OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2010

Estimated average burden hours per response...18.9

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3486

Madison Mosaic Tax-Free Trust

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

W. Richard Mason

Madison/Mosaic Legal and Compliance Department

8777 N. Gainey Center Drive, Suite 220

Scottsdale, AZ 85258

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: September 30

Date of reporting period: March 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Report to Shareholders.

Semi-Annual Report (unaudited)

March 31, 2008

Madison Mosaic Tax-Free Trust

Virginia Tax-Free Fund

Tax-Free National Fund

(logo) Madison Mosaic Funds

www.mosaicfunds.com

Contents

| Letter to Shareholders | 1 |

| Portfolio of Investments | |

| Virginia Tax-Free Fund | 4 |

| Tax-Free National Fund | 6 |

| Statements of Assets and Liabilities | 10 |

| Statements of Operations | 11 |

| Statements of Changes in Net Assets | 12 |

| Financial Highlights | 13 |

| Notes to Financial Statements | 14 |

| Fund Expenses | 16 |

Letter to Shareholders

(Photo of Michael J. Peters) The semi-annual period ended March 31, 2008 saw positive total returns for Madison Mosaic Tax-Free National and Virginia Tax-Free. The funds' yields dipped slightly, in a period which saw the Federal Reserve aggressively lower rates. Tax-Free National returned 1.65% for the six months and Virginia Tax-Free returned 1.73%, well ahead of their peer group. At the end of the period, Virginia Tax-Free showed a 30-day SEC yield of 3.10%, while Tax-Free National was 3.09%.

Over the same period, the Lipper General Municipal Debt Index was down -1.05%, as municipal bonds of longer maturities lost ground. The Lipper Short Municipal Debt Index was up 1.11% for the period, while the Lipper Intermediate Municipal Debt Index was up 1.24%. We benefited from our intermediate maturity positioning as well as our preference for high-quality issuers.

Economic Overview

The beginning of this reporting period in October of 2007 turned out to be an investing environment quite different than the climate earlier in 2007. The first half of the year was driven by a seemingly endless supply of liquidity, driving mergers and acquisitions and a healthy stock market. During the late summer months, concerns surrounding the housing and mortgage markets began to ramp up, signaling the flow of liquidity might subside. By the beginning of the six-month reporting period, we saw increasing stress on the banking system, weakening earnings growth and speculation of a possible recession in 2008.

As we entered 2008, the headlines of America's financial press were filled with words such as implosion, meltdown, and collapse to describe the events unfolding in the financial markets. Yet, despite the volatility and startling headlines, it was a rewarding period for defensive and high-quality segments of the fixed income market. Falling yields, a positively sloped yield curve and solid performance in high-quality market sectors allowed intermediate bonds to lead the way, including the municipal bonds that we emphasize in Tax-Free Trust. During this period investors in higher risk, higher-yield securities such as junk bonds, auction rate securities or mortgage-backed securities based on subprime loans experienced the unpleasant risk often associated with stretching for yield.

In September, just prior to the beginning of our six-month period, the Federal Reserve Board cut rates from 5.25% to 4.50% in two steps. By the end of the period, the Federal Reserve Target Rate had been cut even more dramatically, ending the period at 2.25%.

In addition to these rate cuts, the Fed stepped outside the traditional box by implementing new and, in many cases, unprecedented programs targeting support at a broad swath of the financial sector. These creative solutions showed mixed signs of bearing fruit as our reporting ended in March, as risk premiums grudgingly shrank and the stock market began to show signs of life.

Unlike many other periods, the normally calm world of municipal bonds had a number of newsworthy happenings. At the period's end, the Supreme Court was reviewing a case that could affect the taxability of single-state municipal bonds, and we are keeping an eye on the proceedings. The case known as Davis vs. Kentucky should be decided by the end of June. On another front, although municipal bonds rarely default, particularly highly-rated bonds, many are available with insurance coverage. Unfortunately, many of the companies issuing this insurance coverage were caught up in the subprime loan crisis. As they struggled, investors put selling pressure on the municipal bonds they insured, even though the credit-worthiness of the underlying security was unaffected and might be outstanding. The confluence

Letter to Shareholders • March 31, 2008 (continued)

of illiquidity in the Auction Rate Securities market, the credit downgrades of a number of municipal insurers and a general shedding of risk created a unique situation in which high-quality municipal bonds were offered at yields in excess of Treasury bonds for much of the first quarter of 2008. Once again, we don't believe this insurer situation has a negative impact on the underlying fundamentals of the bonds held in Tax-Free Trust, since we have always concentrated on the quality of the bond issuers who have not been adversely impacted by the insurance woes.

Outlook

The economy remains an increasing source of concern and the most common question is: Are we in a recession? There is little doubt that consumers are battling numerous headwinds, including high energy prices, tight credit availability and slumping asset values (homes and stocks). The labor market is also beginning to show signs of strain, leading us to conclude that a further increase in the unemployment rate lies ahead. It is likely the consumer will continue to struggle over the near-term.

But non-financial corporations remain in solid shape. America's companies did not, by and large, go on a debt binge during this economic cycle, leaving private sector balance sheets highly liquid and lightly leveraged by historical standards. Earnings continue to grow for these companies, thanks in large part to the weak dollar and vibrant export markets. In the end, it is not so much about whether we trip the definition of a recession or just come close. In this case the duration of the downturn seems much more to the point.

While economic woes remain front and center, inflation is also a major source of concern. Consumer prices rose in excess of 4% over the last year. This is not consistent with 10-year Treasury yields at 3.50%. In fact, only three times in the last 30 years have 10-year Treasury yields been lower than CPI inflation.

Looking ahead, we expect the economy to show renewed vigor in the second half of the year, as exports remain a source of strength and the housing market finds a bottom. High-grade municipal bonds appear to be oversold, and we anticipate a relatively strong period for tax-free bonds in the year ahead.

