This presentation is the property of Lawson Products, Inc. and may not be reproduced 1 Investor Presentation August 2013

This presentation is the property of Lawson Products, Inc. and may not be reproduced 2 Forward-Looking Statements "Safe Harbor" Statement under the Securities Litigation Reform Act of 1995: This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. The terms “may,” “should,” “could,” “anticipate,” “believe,” “continues,” “estimate,” “expect,” “intend,” “objective,” “plan,” “potential,” “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include: failure to retain a talented workforce including productive sales representatives; the inability of management to successfully implement strategic initiatives; failure to manage change; the ability to adequately fund our operating and working capital needs through cash generated from operations; the ability to meet the covenant requirements of our line of credit; disruptions of the Company’s information and communication systems; the effect of general economic and market conditions; inventory obsolescence; work stoppages and other disruptions at transportation centers or shipping ports; changing customer demand and product mixes; increases in commodity prices; the influence of controlling stockholders; violations of environmental protection regulations; a negative outcome related to employment tax matters; and, all other factors discussed in the Company’s “Risk Factors” set forth in its Annual Report on Form 10-K for the year ended December 31, 2012 and in its Quarterly Report on Form 10-Q for the period ended June 30, 2013. The Company undertakes no obligation to update any such factors or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events or otherwise. 2

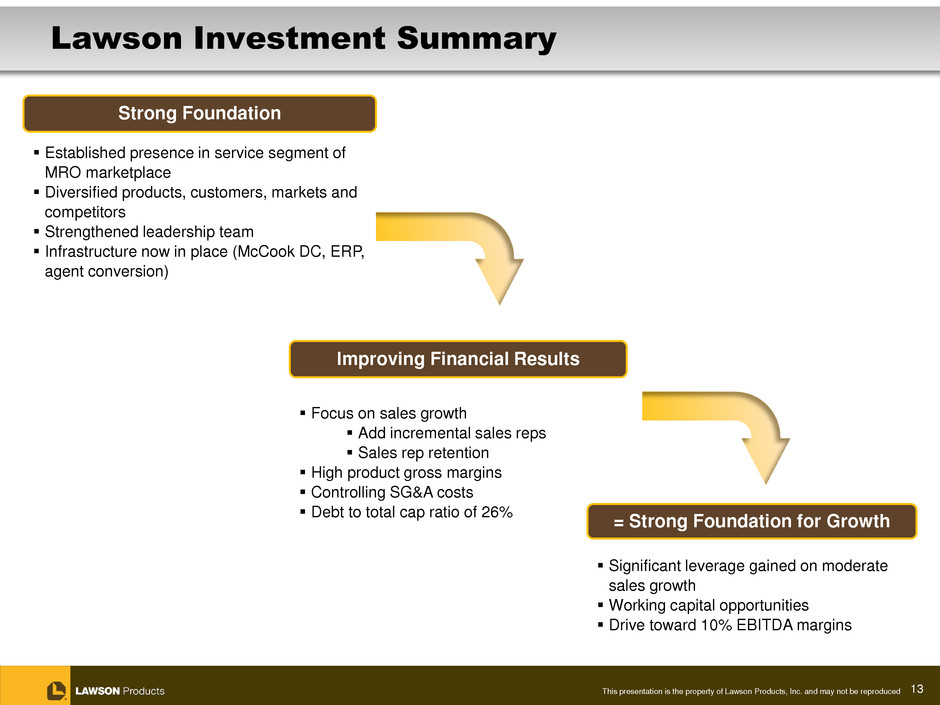

This presentation is the property of Lawson Products, Inc. and may not be reproduced 3 Lawson Investment Summary Established presence in service segment of MRO marketplace Diversified products, customers, markets and competitors Strengthened leadership team Infrastructure now in place (McCook DC, ERP, agent conversion) Focus on sales growth Add incremental sales reps Sales rep retention High product gross margins Controlling SG&A costs Debt to total cap ratio of 26% Significant leverage gained on moderate sales growth Working capital opportunities Drive toward 10% EBITDA margins Strong Foundation Improving Financial Results = Strong Foundation for Growth

