UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

PAULSON CAPITAL CORP.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

PAULSON CAPITAL CORP.

811 SW Naito Parkway, Suite 200

Portland, Oregon 97204

May 7, 2010

Dear Shareholders:

The 2010 Annual Meeting of Shareholders of Paulson Capital Corp. will be held at our headquarters, 811 SW Naito Parkway, Portland, Oregon 97204 in the third-floor conference room on Thursday, June 17, 2010 at 2:00 p.m. (PDT).

The attached material includes the Notice of Annual Meeting, the Proxy Statement, which describes the business to be transacted at the meeting, the Form of Proxy and our Annual Report to Shareholders for the year ended December 31, 2009. We ask that you give them your careful attention. You may also access such materials at www.proxyvote.com.

As in the past, we will be reporting on our activities and you will have an opportunity to ask questions about our operations.

We hope that you are planning to attend the Annual Meeting personally, and we look forward to seeing you. It is important that your shares be represented at the meeting whether or not you are able to attend in person. Accordingly, the return of the enclosed proxy as soon as possible will be greatly appreciated and will ensure that your shares are represented at the Annual Meeting. If you do attend the Annual Meeting, you may, of course, withdraw your proxy if you wish to vote in person.

On behalf of the Board of Directors of Paulson Capital Corp., I would like to thank you for your continued support and confidence.

|

| Sincerely, |

|

/s/ CHESTER L.F. PAULSON |

| CHESTER L.F. PAULSON |

Chairman of the Board, President and Chief Executive Officer |

PAULSON CAPITAL CORP.

811 SW Naito Parkway, Suite 200

Portland, Oregon 97204

(503) 243-6000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On June 17, 2010

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Paulson Capital Corp. will be held at our headquarters, 811 SW Naito Parkway, Portland, Oregon 97204, in the third-floor conference room on Thursday, June 17, 2010 at 2:00 p.m. (PDT) for the following purposes:

| | 1. | To elect five Directors whose term of office will expire in 2011; and |

| | 2. | To transact any other business that properly comes before the Annual Meeting and any adjournments or postponements thereof. |

Holders of Common Stock of record as of the close of business on April 26, 2010 are entitled to receive notice of and vote at the Annual Meeting.

It is important that your shares be represented at the Annual Meeting. For that reason, we ask that you promptly sign, date and mail the enclosed proxy card in the return envelope provided or vote by telephone or online. Shareholders who attend the Annual Meeting may revoke their proxies and vote in person.

|

| By Order of the Board of Directors, |

|

/s/ JACQUELINE M. PAULSON |

| JACQUELINE M. PAULSON |

| Secretary |

Portland, Oregon

May 7, 2010

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on June 17, 2010: The Proxy Statement and the Accompanying Proxy Card and Annual Report are available at www.proxyvote.com.

PAULSON CAPITAL CORP.

811 SW Naito Parkway, Suite 200

Portland, Oregon 97204

(503) 243-6000

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To Be Held On June 17, 2010

This Proxy Statement and the accompanying Notice of Annual Meeting and form of proxy are being furnished to the shareholders of Paulson Capital Corp. in connection with the solicitation of proxies by our Board of Directors for use at our 2010 Annual Meeting of Shareholders (the “Annual Meeting”) to be held in the third-floor conference room of our headquarters, 811 SW Naito Parkway, Portland, Oregon 97204, on Thursday, June 17, 2010 at 2:00 p.m. (PDT) and any adjournments thereof. These proxy materials are first being mailed on or about May 7, 2010 to holders of record on April 26, 2010 of our Common Stock.

This Proxy Statement is being furnished to you with a copy of our Annual Report on Form 10-K for our fiscal year ended December 31, 2009. We will provide, without charge, additional copies of our Annual Report on Form 10-K to each shareholder of record as of the record date that requests a copy in writing. Any exhibits listed in the Annual Report on Form 10-K report also will be furnished upon request at the actual expense we incur in furnishing such exhibit. Any such requests should be directed to the Company’s Secretary at our executive offices set forth above.

This Proxy Statement, our Annual Report and Form of Proxy are also available at www.proxyvote.com.

Voting Rights

Holders of record at the close of business on April 26, 2010 of our Common Stock, no par value (“Common Stock”), are entitled to notice of and to vote at the Annual Meeting and any adjournments thereof. Each outstanding share of Common Stock entitles the holder to one vote. Our Articles of Incorporation do not provide for cumulative voting. On April 26, 2010, 5,893,985 shares of our Common Stock were outstanding.

Quorum and Voting Requirements

The presence in person or by proxy at the Annual Meeting of the holders of at least one-third of the shares of Common Stock entitled to vote will constitute a quorum for the transaction of business at the Annual Meeting. Assuming that a quorum is present, nominees for the election of directors shall be elected by a plurality of votes. Action on any matter other than the election of directors shall be approved if the votes cast in favor of the proposal exceed the number of votes cast against.

Votes cast by proxy or in person at the meeting will be tabulated by the election inspectors appointed for the meeting and who will determine whether a quorum is present. The election inspectors will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the stockholders for a vote. If your shares are held in street name and you do not instruct your broker on how to vote your shares, your brokerage firm, in its discretion, may either leave your shares unvoted or vote your shares on routine matters. The election of directors should be considered non-routine matters. Consequently, without your voting instructions, your brokerage firm cannot vote your shares on this proposal. These unvoted shares, called “broker non-votes,” refer to shares held by brokers who have not received voting instructions from their clients and who do not have discretionary authority to vote on non-routine matters.

