“Applicable Interest Rate” means interest, charged and compounded daily, at the rate of the lesser of (i) 0.0005% per day or (ii) the maximum rate permitted by Applicable Laws.

“Applicable Laws” mean all applicable laws, statutes, codes, ordinances, orders, zoning, rules, regulations, conditions of approval and requirements of all federal, state, county, municipal and governmental authorities and all administrative or judicial orders or decrees and all permits, licenses, approvals and other entitlements issued by governmental entities, and rules of common law, relating to or affecting the Project, the Premises or the Land or the use or operation thereof, whether now existing or hereafter enacted, including, without limitation, the ADA, Environmental Laws and CC&Rs.

“Base Rent” means the amounts set forth in the “Base Rent” Section of this Lease, charged monthly on or before the Lease Commencement Date and thereafter on the first day of each calendar month.

“CC&Rs” means any covenants, conditions and restrictions encumbering the Land and/or the Project or any supplement thereto recorded in any official or public records with respect to the Project or any portion thereof.

“Common Areas” means all areas and facilities at the Project, outside the Premises and premises leased to other tenants, including, if applicable, driveways, sidewalks, parking, loading and landscaped areas.

“Costs of Reletting” means the costs directly and reasonably incurred by Landlord to relet the Premises or a portion thereof, including brokers’ commissions, advertising, and repairs, alterations, improvements and concessions to obtain a new tenant.

“Environmental Laws” means all applicable present and future statutes, regulations, ordinances, rules, codes, judgments, orders or other similar enactments of any governmental authority or agency regulating or relating to health, safety, or environmental conditions on, in, under, or about the Premises or the environment, including without limitation, the following: the federal Comprehensive Environmental Response, Compensation and Liability Act; the federal Resource Conservation and Recovery Act, the federal Clean Air Act; the federal Water Pollution Control Act; and all state and local counterparts thereto, and any regulations or policies promulgated or issued thereunder.

“Financials” means financial information certified by an officer of Tenant as being true and correct, including, but not limited to, (i) credit reports, (ii) tax returns, (iii) current, accurate, audited financial statements for Tenant and Tenant’s business, and (iv) unaudited financial statements (which shall at least include a balance sheet, an income statement and a statement of cash flow) for Tenant and Tenant’s business for each of the 3 years prior to the current financial statement year prepared under generally accepted accounting principles consistently applied.

“Force Majeure” means any strike, act of God, war, terrorist act, shortage of labor or materials, governmental action or orders, civil commotion, epidemic, pandemic, public health emergency or other cause beyond a party’s reasonable control.

“Hazardous Materials” means any substance, material, waste, pollutant, or contaminant listed or defined as hazardous, toxic or dangerous under any Environmental Laws, including asbestos, asbestos containing materials, polychlorinated, per- and polyfluoroalkyl substances, and petroleum, including crude oil or any fraction thereof, natural gas liquids, liquefied natural gas, or synthetic gas usable for fuel (or mixtures of natural gas and such synthetic gas) and explosives, flammables, or radioactive substances of any kind.

“HVAC System” means all heating ventilation, and air conditioning systems and equipment inside or exclusively serving the Premises.

A-2

“Indemnitees” means Landlord’s affiliated entities, and each of Landlord’s and Landlord’s affiliated entities’ respective trustees, members, managers, principals, beneficiaries, partners, directors, officers, employees, shareholders, Mortgagees, agents, contractors, representatives, successors and assigns.

“Land” means the parcel(s) of land on which the Building and other adjacent improvements and appurtenances owned by Landlord are located or situated.

“Lease Year” means the period from the Lease Commencement Date through the succeeding 12 full calendar months (provided, however, that, if the Lease Commencement Date does not occur on the first day of a calendar month, then the first Lease Year shall include the partial calendar month in which the Lease Commencement Date occurs and the succeeding 12 full calendar months) and each successive 12-month period thereafter during the Term.

“Legal Holiday” means any federal holiday or holiday recognized by the state in which the Premises are located.

“Losses” means any and all claims, judgments, causes of action, damages, obligations, penalties, fines, taxes, costs, liens, liabilities, losses, charges and expenses, including without limitation all attorneys’ fees and other professional fees.

“Maintain” or “Maintenance” means to provide such maintenance, repair and, to the extent necessary and appropriate, replacement, as may be needed to keep the subject property in good condition and repair.

“Mortgage” means all ground leases, master leases and all mortgages and deeds of trust or other lien or encumbrance which now or hereafter affect the Premises, the Building or the Project or Landlord’s interest therein (including any modifications, renewals or extensions thereof and all amendments thereto).

“Mortgagee” means the party having the benefit of a Mortgage.

“notice” means any and all notices, requests, demands, approvals and consents.

“Operating Expenses” means the total costs and expenses incurred, or sums paid, by Landlord in the ownership, operation, Maintenance and management of the Premises, the Building and the portion of the remainder of the Project allocable to the Building, including, but not limited to: (1) the charges for any utilities paid by Landlord pursuant to the “Utilities” Section of this Lease; (2) Landlord’s cost to Maintain the Premises, the Building and the portion of the remainder of the Project allocable to the Building, as set forth in “Repairs and Maintenance” Section of this Lease, including, but not limited to: (i) the non-structural portions of the improvements and roof; (ii) life safety systems; (iii) utility lines to the point of connection into the Premises or any other tenant’s leased premises; (iv) Systems not exclusively serving the Premises or any other tenant’s leased premises; and (v) the Common Areas, including, if applicable, driveways, sidewalks, parking, loading and landscaped areas, irrigation systems, storm water facilities and detention ponds; (3) Landlord’s costs for snow and ice removal, exterior pest control, exterior window cleaning, and the operation and Maintenance of exterior stair systems and sanitary lift stations; (4) the costs relating to the insurance maintained by Landlord as described in the “Insurance” Section of this Lease, including, without limitation, Landlord’s cost of any deductible or self-insurance retention; (5) costs of capital improvements or capital replacements made to or acquired for the Premises, Building, and the portion of the remainder of the Project allocable to the Building after the Lease Commencement Date, which capital costs, or an allocable portion thereof, shall be amortized over the period determined by Landlord, together with interest on the unamortized balance at 10%; (6) assessments, association fees and all other costs assessed or charged under the CC&Rs, if any, that are attributable to the Premises, the

