Tivity Health Q3 2019 Earnings Release Supplemental Material November 12, 2019 Exhibit 99.2

Note on Forward-Looking Statements This communication contains certain statements that are “forward-looking” statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based upon current expectations and include all statements that are not historical statements of fact and those regarding the intent, belief or expectations, including, without limitation, statements that are accompanied by words such as “will,” “expect,” “outlook,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” or other similar words, phrases or expressions and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding Tivity Health, Inc.’s (the “Company”) future financial performance and the Company’s acquisition of Nutrisystem, Inc. (“Nutrisystem”), as well as the expected benefits, synergies or opportunities of such acquisition. Readers of this communication should understand that these statements are not guarantees of performance or results. Many risks and uncertainties could affect actual results and cause them to vary materially from the expectations contained in the forward-looking statements. These risks and uncertainties include, among other things: the market’s acceptance of the Company’s new products and services; the Company’s ability to develop and implement effective strategies and to anticipate and respond to strategic changes, opportunities, and emerging trends in the Company’s industry and/or business, as well as to accurately forecast the related impact on the Company’s revenues and earnings; the risk that expected benefits, synergies and growth opportunities of the Company’s acquisition of Nutrisystem may not be achieved in a timely manner or at all, including that the acquisition may not be accretive within the expected timeframe or to the extent anticipated; the Company’s ability to successfully integrate Nutrisystem's business or any other new or acquired businesses, services, technologies, solutions, or products into the Company’s business and to accurately forecast the related costs; the risk that the significant indebtedness incurred in connection with the Company’s acquisition of Nutrisystem may limit the Company’s ability to adapt to changes in the economy or market conditions, expose the Company to interest rate risk for the variable rate indebtedness and require a substantial portion of cash flows from operations to be dedicated to the payment of indebtedness; the Company’s ability to service its debt, make principal and interest payments as those payments become due, and remain in compliance with its debt covenants; the Company’s ability to obtain adequate financing to provide the capital that may be necessary to support its current or future operations; the risks associated with changes in macroeconomic conditions, geopolitical turmoil and the continuing threat of domestic or international terrorism; the impact of any impairment of the Company’s goodwill, intangible assets, or other long-term assets; the risks associated with the potential failures of the Company’s information systems; the risks associated with data privacy or security breaches, computer hacking, network penetration and other illegal intrusions of the Company’s information systems or those of third-party vendors or other service providers, which may result in unauthorized access by third parties, loss, misappropriation, disclosure or corruption of customer, employee or Company information, or other data subject to privacy laws and may lead to a disruption in the Company’s business, costs to modify, enhance, or remediate the Company’s cybersecurity measures, enforcement actions, fines or litigation against the Company, or damage to its business reputation; the impact of any new or proposed legislation, regulations and interpretations relating to Medicare, Medicare Advantage, Medicare Supplement, as well as privacy and security laws; the Company’s ability to attract, hire, or retain key personnel or other qualified employees and to control labor costs; the effectiveness of the reorganization of the Company’s business and its ability to realize the anticipated benefits thereof; the Company’s ability to effectively compete against other entities, whose financial, research, staff, and marketing resources may exceed its resources; the impact of legal proceedings involving the Company and/or its subsidiaries, including any claims related to intellectual property rights; the Company’s ability to enforce its intellectual property rights; the risks associated with deriving a significant concentration of the Company’s revenues from a limited number of its Healthcare segment customers, many of whom are Cautionary Note on Forward-Looking Statements

