SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT 1934 |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2003

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT 1934 |

For the transition period from to

Commission file number 000-13259

SPORTECH PLC

(Exact name of registrant as specified in its charter)

Scotland

(Jurisdiction of incorporation or organization)

Sportech House, Enterprise Way, Wavertree Technology Park,

Liverpool, L13 1FB, England

(Address of principal executive offices)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

| | |

Title of each class

| | Name of each exchange on which registered

|

American Depository Shares, each representing 1 Ordinary Share of 5p | | Non-NASDAQ OTC |

| |

| Ordinary Shares of 5p each* | | Non-NASDAQ OTC |

| *- | Not for trading, but only in connection with the registration of American Depository Shares, pursuant to the requirements of the Securities and Exchange Commission. |

SECURITIES FOR WHICH THERE IS A REPORTING OBLIGATION

PURSUANT TO SECTION 15(d) OF THE ACT:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Ordinary Shares of 5p each (fully paid) 592,074,138

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 x Item 18 ¨

Index

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | |

Introductory Note

Unless the context indicates otherwise, the “Company,” and “Sportech” refer to Sportech PLC and its subsidiaries. “Littlewoods Gaming” refers to Littlewoods Promotions Limited, Littlewoods Lotteries Limited and their respective subsidiaries.

Sportech publishes its financial statements expressed in United Kingdom (“UK”) pounds Sterling. In this document references to “US Dollars”, “US $”, or “$” are to United States (“US”) Dollars, references to “pounds Sterling”, “Sterling” or “£” and “pence” or “p” are to UK currency. For historical information regarding rates of exchange between US Dollars and pounds Sterling, see “Exchange Rates” within “Item 3A – Selected Financial Data”.

Cash dividends paid by Sportech will be in pounds Sterling, and exchange rate fluctuations will affect the US Dollar amounts received by holders of American Depositary Receipts (“ADRs”) on conversion of such dividends. Moreover, fluctuations in the exchange rates between pounds Sterling and the US Dollar will affect the US Dollar equivalent of the pounds Sterling price of the ordinary shares of the Company (the “Ordinary Shares”) on the London Stock Exchange, and, as a result, are likely to affect the market price of the ADRs.

On October 10, 2003, the Company issued a notice of termination of its ADR program. The ADR Program was duly terminated on January 10, 2004. On or after July 12, 2004 all outstanding ADRs will be terminated when the Depositary (Bank of New York) sells off the underlying ordinary shares of the Company and distributes the proceeds to the former ADR holders.

The Company’s fiscal year ends on December 31 of each year, and references herein to “fiscal year” are to the year ended December 31 of the year specified.

Certain information included with this document is forward-looking and involves risks and uncertainties that could result in actual results differing materially from those expressed or implied by the forward looking statements. Forward-looking statements included in this document and in documents incorporated herein by reference generally may be identified by, the words “expects”, “plans”, “anticipates”, “intends”, and similar expressions that indicate the statement addresses the future. Forward-looking statements include, without limitation, projections relating to results of operations and financial conditions and the Company’s plans and objectives for future operations. All forward-looking statements in this report are based upon information available to the Company on the date of this report. Sportech undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. It is not reasonably possible to itemise all of the many factors and specific events that could affect the Company’s future operations or results. Some factors that could significantly impact revenues, expenses, capital expenditures, cash flows and margins include customer demand and other commodity costs, actions of the UK and other governments, inflation, the general economic environment, the ability to reach labour and wage agreements and other items discussed herein, including those discussed in “Item 3D - Risk Factors”.

References below to major headings include all information under such major headings, including subheadings, unless such reference is part of a reference to a subheading, in which case such reference includes only the information contained under such subheading.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 1 |

Item 1. Identity Of Directors, Senior Management And Advisers -Not Applicable.

Item 2. Offer Statistics And Expected Timetable -Not Applicable.

Item 3. Key Information

A. Selected Financial Data

The following table sets out selected historical statement of income data, supplemental financial data and balance sheet data. These are derived from the audited financial statements of the Company. The selected financial data set forth below should be read in conjunction with, and are qualified in their entirety by reference to, the Financial Statements and Notes thereto included elsewhere in this Annual Report. The Company prepares its Financial Statements in accordance with UK GAAP which differ in certain significant respects from US GAAP. A description of the significant differences and reconciliations of net income/(loss) and shareholders’ equity are set forth in Note 30 to the Financial Statements.

| | | | | | | | | | | | | | | | | | |

| Income Statement Data | | Year to 30

September

1999

| | | Three Months to 31 December

1999

| | | Year to 31

December

2000

| | | Year to 31

December

2001

| | | Year to 31

December

2002

| | | Year to 31

December

2003

| |

| | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

Amounts in accordance with UK GAAP: | | | | | | | | | | | | | | | | | | |

Group turnover | | — | | | — | | | 63.0 | | | 183.3 | | | 195.3 | | | 207.9 | |

Cost of sales | | (0.6 | ) | | (0.3 | ) | | (46.9 | ) | | (129.3 | ) | | (139.4 | ) | | (153.0 | ) |

Net operating (expenses)/income | | (0.6 | ) | | (0.4 | ) | | 10.3 | | | (45.4 | ) | | (44.5 | ) | | (45.4 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Operating profit/(loss) | | (1.2 | ) | | (0.7 | ) | | 26.4 | | | 8.6 | | | 11.4 | | | 9.5 | |

Discount on redemption of loan stock | | — | | | — | | | 3.9 | | | — | | | — | | | — | |

Profit on sale of tangible fixed assets | | — | | | — | | | — | | | — | | | 1.4 | | | — | |

Profit on sale of Technology Patents | | — | | | — | | | — | | | — | | | — | | | 0.6 | |

Net interest income payable and similar items | | — | | | — | | | (2.9 | ) | | (9.2 | ) | | (8.2 | ) | | (6.6 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Profit/(loss) on ordinary activities before taxation | | (1.2 | ) | | (0.7 | ) | | 27.4 | | | (0.6 | ) | | 4.6 | | | 3.5 | |

Tax on profit/(loss) on ordinary activities | | — | | | — | | | (2.9 | ) | | (2.1 | ) | | (1.7 | ) | | (3.7 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Retained profit/(loss) for the financial period | | (1.2 | ) | | (0.7 | ) | | 24.5 | | | (2.7 | ) | | 2.9 | | | (0.2 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Weighted average number of ordinary shares (‘000s) | | 254,275 | | | 254,275 | | | 471,148 | | | 592,074 | | | 592,074 | | | 592,074 | |

Net income/(loss) per ordinary share – basic & diluted | | (0.4 | )p | | (0.3 | )p | | 5.2 | p | | (0.5 | )p | | 0.5 | p | | ( 0.0 | )p |

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 2 |

A. Selected Financial Data (continued)

| | | | | | | | | | | | | | | | | | |

| Income Statement Data | | Year to 30

September

1999

| | | Three

Months to 31

December

1999

| | | Year to 31

December

2000

| | | Year to 31

December

2001

| | | Year to 31

December

2002

| | | Year to 31

December

2003

| |

| | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

Amounts in accordance with US GAAP: | | | | | | | | | | | | | | | | | | |

Group turnover | | — | | | — | | | 63.0 | | | 183.3 | | | 195.3 | | | 207.9 | |

Cost of sales | | (0.6 | ) | | (0.3 | ) | | (46.9 | ) | | (129.3 | ) | | (139.4 | ) | | (153.0 | ) |

Net operating (expenses)/income | | (0.6 | ) | | (0.4 | ) | | 10.3 | | | (45.4 | ) | | (36.4 | ) | | (36.7 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Operating profit/(loss) | | (1.2 | ) | | (0.7 | ) | | 26.4 | | | 8.6 | | | 19.5 | | | 18.2 | |

| | | | | | |

Discount on redemption of loan stock | | — | | | — | | | 3.9 | | | — | | | — | | | — | |

Profit on sale of tangible fixed assets | | — | | | — | | | — | | | — | | | 1.4 | | | — | |

Profit on sale of Technology Patents | | — | | | — | | | — | | | — | | | — | | | 0.6 | |

