UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

(Mark One)

| ý | Quarterly Report under Section 13 OR 15(d) of the Securities Exchange Act of 1934 | |

For quarterly period ended June 30, 2014

or

| ¨ | Transition Report under Section 13 OR 15(d) of the Securities Exchange Act of 1934 | |

For the transition period from to

Commission file Number: 0-10546

(Exact name of registrant as specified in its charter)

| Delaware | 36-2229304 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 8770 W. Bryn Mawr Avenue, Suite 900, Chicago, Illinois | 60631 | |

| (Address of principal executive offices) | (Zip Code) | |

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ý |

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The number of shares outstanding of the registrant’s common stock, $1 par value, as of July 15, 2014 was 8,696,986.

TABLE OF CONTENTS

| Page # | ||

2

“Safe Harbor” Statement under the Securities Litigation Reform Act of 1995:

This Quarterly Report on Form 10-Q contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. The terms “may,” “should,” “could,” “anticipate,” “believe,” “continues,” “estimate,” “expect,” “intend,” “objective,” “plan,” “potential,” “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include, but may not be limited to:

| • | failure to recruit, integrate and retain a talented workforce including productive sales representatives; |

| • | the effect of general economic and market conditions; |

| • | the ability to generate sufficient cash to fund our operating requirements; |

| • | the ability to meet the covenant requirements of our line of credit; |

| • | the market price of our common stock may decline; |

| • | inventory obsolescence; |

| • | disruptions of the Company’s information and communication systems; |

| • | work stoppages and other disruptions at transportation centers or shipping ports; |

| • | changing customer demand and product mixes; |

| • | increases in energy and commodity prices; |

| • | disruptions of our information and communication systems; |

| • | cyber attacks or other information security breaches; |

| • | the inability of management to successfully implement strategic initiatives; |

| • | failure to manage change within the organization; |

| • | violations of environmental protection or other governmental regulations; |

| • | negative changes related to tax matters; and |

| • | all other factors discussed in the Company’s “Risk Factors” set forth in its Annual Report on Form 10-K for the year ended December 31, 2013. |

The Company undertakes no obligation to update any such factors or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events or otherwise.

3

PART I - FINANCIAL INFORMATION

ITEM 1. - FINANCIAL STATEMENTS

Lawson Products, Inc.

Condensed Consolidated Balance Sheets

(Dollars in thousands, except share data)

| June 30, 2014 | December 31, 2013 | ||||||

| ASSETS | (Unaudited) | ||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 1,589 | $ | 698 | |||

| Restricted cash | 800 | 800 | |||||

| Accounts receivable, less allowance for doubtful accounts | 33,500 | 30,221 | |||||

| Inventories, net | 43,891 | 45,774 | |||||

| Miscellaneous receivables and prepaid expenses | 4,123 | 4,393 | |||||

| Deferred income taxes | 5 | 5 | |||||

| Discontinued operations | — | 8,960 | |||||

| Total current assets | 83,908 | 90,851 | |||||

| Property, plant and equipment, net | 44,139 | 58,974 | |||||

| Cash value of life insurance | 9,325 | 9,179 | |||||

| Deferred income taxes | 54 | 54 | |||||

| Other assets | 549 | 481 | |||||

| Discontinued operations | — | 406 | |||||

| Total assets | $ | 137,975 | $ | 159,945 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

| Current liabilities: | |||||||

| Revolving line of credit | $ | 2,446 | $ | 16,078 | |||

| Accounts payable | 9,090 | 14,787 | |||||

| Accrued expenses and other liabilities | 23,929 | 23,521 | |||||

| Discontinued operations | 461 | 564 | |||||

| Total current liabilities | 35,926 | 54,950 | |||||

| Security bonus plan | 16,168 | 16,143 | |||||

| Financing lease obligation | 9,832 | 10,223 | |||||

| Deferred compensation | 5,219 | 5,867 | |||||

| Deferred rent liability | 4,590 | 4,961 | |||||

| Other liabilities | 2,015 | 1,889 | |||||

| Total liabilities | 73,750 | 94,033 | |||||

| Stockholders’ equity: | |||||||

| Preferred stock, $1 par value: | |||||||

| Authorized - 500,000 shares, Issued and outstanding — None | — | — | |||||

| Common stock, $1 par value: | |||||||

| Authorized - 35,000,000 shares; Issued - 8,704,800 and 8,670,512 shares, respectively; Outstanding - 8,693,173 and 8,658,885 shares, respectively | 8,705 | 8,671 | |||||

| Capital in excess of par value | 8,159 | 7,799 | |||||

| Retained earnings | 45,487 | 47,644 | |||||

| Treasury stock – 11,627 shares | (187 | ) | (187 | ) | |||

| Accumulated other comprehensive income | 2,061 | 1,985 | |||||

| Total stockholders’ equity | 64,225 | 65,912 | |||||

| Total liabilities and stockholders’ equity | $ | 137,975 | $ | 159,945 | |||

See notes to condensed consolidated financial statements.

