Investor Presentation First Quarter 2020 Presenters: Michael DeCata, President & CEO Ronald Knutson, EVP & CFO © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Lawson Products, Inc. "Safe Harbor" Statement under the Securities Litigation Reform Act of 1995: This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. The terms “may,” “should,” “could,” “anticipate,” “believe,” “continues,” “estimate,” “expect,” “intend,” “objective,” “plan,” “potential,” “project” and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions or beliefs and are subject to a number of factors, assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include: failure to retain a talented workforce including productive sales representatives; the inability of management to successfully implement strategic initiatives; failure to manage change; the ability to adequately fund our operating and working capital needs through cash generated from operations; the ability to meet the covenant requirements of our line of credit; disruptions of the Company’s information and communication systems; the effect of general economic and market conditions; inventory obsolescence; work stoppages and other disruptions at transportation centers or shipping ports; changing customer demand and product mixes; increases in commodity prices; violations of environmental protection regulations; a negative outcome related to tax matters; and, all other factors discussed in the Company’s “Risk Factors” set forth in its Annual Report on Form 10-K for the year ended December 31, 2019 and in the Form 10-Q for the quarter ended March 31, 2020 The Company undertakes no obligation to update any such factors or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events or otherwise. 2 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Lawson Products: At a Glance • Leading service based provider of consumables in MRO market • Serves industrial, commercial, institutional and government markets in all 50 states, Canada, Mexico, Puerto Rico and the Caribbean • Headquartered in Chicago, IL – Strategically located distribution centers – Workforce ~1,600 (~ 1,000 sales reps) • Supplies a comprehensive line of products to the MRO marketplace • VMI and private label drives high gross margins Fasteners Cutting Tools Chemicals Hydraulics Other 3 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

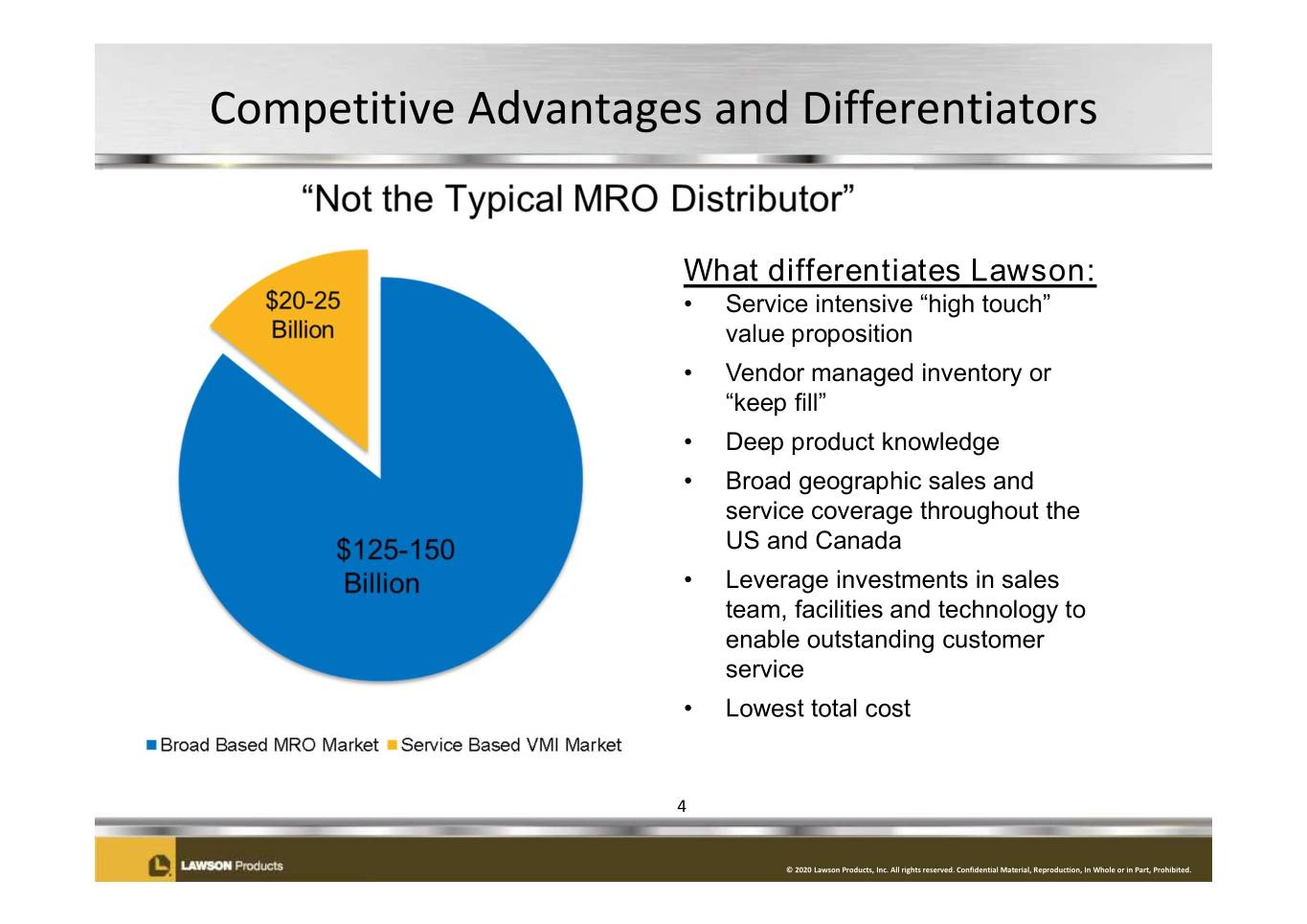

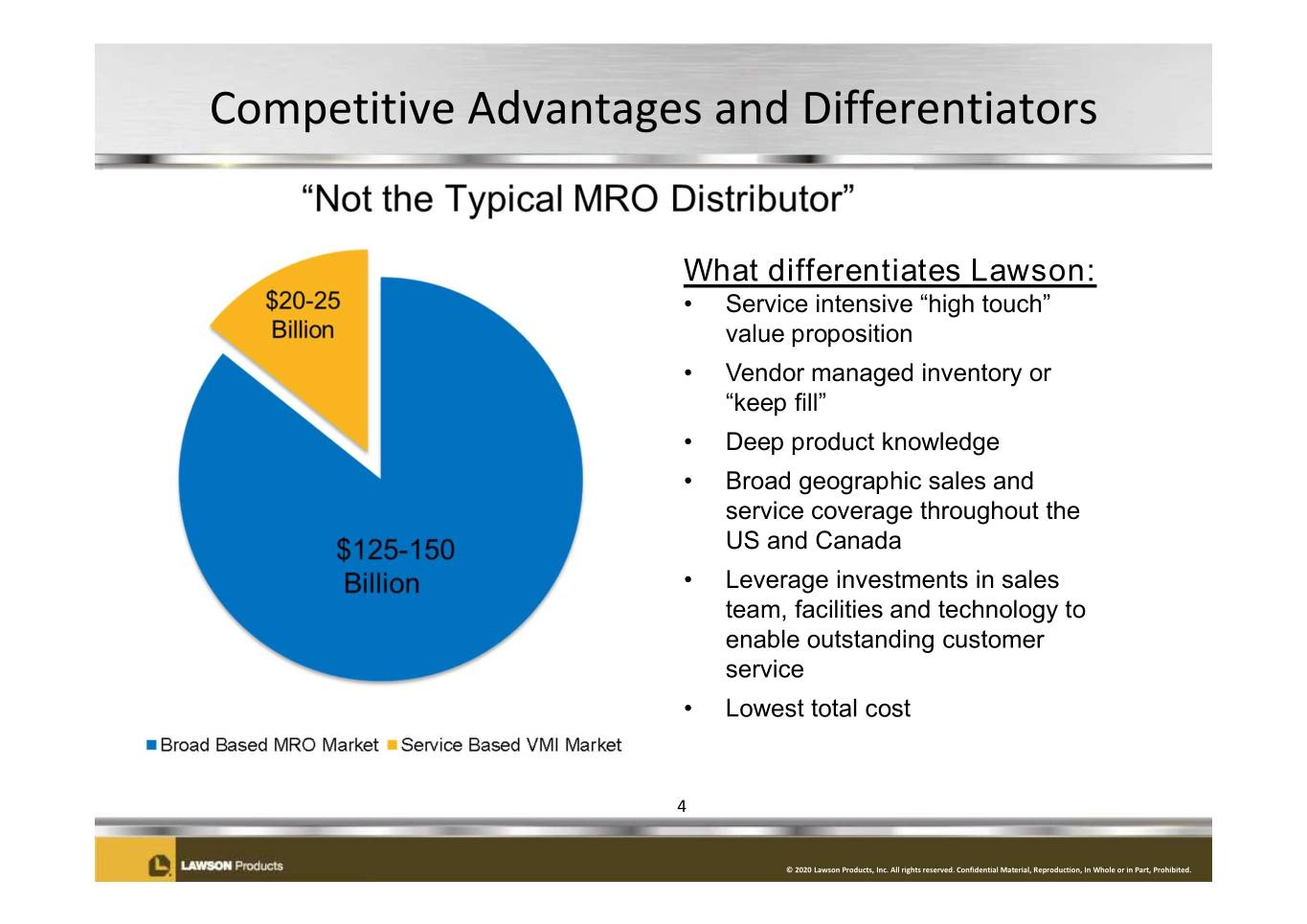

Competitive Advantages and Differentiators What differentiates Lawson: • Service intensive “high touch” value proposition • Vendor managed inventory or “keep fill” • Deep product knowledge • Broad geographic sales and service coverage throughout the US and Canada • Leverage investments in sales team, facilities and technology to enable outstanding customer service • Lowest total cost 4 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Our Commitment to our 70,000+ Customers High touch service and technical expertise drives customer relationships Before After One Company, Zero Headaches Inventory Management Options Access to Industry Knowledge & Expertise • Comprehensivelineofproducts • LawsonManagedInventory • Productrecommendationsfrom your Lawson Representative • Hundredsofpre-builtassortments • Industrialvending • Applicationadvicefromourtest and application engineers • Unlimited sourcing of hard-to-find • Self-service inventory • Complimentary on-site safety & items management product usage training 5 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

