Investor Presentation Third Quarter 2018 Presenters: Michael DeCata, President & CEO Ronald Knutson, EVP & CFO © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Lawson Products, Inc. "Safe Harbor" Statement under the Securities Litigation Reform Act of 1995: This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. The terms “may,” “should,” “could,” “anticipate,” “believe,” “continues,” “estimate,” “expect,” “intend,” “objective,” “plan,” “potential,” “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include: failure to retain a talented workforce including productive sales representatives; the inability of management to successfully implement strategic initiatives; failure to manage change; the ability to adequately fund our operating and working capital needs through cash generated from operations; the ability to meet the covenant requirements of our line of credit; disruptions of the Company’s information and communication systems; the effect of general economic and market conditions; inventory obsolescence; work stoppages and other disruptions at transportation centers or shipping ports; changing customer demand and product mixes; increases in commodity prices; violations of environmental protection regulations; a negative outcome related to tax matters; and, all other factors discussed in the Company’s “Risk Factors” set forth in its Annual Report on Form 10-K for the year ended December 31, 2017. The Company undertakes no obligation to update any such factors or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events or otherwise. 2 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Lawson Products: At a Glance • Leading service based provider of consumables in MRO market • Serves industrial, commercial, institutional and government markets in all 50 states, Canada, Mexico, Puerto Rico and the Caribbean • Headquartered in Chicago, IL – Strategically located distribution centers – Workforce ~1,600 (~ 1,000 sales reps) • Supplies a comprehensive line of products to the MRO marketplace • VMI and private label drives high gross margins Fasteners Cutting Tools Chemicals Hydraulics Other 3 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

