United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03541

Asset Management Fund

(Exact name of registrant as specified in charter)

Three Canal Plaza, Portland, ME 04101

(Address of principal executive offices) (Zip code)

Foreside Management Services, LLC, Three Canal Plaza, Portland, ME 04101

(Name and address of agent for service)

| Registrant's telephone number, including area code: | (800) 701-9502 – AAMA Funds |

Date of fiscal year end: 6/30

Date of reporting period: 6/30/24

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

| AAMA Equity Fund |  |

(AMFEX)

Annual Shareholder Report - June 30, 2024

Fund Overview

This annual shareholder report contains important information about AAMA Equity Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.aamafunds.com/prospectuses-and-reports.html. You can also request this information by contacting us at (800) 701-9502.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| AAMA Equity Fund | $124 | 1.15% |

How did the Fund perform during the reporting period?

The AAMA Equity Fund returned 16.39% for the year ended June 30, 2024. This may be compared to the S&P 500 capitalization weighted index return of 24.56%. Measurements of broader market performance continue to fall behind the headline index with the S&P 500 Equal Weighted Index return of 11.79%, and the S&P Midcap 400 and Smallcap 600 Index returns of 8.66% and 13.57%, respectively.

Looking over the last 12 months, stock prices reached a low point in late October and closed at record highs on June 30th. As has been the case over the last several years, large growth companies have led the market and contributed heavily to the performance of capitalization weighted indices. The S&P 500 Index out-paced the equal weight index by 12.77% over the last six months.

Stock valuations remain elevated relative to the history of S&P 500 Index prices relative to expected 12 month forward earnings. Operating earnings in the second quarter of 2024 are likely to have recovered to match their prior peak posted in the 4th quarter of 2021. Expectations are for earnings to grow from current levels.

The portfolio of the AAMA Equity Fund has included exposure to the Technology sector along with targeted positions in more defensive sectors such as Health Care, Consumer Staples and Utilities. The five year, annualized monthly price volatility of the AAMA Equity Fund is 15.6% versus the 18.0% of the S&P 500 Index.

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| | AAMA Equity Fund | S&P 500® Index | S&P 500® Equal Weight Index |

| 30-06-2017 | 10,000 | 10,000 | 10,000 |

| 30-06-2018 | 11,130 | 11,201 | 11,448 |

| 30-06-2019 | 11,943 | 11,943 | 12,508 |

| 30-06-2020 | 12,402 | 11,589 | 13,461 |

| 30-06-2021 | 16,605 | 17,629 | 19,077 |

| 30-06-2022 | 15,121 | 16,004 | 17,029 |

| 30-06-2023 | 17,241 | 18,336 | 20,349 |

| 30-06-2024 | 20,109 | 20,357 | 25,452 |

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception

(6/30/2017) |

| AAMA Equity Fund | 16.39% | 10.77% | 10.49% |

| S&P 500® Index | 24.56% | 15.05% | 14.28% |

| S&P 500® Equal Weight Index | 11.79% | 10.94% | 10.69% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | $389,227,539 |

| Number of Portfolio Holdings | 47 |

| Advisory Fee | $4,029,091 |

| Portfolio Turnover | 3% |

Asset Weighting (% of total investments)

| Asset Weighting | (% of total investments) |

| Common Stocks | 70.2% |

| Exchange-Traded Funds | 20.7% |

| Money Market Funds | 4.0% |

| U.S. Treasury Obligations | 5.1% |

What did the Fund invest in?

Sector Weighting (% of net assets)

| Sector Weighting | (% of net assets) |

| Technology | 22.5% |

| Exchange-Traded Funds | 20.7% |

| Industrials | 9.9% |

| Communications | 8.1% |

| Consumer Staples | 5.6% |

| Health care | 5.6% |

| Consumer Discretionary | 5.6% |

| U.S. Treasury Obligations | 5.1% |

| Energy | 4.6% |

| Money Market | 4.0% |

| Materials | 3.7% |

| Utilities | 2.8% |

| Financials | 1.9% |

| Liabilities in Excess of Other Assets | -0.1% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net

Assets |

| Vanguard S&P 500 ETF | 11.0% |

| iShares Core S&P 500 ETF | 9.7% |

| Microsoft Corporation | 3.7% |

| Applied Materials, Inc. | 3.4% |

| T-Mobile US, Inc. | 3.3% |

| Alphabet, Inc. - Class A | 3.2% |

| Freeport-McMoRan, Inc. | 3.1% |

| Exxon Mobil Corporation | 2.7% |

| Amazon.com, Inc. | 2.7% |

| QUALCOMM, Inc. | 2.6% |

Material Fund Changes

No material changes occurred during the year ended June 30, 2024.

AAMA Equity Fund (AMFEX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (https://www.aamafunds.com/prospectuses-and-reports.html), including its:

| · | Proxy voting information |

TSR-AR 063024-AMFEX

| AAMA Income Fund |  |

(AMFIX)

Annual Shareholder Report - June 30, 2024

Fund Overview

This annual shareholder report contains important information about AAMA Income Fund for the period of July 1, 2023 to June 30, 2024. You can find additional information about the Fund at https://www.aamafunds.com/prospectuses-and-reports.html. You can also request this information by contacting us at (800) 701-9502.

What were the Fund’s costs for the last year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| AAMA Income Fund | $85 | 0.83% |

How did the Fund perform during the reporting period?

The AAMA Income Fund returned 3.75% for the year ended June 30, 2024. This may be compared to the Bloomberg U.S. Aggregate Bond Index return of 2.63%. Long term maturities fared worse with the Bloomberg U.S. Long Term Treasury Index return of -5.61%.

The Federal Reserve has started to hint at the possibility of a lower Federal Funds targeted interest rate in September as recent data has contained evidence of slowing inflation and a less robust labor market. Inflation had cooled in the last six months of 2023 only to rise again early in 2024. The Fed seems to remain patient in order to become convinced that they are not moving too early.

Headline inflation measured by the 12 month change in the Consumer Price Index (reported by the Bureau of Labor Statistics) has declined from 8.9% to 2.9% over the last two years. However, the core CPI (less food and energy) was recently reported at 3.12%. The Federal Reserve’s favorite measure using the Personal Consumption Expenditure gauge for services (less housing and energy services) was most recently reported at 3.38%. None of the measures are below the stated 2% target.

The AAMA Income Fund continues to be positioned in relatively short-term, high-quality issues which has reduced fund price volatility over the past two years of rising interest rates. Annualized monthly price volatility of the AAMA Income Fund was 2.9% over the last two years compared to the Barclays Aggregate Index volatility of 8.4%.

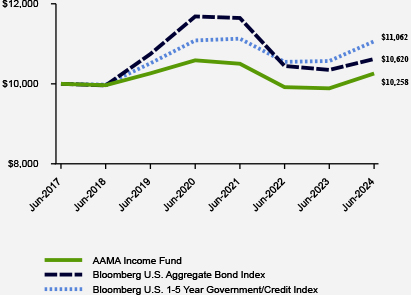

How has the Fund performed since inception?

Total Return Based on $10,000 Investment

| | AAMA Income Fund | Bloomberg U.S. Aggregate Bond Index | Bloomberg U.S. 1-5 Year Government/Credit Index |

| 30-06-2017 | 10,000 | 10,000 | 10,000 |

| 30-06-2018 | 9,982 | 9,982 | 9,982 |

| 30-06-2019 | 10,239 | 10,690 | 10,478 |

| 30-06-2020 | 10,584 | 11,699 | 11,080 |

| 30-06-2021 | 10,513 | 11,699 | 11,142 |

| 30-06-2022 | 9,938 | 10,434 | 10,611 |

| 30-06-2023 | 9,885 | 10,363 | 10,584 |

| 30-06-2024 | 10,258 | 10,620 | 11,062 |

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception

(6/30/2017) |

| AAMA Income Fund | 3.75% | -0.01% | 0.37% |

| Bloomberg U.S. Aggregate Bond Index | 2.63% | -0.23% | 0.86% |

| Bloomberg U.S. 1-5 Year Government/Credit Index | 4.66% | 1.02% | 1.45% |

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

| Fund Statistics |

| Net Assets | $145,645,622 |

| Number of Portfolio Holdings | 16 |

| Advisory Fee (net of waivers) | $871,646 |

| Portfolio Turnover | 0% |

Asset Weighting (% of total investments)

| Asset Weighting | (% of total investments) |

| Money Market Funds | 8.4% |

| Municipal Bonds | 0.9% |

| U.S. Government Agencies | 27.5% |

| U.S. Treasury Obligations | 63.2% |

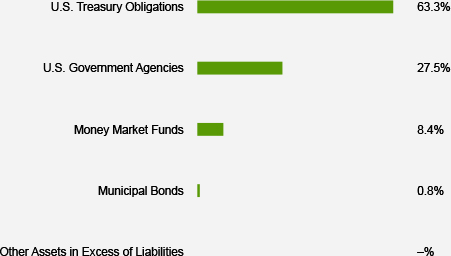

What did the Fund invest in?