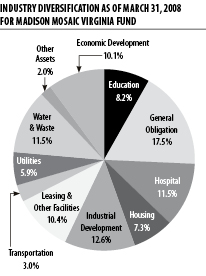

VIRGINIA FUND

The Commonwealth of Virginia maintains an AAA general obligation bond rating based on a well-diversified economy that emphasizes services and government. The Fund had a total return of 1.73% for the semi-annual period and the 30-day SEC yield was 3.10% as of March 31, 2008. The duration of the portfolio was 6.5 years while the average credit quality was maintained at AA. Purchases during the period included Roanoke County Industrial Development Authority Lease Revenue bonds for Public Facilities Projects and Prince George County General Obligation bonds. Virginia ranked 13th in the country in terms of issuance on a year-to-date basis.

2 Semi-annual Report • March 31, 2008

Letter to Shareholders • March 31, 2008 (concluded)

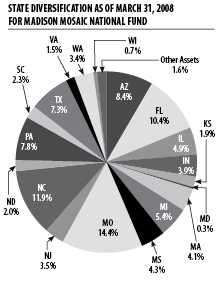

NATIONAL FUND

The National Fund had a total return of 1.65% for the semi-annual period and the 30-day SEC yield was 3.09% as of March 31, 2008. The duration of the portfolio was 6.31 years while 64.2% of the portfolio held Moody's top Aaa rating. Purchases made during the period include Austin, Texas Water and Sewer revenue bonds and Western Boone County, Iowa Multi-school District bonds. The United States and its territories have issued $80,299,800 billion in muni bonds during the three months ending March 31, 2008, which represents a 25.3% decrease in volume over the same period last year.

Sincerely,

(signature)

Michael J. Peters, CFA

Vice-President

Madison Mosaic Tax-Free Trust 3

Madison Mosaic Tax-Free Trust March 31, 2008

Virginia Fund • Portfolio of Investments (unaudited)

Credit Rating* | Principal Amount | Market | ||

| Moody's | S&P | |||

| LONG TERM MUNICIPAL BONDS: 98.0% of net assets | ||||

| Economic Development: 10.1% | ||||

| Aaa | AAA | James City County Economic Development Authority Revenue, 5%, 6/15/19 | $1,050,000 | $1,128,425 |

| Aa2 | AA | Newport News Economic Development Authority Revenue, 5%, 7/1/25 | 745,000 | 763,148 |

| Aaa | AAA | Roanoke County Economic Development Authority Lease Revenue, (Assured Guaranty Insured), 5%, 10/15/16 | 400,000 | 443,616 |

| EDUCATION: 8.2% | ||||

| Aa1 | AA+ | Fairfax County Economic Development Authority, Facilities Revenue, 5%, 4/1/21 | 1,000,000 | 1,045,580 |

| Aaa | AAA | Virginia Polytech Institute & State University Revenue, 5%, 6/1/14 | 775,000 | 847,424 |

| GENERAL OBLIGATION: 17.5% | ||||

| Aaa | AAA | Alexandria, 5%, 1/1/16 | 200,000 | 221,330 |

| Aaa# | AAA | Loudoun County, (Prerefunded 5/1/12 @ 100), 5.25%, 5/1/13 | 620,000 | 678,385 |

| Aaa | AAA | Loudoun County, 5%, 10/1/13 | 500,000 | 533,045 |

| Aa3 | AA | Lynchburg, 5.7%, 6/1/25 | 1,000,000 | 1,082,090 |

| Aaa | nr | Prince George, (Assured Guaranty Insured), 5%, 2/1/20 | 200,000 | 214,596 |

| Aaa | AAA | Richmond, 5%, 7/15/23 | 750,000 | 776,085 |

| Aa1 | AA+ | Virginia Beach, 5%, 3/1/12 | 500,000 | 540,275 |

| HOSPITAL: 11.5% | ||||

| A1 | nr | Augusta County Industrial Development Authority, Hospital Revenue, 5.25%, 9/1/20 | 1,000,000 | 1,048,350 |

| Aaa | AAA | Danville Industrial Development Authority, Hospital Revenue (Danville Regional Medical Center) (AMBAC Insured), 5%, 10/1/10 | 250,000 | 266,460 |

| Aaa | AAA | Hanover County Industrial Development Authority, Revenue (Bon Secours Health System) (MBIA Insured), 6%, 8/15/10 | 200,000 | 216,030 |

| Aaa | AAA | Roanoke Industrial Development Authority, Hospital Revenue (Carilion Health Systems) (MBIA Insured), 5.5%, 7/1/16 | 500,000 | 537,460 |

| Aaa | AAA | Roanoke Industrial Development Authority, Hospital Revenue (Roanoke Memorial Hospitals) (MBIA Insured), 6.125%, 7/1/17 | 500,000 | 584,210 |

| HOUSING: 7.3% | ||||

| nr | AAA | Fairfax County Redevelopment & Housing Authority, Multi-Family Housing Revenue (Castel Lani Project) (FHA Insured), 5.5%, 4/1/28 | 425,000 | 423,976 |

| nr | AAA | Suffolk Redevelopment & Housing Authority, Multi-Family Housing Revenue, 5.6%, 2/1/33 | 1,250,000 | 1,271,588 |

The Notes to Financial Statements are an integral part of these statements.

