Filed Pursuant to Rule 433 under the Securities Act

Registration Statement No. 333-230569

January 4, 2021

| MEMBER INVESTMENT OPPORTUNITIES |

| Member Investment Opportunities CFC OFFERS A RANGE OF INVESTMENT OPTIONS THAT EARN YOUR ELECTRIC COOPERATIVE A MARKET-DRIVEN RATE Investment Products Short-Term Investments CFC’s short-term member investment products can meet your near term (i.e. ≤ 9 months) investment requirements. Interest rates are market driven and set on a daily basis. CFC offers three short-term investment products. Characteristics of each investment are outlined in the table on the next page. All short-term rates are set daily and are based on market conditions. Short-term investments include: • Daily Liquidity Fund • Commercial Paper • Select Notes Short-term investments can potentially streamline your accounts payable process by directing investment proceeds to pay monthly bills and other cash-flow needs. Medium-Term Notes Medium-Term Notes (MTNs) are also available to meet your longer-term investment needs (i.e. 10 months – 30 years). MTNs are senior unsecured debt securities that earn attractive fixed market interest rates. MTN rates are also set daily based on market conditions. Member Capital Securities An alternative long-term investment is CFC’s Member Capital Securities (MCS), which are a form of unsecured subordinated debt that include a fixed interest rate and a 30-year term. Supplementary Services CFC Paying Agent Service CFC’s Paying Agent Services (PAS) allows cooperatives to direct CFC to pay third parties (e.g., power suppliers and other third-party vendors) on the cooperative’s behalf using funds from maturing Commercial Paper, Select Notes and Daily Liquidity Fund investments. CFC’s PAS is a complimentary service to help members maximize investment returns, gain from cash-flow efficiencies and avoid bank wiring fees. CFC QuickDraw CFC’s QuickDraw is an additional service that allows CFC to automatically withdraw funds for Commercial Paper, Select Notes and Daily Liquidity Fund investments directly from authorized bank account (s). QuickDraw is designed to save members time by eliminating the need to instruct banks to wire funds to CFC for investments. How to Invest Investing in CFC products is quick and easy. The CFC Member Center can be contacted by phone at 800-424-2955 between the hours of 8 a.m. and 4:45 p.m. (ET), on business days. Alternatively, the Member Center may be contacted via e-mail at MemberCenter@nrucfc.coop. PLEASE NOTE: Short-term investments can be processed on the CFC member website using a security token provided by CFC; however, long-term investments (e.g., MTN and MCS) will need to be initiated using the Member Center phone line. |

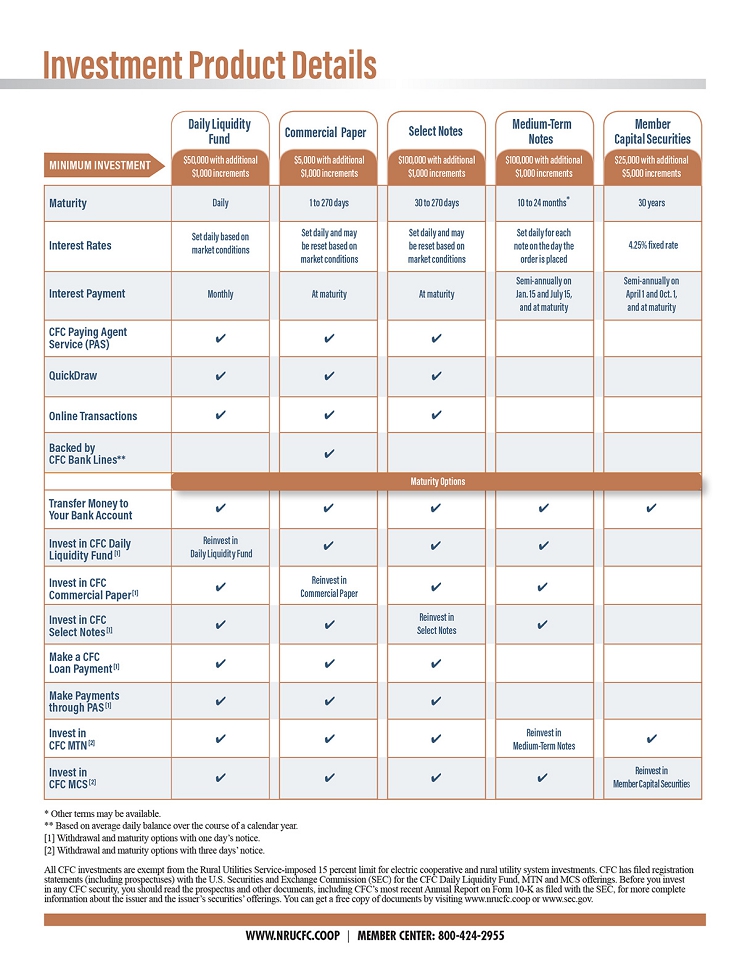

| Investment Product Details Select Notes Fund Commercial Paper Medium-Term Notes Member Capital Securities MINIMUM INVESTMENT$50,000 with additional $1,000 increments $5,000 with additional $1,000 increments $100,000 with additional $1,000 increments $100,000 with additional $1,000 increments $25,000 with additional $5,000 increments Maturity Daily1 to 270 days 30 to 270 days 10 to 24 months* 30 years Interest Rates Set daily based on market conditions Set daily and may be reset based on market conditions Set daily and may be reset based on market conditions Set daily for each note on the day the order is placed Semi-annually on 4.25% fixed rate Semi-annually on Interest Payment MonthlyAt maturity At maturity Jan. 15 and July 15, and at maturity April 1 and Oct. 1, and at maturity CFC Paying Agent Service (PAS) QuickDraw Online Transactions Backed by CFC Bank Lines** Transfer Money to Your Bank Account Invest in CFC Daily Liquidity Fund [1] Invest in CFC Commercial Paper [1] Invest in CFC Select Notes [1] Make a CFC Loan Payment [1] Make Payments through PAS [1] Invest in CFC MTN [2] Reinvest in Daily Liquidity Fund Reinvest in Commercial Paper Maturity Options Reinvest in Select Notes Reinvest in Medium-Term Notes Invest in CFC MCS [2] Reinvest in Member Capital Securities * Other terms may be available. ** Based on average daily balance over the course of a calendar year. [1] Withdrawal and maturity options with one day’s notice. [2] Withdrawal and maturity options with three days’ notice. All CFC investments are exempt from the Rural Utilities Service-imposed 15 percent limit for electric cooperative and rural utility system investments. CFC has filed registration statements (including prospectuses) with the U.S. Securities and Exchange Commission (SEC) for the CFC Daily Liquidity Fund, MTN and MCS offerings. Before you invest in any CFC security, you should read the prospectus and other documents, including CFC’s most recent Annual Report on Form 10-K as filed with the SEC, for more complete information about the issuer and the issuer’s securities’ offerings. You can get a free copy of documents by visiting www.nrucfc.coop or www.sec.gov. |

| 20701 Cooperative Way Dulles, VA 20166 www.nrucfc.coop |