President and Chief Executive Officer Richard Ashworth J.P. Morgan Healthcare Conference NASDAQ: TVTY January 13, 2022 Exhibit 99.1

Cautionary Note on Forward-Looking Statements 2 Note on Forward-Looking Statements This communication contains certain statements that are “forward-looking” statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based upon current expectations and include all statements that are not historical statements of fact and those regarding the intent, belief or expectations, including, without limitation, statements that are accompanied by words such as “will,” “expect,” “outlook,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “would,” “target,” or other similar words, phrases or expressions and variations or negatives of these words. These forward-looking statements include, but are not limited to, the Company’s statements regarding its future financial performance. Readers of this press release should understand that these statements are not guarantees of performance or results. Many risks and uncertainties could affect actual results and cause them to vary materially from the forward-looking statements. These risks and uncertainties include, among other things: impacts from the COVID-19 pandemic (including the response of governmental authorities to combat and contain the pandemic, the closure of fitness centers in the Company’s national network (or operational restrictions imposed on such fitness centers), reclosures and potential additional reclosures as a result of surges in positive COVID-19 cases) on the Company’s business, operations or liquidity; the risks associated with changes in macroeconomic conditions (including the impacts of any recession or changes in consumer spending resulting from the COVID-19 pandemic), widespread epidemics, pandemics (such as the current COVID-19 pandemic, including variant strains of COVID-19) or other outbreaks of disease, geopolitical turmoil, and the continuing threat of domestic or international terrorism; the Company’s ability to collect accounts receivable from its customers and amounts due under its sublease agreements; the market’s acceptance of the Company’s new products and services; the Company’s ability to develop and implement effective strategies and to anticipate and respond to strategic changes, opportunities, and emerging trends in the Company’s industry and/or business, as well as to accurately forecast the related impact on the Company’s revenues and earnings; the impact of any impairment of the Company’s goodwill, intangible assets, or other long-term assets; changes in fair value of the Company’s investment in Sharecare and the expected timing and amount of cash proceeds from the disposition of this investment; the expected timing, amount, and impact of any share repurchases made by the Company; the Company’s ability to attract, hire, or retain key personnel or other qualified employees and to control labor costs; the effectiveness of the reorganization of the Company’s business and the Company’s ability to realize the anticipated benefits; the Company’s ability to effectively compete against other entities, whose financial, research, staff, and marketing resources may exceed its resources; the impact of legal proceedings involving the Company and/or its subsidiaries, products, or services, including any claims related to intellectual property rights, as well as the Company’s ability to maintain insurance coverage with respect to such legal proceedings and claims on terms that would be favorable to it; the impact of severe or adverse weather conditions, the current COVID-19 pandemic (including variant strains of COVID-19), and the potential emergence of additional health pandemics or infectious disease outbreaks on member participation in the Company’s programs; the risks associated with deriving a significant concentration of revenues from a limited number of the Company’s customers, many of whom are health plans; the Company’s ability and/or the ability of its customers to enroll participants and to accurately forecast their level of enrollment and participation in the Company’s programs in a manner and within the timeframe anticipated by the Company; the Company’s ability to sign, renew and/or maintain contracts with its customers and/or the Company’s fitness partner locations under existing terms or to restructure these contracts on terms that would not have a material negative impact on the Company’s results of operations; the ability of the Company’s health plan customers to maintain the number of covered lives enrolled in those health plans during the terms of the Company’s agreements; the Company’s ability to add and/or retain active subscribers in its Prime Fitness program; the impact of any changes in tax rates, enactment of new tax laws, revisions of tax regulations or any claims or litigation with taxing authorities; the impact of a reduction in Medicare Advantage health plan reimbursement rates or changes in plan design; the impact of any new or proposed legislation, regulations and interpretations relating to Medicare, Medicare Advantage, Medicare Supplement, and privacy and security laws; the impact of healthcare reform on the Company’s business; the risks associated with potential failures of the Company’s information systems or those of its third-party vendors, including as a result of telecommuting issues associated with personnel working remotely, which may include a failure to execute on policies and processes in a work-from-home or remote model; the risks associated with data privacy or security breaches, computer hacking, network penetration and other illegal intrusions of the Company’s information systems or those of third-party vendors or other service providers, including those risks that result from the increase in personnel working remotely, which may result in unauthorized access by third parties, loss, misappropriation, disclosure or corruption of customer, employee or the Company’s information, or other data subject to privacy laws and may lead to a disruption in the Company’s business, costs to modify, enhance, or remediate its cybersecurity measures, enforcement actions, fines or litigation against the Company, or damage to its business reputation;

Cautionary Note on Forward-Looking Statements 3 the risks associated with changes to traditional office-centered business processes and/or conducting operations out of the office in a work-from-home or remote model by the Company or its third-party vendors during adverse situations (e.g., during a crisis, disaster, or pandemic), which may result in additional costs and/or may negatively impact productivity and cause other disruptions to the Company’s business; the Company’s ability to enforce its intellectual property rights; the risk that the Company’s indebtedness may limit the Company’s ability to adapt to changes in the economy or market conditions, expose the Company to interest rate risk for the variable rate indebtedness and require a substantial portion of cash flows from operations to be dedicated to the payment of indebtedness; the Company’s ability to service its debt, make principal and interest payments as those payments become due, and remain in compliance with its debt covenants; the Company’s ability to obtain adequate financing to provide the capital that may be necessary to support its current or future operations; counterparty risk associated with the Company’s interest rate swap agreements; and other risks detailed in the Company’s filings with the Securities and Exchange Commission. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to the Company’s filings with the SEC. Except as required by law, the Company undertakes no obligation to update any such forward-looking statements to reflect new information, subsequent events or circumstances.