This presentation is the property of Lawson Products, Inc. and may not be reproduced 4 Lawson Products: At a Glance • Service based provider of consumables in MRO market • Founded in 1952; listed on NASDAQ (LAWS) since 1970 • Serve industrial, commercial, institutional and government markets in all 50 U.S. states, Canada and Puerto Rico • Headquartered in Chicago, IL – 5 distribution centers and 1 corporate HQ – ~1,500 employees • Supplies ~375,000 products to the MRO marketplace Fasteners Cutting Tools Chemicals Hydraulics Other

This presentation is the property of Lawson Products, Inc. and may not be reproduced 5 Legend: Sales Penetration Distribution Center Chicago, IL (HQ) Sales Coverage and Distribution Reach Across North America; Distribution Centers: McCook, IL Fairfield, NJ Reno, NV Suwanee, GA Mississauga, ON (Canada) Lawson Products: At a Glance

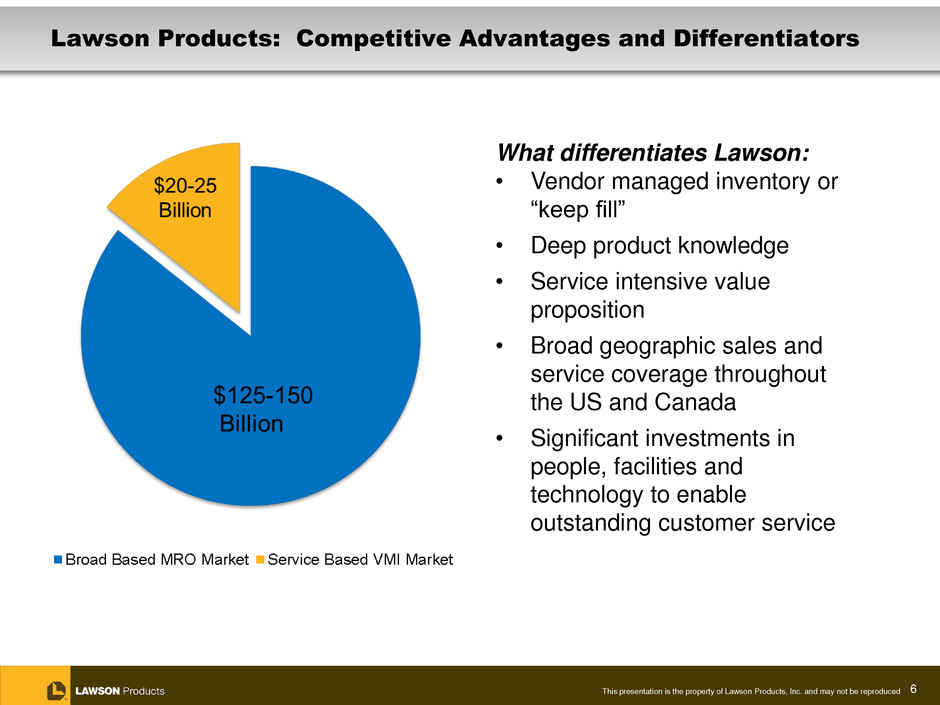

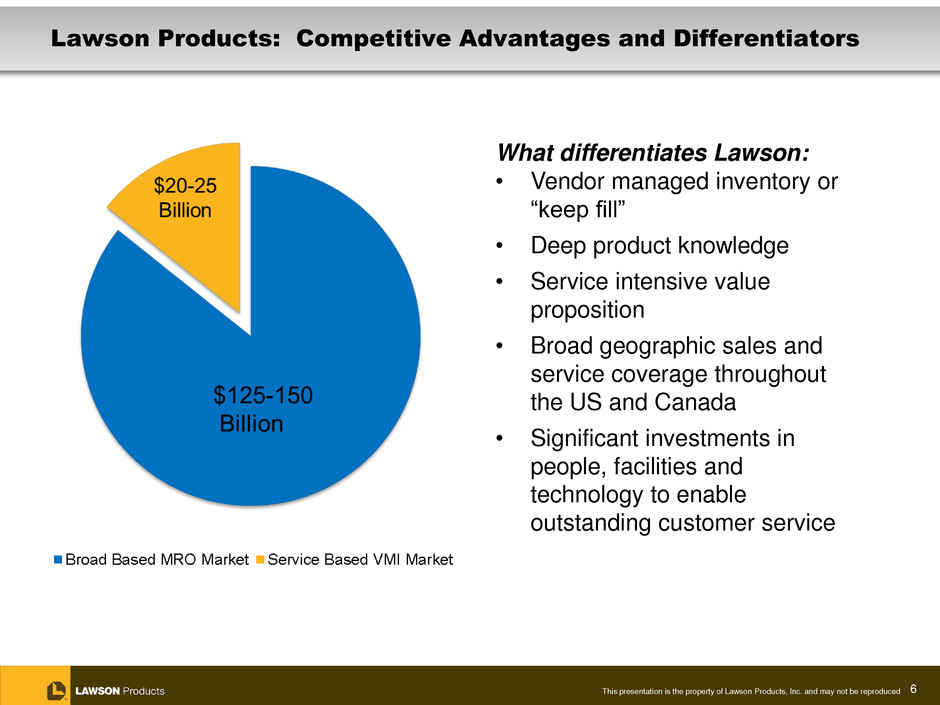

This presentation is the property of Lawson Products, Inc. and may not be reproduced 6 Lawson Products: Competitive Advantages and Differentiators What differentiates Lawson: • Vendor managed inventory or “keep fill” • Deep product knowledge • Service intensive value proposition • Broad geographic sales and service coverage throughout the US and Canada • Significant investments in people, facilities and technology to enable outstanding customer service

This presentation is the property of Lawson Products, Inc. and may not be reproduced 7 Recent Investments Investment Benefits ERP • Foundation for growth • Easier ordering • Improved customer service •Data consistency • Centralized market-based pricing • Enables new E Commerce Site Network Optimization • Leased 306,000 sq ft facility • Reduces overall fixed-cost base • Drive efficiencies in inventory and material handling • Allows centralization of certain inventory Sales Transformation • Increasing sales rep count • New web site • Multiple sales channels • Ease of ordering • Process efficiencies

