Exhibit 13.1

2007 REPORT TO SHAREHOLDERS |

| |

Chairman’s Message | 2 |

| |

2007 in Review | 3 |

| |

Officers | 18 |

| |

F&M Office Directory | 19 |

| |

President’s Message | 20 |

| |

2007 Financial Reports | 21 |

FIRST FARMERS AND MERCHANTS CORPORATION

Condensed Statements, December 31, 2007 and December 31, 2006 (In Thousands of Dollars)

| | 2007 | | 2006 | | % change | |

ASSETS | | | | | | | |

Cash and due from banks | | $ | 35,873 | | $ | 74,981 | | -52.2 | % |

United States government securities

(including agencies & mortgaged backed securities) | | 131,859 | | 126,332 | | 4.4 | % |

Municipal and other securities | | 107,617 | | 101,916 | | 5.6 | % |

Loans, less unearned income and allowance for possible loan losses | | 492,762 | | 466,091 | | 5.7 | % |

Bank premises and equipment, at cost less allowance for depreciation and amortization | | 14,306 | | 10,428 | | 37.2 | % |

Other assets | | 40,629 | | 40,336 | | 0.7 | % |

| | | | | | | |

TOTAL ASSETS | | $ | 823,046 | | $ | 820,084 | | 0.4 | % |

| | | | | | | |

LIABILITIES | | | | | | | |

Deposits | | $ | 698,959 | | $ | 698,962 | | 0.0 | % |

Federal funds purchased and securities sold under repurchase agreements | | 2,507 | | 2,654 | | -5.5 | % |

Other liabilities | | 15,336 | | 14,661 | | 4.6 | % |

| | | | | | | |

TOTAL LIABILITIES | | 716,802 | | 716,277 | | 0.1 | % |

| | | | | | | |

SHAREHOLDERS’ EQUITY | | | | | | | |

Common stock | | 56,800 | | 57,600 | | -1.4 | % |

Additional paid in capital | | — | | 1,120 | | -100.0 | % |

Retained Earnings | | 48,916 | | 46,342 | | 5.6 | % |

Accumulated other comprehensive income | | 528 | | (1,255 | ) | -142.1 | % |

| | | | | | | |

TOTAL EQUITY | | 106,244 | | 103,807 | | 2.3 | % |

| | | | | | | |

TOTAL LIABILITIES & SHAREHOLDERS’ EQUITY | | $ | 823,046 | | $ | 820,084 | | 0.4 | % |

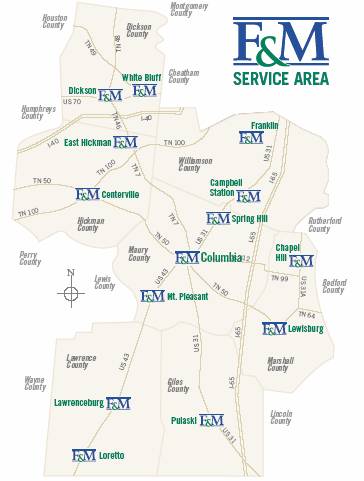

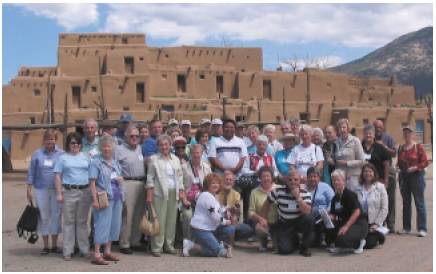

FIRST FARMERS AND MERCHANTS CORPORATION

is a bank holding company headquartered in Columbia, Tennessee. Its sole subsidiary is First Farmers & Merchants Bank. F&M operates more than 20 banking locations in Maury, Lawrence, Marshall, Hickman, Dickson, Giles and Williamson counties of Middle Tennessee. The bank stresses traditional, personal banking relationships while incorporating state-of-the-art technology to provide optimum performance. Since the bank’s establishment in 1909, F&M has worked to uphold the motto, “Dedicated to Community Service.”

FOR MORE INFORMATION: FIRST FARMERS AND MERCHANTS CORP., 816 SOUTH GARDEN STREET, COLUMBIA, TN 38401.

(931) 388-3145 | 800-882-8378 | WWW.FANDMBANK.COM | MEMBER FDIC

FIRST FARMERS & MERCHANTS BANK

1

TO OUR

SHAREHOLDERS:

T. Randy Stevens

First Farmers and Merchants Corporation and its shareholders were blessed in 2007. Income rose significantly, and thanks to our continuing, company-wide focus on efficiency, more profits went to the bottom line. The results speak for themselves:

· Total interest income is up 2.95% over the previous year.

· Total noninterest income is up 4.15%.

· Net income is up 11.60%.

· Basic earnings per share are up 13.53%.

Thanks to an excellent management team, I believe that your bank is well positioned to build on this outstanding performance in the years ahead. Elsewhere in this annual report, you will find a letter from President Tim Pettus that outlines our hopes for the bank and the beliefs that underlie our vision for an even greater First Farmers & Merchants Bank.

Tim and I work with a superior group of banking professionals, including the other members of the executive team: John Tomlinson, who was promoted to Chief Administrative Officer in 2007, and Houston Parks, our Chief Operating Officer. It is because we have great people like John and Houston throughout the bank, at all levels, that we were blessed with such strong results in 2007.

Of course, success is the result of action, and your bank undertook several projects in 2007 that made us an even stronger company. Among these were the formation of a Private Banking Department, led by Harvey Church, and the opening of a new office on Carothers Parkway to serve the dynamic Cool Springs market in Williamson County. Craig Holland, who also joined the bank in 2007, is leading the bank’s expansion into Williamson County, one of the most affluent counties in the nation, where there is a huge demand for quality banking services.

And this just scratches the surface of the many good things happening at your bank. To learn more, I hope you will take a few minutes to read this annual report. By looking back on all we accomplished in 2007, I believe you will understand why we see even greater things ahead. Indeed, you will know why the theme of this report is, “We Believe.”

|

T. Randy Stevens |

Chairman and CEO |

2007 ANNUAL REPORT/WEBELIEVE

2

WE BELIEVE…

INTEGRITY AT

ALL TIMES

|

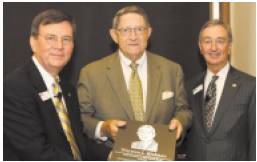

Brad Barrett, TBA President; Waymon L. Hickman, F&M Senior Chairman; Steve White, TBA Chairman. | |

| |

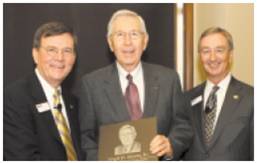

Brad Barrett, TBA President; Virgil H. Moore, Jr., F&M Senior Chairman; Steve White, TBA Chairman. | |

Honors from Tennessee Bankers Association… The Tennessee Bankers Association named Waymon L. Hickman and Virgil H. Moore, Jr. as Leaders in Banking Excellence. The two F&M Senior Chairmen are part of an elite group representing Tennessee bankers who have excelled not only in the areas of banking, but also in community service and civic involvement.

“Waymon Hickman’s name is synonymous with Maury County banking. It is right that he be commended, not only for his banking abilities, but for his significant contributions to the community and to the state of Tennessee,” said Brad Barrett, TBA President.

“Virgil Moore has contributed to the banking industry both statewide and nationally. His devotion to health care and education is evident through his work in the community.”

|

F&M Board of Directors – standing, from left: Tom Napier Gordon, Attorney and Managing Partner, Gordon Brothers Properties; W. Donald Wright, Pharmacist; William R. Walter, Retired CEO, Maury Regional Healthcare System; Lacy Upchurch, President, Tennessee Farm Bureau; James L. Bailey, Jr., Maury County Mayor; H. Terry Cook, Jr., President, Cook Properties Inc.; Kenneth A. Abercrombie, Retired President, Loretto Casket Company; James E. York, Associate Broker and Principal, Stanfield York Company; Dan C. Wheeler, Director, UT Center for Profitable Agriculture; Dr. David S. Williams, Orthodontist; seated, from left: Dr. Joseph W. Remke, III, Optometrist; Dr. O. Rebecca Hawkins, President, CSCC, Columbia State Community College; T. Randy Stevens, Chairman and CEO, F&M; John P. Tomlinson, III, Chief Administrative Officer, F&M; Darlene Baxter, Vice President, Affiliate Services MRH, Executive Director, Maury Regional Healthcare Foundation; Hulet M. Chaney, CEO Emeritus, Tennessee Farmers Insurance Companies. |

3

| |

Virgil H. Moore, Jr., F&M Senior Chairman, and Nancy Moore at ground-breaking for the Virgil and Nancy Moore Family Chapel in Baptist Hospital. | |

Honors from Tennessee Hospital Association… Mr. Hickman was awarded the 2007 Meritorious Service Award for Governance at the Tennessee Hospital Association’s annual meeting. Mr. Hickman’s service to the Maury Regional Hospital Board of Trustees began in 1984.

Baptist Hospital chapel named for Senior Chairman and his wife… Baptist Hospital in Nashville named its new chapel after Virgil and Nancy Moore. The hospital held a groundbreaking ceremony in May to acknowledge the Moores and officially launch construction.

