UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-3561

CAPITAL APPRECIATION VARIABLE ACCOUNT

(Exact name of registrant as specified in charter)

500 Boylston Street, Boston, Massachusetts 02116

(Address of principal executive offices) (Zip code)

Susan S. Newton

Massachusetts Financial Services Company

500 Boylston Street

Boston, Massachusetts 02116

(Name and address of agents for service)

Registrant’s telephone number, including area code: (617) 954-5000

Date of fiscal year end: December 31

Date of reporting period: June 30, 2008

ITEM 1. REPORTS TO STOCKHOLDERS.

PROFESSIONALLY MANAGED COMBINATION

FIXED/VARIABLE ANNUITIES

FOR PERSONAL INVESTMENTS AND

QUALIFIED RETIREMENT PLANS

SEMIANNUAL REPORT Ÿ June 30, 2008

Capital Appreciation Variable Account

Global Governments Variable Account

Government Securities Variable Account

High Yield Variable Account

Money Market Variable Account

Total Return Variable Account

Issued by

Sun Life Assurance Company of Canada (U.S.),

A Wholly Owned Subsidiary of

Sun Life of Canada (U.S.) Holdings, Inc.

Table of Contents

| 1 | ||

| 2 | ||

| 8 | ||

| 28 | ||

| 30 | ||

| 31 | ||

| 33 | ||

| 45 | ||

| Back Cover | ||

| Back Cover | ||

| Back Cover | ||

This report is prepared for the general information of contract owners. It is authorized for distribution to prospective investors only when preceded or accompanied by a current prospectus.

| NOT FDIC INSURED MAY LOSE VALUE NO BANK OR CREDIT UNION GUARANTEE | ||||

| NOT A DEPOSIT NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY OR NCUA/NCUSIF | ||||

Dear Contract Owners:

Negative headlines tend to resonate during difficult markets, and we certainly have had more than our share of tough news recently. As a result consumer, and particularly investor, sentiment are at all-time lows. That said, I do think it is helpful to remember there are always silver linings in the storm clouds if you look hard enough.

Through all of the challenges we have faced, there are some positive underlying trends. In the United States, for example, institutional traders and credit market followers are just now showing increasing signs of confidence and are beginning to take on more risk. At the corporate level, earnings continue to be relatively strong as companies have reduced labor costs, controlled inventories, and relied less on debt to finance expansion. More broadly, low interest rates and strong demand for consumer goods and industrial equipment are good signs for the global economy.

While I do not mean to minimize the risks inherent in today’s markets, periods such as these allow the talented fund managers and research analysts we have at MFS® to test their convictions, reevaluate existing positions, and identify new investment ideas. Our investment process also includes a significant risk management component, with constant attention paid to monitoring market risk, so we can do our best to minimize any surprises to your portfolio.

For investors, this is a great time to check in with your advisor and make sure you have a sound investment plan in place — one that can keep your hard-earned money working over the long term through a strategy that involves asset allocation, diversification, and periodic portfolio rebalancing and reviews. A plan tailored to your distinct needs and goals continues to be the best approach to help you take advantage of the inevitable challenges — and opportunities — that present themselves over time.

Respectfully,

Robert J. Manning

Chief Executive Officer and Chief Investment Officer

MFS Investment Management®

August 15, 2008

The opinions expressed in this letter are subject to change, may not be relied upon for investment advice, and no forecasts can be guaranteed.

1

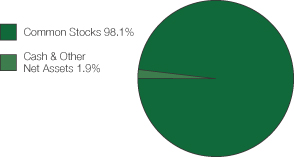

Portfolio Composition — Capital Appreciation Variable Account

Portfolio structure

| Top ten holdings | ||

| Cisco Systems, Inc. | 2.7% | |

| Google, Inc., “A” | 2.6% | |

| Oracle Corp. | 2.5% | |

| Microsoft Corp. | 2.3% | |

| Amdocs Ltd. | 2.2% | |

| Genzyme Corp. | 2.2% | |

| LVMH Moet Hennessy Louis Vuitton S.A. | 2.1% | |

| PepsiCo, Inc. | 2.1% | |

| Danaher Corp. | 2.1% | |

| CVS Caremark Corp. | 2.1% |

| Equity sectors | ||

| Technology | 23.8% | |

| Health Care | 17.0% | |

| Consumer Staples | 9.5% | |

| Energy | 9.1% | |

| Retailing | 8.9% | |

| Financial Services | 7.3% | |

| Special Products & Services | 6.4% | |

| Industrial Goods & Services | 6.0% | |

| Leisure | 4.5% | |

| Utilities & Communications | 2.3% | |

| Basic Materials | 2.1% | |

| Transportation | 1.2% |

Percentages are based on net assets as of 6/30/08.

The portfolio is actively managed and current holdings may be different.

2

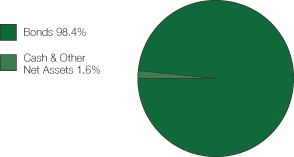

Portfolio Composition — Global Governments Variable Account

Portfolio structure (i)

| Fixed income sectors (i) | ||

| Non-U.S. Government Bonds | 72.9% | |

| U.S. Treasury Securities | 18.7% | |

| Commercial Mortgage-Backed Securities | 2.8% | |

| U.S. Government Agencies | 2.3% | |

| Mortgage-Backed Securities | 1.1% | |

| Municipal Bonds | 0.6% | |

| Credit quality of bonds (r) | ||

| AAA | 65.4% | |

| AA | 34.6% | |

| Portfolio facts | ||

| Average Duration (d)(i) | 6.3 | |

| Average Life (i)(m) | 8.3 yrs. | |

| Average Maturity (i)(m) | 8.9 yrs. | |

| Average Credit Quality of Rated Securities (long-term) (a) | AA+ | |

| Average Credit Quality of Rated Securities (short-term) (a) | A-1 | |

| Country weightings (i) | ||

| United States | 26.8% | |

| Japan | 25.5% | |

| United Kingdom | 11.0% | |

| Germany | 9.5% | |

| France | 5.2% | |

| Spain | 4.8% | |

| Netherlands | 4.7% | |

| Italy | 4.1% | |

| Belgium | 3.9% | |

| Other Countries | 4.5% | |

| (a) | The average credit quality of rated securities is based upon a market weighted average of portfolio holdings that are rated by public rating agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (i) | For purposes of this presentation, the bond component includes accrued interest amounts and may be positively or negatively impacted by the equivalent exposure from any derivative holdings, if applicable. |

| (m) | The average maturity shown is calculated using the final stated maturity on the portfolio’s holdings without taking into account any holdings which have been pre-refunded or pre-paid to an earlier date or which have a mandatory put date prior to the stated maturity. The average life shown takes into account these earlier dates. |

| (r) | Each security is assigned a rating from Moody’s Investors Service. If not rated by Moody’s, the rating will be that assigned by Standard & Poor’s. Likewise, if not assigned a rating by Standard & Poor’s, it will be based on the rating assigned by Fitch, Inc. For those portfolios that hold a security which is not rated by any of the three agencies, the security is considered Not Rated. Holdings in U.S. Treasuries and government agency mortgage-backed securities, if any, are included in the “AAA”-rating category. Percentages are based on the total market value of investments as of 6/30/08. |

Percentages are based on net assets as of 6/30/08, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

