This presentation is the property of Lawson Products, Inc. and may not be reproduced 1 Investor Presentation May 2014

This presentation is the property of Lawson Products, Inc. and may not be reproduced 2 Forward-Looking Statements "Safe Harbor" Statement under the Securities Litigation Reform Act of 1995: This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. The terms “may,” “should,” “could,” “anticipate,” “believe,” “continues,” “estimate,” “expect,” “intend,” “objective,” “plan,” “potential,” “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include: failure to retain a talented workforce including productive sales representatives; the inability of management to successfully implement strategic initiatives; failure to manage change; the ability to adequately fund our operating and working capital needs through cash generated from operations; the ability to meet the covenant requirements of our line of credit; disruptions of the Company’s information and communication systems; the effect of general economic and market conditions; inventory obsolescence; work stoppages and other disruptions at transportation centers or shipping ports; changing customer demand and product mixes; increases in commodity prices; violations of environmental protection regulations; a negative outcome related to tax matters; and, all other factors discussed in the Company’s “Risk Factors” set forth in its Annual Report on Form 10-K for the year ended December 31, 2013. The Company undertakes no obligation to update any such factors or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events or otherwise. 2

This presentation is the property of Lawson Products, Inc. and may not be reproduced 3 Lawson Products: At a Glance • Leading service based provider of consumables in MRO market • Founded in 1952; listed on NASDAQ (LAWS) since 1970 • Serves industrial, commercial, institutional and government markets in all 50 states, Canada, Mexico, Puerto Rico and the Caribbean • Headquartered in Chicago, IL – 5 strategically located distribution centers and 1 corporate HQ – Workforce ~1,500 (over 800 sales reps) • Supplies approximately 300,000 products to the MRO marketplace – Heavy focus on private label Fasteners Cutting Tools Chemicals Hydraulics Other

