Pamela M. Krill

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Report to Shareholders.

ANNUAL REPORT

September 30, 2010

Madison Mosaic

Tax-Free Trust

Virginia Tax-Free Fund

Tax-Free National Fund

Contents

| Management’s Discussion of Fund Performance | |

| Economic Overview | 1 |

| Outlook | 2 |

| Portfolio of Investments | |

| Virginia Tax-Free Fund | 4 |

| Tax-Free National Fund | 6 |

| Statements of Assets and Liabilities | 8 |

| Statements of Operations | 9 |

| Statements of Changes in Net Assets | 10 |

| Financial Highlights | 11 |

| Notes to Financial Statements | 12 |

| Report of Independent Registered Public Accounting Firm | 16 |

| Other Information | 17 |

| Trustees and Officers | 21 |

Management’s Discussion of Fund Performance

The annual period ended September 30, 2010 saw positive annual total returns for Virginia Tax-Free and Tax-Free National during a volatile year for investments. One-year total returns were: 4.54% for Virginia Tax-Free and 4.43% for Tax-Free National. The most current one-year period ended September 30, 2010 was largely one of positive investment returns in an atmosphere of economic recovery and optimism in which lower-quality and more speculative investments held sway.

Over the one-year period of this report Tax-Free National’s peer group, Morningstar Municipal National Long Category, was up 5.63%. The Morningstar Municipal Single State Long Category, the peer group for Virginia Tax-Free, rose 5.44% over the year. The extent that the type of holdings influenced returns over this period can be seen by looking at the Morningstar High Yield Municipal Category, which outpaced all other municipal bond categories with a trailing annual return of 8.52%. This gives a sense of the advantage lower quality bonds experienced over the year. As always, your Madison Mosaic Funds have very little if any exposure to lower-rated bonds, while municipal bond portfolios managed by others may hold a broader spectrum of quality holdings.

Another factor for underperformance was relative durations, as longer bonds outperformed shorter bonds during the period as interest rates worked themselves lower. Both of the Madison Mosaic tax-free funds had durations below their benchmark category averages. The 30-day SEC yield for Virginia Tax-Free saw a reduction across the period from 2.51% to 1.98% while Tax-Free National fell from 2.47% to 1.98%. Looking back over the past three years of economic dislocation, market crash and partial recovery, investors in high-quality municipal bonds came through with solid positive returns; a period in which many other asset classes struggled, as indicated by the three-year -7.16% annualized return of the S&P 500, which is widely used to represent the broader stock market.

ECONOMIC OVERVIEW

Perhaps the best one-word characterization of the economic mood as this one-year period ended would be "uncertainty." Uncertainty regarding future tax rates, employment costs, and sales growth clearly impacted businesses and consumers during the trailing period. Given these uncertainties, few businesses were willing to commit to expanded payrolls or expanded facilities, while investors continued to show a preference for the perceived safety of bonds over stocks.

While the consensus during the preceding period appeared to move from worry over a double-dip recession to an acceptance of an extended period of below-normal growth, economic risks were far from eliminated. The housing sector remained persistently weak and the specter of foreclosures and other repercussions from the credit crisis continued to produce periodic waves of worries. Overseas economic stresses, particularly the sovereign debt crisis in Europe, remained unresolved. The enormous debt taken on by the U.S. government to counteract the banking and credit crisis of 2008 remained a potent overhang for future U.S. economic prospects and the stability of the dollar.

One consequence of the credit crisis was the demise of the key underwriters of municipal bond insurance. The municipal bond market had operated smoothly for many years without the perceived safety net of insurance, and it continues to operate efficiently in the current insurance void. At Madison Mosaic we’ve always had a primary interest in the stability of the issuer, and as such, did not feel deeply affected by the changing insurance landscape. However, the repercussions could still be felt over this reporting period, as the three major credit-rating services, Fitch, Moody’s and Standard & Poor’s, announced that they would be moving to re-rate a major portion of municipal debt based on the likelihood of default, a metric that has long applied to corporate debt, but not to tax-free issuance. We believe this adjustment can be favorable

1 - Annual Report Sept 30, 2010

to holders of Madison Mosaic’s funds, if our high-quality security selection leads to ratings upgrades for our holdings.

One risk factor that can affect holders of all intermediate- and long-term bonds is the impact of rising interest rates. With interest rates across the yield curve at historic lows, we recognize this risk and have attempted to moderate the potential impact by shortening the relative duration of our portfolio. At the end of the period Tax-Free National held a duration of 6.9 years, while its Morningstar peer group had an average of 7.9 years. Virginia Tax-Free held a duration of 6.7 years while its Morningstar peer group was at 7.8 years. The fund’s benchmark, Barclays Capital Municipal Bond Index, had a duration of 8.1 years as of September 30, 2010. The shorter a portfolio’s duration, the less it is predicted to gain or lose when the prevailing interest rates shift.

The low level of interest rates across the period was supported by a number of factors which we feel may not be permanent. Not only did the Fed hold short term rates at record lows, they purchased large quantities of bond issuance, a technique widely referred to as quantitative easing. Economic troubles in Europe help fuel a rise in foreign purchasers of U.S. bonds, while investors continued to rotate money from stocks and money markets into the bond market. All of these supporting factors can shift at any time, and we feel it is prudent to invest with the expectation that there is much more room for rates to rise than to fall. That said, we expect another quarter or two of slow growth before the economy gains any significant momentum. The question remains: What will be the catalyst to spark a real economic turnaround? We suspect the completion of the mid-term elections this November could be just such a catalyst. Once the elections are over, we expect greater clarity with regard to the future fiscal, tax, and even monetary policies. This could stir businesses and consumers out of their current funk.

OUTLOOK

While the outlook for the balance of the year and into the early part of 2011 is for more economic malaise, we expect that by the second half of 2011 the picture will be somewhat brighter. We expect the municipal bond market to be relatively stable over the coming months. As of the end of this period, we perceive our tax-free holdings as a better value than similar Treasuries. It is our conviction that high-quality municipal bonds remain an attractive asset class within a bond allocation, and that within municipal bonds investors will be best served over time with the high-quality issuances we seek.

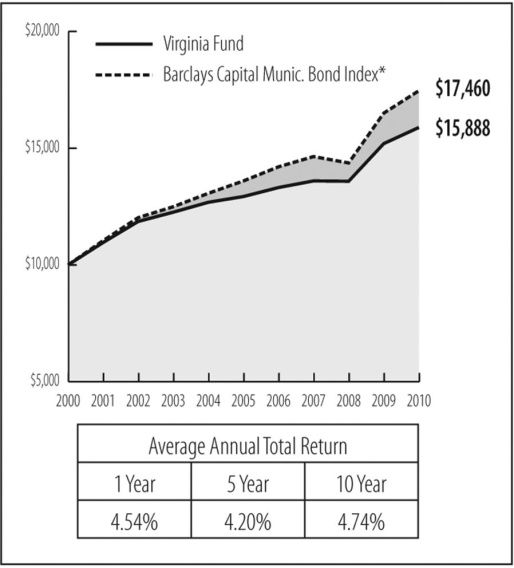

VIRGINIA FUND

The Commonwealth of Virginia maintains an AAA general obligation bond rating based on a well-diversified economy that emphasizes services and government. The fund had a total return of 4.54% for the annual period and the 30-day SEC yield was 1.98% as of September 30, 2010. The duration of the portfolio was 6.74 years while the average maturity was 8.20 years. In terms of quality of holdings, approximately 31.7% of the portfolio was rated by at least one agency at the highest level (AAA for Standard and Poor’s), 38.8% was the equivalent of S&P’s AA, 26.9% A, while 2.6% was not rated. Recent purchases included Hampton Roads Sanitation District-Wastewater revenue bonds and Henrico County Economic Development Authority revenue bonds.

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT WITH THE BARCLAYS CAPITAL MUNICIPAL BOND INDEX FOR MADISON MOSAIC VIRGINIA FUND

Past performance is not predictive of future performance. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.*The Barclays Municipal Index is a benchmark index produced by Barclays Capital that includes tax-exempt bonds with maturities greater than two years selected from issues larger than $50 million.