3

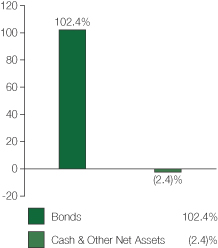

Portfolio Composition — Government Securities Variable Account

Portfolio structure (i)

| Fixed income sectors (i) | ||

| Mortgage-Backed Securities | 57.6% | |

| U.S. Treasury Securities | 26.0% | |

| U.S. Government Agencies | 17.6% | |

| Municipal Bonds | 1.2% |

| Credit quality of bonds (r) | ||

| AAA | 100.0% | |

| Portfolio facts | ||

| Average Duration (d)(i) | 4.9 | |

| Average Life (i)(m) | 7.6 yrs. | |

| Average Maturity (i)(m) | 15.4 yrs. | |

| Average Credit Quality of Rated Securities (long-term) (a) | AAA | |

| Average Credit Quality of Rated Securities (short-term) (a) | A-1 | |

| (a) | The average credit quality of rated securities is based upon a market weighted average of portfolio holdings that are rated by public rating agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (i) | For purposes of this presentation, the bond component includes accrued interest amounts and may be positively or negatively impacted by the equivalent exposure from any derivative holdings, if applicable. |

| (m) | The average maturity shown is calculated using the final stated maturity on the portfolio’s holdings without taking into account any holdings which have been pre-refunded or pre-paid to an earlier date or which have a mandatory put date prior to the stated maturity. The average life shown takes into account these earlier dates. |

| (r) | Each security is assigned a rating from Moody’s Investors Service. If not rated by Moody’s, the rating will be that assigned by Standard & Poor’s. Likewise, if not assigned a rating by Standard & Poor’s, it will be based on the rating assigned by Fitch, Inc. For those portfolios that hold a security which is not rated by any of the three agencies, the security is considered Not Rated. Holdings in U.S. Treasuries and government agency mortgage-backed securities, if any, are included in the “AAA”-rating category. Percentages are based on the total market value of investments as of 6/30/08. |

Percentages are based on net assets as of 6/30/08, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

From time to time “Cash & Other Net Assets” may be negative due to the timing of cash receipts and/or the equivalent exposure of derivatives.

4

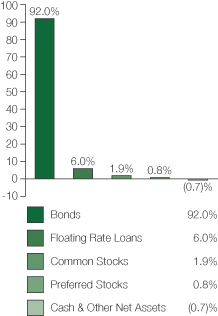

Portfolio Composition — High Yield Variable Account

Portfolio structure (i)

| Top five industries (i) | ||

| Medical & Health Technology & Services | 9.0% | |

| Gaming & Lodging | 8.0% | |

| Utilities - Electric Power | 7.2% | |

| Broadcasting | 6.3% | |

| Energy - Independent | 6.0% |

| Credit quality of bonds (r) | ||

| AAA | 3.3% | |

| AA | 1.0% | |

| A | 1.4% | |

| BBB | 0.6% | |

| BB | 19.5% | |

| B | 52.9% | |

| CCC | 17.7% | |

| D | 0.1% | |

| Not Rated | 3.5% | |

| Portfolio facts | ||

| Average Duration (d)(i) | 4.3 | |

| Average Life (i)(m) | 6.9 yrs. | |

| Average Maturity (i)(m) | 8.3 yrs. | |

| Average Credit Quality of Rated Securities (long-term) (a) | B+ | |

| Average Credit Quality of Rated Securities (short-term) (a) | A-1 | |

| (a) | The average credit quality of rated securities is based upon a market weighted average of portfolio holdings that are rated by public rating agencies. |

| (d) | Duration is a measure of how much a bond’s price is likely to fluctuate with general changes in interest rates, e.g., if rates rise 1.00%, a bond with a 5-year duration is likely to lose about 5.00% of its value. |

| (i) | For purposes of this presentation, the bond component includes accrued interest amounts and may be positively or negatively impacted by the equivalent exposure from any derivative holdings, if applicable. |

| (m) | The average maturity shown is calculated using the final stated maturity on the portfolio’s holdings without taking into account any holdings which have been pre-refunded or pre-paid to an earlier date or which have a mandatory put date prior to the stated maturity. The average life shown takes into account these earlier dates. |

| (r) | Each security is assigned a rating from Moody’s Investors Service. If not rated by Moody’s, the rating will be that assigned by Standard & Poor’s. Likewise, if not assigned a rating by Standard & Poor’s, it will be based on the rating assigned by Fitch, Inc. For those portfolios that hold a security which is not rated by any of the three agencies, the security is considered Not Rated. Holdings in U.S. Treasuries and government agency mortgage-backed securities, if any, are included in the “AAA”-rating category. Percentages are based on the total market value of investments as of 6/30/08. |

Percentages are based on net assets as of 6/30/08, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

From time to time “Cash & Other Net Assets” may be negative due to the timing of cash receipts and/or the equivalent exposure of derivative holdings.

5

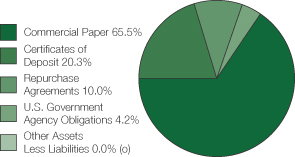

Portfolio Composition — Money Market Variable Account

Portfolio structure (u)

| Short-term credit quality (q) | ||

| Average Credit Quality Short-Term Bonds (a) | A-1 | |

| All holdings are rated “A-1” | ||

| Maturity breakdown (u) | ||

| 0 - 29 days | 49.6% | |

| 30 - 59 days | 20.5% | |

| 60 - 89 days | 12.8% | |

| 90 - 366 days | 17.1% | |

| Other Assets Less Liabilities (o) | 0.0% | |

| (a) | The average credit quality is based upon a market weighted average of portfolio holdings that are rated by public rating agencies. |

| (o) | Less than 0.1%. |

| (q) | Each security is assigned a rating from Moody’s Investors Service. If not rated by Moody’s, the rating will be that assigned by Standard & Poor’s. Likewise, if not assigned a rating by Standard & Poor’s, it will be based on the rating assigned by Fitch, Inc. If not rated by any of the three agencies, the security is considered Not Rated. U.S. Treasuries and U.S. Agency securities are included in the “A-1”-rating category. Percentages are based on the total market value of investments as of 6/30/08. |

| (u) | For purposes of this presentation, accrued interest, where applicable, is included. |

From time to time “Other Assets Less Liabilities” may be negative due to timing of cash receipts.

Percentages are based on net assets as of 6/30/08, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

6

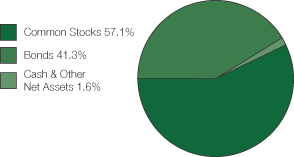

Portfolio Composition — Total Return Variable Account

Portfolio structure (i)

| Top ten holdings (i) | ||

| Fannie Mae, 5.5%, 30 year | 4.2% | |

| Fannie Mae, 6.0%, 30 year | 2.3% | |

| Exxon Mobil Corp. | 2.1% | |

| U.S. Treasury Notes, 4.875%, 2009 | 1.8% | |

| U.S. Treasury Notes, 4.625%, 2008 | 1.7% | |

| Lockheed Martin Corp. | 1.6% | |

| U.S. Treasury Notes, 4.25%, 2013 | 1.6% | |

| TOTAL S.A., ADR | 1.5% | |

| AT&T | 1.2% | |

| Wyeth | 1.2% |

| Equity sectors | ||

| Financial Services | 11.4% | |

| Energy | 9.6% | |

| Utilities & Communications | 7.2% | |

| Consumer Staples | 5.5% | |

| Health Care | 5.4% | |

| Industrial Goods & Services | 5.2% | |

| Technology | 3.3% | |

| Retailing | 3.3% | |

| Leisure | 1.8% | |

| Basic Materials | 1.4% | |

| Autos & Housing | 1.3% | |

| Special Products & Services | 1.0% | |

| Transportation | 0.7% | |

| Fixed income sectors (i) | ||

| Mortgage-Backed Securities | 16.6% | |

| High Grade Corporates | 9.9% | |

| U.S. Treasury Securities | 8.1% | |

| Commercial Mortgage-Backed Securities | 2.8% | |

| U.S. Government Agencies | 1.6% | |

| Non U.S. Government Bonds | 1.0% | |

| Asset-Backed Securities | 0.5% | |

| Emerging Market Bonds | 0.4% | |

| Municipal Bonds | 0.3% | |

| High Yield Corporates | 0.1% | |

| Residential Mortgage-Backed Securities (o) | 0.0% | |

| (i) | For purposes of this presentation, the bond component includes accrued interest amounts and may be positively or negatively impacted by the equivalent exposure from any derivative holdings, if applicable. |

| (o) | Less than 0.1%. |

Percentages are based on net assets as of 6/30/08, unless otherwise noted.