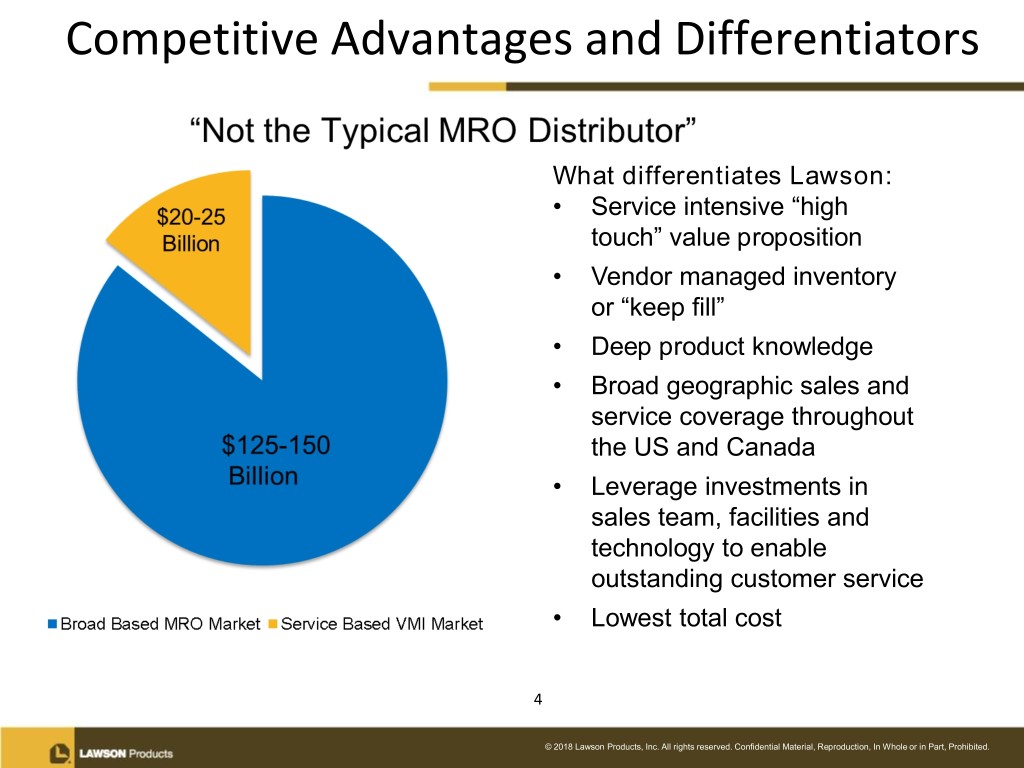

Competitive Advantages and Differentiators What differentiates Lawson: • Service intensive “high touch” value proposition • Vendor managed inventory or “keep fill” • Deep product knowledge • Broad geographic sales and service coverage throughout the US and Canada • Leverage investments in sales team, facilities and technology to enable outstanding customer service • Lowest total cost 4 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Our Commitment to our 70,000+ Customers High touch service and technical expertise drives customer relationships Before After One Company, Zero Headaches Inventory Management Options Access to Industry Knowledge & Expertise • Comprehensive line of products • Lawson Managed Inventory • Product recommendations from your Lawson Representative • Hundreds of pre-built assortments • Industrial vending • Application advice from our test and application engineers • Unlimited sourcing of hard-to-find • Self-service inventory • Complimentary on-site safety & items management product usage training 5 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

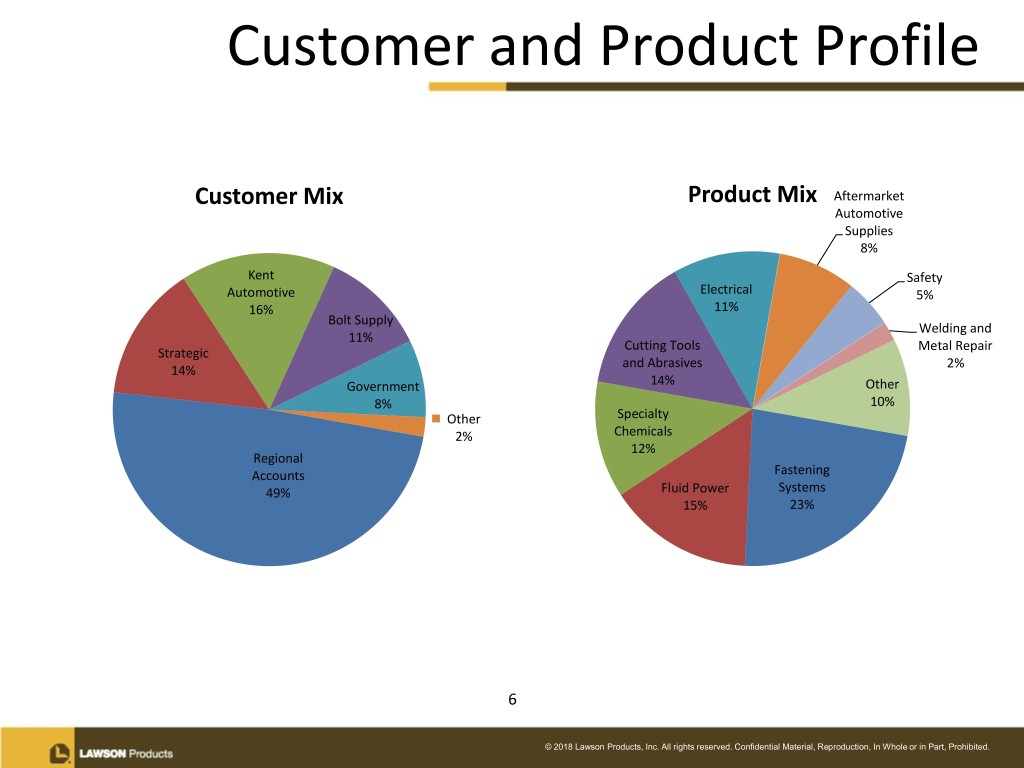

Customer and Product Profile Customer Mix Product Mix Aftermarket Automotive Supplies 8% Kent Safety Automotive Electrical 5% 16% 11% Bolt Supply Welding and 11% Cutting Tools Metal Repair Strategic and Abrasives 2% 14% Government 14% Other 8% 10% Other Specialty 2% Chemicals 12% Regional Accounts Fastening 49% Fluid Power Systems 15% 23% 6 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Lawson Growth Strategy Sales Growth Driven By Add New Drive Sales Acquisitions Sales Rep Reps Productivity Foundational Support ERP Network Sales Lean Six Website Optimization Transformation Sigma 7 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