2 - Annual Report Sept 30, 2010

INDUSTRY ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| Development | 3.1% |

| Education | 10.4% |

| Facilities | 14.2% |

| General | 7.8% |

| General Obligation | 13.2% |

| Medical | 9.2% |

| Multifamily Housing | 10.4% |

| Pollution | 4.3% |

| Power | 3.7% |

| Transportation | 2.7% |

| Utilities | 3.8% |

| Water | 15.5% |

| Cash & Other | 1.7% |

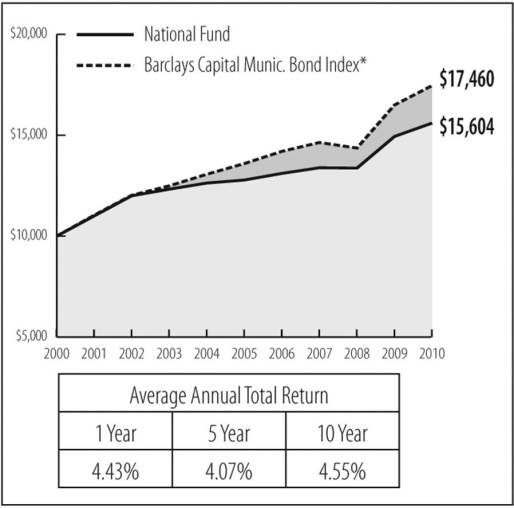

NATIONAL FUND

The National Fund had a total return of 4.43% for the annual period and the 30-day SEC yield was 1.98% as of September 30, 2010. The duration of the portfolio was 6.90 years and the average maturity was 9.15 years. In terms of quality holdings, approximately 37.7% of the portfolio was rated by at least one agency at the highest level (AAA for Standard and Poor’s), 42.9% was the equivalent of S&P’s AA, 11.6% A, and 4.6% BBB, while 3.2% was not rated. Recent purchases included

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT WITH THE BARCLAYS CAPITAL MUNICIPAL BOND INDEX FOR MADISON MOSAIC NATIONAL FUND

Past performance is not predictive of future performance. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.*The Barclays Municipal Index is a benchmark index produced by Barclays Capital that includes tax-exempt bonds with maturities greater than two years selected from issues larger than $50 million.

New York Dormitory Authority Revenue bonds for New York University (insured by Berkshire Hathaway Assurance Corporation) and Florida Board of Education Capital Outlay General Obligation bonds which are

state guaranteed.

STATE ALLOCATION AS A PERCENTAGE OF NET ASSETS |

| Alabama | 1.5% |

| Arkansas | 0.7% |

| Arizona | 6.4% |

| District of Columbia | 0.7% |

| Florida | 8.0% |

| Georgia | 6.3% |

| Illinois | 4.9% |

| Indiana | 5.9% |

| Kentucky | 0.4% |

| Massachusetts | 2.4% |

| Maryland | 0.3% |

| Michigan | 5.4% |

| Missouri | 4.6% |

| Mississippi | 4.0% |

| North Carolina | 13.3% |

| New Jersey | 4.5% |

| New York | 2.9% |

| Pennsylvania | 5.3% |

| Texas | 10.4% |

| Virginia | 4.3% |

| Washington | 2.2% |

| Wisconsin | 2.6% |

| Cash & Other | 3.0% |

We appreciate your confidence in Madison Mosaic Funds and reaffirm our commitment to provide you with competitive returns to meet your investment objectives.

Sincerely,

(signature)

Michael J. Peters, CFA

Vice President

3 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / September 30, 2010

Virginia Fund Portfolio of Investments

| | | |

| LONG TERM MUNICIPAL BONDS - 98.3% | |

| Development - 3.1% | | |

| Prince William County Industrial Development Authority, 5.25%, 2/1/18 | $ 675,000 | $ 807,961 |

| | | |

| Education - 10.4% | | |

| Prince William County Industrial Development Authority, 5%, 10/1/18 | 150,000 | 158,517 |

| University of Virginia, 5%, 6/1/40 | 255,000 | 277,267 |

| Virginia College Building Authority, 5%, 4/1/16 | 100,000 | 111,768 |

| Virginia College Building Authority, 5%, 2/1/23 | 500,000 | 604,080 |

| Virginia College Building Authority, 5%, 9/1/26 | 140,000 | 158,414 |

| Virginia College Building Authority, 5%, 2/1/29 | 375,000 | 422,209 |

| Virginia Polytechnic Institute & State University, (AMBAC) 5%, 6/1/14 | 775,000 | 879,114 |

| Virginia Public School Authority, 5%, 12/1/18 | 100,000 | |

| | | 2,725,351 |

| Facilities - 14.2% | | |

| Gloucester County Industrial Development Authority, (NATL-RE) 4.375%, 11/1/25 | 500,000 | 521,340 |

| Henrico County Economic Development Authority, 5%, 10/1/18 | 170,000 | 204,422 |

| Newport News Industrial Development Authority, 5%, 7/1/25 | 745,000 | 821,742 |

| Northwestern Regional Jail Authority, (NATL-RE) 5%, 7/1/19 | 50,000 | 54,246 |

| Prince William County Park Authority, 4%, 4/15/24 | 320,000 | 332,906 |

| Roanoke County Economic Development Authority, (ASSURED GTY) 5%, 10/15/16 | 400,000 | 471,804 |

| Stafford County & Staunton Industrial Development Authority, (XLCA) 5%, 8/1/21 | 315,000 | 344,238 |

| Stafford County & Staunton Industrial Development Authority, (NATL-RE) 4.5%, 8/1/25 | 700,000 | 724,493 |

| Virginia Public Building Authority, 5.25%, 8/1/23 | 200,000 | |

| | | 3,711,083 |

| General - 7.8% | | |

| Fairfax County Economic Development Authority, (NATL-RE) 5.25%, 9/1/19 | 1,000,000 | 1,002,040 |

| County of Prince William VA, Certificate Participation (AMBAC) 5%, 6/1/22 | 750,000 | 808,943 |

| Puerto Rico Public Finance Corp., (Escrowed To Maturity) (AMBAC) 5.5%, 8/1/27 | 100,000 | 127,027 |

| Virgin Islands Public Finance Authority, (NATL-RE FGIC) 5%, 10/1/23 | 100,000 | |

| | | 2,043,778 |

| | | |

| General Obligation - 13.2% | | |

| City of Alexandria VA, General Obligation 5%, 1/1/16 | $ 200,000 | $ 237,132 |

| County of Henrico VA, General Obligation (Prerefunded 12/01/18 @ 100) 5%, 12/1/24 | 200,000 | 245,954 |

| City of Hopewell VA, General Obligation 5.875%, 7/15/34 | 500,000 | 557,035 |

| County of Loudoun VA, General Obligation 5%, 10/1/13 | 500,000 | 524,390 |

| County of Loudoun VA, General Obligation (Prerefunded 12/01/17 @ 100) 5%, 12/1/18 | 165,000 | 199,558 |

| County of Prince George VA, General Obligation (ASSURED GTY ) 5%, 2/1/20 | 200,000 | 231,232 |

| City of Richmond VA, General Obligation (AGM) 5%, 7/15/23 | 750,000 | 831,743 |

| County of Spotsylvania VA, General Obligation (NATL-RE) 4.25%, 1/15/13 | 250,000 | 270,077 |

| Commonwealth of Virginia, General Obligation 5%, 6/1/26 | 300,000 | |

| | | 3,444,545 |

| Medical - 9.2% | | |

| Augusta County Industrial Development Authority, 5.25%, 9/1/20 | 1,000,000 | 1,124,000 |

| Charlotte County Industrial Development Authority/VA, 5%, 9/1/16 | 335,000 | 360,480 |

| Henrico County Economic Development Authority, (NATL-RE) 6%, 8/15/16 | 300,000 | 331,002 |

| Roanoke Economic Development Authority, (Escrowed To Maturity) (NATL-RE) 6.125%, 7/1/17 | 500,000 | |

| | | 2,410,287 |

| Multifamily Housing - 10.4% | | |

| Fairfax County Redevelopment & Housing Authority, (FHA 542 (C)) (AMT) 5.5%, 4/1/28 | 405,000 | 405,186 |

| Fairfax County Redevelopment & Housing Authority, 4.75%, 10/1/36 | 450,000 | 470,772 |

| Fairfax County Redevelopment & Housing Authority, 5%, 10/1/39 | 300,000 | 320,826 |

| Suffolk Redevelopment & Housing Authority, (AMT) 5.6%, 2/1/33 | 1,250,000 | 1,276,700 |

| Virginia Housing Development Authority, 4.8%, 10/1/39 | 250,000 | |

| | | 2,727,314 |

| Pollution - 4.3% | | |

| Southeastern Public Service Authority, (Escrowed To Maturity) (AMBAC) 5%, 7/1/15 | 635,000 | 726,726 |

| Southeastern Public Service Authority, (AMBAC) 5%, 7/1/15 | 365,000 | |

| | | 1,133,117 |

See accompanying Notes to Financial Statements.