Business ethics symposium presentation… Mr. Hickman served as a panelist at Martin Methodist College’s inaugural Business Ethics Symposium in February. The event topic was “Ethics in Everyday Management.”

|

F&M Honorary Board of Directors - standing, from left: O’Neill D. Moore; Tillman W. Knox; Sam D. Kennedy; Waymon L. Hickman; Edwin (Wick) Halliday; Joe E. Lancaster; Harlan D. Bowsher; seated, from left: James S. Putman; Flavius A. Barker; Virgil H. Moore, Jr.; David I. Wise; Dr. Harold S. Pryor. |

4

WE BELIEVE…

CUSTOMER-CENTERED

BUSINESS

F&M’s new Carothers Parkway office.

Saturday banking at Spring Hill office… Beginning in April, F&M’s Spring Hill office began offering new Saturday hours, from 9 a.m. until 1 p.m.

“This is a prime example of how F&M listens to its customers and acts to ensure they receive the highest level of convenience and customer service possible,” said F&M Chairman and CEO T. Randy Stevens.

| |

Executive Team - from left: John P. Tomlinson, III, Chief Administrative Officer; T. Randy Stevens, Chairman and CEO; Timothy E. Pettus, President; N. Houston Parks, Chief Operating Officer. | |

Carothers Parkway office opens in Williamson County… In December, F&M opened a new location on Carothers Parkway in Franklin. R. Craig Holland, F&M Williamson County President, is leading F&M’s expansion into this new market.

“We are excited about opening a new, full-service office in Franklin,” said Mr. Holland. “F&M offers a rich banking heritage backed by a terrific combination of personal service, value and banking convenience. Our customers benefit from a real community banking experience while also enjoying the latest technological advances that make banking convenient.”

| MARY COLVETT Loan Closing Supervisor Loan Processing Dept. | “WE BELIEVE that our customers are the key to our success. We would not be where we are today without them.” |

5

Chairman’s Club at Taos Pueblo, N.M.

The new office, which offers a full line of personal and commercial products and services, will serve as a temporary location until construction of a new financial center on Cool Springs Boulevard is complete. The office is staffed by a team of experienced professionals including Dick Sevier, First Vice President; Lucy Quillin, Mortgage Lender; and Melissa Goodman, Assistant Branch Manager.

Chairman’s Club tours the Southwest… Members of F&M’s Chairman’s Club visited the Southwest region by train in May. Members rode vintage trains through the northern New Mexico countryside and San Juan Region. They experienced a panoramic view of New Mexico while riding the world’s longest tramway, visited historic locations throughout the region and took in the natural wonders of the Southwest.

Dickson County Advisory Board of Directors - from left: Dr. Dan B. Drinnen, Randal J. Cagle, Freddy N. Pendergrass, R. Neill Milam, Cordia W. Harrington, David B. Brogdon, William D. Joyce, Jr., Carroll W. Ford.

6

| MATT PATTERSON

Senior Credit Analyst Credit Administration Dept. | “WE BELIEVE in going the extra mile. By putting forth extra effort, we can reach

our short–term goals, which in turn will produce the desired long–term results.” |

| |

(From left) Emma Shows; Sylvia Owens; Leesa Stevens; Monica Witherspoon; Sheilah Griggs; Suzanne Estes; Martha Puckette; Tiby Ferguson, F&M Vice President and Director of Marketing, at “Ladies Who Launch” luncheon. | |

Customer appreciation luncheons…F&M held customer appreciation luncheons at several offices during the spring.

Luncheon and seminar series for women business leaders and entrepreneurs… F&M hosted a luncheon for women business leaders and entrepreneurs in October. The luncheon, which was attended by more than 50 women, officially introduced a series of “Ladies Who Launch”seminars presented throughout the fall by F&M and featured guest speaker Sheilah Griggs, Nashville leader of Ladies Who Launch.

“Today’s business culture, more than ever before, realizes the value of women as strong and capable leaders,” said Mr. Stevens. “We hope that the luncheon and seminar series encouraged more women to pursue their entrepreneurial goals or positions of greater responsibility in their current careers.”

WE BELIEVE…

TEAMWORK

FOR EVERYDAY

SUCCESS

F&M University teaches leadership, bank history… In November, 15 employees graduated from F&M University as its first class. An employee education program established in 2007, F&M University is designed to teach participants about the banking

7

| LINDA PEARSON

Vice President East Hickman Office | “WE BELIEVE in aiming for excellence, maintaining integrity and finding courage to change while helping others reach their potential.” |

industry, pass on F&M history, build closer relationships among employees and educate the bank’s future leaders.

F&M University’s first graduating class.

“The first class of F&M University is a very diverse group of employees – some with two years experience, others with 15,” said Timothy E. Pettus, F&M President. “This allows for a well-rounded class where students can learn from each other and grow as bankers.”

The F&M University class met for six months. Sessions were taught by F&M officers and employees on a variety of subjects, including sales, bank operations, trust services, credit administration, banking etiquette, the history of F&M and the future of banking.

Giles County Advisory Board of Directors – from left: Paul Donald Massey; Marcus F. Houston, Giles County Senior Banking Executive; Joseph F. Fowlkes, Jr.; Vicki J. Barnette; W. Preston Murrey, III; Bobby D. Powell; Jim R. Ferrell; Dr. Hugh T. Herrington.

8

In addition to lectures, the F&M University class also completed a final project as a team.

Timothy E. Pettus

Key management team members promoted… F&M named Timothy Pettus President of the bank and its holding company,First Farmers and Merchants Corporation, and John P. Tomlinson, III Chief Administrative Officer.

“Because F&M has long been a leader in our market area, we attract and retain excellent people,” Mr. Stevens said. “Our Executive Leadership Team puts our best and brightest people in the best places to ensure this bank’s continued success.”

Mr. Pettus’ new responsibilities include the promotion of F&M products across the bank’s seven-county franchise.

“This is a very exciting time in F&M’s history,” said Mr.Pettus. “There are unprecedented opportunities thanks to a growing economy and new challenges thanks to increased competition. Both situations are good for our bank because it keeps us passionate about what we do and it keeps us energized and focused on delivering outstanding service.”

Mr. Pettus has 35 years of banking experience. He received a bachelor’s degree from Middle Tennessee State University and is a graduate of the Graduate School of Banking at Louisiana State University.

| |

| |

Management Team - standing, from left: Kim A. Boone, Vice President and Senior Trust Officer; Jason N. Bledsoe, Credit Officer; Leslie R. Brooks, III, Executive Vice President/Commercial Sales Manager; Michael L. Ayer, Senior Relationship Manager/ Commercial Banking; John T. Cotham, Executive Vice President/Human Resources; Paul T. Butts, Jr., First Vice President and Branch Administrator; Brian K. Williams, Chief Credit Officer; Linda L. Hicks, First Vice President and Director of Operations; William F. White, Jr., Williamson County Senior Banking Executive; Patricia P. Bearden, Chief Financial Officer; seated, front left: John P. Tomlinson, III, Chief Administrative Officer; T. Randy Stevens, Chairman and CEO; Timothy E. Pettus, President; N. Houston Parks, Chief Operating Officer. | |

| LARRY LOVE

Vice President & Cheif Appraiser Loan Processing Dept. | “WE BELIEVE honesty, integrity and public trust to be basic concepts inherent to the bank’s philosophy and are demonstrated through its dedication to the community and to the customer.” |

9

| CHRISTY MCBRIDE Financial Analyst Accounting Dept. | “WE BELIEVE that each customer at First Farmers & Merchants Bank is first, foremost and matters.” |

“Teamwork is essential to our success,” said Mr. Tomlinson. “By pooling our talents and insights, F&M has become and remains the leading bank in our market area.”

Mr. Tomlinson has spent his entire 35-year banking career with F&M. He is a graduate of the University of Tennessee, Tennessee Young Bankers School at Vanderbilt University, the Graduate School of Banking and Executive Banking Institute at LSU and Southern Methodist University/Commercial Lending School.

R. Craig Holland

New Williamson County President named… Craig Holland joined F&M as President of Williamson County in 2007. The leader of F&M’s expansion in Williamson County, Mr. Holland has 27 years of banking experience and is a graduate of Western Kentucky University, the Kentucky School of Banking at the University

|

Hickman County Advisory Board of Directors – from left: Louise N. Green, T. Melvin Mays, Malcolm W. Buchanan, Dennis W. Bass, W. Danny Rochelle, Robert L. Haviland, Johnnie Ruth Elrod. |

10

of Kentucky and the Graduate School of Banking at Louisiana State University. He is also a retired major in the United States Army Reserve.

“Craig’s experience, leadership skills and expertise are invaluable,” said Mr. Stevens. “Under Craig’s management, F&M will play an integral role in the commercial and residential growth of Williamson County.”

Other key additions and promotions… Linda Pearson joined F&M as Vice President of the Dickson Business Financial Center and Robert M. “Mickey” Crews, Jr. joined F&M as Vice President in the bank’s Lawrenceburg office. F&M promoted Carol C. Thompson to Vice President in the White Bluff office and William F. White, Jr. to Williamson County Senior Banking Executive.