4

Lawson Products, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(Dollars in thousands, except per share data)

(Unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||

| 2014 | 2013 | 2014 | 2013 | ||||||||||||

| Net sales | $ | 72,080 | $ | 68,317 | $ | 141,284 | $ | 135,530 | |||||||

| Cost of goods sold | 28,277 | 27,683 | 56,203 | 55,082 | |||||||||||

| Gross profit | 43,803 | 40,634 | 85,081 | 80,448 | |||||||||||

| Operating expenses: | |||||||||||||||

| Selling expenses | 22,950 | 20,617 | 44,230 | 42,225 | |||||||||||

| General and administrative expenses | 19,480 | 20,218 | 41,277 | 41,954 | |||||||||||

| Total SG&A | 42,430 | 40,835 | 85,507 | 84,179 | |||||||||||

| Impairment loss | 132 | — | 3,046 | — | |||||||||||

| Operating expenses | 42,562 | 40,835 | 88,553 | 84,179 | |||||||||||

| Operating income (loss) | 1,241 | (201 | ) | (3,472 | ) | (3,731 | ) | ||||||||

| Interest expense | (211 | ) | (221 | ) | (455 | ) | (434 | ) | |||||||

| Other income (expenses), net | 81 | (70 | ) | (67 | ) | (131 | ) | ||||||||

| Income (loss) from continuing operations before income taxes | 1,111 | (492 | ) | (3,994 | ) | (4,296 | ) | ||||||||

| Income tax expense (benefit) | 313 | (501 | ) | (470 | ) | (701 | ) | ||||||||

| Income (loss) from continuing operations | 798 | 9 | (3,524 | ) | (3,595 | ) | |||||||||

| Income and gain from discontinued operations, net of income taxes | — | 388 | 1,367 | 769 | |||||||||||

| Net income (loss) | $ | 798 | $ | 397 | $ | (2,157 | ) | $ | (2,826 | ) | |||||

| Basic and diluted income (loss) per share of common stock: | |||||||||||||||

| Continuing operations | $ | 0.09 | $ | — | $ | (0.41 | ) | $ | (0.42 | ) | |||||

| Discontinued operations | — | 0.05 | 0.16 | 0.09 | |||||||||||

| Net income (loss) per share | $ | 0.09 | $ | 0.05 | $ | (0.25 | ) | $ | (0.33 | ) | |||||

| Basic and diluted weighted average shares outstanding | |||||||||||||||

| Basic weighted average shares outstanding | 8,677 | 8,629 | 8,668 | 8,618 | |||||||||||

| Dilutive effect of stock-based compensation | 121 | 42 | — | — | |||||||||||

| Diluted weighted average shares outstanding | 8,798 | 8,671 | 8,668 | 8,618 | |||||||||||

| Comprehensive income (loss) | |||||||||||||||

| Net income (loss) | $ | 798 | $ | 397 | $ | (2,157 | ) | $ | (2,826 | ) | |||||

| Other comprehensive income (loss), net of tax | |||||||||||||||

| Adjustment for foreign currency translation | 321 | (303 | ) | 76 | (475 | ) | |||||||||

| Net comprehensive income (loss) | $ | 1,119 | $ | 94 | $ | (2,081 | ) | $ | (3,301 | ) | |||||

See notes to condensed consolidated financial statements.

5

Lawson Products, Inc.

Condensed Consolidated Statements of Cash Flows

(Dollars in thousands)

(Unaudited)

| Six Months Ended June 30, | |||||||

| 2014 | 2013 | ||||||

| Operating activities: | |||||||

| Net loss | $ | (2,157 | ) | $ | (2,826 | ) | |

| Less income from discontinued operations | (1,367 | ) | (769 | ) | |||

| Loss from continuing operations | (3,524 | ) | (3,595 | ) | |||

| Adjustments to reconcile loss from continuing operations to net cash used in operating activities: | |||||||

| Depreciation and amortization | 4,458 | 4,305 | |||||

| Stock-based compensation | 1,533 | 1,672 | |||||

| Impairment loss | 3,046 | — | |||||

| Increase in restricted cash | — | (401 | ) | ||||

| Changes in operating assets and liabilities: | |||||||

| Accounts receivable | (3,654 | ) | (4,423 | ) | |||

| Inventories | 1,864 | (2,608 | ) | ||||

| Prepaid expenses and other assets | (899 | ) | 5,975 | ||||

| Accounts payable and other liabilities | (7,663 | ) | (7,689 | ) | |||

| Other | 486 | 96 | |||||

| Net cash used in operating activities of continuing operations | (4,353 | ) | (6,668 | ) | |||

| Investing activities: | |||||||

| Additions to property, plant and equipment | (917 | ) | (1,657 | ) | |||

| Net proceeds related to sale of business | 12,125 | — | |||||

| Net proceeds related to sale of distribution center | 8,307 | — | |||||

| Net cash provided by (used in) investing activities of continuing operations | 19,515 | (1,657 | ) | ||||

