As filed with the Securities and Exchange Commission on August 26, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3489

THE WRIGHT MANAGED EQUITY TRUST

440 Wheelers Farm Road

Milford, Connecticut 06461

Christopher A. Madden

Three Canal Plaza, Suite 600

Portland, ME 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2010 – June 30, 2010

| ITEM 1. | REPORT TO STOCKHOLDERS. |

THE WRIGHT MANAGED BLUE CHIP INVESTMENT FUNDS

SEMI-ANNUAL REPORT

June 30, 2010

THE WRIGHT MANAGED EQUITY TRUST

| | • | | Wright Selected Blue Chip Equities Fund |

| | • | | Wright Major Blue Chip Equities Fund |

| | • | | Wright International Blue Chip Equities Fund |

THE WRIGHT MANAGED INCOME TRUST

| | • | | Wright Total Return Bond Fund |

| | • | | Wright Current Income Fund |

The Wright Managed Blue Chip Investment Funds

The Wright Managed Blue Chip Investment Funds consist of three equity funds from The Wright Managed Equity Trust and two fixed income funds from The Wright Managed Income Trust. Each of the five funds have distinct investment objectives and policies. They can be used individually or in combination to achieve virtually any objective. Further, as they are all “no-load” funds (no commissions or sales charges), portfolio allocation strategies can be altered as desired to meet changing market conditions or changing requirements without incurring any sales charges.

Approved Wright Investment List

Securities selected for investment in these funds are chosen mainly from a list of “investment grade” companies maintained by Wright Investors’ Service (“Wright” or the “Adviser”). Over 31,000 global companies (covering 63 countries) in Wright’s database are screened as new data becomes available to determine any eligible additions or deletions to the list. The qualifications for inclusion as “investment grade” are companies that meet Wright’s Quality Rating criteria. This rating includes fundamental criteria for investment acceptance, financial strength, profitability & stability and growth. In addition, securities, which are not included in Wright’s “investment grade” list, may also be selected from companies in the fund’s specific benchmark (up to 20% of the market value of the portfolio) in order to achieve broad diversification. Different quality criteria may apply for the different funds. For example, the companies in the Major Blue Chip Fund would require a higher Investment Acceptance rating than the companies in the Selected Blue Chip Fund.

Three Equity Funds

Wright Selected Blue Chip Equities Fund (WSBC) (the Fund) seeks to enhance total investment return through price appreciation plus income. The Fund’s portfolio is characterized as a blend of growth and value stocks. The market capitalization of the companies is typically between $1-$10 billion at the time of the Fund’s investment. The Adviser seeks to outperform the Standard & Poor’s 400 Index (S&P 400) by selecting stocks using fundamental company analysis and company specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries and sectors.

Wright Major Blue Chip Equities Fund (WMBC) (the Fund) seeks to enhance total investment return through price appreciation plus income by providing a broadly diversified portfolio of equities of larger well-established companies with market values of $10 billion or more. The Adviser seeks to outperform the Standard & Poor’s 500 Index (S&P 500) by selecting stocks, using fundamental company analysis and company specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries and sectors.

Wright International Blue Chip Equities Fund (WIBC) (the Fund) seeks total return consisting of price appreciation plus income by investing in a broadly diversified portfolio of equities of well-established, non-U.S. companies. The Fund may buy common stocks traded on the securities exchange of the country in which the company is based or it may purchase American Depositary Receipts (ADR’s) traded in the United States. The portfolio is denominated in U.S. dollars and investors should understand that fluctuations in foreign exchange rates may impact the value of their investment. The Adviser seeks to outperform the MSCI Developed World ex U.S. Index by selecting stocks using fundamental company analysis and company-specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries, sectors and countries.

(continued on inside back cover)

Table of Contents

FINANCIAL STATEMENTS

1

Letter to Shareholders

July 2010

Dear Shareholders:

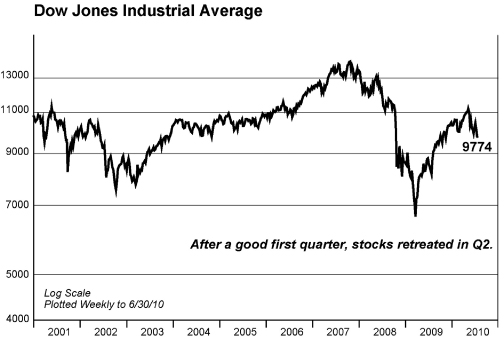

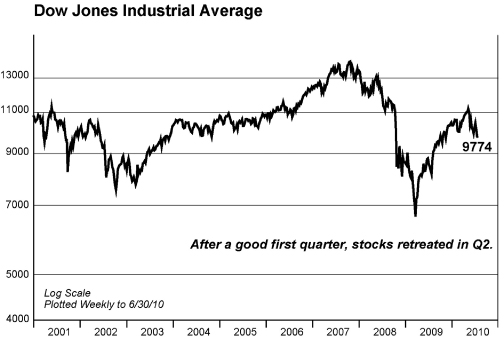

After the steep downtrend of 2008 and the nearly-as-steep rebound of 2009, 2010 is proving to be a mix of both up and down for the stock market. Following a generally satisfactory opening quarter, the second quarter of 2010 saw global stock market averages correct lower, leaving U.S. stocks down about 7% for the first half. Japan and other Asian markets also suffered corrections in the second quarter and their first-half declines were mostly of a kind with those in North America. The exceptional region in 2010 has been Europe, where returns were negative in both first and second quarters in both local currency and (especially) U.S. dollar terms. Emerging markets have held up to the selling pressures reasonably well with the notable exception of Shanghai, where prices have declined roughly 25% this year. The possibility that Shanghai might be the “canary in the coal mine” has added to global market anxiety, particularly given signs that China’s growth engine may be starting to sputter.

European sovereign debt woes have been the major theme in 2010’s markets. Markets have become increasingly concerned that Europe’s debt growth is out of control or alternately that getting it under control will tip Europe’s sluggish economic recovery back into recession. Speculation that one of the Euro nations might default, a possibility that, according to trading in credit default swaps, grew more likely over the course of the second quarter, sent the euro down roughly 9% against the dollar during Q2 (and 15% for the first half). Against Asian currencies, the dollar was mixed during the second quarter, losing ground vis-a-vis the yen and appreciating against other Asian currencies. Interbank financial tensions increased a bit during Q2, but liquidity measures are nowhere near the levels they got to in the panic of 2008.

The U.S. economy expanded at a 2.4% annual rate in Q2, and leading indicators point to a continuation of modest growth for the rest of 2010. Revised figures show that U.S. real GDP increased at a 3.7% annual rate in the March 2010 quarter. Consumer spending on goods has largely been up to expectations, which is why manufacturing has had a more V-shaped recovery than other economic sectors. But spending on consumer services, which is nearly 50% of GDP, has failed to reach even a 1% growth rate since March of 2008. A positive swing in business inventories has boosted GDP growth, although this effect has been offset to some extent by a worsening foreign trade account. Growth in both GDP and final sales of domestic product has been lackluster as compared with the growth rates seen in previous important economic cycles. While disappointing, the recent downdraft in economic momentum is not, in our view, the start of the dreaded double dip, which we continue to rate a less than 25% probability.

The first week of July brought reports on manufacturing and employment that showed an economy whose growth is being constrained by increasing savings rates and the ongoing repair of consumer finances. Federal Reserve figures released in June showed that the economy’s private sector continued to reduce its debt in the March quarter, even as government credit expanded at an annual rate of 16%. The U.S. personal saving rate rose to 6.4% in June, the highest rate in a year, suggesting that consumers remain skeptical that all of the stimulus will produce the economic growth and job opportunities as advertised. For much of the past three decades, it was difficult to overestimate the spending power of the U.S. consumer; now, the soft tone of retail sales and the big drop in the Conference Board’s consumer confidence index suggest that consumers have finally met their match in the jobless economic recovery engineered by Congress and the Federal Reserve.

On the bright side, corporate profits increased significantly in the latest quarter despite the downward shift in economic growth. Pretax profits from current production rose a revised 38% in 2010’s first quarter, the second quarter in a row with year-over-year growth greater than 35%. Pretax earnings were equal to 12.7% of GDP, the highest profit margin since before the recession began in late 2007. The Q2 profit tally of S&P 500 companies’ earnings shows actual earnings topping analysts’ estimates by 10%, according to Bloomberg, after Q1 results beat estimates by a whopping 14%. While these measures of profitability are impressive, we suspect that a more balanced mix of corporate profits and personal income would be more conducive to sustained economic expansion. Another noteworthy aspect of the second quarter’s profit report was the 1% year-on-year increase in corporate dividends, which we take to mean that, after eight quarters of decline, firms’ boards are no longer trying to shore up balance sheets at the expense of dividends.

