UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

þ Definitive Additional Materials

o Soliciting Material under § 240.14a-12

Distribution Solutions Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

þ No fee required

o Fee previously paid with preliminary materials.

o Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Distribution Solutions Group, Inc.

301 Commerce Street, Suite 1700

Fort Worth, TX 76102

Dear Fellow Stockholders:

You are cordially invited to attend our Annual Meeting of Stockholders of Distribution Solutions Group, Inc. ("DSG", the "Company", "Distribution Solutions Group", "we" or "us"), which will be held solely online via live webcast at 10:00 a.m., Central Time, on Thursday, May 23, 2024. Further information about the meeting and the matters to be considered is contained in the formal Notice of Annual Meeting of Stockholders and Proxy Statement on the following pages.

2023 was a successful year for Distribution Solutions Group. We delivered results that were aligned with our strategic initiatives and achieved significant progress toward our long-term value-creation goals. Our leadership team in 2023 demonstrated its ability to accelerate growth through accretive acquisitions, organic growth, and key operational improvement programs. We plan to drive sustainable growth in the future through DSG’s unique, high-touch service models in fragmented end markets with scale in specialty distribution. We remain excited about our acquisition pipeline, which we expect to continue to accelerate growth in 2024 and beyond. Our vision is to leverage our distinct platform of products, solutions, and capabilities to capitalize on strong secular tailwinds, organic and inorganic growth, and long-term profitability and cash flow, creating long-term value for our shareholders.

It is important that your shares be represented at this meeting. Whether or not you plan to attend, we hope that you vote using one of the available voting options outlined on your proxy card.

I am proud of our team’s dedication and progress and want to thank the Board and all of our stakeholders for making 2023 a successful year.

Sincerely,

J. Bryan King

Chairman, President, and Chief Executive Officer

Distribution Solutions Group, Inc.

301 Commerce Street, Suite 1700

Fort Worth, TX 76102

________________

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

May 23, 2024

TO THE STOCKHOLDERS:

We are very pleased that this year’s Annual Meeting will again be a virtual meeting of stockholders, which will be conducted solely online via live webcast on May 23, 2024, at 10:00 a.m., Central Time. You will be able to attend and participate in the Annual Meeting online and vote your shares electronically by visiting: www.meetnow.global/M6ZCFXZ on the meeting date and time described in the accompanying proxy statement.

We continue to embrace the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company. We believe that hosting a virtual meeting will enable greater stockholder attendance and participation from any location around the world.

What will I be voting on?

| | | | | | | | | | | | | | |

| Proposals | | Page Number | | Board Recommendation |

| Election of seven directors | | | | FOR

each nominee |

| Ratification of the Appointment of Grant Thornton, LLP | | | | FOR |

| To approve, on an advisory basis, the compensation of our named executive officers (say-on-pay) | | | | FOR |

| Transaction of such other business as may properly come before the meeting or any adjournment or postponement thereof. | | | | |

Who is entitled to vote at the Annual Meeting?

You may vote at the meeting if you were a Distribution Solutions Group, Inc. stockholder of record at the close of business on the record date. The Board of Directors of the Company (the “Board” or “Board of Directors”) has fixed the close of business on March 28, 2024, as the record date for the determination of stockholders entitled to notice of and to vote at the meeting.

Accompanying this Notice is a Proxy, a Proxy Statement and a copy of the Company's 2023 Annual Report on Form 10-K.

Important Note Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 23, 2024: A copy of this Notice, the accompanying Proxy Statement and the Company's 2023 Annual Report on Form 10-K are available at www.edocumentview.com/DSGR.

By Order of the Board of Directors

Richard D. Pufpaf

Secretary

Fort Worth, Texas

April 10, 2024

The accompanying Proxy Statement is dated April 10, 2024, and the accompanying Proxy Statement and form of proxy are first being sent to Company stockholders on or about April 10, 2024.

TABLE OF CONTENTS

_______________

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 23, 2024

________________

QUESTIONS AND ANSWERS ABOUT THE 2024

ANNUAL MEETING AND VOTING

How do I vote?

You can vote at the Annual Meeting using the voting procedures set forth at www.meetnow.global/M6ZCFXZ or by proxy without attending the meeting. You may also vote your shares by telephone or via the Internet as set forth in the enclosed proxy. Even if you expect to attend the virtual annual meeting, we strongly encourage you to sign and return the enclosed proxy in the envelope provided. If you execute a proxy, you still may attend the virtual meeting and vote using the voting procedures set forth at www.meetnow.global/M6ZCFXZ.

Can I change my vote?

Yes. If you are a registered stockholder, you can change your proxy vote or revoke your proxy at any time before the Annual Meeting by:

(1) Revoking it by written notice to Richard D. Pufpaf, our Secretary, at 301 Commerce Street, Suite 1700, Fort Worth, Texas 76102 before your original proxy is voted at the Annual Meeting;

(2) Delivering a later-dated proxy (including a telephone or Internet vote); or

(3) Voting at the meeting using the voting procedures set forth at www.meetnow.global/M6ZCFXZ.

If you are a beneficial owner and hold your shares in “street name,” please refer to the information forwarded by your bank, broker, or other holder of record for procedures on revoking or changing your proxy.

How many votes do I have?

You will have one vote for every share of Distribution Solutions Group, Inc. ("DSG", "Company", "we", "our") common stock that you owned at the close of business on March 28, 2024, except that, as discussed in Proposal 1 (Election of Directors), stockholders are entitled to cumulative voting in the election of directors. For all other proposals, you will have one vote for every share of DSG common stock that you own.

How many shares are entitled to vote?

There are 46,806,573 shares of DSG common stock outstanding as of March 28, 2024 and entitled to be voted at the meeting.

How many votes are needed to elect the directors?

•Directors will be elected by a plurality of the votes cast at the meeting by the holders of shares present in person or represented by proxy.

•If any nominee should become unavailable for election as a director, which is not contemplated, the proxies will have discretionary authority to vote for a substitute.

•In the absence of a specific direction from a stockholder, proxies in respect of such stockholder’s shares will be voted “For” the election of all named director nominees for which no specific direction is given by that stockholder.

How many votes are needed to pass Proposal 2 (Ratification of Appointment of Grant Thornton, LLP) and Proposal 3 (Advisory Vote to Approve Named Executive Officer ("Named Executive Officer" or "NEO") Compensation)?

•Assuming a quorum is present, approval of each of Proposals 2 and 3 requires the affirmative vote of the holders of a majority of the total voting power of the shares of Company common stock present in person or represented by proxy at the Annual Meeting.

•In the absence of a specific direction from a stockholder on any of Proposals 2 and/or 3, proxies in respect of such stockholder’s shares will be voted “For” the proposal.

What if I vote “Withhold” for the election of a director?

Because directors are elected by a plurality of the votes cast at the Annual Meeting, a proxy marked “Withhold” with respect to one or more director nominees will have no effect on the election of the nominees, assuming that no other director candidates are properly nominated by any Company stockholder and that each director nominee receives at least one vote in the election.

What if I vote “Abstain” on any of Proposals 2 and/or 3 ?

A vote to “Abstain” on Proposal 2 and/or 3 will have the same effect as a vote “Against” that proposal.

What is required for a quorum to be present?

A quorum of stockholders is necessary to hold a valid Annual Meeting. The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the total voting power of all outstanding shares of Company common stock entitled to vote at the Annual Meeting constitutes a quorum. Shares of Company common stock represented at the Annual Meeting by attendance in person or by proxy, whether or not such shares are voted (including shares for which a stockholder directs an “abstention” from voting), will be counted as present for purposes of determining a quorum. Shares underlying “broker non-votes” will also be counted as present for purposes of determining a quorum. If a quorum is not present, the Annual Meeting may be adjourned and reconvened at a later date and/or time.

What is a “broker non-vote”?