| Financing activities: | |||||||

| Net (payments on) proceeds from revolving line of credit | (13,632 | ) | 7,139 | ||||

| Net cash (used in) provided by financing activities of continuing operations | (13,632 | ) | 7,139 | ||||

| Discontinued operations: | |||||||

| Operating cash flows | (639 | ) | 130 | ||||

| Investing cash flows | — | (304 | ) | ||||

| Net cash used in discontinued operations | (639 | ) | (174 | ) | |||

| Increase (decrease) in cash and cash equivalents | 891 | (1,360 | ) | ||||

| Cash and cash equivalents at beginning of period | 698 | 1,640 | |||||

| Cash and cash equivalents at end of period | $ | 1,589 | $ | 280 | |||

See notes to condensed consolidated financial statements.

6

Notes to Condensed Consolidated Financial Statements

Note 1 — Basis of Presentation and Summary of Significant Accounting Policies

The accompanying unaudited condensed consolidated financial statements of Lawson Products, Inc. (the “Company”) have been prepared in accordance with generally accepted accounting principles for interim financial information, the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not contain all disclosures required by generally accepted accounting principles. Reference should be made to the Company’s Annual Report on Form 10-K for the year ended December 31, 2013. In the opinion of the Company, all normal recurring adjustments have been made that are necessary to present fairly the results of operations for the interim periods. Operating results for the three month period ended June 30, 2014 are not necessarily indicative of the results that may be expected for the year ending December 31, 2014.

Following the sale of substantially all of the assets of Automatic Screw Machine Products Company, Inc. (“ASMP”) (See Note 9 - Discontinued Operations), the Company operates in one reportable segment; the Maintenance, Repair and Operations ("MRO") segment as a distributor of products and services to the industrial, commercial, institutional, and governmental maintenance, repair and operations marketplace. Certain reclassifications have been made to the condensed consolidated financial statements for the three and six months ended June 30, 2013 to conform to current period presentation. Such reclassifications had no effect on net income as previously reported.

The effect of restricted stock awards, market stock units and future stock option exercises equivalent to approximately 121,000 and 27,000 shares for the six months ended June 30, 2014 and 2013, respectively, would have been anti-dilutive and therefore were excluded from the computation of diluted earnings per share.

There have been no material changes in the Company's significant accounting policies during the six months ended June 30, 2014 as compared to the significant accounting policies described in our Annual Report on Form 10-K for the year ended December 31, 2013. The Company has determined that there were no subsequent events to recognize or disclose in these condensed consolidated financial statements.

In May 2014, Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-09, Revenue from Contracts with Customers (ASU 2014-09), which supersedes nearly all existing revenue recognition guidance under U.S. GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration to which an entity expects to be entitled for those goods or services. ASU 2014-09 defines a five step process to achieve this core principle and, in doing so, more judgment and estimates may be required within the revenue recognition process than are required under existing U.S. GAAP. This pronouncement is effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period and is to be applied using one of two retrospective application methods, with early application not permitted. The Company is currently evaluating the impact of the pending adoption of ASU 2014-09 on the consolidated financial statements and has not yet determined the method by which it will adopt the standard in 2017.

Note 2 — Restricted Cash

The Company has agreed to maintain $0.8 million in a money market account as collateral for an outside party that is providing certain commercial card processing services for the Company. The Company is restricted from withdrawing this balance without the prior consent of the outside party during the term of the agreement.

Note 3 — Inventories, net

Inventories, consisting primarily of purchased goods which are offered for resale, were as follows:

| (Dollars in thousands) | |||||||

| June 30, 2014 | December 31, 2013 | ||||||

| Inventories, gross | $ | 49,390 | $ | 51,102 | |||

| Reserve for obsolete and excess inventory | (5,499 | ) | (5,328 | ) | |||

| Inventories, net | $ | 43,891 | $ | 45,774 | |||

7

Note 4 — Loan Agreement

In 2012, the Company entered into a Loan and Security Agreement (“Loan Agreement”) which expires in August 2017. Due to the lock box arrangement and a subjective acceleration clause contained in the borrowing agreement, the revolving line of credit is classified as a current liability. The Loan Agreement consists of a $40.0 million revolving line of credit facility, which includes a $10.0 million sub-facility for letters of credit. In December 2013, the Company entered into a Second Amendment to Loan and Security Agreement ("Second Amendment") which revised certain terms of the original Loan Agreement.

Credit available under the Loan Agreement is based upon:

| a) | 80% of the face amount of the Company’s eligible accounts receivable, generally less than 60 days past due, and |

| b) | the lesser of 50% of the lower of cost or market value of the Company’s eligible inventory, generally inventory expected to be sold within 18 months, or $20.0 million. |

The applicable interest rates for borrowings are at the Prime rate or, if the Company elects, the LIBOR rate plus 1.50% to 1.85% based on the Company’s debt to EBITDA ratio. The Loan Agreement is secured by a first priority perfected security interest in substantially all existing assets of the Company. Dividends are restricted to amounts not to exceed $7.0 million annually.

