Exhibit 4

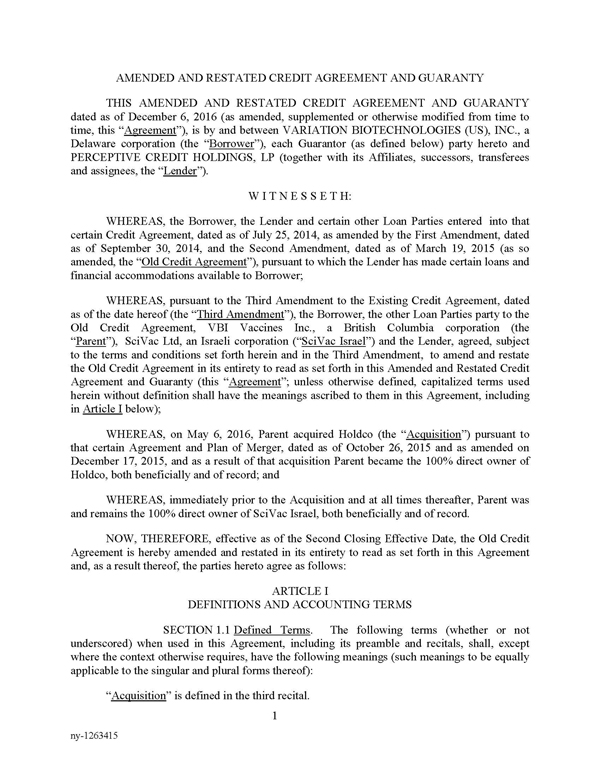

ANNEX A TO THIRD AMENDMENT AMENDED AND RESTATED CREDIT AGREEMENT AND GUARANTY dated as of December 6, 2016 by and among VARIATION BIOTECHNOLOGIES (US), INC., as the Borrower, THE GUARANTORS PARTY HERETO, and PERCEPTIVE CREDIT HOLDINGS, LP, as the Lender ny-1263415

