Exhibit 99.2 NASDAQ: DSGR HIS Company, Inc. (“Hisco”) Acquisition Overview March 31, 2023

Forward-Looking Statements Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the “safe harbor” provisions under the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. The terms “aim,” “anticipate,” “believe,” “contemplates,” “continues,” “could,” “ensure,” “estimate,” “expect,” “forecasts,” “if,” “intend,” “likely,” “may,” “might,” “objective,” “outlook,” “plan,” “positioned,” “potential,” “predict,” “probable,” “project,” “shall,” “should,” “strategy,” “will,” “would,” and other words and terms of similar meaning and expression are intended to identify forward-looking statements. Forward-looking statements do not relate to historical or current facts and are only predictions and reflect the views of Distribution Solutions Group, Inc. (“DSG” or the “Company”) as of the date they are made with respect to future events and financial performance. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. The Company gives no assurance that any goal set forth in forward-looking statements can be achieved and cautions readers not to place undue reliance on such statements, which speak only as of the date made. These statements are based on the Company’s management’s current expectations, intentions or beliefs and are subject to assumptions and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the Company’s business, financial condition and results of operations include (1) unanticipated difficulties or expenditures relating to the acquisition of HIS Company, Inc. (“Hisco”) by the Company (the “Transaction”), (2) the failure to complete the Transaction on the proposed terms or anticipated timeline, (3) the inability to obtain, or delays in obtaining, required approvals under applicable antitrust legislation, (4) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement to acquire Hisco, (5) difficulties integrating the business operations of the Company and Hisco, which may result in the combined company not operating as effectively and efficiently as expected, (6) the Company’s ability to achieve the synergies contemplated with respect to the Transaction, (7) the failure to retain key management and employees of Hisco and its subsidiaries, (8) unfavorable reactions to the Transaction from customers, competitors, suppliers and employees, and (9) the possibility that certain assumptions with respect to Hisco’s business or the Transaction could prove to be inaccurate. In addition to the factors identified herein, certain risks associated with the Company’s business are also discussed from time to time in the reports the Company files with the U.S. Securities and Exchange Commission. The information contained in this presentation is as of the date indicated above. The Company assumes no obligation to update any forward-looking statements contained in this presentation as a result of new information or future events or developments. Non-Solicitation This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act or an exemption therefrom. Non-GAAP Financial Measures, SEC Regulation G GAAP Reconciliations Some of the financial information and data contained in this presentation relating to Hisco, such as revenue and Adjusted EBITDA, have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company believes that these non-GAAP financial measures provide useful information to management and investors regarding certain financial and business trends relating to Hisco’s financial condition and results of operations. DSG does not consider non-GAAP measures an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is they may exclude significant expense and income items that are required by GAAP to be recognized in our consolidated financial statements. In addition, they reflect the exercise of management’s judgment about which expense and income items are excluded or included in determining these non- GAAP financial measures. Non-GAAP financial measures should not be relied upon, in whole or part, in evaluating the financial condition, results of operations or future prospects of DSG, Hisco or the combined company. A reconciliation of the non-GAAP financial measures to the nearest comparable GAAP financial measures is contained in this presentation. 2

Hisco Accelerates DSG’s Vision for Growth 1 2 ‘22 Revenue: ~$1.3B ‘22 Revenue: ~$404M 1 2 ‘22 EBITDA: ~$123M ‘22 EBITDA: ~$29M Diversified distribution company with high-touch, Mission-critical distribution company value-added solutions catering to MRO, OEM and serving electronic assembly, aerospace & Industrial Technologies customers defense, medical and other industrial customers 1,2 ’22 Revenue: ~$1.7B Combined 1,2,3 Results ’22 EBITDA: ~$158M Bolsters DSG’s world-class industrial Expected to achieve cost synergies and Compelling value creation distribution platform significant customer and offering expansion benefits and growth opportunity The Hisco Transaction Accelerates the Growth Trajectory of the Combined DSG Platform (1) Represents adjusted DSG revenue and EBITDA, including Lawson Products pre-merger results. Excludes $53M of revenue and $4M of EBITDA contribution from pre-acquisition results of acquisitions acquired in 2022. See appendix for reconciliations. (2) Represents Hisco 2022 FY (Oct) revenue and Adjusted EBITDA. Excludes $26M of revenue and $2M of annual Adjusted EBITDA acquired in December 2022. See appendix for reconciliations. 3 (3) Inclusive of $6M of synergies (comprised of commercial benefits, net spend savings, and other SG&A savings) expected to be realized over the first year after the Transaction close.