Cautionary Note on Forward-Looking Statements health plans; the Company’s ability and/or the ability of its Healthcare segment customers to enroll participants and to accurately forecast their level of enrollment and participation in the Company’s programs in a manner and within the timeframe anticipated by the Company; the Company’s ability to sign, renew and/or maintain contracts with the Company’s Healthcare segment customers and/or its partner locations under existing terms or restructure these contracts on terms that would not have a material negative impact on the Company’s results of operations; the ability of the Company’s Healthcare segment customers to maintain the number of covered lives enrolled in the plans during the terms of the Company’s agreements; the impact of severe or adverse weather conditions and the potential emergence of a health pandemic or an infectious disease outbreak on member participation in the Company’s Healthcare segment programs; the impact of healthcare reform on the Company’s business; the effectiveness of the Company’s marketing and advertising programs; loss, or disruption in the business, of any of the Company’s food suppliers or its fulfillment provider, or disruptions in the shipping of the Company’s food products for its Nutrition segment; the impact of any claims that the Company’s Nutrition segment personnel are unqualified to provide proper weight loss advice; the impact of health or advertising related claims by the Company’s Nutrition segment customers; competition from other weight management industry participants or the development of more effective or more favorably perceived weight management methods; loss of any of the Company’s Nutrition segment third-party retailer agreements and any obligations associated with such loss; the Company’s ability to continue to develop innovative weight loss programs and enhance its existing programs, or the failure of the Company’s programs to continue to appeal to the market; the impact of claims from the Company’s Nutrition segment competitors regarding advertising or other marketing practices; the Company’s ability to develop and commercially introduce new products and services; the Company’s ability to receive referrals from existing Nutrition segment customers, a decline in which could adversely impact customer acquisition costs; failure to attract or negative publicity with respect to any of the Company’s spokespersons; the Company’s ability to anticipate change and respond to emerging trends for customer preferences and the impact of the same on demand for the Company’s services and products; negative publicity with respect to the weight loss industry; the impact of increased governmental regulation on the Company’s Nutrition segment; claims arising from the sale of ingested products; and other risks detailed in the Company’s filings with the Securities and Exchange Commission. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to the Company’s filings with the SEC. Except as required by law, the Company undertakes no obligation to update any such forward-looking statements to reflect new information, subsequent events or circumstances.