Methods of Voting

Your shares can be voted at the Annual Meeting only if you are present in person or represented by proxy. Whether or not you expect to attend the Annual Meeting, please take the time to vote your proxy.

1

You can vote by proxy in the following three ways: by telephone, by Internet or by mail as detailed on the enclosed proxy.

Voting of Proxies

When a proxy is properly executed and returned, the shares it represents will be voted at the Annual Meeting as directed. If no specification is indicated, the shares will be voted:

| | (1) | “for” the election of each director nominee set forth in this Proxy Statement; and |

| | (2) | at the discretion of your proxies on any other matter that may be properly brought before the Annual Meeting. |

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. Thus, if you do not give your broker or nominee specific voting instructions, your shares may not be voted on those matters. If your shares are not voted, they will not be counted in determining the number of votes cast. Shares represented by such “broker non-votes” will, however, be counted for determining whether there is a quorum.

Revoking Your Proxy

A proxy may be revoked by a shareholder prior to its exercise by written notice to the Secretary of Paulson Capital Corp., by submission of another proxy bearing a later date or by voting in person at the Annual Meeting. Such notice or later proxy will not affect a vote on any matter taken prior to the receipt thereof. The mere presence at the Annual Meeting of the shareholder appointing the proxy will not revoke the appointment. If not revoked, the proxy will be voted at the Annual Meeting in accordance with the instructions indicated on the proxy by the shareholder or, if no instructions are indicated, will be votedFOR the slate of directors.

Proxy Solicitation

All expenses in connection with this solicitation, which are expected to be immaterial, will be borne by us. In addition to solicitation by mail, proxies may be solicited by our directors, officers or other employees by telephone, fax, in person or otherwise without additional compensation. We will also request brokerage firms, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of shares held of record by such persons and will reimburse such entities for their reasonable out-of-pocket expenses in forwarding such material.

Voting Confidentiality

Proxies, ballots and voting tabulations are handled on a confidential basis to protect your voting privacy. This information will not be disclosed, except as required by law.

Voting Results

Voting results will be announced at the Annual Meeting and published in a Form 8-K to be filed after the Annual Meeting.

Driving Directions to Annual Meeting

For driving directions to the Annual Meeting, you may contact Barbara James at 503-243-6000.

2

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 1, 2010, certain information furnished to us with respect to beneficial ownership of our common stock of (i) each director; (ii) the “named executive officers” (as defined under “Executive Compensation”); (iii) all persons known by us to be beneficial owners of more than 5% of our common stock; and (iv) all current executive officers and directors as a group. Except as otherwise noted, the persons listed below have sole investment and voting power with respect to the common stock owned by them. Unless otherwise indicated, the address of each holder is 811 SW Naito Parkway, Suite 200, Portland, Oregon 97204.

| | | | | |

| | | Common Stock (1) | |

Name of Beneficial Owner | | Number of

Shares (2) | | Percent of Shares

Outstanding | |

Chester L.F. and Jacqueline M. Paulson (3) | | 2,600,894 | | 44.1 | % |

Steve H. Kleemann | | 714,800 | | 12.1 | % |

Charles P.A. and Amy Paulson (4) | | 481,398 | | 8.2 | % |

Charles L.F. Paulson (5) | | 167,823 | | 2.8 | % |

Paul F. Shoen | | 56,881 | | * | |

Shannon P. Pratt, D.B.A. | | 46,204 | | * | |

Trent Davis | | 15,000 | | * | |

Chris Schreiber | | 15,000 | | * | |

| | |

All current executive officers and directors as a group (11 persons) | | 3,649,802 | | 60.2 | % |

| (1) | Applicable percentage of ownership is based on 5,893,985 shares of common stock outstanding as of April 1, 2010 together with applicable options for such shareholders. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and includes voting and investment power with respect to shares. |

| (2) | Includes options exercisable or exercisable within 60 days of April 1, 2010 as follows: |

| | |

Chester L.F. and Jacqueline M. Paulson | | — |

Steve H. Kleemann | | 25,000 |

Charles P.A. and Amy Paulson | | — |

Charles L.F. Paulson | | 38,334 |

Paul F. Shoen | | 25,000 |

Shannon P. Pratt, D.B.A. | | 25,000 |

Trent Davis | | 15,000 |

Chris Schreiber | | 15,000 |

| |

All current executive officers and directors as a group | | 168,334 |

| (3) | Includes 2,480,894 shares held by the Paulson Family LLC. |

| (4) | Charles P.A. and Amy Paulson own the shares as joint tenants. The address for Charles P.A. and Amy Paulson is 1022 NW Marshall Street, Suite 450, Portland, Oregon 97209. |

| (5) | Represents shares held as a member of the Paulson Family LLC and options as detailed in Note 2. |

3

ELECTION OF DIRECTORS

(Proposal No. 1)

As recommended and approved by the Nominating and Governance Committee, the Board of Directors has recommended and nominated our five current directors, Messrs. Chester L.F. Paulson, Kleemann, Charles L.F. Paulson and Shoen and Dr. Pratt to serve until the next Annual Meeting of Shareholders or until his or her successor is duly elected and qualified. The persons named on the enclosed proxy (the proxy holders) will vote for election of the nominees unless you have withheld authority for them to do so on your proxy card. If the nominees are unable or decline for good cause to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee named by the current Board of Directors to fill the vacancy. As of the date of this Proxy Statement, the Board of Directors is not aware that a nominee is unable and/or will decline to serve as a director. There is no cumulative voting for election of directors.