The portfolio is actively managed and current holdings may be different.

7

Portfolio of Investments (unaudited) — June 30, 2008

Capital Appreciation Variable Account

| Issuer | Shares/Par | Value ($) | |||

COMMON STOCKS - 98.1% | |||||

Aerospace - 2.1% | |||||

Precision Castparts Corp. | 7,560 | $ | 728,550 | ||

United Technologies Corp. | 45,070 | 2,780,819 | |||

| $ | 3,509,369 | ||||

Alcoholic Beverages - 1.5% | |||||

Diageo PLC | 132,970 | $ | 2,444,141 | ||

Apparel Manufacturers - 3.5% | |||||

LVMH Moet Hennessy Louis | 33,560 | $ | 3,499,013 | ||

NIKE, Inc., “B” | 39,110 | 2,331,347 | |||

| $ | 5,830,360 | ||||

Biotechnology - 3.2% | |||||

Genentech, Inc. (a) | 13,540 | $ | 1,027,686 | ||

Genzyme Corp. (a) | 51,350 | 3,698,227 | |||

Millipore Corp. (a) | 9,910 | 672,493 | |||

| $ | 5,398,406 | ||||

Broadcasting - 2.4% | |||||

Grupo Televisa S.A., ADR | 47,180 | $ | 1,114,392 | ||

News Corp., “A” | 77,920 | 1,171,917 | |||

Omnicom Group, Inc. | 40,190 | 1,803,727 | |||

| $ | 4,090,036 | ||||

Brokerage & Asset Managers - 2.6% | |||||

Charles Schwab Corp. | 104,190 | $ | 2,140,063 | ||

Deutsche Boerse AG | 11,120 | 1,248,132 | |||

Franklin Resources, Inc. | 10,760 | 986,154 | |||

| $ | 4,374,349 | ||||

Business Services - 6.4% | |||||

Amdocs Ltd. (a) | 126,530 | $ | 3,722,513 | ||

Automatic Data Processing, Inc. | 39,950 | 1,673,905 | |||

Fidelity National Information Services, Inc. | 21,350 | 788,029 | |||

Visa, Inc., “A” | 20,710 | 1,683,930 | |||

Western Union Co. | 119,120 | 2,944,646 | |||

| $ | 10,813,023 | ||||

Cable TV - 0.9% | |||||

Comcast Corp., “A” | 82,310 | $ | 1,561,421 | ||

Computer Software - 6.1% | |||||

Citrix Systems, Inc. (a) | 34,460 | $ | 1,013,469 | ||

Microsoft Corp. | 137,380 | 3,779,324 | |||

Oracle Corp. (a) | 203,590 | 4,275,390 | |||

VeriSign, Inc. (a) | 31,170 | 1,178,226 | |||

| $ | 10,246,409 | ||||

Computer Software - Systems - 3.1% | |||||

Apple, Inc. (a) | 10,720 | $ | 1,794,957 | ||

EMC Corp. (a) | 107,320 | 1,576,531 | |||

International Business Machines Corp. | 15,350 | 1,819,436 | |||

| $ | 5,190,924 | ||||

Consumer Goods & Services - 3.4% | |||||

Colgate-Palmolive Co. | 25,100 | $ | 1,734,410 | ||

Estee Lauder Cos., Inc., “A” | 18,850 | 875,583 | |||

Procter & Gamble Co. | 51,260 | 3,117,121 | |||

| $ | 5,727,114 | ||||

Electrical Equipment - 3.9% | |||||

Danaher Corp. | 44,890 | $ | 3,469,997 | ||

General Electric Co. | 47,230 | 1,260,569 | |||

W.W. Grainger, Inc. | 22,730 | 1,859,314 | |||

| $ | 6,589,880 | ||||

Electronics - 6.4% | |||||

Intel Corp. | 135,750 | $ | 2,915,910 | ||

Intersil Corp., “A” | 47,580 | 1,157,146 | |||

| Issuer | Shares/Par | Value ($) | |||

COMMON STOCKS - continued | |||||

Electronics - continued | |||||

KLA-Tencor Corp. | 43,800 | $ | 1,783,098 | ||

National Semiconductor Corp. | 43,310 | 889,587 | |||

Samsung Electronics Co. Ltd., GDR | 7,372 | 2,161,633 | |||

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | 166,264 | 1,813,940 | |||

| $ | 10,721,314 | ||||

Energy - Integrated - 4.0% | |||||

Exxon Mobil Corp. | 34,340 | $ | 3,026,384 | ||

Hess Corp. | 11,450 | 1,444,876 | |||

Marathon Oil Corp. | 42,700 | 2,214,849 | |||

| $ | 6,686,109 | ||||

Food & Beverages - 4.6% | |||||

General Mills, Inc. | 25,500 | $ | 1,549,635 | ||

Nestle S.A. | 58,000 | 2,624,913 | |||

PepsiCo, Inc. | 54,780 | 3,483,460 | |||

| $ | 7,658,008 | ||||

Food & Drug Stores - 2.7% | |||||

CVS Caremark Corp. | 87,499 | $ | 3,462,335 | ||

Walgreen Co. | 33,360 | 1,084,534 | |||

| $ | 4,546,869 | ||||

Gaming & Lodging - 1.2% | |||||

International Game Technology | 36,100 | $ | 901,778 | ||

Royal Caribbean Cruises Ltd. | 51,070 | 1,147,543 | |||

| $ | 2,049,321 | ||||

General Merchandise - 0.5% | |||||

Kohl’s Corp. (a) | 20,380 | $ | 816,015 | ||

Health Maintenance Organizations - 0.5% | |||||

UnitedHealth Group, Inc. | 28,450 | $ | 746,813 | ||

Insurance - 0.7% | |||||

MetLife, Inc. | 21,930 | $ | 1,157,246 | ||

Internet - 3.3% | |||||

eBay, Inc. (a) | 45,660 | $ | 1,247,888 | ||

Google, Inc., “A” (a) | 8,210 | 4,321,908 | |||

| $ | 5,569,796 | ||||

Major Banks - 3.0% | |||||

Bank of New York Mellon Corp. | 43,924 | $ | 1,661,645 | ||

State Street Corp. | 53,140 | 3,400,429 | |||

| $ | 5,062,074 | ||||

Medical & Health Technology & Services - 1.2% | |||||

Cardinal Health, Inc. | 18,300 | $ | 943,914 | ||

VCA Antech, Inc. (a) | 37,550 | 1,043,139 | |||

| $ | 1,987,053 | ||||

Medical Equipment - 4.7% | |||||

Advanced Medical Optics, Inc. (a) | 68,850 | $ | 1,290,249 | ||

Medtronic, Inc. | 53,080 | 2,746,890 | |||

ResMed, Inc. (a) | 33,380 | 1,193,001 | |||

Stryker Corp. | 20,240 | 1,272,691 | |||

Zimmer Holdings, Inc. (a) | 20,700 | 1,408,635 | |||

| $ | 7,911,466 | ||||

Metals & Mining - 0.7% | |||||

BHP Billiton Ltd., ADR | 14,310 | $ | 1,219,069 | ||

Network & Telecom - 4.3% | |||||

Cisco Systems, Inc. (a) | 191,720 | $ | 4,459,407 | ||

Juniper Networks, Inc. (a) | 44,770 | 992,999 | |||

QUALCOMM, Inc. | 19,670 | 872,758 | |||