Creating a More Unified Platform More closely aligns TestEquity to DSG and strengthens the overall organization’s value proposition ✓ Extended cross-sell opportunities ✓ Expanded value-added capabilities across platform ✓ Geographic pull-through deeper into Mexico and South America ✓ Expected to accelerate timeline to higher structural margin profile 4

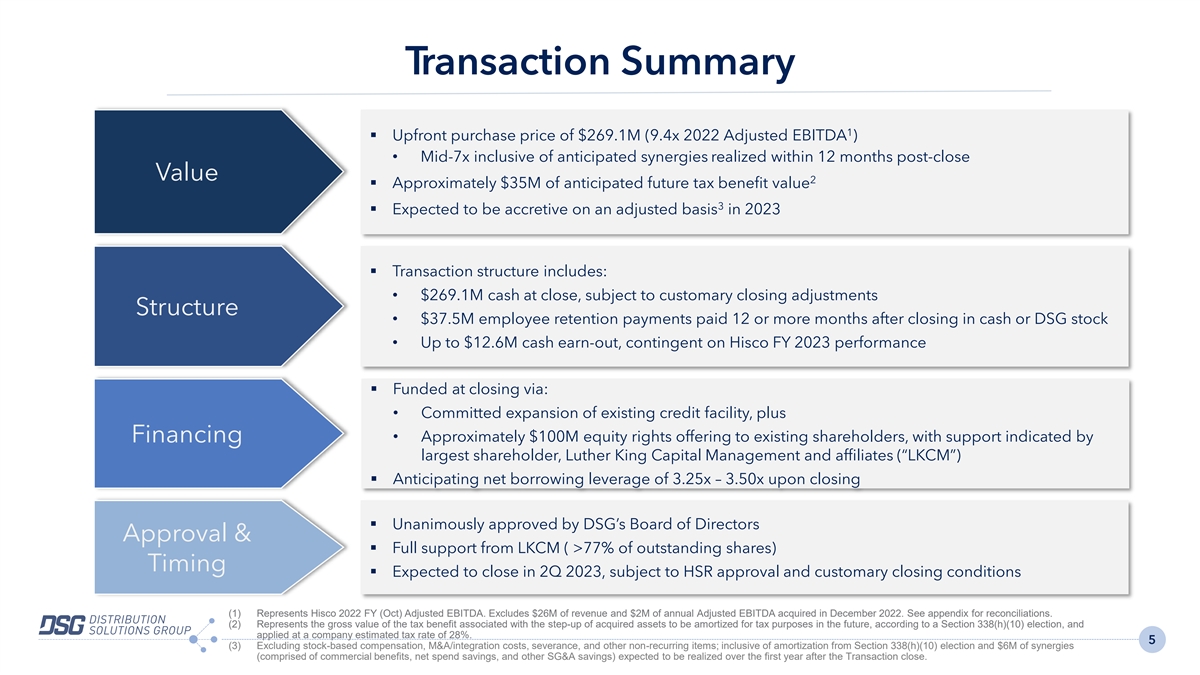

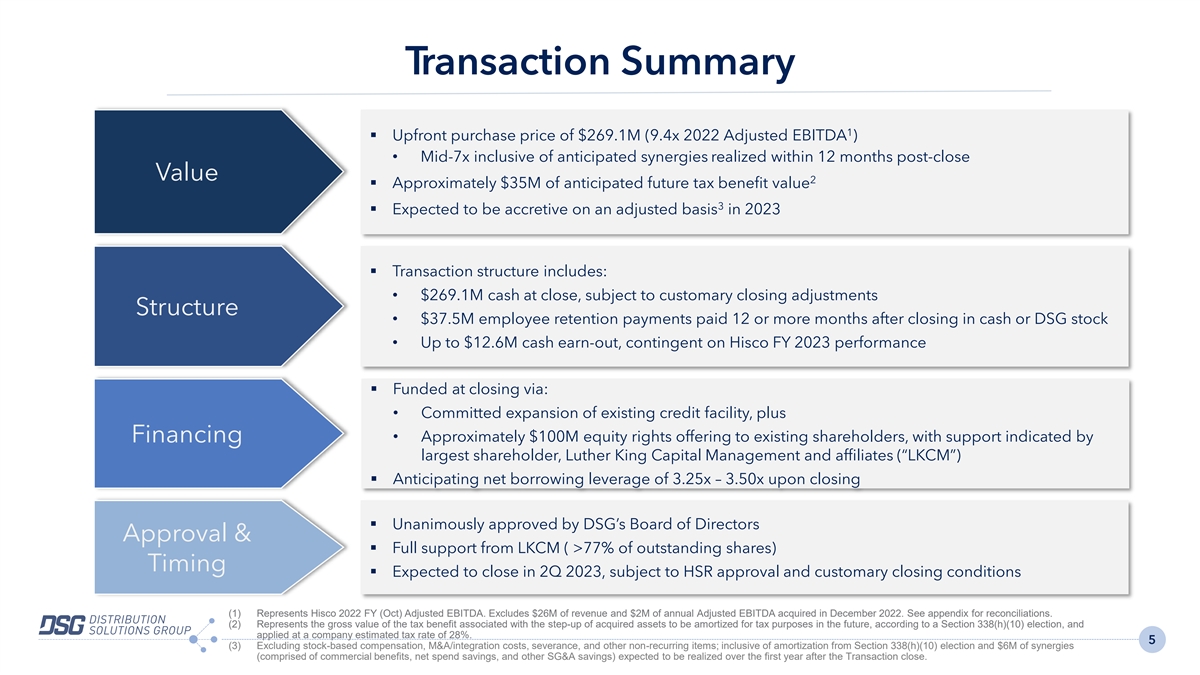

Transaction Summary 1 ▪ Upfront purchase price of $269.1M (9.4x 2022 Adjusted EBITDA ) • Mid-7x inclusive of anticipated synergies realized within 12 months post-close Value 2 ▪ Approximately $35M of anticipated future tax benefit value 3 ▪ Expected to be accretive on an adjusted basis in 2023 ▪ Transaction structure includes: • $269.1M cash at close, subject to customary closing adjustments Structure • $37.5M employee retention payments paid 12 or more months after closing in cash or DSG stock • Up to $12.6M cash earn-out, contingent on Hisco FY 2023 performance ▪ Funded at closing via: • Committed expansion of existing credit facility, plus • Approximately $100M equity rights offering to existing shareholders, with support indicated by Financing largest shareholder, Luther King Capital Management and affiliates (“LKCM”) ▪ Anticipating net borrowing leverage of 3.25x – 3.50x upon closing ▪ Unanimously approved by DSG’s Board of Directors Approval & ▪ Full support from LKCM ( >77% of outstanding shares) Timing ▪ Expected to close in 2Q 2023, subject to HSR approval and customary closing conditions (1) Represents Hisco 2022 FY (Oct) Adjusted EBITDA. Excludes $26M of revenue and $2M of annual Adjusted EBITDA acquired in December 2022. See appendix for reconciliations. (2) Represents the gross value of the tax benefit associated with the step-up of acquired assets to be amortized for tax purposes in the future, according to a Section 338(h)(10) election, and applied at a company estimated tax rate of 28%. 