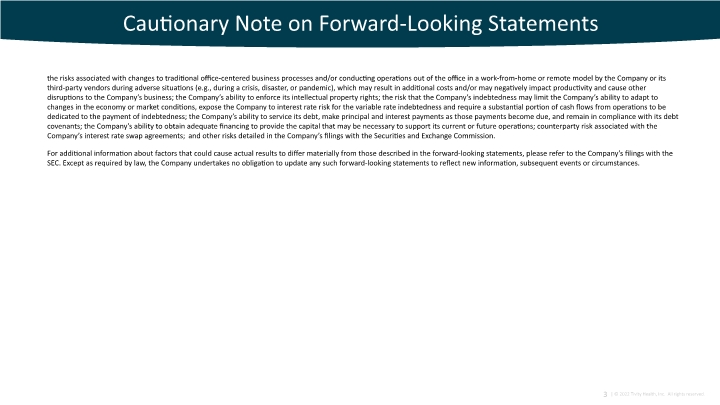

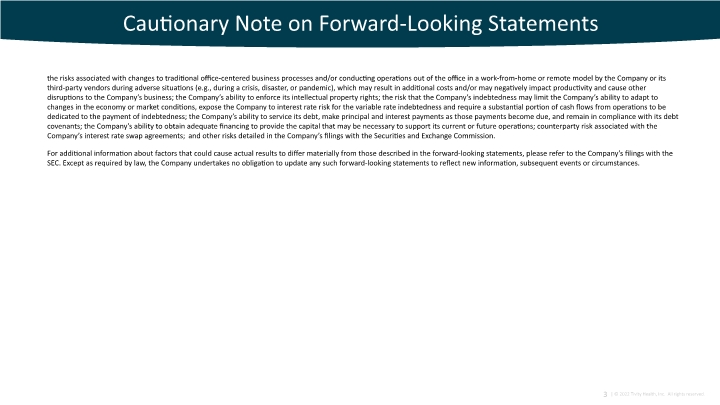

Trusted Brands, Loyal Members, Deep Relationships 4 Free cash flow guidance and adjusted EBITDA guidance are non-GAAP financial measures. See Appendix for a reconciliation of these measures. The Company's guidance as of November 2, 2021 does not include any potential impacts that may occur in the fourth quarter of 2021 from the Company's investment in Sharecare or from any share repurchases made by the Company. Leverage Ratio as of September 30, 2021 (as calculated under the Company’s credit agreement). Holistic wellness solutions The gold standard in senior fitness programs promoting physical and social well-being An affordable, convenient gym network benefit with ~12,500 gyms nationwide $475M – $485M 2021 Revenue Guidance 2.02x Leverage Ratio (2)

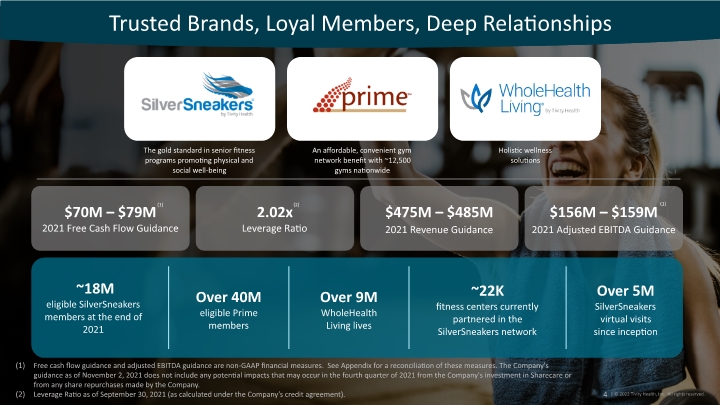

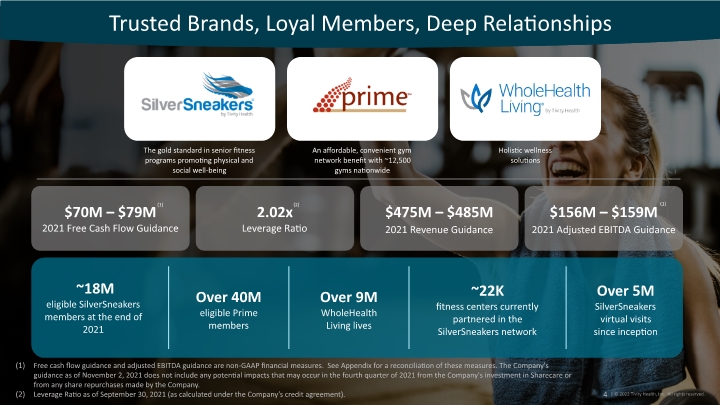

Tivity Health at a Glance 5 Based on publicly disclosed company guidance. Based on eligible lives as of September 30, 2021. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for a reconciliation of this measure. Leading fitness & health platform across Medicare Advantage, Medicare Supplement, and commercial plans, with 30+ year track record #1 market share in senior health & fitness, with 52% of 27M Medicare Advantage lives, and differentiated brand and member engagement 17-year average tenure of top 5 payor relationships (1) ’16A – ’19A CAGR: 8.1% (1) ’16A – ’19A CAGR: 10.2% ’16A – ’19A CAGR: 4.3% COVID Impacted (1) (2)

Investment Highlights 6 Tivity Health is Uniquely Positioned to Enable Healthier, Happier, More Connected Lives Unmatched Brand with Strong Portfolio of Core Assets Attractive Tailwinds from Strong Medicare Advantage Growth Value Proposition that Resonates with Members, Payors and Network Partners Expansive Digital Programming Opportunities Reaching More Members Strong Balance Sheet, Strong Cash Flow and Asset Light Model Strong Management Team

Unmatched Brand: Strong Core Assets 7 (1) 2021 poll conducted among a national sample of adults aged 65+ enrolled in Medicare Advantage.