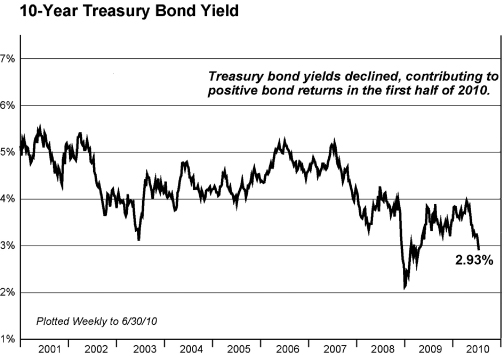

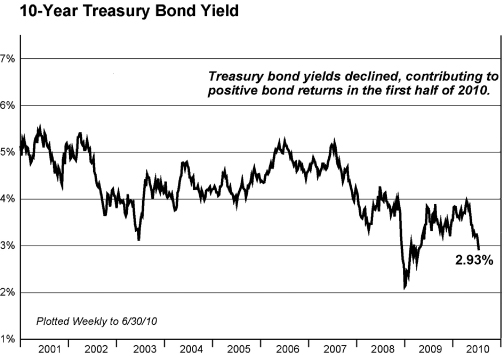

2

Inflation continues to register only a low-level threat for the near term, and the Federal Reserve’s two policy meetings of the second quarter left the Fed’s target for overnight interest rate essentially at zero. Inflation readings remain extremely tame, so much so that the prospect of deflation occasionally rears its head. Over the past six months, the CPI has registered an inflation reading of 0.3%; the core CPI rate (ex food and energy) has been just 0.4%. Long-term inflation expectations, as reflected in the market for nominal and real 10-year Treasury notes, have fallen over 50 basis points since the April high of 2.4% to 1.9% as June was ending.

With inflation expectations muted, the U.S. bond market, as measured by the Barclays U.S. bond market aggregate, produced a better-than-3% return in the second quarter; the aggregate’s 5% return for the first half of 2010 exceeded our full-year target for bond returns. The Treasury yield curve declined broadly during the second quarter: the 10-year Treasury yield declined about 90 basis points and two-year T-note yield fell 40 bps. Since its peak of nearly three percentage points in February, the twos/tens Treasury yield curve has flattened by more than half a percentage point. Concerns about the safety of European sovereign debt in a slowing global economic recovery produced a flight from risk to the presumed safety of Treasury securities and the dollar. Looking forward, it is difficult to see merit in low-yield Treasury securities except under dire economic conditions; assuming even a moderately respectable global recovery stays on track, aggregate bond returns may be only slightly positive over the next two years, with coupon income and a resumption of spread tightening offsetting higher Treasury yields.

The long-awaited stock market correction has arrived, allowing earnings and economic growth a chance to catch up with last year’s stock price advance. The S&P 500’s pullback since its late-April high reached 15% as the second quarter came to a close. Considering that its rise over the March 2009 to April 2010 rally was 80%, steepest 13-month rebound since the 1930s, the magnitude of the current correction isn’t out of the ordinary. With stock prices at only 12 times forecast earnings (S&P 500), we continue to regard stock prices as attractive, provided that the current economic slowdown is, like the one experienced in 2003, just a temporary interruption of an economy gathering momentum. We take encouragement from the fact that high-quality stocks and investment-grade bonds have held up better in the market correction than their lower-quality counterparts. If you have any questions or suggestions on how we can better serve your investment and wealth management needs, please let us know.

Sincerely,

Peter M. Donovan

Chairman & CEO

3

Management Discussion

Equity Funds

The first half of 2010 was a mix of up and down for the stock market. After rising without interruption for more than a year, stocks reversed course in the second quarter of 2010. European sovereign debt woes appeared to be the trigger for the stock market correction. After a recovery that had stocks up 80% from the March 2009 low to the April 2010 peak, a correction was probably overdue. But even if it wasn’t entirely unexpected, the correction was accompanied by an increase in investor anxiety. Investors have become increasingly concerned that getting Europe’s debt under control will seriously dampen the region’s economic growth. As the Fed noted after its June policy meeting, “Financial conditions have become less supportive of growth on balance, largely reflecting developments abroad.” In addition to a worsening of Europe’s debt issues, the second quarter brought signs of a slowdown in economic momentum in the U.S. The recoveries in jobs and consumer spending have been lackluster at best, and with the expiration of the home buyers’ tax credit, the recovery in housing appears to have stalled. The good news has come from manufacturing and corporate profits. Inflation remains tame, a positive to be sure but also an indication that growth is less than robust.

On a total return basis, the S&P 500 lost 11.4% in the quarter, more than erasing its first-quarter gain of 5.4% to put it down 6.7% year to date. The S&P 500’s pull back from its late April high reached 15% as the second quarter came to a close. Over the course of the second quarter, expectations for year-ahead earnings edged slightly lower, but the bulk of the S&P 500’s retreat came from a contraction in its P/E multiple (a proxy for investor confidence) by more than two points, to under 12 times earnings. Nasdaq’s returns for the quarter and the first half of 2010 were similar to the S&P 500’s, while the Dow Jones Industrials’ were just a little better — losses of 9.4% for Q2 and 5.0% for the half. Investors showed some preference for the higher quality stocks within the S&P 500 in the second quarter, but somewhat contrarily they also favored the S&P MidCap 400 and SmallCap 600 over the big-cap S&P 500. The MidCaps lost 9.6% in Q2 and 1.4% for the first half of 2010, while the SmallCap index lost 8.7% for the quarter and less than 1% for the six months. In the first half of 2010, international stocks lagged U.S. equities: the MSCI World ex U.S. index lost 12.5% in dollar terms in the first six months of the year, with a 13.6% loss in Q2 offsetting a modestly positive first half return. In the aggregate, the dollar returns were depressed by the appreciation of the dollar against the currencies represented in the index, with the Euro particularly weak with a 15% loss against the dollar in the first half of the year.

The U.S. economy probably expanded at a 3%-3.5% annual rate in Q2, and leading indicators point to a continuation of modest growth for the rest of 2010. While disappointing, the recent loss of economic momentum will not turn into a new recession in our view. Growth will continue to be limited by cautious spending by consumers. Slow jobs growth, depressed home values and two bear markets in 10 years have consumers concentrating on improving their balance sheets. Even so, there is enough momentum from stimulus spending to keep the recovery going, and we see exports as a plus also. Even with lackluster GDP growth, we expect a solid increase in corporate profits over the next 12 months. Cost reduction efforts are enabling companies to take full advantage of even modest sales growth. With the S&P 500’s P/E at 12 times year-ahead earnings, stocks have priced in much of the risk in the near-term environment, so long as the current slowdown does not turn into something worse. Even if P/E’s remain at these levels, earnings growth alone could make for attractive returns from equities over the coming 12 months. In the shorter-term, however, the increased investor anxiety evident in the second quarter may persist for a while, keeping stocks volatile.

Major Blue Chip Fund

The Wright Major Blue Chip Fund (WMBC) is managed as a blend of the large-cap growth and value stocks in the S&P 500 Composite, selected with a bias toward the higher-quality issues in the index. The WMBC Fund lagged the S&P 500 slightly in the first half of 2010 with a loss of 7.9% compared to a 6.7% loss for the benchmark. After matching the S&P 500’s 5.4% return in the first quarter, the WMBC Fund lost 12.7% in Q2 compared to the S&P 500’s 11.4% loss.

In the first quarter of 2010, WMBC’s emphasis on quality worked against it as investors continued to prefer low-quality issues; however, this was offset by superior stock selection in seven of 10 industry sectors. In the second quarter of the year, increased uncertainty about the economy appeared to send investors back to quality. Investors also preferred more defensive industry sectors in the quarter. Being underweight in utilities, telecom and

4

consumer staples, which were the S&P 500’s best-performing groups (i.e., they had the smallest losses) hurt the relative performance of the Fund. This was partially offset by strong stock selection in such cyclical groups as consumer discretionary, technology and materials. In addition, WMBC took a cash reserve position of about 5% during the second quarter as a response to the more uncertain outlook for equities; this reserve position was a plus for quarterly performance. Looking at individual securities, Apple Computer, D.R Horton, Dover and Family Dollar Stores were among the biggest positive contributors to the Fund’s performance in both the second quarter and first half of 2010. For the quarter and the half, tech stocks Hewlett Packard and Oracle detracted from performance; in the second quarter, General Electric was also a laggard.

Going into the second half of 2010, WMBC was maintaining its modest cash reserve position. However, we expect that equities will continue to be supported by solid profit growth; technology stocks in particular look attractive in terms of potential earnings and current valuations. In addition, corporations have accumulated significant cash on their balance sheets, setting the stage for possible stock buybacks and dividend increases. WMBC is well positioned to take advantage of an environment in which stock performance is driven by fundamentals, with its bias toward the higher-quality and more substantial issues in the S&P 500 and an attractive valuation. As the second half of 2010 got underway, WMBC holdings in the aggregate were priced at lower current and forward P/E multiples than the S&P 500 despite better historical earnings growth and similar forecast earnings growth.