Under applicable stock exchange rules, banks, brokers or other nominees who hold shares in “street name” on behalf of the beneficial owner of such shares have the authority to vote such shares in their discretion on “routine” proposals when they have not received voting instructions from the beneficial owners. However, banks, brokers or other nominees are not allowed to exercise their voting discretion with respect to matters that under applicable stock exchange rules are “non-routine.” A so-called “broker non-vote” results when a bank, broker or other nominee returns a valid proxy voting on one or more matters to be voted on at a stockholders meeting but does not vote on a particular “non-routine” matter because the bank, broker or other nominee does not have discretionary authority to vote on such “non-routine” matter without voting instructions from the beneficial owner of the shares and has not received voting instructions on such “non-routine” matter from the beneficial owner of the shares. The Company believes that Proposals 1 and 3 are considered “non-routine” matters under applicable stock exchange rules, and Proposal 2 is considered a “routine” matter.

What is the effect of a broker non-vote on each of the proposals?

Because directors are elected by a plurality of the votes cast at the meeting, a broker non-vote on Proposal 1 will have no effect on the election of the nominees.

A broker non-vote on Proposal 2 and/or 3 is not considered voting power present at the Annual Meeting for purposes of such proposal, and therefore a broker non-vote will have no effect on the vote on any of those proposals.

Is my vote confidential?

Yes. Your voting records will not be disclosed to us except:

•As required by law;

•To the inspectors of voting; or

•In the event the election is contested.

The tabulator, the proxy solicitation agent, and the inspectors of voting must comply with confidentiality guidelines that prohibit disclosure of votes to DSG. The tabulator of the votes and at least one of the inspectors of voting will be independent of DSG and our officers and directors.

If you are a holder of record and you write comments on your proxy card, your comments will be provided to us, but your vote will remain confidential.

When will I receive the Proxy Statement?

This Proxy Statement will be available to stockholders on or about April 10, 2024 in connection with the solicitation of the accompanying proxy by our Board of Directors. Only stockholders of record at the close of business on March 28, 2024 are entitled to notice of and to vote at the Annual Meeting. We have retained Morrow Sodali LLC, 333 Ludlowe Street, 5th Floor, South Tower, Stamford, Connecticut, 06902, a firm specializing in the solicitation of proxies, to assist in the solicitation at a fee estimated to be $7,000 plus expenses. Officers of the Company may make additional solicitations in person or by telephone. Expenses incurred in the solicitation of proxies will be borne by the Company.

If the accompanying form of proxy is executed and returned in time or you vote your shares by telephone or via the internet as set forth in the enclosed proxy, the shares represented thereby will be voted.

Corporate Governance Highlights

The table below highlights key corporate governance initiatives adopted by the Board of Directors (the "Board" or "Board of Directors") or otherwise approved by stockholders.

| | | | | | | | | | | | | | | | | |

Company

Action | | Stockholder Impact | Additional Detail | | Board Recommendation |

| Board Diversity Policy | | The Board believes that a board made up of highly qualified directors from diverse backgrounds and who reflect the changing population demographics of the markets in which the Company operates, the talent available with the required expertise, and the Company’s evolving customer and employee base, promotes better corporate governance. | Corporate Governance Section | | Adopted at the March 2020 Board Meeting |

| | | | | |

| Social and Environmental Responsibility Policy | | The Company is committed to understanding, monitoring and managing our social and environmental impact, and we recognize the importance of this responsibility as a discipline that helps us manage risks. Sets out the framework for managing our social and environmental commitment. | Corporate Governance Section | | Adopted at the March 2020 Board Meeting |

| | | | | |

| Board Declassification | | Provides for annual election of directors. A declassified board generally means board members are held accountable and are more responsive to stockholders. | Corporate Governance Section | | Adopted at the 2020 Annual Meeting |

| | | | | |

| Corporate Governance Principles | | The Corporate Governance principles and charters are intended to ensure our Board has the necessary authority and practices in place to review and evaluate our business operations and to make decisions that are independent of management. | Corporate Governance Section | | Updated in 2020 |

| | | | | |

| Clawback Policy | | The Board of Directors adopted the Clawback Policy in order to protect the Company in the event that the Company is required to prepare an accounting restatement due to material noncompliance by the Company with any financial reporting requirement under applicable securities laws. The Company amended its Clawback Policy consistent with the requirements of the final Nasdaq listing standards implementing the Securities Exchange Act of 1934 (the “Exchange Act”) Rule 10D-1. | Corporate Governance Section | | Adopted by the Board in 2023 |

| | | | | |

| Anti-Hedging Policy | | Under the Anti-Hedging Policy, the Company prohibits any executive officer of the Company or member of the Company's Board of Directors from purchasing financial instruments that are designed to hedge or offset any decrease in the market value of Company common stock. | Corporate Governance Section | | Adopted at the March 2011 Board Meeting |

| | | | | |

| Cybersecurity | | Cybersecurity is a key enterprise risk. As a result, the Audit Committee reviews our cybersecurity risk management practices and performance, primarily through reports provided by the Chief Information Officers (“CIOs”) and the internal audit department on the Company’s cybersecurity management program. | Corporate Governance Section | | Annual Policy Review |

| | | | | |

Stockholders to call special meeting

| | Increases director accountability. In the event that our Board does not take into account the wishes of our stockholders on any outstanding matter, the stockholders have the ability to bring up such matters at a special meeting. Provides stockholders of the Company the ability to provide their views as to the corporate governance of the Company through the call of a special meeting. | By-Laws | | Adopted in 2020 |

| | | | | |

PROPOSAL 1: ELECTION OF DIRECTORS

Stockholders are entitled to cumulative voting in the election of directors. Under cumulative voting, each stockholder is entitled to that number of votes equal to the number of directors to be elected, multiplied by the number of shares such stockholder owns, and such stockholder may cast his or her votes for one nominee or distribute them in any manner he or she chooses among any number of nominees. Unless otherwise indicated on the proxy card, votes may, in the discretion of the proxies, be equally or unequally allocated among the nominees named below. Directors will be elected by a plurality of the votes cast at the meeting by the holders of shares represented in person or by proxy. Thus, assuming a quorum is present, the seven persons receiving the greatest number of votes will be elected as directors and votes that are withheld will have no effect.

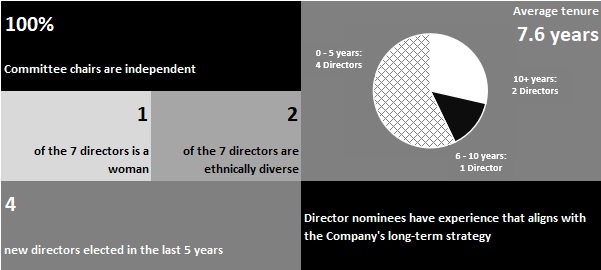

The Amended and Restated By-Laws of the Company provide that the Board of Directors shall consist of such number of members, between five and nine, as the Board determines from time to time. The Company is currently evaluating whether it will fill the resulting vacancy on the Board to replace it's departing director, Mr. Albert, who as previously disclosed will not stand for reelection at the Annual Meeting. At the annual meeting, seven directors are to be elected to serve until the 2025 annual meeting of stockholders. The chart below summarizes the demographics of the seven nominees of our Board of Directors.

| | |

| THE SEVEN NOMINEES FOR THE BOARD OF DIRECTORS |

Directors to Serve Until 2025

| | | | | | | | | | | | | | |

| Name | | Age | | First Year Elected/Appointed Director |

| I. Steven Edelson | | 64 | | 2009 |

| Lee S. Hillman | | 68 | | 2004 |

| J. Bryan King | | 53 | | 2017 |

| Mark F. Moon | | 61 | | 2019 |

| Bianca A. Rhodes | | 65 | | 2021 |

| M. Bradley Wallace | | 51 | | 2023 |

| Robert S. Zamarripa | | 68 | | 2022 |

I. Steven Edelson has served as co-founder and now a non-Managing Director of International Facilities Group, a leading facilities development and management company, since June 1995. Mr. Edelson is the founding principal of IFG Development Group, which provides development advisory services, as well as acts in a development capacity in multiple areas of the real estate industry. Mr. Edelson also serves as Principal and Managing Director of The Mercantile Capital Group, a Chicago-based private equity investment firm. Mr. Edelson is a co-founder of GFRB LLC., a global distribution company that specializes in supply chain optimization. Mr. Edelson is a Director of Bionanosim a leading drug delivery and drug discovery company based in Israel. Mr. Edelson is also a member of the Board of Governors of the Hebrew University in Jerusalem. Mr. Edelson is a Trustee at the Truman Institute for Peace and is the proud recipient of the 2005 Ellis Island Congressional Medal of Honor. In 2014, Mr. Edelson became a NACD Board Leadership Fellow. These professional experiences, along with Mr. Edelson's particular knowledge and experience in capital management, qualify him to serve as a Director.