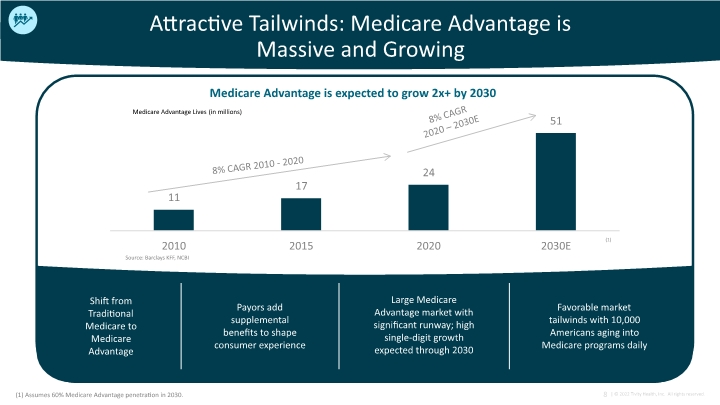

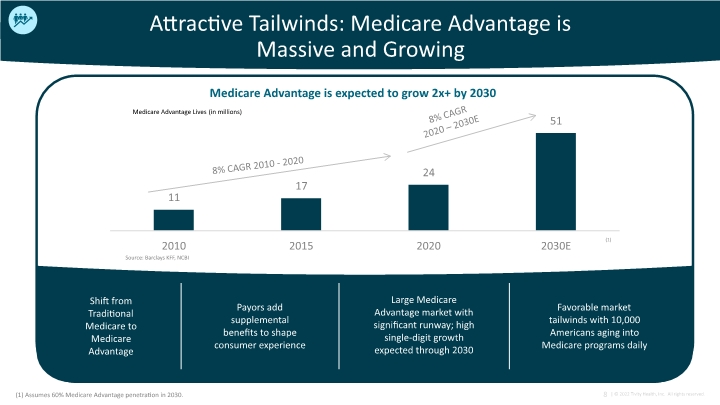

8 (1) Assumes 60% Medicare Advantage penetration in 2030. Medicare Advantage is expected to grow 2x+ by 2030 Source: Barclays KFF, NCBI Medicare Advantage Lives (in millions) 8% CAGR 2010 - 2020 (1) Attractive Tailwinds: Medicare Advantage is Massive and Growing

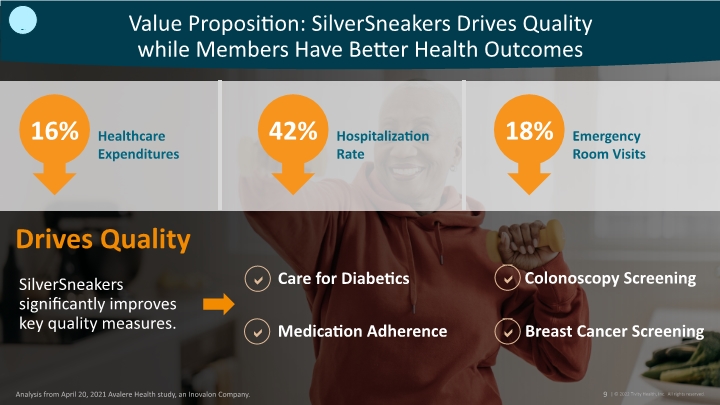

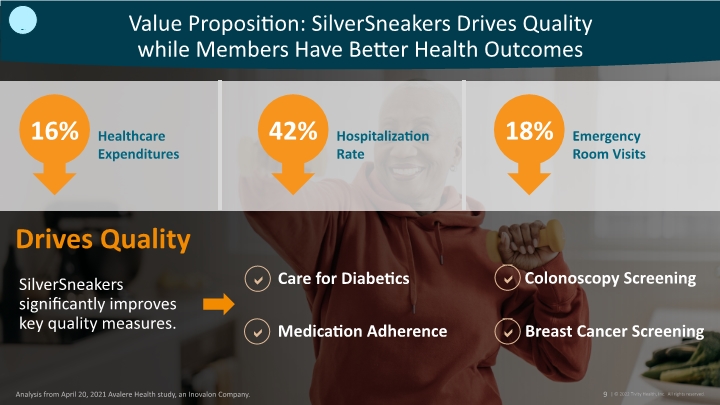

9 Analysis from April 20, 2021 Avalere Health study, an Inovalon Company. Healthcare Expenditures Drives Quality Value Proposition: SilverSneakers Drives Quality while Members Have Better Health Outcomes Emergency Room Visits Care for Diabetics SilverSneakers significantly improves key quality measures. Medication Adherence Colonoscopy Screening Breast Cancer Screening

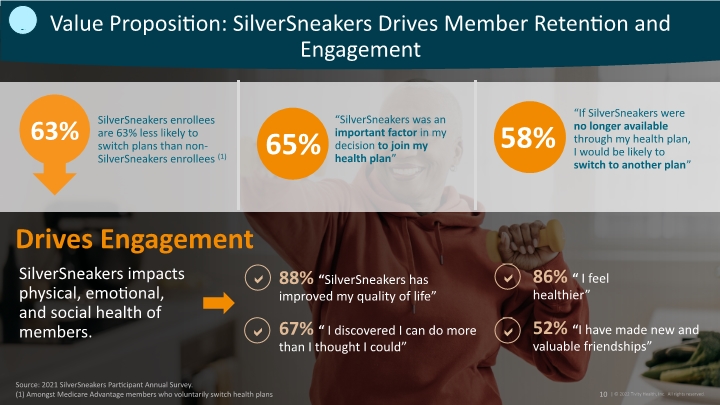

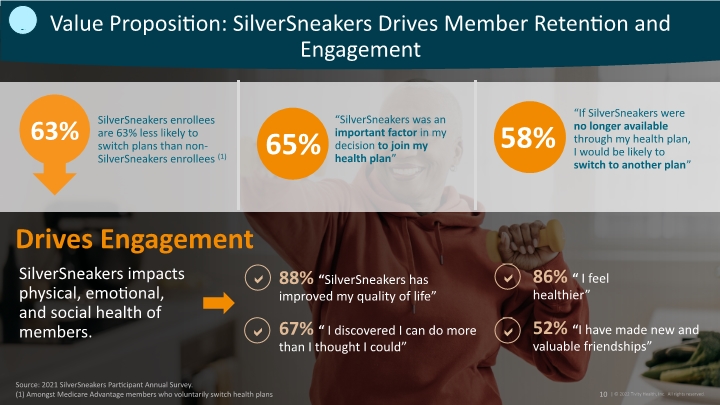

10 Source: 2021 SilverSneakers Participant Annual Survey. (1) Amongst Medicare Advantage members who voluntarily switch health plans Value Proposition: SilverSneakers Drives Member Retention and Engagement SilverSneakers enrollees are 63% less likely to switch plans than non-SilverSneakers enrollees (1) Drives Engagement 88% “SilverSneakers has improved my quality of life” 67% “ I discovered I can do more than I thought I could” 86% “ I feel healthier” 52% “I have made new and valuable friendships” SilverSneakers impacts physical, emotional, and social health of members.