Research in Motion Ltd. (a) | 7,500 | 876,750 | |||

| $ | 7,201,914 | ||||

8-CAVA

Portfolio of Investments (unaudited) — continued

| Issuer | Shares/Par | Value ($) | ||||

COMMON STOCKS - continued | ||||||

Oil Services - 5.1% | ||||||

Halliburton Co. | 61,090 | $ | 3,242,046 | |||

Noble Corp. | 26,630 | 1,729,885 | ||||

Schlumberger Ltd. | 11,750 | 1,262,303 | ||||

Weatherford International Ltd. (a) | 46,260 | 2,294,033 | ||||

| $ | 8,528,267 | |||||

Other Banks & Diversified Financials - 1.0% | ||||||

American Express Co. | 42,570 | $ | 1,603,612 | |||

Personal Computers & Peripherals - 0.6% | ||||||

NetApp, Inc. (a) | 45,890 | $ | 993,977 | |||

Pharmaceuticals - 7.4% | ||||||

Allergan, Inc. | 33,140 | $ | 1,724,937 | |||

Johnson & Johnson | 53,060 | 3,413,880 | ||||

Merck KGaA | 11,980 | 1,701,747 | ||||

Roche Holding AG | 13,750 | 2,471,182 | ||||

Wyeth | 65,470 | 3,139,941 | ||||

| $ | 12,451,687 | |||||

Specialty Chemicals - 1.4% | ||||||

Praxair, Inc. | 25,590 | $ | 2,411,602 | |||

Specialty Stores - 2.2% | ||||||

Lowe’s Cos., Inc. | 43,470 | $ | 902,003 | |||

Nordstrom, Inc. | 44,530 | 1,349,259 | ||||

Staples, Inc. | 57,120 | 1,356,600 | ||||

| $ | 3,607,862 | |||||

Telecommunications - Wireless - 2.3% | ||||||

America Movil S.A.B. de C.V., “L”, ADR | 47,530 | $ | 2,507,208 | |||

Rogers Communications, Inc., “B” | 33,960 | 1,312,894 | ||||

| $ | 3,820,102 | |||||

Trucking - 1.2% | ||||||

FedEx Corp. | 12,120 | $ | 954,935 | |||

United Parcel Service, Inc., “B” | 17,270 | 1,061,587 | ||||

| $ | 2,016,522 | |||||

Total Common Stocks | $ | 164,542,130 | ||||

SHORT-TERM OBLIGATIONS - 1.9% | ||||||

Toyota Motor Credit Corp., | $ | 3,221,000 | $ | 3,221,000 | ||

Total Investments | $ | 167,763,130 | ||||

OTHER ASSETS, | 30,736 | |||||

NET ASSETS - 100.0% | $ | 167,793,866 | ||||

See portfolio footnotes and notes to financial statements.

9-CAVA

Portfolio of Investments (unaudited) — June 30, 2008

Global Governments Variable Account

| Issuer | Shares/Par | Value ($) | |||||

BONDS - 96.2% | |||||||

Foreign Bonds - 71.5% | |||||||

Australia - 1.1% | |||||||

Commonwealth of Australia, 6%, 2017 | AUD | 97,000 | $ | 90,199 | |||

Belgium - 3.7% | |||||||

Kingdom of Belgium, 5.5%, 2017 | EUR | 192,000 | $ | 315,643 | |||

Canada - 1.8% | |||||||

Canada Housing Trust, 4.6%, 2011 | CAD | 52,000 | $ | 52,337 | |||

Government of Canada, 4.5%, 2015 | CAD | 81,000 | 84,011 | ||||

Government of Canada, 5.75%, 2033 | CAD | 16,000 | 19,721 | ||||

| $ | 156,069 | ||||||

Denmark - 0.6% | |||||||

Kingdom of Denmark, 4%, 2015 | DKK | 253,000 | $ | 50,330 | |||

France - 5.0% | |||||||

Republic of France, 6%, 2025 | EUR | 185,000 | $ | 323,510 | |||

Republic of France, 4.75%, 2035 | EUR | 68,000 | 102,977 | ||||

| $ | 426,487 | ||||||

Germany - 9.2% | |||||||

Federal Republic of Germany, | EUR | 152,000 | $ | 242,032 | |||

Federal Republic of Germany, | EUR | 172,000 | 257,309 | ||||

Federal Republic of Germany, | EUR | 152,000 | 279,240 | ||||

| $ | 778,581 | ||||||

Italy - 4.1% | |||||||

Republic of Italy, 4.75%, 2013 | EUR | 221,000 | $ | 344,205 | |||

Japan - 25.5% | |||||||

Development Bank of Japan, | JPY | 27,000,000 | $ | 256,792 | |||

Government of Japan, 0.8%, 2010 | JPY | 7,000,000 | 66,114 | ||||

Government of Japan, 1.5%, 2012 | JPY | 16,000,000 | 153,470 | ||||

Government of Japan, 1.3%, 2014 | JPY | 96,000,000 | 905,351 | ||||

Government of Japan, 1.5%, 2015 | JPY | 11,000,000 | 105,025 | ||||

Government of Japan, 1.7%, 2017 | JPY | 18,000,000 | 172,580 | ||||

Government of Japan, 2.1%, 2024 | JPY | 29,000,000 | 275,616 | ||||

Government of Japan, 2.2%, 2027 | JPY | 19,000,000 | 179,784 | ||||

Government of Japan, 2.4%, 2037 | JPY | 5,000,000 | 47,103 | ||||

| $ | 2,161,835 | ||||||

Netherlands - 4.5% | |||||||

Kingdom of Netherlands, 3.75%, 2014 | EUR | 258,000 | $ | 385,167 | |||

Spain - 4.5% | |||||||

Kingdom of Spain, 5%, 2012 | EUR | 244,000 | $ | 385,665 | |||

Sweden - 0.7% | |||||||

Kingdom of Sweden, 4.5%, 2015 | SEK | 345,000 | $ | 56,971 | |||

United Kingdom - 10.8% | |||||||

United Kingdom Treasury, 9%, 2011 | GBP | 114,000 | $ | 250,875 | |||

United Kingdom Treasury, 8%, 2015 | GBP | 150,000 | 348,470 | ||||

United Kingdom Treasury, 8%, 2021 | GBP | 65,000 | 162,946 | ||||

United Kingdom Treasury, | GBP | 84,000 | 154,452 | ||||

| $ | 916,743 | ||||||

Total Foreign Bonds | $ | 6,067,895 | |||||

U.S. Bonds - 24.7% | |||||||

Asset Backed & Securitized - 2.7% | |||||||

Bayview Commercial Asset Trust, FRN, | CAD | 30,000 | $ | 22,575 | |||

Commercial Mortgage Asset Trust, FRN, | $ | 1,338,267 | 34,308 | ||||

Commercial Mortgage Pass-Through Certificates, FRN, 2.661%, 2017 (n) | 59,000 | 56,984 | |||||

| Issuer | Shares/Par | Value ($) | ||||||

BONDS - continued | ||||||||

U.S. Bonds - continued | ||||||||

Asset Backed & Securitized - continued | ||||||||

Commercial Mortgage Pass-Through Certificates, FRN, 2.671%, 2017 (n) | $ | 94,804 | $ | 89,752 | ||||