Vote Required

If a quorum of shareholders is present at the Annual Meeting, the five nominees for election as directors who receive the greatest number of votes cast at the Annual Meeting will be elected directors.

Recommendation

The Board of Directors recommends that shareholders vote FOR the re-election of Messrs. Chester L.F. Paulson, Kleemann, Charles L.F. Paulson and Shoen and Dr. Pratt.

The following table sets forth the names of the nominees for election as a director. Also set forth is certain information with respect to each such person’s age as of April 26, 2010, principal occupation or employment during the past five years and the year in which they were elected to serve as a director of Paulson Capital Corp.

| | | | | | | | |

Name | | Age | | | | Has Been a Director Since | | |

| Chester L.F. Paulson | | 74 | | | | 1970 | | |

| Steve H. Kleemann | | 69 | | | | 2001 | | |

| Charles L.F. Paulson | | 56 | | | | 2007 | | |

| Shannon P. Pratt, D.B.A. | | 76 | | | | 1998 | | |

| Paul F. Shoen | | 53 | | | | 1998 | | |

Chester L.F. Paulsonfounded Paulson Capital Corp. in 1970 and has served as its Chairman, President and CEO since that time. Mr. Paulson is also the Co-Founder and Chairman of Paulson Capital Corp.’s wholly owned subsidiary, Paulson Investment Company, Inc. (originally Paulson Trading Company). We consider Chester L.F. Paulson a valuable Board member due to his significant holdings of our common stock, as well as the fact that he has been involved in the securities business since 1963. In addition, he has, in the past, served on the boards of other publicly traded companies, which we feel is valuable experience for our Board. Mr. Paulson has been actively involved in the investment banking, financial consulting and project funding for over 40 years. In 1959, Mr. Paulson started his career as a securities trader for June S. Jones Company in Portland, Oregon. Mr. Paulson served in the United States Army as a member of the Army Security Agency and graduated from the University of Oregon with a B.S. in Economics. He furthered his education at the University of Portland where he obtained his Master’s Degree in Business Administration. He currently is a member of the Securities Traders Association, the Southern California Investment Association and the National Investment Bankers Association (“NIBA”).

Steve H. Kleemannhas been a private investor and entrepreneur focusing on the areas of finance and investments since 1966. Because of this experience, we consider Mr. Kleeman a valuable Board member. He also brings to the Board ten years of experience working in the securities industry in institutional sales, research and overseeing trading departments. He also routinely attends securities conferences in order to keep informed of current events. Mr. Kleemann has a B.S. degree in Finance from the University of Southern California.

4

Charles L.F. Paulsonjoined Paulson Investment Company, Inc. in 1972 and has served in various positions since that time. Since 1992, Mr. Paulson has served as Senior Vice President of Proprietary Trading. We believe that this experience, in addition to more than 20 years of experience serving as Head Trader and as a member of Paulson Investment Company, Inc.’s Board of Directors since 1994, makes Mr. Paulson a valuable Board member. Mr. Paulson is the son of Mr. Chester L.F. Paulson and the stepson of Mrs. Jacqueline M. Paulson.FINRA Licenses include: Series 7, 24, 55 and 63.

Shannon P. Pratt, D.B.A.has been the Chairman and CEO of Shannon Pratt Valuations, Inc., a business valuation and financial advisory services firm, since January 2004. From 1995 to October 2005, Dr. Pratt was Managing Owner of Business Valuation Resources. Dr. Pratt is a Lifetime Member Emeritus of the Business Valuation Committee of the American Society of Appraisers. He is also a Lifetime Member Emeritus of the Valuation Advisory Committee of The ESOP Association. Dr. Pratt has received the prestigious Magna Cum Laude award of the National Association of Certified Valuation Analysts for service to the business valuation profession, and he is also the first life member of the Institute of Business Appraisers. Dr. Pratt is a member and a past President of the Portland Society of Financial Analysts, the recipient of the 2002 Distinguished Achievement Award, a member of the Association for Corporate Growth and a past trustee of The Appraisal Foundation. Dr. Pratt holds a Doctor of Business Administration (D.B.A.) from Indiana University with a major in Finance and is also a Chartered Financial Analyst (CFA). Broadly published, he has either authored or co-authored ten books on the subject of business valuation, as well as many other articles, newsletters and papers. Based on the above, we believe that Dr. Pratt brings valuable experience in business valuations and financial analysis to our Board.

Paul F. Shoenis a private investor and also founded and has served as the Chairman of Pantechnicon Aviation, Ltd., a company that buys and sells aircraft, since 1995. Although he is no longer associated with them, over a 15 year period, Mr. Shoen served as a member of various Boards of Directors at the parent and subsidiary levels of Amerco, Inc., including the operational, real estate and insurance companies. He also served in various executive capacities within Amerco, including as President and Vice-President of U-Haul International. Mr. Shoen attended College of the Holy Cross where he earned a B.A. in Psychology. He has also taken graduate-level business courses at the University of Chicago. Mr. Shoen is also the Director of the Paul F. Shoen Foundation, a charitable organization. We believe that Mr. Shoen’s experience on other company boards and as a private investor is valuable to our Board.