Also promoted were Richard J. “Rick” Mullen to First Vice President and Trust Officer, Glynis D. Smith to Audit Officer/Security Officer, Robert C. “Bob” Matthews to Controller, Larry D. Brown to Lawrence County Senior Banking Executive, Tiby C. Ferguson to Vice President/Director of Marketing, Nicole Hall to Marketing Coordinator, Sissy Sewell to Operations Officer, April Bobb to Assistant Trust Officer and Judy Musgrave to Banking Officer.

| |

Markets Team - from left: Marcus F. Houston, Giles County Senior Banking Executive; Larry D. Brown, Lawrence County Senior Banking Executive; Carla F. Hinson, Branch Manager II (Hickman County); R. Craig Holland, Williamson County President; Timothy E. Pettus, President; M. Harvey Church, Maury County Senior Banking Executive/Private Banking; Barry B. White, Marshall County President. Not pictured: C. Glenn Kane, Dickson County Senior Banking Executive. | |

| SANDY WILLIAMS

Loan Processor Loretto Office | “WE BELIEVE in taking care of our customers by providing exceptional customer service.” |

11

| DIANNE GORDON

Main Office Supervisor Main Office | “WE BELIEVE in putting every person that walks in the door of our bank first.” |

WE BELIEVE…

COMMITMENT

TO STRONG

COMMUNITIES

|

Stacey Shedd, F&M Vice President and Private Banker, presents gas cards to Dan Garland, coach of the Babe Ruth team. | |

F&M Supports Lawrenceburg Babe Ruth team…F&M donated 15 gasoline cards totaling $375 to the Lawrenceburg Babe Ruth 14-year-old all-star baseball team to help cover transportation expenses for the 2007 Babe Ruth 14-Year-Old Southeast Regional Tournament.

|

Lawrence County Advisory Board of Directors – back row, from left: Stan Threet; Ben Boston; David Weathers; Jonathan M. Edwards; D. Blake Lay; front row, from left: Timothy E. Pettus, F&M President; Larry D. Brown, F&M Lawrence County Senior Banking Executive; Sheila H. Frisbie; Jim White; Ronnie J. McMasters. |

12

F&M plays integral role in Columbia State capital campaign… The Columbia State Community College Foundation reached its goal of $5 million for its Nurturing for Growth gifts campaign thanks to generous contributions by members of the community, including F&M, which pledged $50,000 to be paid over five years.

In addition to a monetary donation, F&M provided campaign leadership. Mr. Hickman served as a co-chair of the campaign, Mr. Pettus led the Lawrence County campaign and Barry B. White, F&M Marshall County President, led the Marshall County campaign.

Williamson President wins Impact Award… Mr. Holland received a 2007 Williamson County Impact Award in the category of “Community Supporter” for his service on the United Way of Williamson County Board of Directors. Mr. Holland currently serves as campaign chairman and board chair elect for 2008. The award recipients were selected and featured by the Nashville Business Journal.

Bank Director and Senior Executive join hospital board… The Maury Regional Hospital Board of Trustees appointed O. Rebecca Hawkins, Columbia State Community College President and member of the F&M Board of Directors, and M. Harvey Church, F&M Maury County Senior Banking Executive/Private Banking, to its advisory board.

| |

La Societe des 40 Hommes et 8 Chevaux, a fraternal organization, presents a $60,000 donation to the CSCC Nurturing for Growth campaign. Pictured: (from left) Robert McAdams; George Jones; Elaine Kelsey, Executive Director of the CSCC Foundation; Joe Foster; Waymon L. Hickman, Nurturing for Growth Co-chair. | |

| LYNN ROSS Administrative Assistant Credit Administration Dept. | “WE BELIEVE in the leadership and their commitment to be the number one community bank in Middle Tennessee. |

13

F&M’s donations in 2007 to non-profit organizations included…

· $2,500 to the Martin Methodist College Fund in memory of longtime Giles County civic leader Henry Sims. Mr. Sims was a member of the F&M Board of Directors from 2002 until 2006.

· $2,500 to CASA of Maury County, a local chapter of the National Court Appointed Special Advocate (CASA) Association. CASA of Maury County supports and promotes court-appointed volunteer advocacy for abused and neglected children.

· $2,000 to God’s Storehouse, a charitable organization providing free food, clothing and medicine and helping pay rent and utility bills for those in need in Lawrence County.

· $2,000 to Kid’s Place: a Child’s Advocacy Center, which provides advocacy services and therapy to child victims of sexual and severe physical abuse in Lawrence, Giles, Maury and Wayne counties.

· $1,000 to the Horace O. Porter Scholarship Association, which provides college scholarships to Maury County high school graduates.

· $1,000 to Women Are Safe, which works to end domestic violence and aid victims of the crime.

· $8,000 to Swing for Kids celebrity golf tournament. Organized by David Weathers, F&M Lawrence County Advisory Board member, the event’s proceeds benefited children in Lawrence County.

| |

T. Randy Stevens, F&M Chairman and Joseph E. Reeves, Jr., F&M First Vice President, present F&M’s Swing for Kids donation to David Weathers, event organizer and F&M Lawrence County Advisory Board Member. | |

Marshall County Advisory Board of Directors - standing, from left: Nanette P. Todd; Herbert R. Bivens; Terry W. Jackson; Wista M. Crawford; seated from left: Robert M. Beech; Barry B. White, F&M Marshall County President; Elizabeth T. McDow.

14

| KATHY RICHARDSON Deposit Compliance Specialist Compliance Dept. | “WE BELIEVE in providing high quality services and products that meet the financial needs of our customers, because F&M customers really are the bank.” |

F&M participates in community activities… F&M retained its role as presenting sponsor of the 5th Annual First Farmers & Merchants Train Stop Storytelling Festival. Held in May, more than 3,000 people attended the event, which encourages lifelong reading and the preservation of storytelling.

F&M participated in the 2007 Mule Day Parade, in Columbia. Mr. Pettus led the way as his son, Jed Pettus, drove a tractor down the parade route pulling an F&M wagon. Employees riding in the wagon and walking along side the wagon greeted parade spectators.

| |

Trust & Financial Management Department - from left: April Bobb, Assistant Trust Officer; Stephen K. Hughes, Assistant Vice President and Trust Officer; Kim A. Boone, Vice President and Senior Trust Officer; William L. Massey, Vice President and Trust Investment Officer; Amy B. Vaught, Assistant Vice President and Trust Officer; Rick J. Mullen, First Vice President and Trust Officer; Roseann G. Williams, Vice President and Trust Officer. | |

WE BELIEVE…

EXCELLENCE THROUGH

INNOVATION

M. Harvey Church

Private Banking Department established… The department’s mission is to provide exceptional and unique access to all of the bank’s resources in order to generate, sustain and administer wealth for clients. Private Bankers are charged with developing an exclusive strategy for clients to meet their financial goals and objectives.

The new department is led by Harvey Church, who has 20 years of local banking experience. Mr. Church earned a bachelor’s degree from

15

Union University and is a graduate of Darden School of Business at the University of Virginia and the Owen Graduate School of Management at Vanderbilt University.

“This new line of business utilizes the many strengths of F&M,” said Mr. Church. “F&M Private Banking coordinates a variety of product offerings, such as trust, lending and financial management, all under one roof.”

Stacey Shedd

Joining Church is Stacey Shedd, who provides services from the Locust Avenue office in Lawrenceburg. Mr. Shedd has more than 10 years banking experience and earned degrees at Columbia State Community College, Middle Tennessee State University and the University of North Alabama.

Chief Administrative Officer Receives Bank Innovation Award… F&M recognized Mr. Tomlinson as being responsible for significant advances in the bank’s delivery of financial services to customers. As the award winner, Mr. Tomlinson selected the Maury County Library as the recipient of $1,000 to help promote its

Maury County Advisory Board of Directors – from left: M. Harvey Church, F&M Maury County Senior Banking Executive/Private Banking; Dr. Bill Thrasher; Dr. A. Lee Hunter; Emily McKnight; Jimmy Langsdon; H. Thomas Lucas; Russ Parks.

16

| JANICE ERWIN

Teller Martin House Office | “WE BELIEVE everybody is somebody and by listening and offering quality service we can form relationships that last a lifetime.” |

NetLibrary service. NetLibrary allows residents to download audiobooks, PDF versions of books and music from their home computers.

| |

John P. Tomlinson, III, F&M Chief Administrative Officer, presents F&M’s donation to the Maury County Library. Also pictured: Elizabeth Potts, Director of the Maury County Library; Adam Southern, Reference Librarian; T. Randy Stevens, F&M Chairman and CEO. | |

Daily Herald readers elect F&M… Readers of The Daily Herald once again selected F&M as having the best bank service in Maury County.

Advisory Board Member named Manufacturing Executive of the Year… Nashville Business Journal named Cordia Harrington, Founder and Chief Manager of The Bun Companies and a member of F&M’s Dickson County Advisory Board, Manufacturing Executive of the Year.

| |

Cordia Harrington, Nashville Business Journal Manufacturing Executive of the Year. | |

“Cordia exemplifies the determination, hard work and business acumen that is at the foundation of Dickson’s current success as a business and industrial center,” said Mr. Stevens. “She is a valuable member of our Dickson County Advisory Board.”