At June 30, 2014, the Company had an outstanding balance of $2.4 million under its revolving line of credit facility and $1.5 million outstanding letters of credit, leaving additional borrowing availability of $31.0 million. The Company paid interest of $0.5 million and $0.4 million for the six months ended June 30, 2014 and 2013, respectively. The weighted average interest rate was 2.94% for the six months ended June 30, 2014 and the outstanding balance approximates fair value.

In addition to other customary representations, warranties and covenants, we are required to meet a minimum trailing twelve month EBITDA to fixed charges ratio, as defined in the Loan Agreement, and a minimum quarterly tangible net worth level as defined in the Second Amendment. On June 30, 2014, we were in compliance with all financial covenants as detailed below:

| Quarterly Financial Covenants | Requirement | Actual | ||

| EBITDA to fixed charges ratio | 1.10 : 1.00 | 2.56 : 1.00 | ||

| Minimum tangible net worth | $45.0 million | $56.2 million | ||

Note 5 — Severance Reserve

Changes in the Company’s reserve for severance as of June 30, 2014 and 2013 were as follows:

| (Dollars in thousands) | |||||||

| Six Months Ended June 30, | |||||||

| 2014 | 2013 | ||||||

| Balance at beginning of period | $ | 1,769 | $ | 4,417 | |||

| Charged to earnings | 1,018 | — | |||||

| Payments | (1,325 | ) | (986 | ) | |||

| Balance at end of period | $ | 1,462 | $ | 3,431 | |||

Note 6 — Stock-Based Compensation

The Company recorded expense related to stock-based compensation of approximately $1.5 million and $1.7 million during the six months ended June 30, 2014 and 2013, respectively. A summary of stock-based awards issued during the six months ended June 30, 2014 follows:

Stock Performance Rights ("SPRs")

The Company issued 114,753 SPRs to key employees with an average exercise price of $12.89 per share. The SPRs issued in 2014 cliff vest on December 31, 2016 and have a termination date of December 31, 2021.

8

Market Stock Units ("MSUs")

The Company issued 51,292 MSUs to key employees with a vesting date of December 31, 2016. MSU's are exchangeable for the Company's common shares at the end of the vesting period. The number of shares of common stock that will be issued upon vesting, ranging from zero to 76,941, will be determined based upon the trailing thirty trading day average closing price of the Company's common stock on December 31, 2016.

Restricted Stock Units ("RSUs")

The Company issued 25,123 RSUs to the Company's Directors with a vesting date of May 12, 2015. Each RSU is exchangeable for one of the Company's common shares at the end of the vesting period.

Restricted Stock Awards ("RSAs")

The Company issued 12,000 RSAs to key employees which vest ratably each year through May 12, 2017. Each RSA is exchangeable for one of the Company's common shares at the end of the vesting period.

Note 7 — Sale-leaseback and impairment loss

In the first half of 2014 the Company completed the sale of its Reno, Nevada, distribution center. As part of the review of the impact of a sale, the Company determined that the full carrying amount of the asset was not recoverable. Therefore, the Company recorded a $3.0 million non-cash impairment charge. The Company also entered into an agreement to leaseback approximately one half of the building for 10 years for a total of approximately $4.6 million of base rent plus operating expenses and real estate taxes to be paid over the term of the lease.

Note 8 — Income Taxes

Primarily due to the cumulative losses that the Company has incurred over the past three years, the Company determined that it was more likely than not that it will not be able to utilize its deferred tax assets to offset future taxable income. Therefore, substantially all deferred tax assets are subject to a tax valuation allowance until the Company can establish that the recoverability of its deferred tax assets is more likely than not to be realized. Although the Company is in a full tax valuation allowance position, a tax benefit of $0.5 million was recorded in continuing operations for the six months ended June 30, 2014, primarily due to the allocation of tax expenses between continuing and discontinued operations.

The Company and its subsidiaries are subject to U.S. Federal income tax, as well as income tax of multiple state and foreign jurisdictions. As of June 30, 2014, the Company is subject to U.S. Federal income tax examinations for the years 2010 through 2012 and income tax examinations from various other jurisdictions for the years 2006 through 2013. The Company is also currently under examination by the Canada Revenue Authority ("CRA") for the years 2006 through 2010. The CRA examination was completed during May 2013 and resulted in proposed adjustments which amount to $3.4 million of additional tax for the 2008 and 2009 tax years. The Company is not in agreement with these adjustments and filed a request with Competent Authority programs in both the U.S. and Canada in October, 2013. The Competent Authority program assists taxpayers with respect to matters covered in the mutual agreement procedure provisions of tax treaties. Management has not recorded a reserve and is confident that the Company will prevail in this matter. The Company is unable to establish an estimated time frame in which this issue will be resolved through Competent Authority.