First Union National Bank Commercial Mortgage Trust, FRN, | 1,473,470 | 29,443 | ||||||

| $ | 233,062 | |||||||

Mortgage Backed - 1.1% | ||||||||

Fannie Mae, 5.37%, 2013 | $ | 24,303 | $ | 24,860 | ||||

Fannie Mae, 4.78%, 2015 | 23,969 | 23,365 | ||||||

Fannie Mae, 5.09%, 2016 | 25,000 | 24,630 | ||||||

Fannie Mae, 5.424%, 2016 | 24,300 | 24,529 | ||||||

| $ | 97,384 | |||||||

Municipals - 0.6% | ||||||||

Minnesota Public Facilities Authority, Water Pollution Control Rev., “B”, | $ | 45,000 | $ | 48,650 | ||||

U.S. Government Agencies - 2.3% | ||||||||

Aid-Egypt, 4.45%, 2015 | $ | 49,000 | $ | 49,418 | ||||

Small Business Administration, | 39,081 | 36,984 | ||||||

Small Business Administration, | 105,122 | 105,070 | ||||||

| $ | 191,472 | |||||||

U.S. Treasury Obligations - 18.0% | ||||||||

U.S. Treasury Bonds, 4.75%, 2017 | $ | 145,000 | $ | 153,609 | ||||

U.S. Treasury Bonds, 8%, 2021 | 183,000 | 248,208 | ||||||

U.S. Treasury Bonds, 4.75%, 2037 | 52,000 | 53,698 | ||||||

U.S. Treasury Notes, 3.125%, 2008 | 1,000 | 1,004 | ||||||

U.S. Treasury Notes, 2.125%, 2010 | 572,000 | 567,844 | ||||||

U.S. Treasury Notes, 4.75%, 2012 | 267,000 | 281,747 | ||||||

U.S. Treasury Notes, 4%, 2015 | 211,000 | 216,885 | ||||||

| $ | 1,522,995 | |||||||

Total U.S. Bonds | $ | 2,093,563 | ||||||

Total Bonds | $ | 8,161,458 | ||||||

CALL OPTIONS PURCHASED - 0.0% |

| |||||||

U.S. Treasury Notes 10 yr Future - | 1 | $ | 688 | |||||

PUT OPTIONS PURCHASED - 0.0% | ||||||||

USD Currency - | 125,610 | $ | 806 | |||||

REPURCHASE AGREEMENTS - 4.3% | ||||||||

Merrill Lynch, 2.5%, dated 6/30/08, due 7/01/08, total to be received $359,025 (secured by various U.S. Treasury and Federal Agency obligations and Mortgage Backed securities in a jointly traded account), at Cost | $ | 359,000 | $ | 359,000 | ||||

Total Investments | $ | 8,521,952 | ||||||

OTHER ASSETS, | (39,649 | ) | ||||||

NET ASSETS - 100.0% | $ | 8,482,303 | ||||||

10 - WGVA

Portfolio of Investments (unaudited) — continued

Forward Foreign Currency Exchange Contracts at 6/30/08

| Type | Currency | Contracts to Deliver/ Receive | Settlement Date Range | In Exchange For | Contracts at Value | Net Unrealized Appreciation (Depreciation) | ||||||||||||

| Appreciation | ||||||||||||||||||

| SELL | AUD | 43,861 | 8/11/08 | $ | 41,928 | $ | 41,815 | $ | 113 | |||||||||

| SELL | CAD | 17,147 | 8/25/08 | 16,865 | 16,836 | 29 | ||||||||||||

| BUY | CHF | 22,393 | 7/21/08 | 21,620 | 21,961 | 341 | ||||||||||||

| SELL | CLP | 5,130,779 | 7/17/08 | 10,298 | 9,759 | 539 | ||||||||||||

| BUY | CNY | 297,152 | 8/21/08 | 43,000 | 43,627 | 627 | ||||||||||||

| BUY | DKK | 36,123 | 8/12/08 | 7,471 | 7,611 | 140 | ||||||||||||

| BUY | EUR | 596,085 | 8/25/08 | 925,748 | 936,217 | 10,469 | ||||||||||||

| BUY | GBP | 2,000 | 8/26/08 | 3,902 | 3,970 | 68 | ||||||||||||

| BUY | JPY | 67,696,779 | 7/31/08 - 8/26/08 | 630,341 | 640,366 | 10,025 | ||||||||||||

| BUY | NOK | 438,305 | 7/18/08 | 84,444 | 85,967 | 1,523 | ||||||||||||

| BUY | SEK | 244,372 | 7/31/08 | 40,411 | 40,523 | 112 | ||||||||||||

| SELL | SEK | 275,655 | 7/31/08 | 46,000 | 45,710 | 290 | ||||||||||||

| $ | 24,276 | |||||||||||||||||

| Depreciation | ||||||||||||||||||

| SELL | AUD | 50,961 | 8/11/08 | $ | 47,266 | $ | 48,583 | $ | (1,317 | ) | ||||||||

| BUY | CLP | 10,277,005 | 7/17/08 | 20,595 | 19,546 | (1,049 | ) | |||||||||||

| BUY | EUR | 26,400 | 8/25/08 | 41,469 | 41,464 | (5 | ) | |||||||||||

| SELL | EUR | 368,698 | 8/20/08 - 8/25/08 | 572,460 | 579,081 | (6,621 | ) | |||||||||||

| SELL | GBP | 228,458 | 8/26/08 | 447,586 | 453,446 | (5,860 | ) | |||||||||||

| BUY | JPY | 4,315,748 | 7/31/08 | 41,333 | 40,772 | (561 | ) | |||||||||||

| SELL | JPY | 24,590,289 | 7/31/08 - 8/26/08 | 228,994 | 232,367 | (3,373 | ) | |||||||||||

| SELL | NZD | 81,739 | 8/20/08 | 61,162 | 61,740 | (578 | ) | |||||||||||

| $ | (19,364 | ) | ||||||||||||||||

At June 30, 2008, the variable account had sufficient cash and/or securities to cover any commitments under these derivative contracts.

See portfolio footnotes and notes to financial statements.