F&M employees pursue professional development… Mr. Church completed his first year at the Graduate School of Banking at Louisiana State University. Larissa H. Thomas, Retail Processing Supervisor, and Aftan G. Faulkner, Personal Banker, graduated from the Southeastern School of Consumer Credit conducted by the Tennessee Bankers Association. F&M Chief Operating Officer N. Houston Parks was awarded a professional master of banking degree from the Executive Banking Institute in Scottsdale, Ariz. Gail Tindall, F&M Chief Compliance Officer, earned a Certified Regulatory Compliance Manager certification. Only 30 people in Tennessee hold this title.

17

2007

OFFICERS

Virgil H. Moore, Jr., Senior Chairman of the Board

Waymon L. Hickman, Senior Chairman of the Board

T. Randy Stevens, Chairman of the Board and Chief Executive Officer

Timothy E. Pettus, President

N. Houston Parks, Chief Operating Officer

John P. Tomlinson, III, Chief Administrative Officer

Patricia P. Bearden, Chief Financial Officer

Brian K. Williams, Chief Credit Officer

Leslie R. Brooks, III, Executive Vice President / Commercial Sales Manager

John T. Cotham, Executive Vice President / Human Resources

Larry D. Brown, Lawrence County Senior Banking Executive

Shela D. Chessor, Hickman County Senior Banking Executive

M. Harvey Church, Maury County Senior Banking Executive / Private Banking

R. Craig Holland, Williamson County President

Marcus F. Houston, Giles County Senior Banking Executive

C. Glenn Kane, Dickson County Senior Banking Executive

Barry B. White, Marshall County President

William F. White, Jr., Williamson County Senior Banking Executive

Martha M. McKennon, Vice President and Executive Assistant

Michael L. Ayer, Senior Relationship Manager / Commercial Banking

Norma L. Aldridge, First Vice President

Jason N. Bledsoe, Credit Officer

Paul T. Butts, Jr., First Vice President and Branch Administrator

David M. Edwards, First Vice President

Linda L. Hicks, First Vice President and Director of Operations

Richard J. Mullen, First Vice President and Trust Officer

Joseph E. Reeves, Jr., First Vice President

Richard S. Sevier, First Vice President

Kim A. Boone, Vice President and Senior Trust Officer

Gail E. Tindall, Chief Compliance Officer

Richard R. Benson, Vice President

April Bobb, Assistant Trust Officer

W. Gail Cathey, Vice President

Joanna L. Chandler, Bank Manager

Robert M. Crews, Jr., Vice President

Kathleen A. Crick, Training Officer

Suzanne A. Estes, Commercial Banking Officer

Tiby C. Ferguson, Vice President / Director of Marketing

Donna C. Gandee, Vice President

Miriam T. Green, Administrative Assistant

Billy R. Harvel, Vice President

Judy M. Hickman, Assistant Branch Administrator

Stephen K. Hughes, Assistant Vice President and Trust Officer

S. Evelyn Leonard, Internal Controls Officer

R. Larry Love, Vice President and Chief Appraiser

William L. Massey, Jr., Vice President and Trust Investment Officer

Robert C. Matthews, Controller

Marie E. McGrew, Assistant Internal Controls Officer

Carol D. Messer, Branch Manager / Retail Lending

Judy M. Musgrave, Banking Officer

Linda Pearson, Vice President

Lana C. Preston, Vice President / Mortgage Underwriter

Brenda S. Risner, Assistant Vice President

Sissy Sewell, Operations Officer

Stacey C. Shedd, Vice President

Anita G. Simmons, Loan Insurance Officer

Terry D. Skillington, Assistant Vice President

Glynis D. Smith, Audit Officer / Security Officer

Carol C. Thompson, Vice President

Amy B. Vaught, Assistant Vice President and Trust Officer

Teresa L. Walker, Bank Manager

Pamela D. White, Accounting Officer

Roseann G. Williams, Vice President and Trust Officer

Julia R. Wolaver, Vice President and Office Manager

McCoy C. Zachry, Credit Officer and Manager of Special Assets

| DENIECE McCROSKEY CRS/Loan Processor Locust Avenue Office | “WE BELIEVE in building relationships that will last a lifetime.” |

18

OFFICE

DIRECTORY

Columbia |

Main Office (ATM) |

816 South Garden Street |

P.O. Box 1148 |

Columbia, TN 38402-1148 |

(931) 388-3145 |

FAX (931) 380-8359 |

Toll Free 800-882-8378 |

|

Operations Center |

201 West Eighth Street |

Columbia, TN 38401 |

(931) 388-3145 |

FAX (931) 380-8362 |

|

Campbell Plaza Off. (Kroger) (ATM) |

1202 South James Campbell Blvd. |

Columbia, TN 38401 |

(931) 380-8278 |

FAX (931) 380-8351 |

|

Hatcher Lane Office (ATM) |

1501 South James Campbell Blvd. |

Columbia, TN 38401 |

(931) 380-8260 |

FAX (931) 380-8353 |

|

High Street Drive-Through |

515 North High Street |

Columbia, TN 38401 |

(931) 380-8291 |

FAX (931) 380-8355 |

|

Northside Bank Ct. (Kroger) (ATM) |

845 Nashville Highway |

Columbia, TN 38401 |

(931) 380-8280 |

FAX (931) 380-8366 |

Drive-Through (ATM) |

857 Nashville Highway |

(931) 380-8340 |

FAX (931) 380-8363 |

|

Centerville (ATM) |

116 Church Street |

Centerville, TN 37033 |

(931) 729-3522 |

FAX (931) 729-3152 |

|

Chapel Hill (ATM) |

214 Horton Parkway North |

Chapel Hill, TN 37034 |

(931) 364-2062 |

FAX (931) 364-2082 |

Dickson |

Business Financial Center |

A branch of F&M Bank |

106 Highway 70 East, Unit #3 |

Dickson, TN 37055 |

(615) 446-6302 |

FAX (615) 446-6309 |

|

East Hickman (ATM) |

9512 Highway 46 |

Bon Aqua, TN 37025 |

(931) 670-0090 |

FAX (931) 670-3556 |

|

Franklin (ATM) |

Cool Springs Office |

9040 Carothers Parkway |

Franklin, TN 37067 |

(615) 771-6484 |

FAX (615) 771-5059 |

|

Lawrenceburg |

Locust Avenue Office (ATM) |

1501 North Locust Avenue |

Lawrenceburg, TN 38464 |

(931) 762-6490 |

FAX (931) 762-1654 |

|

Crockett Office (ATM) |

116 West Gaines Street |

Lawrenceburg, TN 38464 |

(931) 766-5650 |

FAX (931) 766-5655 |

|

Lewisburg (ATM) |

260 North Ellington |

Lewisburg, TN 37091 |

(931) 359-6222 |

FAX (931) 359-9872 |

|

Loretto (ATM) |

201 Highway 43 South |

Loretto, TN 38469 |

(931) 853-4358 |

FAX (931) 853-4029 |

|

Mt. Pleasant (ATM) |

128 North Main Street |

Mt. Pleasant, TN 38474 |

(931) 379-3292 |

FAX (931) 379-0502 |

Pulaski (ATM) |

Martin House Office |

302 South Second Street |

Pulaski, TN 38478 |

(931) 363-3830 |

FAX (931) 363-3065 |

|

Spring Hill |

Spring Hill Office (ATM) |

5398 Main Street |

Spring Hill, TN 37174 |

(931) 486-2212 |

FAX (931) 486-1033 |

Toll Free 866-727-4455 |

|

Campbell Station Office |

2035 Wall Street |

Spring Hill, TN 37174 |

(615) 302-4940 |

FAX (615) 302-4944 |

Toll Free 866-212-3499 |

|

White Bluff (ATM) |

2011 Highway 47 North |

White Bluff, TN 37187 |

(615) 797-3153 |

FAX (615) 797-4621 |

Additional ATM’s are located at: |

Maury Regional Hospital, Columbia* |

Columbia State Community College* |

Columbia Quik Mart, 1120 Hampshire Pike* |

Lawrenceburg Quik Mart, 710 East Gaines Street* |

Lawrenceburg Super Stop, 1904 West Gaines Street* |

Lewisburg On the Run Market, 1550 Franklin Pike* |

Marshall Plaza, Lewisburg |

955 Higgs Road, Lewisburg |

121 Second Avenue South, Lewisburg |

1700 West College Street, Pulaski |

Saturn Plant, Spring Hill |

Tennessee Farm Bureau Offices, Columbia |

|

|

*Cash dispenser only |

19

“WE BELIEVE”

Timothy E. Pettus

As I write these comments, I am beginning my second year as President of your bank. Words cannot describe the honor, humility and challenge I feel in this role. I certainly thank you, the shareholders, for this wonderful opportunity in my life.

2007 was a great year for our bank in many ways. While we are delighted by the earnings, we are by no means satisfied. The improved earnings were a direct result of the continued support of our customers and the hard work, positive attitudes and expertise of our bank family, coupled with new, improved methods of operation.

You’ll notice that the theme of our 2007 annual report is, “We Believe.” Believing in oneself is a building block of success. Senior management challenged the bank’s employees in 2007 to reach goals and levels of performance that may once have seemed out of reach. Yet, almost every area of bank performance was much improved, thanks to employees believing in themselves and those around them.

In 2008, this is what “We Believe” regarding this year and beyond:

“We Believe” there is still a need for banks that practice community service, rather than just talking about it.

“We Believe” in investing in and maintaining our great staff and encouraging both new employees and veterans to continue to learn and to create new opportunities within our bank.