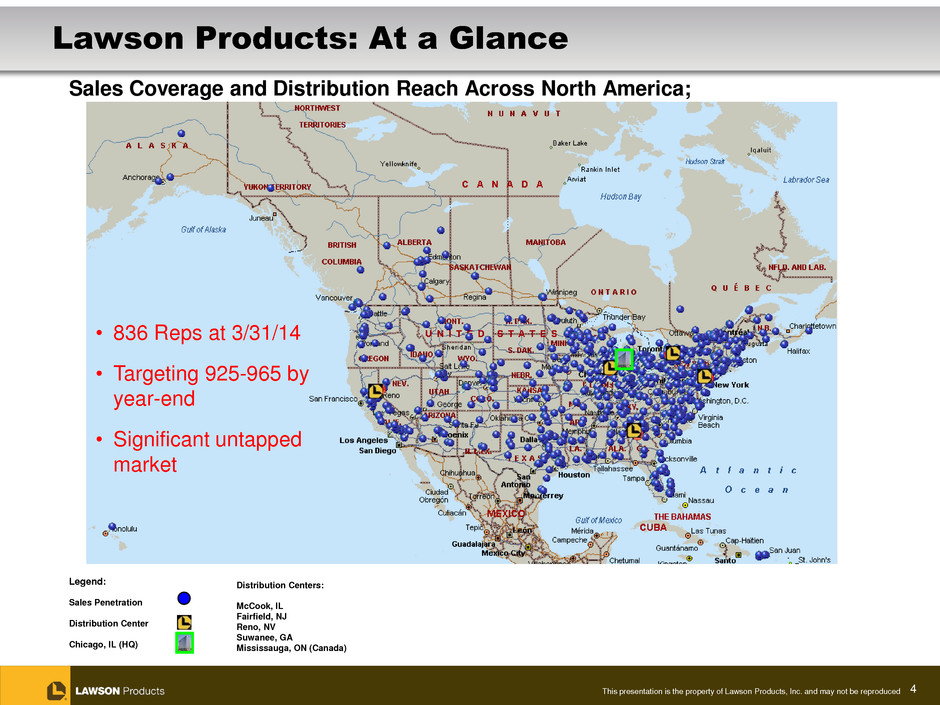

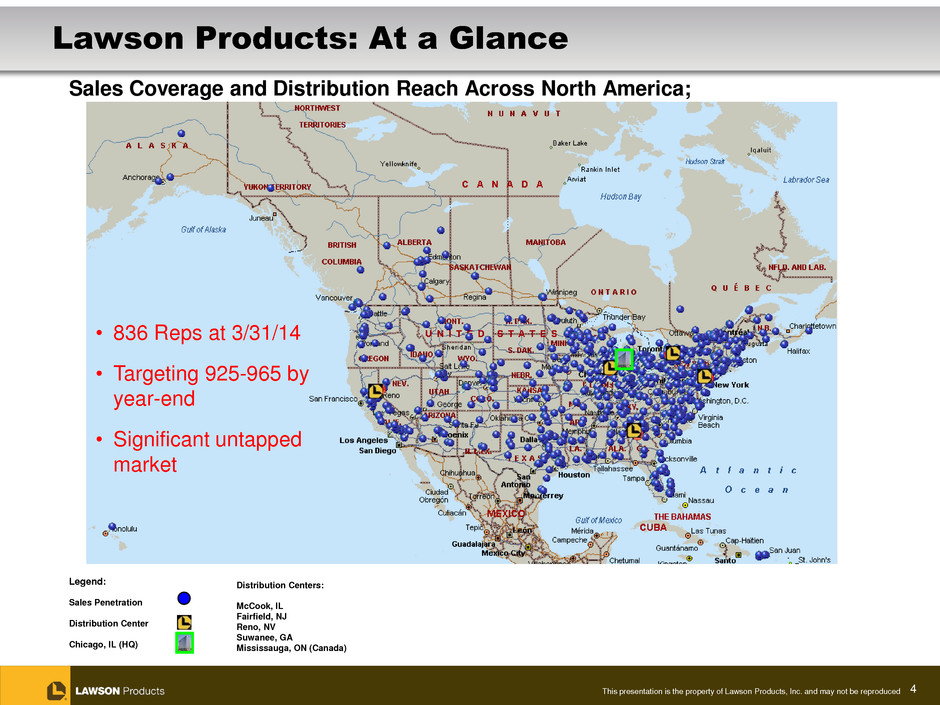

This presentation is the property of Lawson Products, Inc. and may not be reproduced 4 Legend: Sales Penetration Distribution Center Chicago, IL (HQ) Sales Coverage and Distribution Reach Across North America; Distribution Centers: McCook, IL Fairfield, NJ Reno, NV Suwanee, GA Mississauga, ON (Canada) Lawson Products: At a Glance • 836 Reps at 3/31/14 • Targeting 925-965 by year-end • Significant untapped market

This presentation is the property of Lawson Products, Inc. and may not be reproduced 5 Lawson Products: Competitive Advantages and Differentiators What differentiates Lawson: • Service intensive “high touch” value proposition • Vendor managed inventory or “keep fill” • Deep product knowledge • Broad geographic sales and service coverage throughout the US and Canada • Significant investments in people, facilities and technology to enable outstanding customer service “Not the Typical MRO Distributor”

This presentation is the property of Lawson Products, Inc. and may not be reproduced 6 One Company, Zero Headaches Inventory Management Options Access to Industry Knowledge & Expertise • Approximately 300,000 products • Lawson Managed Inventory • Product recommendations from your Lawson Representative • Hundreds of pre-built assortments • Industrial vending • Application advice from our test and application engineers • Unlimited sourcing of hard-to-find items • Self-service inventory management • Complimentary on-site safety & product usage training Our Commitment to our Customers

This presentation is the property of Lawson Products, Inc. and may not be reproduced 7 Recent Investments Lead To: Investment Benefits ERP • Platform for growth • Easier ordering • Improved customer service •Data consistency • Centralized market-based pricing • Enables new E Commerce Site Network Optimization • Consolidated 3 facilities into one state-of-the-art facility (McCook, IL) • Reduces overall fixed-cost base • Drive efficiencies in inventory and material handling • Allows centralization of certain inventory • Consolidate operations in Reno distribution facility Sales Transformation • Increasing sales rep count; added net 30 in Q1 2014 • Multiple sales channels, including new website • Process efficiencies • Real time inventory available to sales force • Aggressively grow sales team in 2014 Lean/Six Sigma • Focus on removing non-value activities • Process cycle time reduction • Cultural shift