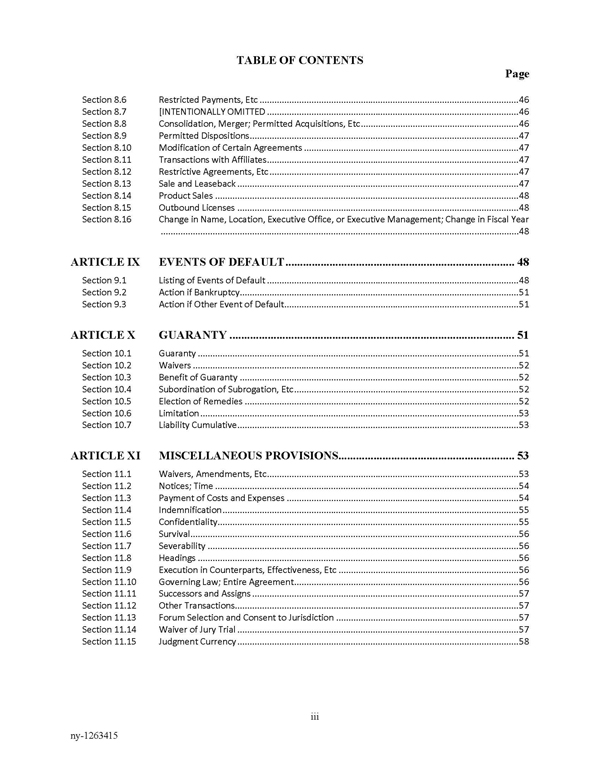

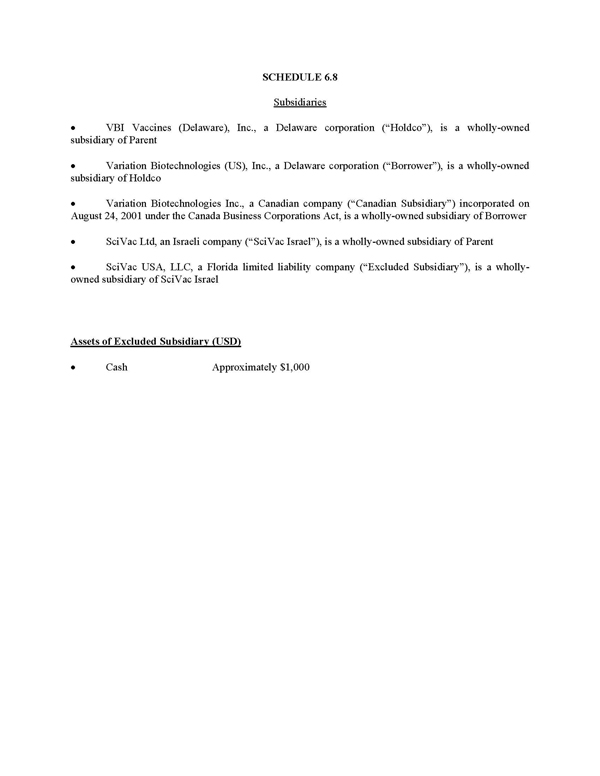

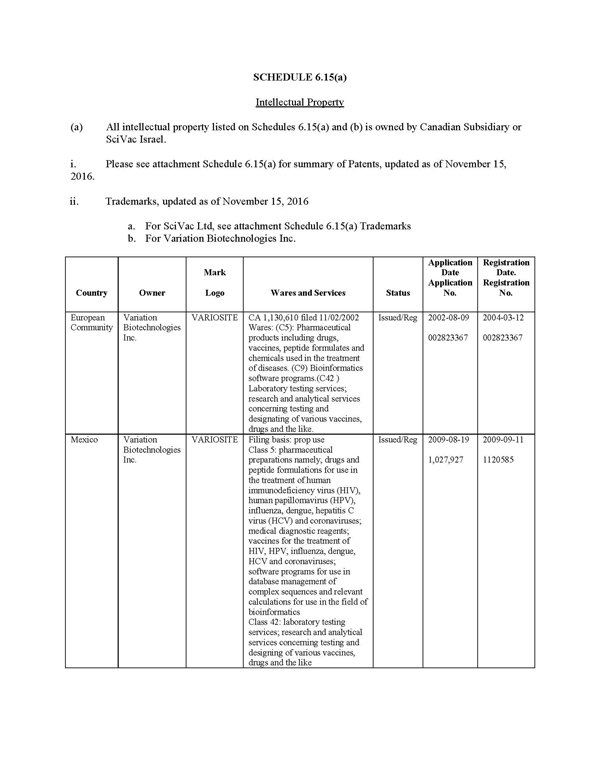

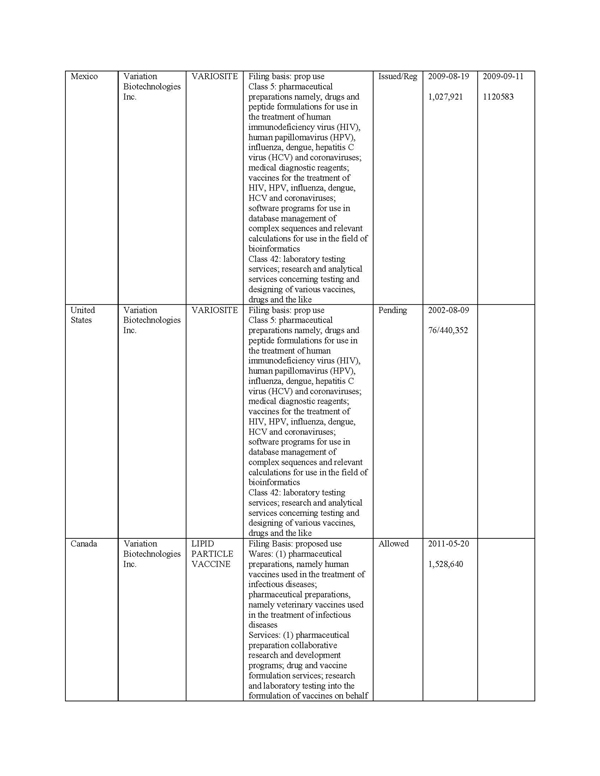

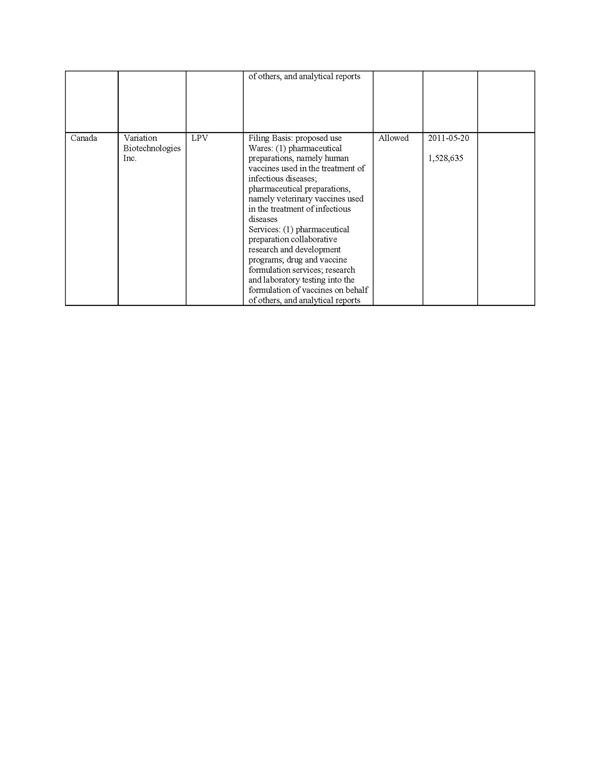

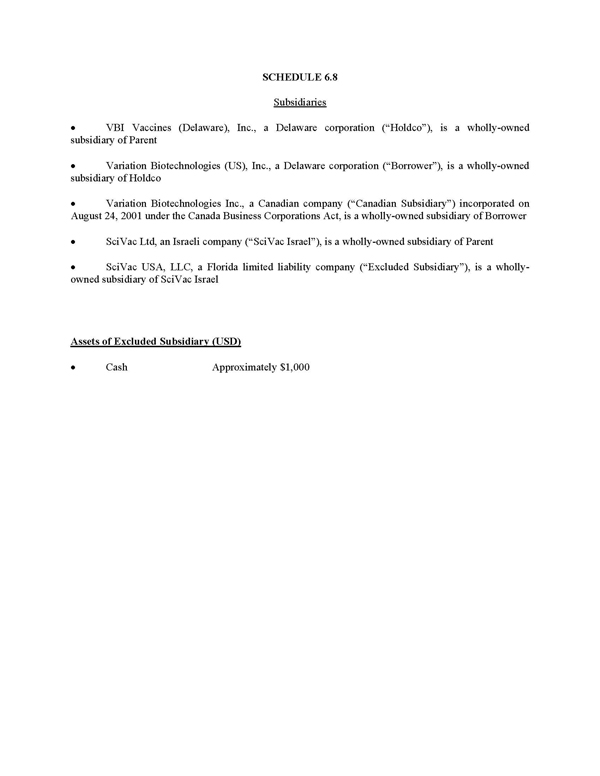

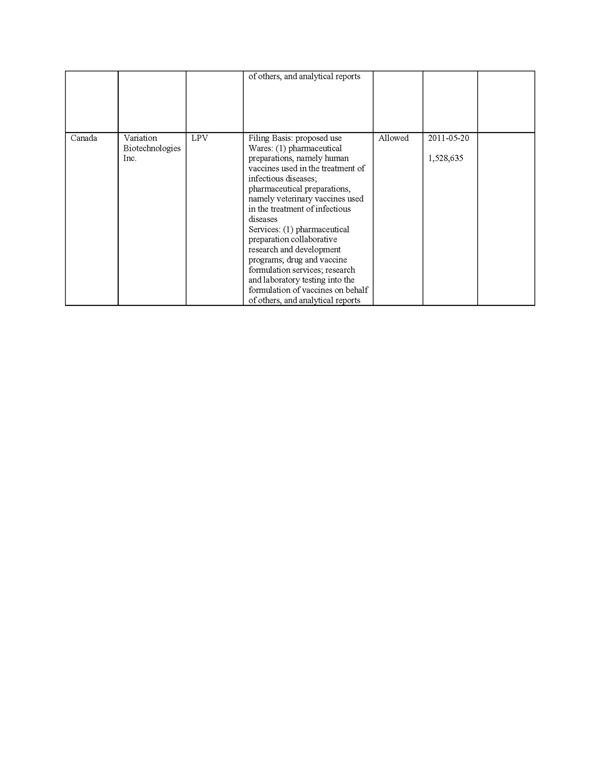

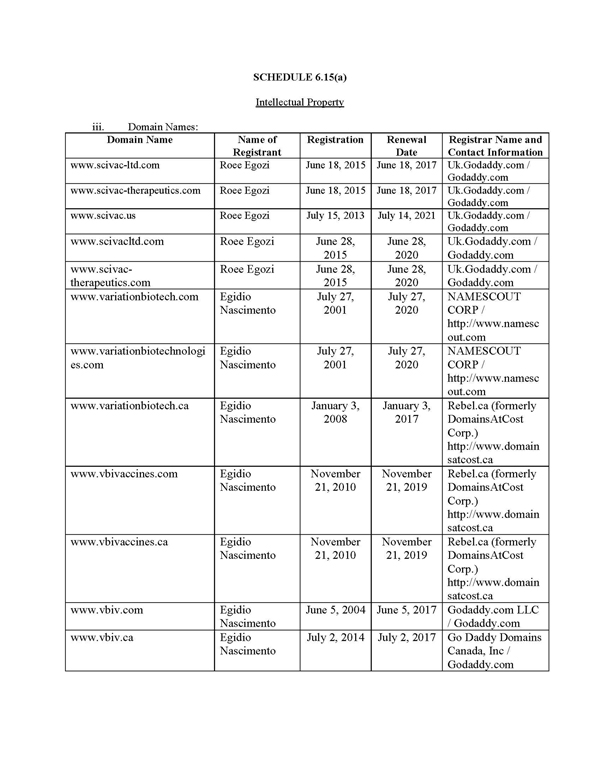

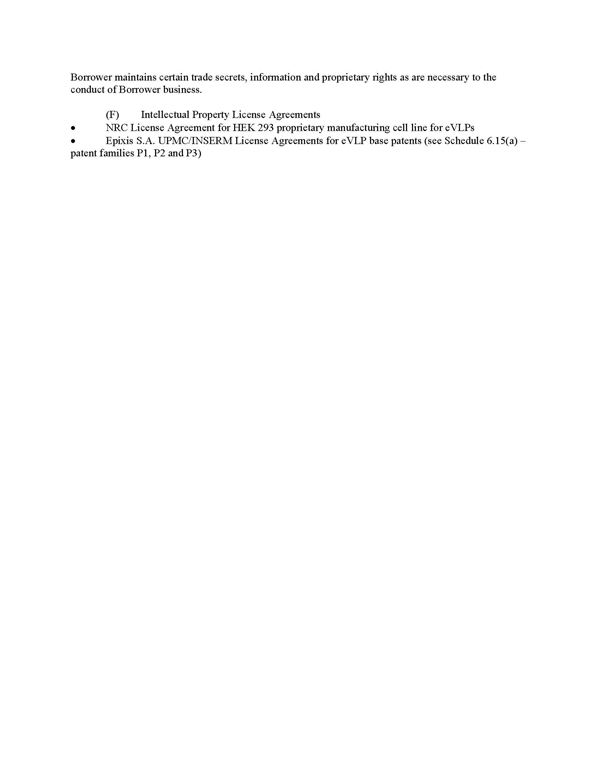

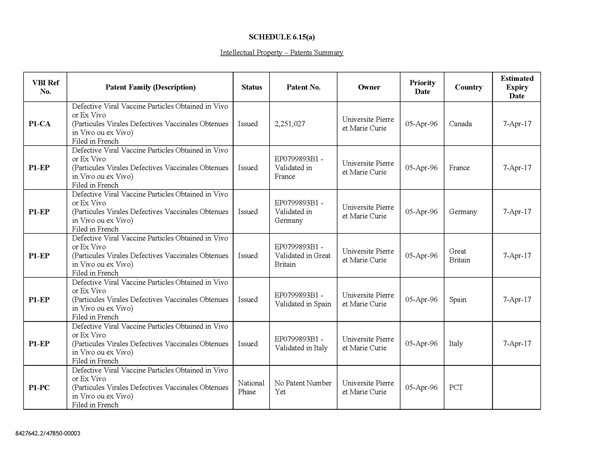

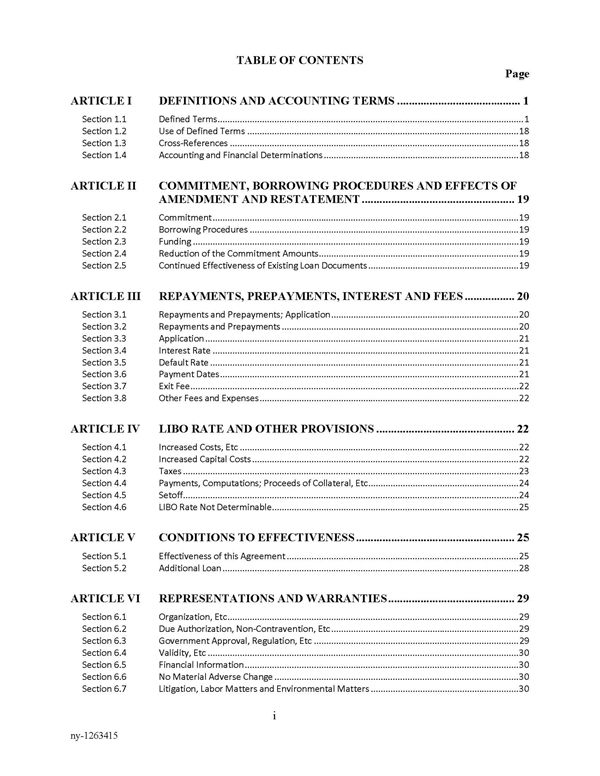

TABLE OF CONTENTS Page ARTICLE I DEFINITIONS AND ACCOUNTING TERMS .......................................... 1 Section 1.1 Defined Terms............................................................................................................................1 Section 1.2 Use of Defined Terms ..............................................................................................................18 Section 1.3 Cross-References .....................................................................................................................18 Section 1.4 Accounting and Financial Determinations ...............................................................................18 ARTICLE II COMMITMENT, BORROWING PROCEDURES AND EFFECTS OF AMENDMENT AND RESTATEMENT .................................................... 19 Section 2.1 Commitment ............................................................................................................................19 Section 2.2 Borrowing Procedures .............................................................................................................19 Section 2.3 Funding ....................................................................................................................................19 Section 2.4 Reduction of the Commitment Amounts.................................................................................19 Section 2.5 Continued Effectiveness of Existing Loan Documents .............................................................19 ARTICLE III REPAYMENTS, PREPAYMENTS, INTEREST AND FEES ................. 20 Section 3.1 Repayments and Prepayments; Application ............................................................................20 Section 3.2 Repayments and Prepayments ................................................................................................20 Section 3.3 Application ...............................................................................................................................21 Section 3.4 Interest Rate ............................................................................................................................21 Section 3.5 Default Rate .............................................................................................................................21 Section 3.6 Payment Dates .........................................................................................................................21 Section 3.7 Exit Fee.....................................................................................................................................22 Section 3.8 Other Fees and Expenses .........................................................................................................22 ARTICLE IV LIBO RATE AND OTHER PROVISIONS ............................................... 22 Section 4.1 Increased Costs, Etc .................................................................................................................22 Section 4.2 Increased Capital Costs ............................................................................................................22 Section 4.3 Taxes ........................................................................................................................................23 Section 4.4 Payments, Computations; Proceeds of Collateral, Etc.............................................................24 Section 4.5 Setoff........................................................................................................................................24 Section 4.6 LIBO Rate Not Determinable....................................................................................................25 ARTICLE V CONDITIONS TO EFFECTIVENESS ...................................................... 25 Section 5.1 Effectiveness of this Agreement ..............................................................................................25 Section 5.2 Additional Loan ........................................................................................................................28 ARTICLE VI REPRESENTATIONS AND WARRANTIES ........................................... 29 Section 6.1 Organization, Etc......................................................................................................................29 Section 6.2 Due Authorization, Non-Contravention, Etc ............................................................................29 Section 6.3 Government Approval, Regulation, Etc ...................................................................................29 Section 6.4 Validity, Etc ..............................................................................................................................30 Section 6.5 Financial Information ...............................................................................................................30 Section 6.6 No Material Adverse Change ...................................................................................................30 Section 6.7 Litigation, Labor Matters and Environmental Matters ............................................................30 i ny-1263415