“We Believe” that F&M must move forward and improve each year. In banking there is no standing still. New markets, new ideas and new products present great opportunities for your bank, and we intend to take full advantage of them, thanks to an innovative staff and supportive shareholders.

“We Believe” that F&M offers the last best chance to do banking right. We are blessed with nearly a century of tradition and success and have a clear picture of where we are headed in this new century.

Finally, “We Believe” that F&M has the momentum, the shareholder value and the staff to ensure and continue its position as one of the largest and best managed independent community banks in Tennessee.

Again, thank you for letting me be a part of this great banking family.

Tim E. Pettus

President

20

COMPARATIVE PERFORMANCE

Set forth below is a graph comparing the yearly change in the cumulative total shareholder return on the common stock of First Famers and Merchants Corporation (FF&M in the graph) against the cumulative total return of the S&P 500 Index *** and the S&P major Regional Bank Index ** for the period of five years commencing December 31, 2002 and ending December 31, 2007.

VALUE OF $100 INVESTED ON DECEMBER 31, 2002

| | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | |

FF&M* | | $ | 100.00 | | $ | 108.15 | | $ | 123.27 | | $ | 133.22 | | $ | 140.62 | | $ | 142.58 | |

S&P MAJOR REGIONAL BANK** | | $ | 100.00 | | $ | 135.51 | | $ | 153.12 | | $ | 154.89 | | $ | 178.27 | | $ | 138.18 | |

S&P 500 INDEX*** | | $ | 100.00 | | $ | 128.68 | | $ | 142.64 | | $ | 149.72 | | $ | 173.43 | | $ | 182.90 | |

* | Assumes that the value of the investment in FF&M was $100 on December 31, 2002, with all dividends reinvested. |

** | Assumes that the value of the investment in the index was $100 on December 31, 2002, with all dividends reinvested. |

*** | Assumes that the value of the investment in the index was $100 on December 31, 2002, with all dividends reinvested. |

21

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

Certain statements contained in this report may not be based on historical facts and are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by, among other things, the use of forward-looking terminology such as “believes,” “expects,” “forecasts,” “hopes,” “may,” “plans,” “will,” or “anticipates,” or the negatives of such terms. We caution you not to place undue reliance on such forward-looking statements in this report because results could differ materially from those anticipated as a result of a variety of factors. These forward-looking statements include, without limitation, those relating to the quality of service provided to customers, the economic conditions for loan growth, the effect of fluctuating interest rates on net interest income, changes in the balance sheet mix, the stability of market rates during 2008, capital expenditures, cash dividends, net recoveries, the adequacy of allowance for loans losses, the loan concentration, future realized assets, and expected maturity of investment securities . Factors that could affect our results include, but are not limited to, changes in economic conditions; fluctuations in prevailing interest rates and the effectiveness of our risk monitoring systems; our ability to maintain credit quality; our ability to provide market competitive products and services; laws and regulations affecting financial institutions in general; our ability to operate and integrate new technology; the effectiveness of our interest rate hedging strategies; government fiscal and monetary policies; changes in our operating or expansion strategy; changes in our assumptions or estimation methodologies; the availability of and costs associated with maintaining and/or obtaining adequate and timely sources of liquidity; limitations on our ability to pay dividends and to meet our cash obligations; assumption and judgments about the collectability of our loan portfolio; our ability to compete with other financial services companies and other factors generally understood to affect the financial results of financial services companies.

22

EXECUTIVE OVERVIEW

General

First Farmers and Merchants Corporation (the “Corporation”) was incorporated on March 31, 1982 as a Tennessee corporation. As of December 31, 2007, the only direct subsidiary of the Corporation was First Farmers and Merchants Bank (the “Bank”), which conducts the principal business of the consolidated company. The Bank was organized in 1954 as a successor to a state bank that was organized in 1909. Previously, the Bank was a national bank and on July 5, 2005, the Bank returned to being a state-chartered bank and its name changed from First Farmers and Merchants National Bank to First Farmers and Merchants Bank. The principal executive offices of the Corporation are located at 816 South Garden Street, Columbia, Maury County, Tennessee. Management of the Corporation evaluates the financial condition of the Corporation in terms of the Bank’s operations within its service area.

All dollar amounts in this report, other than per-share amounts, are in thousands unless otherwise noted.

Financial Condition

The Corporation’s assets consist primarily of its investment in the Bank and other smaller investments. Its primary activities are conducted through the Bank. The Bank is committed to providing quality services in diverse markets and a changing interest rate environment. Management hopes to provide Bank customers the quality service of a community bank and the safety and strength of a regional bank.

At December 31, 2007, the Corporation’s consolidated total assets were $823,046, its consolidated net loans were $492,762, its total deposits were $698,959 and its total shareholders’ equity was $106,244. The economic climate in the Corporation’s market area of Middle Tennessee showed stable conditions in 2007. This economic stabilization can be seen in the increase in loan volume and total deposits— net loans were up 5.7% at December 31, 2007 compared to December 31, 2006. Total deposits remained stable and total shareholders’ equity was up 2.4%. Retained earnings, capital stock and additional paid-in capital were up 0.6%.

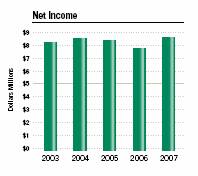

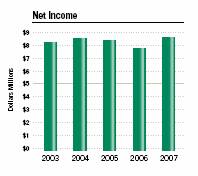

Results of Operations

Consolidated net income in 2007 was up 11.6% compared to 2006. Net interest income was down 3.5% over the same periods. Net income was $8,621 for 2007 compared to $7,725 for 2006 and $8,452 for 2005. On a per common share basis, net income was $1.51 for 2007 versus $1.33 for 2006 and $1.45 for 2005.

The accompanying tables and the discussion and financial information are presented to aid in understanding the Corporation’s financial position and results of operations. The emphasis of this discussion is on the years 2007, 2006 and 2005; however, financial information for prior years will also be presented where appropriate. This discussion should be read in conjunction with the Consolidated Financial Statements and the Notes To Consolidated Financial Statements included elsewhere in this report.

The Corporation’s financial condition depends on the quality and nature of its assets, its liability and capital structure, the market and economic conditions and the quality of its personnel.

23

Net Interest Margin

Net interest margin is defined as the difference between the revenue from earning assets, primarily interest income, and interest expense related to interest-bearing liabilities. The maintenance of the net interest margin at a level that, when coupled with noninterest revenues, exceeds additions to the allowance for loan losses, noninterest expenses and income taxes, and yields an acceptable profit is critical for success in the banking industry. Net interest margin is a function of the average balances of earning assets and interest-bearing liabilities and the yields earned and rates paid on those balances.

Operations are planned to maintain a satisfactory spread between the yields on earning assets and the related cost of interest-bearing funds. The gross interest spread is determined by comparing the taxable equivalent gross interest margin to average earning assets before deducting the allowance for loan losses. This ratio reflects the overall profitability of earning assets, including both those funded by interest-bearing sources and those that do not generate interest (primarily noninterest-bearing demand deposits). This ratio is most often used when analyzing a banking institution’s overall gross margin profitability compared to that of other financial institutions. Management uses calculations and similar ratios to assist in pricing decisions for interest-related products. Table A presents the average daily balances, the components of the gross interest margin (on a taxable equivalent basis), the yield or rate, and the incremental and gross interest spread for each of the last three years by major categories of assets and liabilities.

Table A - - Distribution of Assets, Liabilities, Shareholders’ Equity, Interest Rates and Interest Differential

| | YEAR ENDED DECEMBER 31, | |

| | 2007 | | 2006 | | 2005 | |

| | Average | | Rate/ | | | | Average | | Rate/ | | | | Average | | Rate/ | | | |

| | Balance | | Yield | | Interest | | Balance | | Yield | | Interest | | Balance | | Yield | | Interest | |

| | (Dollars In Thousands) | |

ASSETS | | | | | | | | | | | | | | | | | | | |

Interest-earning assets | | | | | | | | | | | | | | | | | | | |

Loans, net | | $ | 484,308 | | 6.76 | % | $ | 32,759 | | $ | 467,545 | | 6.80 | % | $ | 31,771 | | $ | 440,781 | | 6.27 | % | $ | 27,626 | |

Bank deposits | | 1,805 | | 3.49 | | 63 | | 138 | | 3.62 | | 5 | | 48 | | 2.08 | | 1 | |

Taxable securities | | 127,967 | | 4.27 | | 5,459 | | 165,736 | | 3.99 | | 6,605 | | 224,688 | | 3.85 | | 8,651 | |

Tax-exempt securities | | 93,380 | | 7.39 | | 6,902 | | 96,281 | | 7.49 | | 7,211 | | 72,810 | | 6.59 | | 4,799 | |

Federal funds sold | | 18,568 | | 5.06 | | 940 | | 8,798 | | 5.00 | | 440 | | 7,185 | | 3.07 | | 221 | |

TOTAL EARNING ASSETS | | 726,028 | | 6.35 | | $ | 46,123 | | 738,498 | | 6.23 | | $ | 46,032 | | 745,512 | | 5.54 | | $ | 41,298 | |

Noninterest earning assets | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | 19,827 | | | | | | 22,638 | | | | | | 25,108 | | | | | |