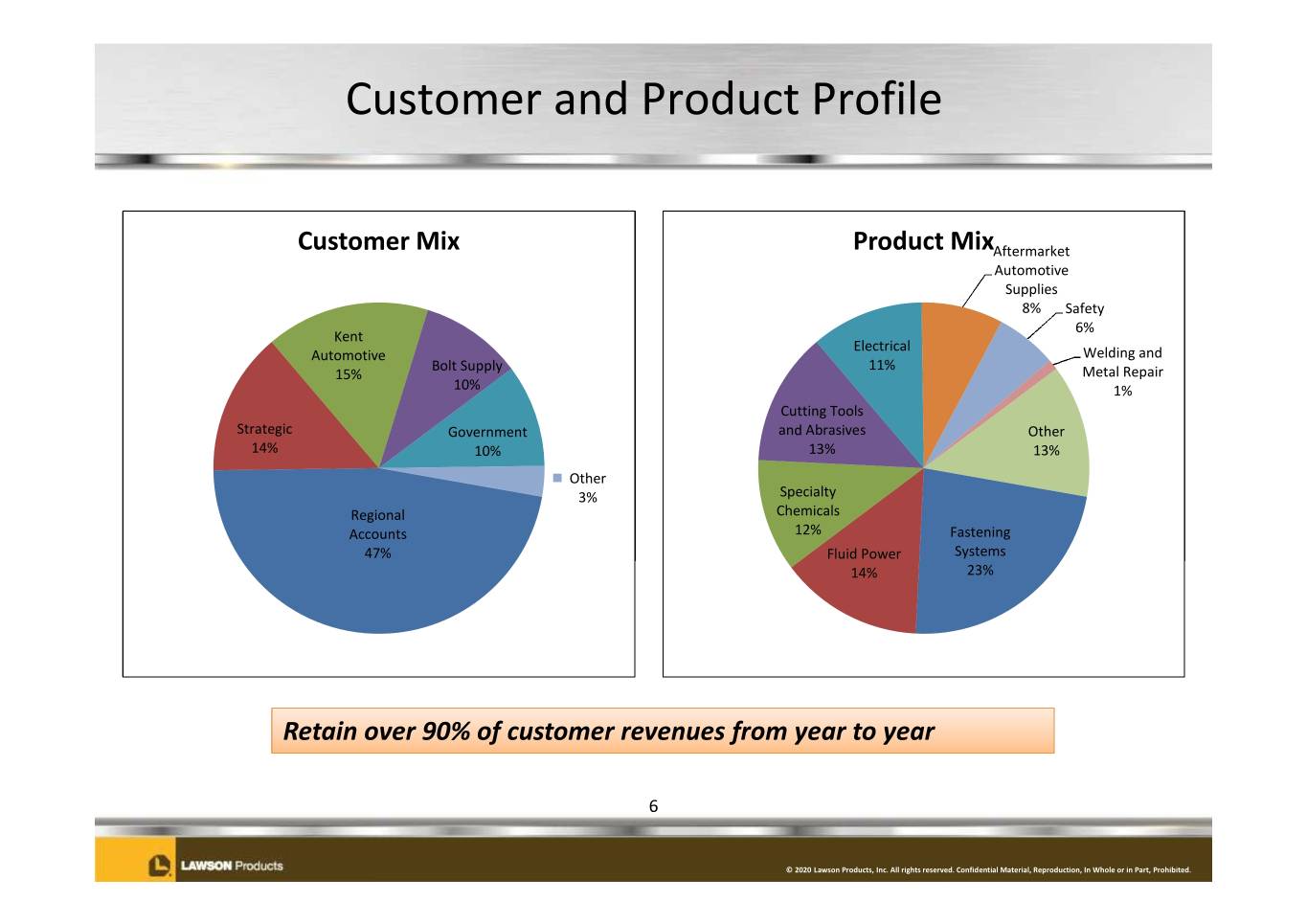

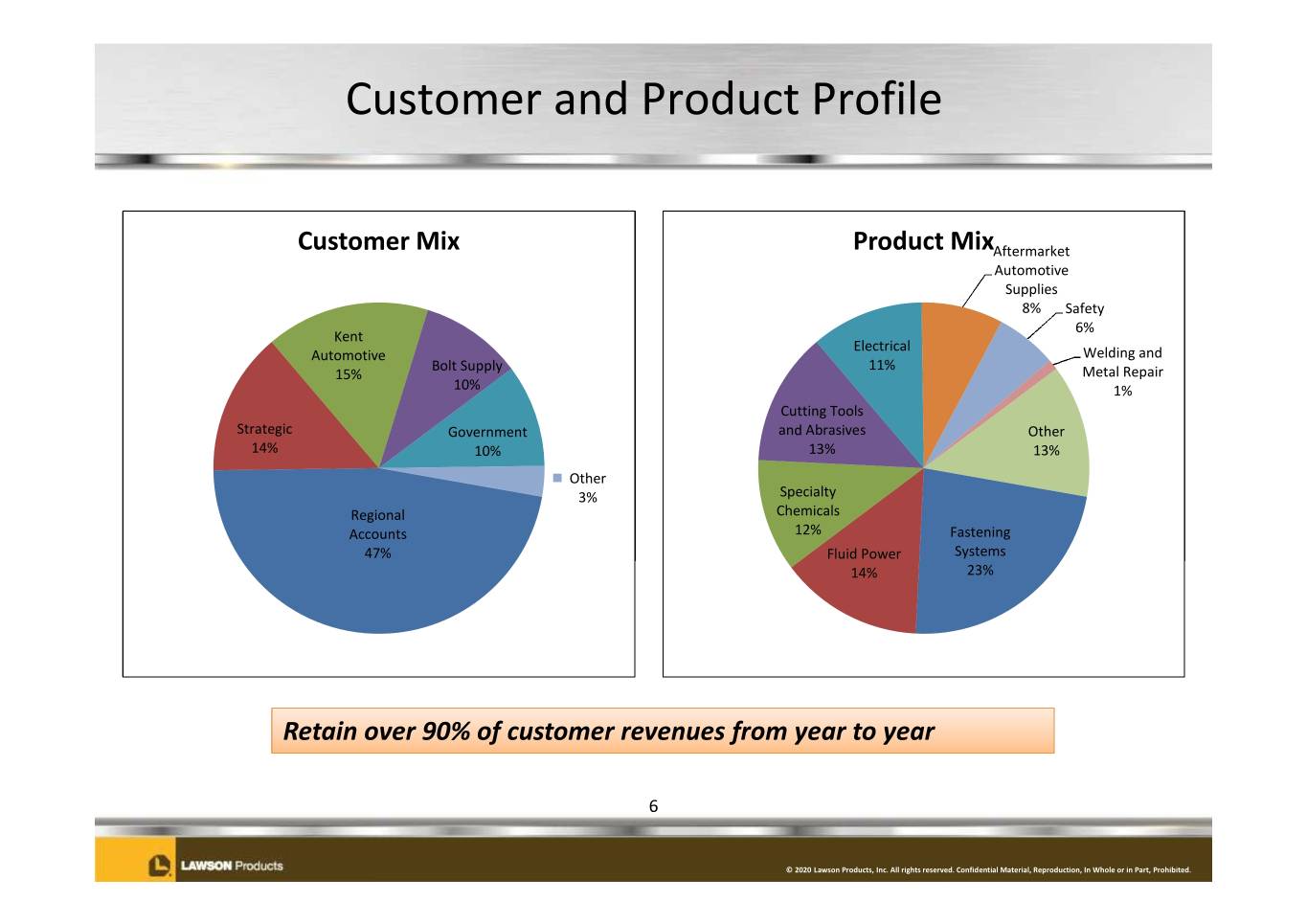

Customer and Product Profile Customer Mix Product MixAftermarket Automotive Supplies 8% Safety 6% Kent Electrical Automotive Welding and Bolt Supply 11% 15% Metal Repair 10% 1% Cutting Tools Strategic Government and Abrasives Other 14% 10% 13% 13% Other 3% Specialty Regional Chemicals Accounts 12% Fastening 47% Fluid Power Systems 14% 23% Retain over 90% of customer revenues from year to year 6 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