4 Semi-annual Report • March 31, 2008

Virginia Fund • Portfolio of Investments • March 31, 2008 (concluded)

Credit Rating* | Principal Amount | Market | ||

| Moody's | S&P | |||

| INDUSTRIAL DEVELOPMENT: 12.6% | ||||

| Aaa | nr | Fairfax County Economic Development Authority (National Wildlife Assoc.), 5.25%, 9/1/19 | 1,000,000 | 1,030,160 |

| Aaa | AAA | Gloucester County Economic Development Authority, Lease Revenue (Courthouse Project) (MBIA Insured), 4.375%, 11/1/25 | 500,000 | 477,805 |

| Aa3 | nr | Prince William County Economic Development Authority, Lease Revenue, 5.25%, 2/1/18 | 375,000 | 415,658 |

| Aaa | AAA | Stafford County Industrial Development Authority Revenue, Municipal League Association, 4.5%, 8/1/25 | 700,000 | 679,448 |

| Aaa | AAA | Stafford County Industrial Development Authority Revenue, Municipal League Association, 5%, 8/1/21 | 315,000 | 326,384 |

| LEASING AND OTHER FACILITIES: 10.4% | ||||

| Aa1 | AA+ | Arlington County Industrial Development Authority Lease Revenue, 5%, 8/1/14 | 500,000 | 551,465 |

| Aaa | nr | Prince William County, County Facility (AMBAC Insured), 5%, 6/1/22 | 750,000 | 775,012 |

| Aaa | nr | Richmond Industrial Development Authority Government Facilities, 5%, 7/15/13 | 1,000,000 | 1,087,320 |

| TRANSPORTATION: 3.0% | ||||

| Aaa | AAA | Richmond Metropolitan Authority Expressway Revenue, (FGIC Insured), 5.25%, 7/15/12 | 350,000 | 381,269 |

| Aa2 | AA | Virginia State Resources Authority Infrastructure Revenue, 4.75%, 5/1/17 | 300,000 | 311,469 |

| UTILITIES: 5.9% | ||||

| Aaa | AAA | Richmond Public Utility Revenue, 4.5%, 1/15/33 | 300,000 | 283,278 |

| Aaa | AAA | Southeastern Public Service Authority Revenue, 5%, 7/1/15 | 1,000,000 | 1,093,190 |

| WATER & WASTE: 11.5% | ||||

| Aaa | AAA | Frederick Regional Sewer System Revenue, (AMBAC), 5%, 10/1/15 | 570,000 | 626,327 |

| Aaa | AAA | Henry County Water & Sewer Revenue, (FSA Insured), 5.25%, 11/15/13 | 700,000 | 780,451 |

| Aaa | AAA | Henry County Water & Sewer Revenue, (FSA Insured), 5.25%, 11/15/15 | 150,000 | 169,122 |

| Aaa | AAA | Upper Occoquan Sewer, Regional Sewer Revenue, (MBIA Insured), 5.15%, 7/1/20 | 1,000,000 | 1,090,150 |

| TOTAL INVESTMENTS (Cost $22,263,183) | $22,700,581 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 2.0% of net assets | 462,232 | |||

| NET ASSETS: 100% | $23,162,813 | |||

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Tax-Free Trust 5

Madison Mosaic Tax-Free Trust March 31, 2008

National Fund • Portfolio of Investments (unaduited)

Credit Rating* | Principal Amount | Market | ||

| Moody's | S&P | |||

| LONG TERM MUNICIPAL BONDS: 98.4% of net assets | ||||

| ARIZONA: 8.4% | ||||

| Aaa# | AAA | Arizona Health Facilities Authority, Hospital Revenue (Phoenix Baptist Hospital) (MBIA Insured), 6.25%, 9/1/11 | $100,000 | $104,499 |

| Baa1 | nr | Arizona Tourism & Sports Authority Tax Revenue Bond, 5%, 7/1/16 | 100,000 | 103,249 |

| Aa3 | AA- | Arizona Transportation Board, Grant Antic, 5%, 7/1/13 | 135,000 | 147,185 |

| Aa1 | AAA | Arizona Transportation Board, Highway Revenue Tolls, 5.25%, 7/1/19 | 215,000 | 230,766 |

| Aaa | nr | Maricopa County Public Corp. Lease Revenue Bond, (AMBAC Insured), 5.5%, 7/1/10 | 245,000 | 261,212 |

| Aaa | nr | Maricopa County Stadium Revenue Bond, (AMBAC Insured), 5.25%, 6/1/12 | 250,000 | 271,840 |

| Aaa | AAA | Maricopa County Unified School District #41 (Gilbert), 5.8%, 7/1/14 | 250,000 | 286,058 |

| Baa2 | nr | Maricopa County Unified School District #090 Saddle Mountain, 5%, 7/1/14 | 75,000 | 77,837 |

| Aaa | AAA | Northern Arizona University, 5%, 9/1/23 | 150,000 | 153,821 |

| Aaa# | AAA | Pima County Unified School District #10 (Amphitheater),(Prerefunded 7/01/09 @100) (FGIC Insured), 5.1%, 7/1/11 | 100,000 | 103,813 |

| Aa2 | AAA | Tempe Excise Tax Revenue, 5%, 7/1/20 | 225,000 | 236,702 |

| Aa3# | AA | Tucson Recreational, (Prerefunded 7/1/09 @ 100), 5.25%, 7/1/18 | 100,000 | 103,934 |

| Aaa# | AAA | University of Arizona Board of Regents (Prerefunded 12/1/09 @100) (FGIC Insured), 5.8%, 6/1/24 | 275,000 | 292,075 |

| FLORIDA: 10.4% | ||||

| Aaa | AAA | Emerald Coast Utilities Authority Revenue Bond, (FGIC Insured), 5%, 1/1/25 | 1,010,000 | 1,010,424 |

| Aaa | AAA | Palm Beach County Solid Waste Authority Revenue Bond, (AMBAC Insured), 6%, 10/1/10 | 1,100,000 | 1,181,488 |

| Aaa | AAA | Peace River, Manasota Regional Water Supply Authority Revenue Bond (FSA Insured), 5%, 10/1/23 | 750,000 | 771,705 |

| ILLINOIS: 4.9% | ||||

| Aaa | AAA | Regional Illinois Transportation Authority, Transit Revenue (AMBAC Insured), 7.2%, 11/1/20 | 300,000 | 368,193 |

| Aaa | nr | Winnebago County, Public Safety Sales Tax Revenue (MBIA Insured), 5%, 12/30/24 | 1,000,000 | 1,021,240 |

| INDIANA: 3.9% | ||||

| nr | AAA | Western Boone, Multi School Building Corp. (FSA Insured), 5%, 1/10/20 | 1,015,000 | 1,094,627 |

| KANSAS: 1.9% | ||||

| Aa2 | AAA | Kansas State Department of Transportation, Hwy Revenue, 6.125%, 9/1/09 | 500,000 | 528,330 |

| MARYLAND: 0.3% | ||||

| Aaa# | AAA | Maryland State Transportation Authority Transportation Facilities Project Revenue, 6.8%, 7/1/16 | 80,000 | 91,061 |

The Notes to Financial Statements are an integral part of these statements.