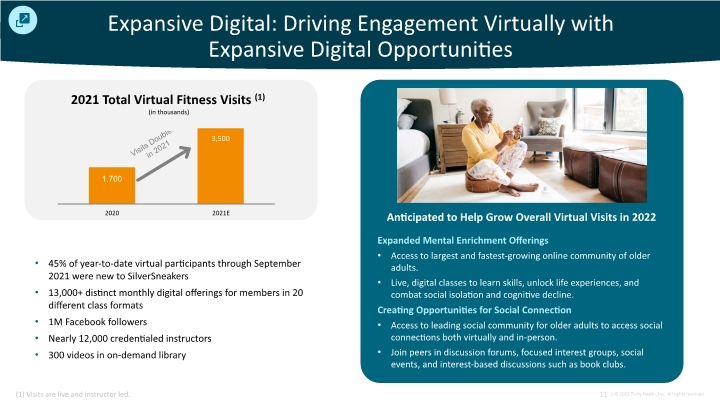

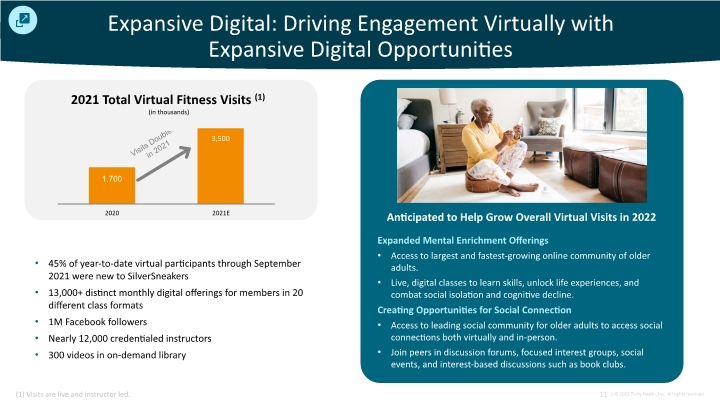

11 (1) Visits are live and instructor led. 45% of year-to-date virtual participants through September 2021 were new to SilverSneakers 13,000+ distinct monthly digital offerings for members in 20 different class formats 1M Facebook followers Nearly 12,000 credentialed instructors 300 videos in on-demand library 2021 Total Virtual Fitness Visits (1) (in thousands) Expansive Digital: Driving Engagement Virtually with Expansive Digital Opportunities Anticipated to Help Grow Overall Virtual Visits in 2022 Expanded Mental Enrichment Offerings Access to largest and fastest-growing online community of older adults. Live, digital classes to learn skills, unlock life experiences, and combat social isolation and cognitive decline. Creating Opportunities for Social Connection Access to leading social community for older adults to access social connections both virtually and in-person. Join peers in discussion forums, focused interest groups, social events, and interest-based discussions such as book clubs.

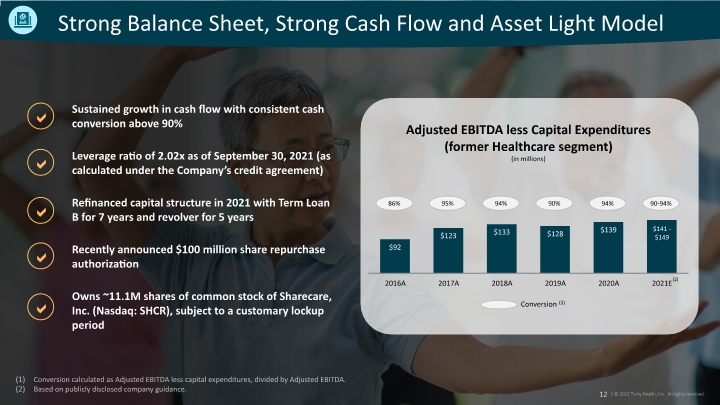

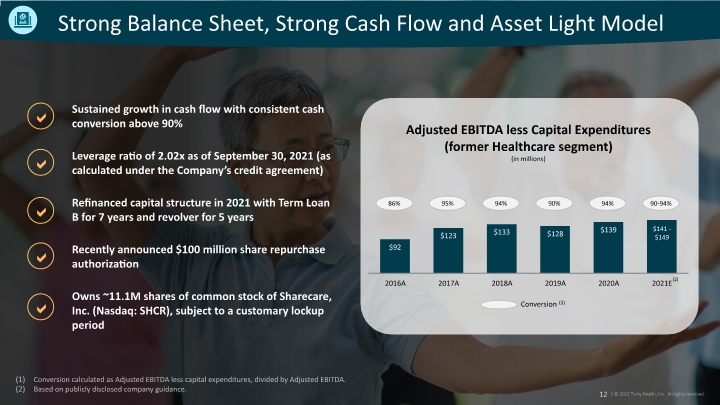

Strong Balance Sheet, Strong Cash Flow and Asset Light Model 12 Conversion calculated as Adjusted EBITDA less capital expenditures, divided by Adjusted EBITDA. Based on publicly disclosed company guidance. | © 2022 Tivity Health, Inc. All rights reserved.