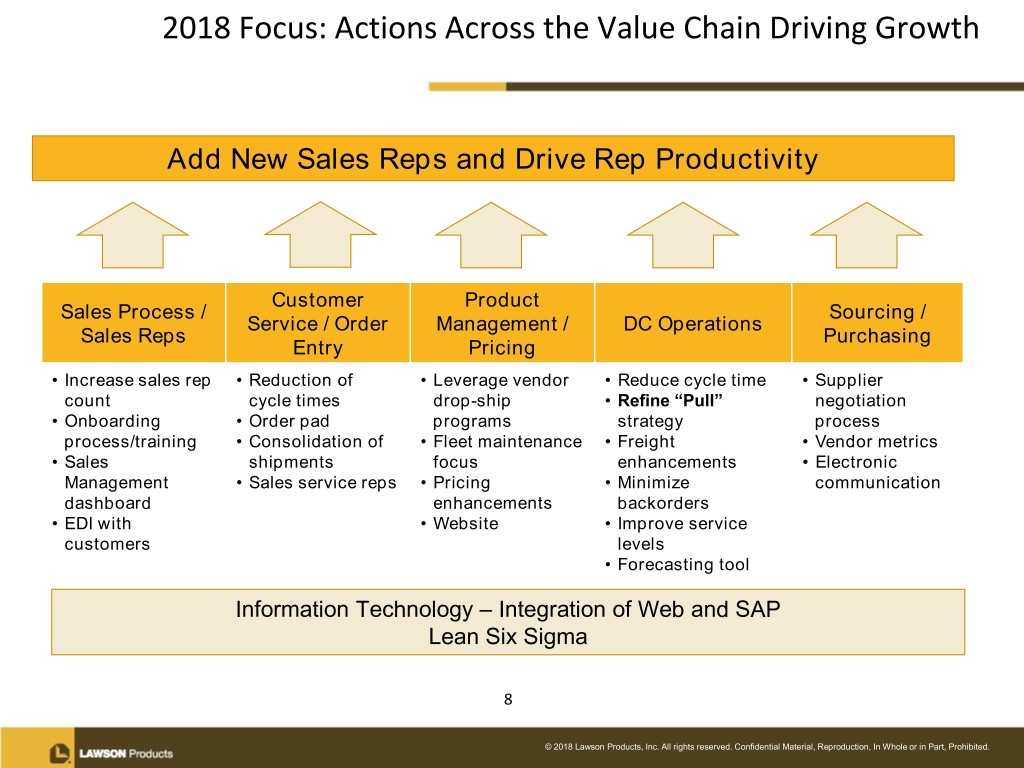

2018 Focus: Actions Across the Value Chain Driving Growth Add New Sales Reps and Drive Rep Productivity Customer Product Sales Process / Sourcing / Service / Order Management / DC Operations Sales Reps Purchasing Entry Pricing • Increase sales rep • Reduction of • Leverage vendor • Reduce cycle time • Supplier count cycle times drop-ship • Refine “Pull” negotiation • Onboarding • Order pad programs strategy process process/training • Consolidation of • Fleet maintenance • Freight • Vendor metrics • Sales shipments focus enhancements • Electronic Management • Sales service reps • Pricing • Minimize communication dashboard enhancements backorders • EDI with • Website • Improve service customers levels • Forecasting tool Information Technology – Integration of Web and SAP Lean Six Sigma 8 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