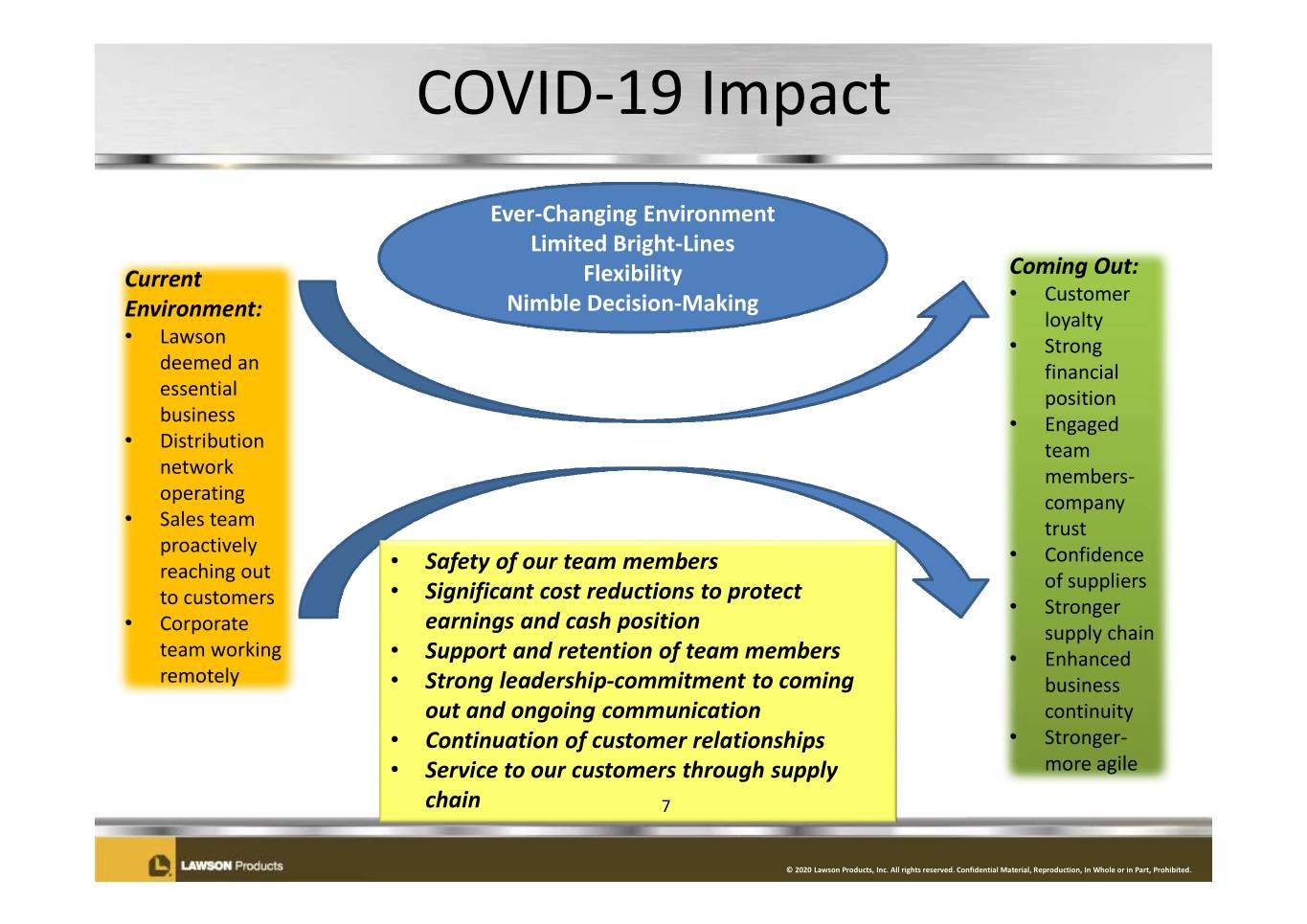

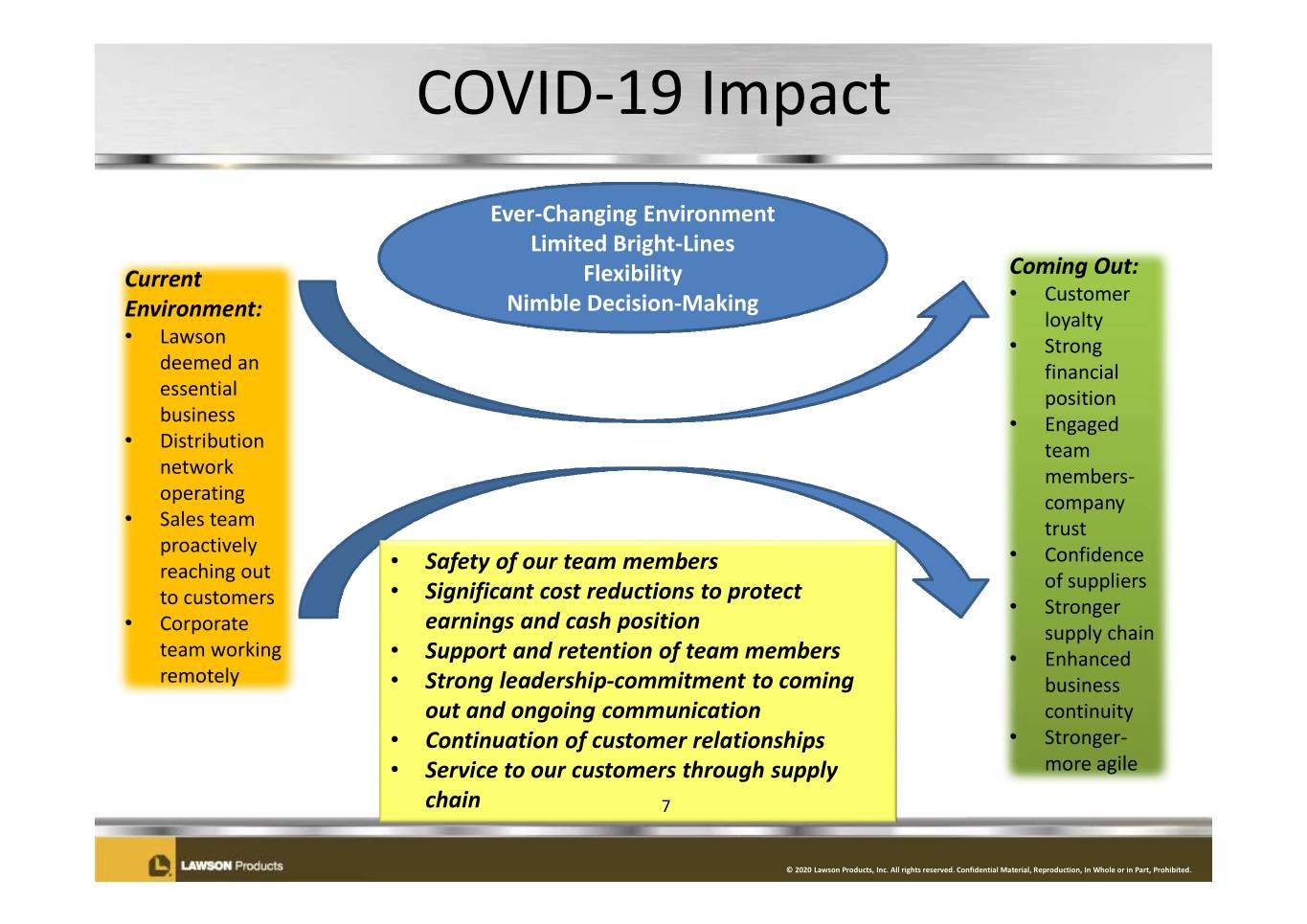

COVID-19 Impact Ever-Changing Environment Limited Bright-Lines Coming Out: Current Flexibility Nimble Decision-Making • Customer Environment: loyalty • Lawson • Strong deemed an financial essential position business • Engaged • Distribution team network members- operating company • Sales team trust proactively • Confidence reaching out • Safety of our team members • Significant cost reductions to protect of suppliers to customers • Stronger • Corporate earnings and cash position supply chain team working • Support and retention of team members • Enhanced remotely • Strong leadership-commitment to coming business out and ongoing communication continuity • Continuation of customer relationships • Stronger- • Service to our customers through supply more agile chain 7 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

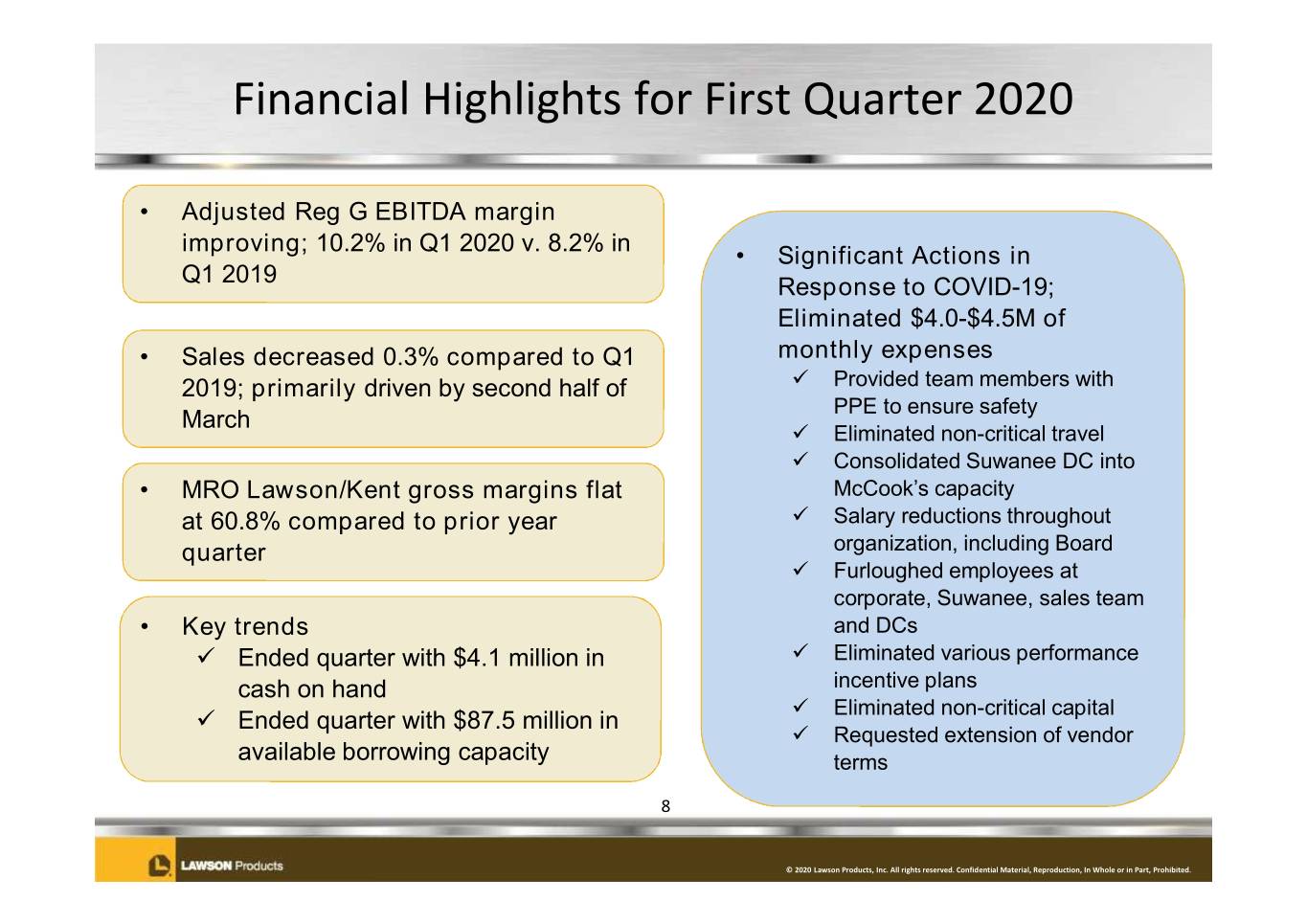

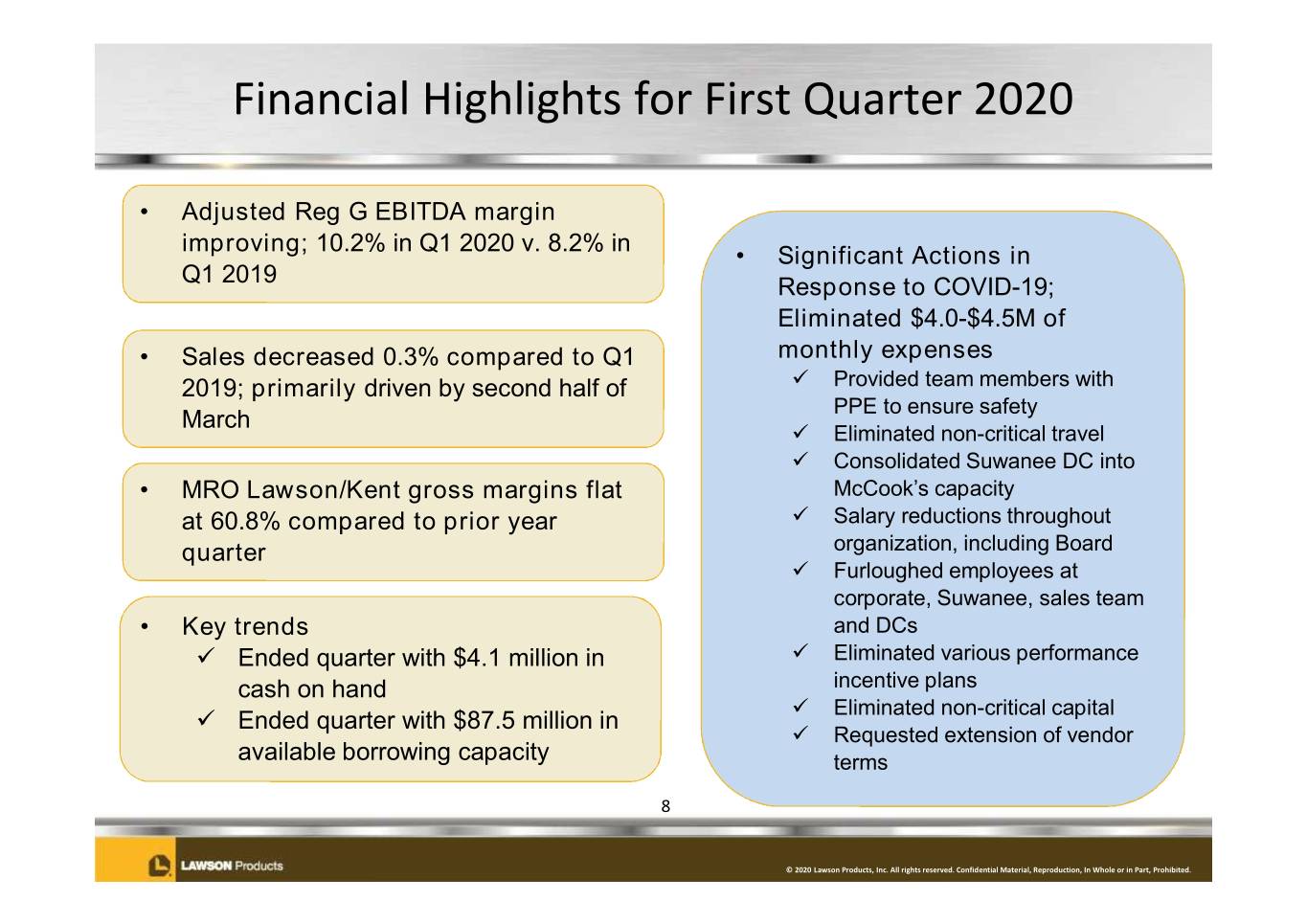

Financial Highlights for First Quarter 2020 • Adjusted Reg G EBITDA margin improving; 10.2% in Q1 2020 v. 8.2% in • Significant Actions in Q1 2019 Response to COVID-19; Eliminated $4.0-$4.5M of • Sales decreased 0.3% compared to Q1 monthly expenses 2019; primarily driven by second half of Provided team members with PPE to ensure safety March Eliminated non-critical travel Consolidated Suwanee DC into • MRO Lawson/Kent gross margins flat McCook’s capacity at 60.8% compared to prior year Salary reductions throughout quarter organization, including Board Furloughed employees at corporate, Suwanee, sales team • Key trends and DCs Ended quarter with $4.1 million in Eliminated various performance cash on hand incentive plans Eliminated non-critical capital Ended quarter with $87.5 million in Requested extension of vendor available borrowing capacity terms 8 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