A-3

Building and/or the portion of the remainder of the Project allocable to the Building in connection with any property owners or maintenance association or operator; (7) the cost to service and maintain the HVAC System; (8) the wages, salaries, and benefits of persons (excluding executive personnel of Landlord or manager and personnel to the extent engaged in the development and/or leasing of the Premises, the Building and/or the portion of the remainder of the Project allocable to the Building) who provide management, repair, maintenance or access control, operational support, bookkeeping and accounting, and related services to the Premises, Building, and/or the Project; and (9) the cost of equipment, tools and materials used in connection with any of the foregoing, including accounting and/or property management software licenses. In addition, the Operating Expense to be allocated to Tenant under this Lease shall include a management fee not to exceed 4% of the Base Rent and Additional Rent for the Project to reimburse Landlord for expenses incurred to any third party or affiliate management company and/or for administration of the Project provided by Landlord. Operating Expenses shall not include: (1) repairs to the extent covered by insurance proceeds that are actually received by Landlord, or paid by Tenant or other third parties; (2) alterations solely attributable to tenants of the Project other than Tenant; (3) financing and refinancing costs (except as provided above), interest on debt or amortization payments on any mortgage, or rental under any ground or underlying lease; (4) leasing commissions, advertising expenses, tenant improvements or other costs directly related to the leasing of the Project; (5) the cost to Maintain the structural portions of the roof (i.e., joists and decking) and structural portion of exterior walls as set forth in the “Repair and Maintenance” Section of this Lease; (6) repairs or rebuilding necessitated by condemnation to the extent that Landlord has received condemnation proceeds for such repairs or rebuilding; (7) depreciation of the Building; (7) the salaries and benefits of executive officers of Landlord, if any, and any personnel above the level of property manager; (8) management fees in excess of four percent (4%) of gross receipts for the Project; (9) costs of providing any service to any other tenant of the Building which is not available to Tenant without an additional charge; (10) all legal, architectural, engineering, accounting and other professional fees unrelated to ownership, management, maintenance or operation of the Project; (11) sums paid by Landlord for any indemnity, damages, fines, late charges, penalties or interest for any late payment or to correct violations of building codes or other laws, regulations or ordinances applicable to the Building if such violations exist as of the Lease Commencement Date; (12) costs and expenses of removal or remediation of Hazardous Materials, provided that the costs of removing materials in the ordinary course of maintenance and repairs shall be included, even if such materials contain some level of Hazardous Materials (e.g., removing asphalt in connection with repairs to the driveways); (13) any ground lease rental; (14) the portion of any costs paid by Landlord to its subsidiaries or affiliates for goods and/or services in the Project, to the extent that such payment exceeds the costs of such goods and/or services if rendered by an unaffiliated third parties of similar skill and experience on a competitive basis; (15) any charitable or political contributions; and (16) Landlord’s general corporate overhead and general administrative expenses unrelated to ownership, management, maintenance or operation of the Project. In no event will Landlord be entitled to collect from all tenants of the Project more than one hundred percent (100%) of the total expenses for the calendar year in question. With respect to any Project with multiple buildings, Landlord will apportion among the Building and any other buildings at the Project any of the foregoing expenses not directly related to a particular building at the Project based on the relative rentable square feet of each.

“Proceeding for Debt Relief” means, with respect to Tenant or any guarantor of Tenant’s obligations hereunder, a case, proceeding or other action seeking to have an order for relief entered on its behalf as a debtor or to adjudicate it as bankrupt or insolvent, or seeking reorganization, arrangement, adjustment, liquidation, dissolution or composition of it or its debts or seeking appointment of a receiver, trustee, custodian or other similar official for it or for all or of any substantial part of its property.

“Rent” means Base Rent and all Additional Rent payable under this Lease.

A-4

“Rules and Regulations” means the rules and regulations of the Project as reasonably established by Landlord from time to time.

“SNDA” means a subordination, non-disturbance and attornment agreement.

“Systems” means any electrical, mechanical, plumbing, heating, ventilating, air conditioning, sprinkler, life safety or security systems serving the Building or Project.

“Taken” or “Taking” means acquisition by a public authority under governmental law, ordinance, or regulation, or by right of eminent domain, or by private purchase in lieu thereof.