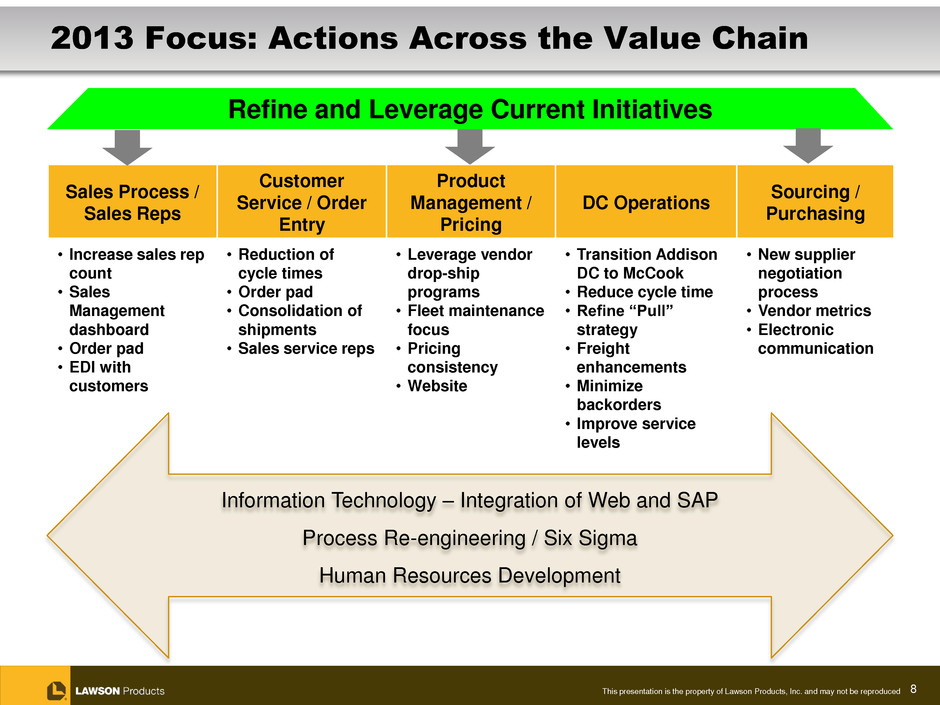

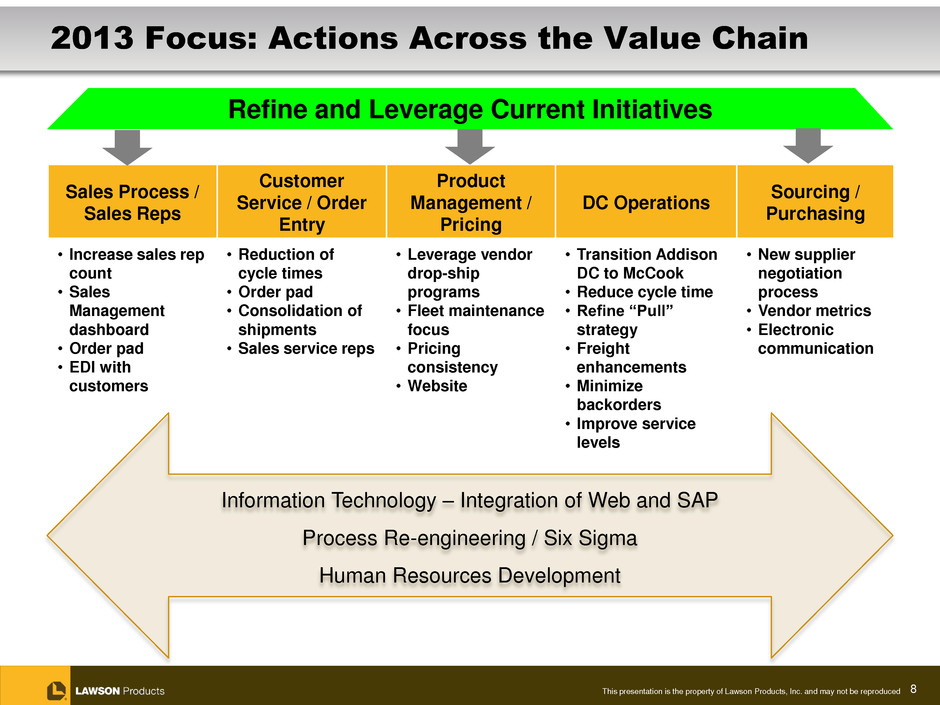

This presentation is the property of Lawson Products, Inc. and may not be reproduced 8 2013 Focus: Actions Across the Value Chain Sales Process / Sales Reps Customer Service / Order Entry Product Management / Pricing DC Operations Sourcing / Purchasing • Increase sales rep count • Sales Management dashboard • Order pad • EDI with customers • Reduction of cycle times • Order pad • Consolidation of shipments • Sales service reps • Leverage vendor drop-ship programs • Fleet maintenance focus • Pricing consistency • Website • Transition Addison DC to McCook • Reduce cycle time • Refine “Pull” strategy • Freight enhancements • Minimize backorders • Improve service levels • New supplier negotiation process • Vendor metrics • Electronic communication Information Technology – Integration of Web and SAP Process Re-engineering / Six Sigma Human Resources Development Refine and Leverage Current Initiatives