Net interest income payable and similar items | | — | | | — | | | (2.9 | ) | | (9.7 | ) | | (8.4 | ) | | (5.7 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Profit/(loss) on ordinary activities before taxation | | (1.2 | ) | | (0.7 | ) | | 27.4 | | | (1.1 | ) | | 12.5 | | | 13.1 | |

Tax on profit/(loss) on ordinary activities | | — | | | — | | | (2.9 | ) | | (2.0 | ) | | (1.6 | ) | | (4.0 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Retained profit/(loss) for the financial period | | (1.2 | ) | | (0.7 | ) | | 24.5 | | | (3.1 | ) | | 10.9 | | | 9.1 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Weighted average number of ordinary shares (‘000s) | | 254,275 | | | 254,275 | | | 471,148 | | | 592,074 | | | 592,074 | | | 592,074 | |

Net income/(loss) per ordinary share – basic & diluted | | (0.4 | )p | | (0.3 | )p | | 5.2 | p | | (0.5 | )p | | 1.8 | p | | 1.5 | p |

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 3 |

A. Selected Financial Data (continued)

| | | | | | | | | | | | | | | | | | |

| Balance Sheet Data | | At 30

September

1999

| | | At 31

December

1999

| | | At 31

December

2000

| | | At 31

December

2001

| | | At 31

December

2002

| | | At 31

December

2003

| |

| | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

Amounts in accordance with UK GAAP: | | | | | | | | | | | | | | | | | | |

Total assets | | 0.2 | | | 0.2 | | | 206.8 | | | 189.4 | | | 179.0 | | | 169.8 | |

Long-term debt | | (20.3 | ) | | (20.3 | ) | | (139.7 | ) | | (117.9 | ) | | (104.0 | ) | | (94.2 | ) |

Net assets/(liabilities) | | (20.4 | ) | | (21.1 | ) | | 31.3 | | | 28.6 | | | 31.5 | | | 31.3 | |

Share capital | | 13.6 | | | 13.6 | | | 30.5 | | | 30.5 | | | 29.6 | | | 29.6 | |

| | | | | | |

Amounts in accordance with US GAAP: | | | | | | | | | | | | | | | | | | |

Total assets | | 0.2 | | | 0.2 | | | 206.8 | | | 190.3 | | | 186.6 | | | 186.8 | |

Long-term debt | | (20.3 | ) | | (20.3 | ) | | (139.7 | ) | | (117.9 | ) | | (104.0 | ) | | (94.2 | ) |

Net assets/(liabilities) | | (20.4 | ) | | (21.1 | ) | | 31.3 | | | 28.2 | | | 39.1 | | | 48.2 | |

Capital stock | | 13.6 | | | 13.6 | | | 30.5 | | | 30.5 | | | 29.6 | | | 29.6 | |

| | | | | | |

Total shareholders’ funds/(deficit): | | | | | | | | | | | | | | | | | | |

As reported under UK GAAP: | | (20.4 | ) | | (21.1 | ) | | 31.3 | | | 28.6 | | | 31.5 | | | 31.3 | |

As reported under US GAAP: | | (20.4 | ) | | (21.1 | ) | | 31.3 | | | 28.2 | | | 39.1 | | | 48.2 | |

The Company has not paid cash dividends in the five year period for which financial information is presented above.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 4 |

A. Selected Financial Data (continued)

Exchange Rates

The Noon Buying Rate expressed in US Dollars to pounds Sterling as of June 25, 2004 was $1.82. The following table sets forth, for the periods and dates indicated, certain information concerning the Noon Buying Rate, expressed in US Dollars to pound sterling.

| | | | | | | | |

Year Ended

| | End rate

| | Average rate

| | High

| | Low

|

30 September 1999 | | 1.65 | | 1.63 | | 1.68 | | 1.55 |

1 October – 31 December 1999 | | 1.62 | | 1.61 | | 1.65 | | 1.58 |

31 December 2000 | | 1.49 | | 1.51 | | 1.62 | | 1.42 |

31 December 2001 | | 1.45 | | 1.44 | | 1.51 | | 1.37 |

31 December 2002 | | 1.61 | | 1.50 | | 1.61 | | 1.41 |

31 December 2003 | | 1.79 | | 1.64 | | 1.79 | | 1.55 |

| | | | |

Month

| | | | | | | | |

December 2003 | | — | | — | | 1.79 | | 1.72 |

January 2004 | | — | | — | | 1.85 | | 1.79 |

February 2004 | | — | | — | | 1.91 | | 1.82 |

March 2004 | | — | | — | | 1.87 | | 1.79 |

April 2004 | | — | | — | | 1.86 | | 1.77 |

May 2004 | | — | | — | | 1.84 | | 1.76 |

| Source | : The Bank of England |

B. Capitalization And Indebtedness– Not Applicable.

C. Reasons For The Offer And Use Of Proceeds– Not Applicable.

D. Risk Factors

This section describes some of the risks that could affect the Company’s business and results of operations. These factors should be considered in connection with any forward looking statements contained in this report and the cautionary statement contained in the “Introductory Note”.

The Company’s businesses are highly competitive and have experienced, and the Company expects will continue to experience, significant changes. In addition, the Company’s future performance is subject to a variety of factors over which it has little or no control, including indebtedness / liquidity risk, adverse governmental regulation, competition and adverse changes in economic conditions. There may be other risks that the Company has not identified that could have a material adverse effect on the Company’s business, revenues, operating income, net assets and liquidity and capital resources.

Substantial indebtedness / liquidity risk

The Company has incurred significant indebtedness and may incur additional indebtedness in the future. The Company’s indebtedness may restrict the Company’s liquidity with respect to working capital, requisitions, new product developments or other purposes. For more information on the Company’s debts, see Notes 18 to 20 to the Financial Statements which are incorporated herein by reference, and also the schedule of significant contractual commitments discussed in “Item 5B - Liquidity and Capital Resources”.

Interest rate risk

All of the Company’s debts have floating interest rates (though a significant portion is subject to an interest rate cap). Although the Company expects to have sufficient working capital, interest rate volatility may nevertheless affect the Company’s operations and financial results. For more information on the Company’s interest rates, please see Note 20 to the Financial Statements which is incorporated herein by reference.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 5 |

D. Risk Factors (continued)

Government regulation

The Company’s operations are subject to a high degree of UK regulations covering most aspects of its gaming, football pools, sports betting and lottery businesses. Future operating and financial results may vary based upon the effects of such regulation, including the granting, timing and renewal of permits needed to operate the Company’s gaming, football pools, sports betting and lottery businesses, and the cost associated with such permits and regulations.

The consequences for the UK gambling industry and government taxation revenues as gamblers decide to move offshore have been recognised in the recently announced review of gambling legislation, which has been asked to examine internet gambling. Whilst therefore it is probable that legislation will be brought in to regulate internet gaming, it is premature to speculate on its likely form. However, there can be no assurances that the ultimate form of such legislation would not have an adverse effect on the Company’s financial and operating results.

Competition

Most of the markets in which the Company operates are highly competitive. The Company faces competition from other competing companies and the United Kingdom national lottery. The Company’s pricing decisions are affected by many factors, including competition from other companies, some of which may have greater financial resources or economies of scale. This may cause the Company’s operations and financial results to vary from period to period.

Economic and other conditions

The demand for the Company’s businesses and, accordingly, the Company’s operating and financial results may be affected by changes in local, regional, and national economic, political and other conditions. Significant and prolonged downturns in economic conditions would be likely to have an adverse effect on the Company. In addition, other demand-related factors such as war, political instability (or the threat thereof) or the continuation or escalation of terrorist activities could have an adverse effect on the Company’s financial results and operations.

Geographic and business concentration

The Company operates almost exclusively within the United Kingdom and expects that a large portion of its operating profits, for the financial year ended 31 December 2004 at least, will be generated by one business stream, football pools. Any significant decline in the performance of this business stream could have a material adverse effect on the financial results of the Company.