5 (3) Excluding stock-based compensation, M&A/integration costs, severance, and other non-recurring items; inclusive of amortization from Section 338(h)(10) election and $6M of synergies (comprised of commercial benefits, net spend savings, and other SG&A savings) expected to be realized over the first year after the Transaction close.

Industry-Leading Industrial Distribution Platform MRO Focus OEM Focus Industrial Technologies Focus Leading vendor managed Leading global supply chain services Leading supplier of electronic & specialty inventory provider of C-parts and C-parts provider to OEM production supplies and T&M equipment to the MRO market and aftermarket across OEM and MRO markets 1 1 1,2 ~29% of Sales ~23% of Sales ~48% of Sales Hisco Acquisition Benefits ✓ Elevates organic growth rate of all ✓ Provides immediate scale; pro forma 1,2 businesses through commercial revenue 2022 revenue of ~$1.7B and ✓ Enhances DSG’s suite of value- 1,2,3 opportunities adjusted EBITDA of ~$158M added capabilities leverageable ✓ Diversifies products and across the entire platform ✓ Generates strong and sustainable geographies, while capitalizing on pro forma cash flow nearshoring trends (1) Represents adjusted DSG revenue and EBITDA, including Lawson Products pre-merger results. Excludes $53M of revenue and $4M of EBITDA contribution from pre-acquisition results of acquisitions acquired in 2022. See appendix for reconciliations. (2) Represents Hisco 2022 FY (Oct) revenue and Adjusted EBITDA. Excludes $26M of revenue and $2M of annual Adjusted EBITDA acquired in December 2022. See appendix for reconciliations. 6 (3) Inclusive of $6M of synergies (comprised of commercial benefits, net spend savings, and other SG&A savings) expected to be realized over the first year after the Transaction close.