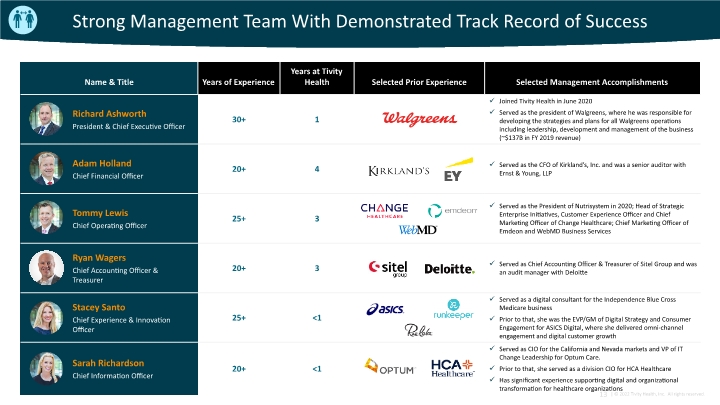

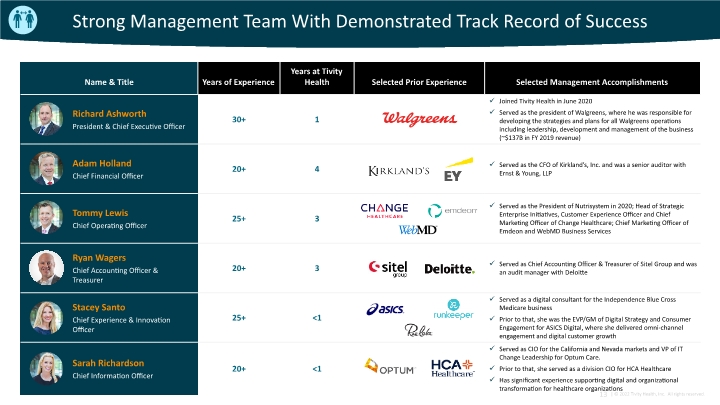

Strong Management Team With Demonstrated Track Record of Success 13

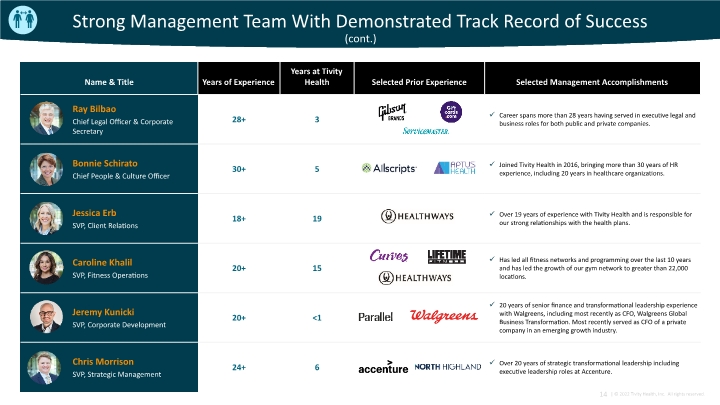

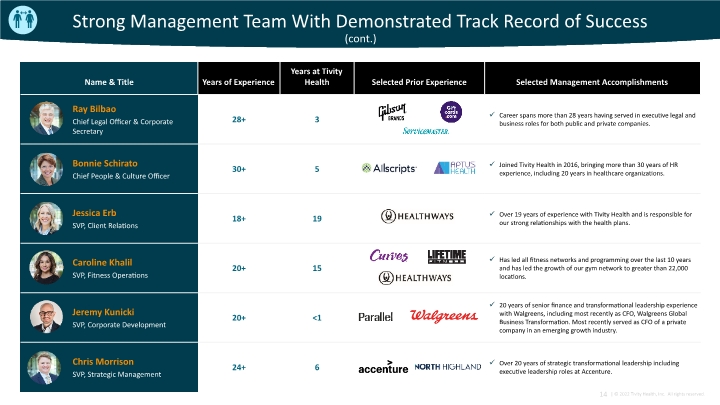

Strong Management Team With Demonstrated Track Record of Success (cont.) 14

Flagship Brands

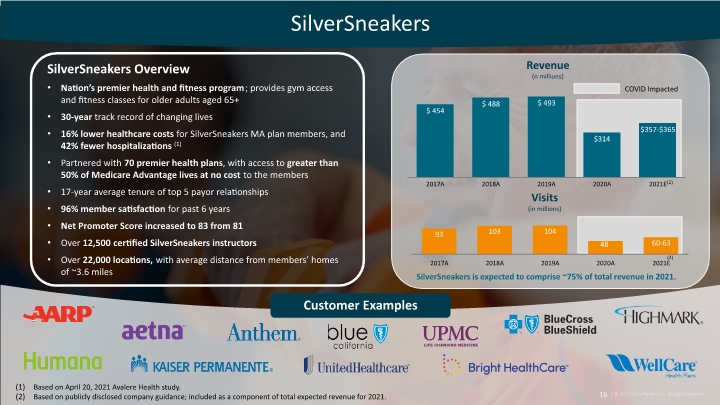

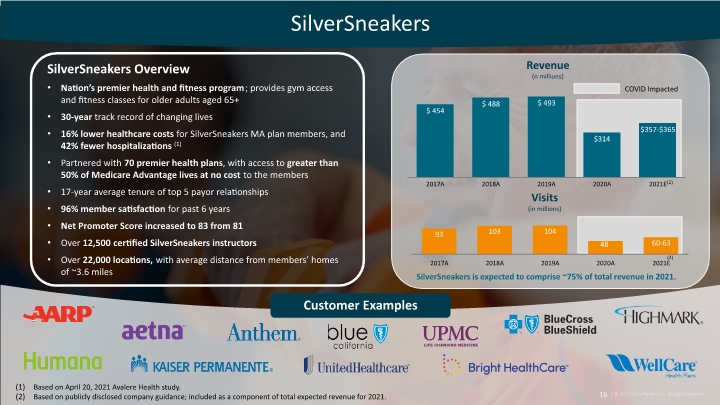

SilverSneakers Overview SilverSneakers 16 Based on April 20, 2021 Avalere Health study. Based on publicly disclosed company guidance; included as a component of total expected revenue for 2021. Nation’s premier health and fitness program; provides gym access and fitness classes for older adults aged 65+ 30-year track record of changing lives 16% lower healthcare costs for SilverSneakers MA plan members, and 42% fewer hospitalizations (1) Partnered with 70 premier health plans, with access to greater than 50% of Medicare Advantage lives at no cost to the members 17-year average tenure of top 5 payor relationships 96% member satisfaction for past 6 years Net Promoter Score increased to 83 from 81 Over 12,500 certified SilverSneakers instructors Over 22,000 locations, with average distance from members’ homes of ~3.6 miles Customer Examples SilverSneakers is expected to comprise ~75% of total revenue in 2021. Revenue (n millions) COVID Impacted (2) Visits (in millions) (2)

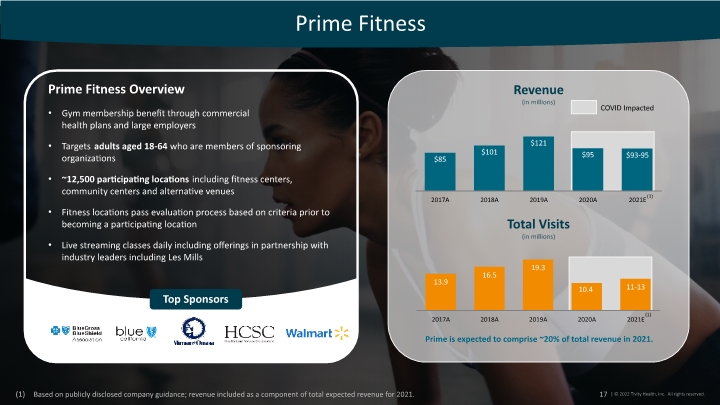

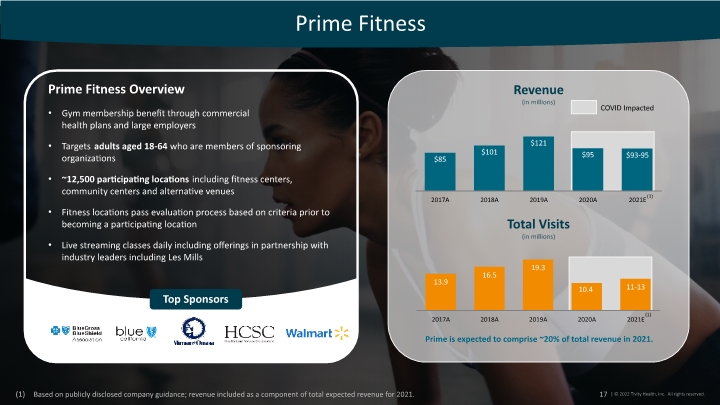

Prime Fitness 17 Gym membership benefit through commercial health plans and large employers Targets adults aged 18-64 who are members of sponsoring organizations ~12,500 participating locations including fitness centers, community centers and alternative venues Fitness locations pass evaluation process based on criteria prior to becoming a participating