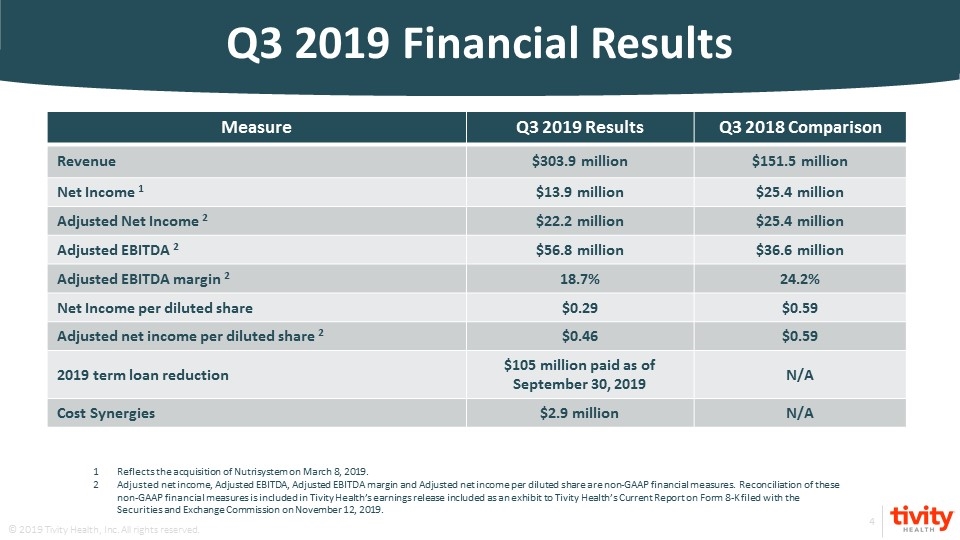

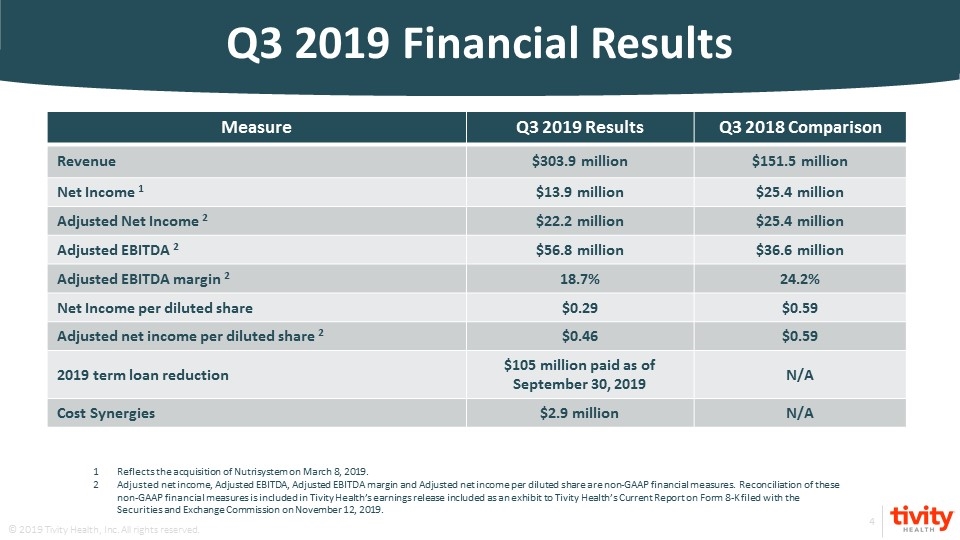

Measure Q3 2019 Results Q3 2018 Comparison Revenue $303.9 million $151.5 million Net Income 1 $13.9 million $25.4 million Adjusted Net Income 2 $22.2 million $25.4 million Adjusted EBITDA 2 $56.8 million $36.6 million Adjusted EBITDA margin 2 18.7% 24.2% Net Income per diluted share $0.29 $0.59 Adjusted net income per diluted share 2 $0.46 $0.59 2019 term loan reduction $105 million paid as of September 30, 2019 N/A Cost Synergies $2.9 million N/A Q3 2019 Financial Results Reflects the acquisition of Nutrisystem on March 8, 2019. Adjusted net income, Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income per diluted share are non-GAAP financial measures. Reconciliation of these non-GAAP financial measures is included in Tivity Health’s earnings release included as an exhibit to Tivity Health’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 12, 2019.

Enterprise Investment Highlights & Updates Reaffirms 2019 Financial Guidance Continued Strong Free Cash Flow Resulting in Debt Paydown Ahead of Schedule On Plan to Achieve Cost Synergies. Revenue Synergies are Progressing Enterprise Level Social Determinants of Health We believe the healthcare system has an increasing interest in addressing the Social Determinants of Health as a way to decrease costs and improve health We believe Tivity Health has a great platform to address the following three critical areas for our health plan partners, members and caregivers: Physical Inactivity Social Isolation / Loneliness, and Nutrition Our holistic approach encompasses nutritional intervention, physical activity, community engagement and behavior modification We are leveraging this platform and approach to become a collaborative partner in managing “health” and not sick care Tivity Health signed two small Post-Discharge Meal Delivery contracts and two pilots