Earnings from the Company’s foreign subsidiaries are considered to be indefinitely reinvested. A distribution of these non-U.S. earnings in the form of dividends or otherwise would subject the Company to both U.S. Federal and state income taxes, as adjusted for foreign tax credits.

9

Note 9 — Discontinued Operations

On February 14, 2014, the Company completed the sale of substantially all of the assets of ASMP, a wholly-owned subsidiary, to Nelson Stud Welding, Inc. (“Buyer”), an indirect subsidiary of Doncasters Group Limited, for a purchase price of $12.5 million, subject to adjustments based on the closing date net working capital, plus the assumption of certain liabilities. In addition, the Buyer agreed to lease the real property located in Decatur, Alabama currently used by ASMP. The Company has classified ASMP's operating results as discontinued operations for all periods presented.

The following table details the components of income from discontinued operations:

| (Dollars in thousands, except per share data) | ||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Net sales of ASMP | $ | — | $ | 4,767 | $ | 2,462 | $ | 9,549 | ||||||||

| Pre-tax income (loss) from discontinued operations | ||||||||||||||||

| ASMP | $ | — | $ | 723 | $ | 346 | $ | 1,390 | ||||||||

| Other discontinued operations | — | (4 | ) | — | (33 | ) | ||||||||||

| Total pre-tax income | — | 719 | 346 | 1,357 | ||||||||||||

| Income tax expense | — | (331 | ) | (133 | ) | (588 | ) | |||||||||

| Income from discontinued operations | $ | — | $ | 388 | $ | 213 | $ | 769 | ||||||||

| Sale of discontinued operations | ||||||||||||||||

| Pre-tax gain on sale of ASMP | $ | — | $ | — | $ | 1,877 | $ | — | ||||||||

| Income tax expense | — | — | (723 | ) | — | |||||||||||

| Net gain on sale of ASMP | $ | — | $ | — | $ | 1,154 | $ | — | ||||||||

| Income from discontinued operations, net of taxes | $ | — | $ | 388 | $ | 1,367 | $ | 769 | ||||||||

| Basic and diluted income per share | ||||||||||||||||

| ASMP | $ | — | $ | 0.05 | $ | 0.16 | $ | 0.09 | ||||||||

| Other discontinued operations | — | — | — | — | ||||||||||||

| Total | $ | — | $ | 0.05 | $ | 0.16 | $ | 0.09 | ||||||||

Note 10 — Contingent Liabilities

In 2012, the Company identified that a site it owns in Decatur, Alabama contains hazardous substances in the soil and groundwater as a result of historical operations prior to the Company's ownership. The Company has retained an environmental consulting firm to further investigate the contamination including the measurement and monitoring of the site. In August 2013, the site was enrolled in Alabama's voluntary cleanup program. At this time insufficient data regarding the situation has been collected to reasonably estimate the extent of the contamination or the cost, if any, of remedying this situation. Accordingly, the Company has not established a reserve for any remediation costs.

10

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

During the first half of 2014, we completed the previously announced sale of substantially all of the assets of Automatic Screw Machine Products Company, Inc. (“ASMP”), our wholly-owned subsidiary, to Nelson Stud Welding, Inc. (“Buyer”), an indirect subsidiary of Doncasters Group Limited, for net cash proceeds of approximately $12.1 million, We currently operate in one reportable segment: the Maintenance, Repair and Operations ("MRO") segment as a distributor of products and services to the industrial, commercial, institutional, and governmental maintenance, repair and operations marketplace. Certain reclassifications have been made to prior period amounts to conform to current period presentation. Such reclassifications had no effect on net income as previously reported.

The MRO industry is highly fragmented. We compete for business with several national distributors as well as a large number of regional and local distributors. The MRO business is significantly influenced by the overall strength of the manufacturing sector of the U.S. economy. One measure used to evaluate the strength of the industrial products market is the PMI index published by the Institute for Supply Management, which is considered by many economists to be the most reliable near-term economic barometer available. A measure above 50 generally indicates expansion of the manufacturing sector while a measure below 50 generally represents contraction. The average monthly PMI was 55.8 in the second quarter of 2014 compared to 50.3 in the second quarter of 2013 indicating a modest increase in the U.S. manufacturing growth rate from a year ago.