4 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust Virginia Portfolio of Investments / concluded / September 30, 2010

| | | |

LONG TERM MUNICIPAL BONDS (continued) | |

| Power - 3.7% | | |

| Chesterfield County Economic Development Authority, 5%, 5/1/23 | $ 565,000 | $ 621,263 |

| Puerto Rico Electric Power Authority, (BHAC-CR MBIA-RE FGIC) 5.25%, 7/1/24 | 290,000 | |

| | | 967,276 |

| Transportation - 2.7% | | |

| Puerto Rico Highway & Transportation Authority, (ASSURED GTY) 5.25%, 7/1/34 | 100,000 | 111,961 |

| Richmond Metropolitan Authority, (NATL-RE FGIC) 5.25%, 7/15/12 | 350,000 | 375,431 |

| Richmond Metropolitan Authority, (NATL-RE FGIC) 5.25%, 7/15/22 | 200,000 | |

| | | 719,812 |

| Utilities - 3.8% | | |

| City of Richmond VA, (AGM) 4.5%, 1/15/33 | 940,000 | 981,736 |

| | | |

| Water - 15.5% | | |

| Fairfax County Water Authority, 5.25%, 4/1/23 | $ 180,000 | $ 226,424 |

| Frederick-Winchester Service Authority, (AMBAC) 5%, 10/1/15 | 570,000 | 659,017 |

| Hampton Roads Sanitation District, 5%, 4/1/33 | 250,000 | 271,600 |

| Henry County Public Service Authority, (AGM) 5.25%, 11/15/13 | 700,000 | 772,289 |

| Henry County Public Service Authority, (AGM) 5.25%, 11/15/15 | 150,000 | 170,830 |

| City of Norfolk VA, (NATL-RE) 5.9%, 11/1/25 | 210,000 | 210,584 |

| Upper Occoquan Sewage Authority, (NATL-RE) 5.15%, 7/1/20 | 1,000,000 | 1,217,150 |

| Virginia Resources Authority, 5%, 10/1/27 | 300,000 | 345,435 |

| Virginia Resources Authority, 5%, 11/1/31 | 160,000 | |

| | | 4,047,355 |

Total Investments - 98.3% (Cost $24,203,978) | 25,719,615 |

| Net Other Assets and Liabilities - 1.7% | |

| Total Net Assets - 100.0% | |

See accompanying Notes to Financial Statements.

5 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / September 30, 2010

National Fund Portfolio of Investments

| | | |

| LONG TERM MUNICIPAL BONDS - 97.0% | |

| Alabama - 1.5% | | |

| Troy University, (ASSURED GTY) 4.125%, 11/1/23 | $ 420,000 | $ 435,611 |

| Arkansas - 0.7% | | |

| City of Fort Smith AR, (AGM) 5%, 10/1/21 | 175,000 | 203,068 |

| Arizona - 6.4% | | |

| Arizona Health Facilities Authority, (Escrowed To Maturity) (NATL-RE) 6.25%, 9/1/11 | 15,000 | 15,420 |

| Arizona Sports & Tourism Authority, 5%, 7/1/16 | 100,000 | 101,371 |

| Arizona Transportation Board, 5%, 7/1/13 | 135,000 | 149,862 |

| City of Tempe AZ, 5%, 7/1/20 | 225,000 | 251,048 |

| Glendale Western Loop 101 Public Facilities Corp., 6%, 7/1/24 | 525,000 | 573,751 |

| Maricopa County Stadium District/AZ, (AMBAC) 5.25%, 6/1/12 | 250,000 | 265,225 |

| Maricopa County Unified School District No. 41 Gilbert, General Obligation (AGM) 5.8%, 7/1/14 | 250,000 | 291,620 |

| Maricopa County Unified School District No. 090 Saddle Mountain, General Obligation 5%, 7/1/14 | 75,000 | 77,714 |

| Northern Arizona University, Certificate Participation (AMBAC) 5%, 9/1/23 | 150,000 | |

| | | 1,881,680 |

| District of Columbia - 0.7% | | |

| District of Columbia, General Obligation (NATL-RE) 5.5%, 6/1/12 | 185,000 | 195,388 |

| Florida - 8.0% | | |

| Emerald Coast Utilities Authority, (NATL-RE FGIC) 5%, 1/1/25 | 1,010,000 | 1,044,683 |

| Florida State Board of Education, General Obligation (ST GTD) 4.75%, 6/1/35 | 500,000 | 515,975 |

| Peace River/Manasota Regional Water Supply Authority, (AGM) 5%, 10/1/23 | 750,000 | |

| | | 2,354,353 |

| Georgia - 6.3% | | |

| Augusta-Richmond County Coliseum Authority, (CNTY GTD) 5%, 10/1/23 | 670,000 | 779,264 |

| City of Atlanta GA, (AGM) 5.75%, 11/1/30 | 300,000 | 369,135 |

| Emanuel County Hospital Authority, (AMBAC CNTY GTD) 4.3%, 7/1/17 | 250,000 | 279,567 |

| Gwinnett County Development Authority, Certificate Participation (NATL-RE) 5.25%, 1/1/18 | 225,000 | 270,351 |

| Private Colleges & Universities Authority, 5%, 9/1/38 | 130,000 | |

| | | 1,838,787 |

| | | |

| Illinois - 4.9% | | |

| County of Winnebago IL, General Obligation (NATL-RE) 5%, 12/30/24 | $1,000,000 | $ 1,072,110 |

| Regional Transportation Authority, (AMBAC GO OF AUTH) 7.2%, 11/1/20 | 300,000 | |

| | | 1,440,438 |

| Indiana - 5.9% | | |

| Indianapolis Local Public Improvement Bond Bank, (ASSURED GTY) 5.5%, 1/1/38 | 475,000 | 529,502 |

| Western Boone Multi-School Building Corp., General Obligation (AGM ) 5%, 1/10/20 | 1,015,000 | |

| | | 1,736,499 |

| Kentucky - 0.4% | | |

| Laurel County School District Finance Corp., (AGM SEEK) 4%, 6/1/16 | 110,000 | 123,270 |

| | | |

| Massachusetts - 2.4% | | |

| Massachusetts School Building Authority, (AGM) 5%, 8/15/23 | 635,000 | 707,225 |

| Maryland - 0.3% | | |

| Maryland State Transportation Authority, (Escrowed To Maturity) 6.8%, 7/1/16 | 65,000 | 75,685 |

| Michigan - 5.4% | | |

| Charles Stewart Mott Community College, General Obligation (NATL-RE) 5%, 5/1/18 | 720,000 | 792,720 |

| Detroit City School District, General Obligation (FGIC Q-SBLF) 6%, 5/1/20 | 300,000 | 353,595 |

| Redford Unified School District No. 1, General Obligation (AMBAC Q-SBLF) 5%, 5/1/22 | 410,000 | |

| | | 1,599,193 |

| Missouri - 4.6% | | |

| City of O’Fallon MO, Certificate Participation (NATL-RE) 5.25%, 11/1/16 | 100,000 | 112,699 |

| County of St Louis MO, (Escrowed To Maturity) (AMT) 5.65%, 2/1/20 | 500,000 | 591,405 |

| Jefferson City School District/MO, General Obligation (Escrowed To Maturity) 6.7%, 3/1/11 | 55,000 | 56,432 |

| Missouri State Board of Public Buildings, 5.5%, 10/15/13 | 300,000 | 340,740 |

| St. Louis Industrial Development Authority, 6.65%, 5/1/16 | 200,000 | |

| | | 1,342,116 |

| Mississippi - 4.0% | | |

| Harrison County Wastewater Management District, (Escrowed To Maturity) (FGIC) 8.5%, 2/1/13 | 500,000 | 566,540 |

| Harrison County Wastewater Management District, (Escrowed To Maturity) (FGIC) 7.75%, 2/1/14 | 500,000 | |

| | | 1,179,865 |

See accompanying Notes to Financial Statements.