Lee S. Hillman has served as the lead independent director of DSG (f/k/a Lawson Products, Inc.), since March 2017. Mr. Hillman has served as President of Liberation Advisory Group, a private management consulting firm, since 2003. Mr. Hillman has also served as Chief Executive Officer of Performance Health Systems, LLC, a business distributing Power Plate™ and bioDensity® branded, specialty health and exercise equipment since 2012, and its predecessor since 2009. From February 2006 to May 2008, Mr. Hillman served as Executive Chairman and Chief Executive Officer of Power Plate International (“Power Plate”) and from 2004 through 2006 as CEO of Power Plate North America. Previously, from 1996 through 2002, Mr. Hillman was CEO of Bally Total Fitness Corporation, then the world’s largest fitness membership club business. Mr. Hillman currently serves as chair of the Audit Committee and member of the Compensation Committee of Franklin BSP Capital Corporation and chair of the Audit Committee of Benefit Street Partners Multifamily Trust, Inc. Previously he has served as a member of the Board of Directors of Franklin BSP Lending Corporation, HC2 Holdings, Inc., HealthSouth Corporation, Wyndham International, RCN Corporation (where he was Chairman of the Board), Bally Total Fitness Corporation (where he was Chairman of the Board), Holmes Place, Plc., Continucare Corp. and Professional Diversity Network, Inc. He also served as a member of the Board of Trustees of the Adelphia Recovery Trust. These professional experiences, along with Mr. Hillman’s particular knowledge and experience in accounting, finance and restructuring businesses and having served as Chief Executive Officer, Chief Financial Officer, and/or director of other publicly traded U.S. and international companies and as a former audit partner of an international accounting firm, qualify him to serve as a Director.

J. Bryan King, CFA, is a Principal of Luther King Capital Management Corporation ("LKCM"), an SEC-registered investment advisor with approximately $26.3 billion of assets under management as of December 31, 2023, and Founder and Managing Partner of LKCM Capital Group and LKCM Headwater Investments, the private capital investment group of LKCM. On April 27, 2022, the Board of Directors of the Company appointed Mr. King to serve as President and Chief Executive Officer of DSG (f/k/a Lawson Products, Inc.), effective May 1, 2022, which is in addition to his role as Chairman of the Board of the Company. Mr. King has acted as an investment manager responsible for lower middle market investments in public and private companies since 1994 when he joined his first distribution company board. Those private capital focused partnerships manage over approximately $3 billion of flexible private capital focused on long-term investment strategies to drive stockholder value through building more profitable and durable businesses. The LKCM investment team and their affiliates and related parties generally represent approximately 30% of the capital in the partnerships, and outside capital is predominantly limited to taxable investors with prior significant experience building businesses similar to those in which LKCM invests. In 2003, Mr. King established the LKCM Distribution Holdings advisory board of operating partners, key limited partners, and relevant thought leaders to support LKCM Capital Group and its affiliates' investment activities in value-added distribution and related service offerings. In specialty distribution, Mr. King has Chaired and/or been the Managing Partner with direct controlling oversight of DSG (f/k/a Lawson Products, Inc.), TestEquity, Gexpro Services, Relevant Industrial Solutions, Critical Rental Solutions, Commercial Buildings Solutions, Industrial Distribution Group (IDG), Rawson, Golden State Medical Supply, and the ERIKS North American assets, including Lewis-Goetz (LGG), and XMEK (f/k/a ERIKS Seals and Plastics). He also has served in various capacities, including Chairman, on and alongside of many other boards of both public and private companies, as well as numerous not for profit and community organizations. Mr. King graduated from Princeton University, where he was a two sport varsity athlete and today serves on the advisory board for the Princeton University Museum of Art. He also graduated from Harvard Business School, as well as Texas Christian University where he serves on the Executive Committee of Trustees and chairs the Investment Committee with oversight over the TCU Endowment, and previously chaired the Fiscal Affairs, and Audit and Risk Management committees. These professional experiences, along with Mr. King's particular knowledge and expertise in finance and capital management, qualify him to serve as a Director.

Mark F. Moon has served as President of MFM Advisory Services since 2016 and as an advisor and operating partner for LKCM since 2016. In 2016, Mr. Moon joined the Board of Directors for BearCom LLC, which is the largest value-added distributor of two-way radio communications and solutions. Mr. Moon also served on the Board of Directors for TestEquity prior to the business combination with Lawson Products and Gexpro Services. Mr. Moon served for more than thirty years with Motorola Solutions, Inc. from 1985 to 2016. During this time, he held a variety of leadership roles culminating in the responsibility for leading 10,000+ employees located in 100+ countries. Prior to his retirement, he served as President with responsibilities for the strategy of the company and leading all aspects of global operations including Sales and Marketing, Product Research and Development, Software and Services, and Supply Chain. In addition, Mr. Moon served as Chairman of the Board of Directors for Vertex Standard, as a member of the Board of Directors for the National Fallen Firefighters Foundation and as a member of the Advisory Board of the Georgia Institute of Technology’s School of Industrial and Systems Engineering where he was named to the Academy of Distinguished Engineering Alumni in 2014. These professional experiences, along with Mr. Moon’s particular knowledge and expertise in sales and marketing, global operations and supply chain management qualify him to serve as a Director.

Bianca A. Rhodes has served as the President and Chief Executive Officer of Knight Aerospace Medical Systems, LLC, a global leader in custom air medical transport products, since 2014. Ms. Rhodes currently serves as a member of the Board of Directors for Intuity Medical, Inc. and Dura Software. Prior to this time, she founded CrossRhodes Consulting where she advised private enterprises on financial and operating issues helping them to raise capital and structure buyouts while also managing a family real estate business. Ms. Rhodes began her career as a commercial banker with the National Bank of Commerce in San Antonio and later joined TexCom Management Services, a computer leasing company. At TexCom she was instrumental in the sale of the company to Intelogic Trace (NYSE:IT) where she became the CFO. Additionally, she has served as CFO of Kinetics Concepts Inc. (NASDAQ:KNCI), a global corporation that produces medical technology for wounds and wound healing. During her tenure there, she engineered a successful turnaround, significantly increasing the company’s value, prior to going private. These professional experiences, along with knowledge and experience acquired in managing distribution and technology firms, qualify Ms. Rhodes to serve as a Director.

M. Bradley Wallace has served as a Founding Partner of LKCM Headwater Investments, the private capital investment group of LKCM, where he is responsible for all aspects of the investment process including sourcing and analyzing new investment opportunities and overseeing the implementation of post-transaction operational initiatives, several of which have been within the Industrial Distribution sector. Mr. Wallace has served on the board of several portfolio companies of LKCM Headwater Investments, including the Chairman of the Board of Gexpro Services prior to the business combination with Lawson Products and TestEquity, Alliance Consumer Group, Pavement Maintenance Group, and Partner Industrial. Mr. Wallace also serves as an investment professional for LKCM Capital Group, he served for two years as the Chief Financial Officer for a $200M retail chain, where he was responsible for restructuring the business and integration of several acquisitions subsequent to LKCM Capital Group’s initial purchase of the assets out of bankruptcy. Prior to joining LKCM, Mr. Wallace served as Principal and Portfolio Manager for KBK Capital, where he served on the investment committee and was responsible for senior debt, mezzanine and private equity transactions. While at KBK, he served as a Director and interim Chief Executive Officer of a food manufacturing and distribution company, overseeing the restructuring of its management. Mr. Wallace began his career in finance as an originator and manager of $100 million factoring and asset-based lending portfolio. Mr. Wallace graduated with a Bachelor of Business Administration and a Masters of Business Administration, with the honor of Top Scholar, from Texas Christian University. These professional experiences, along with Mr. Wallace’s particular knowledge and expertise in finance, investments, and accounting qualify him to serve as a Director.