Bank premises and equipment | | 11,849 | | | | | | 11,544 | | | | | | 12,264 | | | | | |

Other assets | | 39,535 | | | | | | 34,793 | | | | | | 36,681 | | | | | |

TOTAL ASSETS | | $ | 797,239 | | | | | | $ | 807,473 | | | | | | $ | 819,565 | | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilites | | | | | | | | | | | | | | | | | | | |

Time and savings deposits: | | | | | | | | | | | | | | | | | | | |

NOW and money market accounts | | $ | 197,168 | | 1.09 | % | $ | 2,143 | | $ | 209,814 | | 0.88 | % | $ | 1,848 | | $ | 235,524 | | 0.66 | % | $ | 1,551 | |

Savings | | 83,916 | | 1.06 | | 893 | | 93,854 | | 0.99 | | 933 | | 107,597 | | 0.95 | | 1,027 | |

Time | | 184,272 | | 4.65 | | 8,567 | | 166,868 | | 3.91 | | 6,519 | | 161,929 | | 2.80 | | 4,533 | |

Time over $100 | | 87,055 | | 4.90 | | 4,267 | | 92,521 | | 4.37 | | 4,039 | | 79,012 | | 3.32 | | 2,626 | |

TOTAL INTEREST BEARING DEPOSITS | | 552,411 | | 2.87 | | 15,870 | | 563,057 | | 2.37 | | 13,339 | | 584,062 | | 1.67 | | 9,737 | |

Federal funds purchased and securities sold under agreements to repurchase | | 3,264 | | 4.35 | | 142 | | 8,753 | | 4.99 | | 437 | | 5,403 | | 2.81 | | 152 | |

Other liabilities | | 230 | | 4.78 | | 11 | | 257 | | 4.67 | | 12 | | 322 | | 2.80 | | 9 | |

TOTAL INTEREST-BEARING LIABILITIES | | 555,905 | | 2.88 | | $ | 16,023 | | 572,067 | | 2.41 | | $ | 13,788 | | 589,787 | | 1.68 | | $ | 9,898 | |

Noninterest-bearing liabilities | | | | | | | | | | | | | | | | | | | |

Demand deposits | | 121,318 | | | | | | 117,242 | | | | | | 115,183 | | | | | |

Other liabilities | | 13,892 | | | | | | 12,831 | | | | | | 11,637 | | | | | |

TOTAL LIABILITIES | | 691,115 | | | | | | 702,140 | | | | | | 716,607 | | | | | |

Shareholders’ equity | | 106,124 | | | | | | 105,333 | | | | | | 102,958 | | | | | |

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | | $ | 797,239 | | | | | | $ | 807,473 | | | | | | $ | 819,565 | | | | | |

Spread between combined rate earned and combined rates paid* | | | | 3.47 | % | | | | | 3.82 | % | | | | | 3.86 | % | | |

Net yield on interest-earning assets* | | | | 4.15 | % | | | | | 4.37 | % | | | | | 4.21 | % | | |

24

| * Taxable equivalent basis |

| Notes: | |

| 1. | U.S. government, government agency and corporate debt securities plus equity securities in the available-for-sale and held-to-maturity categories are taxable securities. Most municipal debt securities are nontaxable and classified as held-to-maturity. | |

| | |

| 2. | The taxable equivalent adjustment has been computed based on a 34% federal income tax rate and has given effect to the disallowance of interest expense, for federal income tax purposes, related to certain tax-free assets. Loans include nonaccrual loans for all years presented. | |

| 3. | The average balances of the amortized cost of available-for-sale securities were used in the calculations in this table. | |

25

Table B sets forth, for the periods indicated, a summary of consolidated changes in interest earned and interest paid, reflected by the interest generated by volume changes and the interest generated by changes in the yield or rate. On a tax equivalent basis, net interest income decreased $2,144 for the year ending December 31, 2007, as financial products repriced in the fluctuating rate environment. Interest paid on interest-bearing deposits was up primarily because of the higher average interest rates.

TABLE B - Volume and Yield/Rate Variances

(Taxable Equivalent Basis - In Thousands)

| | 2007 Compared to 2006 | | 2006 Compared to 2005 |

| | | | | | Net | | | | | | Net | |

| | | | Yield | | Increase | | | | Yield | | Increase | |

| | Volume | | /Rate | | (Decrease) | | Volume | | /Rate | | (Decrease) | |

Revenue earned on | | | | | | | | | | | | | |

Loans, net | | $ | 1,140 | | $ | (152 | ) | $ | 988 | | $ | 1,678 | | $ | 2,467 | | $ | 4,145 | |

Bank deposits | | 60 | | (2 | ) | 58 | | 2 | | 2 | | 4 | |

Investment securities | | | | | | | | | | | | | |

Taxable securities | | (1,507 | ) | 361 | | (1,146 | ) | (2,270 | ) | 224 | | (2,046 | ) |

Tax-free securities | | (217 | ) | (92 | ) | (309 | ) | 1,547 | | 865 | | 2,412 | |

Federal funds Sold | | 489 | | 11 | | 500 | | 50 | | 169 | | 219 | |

Total interest earning assets | | (35 | ) | 126 | | 91 | | 1,007 | | 3,727 | | 4,734 | |

Interest paid on | | | | | | | | | | | | | |

NOW and money market accounts | | (111 | ) | 406 | | 295 | | (170 | ) | 467 | | 297 | |

Savings deposits | | (98 | ) | 58 | | (40 | ) | (131 | ) | 37 | | (94 | ) |

Time deposits | | 680 | | 1,368 | | 2,048 | | 138 | | 1,848 | | 1,986 | |

Time deposits over $100,000 | | (239 | ) | 467 | | 228 | | 448 | | 965 | | 1,413 | |

Federal funds purchased and securities sold under agreements to repurchase | | (274 | ) | (21 | ) | (295 | ) | 94 | | 191 | | 285 | |

Short term debt | | (1 | ) | — | | (1 | ) | (2 | ) | 5 | | 3 | |

Total interest-bearing funds | | (43 | ) | 2,278 | | 2,235 | | 377 | | 3,513 | | 3,890 | |

Net interest earnings | | $ | 8 | | $ | (2,152 | ) | $ | (2,144 | ) | $ | 630 | | $ | 214 | | $ | 844 | |

Notes:

1. The change in interest earned or paid resulting from both volume and rate or yield has been allocated accordingly in proportion to the relationship of the absolute dollar amounts of the change in each. Loans include nonaccrual loans for all years presented.

2. The computation of the taxable equivalent adjustment has given effect to the disallowance of interest expense, for federal income tax purposes, related to certain tax-free assets.

3. U.S. government, government agency and corporate debt securities plus equity securities in the available-for-sale and held-to-maturity categories are taxable securities. Most municipal debt securities are nontaxable and classified as held-to-maturity.

26

Assets and Liabilities

Average earning assets decreased 1.7% as of December 31, 2007 compared to December 31, 2006 and decreased 0.9% as of December 31, 2006 compared to December 31, 2005. Stable local economic conditions contributed to the nominal change in average earning assets during 2007. Management of the Corporation believes that similar conditions for loan growth will continue in 2008. As a financial institution, the Bank’s primary earning asset is loans. At December 31, 2007, average net loans represented 66.7% of average earning assets. Average net loans were up 3.6% as of December 31, 2007 compared to December 31, 2006 and increased 6.1% as of December 31, 2006 compared to December 31, 2005.

Average investments, which were 33.3% of average earning assets at December 31, 2007, decreased 10.8% from year end 2006 compared to a 11.1% decrease at the end of 2006 from year end 2005. Maturing securities and other available funds were invested in loans and provided a source of funds to offset the decrease in deposits. Average total assets declined 1.3% during 2007 compared to a decrease during 2006 of 1.5%.

The Bank’s average deposits declined 1.0% as of December 31, 2007 compared to December 31, 2006 because interest rate competition increased from existing banks and non banks, including the emergence of new banking organizations in our service area. The Bank’s average deposits declined 2.7% as of December 31, 2006 compared to December 31, 2005. Interest bearing transaction accounts at December 31, 2007, were down 1.9% from the average at December 31, 2006. Time deposits under $100 increased 10.4% as of December 31, 2007 compared to December 31, 2006 and time deposits over $100 decreased 5.9% primarily because the Bank decreased its reliance on short term large dollar certificates of deposit. Average savings deposits decreased 10.6% at December 31, 2007 compared to December 31, 2006. As reflected by these changes, the Bank experienced a shift of funds by its customers out of savings deposits and into time deposits. Savings deposits have historically been steady providers of a core, low cost, source of funding.

27

Customer relationship development helped maintain a stable base in noninterest-bearing deposits during 2007. The Bank’s noninterest-bearing deposits have remained strong and were 18.0% of average total deposits at December 31, 2007, 17.2% of average total deposits at December 31, 2006 and 16.5% of average total deposits at 12/31/05. This core of noninterest-bearing funds increased 3.5% for 2007.

The Corporation and the Bank do not have any long-term debt or other obligations with the exception of certain operating leases that are discussed in Note 7 of the Notes To Consolidated Financial Statements included elsewhere in this report.