Risks relating to current and future operations

There can be no assurance with respect to the Company’s future operations and financial results.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 6 |

Item 4. Information On The Company

A. History And Development Of The Company

General

Until 4 September 2000, the business of the Company was the licensing and exploitation of its patents covering disk drive technology. The principal objective of the Company was to collect royalties from third parties on the manufacture and sale of disk drives in respect of which the Company holds patents registered in the United States, Canada and certain major Western European countries.

On 4 September 2000, Sportech acquired Littlewoods Gaming, which comprised the football pools, fixed odds betting and charity lottery management businesses of The Littlewoods Organisation PLC. Consequent to this acquisition the focus of the business has changed to that sector and the Company changed its name from Rodime PLC to Sportech PLC at that time.

Additionally, the Company intends in the future to seek new opportunities to increase shareholder value through strategies involving acquisitions as well as management and development of existing business streams.

Sportech PLC was incorporated in Scotland on August 17, 1979 and commenced business in October 1980. Its head office was located at 4 Heriot Row, Edinburgh, EH3 6HU, Scotland until December 2000. From January 2001 to May 2002 its head office was located at Walton Hall Avenue, Liverpool, L67 1AA, England, and since May 2002 its head office is located at 2 Enterprise Way, Wavertree Technology Park, Liverpool L13 1FB (telephone number 0044-151-525-3677). The Company’s registered office is at 249 West George Street, Glasgow, G2 4RB, Scotland, and its registered number is 69140. Sportech PLC is a going concern. The name and address of the Company’s US agent is Bank of New York Company Inc., 1, Wall Street, New York, N.Y. 10286.

Historical Summary

Through to August 1991 the Company’s business was the development, manufacture and marketing of high performance magnetic rigid disk drives. For a number of years prior to 1991 the Company incurred operating losses. Economic and industry conditions made it unlikely that the Company would achieve a return to profitability. Consolidation took place within the industry and many smaller manufacturers ceased trading. This resulted in the disk drive manufacturing industry becoming dominated by a few large companies, many of which had significantly greater financial resources and economies of scale than the Company.

In March 1991 the Directors reported that, because of the problems noted above, the Company had exhausted much of its working capital and would not be able to continue in the disk drive industry unless it could find a partner to share the risks associated with manufacturing. Shareholders were also advised that the Company was actively seeking potential joint venture manufacturing partners but that the outcome was uncertain. By August 1991 the Company had been unable to conclude any arrangement with joint venture parties and these factors led the Directors to conclude that it was not feasible in the long term to continue the manufacture and sale of disk drives. Subsequently, the Company’s manufacturing operations in Singapore were sold to Myrica Technology Inc, and the Company’s subsidiaries (Rodime Europe Limited, Rodime Singapore Pte Limited and Rodime Inc) were liquidated. Although the Company sold its manufacturing operations, the Company continued to seek revenue from its remaining assets, primarily patents covering its disk drive technology. In some cases, the Company deemed it necessary to file lawsuits for patent infringement against certain parties. The most significant lawsuit was filed against Seagate Technology Inc. in 1992. In 2000, Seagate paid to Rodime a settlement fee equal to $45m (£27.8m) in satisfaction of all claims raised in the lawsuit.

Acquisition of Littlewoods Gaming

Following the successful settlement of the Company’s legal action against Seagate and the redemption of outstanding loan stock, the Company embarked on a search for potential added value acquisition opportunities. This search culminated in the purchase on 4 September 2000 of Littlewoods Gaming for £162.5m and the renaming of the Company from Rodime PLC to Sportech PLC. Now the core business of the Company, Littlewoods Gaming is the foremost UK provider of gaming products direct to customers in their homes. Littlewoods Gaming has a brand which is synonymous with football (i.e. soccer) in the UK and the Company expects that this brand will be well placed to take advantage of high growth opportunities particularly through new media channels. The purchase of Littlewoods Gaming was financed by the issue of new ordinary shares raising £28.7m and by the draw down of long term loans totalling £140.0m. As part of the process of raising this new ordinary share capital the Bank of Scotland’s holding was reduced from 49.7% to 28.4% of the enlarged capital of the Company. The Bank of Scotland is one of the Company’s most significant shareholders and is its most significant lender.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 7 |

A. History And Development Of The Company (continued)

Acquisition of Littlewoods Gaming (continued)

The financial reporting period of the Company was also reviewed at the time of the acquisition, and the financial reporting date was amended from 30 September to 31 December.

Disposal of Technology Patents Business

On 1 July 2003, the Company sold its remaining patents business for $1.5m to a company based in the US. This resulted in a profit after disposal costs of £0.6m. Consequent upon this disposal, the Littlewoods Gaming business is now the core business of the Company.

Capital Expenditures and Divestitures

See “Item 5B – Liquidity and Capital Resources”.

B. Business Overview

Principal activities and markets

Until September 2000 and the acquisition of Littlewoods Gaming, the Company’s principal activity was the exploitation through licensing and litigation of its pioneering patents relating to 3½ inch disk drive technology. In addition to the two U.S. patents (the ‘988 and ‘383 patents) formed the basis of the Company’s original patent licensing and litigation program, the Company held and maintained several patents relating to disk drive and other storage system technology which should have broader application than the ‘988 and ‘383 patents.

The Company’s patents principally covered certain hard disk drives which are either manufactured or sold in or into the United States, Canada and certain major Western European countries. For more information on the Company’s patents at this time, see “Patents and Licences” on page 13.

The Company’s patent licensing and exploitation activity has in years prior to 1999 generated revenue from three types of licences:

| | (a) | fully paid up agreements whereby a lump sum payment by the licensee extinguishes liability for both past and future patent infringement; |

| | (b) | running royalty agreements whereby the licensee agrees to pay Sportech a percentage of past and future revenue from infringing disk drives sold and/or manufactured in the United States; and |

| | (c) | release agreements whereby the licensee pays a lump sum for prior infringement when no ongoing licence is required in the future. |

The Company’s most significant patent infringement suit was against Seagate Technology Inc (“Seagate”) (see Note 27 to the Financial Statements). After more than seven years of litigation, the case was finally settled in January 2000 by the payment of £27.8m million from Seagate to the Company, in full and final settlement of the Company’s claims, without admission of liability by either party.

At that time, there remained around 20 patents owned by the Company, principally relating to disk drive and storage access technologies.

During the financial year ending 31 December 2001, the Company had entered into an agreement granting an exclusive licence to QED Intellectual Property Limited in respect of all patents held by the Company involving disk drive technology. The agreement empowered QED to exploit these intellectual property rights world wide to the mutual benefit of the parties until expiry of each patent. Their fees were linked to the amount of revenue generated. The agreement was performance related and the contract was terminated in June 2002.

Following the termination of this contract the Company undertook a further review of the most effective way of deriving value from the patent portfolio. It was concluded that best value could be obtained by selling the remaining patents. In consequence, on 1 July 2003, the Company sold its remaining patents business for $1.5m to a company based in the US. This resulted in a profit after disposal costs of £0.6m. Since the acquisition of Littlewoods Gaming, the Company’s principal activity is now Gaming consisting of Football Pools, Games & Lotteries, Interactive Television Gaming and Sports Betting.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 8 |

B. Business Overview (continued)

Football Pools

Littlewoods Pools is the leading football (i.e. soccer) pools promoter in the United Kingdom and has been trading for 80 years. Football pools are a competition in which players select a minimum of 10 football matches from a list of 49 and score points based on the matches results. The prize fund is determined by the value of entry fees less taxes and administration expenses, and this prize fund is divided amongst the winning players.

In the period since acquisition, the football pools business has remained profitable and cash generative, despite a continuing decline in sales revenue, which is currently around 11% year on year. The way in which the game is played and the distribution efficiency have changed significantly since 1994 when virtually all entries were paper coupons, to today, with over 68% of football pools entries now gathered by telephone and electronically, including portable “pools card” terminals. Not only do these methods make the football pools quick and easy to play, but they completely eliminate all paper processing. This changing collection profile, together with increased automation in the processing and marking systems, has helped reduce costs and maintain operating profitability.

In 2002, the Company purchased the pools business of a small competitor, Zetters, thus increasing further its leading position in the market. This business, which operated from London, was transferred to the Liverpool operation during the course of 2003 with a complete transfer achieved by January 2004.