location Live streaming classes daily including offerings in partnership with industry leaders including Les Mills Prime Fitness Overview Top Sponsors Revenue (in millions) Total Visits (in millions) COVID Impacted Based on publicly disclosed company guidance; revenue included as a component of total expected revenue for 2021. (1) Prime is expected to comprise ~20% of total revenue in 2021.

2022 Priorities and Financial Drivers

Capital Allocation Priorities and 2022 Financial Drivers 19 Maintain Balance Sheet Strength & Flexibility Balance sheet strength with leverage ratio of 2.02x (as of September 30, 2021) and improved capital structure Invest in Growth Opportunities Prioritizing investment in organic growth Opportunities that accelerate enablement of healthier, happier, more connected lives Maximize Shareholder Returns Recently announced $100M share repurchase program Disciplined & Thoughtful Approach to Capital Allocation Deploying capital to drive greatest shareholder value We anticipate year-over-year increases in Total Revenue, Adjusted EBITDA and Free Cash Flow Driven by forecasted growth in SilverSneakers revenue through more eligible members, in-person visits and live virtual visits New non-fitness digital revenues are anticipated to contribute to our growth from driving participation in mental enrichment and social connection Growth in Prime revenue from a projected increase in net-new subscribers Free Cash Flow estimated to grow, including continued investment in our new strategic initiatives Full 2022 guidance will be provided in our February earnings announcement 2022 Financial Drivers

Mission, Vision and Strategic Pillars 20 Mission To empower people, communities and partners through a shared passion to improve health and support life’s journey Vision Healthier, happier, more connected lives