6 Semi-annual Report • March 31, 2008

National Fund • Portfolio of Investments • March 31, 2008 (continued)

Credit Rating* | Principal Amount | Market | ||

| Moody's | S&P | |||

| MASSACHUSETTS: 4.1% | ||||

| Aa2 | AA | Massachusetts Bay Transportation Authority, Transit Revenue, 7%, 3/1/14 | 1,000,000 | 1,171,220 |

| MICHIGAN: 5.4% | ||||

| Aaa | AAA | Charles Stewart Mott Community College, (MBIA Insured), 5%, 5/1/18 | 720,000 | 763,070 |

| Aa3 | AA- | Detroit City School District, (FGIC Insured), 6%, 5/1/20 | 300,000 | 338,543 |

| Aaa | AAA | Redford United School District, (AMBAC Insured), 5%, 5/1/22 | 410,000 | 432,070 |

| MISSISSIPPI: 4.3% | ||||

| Aaa | AAA | Harrison County Wastewater Management District, Sewer Revenue, (Wastewater Treatment Facilities) (FGIC Insured), 7.75%, 2/1/14 | 500,000 | 607,000 |

| Aaa | AAA | Harrison County Wastewater Management District, Sewer Revenue, (Wastewater Treatment Facilities) (FGIC Insured), 8.5%, 2/1/13 | 500,000 | 600,925 |

| MISSOURI: 14.4% | ||||

| A1 | nr | Greene County Certificate Participation, 5.25%, 7/1/11 | 300,000 | 319,308 |

| Aaa | AAA | Jackson County Reorg School District #7, Lees Summit, (FSA Insured), 5.25%, 3/1/14 | 300,000 | 323,577 |

| Aaa | nr | Jefferson County Public Water Supply District Number C-1 (AMBAC Insured), 5.25%, 12/1/16 | 130,000 | 139,989 |

| Aa2 | nr | Jefferson County School District, 6.7%, 3/1/11 | 155,000 | 166,712 |

| Aa1 | nr | Lees Summit, 4.7%, 4/1/21 | 325,000 | 331,958 |

| Aaa | AAA | Mehlville School District R-9, Certificate Participation, (FSA Insured), 5%, 9/1/19 | 300,000 | 311,643 |

| Aa1 | AA+ | Missouri State Board Public Buildings, 5.5%, 10/15/13 | 300,000 | 337,485 |

| Aa1 | AA+ | Missouri State Health & Educational Facilities Authority Revenue Bond, 5%, 11/1/09 | 500,000 | 521,745 |

| Aaa | AAA | Missouri State Highway & Transportation, Street & Road Revenue, 5.25%, 2/1/20 | 250,000 | 268,648 |

| Aa1 | AA+ | North Kansas City School District, 4.25%, 3/1/16 | 300,000 | 309,927 |

| nr | AAA | St Louis County, Mortgage Revenue Bond, (AMT), 5.65%, 2/1/20 | 500,000 | 520,595 |

| A2 | A | St Louis Industrial Development Authority Pollution Control Revenue, 6.65%, 5/1/16 | 200,000 | 224,524 |

| Aaa# | nr | St Louis Municipal Finance Corporation, Leasehold Revenue Bond (Prerefunded 2/15/10 @ $101) (AMBAC Insured), 5.75%, 2/15/17 | 300,000 | 322,014 |

| NEW JERSEY: 3.5% | ||||

| Aaa# | AAA | New Jersey State Turnpike Authority Revenue, 6.5%, 1/1/16 | 850,000 | 980,186 |

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Tax-Free Trust 7

National Fund • Portfolio of Investments • March 31, 2008 (continued)

Credit Rating* | Principal Amount | Market | ||

| Moody's | S&P | |||

| NORTH CAROLINA: 11.9% | ||||

| Aaa | AAA | Lincolnton Enterprise Systems Revenue Bond, 5%, 5/1/17 | 800,000 | 832,840 |

| Aaa | AAA | Macon County, 5%, 6/1/13 | 500,000 | 543,970 |

| Baa1 | nr | North Carolina Medical Care Community Revenue, 5.5%, 10/1/24 | 500,000 | 465,140 |

| Aa2 | AA+ | Raleigh, Certificate Participation, Leasing Revenue, 4.75%, 6/1/25 | 590,000 | 586,543 |

| Aaa | AAA | University North Carolina Systems, (AMBAC Insured), 5.25%, 4/1/21 | 890,000 | 933,752 |

| NORTH DAKOTA: 2.0% | ||||

| Baa2 | nr | Grand Forks Health Care Systems Revenue Bond, 7.125%, 8/15/24 | 500,000 | 559,485 |

| PENNSYLVANIA: 7.8% | ||||

| Aaa | AAA | Lehigh County General Obligation (Lehigh Valley Hospital) (MBIA Insured), 7%, 7/1/16 | 1,000,000 | 1,159,920 |

| Aaa | AAA | Pennsylvania Higher Educational Facilities Authority Revenue Bond, 5%, 4/1/20 | 1,000,000 | 1,047,620 |

| SOUTH CAROLINA: 2.3% | ||||

| A2# | A+ | Lexington County Health Services District Inc., Hospital Revenue Bond, 5.75%, 1/1/28 | 100,000 | 113,530 |