In 2002, new technology was introduced for the marking of football pools coupons. This technology is less labour and space intensive than the technology it replaced. The smaller scale of new coupon processing equipment enabled processing to be concentrated in one of two pools processing buildings. The surplus land and building were sold for redevelopment generating proceeds of £2.0m and realising an exceptional gain on disposal of £1.4m.

In 2002, the UK government changed the way Pool Betting Duty is calculated from being 17.5% of stakes to 15% of gross profit defined as stakes less winnings, and this has lowered the tax burden on the business.

The Company’s efforts in 2003 significantly continued to focus on three main areas: further cost reductions to sustain profitability of football pools; repackaging the game and the way it is played to increase its appeal to different market segments; and extending its distribution capabilities through the use of new media channels. This will continue in 2004.

Games and Lotteries

This part of the business derives income from the running of games and competitions such as Spot The Ball, the on-line casino, littlewoodscasino.com, and from acting as an external lottery manager for the running of society charity lotteries. During the year the Company continued its investment in new product concepts and delivery platforms. Sales of products through the door to door collector channel continued to decline.

During 2002, a non-core part of the Lotteries business, “Pull-tabs”, was sold generating a surplus of £0.5m.

During 2003, the key development in Games & Lotteries was the successful operation and extension of an on-line casino, littlewoodscasino.com, which launched in August 2002 and achieved operating profits in line with expectations in 2003.

In September 2003, the location of the casino was moved from the Isle of Man to the Netherlands Antilles as the extent of the regulation in the Isle of Man was excessively restrictive. Following the move, the casino was successfully expanded to provide integrated jackpot products, and in November 2003 poker games and tournaments were launched on littlewoodspoker.com. Our combined casino and poker sites now offer a choice of over 70 different games.

Extended scratchcard trials with two major UK supermarket groups, Sainsbury’s and Safeway, continue, with both retailers having stocked Littlewoods core scratchcards in store for the first time during 2003. Littlewoods Gaming continues to establish relationships with high profile charities and good causes with broad appeal. Our Poppy Appeal scratchcard last autumn was a notable success. The latest of these collaborations is the British Olympic Association scratchcard, which launched in April 2004 and is aimed at supporting Team GB in Athens this summer.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 9 |

B. Business Overview (continued)

Interactive Television Gaming

The Company has entered a contract with Independent Television, one of the two major terrestrial UK broadcasters, to supply interactive gaming services in return for certain payments and minimum guarantees. This contract

| | • | offers the opportunity to provide gaming directly linked to programming content; and |

| | • | represents a 24:7 interactive distribution channel for a range of interactive gaming and betting products. |

This business has no turnover up to 31 December 2003 as it is still in development.

The Littlewoods Bet Direct product is being introduced to ITV’s interactive service. This will be the only betting service available behind ITV’s football and sports related coverage.

It is planned to introduce a 24:7 Game Zone on the ITV interactive service, which will include a range of non-programme related compelling “pay to play to win” games which viewers can access and enjoy at their leisure.

Sports Betting

Littlewoods Bet Direct currently provides customers with a wide range of betting opportunities across telephone, internet and satellite (Sky Digital) platforms. Organic growth across telephone and internet has delivered annual revenues of £101.7m which was 22% higher than 2002 (2002: £83.1m). This growth was underpinned by a 10% increase in average telephone stakes and a 35% increase in average internet stakes. Overall, customer numbers increased to 313,000 (2002: 272,000). However, this revenue growth was not reflected in retained gross win, principally as a result of a run of poor horse racing results which reduced the gross win rate (GWR) to 7.3% as against 9.6% in 2002. This is the principal reason why losses increased to £3.1m in 2003 (2002: loss of £2.0m) although there was also the impact of development costs associated with the launch of interactive betting services on the attheraces and Sky Active television channels.

Although margins did improve in the second half of 2003 on telephone betting, the gross win performance was nevertheless disappointing and is intended to be addressed through a number of key actions. In particular, the reliance on horse racing is intended to be reduced by increasing the share of the football betting market, where GWR over the last two years has been maintained at 11%. In addition, more betting opportunities will be exploited in other sports including cricket, tennis, rugby and golf, and the introduction of in-running betting across a number of sports. The Littlewoods Bet Direct presence will also be launched on ITV, and growing our Sky Active presence, where experience since launch, and the experience of the market generally, points to a GWR above 10%. The betdirect.net internet site is undergoing a major upgrade.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 10 |

B. Business Overview (continued)

Segmental Information

The Company’s revenues are generated through three businesses: Football Pools, Games & Lotteries and Betting. A fourth business, Interactive Television Gaming, only commenced trading in 2004 and to date has not produced a material amount of revenue.

The Company’s segments for reporting purposes are the above four businesses (making up Littlewoods Gaming) along with Technology Patents, which was disposed of in 2003.

The following table shows the Company’s principal markets, including a breakdown of financial results under UK GAAP by category of activity and geographic market for each of the last three years. Substantially all of the Company’s business activity occurs within the United Kingdom.

| | | | | | | | | |

| | | Year to 31

December

2001

| | | Year to 31

December

2002

| | | Year to 31

December

2003

| |

| | | £m | | | £m | | | £m | |

Profits/(losses) | | | | | | | | | |

Generated from the United States: | | | | | | | | | |

Patent income | | (0.6 | ) | | — | | | — | |

Profit on sale of Technology Patents | | — | | | — | | | 0.6 | |

| | | |

Generated from the United Kingdom: | | | | | | | | | |

Football Pools | | 23.2 | | | 25.6 | | | 25.6 | |

Games & Lotteries | | 0.5 | | | 0.9 | | | 1.0 | |

Interactive Television Gaming | | (1.6 | ) | | (2.3 | ) | | (3.6 | ) |

Sports Betting | | (4.0 | ) | | (2.0 | ) | | (3.1 | ) |

| | |

|

| |

|

| |

|

|

| | | 17.5 | | | 22.2 | | | 20.5 | |

Restructuring costs | | — | | | (2.0 | ) | | (1.3 | ) |

Amortisation of goodwill | | (8.9 | ) | | (8.8 | ) | | (9.1 | ) |

| | |

|

| |

|

| |

|

|

| | | 8.6 | | | 11.4 | | | 10.1 | |

Profit on sale of fixed assets | | — | | | 1.4 | | | — | |

Interest income | | 0.4 | | | 0.2 | | | 0.2 | |

Interest expense | | (9.6 | ) | | (8.3 | ) | | (6.8 | ) |

Amortisation of loan arrangement fee | | — | | | (0.1 | ) | | — | |

| | |

|

| |

|

| |

|

|

Income/(loss) before tax expense | | (0.6 | ) | | 4.6 | | | 3.5 | |

| | |

|

| |

|

| |

|

|

Net assets | | | | | | | | | |

Football Pools | | 43.2 | | | 48.8 | | | 52.9 | |

Games & Lotteries | | (2.8 | ) | | (2.1 | ) | | (1.2 | ) |

Interactive Television Gaming | | (1.2 | ) | | (3.2 | ) | | (6.2 | ) |

Sports Betting | | (10.6 | ) | | (12.0 | ) | | (14.2 | ) |

Technology Patents | | — | | | — | | | — | |

| | |

|

| |

|

| |

|

|

| | | 28.6 | | | 31.5 | | | 31.3 | |

| | |

|

| |

|

| |

|

|

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 11 |

B. Business Overview (continued)

Seasonality of the Company’s Main Business

The Company is not aware of any seasonal factors that materially affect the business of the Company.

Sources and Availability of Raw Materials

The Company does not expect to engage in the manufacture of physical products and for this reason is not affected by supply availability issues.

Marketing Channels Used by the Company

The importance of reliable and secure distribution in the football pools business cannot be over-emphasised, and Littlewoods Gaming has built its world class reputation over 80 years since 1923. While the Company now offers many choices of distribution, the cornerstone remains the 16,000 strong network of door-to-door collectors of coupons and stakes, which provides a unique service throughout the UK. This network is augmented by telephone, post, internet and interactive digital television distribution, all of which currently take the Company’s products into some 1.6 million households every week.