Robert S. Zamarripa founded Zam Capital, a business advisory and investment company in 2012. Additionally, Mr. Zamarripa founded ZJR, an industrial real estate holding company in 1988 and is currently a managing partner. Mr. Zamarripa founded OneSource Distributors in 1983, serving as Chairman and Chief Executive Officer until 2013. OneSource is a leading electrical, utility and industrial automation distributor in the United States and Mexico. OneSource is recognized as an industry leader in providing technology driven value and supply chain services to its customers. Additionally, OneSource was recognized as the fifth largest Hispanic owned business in the United States by Hispanic Business Magazine in 2011. OneSource was ranked as one of the top 20 largest Electrical Distributors in the United States in 2011 by Electrical Wholesale Magazine. Mr. Zamarripa has served on the Board of Directors for Flow Control Group (2021 - present), SourceAlliance.com (1990 - 1992) and IMARK Group (2008 - 2012). Additionally, Mr. Zamarripa has served in advisory board positions for the following electrical, industrial and automation equipment manufacturers: Rockwell Automation, Eaton Corporation, General Electric Company, Hoffman Engineering, Hubbell Inc., Thomas and Betts Corporation, ABB and Leviton Manufacturing Co. Inc. In addition, Mr. Zamarripa served as a strategic advisor to a special committee of the Company’s Board of Directors in connection with the business combination between Lawson Products, TestEquity and Gexpro Services. Mr. Zamaripa graduated with a Bachelor of Arts from the University of California, Santa Barbara. These professional experiences, along with knowledge and experience acquired in managing and leading distribution firms, qualify Mr. Zamarripa to serve as a Director.

Recommendation of the Board

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THESE NOMINEES.

PROPOSAL 2: RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON, LLP

The Audit Committee of the Board of Directors (the “Audit Committee”) of the Company has appointed Grant Thornton, LLP (“GT”) to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024. Although the Company’s governing documents do not require the submission of this matter to stockholders, the Board of Directors considers it desirable that the appointment of GT be ratified by stockholders.

Changes in the Company’s Independent Registered Public Accounting Firm

As previously reported in the Company’s Form 8-K filed with the U.S. Securities and Exchange Commission (“SEC”) on May 25, 2023 (the “Auditor Change Form 8-K”), on May 19, 2023, the Audit Committee approved the dismissal of BDO USA, LLP (“BDO”) as the Company’s independent registered public accounting firm.

BDO’s report on the Company’s financial statements as of and for the year ended December 31, 2022 contained no adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope, or accounting principles. BDO’s report on the effectiveness of internal control over financial reporting included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 expressed an adverse opinion on the effectiveness of the Company’s internal control over financial reporting as of December 31, 2022.

During the years ended December 31, 2021 and December 31, 2022 and the subsequent interim period preceding the dismissal of BDO on May 19, 2023, there were (i) no “disagreements” (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) with BDO on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BDO, would have caused BDO to make reference to the subject matter of the disagreements in connection with BDO’s report; and (ii) no “reportable events” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K), except for the previously disclosed material weakness regarding management’s failure to have sufficient technical accounting resources and personnel at TestEquity to design and maintain controls over i) business combinations, ii) disposal of rental equipment, iii) revenue recognition, iv) account reconciliations, v) accounting policies and vi) segregation of duties. This reportable event was discussed among the Company’s management, the Audit Committee, the board of directors of the Company and BDO. BDO has been authorized by the Company to respond fully to the inquiries of GT, the successor accountant, concerning this reportable event.

As also previously reported in the Auditor Change Form 8-K, on May 19, 2023, the Audit Committee approved the appointment of GT as the Company’s new independent registered public accounting firm. GT was formally engaged on May 25, 2023.

During the years ended December 31, 2021 and December 31, 2022 and the subsequent interim period preceding the appointment of GT on May 19, 2023, neither the Company nor anyone on its behalf consulted with GT regarding (i) either the application of accounting principles to a specific transaction (either completed or proposed); or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report nor oral advice was provided to the Company that GT concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any matter that was either the subject of a “disagreement” (as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) or a “reportable event” (as that term is defined in Item 304(a)(1)(v) of Regulation S-K).

Additional Information

GT audited the Company’s 2023 consolidated financial statements, and BDO audited the Company’s 2022 consolidated financial statements. See “Fees Paid to Independent Auditors” for additional information, including certain information about fees paid to GT and BDO.

One or more representatives of GT are expected to be present at the meeting. The representatives of GT will have an opportunity to make a statement if they desire, and are expected to be available to respond to questions from stockholders.

If the appointment of GT is not ratified, the Audit Committee of the Board of Directors will reconsider the appointment.

Recommendation of the Board

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON, LLP.

PROPOSAL 3: ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION

(SAY-ON-PAY VOTE)

As required by Section 14A of the Exchange Act we are providing our stockholders with a vote on a non-binding, advisory basis on the compensation of our Named Executive Officers ("NEOs"), as such compensation is disclosed under Item 402 under the SEC's Regulation S-K in the Compensation Overview ("Overview") section of this Proxy Statement, the accompanying tabular disclosure regarding such compensation and the related narrative disclosure.

The Company held its first advisory, non-binding stockholder vote on the compensation of the Company’s NEOs (commonly known as a "Say-on-Pay Proposal") at its 2011 annual meeting of stockholders. The Company held its most recent stockholder vote on the frequency of such Say-On-Pay Proposals at its 2017 annual meeting of stockholders and, at such meeting, the stockholders of the Company elected to hold a say-on-pay vote every year. In light of the foregoing, the Compensation Committee implemented a stockholder advisory vote on executive compensation on an annual basis. At our annual meeting of stockholders held on May 19, 2023, our Say-on-Pay Proposal received 99.96% support from our stockholders (excluding broker non-votes and abstentions). The Compensation Committee believes that this most recent stockholder vote strongly endorsed the compensation philosophy of the Company.

Our executive compensation programs are designed to enable us to attract, motivate and retain executive talent critical to our success. Consistent with our performance-based compensation philosophy, we reserve a significant portion of potential compensation for performance- and equity-based programs. Our performance-based annual incentive program rewards the Company's NEOs for achievement of key operational goals that we believe will provide the foundation for creating long-term stockholder value, while our equity awards, mainly in the form of market stock units ("MSUs"), stock performance rights ("SPRs"), restricted stock units ("RSUs"), performance-based awards ("PAs"), non-qualified stock options and restricted stock awards ("RSAs"), reward long-term performance and align the interests of management with those of our stockholders. In 2022, the primary focus of the long-term incentive program transitioned to equity awards primarily granted in the form of non-qualified stock options that are significantly "out of the money" and will only realize value in the event of significant appreciation in the Company's stock price.

Our Chairman, CEO and President, J. Bryan King, does not accept any form of compensation from the Company in connection with his role with the Company.

The Company also has adopted and adheres to best practices in executive compensation, including the adoption and maintenance of clawback provisions, prohibitions on hedging, and other policies, and eschews problematic pay practices. For example:

•our compensation programs are heavily weighted toward performance-based compensation;

•we have adopted and maintain compensation clawback provisions and have amended our Clawback Policy consistent with the requirements of the final Nasdaq listing standards implementing Exchange Act Rule 10D-1;

•we prohibit executives and directors from hedging their company stock ownership;

•we do not provide for tax gross-ups for change-in-control payments;

•we do not provide supplemental pension benefits or any other perquisites for former or retired executives;

•we do not provide personal use of corporate aircraft, personal security systems maintenance and/or installation or executive life insurance;

•we do not pay or provide payments for terminations for cause or resignations other than for good reason; and

•our Compensation Committee is composed solely of independent, outside directors and it retains its own independent compensation consultant.