Hisco At a Glance 1 Largest Suppliers Business Overview Select Product Offering Mix ▪ Leading broadline industrial supplies 3% Adhesives, Sealants & Tapes 4% distribution business with integrated footprint 4% Soldering & Rework across the United States, Canada, and Mexico 4% Chemical & Cleaning Supplies 4% ▪ Headquartered in Houston, TX with 38 Electrical 4% 36% branches and ~600 employees Labeling & Identification 4% Packaging & Shipping ▪ High-margin, value-added services including 9% Paints & Coatings precision converting and packaging for Static Control adhesives, sealants, and specialty chemicals 28% Hand & Power Tools ▪ Deeply embedded with customers, providing Abrasives requirement-driven solutions Value-Added Services End Markets Custom Fabrication Precision Slitting Converting / Aerospace Repackaging Packaging / Labeling Die Cutting Electronic General Industrial Assembly Cold / Clean Room Storage Labeling / Printing Vendor-Managed Inventory Prototyping Medical Devices Transportation (1) Represents FY 2022 revenue; excludes Alliance Printing revenue and certain value-added services not categorized by company into revenue buckets. 7

Hisco’s Strategic Fit with TestEquity Scaled Geographic Footprint Highly Complementary Businesses Strong, complementary fit with Aligned Product TestEquity’s niche, specialty product offerings and value-add Offerings / Services services Strategic alignment with TestEquity’s suppliers, particularly Suppliers within Electronic Production Supplies (“EPS”) “Best of both” consolidation with Hisco Operational meaningful combination benefits, HQ / Marketing including facility optimization and Structure US Distribution Facility operating resource leverage HiscoMex Distribution Facility Investment Tailwinds in Precision Converting Facility Southern US and Mexico Adhesives Materials Group • 50% of CHIPS Act’s $200M in semiconductor TestEquity Beneficiary of growth driven by 2 investment allocated to the US Southwest region Benefits of Corporate Office CHIPS Act in the Southwestern US • Nearshoring trends shifting significant HQ / T&M Central Market Tailwinds manufacturing capacity into Mexico and nearshoring trends in Mexico EPS Central US/Mex TE Distribution Facility 1 Transformed Industrial Technologies Focus with ~2/3 of Business Driven by Production Supplies and Value-added Services (1) Based on each of TestEquity and Hisco’s FY 2022 revenues. (2) Source: Semiconductor Industry Association. 8

DSG Go-Forward Vision for Growth Best-in-Class Specialty Distribution Platform Poised for Accelerated Growth + Positioned for Organic Growth Opportunities Actionable Acquisition Program ▪ In-house Corporate Development team with first-class experience ✓ Unique Total Customer and Supplier Value Proposition ▪ Highly fragmented markets with thousands of smaller competitors ▪ Established track record of purchasing and integrating complementary, accretive businesses Comprehensive Value-Added Capabilities Across Premier Brands ✓ ▪ Well-capitalized to selectively pursue incremental acquisitions Value-Added Acquisitions Geographic / Infill Expansion Opportunities Across North America ✓ ✓ Enhanced Digital Capabilities Across the Platform ~Q2 2023 Proven Management Team with Clear Vision of Value Creation ✓ Continued Commitment to Drive Expanded EBITDA Margins ✓ 2017 - 2020 2021 2022 9