Sector Weighting (% of net assets)

| Sector Weighting | (% of net assets) |

| U.S. Treasury Obligations | 63.3% |

| U.S. Government Agencies | 27.5% |

| Money Market Funds | 8.4% |

| Municipal Bonds | 0.8% |

| Other Assets in Excess of Liabilities | -% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net

Assets |

| U.S. Treasury Bills, 5.366%, due 07/23/24 | 13.7% |

| U.S. Treasury Bills, 5.369%, due 08/22/24 | 13.6% |

| U.S. Treasury Bills, 5.364%, due 10/22/24 | 13.5% |

| Federal National Mortgage Association, 2.125%, due 04/24/26 | 7.5% |

| U.S. Treasury Bills, 5.351%, due 09/24/24 | 6.8% |

| U.S. Treasury Notes, 0.500%, due 04/30/27 | 6.1% |

| U.S. Treasury Notes, 1.125%, due 02/29/28 | 6.1% |

| Federal National Mortgage Association, 0.750%, due 10/8/27 | 3.6% |

| U.S. Treasury Notes, 1.875%, due 08/31/24 | 3.4% |

| Federal Home Loan Bank, 2.750%, due 12/13/24 | 3.4% |

Material Fund Changes

No material changes occurred during the year ended June 30, 2024.

AAMA Income Fund (AMFIX)

Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund’s website (https://www.aamafunds.com/prospectuses-and-reports.html), including its:

| · | Proxy voting information |

TSR-AR 063024-AMFIX

(a) The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. This code of ethics is included as an Exhibit.

(b) During the period covered by the report, with respect to the registrant’s code of ethics that applies to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions; there have been no amendments to, nor any waivers granted from, a provision that relates to any element of the code of ethics definition enumerated in paragraph (b) of this Item 2.

| Item 3. | Audit Committee Financial Expert. |

3(a)(1) The registrant’s board of directors has determined that the registrant has at least one audit committee financial expert serving on its audit committee.

3(a)(2) The audit committee financial expert is David Gruber, who is “independent” for purposes of this Item 3 of Form N-CSR.

| Item 4. | Principal Accountant Fees and Services. |

(a) Audit Fees. Audit fees totaled $48,250 and $46,000 in fiscal years 2024 and 2023 respectively, including fees associated with the annual audit and filings of the registrant’s Form N-1A and Form N-CEN.

(b) Audit-Related Fees. There were no audit related fees billed in fiscal years 2024 and 2023.

(c) Tax Fees. Fees for tax compliance and review services totaled $10,500 and $11,500 in fiscal years 2024 and 2023, respectively.

(d) All Other Fees. There were no other fees in fiscal years 2024 and 2023.

(e)(1) Except as permitted by rule 2-01(c)(7)(i)(C) of regulation S-X the trust’s audit committee must pre-approve all audit and non-audit services provided by the independent accountants relating to the operations or financial reporting of the funds. Prior to the commencement of any audit or non-audit services to the fund, the audit committee reviews the services to determine whether they are appropriate and permissible under applicable law.

(f) Not applicable

| (g) | 2024 $10,500

2023 $11,500 |

(h) The Audit Committee considered the non-audit services rendered to the registrant’s investment adviser and believes the services are compatible with the principal accountant’s independence.

| Item 5. | Audit Committee of Listed Companies. |

Not applicable.

| Item 6. | Schedule of Investments. |

| (a) | The Schedule of Investments in securities of unaffiliated issuers is included in the report to shareholders filed under Item 1 of this Form. |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

ITEM 8 – AMF N-CSR June 30, 2024

AAMA Equity Fund

Ticker: AMFEX

AAMA Income Fund

Ticker: AMFIX

Financial Statements

June 30, 2024

AAMA Funds |

Letter To Shareholders

(Unaudited) | June 30, 2024 |

Dear Fellow Shareholder:

Attached are the June 30, 2024 Annual Reports for the AAMA Equity Fund and the AAMA Income Fund.

One year ago, we wrote that “the recession of 2023 appears to be the most widely predicted potential recession in history and for good reasons. In fact, certain reliable indicators essentially ’guarantee’ a recession. Yet, economic conditions continue to skate past the abyss”. Contrary to recessionary forecasts for the last two years, we have been consistently constructive towards the U.S. economy. As we start the second half of 2024, recession forecasts continue, although a ‘soft landing’ seems to be the consensus. We now see the potential developing for a weakening economy starting in early 2025.

Inflation has continued to decline, although it is still higher than the Federal Reserve’s 2% target. The unemployment rate remaining near historic lows has allowed the Federal Reserve to be patient with plans to ease monetary policy, despite persistent calls for an easing policy. Accordingly, the markets continue to watch the Federal Reserve for signals as to when they might make the first rate cut since the pandemic.

Corporate profit forecasts suggest that the recently completed second quarter will finally report operating earnings that exceed the peak from three years ago, with optimistic forecasts for later this year and thru 2025.

The upcoming U.S. Presidential election and continued geopolitical tensions along with any number of other unanticipated developments could result in increased volatility in the markets. As long-term investors who have lived through numerous market cycles, we have learned not to try to predict short-term market movements. Instead, we continue to monitor market valuations and strive to deploy consistent investment strategies in the Equity and Income Funds with the goal of assisting you in meeting your investment goals and objectives.

1

AAMA Funds |

Letter To Shareholders

(Unaudited) (Continued) |

As always, we encourage you to continue to work with your financial advisor to plan and implement strategies to grow and protect your long-term asset values. We also appreciate the confidence demonstrated by your investment within the AAMA Family of mutual funds.