The Board believes that the above information and the information within the Compensation Overview section starting on page 24 of this Proxy Statement demonstrates that our executive compensation program was designed appropriately and is working to ensure that management's interests are aligned with our stockholders' interests and support long-term value creation. Accordingly, the following resolution is to be submitted for a stockholder vote at the meeting:

"RESOLVED, that the Company's stockholders approve, on an advisory basis, the compensation of the NEOs, as disclosed pursuant to Item 402 of Securities and Exchange Commission Regulation S-K, including the Compensation Overview, the compensation tables and narrative disclosures in this Proxy Statement."

Because the vote is advisory, it will not be binding on the Board. The vote on this Say-On-Pay Proposal is not intended to address any specific element of compensation. However, as in the past, the Board and the Compensation Committee will review the voting results and take into account the outcome when considering future executive compensation arrangements. The Board and management are committed to our stockholders and understand that it is useful and appropriate to obtain the views of our stockholders when considering the design and initiation of executive compensation programs.

Recommendation of the Board

THE BOARD RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" PROPOSAL 3 TO APPROVE THE COMPENSATION OF THE COMPANY'S NAMED EXECUTIVE OFFICERS, AS DESCRIBED IN THE COMPENSATION OVERVIEW, THE COMPENSATION TABLES AND NARRATIVE DISCLOSURES IN THE PROXY STATEMENT.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of March 28, 2024 concerning the beneficial ownership by each person (including any “group” as defined in Section 13(d)(3) of the Exchange Act) known by the Company to own beneficially more than 5% of the outstanding shares of Company common stock, each of the Company’s current directors (all of whom are nominees for re-election, other than Mr. Albert), each of the Company’s Named Executive Officers, and all of the Company’s current executive officers and directors as a group. Unless otherwise noted below, the address of each beneficial owner listed in the table is 301 Commerce Street, Suite 1700, Fort Worth, Texas, 76102. Since the voting or dispositive power of certain shares listed in the following table is shared, in some cases the same securities are included with more than one name in the table. The total number of shares of Company common stock issued and outstanding as of March 28, 2024 is 46,806,573.

| | | | | | | | | | | | | | | | | |

| Name of Beneficial Owner | Number of Shares Beneficially Owned | | % |

| Five Percent Stockholders | | | |

| Luther King Capital Management Corporation (1) | 36,357,588 | | | 77.7 | % |

| | 301 Commerce Suite 1600, Fort Worth, Texas 76102 | | | |

| | | | | |

| Current Directors | | | |

| Andrew B. Albert | 120,588 | | | 0.3 | % |

| I. Steven Edelson | 90,588 | | | 0.2 | % |

| Lee S. Hillman | 99,166 | | | 0.2 | % |

| J. Bryan King (2) | 35,838,638 | | | 76.6 | % |

| Mark F. Moon | 37,194 | | | * |

| Bianca A. Rhodes | 12,640 | | | * |

| M. Bradley Wallace | — | | | * |

| Robert S. Zamarripa | 25,640 | | | * |

| | | | | |

| Named Executive Officers | | | |

| Ronald J. Knutson | 85,496 | | | 0.2 | % |

| Cesar A. Lanuza | 70,398 | | | 0.2 | % |

| | | | | |

| All Current Executive Officers & Directors (22 persons) | 36,471,656 | | | 77.9 | % |

(1) Based on a Schedule 13D filed with the SEC by Luther King Capital Management Corporation (“LKCM”), J. Bryan King and various other persons and entities (as amended by amendments thereto through and including Amendment No. 28 to Schedule 13D/A filed with the SEC on December 27, 2023. Includes (i) 3,578,228 shares held by PDLP Lawson, LLC (“PDP”), a wholly-owned subsidiary of LKCM Private Discipline Master Fund, SPC (“Master Fund”), (ii) 552,500 shares held by LKCM Investment Partnership, L.P. (“LIP”), (iii) 56,470 shares held by LKCM Micro-Cap Partnership, L.P. (“Micro”), (iv) 23,182 shares held by LKCM Core Discipline, L.P. (“Core”), (v) 1,184,652 shares held by LKCM Headwater Investments II, L.P. (“HW2”), (vi) 3,522,988 shares held by Headwater Lawson Investors, LLC (“HLI”), (vii)16,000,000 shares held by 301 HW Opus Investors, LLC (“Gexpro Services Stockholder”), (viii) 8,000,000 shares held by LKCM TE Investors, LLC (“TestEquity Equityholder”) and (ix) 5,524 shares held by a separately managed portfolio for which LKCM serves as investment manager. LKCM and/or one of more of its affiliates serve as (A) the investment manager for Master Fund, PDP, LIP, Micro, Core, HW2 and HLI, (B) the investment manager for a controlling member of Gexpro Services Stockholder and (C) the investment manager for two controlling members of TestEquity Equityholder. J. Luther King, Jr. is a controlling stockholder of LKCM and a controlling member of the general partner of LIP. J. Luther King, Jr. and J. Bryan King are controlling members of the general partner of the general partners of each of Micro and Core. J. Bryan King is (A) a controlling member of the general partner of HW2, (B) a controlling member of the general partner of a controlling member of Gexpro Services Stockholder, (C) a controlling member of the general partners of each of two controlling members of TestEquity Equityholder and (D) the president of HLI. J. Luther King, Jr. and J. Bryan King are controlling members of the general partner of the sole holder of the management shares of Master Fund. J. Bryan King is the son of J. Luther King, Jr. Each of the persons and entities listed in this footnote expressly disclaims membership in a group under the Exchange Act and expressly disclaims beneficial ownership of the securities reported in the table, except to the extent of its pecuniary interest therein. See also footnote 2.

(2) Based on a Schedule 13D filed with the SEC by LKCM, J. Bryan King and various other persons and entities (as amended by amendments thereto through and including Amendment No. 28 to Schedule 13D/A filed with the SEC on December 27, 2023). Includes (i) 3,578,228 shares held by PDP, (ii) 56,470 shares held by Micro, (iii) 23,182 shares held by Core, (iv) 1,184,652 shares held by HW2, (v) 3,522,988 shares held by HLI, (vi) 16,000,000 shares held by Gexpro Services Stockholder, (vii) 8,000,000 shares held by TestEquity Equityholder and (viii) 39,074 shares held directly by J. Bryan King. LKCM Private Discipline Management, L.P. (“PD Management”) is the sole holder of the management shares of Master Fund (which wholly owns PDP), and LKCM Alternative Management, LLC (“Alternative”) is the general partner of PD Management. Alternative is the general partner of LKCM Micro-Cap Management, L.P. (“Micro GP”), which is the general partner of Micro. Alternative is the general partner of LKCM Core Discipline Management, L.P. (“Core GP”), which is the general partner of Core. LKCM Headwater Investments II GP, L.P. (“HW2 GP”) is the general partner of HW2. LKCM Headwater Investments III GP, L.P. (“HW3 GP”) is the general partner of a controlling member of Gexpro Services Stockholder. LKCM Headwater II Sidecar Partnership GP, L.P. (“Sidecar GP”) is the general partner of LKCM Headwater II Sidecar Partnership, L.P. (“Sidecar”). HW2 and Sidecar are controlling members of TestEquity Equityholder. J. Bryan King is a controlling member of Alternative, HW2 GP, HW3 GP and Sidecar GP and is the president of HLI.

J. Bryan King expressly disclaims beneficial ownership of the securities reported herein, except to the extent of his pecuniary interest therein. See also footnote 1.

CORPORATE GOVERNANCE

Board Leadership Structure

Our Amended and Restated By-Laws provide that the roles of Board Chairman and President and Chief Executive Officer ("CEO") may be filled by the same or different individuals. This provides the Board the flexibility to determine whether these roles should be combined or separated based on the Company's circumstances and needs at any given time. The role of Chairman of the Board and CEO is currently held by J. Bryan King. In March 2017, the Board created the position of lead independent director and appointed Mr. Lee S. Hillman to this position to help reinforce the independence of the Board as a whole. Prior to Mr. Hillman’s appointment, the Board did not have a lead independent director.