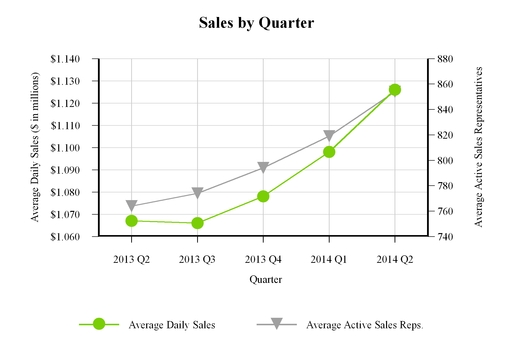

Our sales are also affected by the number of sales representatives and the amount of sales which each representative can generate, which we measure as average sales per day per sales representative. In the first half of 2014, we added 72 net new sales representatives to a total of 878 at June 30, 2014. We plan to increase our sales force by approximately 15% to 20% by the end of 2014 compared to the end of 2013. While we anticipate future sales growth from our expanded sales force, we also anticipate a short-term decrease in average sales per day per sales representative, as new representatives build up customer relationships in their territories.

Average daily sales in the second quarter of 2014 rose above the average daily sales in the second quarter of 2013 by 5.5%, as we had an average of 90 more sales representatives participating in the second quarter of 2014 than we did in the prior year quarter.

Due to a continuing focus on controlling costs and improving the efficiency of our operations, our selling, general and administrative expenses continued to decrease as a percentage of sales in the second quarter of 2014 compared to a year ago.

11

Quarter ended June 30, 2014 compared to the quarter ended June 30, 2013

A summary of our financial performance for the three months ended June 30, 2014 and 2013 is presented below:

| 2014 | 2013 | ||||||||||||

| ($ in thousands) | Amount | % of Net Sales | Amount | % of Net Sales | |||||||||

| Net sales | $ | 72,080 | 100.0 | % | $ | 68,317 | 100.0 | % | |||||

| Cost of goods sold | 28,277 | 39.2 | % | 27,683 | 40.5 | % | |||||||

| Gross profit | 43,803 | 60.8 | % | 40,634 | 59.5 | % | |||||||

| Operating expenses: | |||||||||||||

| Selling expenses | 22,950 | 31.8 | % | 20,617 | 30.2 | % | |||||||

| General and administrative expenses | 19,480 | 27.1 | % | 20,218 | 29.6 | % | |||||||

| Total SG&A | 42,430 | 58.9 | % | 40,835 | 59.8 | % | |||||||

| Impairment loss | 132 | 0.2 | % | — | — | % | |||||||

| Total operating expenses | 42,562 | 59.1 | % | 40,835 | 59.8 | % | |||||||

| Operating income (loss) | 1,241 | 1.7 | % | (201 | ) | (0.3 | )% | ||||||

| Other expenses, net | (130 | ) | (0.2 | )% | (291 | ) | (0.4 | )% | |||||

| Income (loss) from continuing operations before income taxes | 1,111 | 1.5 | % | (492 | ) | (0.7 | )% | ||||||

| Income tax expense (benefit) | 313 | 0.4 | % | (501 | ) | (0.7 | )% | ||||||

| Income from continuing operations | $ | 798 | 1.1 | % | $ | 9 | — | % | |||||

Net Sales

Net sales for the second quarter of 2014 increased 5.5% to $72.1 million from $68.3 million in the second quarter of 2013. Excluding the Canadian exchange rate impact of $0.4 million, net sales increased 6.1% over the prior year quarter. Average daily sales increased to $1.126 million in the second quarter of 2014 compared to $1.067 million in the prior year quarter primarily due to an increase in sales of nearly 10% in our national accounts and approximately 20% in our Kent Automotive business, an increase in the average number of sales representatives and improved productivity of our existing sales representatives. Both the second quarter of 2014 and 2013 included 64 selling days. Average daily sales per sales representative declined by 5.6% over the prior year period as newly hired sales representatives are in the early stages of building up customer relationships in their territories.

12

Gross Profit

Gross profit increased 7.8% in the second quarter of 2014 to $43.8 million from $40.6 million in the prior year quarter and increased as a percent of net sales to 60.8% from 59.5% a year ago, primarily due to lower outbound freight expense and improved distribution center efficiencies.

Selling Expenses

Selling expenses consist of compensation paid to our sales representatives and related expenses to support our sales efforts. Selling expenses increased $2.4 million to $23.0 million in the second quarter of 2014 from $20.6 million in the prior year quarter. As a percent of net sales, selling expenses increased to 31.8% in the second quarter of 2014 compared to 30.2% in the second quarter of 2013, primarily due to fixed costs associated with new sales representatives as they build up sales volumes in their territories.

General and Administrative Expenses

General and administrative expenses consist of expenses to operate our distribution network and overhead expenses to manage the business. General and administrative expenses decreased to $19.5 million in the second quarter of 2014 from $20.2 million in the prior year quarter. The decrease was primarily driven by the reduction costs incurred in 2013 associated with the McCook distribution center becoming fully operational and lower compensation expense, partially offset by an increase of $0.3 million in severance expense in 2014.

Impairment Loss

In the first quarter of 2014 we entered into an agreement to sell our Reno, Nevada distribution center. An additional $0.1 million non-cash impairment charge was recorded in the second quarter of 2014 to reflect the final sales price.