Sincerely,

|

|

Robert D. Baker | Philip A. Voelker |

Co-Portfolio Managers | |

2

AAMA Equity Fund

Schedule of Portfolio Investments

June 30, 2024 |

COMMON STOCKS — 70.3% | | Shares | | | Fair Value | |

AEROSPACE & DEFENSE — 1.2% | | | | | | | | |

RTX Corporation | | | 46,696 | | | $ | 4,687,811 | |

| | | | | | | | | |

BANKING — 1.9% | | | | | | | | |

JPMorgan Chase & Company | | | 37,400 | | | | 7,564,524 | |

| | | | | | | | | |

BEVERAGES — 1.1% | | | | | | | | |

PepsiCo, Inc. | | | 26,400 | | | | 4,354,152 | |

| | | | | | | | | |

BIOTECH & PHARMA — 3.0% | | | | | | | | |

Amgen, Inc. | | | 15,000 | | | | 4,686,750 | |

Johnson & Johnson | | | 48,000 | | | | 7,015,680 | |

| | | | | | | | 11,702,430 | |

CONTAINERS & PACKAGING — 0.6% | | | | | | | | |

Ball Corporation | | | 37,000 | | | | 2,220,740 | |

| | | | | | | | | |

DIVERSIFIED INDUSTRIALS — 2.2% | | | | | | | | |

Emerson Electric Company | | | 78,400 | | | | 8,636,544 | |

| | | | | | | | | |

E-COMMERCE DISCRETIONARY — 2.7% | | | | | | | | |

Amazon.com, Inc. (a) | | | 54,000 | | | | 10,435,500 | |

| | | | | | | | | |

ELECTRIC UTILITIES — 2.8% | | | | | | | | |

American Electric Power Company, Inc. | | | 23,000 | | | | 2,018,020 | |

Constellation Energy Corporation | | | 10,000 | | | | 2,002,700 | |

Duke Energy Corporation | | | 19,000 | | | | 1,904,370 | |

Exelon Corporation | | | 30,000 | | | | 1,038,300 | |

Public Service Enterprise Group, Inc. | | | 25,000 | | | | 1,842,500 | |

Southern Company (The) | | | 25,000 | | | | 1,939,250 | |

| | | | | | | | 10,745,140 | |

ENGINEERING & CONSTRUCTION — 1.1% | | | | | | | | |

Quanta Services, Inc. | | | 16,100 | | | | 4,090,849 | |

| | | | | | | | | |

HEALTH CARE FACILITIES & SERVICES — 2.5% | | | | | | | | |

UnitedHealth Group, Inc. | | | 19,400 | | | | 9,879,644 | |

See accompanying notes to financial statements. |

3

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued) |

COMMON STOCKS — 70.3% (Continued) | | Shares | | | Fair Value | |

HOUSEHOLD PRODUCTS — 1.3% | | | | | | | | |

Procter & Gamble Company (The) | | | 29,400 | | | $ | 4,848,648 | |

| | | | | | | | | |

INDUSTRIAL SUPPORT SERVICES — 2.8% | | | | | | | | |

Fastenal Company | | | 30,000 | | | | 1,885,200 | |

Grainger (W.W.), Inc. | | | 10,100 | | | | 9,112,624 | |

| | | | | | | | 10,997,824 | |

INTERNET MEDIA & SERVICES — 3.2% | | | | | | | | |

Alphabet, Inc. - Class A | | | 68,000 | | | | 12,386,200 | |

| | | | | | | | | |

LEISURE FACILITIES & SERVICES — 1.4% | | | | | | | | |

Starbucks Corporation | | | 70,000 | | | | 5,449,500 | |

| | | | | | | | | |

METALS & MINING — 3.1% | | | | | | | | |

Freeport-McMoRan, Inc. | | | 250,000 | | | | 12,150,000 | |

| | | | | | | | | |

OIL & GAS PRODUCERS — 4.6% | | | | | | | | |

Chevron Corporation | | | 46,500 | | | | 7,273,530 | |

Exxon Mobil Corporation | | | 92,000 | | | | 10,591,040 | |

| | | | | | | | 17,864,570 | |

RETAIL - CONSUMER STAPLES — 3.2% | | | | | | | | |

Kroger Company (The) | | | 102,500 | | | | 5,117,825 | |

Walmart, Inc. | | | 109,800 | | | | 7,434,558 | |

| | | | | | | | 12,552,383 | |

RETAIL - DISCRETIONARY — 1.5% | | | | | | | | |

Home Depot, Inc. (The) | | | 17,000 | | | | 5,852,080 | |

| | | | | | | | | |

SEMICONDUCTORS — 7.6% | | | | | | | | |

Applied Materials, Inc. | | | 56,000 | | | | 13,215,440 | |

QUALCOMM, Inc. | | | 50,900 | | | | 10,138,262 | |

Texas Instruments, Inc. | | | 31,700 | | | | 6,166,601 | |

| | | | | | | | 29,520,303 | |

See accompanying notes to financial statements. |

4

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued) |

COMMON STOCKS — 70.3% (Continued) | | Shares | | | Fair Value | |

SOFTWARE — 5.6% | | | | | | | | |

Adobe, Inc. (a) | | | 13,200 | | | $ | 7,333,128 | |

Microsoft Corporation | | | 32,500 | | | | 14,525,875 | |

| | | | | | | | 21,859,003 | |

TECHNOLOGY HARDWARE — 5.5% | | | | | | | | |

Apple, Inc. | | | 47,200 | | | | 9,941,264 | |

Cisco Systems, Inc. | | | 131,600 | | | | 6,252,316 | |

Corning, Inc. | | | 134,800 | | | | 5,236,980 | |

| | | | | | | | 21,430,560 | |

TECHNOLOGY SERVICES — 3.8% | | | | | | | | |

Mastercard, Inc. - Class A | | | 11,100 | | | | 4,896,876 | |

Visa, Inc. - Class A | | | 37,400 | | | | 9,816,378 | |

| | | | | | | | 14,713,254 | |

TELECOMMUNICATIONS — 5.0% | | | | | | | | |

AT&T, Inc. | | | 330,000 | | | | 6,306,300 | |

T-Mobile US, Inc. | | | 73,815 | | | | 13,004,727 | |

| | | | | | | | 19,311,027 | |

TRANSPORTATION & LOGISTICS — 2.6% | | | | | | | | |

Norfolk Southern Corporation | | | 14,200 | | | | 3,048,598 | |

Union Pacific Corporation | | | 19,800 | | | | 4,479,948 | |

United Parcel Service, Inc. - Class B | | | 20,000 | | | | 2,737,000 | |

| | | | | | | | 10,265,546 | |

| | | | | | | | | |

TOTAL COMMON STOCKS (Cost $129,630,212) | | | | | | $ | 273,518,232 | |

|

EXCHANGE-TRADED FUNDS — 20.7% | | Shares | | | Fair Value | |

iShares Core S&P 500 ETF | | | 69,200 | | | $ | 37,868,316 | |

Vanguard S&P 500 ETF | | | 85,600 | | | | 42,811,128 | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $35,837,002) | | | | | | $ | 80,679,444 | |

See accompanying notes to financial statements. |

5

AAMA Equity Fund

Schedule of Portfolio Investments

(Continued) |

U.S. TREASURY

OBLIGATIONS — 5.1% | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

U.S. TREASURY BILLS — 5.1% (b) | | | | | | | | | | | | | | | | |

U.S. Treasury Bills | | | 5.366 | % | | | 07/23/24 | | | $ | 10,000,000 | | | $ | 9,967,917 | |

U.S. Treasury Bills | | | 5.336 | % | | | 08/20/24 | | | | 10,000,000 | | | | 9,927,118 | |

TOTAL U.S. TREASURY OBLIGATIONS (Cost $19,895,417) | | | | | | | | | | | | | | $ | 19,895,035 | |

|

MONEY MARKET FUNDS — 4.0% | | Shares | | | Fair Value | |

First American U.S. Treasury Money Market Fund - Class Z, 5.16% (c) (Cost $15,539,691) | | | 15,539,691 | | | $ | 15,539,691 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $200,902,322) — 100.1% | | | | | | $ | 389,632,402 | |

| | | | | | | | | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.1%) | | | | | | | (404,863 | ) |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 389,227,539 | |

(a) | Non-income producing security. |

(b) | Rate shown is the annualized yield at time of purchases. |

(c) | The rate shown is the 7-day effective yield as of June 30, 2024. |

See accompanying notes to financial statements. |

6

AAMA Income Fund

Schedule of Portfolio Investments

June 30, 2024 |

MUNICIPAL BONDS — 0.8% | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

City of Powell, Ohio, Various Purpose Ltd., GO Bond, Series 2021, (Cost $1,351,414) | | | 2.000 | % | | | 12/01/26 | | | $ | 1,320,000 | | | $ | 1,236,495 | |

|

U.S. GOVERNMENT

AGENCIES — 27.5% | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

FEDERAL FARM CREDIT BANK — 3.4% | | | | | | | | | | | | | | | | |

Federal Farm Credit Bank | | | 1.750% | | | | 02/25/25 | | | $ | 5,000,000 | | | $ | 4,885,648 | |

| | | | | | | | | | | | | | | | | |

FEDERAL HOME LOAN BANK — 9.7% | | | | | | | | | | | | | | | | |

Federal Home Loan Bank | | | 2.750% | | | | 12/13/24 | | | | 5,000,000 | | | | 4,940,800 | |

Federal Home Loan Bank | | | 1.750% | | | | 09/12/25 | | | | 5,000,000 | | | | 4,821,375 | |

Federal Home Loan Bank | | | 1.650% | | | | 11/24/28 | | | | 5,000,000 | | | | 4,405,039 | |

| | | | | | | | | | | | | | | | 14,167,214 | |

FEDERAL NATIONAL MORTGAGE ASSOCIATION — 14.4% | | | | | | | | | | | | | | | | |

Federal National Mortgage Association | | | 0.625% | | | | 04/22/25 | | | | 5,000,000 | | | | 4,821,291 | |