6 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / National Fund Portfolio of Investments / concluded / September 30, 2010

| | | |

LONG TERM MUNICIPAL BONDS (continued) | | |

| North Carolina - 13.3% | | |

| Board of Governors of the University of North Carolina, (NATL-RE) 5%, 10/1/15 | $ 215,000 | $ 247,577 |

| Board of Governors of the University of North Carolina, (AMBAC) 5.25%, 4/1/21 | 890,000 | 921,871 |

| City of Raleigh NC, Certificate Participation 4.75%, 6/1/25 | 590,000 | 633,306 |

| County of Dare NC, Certificate Participation (AMBAC) 5%, 6/1/23 | 600,000 | 635,814 |

| County of Forsyth NC, 4.5%, 4/1/21 | 650,000 | 739,199 |

| North Carolina Medical Care Commission, (HUD SECT 8) 5.5%, 10/1/24 | 500,000 | 516,930 |

| State of North Carolina, 4.5%, 5/1/27 | 200,000 | |

| | | 3,912,019 |

| New Jersey - 4.5% | | |

| New Jersey State Turnpike Authority, (Escrowed To Maturity) (NATL-RE-IBC) 6.5%, 1/1/16 | 850,000 | 993,446 |

| New Jersey State Turnpike Authority, (BHAC-CR FSA) 5.25%, 1/1/28 | 250,000 | |

| | | 1,306,381 |

| New York - 2.9% | | |

| New York State Dormitory Authority, (BHAC-CR AMBAC) 5.5%, 7/1/31 | 250,000 | 309,360 |

| Port Authority of New York & New Jersey, (GO OF AUTH) 5.375%, 3/1/28 | 455,000 | |

| | | 859,560 |

| Pennsylvania - 5.3% | | |

| Lehigh County General Purpose Authority, (NATL-RE GO OF HOSP) 7%, 7/1/16 | 880,000 | 987,448 |

| Pennsylvania Higher Educational Facilities Authority, (NATL-RE) 5%, 4/1/20 | 500,000 | |

| | | 1,542,783 |

| Texas - 10.4% | | |

| City of San Antonio TX, 5.125%, 5/15/29 | 500,000 | 562,560 |

| City of Sugar Land TX, General Obligation Ltd. 5%, 2/15/28 | 350,000 | 387,146 |

| County of Harris TX, General Obligation Ltd. (Prerefunded 10/01/18 @ 100) 5.75%, 10/1/24 | 250,000 | 315,112 |

| Lower Colorado River Authority, (Escrowed To Maturity) (AMBAC) 6%, 1/1/17 | 305,000 | 379,655 |

| Mueller Local Government Corp., 5%, 9/1/25 | 1,280,000 | |

| | | 3,043,206 |

| | | |

| Virginia - 4.3% | | |

| City of Hopewell VA, General Obligation 5.875%, 7/15/34 | $ 500,000 | $ 557,035 |

| Fairfax County Redevelopment & Housing Authority, 5%, 10/1/39 | 265,000 | 283,396 |

| Henry County Public Service Authority, (AGM) 5.25%, 11/15/15 | 150,000 | 170,831 |

| Virginia Housing Development Authority, 4.8%, 10/1/39 | 250,000 | |

| | | 1,265,092 |

| Washington - 2.2% | | |

| Grays Harbor County Public Utility District No. 1, (AGM) 5.25%, 7/1/24 | 605,000 | 652,753 |

| Wisconsin - 2.6% | | |

| State of Wisconsin, General Obligation 5%, 5/1/24 | 285,000 | 305,865 |

| Wisconsin Health & Educational Facilities Authority, 5.25%, 10/1/21 | 200,000 | 208,436 |

| Wisconsin Health & Educational Facilities Authority, (NATL-RE) 5.5%, 12/1/20 | 250,000 | |

| | | 764,611 |

Total Investments - 97.0% (Cost $26,770,859) | 28,459,583 |

| Net Other Assets and Liabilities - 3.0% | |

| Total Net Assets - 100.0% | |

| AGM | Assured Guaranty Municipal Corp |

| AMBAC | AMBAC Indemnity Corporation |

| ASSURED GTY | Assured Guaranty |

| BHAC-CR | Berkshire Hathaway Assuranty Corp |

| CNTY GTD | County Guaranteed |

| FGIC | Financial Guaranty Insurance Company |

| FHA 542 C | FHA Insured Multifamily Loan Program |

| FSA | Financial Security Assurance |

| GO OF AUTH | General Obligation of Issuing Authority |

| HUD SECT 8 | HUD Insured Multifamily Housing |

| MBIA-RE | MBIA Insurance Corp |

| NATL-RE | National Public Finance Guarantee Corp |

| Q-SBLF | Qualified School Board Loan Fund |

| SEEK | Obligation assumed by AGM |

| ST GTD | State Guaranteed |

| XLCA | XL Capital Assuranty |

See accompanying Notes to Financial Statements.

7 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / September 30, 2010

Statements of Assets and Liabilities

| | | |

| ASSETS | | |

| Investment securities, at value* (Note 1) | $25,719,615 | $28,459,583 |

| Cash | 134,118 | 486,245 |

| Receivables | | |

| Interest | 329,464 | 418,166 |

| Capital shares sold | | |

| Total assets | 26,183,247 | 29,369,052 |

| | | |

| LIABILITIES | | |

| Payables | | |

| Dividends | 4,270 | 11,255 |

| Capital shares redeemed | 974 | 3,495 |

| Independent trustee fees | 750 | 750 |

| Auditor fees | | |

| Total liabilities | 12,994 | 22,500 |

| | | |

| NET ASSETS | | |

| | | |

| Net assets consists of: | | |

| Paid in capital | 24,527,808 | 27,434,968 |

| Accumulated net realized gains | 126,808 | 222,860 |

| Net unrealized appreciation on investments | | |

| Net assets | | |

| | | |

| CAPITAL SHARES OUTSTANDING | | |

| An unlimited number of capital shares, without par value, are authorized (Note 6) | 2,184,504 | 2,628,787 |

| | | |

| NET ASSET VALUE PER SHARE | | |

| | | |

| * INVESTMENT SECURITIES, AT COST | | |

See accompanying Notes to Financial Statements.

8 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust

Statements of Operations

For the year ended September 30, 2010

| | | |

INVESTMENT INCOME (Note 1) | | |

| Interest income | $ 1,054,671 | $ 1,256,316 |

| | | |

EXPENSES (Notes 2, 3 and 7) | | |

| Investment advisory fees | 159,541 | 181,750 |

| Service agreement fees | 91,896 | 114,689 |

| Independent trustee fees | 3,000 | 3,000 |

| Auditor fees | | |

| Total expenses | 262,062 | 307,064 |

| | | |

| NET INVESTMENT INCOME | 792,609 | 949,252 |

| | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | |

| Net realized gain on investments | 151,525 | 222,860 |

| Change in net unrealized appreciation of investments | | |

| | | |

| NET GAIN ON INVESTMENTS | | |

| | | |

| TOTAL INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | |

See accompanying Notes to Financial Statements.

9 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust

Statements of Changes in Net Assets

| | | |

| Year Ended September 30, | Year Ended September 30, |

| | | | | |

| INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | |

| Net investment income | $ 792,609 | $ 761,231 | $ 949,252 | $ 947,529 |

| Net realized gain on investments | 151,525 | 125,518 | 222,860 | 156,065 |

| Change in net unrealized appreciation on investments | | | | |

| Total increase in net assets resulting from operations | 1,143,497 | 2,599,931 | 1,258,987 | 3,052,901 |

| | | | | |

| DISTRIBUTION TO SHAREHOLDERS | | | | |

| From net investment income | (792,609) | (761,231) | (949,252) | (947,529) |

| From net realized gains | | | | |

| Total distributions | (898,033) | (862,897) | (1,077,253) | (1,122,801) |

| | | | | |

CAPITAL SHARE TRANSACTIONS (Note 6) | | | | |

| | | | | |

| NET INCREASE IN NET ASSETS | 287,133 | 3,467,548 | 203,237 | 2,545,178 |

| | | | | |

| NET ASSETS | | | | |

| Beginning of period | | | | |

| End of period | | | | |

See accompanying Notes to Financial Statements.

