Letter to Shareholders

November 11, 2019

| Re: | Brinker International, Inc. |

Annual Meeting of Shareholders – November 20, 2019

Proposal 3 - Advisory Vote to Approve Executive Compensation

Dear Shareholder:

We are writing to ask for your support by voting in accordance with the recommendations of the Board of Directors of Brinker International, Inc. (“Brinker or the “Company”) on all of the proposals included in our Proxy Statement, which was filed on October 4, 2019.In particular, we are requesting your support on Proposal 3 – the annual advisory vote to approve the compensation paid to our Named Executive Officers (referred to as the “Say on Pay” Proposal).As described in our Proxy Statement and below, we believe our fiscal 2019 executive compensation program reinforces and aligns with our operational and financial performance and is in the best interests of the Company’s shareholders.

Brinker Achieved Solid Financial Results in 2019

Brinker had a fantastic 2019 fiscal year, with sales and traffic significantly outperforming the industry, double digit growth in earnings per diluted share, and improvement in all of our primary guest metrics. In particular:

| | • | | Earnings per diluted share, on a GAAP basis, increased 45.6% to $3.96 compared to $2.72 in fiscal 2018. |

| | • | | Same store sales for the company increased 2.1%, which included a 2.3% increase at Chili’s Grill & Bar and a 0.6% increase at Maggiano’s Little Italy. Sales growth at Chili’s primarily grew because of a 2.3% increase in guest traffic. |

| | • | | The company paid $1.52 per share in dividends in fiscal 2019. |

| | • | | The company completed the sale and leaseback of 152 restaurants for gross proceeds of approximately $495 million and net proceeds of approximately $407 million. |

| | • | | The company repurchased $167.7 million in shares in fiscal 2019. |

| | • | | The company reduced its long-term debt by approximately $291 million. |

| | • | | The company invested approximately $168 million in capital expenditures, which included reimaging more than 200 Chili’s restaurants. |

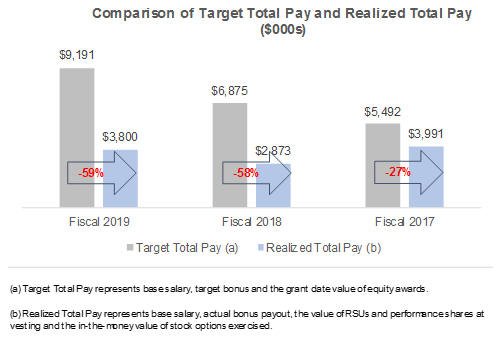

Executive Compensation Is Directly Linked to Actual Performance

As a result of performance above expectations, our executives achieved a payout of 158.9% of target under the Brinker Profit Sharing Plan.Two-thirds of the payout of the Brinker Profit Sharing Plan is based on achievement of an Adjusted Net Income target. The Adjusted Net Income target for fiscal 2019 was set by the Compensation Committee at $161.8 million, which was $7.1 million lower than the fiscal 2018 target. The Compensation Committee believed it was appropriate to set a lower Adjusted Net Income target for fiscal 2019 as compared to fiscal 2018 in light of the impact to Adjusted Net Income of the Company’s sale leaseback transactions. The sale leaseback transactions unlocked significant value from the Company’s real estate holdings, but resulted in increases to our rent expense, with $30.4 million of additional rent expense in fiscal 2019 as compared to fiscal 2018. The Compensation Committee took into account this significant increase in rent expense in establishing the Adjusted Net Income target for fiscal 2019 at a level that was lower than the target for fiscal 2018. It should also be noted that the significant gain from the sale leaseback transactions was not included in the Adjusted Net Income achievement. By setting a lower Adjusted Net Income target to account for the additional rent expense and by excluding gains from the sale leaseback transactions, the Compensation Committee neutralized the impact of the sale leaseback transactions and maintained an effective Brinker Profit Sharing Plan target that motivated executives to achieve great results for shareholders.

In addition to Adjusted Net Income,one-third of the payout of the Brinker Profit Sharing Plan was based on two equally weighted KPIs: comparable same-restaurant sales and guest feedback scores on food quality at Chili’s. The target for comparable same-restaurant sales for fiscal 2019 was 2.0%, with actual achievement at 2.1%. The target for Food Great scores under the Company’s scoring methodology for fiscal 2019 was 64.5, with actual achievement at 66.0. The Compensation Committee believes that the targets set with respect to these metrics for fiscal 2019 appropriately incentivized performance.

Performance-Based Stock Options Provide Appropriate Incentives to CEO

The Company consistently uses stretch goals for its performance-based compensation. As previously disclosed, in August 2017, the Company approved the grant of 500,000 Performance-Based Options to the Company’s CEO, Mr. Roberts. These options were granted to incentivize significant growth in