This presentation is the property of Lawson Products, Inc. and may not be reproduced 8 2014 Focus: Actions Across the Value Chain Driving Growth Sales Process / Sales Reps Customer Service / Order Entry Product Management / Pricing DC Operations Sourcing / Purchasing • Increase sales rep count • Sales Management dashboard • Order pad • EDI with customers • Reduction of cycle times • Order pad • Consolidation of shipments • Sales service reps • Leverage vendor drop-ship programs • Fleet maintenance focus • Pricing enhancements • Website • Reduce cycle time • Refine “Pull” strategy • Freight enhancements • Minimize backorders • Improve service levels • Supplier negotiation process • Vendor metrics • Electronic communication Information Technology – Integration of Web and SAP Process Re-engineering / Six Sigma Human Resources Development Refine and Leverage Current Initiatives

This presentation is the property of Lawson Products, Inc. and may not be reproduced 9 Financial Highlights •Focused on revenue growth Number of sales reps and sales rep productivity •Ended Q1 2014 with 836 sales reps, up 10% from Q1 2013 –Added 30 net additional sales reps in Q1 2014 •Strong balance sheet – Debt to total cap of 16% – Significant capital investments over past 3 years to drive growth •Closed on the sale of Automatic Screw Machine Products, a non-core subsidiary, in February 2014 for $12.5M sales price • Signed LOI to sell Reno distribution facility for $8.7M –Will leaseback portion of facility currently in use by Company for greater operational efficiency