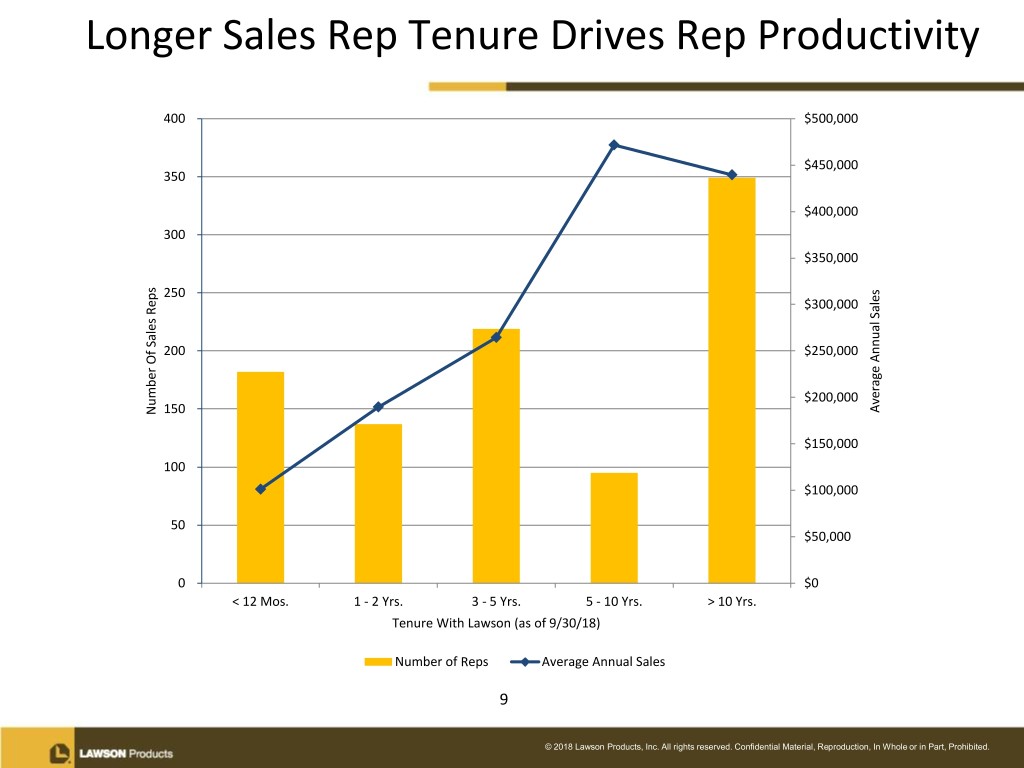

Longer Sales Rep Tenure Drives Rep Productivity 400 $500,000 $450,000 350 $400,000 300 $350,000 250 $300,000 200 $250,000 $200,000 Average Average AnnualSales Number Of Sales Reps 150 $150,000 100 $100,000 50 $50,000 0 $0 < 12 Mos. 1 - 2 Yrs. 3 - 5 Yrs. 5 - 10 Yrs. > 10 Yrs. Tenure With Lawson (as of 9/30/18) Number of Reps Average Annual Sales 9 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