The Company’s future distribution strategy will have two main themes. Its own multi channel development will focus on extending its penetration into the home gaming market and becoming an important content provider for those with appropriate distribution channels into retail outlets.

The Company believes the new media channels, particularly interactive digital television, will open up a much wider playing audience and provide an ideal platform for many of its gaming concepts.

Dependency Upon Patents and Licences

Patents

Prior to September 2000, the Company was dependent for its income on patents. In 1983, the Company completed the development of and demonstrated the world’s first 3 1/2 inch hard disk drive product, and applied for a patent in the US in February 1984 (US Patent Number 4568988) (‘988). A continuation patent was filed in the US in November 1985 (US Patent Number 4683383) (‘383). These patents were issued in February 1986 and January 1987, respectively. Court rulings have narrowed the scope of the claims of these patents to certain types of drives.

The licensing program for the ‘988 and ‘383 patents has resulted in the Company reaching agreement with twenty licensees, including negotiated settlements with Seagate Technology, IBM, Miniscribe and Corner Peripherals. Under United States law, the Company was entitled to receive royalties through to the year 2003.

After significant development activity Rodime applied in September 1990 for a US patent in respect of an invention which digitally positions read/write heads over media (the means by which information is retrieved or stored in rotating storage devices). In September 1991, further international patent applications were made for the European Community and Canadian markets. The US Patents and Trademarks office issued to the Company seven patents in respect of this technology during 1997.

During 2003, the Company undertook a review of the most effective way of deriving value from the patent portfolio. It was concluded that best value could be obtained by selling the remaining patents. In consequence, on 1 July 2003, the Company sold its remaining patents business for $1.5m to a company based in the US. This resulted in a profit after disposal costs of £0.6m.

Following the disposal of this business segment, the Company is no longer dependent on patents.

Licenses

The businesses comprising Littlewoods Gaming operate utilising licenses issued by the United Kingdom for betting and gaming and for the management of charity lottery competitions, and a license issued by Netherlands Antilles to operate internet casinos. Licences formerly held in both the Isle of Man and Alderney to operate internet casinos have not been renewed.

As part of the acquisition agreement for Littlewoods Gaming, Littlewoods Gaming has been licensed by Littlewoods Limited (formerly The Littlewoods Organisation), at no cost, to use “Littlewoods” as part of the Littlewoods Gaming branding for betting, gaming and lottery products. The agreement will run until 3 September 2010 unless previously terminated (for material breach or insolvency) or renewed by agreement between the parties.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 12 |

B. Business Overview (continued)

Competitive Position

The competitive position of Littlewoods Gaming is as follows:

Football Pools – Littlewoods Pools is dominant within its sector, accounting for over 80% of the British football pools market. This was reinforced by the acquisition of a competitor, Zetters Pools. This sector has been in decline since the introduction of the United Kingdom national lottery in 1994.

Games & Lotteries – Littlewoods Lotteries is the major private charity lottery manager in the United Kingdom. However, the number of such private lottery managers and their share of the market is small in a sector dominated by Camelot, the operator of the United Kingdom national lottery.

Interactive Television Gaming – The Company has an exclusive contract with ITV for fixed odds betting which commenced in March 2004 making Littlewoods Gaming the principal supplier of all interactive gaming and betting content behind ITV programming across all channels. Furthermore, the Company’s interactive betting service is now established on the Sky platform, and will be enhanced by the addition of fixed-odds games throughout 2004. Sportech is at the vanguard of this brand new entertainment experience and is ideally positioned to grow the interactive betting and gaming market at a number of levels, having invested in the technical and content expertise required to exploit this opportunity throughout 2003.

Sports Betting – the Company, trading as Bet Direct and formerly Bet247, is a relatively new entrant, commencing trading in 1998, in a highly competitive sector dominated by several major long established competitors, such as William Hill and Ladbrokes. The competition in the sector has recently been increased further by the emergence of online betting exchanges.

Material Effects of Government Regulations

The main trading subsidiaries of the Company, Littlewoods Promotions Limited and Littlewoods Lotteries Limited operate their businesses subject to UK government issued licences.

Betting and gaming

Betting and gaming in the UK is subject to regulation. The first comprehensive legislation governing the industry was the Betting, Gaming and Lotteries Act 1963 which provided a regulatory framework for the whole industry. The laws governing gaming (including casinos, bingo and gaming machines) and lotteries have since been codified separately in two acts - the Gaming Act 1968 and the Lotteries and Amusements Act 1976. The Gaming Act 1968 established the Gaming Board for Great Britain, the regulatory body for casinos, bingo clubs, gaming machines and the larger society and all local lotteries in Great Britain.

Pools

Pools are regulated by the Betting, Gaming and Lotteries Act 1963. Pools promoters are required to register with the local government authority and must also have a permit from Customs and Excise for each premises from which they operate pools betting or fixed-odds coupon betting.

Telephone betting

Telephone betting in the UK is regulated under the Betting, Gaming and Lotteries Act 1963 as a bookmaking operation. The main provision of the Act is to require anyone who accepts bets on his own account in the course of his business to hold a bookmaker’s permit. An application for a permit in England and Wales must be made to the local court acting for the local area in which the applicant has its head office.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 13 |

B. Business Overview (continued)

Material Effects of Government Regulations (continued)

Lotteries and scratchcards

The Lotteries and Amusements Act 1976 differentiates between private lotteries (restricted to members of a society or a club) and society lotteries (open to all but run on behalf of a charity or not-for-profit society).

| | • | Private lotteries (which the Company is no longer involved in) |

These are lotteries restricted to members of a society or club or other persons visiting its premises. There is no limit placed upon the price of each ticket or the size of any of the prizes.

The Lotteries and Amusements Act 1976 permits individuals and companies to act as managers (generally referred to as external lottery managers or ‘ELMs’) of lotteries for charities and other ‘societies’, subject to certification by the Gaming Board. Society lotteries are subject to certain restrictions, which were altered by The Lotteries (Variation of Monetary Limits) Order 2002 on 17 June 2002, in particular:

| | • | The proportion of proceeds allocated to prizes must not be more than 55%. |

| | • | The proportion of proceeds allocated to expenses (including the ELM’s fee and any VAT thereon) is restricted to a maximum of 35%. |

| | • | The sum of the prizes and expenses percentages must not exceed 80%, thus leaving at least 20% for the society. |

| | • | Tickets in a society lottery may not be ‘sold by means of a machine’. |

| | • | The scheme for each society lottery must be approved in advance by the Gaming Board. |

| | • | The price of each ticket or chance is limited to £2 maximum. |

| | • | The maximum size of each society lottery is limited to £2,000,000 and the maximum top prize is the higher of 10% of the proceeds or £25,000. In practice, therefore, the maximum top prize is £200,000. |

The other forms of lottery which may lawfully be promoted to members of the general public are those run as part of the National Lottery. These include the scratchcards marketed under the ‘Instants’ brand by Camelot and the main on-line Lottery draws. The main operator of the Lottery is licensed under Section 5 of the 1993 National Lottery Act. However, other companies are permitted to run lotteries under the Lottery umbrella (as Vernons, a competitor, did with its ‘Easy Play’ game) provided that they obtain a licence under Section 6 of the Act from the National Lottery Commission and conclude an agreement with the Section 5 licensee (Camelot, at present); this has proven to be an involved process which only one competitor has completed.

Internet

The current legal position in the UK regarding the internet for the various gambling sectors is as follows:

Bookmakers have for many years been able to accept telephone bets from clients with credit accounts. Similarly, therefore, they may accept bets over the internet using it as a form of communication. Likewise, football pools operators have always been able to accept entries by post and can therefore also use the internet.

| | • | Casinos, bingo and gaming machines |

Casino, bingo and machine gaming can only be conducted on licensed or registered premises and players have to be present on the premises when gaming. Hence no licence could be granted in the UK to an internet casino and it would be illegal to operate one in the UK.