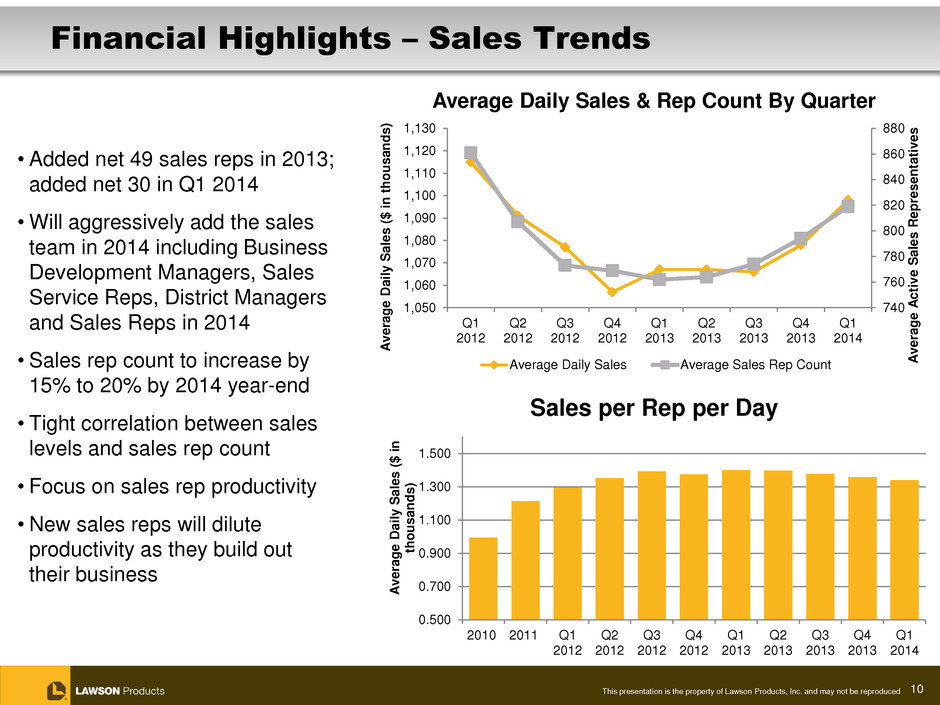

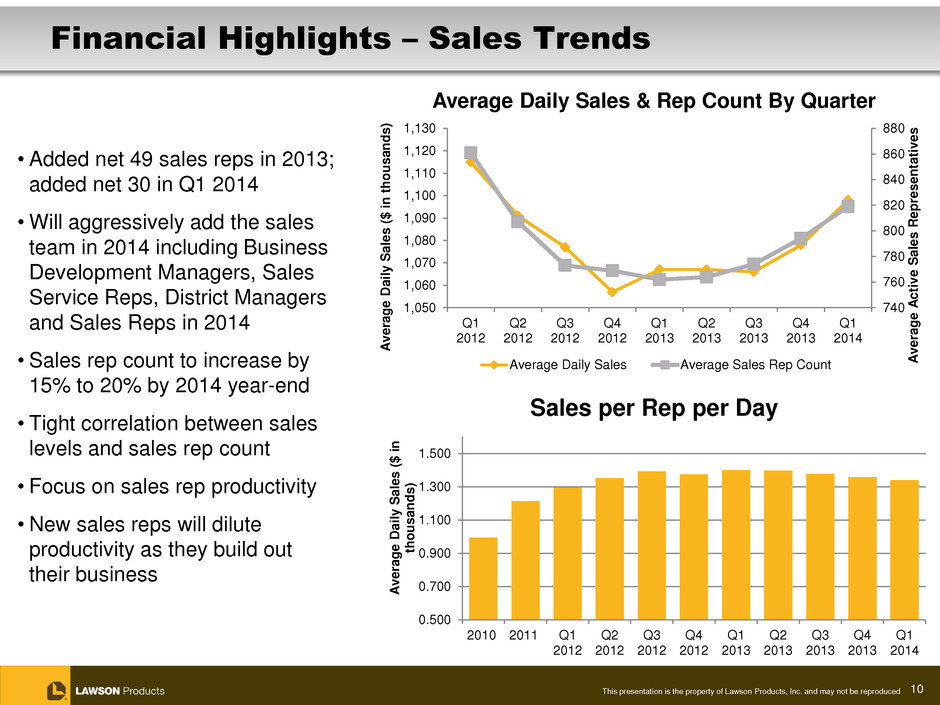

This presentation is the property of Lawson Products, Inc. and may not be reproduced 10 Financial Highlights – Sales Trends • Added net 49 sales reps in 2013; added net 30 in Q1 2014 •Will aggressively add the sales team in 2014 including Business Development Managers, Sales Service Reps, District Managers and Sales Reps in 2014 • Sales rep count to increase by 15% to 20% by 2014 year-end • Tight correlation between sales levels and sales rep count • Focus on sales rep productivity • New sales reps will dilute productivity as they build out their business 740 760 780 800 820 840 860 880 1,050 1,060 1,070 1,080 1,090 1,100 1,110 1,120 1,130 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 A v e rage A cti v e S al e s Repre s en tati v e s A v e rage Dail y S al e s ( $ in t h o u s a n d s ) Average Daily Sales & Rep Count By Quarter Average Daily Sales Average Sales Rep Count 0.500 0.700 0.900 1.100 1.300 1.500 2010 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 A v e rage Dail y S al e s ( $ in th o u s a n d s ) Sales per Rep per Day