DIRECTOR INDEPENDENCE AND LEADERSHIP STRUCUTURE

The Board of Directors has determined that each of Dr. Pratt and Messrs. Kleemann and Shoen are “independent directors” under Nasdaq Stock Market Marketplace Rule 5000(a)(19). The Board of Directors has also determined that each member of the three committees of the Board of Directors meets the independence requirements applicable to those committees prescribed by Nasdaq and the Securities and Exchange Commission, including Rule 10A-3(b)(1) under the Securities Exchange Act of 1934 (the “Exchange Act”) related to audit committee member independence.

The positions of Chief Executive Officer and Chairman of the Board are filled a single individual, Mr. Chester L.F. Paulson. Chester L.F. Paulson holds an MBA and has been involved in the securities business since 1963. He has, in the past, served on the boards of other publicly traded companies.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

The Chairman of our Board of Directors, Chester L.F. Paulson, is the founder of Paulson Capital Corp. and serves as our Chief Executive Officer. The Board of Directors determined that it was in the best interests of our stockholders for Mr. Chester L.F. Paulson to continue to serve as Chairman of the Board, given the depth of his experience with our firm and our industry. The independent members of our Board of Directors have not chosen to appoint a “lead independent director.” Our Board of Directors reviews the structure of our Board of Directors and its committees each year as a part of its annual self evaluation process, and in that context considers, among other things, issues of structure and leadership. The Board of Directors is satisfied that its current structure and processes are well suited for the Company, given its simple business model, size and stock ownership.

5

The Board of Directors is responsible for risk management and oversight. The Audit Committee is responsible for monitoring risk management and receives regular reports on risk matters, including financial, legal and regulatory risks, at its meetings. In addition, the Audit Committee has regular discussions with the Chief Financial Officer and external auditors to discuss issues related to risk management. The Audit Committee, in turn, reports any material risk issues to the full Board of Directors.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors held five meetings during the year ended December 31, 2009. During 2009, no director attended fewer than 75% of the meetings of the Board of Directors and any committees of which the director was a member. Although we do not maintain a formal policy regarding director attendance at our annual meeting of shareholders, members of the Board of Directors are encouraged to attend. All of the members of the Board of Directors attended our 2009 annual meeting of shareholders.

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act.

Audit Committee. During 2009, our Audit Committee consisted of Mr. Kleemann, Dr. Pratt (Chair) and Mr. Shoen. The Audit Committee reviews and makes recommendations to the Board of Directors concerning our internal accounting procedures, reviews and consults with our independent accountants on the accounting principles and auditing practices used for our financial statements and makes recommendations to the Board of Directors concerning the engagement of independent accountants and the scope of the audit to be undertaken by the accountants. The Board of Directors has determined that all members of our Audit Committee are independent under the rules of the Nasdaq Capital Market, and that Dr. Pratt qualifies as an “audit committee financial expert” as defined by the rules of the SEC. The Audit Committee held six meetings during 2009. The Audit Committee Charter is available on our website at www.paulsoninvestment.com.

Compensation Committee. During 2009, our Compensation Committee consisted of Mr. Kleemann, Dr. Pratt (Chair) and Mr. Shoen. The Compensation Committee is primarily responsible for reviewing the compensation of our executive officers, including the Chief Executive Officer, and for administering our stock option plan. The Board of Directors has determined that all members of our Compensation Committee are independent under the rules of the Nasdaq Capital Market. The Compensation Committee held five meetings during 2009. The Compensation Committee does not have a charter.

Nominating and Governance Committee.During 2009, our Nominating and Governance Committee consisted of Mr. Kleemann, Dr. Pratt (Chair) and Mr. Shoen. The Nominating and Governance Committee is responsible for i) nominating and recommending nominees for the Board and submitting the names of such nominees to the full Board for their approval; ii) evaluating the composition, size and governance of the Board and its committees and making recommendations regarding future planning and appointment of Directors to the committees; and iii) establishing a policy for considering shareholder nominees for election to our Board. The Board of Directors has determined that all members of our Nominating and Governance Committee are independent under the rules of the Nasdaq Capital Market. The Nominating and Governance Committee did not hold any meetings during 2009. The Nominating and Governance Committee Charter is available on our website at www.paulsoninvestment.com.

6

PROCEDURES FOR SELECTING AND NOMINATING DIRECTOR CANDIDATES

In evaluating the appropriate characteristics of candidates for service as a director, the Nominating and Governance Committee (the “Committee”) takes into account many factors. At a minimum, director candidates must demonstrate high standards of ethics, integrity and professionalism, independence, sound judgment, community leadership and meaningful experience in business, law or finance or other appropriate endeavor. In addition, the candidates must be committed to representing the long-term interests of our shareholders. In addition to these minimum qualifications, the Committee also considers other factors it deems appropriate based on the current needs of the Board, including specific business and financial expertise currently desired on the Board and experience as a director of a public company. The Committee does not have a formal policy with respect to diversity; however, the Board and the Committee believe that it is essential that Board members represent diverse viewpoints. With these factors and characteristics in mind, the Committee will generally begin its search by seeking nominations from existing members of the Board and management. The Committee will also reassess the qualifications of a director, including the director’s past contributions to the Board and the director’s attendance and contributions at Board and committee meetings, prior to recommending a director for reelection to another term.