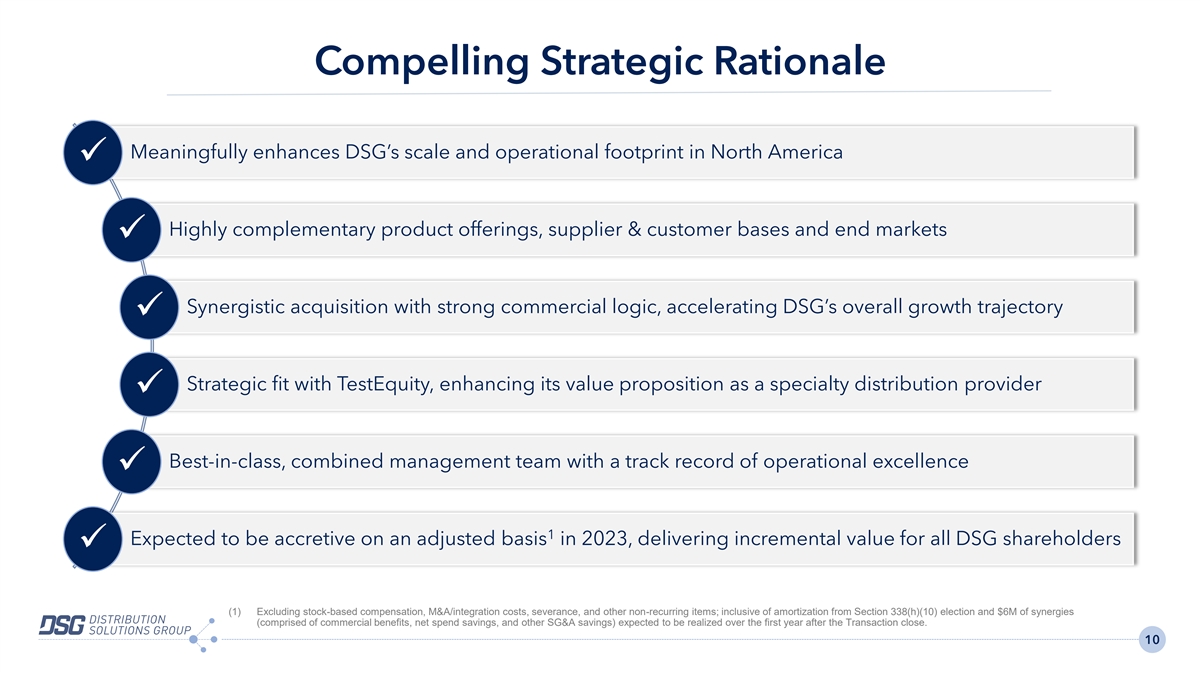

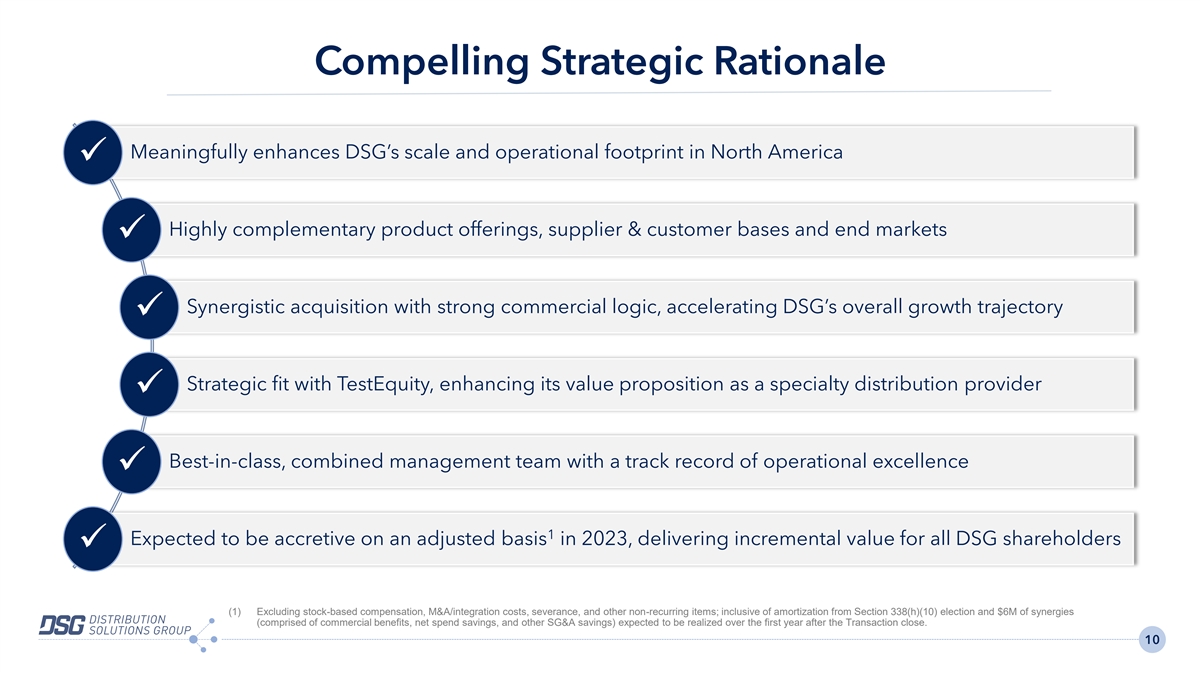

Compelling Strategic Rationale Meaningfully enhances DSG’s scale and operational footprint in North America ✓ Highly complementary product offerings, supplier & customer bases and end markets ✓ Synergistic acquisition with strong commercial logic, accelerating DSG’s overall growth trajectory ✓ Strategic fit with TestEquity, enhancing its value proposition as a specialty distribution provider ✓ Best-in-class, combined management team with a track record of operational excellence ✓ 1 Expected to be accretive on an adjusted basis in 2023, delivering incremental value for all DSG shareholders ✓ (1) Excluding stock-based compensation, M&A/integration costs, severance, and other non-recurring items; inclusive of amortization from Section 338(h)(10) election and $6M of synergies (comprised of commercial benefits, net spend savings, and other SG&A savings) expected to be realized over the first year after the Transaction close. 10

Investor Contacts Three Part Advisors, LLC (214) 872-2710 Steven Hooser shooser@threepa.com Sandy Martin smartin@threepa.com 11 Hisco Acquisition Overview

Appendix 12 Hisco Acquisition Overview

Reconciliation of GAAP Revenue and GAAP Operating Income to Non- GAAP Adjusted Revenue and Non-GAAP Adjusted EBITDA (Dollars in Thousands) Distribution Solutions Group Hisco Year Ended Year Ended 12/31/2022 10/31/2022 GAAP Revenue $ 1,151,422 GAAP Revenue $ 403,675 Pre-Merger Revenue (1) 117,877 Adjusted Revenue $ 1,269,299 GAAP Operating Income $ 41,786 GAAP Operating Income $ 9,101 Pre-Merger Operating Income (1) 12,076 Adjusted Operating Income $ 53,862 Depreciation and amortization 47,275 Depreciation and amortization 7,306 Adjustments: Adjustments: Merger/integration costs (2) 15,633 Merger/integration costs (2) - Stock-based