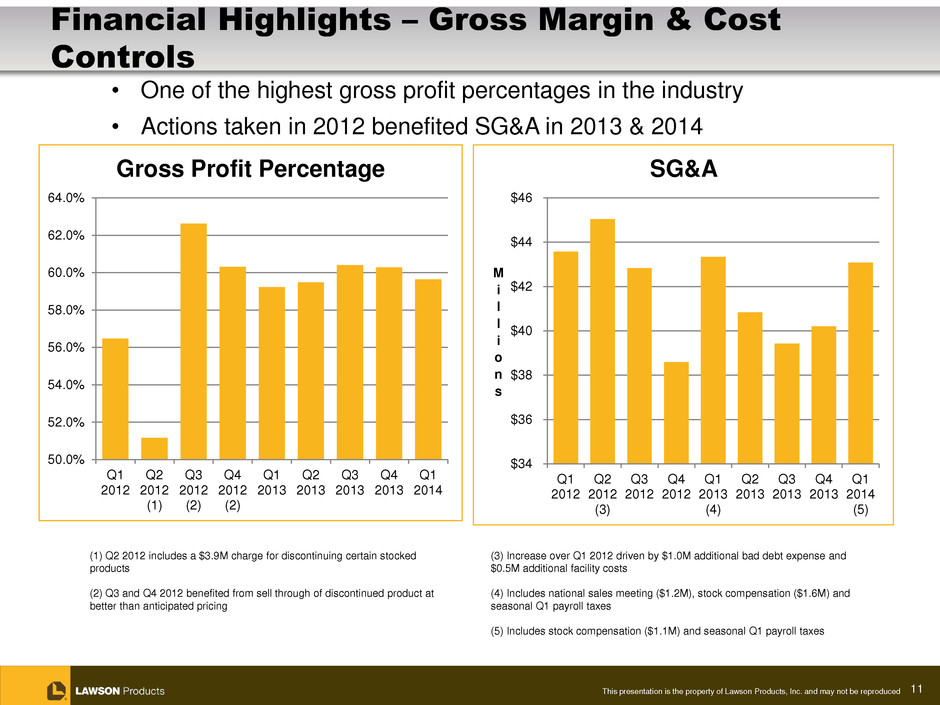

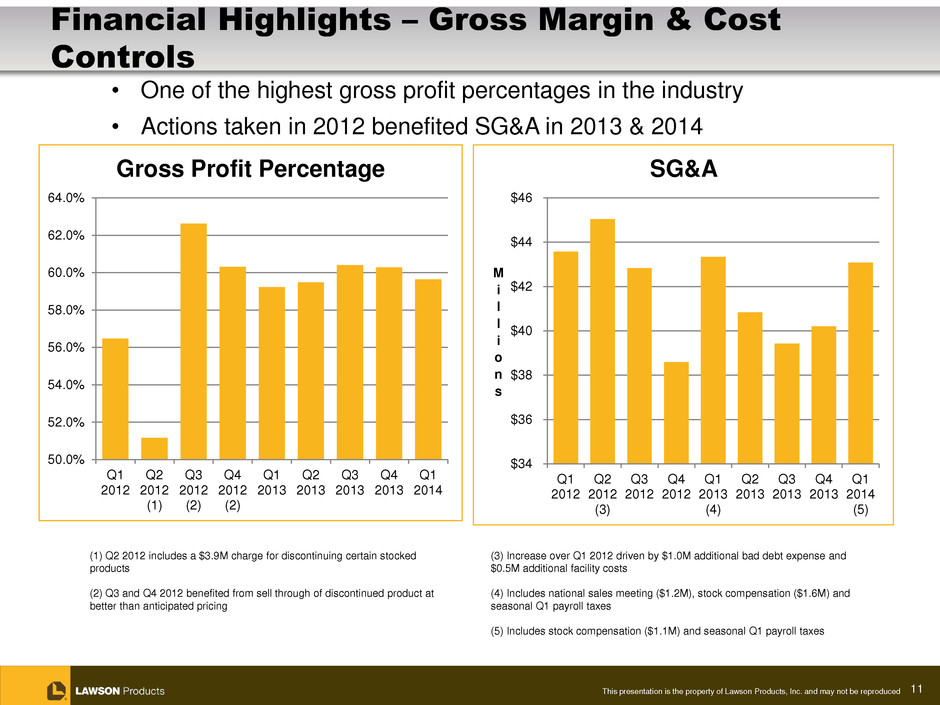

This presentation is the property of Lawson Products, Inc. and may not be reproduced 11 (1) Q2 2012 includes a $3.9M charge for discontinuing certain stocked products (2) Q3 and Q4 2012 benefited from sell through of discontinued product at better than anticipated pricing (3) Increase over Q1 2012 driven by $1.0M additional bad debt expense and $0.5M additional facility costs (4) Includes national sales meeting ($1.2M), stock compensation ($1.6M) and seasonal Q1 payroll taxes (5) Includes stock compensation ($1.1M) and seasonal Q1 payroll taxes • One of the highest gross profit percentages in the industry • Actions taken in 2012 benefited SG&A in 2013 & 2014 Financial Highlights – Gross Margin & Cost Controls 50.0% 52.0% 54.0% 56.0% 58.0% 60.0% 62.0% 64.0% Q1 2012 Q2 2012 (1) Q3 2012 (2) Q4 2012 (2) Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Gross Profit Percentage $34 $36 $38 $40 $42 $44 $46 Q1 2012 Q2 2012 (3) Q3 2012 Q4 2012 Q1 2013 (4) Q2 2013 Q3 2013 Q4 2013 Q1 2014 (5) M i l l i o n s SG&A