Federal National Mortgage Association | | | 2.125% | | | | 04/24/26 | | | | 11,454,000 | | | | 10,930,398 | |

Federal National Mortgage Association | | | 0.750% | | | | 10/08/27 | | | | 5,957,000 | | | | 5,272,130 | |

| | | | | | | | | | | | | | | | 21,023,819 | |

TOTAL U.S. GOVERNMENT AGENCIES (Cost $42,475,526) | | | | | | | | | | | | | | $ | 40,076,681 | |

See accompanying notes to financial statements. |

7

AAMA Income Fund

Schedule of Portfolio Investments

(Continued) |

U.S. TREASURY

OBLIGATIONS — 63.3% | | Coupon | | | Maturity | | | Principal

Amount | | | Fair Value | |

U.S. TREASURY BILLS — 47.6% (a) | | | | | | | | | | | | | | | | |

U.S. Treasury Bills | | | 5.366% | | | | 07/23/24 | | | $ | 20,000,000 | | | $ | 19,935,833 | |

U.S. Treasury Bills | | | 5.369% | | | | 08/22/24 | | | | 20,000,000 | | | | 19,849,009 | |

U.S. Treasury Bills | | | 5.351% | | | | 09/24/24 | | | | 10,000,000 | | | | 9,876,939 | |

U.S. Treasury Bills | | | 5.364% | | | | 10/22/24 | | | | 20,000,000 | | | | 19,672,928 | |

| | | | | | | | | | | | | | | | 69,334,709 | |

U.S. TREASURY NOTES — 15.6% | | | | | | | | | | | | | | | | |

U.S. Treasury Notes | | | 1.875% | | | | 08/31/24 | | | | 5,000,000 | | | | 4,969,662 | |

U.S. Treasury Notes | | | 0.500% | | | | 04/30/27 | | | | 10,000,000 | | | | 8,937,109 | |

U.S. Treasury Notes | | | 1.125% | | | | 02/29/28 | | | | 10,000,000 | | | | 8,883,984 | |

| | | | | | | | | | | | | | | | 22,790,755 | |

TOTAL U.S. TREASURY OBLIGATIONS (Cost $94,139,549) | | | | | | | | | | | | | | $ | 92,125,464 | |

|

MONEY MARKET FUNDS — 8.4% | | Shares | | | Fair Value | |

First American U.S. Treasury Money Market Fund - Class Z, 5.16% (b) (Cost $12,266,180) | | | 12,266,180 | | | $ | 12,266,180 | |

| | | | | | | | | |

TOTAL INVESTMENTS (Cost $150,232,669) — 100.0% | | | | | | $ | 145,704,820 | |

| | | | | | | | | |

LIABILITIES IN EXCESS OF OTHER ASSETS — (0.0%) (c) | | | | | | | (59,198 | ) |

| | | | | | | | | |

NET ASSETS — 100.0% | | | | | | $ | 145,645,622 | |

(a) | Rate shown is the annualized yield at time of purchase. |

(b) | The rate shown is the 7-day effective yield as of June 30, 2024. |

(c) | Percentage rounds to less than 0.1% |

See accompanying notes to financial statements. |

8

AAMA Funds

Statements of Assets and Liabilities

June 30, 2024 |

| | AAMA

Equity Fund | | | AAMA

Income Fund | |

ASSETS | | | | | | | | |

Investments in securities: | | | | | | | | |

At cost | | $ | 200,902,322 | | | $ | 150,232,669 | |

At value | | $ | 389,632,402 | | | $ | 145,704,820 | |

Receivable for capital shares sold | | | 137,031 | | | | 3,993 | |

Dividends and interest receivable | | | 221,094 | | | | 265,186 | |

Other assets | | | 43,564 | | | | 25,736 | |

TOTAL ASSETS | | | 390,034,091 | | | | 145,999,735 | |

| | | | | | | | | |

LIABILITIES | | | | | | | | |

Payable for capital shares redeemed | | | 387,259 | | | | 246,992 | |

Payable to Adviser (Note 4) | | | 323,107 | | | | 67,920 | |

Payable to administrator (Note 4) | | | 19,075 | | | | 7,074 | |

Payable to Ultimus (Note 4) | | | 8,710 | | | | 5,975 | |

Accrued Trustee fees (Note 7) | | | 3,830 | | | | 1,420 | |

Other accrued expenses | | | 64,571 | | | | 24,732 | |

TOTAL LIABILITIES | | | 806,552 | | | | 354,113 | |

| | | | | | | | | |

NET ASSETS | | $ | 389,227,539 | | | $ | 145,645,622 | |

| | | | | | | | | |

Net assest consist of: | | | | | | | | |

Paid-in capital | | $ | 168,761,683 | | | $ | 154,171,089 | |

Distributable earnings (accumulated deficit) | | | 220,465,856 | | | | (8,525,467 | ) |

Net assets | | $ | 389,227,539 | | | $ | 145,645,622 | |

| | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number of shares authorized) | | | 21,022,930 | | | | 6,151,882 | |

| | | | | | | | | |

Net asset value, offering price and redemption price per share | | $ | 18.51 | | | $ | 23.67 | |

See accompanying notes to financial statements. |

9

AAMA Funds

Statements of Operations

For the Year Ended June 30, 2024 |

| | AAMA

Equity Fund | | | AAMA

Income Fund | |

INVESTMENT INCOME | | | | | | | | |

Dividends | | $ | 8,153,883 | | | $ | 2,691,776 | |

Interest | | | 96,200 | | | | 1,470,777 | |

TOTAL INVESTMENT INCOME | | | 8,250,083 | | | | 4,162,553 | |

| | | | | | | | | |

EXPENSES | | | | | | | | |

Management fees (Note 4) | | | 4,029,091 | | | | 1,038,396 | |

Administration fees (Note 4) | | | 237,195 | | | | 81,234 | |

Fund accounting fees (Note 4) | | | 81,384 | | | | 48,775 | |

Registration and filing fees | | | 41,556 | | | | 35,721 | |

Trustees’ fees and expenses (Note 7) | | | 47,187 | | | | 16,549 | |

Shareholder reporting expenses | | | 35,264 | | | | 18,159 | |

Legal fees | | | 34,936 | | | | 12,123 | |

Transfer agent fees (Note 4) | | | 22,500 | | | | 22,500 | |

Custodian and bank service fees | | | 30,565 | | | | 11,906 | |

Audit and tax services fees | | | 28,795 | | | | 10,887 | |

Insurance expense | | | 28,722 | | | | 9,117 | |

Other expenses | | | 14,662 | | | | 15,407 | |

TOTAL EXPENSES | | | 4,631,857 | | | | 1,320,774 | |

Less fees voluntarily waived by the Adviser (Note 4) | | | — | | | | (166,750 | ) |

NET EXPENSES | | | 4,631,857 | | | | 1,154,024 | |

| | | | | | | | | |

NET INVESTMENT INCOME | | | 3,618,226 | | | | 3,008,529 | |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS | | | | | | | | |

Net realized gains (losses) on investment transactions | | | 36,714,881 | | | | (3,121,648 | ) |

Net change in unrealized appreciation (depreciation) on investments | | | 21,347,889 | | | | 5,198,628 | |

NET REALIZED AND UNREALIZED GAINS ON INVESTMENTS | | | 58,062,770 | | | | 2,076,980 | |

| | | | | | | | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 61,680,996 | | | $ | 5,085,509 | |

See accompanying notes to financial statements. |

10

AAMA Equity Fund

Statements of Changes in Net Assets |

| | Year Ended

June 30,

2024 | | | Year Ended

June 30,

2023 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 3,618,226 | | | $ | 3,514,817 | |

Net realized gains on investment transactions | | | 36,714,881 | | | | — | |

Net change in unrealized appreciation (depreciation) on investments | | | 21,347,889 | | | | 46,394,556 | |

Net increase in net assets resulting from operations | | | 61,680,996 | | | | 49,909,373 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (3,746,178 | ) | | | (17,561,517 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 59,822,728 | | | | 61,349,782 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 3,729,615 | | | | 17,527,410 | |