| Aaa | AAA | Orangeburg County Government Action Authority, (MBIA Insured), 5%, 10/1/12 | 500,000 | 536,965 |

| TEXAS: 7.3% | ||||

| Aaa | AAA | Austin Water and Wastewater Revenue, 5%, 5/15/20 | 400,000 | 418,532 |

| Aaa | AAA | Lower Colorado River Authority, Utility Revenue, (AMBAC Insured), 6%, 1/1/17 | 305,000 | 357,975 |

| Aa3 | AA | Mueller Local Government, Contract Revenue, 5%, 9/1/25 | 1,280,000 | 1,299,264 |

| VIRGINIA: 1.5% | ||||

| Aaa | AAA | Henry County Water & Sewer Revenue, (FSA Insured), 5.25%, 11/15/15 | 150,000 | 169,122 |

| Aaa | nr | Prince George, (Assured Guaranty Insured), 5%, 2/1/20 | 100,000 | 107,298 |

| Aaa | nr | Richmond Industrial Development Authority Government Facilities Revenue Bond, (AMBAC Insured), 5%, 7/15/16 | 150,000 | 163,794 |

| WASHINGTON: 3.4% | ||||

| Aaa | AAA | Grays Harbor County Public Utility #001, Electric Revenue Bond, 5.25%, 7/1/24 | 605,000 | 631,602 |

| Aaa | AAA | King County School District #415 Kent, (FSA Insured), 5.5%, 6/1/16 | 300,000 | 340,209 |

The Notes to Financial Statements are an integral part of these statements.

8 Semi-annual Report • March 31, 2008

National Fund • Portfolio of Investments • March 31, 2008 (concluded)

Credit Rating* | Principal Amount | Market | ||

| Moody's | S&P | |||

| WISCONSIN: 0.7% | ||||

| nr | BBB | Wisconsin Health & Educational Facilities Authority Revenue Bond, Carroll College Inc. Project, 5.25%, 10/1/21 | 200,000 | 199,616 |

| TOTAL INVESTMENTS (Cost $27,252,378) | $27,898,375 | |||

| CASH AND RECEIVABLES LESS LIABILITIES: 1.6% of net assets | 456,223 | |||

| NET ASSETS: 100% | $28,354,598 | |||

Notes to Portfolios of Investments:

# - Refunded or escrowed to maturity

AMBAC - American Municipal Bond Assurance Corporation

AMT - Subject to Alternative Minimum Tax

FGIC - Financial Guaranty Insurance Company

FHA- Federal Housing Administration

FSA - Federal Security Assistance

MBIA- Municipal Bond Investors Assurance Corporation

Moody's - Moody's Investors Service, Inc.

nr - Not rated

S&P - Standard & Poor's Corporation

* - Credit ratings are unaudited

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Tax-Free Trust 9

Madison Mosaic Tax-Free Trust

Statements of Assets and Liabilities (unaudited)

Virginia Fund | National Fund | |

| ASSETS | ||

| Investment securities, at value* (Note 1) | $22,700,581 | $27,898,375 |

| Cash | 179,048 | 53,759 |

| Receivables | ||

| Interest | 292,664 | 416,539 |

| Capital shares sold | -- | 6,383 |

| Total assets | 23,172,293 | 28,375,056 |

| LIABILITIES | ||

| Payables | ||

| Dividends | 4,765 | 11,859 |

| Capital shares redeemed | 450 | 4,334 |

| Independent trustee fees | 750 | 750 |

| Auditor fees | 3,515 | 3,515 |

| Total liabilities | 9,480 | 20,458 |

| NET ASSETS | $23,162,813 | $28,354,598 |

| Net assets consists of: | ||

| Paid in capital | $22,709,502 | $27,623,357 |

| Accumulated net realized gains | 15,913 | 85,244 |

| Net unrealized appreciation on investments | 437,398 | 645,997 |

| Net assets | $23,162,813 | $28,354,598 |

| CAPITAL SHARES OUTSTANDING | ||

| An unlimited number of capital shares, without par value, are authorized (Note 6) | 2,032,035 | 2,648,089 |

| NET ASSET VALUE PER SHARE | $11.40 | $10.71 |

| * INVESTMENT SECURITIES, AT COST | $22,263,183 | $27,252,378 |

The Notes to Financial Statements are an integral part of these statements.

10 Semi-annual Report • March 31, 2008

Madison Mosaic Tax-Free Trust

Statements of Operations (unaudited)

For the six-months ended March 31, 2008

Virginia Fund | National Fund | |

| INVESTMENT INCOME (Note 1) | ||

| Interest income | $506,173 | $646,954 |

| EXPENSES (Notes 2, 3 and 7) | ||

| Investment advisory fees | 72,619 | 89,226 |

| Other expenses | 41,828 | 56,395 |

| Independent trustee fees | 1,500 | 1,500 |

| Auditor fees | 3,515 | 3,515 |

| Total expenses | 119,462 | 150,636 |

| NET INVESTMENT INCOME | 386,711 | 496,318 |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||

| Net realized gain on investments | 20,750 | 85,244 |

| Change in net unrealized depreciation of investments | (21,466) | (118,551) |

| NET LOSS ON INVESTMENTS | (716) | (33,307) |

| TOTAL INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $385,995 | $463,011 |