Selected Blue Chip Fund

Mid-cap stocks have continued their comparatively strong performance of 2009 into 2010: the S&P MidCap 400 outperformed the S&P 500 in the first half of 2010 with a loss of 1.4% compared to the 500’s 6.7% loss. The Wright Selected Blue Chip Fund (WSBC) lost 1.7% in the first half of 2010 compared to a 1.4% loss for the S&P MidCap 400 benchmark. In the first quarter of the year, the WSBC Fund was ahead of the benchmark with a 9.4% gain compared to 9.1%, but the Fund’s second quarter loss of 10.1% was slightly worse than the benchmark’s 9.6% loss.

In the first quarter of 2010, strong stock selection, particularly in the health care, materials, and consumer discretionary groups, accounted for WSBC’s outperformance compared to the S&P MidCap 400. In Q2, stock selection accounted for the bulk of the WSBC Fund’s downside divergence from its benchmark, particularly in the industrial sector. Partially offsetting this was strong stock selection in information technology. Sector positioning had a smaller impact for both periods. Being underweight in utilities was positive in Q1 but negative in Q2 as investors became more defensive. The Fund’s overweight position in consumer discretionary stocks was also negative in Q2. A cash reserve position taken in the second quarter as market sentiment turned negative benefitted performance. Among individual holdings, positive contributors in the second quarter and the first half of 2010 were technology company Sybase, Cimarex Energy and healthcare company Lincare Holdings; laggards included tech stock Avnet, energy company Oceaneering International and retailer American Eagle.

In the second quarter of 2010, investors shifted toward a preference for quality stocks, which we expect will continue in the uncertain environment of the second half. The WSBC Fund is positioned in the mid-cap universe to take advantage of a preference for quality. WSBC continues to be biased to the larger companies in the index and its holdings have better historical earnings growth than the index constituents. In the aggregate, WSBC stocks had lower current and forward P/E multiples than those in the MidCap 400 with slightly better expected earnings growth. WIS continues to advise diversity in investment portfolios as the best way to navigate difficult economic times.

International Blue Chip Fund

The MSCI World ex U.S. Index lagged the S&P 500 in the first half of 2010 with a 12.5% loss in dollars compared to a 6.7% loss for the S&P 500. The Wright International Blue Chip Fund (WIBC) lagged the MSCI benchmark in the first half of the year with a loss of 15.5%. In the first quarter WIBC had a slightly smaller gain (0.8%) than the MSCI index (1.4%), while in the second quarter its 16.2% loss was larger than the benchmark’s 13.6% shortfall.

In the first quarter of 2010, WIBC was helped by being overweight in the strong industrial sector and good stock selection in materials; but these positives were offset by unfavorable stock selection in a number of other sectors.

5

In the second quarter, WIBC was negatively affected by a lagging performance in its industrial company holdings in Japan, which were affected by concerns about slowing growth in China. Additionally, holdings of mining companies in Australia were affected by a proposed new mining tax. (The proposal has since been modified to be less burdensome.) There was also some weakness in European financial stock holdings in Q2; the companies have been reviewed and found to be in sound condition. On the plus side was the positive effect of a cash reserve position taken in the quarter and a solid performance by the Fund’s IT holdings. Although overall the Fund’s selections in energy also had a positive effect, its position in BP detracted from results in the quarter. Other detracting stocks for the quarter were Japanese industrial Mitsui and Spanish telecom company Telefonica. Contributing positively were health care stocks AstraZeneca and Shionogi and tech stock Itochu Techno-Solutions. For the first half, tech company Grupo CGI and Toronto Dominion Bank were positive contributors, while BP and Telefonica detracted.

Moving into the second half of the year, WIBC remains overweight in technology because of the good earnings prospects and valuations offered by this sector. The Fund’s positioning also reflects the view that despite market concerns, emerging markets such as China will continue to drive global growth. WIBC is well positioned to benefit from a trend back toward quality and also offers attractive value. In the aggregate, its holdings are priced at significant discounts to the MSCI World ex U.S. index in terms of current and forward price/earnings ratios and price/cash flow ratios. We continue to see the inclusion of international stocks as likely to enhance returns in diversified investment portfolios.

Fixed Income Funds

After holding steady in the first quarter, Treasury bond yields fell significantly in the second quarter of 2010. Fears about Europe’s finances sent global investors to the relatively safety of U.S. Treasury bonds as Q2 progressed. The perceived need for a safe haven, indications of slowing growth in the U.S. and the low near-term inflation threat offset the prospect of increased Treasury issuance to fund rising budget deficits. Over the past six months, the CPI has registered an inflation reading of close to zero; the core CPI rate (ex food and energy) has been just 0.6%. Long-term inflation expectations, as reflected in the market for nominal and real 10-year Treasury notes, have fallen over 50 basis points since the April high. The 10-year Treasury yield fell 90 basis points in the second quarter to 2.93%, the lowest since April 2009. Two-year yields fell 40 basis points. Since its peak of nearly three percentage points in February, the Treasury curve between two-year and 10-year yields has flattened by more than half a percentage point. The yield on the 90-day Treasury bill rate has stayed under 0.2% for the first half of this year as the expected date for the first Federal Reserve tightening was pushed further out on the investment horizon. In its latest policy statement, the Fed reiterated its position that “economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.” The fed funds futures market is forecasting that the Fed’s first rate hike won’t come until the second quarter of 2011; three months ago, the futures market was forecasting a rate hike late this year.

The Barclays Capital U.S. Aggregate Bond Index returned 3.5% in the second quarter of 2010, pushing its first-half return to 5.3%. In the first quarter of 2010, Treasurys were the weakest sector of the investment-grade universe with a 1.1% return and the Aggregate return benefitted from the spread tightening on non-Treasury sectors. In contrast, Treasury bonds led the way in Q2 with a 4.7% return. Other sectors’ returns were positive in Q2, but lagged Treasurys. Spreads on corporate bonds edged out a bit in Q2, but corporates still managed a respectable 3.4% return for the quarter, which combined with their better-than-2% return in Q1 had them just about matching Treasury’s 5.9% return for the six months. Agency issues returned 2.5% in Q2 and 3.8% YTD. Mortgage-backed, asset-backed and commercial mortgage-backed issues had returns in the 2.5%-3.0% range in the latest three months; for the year-to-date, the CMBS sector led the Aggregate with a 12% return.

We believe it is unlikely that the Fed will change its near-zero interest rate policy until 2011. The slowdown in economic momentum and increased risk emanating from Europe argue against a near-term rate hike. It also should be a while before inflation starts to put upward pressure on interest rates. Looking forward, however, it is difficult to see much near-term upside potential in low-yielding Treasury securities except under dire economic conditions; if, as we expect, we avoid that outcome, rates should be heading higher by the end of the year as confidence sends investors toward riskier investments and Fed tightening draws closer. Assuming global recovery stays on track, aggregate bond returns may be anemic over the next two years, with coupon income and a resumption of spread tightening offsetting the price effects of higher Treasury yields. In the interim we may see some continued volatility in stocks, which will work to the bond market’s favor.

6

Current Income Fund

In the first half of 2010, the mortgage-backed sector of the bond market returned 4.6%, lagging both Treasury bonds, which returned 5.9%, and the Barclays Capital U.S. Aggregate Bond Index, which returned 5.3%. In the second quarter, the MBS sector returned 2.9% compared to 3.5% for the Barclays Aggregate and 4.7% for Treasurys. The Wright Current Income Fund (WCIF) is managed to be primarily invested in GNMA issues (mortgage-based securities, known as Ginnie Maes, guaranteed by the full faith and credit of the U.S. government) and other mortgage-based securities. The WCIF Fund is actively managed to maximize income and minimize principal fluctuation. In the first half of 2010, WCIF returned 4.6% compared to 5.3% for the Barclay’s Capital GNMA bond index. In Q1 the Fund lagged the index’s 1.9% with a 1.5% return, while in Q2, WCIF returned 3.1% compared to 3.3% for the benchmark. WCIF had a yield of 4.2% at June 2010 calculated according to SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield.

In addition to its holdings in Ginnie Maes (about 60% of assets at mid-year), WCIF also held MBS securities backed by Fannie Mae (FNMA) and Freddie Mac (FHLMC). These issues had returns that were slightly behind Ginnie Mae returns in both the first and second quarters of 2010. At mid-2010, about 3% of the WCIF portfolio was invested in non-Agency mortgages. The Fund’s selection of mortgages had a slightly shorter duration than the GNMA index during the first half. This worked against the Fund in both quarters. In keeping with its goal of providing high income, the WCIF Fund was overweight in higher coupon issues (average coupon of 5.9% at mid-year vs 5.1% for the GNMA index). The Fund’s holdings of higher-coupon, well-seasoned bonds contributed to the Fund’s having less negative convexity than the Barclays benchmark, which contributes to a more stable performance when interest rates are volatile.

Total Return Bond Fund

In the first half of 2010, the return on the Barclays Capital U.S. Aggregate bond index was 5.3%. In the first quarter, the Aggregate’s positive return was led by spread products, in the second by Treasury bonds. The Wright Total Return Bond Fund (WTRB), a diversified bond fund, returned 4.8% for the first half of 2010 compared to the benchmark’s 5.3% return. In the first quarter of 2010, WTRB returned 1.9% compared to 1.8% for its benchmark, while for Q2 WTRB returned 2.9% compared to 3.5% for the Barclay’s index. WTRB had a yield of 2.8% at June 2010 calculated according to SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield.