11-WGVA

Portfolio of Investments (unaudited) — June 30, 2008

Government Securities Variable Account

| Issuer | Shares/Par | Value ($) | ||||

BONDS - 95.0% | ||||||

Agency - Other - 5.7% | ||||||

Financing Corp., 9.4%, 2018 | $ | 1,020,000 | $ | 1,381,217 | ||

Financing Corp., 10.35%, 2018 | 1,150,000 | 1,654,427 | ||||

Financing Corp., STRIPS, 0%, 2017 | 1,220,000 | 796,152 | ||||

| $ | 3,831,796 | |||||

Mortgage Backed - 57.4% | ||||||

Fannie Mae, 4.73%, 2012 | $ | 91,746 | $ | 90,983 | ||

Fannie Mae, 4.79%, 2012-2015 | 1,032,900 | 1,035,956 | ||||

Fannie Mae, 4.845%, 2013 | 253,374 | 251,317 | ||||

Fannie Mae, 5%, 2013-2027 | 2,687,695 | 2,697,529 | ||||

Fannie Mae, 5.06%, 2013-2017 | 192,031 | 190,395 | ||||

Fannie Mae, 4.545%, 2014 | 113,216 | 110,225 | ||||

Fannie Mae, 4.6%, 2014 | 122,051 | 119,067 | ||||

Fannie Mae, 4.61%, 2014 | 370,129 | 361,558 | ||||

Fannie Mae, 4.77%, 2014 | 103,146 | 101,227 | ||||

Fannie Mae, 4.849%, 2014 | 761,059 | 750,852 | ||||

Fannie Mae, 4.871%, 2014 | 468,091 | 463,308 | ||||

Fannie Mae, 5.1%, 2014 | 134,379 | 133,855 | ||||

Fannie Mae, 4.5%, 2015-2020 | 2,394,853 | 2,337,476 | ||||

Fannie Mae, 4.56%, 2015 | 157,441 | 152,114 | ||||

Fannie Mae, 4.62%, 2015 | 175,426 | 170,253 | ||||

Fannie Mae, 4.665%, 2015 | 106,275 | 103,253 | ||||

Fannie Mae, 4.7%, 2015 | 122,130 | 118,872 | ||||

Fannie Mae, 4.74%, 2015 | 98,299 | 95,838 | ||||

Fannie Mae, 4.81%, 2015 | 124,796 | 121,834 | ||||

Fannie Mae, 4.815%, 2015 | 117,000 | 114,386 | ||||

Fannie Mae, 4.82%, 2015 | 335,169 | 328,281 | ||||

Fannie Mae, 4.89%, 2015 | 86,023 | 84,578 | ||||

Fannie Mae, 4.925%, 2015 | 338,240 | 333,522 | ||||

Fannie Mae, 5.471%, 2015 | 115,027 | 116,489 | ||||

Fannie Mae, 6.5%, 2016-2036 | 1,381,545 | 1,433,884 | ||||

Fannie Mae, 4.995%, 2017 | 297,377 | 294,362 | ||||

Fannie Mae, 5.5%, 2017-2035 | 9,424,483 | 9,374,427 | ||||

Fannie Mae, 6%, 2017-2037 | 2,473,180 | 2,512,363 | ||||

Fannie Mae, 4.88%, 2020 | 84,499 | 84,273 | ||||

Fannie Mae, 5.19%, 2020 | 81,305 | 79,504 | ||||

Fannie Mae, 7.5%, 2022-2031 | 140,568 | 151,721 | ||||

Freddie Mac, 4.5%, 2013-2021 | 168,039 | 168,484 | ||||

Freddie Mac, 4.375%, 2015 | 392,236 | 391,247 | ||||

Freddie Mac, 5%, 2016-2027 | 2,960,826 | 2,986,434 | ||||

Freddie Mac, 6%, 2021-2037 | 2,324,739 | 2,361,150 | ||||

Freddie Mac, 5.5%, 2022-2035 | 4,505,473 | 4,499,138 | ||||

Freddie Mac, 6.5%, 2032-2037 | 600,240 | 623,459 | ||||

Ginnie Mae, 5.5%, 2033-2038 | 2,535,652 | 2,530,122 | ||||

Ginnie Mae, 5.612%, 2058 | 381,353 | 380,043 | ||||

Ginnie Mae, 6.36%, 2058 | 344,793 | 353,979 | ||||

| $ | 38,607,758 | |||||

Municipals - 1.2% | ||||||

California Educational Facilities Authority Rev. (Stanford University), “T-1”, 5%, 2039 | $ | 670,000 | $ | 695,762 | ||

Minnesota Public Facilities Authority, Water Pollution Control Rev., “B”, 5%, 2018 | 105,000 | 113,516 | ||||

| $ | 809,278 | |||||

U.S. Government Agencies - 11.6% | ||||||

Aid-Egypt, 4.45%, 2015 | $ | 473,000 | $ | 477,035 | ||

Aid-Peru, 9.98%, 2008 | 91,114 | 91,123 | ||||

Empresa Energetica Cornito Ltd., | 1,152,000 | 1,192,735 | ||||

Farmer Mac, 5.5%, 2011 (n) | 690,000 | 731,263 | ||||

Small Business Administration, | 13,942 | 14,258 | ||||

Small Business Administration, | 1,645 | 1,679 | ||||

| Issuer | Shares/Par | Value ($) | ||||

BONDS - continued | ||||||

U.S. Government Agencies - continued | ||||||

Small Business Administration, | $ | 388,402 | $ | 402,515 | ||

Small Business Administration, | 513,799 | 539,923 | ||||

Small Business Administration, | 205,026 | 203,067 | ||||

Small Business Administration, | 463,818 | 453,454 | ||||

Small Business Administration, | 263,257 | 257,933 | ||||

Small Business Administration, | 231,791 | 226,177 | ||||

Small Business Administration, | 344,851 | 338,036 | ||||

Small Business Administration, | 280,316 | 276,958 | ||||

U.S. Department of Housing & Urban Development, 6.36%, 2016 | 500,000 | 527,028 | ||||

U.S. Department of Housing & Urban Development, 6.59%, 2016 | 2,045,000 | 2,050,789 | ||||

| $ | 7,783,973 | |||||

U.S. Treasury Obligations - 19.1% | ||||||

U.S. Treasury Bonds, 9.25%, 2016 | $ | 409,000 | $ | 556,687 | ||

U.S. Treasury Bonds, 7.5%, 2016 | 218,000 | 272,313 | ||||

U.S. Treasury Bonds, 4.75%, 2017 | 993,000 | 1,051,959 | ||||

U.S. Treasury Bonds, 7.875%, 2021 | 396,000 | 527,979 | ||||

U.S. Treasury Bonds, 6.25%, 2023 | 322,000 | 383,105 | ||||

U.S. Treasury Bonds, 6.75%, 2026 (f) | 3,382,000 | 4,281,135 | ||||

U.S. Treasury Bonds, 5.25%, 2029 | 876,000 | 950,392 | ||||

U.S. Treasury Bonds, 4.375%, 2038 | 727,000 | 708,598 | ||||

U.S. Treasury Notes, 4.75%, 2010 | 1,860,000 | 1,926,408 | ||||

U.S. Treasury Notes, 2.125%, 2010 | 500,000 | 496,367 | ||||

U.S. Treasury Notes, 4.125%, 2012 | 1,159,000 | 1,199,655 | ||||

U.S. Treasury Notes, 12%, 2013 | 19,000 | 19,212 | ||||

U.S. Treasury Notes, 4%, 2014 | 211,000 | 217,610 | ||||

U.S. Treasury Notes, 4.75%, 2014 | 261,000 | 279,800 | ||||

| $ | 12,871,220 | |||||

Total Bonds | $ | 63,904,025 | ||||

REPURCHASE AGREEMENTS - 3.3% | ||||||

Merrill Lynch, 2.5%, dated 6/30/08, | $ | 2,239,000 | $ | 2,239,000 | ||

Total Investments | $ | 66,143,025 | ||||

OTHER ASSETS, | 1,153,312 | |||||

NET ASSETS - 100.0% | $ | 67,296,337 | ||||

12-GSVA

Portfolio of Investments (unaudited) — continued

Futures contracts outstanding at 6/30/08

| Description | Contracts | Value | Expiration Date | Unrealized Appreciation (Depreciation) | |||||||

| U.S. Treasury Bond 30 yr (Short) | 14 | $ | 1,618,313 | Sep - 08 | $ | (36,799 | ) | ||||

| U.S. Treasury Note 5 yr (Long) | 51 | 5,638,289 | Sep - 08 | 21,736 | |||||||

| U.S. Treasury Note 10 yr (Long) | 3 | 341,766 | Sep - 08 | 4,068 | |||||||

| $ | (10,995 | ) | |||||||||

At June 30, 2008, the variable account had sufficient cash and/or other liquid securities to cover any commitments under these derivative contracts.