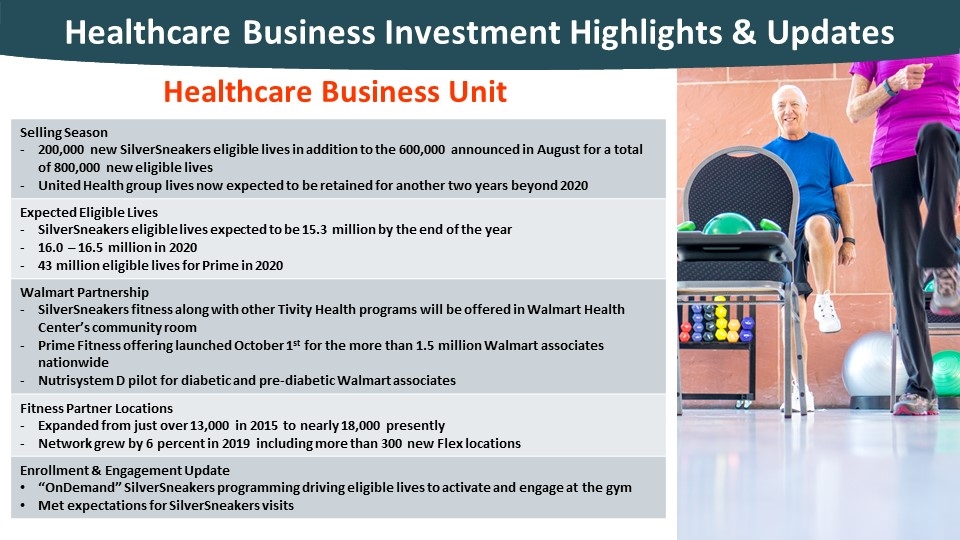

Healthcare Business Unit Healthcare Business Investment Highlights & Updates Selling Season 200,000 new SilverSneakers eligible lives in addition to the 600,000 announced in August for a total of 800,000 new eligible lives United Health group lives now expected to be retained for another two years beyond 2020 Expected Eligible Lives SilverSneakers eligible lives expected to be 15.3 million by the end of the year 16.0 – 16.5 million in 2020 43 million eligible lives for Prime in 2020 Walmart Partnership SilverSneakers fitness along with other Tivity Health programs will be offered in Walmart Health Center’s community room Prime Fitness offering launched October 1st for the more than 1.5 million Walmart associates nationwide Nutrisystem D pilot for diabetic and pre-diabetic Walmart associates Fitness Partner Locations Expanded from just over 13,000 in 2015 to nearly 18,000 presently Network grew by 6 percent in 2019 including more than 300 new Flex locations Enrollment & Engagement Update “OnDemand” SilverSneakers programming driving eligible lives to activate and engage at the gym Met expectations for SilverSneakers visits