Sector allocation played a major role in the TRB Fund’s first half performance. In the first quarter of 2010, as spreads tightened, WTRB benefitted from being significantly overweight in corporate bonds and slightly overweight in commercial mortgages and asset-backed securities. In the second quarter of 2010, being overweight in these sectors (especially corporate bonds, which accounted for 42% of WTRB’s assets at mid year compared to 22% for the Aggregate) contributed to the underperformance of the Fund. In Q2, all three of these sectors underperformed Treasury bonds, where the Fund is relatively underweight. The Fund was also underweight in agencies and mortgage-backed securities, which were lagging sectors.

WTRB’s duration position was shorter than the Barclays Aggregate throughout the first half of 2010. This had a negative effect on the Fund’s relative performance, more so in the second quarter, when interest rates fell sharply, than in the first, when rates were relatively steady. The Fund was about 0.1 years shorter than the index at mid year and was also positioned relatively neutral to its Aggregate benchmark along the yield curve. This positioning reflects our view that given the current low level of interest rates, the next significant move in rates is likely to be higher. However, with economic growth likely to remain modest and inflation posing no near-term threat, it may be some time before anticipation of Fed tightening triggers that upward move.

7

The U.S. Securities Markets

8

Fund Expenses

Example:

As a shareholder of a fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs including management fees; distribution or service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (January 1, 2010 — June 30, 2010).

Actual Expenses:

The first line of the tables shown on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes:

The second line of the tables provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if payable). Therefore, the second line of the tables is useful in comparing ongoing costs only, and will help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

9

EQUITY FUNDS

Wright Selected Blue Chip Equities Fund

| | | | | | | | | |

| | | Beginning

Account

Value

(1/1/10) | | Ending Account

Value

(6/30/10) | | Expenses

Paid During

Period* (1/1/10-

6/30/10) |

| Actual Fund Shares | | $ | 1,000.00 | | $ | 983.05 | | $ | 6.88 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | | $ | 1,000.00 | | $ | 1,017.85 | | $ | 7.00 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on December 31, 2009. |

Wright Major Blue Chip Equities Fund

| | | | | | | | | |

| | | Beginning

Account

Value

(1/1/10) | | Ending Account

Value

(6/30/10) | | Expenses

Paid During

Period* (1/1/10-

6/30/10) |

| Actual Fund Shares | | $ | 1,000.00 | | $ | 920.96 | | $ | 6.72 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | | $ | 1,000.00 | | $ | 1,017.80 | | $ | 7.05 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.41% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on December 31, 2009. |

Wright International Blue Chip Equities Fund

| | | | | | | | | |

| | | Beginning

Account

Value

(1/1/10) | | Ending Account

Value

(6/30/10) | | Expenses

Paid During

Period* (1/1/10-

6/30/10) |

| Actual Fund Shares | | $ | 1,000.00 | | $ | 845.02 | | $ | 7.50 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | | $ | 1,000.00 | | $ | 1,016.66 | | $ | 8.20 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.64% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on December 31, 2009. |

FIXED INCOME FUNDS

Wright Total Return Bond Fund

| | | | | | | | | |

| | | Beginning

Account

Value

(1/1/10) | | Ending Account

Value

(6/30/10) | | Expenses

Paid During

Period* (1/1/10-

6/30/10) |

| Actual Fund Shares | | $ | 1,000.00 | | $ | 1,047.97 | | $ | 3.55 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | | $ | 1,000.00 | | $ | 1,021.32 | | $ | 3.51 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.70% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on December 31, 2009. |

Wright Current Income Fund

| | | | | | | | | |

| | | Beginning

Account

Value

(1/1/10) | | Ending Account

Value

(6/30/10) | | Expenses

Paid During

Period* (1/1/10-

6/30/10) |

| Actual Fund Shares | | $ | 1,000.00 | | $ | 1,045.75 | | $ | 4.57 |

| Hypothetical (5% return per year before expenses) |

| Fund Shares | | $ | 1,000.00 | | $ | 1,020.33 | | $ | 4.51 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.90% multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on December 31, 2009. |

10

Wright Selected Blue Chip Equities Fund (WSBC)

Portfolio of Investments — As of June 30, 2010 (Unaudited)