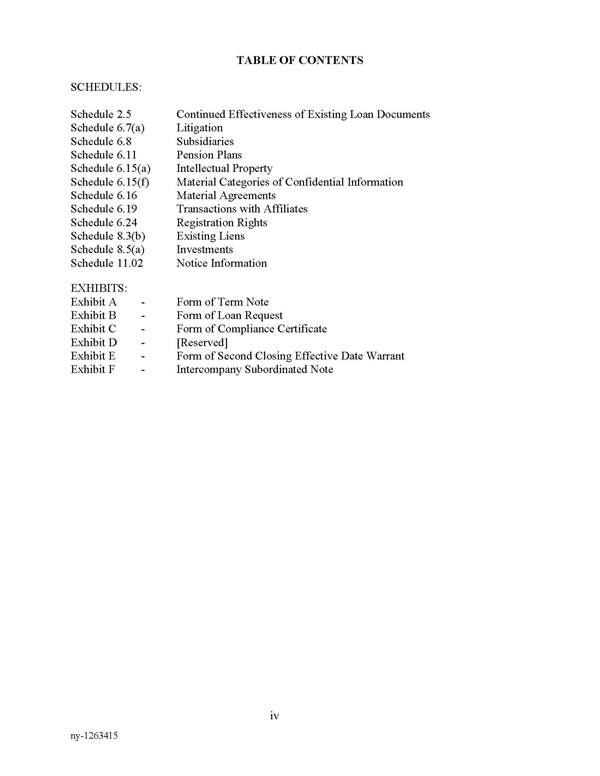

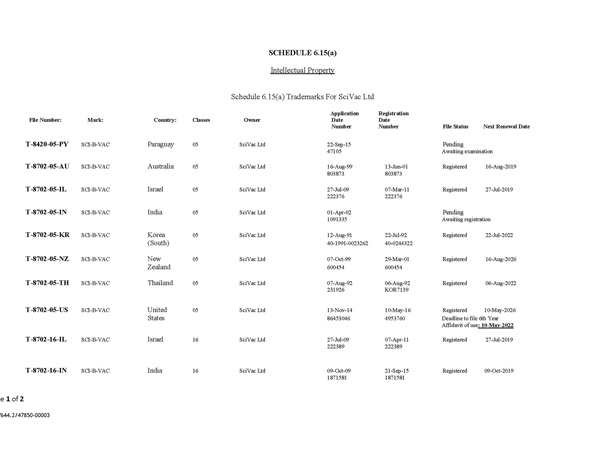

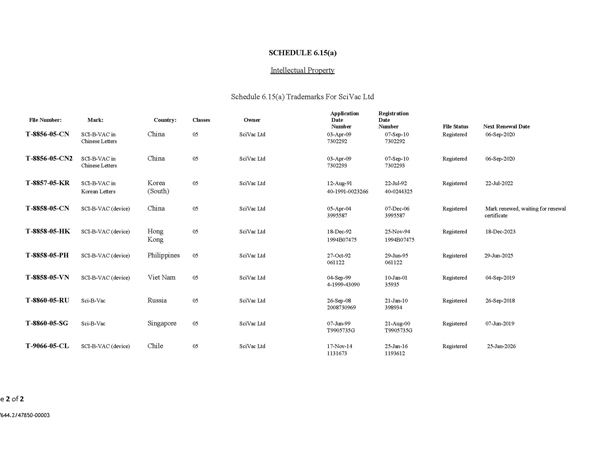

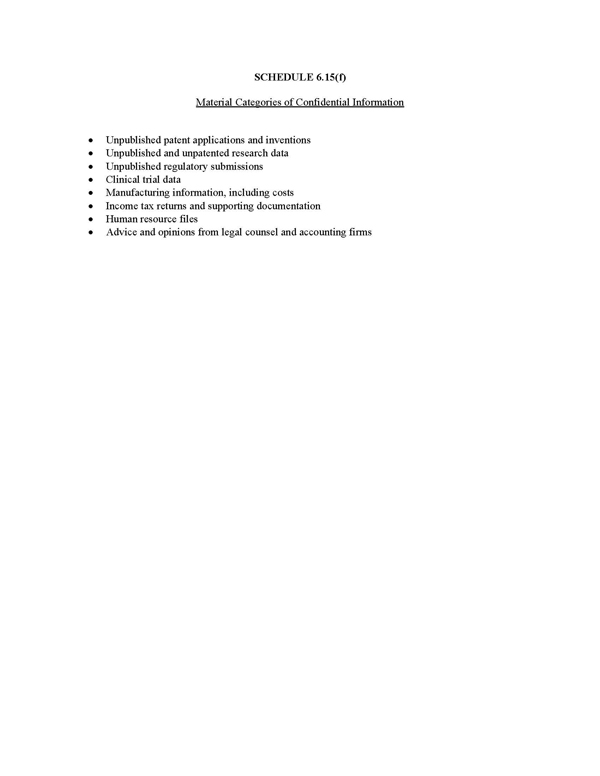

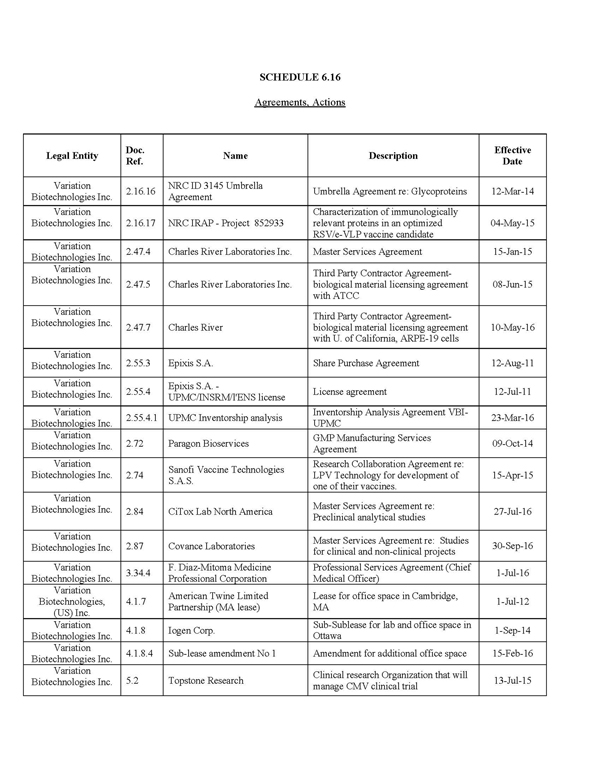

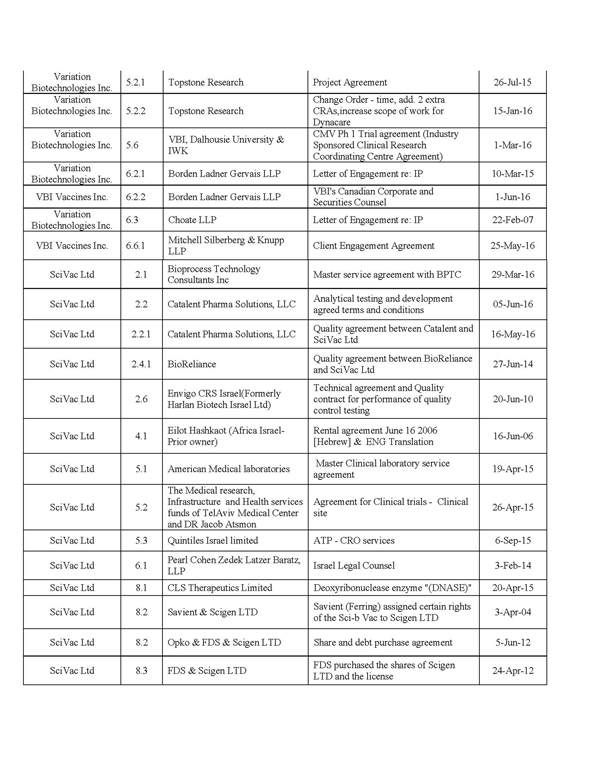

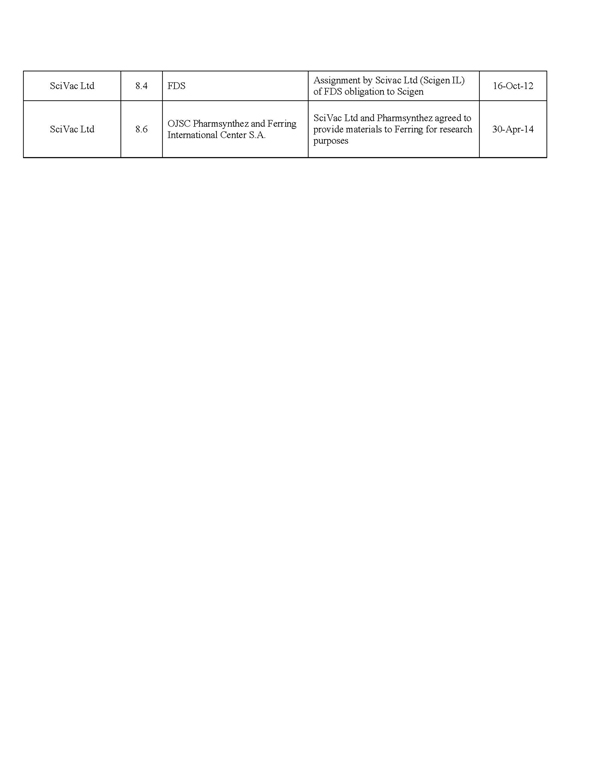

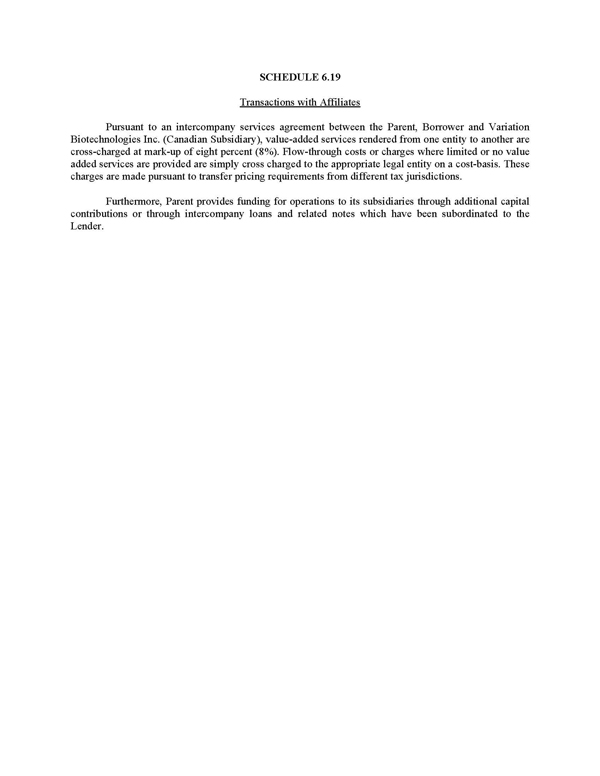

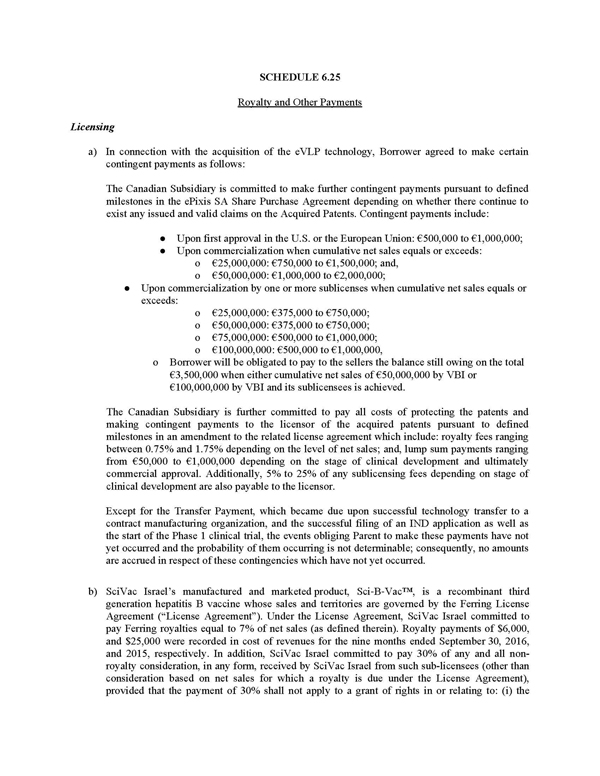

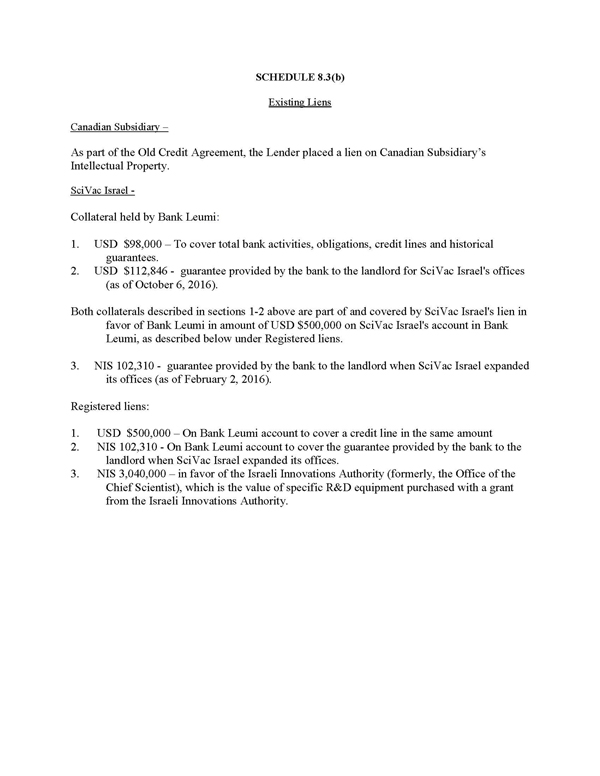

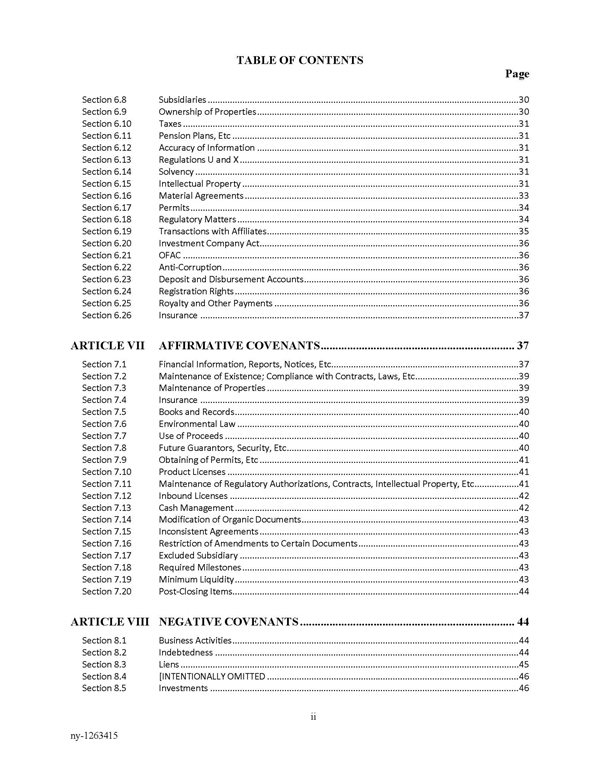

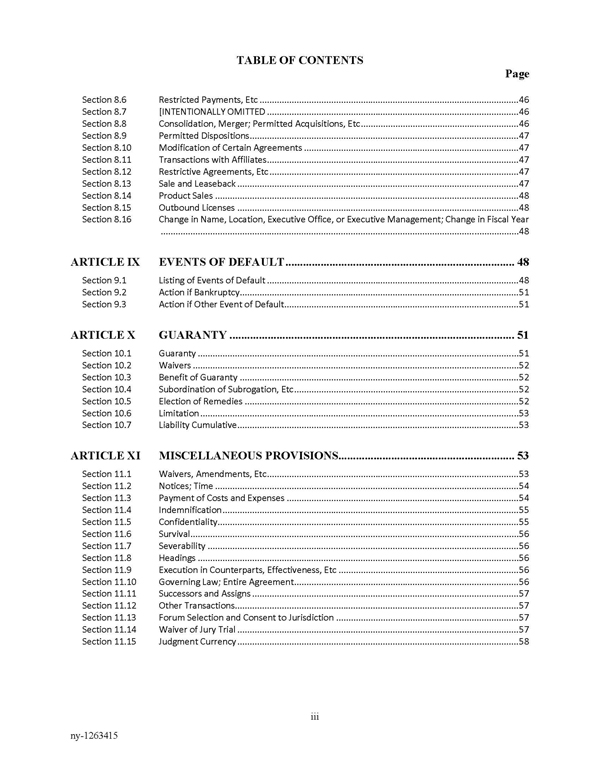

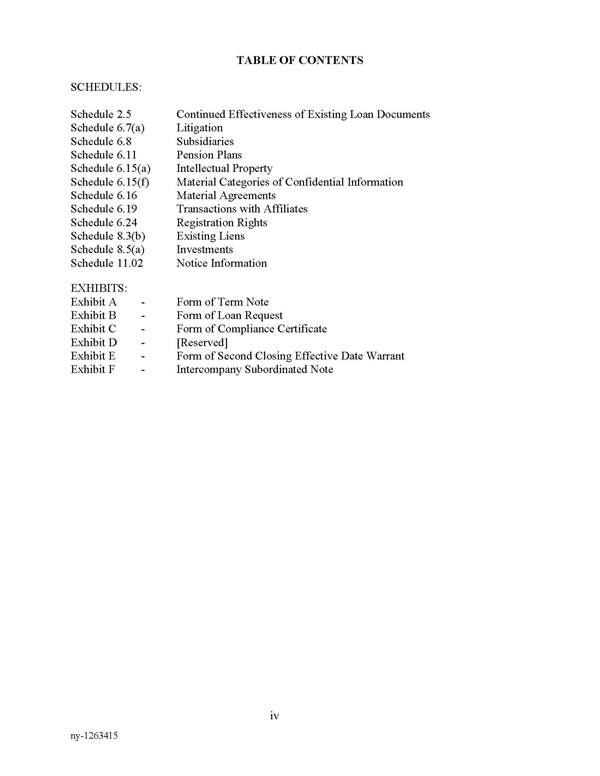