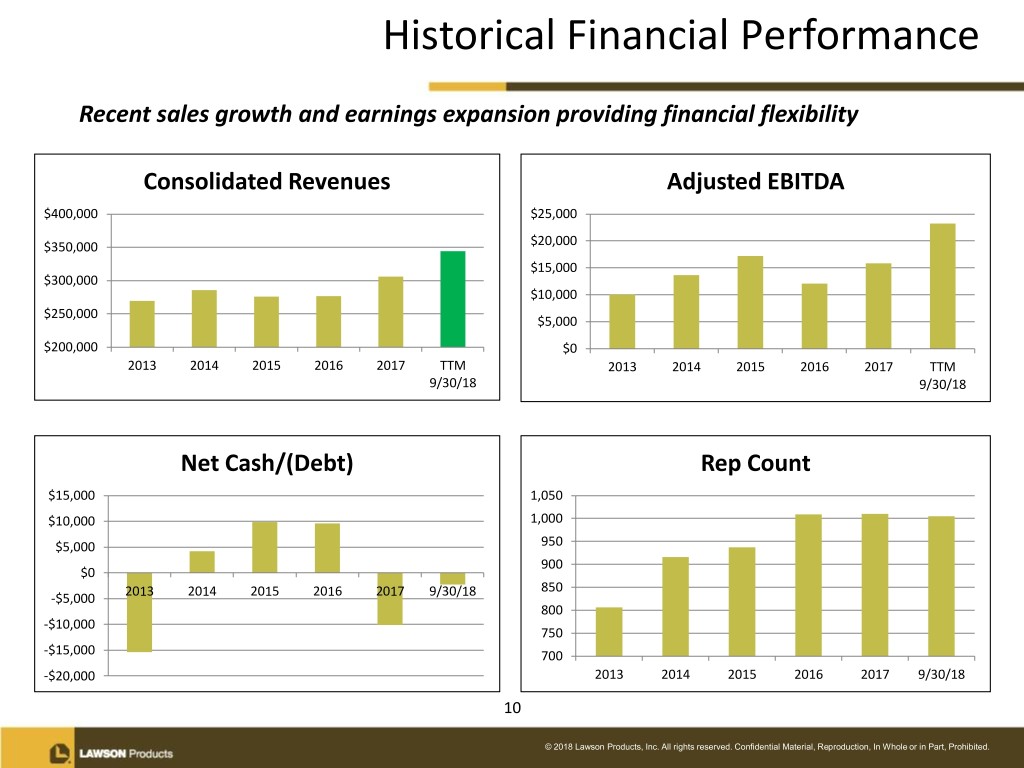

Historical Financial Performance Recent sales growth and earnings expansion providing financial flexibility Consolidated Revenues Adjusted EBITDA $400,000 $25,000 $350,000 $20,000 $15,000 $300,000 $10,000 $250,000 $5,000 $200,000 $0 2013 2014 2015 2016 2017 TTM 2013 2014 2015 2016 2017 TTM 9/30/18 9/30/18 Net Cash/(Debt) Rep Count $15,000 1,050 $10,000 1,000 $5,000 950 900 $0 2013 2014 2015 2016 2017 9/30/18 850 -$5,000 800 -$10,000 750 -$15,000 700 -$20,000 2013 2014 2015 2016 2017 9/30/18 10 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Financial Highlights for Third Quarter 2018 • Sales increased 17.0% YOY • Strong gross margins • Adjusted EBITDA margin improving 8.3% in Q3 2018 v. 7.2% in Q3 2017 Continued investment in new sales reps Cost control measures in place • Continued expansion through acquisitions Acquired Screw Products in October 2018 Acquired Bolt Supply House in October 2017 Completed six acquisitions in the last 3 years • Strong balance sheet Significant capital investments completed to support growth $40 million credit facility in place 11 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Lawson Products: Poised for Growth • Leverage Current Infrastructure • Continued Sales Growth • Foundational Investments Completed • Operational Excellence • Large Fragmented Market 12 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

For More Information Contact: Ronald J. Knutson EVP, CFO Investor Relations (773) 304-5665 ron.knutson@lawsonproducts.com And see our Website at http://www.lawsonproducts.com/company-info/investor-relations.jsp 13 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Appendices 14 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Significant Activities Appendix P-1 August 2011 Implemented SAP October 2011 Commenced construction of new McCook, Ill distribution center May 2012 Relocated corporate headquarters June 2012 Restructured senior team. Announced $20M cost savings plan Transitioned packaging facility to McCook, Ill distribution center August 2012 Entered into new five-year $40M credit facility Announced new CEO and President, Michael G. DeCata October 2012 Consolidated Vernon Hills distribution center into McCook, Ill November 2012 Rolled out new website to existing web customers December 2012 Completed transition of U.S. independent agents to employees April 2013 Roll-out of new website to new web customers April/May 2013 McCook DC begins to ship customer orders November 2013 Entered into sub-lease of headquarters space to generate $2.9M of future cash savings December 2013 Ended year with over 800 sales reps – First increase in 8 years February 2014 Closed on Automatic Screw Machine Products sale for net proceeds of $12.1M June 2014 Entered into sale-leaseback of Reno distribution facility for net proceeds of $8.3M December 2014 Ended year with over 900 sales reps February 2015 Held North American sales meeting September 2015 Completed West Coast Fasteners acquisition March 2016 Completed Perfect Products of Michigan acquisition May 2016 Completed F. B. Feeney acquisition June 2016 Expanded sales team to over 1,000 sales reps September 2016 Extended credit facitlity to August, 2020 November 2016 Completed Mattic Industries acquisition March 2017 Consolidated Fairfield, NJ distribution operations into McCook, Ill and Suwanee, GA May 2017 Sold Fairfield, NJ distribution center for a gain of $5.4M October 2017 Completed Bolt Supply House acquisition April 2018 Opened MRO distribution center in Calgary, Canada October 2018 Completed Screw Products acquisition and added Bolt Supply branch 15 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