| | | | | |

| | | Shares | | Value |

| | | | | | |

| EQUITY INTERESTS — 97.1% |

|

| AEROSPACE & DEFENSE — 0.7% |

| BE Aerospace, Inc.* | | 4,750 | | $ | 120,792 |

| | | | |

|

|

|

| AUTOMOBILES & COMPONENTS — 1.9% |

| Advance Auto Parts, Inc. | | 4,420 | | $ | 221,796 |

| Oshkosh Corp.* | | 3,310 | | | 103,140 |

| | | | |

|

|

| | | | | $ | 324,936 |

| | | | |

|

|

|

| BANKS — 2.8% |

| Commerce Bancshares, Inc. | | 4,720 | | $ | 169,873 |

| Fulton Financial Corp. | | 7,135 | | | 68,853 |

| SVB Financial Group* | | 5,875 | | | 242,226 |

| | | | |

|

|

| | | | | $ | 480,952 |

| | | | |

|

|

|

| CAPITAL GOODS — 2.8% |

| SPX Corp. | | 4,310 | | $ | 227,611 |

| Thomas & Betts Corp.* | | 6,990 | | | 242,553 |

| | | | |

|

|

| | | | | $ | 470,164 |

| | | | |

|

|

|

| CHEMICALS — 1.8% |

| Albemarle Corp. | | 1,680 | | $ | 66,713 |

| Ashland, Inc. | | 1,680 | | | 77,986 |

| Cytec Industries, Inc. | | 2,125 | | | 84,979 |

| Olin Corp. | | 4,140 | | | 74,893 |

| | | | |

|

|

| | | | | $ | 304,571 |

| | | | |

|

|

|

| COMMERCIAL SERVICES & SUPPLIES — 2.7% |

| Global Payments, Inc. | | 4,250 | | $ | 155,295 |

| Manpower, Inc. | | 3,635 | | | 156,959 |

| Teleflex, Inc. | | 2,740 | | | 148,727 |

| | | | |

|

|

| | | | | $ | 460,981 |

| | | | |

|

|

|

| CONSUMER PRODUCTS — 0.7% |

| Mohawk Industries, Inc.* | | 2,690 | | $ | 123,094 |

| | | | |

|

|

|

| DIVERSIFIED FINANCIALS — 3.1% |

| Affiliated Managers Group, Inc.* | | 2,420 | | $ | 147,063 |

| Lender Processing Services, Inc. | | 2,210 | | | 69,195 |

| Raymond James Financial, Inc. | | 7,217 | | | 178,188 |

| SEI Investments Co. | | 6,210 | | | 126,436 |

| | | | |

|

|

| | | | | $ | 520,882 |

| | | | |

|

|

|

| EDUCATION — 0.4% |

| ITT Educational Services, Inc.* | | 805 | | $ | 66,831 |

| | | | |

|

|

|

| ELECTRONIC EQUIPMENT & INSTRUMENTS — 8.0% |

| Arrow Electronics, Inc.* | | 7,610 | | | 170,083 |

| Avnet, Inc.* | | 10,850 | | | 261,593 |

| Hubbell, Inc. — Class B | | 4,365 | | | 173,247 |

| Lincoln Electric Holdings, Inc. | | 2,405 | | | 122,631 |

| Pentair, Inc. | | 4,810 | | | 154,882 |

| Rovi Corp.* | | 2,685 | | | 101,788 |

| Synopsys, Inc.* | | 4,305 | | | 89,845 |

| Tech Data Corp.* | | 2,235 | | | 79,611 |

| Vishay Intertechnology, Inc.* | | 14,265 | | | 110,411 |

| | | | | |

| | | Shares | | Value |

| | | | | | |

| ELECTRONIC EQUIPMENT & INSTRUMENTS — continued |

| Woodward Governor Co. | | 3,775 | | $ | 96,376 |

| | | | |

|

|

| | | | | $ | 1,360,467 |

| | | | |

|

|

|

| ENERGY — 5.3% |

| Cimarex Energy Co. | | 3,690 | | $ | 264,130 |

| Energen Corp. | | 6,600 | | | 292,578 |

| FMC Technologies, Inc.* | | 2,180 | | | 114,799 |

| Helix Energy Solutions Group, Inc.* | | 7,170 | | | 77,221 |

| Oceaneering International, Inc.* | | 3,470 | | | 155,803 |

| | | | |

|

|

| | | | | $ | 904,531 |

| | | | |

|

|

|

| FOOD, BEVERAGE & TOBACCO — 0.8% |

| Ralcorp Holdings, Inc.* | | 2,515 | | $ | 137,822 |

| | | | |

|

|

|

| HEALTH CARE EQUIPMENT & SERVICES — 9.1% |

| Community Health Systems, Inc.* | | 2,795 | | $ | 94,499 |

| Health Management Associates, Inc. — Class A* | | 16,565 | | | 128,710 |

| Henry Schein, Inc.* | | 2,795 | | | 153,445 |

| Kinetic Concepts, Inc.* | | 4,585 | | | 167,398 |

| LifePoint Hospitals, Inc.* | | 5,875 | | | 184,475 |

| Lincare Holdings, Inc.* | | 17,370 | | | 564,699 |

| Owens & Minor, Inc. | | 3,020 | | | 85,708 |

| Service Corp. International | | 10,860 | | | 80,364 |

| STERIS Corp. | | 2,760 | | | 85,781 |

| | | | |

|

|

| | | | | $ | 1,545,079 |

| | | | |

|

|

|

| HOUSEHOLD & PERSONAL PRODUCTS — 1.7% |

| Church & Dwight Co., Inc. | | 2,405 | | $ | 150,818 |

| Tupperware Brands Corp. | | 3,355 | | | 133,697 |

| | | | |

|

|

| | | | | $ | 284,515 |

| | | | |

|

|

| | |

| INDUSTRIAL — 2.7% | | | | | |

| Joy Global, Inc. | | 3,915 | | $ | 196,102 |

| Timken Co. | | 5,815 | | | 151,132 |

| Valmont Industries, Inc. | | 1,510 | | | 109,717 |

| | | | |

|

|

| | | | | $ | 456,951 |

| | | | |

|

|

| | |

| INSURANCE — 8.0% | | | | | |

| American Financial Group, Inc. | | 5,055 | | $ | 138,103 |

| Everest Re Group, Ltd. | | 935 | | | 66,123 |

| HCC Insurance Holdings, Inc. | | 12,085 | | | 299,225 |

| Horace Mann Educators Corp. | | 8,070 | | | 123,471 |

| Protective Life Corp. | | 4,360 | | | 93,260 |

| Reinsurance Group of America, Inc. | | 2,405 | | | 109,933 |

| StanCorp Financial Group, Inc. | | 6,095 | | | 247,091 |

| W.R. Berkley Corp. | | 10,962 | | | 290,055 |

| | | | |

|

|

| | | | | $ | 1,367,261 |

| | | | |

|

|

| | |

| MACHINERY — 1.7% | | | | | |

| Bucyrus International, Inc. | | 1,640 | | $ | 77,818 |

| Regal-Beloit Corp. | | 1,600 | | | 89,248 |

| Wabtec Corp. | | 3,075 | | | 122,662 |

| | | | |

|

|

| | | | | $ | 289,728 |

| | | | |

|

|

See notes to financial statements

11

Wright Selected Blue Chip Equities Fund (WSBC)

Portfolio of Investments — As of June 30, 2010 (Unaudited) — continued

| | | | | |

| | | Shares | | Value |

| | | | | | |

| MATERIALS — 6.1% | | | | | |

| Airgas, Inc. | | 1,665 | | $ | 103,563 |

| Crane Co. | | 2,965 | | | 89,573 |

| FMC Corp. | | 1,620 | | | 93,037 |

| Lubrizol Corp. | | 2,910 | | | 233,702 |

| Packaging Corp. of America | | 2,300 | | | 50,646 |

| Reliance Steel & Aluminum Co. | | 2,575 | | | 93,086 |

| Sonoco Products Co. | | 3,855 | | | 117,500 |

| Steel Dynamics, Inc. | | 5,470 | | | 72,149 |

| Temple-Inland, Inc. | | 9,005 | | | 186,133 |

| | | | |

|

|

| | | | | $ | 1,039,389 |

| | | | |

|

|

| | |

| MEDIA — 0.4% | | | | | |

| Harte-Hanks, Inc. | | 5,650 | | $ | 59,043 |

| | | | |

|

|

| | |

| OIL & GAS — 2.1% | | | | | |

| Newfield Exploration Co.* | | 3,970 | | $ | 193,974 |

| Southern Union Co. | | 3,500 | | | 76,510 |

| Unit Corp.* | | 2,180 | | | 88,486 |

| | | | |

|

|

| | | | | $ | 358,970 |

| | | | |

|

|

|

| PHARMACEUTICALS & BIOTECHNOLOGY — 2.9% |

| Endo Pharmaceuticals Holdings, Inc.* | | 9,900 | | $ | 216,018 |

| Medicis Pharmaceutical Corp. — Class A | | 5,370 | | | 117,496 |

| Perrigo Co. | | 2,760 | | | 163,033 |

| | | | |

|

|

| | | | | $ | 496,547 |

| | | | |

|

|

| | |

| REAL ESTATE — 5.8% | | | | | |

| Hospitality Properties Trust (REIT) | | 10,855 | | $ | 229,040 |

| Jones Lang LaSalle, Inc. | | 4,700 | | | 308,508 |

| NVR, Inc.* | | 390 | | | 255,462 |

| UDR, Inc. (REIT) | | 10,211 | | | 195,336 |

| | | | |

|

|

| | | | | $ | 988,346 |

| | | | |

|

|

| | |

| RETAILING — 11.3% | | | | | |

| Aeropostale, Inc.* | | 9,935 | | $ | 284,538 |

| American Eagle Outfitters, Inc. | | 10,185 | | | 119,674 |

| Dick’s Sporting Goods, Inc.* | | 6,600 | | | 164,274 |

| Dollar Tree, Inc.* | | 3,863 | | | 160,796 |

| Foot Locker, Inc. | | 7,165 | | | 90,422 |

| Fossil, Inc.* | | 3,690 | | | 128,043 |

| Guess?, Inc. | | 2,975 | | | 92,939 |

| Hanesbrands, Inc.* | | 5,030 | | | 121,022 |

| PetSmart, Inc. | | 2,295 | | | 69,240 |

| Phillips-Van Heusen Corp. | | 3,190 | | | 147,601 |

| Rent-A-Center, Inc.* | | 5,550 | | | 112,443 |

| Ross Stores, Inc. | | 6,375 | | | 339,724 |

| Warnaco Group, Inc. (The)* | | 2,480 | | | 89,627 |

| | | | |

|

|

| | | | | $ | 1,920,343 |

| | | | |

|

|

| | |

| SOFTWARE & SERVICES — 10.4% | | | | | |

| Acxiom Corp.* | | 17,950 | | $ | 263,685 |

| F5 Networks, Inc.* | | 3,915 | | | 268,452 |

| Factset Research Systems, Inc. | | 1,400 | | | 93,786 |

| Fair Isaac Corp. | | 3,695 | | | 80,514 |

| Ingram Micro, Inc.* | | 8,935 | | | 135,723 |

| McAfee, Inc.* | | 2,100 | | | 64,512 |

| | | | | | |

| | | Shares | | Value | |

| | | | | | | |

|

| SOFTWARE & SERVICES — continued | |

| Parametric Technology Corp.* | | 11,020 | | $ | 172,683 | |

| Sybase, Inc.* | | 9,340 | | | 603,924 | |

| ValueClick, Inc.* | | 8,165 | | | 87,284 | |

| | | | |

|

|

|

| | | | | $ | 1,770,563 | |

| | | | |

|

|

|

|

| TELECOMMUNICATION SERVICES — 1.1% | |

| NeuStar, Inc. — Class A* | | 5,090 | | $ | 104,956 | |

| Syniverse Holdings, Inc.* | | 3,685 | | | 75,358 | |

| | | | |

|

|

|

| | | | | $ | 180,314 | |

| | | | |

|

|

|

| | |

| UTILITIES — 2.8% | | | | | | |

| MDU Resources Group, Inc. | | 14,153 | | $ | 255,179 | |

| Oneok, Inc. | | 5,260 | | | 227,495 | |

| | | | |

|

|

|

| | | | | $ | 482,674 | |

| | | | |

|

|

|

| TOTAL EQUITY INTERESTS — 97.1% | | | | | | |

| (identified cost, $15,006,831) | | | | $ | 16,515,746 | |

|

| SHORT-TERM INVESTMENTS — 2.9% | |

| Fidelity Government Money Market Fund, 0.05% | | 496,208 | | $ | 496,208 | |

| | | | |

|

|

|

| TOTAL SHORT-TERM INVESTMENTS — 2.9% | | | | |

| (identified cost, $496,208) | | | | $ | 496,208 | |

| | | | |

|

|

|

| | |

| TOTAL INVESTMENTS — 100.0% (identified cost, $15,503,039) | | | | $ | 17,011,954 | |

| |

| OTHER ASSETS, LESS LIABILITIES — 0.0% | | | (669 | ) |

| | | | |

|

|

|

| | |

| NET ASSETS — 100.0% | | | | $ | 17,011,285 | |

| | | | |

|

|

|

REIT — Real Estate Investment Trust

| * | Non-income producing security. |

| | |

| Portfolio Composition by Sector |

| % of net assets at 06/30/10 |

| Financials | | 18.4% |

| Information Technology | | 17.6% |

| Consumer Discretionary | | 17.3% |

| Industrials | | 13.5% |

| Health Care | | 12.8% |

| Other | | 20.4% |

See notes to financial statements

12

Wright Selected Blue Chip Equities Fund (WSBC)