10 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust

Financial Highlights

Selected data for a share outstanding for the year indicated.

|

| | Year Ended September 30, |

| | | | |

| Net asset value, beginning of year | $11.87 | $11.01 | $11.43 | $11.63 | $11.69 |

| Investment operations: | | | | | |

| Net investment income | 0.37 | 0.37 | 0.38 | 0.39 | 0.39 |

| Net realized and unrealized gain (loss) on investments | | | | | |

| Total from investment operations | 0.53 | 1.28 | (0.01) | 0.24 | 0.34 |

| Less distribution from: | | | | | |

| Net investment income | (0.37) | (0.37) | (0.38) | (0.39) | (0.39) |

| Net realized gains | | | | | |

| Total distributions | (0.42) | (0.42) | (0.41) | (0.44) | (0.40) |

| Net asset value, end of year | $11.98 | $11.87 | $11.01 | $11.43 | $11.63 |

Total return (%) | 4.54 | 11.87 | (0.11) | 2.13 | 2.98 |

| Ratios and supplemental data | | | | | |

Net assets, end of year (in thousands) | $26,170 | $25,883 | $22,416 | $23,240 | $26,225 |

| Ratio of expenses to average net assets (%) | 1.03 | 1.03 | 1.03 | 1.03 | 1.02 |

| Ratio of net investment income to average net assets (%) | 3.10 | 3.26 | 3.31 | 3.37 | 3.33 |

| Portfolio turnover (%) | 19 | 18 | 7 | 12 | 21 |

|

| | Year Ended September 30, |

| | | | |

| Net asset value, beginning of year | $11.09 | $10.34 | $10.75 | $10.95 | $11.11 |

| Investment operations: | | | | | |

| Net investment income | 0.36 | 0.37 | 0.38 | 0.38 | 0.38 |

| Net realized and unrealized gain (loss) on investments | | | | | |

| Total from investment operations | 0.48 | 1.19 | 0.00 | 0.23 | 0.28 |

| Less distribution from: | | | | | |

| Net investment income | (0.36) | (0.37) | (0.38) | (0.38) | (0.38) |

| Net realized gains | | | | | |

| Total distributions | (0.41) | (0.44) | (0.41) | (0.43) | (0.44) |

| Net asset value, end of year | $11.16 | $11.09 | $10.34 | $10.75 | $10.95 |

Total return (%) | 4.43 | 11.73 | (0.13) | 2.14 | 2.56 |

| Ratios and supplemental data | | | | | |

Net assets, end of year (in thousands) | $29,347 | $29,143 | $26,598 | $28,579 | $30,721 |

| Ratio of expenses to average net assets (%) | 1.06 | 1.06 | 1.06 | 1.05 | 1.06 |

| Ratio of net investment income to average net assets (%) | 3.26 | 3.44 | 3.47 | 3.52 | 3.45 |

| Portfolio turnover (%) | 19 | 17 | 13 | 17 | 34 |

See accompanying Notes to Financial Statements.

11 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust

Notes to Financial Statements

1. Summary of Significant Accounting Policies. Madison Mosaic Tax-Free Trust (the "Trust") is registered with the Securities and Exchange Commission (the "SEC") under the Investment Company Act of 1940 as an open-end, diversified investment management company. The Trust maintains two separate funds, the Virginia Tax-Free Fund (the "Virginia Fund") and the Tax-Free National Fund (the "National Fund") (collectively the "Funds"), which invest principally in securities exempt from federal income taxes, commonly known as "municipal" securities. The Virginia Fund invests solely in securities exempt from both federal and Virginia state income taxes. The National Fund invests in securities exempt from federal taxes. Both Funds invest in intermediate and long-term securities. Because the Trust is 100% no-load, the shares of each Fund are offered and redeemed at the net asset value per share.

Securities Valuation: Securities having maturities of 60 days or less are valued at amortized cost, which approximates market value. Securities having longer maturities, for which quotations are readily available, are valued at the mean between their closing bid and ask prices. Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures approved by the Board of Trustees.

Fair Value Measurements: In accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 820, Fair Value Measurements and Disclosures, fair value is defined as the price that each fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data "inputs" and minimize the use of unobservable "inputs" and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability, developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability, developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

| | Level 1: Quoted prices in active markets for identical securities |

| | Level 2: Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | Level 3: Significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments) |

In April 2009, the FASB also issued guidance on how to determine the fair value of assets and liabilities when the volume and level of activity for the asset/liability have significantly decreased as well as guidance on identifying circumstances that indicate a transaction is not orderly. The valuation techniques used by the funds to measure fair value for the period ended September 30, 2010 maximized the use of observable inputs and minimized the use of unobservable inputs.

The following is a summary of the inputs used as of September 30, 2010 in valuing the Funds’ investments carried at fair value:

12 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / Notes to Financial Statements / continued

| | | | |

| Virginia Fund | | | | |

| Long Term Municipal Bonds | $ -- | | $ -- | |

| Total | $ -- | $25,719,615 | $ -- | $25,719,615 |

| National Fund | | | | |

| Long Term Municipal Bonds | -- | | -- | |

| Total | $ -- | $28,459,583 | $ -- | $28,459,583 |

At September 30, 2010 and for the year then ended, the Funds held no Level 3 securities. Please see the Portfolio of Investments for each respective Fund for a listing of all securities within the Long Term Municipal Bond category. |

The Funds have adopted the Accounting Standard Update, Fair Value Measurements and Disclosures; Improving Disclosures about Fair Value Measurements which provides guidance on how investment assets and liabilities are to be valued and disclosed. Specifically, the amendment requires reporting entities to disclose i) the input and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements, for Level 2 or Level 3 positions, ii) transfers between all levels (including Level 1 and Level 2) will be required to be disclosed on a gross basis (i.e. transfers out must be disclosed separately from transfers in) as well as the reason(s) for the transfer and iii) purchases, sales, issuances and settlements must be shown on a gross basis in the Level 3 rollforward rather than as one net number. The effective date of the amendment is for interim and annual periods beginning after December 15, 2009 however, the requirement to provide the Level 3 activity for purchases, sales, issuance and settlements on a gross basis will be effective for interim and annual periods beginning after December 15, 2010. There were no transfers between Level 1 and Level 2 during the year ended September 30, 2010.

Derivatives: The Funds adopted ASC 815, Derivatives and Hedging intended to enhance financial statement disclosures for derivative instruments and hedging activities. Management has determined that there is no impact on the Fund’s financial statements as the Funds do not hold derivative financial instruments.

Investment Transactions: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and Federal income tax purposes.

Investment Income: Interest income is recorded on an accrual basis. Bond premium is amortized and original issue discount and market discount are accreted over the expected life of each applicable security using the effective interest method.

Distribution of Income and Gains: Distributions are recorded on the ex-dividend date. Net investment income, determined as gross investment income less total expenses, is declared as a regular dividend and distributed to shareholders monthly. Capital gain distributions, if any, are declared and paid annually at calendar year-end. Additional distributions may be made if necessary. Distributions paid during the years ended September 30, 2010 and 2009 were identical for book purposes and tax purposes.

The tax character of capital gain distributions paid for the Virginia Fund was $24,717 short-term and $80,707 long-term capital gain for the year ended September 30, 2010 and $101,666 long-term capital gain for the year ended September 30, 2009. The tax character of capital gain distributions paid for the National Fund was $128,001 long-term capital gain for the year ended September 30, 2010 and $175,272 long-term capital gain for the year ended September 30, 2009. There were no short-term capital gain distributions for the Virginia Fund for the year ended September 30, 2009 or the National Fund for the years ended September 30, 2010 or 2009.

As of September 30, 2010, the components of distributable earnings on a tax basis were as follows:

Virginia Fund:

| Accumulated net realized gains | $ 126,808 |

| Net unrealized appreciation on investments | |

| | |

National Fund:

| Accumulated net realized gains | $ 222,860 |

| Net unrealized appreciation on investments | |

| | |

13 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / Notes to Financial Statements / continued

Net realized gains or losses may differ for financial and tax reporting purposes as a result of loss deferrals related to wash sales and post-October transactions.

Income Tax: No provision is made for Federal income taxes since it is the intention of the Funds to comply with the provisions of the Internal Revenue Code available to investment companies and to make the requisite distribution to shareholders of taxable income which will be sufficient to relieve it from all or substantially all Federal income taxes.

The Funds adopted ASC 740, Accounting for Uncertainty in Income Taxes. The implementation resulted in no material liability for unrecognized tax benefits and no material change to the beginning net asset value of the Funds. Tax years open to examination by tax authorities under the statute of limitations include fiscal 2007 through 2010.

As of and during the period ended September 30, 2010, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the Funds did not incur any interest or penalties.

Cash Concentration: At times, the Funds maintain cash balances at financial institutions in excess of federally insured limits. The Funds monitor this credit risk and have not experienced any losses related to this risk.

Use of Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. Investment Advisory Fees. The Investment Advisers to the Trust, Madison Mosaic, LLC, a wholly owned subsidiary of Madison Investment Advisors, Inc., and Madison Investment Advisors, Inc. (together, the "Adviser"), earns an advisory fee equal to 0.625% per annum of the average net assets of the Funds. The fees are accrued daily and are paid monthly.