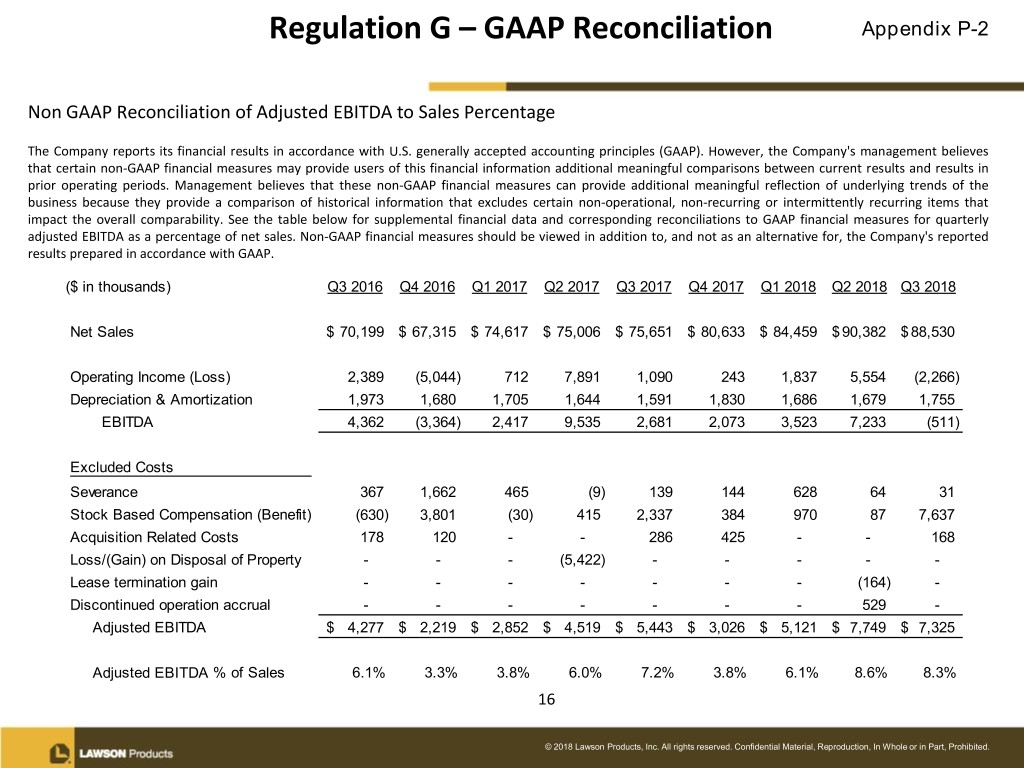

Regulation G – GAAP Reconciliation Appendix P-2 Non GAAP Reconciliation of Adjusted EBITDA to Sales Percentage The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). However, the Company's management believes that certain non-GAAP financial measures may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. Management believes that these non-GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a comparison of historical information that excludes certain non-operational, non-recurring or intermittently recurring items that impact the overall comparability. See the table below for supplemental financial data and corresponding reconciliations to GAAP financial measures for quarterly adjusted EBITDA as a percentage of net sales. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company's reported results prepared in accordance with GAAP. ($ in thousands) Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Net Sales $ 70,199 $ 67,315 $ 74,617 $ 75,006 $ 75,651 $ 80,633 $ 84,459 $ 90,382 $ 88,530 Operating Income (Loss) 2,389 (5,044) 712 7,891 1,090 243 1,837 5,554 (2,266) Depreciation & Amortization 1,973 1,680 1,705 1,644 1,591 1,830 1,686 1,679 1,755 EBITDA 4,362 (3,364) 2,417 9,535 2,681 2,073 3,523 7,233 (511) Excluded Costs Severance 367 1,662 465 (9) 139 144 628 64 31 Stock Based Compensation (Benefit) (630) 3,801 (30) 415 2,337 384 970 87 7,637 Acquisition Related Costs 178 120 - - 286 425 - - 168 Loss/(Gain) on Disposal of Property - - - (5,422) - - - - - Lease termination gain - - - - - - - (164) - Discontinued operation accrual - - - - - - - 529 - Adjusted EBITDA $ 4,277 $ 2,219 $ 2,852 $ 4,519 $ 5,443 $ 3,026 $ 5,121 $ 7,749 $ 7,325 Adjusted EBITDA % of Sales 6.1% 3.3% 3.8% 6.0% 7.2% 3.8% 6.1% 8.6% 8.3% 16 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