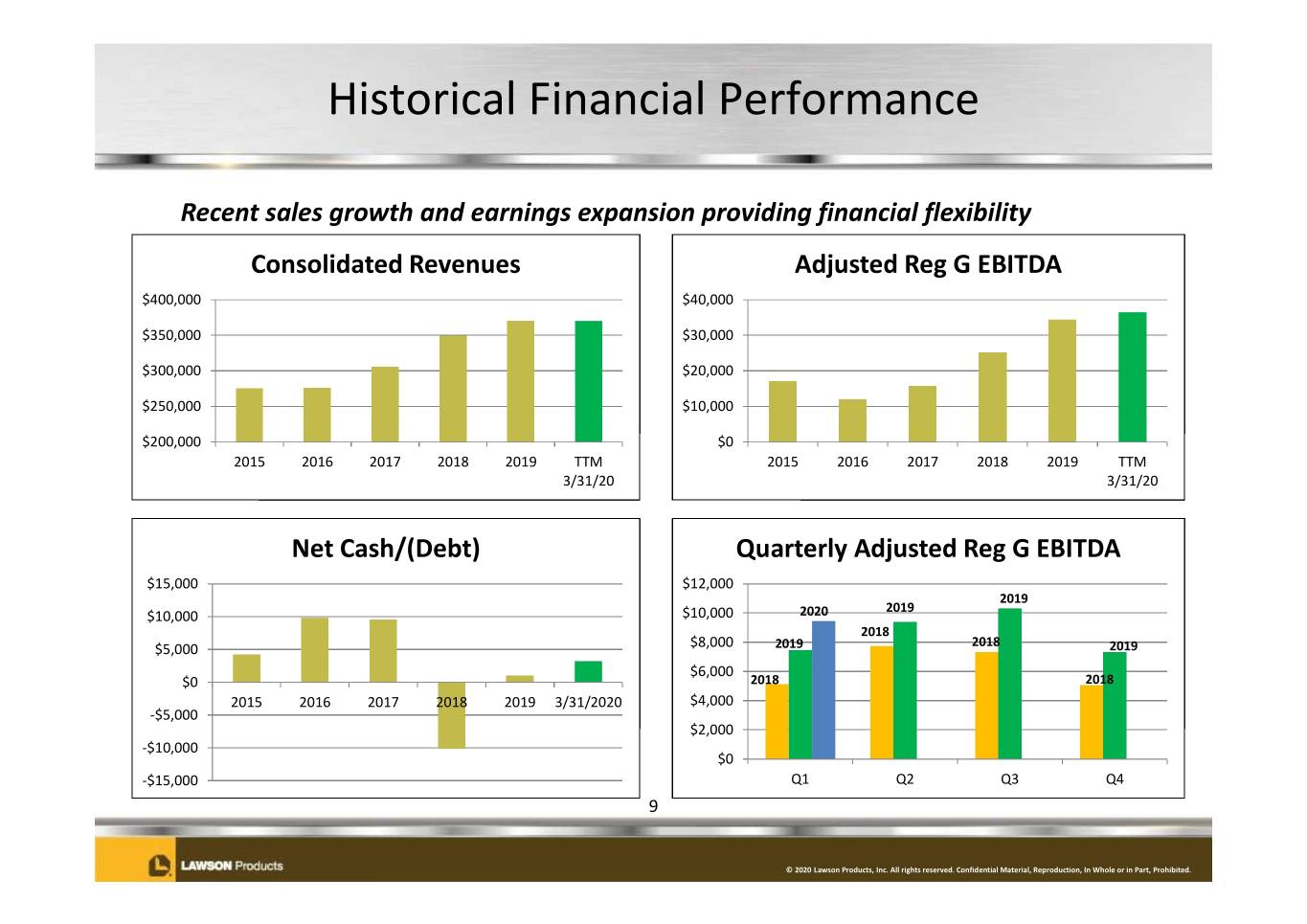

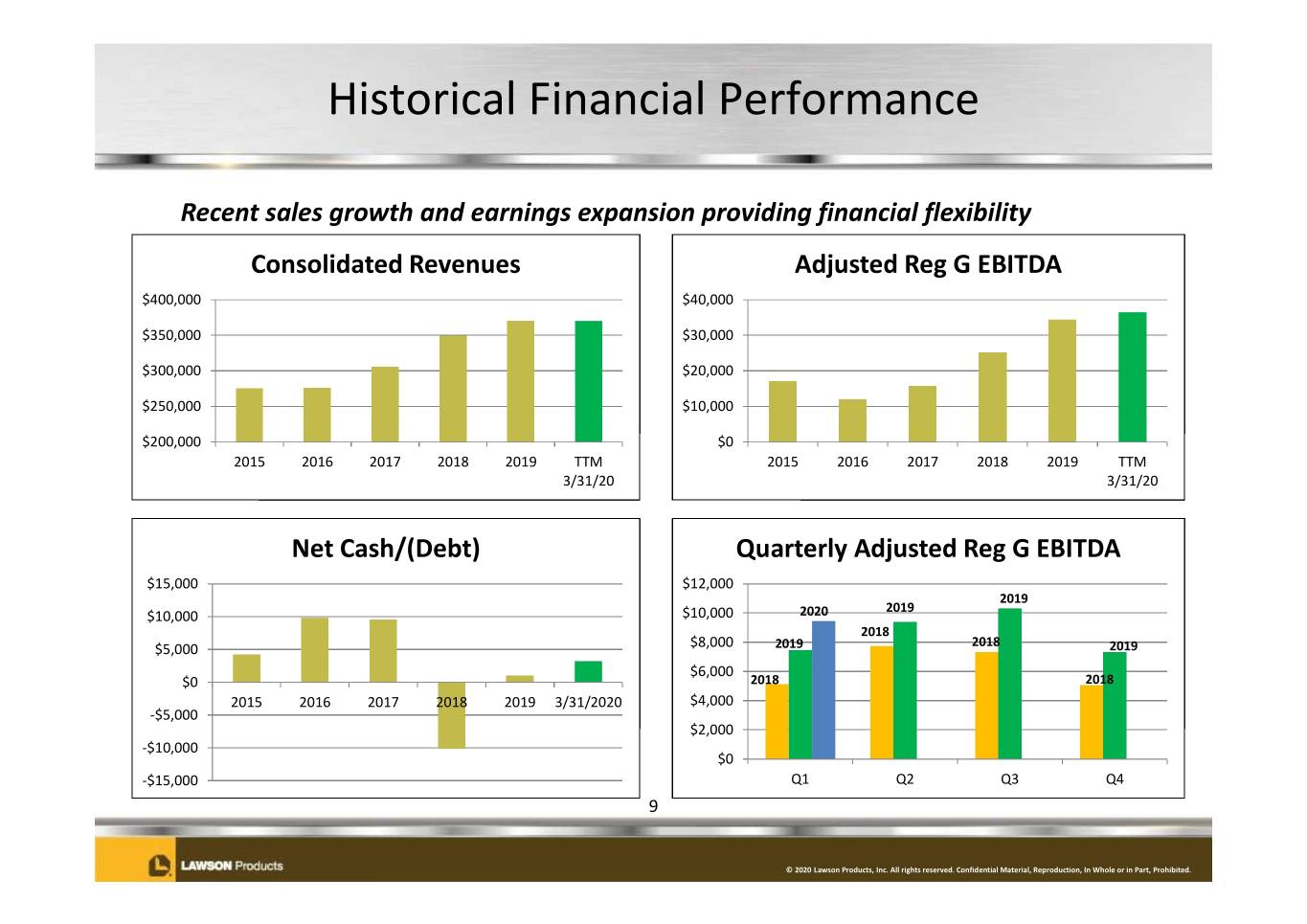

Historical Financial Performance Recent sales growth and earnings expansion providing financial flexibility Consolidated Revenues Adjusted Reg G EBITDA $400,000 $40,000 $350,000 $30,000 $300,000 $20,000 $250,000 $10,000 $200,000 $0 2015 2016 2017 2018 2019 TTM 2015 2016 2017 2018 2019 TTM 3/31/20 3/31/20 Net Cash/(Debt) Quarterly Adjusted Reg G EBITDA $15,000 $12,000 2019 2019 $10,000 $10,000 2020 2018 $5,000 $8,000 2019 2018 2019 $6,000 $0 2018 2018 2015 2016 2017 2018 2019 3/31/2020 $4,000 -$5,000 $2,000 -$10,000 $0 -$15,000 Q1 Q2 Q3 Q4 9 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