Embedded Video in Presentation 21 Video

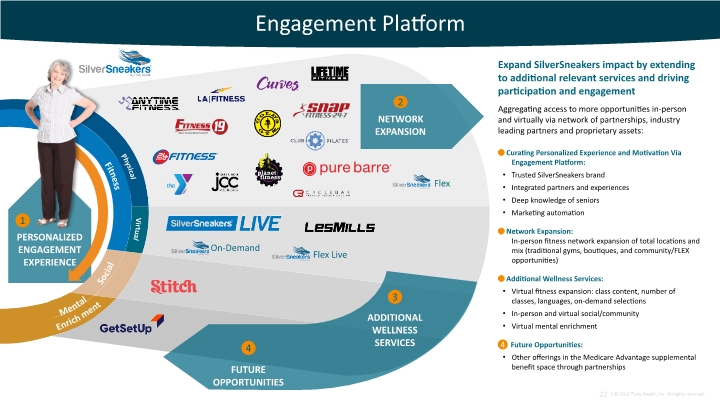

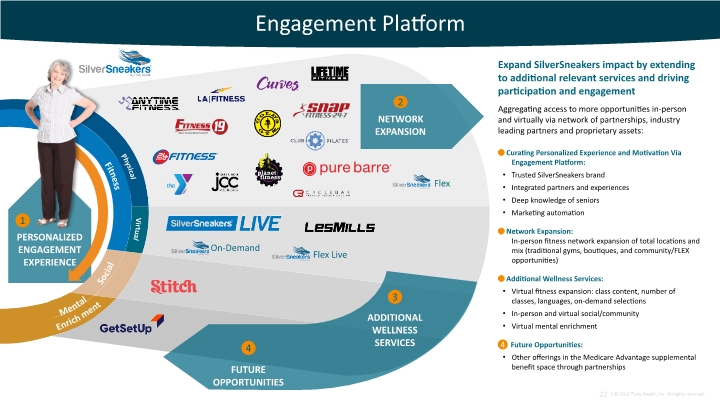

PERSONALIZED ENGAGEMENT EXPERIENCE 1 Engagement Platform 22 Fitness Mental Enrichment Social Physical Virtual Flex Flex Live On-Demand

Investment Highlights 23 Tivity Health is Uniquely Positioned to Enable Healthier, Happier, More Connected Lives Unmatched Brand with Strong Portfolio of Core Assets Attractive Tailwinds from Strong Medicare Advantage Growth Value Proposition that Resonates with Members, Payors and Network Partners Expansive Digital Programming Opportunities Reaching More Members Strong Balance Sheet, Strong Cash Flow and Asset Light Model Strong Management Team

Appendix

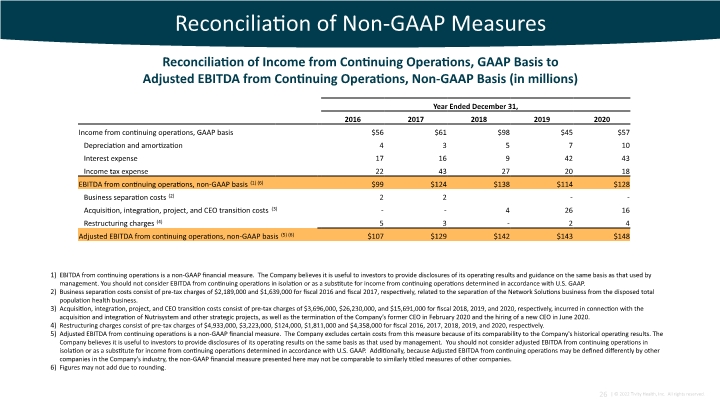

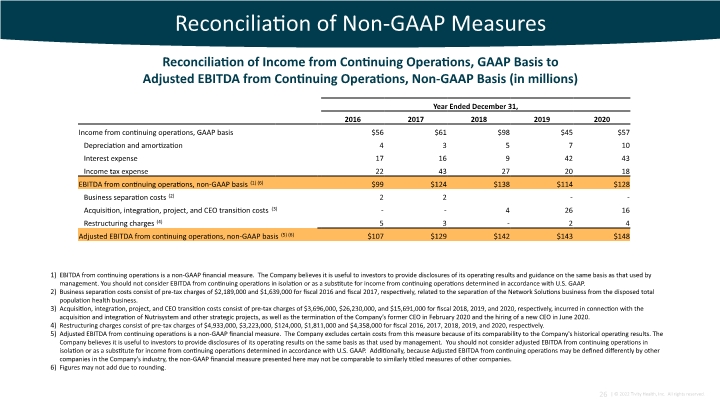

Reconciliation of Non-GAAP Measures Reconciliation of Income from Continuing Operations, GAAP Basis to Adjusted EBITDA from Continuing Operations, Non-GAAP Basis (in millions) 26 EBITDA from continuing operations is a non-GAAP financial measure. The Company believes it is useful to investors to provide disclosures of its operating results and guidance on the same basis as that used by management. You should not consider EBITDA from continuing operations in isolation or as a substitute for income from continuing operations determined in accordance with U.S. GAAP. Business separation costs consist of pre-tax charges of $2,189,000 and $1,639,000 for fiscal 2016 and fiscal 2017, respectively, related to the separation of the Network Solutions business from the disposed total population health business. Acquisition, integration, project, and CEO transition costs consist of pre-tax charges of $3,696,000, $26,230,000, and $15,691,000 for fiscal 2018, 2019, and 2020, respectively, incurred in connection with the acquisition and integration of Nutrisystem and other strategic projects, as well as the termination of the Company’s former CEO in February 2020 and the hiring of a new CEO in June 2020. Restructuring charges consist of pre-tax charges of $4,933,000, $3,223,000, $124,000, $1,811,000 and $4,358,000 for fiscal 2016, 2017, 2018, 2019, and 2020, respectively. Adjusted EBITDA from continuing operations is a non-GAAP financial measure. The Company excludes certain costs from this measure because of its comparability to the Company's historical operating results. The Company believes it is useful to investors to provide disclosures of its operating results on the same basis as that used by management. You should not consider adjusted EBITDA from continuing operations in isolation or as a substitute for income from continuing operations determined in accordance with U.S. GAAP. Additionally, because Adjusted EBITDA from continuing operations may be defined differently by other companies in the Company’s industry, the non-GAAP financial measure presented here may not be comparable to similarly titled measures of other companies. Figures may not add due to rounding.