3. Other Expenses. Under a separate Services Agreement, the Adviser will provide or arrange for each Fund to have all necessary operational and support services for a fee based on a percentage of each Fund’s average net assets, other than the expenses of the Trust’s Independent Trustees and auditor ("Independent Service Providers"), which are paid directly based on cost and any costs associated with the Lines of Credit described in Note 7. The Funds also pay their fees related to portfolio holdings and extraordinary or nonrecurring fees. For the year ended September 30, 2010, the services fee was based on the following percentage of average net assets: (i) 0.36% for the Virginia Fund, and (ii) 0.40% for the National Fund on assets less than $25 million and 0.36% for all assets greater than $25 million. The Funds use U.S. Bancorp Fund Services LLC as their transfer agent and U.S. Bank as their custodian. The transfer agent and custodian fees are paid by the Adviser and allocated to the Funds and are included in other expenses (i.e., these fees are included in the service fee payable to the Adviser under the Services Agreement). The amount paid directly for Independent Service Providers fees and extraordinary expenses for the period ended September 30, 2010 was $10,625 per Fund.

4. Aggregate Cost and Unrealized Appreciation. The aggregate cost for federal income tax purposes and the net unrealized appreciation (depreciation) are stated as follows as of September 30, 2010:

| | | |

| Aggregate Cost | | |

| Gross unrealized appreciation | 1,515,637 | 1,692,118 |

| Gross unrealized depreciation | | |

| Net unrealized appreciation | | |

5. Investment Transactions. Purchases and sales of securities (excluding short-term securities) for the year ended September 30, 2010, were as follows:

| | | |

| Virginia Fund | $4,770,303 | $4,685,088 |

| National Fund | $5,337,090 | $5,515,125 |

14 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / Notes to Financial Statements / concluded

6. Capital Share Transactions. An unlimited number of capital shares, without par value, are authorized. Transactions in capital shares were as follows:

| | Year Ended September 30, |

| | |

| In Dollars | | |

| Shares sold | $1,733,799 | $ 3,457,345 |

| Shares issued in reinvestment of dividends | | |

| Total shares issued | 2,566,230 | 4,249,771 |

| Shares redeemed | | |

| Net increase | | |

| | | |

| In Shares | | |

| Shares sold | 147,655 | 300,038 |

| Shares issued in reinvestment of dividends | | |

| Total shares issued | 218,536 | 369,273 |

| Shares redeemed | | |

| Net increase | | |

| | Year Ended September 30, |

| | |

| In Dollars | | |

| Shares sold | $2,066,561 | $ 2,057,060 |

| Shares issued in reinvestment of dividends | | |

| Total shares issued | 3,001,984 | 3,036,249 |

| Shares redeemed | | |

| Net increase | | |

| | | |

| In Shares | | |

| Shares sold | 187,974 | 191,634 |

| Shares issued in reinvestment of dividends | | |

| Total shares issued | 273,409 | 283,240 |

| Shares redeemed | | |

| Net increase | | |

7. Lines of Credit. The Virginia Fund and the National Fund both have a $2.5 million revolving credit facility with a bank for temporary emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. The interest rate on the outstanding principal amount is equal to the prime rate less 0.5% (effective rate of 2.75% at September 30, 2010). The lines of credit contain loan covenants with respect to certain financial ratios and operating matters. Both Funds were in compliance with these covenants as of September 30, 2010 and 2009. During the year ended September 30, 2010, neither Fund borrowed on their lines of credit.

8. Subsequent Events. Management has evaluated the impact of all subsequent events on the Trust. No events have taken place that meet the definition of a subsequent event that requires adjustment to, or disclosure in the financial statements.

15 - Annual Report Sept 30, 2010

Report of Independent Registered Public Accounting Firm

TO THE BOARD OF TRUSTEES AND SHAREHOLDERS OF MADISON MOSAIC TAX-FREE TRUST

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments of the Madison Mosaic Tax-Free Trust (the "Trust"), comprising the Virginia Tax-Free Fund and Tax-Free National Fund (collectively, the "Funds"), as of September 30, 2010 and the related statements of operations for the year then ended and the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2010 by correspondence with the Funds’ custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds constituting the Trust as of September 30, 2010, and the results of their operations for the year then ended and the changes in their net assets for each of the two years in the period then ended and financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

(signature)

Grant Thornton, LLP

Chicago, Illinois

November 22, 2010

16 - Annual Report Sept 30, 2010

Other Information

Fund Expenses (unaudited)

Example

This Example is intended to help you understand your costs (in dollars) of investing in a Fund and to compare these costs with the costs of investing in other mutual funds. See footnotes 2 and 3 above for an explanation of the types of costs charged by the funds.

This Example is based on an investment of $1,000 invested on April 1, 2010 and held for the six-months ended September 30, 2010.

Actual Expenses

The following table titled "Based on Actual Total Return" provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,500 ending account valued divided by $1,000 = 8.5), then multiply the result by the number under the heading entitled "Expenses Paid During the Period."

Based on Actual Total Return1 |

| | | | | | Expenses Paid During the Period3 |

| Virginia Fund | 4.79% | $1,000.00 | $1,047.88 | 1.03% | $5.27 |

| National Fund | 4.73% | $1,000.00 | $1,047.33 | 1.06% | $5.42 |

1For the six-months ended September 30, 2010. |

2Assumes reinvestment of all dividends and capital gains distributions, if any, at net asset value. |

3Expenses are equal to the respective Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Hypothetical Example for Comparison Purposes

The table below titled "Based on Hypothetical Total Return" provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not either fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in a Madison Mosaic Tax-Free Trust Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Madison Mosaic Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Based on Hypothetical Total Return1 |

| | Hypothetical Annualized Total Return | | | | Expenses Paid During the Period2 |

| Virginia Fund | 5.00% | $1,000.00 | $1,025.33 | 1.03% | $5.21 |

| National Fund | 5.00% | $1,000.00 | $1,025.33 | 1.06% | $5.36 |

1For the six-months ended September 30, 2010. |

2Expenses are equal to the respective Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

17 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / Other Information / continued

Federal Tax Information. The Form 1099-DIV you receive in January 2011 will show the tax status of all distributions paid to your account in calendar 2010. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in a Fund. As required by the Internal Revenue Code regulations, shareholders must be notified within 60 days of a Fund’s fiscal year end regarding the status of exempt-interest dividends. The Virginia Tax-Free and Tax-Free National Funds designate 100% and 100%, respectively of dividends from net investment income as exempt-interest dividends.

Forward-Looking Statement Disclosure. One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements." Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "estimate," "may," "will," "expect," "believe," "plan" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information. The Trust only invests in non-voting securities. Nevertheless, the Trust adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Trust’s portfolios. These policies are available to you upon request and free of charge by writing to Madison Mosaic Funds,

550 Science Drive, Madison, WI 53711 or by calling toll-free at 1-800-368-3195. The Trust’s proxy voting policies may also be obtained by visiting the SEC’s web site at www.sec.gov. The Trust will respond to shareholder requests for copies of our policies within two business days of request by first-class mail or other means designed to ensure prompt delivery.

N-Q Disclosure. The Trust files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Trust’s Forms N-Q are available on the SEC’s website. The Trust’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information about the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. Form N-Q and other information about the Trust are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. Copies of this information may also be obtained, upon payment of a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington, DC 20549-0102. Finally, you may call us at 800-368-3195 if you would like a copy of Form N-Q and we will mail one to you at no charge.

Discussion of Contract Renewal (Unaudited). With regard to the nature, extent and quality of the services to be provided by the Adviser, the Board reviewed the biographies and tenure of the personnel involved in Trust management and the experience of the Adviser and its affiliates as investment manager to other investment companies with similar investment strategies. They recognized the wide array of investment professionals employed by the firm. Representatives of the Adviser discussed the firm’s ongoing investment philosophies and strategies intended to provide superior performance consistent with each Fund’s investment objectives under various market scenarios. The Trustees also noted their familiarity with the Adviser and its affiliates due to the Adviser’s history of providing advisory services to the Madison Mosaic organization as well as the MEMBERS Mutual Funds, Ultra Series Fund and the Madison Strategic Sector Premium Fund.

The Board also discussed the quality of services provided to the Trust by its transfer agent and custodian as well as the various administrative services provided directly by the Adviser.

With regard to the investment performance of the Trust and the investment adviser, the Board reviewed current performance information provided in the written Board materials. They discussed the reasons for both outperformance and underperformance compared with peer groups and applicable indices and benchmarks. A comprehensive discussion of fund performance and market conditions followed. Representatives of the Adviser discussed with the Board the methodology for arriving at peer groups and indices used for performance comparisons. The Board

18 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / Other Information / continued

noted the consistency of the Adviser’s management and, as such, looked beyond short-term performance for the last year as part of its considerations.

With regard to the costs of the services to be provided and the profits to be realized by the investment adviser and its affiliates from the relationship with the Trust, the Board reviewed the expense ratios for a variety of other funds in each Fund’s peer group with similar investment objectives.