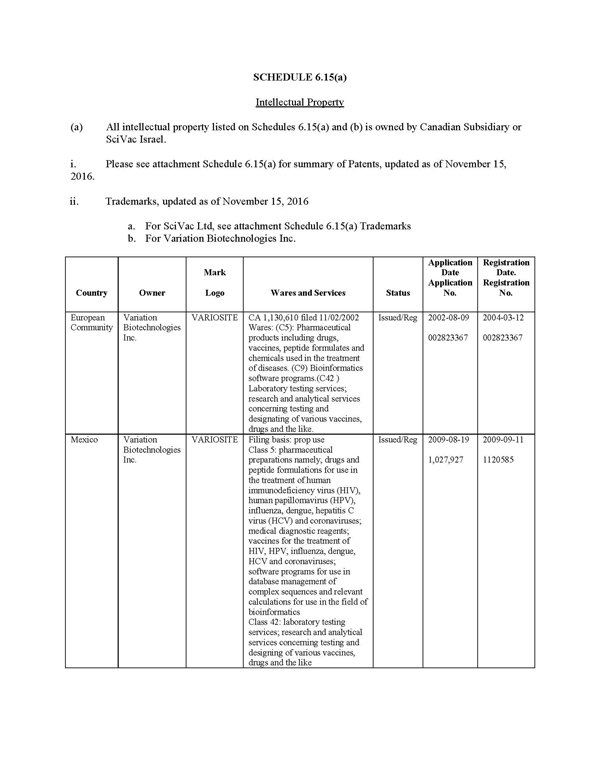

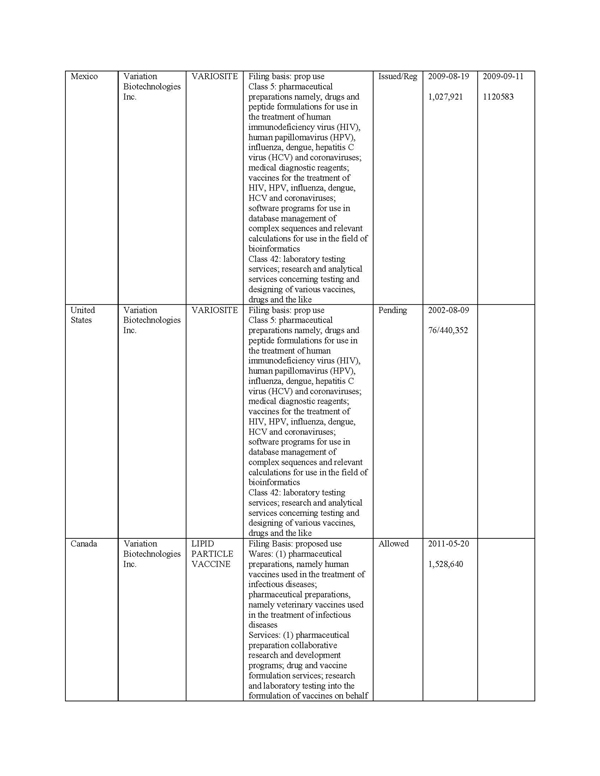

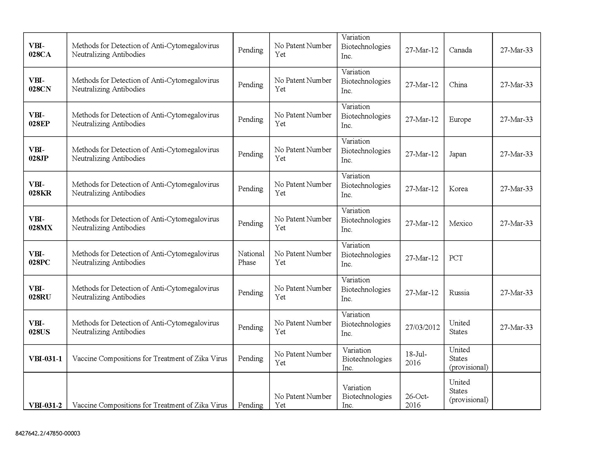

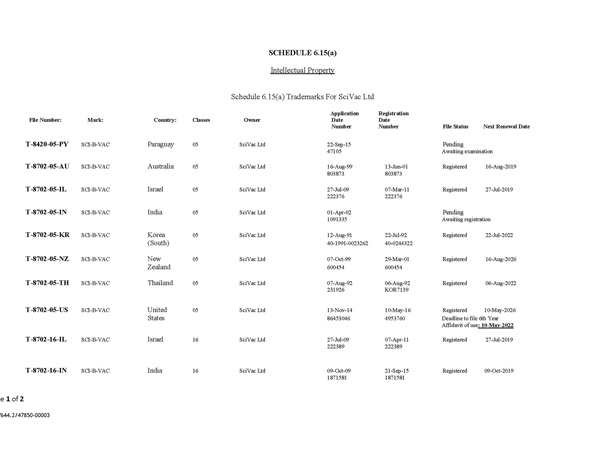

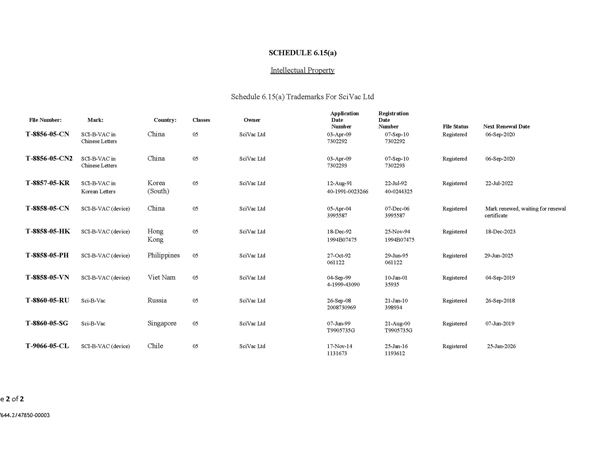

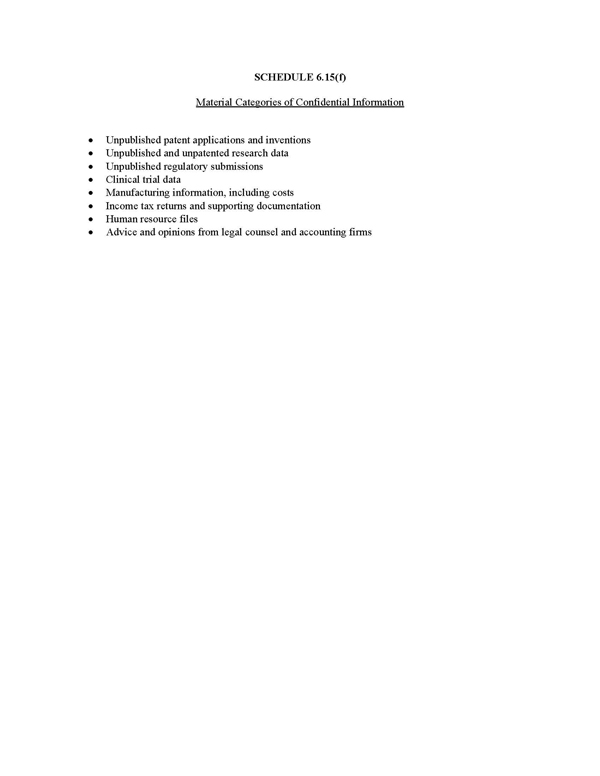

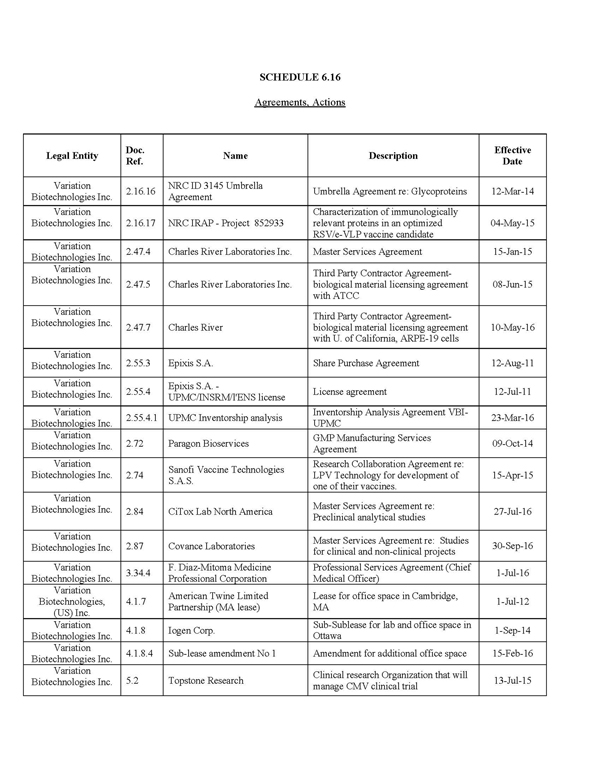

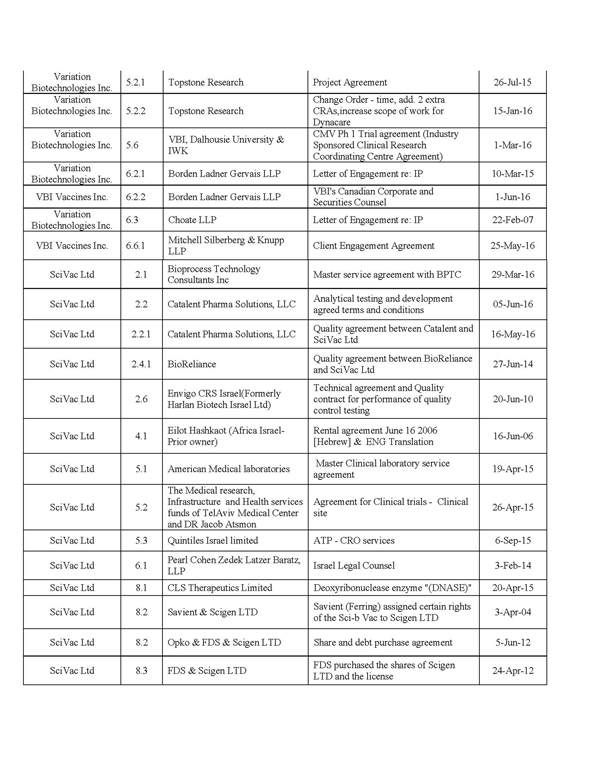

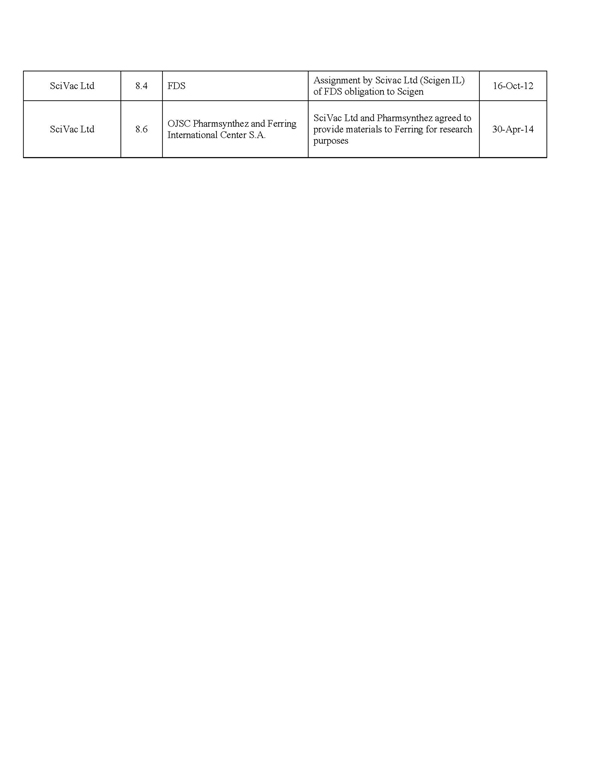

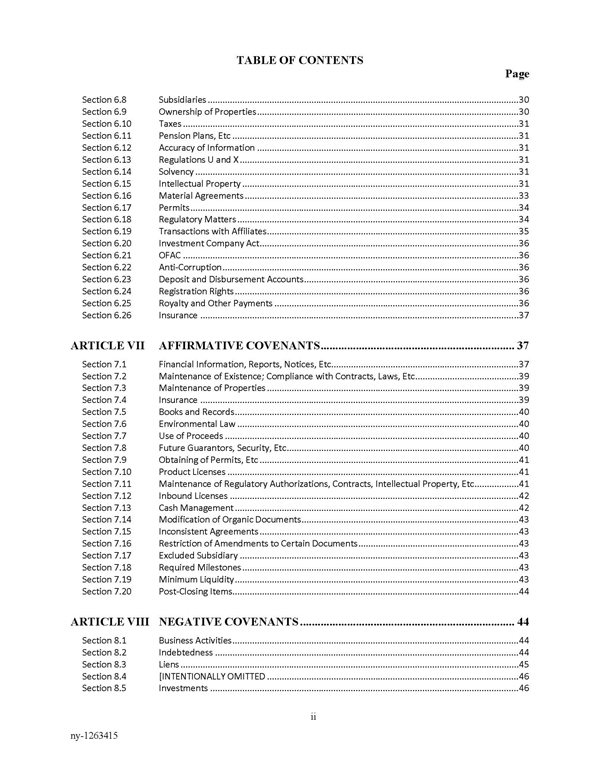

TABLE OF CONTENTS Page Section 6.8 Subsidiaries 30 Section 6.9 Ownership of Properties 30 Section 6.10 Taxes 31 Section 6.11 Pension