Lottery tickets can be sold by post or telephone but not by means of a machine, except in the case of the National Lottery (subject to conditions) and private lotteries. This has led to the Gaming Board giving permission to one external lottery manager (ELM), Littlewoods Gaming, to operate lotteries over the internet so long as it is merely used, rather like a telephone, as a means of communication connecting the buyers and sellers of tickets and the actual sale is carried out by human agency.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 14 |

B. Business Overview (continued)

Material Effects of Government Regulations (continued)

The global reach of the internet enables residents of one country to participate in gambling opportunities offered from other countries. This has provided the opportunity for UK operators to expand their off-shore capabilities in order both to gain access to a far wider universe of gamblers and to offer a greater range of products, particularly low tax or tax-free betting.

The consequences for the UK gambling industry and government taxation revenues as gamblers decide to move offshore have been recognised in the recently announced review of gambling legislation, which has been asked to examine internet gambling. Whilst therefore it is probable that legislation will be brought in to regulate internet gaming, it is premature to speculate on its likely form. However, there can be no assurances that the ultimate form of such legislation would not have an adverse effect on the Company’s financial and operating results.

Current UK Gambling Review

The UK government has recently commissioned a review of gambling legislation to examine to what extent the legal framework under which gambling is conducted in the UK could be modernised. The report resulting from this review has now been published and its recommendations are designed to simplify the regulation of gambling and to extend choice for adult gamblers, whist keeping the industry free from the influence of crime. Its main proposals in summary are:

| | • | All regulation relating to gambling be incorporated in a single Act of Parliament and controlled by a single regulator with licensing of individuals and companies being undertaken by the Gambling Commission. |

| | • | A range of measures be introduced to ease ability of adult gamblers to play. The main features that relate to the Company are that betting on the National Lottery is to be permitted and the use of credit cards is to be approved for gambling purchases. |

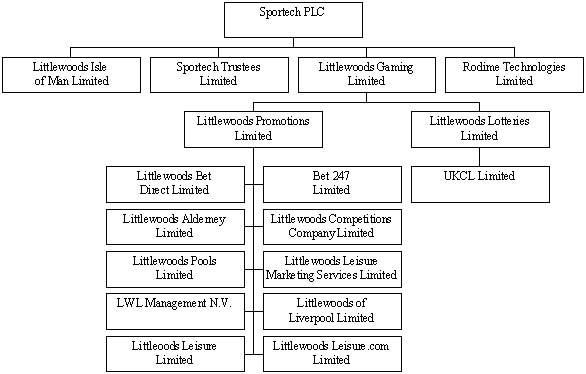

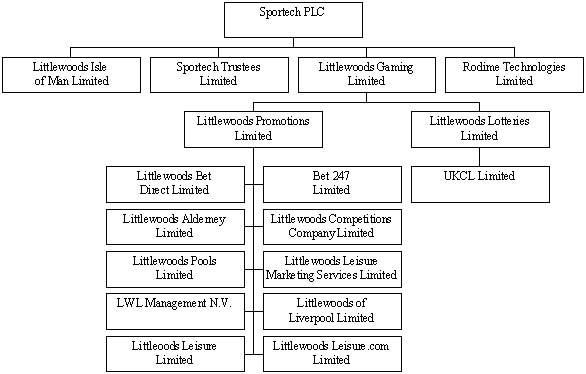

C. Organisational Structure

Sportech PLC heads the Group containing the companies listed in note 1(c) to the Financial Statements, which is incorporated herein by reference. 100% of the ordinary shares of all of the companies are held by Sportech, either directly or indirectly, and hence they are all included in the consolidated financial statements. The organisational structure is as follows:

All of these companies are incorporated in England and Wales with the exceptions of Sportech PLC and Rodime Technologies Limited (incorporated in Scotland), Littlewoods Isle of Man Limited (incorporated in the Isle of Man), LWL Management NV (incorporated in Netherlands Antilles) and Littlewoods Alderney Limited (incorporated in Alderney).

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 15 |

D. Property, Plants And Equipment

Until the acquisition of Littlewoods Gaming the Company occupied offices totalling 800 sq. ft in Edinburgh, Scotland. These premises were occupied under a short-term lease that expired in February 2001.

In January 2001 the Company moved its headquarters to the premises of Littlewoods Gaming at Walton Hall Avenue in Liverpool. This property was held under a long leasehold (999 year lease) and carried in the balance sheet at £1.1m. The company also rents a number of smaller properties in the United Kingdom. In May 2002 the Company moved its headquarters to new premises in the Wavertree Technology Park in Liverpool, which was named Sportech House. This left the football pools operation in 2 buildings at the Walton Hall Avenue site. One of these was extensively refurbished incurring capital additions of £1.1m, and the entirety of the football pools operation moved into it. The second, along with surplus land, was disposed of during the financial year to 31 December 2002, resulting in a profit on disposal of £1.4m. The Walton Hall Avenue site occupied 501,000 square feet before the disposal; 334,000 square feet were sold with 167,000 square feet retained.

The Wavertree Technology Park premises is held under a 10 year lease that expires in January 2011. These premises comprise 23,000 square feet of purpose built office accommodation. During the year ended 31 December 2002, the Company spent £0.6m fitting out Sportech House.

Following the acquisition of the Zetters football pools business, the Company now holds the remaining lease for two floors of Saffron House in London, which houses the Zetters football pools business. This expires in September 2005. This also now houses certain parts of the Interactive unit.

The most significant element of the plant and equipment relates to pools collector handheld terminals. These are data capture terminals used by a national network of door to door collectors to capture details of football pools entries for onward transmission to the Football Pools operational headquarters at Walton Hall Avenue.

For information on the closing balance value of property, plant and equipment see Note 13 to the Financial Statements.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 16 |

Item 5. Operating And Financial Review And Prospects

A. Operating Results

Non-GAAP measure

The discussion below contains references to ‘operating profit (before goodwill amortisation and restructuring)’. This is a non-GAAP measure derived from operating profit. It is used as it provides investors with a better insight into the results as it focuses on the underlying performance of the business. A demonstration of how operating profit before restructuring costs and amortisation of goodwill reconciles to operating profit is set out below, using the 2003, 2002 and 2001 operating results:

| | | | | | | | | |

| | | 2003

| | | 2002

| | | 2001

| |

| | | £m | | | £m | | | £m | |

Operating profit (before goodwill amortisation and restructuring) | | 19.9 | | | 22.2 | | | 17.5 | |

Restructuring costs | | (1.3 | ) | | (2.0 | ) | | — | |

Amortisation of goodwill | | (9.1 | ) | | (8.8 | ) | | (8.9 | ) |

| | |

|

| |

|

| |

|

|

Operating profit | | 9.5 | | | 11.4 | | | 8.6 | |

| | |

|

| |

|

| |

|

|

Overview

The turnover of the Football Pools business continues to decline though the Company continues to adopt policies to limit that decline. The revenues in the Betting business continue to increase, though the operating profit in this segment was affected by poor horse racing results. A fuller analysis of the 2003 figures is set out in the discussion below.

The Company’s sales revenue for the year was £207.9m, an increase of 6.5% on the 2002 figure of £195.3m. The increase reflects strong growth in Sports Betting revenues, with turnover 22% higher at £101.7m. This has been partially offset by the continuing decline of the Football Pools business, although the rate of decline in turnover reduced further to 11%, reflecting customer retention programmes in the direct and collector channels, along with the full-year benefit of Zetters.

The table below summarises the Company’s operating profit / (loss), before restructuring costs and amortisation of goodwill, from each of its businesses:

| | | | | | | | | |

| For the year ended 31 December | | 2003

| | | 2002

| | | 2001

| |

| | | £m | | | £m | | | £m | |

Football Pools | | 26.0 | | | 25.6 | | | 23.2 | |

Games & Lotteries | | 1.3 | | | 0.9 | | | 0.5 | |

Interactive Television Gaming | | (4.3 | ) | | (2.3 | ) | | (1.6 | ) |

Betting | | (3.1 | ) | | (2.0 | ) | | (4.0 | ) |

| | |

|

| |

|

| |

|

|

Littlewoods Gaming | | 19.9 | | | 22.2 | | | 18.1 | |

Technology Patents | | — | | | — | | | (0.6 | ) |

| | |

|

| |

|

| |

|

|

Operating profit (before goodwill amortisation and restructuring) | | 19.9 | | | 22.2 | | | 17.5 | |

| | |

|

| |

|

| |

|

|

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 17 |

A. Operating Results (continued)

Operating results for the 12 months ended 31 December 2003 vs. 2002

Football Pools

Turnover decreased to £89.8m (2002: £100.8m). This represents a rate of decline of 11% (2002: 15%), reflecting customer retention programmes in the direct and collector channels, along with the full-year benefit of Zetters.