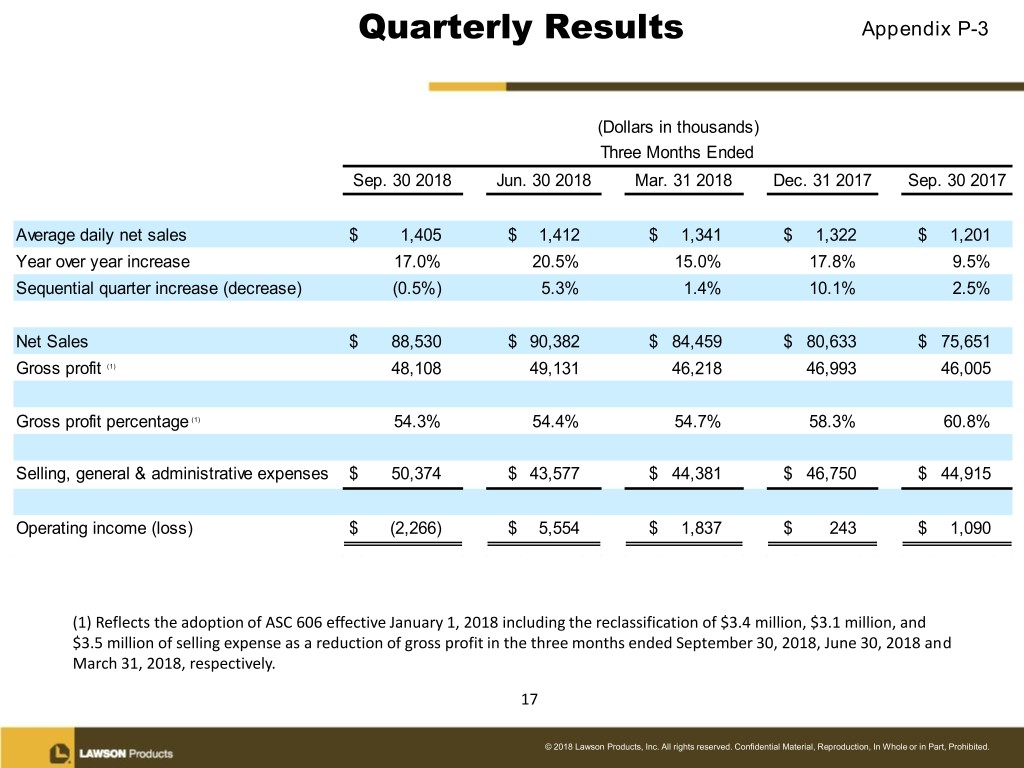

Quarterly Results Appendix P-3 (Dollars in thousands) Three Months Ended Sep. 30 2018 Jun. 30 2018 Mar. 31 2018 Dec. 31 2017 Sep. 30 2017 Average daily net sales $ 1,405 $ 1,412 $ 1,341 $ 1,322 $ 1,201 Year over year increase 17.0% 20.5% 15.0% 17.8% 9.5% Sequential quarter increase (decrease) (0.5%) 5.3% 1.4% 10.1% 2.5% Net Sales $ 88,530 $ 90,382 $ 84,459 $ 80,633 $ 75,651 Gross profit (1) 48,108 49,131 46,218 46,993 46,005 Gross profit percentage (1) 54.3% 54.4% 54.7% 58.3% 60.8% Selling, general & administrative expenses $ 50,374 $ 43,577 $ 44,381 $ 46,750 $ 44,915 Operating income (loss) $ (2,266) $ 5,554 $ 1,837 $ 243 $ 1,090 (1) Reflects the adoption of ASC 606 effective January 1, 2018 including the reclassification of $3.4 million, $3.1 million, and $3.5 million of selling expense as a reduction of gross profit in the three months ended September 30, 2018, June 30, 2018 and March 31, 2018, respectively. 17 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