Plans, Etc 31 Section 6.12 Accuracy of Information 31 Section 6.13 Regulations U and X 31 Section 6.14 Solvency 31 Section 6.15 Intellectual Property 31 Section 6.16 Material Agreements 33 Section 6.17 Permits 34 Section 6.18 Regulatory Matters 34 Section 6.19 Transactions with Affiliates 35 Section 6.20 Investment Company Act 36 Section 6.21 OFAC 36 Section 6.22 Anti-Corruption 36 Section 6.23 Deposit and Disbursement Accounts 36 Section 6.24 Registration Rights 36 Section 6.25 Royalty and Other Payments 36 Section 6.26 Insurance 37 ARTICLE VII AFFIRMATIVE COVENANTS 37 Section 7.1 Financial Information, Reports, Notices, Etc 37 Section 7.2 Maintenance of Existence; Compliance with Contracts, Laws, Etc 39 Section 7.3 Maintenance of Properties 39 Section 7.4 Insurance 39 Section 7.5 Books and Records 40 Section 7.6 Environmental Law 40 Section 7.7 Use of Proceeds 40 Section 7.8 Future Guarantors, Security, Etc 40 Section 7.9 Obtaining of Permits, Etc 41 Section 7.10 Product Licenses 41 Section 7.11 Maintenance of Regulatory Authorizations, Contracts, Intellectual Property, Etc 41 Section 7.12 Inbound Licenses 42 Section 7.13 Cash Management 42 Section 7.14 Modification of Organic Documents 43 Section 7.15 Inconsistent Agreements 43 Section 7.16 Restriction of Amendments to Certain Documents 43 Section 7.17 Excluded Subsidiary 43 Section 7.18 Required Milestones 43 Section 7.19 Minimum Liquidity 43 Section 7.20 Post-Closing Items 44 ARTICLE VIII NEGATIVE COVENANTS 44 Section 8.1 Business Activities 44 Section 8.2 Indebtedness 44 Section 8.3 Liens 45 Section 8.4 [INTENTIONALLY OMITTED 46 Section 8.5 Investments 46 ii ny-1263415