Other Expenses, Net

Other expenses, net of $0.1 million and $0.3 million for the three months ended June 30, 2014 and 2013, respectively, consist primarily of approximately $0.2 million of interest charged on the outstanding borrowings under our Loan Agreement in both 2014 and 2013.

13

Income Tax Expense (Benefit)

Primarily due to historical cumulative losses, substantially all of our deferred tax assets are subject to a tax valuation allowance. Although we are in a full tax valuation allowance position, income tax expense of $0.3 million for the three months ended June 30, 2014 and an income tax benefit of $0.5 million for the three months ended June 30, 2013 were recorded as a result of the allocation of income tax between continuing and discontinued operations.

Income from Continuing Operations

We reported income from continuing operations of $0.8 million in the second quarter of 2014 compared to essentially break-even in the second quarter of 2013.

Six months ended June 30, 2014 compared to the six months ended June 30, 2013

A summary of our financial performance for the six months ended June 30, 2014 and 2013 is presented below:

| 2014 | 2013 | ||||||||||||

| ($ in thousands) | Amount | % of Net Sales | Amount | % of Net Sales | |||||||||

| Net sales | $ | 141,284 | 100.0 | % | $ | 135,530 | 100.0 | % | |||||

| Cost of goods sold | 56,203 | 39.8 | % | 55,082 | 40.6 | % | |||||||

| Gross profit | 85,081 | 60.2 | % | 80,448 | 59.4 | % | |||||||

| Operating expenses: | |||||||||||||

| Selling expenses | 44,230 | 31.3 | % | 42,225 | 31.2 | % | |||||||

| General and administrative expenses | 41,277 | 29.2 | % | 41,954 | 30.9 | % | |||||||

| Total SG&A | 85,507 | 60.5 | % | 84,179 | 62.1 | % | |||||||

| Impairment loss | 3,046 | 2.2 | % | — | 0.1 | % | |||||||

| Total operating expenses | 88,553 | 62.7 | % | 84,179 | 62.2 | % | |||||||

| Operating loss | (3,472 | ) | (2.5 | )% | (3,731 | ) | (2.8 | )% | |||||

| Other expenses, net | (522 | ) | (0.4 | )% | (565 | ) | (0.4 | )% | |||||

| Loss from continuing operations before income taxes | (3,994 | ) | (2.8 | )% | (4,296 | ) | (3.2 | )% | |||||

| Income tax benefit | (470 | ) | (0.3 | )% | (701 | ) | (0.5 | )% | |||||

| Loss from continuing operations | $ | (3,524 | ) | (2.5 | )% | $ | (3,595 | ) | (2.7 | )% | |||

Net Sales

Net sales for the six months ended June 30, 2014 increased 4.2% to $141.3 million from $135.5 million in the six months ended June 30, 2013. Excluding the Canadian exchange rate impact of $1.0 million, net sales increased 5.0% when compared to the same period last year. Average daily sales increased to $1.112 million in the first half of 2014 compared to $1.067 million in the prior period primarily due an increase in sales of approximately 7% in our national accounts and 18% in our Kent Automotive business, an increase in the average number of sales representatives and improved productivity of our existing sales representatives. On a year-to-date basis, both 2014 and 2013 included 127 selling days. Average daily sales per sales representative declined by 4.9% over the prior year period as newly hired sales representatives are in the early stages of building up customer relationships in their territories.

14

Gross Profit

Gross profit increased 5.8% in the first six months of 2014 to $85.1 million from $80.4 million in the first six months of 2013 and increased as a percent of net sales to 60.2% from 59.4% a year ago, primarily due to lower outbound freight expense and improved distribution center efficiencies.

Selling Expenses

Selling expenses consist of compensation paid to our sales representatives and related expenses to support our sales efforts. Selling expenses increased $2.0 million to $44.2 million in the first six months of 2014 from $42.2 million in the first six months of 2013. As a percent of net sales, selling expenses increased slightly to 31.3% in the first half of 2014 compared to 31.2% in the first half of 2013. Increased costs associated with new sales representatives including compensation, hiring and onboarding were partially offset by expenses incurred in the first half of 2013 related to a non-recurring national sales meeting.

General and Administrative Expenses

General and administrative expenses consist of expenses to operate our distribution network and overhead expenses to manage the business. General and administrative expenses decreased to $41.3 million in the first half of 2014 from $42.0 million in the prior year period. The decrease was primarily driven by lower employee compensation expense and costs associated with the opening of the McCook distribution facility in 2013, partially offset by a $1.0 million increase in severance expense.

Impairment Loss

In the first half of 2014 we completed the sale of our Reno, Nevada distribution center. During the process we determined that the full carrying amount of the asset was not recoverable. Therefore, we recorded a $3.0 million non-cash impairment charge to reduce the carrying value of the property to its actual fair market value.

Other Expenses, Net

Other expenses, net of $0.5 million and $0.6 million for the six months ended June 30, 2014 and 2013, respectively, consist primarily of interest charged on the outstanding borrowings under our Loan Agreement.