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Tax-Free Trust 11

Madison Mosaic Tax-Free Trust

Statements of Changes in Net Assets

Virginia Fund | National Fund | |||

(unaudited) | Year Ended Sept. 30, | (unaudited) | Year Ended Sept. 30, | |

2008 | 2007 | 2008 | 2007 | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | ||||

| Net investment income | $386,711 | $847,564 | $496,318 | $1,030,411 |

| Net realized gain on investments | 20,750 | 65,158 | 85,244 | 129,897 |

| Change in net unrealized depreciation on investments | (21,466) | (396,126) | (118,551) | (550,342) |

| Total increase in net assets resulting from operations | 385,995 | 516,596 | 463,011 | 609,966 |

| DISTRIBUTION TO SHAREHOLDERS | ||||

| From net investment income | (386,711) | (847,564) | (496,318) | (1,030,411) |

| From net realized gains | (69,995) | (118,708) | (73,627) | (131,426) |

| Total distributions | (456,706) | (966,272) | (569,945) | (1,161,837) |

| CAPITAL SHARE TRANSACTIONS (Note 6) | (6,694) | (2,534,662) | (117,660) | (1,589,942) |

| TOTAL DECREASE IN NET ASSETS | (77,405) | (2,984,338) | (224,594) | (2,141,813) |

| NET ASSETS | ||||

| Beginning of period | $23,240,218 | $26,224,556 | $28,579,192 | $30,721,005 |

| End of period | $23,162,813 | $23,240,218 | $28,354,598 | $28,579,192 |

The Notes to Financial Statements are an integral part of these statements.

12 Semi-annual Report • March 31, 2008

Madison Mosaic Tax-Free Trust

Financial Highlights

Selected data for a share outstanding for the year indicated.

VIRGINIA FUND

(unaudited) | Year Ended September 30, | ||||

2008 | 2007 | 2006 | 2005 | 2004 | |

| Net asset value, beginning of year | $11.43 | $11.63 | $11.69 | $11.92 | $12.06 |

| Investment operations: | |||||

| Net investment income | 0.19 | 0.39 | 0.39 | 0.38 | 0.41 |

| Net realized and unrealized loss on investments | -- | (0.15) | (0.05) | (0.15) | -- |

| Total from investment operations | 0.19 | 0.24 | 0.34 | 0.23 | 0.41 |

| Less distribution from: | |||||

| net investment income | (0.19) | (0.39) | (0.39) | (0.38) | (0.41) |

| net realized gains | (0.03) | (0.05) | (0.01) | (0.08) | (0.14) |

| Total distributions | (0.22) | (0.44) | (0.40) | (0.46) | (0.55) |

| Net asset value, end of year | $11.40 | $11.43 | $11.63 | $11.69 | $11.92 |

| Total return (%) | 1.73 | 2.13 | 2.98 | 1.94 | 3.46 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in thousands) | $23,163 | $23,240 | $26,225 | $27,649 | $28,157 |

| Ratio of expenses to average net assets (%) | 1.031 | 1.03 | 1.02 | 1.02 | 1.02 |

| Ratio of net investment income to average net assets (%) | 3.331 | 3.37 | 3.33 | 3.22 | 3.41 |

| Portfolio turnover (%) | 5 | 12 | 21 | 12 | 16 |

NATIONAL FUND

(unaudited) | Year Ended September 30, | ||||

2008 | 2007 | 2006 | 2005 | 2004 | |

| Net asset value, beginning of year | $10.75 | $10.95 | $11.11 | $11.35 | $11.45 |

| Investment operations: | |||||

| Net investment income | 0.19 | 0.38 | 0.38 | 0.37 | 0.38 |

| Net realized and unrealized loss on investments | (0.01) | (0.15) | (0.10) | (0.24) | (0.10) |

| Total from investment operations | 0.18 | 0.23 | 0.28 | 0.13 | 0.28 |

| Less distribution from: | |||||

| net investment income | (0.19) | (0.38) | (0.38) | (0.37) | (0.38) |

| net realized gains | (0.03) | (0.05) | (0.06) | -- | -- |

| Total distributions | (0.22) | (0.43) | (0.44) | (0.37) | (0.38) |

| Net asset value, end of year | $10.71 | $10.75 | $10.95 | $11.11 | $11.35 |

| Total return (%) | 1.65 | 2.14 | 2.56 | 1.19 | 2.47 |

| Ratios and supplemental data | |||||

| Net assets, end of year (in thousands) | $28,355 | $28,579 | $30,721 | $21,576 | $22,526 |

| Ratio of expenses to average net assets (%) | 1.061 | 1.05 | 1.06 | 1.07 | 1.07 |

| Ratio of net investment income to average net assets (%) | 3.481 | 3.52 | 3.45 | 3.31 | 3.31 |

| Portfolio turnover (%) | 7 | 17 | 34 | 9 | 28 |

1Annualized.

The Notes to Financial Statements are an integral part of these statements.

Madison Mosaic Tax-Free Trust 13

Notes to Financial Statements

1. Summary of Significant Accounting Policies. Madison Mosaic Tax-Free Trust (the "Trust") is registered with the Securities and Exchange Commission under the Investment Company Act of 1940 as an open-end, diversified investment management company. The Trust maintains two separate funds, the Virginia Tax-Free Fund ("Virginia Fund") and the Tax-Free National Fund (the "National Fund") which invest principally in securities exempt from federal income taxes, commonly known as "municipal" securities. The Virginia Fund invests solely in securities exempt from both federal and state income taxes. The National Fund invests in securities exempt from federal taxes. Both Funds invest in intermediate and long-term securities. Because the Trust is 100% no-load, the shares of each Fund are offered and redeemed at the net asset value per share.

Securities Valuation: The Funds value securities having maturities of 60 days or less at amortized cost, which approximates fair market value. Securities having longer maturities, for which market quotations are readily available are valued at the mean between their bid and ask prices. Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures approved by the Board of Trustees.

Investment Transactions: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and Federal income tax purposes.

Investment Income: Interest income is recorded on an accrual basis. Bond premium is amortized and original issue discount and market discount are accreted over the expected life of each applicable security using the effective interest method.

Distribution of Income and Gains: Distributions are recorded on the ex-dividend date. Net investment income, determined as gross investment income less total expenses, is declared as a regular dividend and distributed to shareholders monthly. Capital gain distributions, if any, are declared and paid annually at calendar year-end. Additional distributions may be made if necessary. Distributions paid during the years ended September 30, 2007 and 2006 were identical for book purposes and tax purposes.