compensation (3) (6,147) Stock-based compensation (9) 6,872 Severance costs (4) 3,422 Severance costs (4) - Acquisition related costs (5) 2,782 Acquisition related costs (5) 873 Inventory net realizable value adj. (6) 1,737 Inventory net realizable value adj. (6) 4,353 Inventory step-up (7) 2,867 Inventory step-up (7) - Other non-recurring (8) 1,597 Other non-recurring (8) - Adjusted EBITDA $ 123,028 Adjusted EBITDA $ 28,505 (1) Lawson Products revenue and operating income for the three months ended March 31, 2022, were not included in the Company's GAAP operating results under reverse merger acquisition accounting . (2) Merger transaction costs related to the negotiation, review and execution of the merger agreements relating to the business combination of Lawson Products, TestEquity and Gexpro Services and subsequent integration costs. (3) Expense primarily for stock-based compensation (benefit), of which a portion varies with the Company’s stock price. (4) Includes severance expense for actions taken, not related to a formal restructuring plan. (5) Expense for acquisition related costs, unrelated to the business combination of Lawson Products, TestEquity and Gexpro Services. (6) Inventory net realizable value adjustment recorded to reduce inventory related to discontinued products where the anticipated net realizable value was lower than the cost reflected in the Company's records. (7) Inventory fair value step-up adjustments resulting from the reverse merger acquisition accounting for Lawson Products and acquisition accounting for additional acquisitions completed by Gexpro Services. (8) Other non-recurring costs consists of sales force optimization and other non-recurring items. (9) Compensation expense for the fair market value of shares released and contributed to the Company's Employee Stock Ownership Plan. 13