“Taxes” means (a) all taxes, assessments, supplementary taxes, possessory interest taxes, levies, fees, exactions and other governmental charges, together with any interest, charges, and fees in connection therewith, which are assessed, levied, charged, conferred or imposed by any public authority upon the Premises, the Building, the portion of the remainder of the Project allocable to the Building, or any other improvements, fixtures, equipment or other property located at or on the Premises, the Building, or the portion of the remainder of the Project allocable to the Building, any excise, use, margin, transaction, sales or privilege taxes, assessments, levies or charges and other taxes assessed or imposed upon the rents payable to Landlord under this Lease (excluding net income taxes imposed on Landlord unless such net income taxes are in substitution for any Taxes payable hereunder), including but not limited to, gross receipts taxes, assessments for special improvement districts and building improvement districts, governmental charges, fees and assessments for police, fire, traffic mitigation or other governmental service of purported benefit to the Premises, Building, or the portion of the Project allocable to the Building, taxes and assessments levied in substitution or supplementation in whole or in part of any such taxes and assessments and the share of the Premises, Building and portion of the Project allocable to the Building of any real estate taxes and assessments under any reciprocal easement agreement, common area agreement or similar agreement as to the Premises, Building and the portion of the Project allocable to the Building, (b) all personal property taxes for property that is owned by Landlord and used in connection with the operation, maintenance and repair of the Premises, Building or the portion of the Project allocable to the Building, and (c) all costs and fees incurred in connection with seeking reductions in any tax liabilities described in (a) and (b), including, without limitation, any costs incurred by Landlord for compliance, review and appeal of tax liabilities. With respect to any Project with multiple buildings, Landlord will apportion among the Building and any other buildings at the Project any of the foregoing expenses not directly related to a particular building at the Project based on the relative rentable square feet of each.

“Tenant Party” or “Tenant’s Parties” means Tenant’s and Tenant’s affiliates’ employees, agents, customers, visitors, representatives, invitees, licensees, contractors, assignees or subtenants.

“Tenant Portal” means the online tenant portal described in Exhibit D, through which Landlord can deliver notices and communicate with Tenant, and Tenant can fulfill certain of its obligations under this Lease.

“Tenant’s Property” means all fixtures, furniture, equipment (including any racking and/or telecommunications, data and/or security equipment), merchandise, inventory, and all other personal property and other contents contained within the Premises whether installed in, or brought upon, the Premises by Tenant, a Tenant Party or Tenant’s assignees, subtenants or occupants.

“Term” means the period commencing on the Lease Commencement Date and ending on the Lease Expiration Date.

A-5

“Transfer” means (i) any assignment, transfer, pledge or other encumbrance of all or a portion of Tenant’s interest in this Lease, or (ii) any sublease, license or concession of all or a portion of Tenant’s interest in the Premises. If the entity(ies) which directly or indirectly controls the voting shares/rights of Tenant (other than through the ownership of voting securities listed on a recognized securities exchange) changes at any time, such change of ownership or control shall constitute a Transfer.

“Use” means having a right to possess, use, or occupy the Premises.

A-6

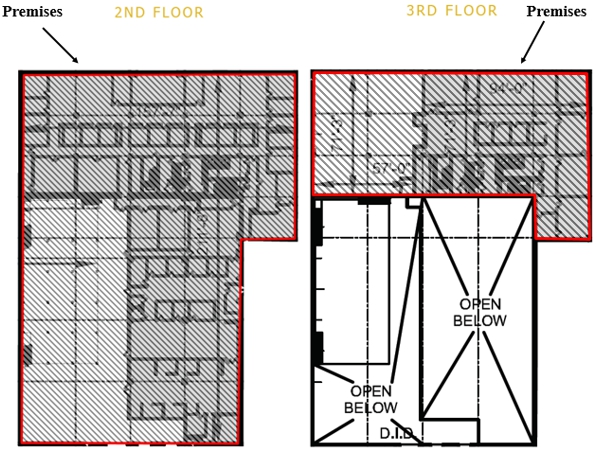

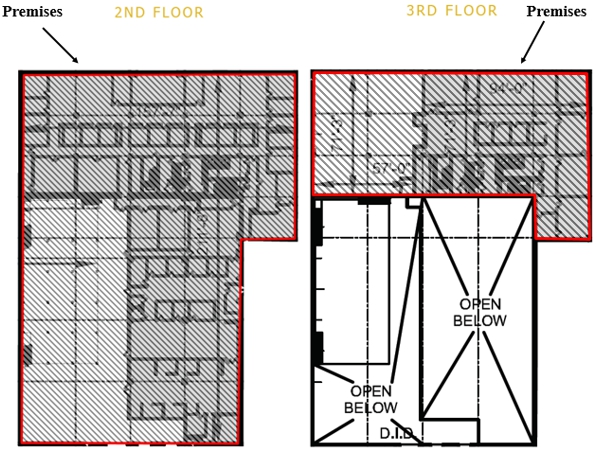

EXHIBIT B

PREMISES

The Premises occupy the space between the walls, and floor and ceiling, of the Building, as depicted below.

Tenant has right to the following use of Common Areas: up to 95 vehicular parking spaces, on a non-reserved basis, in the parking areas to the extent specifically set forth in this Lease and reasonable use of the driveways, sidewalks, and loading areas to gain access to the Premises, and the landscaped areas of the Project, subject to the Rules and Regulations set forth by Landlord from time to time.

Unless otherwise noted, Tenant’s right to use of Common Areas (a) is not exclusive and (b) shall be at all times subject to Landlord’s policies.

[remainder of page left blank]

B-1

EXHIBIT C

RULES AND REGULATIONS

Capitalized terms used but not defined herein shall have the meanings given in Tenant’s Lease.

1. Tenant will use the Premises in a careful, safe and proper manner and will not commit waste, overload the floor or structure or otherwise damage the Premises or Building. Tenant shall not permit any objectionable or unpleasant odors, smoke, dust, gas, noise, or vibrations to emanate from the Premises, or take any other action that would constitute a nuisance or would disturb, unreasonably interfere with, or endanger Landlord, Landlord’s performance of its obligations under the Lease or other leases with other tenants, or other tenants in the Building or Project. Tenant shall occupy the Premises in compliance with all Applicable Laws for the Premises or Project.

2. Tenant shall not impair in any way the fire safety system and shall comply with all safety, fire protection and evacuation procedures and regulations established by Landlord, any governmental agency or any insurance company insuring the Project, including without limitation the insurer’s fire protection impairment procedures. No person shall go on the roof without Landlord’s prior written permission.

3. Skylights, windows, doors and transoms shall not be covered or obstructed by Tenant, and Tenant shall not install any window covering which would affect the exterior appearance of the Building.

4. No antenna, aerial, discs, dishes or other such device shall be erected on the roof or exterior walls of the Premises, or on the grounds, without the written consent of the Landlord in each instance. Any device so installed without such written consent shall be subject to removal by Tenant, at Tenant’s sole cost and expense, without notice at any time. Tenant, at its sole cost and expense, shall repair any damage resulting from such removal and shall restore the Project to good order and condition.

5. No loud speakers, televisions, phonographs, radios or other devices shall be used in a manner so as to be heard or seen outside of the Premises without the prior written consent of the Landlord.

6. The outside areas immediately adjoining the Premises shall be kept clean and free from dirt and rubbish by the Tenant, including Tenant inventory, to the satisfaction of Landlord, and Tenant shall not place or permit any obstruction or materials in such areas or permit any work to be performed outside the Premises.

7. No open storage or auctions shall be permitted in the Project.

8. All garbage and refuse shall be placed in containers placed at the location designated for refuse collection, in the manner specified by Landlord. If Landlord consents to Tenant placing other containers, storage devices, construction dumpsters or similar vessels in the Project, Tenant must place plywood or other protective material under such items to protect the pavement or asphalt.

9. Tenant shall not disturb, solicit, or canvass any occupant of the Building and shall cooperate to prevent same.

10. Neither Tenant nor its agents, employees, contractors, guests or invitees shall smoke or permit smoking in the Common Areas, unless a portion of the Common Areas have been declared a designated smoking area by Landlord, nor shall the above parties allow smoke from the Premises to emanate into the Common Areas or any other part of the Project. Landlord shall have the right to designate the Project or Building (including the Premises) as a non-smoking building.

C-1

11. Unless otherwise directed by Landlord, Tenant shall have the right to park in common with other tenants of the Project in those areas designated by Landlord for non-reserved parking. Tenant shall comply with all parking regulations promulgated by Landlord from time to time for the orderly use of the vehicle parking area. Tenant agrees not to overburden the parking facilities and agrees to cooperate with Landlord and other tenants in the use of parking facilities. Landlord shall not be responsible for enforcing Tenant’s parking rights against any third parties. The parking spaces shall be used for parking by vehicles no larger than full-size passenger automobiles, SUVs or pick-up trucks (“Permitted Size Vehicles”). No vehicle or equipment shall remain upon the Common Area longer than 72 hours. Parked vehicles shall not be used for vending or any other business or other activity while parked in the parking areas. Tenant may store overnight in the normal course of its business one operative tractor/trailer or truck for each dock high loading position exclusive to the Premises, if any, provided this overnight storage does not interfere with other tenant’s use of the Building or Project. Vehicles other than Permitted Size Vehicles shall otherwise be parked and loaded or unloaded as directed by Landlord. Tenant shall not permit or allow any vehicles that belong to or are controlled by Tenant or Tenant’s employees, suppliers, shippers, customers, contractors or invitees to be loaded, unloaded, or parked in areas other than those designated by Landlord for such activities. If Tenant permits or allows any of the prohibited activities described in this Section, then Landlord shall have the right, without notice, in addition to such other rights and remedies that it may have, to remove or tow away the vehicle involved and charge the cost to Tenant, which cost shall be immediately payable upon demand by Landlord. No vehicle or equipment of any kind shall be dismantled or repaired or serviced on the Common Area. All vehicles entering or parking in the parking areas shall do so at owner’s sole risk and Landlord assumes no responsibility for any damage, destruction, vandalism or theft.

12. Tenant shall not use or keep on the Project or Premises (i) any matter having an offensive odor or which may negatively affect the indoor air quality of the Building, (ii) any explosive or highly flammable material (including any fuel source not provided by Landlord), or (iii) any form of hemp or marijuana or ingredient thereof (e.g., THC or CBD) or any product containing same; nor shall any animals other than handicap assistance dogs in the company of their handlers be brought into or kept in or about the Project.

13. Tenant assumes all responsibility for protecting the Premises from theft and vandalism; provided, however, Tenant shall not install additional locks upon any door of the Premises or permit any duplicate keys to be made, or retain any keys upon the Lease Expiration Date.

14. Tenant shall cause all Tenant Parties to comply with these Rules and Regulations.

15. Landlord shall not be responsible or liable to Tenant for the non-performance of any other tenant or occupant of the Building or Project of the Rules and Regulations or for any interference or disturbance of Tenant by any other tenant or occupant.

16. Landlord reserves the right to make such amendments to these Rules and Regulations from time to time that are not inconsistent with the Lease.

C-2

EXHIBIT D

PAYMENT INSTRUCTIONS AND TENANT PORTAL

Tenant must before, or promptly after, the Lease Commencement Date register with the Tenant Portal as indicated below. Tenant hereby consents to receive any written or other notice under this Lease through the Tenant Portal.

Tenant agrees to make any payments required under this Lease by one of the following methodologies:

1. Through the Tenant Portal, as described below.

2. By wire.

3. By check.

4. By ACH.

Landlord will provide Yardi enrollment instructions, address for payment of Rent by check, and wire instructions for payment of Rent by wire in a separate “welcome package” or other communication.

D-1

EXHIBIT E

MINIMUM SERVICE CONTRACT REQUIREMENTS

Service Contract. The Service Contract for the HVAC System required under the Lease must become effective within 30 days of Tenant’s occupancy of the Premises, and service visits must be performed on at least a quarterly basis unless otherwise agreed in writing by Landlord. The maintenance contract must include the following services:

1. Adjust belt tension;

2. Lubricate all moving parts, as necessary;

3. Inspect and adjust all temperature and safety controls;

4. Check refrigeration system for leaks and operation;

5. Check refrigeration system for moisture;

6. Inspect compressor oil level and crank case heaters;

7. Check head pressure, suction pressure and oil pressure;

8. Inspect air filters and replace when necessary;

9. Check space conditions;

10. Check condensate drains and drain pans and clean, if necessary;

11. Inspect and adjust all valves;

12. Check and adjust dampers; and

13. Run machine through complete cycle.

E-1

EXHIBIT F

MOVE OUT CONDITIONS

Notwithstanding anything to the contrary in this Lease, Tenant is obligated to check and address prior to move-out of the Premises the following items. The following list is designed to assist Tenant in the move-out procedures but is not intended to be all inclusive.

1. All lighting is to be placed into good working order, including, without limitation, replacement of bulbs, ballasts and lenses consistent with existing lighting, as needed.

2. All truck doors, dock levelers and pedestrian doors, are to be serviced and placed in good operating order. This includes the necessary replacement of any dented truck door panels and adjustment of door tension to insure proper operation. All door panels which are replaced are to be painted to match the Building standard.

3. All columns in the Premises are to be inspected for damage and Tenant shall be responsible for repairs to such structural columns resulting from damage caused by or attributable to Tenant and/or Tenant’s Parties.

4. HVAC Systems, including without limitation, warehouse heaters, industrial fans, exhaust and ventilation systems, air rotation units, and infrared tube heaters (if applicable), are to be placed in good working order, including the necessary replacement of any parts to return the HVAC System to a well-maintained condition. Upon move-out, Landlord will have an exit inspection performed by a certified mechanical contractor to determine the condition of the HVAC System.

5. All holes in the sheetrock walls of the Premises are to be repaired/painted prior to move-out, and all striping and markings on floor (including the warehouse floor) are to be removed in their entirety in a manner so as not to detrimentally affect the slab, which such removal methods and/or processes shall be subject to Landlord’s prior approval thereof.

6. The carpets and tiles are to be in a clean condition and not have any holes or chips in them. Landlord will accept reasonable wear and tear on these items provided they appear to be in a maintained condition.

7. The Premises is to be returned in a clean condition, including the cleaning of the offices, coffee bar, restroom areas, windows and other portions of the Premises.

8. The warehouse area of the Premises is to be in broom clean condition, free of debris and cobwebs, with all inventory and racking removed. There are to be no protrusion of anchors or bolts from the warehouse floor. All bolts, anchors or other devices used to attach or affix Tenant’s trade fixtures are to be removed, subject to Landlord’s prior written approval. If machinery/equipment is removed, the electrical lines are to be properly terminated at the nearest junction box.

9. All exterior windows with cracks or breakage are to be replaced, and all damaged window mullions are to be repaired or replaced, as necessary.

10. Tenant shall provide to Landlord the keys and passcodes for all locks on the Premises, including front doors, rear doors, and interior doors.

F-1

11. Except as otherwise agreed to in writing, it is expressly agreed that any and all telephonic, coaxial, ethernet, or other data, computer, word-processing, facsimile, cabling, or electronic wiring installed by Tenant in, on or about the Premises, including all lines above the office ceiling (collectively, “Wiring”) is to be removed in its entirety, at Tenant’s sole cost and expense. Tenant shall be responsible for any and all damages to the Premises caused by such removal.

12. All electrical systems are to be left in a safe condition that conforms to Applicable Laws. Bare wires and dangerous installations are to be corrected prior to move-out.

13. All plumbing fixtures are to be in good working order, including the water heater. Faucets and toilets are to be leak-free. Any sump pumps in the truck well shall be free of debris and operational.

14. All dock bumpers must be left in place and well secured.

15. All Tenant exterior and interior signs shall be removed and at a minimum, the wall surface shall be restored and painted to match the existing color, it being expressly understood that Tenant shall be responsible for any and all damages to the Premises, the Building or the Project caused by such signage removal.

16. All waste containers placed in or about the Premises or the Project by Tenant (including in the dock areas of the Premises) shall be removed and the areas related thereto returned in a clean and sanitary condition, free of debris.

17. Any and all roof penetrations caused by Tenant or any Tenant Party shall be resealed in a watertight condition.

F-2

EXHIBIT G

STATE LAW ADDENDUM

ISRA Compliance. (a) Tenant shall, at Tenant’s sole cost and expense, comply with the Industrial Site Recovery Act (N.J.S.A. 13:lK-6 et seq.), the regulations promulgated thereunder and any amending and successor legislation and regulations (collectively, “ISRA”). Tenant shall, at Tenant’s sole cost and expense, make all submissions to, provide all information to, and comply with all requirements of the·LSRP and the New Jersey Department of Environmental Protection or its successor (the “NJDEP”), as appropriate. Tenant’s obligations under this Exhibit G shall arise if there is a closing of operations, a transfer of ownership or operations, or a change in ownership at or affecting the Premises as defined in ISRA, whether triggered by Landlord or Tenant. Provided this Lease is not previously canceled or terminated by either party or by operation of law, Tenant shall commence any required submission to the NJDEP in anticipation of the end of the Term no later than one year prior to the expiration date of this Lease.

(b) For purposes of this Lease, “Environmental Documents” means, collectively, all environmental documentation concerning the Premises and soil and groundwater under or proximate to the Premises or any contaminant plume arising from the Premises, including, without limitation, all sampling plans, clean-up plans, Preliminary Assessment Reports, Site Investigation Workplans and Reports, Remedial Investigation Workplans and Reports, Remedial Action Workplans and Reports (all as defined in the Technical Requirements) or the equivalent, sampling results, sampling result reports, data, diagrams, charts, maps, analyses, conclusions, quality assurance/quality control documentation, correspondence to or from NJDJEP or any other municipal, county, state or federal governmental authority, submissions to NJDEP or any other municipal, county, state or federal governmental authority and directives, orders, approvals and disapprovals issued by NJDEP or any other municipal, county, state or federal governmental authority. During the Term and thereafter promptly after receipt by Tenant or Tenant’s representatives, Tenant shall deliver to Landlord all Environmental Documents concerning or generated by or on behalf of Tenant, whether currently or hereafter existing. Tenant shall notify Landlord in advance of all meetings scheduled between Tenant or Tenant’s representatives and NJDEP or any other environmental authority relating to Tenant’s obligations under this Exhibit G, and Landlord and Landlord’s representatives shall have the right, without the obligation, to attend and participate in all such meetings.

(c) At no expense to Landlord, upon any ISRA triggering event, Tenant shall promptly prepare and submit to NJDEP all applications and related forms and documentation which support any applicable ISRA exemption and provide copies thereof to Landlord.

(d) Should Tenant’s operations at the Premises be outside of those industrial operations covered by ISRA, Tenant shall, at Tenant’s sole cost and expense, submit to Landlord an opinion of counsel certifying the non-applicability of ISRA. Landlord retains the right to require Tenant to perform a Preliminary Assessment prior to the expiration date of this Lease. Should the Preliminary Assessment identify conditions that warrant further investigation, in Landlord’s opinion, Tenant shall hire a LSRP and consultant satisfactory to Landlord to undertake sampling at the Premises sufficient to determine whether Hazardous Materials exist or have been spilled, discharged or placed in, on, under or about the Premises during the Term. Tenant’s sampling shall also establish the integrity of all underground storage tanks at the Premises, if any. Should the sampling reveal any spill, discharge or placing of Hazardous Materials in, on, under or about the Premises by any person or entity other than Landlord or Landlord’s agents, then

G-1

and in such event, Tenant shall, at Tenant’s expense, prior to the expiration or earlier termination of the Term, promptly remediate the Premises in accordance with the terms and conditions of Section 15 of the Lease and this Exhibit G and to the satisfaction of Landlord and NJDEP.

(e) Should a Remedial Action Workplan be prepared and the remedial action described therein be undertaken because Hazardous Materials exist in concentrations which exceed any applicable threshold or limit in, on, under or about the Premises unless caused by Landlord or Landlord’s agents, employees or contactors), Tenant shall, at Tenant’s sole cost and expense, establish, as and when required, a remediation funding source. Tenant shall promptly implement the Remedial Action Workplan to the satisfaction of the LSRP, Landlord and, if required, NJDEP. In no event shall Tenant’s remedial action involve engineering or institutional controls, including, without limitation, capping, deed notice, declaration of restriction or other institutional control notice pursuant to P.L. 1993, c.139, and Tenant’s remedial action shall meet the most stringent NJDEP remediation standards for soil, surface water and groundwater. Promptly upon completion of all required investigatory and remedial activities, Tenant shall restore the affected areas of the Premises from any damage or condition caused by the work, including, without limitation, pursuant to applicable Environmental Requirements, the closing of any wells installed at the Premises and obtain a Response Action Outcome (“RAO”) from the LSRP or No Further Action Letter from NJDEP, whichever is applicable.

(f) If Tenant fails to submit to Landlord any of the following (any or all of such items described in clauses (i) through (iv) being sometimes hereinafter referred to as an “ISRA Clearance”): (i) a legal opinion of non-applicability as set forth in subparagraph (d) above; (ii) NJDEP approval of an applicable ISRA exemption; (iii) an unconditional sitewide RAO; or (iv) a No Further Action Letter/Covenant Not To Sue Letter from NJDEP; or fails to remediate the Premises pursuant to subsection (e) above prior to the expiration or earlier termination of the Lease, then upon the expiration or earlier termination of the Lease, Landlord shall have the option either to consider this Lease as having ended or to treat Tenant as a holdover tenant in possession of the Premises pursuant to Section 23 of this Lease. If Landlord considers this Lease as having ended, then Tenant shall nevertheless be obligated to promptly obtain ISRA Clearance or fulfill the obligations set forth in subsection (e) above, as the case may be, and shall execute a site access agreement acceptable to the Landlord and provide any insurance or other assurances required therein. Tenant shall remain responsible to address, at Tenant’s sole cost and expanse, any comments or requirements of NJDEP arising from an audit of the RAO or any document submitted by Tenant’s LSRP.

(g) Notwithstanding anything to the contrary set forth in this Lease, the Permitted Use shall be limited to operations having the following NAICS numbers: 339999. Except if and to the extent Tenant obtains Landlord’s prior written consent thereto (which prior written consent of Landlord may be withheld by Landlord in Landlord’s sole and absolute discretion) and Landlord and Tenant execute and deliver such amendments to this Lease relating thereto as shall be deemed necessary, in form and substance and in all other respects by Landlord, in Landlord’s sole and absolute discretion, Tenant shall make no use of the Premises other than for the Permitted Use and as prescribed by this subparagraph (g). Tenant’s obligations contained in this Lease shall survive the expiration or earlier termination of this Lease. Tenant’s failure to abide by the terms of this Exhibit G shall be restrainable by injunction.

G-2

EXHIBIT H

LANDLORD WORK

Landlord shall perform the following work in the Premises, at no additional cost to Tenant, using Building standard methods, materials and finishes (collectively, the “Landlord Work”): perform the work necessary to place the Premises in a broom clean condition, and place all mechanical equipment, loading doors, HVAC units, and lighting fixtures serving the Premises in good working order, failing which, Landlord shall, as Tenant’s sole and exclusive remedy, cause the same to be in such condition at no additional cost to Tenant. In addition, if any HVAC units serving the Premises require repairs or replacements during the first twelve (12) months of the initial Term (the “HVAC Warranty Period”), excluding any repairs or replacements necessitated by any negligent action or inaction of Tenant or a Tenant Party, Landlord shall make such required repairs or replacements to such items during such period, at no additional cost to Tenant. Tenant acknowledges that the Landlord Work may be performed by Landlord, in the Premises during normal business hours both prior and subsequent to the Lease Commencement Date. Landlord and Tenant agree to cooperate with each other in order to enable the Landlord Work to be performed in a timely manner and with as little inconvenience to the performance of the Tenant Work and the operation of Tenant’s business as is reasonably possible. Tenant acknowledges and agrees that it will be responsible, at its sole cost, for moving and protecting its furniture, fixtures, equipment and other personal property as may be necessary in connection with the performance of the Landlord Work, and Tenant shall coordinate the same with the contractor performing the Landlord Work. Notwithstanding anything contained herein or in the Lease to the contrary, Landlord shall not be obligated to perform the Landlord Work during the continuance of an uncured default by Tenant under the Lease, and any delay in the completion of the Landlord Work or inconvenience suffered by Tenant during the performance of the Landlord Work shall not delay the Lease Commencement Date nor shall it subject Landlord to any liability for any loss or damage resulting therefrom or entitle Tenant to any credit, abatement or adjustment of Rent or other sums payable under the Lease.

H-1

EXHIBIT I

TENANT WORK

1. Tenant Work; Completion by Tenant; Allowance.

(a) Tenant and its contractor(s), at Tenant’s sole cost and expense, shall complete improvements to the Premises in accordance with plans therefor, which are subject to Landlord’s approval, such approval not to be unreasonably withheld, delayed or conditioned, and subject to Tenant’s compliance with the “Alterations; Liens” Section of the Lease (the “Tenant Work”). The Tenant Work shall constitute Alterations for all purposes under the Lease, and Tenant shall comply with the terms of the “Alterations; Liens” Section of the Lease in performing the Tenant Work. Any approval by Landlord of the Tenant Work or the plans therefor shall not be a representation or warranty of Landlord that the Tenant Work or such plans are adequate for any use or comply with applicable insurance requirements, but shall merely be the consent of Landlord thereto. Tenant shall be responsible for all elements of the design of the Tenant Work (including without limitation, compliance with law, functionality of design, the structural integrity of the design, the configuration of the Premises and the placement of the Tenant’s Property). Tenant Work shall be performed in such a manner as to minimize any interference with other tenants of the Project. Tenant shall expeditiously, diligently and in good faith use its best efforts to cause the Tenant Work to be commenced promptly after the date of the Lease and to be completed promptly after the commencement thereof. Any warranties from Tenant’s contractor(s) shall be for the benefit of Landlord as well as Tenant and Tenant shall deliver such warranties to Landlord upon receipt.

(b) Provided Tenant is not then in default under the Lease, within 30 days after the later of (a) the Lease Commencement Date, or (b) the date of Landlord’s receipt of all of the Tenant Deliverables (as herein defined), Landlord shall reimburse Tenant for the cost therefor in an amount (the “Allowance”) equal to the lesser of (i) $219,875.00, or (ii) the reasonable, documented and out-of-pocket costs actually incurred by Tenant in connection with the construction of the Tenant Work (the “Tenant’s Cost”), provided Landlord will not reimburse for any furniture, equipment, phone or data cabling, security systems, moving costs, or other personal property. For purposes hereof, the “Tenant Deliverables” shall mean: (1) bona fide, third party invoices for the actual, out-of-pocket costs of constructing the Tenant Work; (2) full and final waivers of lien from all persons performing work or supplying or fabricating materials in connection with the Tenant Work fully executed and in recordable form; and (3) as-built plans of the Tenant Work. Landlord shall have no further obligations to pay for any costs incurred in connection with the Tenant Work. No reimbursement of the Allowance (hereinafter defined) shall be made by Landlord until Tenant has first paid to, as applicable, the general contractor, architects, engineers, and other consultants, from Tenant’s own funds (and provided reasonable evidence thereof to Landlord) the anticipated amount by which the Tenant’s Cost exceeds the amount of the Allowance. Notwithstanding the foregoing, if, on or before February 28, 2023, all Tenant Deliverables have not been submitted to Landlord then this subsection (b) shall be deemed terminated and of no further force or effect and Landlord shall have no obligation to reimburse Tenant as set forth herein.

(c) Tenant agrees to accept the Premises in its “as-is” condition and configuration, it being agreed that Landlord shall not be required to perform any work or incur any costs in connection with the construction or demolition of any improvements in the Premises, other than the Landlord Work as set forth in Exhibit H above and the payment of the Allowance subject to the conditions set forth above

I-1

EXHIBIT J

OPTION TO RENEW

1. Option to Renew.

(a) Provided that there then exists no Event of Default by Tenant under the Lease, nor any event that with the giving of notice and/or the passage of time would constitute an Event of Default, and that Tenant is the sole occupant of the Premises, Tenant shall have the right and option (the “Extension Option”) to extend the Term of this Lease for one additional period of sixty (60) months (the “Extension Period”), exercisable by giving Landlord prior written notice, no later than that date that is nine (9) months prior to the Lease Expiration Date, and no earlier than the date that is twelve (12) months prior to the Lease Expiration Date, of Tenant’s election to extend the Term; it being agreed that time is of the essence and that this option is personal to Tenant and is non-transferable to any assignee or sublessee other than to a Tenant Affiliate (regardless of whether any such assignment or sublease was made with or without Landlord’s consent) or other party. In the event a Tenant Affiliate assignee exercises an Extension Option set forth herein, Tenant shall remain liable under the Lease for all of the obligations of the tenant hereunder during such Extension Period, whether or not Tenant has consented to or is notified of such renewal and Landlord shall have no obligation to obtain the consent of Tenant or to notify Tenant of such renewal.

(b) Such Extension Period shall be under the same terms and conditions as provided in the Lease except as follows:

(i) the Extension Period shall begin on the day after the initial Lease Expiration Date and thereafter the Lease Expiration Date shall be deemed to be the last day of the Extension Period;

(ii) there shall be no further options to extend other than as set forth in paragraph (a) above; and

(iii) the Base Rent for the first year of the Extension Period shall be equal to the fair market rental value of the Premises (the “FMR”) as of the date the Tenant exercises its Extension Option.

(iv) the Base Rent for each year after the first year of the Extension Period shall be equal to the Base Rent payable during the preceding year, increased in accordance with the increases assumed in determination of the FMR.

(v) For avoidance of doubt, Landlord may update and charge Estimated Expenses as provided for in the Lease.

(c) In determining the FMR, Landlord shall take into account and make appropriate adjustments to reflect current market terms, conditions and concessions for similar renewal transactions in similar industrial buildings that are then generally available in the market where the Premises are located, including any other renewal transactions (and taking into account whether such terms, conditions and concessions are being made available by Landlord) as of the date Tenant exercises its Extension Option. Landlord can decide not to calculate the FMR, in which case the Base Rent for the first year of the Extension Period shall be equal to the Base Rent payable in the immediately preceding Lease Year increased by 3% per annum. In the alternative, within 15 days after Landlord receives notice of Tenant’s exercise of the Extension Option, Landlord will give notice to Tenant (the “FMR Notice”) of Landlord’s opinion of the FMR and comparing the FMR to the Base Rent payable in the immediately preceding Lease Year. If Tenant does not respond to the FMR Notice within 15 days after delivery, Landlord’s

J-1

opinion of the FMR shall be deemed accepted as the Base Rent due for the first year of the Additional Period. If, during such 15-day period, Tenant gives Landlord notice that Tenant contests Landlord’s determination of the FMR (an “Objection Notice”), which notice must contain therein Tenant’s opinion of the FMR, the parties will attempt to arrive at a mutually agreeable FMR. If, within 15 days after Landlord’s receipt of the Objection Notice the parties have not agreed on the FMR, Tenant, by written notice to Landlord (the “Arbitration Notice”) within 10 days after the expiration of such 15 day period, shall have the right to have the FMR determined in accordance with the arbitration procedures described in paragraph (d) below. If the parties have not agreed on the FMR within such 15 day period and Tenant fails to timely exercise its right to arbitrate, then Tenant’s option to extend the Term of the Lease shall be deemed not to have been exercised, and, thereafter, shall be void.

(d) If Tenant timely provides Landlord with an Arbitration Notice, Landlord and Tenant, within 10 days after Landlord’s receipt of the Arbitration Notice, shall each simultaneously submit to the other its good faith estimate of the FMR for the Premises during the Extension Period (collectively referred to as the “Estimates”) and shall each select a broker (hereinafter, a “broker”) to determine which of the two Estimates most closely reflects the FMR for the Premises during the Extension Period. Each broker so selected shall (i) be a licensed commercial real estate broker and (ii) have not less than 10 years’ experience in the field of commercial brokerage in connection with buildings comparable to the Building in area in which the Project is located. Upon selection, Landlord’s and Tenant’s brokers shall work together in good faith to agree upon which of the two Estimates most closely reflects the FMR for the Premises during the Extension Period. The Estimate chosen by such brokers shall be binding on both Landlord and Tenant as the Base Rent rate for the Premises during the Extension Period. If either Landlord or Tenant fails to appoint a broker within the 10 day period referred to above, the broker appointed by the other party shall be the sole broker for the purposes hereof. If the two brokers cannot agree upon which of the two Estimates most closely reflects the FMR within 30 days after their appointment, then, within 10 days after the expiration of such 30 day period, the two brokers shall select a third broker meeting the aforementioned criteria. Once the third broker (i.e. arbitrator) has been selected as provided for above, then, as soon thereafter as practicable but in any case within 14 days, the arbitrator shall make his or her determination of which of the two Estimates most closely reflects the FMR and such Estimate shall be binding on both Landlord and Tenant as the Base Rent rate for the Premises during the Extension Period. The parties shall share equally in the costs of the arbitrator. Any fees of any broker, counsel or experts engaged directly by Landlord or Tenant shall be borne by the party retaining such broker, counsel or expert.

(e) Landlord may request to amend the Lease to reflect the extension of the Lease as described in this Exhibit.

J-2