The tax character of distributions paid for the Virginia Fund was $118,708 long-term for the year ended September 30, 2007 and $29,699 long-term for the year ended September 30, 2006. The tax character of distributions paid for the National Fund was $131,426 long-term for the year ended September 30, 2007 and $110,965 long-term for the year ended September 30, 2006. There were no short-term capital gain distributions for either Fund for the years ended September 30, 2007 or 2006.

As of March 31, 2008 the components of distributable earnings on a tax basis were as follows (unaudited):

Virginia Fund:

| Accumulated net realized gains | $15,913 |

| Net unrealized appreciation on investments | 437,398 |

$453,311 |

National Fund:

| Accumulated net realized gains | $85,244 |

| Net unrealized appreciation on investments | 645,997 |

$731,241 |

Net realized gains or losses may differ for financial and tax reporting purposes as a result of loss deferrals related to wash sales and post-October transactions.

Income Tax: No provision is made for Federal income taxes since it is the intention of the Funds to comply with the provisions of the Internal Revenue Code available to investment companies and to make the requisite distribution to shareholders of taxable income which will be sufficient to relieve it from all or substantially all Federal Income Taxes.

Use of Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. Investment Advisory Fees and Other Transactions with Affiliates. The investment advisor to the Trust, Madison Mosaic, LLC, a wholly owned subsidiary of Madison Investment Advisors, Inc. (the "Advisor"), earns an advisory fee equal to 0.625% per annum of the average net assets of the Funds. The fees are accrued daily and are paid monthly.

3. Other Expenses. Under a separate Services Agreement, the Advisor will provide or arrange for each Fund to have all necessary operational and support services for a fee based on a percentage of average net assets, other than the expenses of the Trust's Independent Trustees and auditor ("Independent Service

14 Semi-annual Report • March 31, 2008

Notes to Financial Statements (continued)

Providers") which are paid directly based on cost and any costs associated with the Lines of Credit described in Note 7. For the six-months ended March 31, 2008, the services fee was based on the following percentage of average net assets: 0.36% for the Virginia Fund and 0.40% for the National Fund on assets less than $25 million and 0.36% for all assets greater than $25 million. The amount paid by each Fund directly for Independent Service Providers fees for the six-months ended was $5,015. The Funds use US Bancorp Fund Services LLC as their transfer agent and US Bank as their custodian. The transfer agent and custodian fees are paid by the Advisor and allocated to the Funds pursuant to a services agreement and are included in other expenses.

4. Aggregate Cost and Unrealized Appreciation. The aggregate cost for federal income tax purposes and the net unrealized appreciation (depreciation) are stated as follows as of March 31, 2008 (unaudited):

Virginia Fund | National Fund | |

| Aggregate Cost | $22,263,183 | $27,252,378 |

| Gross unrealized appreciation | 594,581 | 968,342 |

| Gross unrealized depreciation | (157,183) | (322,345) |

| Net unrealized appreciation | $437,398 | $645,997 |

5. Investment Transactions. Purchases and sales of securities (excluding short-term securities) for the six-months ended March 31, 2008, were as follows (unaudited):

Purchases | Sales | |

| Virginia Fund | $1,072,170 | $1,261,016 |

| National Fund | $2,298,775 | $1,999,889 |

6. Capital Share Transactions. An unlimited number of capital shares, without par value, are authorized. Transactions in capital shares were as follows:

(unaudited) | Year Ended Sept. 30, | |

| Virginia Fund | 2008 | 2007 |

| In Dollars | ||

| Shares sold | $620,697 | $916,537 |

| Shares issued in reinvestment of dividends | 423,200 | 900,391 |

| Total shares issued | 1,043,897 | 1,816,928 |

| Shares redeemed | (1,050,591) | (4,351,590) |

| Net decrease | $(6,694) | $(2,534,662) |

| In Shares | ||

| Shares sold | 53,741 | 79,845 |

| Shares issued in reinvestment of dividends | 37,004 | 78,293 |

| Total shares issued | 90,745 | 158,138 |

| Shares redeemed | (91,134) | (380,598) |

| Net decrease | (389) | (222,460) |

(unaudited) Six-Months Ended | Year Ended Sept. 30, | |

| National Fund | 2008 | 2007 |

| In Dollars | ||

| Shares sold | $615,704 | $1,767,944 |

| Shares issued in reinvestment of dividends | 489,142 | 983,612 |

| Total shares issued | 1,104,846 | 2,751,556 |

| Shares redeemed | (1,222,506) | (4,341,498) |

| Net decrease | $(117,660) | $(1,589,942) |

| In Shares | ||

| Shares sold | 57,692 | 163,241 |

| Shares issued in reinvestment of dividends | 45,512 | 90,894 |

| Total shares issued | 103,204 | 254,135 |

| Shares redeemed | (113,447) | (400,667) |

| Net decrease | (10,243) | (146,532) |

7. Lines of Credit. The Virginia Fund has a $7.5 million and the National Fund has an $8 million revolving credit facility with a bank for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The interest rate on the outstanding principal amount is equal to the prime rate less 0.5% (effective rate of 4.50% at March 31, 2008). The lines of credit contain loan covenants with respect to certain financial ratios and operating

Madison Mosaic Tax-Free Trust 15

Notes to Financial Statements (concluded)

matters. Both Funds were in compliance with these covenants as of September 30, 2007 and 2006. During the six-months ended March 31, 2008, neither Fund borrowed on their lines of credit.

8. New Accounting Pronouncement. In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, "Accounting for Uncertainty in Income Taxes – an Interpretation of FASB Statement No. 109" ("FIN 48"), which clarifies the accounting for uncertainty in tax positions taken or expected to be taken in a tax return. FIN 48 provides guidance on the measurement, recognition, classification and disclosure of tax positions, along with accounting for the related interest and penalties. FIN 48 is effective for fiscal years beginning after December 15, 2006, and is to be applied to all open tax years as of the date of effectiveness. Management has determined there is no material impact on the financial statements of the Funds in applying the various provisions of FIN 48.