This presentation is the property of Lawson Products, Inc. and may not be reproduced 9 Financial Highlights •Focused on revenue growth Number of sales reps and sales rep productivity •June YTD 2013: – 773 sales reps, up 16 from January 1, 2013 •$20M of cost reductions right-sized the organization – ~$13M in annualized employee compensation – ~$7M in COGS, freight, T&E and other controllable costs •2012 impacted by non-recurring charges (goodwill, severance, asset sales, taxes) •Strong balance sheet – Debt to total cap of 26% – $25.4M of net capital spend 2010 through June 2013 • $12.3M ERP • $14.4M McCook Consolidated DC • $4.4M Corporate Headquarters • $1.6M Web • $14.3M of proceeds from asset sales • In June, signed letter of intent to sell Automatic Screw Machine Products, a non-core subsidiary for $12.5M. Expected to close in October.

This presentation is the property of Lawson Products, Inc. and may not be reproduced 10 Financial Highlights – Sales Trends •Focus on sales rep productivity •Number of sales reps leveled off in 2012 •Add incremental sales reps in 2013 and beyond •Tight correlation between sales levels and sales rep count

This presentation is the property of Lawson Products, Inc. and may not be reproduced 11 Financial Highlights – Gross Margin & Cost Controls (1) Q2 2012 includes a $3.9M charge for discontinuing certain stocked products (2) Q3 and Q4 2012 benefited from sell through of discontinued product at better than anticipated pricing (3) Increase over Q1 2012 driven by $1.0M additional bad debt expense and $0.5M additional facility costs (4) Includes national sales meeting ($1.2M), stock compensation ($1.6M) and seasonal Q1 payroll taxes In June, the Company entered into a non-binding letter of intent to sell substantially all of the net assets of its Automatic Screw Machine Products subsidiary and as a result all prior period amounts have been reclassified to reflect discontinued operations treatment.