Our Board of Directors has adopted procedures by which stockholders may recommend nominees to the Board. The Nominating and Governance Committee will consider any director candidate recommended by shareholders on the same basis as it considers other director candidates. Shareholders may also submit a letter and relevant information about the candidate to the Secretary at Paulson Capital Corp., 811 SW Naito Parkway, Suite 200, Portland, Oregon 97204.

SHAREHOLDER COMMUNICATIONS WITH DIRECTORS

Any shareholder may contact our Board of Directors (or any individual Director) in writing by addressing the communication to: Board of Directors, Paulson Capital Corp., c/o Corporate Secretary, 811 S.W. Naito Parkway, Suite 200, Portland, Oregon 97204.

DIRECTOR COMPENSATION

Other than our Audit Committee Chair, our non-employee Directors did not receive any cash compensation for their services in 2009. They were, however, reimbursed for travel and incidental expenses incurred for attending our Board meetings. Mr. Chester L.F. Paulson, Mr. Charles L.F. Paulson and Mrs. Paulson, a former Board member, have never received any additional compensation for their service on the Board. The following table summarizes compensation earned by non-employee members of our Board of Directors related to their 2009 service:

| | | | | | | | | | |

Name | | Option

Awards | | All

Other

Compensation | | | Total |

Steve H. Kleemann | | $ | 12,250 | | $ | — | | | $ | 12,250 |

Shannon P. Pratt, D.B.A. | | | 12,250 | | | 10,000 | (1) | | | 22,250 |

Paul F. Shoen | | | 12,250 | | | — | | | | 12,250 |

| (1) | Represents cash received for assistance as our Audit Committee Chair. |

Equity incentive awards outstanding at December 31, 2009 for each non-employee Director were as follows:

| | |

Name | | Option

Awards (#) |

Steve H. Kleemann | | 25,000 |

Shannon P. Pratt, D.B.A. | | 25,000 |

Paul F. Shoen | | 25,000 |

7

CODE OF ETHICS

We have adopted a code of ethics that applies to our officers (including our principal executive, financial and accounting officers), directors, employees and consultants. The text of our code of ethics is posted at our Internet website, located at www.paulsoninvestment.com. Furthermore, if disclosure of an amendment or waiver to our code of ethics is required by Item 5.05 of Form 8-K, we intend to satisfy such disclosure either by timely filing a Form 8-K or by posting such information at the same Internet website.

EXECUTIVE OFFICERS

The following table identifies the executive officers of Paulson Capital Corp. and its 100% owned operating subsidiary, Paulson Investment Company, Inc., as of April 30, 2010, the positions they hold and the year in which they began serving as an executive officer. Officers are appointed by their respective Boards of Directors to hold office until their successors are elected and qualified.

| | | | | | |

Name | | Age | | Current Position(s) with Company | | Employee Since |

| Chester L.F. Paulson | | 74 | | Chairman of the Board, President and Chief Executive Officer of Paulson Capital Corp. | | 1970 |

| | | |

| Jacqueline M. Paulson | | 71 | | Secretary and Treasurer of Paulson Capital Corp. | | 1970 |

| | | |

| Trent Davis | | 42 | | President and CEO of Paulson Investment Company, Inc. | | 1991 |

| | | |

| Nils Ericson | | 52 | | Chief Compliance Officer of Paulson Investment Company, Inc. | | 2010 |

| | | |

| Karen Johannes | | 50 | | Chief Financial Officer of Paulson Capital Corp. and Paulson Investment Company, Inc. | | 2003 |

| | | |

| Lorraine Maxfield | | 59 | | Senior Vice President, Corporate Finance, Paulson Investment Company, Inc. | | 1983 |

| | | |

| Chris Schreiber | | 45 | | Senior Vice President, National Sales, Paulson Investment Company, Inc. | | 2002 |

There are no family relationships between our officers and directors other than the following:

| | • | | Chester L.F. Paulson and Jacqueline M. Paulson being husband and wife; |

| | • | | Charles L.F. Paulson is the son of Chester L.F. Paulson and stepson of Jacqueline M. Paulson; and |

| | • | | Trent Davis is the son-in-law of Chester L.F. Paulson and Jacqueline M. Paulson. |

For biographical information on Chester L.F. Paulson, see “Election of Directors” above.

Jacqueline M. Paulsonis the wife of Chester L.F. Paulson. Mrs. Paulson co-founded Paulson Investment Company, Inc. along with her husband, Chester Paulson, in 1970. From 1970 until 2009, Mrs. Paulson served as a Director for both Paulson Capital Corp. and Paulson Investment Company, Inc. Mrs. Paulson became Secretary and Treasurer of both Paulson Capital Corp. and Paulson Investment Company, Inc. in 1976. Mrs. Paulson earned a B.A. in Education from Linfield College and completed graduate coursework at the University of Washington.

Trent Davisjoined Paulson Investment Company, Inc. in 1991 in our Operations Department, in 1992 moved to equity trading and, in 1996, was promoted to Senior Vice President, Syndicate/National Sales Department. In July 2005, Mr. Davis was promoted to President and CEO of Paulson Investment Company, Inc. Mr. Davis served as a board member and Chairman of the National Investment Banking Association during 2003. Mr. Davis holds a B.S. in Business and Economics from Linfield College and has earned a Master’s Degree in Business Administration from the University of Portland.FINRA Licenses include: Series 7, 24, 63 and 66.