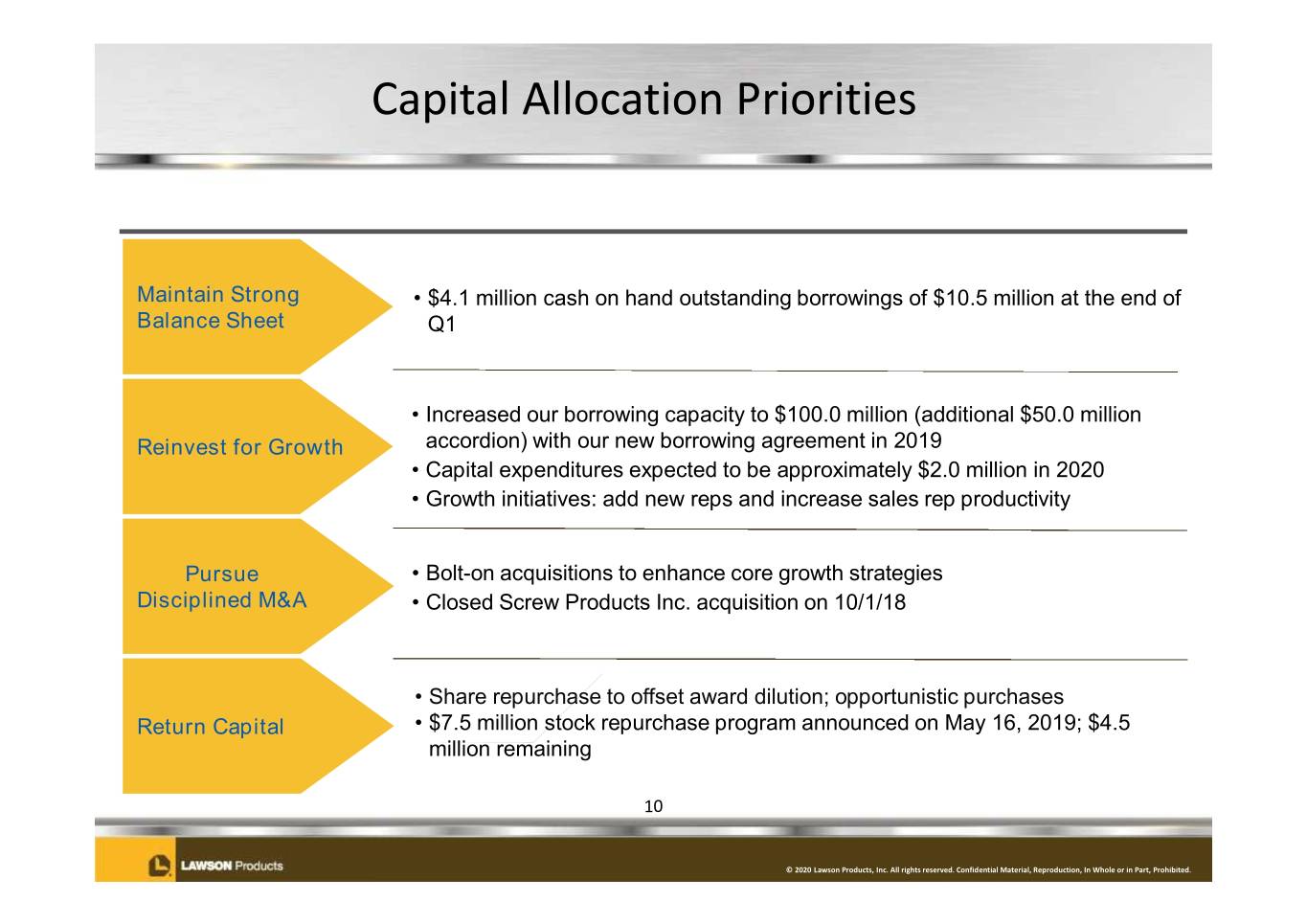

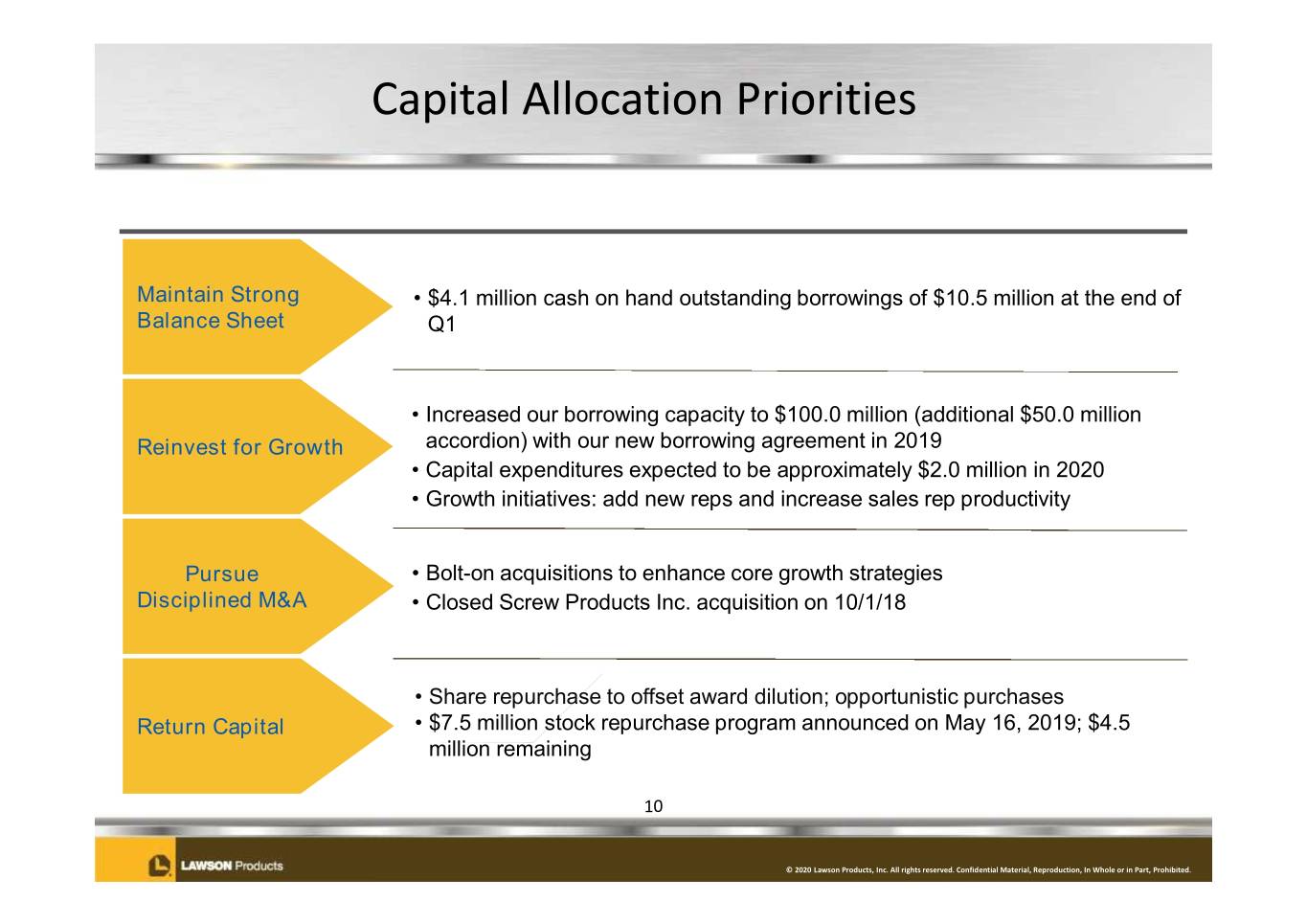

Capital Allocation Priorities Maintain Strong • $4.1 million cash on hand outstanding borrowings of $10.5 million at the end of Balance Sheet Q1 • Increased our borrowing capacity to $100.0 million (additional $50.0 million Reinvest for Growth accordion) with our new borrowing agreement in 2019 • Capital expenditures expected to be approximately $2.0 million in 2020 • Growth initiatives: add new reps and increase sales rep productivity Pursue • Bolt-on acquisitions to enhance core growth strategies Disciplined M&A • Closed Screw Products Inc. acquisition on 10/1/18 • Share repurchase to offset award dilution; opportunistic purchases Return Capital • $7.5 million stock repurchase program announced on May 16, 2019; $4.5 million remaining 10 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Lawson Growth Strategy Sales Growth Driven By New Sales Sales Rep Acquisitions Reps Productivity Foundational Support ERP Network Sales Lean Six Website Optimization Transformation Sigma 11 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