The Board noted that the Adviser or its affiliates provided investment management services to other investment company and non-investment company clients and considered the fees charged by the Adviser to such funds and clients for purposes of determining whether the given advisory fee was disproportionately large under the so-called "Gartenberg" standard traditionally used by investment company boards in connection with contract renewal considerations. The Board took those fees into account and considered the differences in services and time required by the various types of funds and clients to which the Adviser provided services. The Board recognized that significant differences may exist between the services provided to one type of fund or client and those provided to others, such as those resulting from a greater frequency of shareholder redemptions in a mutual fund and the higher turnover of mutual fund assets. The Board gave such comparisons the weight that they merit in light of the similarities and differences between the services that the various funds require and were wary of "inapt comparisons." They considered that, if the services rendered by the Adviser to one type of fund or client differ significantly from others, then the comparison should not be used. In the case of non-investment company clients for which the Adviser may act as either investment adviser or subadviser, the Board noted that the fee may be lower than the fee charged to the Trust. The Board noted too the various administrative, operational, compliance, legal and corporate communication services required to be handled by the Adviser which are performed for investment company clients but are not performed for other institutional clients.

The Trustees reviewed each fund’s fee structure based on total fund expense ratio as well as by comparing advisory fees to other advisory fees. The Board noted the simple expense structure maintained by the Trust (i.e. an advisory fee and a capped administrative "services" expense). The Board paid particular attention to the total expense ratios paid by other funds with similar investment objectives, recognizing that such a comparison, while not completely dispositive, was nevertheless an important consideration.

The Trustees sought to ensure that fees paid by the Trust were appropriate. The Board reviewed materials demonstrating that although the Adviser is compensated for a variety of the administrative services it provides or arranges to provide to the Trust pursuant to its Services Agreements with the Trust, such compensation generally does not cover all costs due to the cap on administrative expenses. Administrative, operational, regulatory and compliance fees and costs in excess of the Services Agreement fees are paid by the Adviser from investment advisory fees earned. In this regard, the Trustees noted that examination of each Fund’s total expense ratio compared to those of other investment companies was more meaningful than a simple comparison of basic "investment management only" fee schedules.

In reviewing costs and profits, the Board noted the salaries of all portfolio management personnel, trading desk personnel, corporate accounting personnel and employees of the Adviser who serve as Trust officers, as well as facility costs (rent), could not be supported by fees received from the Trust alone. However, the Board recognized that the Trust is profitable to the Adviser because such salaries and fixed costs are already paid in whole or in part from revenue generated by management of the remaining assets managed by the Adviser. The Trustees noted that total assets managed by the Adviser and its affiliates approximated $15 billion at the time of the meeting. As a result, although the fees paid by each Fund at its present size might not be sufficient to profitably support a stand-alone fund, the Trust is reasonably profitable to the Adviser as part of its larger, diversified organization. In sum, the Trustees recognized that the Trust is important to the Adviser, is managed with the attention given to other firm clients and is not treated as "loss leader."

With regard to the extent to which economies of scale would be realized as each Fund grows, the Trustees recognized that at their current sizes, it was premature to discuss any economies of scale not already factored into existing advisory and services agreements.

Counsel to the non-interested Trustees met with the Independent Trustee previous to their consideration of

19 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust / Other Information / Concluded

the renewal of the contracts and reviewed the written materials provided by the Adviser. He noted that the Independent Trustees had considered such materials in light of the aforementioned Gartenberg standards as well as criteria either set forth or discussed in the recent Supreme Court decision in Jones v. Harris regarding the investment company contract renewal process under Section 15(c) of the Investment Company Act of 1940, as amended. The Independent Trustees made a variety of additional inquiries regarding such written materials to the Adviser and representatives of the Adviser discussed each matter raised.

Finally, the Board reviewed the role of Mosaic Funds Distributor, LLC. They noted that the Adviser pays all distribution expenses of Madison Mosaic Funds because the Trusts do not pay distribution fees. Such expenses include FINRA regulatory fees and "blue sky" fees charged by state governments in order to permit the funds to be offered in the various United States jurisdictions.

Although no change in control was contemplated, it was contemplated that instead of having an investment advisory relationship with both Madison Mosaic, LLC and Madison Investment Advisors, Inc. (the former being a wholly owned subsidiary of the latter), the renewal of the advisory contracts should be with a single Madison Investment Advisors registered investment adviser entity. There was no other material change in the relationship between the Trust and the Adviser and there was no change of control. The advisory contracts were renewed with Madison Mosaic, LLC which changed its name to Madison Investment Advisors, LLC on November 30, 2010 and become a wholly owned subsidiary of Madison Asset Management, LLC, which, in turn, is a subsidiary of Madison Investment Advisors, Inc. (which changed its name to Madison Investment Holdings, Inc. on November 30, 2010) (the various Madison entities are collectively referred to as "Madison").

The Board then asked the Adviser if there was anything else not provided in written Board materials or orally presented to the Board for consideration that the Adviser wished to disclose in connection with the proposed renewal of the investment advisory agreements between it and the applicable Trusts. Representatives of the Adviser confirmed that there were no additional matters for the Trustees to consider.

Based on all of the material factors explained above, plus a number of other matters that the Trustees are generally required to consider under guidelines developed by the Securities and Exchange Commission, the Trustees concluded that Madison’s contract should be renewed for another year.

20 - Annual Report Sept 30, 2010

Madison Mosaic Tax-Free Trust

Trustees and Officers

Interested Trustees and Officers

Name and Year of Birth | Position(s) and Length of Time Served | Principal Occupation(s) During Past Five Years | Other Directorships/Trusteeships |

Katherine L. Frank1 1960 | President, 1996 - Present, and Trustee, 2001- Present | Madison Investment Advisors, Inc. ("MIA"), Managing Director and Vice President, 1986 - Present; Madison Asset Management, LLC ("MAM"), Director and Vice President, 2004 - Present; Madison Mosaic, LLC, President, 1996 - Present; Madison Mosaic Funds (13 funds, including the Trust) and Madison Strategic Sector Premium Fund (closed end fund), President, 1996 - Present ; Madison/Claymore Covered Call and Equity Strategy Fund (closed end fund), Vice President, 2005 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16) (mutual funds), President, 2009 - Present | Madison Mosaic Funds (all but Equity Trust) and Madison Strategic Sector Premium Fund, 1996 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), 2009 - Present |

Frank E. Burgess 1942 | Trustee and Vice President, 1996 - Present | MIA, Founder, President and Director, 1973 - Present; MAM, President and Director, 2004 - Present; Madison Mosaic Funds (13 funds, including the Trust) and Madison Strategic Sector Premium Fund, Vice President, 1996 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), Vice President, 2009 - Present | Madison Mosaic Funds (13), Madison Strategic Sector Premium Fund, and Madison/Claymore Covered Call & Equity Strategy Fund, 1996 - Present; Capitol Bank of Madison, WI, 1995 - Present; American Riviera Bank of Santa Barbara, CA, 2006 - Present |

Jay R. Sekelsky 1959 | Vice President, 1996 - Present | MIA, Managing Director and Vice President, 1990 - Present; MAM, Director, 2009 - Present; Madison Mosaic, LLC, Vice President, 1996 - Present; Madison Mosaic Funds (13 funds, including the Trust) and Madison Strategic Sector Premium Fund, Vice President, 1996 - Present; Madison/Claymore Covered Call & Equity Strategy Fund, Vice President, 2004 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), Vice President, 2009 - Present | N/A |

Paul Lefurgey 1964 | Vice President, 2009 - Present | MIA, Managing Director, Head of Fixed Income, 2005 - Present; Madison Mosaic Funds (13 funds, including the Fund) and Madison Strategic Sector Premium Fund, Vice President, 2009 - Present; MEMBERS Capital Advisors, Inc. ("MCA") (investment advisory firm), Madison, WI, Vice President 2003 - 2005; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), Vice President, 2009 - Present | N/A |

Greg D. Hoppe 1969 | Treasurer, 2009 - Present Chief Financial Officer, 1999 - 2009 | MIA, Vice President, 1999 - Present; MAM, Vice President, 2009 - Present; Madison Mosaic, LLC, Vice President, 1999 - Present; Madison Mosaic Funds (13 funds, including the Fund), Treasurer, 2009 - Present; Chief Financial Officer, 1999 - 2009; Madison Strategic Sector Premium Fund, Treasurer, 2005 - Present; Chief Financial Officer, 2005 - 2009; Madison/Claymore Covered Call & Equity Strategy Fund, Vice President, 2008 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), Treasurer, 2009 - Present | N/A |

1 "Interested person" as defined in the Investment Company Act of 1940. Considered an interested Trustee because of the position held with the investment advisor of the Fund.