LIQUIDITY AND CAPITAL RESOURCES

The Bank uses a formal asset and liability management process to ensure adequate liquidity and control interest rate risk. The Bank’s goal of liquidity management is to provide adequate funds to meet loan demand and any potential unexpected deposit withdrawals. The Bank accomplishes this goal by striving for consistent core deposit growth, holding adequate liquid assets and maintaining unused capacity to borrow funds. The Bank’s objective of interest rate risk management is to maintain reasonable stability in the gross interest margin despite changes in the level of interest rates and the spread among interest rates.

Liquidity

At December 31, 2007, available liquidity was $244,400, including $224,800 of available credit from various sources. This is compared to $129.0 million as of December 31, 2006. The Bank’s goal of liquidity management is to provide adequate funds to meet loan demand and any potential unexpected deposit withdrawals. The Bank accomplishes this goal by striving for consistent core deposit growth, holding adequate liquid assets and maintaining unused capacity to borrow funds. The Bank’s objective of interest rate risk management is to maintain reasonable stability in the gross interest margin despite changes in the level of interest rates and the spread among interest rates.

Interest Rate Risk

The Bank uses an earnings simulation model to evaluate the impact of different interest rate scenarios on the gross margin. Each quarter, the Bank’s Asset/Liability Committee monitors the relationship of rate sensitive earning assets to rate sensitive interest-bearing liabilities (interest rate sensitivity), which is the principal factor in determining the effect that fluctuating interest rates will have on future net interest income. Rate sensitive earning assets and interest-bearing liabilities are those that can be repriced to current market rates within a defined time period. The Asset/Liability Committee measures near-term risk (within the next 12 months) to net interest income resulting from changes in interest rates. The model incorporates the Bank’s assets and liabilities, together with forecasted changes in the balance sheet mix and assumptions that reflect the current interest rate environment, to simulate the effect of possible changes in interest rates on net interest income. As a policy, budgeted financial goals are monitored on a monthly basis by the Asset/Liability Committee where the actual dollar change in net interest income, given different interest rate movements, is reviewed. A negative dollar change in net interest income for a 12-month period of less than 4.5% of net interest income given a 300 basis point shift in interest rates is considered an acceptable rate risk position. At December 31, 2007, if interest rates were to rise 300 basis points (3.0%) over the next 12 months, net interest income would be $556 less than currently projected if rates were to remain stable. This would be a decline in net interest income of 1.8%, which is within policy guidelines established by the Bank’s Board of Directors.

��

28

Another tool used to monitor the Bank’s overall interest rate sensitivity is a gap analysis. Table C shows the Bank’s rate-sensitive position at December 31, 2007, as measured by a gap analysis (the difference between the earning asset and interest-bearing liability amounts scheduled to be re-priced to current market rates in subsequent periods). Non-maturing balances such as money market, savings and NOW accounts have no contractual or stated maturities. Management has attempted to use historical data (pricing history) on these categories to best determine the impact of these non-maturing balances on the net interest margin as the interest rates change. Management anticipates rates to decrease slightly in 2008 and has determined the Bank to be in an acceptable rate risk position. Table A provides additional information regarding the largest components of interest-bearing liabilities.

TABLE C - Rate Sensitivity of Earning Assets and Interest-Bearing Liabilities |

(Dollars in Thousands)

| | Three

Months | | Three to

Six | | Six to 12 | | Over

One | | | |

As of December 31, 2007 | | or Less | | Months | | Months | | Year | | Total | |

Earning assets | | | | | | | | | | | |

Bank time deposits | | $ | 176 | | $ | — | | $ | — | | $ | — | | $ | 176 | |

Taxable investment securities | | 10,494 | | 3,688 | | 12,255 | | 118,359 | | 144,796 | |

Tax-exempt investment securities | | 2,699 | | 1,958 | | 678 | | 89,345 | | 94,680 | |

Loans and leases, net of deferred fees | | 85,518 | | 31,210 | | 62,332 | | 321,083 | | 500,143 | |

Total earning assets | | 98,887 | | 36,856 | | 75,265 | | 528,787 | | 739,795 | |

Interest-bearing liabilities | | | | | | | | | | | |

NOW and money market accounts | | — | | — | | — | | 196,723 | | 196,723 | |

Savings | | — | | — | | — | | 81,852 | | 81,852 | |

Time | | 66,996 | | 61,102 | | 38,502 | | 15,341 | | 181,941 | |

Time over $100,000 | | 53,417 | | 26,506 | | 23,848 | | 3,629 | | 107,400 | |

Federal Funds purchased and repurchase agreements | | — | | — | | — | | — | | — | |

Other short-term debt | | 3,108 | | — | | — | | — | | 3,108 | |

Total interest bearing liabilities | | 123,521 | | 87,608 | | 62,350 | | 297,545 | | 571,024 | |

Period gap | | (24,634 | ) | (50,752 | ) | 12,915 | | 231,242 | | 168,771 | |

Cumulative gap | | $ | (24,634 | ) | $ | (75,386 | ) | $ | (62,471 | ) | $ | 168,771 | | | |

| | | | | | | | | | | | | | | | |

Capital

Historically, internal growth has financed the capital needs of the Bank. The Corporation and the Bank do not have any long-term debt. The Corporation and Bank have plans for capital expenditures in the next 12 months. The Bank plans to build two branches by the end of 2008: one in Maury County and one in Williamson County.

Cash dividends declared in 2007 were 46.0% of net income compared to 50.5% for 2006. The Corporation plans to continue an average annual payout ratio over 20% while continuing to maintain a capital to asset ratio reflecting financial strength and adherence to regulatory guidelines.

At December 31, 2007, the Corporation had a ratio of Tier I Capital to average assets of 12.2%. This compares to a ratio of Tier I capital to average assets of 12.0% at December 31, 2006. This ratio change slightly because retained earnings, capital stock and additional paid-in capital were stable and average total assets declined 1.3% during 2007.

The minimum guideline for the ratio of total capital to risk-weighted assets is 8%. Tier 1 Capital generally consists of common stock. Tier I Capital must equal at least 4% of risk-weighted assets. As of

29

December 31, 2007, the Corporation’s ratios of Tier I Capital to risk-weighted assets and total Capital to risk-weighted assets were 16.9% and 18.2%, respectively. At December 31, 2006, the comparable ratios were 18.6% and 19.8%, respectively. Please refer to Note 10 in the Notes to Consolidated Financial Statements included elsewhere in this report for more information on the capital strength of the Corporation and the Bank.

The following table summarized the Corporation’s contractual obligations as of December 31, 2007:

| | Payment due by period | |

Contractual Obligations | | Total | | Less than 1

year | | 1-3 years | | 3-5 years | | More than 5

years | |

Operating Lease Obligations | | $ | 1,615 | | $ | 357 | | $ | 537 | | $ | 487 | | $ | 234 | |

| | | | | | | | | | | | | | | | |

Loans and Loan Quality

As with most commercial banking institutions, the Bank’s loan portfolio is the largest component of earning assets and, therefore, provides the highest amount of revenue. The loan portfolio also contains, as a result of credit quality, the highest exposure to risk. When analyzing potential loans, management assesses both interest rate objectives and credit quality objectives in determining whether to make a given loan and the appropriate pricing for that loan. The Bank maintains a diversified portfolio in order to spread its risk and reduce its exposure to economic downturns that may occur in different segments of the economy or in particular industries. As of December 31, 2007, total loans maturing and repricing after one year that have predetermined interest rates and floating or adjustable interest rates are $294 million and $59 million, respectively. The composition of the loan portfolio is disclosed in detail in Note 3 in the Notes to Consolidated Financial Statements included elsewhere in this report.

The lending activities of the Bank are subject to written underwriting standards and policies established by the Bank’s Board of Directors and management that include loan review procedures and approvals. Applications for loans are taken by designated employees at 13 of the Bank’s offices. Depending primarily on the amount of the loan, there are various approval levels required, including an Executive Committee of the Bank’s Board of Directors that meets weekly.

The Bank has a credit administration function that is responsible for assisting loan officers in underwriting new loans, reviewing problem loans, monitoring the status of problem loans from period to period and assisting in their resolution. This review process also includes semi-annual reviews by an outside party to assess the quality of the loan portfolio independently. Management has concluded that this independent review has served to strengthen underwriting practices. The analysis and review by the Bank’s credit administration department also include a formal review that is prepared quarterly to assess the risk in the loan portfolio and to determine the adequacy of the allowance for loan losses. Loan reviews of all relationships aggregating $250 and greater are completed on an annual schedule. At December 31, 2007 loans totaling $8.2 million, or 1.7% of the portfolio, were classified as other assets especially mentioned. This compares to loans totaling $11.4 million so classified at December 31, 2006. There were no loans classified as doubtful at December 31, 2007 and December 31, 2006. The bank closed the year with $7.4 million in classified assets, which includes substandard loans, doubtful loans and Other Real Estate Owned (“OREO”). This represents a increase of $1.8 million or 32.1% from December 31, 2006. Classified assets represented 7.2% of Tier I Capital and ALLL, which was up from 5.3% at 12/31/06 and below the Bank’s objective of 12.0%. For most of 2007, delinquency levels remained below the year-end level of 1.2% and well below both the Bank’s target level of 12% and peer group average. Loans that are impaired and not accruing interest were more actively monitored to determine those for which more aggressive action plans should be taken. The Bank ended 2007 with a net recovery of $119, for a net recovery percentage of

30

0.02%. The Bank does not expect to sustain a prolonged period of net recoveries, although this marks the third consecutive year in which a net recovery has been recorded. The Bank’s charge-off levels continue to track below the Bank’s target level of 0.25% and its peer group average of 0.12%. Management believes that the allowance for loan losses was adequate at December 31, 2007.