See portfolio footnotes and notes to financial statements.

13-GSVA

Portfolio of Investments (unaudited) — June 30, 2008

High Yield Variable Account

| Issuer | Shares/Par | Value ($) | |||||

BONDS - 88.7% | |||||||

Aerospace - 1.2% | |||||||

Hawker Beechcraft Acquisition Co. LLC, 9.75%, 2017 | $ | 240,000 | $ | 240,000 | |||

Vought Aircraft Industries, Inc., 8%, 2011 | 315,000 | 292,950 | |||||

| $ | 532,950 | ||||||

Airlines - 0.6% | |||||||

Continental Airlines, Inc., 7.339%, 2014 | $ | 281,000 | $ | 213,560 | |||

Continental Airlines, Inc., 6.9%, 2017 | 53,024 | 43,745 | |||||

Continental Airlines, Inc., 6.748%, 2017 | 42,178 | 34,797 | |||||

| $ | 292,102 | ||||||

Asset Backed & Securitized - 4.8% | |||||||

ARCap REIT, Inc., CDO, “H”, | $ | 165,567 | $ | 57,948 | |||

Banc of America Commercial Mortgage, Inc., 5.39%, 2045 | 75,059 | 68,002 | |||||

Banc of America Commercial Mortgage, Inc., FRN, 5.772%, 2017 | 315,434 | 285,292 | |||||

Banc of America Commercial Mortgage, Inc., FRN, 6.002%, 2017 | 71,823 | 65,689 | |||||

Citigroup Commercial Mortgage Trust, FRN, 5.7%, 2017 | 148,212 | 96,907 | |||||

Credit Suisse Mortgage Capital Certificate, 5.343%, 2039 | 70,665 | 63,474 | |||||

Crest Ltd., CDO, 7%, 2040 | 154,000 | 79,969 | |||||

First Union National Bank Commercial Mortgage Trust, 6.75%, 2032 | 165,000 | 137,908 | |||||

JPMorgan Chase Commercial Mortgage Securities Corp., 5.44%, 2045 | 224,410 | 203,629 | |||||

JPMorgan Chase Commercial Mortgage Securities Corp., 5.372%, 2047 | 114,643 | 103,402 | |||||

JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 5.466%, 2047 | 145,361 | 129,756 | |||||

JPMorgan Chase Commercial Mortgage Securities Corp., FRN, 6.26%, 2051 | 110,000 | 80,796 | |||||

Merrill Lynch Mortgage Trust, FRN, | 110,000 | 79,766 | |||||

Merrill Lynch/Countrywide Commercial Mortgage Trust, FRN, 5.204%, 2049 | 242,759 | 216,761 | |||||

Merrill Lynch/Countrywide Commercial Mortgage Trust, FRN, 5.902%, 2050 | 62,000 | 56,497 | |||||

Wachovia Bank Commercial Mortgage Trust, FRN, 5.941%, 2047 | 87,180 | 60,931 | |||||

Wachovia Bank Commercial Mortgage Trust, FRN, 6.099%, 2051 | 240,129 | 220,660 | |||||

