(including the Debt Financing Documents and the transactions contemplated thereby) and the other transactions contemplated by this Agreement. The board of directors of US Holdco has approved this Agreement, the Merger and the other transactions contemplated by this Agreement. The board of directors of Merger Sub has (x) approved and declared the advisability of this Agreement, the Merger and the other Transactions, and (y) directed that this Agreement be submitted to the sole stockholder of Merger Sub for its adoption and recommended that the sole stockholder of Merger Sub adopt this Agreement. This Agreement has been duly executed and delivered by each of Parent, US Holdco and Merger Sub and, assuming the due authorization, execution and delivery of this Agreement by the Company, constitutes the valid and binding obligation of each of Parent, US Holdco and Merger Sub, enforceable against each of them in accordance with its terms, subject to the Bankruptcy and Equity Exception.

(b) The execution and delivery of this Agreement by each of Parent, US Holdco and Merger Sub does not, and the consummation by Parent, US Holdco and Merger Sub of the Transactions and the Financing shall not, (i) conflict with, or result in any violation or breach of, any provision of the certificate of incorporation, bylaws, articles or other organizational documents of Parent, US Holdco or Merger Sub, (ii) conflict with, or result in any violation or breach of, or constitute a default (or give rise to a right of termination, cancellation or acceleration of any obligation or loss of any material benefit) under, or require a consent or waiver under, any of the terms, conditions or provisions of any material agreement or other instrument to which Parent, US Holdco or Merger Sub is a party or by which any of them or any of their properties or assets may be bound, or (iii) subject to compliance with the requirements specified in clauses (i) through (ix) of Section 4.2(c), conflict with or violate any permit, concession, franchise, license, judgment, injunction, order, decree, statute, law, ordinance, rule or regulation applicable to Parent, US Holdco or Merger Sub or any of its or their respective properties or assets, or any other Applicable Law, except in the case of clauses (ii) and (iii) of this Section 4.2(b) for any such conflicts, violations, breaches, defaults, terminations, cancellations, accelerations, losses, penalties or Liens, and for any consents or waivers not obtained, that, individually or in the aggregate, have not had and would not reasonably be expected to have a Parent Material Adverse Effect.

(c) No consent, approval, license, permit, order or authorization of, or registration, declaration, notice or filing with, any Governmental Entity or any stock market or stock exchange on which ordinary shares of Parent are listed for trading is required by or with respect to Parent, US Holdco or Merger Sub in connection with the execution and delivery of this Agreement by Parent, US Holdco or Merger Sub or the consummation by Parent, US Holdco or Merger Sub of the Transactions or the Financing, except for (i) the pre-merger notification requirements under the HSR Act and any requirements under other applicable Antitrust Laws, (ii) the filing of the Certificate of Merger with the Secretary of State and appropriate corresponding documents with the appropriate authorities of other states in which the Company is qualified as a foreign corporation to transact business, (iii) the filing of the Proxy Statement with the SEC in accordance with the Exchange Act, (iv) such consents, approvals, orders, authorizations, registrations, declarations, notices and filings as may be required under applicable state securities laws and the rules and regulations of the AIM, (v) the CFIUS Clearance, (vi) the DCSA Approval, (vii) notices to be delivered pursuant to Sections 122.4(a) and 122.4(b) of the ITAR, (viii) the Share Admission and (ix) such other consents, approvals, licenses, permits, orders, authorizations, registrations, declarations, notices and filings which, if not obtained or made, would not reasonably be expected to have, individually or in the aggregate, a Parent Material Adverse Effect.

(d) Since January 1, 2018, none of Parent, US Holdco, Merger Sub, or any of their respective Affiliates, has owned any shares of Company Common Stock or any securities convertible into, or exchangeable for, shares of Company Common Stock.

(e) No vote of the holders of any class or series of Parent’s capital stock or other securities is necessary for the consummation by Parent of the Transactions or the Financing.

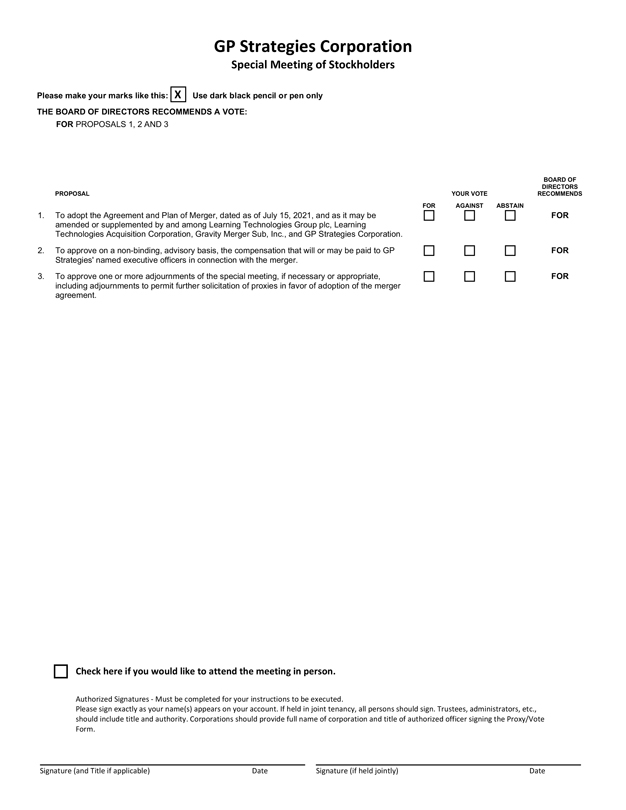

4.3 Information Provided. The information supplied or to be supplied by or on behalf of Parent or which relates to Parent and is approved by Parent for inclusion in the Proxy Statement on the date it is first mailed to

A-25