Lead Independent Director

Pursuant to our Corporate Governance Principles, the lead independent director shall be an independent, non-employee director designated by our Board who shall serve in a lead capacity to coordinate the activities of the other independent directors, interface with and advise the Chairman of the Board, and perform such other duties as are specified in the charter or as our Board may determine. As a result, we believe that the lead independent director can help ensure the effective independent functioning of the Board in its oversight responsibilities. In addition, we believe that the lead independent director is better positioned to build a consensus among directors and to serve as a conduit between the other independent directors and the Board chairperson. The lead independent director's responsibilities include that he/she:

•presides at all Board meetings at which the Chairman of the Board is not present and at all executive sessions;

•has authority to call meetings of the independent directors;

•serves as a liaison between the Chairman of the Board and the independent directors, and between the Chairman of the Board and CEO if the roles are held by different individuals, when necessary to provide a supplemental channel of communication;

•works with the Chairman of the Board in developing and approving Board meeting agendas, schedules, and information provided to the Board;

•guides the CEO succession process together with the Compensation Committee and with input from the Nominating and Corporate Governance Committee (and similarly guides the Chairman of the Board succession process if the Chairman of the Board and CEO roles are held by different individuals);

•ensures the implementation of a Committee self-evaluation process; reviews reports from each Committee to the Board; and provides guidance to Committee Chairs, as needed, with respect to Committee topics, issues, and functions;

•facilitates the Board’s self-evaluation process; and

•communicates with significant stockholders and other stakeholders on matters involving broad corporate policies and practices when appropriate.

Board of Director Meetings and Committees

The Board of Directors has standing Audit, Compensation, and Nominating and Corporate Governance Committees. All of these committees have adopted a charter for their respective committee. These charters may be viewed on the Company's website, www.distributionsolutionsgroup.com, and copies may be obtained by request to the Secretary of the Company. Those requests should be sent to Corporate Secretary, Distribution Solutions Group, Inc., 301 Commerce Street, Suite 1700, Fort Worth, Texas, 76102.

Annual Meeting Attendance Policy

The Company expects all members of the Board of Directors to attend the Annual Meeting, but from time to time, other commitments may prevent a director from attending a meeting.

Director Attendance at Board of Directors and Committee Meetings

In 2023, the directors attended on average, either in person or via teleconference or video conference, 99.1% of the meetings of the Board of Directors and 100% of the respective Audit, Compensation, and Nominating and Corporate Governance Committees' meetings on which they served. As required under the applicable Nasdaq listing standards, in the fiscal year ending December 31, 2023, our independent directors met nine times in regularly scheduled executive sessions at which only our independent directors were present.

All of the directors attended the last Annual Meeting held on May 19, 2023. The following chart shows the membership and chairpersons of our Audit, Compensation, and Nominating and Corporate Governance Committees, number of committee meetings held in 2023 and committee member attendance.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | Board of Directors | | Audit | | Compensation | | Nominating & Corporate Governance |

Andrew B. Albert (1) | | 15 | | 10 | | | | 4* |

| I. Steven Edelson | | 15 | | | | 5 | | 4 |

| Lee S. Hillman | | 15 | | 10* | | 5* | | |

| J. Bryan King | | 15* | | | | | | |

| Mark F. Moon | | 15 | | | | 5 | | 4 |

| Bianca A. Rhodes | | 14 | | 10 | | | | 4 |

M. Bradley Wallace (2) | | 6 | | | | | | |

| Robert S. Zamarripa | | 15 | | 10 | | 5 | | |

| Number of Meetings Held | | 15 | | 10 | | 5 | | 4 |

* Chairperson as of December 31, 2023

(1) As previously disclosed, Mr. Albert will not stand for reelection at the Annual Meeting.

(2) Effective May 19, 2023, M. Bradley Wallace was elected to the Board.

The Audit Committee

The functions of the Audit Committee of the Board of Directors include (i) reviewing the Company's procedures for monitoring internal control over financial reporting; (ii) overseeing the appointment, compensation, retention and oversight of the Company's independent auditors; (iii) reviewing the scope and results of the audit by the Company's independent auditors; (iv) reviewing the annual audited financial statements and quarterly financial statements with management and the independent auditors; (v) periodically reviewing with the Company's General Counsel potentially material legal and regulatory matters and corporate compliance; and (vi) reviewing and approving all related party transactions. Additionally, the Audit Committee provides oversight of the Company's Enterprise Risk Management program.

The Audit Committee consists of Lee S. Hillman (Chair), Andrew B. Albert, Bianca A. Rhodes and Robert S. Zamarripa. Each member of the Audit Committee satisfies the independence requirements of The Nasdaq Stock Market and the SEC and satisfies the financial sophistication requirements of The Nasdaq Stock Market.

The Board of Directors has determined that Lee Hillman, member of the Audit Committee of the Board of Directors, qualifies as an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K, and that Mr. Hillman is “independent” as the term is defined in the listing standards of the NASDAQ Stock Market.

The Compensation Committee

The Compensation Committee discharges the responsibilities of the Board of Directors relating to compensation of the CEO and establishes compensation for all other executive officers of the operating companies and the named executive officers of the Company. The Compensation Committee is responsible for (i) reviewing and approving corporate goals and objectives relevant to the compensation for executive officers; (ii) evaluating the performance of executive officers in light of those goals and objectives; and (iii) setting the compensation level of executive officers based on this evaluation. The Compensation Committee also administers incentive compensation plans and equity-based plans established or maintained by the Company from time to time; makes recommendations to the Board of Directors with respect to the adoption, amendment, termination or replacement of the plans; and recommends to the Board of Directors the compensation for members of the Board of Directors. The Compensation Committee reviews and approves the compensation programs for the CEO and other executive officers whose compensation is included in this report. The CEO makes recommendations on compensation to the Compensation

Committee for all executive officers except himself or herself. The CEO may not be present in any meeting of the Compensation Committee in which his or her compensation is discussed.

The Compensation Committee consists of Lee S. Hillman (Chair), I. Steven Edelson, Mark F. Moon and Robert S. Zamarripa. Each member of the Compensation Committee has satisfied the independence requirements of The Nasdaq Stock Market (including the enhanced independence requirements for Compensation Committee members) and is an “outside director” as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

The Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies and nominates potential directors to the Board of Directors and otherwise takes a leadership role in shaping the corporate governance of the Company.

The Nominating and Corporate Governance Committee consists of Andrew B. Albert (Chair), I. Steven Edelson, Mark F. Moon and Bianca A. Rhodes. Each member of the Nominating and Corporate Governance Committee has satisfied the independence requirements of The Nasdaq Stock Market.

Director Nominations

The Nominating and Corporate Governance Committee will consider Board of Director nominees recommended by stockholders. Those recommendations should be sent to the Chairman of the Nominating and Corporate Governance Committee, c/o Corporate Secretary of Distribution Solutions Group, Inc., 301 Commerce Street, Suite 1700, Fort Worth, Texas, 76102.

The Nominating and Corporate Governance Committee will follow procedures which the Nominating and Governance Committee deems reasonable and appropriate in the identification of candidates for election to the Board of Directors and evaluating the background and qualifications of those candidates. Those processes include consideration of nominees suggested by an outside search firm, by incumbent members of the Board of Directors and by stockholders. The manner in which the Nominating and Corporate Governance Committee evaluates nominees for director is the same regardless of whether the nominee is recommended by a security holder.