The operating profit (before goodwill amortisation and restructuring) of Football Pools was slightly ahead of 2002 at £26.0m (2002: £25.6m), as a result of the continued focus on generating operating efficiencies and initial synergies relating to the Zetters integration. While the Zetters identity has been retained, operations have now transferred to Littlewoods Football Pools, utilising more fully the Company’s call centre and recently implemented scanning technologies.

The Company continues to explore opportunities to further develop the Football Pools product in order to increase its attraction to new players.

Games & Lotteries

Turnover increased to £16.4m (2002: £11.4m), mainly as a result of the continued expansion of the online casino, Littlewoodscasino.com, and our other gaming site, LittlewoodsGameOn.com.

Operating profit (before goodwill amortisation and restructuring) increased to £1.3m (2002: £0.9m) mainly stemming from the successful operation and extension of the on-line casino, littlewoodscasino.com, which launched in August 2002. In September 2003, the casino was successfully expanded to provide integrated jackpot products, and in November 2003 poker games and tournaments were launched on littlewoodspoker.com. The combined casino and poker sites now offer a choice of over 70 different games.

Off-line games such as Spot the Ball and Lotto 3/4 continue to be profitable, as a result of lower product and distribution costs. In addition, charity scratchcards have undergone a major redesign with new stakes and prizes introduced in an effort to revitalise sales.

Extended scratchcard trials with Sainsbury’s and Safeway supermarkets continue, with both retailers having stocked Littlewoods core scratchcards in store for the first time during 2003.

Littlewoods Gaming continues to establish relationships with high profile charities and good causes with broad appeal. The Poppy Appeal scratchcard last autumn was a notable success. The latest of these collaborations is the British Olympic Association scratchcard, which was launched in April 2004 and is aimed at supporting Team GB in Athens this summer.

Interactive Television Gaming

This business had no turnover up to 31 December 2003 as it was still in development.

The operating loss (before goodwill amortisation and restructuring) of £4.3m (2002: £2.3m) represents the costs of beginning to establish this business.

The interactive television gaming contract with ITV:

| | • | offers the opportunity to provide gaming directly linked to programming content; and |

| | • | represents a 24:7 interactive distribution channel for a range of interactive gaming and betting products. |

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 18 |

A. Operating Results (continued)

Operating results for the 12 months ended 31 December 2003 vs. 2002 (continued)

Betting

Littlewoods Bet Direct currently provides customers with a wide range of betting opportunities across telephone, internet and Sky Digital platforms. Organic growth across telephone and internet delivered annual revenues of over £100m for the first time, which at £101.7m was 22% higher than 2002 (2002: £83.1m). This growth was underpinned by a 10% increase in average telephone stakes and a 35% increase in average internet stakes. Overall, customer numbers increased to 313,000 (2002: 272,000).

This revenue growth was not reflected in retained gross win, principally as a result of a run of poor horse racing results which reduced the gross win rate (GWR) to 7.3% as against 9.6% in 2002. This is the principal reason why the operating loss (before goodwill amortisation and restructuring) increased to £3.1m in 2003 (2002: £2.0m) although there was also the impact of development costs associated with the launch of interactive betting services on attheraces and Sky Active.

Although margins did improve in the second half of 2003 on telephone betting, the gross win performance was nevertheless disappointing and is intended to be addressed through a number of key actions. In particular, the Company aims to reduce the reliance on horse racing by increasing it’s share of the football betting market, where GWR over the last two years has been maintained at 11%. In addition, betting opportunities in other sports including cricket, tennis, rugby and golf will be exploited, and the introduction of in-running betting across a number of sports. The Company is also launching the Littlewoods Bet Direct presence on ITV, and growing it’s Sky Active presence, where experience since launch, and of the market generally, points to a GWR above 10%. The betdirect.net internet site is undergoing a major upgrade.

Operating Profit

Following goodwill amortisation of £9.1m (2002: £8.8m) and restructuring costs of £1.3m (2002: £2.0m), operating profit was £9.5m (2002: £11.4m). Restructuring costs of £1.3m in 2003 mainly reflect the full integration of Zetters Football Pools, along with a reorganisation following the disposal of the Rodime Technology Patents business.

Cashflow

Operating cash flow in 2003 was stronger than in 2002 at £18.6m (2002: £18.1m) enabling continued investment in growth strategies. Total capital expenditure during the year was £3.0m (2002: £4.9m) which included further investment in developing games and betting content for interactive television.

Financial position

Sportech started the year ending 31 December 2003 with net assets of £31.5m. The Company’s loss after taxation for the year ending 31 December 2003 was £0.2m after amortising £9.1m of goodwill. Net assets were £31.3m at 31 December 2003.

Goodwill

The amortisation charge for the year relating to the Littlewoods Gaming acquisition was £8.7m. A further £0.4m relating to the Zetters Pools Business resulted in a total amortisation charge for the year of £9.1m (2002: £8.8m).

Taxation

The total tax charge for the year ended 31 December 2003 was £3.7m on profits of £3.5m. A reconciliation of the effective rate of tax to the standard rate is given in Note 10 of the Financial Statements. The main reconciling item is for goodwill amortisation not allowable for tax.

Net interest

Net interest paid for the year ending 31 December 2003 was £6.6m compared with £8.2m for the period ended 31 December 2002, reflecting a decrease in the level of bank loans and lower interest rates.

Inflation

The effects of inflation on the Company’s financial position and results of operations were not material during the year ending 31 December 2003.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 19 |

A. Operating Results (continued)

Operating results for the 12 months ended 31 December 2002 vs. 2001

The financial results for the period reflect the acquisition by the Company of the Zetters Pools business on 29 August 2002 for net cash of £0.7m (purchase price of £1.4m offset by £0.7m cash acquired) delivering a customer base of 60,000. There has been no exceptional customer loss following acquisition, and the business has performed in line with expectations, contributing £1.8m to turnover and £0.4m to operating profit.

The only amounts relating to the Technology Patents business in the year were patent exploitation consultancy fees amounting to less than £0.1m.

Football Pools

Turnover was £100.8m in 2002 compared to £119.0m in 2001. This includes the above £1.8m in respect of Zetters Pools in 2002 (2001: nil). The like for like rate of decline in turnover in the second half of the year reduced further to 14%.

The operating profit (before goodwill amortisation and restructuring) of Football Pools increased to £25.6m (2001: £23.2m), reflecting significant improvement in operating efficiencies, the reduction in the duty burden from April 2002 and a £0.4m contribution from Zetters since its acquisition in August 2002.

The Company continues to identify opportunities to rationalise the operational and overhead base of the football pools whilst extending our distribution of this product via television, internet and overseas businesses.

Games & Lotteries

Turnover was slightly down on 2001 at £11.4m (2001: £12.5m).

Operating profit before restructuring costs and amortisation of goodwill for Games & Lotteries increased by £0.4m to £0.9m (2001: £0.5m), mainly due to the £0.5m profit from the sale of the Pull Tabs lottery business. 2002 was a period of significant transition for the soft gaming business as the Company concluded a number of major new distribution arrangements, significantly enhancing both on line and off line customer access, while withdrawing from low growth marginal businesses such as Pull Tabs lotteries.

Growth of on-line games has been underpinned by the launch of LittlewoodsCasino.com, the on-line casino, which was launched in August 2002. Levels of customer interest in this product are encouraging and the choice and quality of games available was enhanced in the second half of 2003.

The Company’s plan to capture a larger share of the £500m scratchcard market was boosted by groundbreaking retail distribution deals with both Sainsbury’s and Safeway for the supply of own label scratchcards dedicated for specific charities such as Comic Relief and Great Ormond Street Hospital.