21 - Annual Report Sept 30, 2010

Name and Year of Birth | Position(s) and Length of Time Served | Principal Occupation(s) During Past Five Years | Other Directorships/Trusteeships |

Holly S. Baggot 1960 | Secretary and Assistant Treasurer, 2009 - Present | MAM, Vice President, 2009 - Present; MCA, Director-Mutual Funds, 2008 - 2009; Director-Mutual Fund Operations, 2006 - 2008; Operations Officer-Mutual Funds, 2005 - 2006; Senior Manager-Product & Fund Operations, 2001 - 2005; Madison Mosaic Funds (13 funds, including the Fund) and Madison Strategic Sector Premium Fund, Secretary and Assistant Treasurer, 2009 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), Assistant Treasurer, 2009 - Present; Secretary, 1999 - Present; Treasurer, 2008 - 2009; Assistant Treasurer, 1997 - 2007 | N/A |

W. Richard Mason 1960 | Chief Compliance Officer, 1992 - Present Corporate Counsel and Assistant Secretary, 2009 - Present General Counsel and Secretary, 1992 - 2009 | MIA, MAM, Madison Scottsdale, LC (an affiliated investment advisory firm of MIA) and Madison Mosaic, LLC, General Counsel and Chief Compliance Officer, 1996 - 2009; Chief Compliance Officer and Corporate Counsel, 2009 - Present; Mosaic Funds Distributor, LLC (an affiliated brokerage firm of MIA), Principal, 1998 - Present; Concord Asset Management ("Concord") (an affiliated investment advisory firm of MIA), LLC, General Counsel, 1996 - 2009; Madison Mosaic Funds (13 funds, including the Fund) and Madison Strategic Sector Premium Fund, General Counsel, Chief Compliance Officer, 1992 - 2009; Chief Compliance Officer, Corporate Counsel, Secretary and Assistant Secretary, 2009 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), Chief Compliance Officer, Corporate Counsel and Assistant Secretary, 2009 - Present | N/A |

Pamela M. Krill 1966 | General Counsel, Chief Legal Officer and Assistant Secretary, 2009 - Present | MIA, MAM, Madison Scottsdale, LC, Madison Mosaic, LLC, Mosaic Funds Distributor, and Concord, General Counsel and Chief Legal Officer, 2009 - Present; Madison Mosaic Funds (13 funds, including the Trust) and Madison Strategic Sector Premium Fund, General Counsel, Chief Legal Officer and Assistant Secretary, 2009 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), General Counsel, Chief Legal Officer and Assistant Secretary, 2009 - Present; CUNA Mutual Insurance Society (insurance company with affiliated investment advisory, brokerage and mutual fund operations), Madison, WI, Managing Associate General Counsel-Securities & Investments, 2007 - 2009; Godfrey & Kahn, S.C. (law firm), Madison and Milwaukee, WI, Shareholder, Securities Practice Group, 1994-2007 | N/A |

Independent Trustees

Name and Year of Birth | Position(s) and Length of Time Served1 | Principal Occupation(s) During Past Five Years | Portfolios Overseen in Fund Complex2 | Other Directorships/Trusteeships |

Lorence D. Wheeler 1938 | Trustee, 1996 - Present | Retired investor; Credit Union Benefits Services, Inc. (a provider of retirement plans and related services for credit union employees nationwide), Madison, WI, President, 1997 - 2001 | 43 | Grand Mountain Bank FSB and Grand Mountain Bancshares, Inc. 2003 - Present; Madison Mosaic Funds (13 funds, including the Trust) and Madison Strategic Sector Premium Fund, 1996 - Present; Madison/Claymore Covered Call and Equity Strategy Fund, 1996 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), 2009 - Present |

22 - Annual Report Sept 30, 2010

Name and Year of Birth | Position(s) and Length of Time Served1 | Principal Occupation(s) During Past Five Years | Portfolios Overseen in Fund Complex2 | Other Directorships/Trusteeships |

Philip E. Blake 1944 | Trustee, 2001 - Present | Retired investor; Lee Enterprises, Inc (news and advertising publisher), Madison, WI, Vice President, 1998 - 2001; Madison Newspapers, Inc., Madison, WI, President and Chief Executive Officer, 1993 - 2000 | 43 | Madison Newspapers, Inc., 1993 - Present; Meriter Hospital & Health Services, 2000 - Present; Edgewood College, 2003 - Present; Madison Mosaic Funds (13 funds, including the Trust) and Madison Strategic Sector Premium Fund, 1996 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), 2009 - Present |

James R Imhoff, Jr. 1944 | Trustee, 1996 - Present | First Weber Group (real estate brokers), Madison, WI, Chief Executive Officer, 1996 - Present | 43 | Park Bank, 1978 - Present; Madison Mosaic Funds (13 funds, including the Trust) and Madison Strategic Sector Premium Fund, 1996 - Present; Madison/Claymore Covered Call and Equity Strategy Fund, 1996 - Present; MEMBERS Mutual Funds (13) and Ultra Series Fund (16), 2009 - Present |

1 Independent Trustees serve in such capacity until the Trustee reaches the age of 76, unless retirement is waived by unanimous vote of the remaining Trustees on an annual basis.

2 As of the date of this Annual Report, the Fund Complex consists of the Trust with 2 portfolios (i.e., the two Funds), the MEMBERS Mutual Funds with 13 portfolios, the Ultra Series Fund with 16 portfolios, the Madison Strategic Sector Premium Fund (a closed-end fund) and the Madison Mosaic Equity, Income and Government Money Market Trusts, which together have 11 portfolios, for a grand total of 43 separate portfolios in the Fund Complex.

The Statement of Additional Information contains more information about the Trustees and is available upon request. To request a free copy, call Madison Mosaic Funds at 1-800-368-3195.

23 - Annual Report Sept 30, 2010

The Madison Mosaic Family of Mutual Funds

Madison Mosaic Equity Trust

Investors Fund

Balanced Fund

Mid-Cap Fund

Disciplined Equity Fund

Small/Mid-Cap Fund

Madison Institutional Equity Option Fund

Madison Mosaic Income Trust

Government Fund

Intermediate Income Fund

Institutional Bond Fund

Madison Mosaic Tax-Free Trust

Virginia Tax-Free Fund

Tax-Free National Fund

Madison Mosaic Government Money Market

For more complete information on any Madison Mosaic fund, including charges and expenses, request a prospectus by calling 1-800-368-3195. Read it carefully before you invest or send money. This document does not constitute an offering by the distributor in any jurisdiction in which such offering may not be lawfully made. Mosaic Funds Distributor, LLC.

TRANSER AGENT

Madison Mosaic Funds(R)

c/o US Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, WI 53201-0701

TELEPHONE NUMBERS

Shareholder Service

Toll-free nationwide: 888-670-3600

Mosaic Tiles (24 hour automated information)

Toll-free nationwide: 800-336-3600

550 Science Drive

Madison, Wisconsin 53711

Madison Mosaic Funds

www.mosaicfunds.com

SEC File Number 811-3486

Item 2. Code of Ethics.

(a) The Trust has adopted a code of ethics that applies to the Trust’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions, regardless of whether these individuals are employed by the Trust or a third party. The code was first adopted during the fiscal year ended September 30, 2003.

(c) The code has not been amended since it was initially adopted.

(d) The Trust granted no waivers from the code during the period covered by this report.

(f) Any person may obtain a complete copy of the code without charge by calling Madison Mosaic Funds at 800-368-3195 and requesting a copy of the Madison Mosaic Funds Sarbanes Oxley Code of Ethics.

Item 3. Audit Committee Financial Expert.

In July 2009, James R. Imhoff, an “independent” Trustee and a member of the Trust’s audit committee, was elected to serve as the Trust’s audit committee financial expert among the three Mosaic independent Trustees who so qualify to serve in that capacity. He succeeded Lorence R. Wheeler who served in that capacity from July 2008 through July 2009.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. Note that fees are accrued pursuant to the Services Agreement, but are paid directly to the accountants. Total audit fees paid (or to be paid) to the registrant's principal accountant for the fiscal years ended September 30, 2010 and 2009, respectively, out of the Services Agreement fees collected from all Madison Mosaic Funds were $87,800 ($107,800 including the Madison Strategic Sector Premium Fund, an affiliated closed-end fund ("MSP")) and $85,300 ($107,800 including MSP). Of these amounts, approximately $14,000 and $14,000, respectively, was or will be attributable to the registrant and the remainder was or will be attributable to audit services provided to other Madison Mosaic Funds registrants.

(b) Audit-Related Fees. Not applicable.

(c) Tax-Fees. Not applicable.