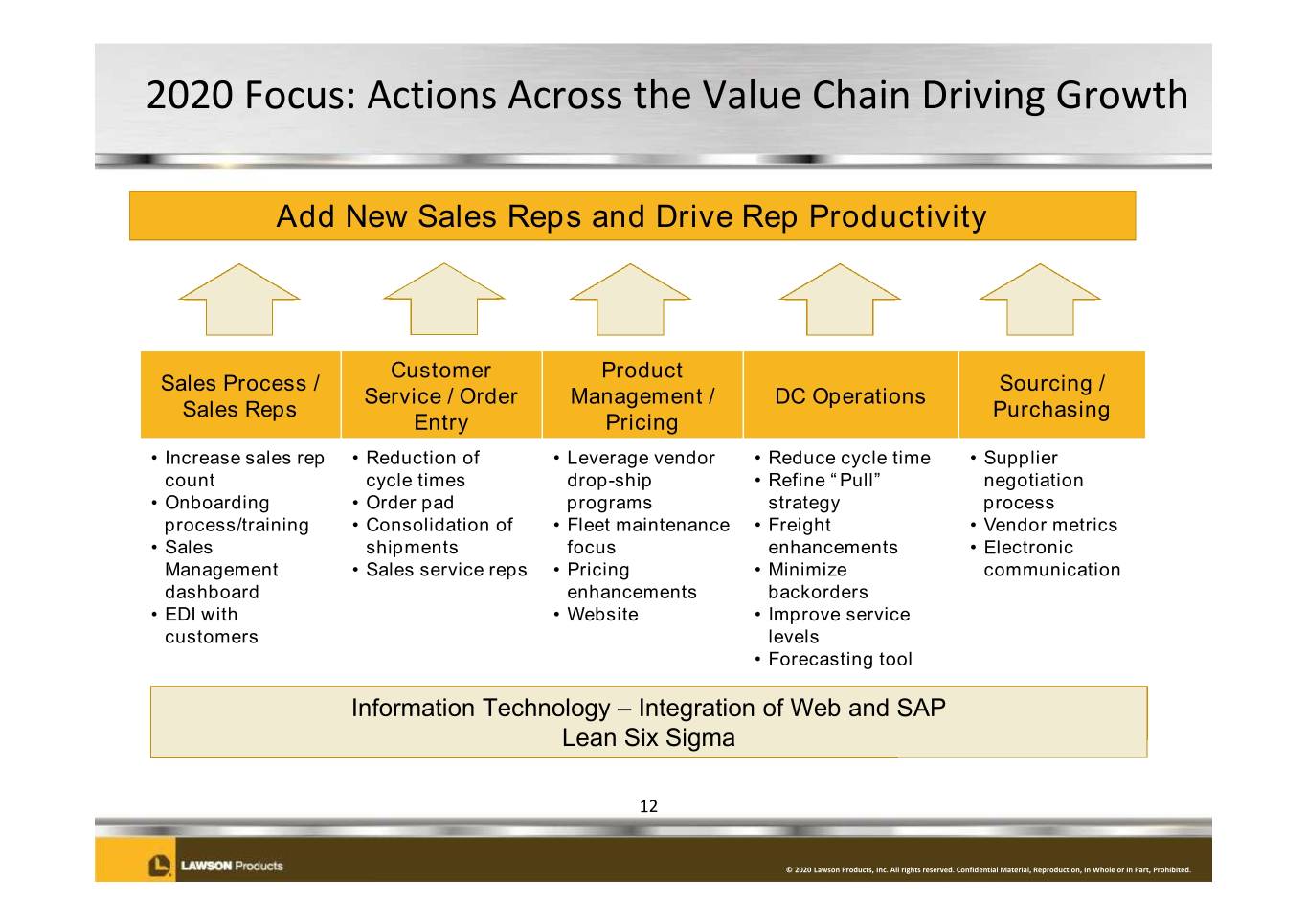

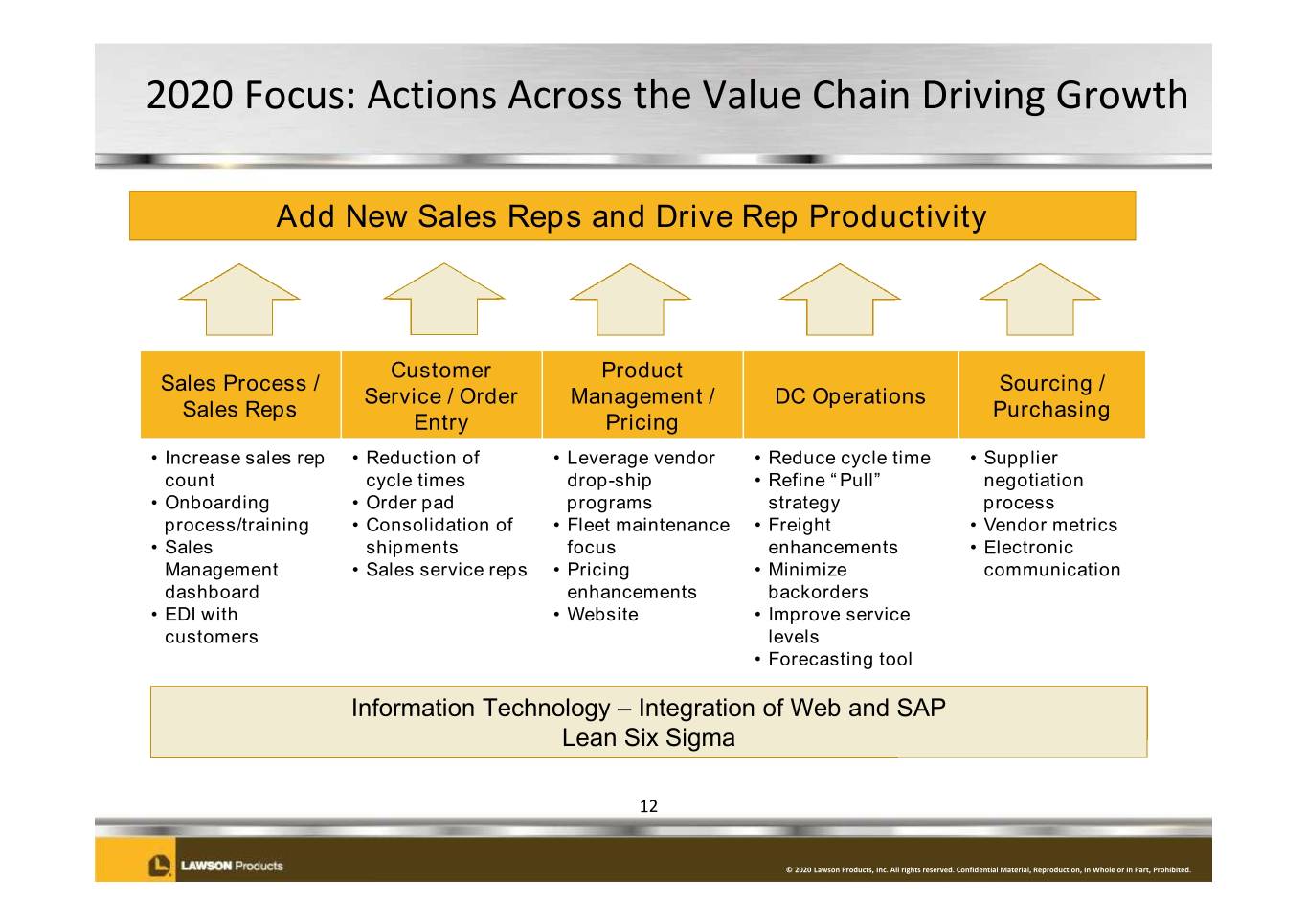

2020 Focus: Actions Across the Value Chain Driving Growth Add New Sales Reps and Drive Rep Productivity Customer Product Sales Process / Sourcing / Service / Order Management / DC Operations Sales Reps Purchasing Entry Pricing • Increase sales rep • Reduction of • Leverage vendor • Reduce cycle time • Supplier count cycle times drop-ship • Refine “Pull” negotiation • Onboarding • Order pad programs strategy process process/training • Consolidation of • Fleet maintenance • Freight • Vendor metrics • Sales shipments focus enhancements • Electronic Management • Sales service reps • Pricing • Minimize communication dashboard enhancements backorders • EDI with • Website • Improve service customers levels • Forecasting tool Information Technology – Integration of Web and SAP Lean Six Sigma 12 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

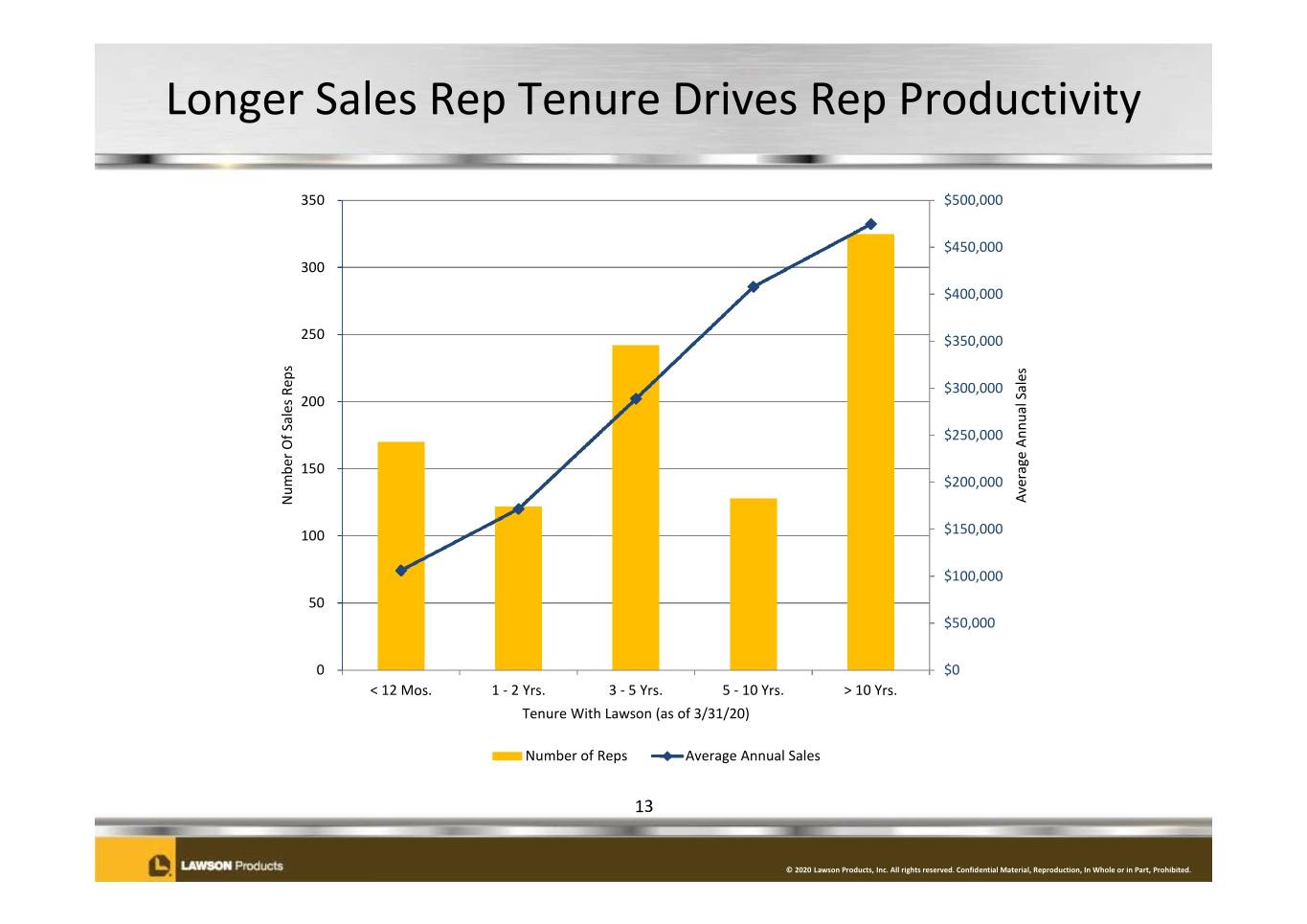

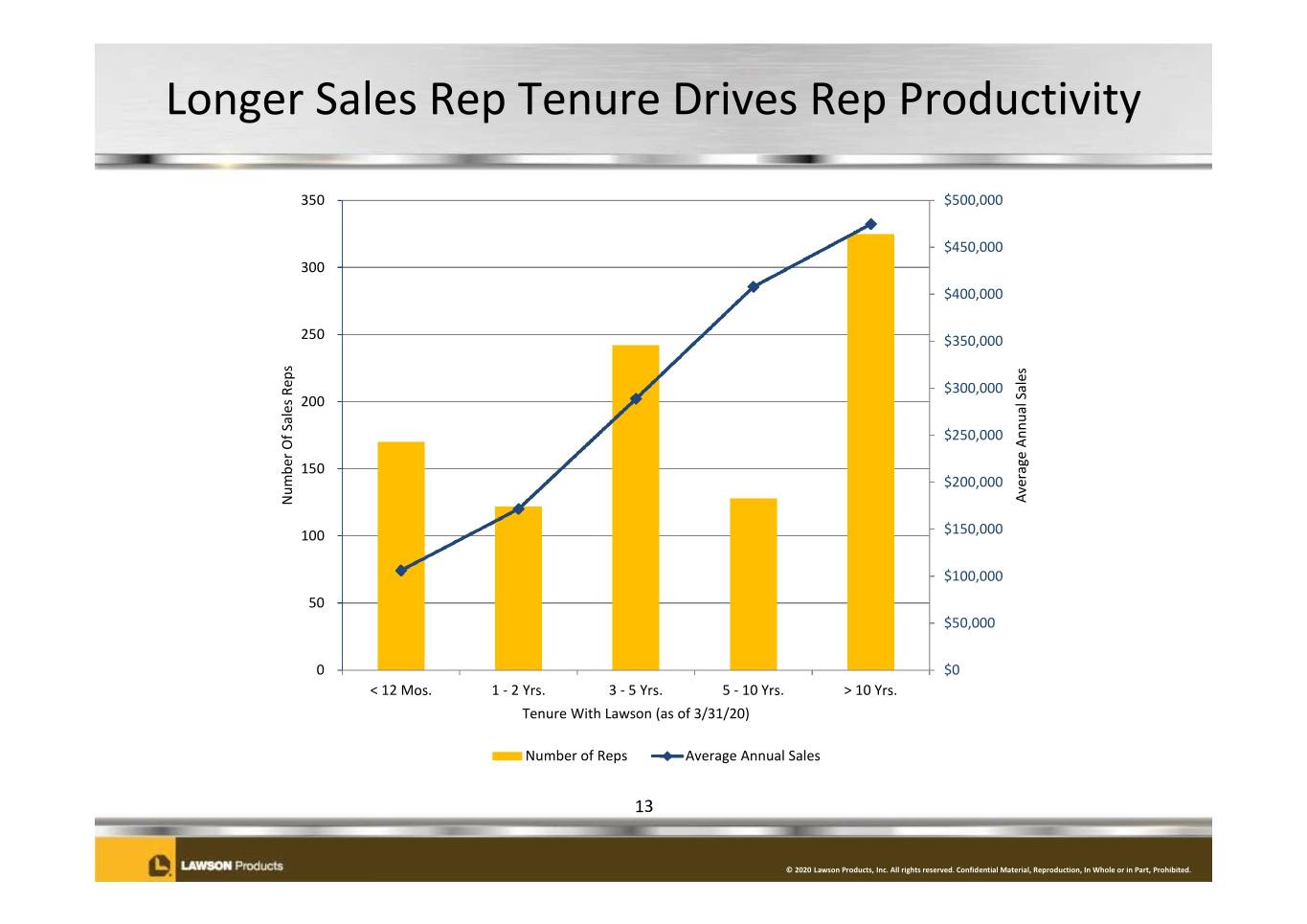

Longer Sales Rep Tenure Drives Rep Productivity 350 $500,000 $450,000 300 $400,000 250 $350,000 s s p e l e a R $300,000 S s 200 l e a l u a n S n f $250,000 A O r e e g a b 150 r m $200,000 e v u A N 100 $150,000 $100,000 50 $50,000 0 $0 < 12 Mos. 1 - 2 Yrs. 3 - 5 Yrs. 5 - 10 Yrs. > 10 Yrs. Tenure With Lawson (as of 3/31/20) Number of Reps Average Annual Sales 13 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Lawson Products: Poised for Growth • Leverage Current Infrastructure • Continued Sales Growth • Foundational Investments Completed • Operational Excellence • Large Fragmented Market 14 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