Payments for shares redeemed | | | (145,105,056 | ) | | | (82,814,841 | ) |

Net decrease in net assets from capital share transactions | | | (81,552,713 | ) | | | (3,937,649 | ) |

| | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (23,617,895 | ) | | | 28,410,207 | |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 412,845,434 | | | | 384,435,227 | |

End of year | | $ | 389,227,539 | | | $ | 412,845,434 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 3,526,363 | | | | 4,048,605 | |

Shares reinvested | | | 221,474 | | | | 1,210,456 | |

Shares redeemed | | | (8,444,079 | ) | | | (5,465,034 | ) |

Net decrease in shares outstanding | | | (4,696,242 | ) | | | (205,973 | ) |

Shares outstanding, beginning of year | | | 25,719,172 | | | | 25,925,145 | |

Shares outstanding, end of year | | | 21,022,930 | | | | 25,719,172 | |

See accompanying notes to financial statements. |

11

AAMA Income Fund

Statements of Changes in Net Assets |

| | Year Ended

June 30,

2024 | | | Year Ended

June 30,

2023 | |

FROM OPERATIONS | | | | | | | | |

Net investment income | | $ | 3,008,529 | | | $ | 1,739,785 | |

Net realized losses on investment transactions | | | (3,121,648 | ) | | | — | |

Net change in unrealized appreciation (depreciation) on investments | | | 5,198,628 | | | | (2,213,026 | ) |

Net increase (decrease) in net assets resulting from operations | | | 5,085,509 | | | | (473,241 | ) |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS (Note 2) | | | (3,015,665 | ) | | | (1,738,802 | ) |

| | | | | | | | | |

FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 35,857,802 | | | | 21,428,724 | |

Net asset value of shares issued in reinvestment of distributions to shareholders | | | 3,008,844 | | | | 1,736,403 | |

Payments for shares redeemed | | | (37,885,422 | ) | | | (27,824,723 | ) |

Net increase (decrease) in net assets from capital share transactions | | | 981,224 | | | | (4,659,596 | ) |

| | | | | | | | | |

TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 3,051,068 | | | | (6,871,639 | ) |

| | | | | | | | | |

NET ASSETS | | | | | | | | |

Beginning of year | | | 142,594,554 | | | | 149,466,193 | |

End of year | | $ | 145,645,622 | | | $ | 142,594,554 | |

| | | | | | | | | |

CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 1,521,765 | | | | 916,106 | |

Shares reinvested | | | 128,104 | | | | 74,467 | |

Shares redeemed | | | (1,613,670 | ) | | | (1,190,614 | ) |

Net increase (decrease) in shares outstanding | | | 36,199 | | | | (200,041 | ) |

Shares outstanding, beginning of year | | | 6,115,683 | | | | 6,315,724 | |

Shares outstanding, end of year | | | 6,151,882 | | | | 6,115,683 | |

See accompanying notes to financial statements. |

12

AAMA Equity Fund

Financial Highlights |

Per Share Data for a Share Outstanding Throughout Each Year |

| | Year Ended

June 30,

2024 | | | Year Ended

June 30,

2023 | | | Year Ended

June 30,

2022 | | | Year Ended

June 30,

2021 | | | Year Ended

June 30,

2020 | |

Net asset value at beginning of year | | $ | 16.05 | | | $ | 14.83 | | | $ | 16.26 | | | $ | 12.22 | | | $ | 11.91 | |

| | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (a) | | | 0.17 | | | | 0.14 | | | | 0.06 | | | | 0.05 | | | | 0.08 | |

Net realized and unrealized gains (losses) on investments | | | 2.44 | | | | 1.77 | | | | (1.45 | ) | | | 4.05 | | | | 0.33 | |

Total from investment operations | | | 2.61 | | | | 1.91 | | | | (1.39 | ) | | | 4.10 | | | | 0.41 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.15 | ) | | | (0.10 | ) | | | (0.04 | ) | | | (0.06 | ) | | | (0.10 | ) |

Net realized gains | | | — | | | | (0.59 | ) | | | — | | | | — | | | | — | |

Total distributions | | | (0.15 | ) | | | (0.69 | ) | | | (0.04 | ) | | | (0.06 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 18.51 | | | $ | 16.05 | | | $ | 14.83 | | | $ | 16.26 | | | $ | 12.22 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (b) | | | 16.39 | % | | | 13.43 | % | | | (8.59 | %) | | | 33.64 | % | | | 3.41 | % |

| | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 389,228 | | | $ | 412,845 | | | $ | 384,435 | | | $ | 433,437 | | | $ | 358,993 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets (c) | | | 1.15 | % | | | 1.14 | % | | | 1.15 | % | | | 1.16 | % | | | 1.18 | % |

Ratio of net expenses to average net assets (c) | | | 1.15 | % | | | 1.14 | % | | | 1.15 | %(d)(e) | | | 1.16 | % | | | 1.18 | % |

Ratio of net investment income to average net assets (a)(c) | | | 0.90 | % | | | 0.90 | % | | | 0.34 | %(d)(e) | | | 0.33 | % | | | 0.67 | % |

Portfolio turnover rate | | | 3 | % | | | 0 | % | | | 5 | % | | | 0 | %(f) | | | 22 | % |

(a) | Recognition of net investment income by the Fund is affected by the timing of the declaration of the dividends and distributions by the underlying investment companies in which the Fund invests. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if the Adviser and/or administrator had not reduced fees for the year ended June 30, 2022. |

(c) | The ratios of income and expenses to average net assets do not reflect the Fund’s proportionate share of income and expenses of the underlying investment companies in which the Fund invests. |

(d) | Ratio was determined after fee reductions. |

(e) | The impact of the voluntary fee waiver by the administrator for the year ended June 30, 2022 was less than 0.005%. |

(f) | Percentage rounds to less than 1%. |

See accompanying notes to financial statements. |

13

AAMA Income Fund

Financial Highlights |

Per Share Data for a Share Outstanding Throughout Each Year |

| | Year Ended

June 30,

2024 | | | Year Ended

June 30,

2023 | | | Year Ended

June 30,

2022 | | | Year Ended

June 30,

2021 | | | Year Ended

June 30,

2020 | |

Net asset value at beginning of year | | $ | 23.32 | | | $ | 23.67 | | | $ | 25.22 | | | $ | 25.58 | | | $ | 25.06 | |

| | | | | | | | | | | | | | | | | | | | | |

Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (a) | | | 0.51 | | | | 0.28 | | | | 0.14 | | | | 0.17 | | | | 0.27 | |

Net realized and unrealized gains (losses) on investments | | | 0.35 | | | | (0.35 | ) | | | (1.54 | ) | | | (0.37 | ) | | | 0.52 | |

Total from investment operations | | | 0.86 | | | | (0.07 | ) | | | (1.40 | ) | | | (0.20 | ) | | | 0.79 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.51 | ) | | | (0.28 | ) | | | (0.15 | ) | | | (0.16 | ) | | | (0.27 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of year | | $ | 23.67 | | | $ | 23.32 | | | $ | 23.67 | | | $ | 25.22 | | | $ | 25.58 | |

| | | | | | | | | | | | | | | | | | | | | |

Total return (b) | | | 3.75 | % | | | (0.30 | %) | | | (5.57 | %) | | | (0.80 | %) | | | 3.17 | % |

| | | | | | | | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | $ | 145,646 | | | $ | 142,595 | | | $ | 149,466 | | | $ | 148,120 | | | $ | 153,568 | |

| | | | | | | | | | | | | | | | | | | | | |

Ratio of total expenses to average net assets (c) | | | 0.95 | % | | | 0.93 | % | | | 0.90 | % | | | 0.91 | % | | | 0.93 | % |

Ratio of net expenses to average net assets (a)(c)(d)(e) | | | 0.83 | % | | | 0.83 | % | | | 0.83 | % | | | 0.83 | % | | | 0.83 | % |

Ratio of net investment income to average net assets (a)(c)(d)(e) | | | 2.18 | % | | | 1.19 | % | | | 0.55 | % | | | 0.67 | % | | | 1.06 | % |