The Nominating and Corporate Governance Committee will seek candidates having experience and abilities relevant to serving as a director of the Company and who represent the best interests of stockholders as a whole and not any specific interest group or constituency. The Board and Nominating and Corporate Governance Committee has a policy with regard to consideration of diversity in identifying director nominees as set forth under “Board Diversity Policy” on page 21. The Nominating and Corporate Governance Committee will consider a candidate’s qualifications and background including, but not limited to, responsibility for operating a public company or a division of a public company, other relevant business experience, a candidate’s technical background or professional qualifications and other public company boards of directors on which the candidate serves. The Nominating and Corporate Governance Committee will also consider whether the candidate would be “independent” for purposes of The Nasdaq Stock Market and the rules and regulations of the SEC. The Nominating and Corporate Governance Committee may, from time to time, engage the service of a professional search firm to identify and evaluate potential nominees. Mr. Wallace was referred by Andrew B. Albert as a board prospect to the Nominating and Governance Committee, which then conducted a thorough background check prior to nominating him to the Board of Directors.

Determination of Independence

The Company’s Board of Directors has determined that directors Andrew B. Albert, I. Steven Edelson, Lee S. Hillman, Mark F. Moon, Bianca A. Rhodes and Robert S. Zamarripa, are independent within the meaning of the rules of The Nasdaq Stock Market. In determining independence, the Board of Directors considered the specific criteria for independence under The Nasdaq Stock Market rules and also the facts and circumstances of any other relationships of individual directors with the Company. Mr. King, our Chairman of the Board, President and CEO, and Mr. Wallace are not considered independent directors.

The independent directors and the committees of the Board of Directors regularly meet in executive session without the presence of any management directors or representatives.

Code of Conduct

The Company, and its operating companies, has adopted a Code of Conduct applicable to all employees and sales representatives. The Company’s Code of Conduct is applicable to senior financial executives including the principal executive officer, principal financial officer and principal accounting officer of the Company. The Company’s Code of Conduct is available on the Corporate Governance page in the Investor Relations section of the Company’s website at www.distributionsolutionsgroup.com. The Company intends to post on its website any amendments to, or waivers from its Code of Conduct applicable to senior financial executives. The Company will provide any persons with a copy of its Code of Conduct without charge upon written request directed to the Company’s Secretary at the Company’s address listed in this proxy statement.

The Board of Directors Role in Risk Oversight and Assessment

The Board is responsible for overseeing the most significant risks facing the Company and for determining whether management is responding appropriately to those risks. The Board implements its risk oversight function both as a whole and through committees. The Board has formalized much of its risk management oversight function through the Audit Committee.

The Board committees have significant roles in carrying out the risk oversight function which include, but are not limited to, the following:

•The Audit Committee provides oversight of the Company’s Enterprise Risk Management program related to the Company’s financial statements, the financial reporting process, accounting and legal matters and oversees the internal audit function; and

•The Compensation Committee oversees the Company’s compensation programs from the perspective of whether they encourage individuals to take unreasonable risks that could result in having a materially adverse effect on the Company.

While the Board oversees risk management, Company management is charged with managing risk. Management is responsible for establishing and maintaining an adequate system of internal controls over financial reporting and establishing controls to prevent or detect any unauthorized acquisition, use or disposition of the Company’s assets.

The Company has retained a consulting firm to serve as its internal audit department to monitor and test the adequacy of the internal controls and report the results of this oversight function to the Audit Committee on a regular basis. Part of the internal audit department’s mission, as described in its charter, is to bring a “systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.” One way which the internal audit department carries this out is by evaluating the Company’s network of risk management programs and reporting the results to the Audit Committee.

Management conducts detailed periodic business reviews of the Company’s business. These reviews include discussions of future risks faced by various departments and functional areas across the organization. An example of our commitment to risk management is our adherence to the ISO 9001:2015 Standards (“ISO Standards”) which is a quality management system that encompasses the supply chain and distribution centers. ISO standards require that we identify risks in the quality management system, plan actions to address the risk, and evaluate the effectiveness of those plans. We are audited by a third-party ISO certifier, and as part of this audit, we must demonstrate and show evidence of three items; the risks, the plan to address the risks, and the monitoring of the effectiveness of our internal controls.

The Company has also established a Disclosure Committee which is comprised of senior management from various functional areas. The Disclosure Committee meets at least quarterly to review all disclosures and forward-looking statements made by DSG to its security holders and ensures they are accurate and complete and fairly present DSG’s financial condition and results of operations in all material respects.

Additionally, the Company has established and communicated to its employees a Code of Business Conduct, as mentioned previously, and maintains an ethics helpline where employees can confidentially and anonymously express any concerns they may have of any suspected ethics violations either through a dedicated website or through a toll-free telephone number. The Company requires various forms of annual compliance training of all employees.

Cybersecurity

Our Board, in coordination with the Audit Committee, oversees the management of risks from cybersecurity threats, including the policies, standards, processes and practices that the Company’s management implements to address risks from cybersecurity threats. The Audit Committee reports to the Board on our cybersecurity risk management practices and performance, generally on a quarterly basis. The Audit Committee receives reports from senior members of management, including from each of our Chief Information Officers (“CIOs”) (which include the CIO of each of our principal operating companies: Lawson Products, TestEquity and Gexpro Services), and the internal audit department regarding the cybersecurity risk management program. We have also established a governance structure under each of the CIOs that oversee investments in systems, resources, and processes as part of the continued maturity of our cybersecurity posture.

Our cybersecurity risk management program is part of our overall enterprise risk management program, and is focused on identifying, assessing, managing, and remediating material risks from cybersecurity incidents. We rely on risk-based security controls, including access limitations and contractual requirements on third-party service providers, as part of our overall approach of protecting the integrity, availability and confidentiality of our important systems and information. We have an established cyber incident response plan to respond to cyber incidents. Additional information relating to cybersecurity is contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

Human Capital Resources

Our organization supports a culture of continuous improvement and emphasizes the importance of addressing the needs of our customers. We require our employees to act with integrity in every aspect of our business while encouraging them to be results driven, team oriented and progressive.

As of December 31, 2023, our combined workforce included approximately 3,700 individuals, comprised of approximately 1,662 in sales and marketing, approximately 1,465 in operation and distribution and approximately 585 in management and administration. Approximately 1,685 individuals are within Lawson, 1,160 are within TestEquity, 712 are within Gexpro Services, with the remaining in corporate or other non-reportable segments. For more information with respect to Human Capital Resources, please refer to the Company's Annual Report on Form 10-K for the year ended December 31, 2023.

Board Diversity Policy

The Board believes that a board made up of highly qualified directors from diverse backgrounds and who reflect the changing population demographics of the markets in which the Company operates, the talent available with the required expertise, and the Company’s evolving customer and employee base, promotes better corporate governance. To support this, the Nominating and Corporate Governance Committee will, when identifying candidates to recommend for appointment/election to the Board:

•consider only candidates who are highly qualified based on their experience, functional expertise, and personal skills and qualities;

•consider diversity criteria including gender, age, ethnicity and geographic background; and

•in addition to its own search, may engage qualified independent external advisors to conduct a search for candidates that meet the Board’s skills and diversity criteria to help achieve its diversity aspirations.

Board appointments will be based on merit and candidates will be considered against objective criteria, having due regard for the benefits of diversity on the Board, including race, ethnicity and gender. In furtherance of this commitment, the Nominating and Corporate Governance Committee shall require that the list of candidates to be considered by the Nominating and Corporate Governance Committee and/or the Board for nomination to our Board include candidates with diversity of race, ethnicity, and gender.

Social and Environmental Responsibility Policy

DSG is committed to understanding, monitoring and managing our social and environmental impact, and we recognize the importance of this responsibility as a discipline that helps us manage risks. In alignment with our Code of Business Conduct and our Corporate Governance Principles, we aim to ensure that matters of social and environmental responsibility are considered and supported in our operations and administrative matters and are consistent with DSG stakeholders’ best interests.