For More Information Contact: Ronald J. Knutson EVP, CFO Investor Relations (773) 304-5665 ron.knutson@lawsonproducts.com And see our Website at http://www.lawsonproducts.com/company-info/investor-relations.jsp 15 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Appendices 16 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

Significant Activities Appendix P-1 August 2011 Implemented SAP October 2011 Commenced construction of new McCook, Ill distribution center May 2012 Relocated corporate headquarters June 2012 Restructured senior team. Announced $20M cost savings plan Transitioned packaging facility to McCook, Ill distribution center August 2012 Entered into new five-year $40M credit facility Announced new CEO and President, Michael G. DeCata October 2012 Consolidated Vernon Hills distribution center into McCook, Ill November 2012 Rolled out new website to existing web customers December 2012 Completed transition of U.S. independent agents to employees April 2013 Roll-out of new website to new web customers April/May 2013 McCook DC begins to ship customer orders November 2013 Entered into sub-lease of headquarters space to generate $2.9M of future cash savings December 2013 Ended year with over 800 sales reps – First increase in 8 years February 2014 Closed on Automatic Screw Machine Products sale for net proceeds of $12.1M June 2014 Entered into sale-leaseback of Reno distribution facility for net proceeds of $8.3M December 2014 Ended year with over 900 sales reps February 2015 Held North American sales meeting September 2015 Completed West Coast Fasteners acquisition March 2016 Completed Perfect Products of Michigan acquisition May 2016 Completed F. B. Feeney acquisition June 2016 Expanded sales team to over 1,000 sales reps September 2016 Extended credit facitlity to August, 2020 November 2016 Completed Mattic Industries acquisition March 2017 Consolidated Fairfield, NJ distribution operations into McCook, Ill and Suwanee, GA May 2017 Sold Fairfield, NJ distribution center for a gain of $5.4M October 2017 Completed Bolt Supply House acquisition April 2018 Opened MRO distribution center in Calgary, Canada October 2018 Completed Screw Products acquisition and added Bolt Supply branch June 2019 Achieved Q2 9.8% adjusted EBITDA, net of ASC 842 impact of 0.3% September 2019 Achieved Q3 10.9% adjusted EBITDA; hired VP, M&A October 2019 Entered into new five-year $100M credit facility, with additional $50 million accordion feature 17 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

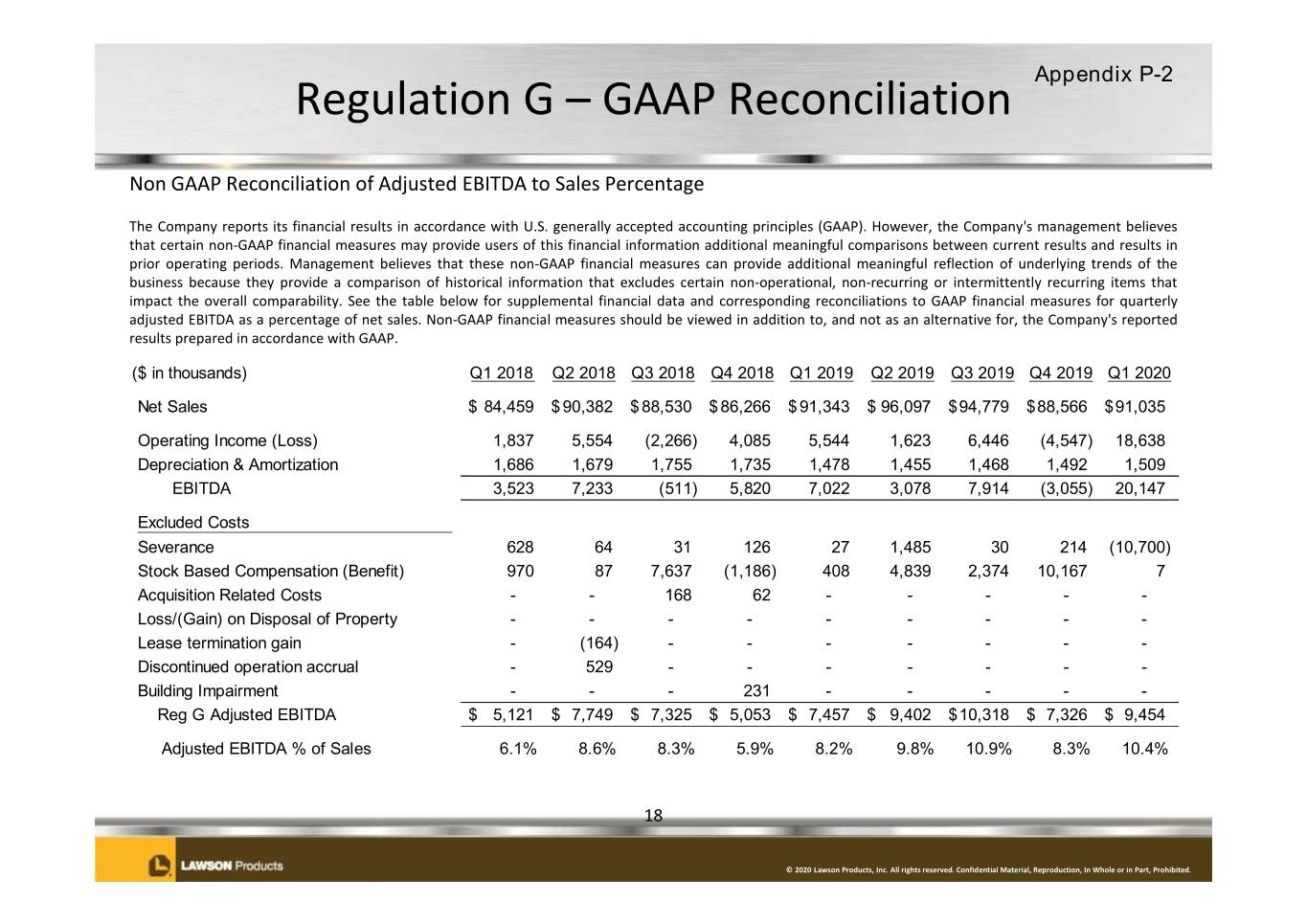

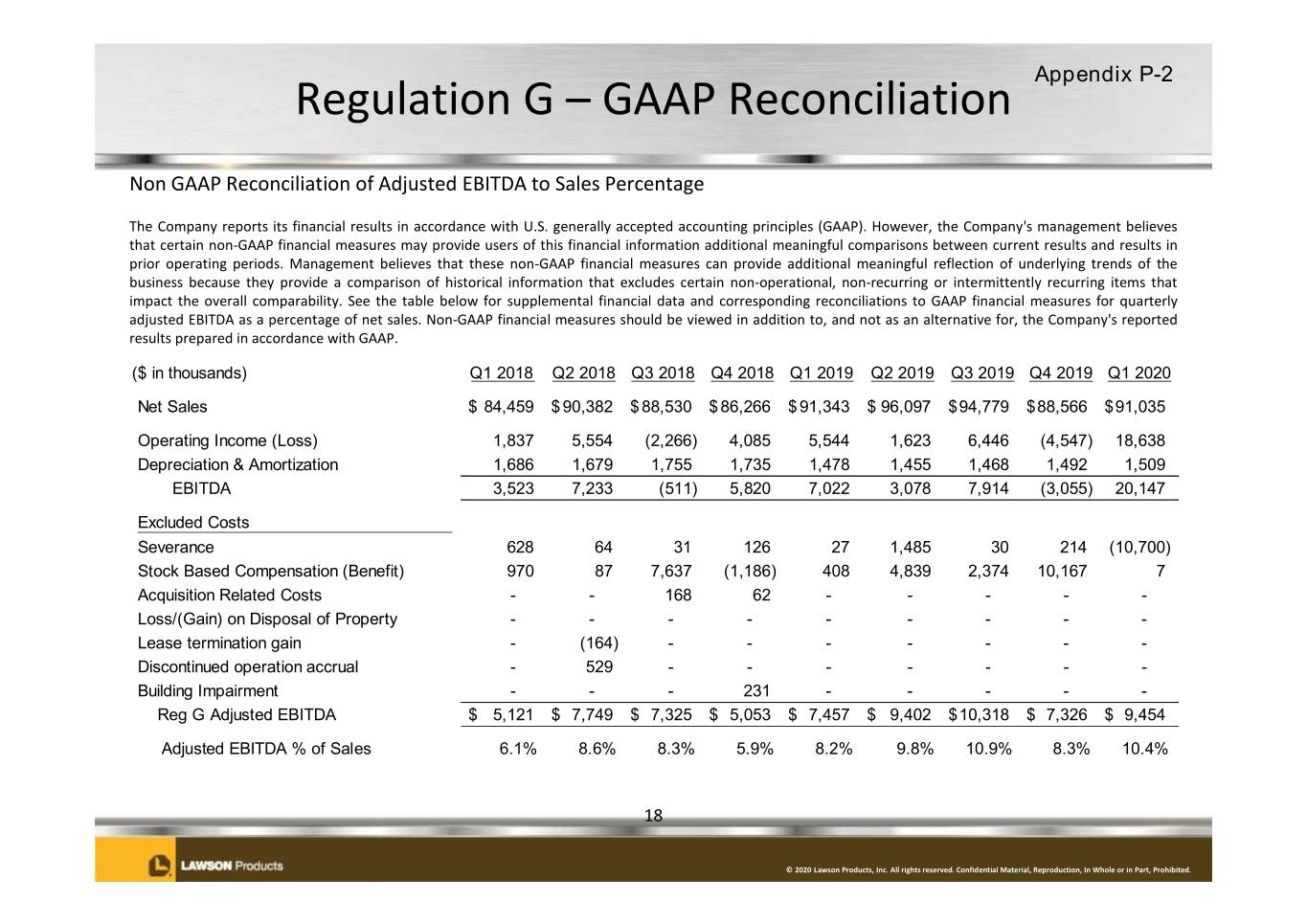

Appendix P-2 Regulation G – GAAP Reconciliation Non GAAP Reconciliation of Adjusted EBITDA to Sales Percentage The Company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). However, the Company's management believes that certain non-GAAP financial measures may provide users of this financial information additional meaningful comparisons between current results and results in prior operating periods. Management believes that these non-GAAP financial measures can provide additional meaningful reflection of underlying trends of the business because they provide a comparison of historical information that excludes certain non-operational, non-recurring or intermittently recurring items that impact the overall comparability. See the table below for supplemental financial data and corresponding reconciliations to GAAP financial measures for quarterly adjusted EBITDA as a percentage of net sales. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company's reported results prepared in accordance with GAAP. ($ in thousands) Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Net Sales $ 84,459 $ 90,382 $ 88,530 $ 86,266 $ 91,343 $ 96,097 $94,779 $88,566 $91,035 Operating Income (Loss) 1,837 5,554 (2,266) 4,085 5,544 1,623 6,446 (4,547) 18,638 Depreciation & Amortization 1,686 1,679 1,755 1,735 1,478 1,455 1,468 1,492 1,509 EBITDA 3,523 7,233 (511) 5,820 7,022 3,078 7,914 (3,055) 20,147 Excluded Costs Severance 628 64 31 126 27 1,485 30 214 (10,700) Stock Based Compensation (Benefit) 970 87 7,637 (1,186) 408 4,839 2,374 10,167 7 Acquisition Related Costs - - 168 62 - - - - - Loss/(Gain) on Disposal of Property - - - - - - - - - Lease termination gain - (164) - - - - - - - Discontinued operation accrual - 529 - - - - - - - Building Impairment - - - 231 - - - - - Reg G Adjusted EBITDA $ 5,121 $ 7,749 $ 7,325 $ 5,053 $ 7,457 $ 9,402 $10,318 $ 7,326 $ 9,454 Adjusted EBITDA % of Sales 6.1% 8.6% 8.3% 5.9% 8.2% 9.8% 10.9% 8.3% 10.4% 18 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.