Portfolio turnover rate | | | 0 | % | | | 0 | % | | | 39 | % | | | 37 | % | | | 33 | % |

(a) | Recognition of net investment income by the Fund is affected by the timing of the declaration of the dividends and distributions by the underlying investment companies in which the Fund invests. |

(b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. The returns shown do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. The total returns would have been lower if the Adviser and/or administrator had not reduced fees. |

(c) | The ratios of income and expenses to average net assets do not reflect the Fund’s proportionate share of income and expenses of the underlying investment companies in which the Fund invests. |

(d) | Ratio was determined after fee reductions. |

(e) | The impact of the voluntary fee waiver by the Adviser and/or administrator for the years ended June 30, 2024, 2023, 2022, 2021, and 2020, was 0.12%, 0.10%, 0.07%, 0.08%,and 0.10%, respectively. |

See accompanying notes to financial statements. |

14

AAMA Funds

Notes to Financial Statements

June 30, 2024

1. Organization

AAMA Equity Fund and AAMA Income Fund (individually, a “Fund,” and, collectively, the “Funds” or “AAMA Funds”) are each a separate series of Asset Management Fund (the “Trust”), a professionally managed, diversified, open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust is organized as a Delaware statutory trust operating under a Second Amended and Restated Declaration of Trust dated November 27, 2018. Other series of the Trust are not included in this report. The inception date of the Funds was June 30, 2017. The Funds commenced operations on July 3, 2017, when they began to execute their investment objectives, which included purchasing investments.

AAMA Equity Fund’s investment objective is long-term capital appreciation.

AAMA Income Fund’s investment objective is current income with a secondary objective of preservation of capital.

2. Significant Accounting Policies

Each Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies.” The following is a summary of the Funds’ significant accounting policies used in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Regulatory update — Tailored Shareholder Reports for Mutual Funds and Exchange-Traded Funds (“ETFs”) – Effective January 24, 2023, the Securities and Exchange Commission (the “SEC”) adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will no longer appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed with the SEC on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. The Funds have implemented the rule and form requirements, as applicable, and are currently adhering to the requirements.

Securities valuation — The Funds record their investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The valuation techniques used by the Funds maximize

15

AAMA Funds

Notes to Financial Statements (Continued)

the use of observable inputs and minimize the use of unobservable inputs in determining fair value. These inputs are summarized in the three broad levels listed below:

● | Level 1 — quoted prices in active markets for identical securities |

● | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

● | Level 3 — significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments) |

Portfolio securities are valued as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally, 4:00 p.m., Eastern time) on each day the NYSE is open. Listed securities, including common stocks and exchange-traded funds (“ETFs”), for which market quotations are readily available are valued at the closing prices on the primary exchange where the securities are normally traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. Investments in other investment companies, except ETFs, are valued at their reported net asset value (“NAV”). In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Debt securities are typically valued on the basis of valuations provided by independent pricing services approved by Advanced Asset Management Advisors, Inc. (the “Adviser”), the Valuation Designee, that determine valuations based upon market transactions for normal, institutional-size trading units of similar securities. Short-term debt investments of sufficient credit quality maturing in less than 61 days may be valued at amortized cost if it is determined that amortized cost approximates fair value. In each of these situations, valuations are typically categorized as Level 2 in the fair value hierarchy.

Securities for which market quotations are not readily available (e.g., an approved pricing service does not provide a price, a price has become stale, or an event occurs that materially affects the furnished price) are valued by the Valuation Designee. In these cases, the Valuation Designee determines in good faith, subject to procedures approved by the Board of Trustees (the “Board”), the fair value of such securities (“good faith fair valuation”). When a good faith fair valuation of a security is required, consideration is generally given to a number of factors, including, but not limited to the following: type of security, nature and duration of any restrictions on disposition of the security, forces that influence the market in which the security is purchased or sold, existence of merger proposals or tender offers, expectation of additional news about the company and volume and depth of public trading in similar securities of the issuer or

16

AAMA Funds

Notes to Financial Statements (Continued)

similar companies. Depending on the source and relative significance of the valuation inputs in these instances, the valuations for these securities will be classified as Level 2 or Level 3 in the fair value hierarchy.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. The inputs used to measure the fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement.

The following is a summary of each Fund’s investments and the inputs used to value the investments as of June 30, 2024, by security type:

AAMA Equity Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Common Stocks | | $ | 273,518,232 | | | $ | — | | | $ | — | | | $ | 273,518,232 | |

Exchange-Traded Funds | | | 80,679,444 | | | | — | | | | — | | | | 80,679,444 | |

U.S. Treasury Obligations | | | — | | | | 19,895,035 | | | | — | | | | 19,895,035 | |

Money Market Funds | | | 15,539,691 | | | | — | | | | — | | | | 15,539,691 | |

Total | | $ | 369,737,367 | | | $ | 19,895,035 | | | $ | — | | | $ | 389,632,402 | |

AAMA Income Fund | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Municipal Bonds | | $ | — | | | $ | 1,236,495 | | | $ | — | | | $ | 1,236,495 | |

U.S. Government Agencies | | | — | | | | 40,076,681 | | | | — | | | | 40,076,681 | |

U.S. Treasury Obligations | | | — | | | | 92,125,464 | | | | — | | | | 92,125,464 | |

Money Market Funds | | | 12,266,180 | | | | — | | | | — | | | | 12,266,180 | |

Total | | $ | 12,266,180 | | | $ | 133,438,640 | | | $ | — | | | $ | 145,704,820 | |

Refer to each Fund’s Schedule of Portfolio Investments for a listing of the securities by security type and industry type. The Funds did not hold derivative instruments or any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the year ended June 30, 2024.

Share valuation — The NAV per share of each Fund is calculated daily by dividing the total value of its assets, less liabilities, by the number of shares outstanding. The offering price and redemption price per share of each Fund is equal to the NAV per share.

17

AAMA Funds

Notes to Financial Statements (Continued)

Investment income — Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income, if any, are recorded at the fair value of the securities received. Discounts and premiums on fixed income securities are amortized using the interest method. Withholding taxes on foreign dividends, if any, have been recorded in accordance with the Trust’s understanding of the applicable country’s rules and tax rates.

Distributions to shareholders — Dividends arising from net investment income, if any, are declared and paid annually to shareholders of the AAMA Equity Fund. Dividends arising from net investment income are declared and paid monthly to shareholders of the AAMA Income Fund. Net realized capital gains, if any, are distributed at least once each year. The amount of distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax” differences are permanent in nature and are primarily due to differing treatments of net short-term capital gains.

Dividends and distributions are recorded on the ex-dividend date. The tax character of distributions paid during the years ended June 30, 2024 and 2023 was as follows:

| | Years

Ended | | | Ordinary

Income | | | Long-Term

Capital Gains | | | Total

Distributions | |

AAMA Equity Fund | | | 6/30/2024 | | | $ | 3,746,178 | | | $ | — | | | $ | 3,746,178 | |

| | | | 6/30/2023 | | | $ | 2,589,794 | | | $ | 14,971,723 | | | $ | 17,561,517 | |

AAMA Income Fund | | | 6/30/2024 | | | $ | 3,015,665 | | | $ | — | | | $ | 3,015,665 | |

| | | | 6/30/2023 | | | $ | 1,738,802 | | | $ | — | | | $ | 1,738,802 | |

Investment transactions — Investment transactions are accounted for on trade date. Realized gains and losses on investments sold are determined on a specific identification basis.

Expenses — Expenses incurred by the Trust that do not relate to a specific Fund of the Trust are allocated to the individual Funds based on each Fund’s relative net assets or another appropriate basis.

Estimates — The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts of increase (decrease) in net assets resulting from operations during the reporting period. Actual results could differ from those estimates.

18

AAMA Funds

Notes to Financial Statements (Continued)

Federal income tax — Each Fund has qualified and intends to continue to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”). Qualification generally will relieve the Funds of liability for federal income taxes to the extent 100% of their net investment income and net realized capital gains are distributed in accordance with the Code.

In order to avoid imposition of the excise tax applicable to regulated investment companies, it is also each Fund’s intention to declare as dividends in each calendar year at least 98% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts from prior years.