Table D summarizes average loan balances and reconciles the allowance for loan losses at December 31, 2003, 2004, 2005, 2006 and 2007. Additions or reductions to the allowance, which have been included in operating expenses, are also included. First mortgage loans secured by one to four-family residential properties make up 37.1% of the total loan portfolio. The Bank continues to have a concentration in residential mortgage loans; however, management of the Bank remains comfortable with this concentration of loan type given the strong underwriting practices within this portfolio and the acceptable level of historical losses. The environment for commercial, industrial and commercial real estate lending remains largely unchanged in the seven counties within which the Bank operates. The Bank does not have any industry concentrations as measured by regulatory guidelines. However, the Bank does have heavy exposure among five broad industry categories– construction, manufacturing, real estate rental and leasing, other services, and public administration. Given the level of exposure in each of these categories, the particular industries are monitored closely to ensure that underwriting practices and policies, as well as allowance levels, match the level of risk posed. For more information about the Bank’s loan concentration, please refer to Note 1 in the Notes to Consolidated Financial Statements included elsewhere in this report.

Loans having recorded investments of $2.3 million and $2.0 million at December 31, 2007 and 2006, have been identified as impaired and are not accruing interest in accordance with the provision of Statement of Financial Accounting Standards No. 114 (“SFAS 114”), “Accounting by Creditors for Impairment of a Loan.” These types of loans are considered nonaccrual loans and represent 0.5% and 0.4% of gross loans as of December 31, 2007 and 2006, respectively. Interest received on these loans during 2007 was $135, during 2006 was $122, and during 2005 was $136. The gross interest income that would have been recorded if the loans had been current in accordance with their original terms and had been outstanding throughout the period or since origination, if held for part of the period, was $228, $200, and $251 for the years ended December 31, 2007, 2006, and 2005, respectively. The Bank has no loans that are past due 90 days or more and no “troubled debt restructurings” as defined in SFAS 15 that are not included in nonaccrual loans as of December 31, 2007 and 2006. Please refer to Note 1 and Note 3 in the Notes to Consolidated Financial Statements that are included elsewhere in this material for more information on the Bank’s policy regarding loan impairment.

31

TABLE D – The Loan Portfolio

(Dollars In Thousands) | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| | | | | | | | | | | |

Average amount of gross loans outstanding | | $491,627 | | $475,226 | | $448,868 | | $428,671 | | $456,187 | |

| | | | | | | | | | | |

Balance of allowance for possible loan losses at beginning of year | | 7,262 | | 7,794 | | 8,509 | | 10,123 | | 11,375 | |

| | | | | | | | | | | |

Loans charged off | | | | | | | | | | | |

Loans secured by real estate | | 42 | | 207 | | 287 | | 364 | | 958 | |

Commercial and industrial loans | | — | | 94 | | 138 | | 1,017 | | 296 | |

Loans to individuals | | 115 | | 62 | | 126 | | 299 | | 712 | |

TOTAL LOANS CHARGED OFF | | 157 | | 363 | | 551 | | 1,680 | | 1,966 | |

Recoveries of loans previously charged off | | | | | | | | | | | |

Loans secured by real estate | | 51 | | 110 | | 555 | | 187 | | 22 | |

Commercial and industrial loans | | 155 | | 92 | | 73 | | 259 | | 67 | |

Loans to individuals | | 70 | | 265 | | 98 | | 297 | | 192 | |

TOTAL RECOVERIES | | 276 | | 467 | | 726 | | 743 | | 281 | |

| | | | | | | | | | | |

NET LOANS CHARGED OFF | | (119 | ) | (104 | ) | (175 | ) | 937 | | 1,685 | |

| | | | | | | | | | | |

Provision (reduction) charged (credited) to operating expenses | | — | | (636 | ) | (890 | ) | (677 | ) | 433 | |

| | | | | | | | | | | |

BALANCE AT END OF YEAR | | $7,381 | | $7,262 | | $7,794 | | $8,509 | | $10,123 | |

Ratio of net charge-offs during the period to average gross loans outstanding | | (0.02 | )% | (0.02 | )% | (0.04 | )% | 0.22 | % | 0.37 | % |

Interest Income

Total interest income increased 3.0% during 2007 due to the increased volume in loans. Interest and fees earned on loans was 76.1% of gross interest income during 2007 and increased 6.4% in 2007 compared to 2006 as a result of the financial products repricing and loan volume increasing throughout the year. Interest and fees earned on loans increased 6.4% during 2007 compared to 2006 as a result of higher yields and increasing loan volume. Interest earned on securities and other investments was 23.9% of gross interest income during 2007 and was down 6.6% from 2006 primarily because of the decrease in volume.

Interest Expense

Total interest expense increased 16.2% during 2007, compared to a 39.3% increase during 2006, and a 16.6% increase during 2005. Increases in the average interest rate paid on interest bearing liabilities contributed to the higher interest expense. The cost of interest-bearing deposits is monitored quarterly by the Bank’s Asset/Liability Committee. The net interest margin (tax equivalent net interest income divided by average earning assets) was 4.15%, 4.37% and 4.21% for years ending December 31, 2007, 2006, and 2005, respectively.

Net interest income on a fully taxable equivalent basis is influenced primarily by changes in: (i) the volume and mix of earning assets and sources of funding; (ii) market rates of interest; and (iii) income tax rates. The impact of some of these factors can be controlled by management policies and actions. External factors can also have a significant impact on changes in net interest income from one period to another. Some examples of such factors are: (i) the strength of credit demands by customers; (ii) Federal Reserve Board monetary policy; and (iii) fiscal and debt management policies of the federal government, including changes in tax laws.

32

Noninterest Income and Expenses

Noninterest income increased 4.2% during 2007. There was no gain on sale of available-for-sale securities in 2007, whereas 2006 reflected a $51 gain. Income from fiduciary services offered in the Bank’s Trust department was up 12.9%, representing 22.3% of total noninterest income. Noninterest income decreased 0.4% during 2006 and decreased 1.3% during 2005.

Noninterest expenses, excluding the provision for possible loan losses, decreased 6.7% during 2007. Decreases in salaries and employee benefits contributed to this decrease. Noninterest expenses, excluding the provision for possible loan losses, increased 2.2% during 2006. Noninterest expenses increased 1.8 % during 2005.

Net Income

Net income was 11.6% higher in 2007 than in 2006. The increase in loan volumes, decrease in salaries and employee benefits, and decrease in deposit rates were primary reasons for the increase. Net income was 8.6% lower in 2006 than in 2005. The increase in interest expense was a primary reason for the decline.

33

OFF-BALANCE SHEET ARRANGEMENTS

As of December 31, 2007, the Bank was a party to financial instruments with off-balance-sheet risk in the normal course of business to meet the financing needs of its customers. These financial instruments include commitments to extend credit and standby letters of credit. Please refer to Note 9 of the Notes to Consolidated Financial Statements included elsewhere in this report for more information on the Bank’s commitments and contingencies. Please refer to Table C under the heading “Liquidity and Capital Resources” for a summary of our earning assets and interest-bearing liabilities by maturities that are included in the Consolidated Balance Sheet.

IMPACT OF RECENTLY ISSUED ACCOUNTING STANDARDS ON THE FINANCIAL STATEMENTS

In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 157 (FAS-157), Fair Value Measurements. FAS-157 defines fair value, establishes a framework for measuring fair value in accordance with general accepted accounting principles, and expands disclosures about fair value measurements. The provisions of FAS-157 are effective for the Corporation for fiscal years beginning after November 15, 2007.

In February 2007, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 159 (FAS-159), The Fair Value Option for Financial Assets and Financial Liabilities – Including an Amendment of FASB Statement No. 115. The fair value option established by FAS-159 permits all entities to choose to measure eligible items at fair value at the specified election dates. A business entity will report unrealized gain and losses on items for which the fair value option has been elected in earnings at each subsequent reporting date. FAS-159 is effective for the Company for fiscal years beginning after November 15, 2007. Management chose not to utilize this option for 2007.

In December 2007, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards No. 160 (FAS-160), Noncontrolling Interests in Consolidated Financial Statements – An amendment of ARB No. 51. FAS-160 establishes new accounting and reporting standards for a parent company’s noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. Specifically, this statement requires the recognition of a noncontrolling interest (minority interest) as equity in the consolidated financial statements, which is reported separate from the parent’s equity. The amount of net income attributable to the noncontrolling interest will be included in consolidated net income on the face of the income statement. FAS-160 clarifies that changes in a parent’s ownership interest in a subsidiary, which do not result in deconsolidation, are equity transactions if the parent retains its controlling financial interest. In addition, this statement requires that a parent recognize a gain or loss in results of operations when a subsidiary is deconsolidated. Such gain or loss will be measured using the fair value of the noncontrolling equity investment at the deconsolidation date. FAS-160 is effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008. Management is currently evaluating the impact, if any, of the adoption of these pronouncements on the financial statements.