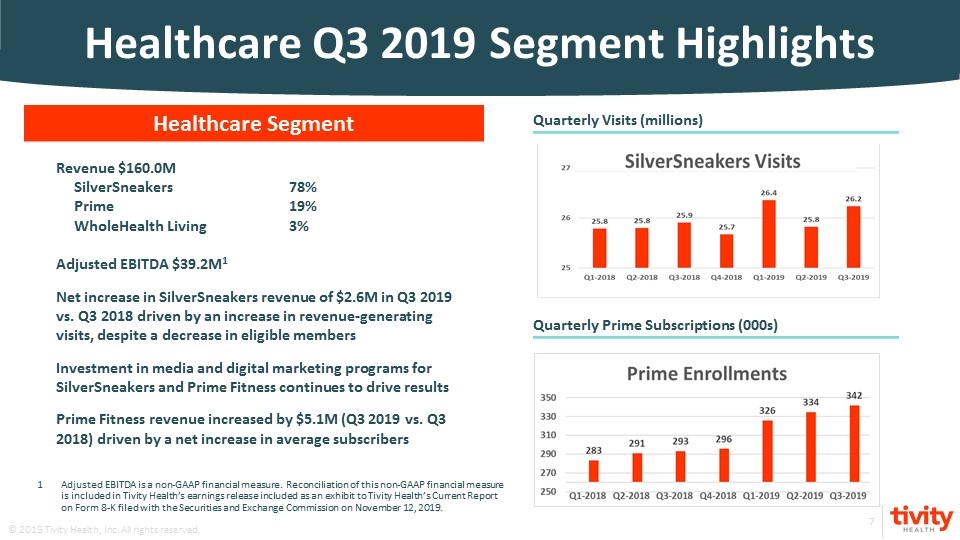

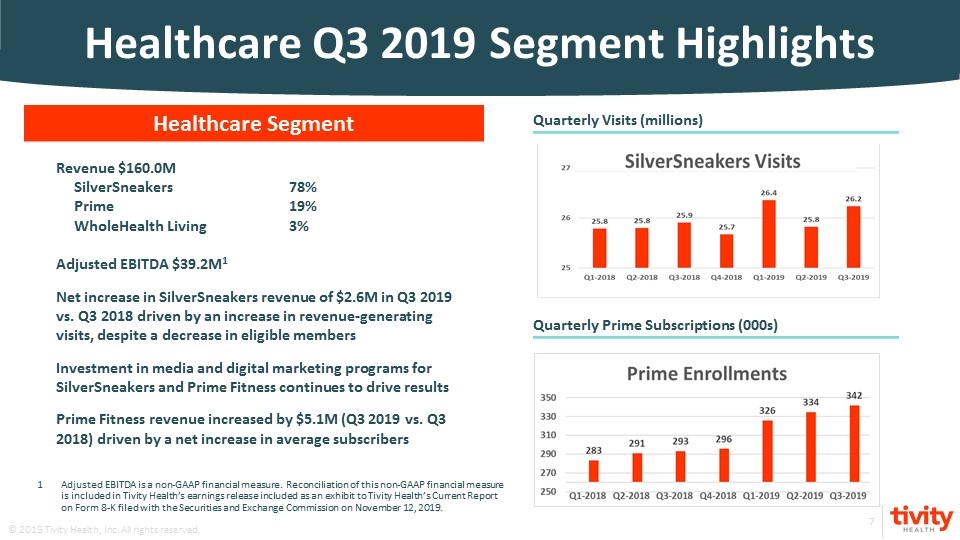

Healthcare Segment Healthcare Q3 2019 Segment Highlights Revenue $160.0M SilverSneakers 78% Prime19% WholeHealth Living3% Adjusted EBITDA $39.2M1 Net increase in SilverSneakers revenue of $2.6M in Q3 2019 vs. Q3 2018 driven by an increase in revenue-generating visits, despite a decrease in eligible members Investment in media and digital marketing programs for SilverSneakers and Prime Fitness continues to drive results Prime Fitness revenue increased by $5.1M (Q3 2019 vs. Q3 2018) driven by a net increase in average subscribers Quarterly Visits (millions) Quarterly Prime Subscriptions (000s) Adjusted EBITDA is a non-GAAP financial measure. Reconciliation of this non-GAAP financial measure is included in Tivity Health’s earnings release included as an exhibit to Tivity Health’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 12, 2019.

Nutrition Business Unit Nutrition Business Investment Highlights & Updates Two-Pronged Strategy (O-E) Optimization of the Core – executing on a comprehensive plan for 2020 Diet Season Growth consisting of four major action areas: Drive Program Innovation Enhance Customer Engagement Technology Expand Digital Marketing Refine the Creative Messaging and Approach Expansion into New Channels – executing on the Following Key Areas: Post Discharge - launch of our new “Wisely Well” line of products in January (fully prepared meals that are nutrient-dense and made to not only satisfy hunger, but to nurture and energize the body Eldercare Chronic Care Pilots with Humana and Walmart Direct Selling Model under review Eldercare / Caregiver – expanding Post-Discharge beyond 4 weeks