8

Nils Ericson joined Paulson Investment Company in February 2010 as the Chief Compliance Officer for all aspects of Paulson Capital Corp. business. Mr. Ericson brings nearly 25 years experience as a compliance professional working with securities and consulting firms, with specific expertise in sales and trading surveillance, risk management, monitoring and process refinement implementations. He began his career as a trading manager based in San Diego, California and oversaw all trading books and records. Mr. Ericson furthered his career in the role of Vice President of Compliance/Trading at two California based financial services firms and during this time developed internal processes and procedures to add efficiency, transparency and productivity in accordance with regulations. Prior to joining Paulson, Mr. Ericson served as the Chief Compliance Officer for Scottsdale Capital Advisors from December 2009 until joining Paulson Investment Company. Prior to that, he served as Compliance Manager for Private Consulting Group, Inc. in Portland, Oregon from January 2006 to March 2009, where he was responsible for management of all trading functions and regulatory reporting, development and administration of monitoring systems for surveillance reporting, supervision and hosting of firm wide training efforts, Investment Advisory billing and reporting, as well as extensive electronic communications reviews. Prior to this, Mr. Ericson served as Vice President of Trading and Compliance at Investors Resources Group from December 2003 to October 2005. Mr. Ericson attended the University of San Diego, majoring in Business Administration. FINRA Licenses include: Series 7, 4, 24, 53, 55, 3 and 63.

Karen Johannesjoined Paulson Capital Corp. and Paulson Investment Company, Inc. in October 2003 as Senior Vice President, Accounting and in March 2006 was promoted to Chief Financial Officer. From January 1998 to October 2003, Ms. Johannes was a Senior Financial Analyst for Willamette Management Associates, a valuation consulting, economic analysis and financial advisory services firm. Ms. Johannes authored numerous articles on business valuation for the newsletter Insights, which was published by Willamette Management Associates. Ms. Johannes graduated from Oregon State University with a B.S. in Business Administration and has earned a Master’s Degree in Business Administration from the University of Washington. Ms. Johannes is also a Certified Public Accountant (CPA), inactive status.FINRA Licenses include: Series 27.

Lorraine Maxfield joined Paulson Investment Company, Inc. in 1983 as a junior research analyst. In January 1993, Ms. Maxfield was promoted to Vice President of Research and, in March 1995, was promoted to Senior Vice President of Research. Subsequently, Ms. Maxfield was promoted to Senior Vice President, Corporate Finance. Ms. Maxfield worked as a junior high school teacher for seven years before joining Paulson, teaching classes in English literature, grammar, speech and drama. Ms. Maxfield attended the University of Oregon where she earned a B.A. in English and an M.A. in English Education, and later returned to the University of Oregon to earn her Master’s Degree in Business Administration. Ms. Maxfield is also a Chartered Financial Analyst (CFA).FINRA Licenses include: Series 7, 24 and 63.

Chris Schreiberjoined Paulson Investment Company, Inc. in August 2002 as manager of our Manhattan branch office. In July 2005, Mr. Schreiber was promoted to Senior Vice President of National Sales. Prior to joining Paulson Investment Company, Inc., Mr. Schreiber was employed by Weatherly Securities. Mr. Schreiber is a member of the National Investment Banking Association and is on the Board of Advisors for Blue Jays Unlimited, which is a board at Johns Hopkins University that supports student athletes. Mr. Schreiber earned a B.A. in Political Science from Johns Hopkins University.FINRA Licenses include: Series 7, 24 and 63.

9

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides certain summary information concerning compensation awarded to, earned by or paid to our (i) Principal Executive Officer (“PEO”); and (ii) our two next most highly compensated executive officers, other than our PEO, who were serving as executive officers at the end of the last completed fiscal year and whose total compensation was greater than $100,000; (herein referred to as the “named executive officers”).

| | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | Salary

($) | | Option

Awards

($) | | Non-Equity

Incentive Plan

Compensation

($)(1) | | All Other

Compen-

sation

($)(2) | | Total

($) |

Chester L.F. Paulson Chairman, President and CEO of Paulson Capital Corp. (“PEO”) | | 2009

2008 | | $

| 108,500

— | | $

| —

— | | $

| 11,154

85,776 | | $

| 34,856

112,617 | | $

| 154,510

198,393 |

| | | | | | |

Trent Davis President and CEO of Paulson Investment Company, Inc. | | 2009

2008 | |

| 42,285

44,904 | |

| 7,350

— | |

| 115,888

167,062 | |

| 26,218

75,448 | |

| 191,741

287,414 |

| | | | | | |

Chris Schreiber Senior VP, National Sales, Paulson Investment Company, Inc. | | 2009

2008 | |

| 77,400

72,000 | |

| 7,350

— | |

| 119,733

118,728 | |

| 10,202

42,799 | |

| 214,685

233,527 |

| (1) | Represents commissions earned pursuant to performance-based compensation arrangements. |

| (2) | All Other Compensation in 2009 included the following: |

| | | | | | | | | | | | |

Name | | Warrant

Related | | Auto

Allowance | | 401(k)

Match | | Total |

Chester L.F. Paulson | | $ | 22,750 | | $ | 12,000 | | $ | 106 | | $ | 34,856 |

Trent Davis | | | 14,218 | | | 12,000 | | | — | | | 26,218 |

Chris Schreiber | | | 9,479 | | | — | | | 723 | | | 10,202 |

Warrant related compensation relates to the difference between the exercise price of warrants and the fair market value of the underlying stock when sold. Such warrants were received in connection with offerings underwritten by Paulson Investment Company, Inc.