On September 15, 2006, the Financial Accounting Standards Board issued Standard No. 157, "Fair Value Measurements" ("FAS 157"). FAS 157 addresses how companies should measure fair value when specified assets and liabilities are measured at fair value for either recognition or disclosure purposes under generally accepted accounting principles (GAAP). FAS 157 is intended to make the measurement of fair value more consistent and comparable and improve disclosures about those measures. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007. At this time, management believes the adoption of FAS 157 will have no material impact on the financial statements of the Funds.

Fund Expenses. (unaudited)

Example: This Example is intended to help you understand your costs (in dollars) of investing in a Fund and to compare these costs with the costs of investing in other mutual funds. See footnotes 2 and 3 above for an explanation of the types of costs charged by the funds. This Example is based on an investment of $1,000 invested on October 1, 2007 and held for the six-months ended March 31, 2008.

Actual Expenses

The table below titled "Based on Actual Total Return" provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,500 ending account valued divided by $1,000 = 8.5), then multiply the result by the number under the heading entitled "Expenses Paid During the Period."

| Based on Actual Total Return1 | |||||

Actual Total Return2 | Beginning Account Value | Ending Account Value | Annualized Expense Ratio3 | Expenses Paid During the Period3 | |

| Virginia Fund | 1.73% | $1,000.00 | $1,017.32 | 1.03% | $5.19 |

| National Fund | 1.65% | $1,000.00 | $1,016.48 | 1.06% | $5.33 |

| 1For the six-months ended March 31, 2008. | |||||

| 2Assumes reinvestment of all dividends and capital gains distributions, if any, at net asset value. | |||||

| 3Expenses are equal to the respective Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 366. | |||||

Hypothetical Example for Comparison Purposes

The table below titled "Based on Hypothetical Total Return" provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not any fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in a Mosaic Tax-Free Trust Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Mosaic Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

16 Semi-annual Report • March 31, 2008

| Based on Hypothetical Total Return1 | |||||

Hypothetical Annualized Total Return | Beginning Account Value | Ending | Annualized Expense Ratio2 | Expenses Paid During the Period2 | |

| Virginia Fund | 5.00% | $1,000.00 | $1,025.26 | 1.03% | $5.20 |

| National Fund | 5.00% | $1,000.00 | $1,025.26 | 1.06% | $5.34 |

| 1For the six-months ended March 31, 2008. | |||||

| 2Expenses are equal to the respective Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 366. | |||||

Forward-Looking Statement Disclosure. One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate," "may," "will," "expect," "believe," "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information. The Trust only invests in non-voting securities. Nevertheless, the Trust adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Trust's portfolios. These policies are available to you upon request and free of charge by writing to Madison Mosaic Funds, 550 Science Drive, Madison, WI 53711 or by calling toll-free at 1-800-368-3195. The Trust's proxy voting policies may also be obtained by visiting the Securities and Exchange Commission web site at www.sec.gov. The Trust will respond to shareholder requests for copies of our policies within two business days of request by first-class mail or other means designed to ensure prompt delivery.

N-Q Disclosure. The Trust files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (the "Commission") for the first and third quarters of each fiscal year on Form N-Q. The Trust's Forms N-Q are available on the Commission's website. The Trust's Forms N-Q may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information about the operation of the Public Reference Room may be obtained by calling the Commission at 1-202-942-8090. Form N-Q and other information about the Trust are available on the EDGAR Database on the Commission's Internet site at http://www.sec.gov. Copies of this information may also be obtained, upon payment of a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov, or by writing the Commission's Public Reference Section, Washington, DC 20549-0102. Finally, you may call us at 800-368-3195 if you would like a copy of Form N-Q and we will mail one to you at no charge.

Madison Mosaic Tax-Free Trust 17

The Madison Mosaic Family of Mutual Funds

Madison Mosaic Equity Trust

Investors Fund

Balanced Fund

Mid-Cap Fund

Disciplined Equity Fund

Madison Institutional Equity Option Fund

Madison Mosaic Income Trust

Government Fund

Core Bond Fund

Institutional Bond Fund

Madison Mosaic Tax-Free Trust

Virginia Tax-Free Fund

Tax-Free National Fund

Madison Mosaic Government Money Market

For more complete information on any Madison Mosaic fund, including charges and expenses, request a prospectus by calling 1-800-368-3195. Read it carefully before you invest or send money. This document does not constitute an offering by the distributor in any jurisdiction in which such offering may not be lawfully made. Mosaic Funds Distributor, LLC.

TRANSER AGENT

Madison Mosaic Funds(R)

c/o US Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

TELEPHONE NUMBERS

Shareholder Service

Toll-free nationwide: 888-670-3600

Mosaic Tiles (24 hour automated information)

Toll-free nationwide: 800-336-3063

550 Science Drive

Madison, Wisconsin 53711

Madison Mosaic Funds

www.mosaicfunds.com

SEC File Number 811-3486

Item 2. Code of Ethics.

Not applicable in semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable in semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable in semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments

Included in report to shareholders above.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

No changes.

Item 11. Controls and Procedures.

(a) The Trust’s principal executive officer and principal financial officer determined that the Trust’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the "Act")) are effective, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934 within 90 days of the date of this report. There were no significant changes in the Trust’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation. The officers identified no significant deficiencies or material weaknesses.

(b) There were no changes in the Trust's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Code of ethics referred to in Item 2.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Madison Mosaic Tax-Free Trust

By: (signature)

W. Richard Mason, Secretary

Date: May 15, 2008

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By: (signature)

Katherine L. Frank, Chief Executive Officer

Date: May 15, 2008

By: (signature)

Greg Hoppe, Chief Financial Officer

Date: May 15, 2008