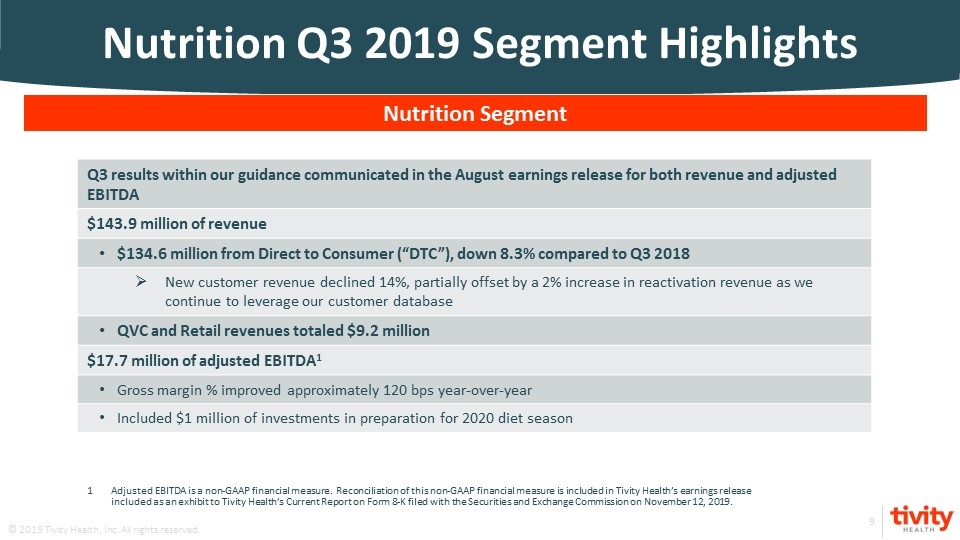

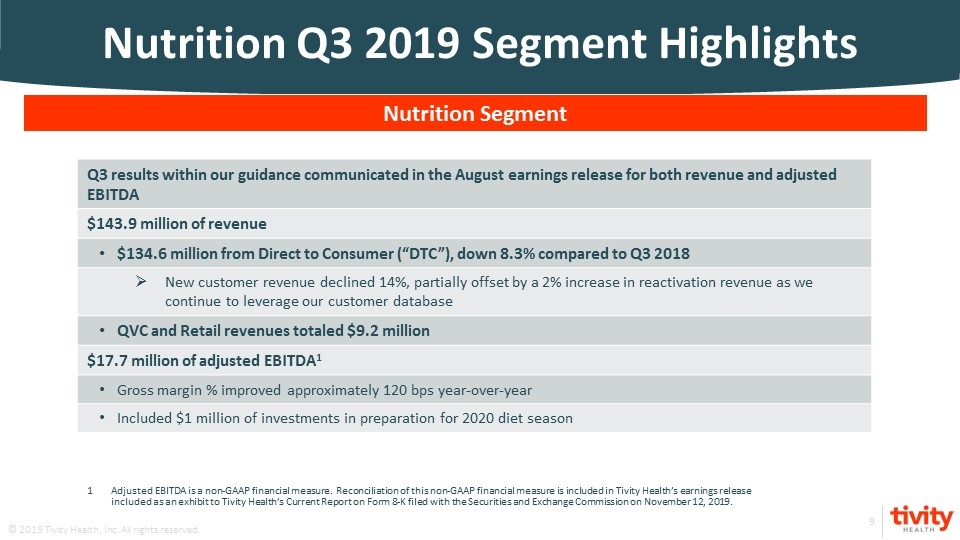

Nutrition Q3 2019 Segment Highlights Nutrition Segment Adjusted EBITDA is a non-GAAP financial measure. Reconciliation of this non-GAAP financial measure is included in Tivity Health’s earnings release included as an exhibit to Tivity Health’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 12, 2019. Q3 results within our guidance communicated in the August earnings release for both revenue and adjusted EBITDA $143.9 million of revenue $134.6 million from Direct to Consumer (“DTC”), down 8.3% compared to Q3 2018 New customer revenue declined 14%, partially offset by a 2% increase in reactivation revenue as we continue to leverage our customer database QVC and Retail revenues totaled $9.2 million $17.7 million of adjusted EBITDA1 Gross margin % improved approximately 120 bps year-over-year Included $1 million of investments in preparation for 2020 diet season