The tax character of accumulated earnings as of June 30, 2024 was as follows:

| | AAMA

Equity Fund | | | AAMA

Income Fund | |

Tax cost of investments | | $ | 200,902,322 | | | $ | 150,232,669 | |

Gross unrealized appreciation | | $ | 189,112,015 | | | $ | 98 | |

Gross unrealized depreciation | | | (381,935 | ) | | | (4,527,947 | ) |

Net unrealized appreciation (depreciation) | | | 188,730,080 | | | | (4,527,849 | ) |

Undistributed ordinary income | | | 1,791,651 | | | | — | |

Accumulated capital and other losses | | | — | | | | (3,997,618 | ) |

Undistributed long-term gains | | | 29,944,125 | | | | — | |

Distributable earnings (accumulated deficit) | | $ | 220,465,856 | | | $ | (8,525,467 | ) |

As of June 30, 2024, AAMA Equity Fund reclassified $6,770,756 of paid-in capital against accumulated earnings on the Statement of Assets and Liabilities. Such reclassification, the result of permanent differences relating to the utilization of earnings and profits distributed to shareholders on redemption of shares, had no effect on the Fund’s net assets or NAV per share. AAMA Income Fund had short-term capital loss carryforwards of $621,176 and long-term capital loss carryforwards of $3,376,442 for income tax purposes. These capital loss carryforwards, which do not expire, may be utilized in future years to offset realized capital gains, if any, prior to distributing such gains to shareholders.

For the year ended June 30, 2024, AAMA Income Fund reclassified $5,158 of accumulated deficit against paid-in capital on the Statements of Assets and Liabilities. Such reclassification, the result of permanent differences between the financial statement an income tax reporting requirements, had no effect on the Fund’s net assets or NAV per share.

19

AAMA Funds

Notes to Financial Statements (Continued)

The Funds recognize the tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has reviewed each Fund’s tax positions for all open tax years (generally, three years) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements. The Funds identify their major tax jurisdiction as U.S. Federal. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense on the Statements of Operations. During the year ended June 30, 2024, the Funds did not incur any interest or penalties.

3. Investment Transactions

Investment transactions, other than short-term investments, were as follows for the year ended June 30, 2024:

Non-US Government | | AAMA

Equity Fund | | | AAMA

Income Fund | |

Purchase of investment securities | | $ | 11,681,691 | | | $ | — | |

Proceeds from sales of investment securities | | $ | 105,045,529 | | | $ | 22,484,016 | |

US Government (long-term) | | AAMA

Equity Fund | | | AAMA

Income Fund | |

Purchase of U.S. government securities | | $ | — | | | $ | — | |

Proceeds from sales and maturities of U.S. government securities | | $ | — | | | $ | 27,575,000 | |

4. Transactions with Related Parties

INVESTMENT ADVISORY AGREEMENT

Each Fund’s investments are managed by the Adviser under the terms of an Investment Advisory Agreement. AAMA Equity Fund pays the Adviser a management fee, which is computed and accrued daily and paid monthly, at an annual rate of 1.00% of its average daily net assets. AAMA Income Fund pays the Adviser a management fee, which is computed and accrued daily and paid monthly, at an annual rate of 0.75% of its average daily net assets.

During the year ended June 30, 2024, the Adviser voluntarily waived its management fees in the amount of $166,750 for AAMA Income Fund. These voluntary waivers are not eligible for recovery by the Adviser in future periods.

During the year ended June 30, 2024, there were no expense cap limitations in place for the Funds.

20

AAMA Funds

Notes to Financial Statements (Continued)

BUSINESS MANAGER AND ADMINISTRATOR

Foreside Management Services, LLC (“Foreside”), d/b/a ACA Group, serves as the Trust’s business manager and administrator. Pursuant to the terms of a Management and Administration Agreement (the “Agreement”) between the Trust, on behalf of the Funds, and Foreside, Foreside performs and coordinates all management and administration services for the Trust either directly or through working with the Trust’s service providers. Services provided under the Agreement by Foreside include, but are not limited to, coordinating and monitoring activities of the third party service providers to the Funds; making employees available to serve as officers of the Trust, including but not limited to, President, Secretary, Chief Compliance Officer, Anti-Money Laundering Officer, Treasurer and others as are deemed necessary and appropriate; performing compliance services for the Trust, including maintaining the Trust’s compliance program as required under the 1940 Act; managing the process of filing amendments to the Trust’s registration statement and other reports to shareholders; coordinating the Board meeting preparation process; reviewing financial reports and filing them with the U.S. Securities and Exchange Commission (the “SEC”); and maintaining books and records in accordance with applicable laws and regulations.

Foreside acts as the Distributor for the Funds. The Distributor serves as the principal underwriter for shares of the Funds and is a broker-dealer registered under the Securities Exchange Act of 1934, as amended, and a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”).

Pursuant to the Agreement, the Funds pay Foreside an annual fee of $210,000 plus 0.02% of average daily net assets, subject, however, to a minimum fee of $300,000.

OTHER SERVICE PROVIDER

Ultimus Fund Solutions, LLC (“Ultimus”) serves as the transfer agent, fund accountant and financial administrator for the Funds. The transfer agent services provided by Ultimus to the Funds include, but are not limited to (i) processing shareholder purchase and redemption requests; (ii) processing dividend payments; and (iii) maintaining shareholder account records. The administrative and fund accounting services provided by Ultimus to the Funds include (i) computing each Fund’s NAV for purposes of the sale and redemption of its shares; (ii) computing the dividends payable by each Fund; (iii) preparing certain periodic reports and statements; and (iv) maintaining the general ledger and other accounting records for the Funds.

21

AAMA Funds

Notes to Financial Statements (Continued)

PRINCIPAL HOLDERS OF FUND SHARES

As of June 30, 2024, the following account holders owned of record 25% or more of the outstanding shares of each Fund:

NAME OF RECORD OWNER | % Ownership |

AAMA Equity Fund | |

Charles Schwab and Company Inc. (for the benefit of its clients) | 69% |

AAMA Income Fund | |

Charles Schwab and Company Inc. (for the benefit of its clients) | 77% |

A beneficial owner of 25% or more of each Fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting.

5. Investments in Other Investment Companies

The Funds may invest a significant portion of their assets in shares of one or more investment companies, including ETFs. ETFs issue their shares to authorized participants in return for a specific basket of securities and/or cash. The authorized participants then sell the ETF’s shares on the secondary market. In other words, ETF shares are traded on a securities exchange based on their fair value. There are certain risks associated with investments in ETFs. Disruptions to the creations and redemptions process through which authorized participants directly purchase and sell ETF shares, the existence of extreme market volatility or potential lack of an active trading market, or changes in the liquidity of the market for an ETF’s underlying portfolio holdings, may result in the ETF’s shares trading at significantly above (at a premium to) or below (at a discount to) NAV, which may result in the Funds paying significantly more or receiving significantly less for ETF shares than the value of the relevant ETF’s underlying holdings. An ETF’s shares could also trade at a premium or discount to NAV when an ETF’s underlying securities trade on a foreign exchange that is closed when the securities exchange on which the ETF trades is open. The current price of the ETF’s underlying securities and the last quoted price for the underlying security are likely to deviate in such circumstances. There can be no assurance that an active trading market for an ETF’s shares will develop or be maintained. Trading may be halted, for example, due to market conditions. Because the value of ETF shares depends on the demand in the market, a Fund’s holdings may not be able to be liquidated at the most optimal time, adversely affecting performance. There can be no assurance that an ETF’s investment objectives will be achieved. Each ETF is subject to specific risks, depending on the nature of the ETF. These risks could include liquidity risk, sector risk, foreign and emerging market risk, as well as risks associated with

22

AAMA Funds

Notes to Financial Statements (Continued)

real estate investments and natural resources. ETFs in which a Fund invests will not be able to replicate exactly the performance of the indices they track, if any, because the total return generated by the securities will be reduced by transaction costs incurred in adjusting the actual balance of the securities. In addition, ETFs in which a Fund invests will incur expenses not incurred by their applicable indices. Certain securities in the indices tracked by the ETFs may, from time to time, temporarily be unavailable, which may further impede the ETFs’ ability to track their applicable indices. An investment in an ETF presents the risk that the ETF may no longer meet the listing requirements of any applicable exchanges on which the ETF is listed. As of June 30, 2024, AAMA Equity Fund had 20.7% of the fair value of its net assets invested in ETFs.

6. Contingencies and Commitments

The Funds indemnify the Trust’s officers and Trustees for certain liabilities that might arise from their performance of their duties to the Funds. Additionally, in the normal course of business the Funds enter into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Trust expects the risk of loss to be remote.

7. Trustee Compensation

The Independent Trustees are compensated for their services to the Trust by the Funds. Each Independent Trustee receives an annual retainer plus meeting fees (which vary depending on meeting type). Collectively, the Independent Trustees were paid $124,800 in fees during the year ended June 30, 2024, for the entire Trust, which includes another fund not managed by Advanced Asset Management Advisors, Inc. The Funds paid Trustee compensation in the amount of $62,400 for the year ended June 30, 2024. In addition, the Funds reimburse Trustees for out-of-pocket expenses incurred in conjunction with attendance of meetings.

8. Subsequent Events

The Funds are required to recognize in the financial statements the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statements of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Funds are required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

23

AAMA Funds

Report of Independent Registered Public Accounting Firm

To the Shareholders of AAMA Funds and

Board of Trustees of Asset Management Fund

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of portfolio investments, of AAMA Equity Fund and AAMA Income Fund (the “AAMA Funds” or the “Funds”), each a series of Asset Management Fund, as of June 30, 2024, the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of June 30, 2024, the results of their operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2024, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant

24

AAMA Funds

Report of Independent Registered Public Accounting Firm (Continued)

estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Funds’ auditor since 2017.

COHEN & COMPANY, LTD.

Milwaukee, Wisconsin

August 28, 2024

25

AAMA Funds

Other Information (Unaudited)

Information regarding how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the Funds website at aamafunds.com, upon request by calling toll-free 1-800-701-9502, or on the SEC’s website at www.sec.gov.

The Trust files a complete listing of portfolio holdings of the Funds with the SEC as of the end of the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The filings are available upon request, by calling 1-800-701-9502. Furthermore, you may obtain a copy of these filings on the SEC’s website at www.sec.gov and the Funds’ website at www.aamafunds.com. The Statement of Additional Information includes additional information about Trustees and is available, without charge, upon request, by calling 1-800-701-9502.

Federal Tax Information (Unaudited)

For the fiscal year ended June 30, 2024, AAMA Equity designated $6,770,756 as long-term capital gain distributions.

Qualified Dividend Income – For the fiscal year ended June 30, 2024, AAMA Equity Fund and AAMA Income Fund have designated 100.00% and 0.00% respectively, of ordinary income distributions, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate.

Dividends Received Deduction – Corporate Shareholders are generally entitled to take the dividends received deduction on the portion of a Fund’s dividends that qualify under tax law. For the fiscal year ended June 30, 2024, 100.00% and 0.00%, of ordinary income dividends paid by AAMA Equity Fund and AAMA Income Fund, respectively, qualify for the corporate dividends received deduction.

26

This page intentionally left blank.

This page intentionally left blank.

This page intentionally left blank.

Investment Advisor

Advanced Asset Management Advisors, Inc.

4995 Bradenton Avenue, Suite 210

Dublin, Ohio 43017

Business Manager and Administrator

Foreside Management Services, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

Financial Administrator and Transfer and Dividend Agent

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

Distributor

Foreside Financial Services, LLC

Three Canal Plaza, Suite 100

Portland, Maine 04101

Legal Counsel

Vedder Price P.C.

222 N. LaSalle Street

Chicago, Illinois 60601

Custodian

U.S. Bank, N.A.

1555 N. Rivercenter Drive, MK-WI-S302

Milwaukee, Wisconsin 53212

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

342 N. Water Street, Suite 830

Milwaukee, WI 53202

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

There were no changes in or disagreements with the Funds’ accountants during the period.

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Disclosed as part of the financial statements included in Item 7 (a).

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Confidential VP Draft

AAMA EQUITY FUND

AAMA INCOME FUND

Statement Regarding Basis for Renewal of Investment Advisory Agreement

Pursuant to Form N-CSR, Item 11

At a meeting held on May 14, 2024 (the “Meeting”), the Board of Trustees (the “Board,” with the members of the Board referred to as the “Trustees”) of Asset Management Fund (the “Trust”), including the Trustees who are not “interested persons,” as defined by the Investment Company Act of 1940, as amended (the “1940 Act”), of the Trust (the “Independent Trustees”), unanimously approved the continuation of the investment advisory agreement (the “Advisory Agreement”) between the Trust, on behalf of its series, AAMA Equity Fund and AAMA Income Fund (each, a “Fund” and collectively, the “Funds”), and Advanced Asset Management Advisors, Inc. (“AAMA” or the “Adviser”). The Board determined that the continuation of the Advisory Agreement is in the best interests of each Fund in light of the nature, extent and quality of the services provided and such other factors and information as the Board considered to be relevant in the exercise of its reasonable business judgment, as summarized below.

In considering the renewal of the Advisory Agreement at the Meeting, the Board took into account its duties under the 1940 Act, as well as under the general principles of state law, in reviewing and approving advisory contracts; the requirements of the 1940 Act in such matters; the fiduciary duty of investment advisers established by Section 36(b) of the 1940 Act with respect to advisory agreements and their receipt of compensation under such agreements; the standards used by courts in determining whether fees charged to mutual funds by their investment advisers are “excessive” in violation of Section 36(b); and the factors to be considered by the Board in voting on such agreements. In advance of the Meeting, the Board received information and materials from the Adviser in connection with the proposed continuation of the Advisory Agreement, including, among other things, a description of the services provided by the Adviser to each Fund and information regarding the relevant personnel responsible for such services and their experience; comparative information regarding each Fund’s investment performance, fees and expenses; information regarding the potential for the Adviser to experience economies of scale in the provision of services to the Funds and the extent to which any potential scale benefits may be shared with shareholders; information regarding the Adviser’s overall financial condition and ability to carry out its obligations to the Funds; Adviser profitability data; information regarding the Adviser’s compliance program resources and compliance policies and procedures; and information regarding any “fall-out” benefits—i.e., ancillary benefits derived or that may be derived by the Adviser from its relationship with the Funds.

At the Meeting, the Board met with representatives of the Adviser to review and discuss the materials provided in advance of the Meeting. The Board, which is composed entirely of Independent Trustees, also met independently of management to review and discuss the materials received from the Adviser and Trust counsel. The Independent Trustees weighed and considered the information provided in light of their substantial accumulated experience in governing the Funds and applied their business judgment to determine whether the Advisory Agreement continues to be a reasonable business arrangement from each Fund’s perspective.

Confidential VP Draft

In approving the continuation of the Advisory Agreement, the Board considered such information as the Board deemed reasonably necessary to evaluate the terms of the Advisory Agreement. The Board noted that performance information is provided to the Board on an ongoing basis at regular Board meetings held throughout the year. Furthermore, at each of its meetings, the Board covers an agenda of topics and materials and considers factors that are relevant to its annual consideration of the Advisory Agreement for the Funds, including the services and support provided to each of the Funds. The Board also considered that shareholders chose to invest or remain invested in the Funds having received and with access to disclosures regarding the Funds’ investment advisory fees and the Adviser’s role in managing the Funds. The Board determined that, given the totality of information provided with respect to the Advisory Agreement, the Board, in its judgment, had received sufficient information to renew the Advisory Agreement.

In its deliberations, the Board did not identify any single factor or group of factors as being determinative. Rather, the Board’s approval was based on each Trustee’s business judgment after consideration of the information as a whole. Individual Trustees may have weighed certain factors differently and assigned varying degrees of materiality to information considered by the Board.

Nature, Extent and Quality of Services. The Board considered the nature, extent and quality of services provided by the Adviser to each Fund, including the compliance program established by the Adviser and the level of compliance attained by the Adviser. The Board reviewed the Adviser’s portfolio management services and considered the experience and skills of the Adviser’s investment management team.