STATEMENT OF ASSETS AND LIABILITIES

As of June 30, 2010 (Unaudited)

| | | | |

| ASSETS: | | | | |

| | | | | |

Investments, at value

(identified cost $15,503,039) (Note 1A) | | $ | 17,011,954 | |

Receivable for fund shares sold | | | 22,378 | |

Dividends receivable | | | 13,771 | |

Prepaid expenses and other assets | | | 26,644 | |

| | |

|

|

|

Total assets | | $ | 17,074,747 | |

| | |

|

|

|

| |

| LIABILITIES: | | | | |

Payable for fund shares reacquired | | $ | 50,300 | |

Accrued expenses and other liabilities | | | 13,162 | |

| | |

|

|

|

Total liabilities | | $ | 63,462 | |

| | |

|

|

|

| NET ASSETS | | $ | 17,011,285 | |

| | |

|

|

|

| |

| NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 17,422,668 | |

Accumulated net realized loss on investments | | | (1,881,566 | ) |

Distributions in excess of net investment income | | | (38,732 | ) |

Unrealized appreciation on investments | | | 1,508,915 | |

| | |

|

|

|

Net assets applicable to outstanding shares | | $ | 17,011,285 | |

| | |

|

|

|

| |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING | | | 2,061,245 | |

| | |

|

|

|

| |

| NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST | | $ | 8.25 | |

| | |

|

|

|

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2010 (Unaudited)

| | | | |

| INVESTMENT INCOME (Note 1C) | | | | |

| | | | | |

Dividend income | | $ | 88,402 | |

Interest income | | | 3 | |

| | |

|

|

|

Total investment income | | $ | 88,405 | |

| | |

|

|

|

| |

| Expenses – | | | | |

Investment adviser fee (Note 3) | | $ | 54,656 | |

Administrator fee (Note 3) | | | 10,931 | |

Compensation of Trustees who are not employees of the investment adviser or administrator | | | 7,649 | |

Custodian fee (Note 1F) | | | 771 | |

Accountant fees | | | 18,814 | |

Distribution expenses (Note 4) | | | 22,773 | |

Transfer and dividend disbursing agent fees | | | 16,474 | |

Printing | | | 110 | |

Shareholder communications | | | 1,441 | |

Audit services | | | 16,626 | |

Legal services | | | 3,350 | |

Registration costs | | | 5,155 | |

Miscellaneous | | | 4,849 | |

| | |

|

|

|

Total expenses | | $ | 163,599 | |

| | |

|

|

|

| |

| Deduct – | | | | |

Waiver and/or reimbursement by the principal underwriter and/or investment adviser

(Note 3 and 4) | | $ | (36,067 | ) |

| | |

|

|

|

Total deductions | | $ | (36,067 | ) |

| | |

|

|

|

Net expenses | | $ | 127,532 | |

| | |

|

|

|

Net investment loss | | $ | (39,127 | ) |

| | |

|

|

|

|

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

Net realized gain on investment transactions | | $ | 351,978 | |

Net change in unrealized appreciation (depreciation) on investments | | | (623,775 | ) |

| | |

|

|

|

Net realized and unrealized loss on investments | | $ | (271,797 | ) |

| | |

|

|

|

Net decrease in net assets from operations | | $ | (310,924 | ) |

| | |

|

|

|

See notes to financial statements

13

Wright Selected Blue Chip Equities Fund (WSBC)

| | | | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | Six Months Ended

June 30, 2010

(Unaudited) | | | Year Ended

December 31, 2009 | |

| | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

From operations – | | | | | | | | |

Net investment income (loss) | | $ | (39,127 | ) | | $ | 21,795 | |

Net realized gain (loss) on investment transactions | | | 351,978 | | | | (818,298 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (623,775 | ) | | | 5,533,574 | |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets from operations | | $ | (310,924 | ) | | $ | 4,737,071 | |

| | |

|

|

| |

|

|

|

Distributions to shareholders (Note 2) | | | | | | | | |

From net investment income | | $ | (16,757 | ) | | $ | — | |

| | |

|

|

| |

|

|

|

Total distributions | | $ | (16,757 | ) | | $ | — | |

| | |

|

|

| |

|

|

|

| Net increase (decrease) in net assets from fund share transactions (Note 6) | | $ | 575,979 | | | $ | (1,337,892 | ) |

| | |

|

|

| |

|

|

|

| Net increase in net assets | | $ | 248,298 | | | $ | 3,399,179 | |

| | |

| NET ASSETS: | | | | | | | | |

At beginning of period | | | 16,762,987 | | | | 13,363,808 | |

| | |

|

|

| |

|

|

|

At end of period | | $ | 17,011,285 | | | $ | 16,762,987 | |

| | |

|

|

| |

|

|

|

| | |

| UNDISTRIBUTED (DISTRIBUTIONS IN EXCESS OF) NET INVESTMENT INCOME INCLUDED IN NET ASSETS AT END OF PERIOD | | $ | (38,732 | ) | | $ | 17,152 | |

| | |

|

|

| |

|

|

|

See notes to financial statements

14

Wright Selected Blue Chip Equities Fund (WSBC)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

June 30, 2010

(Unaudited) | | | Year Ended December 31,

| |

| FINANCIAL HIGHLIGHTS | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | |

| Net asset value, beginning of period | | $ | 8.402 | | | $ | 6.060 | | | $ | 11.100 | | | $ | 12.270 | | | $ | 13.030 | | | $ | 13.226 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss)(1) (2) | | $ | (0.019 | ) | | $ | 0.011 | | | $ | (0.013 | ) | | $ | (0.013 | ) | | $ | (0.034 | ) | | $ | (0.053 | ) |

Net realized and unrealized gain (loss) | | | (0.122 | ) | | | 2.331 | | | | (4.121 | ) | | | 1.340 | | | | 0.529 | | | | 1.476 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total income (loss) from investment operations | | $ | (0.141 | ) | | $ | 2.342 | | | $ | (4.134 | ) | | $ | 1.327 | | | $ | 0.495 | | | $ | 1.423 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | $ | (0.008 | ) | | $ | — | | | $ | — | | | $ | (0.016 | ) | | $ | — | | | $ | — | |

From net realized gains | | | — | | | | — | | | | (0.906 | ) | | | (2.481 | ) | | | (1.255 | ) | | | (1.619 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total distributions | | $ | (0.008 | ) | | $ | — | | | $ | (0.906 | ) | | $ | (2.497 | ) | | $ | (1.255 | ) | | $ | (1.619 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| Net asset value, end of period | | $ | 8.253 | | | $ | 8.402 | | | $ | 6.060 | | | $ | 11.100 | | | $ | 12.270 | | | $ | 13.030 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Total Return(3) | | | (1.69% | )(4) | | | 38.61% | | | | (39.81% | ) | | | 11.59% | | | | 3.77% | | | | 11.09% | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Ratios/Supplemental Data(1): | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 17,011 | | | $ | 16,763 | | | $ | 13,364 | | | $ | 23,923 | | | $ | 38,352 | | | $ | 47,652 | |

Ratios (As a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | | | | | |

Net expenses | | | 1.40% | (5) | | | 1.36% | | | | 1.26% | | | | 1.26% | | | | 1.26% | | | | 1.27% | |

Net expenses after custodian fee reduction | | | N/A | (5) | | | 1.36% | | | | 1.25% | | | | 1.25% | | | | 1.25% | | | | 1.25% | |

Net investment income (loss) | | | (0.43% | )(5) | | | 0.15% | | | | (0.15% | ) | | | (0.10% | ) | | | (0.27% | ) | | | (0.18% | ) |

| Portfolio turnover rate | | | 30% | (4) | | | 41% | | | | 72% | | | | 67% | | | | 66% | | | | 110% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

(1) For the six months ended June 30, 2010, and for the years ended December 31, 2009, 2008, 2007, 2006 and 2005, the operating expenses of the Fund were reduced by a waiver of fees and/or allocation of expenses to the principal underwriter and/or investment adviser. Had such action not been undertaken, net investment loss per share and the ratios would have been as follows: | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| Net investment loss per share(2) | | $ | (0.036 | ) | | $ | (0.045 | ) | | $ | (0.068 | ) | | $ | (0.064 | ) | | $ | (0.058 | ) | | $ | (0.111 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Ratios (As a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses | | | 1.80% | (5) | | | 2.15% | | | | 1.90% | | | | 1.66% | | | | 1.46% | | | | 1.45% | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Expenses after custodian fee reduction | | | N/A | (5) | | | 2.15% | | | | 1.89% | | | | 1.66% | | | | 1.44% | | | | 1.43% | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net investment loss | | | (0.83% | )(5) | | | (0.64% | ) | | | (0.79% | ) | | | (0.51% | ) | | | (0.46% | ) | | | (0.38% | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (2) | Computed using average shares outstanding. |

| (3) | Total return is calculated assuming a purchase at the net asset value on the first day and a sale at the net asset value on the last day of each period reported. Dividends and distributions, if any, are assumed to be reinvested at the net asset value on the reinvestment date. |