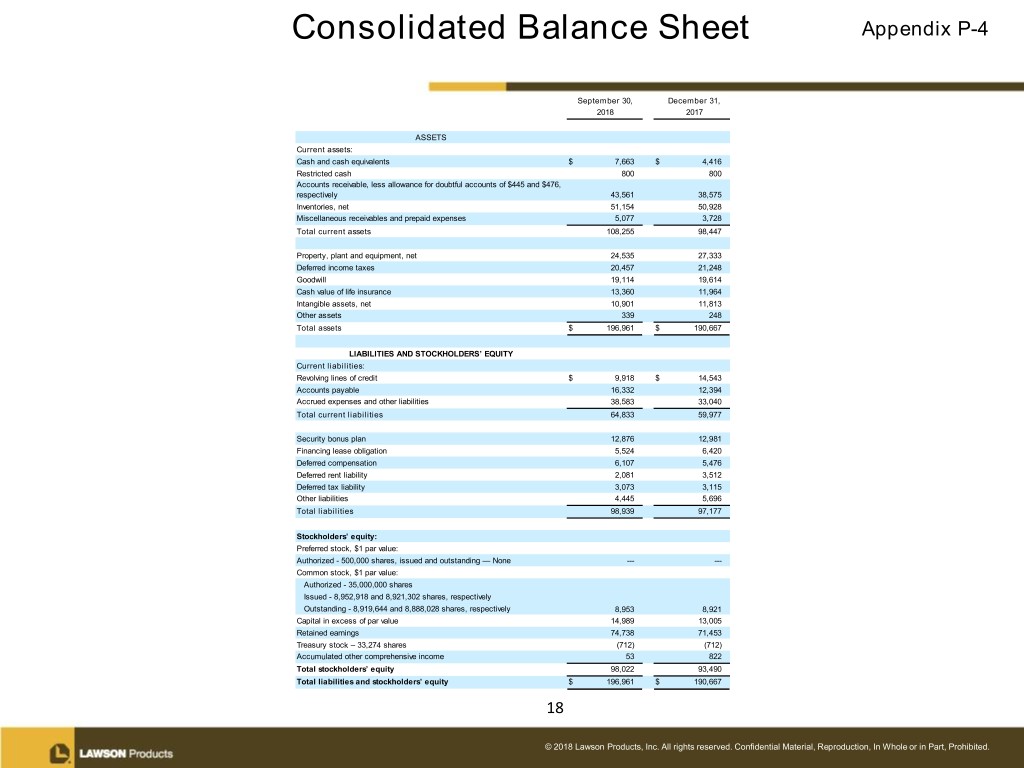

Consolidated Balance Sheet Appendix P-4 September 30, December 31, 2018 2017 ASSETS Current assets: Cash and cash equivalents $ 7,663 $ 4,416 Restricted cash 800 800 Accounts receivable, less allowance for doubtful accounts of $445 and $476, respectively 43,561 38,575 Inventories, net 51,154 50,928 Miscellaneous receivables and prepaid expenses 5,077 3,728 Total current assets 108,255 98,447 Property, plant and equipment, net 24,535 27,333 Deferred income taxes 20,457 21,248 Goodwill 19,114 19,614 Cash value of life insurance 13,360 11,964 Intangible assets, net 10,901 11,813 Other assets 339 248 Total assets $ 196,961 $ 190,667 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Revolving lines of credit $ 9,918 $ 14,543 Accounts payable 16,332 12,394 Accrued expenses and other liabilities 38,583 33,040 Total current liabilities 64,833 59,977 Security bonus plan 12,876 12,981 Financing lease obligation 5,524 6,420 Deferred compensation 6,107 5,476 Deferred rent liability 2,081 3,512 Deferred tax liability 3,073 3,115 Other liabilities 4,445 5,696 Total liabilities 98,939 97,177 Stockholders’ equity: Preferred stock, $1 par value: Authorized - 500,000 shares, issued and outstanding — None --- --- Common stock, $1 par value: Authorized - 35,000,000 shares Issued - 8,952,918 and 8,921,302 shares, respectively Outstanding - 8,919,644 and 8,888,028 shares, respectively 8,953 8,921 Capital in excess of par value 14,989 13,005 Retained earnings 74,738 71,453 Treasury stock – 33,274 shares (712) (712) Accumulated other comprehensive income 53 822 Total stockholders’ equity 98,022 93,490 Total liabilities and stockholders’ equity $ 196,961 $ 190,667 18 © 2018 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.