Interactive Television Gaming

As noted above, this business has no turnover up to 31 December 2003 as it is still in development.

The operating loss (before goodwill amortisation and restructuring) of £2.3m (2001: £1.6m) represents the costs of acquiring an interactive television gaming contract with ITV and developing the gaming functionality to be used by this business.

Betting

Betting continued to deliver strong revenue growth, with turnover 60% higher, at £83.1m (2001: £51.8m). This growth reflected the benefits of a level playing field arising from the elimination of tax for customers in October 2001. As a result of the increased betting volumes, the operating loss (before goodwill amortisation and restructuring) was halved during the year to £2.0m compared to £4.0m in 2001. Customer numbers increased by 20% to 272,000 (2001: 227,000), with average stakes per telephone call up 23% to £36 (2001: £29) and the average internet bet up 26% to £17 (2001: £13). Following a strong first half, gross win margins eased back in the second half, in line with market trends, leading to a gross win margin for the full year of 10% (compared to 11% in 2001).

The commencement of an all weather racing sponsorship programme covering three seasons and ending on 1 May 2004, positioning the Littlewoods Bet Direct brand at more than one in five UK televised horse racing events, significantly raised Littlewoods Bet Direct’s profile. The business continued to provide a variety of unique best and special bet offers to customers, generating continued media exposure for the brand.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 20 |

A. Operating Results (continued)

Operating results for the 12 months ended 31 December 2002 vs. 2001 (continued)

Operating Profit

Following goodwill amortisation of £8.8m (2001: £8.9m) and restructuring costs of £2.0m (2001: nil), the Company’s operating profit was £11.4m compared with £8.6m in 2001.

Restructuring costs of £2.0m in 2002 related mainly to redundancies.

Cashflow

The Company’s operating cashflow for the year was £18.1m compared with £15.7m for 2001, reflecting the increased operating profit. The acquisition of the Zetters Pools business was almost entirely funded by the proceeds from the sale of the Pull Tabs business. Scheduled loan payments of £16m were made in the year, and a £2m drawdown was made against a new facility set up to finance the investment in the Interactive business.

Financial position

Sportech started the year ending 31 December 2002 with net assets of £28.6m. The Company’s profit after taxation for the year ending 31 December 2001 was £2.9m after amortising £8.8m of goodwill. Net assets were £31.5m at 31 December 2002.

Goodwill

The acquisition of the Zetters Pools business resulted in an addition to goodwill of £1.3m. This is being amortised over 3 years, resulting in a charge for the period since acquisition to 31 December 2002 of £0.1m. The amortisation charge for the year relating to the Littlewoods Gaming acquisition was £8.7m, resulting in a total amortisation charge for the year of £8.8m (2001: £8.9m).

Taxation

The total tax charge for the year ended 31 December 2002 was £1.7m on profits of £4.6m. A reconciliation of the effective rate of tax to the standard rate is given in Note 10 of the Financial Statements.

Net interest

Net interest paid for the year ending 31 December 2002 was £8.2m compared with £9.2m for the period ended 31 December 2001, reflecting a decrease in the level of bank loans.

Inflation

The effects of inflation on the Company’s financial position and results of operations were not material during the year ending 31 December 2002.

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 21 |

A. Operating Results (continued)

Critical accounting policies

Our consolidated financial statements, included in “Item 17 - Financial Statements”, are prepared based on the accounting policies described in Note 2 to the consolidated financial statements which are in conformity with UK generally accepted accounting principles, which differs in significant respects from US generally accepted accounting principles.

The preparation of our consolidated financial statements in conformity with UK generally accepted accounting principles, and the reconciliation of these financial statements to US generally accepted accounting principles as described in Note 30, requires management to make estimates and assumptions that affect the carrying value of assets and liabilities at the date of the consolidated financial statements and the reported amount of sales and expenses during the periods reported in these financial statements. Certain of our accounting policies require the application of management judgment in selecting assumptions when making significant estimates about matters that are inherently uncertain. Management bases its estimates on historical experience and other assumptions that it believes are reasonable.

We believe that the following are our more critical accounting estimates used in the preparation of our consolidated financial statements that could have a significant impact on our future consolidated results of operations, financial position and cash flows. Actual results could differ from estimates. These accounting estimates, and the following description, have been developed in consultation with the Company’s senior management and audit committee.

Impairment

The Company has made a significant investment in Littlewoods Gaming resulting in a significant goodwill amount being carried in the balance sheet. Under UK GAAP, this goodwill amount is tested for impairment when management believes that circumstances indicate that it is appropriate to make such a test. Factors that would trigger such an impairment review would include significant under-performance in relation to expected operating results, changes in the overall strategy for the business or negative industry or economic trends. The Company’s estimation techniques for determining the impairment of goodwill includes an analysis of the Company’s discounted cash flows. Changes in the Company’s estimation techniques with respect to goodwill impairment could materially effect the Company’s presentation of its financial results and operations.

Under US GAAP, the goodwill is tested for impairment on an annual basis. Please refer to Note 30(e) to the Financial Statements which is incorporated herein by reference.

Provision for collector incentive scheme

In December 1996, an incentive scheme to reward football pools collectors was established. Under the terms of the scheme, the collectors earn points on the basis of their sales. These points can be converted into vouchers to purchase items from high street shops. On the basis of similar schemes and past redemption rates, estimation techniques for determining the expected future redemption rate and liabilities attributable to these points have been established. The Company has used an estimated redemption rate of 58% in preparing the accruals as at 31 December 2003 and 31 December 2002, and hence the value of the points not provided for in these financial statements amounts to £2.6m in 2003 compared with £2.4m in 2002. Changes in the Company’s estimation techniques with respect to this scheme could materially effect the Company’s presentation of its financial results and operations. Below is a sensitivity analysis of the redemption rate assumption as at 31 December 2003 and 31 December 2002:

| | | | | | | | | | | | | | |

| | | As at 31 December 2003

| | As at 31 December 2002

|

| | | Provided

| | | Unprovided

| | Total

| | Provided

| | | Unprovided

| | Total

|

| | | £m | | | £m | | £m | | £m | | | £m | | £m |

Current redemption rate of 58% | | 3.6 | | | 2.6 | | 6.2 | | 3.4 | | | 2.4 | | 5.8 |

| | | | | | |

Redemption rate of 40% | | 2.5 | | | 3.7 | | 6.2 | | 2.3 | | | 3.5 | | 5.8 |

Resultant increase in profit before tax | | 1.1 | | | | | | | 1.1 | | | | | |

| | | | | | |

Redemption rate of 80% | | 5.0 | | | 1.2 | | 6.2 | | 4.6 | | | 1.2 | | 5.8 |

Resultant (decrease) in profit before tax | | (1.4 | ) | | | | | | (1.2 | ) | | | | |

| | | | | | |

Redemption rate of 100% | | 6.2 | | | — | | 6.2 | | 5.8 | | | — | | 5.8 |

Resultant (decrease) in profit before tax | | (2.6 | ) | | | | | | (2.4 | ) | | | | |

| | |

Sportech PLC Form 20-F for the year ended 31 December 2003 | | 22 |

A. Operating Results (continued)

Critical accounting policies

Depreciation and amortisation

The Company’s depreciation and amortisation policies are based on management estimates of the future economic lives of tangible and intangible fixed assets. The depreciation and amortisation of goodwill is governed in part by UK Financial Reporting Standard 11 and is written off over a period of 20 years. Depreciation is provided for in the Company’s financial statements on a straight-line basis to write off the cost of fixed assets over their anticipated useful lives at the following annual rates:

| | |

Long leasehold land | | NIL |

Long leasehold buildings | | Over remaining estimated useful life (12 years) |

Buildings fixtures and fittings | | 4.0% - 20% |

Plant, equipment and other fixtures and fittings | | 10.0% – 33.3% |

Leasehold improvements | | 10.0% (or period of lease if shorter) |

Computers | | 14.3% - 33.3% |

Motor vehicles | | 12.5% - 25.0% |

Hand-held pools bet capture equipment | | 16.7% |