Outstanding Equity Awards at December 31, 2009

| | | | | | | |

| | | Option Awards |

Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | Option

Exercise

Price ($/Sh.) | | Option

Expiration

Date |

Chester L.F. Paulson | | — | | | — | | — |

Trent Davis | | 15,000 | | $ | 1.13 | | 06/30/16 |

Chris Schreiber | | 15,000 | | $ | 1.13 | | 06/30/16 |

Compensation expense is the most significant expense for us. Compensation expense generally follows the increase or decrease in net revenues, reflecting the connection of incentive-based pay to our overall performance.

Our Board of Directors is responsible for establishing our compensation program. The Compensation Committee has been delegated by the Board of Directors to annually review the officer compensation program and approve appropriate modifications to the senior officer compensation packages. The Compensation Committee is responsible for establishing the compensation of the CEO and reviews and

10

approves the recommendations of the CEO regarding compensation and incentive packages of other senior executive officers. The Compensation Committee does not delegate this authority and we do not use compensation consultants.

AUDIT COMMITTEE REPORT

The Audit Committee has reviewed and discussed the audited financial statements with management. The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA,Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee also has received the written disclosures and the letter from the independent accountant required by applicable requirements of the of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the accountant’s independence. Based on the review and discussions referred to above, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report.

This report of the Audit Committee does not constitute “soliciting material” and should not be deemed “filed” or incorporated by reference into any of Paulson Capital Corp.’s filings under the Securities Act of 1933 or the Exchange Act, except to the extent Paulson Capital Corp. specifically incorporates this report by reference herein.

Submitted by the Audit Committee of the Board of Directors:

Mr. Steve Kleemann

Dr. Shannon Pratt (Chair)

Mr. Paul Shoen

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

McGladrey & Pullen, LLP served as our independent registered public accountants for the fiscal years ended December 31, 2009 and 2008. We utilize the services of Grant Thornton LLP for our tax services. Representatives from McGladrey & Pullen, LLP will not be attending the Annual Meeting.

Principal Accounting Firm Fees

We paid the following fees for services performed by McGladrey & Pullen, LLP in 2009 and 2008:

| | | | | | | | | | | | |

| | | 2009 | | % Pre-approved

by Audit

Committee | | | 2008 | | % Pre-approved

by Audit

Committee | |

Audit Fees(1) | | $ | 155,800 | | 100 | % | | $ | 136,500 | | 100 | % |

Audit Related Fees | | | — | | — | | | | — | | — | |

Tax Fees | | | — | | — | | | | — | | — | |

All Other Fees | | | — | | — | | | | — | | — | |

| | | | | | | | | | | | |

| | $ | 155,800 | | | | | $ | 136,500 | | | |

| | | | | | | | | | | | |

| (1) | Audit fees represent fees for professional services provided in connection with the audit of our financial statements and review of our quarterly financial statements and audit services provided in connection with other statutory or regulatory filings. |

11

Pre-Approval of Audit and Non-Audit Services

The Audit Committee engages the Independent Registered Public Accountants to audit the financial statements of Paulson Capital Corp. Management approves the tax services that are provided by a separate independent registered public accounting firm. Any audit-related or other services required by an independent registered public accounting firm will be discussed with, and approved by, the Audit Committee as needed. The Audit Committee has determined that this practice is compatible with maintaining the principal accountant’s independence.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act requires our directors and executive officers and persons who own more than ten percent of the outstanding shares of our common stock (“ten percent shareholders”), to file with the SEC initial reports of beneficial ownership and reports of changes in beneficial ownership of shares of our common stock and other equity securities. To our knowledge, based solely on review of the copies of such reports furnished to us or otherwise in our files and on written representations from our directors, executive officers and ten percent shareholders that no other reports were required, during the fiscal year ended December 31, 2009, our officers, directors and ten percent shareholders complied with all applicable Section 16(a) filing requirements, except as follows:

| | • | | Dr. Pratt filed one late Form 4 reporting the sale of 6,000 shares of our common stock; |

| | • | | Mr. Charles L.F. Paulson filed one late Form 4 reporting the sale of 1,000 shares of our common stock; and |

| | • | | Mr. McChesney, an officer of Paulson Investment Company, filed one late Form 4 reporting the exercise of 1,500 stock options and the sale of the 1,500 shares of our common stock underlying the options. |

SHAREHOLDER PROPOSALS

Any shareholder proposal to be considered for inclusion in proxy materials for our 2011 Annual Meeting must be received at our principal executive offices no later than January 7, 2011 (120 days prior to the anniversary of the mailing of our proxy materials for our 2010 Annual Meeting). To be eligible for inclusion in the 2011 proxy materials, proposals must conform to the requirements set forth in Regulation 14A under the Securities Exchange Act of 1934. A proxy may confer discretionary authority to vote on any matter received by us after March 23, 2011 (45 days prior to the anniversary of the mailing of our proxy materials for our 2010 Annual Meeting).

12

HOUSEHOLDING

We are sending only one Annual Report and Proxy Statement to certain street-name shareholders who share a single address, unless we received contrary instructions from any shareholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if you are residing at such an address and wish to receive a separate Annual Report on Form 10-K or Proxy Statement in the future, you may telephone our Secretary at (503) 243-6000 or write to her at Paulson Capital Corp., 811 SW Naito Parkway, Suite 200, Portland, Oregon 97204. If you are receiving multiple copies of our Annual Report on Form 10-K and Proxy Statement, you may request householding by contacting the Secretary in the same manner.