This presentation is the property of Lawson Products, Inc. and may not be reproduced 12 Financial Highlights – Adjusted EBITDA Adjusted EBITDA excludes non-recurring costs, severance, stock based compensation and gains on disposal of properties - See Regulation G Non-GAAP reconciliation in appendix P-2 -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Adjusted EBITDA % of Sales

This presentation is the property of Lawson Products, Inc. and may not be reproduced 13 Lawson Products: Poised for Growth Established presence in service segment of large MRO marketplace Diversified products, customers and markets Strong leadership team Infrastructure now in place (McCook DC, ERP, agent to sales rep conversion) Focus on sales growth Add incremental sales reps Sales rep retention Existing rep productivity High product gross margins SG&A costs controls Debt to total cap ratio of 16% Large, fragmented market Significant leverage gained on moderate sales growth Less economically/industry sensitive Drive toward 10% EBITDA margins Strong Foundation Improving Financial Results = Strong Foundation for Growth

This presentation is the property of Lawson Products, Inc. and may not be reproduced 14 For More Information Contact: Ronald J. Knutson EVP, CFO Investor Relations (773) 304-5665 ron.knutson@lawsonproducts.com And see our Website at http://www.lawsonproducts.com/company-info/investor-relations.jsp LAWS listed NASDAQ www.lawsonproducts.com

This presentation is the property of Lawson Products, Inc. and may not be reproduced 15 Appendices