This policy applies to activities undertaken by or on behalf of DSG and sets out the framework for managing our social and environmental commitment, for which our Board has responsibility for the overall strategy. In addition, the Board has delegated the day-to-day responsibility of implementation and adherence to this policy to various DSG leaders within the Company whose primary goal is to ensure that appropriate organizational structures are in place to effectively identify, monitor, and manage social and environmental responsibility issues and performance relevant to our business. This policy is built on the following areas that reflect existing and emerging standards of social and environmental responsibility. We will:

•Stakeholder Engagement: engage our key stakeholders including employees, customers, stockholders and suppliers, to ensure their needs and concerns are heard and addressed, and if appropriate, incorporated into our strategy;

•Decision Making: integrate social and environmental considerations in our decision-making processes;

•Compliance with Laws and Regulations: meet or exceed all legal and regulatory requirements, including social and environmental requirements, which are applicable to our business operations;

•Workplace: create a safe, healthy, fair and enriching working environment where all employees are treated with respect and are able to achieve their full potential;

•Environment: identify and minimize potential negative environmental impacts of our operations where possible;

•Supply Chain: work with vendors to strengthen the social and environmental aspects of products and services we deliver to our customers; and

•Supplier Code of Conduct: we are committed to the highest ethical standards in the conduct of our business affairs and in our relationships with suppliers and customers. The purpose of this policy is to communicate the policy we have in place for our employees regarding their receipt of business gifts, meals and entertainment.

Compensation Risk Assessment

The Compensation Committee has reviewed the compensation programs of the Company to determine if they encourage individuals to take unreasonable risks and has determined that any risks arising from these compensation programs are not reasonably likely to have a material adverse effect on the Company. The Compensation Committee reviewed the Company’s existing compensation, with particular attention to the performance metrics, programs and practices that mitigate risk (e.g., clawback policies), and the mix of short-term and long-term compensation, and the Compensation Committee determined that these features promoted a responsible mix of compensation and risk.

Clawback Policy

In 2023, the Board of Directors timely approved an amended policy for recoupment of incentive compensation received by current or former executive officers on or after October 2, 2023 (the “Clawback Policy”). The Board of Directors adopted the updated terms of the Clawback Policy to meet the requirements of the final Nasdaq listing standards implementing Exchange Act Rule 10D-1. The Clawback Policy provides that following an accounting restatement, the Compensation Committee must assess whether any incentive amounts paid to current and former executive officers were in excess of what should have been paid based on the revised financials, and thus should be subject to recovery. The policy has a three-year look-back and applies to both current and former executives, regardless of such executive’s fault, misconduct or involvement in causing the restatement. The Company’s prior clawback policy will continue to cover compensation earned or received prior to October 2, 2023.

Anti-Hedging Policy

Under the Anti-Hedging Policy, the Company prohibits any executive officer of the Company or member of the Company's Board of Directors (or any designee of such executive officer or director) from purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds) that are designed to hedge or offset any decrease in the market value of Company common stock (a) granted to the executive officer or director by the Company as part of the compensation of the executive officer or director; or (b) held, directly or indirectly, by the executive officer or director.

Corporate Governance Principles (Guidelines)

The Corporate Governance Principles and the charters of the three standing committees of the Board of Directors describe our governance framework. The Corporate Governance Principles and charters are intended to ensure our Board has the necessary authority and practices in place to review and evaluate our business operations and to make decisions that are independent of management. Our Corporate Governance Principles also are intended to align the interests of directors and management with those of our stockholders and comply with or exceed the requirements of the Nasdaq Stock Market and applicable law. They establish the practices our Board follows with respect to:

•Responsibilities of directors

•Board size

•Director independence

•Attendance at meetings

•Access to senior management

Copies of these Corporate Governance Principles are available through our website at www.distributionsolutionsgroup.com. The Company will also provide a copy of the Code of Business Conduct without charge upon written request directed to the Company at c/o Corporate Secretary, Distribution Solutions Group, Inc., 301 Commerce Street, Suite 1700, Fort Worth, Texas, 76102.

Stockholder Communications with the Board of Directors

Stockholders may send communications to members of the Board of Directors by either sending a communication to the Board of Directors or a committee thereof and/or a particular member c/o Corporate Secretary, Distribution Solutions Group, Inc., 301 Commerce Street, Suite 1700, Fort Worth, Texas, 76102. All such communications will be reviewed promptly and, as appropriate, forwarded to the Board of Directors or the relevant committee or individual member of the Board of Directors or committee based on the subject matter of the communication. With respect to other correspondence received by the Company that is addressed to one or more directors, the Board has requested that the following items not be distributed to directors, because they generally fall into the purview of management, rather than the Board: junk mail and mass mailings, product and services complaints, product and services inquiries, resumes and other forms of job inquiries, solicitations for charitable donations, surveys, business solicitations and advertisements.

REMUNERATION OF EXECUTIVE OFFICERS

COMPENSATION OVERVIEW

We continue to qualify as a “smaller reporting company,” as defined in Item 10(f)(1) of Regulation S-K promulgated under the Exchange Act, for purposes of this proxy statement. We have elected to provide in this proxy statement certain scaled disclosures as permitted under the Exchange Act for smaller reporting companies. Therefore, we do not provide in this proxy statement a compensation discussion and analysis or a compensation committee report, compensation and risk and compensation ratio disclosures, among other disclosures.

This section of the proxy statement explains how our executive compensation programs are designed and operate in practice with respect to our executives and specifically the following persons who constitute the Company’s NEOs.

| | | | | | | | |

| Named Executive Officer | | Title |

| J. Bryan King | | Chairman, President and Chief Executive Officer |

| Ronald J. Knutson | | Executive Vice President, Chief Financial Officer and Treasurer |

| Cesar A. Lanuza | | President and Chief Executive Officer, Lawson Products, Inc. |

DSG NEO Business Overview and Management Structure

DSG has three principal operating companies: Lawson Products, Inc., an Illinois corporation ("Lawson"), TestEquity Acquisition, LLC, a Delaware limited liability company ("TestEquity"), and 301 HW Opus Holdings, Inc., a Delaware corporation conducting business as Gexpro Services ("Gexpro Services"). The complementary distribution operations of Lawson, TestEquity and Gexpro Services were combined on April 1, 2022, to create a global specialty distribution company. With that said, there are three distinct senior management teams, including chief executive officers and chief financial officers, who have duties and responsibilities primarily at the operating company level, including certain executives, who have a significant portion of their duties and responsibilities at the DSG/holding company level as well.

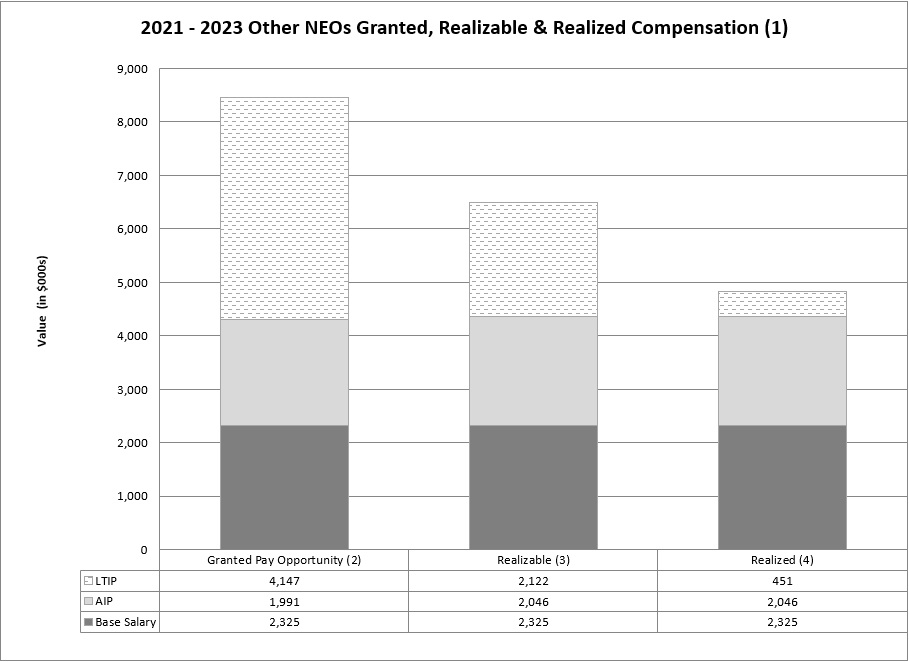

Compensation Practices, Philosophy and Objectives