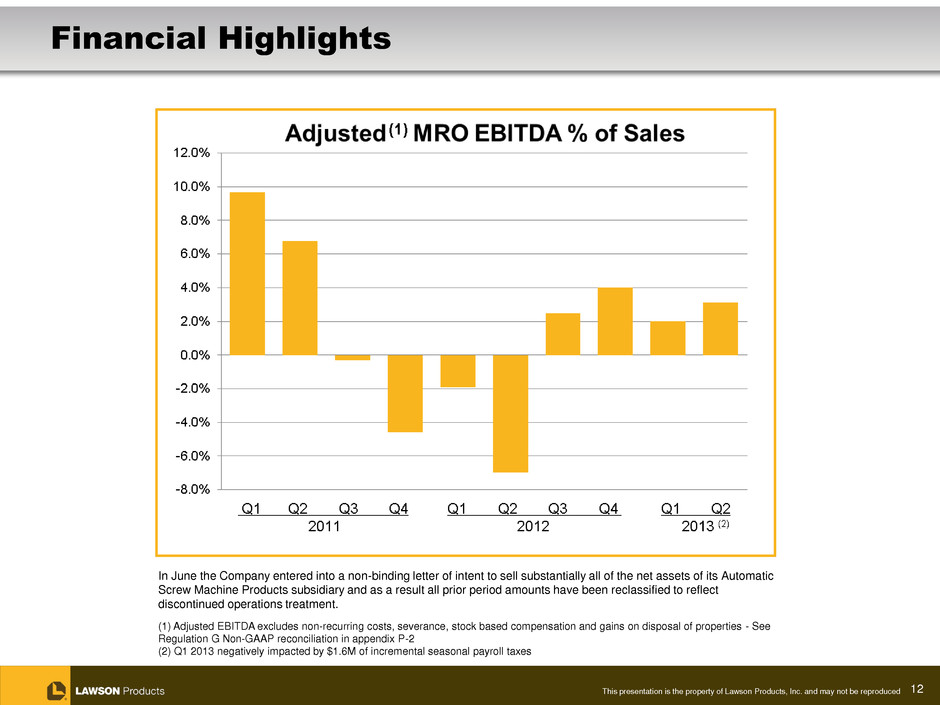

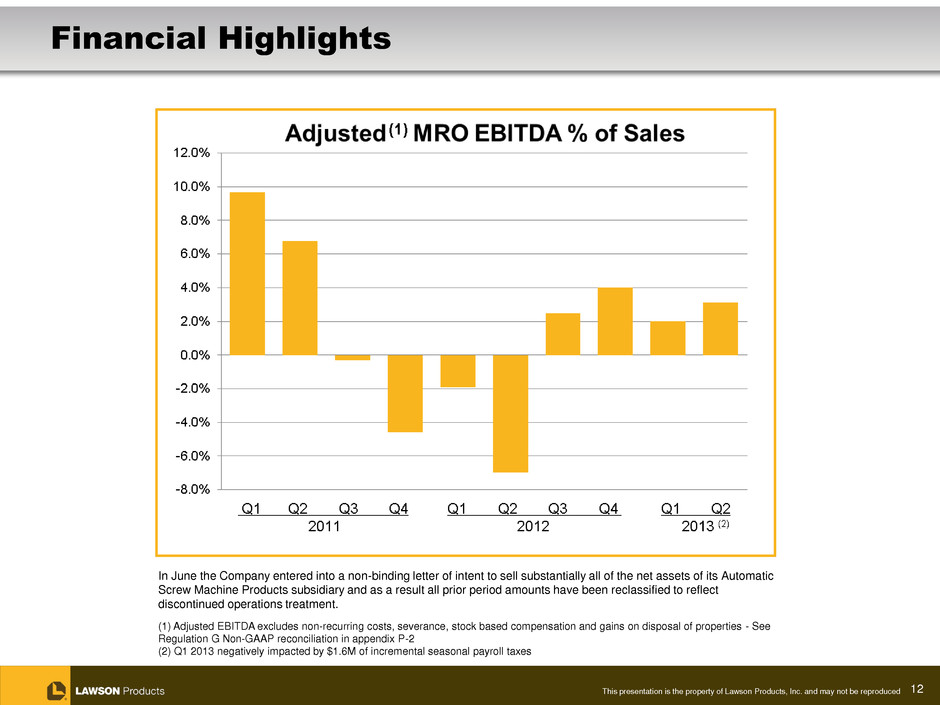

This presentation is the property of Lawson Products, Inc. and may not be reproduced 12 Financial Highlights (1) Adjusted EBITDA excludes non-recurring costs, severance, stock based compensation and gains on disposal of properties - See Regulation G Non-GAAP reconciliation in appendix P-2 (2) Q1 2013 negatively impacted by $1.6M of incremental seasonal payroll taxes In June the Company entered into a non-binding letter of intent to sell substantially all of the net assets of its Automatic Screw Machine Products subsidiary and as a result all prior period amounts have been reclassified to reflect discontinued operations treatment.

This presentation is the property of Lawson Products, Inc. and may not be reproduced 13 Lawson Investment Summary Established presence in service segment of MRO marketplace Diversified products, customers, markets and competitors Strengthened leadership team Infrastructure now in place (McCook DC, ERP, agent conversion) Focus on sales growth Add incremental sales reps Sales rep retention High product gross margins Controlling SG&A costs Debt to total cap ratio of 26% Significant leverage gained on moderate sales growth Working capital opportunities Drive toward 10% EBITDA margins Strong Foundation Improving Financial Results = Strong Foundation for Growth

This presentation is the property of Lawson Products, Inc. and may not be reproduced 14 For More Information Contact: Ronald J. Knutson EVP, CFO Investor Relations (773) 304-5665 ron.knutson@lawsonproducts.com And see our Website at http://www.lawsonproducts.com/company-info/investor-relations.jsp LAWS listed NASDAQ www.lawsonproducts.com