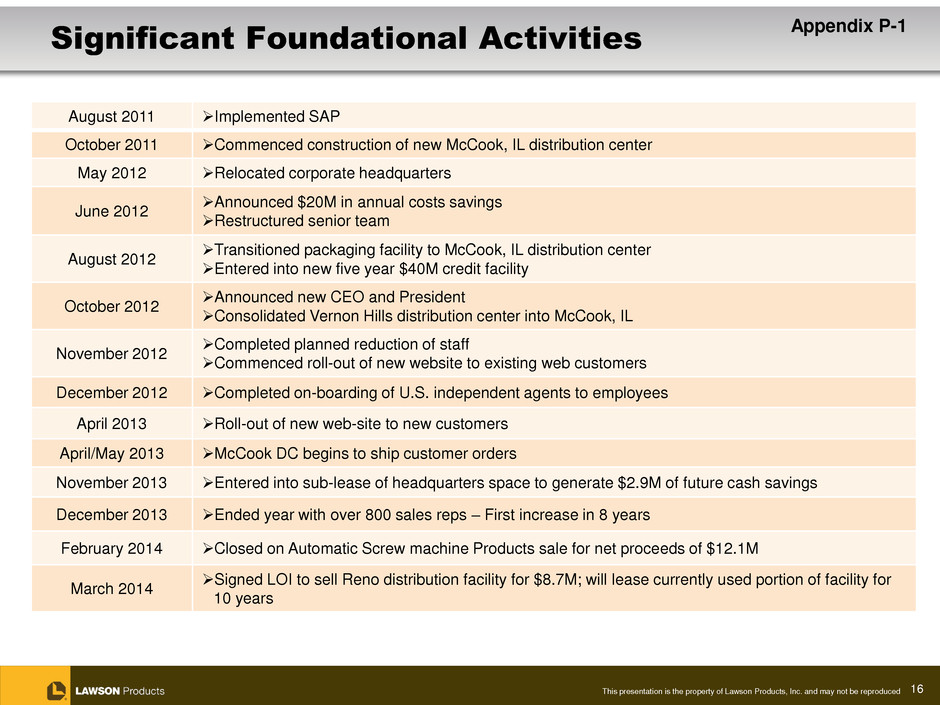

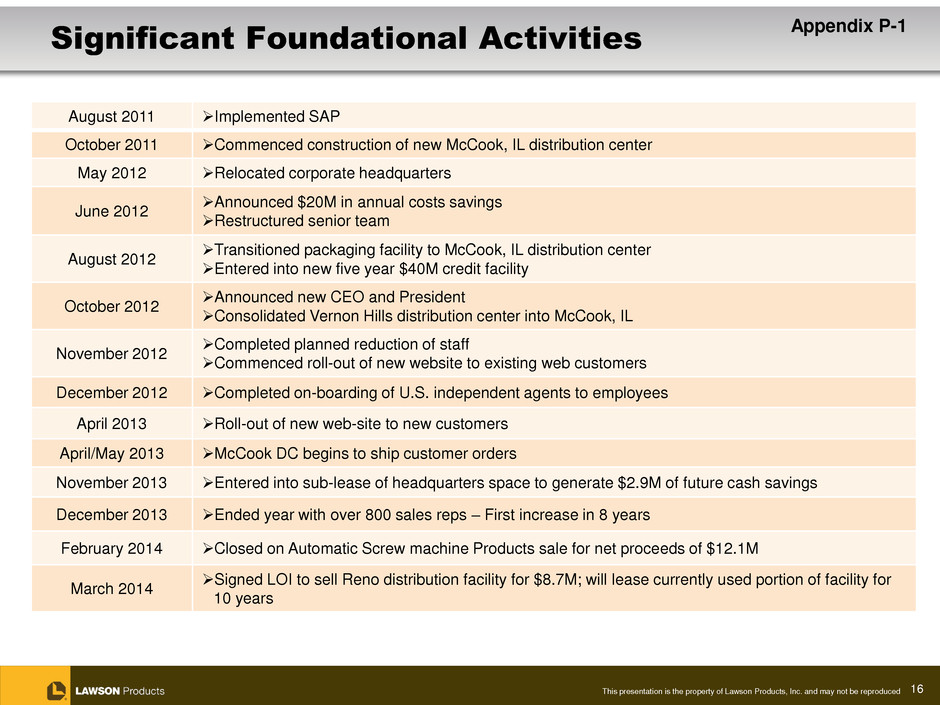

This presentation is the property of Lawson Products, Inc. and may not be reproduced 16 Significant Foundational Activities August 2011 Implemented SAP October 2011 Commenced construction of new McCook, IL distribution center May 2012 Relocated corporate headquarters June 2012 Announced $20M in annual costs savings Restructured senior team August 2012 Transitioned packaging facility to McCook, IL distribution center Entered into new five year $40M credit facility October 2012 Announced new CEO and President Consolidated Vernon Hills distribution center into McCook, IL November 2012 Completed planned reduction of staff Commenced roll-out of new website to existing web customers December 2012 Completed on-boarding of U.S. independent agents to employees April 2013 Roll-out of new web-site to new customers April/May 2013 McCook DC begins to ship customer orders November 2013 Entered into sub-lease of headquarters space to generate $2.9M of future cash savings December 2013 Ended year with over 800 sales reps – First increase in 8 years February 2014 Closed on Automatic Screw machine Products sale for net proceeds of $12.1M March 2014 Signed LOI to sell Reno distribution facility for $8.7M; will lease currently used portion of facility for 10 years Appendix P-1