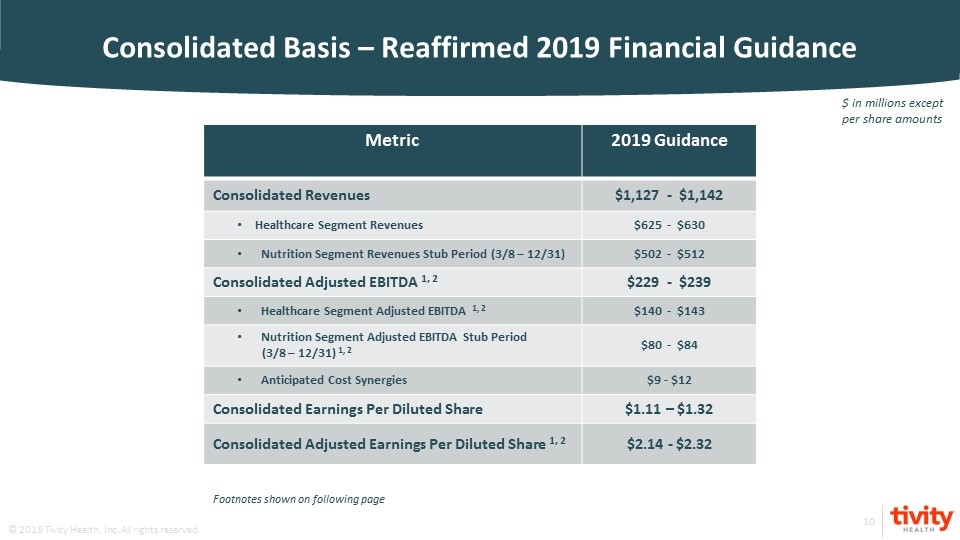

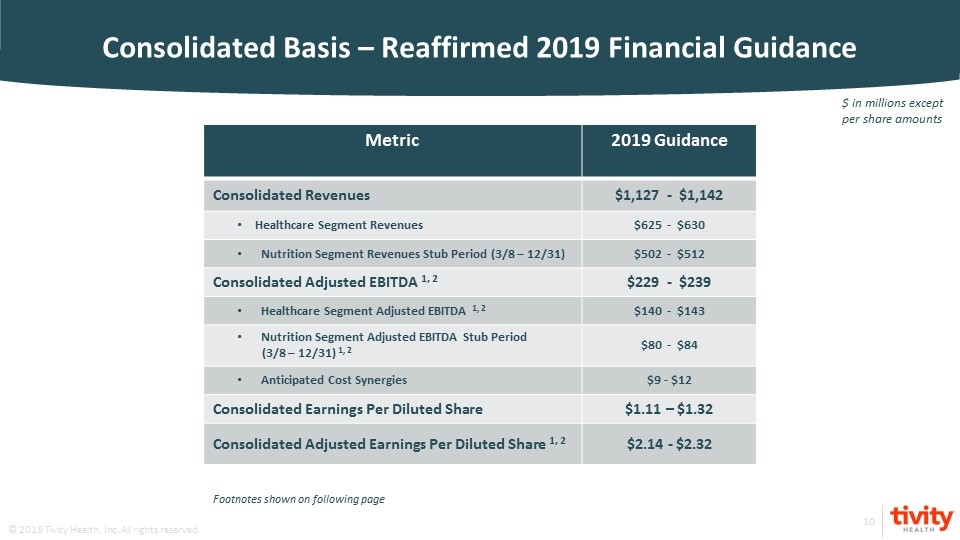

Consolidated Basis – Reaffirmed 2019 Financial Guidance Metric 2019 Guidance Consolidated Revenues $1,127 - $1,142 Healthcare Segment Revenues $625 - $630 Nutrition Segment Revenues Stub Period (3/8 – 12/31) $502 - $512 Consolidated Adjusted EBITDA 1, 2 $229 - $239 Healthcare Segment Adjusted EBITDA 1, 2 $140 - $143 Nutrition Segment Adjusted EBITDA Stub Period (3/8 – 12/31) 1, 2 $80 - $84 Anticipated Cost Synergies $9 - $12 Consolidated Earnings Per Diluted Share $1.11 – $1.32 Consolidated Adjusted Earnings Per Diluted Share 1, 2 $2.14 - $2.32 Footnotes shown on following page $ in millions except per share amounts

Consolidated Basis – Reaffirmed 2019 Financial Guidance Footnotes Adjusted EBITDA and Adjusted Earnings per Diluted Share are forward-looking non-GAAP financial measures. A reconciliation of Adjusted Earnings per Diluted Share guidance for the year ending December 31, 2019 to the comparable GAAP financial measure is included as an exhibit to Tivity Health’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 12, 2019. The Company does not provide a reconciliation of Adjusted EBITDA guidance to the most directly comparable GAAP financial measure because it is unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the financial impact of certain items. We believe Adjusted EBITDA and Adjusted Earnings per Diluted Share are useful measures of performance. You should not consider Adjusted EBITDA and Adjusted Earnings per Diluted Share in isolation or as a substitute for net income or Earnings per Diluted Share, respectively, in each case, determined in accordance with GAAP. Additionally, because Adjusted EBITDA and Adjusted Earnings per Diluted Share may be defined differently by other companies in the Company’s industry, the non-GAAP financial measures presented here may not be comparable to similarly titled measures of other companies.