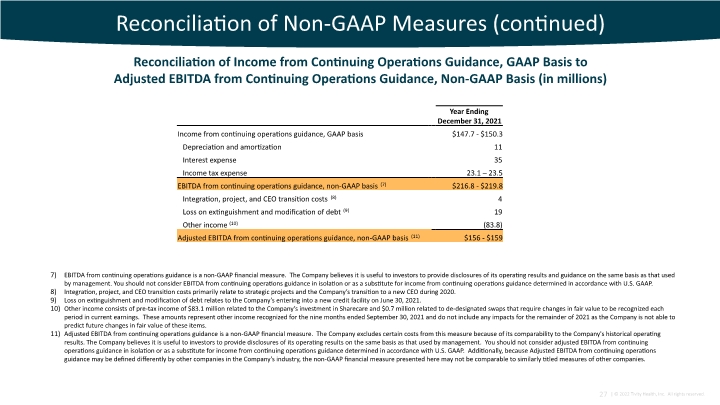

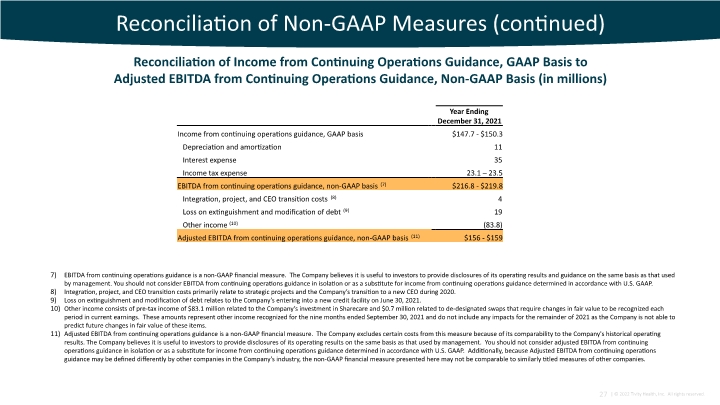

Reconciliation of Non-GAAP Measures (continued) Reconciliation of Income from Continuing Operations Guidance, GAAP Basis to Adjusted EBITDA from Continuing Operations Guidance, Non-GAAP Basis (in millions) 27 EBITDA from continuing operations guidance is a non-GAAP financial measure. The Company believes it is useful to investors to provide disclosures of its operating results and guidance on the same basis as that used by management. You should not consider EBITDA from continuing operations guidance in isolation or as a substitute for income from continuing operations guidance determined in accordance with U.S. GAAP. Integration, project, and CEO transition costs primarily relate to strategic projects and the Company’s transition to a new CEO during 2020. Loss on extinguishment and modification of debt relates to the Company’s entering into a new credit facility on June 30, 2021. Other income consists of pre-tax income of $83.1 million related to the Company’s investment in Sharecare and $0.7 million related to de-designated swaps that require changes in fair value to be recognized each period in current earnings. These amounts represent other income recognized for the nine months ended September 30, 2021 and do not include any impacts for the remainder of 2021 as the Company is not able to predict future changes in fair value of these items. Adjusted EBITDA from continuing operations guidance is a non-GAAP financial measure. The Company excludes certain costs from this measure because of its comparability to the Company's historical operating results. The Company believes it is useful to investors to provide disclosures of its operating results on the same basis as that used by management. You should not consider adjusted EBITDA from continuing operations guidance in isolation or as a substitute for income from continuing operations guidance determined in accordance with U.S. GAAP. Additionally, because Adjusted EBITDA from continuing operations guidance may be defined differently by other companies in the Company’s industry, the non-GAAP financial measure presented here may not be comparable to similarly titled measures of other companies.

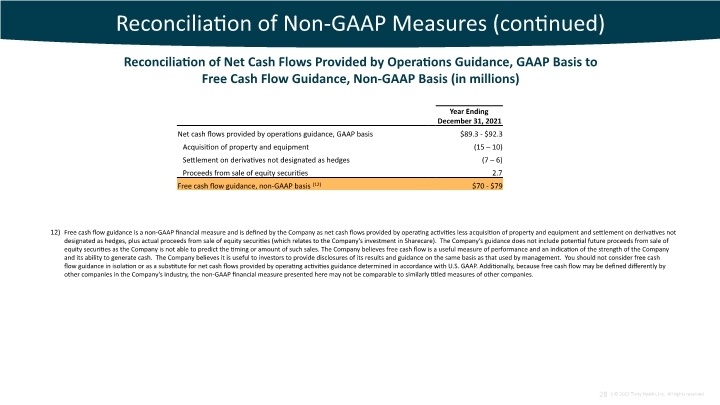

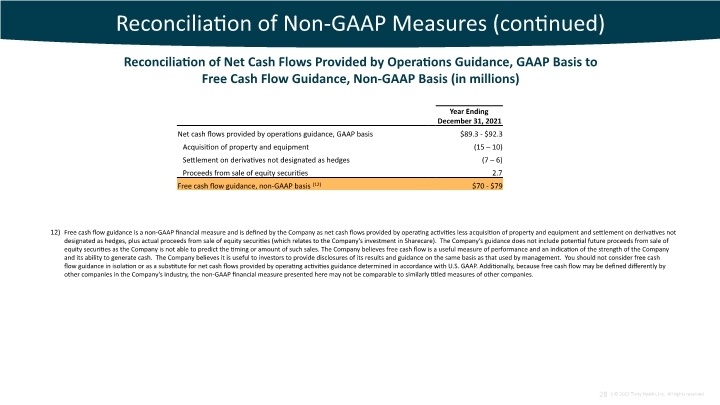

Reconciliation of Non-GAAP Measures (continued) Reconciliation of Net Cash Flows Provided by Operations Guidance, GAAP Basis to Free Cash Flow Guidance, Non-GAAP Basis (in millions) 28 Free cash flow guidance is a non-GAAP financial measure and is defined by the Company as net cash flows provided by operating activities less acquisition of property and equipment and settlement on derivatives not designated as hedges, plus actual proceeds from sale of equity securities (which relates to the Company’s investment in Sharecare). The Company’s guidance does not include potential future proceeds from sale of equity securities as the Company is not able to predict the timing or amount of such sales. The Company believes free cash flow is a useful measure of performance and an indication of the strength of the Company and its ability to generate cash. The Company believes it is useful to investors to provide disclosures of its results and guidance on the same basis as that used by management. You should not consider free cash flow guidance in isolation or as a substitute for net cash flows provided by operating activities guidance determined in accordance with U.S. GAAP. Additionally, because free cash flow may be defined differently by other companies in the Company’s industry, the non-GAAP financial measure presented here may not be comparable to similarly titled measures of other companies.