This presentation is the property of Lawson Products, Inc. and may not be reproduced 17 Regulation G – GAAP Reconciliation Non GAAP Reconciliation of Adjusted EBITDA to Sales Percentage The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). However, the Company's management believes that certain non-GAAP financial measures may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. Management believes that these non-GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a comparison of historical information that excludes certain infrequently occurring or non-operational items that impact the overall comparability. See the table below for supplemental financial data and corresponding reconciliations to GAAP financial measures for quarterly adjusted EBITDA as a percentage of net sales. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company's reported results prepared in accordance with GAAP. Appendix P-2 ($ in thousands) Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Net Sales 79,255$ 80,625$ 71,490$ 69,029$ 71,364$ 69,830$ 67,863$ 64,505$ 67,213$ 68,317$ 68,235$ 65,738$ 69,204$ Operating Income (Loss) 3,542 1,397 (3,480) (6,995) (3,466) (42,084) (1,740) 2,057 (3,530) (201) 870 (3,002) (4,713) Depreciation & Amortization 1,260 1,315 1,160 1,675 1,715 1,566 1,963 1,841 2,061 2,244 2,367 2,358 2,295 EBITDA 4,802 2,712 (2,320) (5,320) (1,751) (40,518) 223 3,898 (1,469) 2,043 3,237 (644) (2,418) Excluded Costs Severance 745 465 282 122 185 6,585 1,410 (159) - 2 962 (127) 728 Stock Based Compensation (Benefit) 227 (95) (538) 467 198 (1,015) 77 434 1,596 76 33 562 1,125 ERP Implementation Costs 1,902 2,388 2,344 339 - - - - - - - - Loss/(Gain) on Disposal of Property - - - 22 - (2,122) (11) (1,588) - - (36) 32 10 Employment Tax Matter - - - 1,200 - - - - - - - - - Loss on Sub-Lease - - - - - - - - - - - 2,928 - o ill Impairment - - - - - 28,306 - - - - - - - I v nt ry Rati alization - - - - - 3,893 - - - - - - - National sales meeting - - - - - - - - 1,225 - - - - Property Impairment Loss - - - - - - - - - - - - 2,914 Adjusted EBITDA 7,676$ 5,470$ (232)$ (3,170)$ (1,368)$ (4,871)$ 1,699$ 2,585$ 1,352$ 2,121$ 4,196$ 2,751$ 2,359$ Adjusted EBITDA % of Sales 9.7% 6.8% -0.3% -4.6% -1.9% -7.0% 2.5% 4.0% 2.0% 3.1% 6.1% 4.2% 3.4%

This presentation is the property of Lawson Products, Inc. and may not be reproduced 18 Quarterly Results Appendix P-3 ($ in thousands) Number of business days Average daily net sales $ 1,098 $ 1,078 $ 1,066 $ 1,067 $ 1,067 Sequential quarter increase (decrease) Average active sales rep. count (1) Period-end active sales rep. count Sales per rep. per day $ 1.341 $ 1.358 $ 1.377 $ 1.397 $ 1.4 Sequential quarter increase (decrease) Net sales $ 69,204 $ 65,738 $ 68,235 $ 68,317 $ 67,213 Gross profit Gross profit percentage Operating expenses Selling, general & administrative expenses $ 43,077 $ 40,101 $ 40,350 $ 40,835 $ 43,344 Other expenses, net (2) Operating income (loss) $ (4,713) $ (3,002) $ 870 $ (201) $ (3,530) Three Months Ended Mar. 31, 2014 Dec. 31, 2013 Sep. 30, 2013 Jun. 30, 2013 Mar. 31, 2013 63 61 64 64 63 1.9% 1.1% (0.1%) 0.0% 0.9% 819 794 774 764 762 836 806 784 773 760 (1.3%) (1.4%) (1.4%) (0.2%) 1.8% 41,278 39,627 41,220 40,634 39,814 59.2% 2,914 2,528 — — — 43,34445,991 42,629 40,350 40,835 59.6% 60.3% 60.4% 59.5%

This presentation is the property of Lawson Products, Inc. and may not be reproduced 19 2013 Consolidated Balance Sheet Appendix P-4 ($ in thousands) ASSETS Current assets: Cash and cash equivalents $ 988 Restricted cash Accounts receivable, less allowance for doubtful accounts Inventories, net Miscellaneous receivables and prepaid expenses Deferred income taxes Property held for sale Discontinued operations Total current assets Property, plant and equipment, net Cash value of life insurance Deferred income taxes Other assets Discontinued operations Total assets $ 146,723 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Revolving line of credit $ 11,635 Accounts payable Accrued expenses and other liabilities Discontinued operations Total current liabilities Security bonus plan Financing lease obligation Deferred compensation Deferred rent liability Other liabilities Total liabilities Stockholders’ equity Total liabilities and stockholders’ equity $ 146,723 March 31, 2014 (Unaudited) 4,829 5 8,439 800 32,904 43,351 45,588 9,300 54 — 91,316 10,040 465 — 15,865 10,028 22,579 1,150 45,404 62,872 83,851 5,530 4,858 2,166