Income Tax Benefit

Primarily due to historical cumulative losses, substantially all of our deferred tax assets are subject to a tax valuation allowance. Although we are in a full tax valuation allowance position, income tax benefits of $0.5 million and $0.7 million were recorded for the six months ended June 30, 2014 and 2013, respectively, primarily due to the allocation of income taxes between continuing and discontinued operations.

Loss from Continuing Operations

We reported a loss from continuing operations of $3.5 million in the first half of 2014 compared to a loss from continuing operations of $3.6 million in the first half of 2013. The loss recorded in 2014 was primarily driven by the impairment charge related to the sale of the Reno, Nevada, distribution center and severance expense.

15

Liquidity and Capital Resources

Cash and cash equivalents were $1.6 million on June 30, 2014 compared to $0.7 million on December 31, 2013. Net cash used in continuing operations of $4.4 million for the six months ended June 30, 2014 was primarily to fund an increase in accounts receivable of $3.7 million, reflecting increased sales during the second quarter compared to the fourth quarter of 2013, as well as to pay down accounts payable and other liabilities. The $6.7 million of net cash used in operations in the first six months months of 2013 was primarily used to fund increases in working capital.

In the first half of 2014, we received $12.1 million of net proceeds from the sale of our ASMP subsidiary and we received net proceeds of $8.3 million from the sale of the Reno, Nevada, distribution center. Capital expenditures were $0.9 million in the first six months of 2014 compared to $1.7 million in the first six months of 2013. Capital expenditures in the first six months of 2014 were primarily for improvements to our information technology and our distribution centers. Capital expenditures in the first six months of 2013 were primarily for warehouse equipment to support the McCook facility and for improvements to our sales order entry system and website.

Primarily using the net proceeds on the sale of ASMP and our Reno, Nevada, distribution center, we were able to pay down our revolving line of credit by $13.6 million in the first six months of 2014. No dividends were paid to shareholders in the first six months of 2014 or 2013. Dividends are currently restricted under the Loan Agreement to amounts not to exceed $7.0 million annually.

Loan Agreement

In addition to other customary representations, warranties and covenants, we are required to meet a minimum trailing twelve month EBITDA to fixed charges ratio, as defined in the Loan Agreement, and a minimum quarterly tangible net worth level as defined in the Second Amendment. On June 30, 2014, we were in compliance with all financial covenants as detailed below:

| Quarterly Financial Covenants | Requirement | Actual | ||

| EBITDA to fixed charges ratio | 1.10 : 1.00 | 2.56 : 1.00 | ||

| Minimum tangible net worth | $45.0 million | $56.2 million | ||

While we met the minimum financial covenant levels for the quarter ended June 30, 2014, failure to meet these covenant requirements in future quarters could lead to higher financing costs, increased restrictions, or reduce or eliminate our ability to borrow funds and could have a material adverse effect on our business, financial condition and results of operations.

At June 30, 2014, we had an outstanding loan balance of $2.4 million and $1.5 million of outstanding letters of credit with additional borrowing availability of $31.0 million under our Loan Agreement. We believe cash provided by operations and funds available under our Loan Agreement are sufficient to fund our operating requirements, strategic initiatives and capital improvements throughout the remainder of 2014.

16

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

There have been no material changes in market risk at June 30, 2014 from that reported in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013.

ITEM 4. CONTROLS AND PROCEDURES

Under the supervision and with the participation of our senior management, including our Chief Executive Officer and Chief Financial Officer, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as of the end of the period covered by this report (the “Evaluation Date”). Based on this evaluation, our Chief Executive Officer and Chief Financial Officer concluded as of the Evaluation Date that our disclosure controls and procedures were effective such that (i) the information relating to Lawson, including our consolidated subsidiaries, required to be disclosed in our SEC reports is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and (ii) include, without limitation, controls and procedures designed to ensure that information required to be disclosed is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

There was no change in the Company’s internal control over financial reporting during the quarter ended June 30, 2014 that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.

17

PART II

OTHER INFORMATION

ITEMS 1, 1A, 2, 3, 4 and 5 of Part II are inapplicable and have been omitted from this report.

ITEM 6. EXHIBITS

| Exhibit # | |

| 31.1 | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32 | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101.INS | XBRL Instance Document |

| 101.SCH | XBRL Taxonomy Extension Schema Document |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document |

18

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| LAWSON PRODUCTS, INC. | |||

| (Registrant) | |||

| Dated: | July 24, 2014 | /s/ Michael G. DeCata | |

| Michael G. DeCata | |||

| President and Chief Executive Officer | |||

| (principal executive officer) | |||

| Dated: | July 24, 2014 | /s/ Ronald J. Knutson | |

| Ronald J. Knutson | |||

| Executive Vice President and Chief Financial Officer | |||

| (principal financial and accounting officer) | |||

19