See notes to financial statements

15

Wright Major Blue Chip Equities Fund (WMBC)

Portfolio of Investments — As of June 30, 2010 (Unaudited)

| | | | | |

| | | Shares | | Value |

| | | | | | |

| EQUITY INTERESTS — 96.6% |

|

| AEROSPACE — 4.3% |

| General Dynamics Corp. | | 4,305 | | $ | 252,101 |

| Honeywell International, Inc. | | 4,915 | | | 191,832 |

| Northrop Grumman Corp. | | 3,615 | | | 196,801 |

| Raytheon Co. | | 3,025 | | | 146,380 |

| United Technologies Corp. | | 2,060 | | | 133,715 |

| | | | |

|

|

| | | | | $ | 920,829 |

| | | | |

|

|

|

| AUTOMOBILES & COMPONENTS — 0.9% |

| Ford Motor Co.* | | 12,215 | | $ | 123,127 |

| Johnson Controls, Inc. | | 2,315 | | | 62,204 |

| | | | |

|

|

| | | | | $ | 185,331 |

| | | | |

|

|

| BANKS — 4.6% |

| Bank of America Corp. | | 19,495 | | $ | 280,143 |

| Bank of New York Mellon Corp. (The) | | 3,530 | | | 87,156 |

| US Bancorp | | 8,835 | | | 197,462 |

| Wells Fargo & Co. | | 15,865 | | | 406,144 |

| | | | |

|

|

| | | | | $ | 970,905 |

| | | | |

|

|

| CAPITAL GOODS — 4.5% |

| 3M Co. | | 2,345 | | $ | 185,232 |

| General Electric Co. | | 31,825 | | | 458,917 |

| Lockheed Martin Corp. | | 4,270 | | | 318,115 |

| | | | |

|

|

| | | | | $ | 962,264 |

| | | | |

|

|

| COMMUNICATIONS EQUIPMENT — 2.2% |

| Cisco Systems, Inc.* | | 3,530 | | $ | 75,224 |

| Harris Corp. | | 5,990 | | | 249,484 |

| L-3 Communications Holdings, Inc. | | 1,950 | | | 138,138 |

| | | | |

|

|

| | | | | $ | 462,846 |

| | | | |

|

|

| COMPUTERS & PERIPHERALS — 12.5% |

| Apple, Inc.* | | 4,035 | | $ | 1,014,924 |

| Hewlett-Packard Co. | | 17,045 | | | 737,708 |

| International Business Machines Corp. | | 7,300 | | | 901,404 |

| | | | |

|

|

| | | | | $ | 2,654,036 |

| | | | |

|

|

|

| CONSUMER DURABLES & APPAREL — 0.8% |

| Coach, Inc. | | 4,820 | | $ | 176,171 |

| | | | |

|

|

|

| DIVERSIFIED FINANCIALS — 8.5% |

| American Express Co. | | 6,685 | | $ | 265,394 |

| Fiserv, Inc.* | | 1,805 | | | 82,416 |

| Goldman Sachs Group, Inc. (The) | | 2,805 | | | 368,212 |

| JPMorgan Chase & Co. | | 19,145 | | | 700,898 |

| Mastercard, Inc. — Class A | | 735 | | | 146,655 |

| PNC Financial Services Group, Inc. | | 4,505 | | | 254,533 |

| | | | |

|

|

| | | | | $ | 1,818,108 |

| | | | |

|

|

|

| ENERGY — 7.4% |

| Apache Corp. | | 1,705 | | $ | 143,544 |

| Cameron International Corp.* | | 4,920 | | | 159,998 |

| Chevron Corp. | | 2,815 | | | 191,026 |

| Ensco PLC, ADR | | 5,295 | | | 207,988 |

| FMC Technologies, Inc.* | | 8,020 | | | 422,333 |

| National Oilwell Varco, Inc. | | 9,530 | | | 315,157 |

| | | | | |

| | | Shares | | Value |

| | | | | | |

| ENERGY — continued |

| Peabody Energy Corp. | | 3,580 | | $ | 140,085 |

| | | | |

|

|

| | | | | $ | 1,580,131 |

| | | | |

|

|

|

| FOOD, BEVERAGE & TOBACCO — 2.5% |

| Altria Group, Inc. | | 11,935 | | $ | 239,177 |

| Archer-Daniels-Midland Co. | | 4,905 | | | 126,647 |

| Tyson Foods, Inc. — Class A | | 6,320 | | | 103,585 |

| Whole Foods Market, Inc.* | | 1,885 | | | 67,898 |

| | | | |

|

|

| | | | | $ | 537,307 |

| | | | |

|

|

|

| HEALTH CARE EQUIPMENT & SERVICES — 4.4% |

| Aetna, Inc. | | 5,505 | | $ | 145,222 |

| Express Scripts, Inc.* | | 5,960 | | | 280,239 |

| Medtronic, Inc. | | 6,935 | | | 251,532 |

| UnitedHealth Group, Inc. | | 3,890 | | | 110,476 |

| WellPoint, Inc.* | | 2,820 | | | 137,983 |

| | | | |

|

|

| | | | | $ | 925,452 |

| | | | |

|

|

|

| HOTELS, RESTAURANTS & LEISURE — 0.4% |

| Wyndham Worldwide Corp. | | 4,660 | | $ | 93,852 |

| | | | |

|

|

|

| HOUSEHOLD DURABLES — 2.3% |

| Procter & Gamble Co. (The) | | 8,185 | | $ | 490,936 |

| | | | |

|

|

|

| INSURANCE — 7.6% |

| Aflac, Inc. | | 6,045 | | $ | 257,940 |

| Chubb Corp. | | 8,590 | | | 429,586 |

| CIGNA Corp. | | 2,260 | | | 70,196 |

| Genworth Financial, Inc.* | | 7,995 | | | 104,495 |

| MetLife, Inc. | | 2,615 | | | 98,742 |

| Prudential Financial, Inc. | | 2,110 | | | 113,223 |

| Torchmark Corp. | | 1,725 | | | 85,405 |

| Travelers Cos, Inc. (The) | | 5,620 | | | 276,785 |

| Unum Group | | 8,410 | | | 182,497 |

| | | | |

|

|

| | | | | $ | 1,618,869 |

| | | | |

|

|

|

| MATERIALS — 4.1% |

| Ball Corp. | | 1,775 | | $ | 93,773 |

| EI du Pont de Nemours & Co. | | 5,480 | | | 189,553 |

| Freeport-McMoRan Copper & Gold, Inc. | | 4,250 | | | 251,302 |

| Pactiv Corp.* | | 7,620 | | | 212,217 |

| PPG Industries, Inc. | | 895 | | | 54,067 |

| Precision Castparts Corp. | | 785 | | | 80,792 |

| | | | |

|

|

| | | | | $ | 881,704 |

| | | | |

|

|

|

| MEDIA — 3.2% |

| Comcast Corp. — Class A | | 15,925 | | $ | 276,617 |

| DIRECTV — Class A* | | 5,245 | | | 177,910 |

| Viacom, Inc. — Class B | | 7,205 | | | 226,021 |

| | | | |

|

|

| | | | | $ | 680,548 |

| | | | |

|

|

|

| PHARMACEUTICALS & BIOTECHNOLOGY — 7.5% |

| Amgen, Inc.* | | 6,485 | | $ | 341,111 |

| Forest Laboratories, Inc.* | | 2,935 | | | 80,507 |

| Johnson & Johnson | | 9,990 | | | 590,009 |

| McKesson Corp. | | 1,435 | | | 96,375 |

See notes to financial statements

16

Wright Major Blue Chip Equities Fund (WMBC)

