pricing concessions that the industry accepted as part of the political process of enacting healthcare reform.

Volume growth, pricing and enhanced operating leverage, net of continued adverse payer mix shifts are expected to contribute $80 million by 2013. We also expect run rate improvement in Medicaid funding, including follow-on California Provider Fees and Provider Fees in other states, to contribute an additional $40 million in this period.

These assumptions result in the mid-point of our 2013 EBITDA Outlook coming in at one billion four hundred thirty-five million dollars and a margin of 13-14%, which is sufficient to close roughly 80% of the margin gap relative to current peer group performance.

This growth trajectory provides significant value creation for our shareholders. But, as we move into 2014 and 2015, with all aspects of the Affordable Care Act coming into play, we expect additional acceleration in our earnings growth.

Slide 29: EBITDA Walk-Forward 2013-2015

Slide 29 starts from the mid-point of our 2013 Outlook with an EBITDA of one billion four hundred thirty-five million dollars, and builds to our mid-point for our 2015 Outlook of two billion dollars.

To remain conservative, you’ll note we added no incremental EBITDA contribution during this time period from additional acquisitions in our outpatient business, consistent with our practice of not including unidentified acquisitions.

Conifer and MPI continue to make significant contributions however, contributing an incremental $50 million and $100 million, respectively. Our Health IT initiative will contribute an estimated positive $44 million in 2015, which is roughly $10 million less than it will contribute to 2013 EBITDA, hence the negative $10 million on this chart.

The impact from healthcare reform is expected to add more than $230 million to EBITDA in 2015 relative to 2013. This impact reflects the increased utilization of our hospitals and outpatient centers by previously uninsured segments of our patient population. This aggregate contribution reverses the unfavorable $90 million impact we expect through 2013, and adds as much as $140 million beyond this breakeven point.

Volumes, pricing and operating leverage continue to drive growth, adding almost $200 million to our 2015 Outlook. In part, this growth reflects a stabilization in payer mix, which had been assumed to be eroding through 2013.

| Investor Call – January 11, 2011 | 12 |

The aggregate impact from these items puts the mid-point of our 2015 Outlook at two billion dollars, with a margin of 16-18%. By this point, we expect to have more than fully closed the current margin gap relative to the peer group.

We believe this Outlook is realistic and, as I mentioned, was prepared as part of our normal long-range planning last Fall, and reflects 2010 results. We believe it creates meaningful shareholder value. Under normal circumstances we wouldn’t provide an outlook so far into the future, but we felt it was important for shareholders to make their own determinations regarding the value and achievability of the plan.

Slide 30: Tenet Healthcare: A Compelling Investment

To summarize on Slide 30, I made several points at the outset about our industry being at an inflection point with strong favorable trends. Moreover, Tenet represents a compelling investment within the industry. We have produced an enviable track record of growth in the real drivers of shareholder value.

The growth we’ve generated is the product of a clear and consistent strategy that has built significant momentum. It hasn’t been easy. We’ve generated this growth through the basics of a high quality value proposition for our customers, very effective cost controls, and investments in technology and our physical plants. We have dramatically reduced our risk profile and financial leverage. We emphasize high standards of clinical quality and regulatory compliance, and our strategies are sustainable.

Once again, we exceeded our operating targets in 2010 and we look forward to building on that momentum in the year ahead.

[PAUSE]

This concludes my prepared remarks, but before I ask the operator to open the call to Q&A, I have a couple of requests. Due to our limited time, and in fairness to others in the queue, I’d like to request that you ask just one question. And because we are constrained in what else we can discuss, I’d also ask that you limit your questions to our fundamentals and Outlook. Finally, I don’t anticipate that we’ll be able to get through the queue entirely, so if you have a question and we aren’t able to call on you, please feel free to call us later this morning at 469-893-2522.

Operator, please open the call to questions.

# # #

Forward-Looking Statements