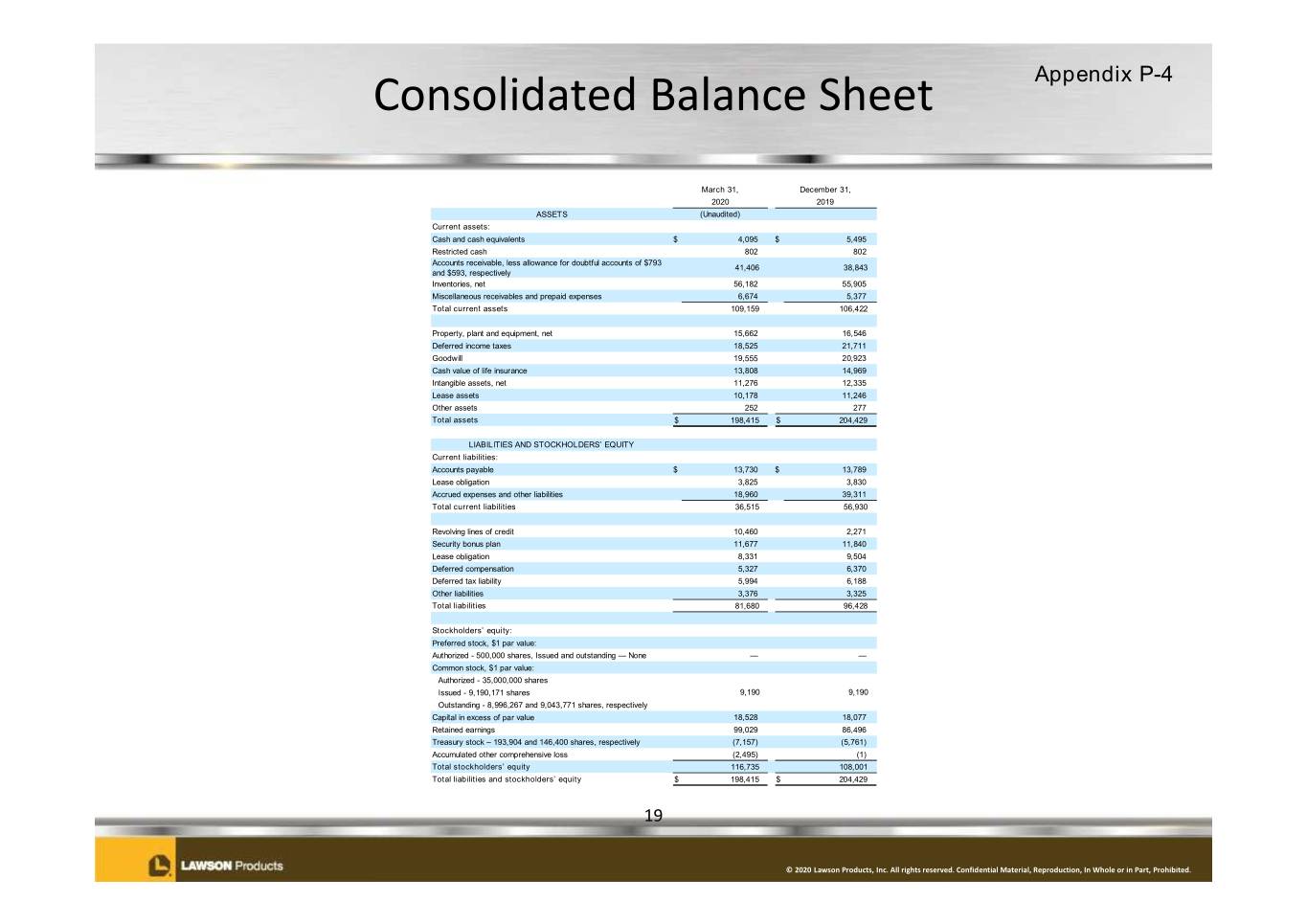

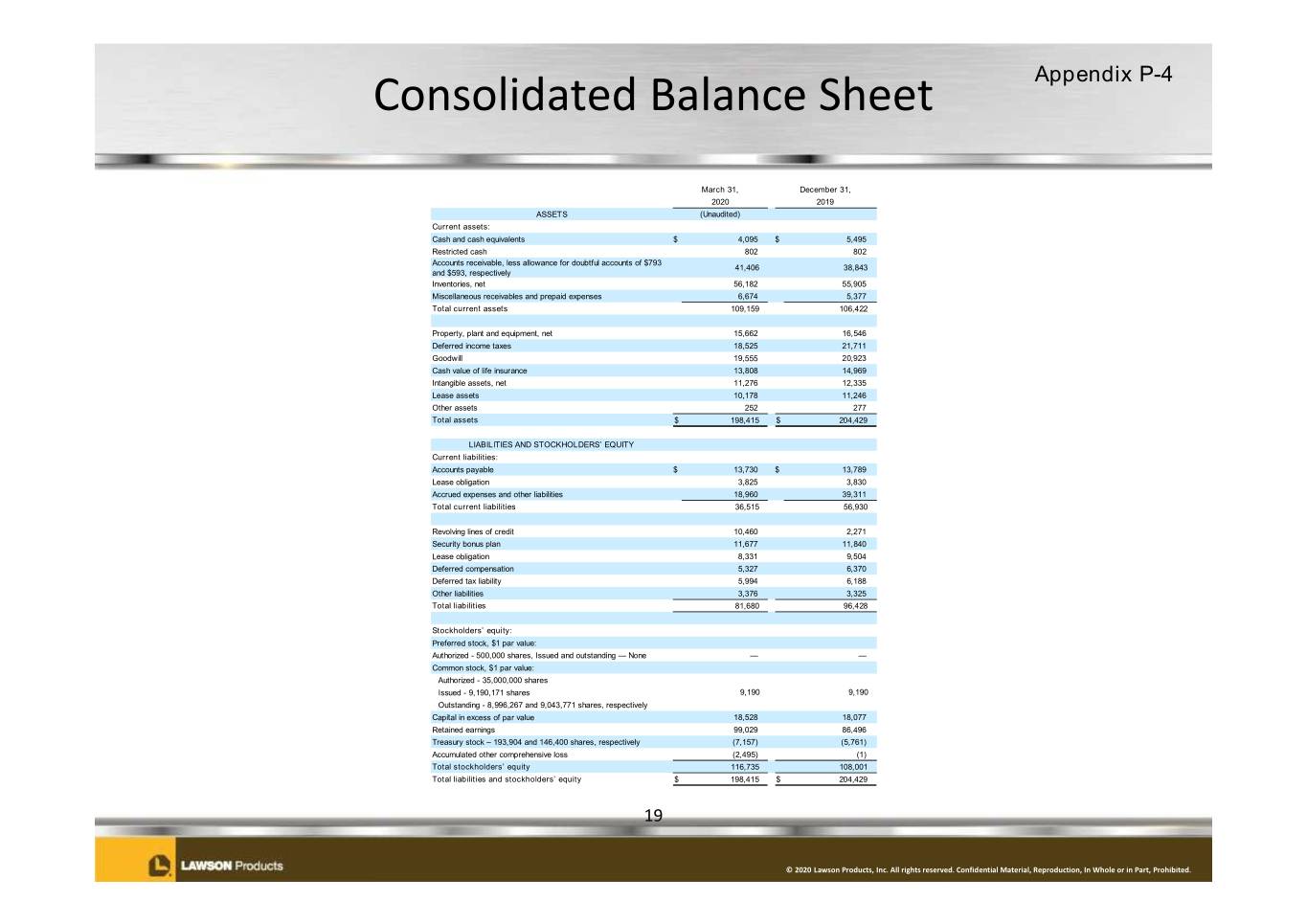

Consolidated Balance Sheet Appendix P-4 March 31, December 31, 2020 2019 ASSETS (Unaudited) Current assets: Cash and cash equivalents $ 4,095 $ 5,495 Restricted cash 802 802 Accounts receivable, less allowance for doubtful accounts of $793 41,406 38,843 and $593, respectively Inventories, net 56,182 55,905 Miscellaneous receivables and prepaid expenses 6,674 5,377 Total current assets 109,159 106,422 Property, plant and equipment, net 15,662 16,546 Deferred income taxes 18,525 21,711 Goodwill 19,555 20,923 Cash value of life insurance 13,808 14,969 Intangible assets, net 11,276 12,335 Lease assets 10,178 11,246 Otherassets 252 277 Total assets $ 198,415 $ 204,429 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities: Accounts payable $ 13,730 $ 13,789 Lease obligation 3,825 3,830 Accrued expenses and other liabilities 18,960 39,311 Total current liabilities 36,515 56,930 Revolving lines of credit 10,460 2,271 Security bonus plan 11,677 11,840 Lease obligation 8,331 9,504 Deferred compensation 5,327 6,370 Deferred tax liability 5,994 6,188 Other liabilities 3,376 3,325 Total liabilities 81,680 96,428 Stockholders’ equity: Preferred stock, $1 par value: Authorized - 500,000 shares, Issued and outstanding — None — — Common stock, $1 par value: Authorized - 35,000,000 shares Issued - 9,190,171 shares 9,190 9,190 Outstanding - 8,996,267 and 9,043,771 shares, respectively Capital in excess of par value 18,528 18,077 Retained earnings 99,029 86,496 Treasury stock – 193,904 and 146,400 shares, respectively (7,157) (5,761) Accumulated other comprehensive loss (2,495) (1) Total stockholders’ equity 116,735 108,001 Total liabilities and stockholders’ equity $ 198,415 $ 204,429 19 © 2020 Lawson Products, Inc. All rights reserved. Confidential Material, Reproduction, In Whole or in Part, Prohibited.