Portfolio of Investments — As of June 30, 2010 (Unaudited) — continued

| | | | | |

| | | Shares | | Value |

| | | | | | |

| PHARMACEUTICALS & BIOTECHNOLOGY — continued |

| Pfizer, Inc. | | 33,490 | | $ | 477,567 |

| | | | |

|

|

| | | | | $ | 1,585,569 |

| | | | |

|

|

|

| RETAILING — 9.0% |

| Big Lots, Inc.* | | 5,975 | | $ | 191,738 |

| CVS Caremark Corp. | | 12,000 | | | 351,840 |

| Darden Restaurants, Inc. | | 1,705 | | | 66,239 |

| Estee Lauder Cos., Inc. (The) | | 3,650 | | | 203,415 |

| Family Dollar Stores, Inc. | | 3,880 | | | 146,237 |

| Gap, Inc. (The) | | 3,460 | | | 67,332 |

| Mattel, Inc. | | 3,845 | | | 81,360 |

| Ross Stores, Inc. | | 2,290 | | | 122,034 |

| Sherwin-Williams Co. (The) | | 1,675 | | | 115,893 |

| Starbucks Corp. | | 9,680 | | | 235,224 |

| Urban Outfitters, Inc.* | | 4,145 | | | 142,547 |

| Wal-Mart Stores, Inc. | | 4,100 | | | 197,087 |

| | | | |

|

|

| | | | | $ | 1,920,946 |

| | | | |

|

|

|

| SOFTWARE & SERVICES — 6.4% |

| CA, Inc. | | 7,895 | | $ | 145,268 |

| EMC Corp.* | | 4,710 | | | 86,193 |

| Google, Inc. — Class A* | | 315 | | | 140,159 |

| Intel Corp. | | 6,160 | | | 119,812 |

| Microsoft Corp. | | 10,095 | | | 232,286 |

| Oracle Corp. | | 29,420 | | | 631,353 |

| | | | |

|

|

| | | | | $ | 1,355,071 |

| | | | |

|

|

|

| TELECOMMUNICATION SERVICES — 2.1% |

| AT&T, Inc. | | 8,085 | | $ | 195,576 |

| CenturyLink, Inc. | | 2,280 | | | 75,947 |

| Verizon Communications, Inc. | | 5,920 | | | 165,878 |

| | | | |

|

|

| | | | | $ | 437,401 |

| | | | |

|

|

|

| UTILITIES — 1.4% |

| Constellation Energy Group, Inc. | | 9,500 | | $ | 306,375 |

| | | | |

|

|

| TOTAL EQUITY INTERESTS — 96.6% | | | |

| (identified cost, $22,784,824) | | | | $ | 20,564,651 |

| | | | | | |

| | | Shares | | Value | |

| | | | | | | |

| INVESTMENT COMPANIES — 4.9% | |

| iShares Barclays 1-3 Year Treasury Bond Fund | | 12,355 | | $ | 1,039,303 | |

| | | | |

|

|

|

| |

| TOTAL INVESTMENT COMPANIES — 4.9% | | | | |

| (identified cost, $1,035,351) | | | | $ | 1,039,303 | |

| | | | |

|

|

|

| |

| TOTAL INVESTMENTS — 101.5% | | | | |

| (identified cost, $23,820,175) | | | | $ | 21,603,954 | |

| |

| OTHER ASSETS, LESS LIABILITIES — (1.5)% | | | (326,929 | ) |

| | | | |

|

|

|

| |

| NET ASSETS — 100.0% | | $ | 21,277,025 | |

| | | | |

|

|

|

ADR — American Depository Receipt

PLC — Public Limited Company

| * | Non-income producing security. |

| | |

| Portfolio Composition by Sector |

| % of portfolio at 06/30/10 |

| Information Technology | | 21.1% |

| Financials | | 19.0% |

| Health Care | | 11.9% |

| Consumer Discretionary | | 10.1% |

| Industrials | | 9.7% |

| Other | | 28.2% |

See notes to financial statements

17

Wright Major Blue Chip Equities Fund (WMBC)

STATEMENT OF ASSETS AND LIABILITIES

As of June 30, 2010 (Unaudited)

| | | | |

| | | | | |

| ASSETS: | | | | |

Investments, at value

(identified cost $23,820,175) (Note 1A) | | $ | 21,603,954 | |

Receivable for fund shares sold | | | 15,871 | |

Dividends receivable | | | 20,861 | |

Prepaid expenses and other assets | | | 30,477 | |

| | |

|

|

|

Total assets | | $ | 21,671,163 | |

| | |

|

|

|

| |

| LIABILITIES: | | | | |

Demand note payable (Note 8) | | $ | 361,739 | |

Payable for fund shares reacquired | | | 21,500 | |

Accrued expenses and other liabilities | | | 10,899 | |

| | |

|

|

|

Total liabilities | | $ | 394,138 | |

| | |

|

|

|

| NET ASSETS | | $ | 21,277,025 | |

| | |

|

|

|

| |

| NET ASSETS CONSIST OF: | | | | |

Paid-in capital | | $ | 43,649,424 | |

Accumulated net realized loss on investments | | | (20,214,887 | ) |

Undistributed net investment income | | | 58,709 | |

Unrealized depreciation on investments | | | (2,216,221 | ) |

| | |

|

|

|

Net assets applicable to outstanding shares | | $ | 21,277,025 | |

| | |

|

|

|

| |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING | | | 2,126,623 | |

| | |

|

|

|

| |

| NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE OF BENEFICIAL INTEREST | | $ | 10.01 | |

| | |

|

|

|

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2010 (Unaudited)

| | | | |

| | | | | |

| INVESTMENT INCOME (Note 1C) | | | | |

Dividend income | | $ | 238,696 | |

Interest income | | | 6 | |

| | |

|

|

|

Total investment income | | $ | 238,702 | |

| | |

|

|

|

| |

| Expenses – | | | | |

Investment adviser fee (Note 3) | | $ | 76,511 | |

Administrator fee (Note 3) | | | 15,302 | |

Compensation of Trustees who are not employees of the investment adviser or administrator | | | 7,263 | |

Custodian fee (Note 1F) | | | 3,045 | |

Accountant fees | | | 18,165 | |

Distribution expenses (Note 4) | | | 31,879 | |

Transfer and dividend disbursing agent fees | | | 14,956 | |

Printing | | | 142 | |

Shareholder communications | | | 2,156 | |

Audit services | | | 16,439 | |

Legal services | | | 4,845 | |

Registration costs | | | 5,416 | |

Miscellaneous | | | 6,208 | |

| | |

|

|

|

Total expenses | | $ | 202,327 | |

| | |

|

|

|

| |

| Deduct – | | | | |

Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 3 and 4) | | $ | (22,430 | ) |

| | |

|

|

|

Total deductions | | $ | (22,430 | ) |

| | |

|

|

|

Net expenses | | $ | 179,897 | |

| | |

|

|

|

Net investment income | | $ | 58,805 | |

| | |

|

|

|

|

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | |

Net realized gain on investment transactions | | $ | 580,347 | |

Net change in unrealized appreciation (depreciation) on investments | | | (2,445,635 | ) |

| | |

|

|

|

Net realized and unrealized loss on investments | | $ | (1,865,288 | ) |

| | |

|

|

|

Net decrease in net assets from operations | | $ | (1,806,483 | ) |

| | |

|

|

|

See notes to financial statements

18

Wright Major Blue Chip Equities Fund (WMBC)

| | | | | | | | |

| STATEMENTS OF CHANGES IN NET ASSETS | | Six Months Ended

June 30, 2010

(Unaudited) | | | Year Ended

December 31, 2009 | |

| | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | | | |

From operations – | | | | | | | | |

Net investment income | | $ | 58,805 | | | $ | 349,233 | |

Net realized gain (loss) on investment transactions | | | 580,347 | | | | (3,186,606 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | (2,445,635 | ) | | | 8,788,094 | |

| | |

|

|

| |

|

|

|

Net increase (decrease) in net assets from operations | | $ | (1,806,483 | ) | | $ | 5,950,721 | |

| | |

|

|

| |

|

|

|

Distributions to shareholders (Note 2) | | | | | | | | |

From net investment income | | $ | (2,147 | ) | | $ | (338,949 | ) |

| | |

|

|

| |

|

|

|

Total distributions | | $ | (2,147 | ) | | $ | (338,949 | ) |

| | |

|

|

| |

|

|

|

| Net decrease in net assets from fund share transactions (Note 6) | | $ | (4,251,700 | ) | | $ | (10,758,001 | ) |

| | |

|

|

| |

|

|

|

| Net decrease in net assets | | $ | (6,060,330 | ) | | $ | (5,146,229 | ) |

| | |

| NET ASSETS: | | | | | | | | |

At beginning of period | | | 27,337,355 | | | | 32,483,584 | |

| | |

|

|

| |

|

|

|

At end of period | | $ | 21,277,025 | | | $ | 27,337,355 | |

| | |

|

|

| |

|

|

|

| | |

| UNDISTRIBUTED NET INVESTMENT INCOME INCLUDED IN NET ASSETS AT END OF PERIOD | | $ | 58,709 | | | $ | 2,051 | |

| | |

|

|

| |

|

|

|

See notes to financial statements

19

Wright Major Blue Chip Equities Fund (WMBC)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months

Ended

June 30,

2010

(Unaudited)

| | | Year Ended December 31,

| |

| FINANCIAL HIGHLIGHTS | | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | |

| Net asset value, beginning of period | | $ | 10.868 | | | $ | 9.340 | | | $ | 14.520 | | | $ | 13.790 | | | $ | 12.420 | | | $ | 11.780 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income(1) (2) | | $ | 0.025 | | | $ | 0.099 | | | $ | 0.104 | | | $ | 0.091 | | | $ | 0.062 | | | $ | 0.077 | |

Net realized and unrealized gain (loss) | | | (0.887 | ) | | | 1.562 | | | | (5.169 | ) | | | 0.728 | | | | 1.374 | | | | 0.651 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total income (loss) from investment operations | | $ | (0.862 | ) | | $ | 1.661 | | | $ | (5.065 | ) | | $ | 0.819 | | | $ | 1.436 | | | $ | 0.728 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |