- ONTO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

10-K/A Filing

Onto Innovation (ONTO) 10-K/A2005 FY Annual report (amended)

Filed: 2 May 05, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 1, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 Or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 0-13470

NANOMETRICS INCORPORATED

(Exact name of registrant as specified in its charter)

| California | 94-2276314 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

1550 Buckeye Drive Milpitas, California | 95035 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (408) 435-9600

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of July 2, 2004, the last business day of our most recently completed second fiscal quarter, the aggregate market value of the Common Stock of the registrant held by non-affiliates was approximately $73,351,027. Shares of voting stock held by each officer and director and by each person who owns 5% or more of the outstanding voting stock have been excluded because such persons may be deemed to be “affiliates” as that term is defined under the rules and regulations of the Securities Exchange Act of 1934, as amended. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 24, 2005, 12,576,644 shares of the registrant’s Common Stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Explanatory Note

This Amendment No. 1 on Form 10-K/A amends the Annual Report on Form 10-K for the fiscal year ended January 1, 2005 that we previously filed with the Securities and Exchange Commission on March 23, 2005. In accordance with General Instruction G to the Form 10-K, the information required by Items 10, 11, 12, 13 and 14 of Part III was omitted from our Form 10-K as filed and was to be incorporated by reference to our definitive proxy statement for our 2005 Annual Meeting of Shareholders. Since we will not in fact file our proxy statement within 120 days from the end of our fiscal year, we are filing this Amendment No. 1 solely for the purpose of providing the information required by Items 10, 11, 12, 13 and 14 of Part III of Form 10-K. Unless otherwise expressly stated, this Amendment No. 1 does not reflect events occurring after the filing of the original Form 10-K, or modify or update in any way disclosures contained in the original Form 10-K.

PART III

ITEM 10. DIRECTORS AND EXECUTIVE OFFICERS OF THE REGISTRANT

Directors

The following table sets forth information with respect to our directors as of January 1, 2005. Information concerning our executive officers is set forth under the caption “Business—Executive Officers of the Registrant” in Part I of our Annual Report on Form 10-K, which we filed with the SEC on March 23, 2005 and which is incorporated herein by reference.

Name | Age | Director Since | ||||

Vincent J. Coates | 80 | 1975 | ||||

John D. Heaton | 45 | 1995 | ||||

Edmond R. Ward | 65 | 1999 | ||||

William G. Oldham | 66 | 2000 | ||||

Stephen J. Smith | 58 | April 2004 | ||||

J. Thomas Bentley | 55 | April 2004 | ||||

Norman V. Coates | 55 | June 2004 |

Vincent J. Coates has been Chairman of the Board since Nanometrics was founded in 1975. He has been Nanometrics’ Secretary since February 1989. He also served as Chief Executive Officer through April 1998 and President from Nanometrics’ founding through May 1996, except for the period of January 1986 through February 1987 when he served exclusively as Chief Executive Officer. Mr. Coates has also served as Chairman of the Board of Nanometrics Japan Ltd., a subsidiary of Nanometrics, since its inception in November 1984. Prior to his employment at Nanometrics, Mr. Coates co-founded Coates and Welter Instrument Corporation, a designer of electron microscopes, the assets of which were subsequently acquired by Nanometrics. Mr. Coates also spent over twenty years working in engineering, sales and international operations for the Perkin-Elmer Corporation, a manufacturer of analytical instruments. In 1995, he received an award which recognized his contribution to the industry from Semiconductor and Equipment and Materials International, an industry trade organization.

John D. Heaton has served as a director of Nanometrics since July 1995. Since April 1998, he has been Chief Executive Officer of Nanometrics. From May 1996 to April 1998, he served as Nanometrics’ President and Chief Operating Officer. Mr. Heaton has also served as President of Nanometrics Japan Ltd., a subsidiary of Nanometrics, since January 1998. Beginning in 1978, Mr. Heaton served in various technical positions at National Semiconductor, a semiconductor manufacturer, and prior to joining Nanometrics in 1990.

Edmond R. Ward has served as a director of Nanometrics since July 1999. Beginning in January 2002, Mr. Ward has served as Chief Technical Officer of Unity Semiconductor, a semiconductor design and manufacturing company. Since April 1999, Mr. Ward has been a General Partner of Virtual Founders, a venture capital firm. From April 1992 to June 1997, Mr. Ward was the Vice President of Technology at Silicon Valley Group, Inc., a supplier of wafer processing equipment.

William G. Oldham has served as a director of Nanometrics since June 2000. Since 1964, Mr. Oldham has been a faculty member at the University of California, Berkeley, where he researches EUV and Maskless Lithography and, since 1996, has been the Director of the DARPA/SRC Research Network for Advanced Lithography. He has served as a consultant in various intellectual property matters and serves on the board of directors of Cymer, Inc., a supplier of light sources for deep ultraviolet (DUV) photolithography systems used in the manufacturing of semiconductors.

-2-

Stephen J Smith has served as a director of Nanometrics since April 2004. Dr. Smith has been a professor in the Department of Molecular and Cellular Physiology at the Stanford University School of Medicine since 1989, where he researches brain development and function with special interests in the dynamic and structural aspects of synapse and circuit formation and synaptic plasticity. Dr. Smith is the author of numerous research articles in the fields of cellular and molecular neuroscience.

J. Thomas Bentley has served as a director of Nanometrics since April 2004. Mr. Bentley is a co-founder of Alliant Partners, a leading merger and acquisition firm for emerging and mid-market technology companies. For the past 10 years, Mr. Bentley has worked with some of Alliant’s largest clients on their strategic acquisitions and divestitures. His expertise is in financial, tax and accounting structuring of merger transactions. Mr. Bentley holds a Master of Science degree in Management from M.I.T. and currently serves as a senior advisor to Alliant Partners.

Mr. Norman V. Coates served as a director of Nanometrics from May 1988 through June 2001. He was re-appointed to the Nanometrics board of directors on June 30, 2004. He has operated Gem of the River Produce, a farming and produce packing operation in Orleans, California, as a sole proprietor since 1978. He has also been manager of the Boise Creek Farm operation since 1985 and a manager of Coates Vineyards since 1997.

Certain Relationships

Vincent J. Coates is the father of Norman V. Coates. There are no other family relationships between any of the foregoing directors or between any such directors and any of our executive officers.

Audit Committee

The audit committee of our board of directors reviews and monitors the corporate financial reporting as well as the internal and external audits of Nanometrics, including among other things, our internal audit and control functions, the results and scope of the annual audit and other services provided by our independent auditors, and our compliance with legal matters that may have a significant impact on our financial reports. In addition, the audit committee has the responsibility to consider and recommend the employment of, and to review fee arrangements with, our independent auditors. The audit committee also monitors transactions between Nanometrics and its officers, directors and employees for any potential conflicts of interest. The audit committee met (or acted by written consent) five (5) times during the fiscal year ended January 1, 2005.

The members of the audit committee during the fiscal year ended January 1, 2005 were William Oldham, Nathaniel Brenner (through March 2004), Edmond R. Ward and J. Thomas Bentley (beginning in April 2004). Mr. Brenner, the audit committee’s financial expert in the fiscal year ended January 3, 2004, resigned his position as director as well as his committee assignments effective as of March 2004. At the recommendation of the nominating/governance committee, the board of directors appointed J. Thomas Bentley to the audit committee as of May 26, 2004. Mr. Bentley was appointed by the board of directors to serve as the audit committee’s financial expert and chairman. Each member of our audit committee is an “independent director” as that term is defined under the applicable Nasdaq National Market listing standards. The audit committee has adopted a written charter, which is available on our website at www.nanometrics.com.

-3-

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission and the Nasdaq National Market. Executive officers, directors and greater than ten percent shareholders are required by Securities and Exchange Commission regulations to furnish Nanometrics with copies of all Section 16(a) forms that they file. Based solely on its review of the copies of such forms received by it or written representations from certain reporting persons, we believe that, with the exception of Roger Ingalls, Jr., during the fiscal year ended January 1, 2005, our executive officers, directors and greater than ten percent shareholders complied with all applicable filing requirements. Mr. Ingalls failed to timely report an option grant on Form 4.

Code of Business Conduct and Ethics

We have adopted a code of ethics, entitled the Code of Business Conduct and Ethics, that applies to our employees, including our chief executive officer and chief financial officer. The Code of Business Conduct and Ethics is posted on our website, www.nanometrics.com.

ITEM 11. EXECUTIVE COMPENSATION

Compensation of Executive Officers

The following table sets forth the compensation paid during the past three fiscal years to (i) the chief executive officer, (ii) each of the four most highly compensated executive officers (or such lesser number of executive officers as we may have) not serving as chief executive officer and (iii) up to an additional two individuals that would have been included under item (ii) but for the fact that the individuals were not serving as executive officers as of January 1, 2005, all of whom are collectively referred to as the Named Officers.

Summary Compensation Table

| Annual Compensation | Long Term Compensation Awards | |||||||||

Name and Principal Position | Fiscal Year | Salary | Bonus | Securities Underlying Options (#) | ||||||

John D. Heaton | 2004 2003 2002 | $ | 341,800 342,800 343,800 | $ | 79,314 — — | 100,000 572,500 275,000 | ||||

Vincent J. Coates | 2004 2003 2002 | $ | 204,800 204,800 204,800 | | — — — | — — — | ||||

Roger Ingalls, Jr. | 2004 2003 2002 | $ | 195,265 198,965 201,834 | $ | 29,658 — — | 5,000 31,500 25,000 | ||||

Paul B. Nolan | 2004 2003 2002 | $ | 183,055 179,050 162,234 | $ | 29,864 — — | — — 50,000 | ||||

-4-

Stock Options Granted in the Fiscal Year Ended January 1, 2005

The following table sets forth information with respect to stock options granted during the fiscal year ended January 1, 2005 to each of the Named Officers. All options were granted under our 2000 Stock Option Plan. The potential realizable value amounts in the last two columns of the following chart represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. The assumed 5% and 10% annual rates of stock price appreciation from the date of grant to the end of the option term are provided in accordance with rules of the Securities and Exchange Commission and do not represent our estimate or projection of the future common stock price. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock, overall market conditions and the option holder’s continued employment through the vesting period.

| Individual Grants | ||||||||||||||||

| Number of Securities Underlying Options Granted (#)(1) | % of Total Year (2) | Exercise ($/Sh) | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | ||||||||||||

Name | 5% ($) | 10% ($) | ||||||||||||||

John D. Heaton | 100,000 | 22 | % | $ | 12.02 | 5/26/11 | $ | 332,000 | $ | 734,000 | ||||||

Vincent J. Coates | 0 | 0 | — | — | — | |||||||||||

Roger Ingalls, Jr. | 5,000 | 1.1 | % | 10.37 | 8/23/11 | 14,350 | 31,650 | |||||||||

Paul B. Nolan | 0 | 0 | — | — | — | |||||||||||

| (1) | All options granted to the Named Officers in fiscal 2004 were granted at exercise prices equal to the fair market value of our common stock on the dates of grant. Historically, options granted become exercisable at the rate of 33% on the first anniversary date of the option grant and 33% of the option shares become exercisable each full year thereafter, such that full vesting occurs three years after the date of grant. Options lapse after 7 years or 90 days after termination of employment. |

| (2) | Based on 453,550 options granted during the fiscal year ended January 1, 2005. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth the number of shares covered by both exercisable and unexercisable stock options held by each of the Named Officers at January 1, 2005. As indicated below, two Named Officers, John D. Heaton and Paul B. Nolan, exercised stock options during the fiscal year ended January 1, 2005.

Name | Shares Acquired on Exercise (#) | Value Received ($) (1) | Number of Securities Underlying Unexercised Options at Fiscal Year-End (#) | Value of Unexercised In-the-Money Options at Fiscal Year-End (#) (2) | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

John D. Heaton | 100,000 | $ | 674,000 | 219,583 | 409,917 | $ | 2,243,722 | $ | 3,477,728 | ||||||

Vincent J. Coates | — | — | — | — | — | — | |||||||||

Roger Ingalls, Jr. | — | — | 15,750 | 20,750 | 164,115 | 192,865 | |||||||||

Paul B. Nolan | 26,666 | 213,594 | 16,666 | 16,668 | 9,132 | 135,107 | |||||||||

| (1) | The value realized upon exercise is (i) the fair market value of our common stock on the date of exercise, less the option exercise price per share, multiplied by (ii) the number of shares underlying the options exercised. |

| (2) | The value of unexercised options is (i) the fair market value of our common stock on December 31, 2004 ($16.12 per share), less the option exercise price of in-the-money options, multiplied by (ii) the number of shares underlying such options. |

-5-

Compensation of Directors

Directors who are not also our employees of receive an annual retainer fee of $5,000, plus $1,000 for each board and committee meeting attended. Directors are also eligible to participate in our Directors’ Stock Option Plan. Each audit committee member receives an additional $3,000 annual retainer and $500 for attending quarterly earnings release conference calls. Additionally, the audit committee chairman receives an incremental $2,000 retainer for serving in such capacity.

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

Pursuant to the terms of an agreement between Nanometrics and Vincent J. Coates, the Chairman of the Board, dated May 1, 1985, as amended and restated in August 1996 and April 1998, we are obligated to continue to pay Mr. Coates his salary and benefits for five years from the date of his resignation in the event Mr. Coates is required to resign as Chairman of the Board under certain circumstances, including a change of control.

In April 1998, Nanometrics entered into an agreement with John D. Heaton pursuant to which we agreed to pay Mr. Heaton his annual salary (excluding bonuses) for a period of one year from the date that he is required or requested for any reason not involving good cause, including a change of control, to involuntarily relinquish his positions as President, Chief Executive Officer and director. If Mr. Heaton leaves voluntarily, or if he is asked to leave under certain circumstances, no such severance payment is required.

In March 1995, Nanometrics entered into an agreement with Roger Ingalls, Jr. pursuant to which we agreed to pay Mr. Ingalls his annual salary (excluding bonuses) for a period of one hundred twenty (120) days from the date he is terminated without cause.

Compensation/Stock Option Committee Interlocks and Insider Participation

No member of the compensation/stock option committee of our board of directors serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation/stock option committee.

Report of the Compensation/Stock Option Committee of the Board of Directors

The following is the report of the compensation/stock option committee of our board of directors describing compensation policies and rationales applicable to certain of our executive officers with respect to the compensation paid to such executive officers for the fiscal year ended January 1, 2005. The information contained in such report shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act or Exchange Act, except to the extent that we specifically incorporate it by reference into such filing.

General. The compensation/stock option committee is responsible for making recommendations to the board of directors with respect to cash compensation levels for certain of our executive officers. During fiscal year ended January 1, 2005, the compensation/stock option committee also was responsible for determining levels of equity-based compensation for our employees.

Compensation Philosophy. The compensation/stock option committee makes recommendations as to the salaries of certain of the executive officers by considering (i) the salaries of executive officers in similar positions at comparably-sized peer companies, (ii) our financial performance over the past year based upon

-6-

revenues and operating results and (iii) the achievement of individual performance goals related to each executive officer’s duties and areas of responsibility. The compensation/stock option committee makes recommendations as to the levels of cash bonuses awarded to certain of our executive officers and views such bonuses as being an integral part of its performance based compensation program. Such bonuses are based on our profits and are determined as a percentage of the officer’s salaries.

Equity-Based Compensation. The compensation/stock option committee views stock options as an important part of its long-term, performance-based compensation program. The compensation/stock option committee grants stock options to all employees of Nanometrics under its 2000 Stock Option Plan and 2002 Nonstatutory Stock Option Plan based upon the committee’s estimation of each employee’s contribution to our long-term growth and profitability. The 2000 Stock Option Plan is intended to provide additional incentives to the executive officers to maximize shareholder value. Options are granted under the 2000 Stock Option Plan and the 2002 Nonstatutory Stock Option Plan at the then-current market price and are generally subject to three-year vesting periods to encourage key employees to remain with us.

Compensation of the Chief Executive Officer. The compensation/stock option committee has reviewed all components of the chief executive officer’s compensation, including salary, bonus, equity, stock options, and the obligations under our change of control severance agreement with Mr. Heaton.

Based on this review, the compensation/stock option committee found Mr. Heaton’s total compensation (and, in the case of the change of control severance agreement, potential payout) in the aggregate to be reasonable and not excessive. Furthermore, although Mr. Heaton made valuable contributions during fiscal year ended January 3, 2004, in light of economic conditions, the compensation/stock option committee determined that an increase to the base salary of the chief executive officer would not be appropriate. It should be noted that when the compensation/stock option committee considers any component of the chief executive officer’s total compensation, the aggregate amounts and mix of all the components, including accumulated (realized and unrealized) option gains are taken into consideration in the compensation/stock option committee’s decisions.

Section 162(m). We intend that awards granted under our 2000 Stock Option Plan and 2002 Nonstatutory Stock Option Plan be deductible by us under Section 162(m) of the Internal Revenue Code of 1986, as amended.

Members of the Compensation/Stock Option Committee

Edmond Ward, Chairman

J. Thomas Bentley

Stephen J Smith

-7-

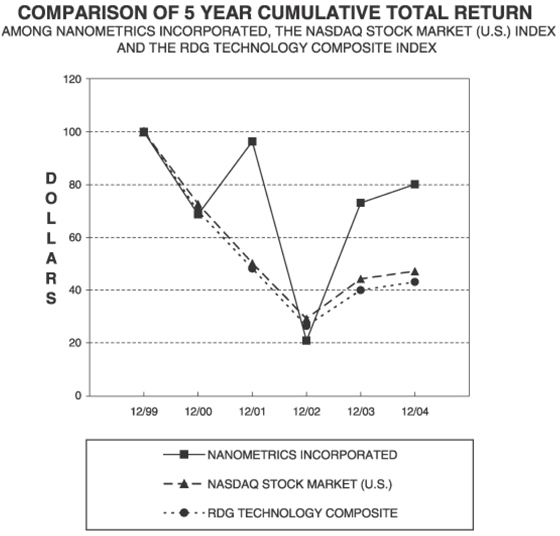

Stock Performance Graph

The following graph compares the cumulative total return to shareholders of our common stock from December 31, 1999 through December 31, 2004 to the cumulative total return over such period of (i) the Nasdaq Stock Market (U.S.) Index and (ii) the RDG Technology Composite Index. The results shown assume that $100 was invested on December 31, 1999 in our common stock and in each of the other two indices with any dividends reinvested.

The information contained in the performance graph shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filing under the Securities Act or Exchange Act, except to the extent that we specifically incorporate it by reference into such filing.

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN AMONG NANOMETRICS INCORPORATED, THE NASDAQ STOCK MARKET (U.S.) INDEX AND THE RDG TECHNOLOGY COMPOSITE INDEX

-8-

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS

Equity Compensation Plan Information

All of our equity compensation plans except the 2002 Non Statutory Stock Option Plan were approved by our shareholders. Under the 2002 Non Statutory Stock Option Plan, in which employees and consultants participate, 1,200,000 shares are authorized; options to acquire our common stock under this plan vest at a rate of 33.3% upon each anniversary of the stock option grant, and expire seven years from the date of grant.

The following table sets forth, for all of our existing equity compensation plans, the number of outstanding option grants and the number of shares remaining available for issuance as of the fiscal year ended January 1, 2005.

Number of Issued Upon | Weighted Average Exercise Price of Outstanding Options | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (1) | |||||

Equity Compensation Plans Approved by Security Holders | 1,555,629 | $ | 11.94 | 483,444 | |||

Equity Compensation Plans Not Approved by Security Holders | 1,076,646 | $ | 8.13 | 35,359 | |||

| (1) | Excludes securities to be issued upon exercise of outstanding options. |

Security Ownership of Management and Certain Beneficial Owners of Nanometrics

The following table sets forth beneficial ownership of our common stock as of April 27, 2005, by each director or nominee, by each of the Named Officers, by all directors and Named Officers as a group, and by all persons known to us to be the beneficial owners of more than 5% of our common stock. Unless otherwise indicated, all persons named below can be reached at Nanometrics Incorporated, 1550 Buckeye Drive, Milpitas, California 95035.

-9-

Name of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned (1) | Percent of Total | |||

Vincent J. Coates (2) | 3,376,274 | 26.76 | % | ||

Artemis Investment Management LLC (3) | 881,800 | 6.99 | |||

August Technology Corporation (4) | 4,012,937 | 30.31 | |||

Dimensional Fund Advisors Inc. (5) | 913,148 | 7.24 | |||

John D. Heaton (6) | 489,166 | 3.73 | |||

Edmond R. Ward (7) | 31,999 | * | |||

William G. Oldham (8) | 39,999 | * | |||

Paul B. Nolan (9) | 25,000 | * | |||

Roger Ingalls, Jr. (10) | 40,500 | * | |||

Stephen J. Smith (11) | 3,333 | * | |||

J. Thomas Bentley (12) | 3,333 | * | |||

Norman V. Coates (13) | 3,333 | * | |||

All Named Officers and directors as a group (nine (9) persons) (14) | 4,012,937 | 30.31 | % |

| * | Represents less than 1% of outstanding shares of common stock. |

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. The number of shares beneficially owned by a person includes shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of April 27, 2005. Such shares issuable pursuant to such options are deemed outstanding for computing the percentage ownership of the person holding such options but are not deemed outstanding for the purposes of computing the percentage ownership of each other person. |

| (2) | Includes 3,376,154 shares of common stock held of record by the Vincent J. Coates Separate Property Trust, U/D/T dated August 7, 1981, for which Mr. Coates acts as trustee. |

| (3) | According to a Schedule 13G filed on February 10, 2004, Artemis Investment Management LLC may be deemed to be the beneficial owner of 881,800 shares of common stock. |

| (4) | By virtue of a voting agreement it entered into on January 21, 2005 with our Named Officers and directors, August Technology Corporation may be deemed to be the beneficial owner of 3,392,274 shares of common stock and 620,663 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

| (5) | According to a Schedule 13G/A filed on February 9, 2005, Dimensional Fund Advisors Inc. may be deemed to be the beneficial owner of 913,148 shares of common stock. |

| (6) | Includes 489,166 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

| (7) | Includes 29,999 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

| (8) | Includes 39,999 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

| (9) | Includes 20,000 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

| (10) | Includes 31,500 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

-10-

| (11) | Includes 3,333 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

| (12) | Includes 3,333 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

| (13) | Includes 3,333 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

| (14) | Includes 620,663 shares of common stock issuable upon exercise of outstanding options exercisable within 60 days of April 27, 2005. |

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On January 21, 2005, we announced a definitive agreement to merge our business with August Technology Corporation, a leading provider of defect inspection technology headquartered in Bloomington, Minnesota. Upon consummation of the merger, we will be renamed “August Nanometrics Inc.” and reincorporated into Delaware. Additionally, August Technology will become a wholly owned subsidiary of August Nanometrics. Each share of August Technology common stock will be converted into the right to receive 0.6401 of a share of August Nanometrics common stock upon consummation of the merger. The merger is expected to close during the second quarter of 2005, and is subject to customary closing conditions, including receipt of shareholder approval from our shareholders and those of August Technology.

Members of our board of directors and certain executive officers may have interests in the merger. These interests include:

| • | the appointment of three of our current directors as directors of August Nanometrics upon completion of the merger and the appointment of certain of our executive officers as executive officers of August Nanometrics upon completion of the merger; |

| • | the potential receipt of severance payments by certain of our executive officers (see “Employment Contracts and Termination of Employment and Change-in-Control Arrangements,” above, for more information); and |

| • | the provision of directors’ and officers’ insurance coverage to our current directors and officers following the merger. |

ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES

The following table summarizes the aggregate fees that we expect to pay BDO Seidman, LLP for fiscal 2004 and fees billed to us by Deloitte & Touche LLP for fiscal 2003 and 2002.

Type of Fees | Fiscal 2004 (5) | Fiscal 2003 | Fiscal 2002 | ||||||

Audit Fees (1) | $ | 375,215 | $ | 263,680 | $ | 264,239 | |||

Audit-Related Fees (2) | 4,400 | — | — | ||||||

Tax Fees (3) | — | 127,690 | 222,255 | ||||||

All Other Fees (4) | — | 7,500 | — | ||||||

Total Fees | $ | 379,615 | $ | 398,870 | $ | 486,494 | |||

| (1) | Fees for audit services consist of: |

| • | Audit of our annual financial statements |

| • | Reviews of our quarterly financial statements |

-11-

| • | Statutory and regulatory audits, consents and other services related to Securities and Exchange Commission filings |

| (2) | Fees for audit-related services billed in fiscal 2004 consisted of consultations on SEC comment letters |

| (3) | Fees for tax services billed in fiscal 2003 consisted of tax compliance assistance, transfer pricing documentation and assistance with tax return filings in certain foreign jurisdictions |

| (4) | All other fees consisted of training on the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 |

| (5) | In fiscal 2004, Deloitte & Touche LLP billed us $74,036, $57,330, $13,913 and $0 for audit, audit-related, tax and all other fees, respectively. |

In considering the nature of the services provided by the independent registered public accountants, the audit committee determined that such services are compatible with the provision of independent audit services. The audit committee discussed these services with the independent registered public accountants and our management to determine that they are permitted under the rules and regulations concerning auditors’ independence promulgated by the Securities and Exchange Commission to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

Audit Committee Pre-Approval Policy

Pursuant to our audit committee charter, our audit committee must pre-approve all audit and non-audit services, and the related fees, provided to us by our independent auditors, or subsequently approve non-audit services in those circumstances where a subsequent approval is necessary and permissible under the Exchange Act or the rules of the Securities and Exchange Commission. Accordingly, the audit committee pre-approved all services and fees provided by Deloitte & Touche LLP and BDO Seidman, LLP during the year ended January 1, 2005 and has concluded that the provision of these services is compatible with the accountants’ independence.

-12-

PART IV

ITEM 15. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

Exhibits.

The following exhibits are filed with this Form 10-K/A:

| Exhibit Number | Description | |

| 31.1 | Certification of Chief Executive Officer Pursuant to Rule 13a-14(a) of the Securities Exchange Act of 1934. | |

| 31.2 | Certification of Chief Financial Officer Pursuant to Rule 13a-14(a) of the Securities Exchange Act of 1934. | |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer Pursuant to Rule 13a-14(b) of the Securities Exchange Act of 1934 and 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. | |

-13-

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dated: May 2, 2005 | NANOMETRICS INCORPORATED | |||

By: | /s/ PAUL B. NOLAN | |||

Paul B. Nolan | ||||

Chief Financial Officer and Vice President | ||||

-14-