Appendix

Nutrisystem Stand-Alone 2019 Full Year Review on a Stand-Alone Basis

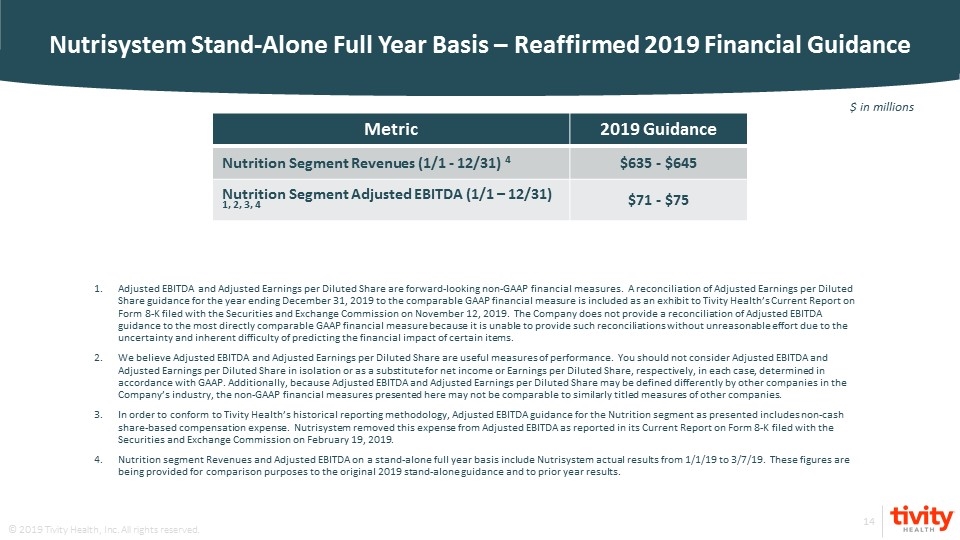

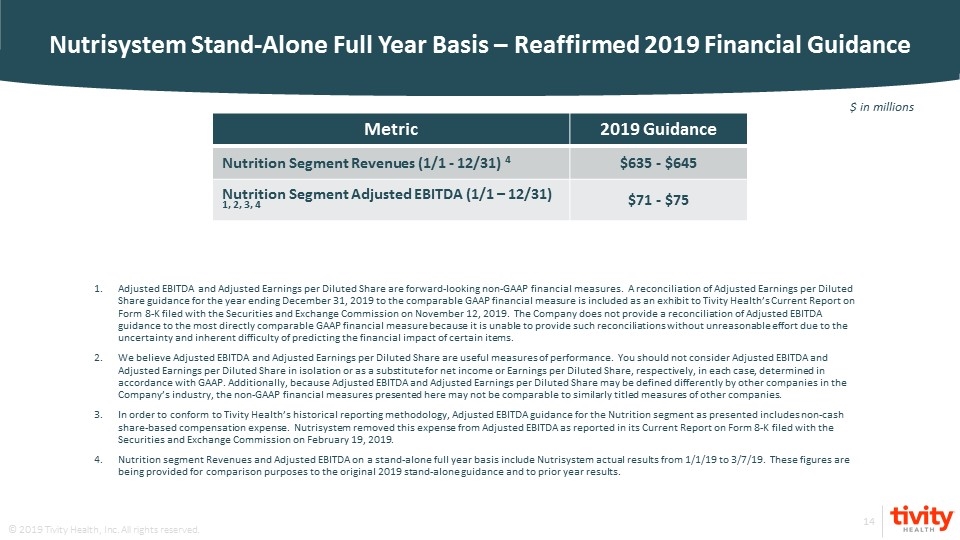

Nutrisystem Stand-Alone Full Year Basis – Reaffirmed 2019 Financial Guidance Metric 2019 Guidance Nutrition Segment Revenues (1/1 - 12/31) 4 $635 - $645 Nutrition Segment Adjusted EBITDA (1/1 – 12/31) 1, 2, 3, 4 $71 - $75 Adjusted EBITDA and Adjusted Earnings per Diluted Share are forward-looking non-GAAP financial measures. A reconciliation of Adjusted Earnings per Diluted Share guidance for the year ending December 31, 2019 to the comparable GAAP financial measure is included as an exhibit to Tivity Health’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 12, 2019. The Company does not provide a reconciliation of Adjusted EBITDA guidance to the most directly comparable GAAP financial measure because it is unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the financial impact of certain items. We believe Adjusted EBITDA and Adjusted Earnings per Diluted Share are useful measures of performance. You should not consider Adjusted EBITDA and Adjusted Earnings per Diluted Share in isolation or as a substitute for net income or Earnings per Diluted Share, respectively, in each case, determined in accordance with GAAP. Additionally, because Adjusted EBITDA and Adjusted Earnings per Diluted Share may be defined differently by other companies in the Company’s industry, the non-GAAP financial measures presented here may not be comparable to similarly titled measures of other companies. In order to conform to Tivity Health’s historical reporting methodology, Adjusted EBITDA guidance for the Nutrition segment as presented includes non-cash share-based compensation expense. Nutrisystem removed this expense from Adjusted EBITDA as reported in its Current Report on Form 8-K filed with the Securities and Exchange Commission on February 19, 2019. Nutrition segment Revenues and Adjusted EBITDA on a stand-alone full year basis include Nutrisystem actual results from 1/1/19 to 3/7/19. These figures are being provided for comparison purposes to the original 2019 stand-alone guidance and to prior year results. $ in millions