TRANSACTION OF OTHER BUSINESS

As of the date of this Proxy Statement, the Board of Directors is not aware of any other matters that may come before this meeting. It is the intention of the persons named in the enclosed proxy to vote the proxy in accordance with their best judgment if any other matters do properly come before the meeting. Please return your proxy as soon as possible. Unless a quorum of the outstanding shares entitled to vote is represented at the meeting, no business can be transacted. Please act promptly to insure that you will be represented at this important meeting.

ANNUAL REPORT ON FORM 10-K

We have filed our Annual Report on Form 10-K for the fiscal year ended December 31, 2009. A copy of the Annual Report on Form 10-K has been mailed concurrently with this Proxy Statement to all shareholders entitled to notice of and to vote at the Annual Meeting. Our financial statements and management’s discussion and analysis of financial condition and results of operations are incorporated by reference to our Annual Report on Form 10-K for the period ended December 31, 2009.

|

| By Order of the Board of Directors: |

|

| /S/ JACQUELINE M. PAULSON |

| Jacqueline M. Paulson |

| Secretary |

Dated: May 7, 2010

13

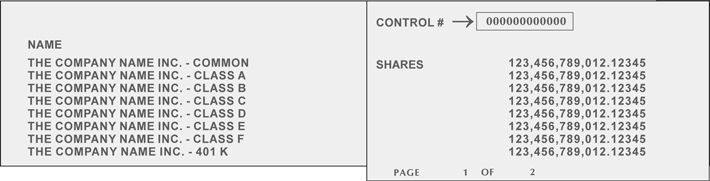

| | | | | | | | |

| |  | |  | | | | |

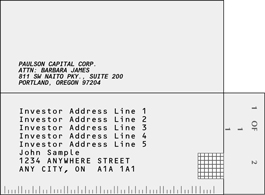

| | | VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. | |  | | |

| | | Electronic Delivery of Future PROXY MATERIALS | | | |

| | | If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. | | | |

| | | VOTE BY PHONE - 1-800-690-6903 | | | |

| | | Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. | | | |

| | | VOTE BY MAIL | | | |

| | | Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. | | | | |

| | | | | | |

|

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: x | | |

| | | | |

| | | KEEP THIS PORTION FOR YOUR RECORDS | | |

| | DETACH AND RETURN THIS PORTION ONLY | | |

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. | | |

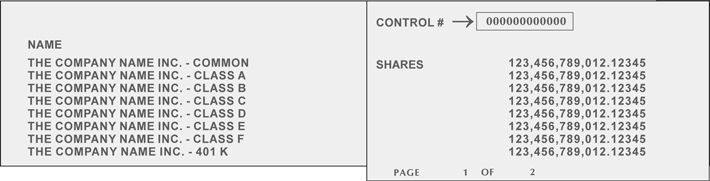

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | For

All | | Withhold

All | | For All

Except | | To withhold authority to vote for any

individual nominee(s), mark “For All Except”

and write the number(s) of the nominee(s) on

the line below. | |  | |  |

| | The Board of Directors recommends that you vote FOR the following: | | | | | | | | | |

| | | | | | | | ¨ | | ¨ | | ¨ | | | | | | | | | | | | | |

| | 1. | | Election of Directors | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Nominees | | | | | | | | | | | | | | | | | | | | | | | |

| | 01 | | Chester L. F. Paulson 02 Steve H. Kleemann 03 Charles L. F. Paulson 04 Shannon P. Pratt, Ph.D. 05 Paul F. Shoen | | | |

| | | The Board of Directors does not have a recommendation for voting on the following proposal(s): | | | | | | For | | Against | | Abstain | | |

| | 2. | | Other Matters. At the discretion of the proxy holder, on such other business as may properly come before the meeting and any adjournments or postponements thereof. | | | | ¨ | | ¨ | | ¨ | | |

| | Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer. | | | | | |  | | |

| | | | | | | | | | | | | | | | | | | | |

| |  | | | | | | | | | | | | | | | | | | |

| | Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:The Notice & Proxy Statement, Annual Report on Form 10-K is/are available atwww.proxyvote.com. |

| | | | | | | | |

| | | | |

| | | | | | | | |

| | | | | | | | |

| |

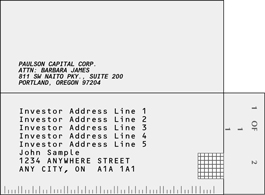

| | PAULSON CAPITAL CORP. Revocable Proxy for Annual Meeting of Shareholders to be Held on June 17, 2010 2:00 PM | | |

| | | | The undersigned hereby appoints Chester L.F. Paulson and Jacqueline M. Paulson, and each of them, proxies of the undersigned, each with full power of substitution to represent and to vote on behalf of the undersigned all shares of Common Stock of Paulson Capital Corp. at the annual meeting to be held at 2:00 p.m. on Thursday, June 17, 2010, and any adjournments or postponements thereof, with all powers the undersigned would possess if personally present, with respect to the following: 1. Election of Directors 2. Other Matters. At the discretion of the proxy holder, on such other business as may come before the meeting and any adjournments or postponements thereof. THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS OF THE COMPANY. IF NO SPECIFIC DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED FOR EACH OF THE NOMINEES FOR DIRECTOR. Continued and to be signed on reverse side | | |