This presentation is the property of Lawson Products, Inc. and may not be reproduced 15 Appendices

This presentation is the property of Lawson Products, Inc. and may not be reproduced 16 Significant Recent Activities August 2011 Implemented SAP October 2011 Commenced construction of new McCook, IL distribution center May 2012 Relocated corporate headquarters June 2012 Announced $20M in annual costs savings Headcount reduction of ~100 individuals Gross margin improvements in freight, free goods and pricing Restructured senior team August 2012 Transitioned packaging facility to McCook, IL distribution center Entered into new five year $40M credit facility October 2012 Announced new CEO and President Consolidated Vernon Hills distribution center into McCook, IL November 2012 Completed planned reduction of staff Commenced roll-out of new website to existing web customers December 2012 Completed on-boarding of U.S. independent agents to employees April 2013 Roll-out of new web-site to new customers April/May 2013 McCook DC begins to ship customer orders Appendix P-1

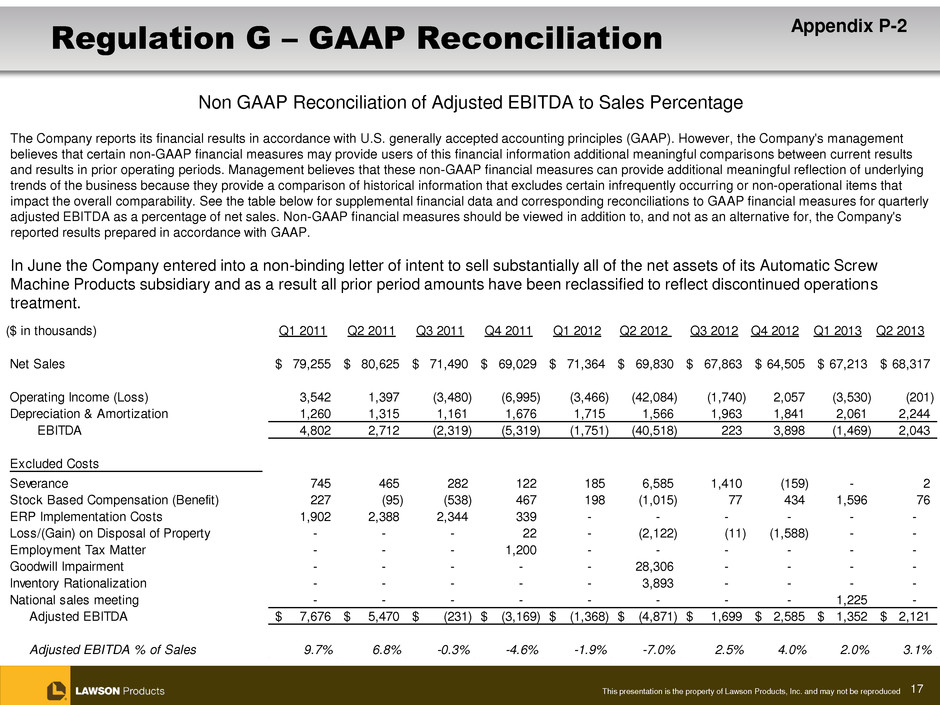

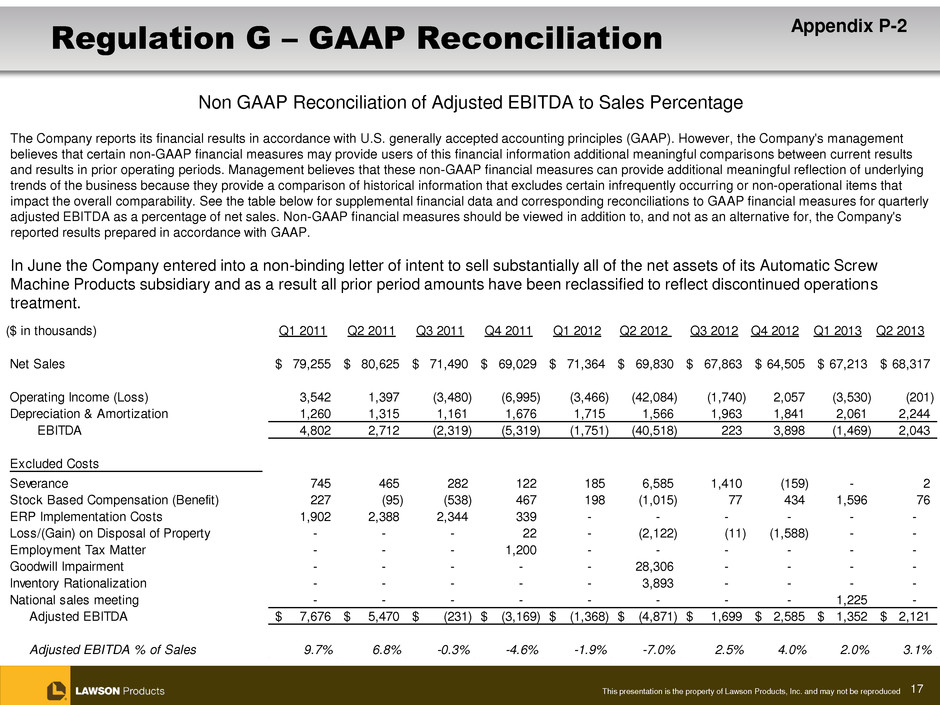

This presentation is the property of Lawson Products, Inc. and may not be reproduced 17 Regulation G – GAAP Reconciliation Non GAAP Reconciliation of Adjusted EBITDA to Sales Percentage The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). However, the Company's management believes that certain non-GAAP financial measures may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. Management believes that these non-GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a comparison of historical information that excludes certain infrequently occurring or non-operational items that impact the overall comparability. See the table below for supplemental financial data and corresponding reconciliations to GAAP financial measures for quarterly adjusted EBITDA as a percentage of net sales. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company's reported results prepared in accordance with GAAP. In June the Company entered into a non-binding letter of intent to sell substantially all of the net assets of its Automatic Screw Machine Products subsidiary and as a result all prior period amounts have been reclassified to reflect discontinued operations treatment. Appendix P-2 ($ in thousands) Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Net Sales 79,255$ 80,625$ 71,490$ 69,029$ 71,364$ 69,830$ 67,863$ 64,505$ 67,213$ 68,317$ Operating Income (Loss) 3,542 1,397 (3,480) (6,995) (3,466) (42,084) (1,740) 2,057 (3,530) (201) Depreciation & Amortization 1,260 1,315 1,161 1,676 1,715 1,566 1,963 1,841 2,061 2,244 EBITDA 4,802 2,712 (2,319) (5,319) (1,751) (40,518) 223 3,898 (1,469) 2,043 Excluded Costs Severan e 745 465 282 122 185 6,585 1,410 (159) - 2 Stock Based Compensation (Benefit) 227 (95) (538) 467 198 (1,015) 77 434 1,596 76 ERP Impl m tation Costs 1,902 2,388 2,344 339 - - - - - - L s /(G i ) on Disposal of Property - - - 22 - (2,122) (11) (1,588) - - Emp yment Tax Matter - - - 1,200 - - - - - - Goodwill Impairment - - - - - 28,306 - - - - Inventory Rationalization - - - - - 3,893 - - - - National sales meeting - - - - - - - - 1,225 - Adjusted EBITDA 7,676$ 5,470$ (231)$ (3,169)$ (1,368)$ (4,871)$ 1,699$ 2,585$ 1,352$ 2,121$ Adjusted EBITDA % of Sales 9.7% 6.8% -0.3% -4.6% -1.9% -7.0% 2.5% 4.0% 2.0% 3.1%