Wachovia Credit, CDO, FRN, | 250,000 | 138,258 | |||||

| $ | 2,145,645 | ||||||

Automotive - 2.9% | |||||||

Allison Transmission, Inc., 11%, 2015 (n) | $ | 355,000 | $ | 317,725 | |||

Ford Motor Credit Co. LLC, | 190,000 | 161,178 | |||||

Ford Motor Credit Co. LLC, 12%, 2015 | 350,000 | 307,883 | |||||

Ford Motor Credit Co. LLC, 8%, 2016 | 300,000 | 218,029 | |||||

Ford Motor Credit Co. LLC, FRN, | 155,000 | 136,467 | |||||

General Motors Corp., | 291,000 | 172,418 | |||||

| $ | 1,313,700 | ||||||

Broadcasting - 5.7% | |||||||

Allbritton Communications Co., | $ | 328,000 | $ | 318,980 | |||

Bonten Media Acquisition Co., | 135,000 | 98,550 | |||||

| Issuer | Shares/Par | Value ($) | |||||

BONDS - (continued) | |||||||

Broadcasting - (continued) | |||||||

CanWest MediaWorks LP, | $ | 160,000 | $ | 130,400 | |||

DIRECTV Holdings LLC, | 245,000 | 241,325 | |||||

Lamar Media Corp., 6.625%, 2015 | 225,000 | 204,750 | |||||

Lamar Media Corp., “C”, 6.625%, 2015 | 145,000 | 131,950 | |||||

LBI Media, Inc., 8.5%, 2017 (n) | 150,000 | 115,500 | |||||

LIN TV Corp., 6.5%, 2013 | 320,000 | 292,800 | |||||

Local TV Finance LLC, 9.25%, 2015 (n)(p) | 235,000 | 183,300 | |||||

Newport Television LLC, 13%, 2017 (n)(p) | 280,000 | 246,400 | |||||

Nexstar Broadcasting Group, Inc., | 270,000 | 234,900 | |||||

Univision Communications, Inc., | 450,000 | 330,750 | |||||

Young Broadcasting, Inc., 8.75%, 2014 | 80,000 | 43,200 | |||||

| $ | 2,572,805 | ||||||

Brokerage & Asset Managers - 0.7% | |||||||

Nuveen Investments, Inc., | $ | 350,000 | $ | 322,875 | |||

Building - 1.8% | |||||||

Associated Materials, Inc., 9.75%, 2012 | $ | 75,000 | $ | 74,250 | |||

Associated Materials, Inc., | 120,000 | 79,200 | |||||

Building Materials Corp. of America, | 165,000 | 135,300 | |||||

Nortek Holdings, Inc., 10%, 2013 (n) | 110,000 | 105,050 | |||||

Nortek Holdings, Inc., 8.5%, 2014 | 195,000 | 124,800 | |||||

Ply Gem Industries, Inc., 9%, 2012 | 345,000 | 202,688 | |||||

Ply Gem Industries, Inc., | 85,000 | 77,988 | |||||

| $ | 799,276 | ||||||

Business Services - 0.7% | |||||||

SunGard Data Systems, Inc., | $ | 326,000 | $ | 327,630 | |||

Cable TV - 3.9% | |||||||

CCH I Holdings LLC, 11%, 2015 | $ | 105,000 | $ | 77,831 | |||

CCH II Holdings LLC, 10.25%, 2010 | 380,000 | 367,650 | |||||

CCO Holdings LLC, 8.75%, 2013 | 705,000 | 648,600 | |||||

CSC Holdings, Inc., 6.75%, 2012 | 285,000 | 267,900 | |||||

CSC Holdings, Inc., 8.5%, 2015 (n) | 5,000 | 4,913 | |||||

Mediacom LLC, 9.5%, 2013 | 180,000 | 169,650 | |||||

NTL Cable PLC, 9.125%, 2016 | 228,000 | 213,750 | |||||

| $ | 1,750,294 | ||||||

Chemicals - 3.6% | |||||||

Innophos, Inc., 8.875%, 2014 | $ | 265,000 | $ | 265,000 | |||

Koppers Holdings, Inc., 9.875%, 2013 | 220,000 | 231,000 | |||||

Koppers Holdings, Inc., 0% to 2009, | 348,000 | 314,940 | |||||

Momentive Performance Materials, Inc., | 75,000 | 64,125 | |||||

Momentive Performance Materials, Inc., | 304,000 | 226,480 | |||||

Nalco Co., 7.75%, 2011 | 235,000 | 235,000 | |||||

Nalco Co., 8.875%, 2013 | 300,000 | 307,500 | |||||

| $ | 1,644,045 | ||||||

Computer Software - 0.6% | |||||||

First Data Corp., 9.875%, 2015 (n) | $ | 305,000 | $ | 265,350 | |||

Consumer Goods & Services - 2.2% | |||||||

Corrections Corp. of America, | $ | 120,000 | $ | 115,500 | |||

GEO Group, Inc., 8.25%, 2013 | 180,000 | 183,600 | |||||

14-HYVA

Portfolio of Investments (unaudited)— continued

| Issuer | Shares/Par | Value ($) | |||||

BONDS - continued | |||||||

Consumer Goods & Services - continued | |||||||

Jarden Corp., 7.5%, 2017 | $ | 75,000 | $ | 65,250 | |||

KAR Holdings, Inc., 10%, 2015 | 170,000 | 142,800 | |||||

Service Corp. International, | 110,000 | 110,000 | |||||

Service Corp. International, 7%, 2017 | 400,000 | 382,000 | |||||

| $ | 999,150 | ||||||

Containers - 1.2% | |||||||

Crown Americas LLC, | $ | 150,000 | $ | 149,625 | |||

Graham Packaging Co. LP, | 165,000 | 146,025 | |||||

Greif, Inc., 6.75%, 2017 | 165,000 | 159,225 | |||||

Owens-Brockway Glass Container, Inc., | 105,000 | 107,625 | |||||

| $ | 562,500 | ||||||

Defense Electronics - 0.9% | |||||||

L-3 Communications Corp., | $ | 235,000 | $ | 220,313 | |||

L-3 Communications Corp., | 215,000 | 198,338 | |||||

| $ | 418,651 | ||||||

Electronics - 0.9% | |||||||

Avago Technologies Finance, | $ | 120,000 | $ | 129,000 | |||

Flextronics International Ltd., | 125,000 | 116,875 | |||||

Spansion LLC, 11.25%, 2016 (n) | 240,000 | 148,800 | |||||

| $ | 394,675 | ||||||

Emerging Market Sovereign - 0.6% | |||||||

Republic of Argentina, FRN, | $ | 303,750 | $ | 255,675 | |||

Energy - Independent - 5.9% | |||||||

Chaparral Energy, Inc., 8.875%, 2017 | $ | 160,000 | $ | 138,800 | |||

Chesapeake Energy Corp., 7%, 2014 | 149,000 | 146,020 | |||||

Chesapeake Energy Corp., | 265,000 | 250,425 | |||||

Forest Oil Corp., 7.25%, 2019 | 150,000 | 144,000 | |||||

Forest Oil Corp., 7.25%, 2019 (n) | 35,000 | 33,600 | |||||

Hilcorp Energy I LP, 7.75%, 2015 (n) | 20,000 | 19,200 | |||||

Hilcorp Energy I LP, 9%, 2016 (n) | 115,000 | 117,013 | |||||

Mariner Energy, Inc., 8%, 2017 | 140,000 | 135,450 | |||||

Newfield Exploration Co., 6.625%, 2014 | 250,000 | 235,000 | |||||

OPTI Canada, Inc., 8.25%, 2014 | 320,000 | 318,400 | |||||

Plains Exploration & Production Co., | 355,000 | 340,800 | |||||

Plains Exploration & Production Co., | 70,000 | 70,000 | |||||

Quicksilver Resources, Inc., | 355,000 | 330,594 | |||||

SandRidge Energy, Inc., | 95,000 | 97,375 | |||||

SandRidge Energy, Inc., 8%, 2018 (n) | 130,000 | 130,650 | |||||

Southwestern Energy Co., 7.5%, 2018 (n) | 140,000 | 144,047 | |||||

| $ | 2,651,374 | ||||||

Entertainment - 0.5% | |||||||

AMC Entertainment, Inc., 11%, 2016 | $ | 150,000 | $ | 148,500 | |||

Marquee Holdings, Inc., 9.505%, 2014 | 115,000 | 90,275 | |||||

| $ | 238,775 | ||||||

| Issuer | Shares/Par | Value ($) | |||||

BONDS - continued | |||||||

Financial Institutions - 1.0% | |||||||

General Motors Corp., | $ | 422,000 | $ | 303,237 | |||

General Motors Corp., | 217,000 | 141,175 | |||||

Residential Capital LLC, 9.625%, 2015 (z) | 10,000 | 4,850 | |||||

| $ | 449,262 | ||||||

Food & Beverages - 2.5% | |||||||

ARAMARK Corp., 8.5%, 2015 | $ | 420,000 | $ | 411,600 | |||

B&G Foods, Inc., 8%, 2011 | 175,000 | 171,938 | |||||

Dean Foods Co., 7%, 2016 | 215,000 | 186,513 | |||||

Del Monte Corp., 6.75%, 2015 | 185,000 | 176,213 | |||||

Michael Foods, Inc., 8%, 2013 | 175,000 | 172,375 | |||||

| $ | 1,118,639 | ||||||

Forest & Paper Products - 2.5% | |||||||

Buckeye Technologies, Inc., 8%, 2010 | $ | 49,000 | $ | 49,000 | |||

Buckeye Technologies, Inc., 8.5%, 2013 | 375,000 | 373,125 | |||||

Georgia-Pacific Corp., 7.125%, 2017 (n) | 135,000 | 126,900 | |||||

Georgia-Pacific Corp., 8%, 2024 | 75,000 | 69,375 | |||||

Graphic Packaging International Corp., | 115,000 | 109,825 | |||||

JSG Funding PLC, 7.75%, 2015 | 25,000 | 22,750 | |||||

Millar Western Forest Products Ltd., | 245,000 | 159,250 | |||||

NewPage Holding Corp., 10%, 2012 | 80,000 | 81,000 | |||||

Smurfit-Stone Container Corp., 8%, 2017 | 165,000 | 132,000 | |||||

| $ | 1,123,225 | ||||||

Gaming & Lodging - 7.0% | |||||||

Firekeepers Development Authority, | $ | 145,000 | $ | 141,738 | |||

Fontainebleau Las Vegas Holdings LLC, | 345,000 | 224,250 | |||||

Harrah’s Operating Co., Inc., 5.5%, 2010 | 140,000 | 125,125 | |||||

Harrah’s Operating Co., Inc., | 170,000 | 104,125 | |||||

Harrah’s Operating Co., Inc., | 415,000 | 344,450 | |||||

Harrah’s Operating Co., Inc., | 300,000 | 220,500 | |||||

Mandalay Resort Group, 9.375%, 2010 | 175,000 | 175,000 | |||||

MGM Mirage, 8.5%, 2010 | 140,000 | 138,250 | |||||

MGM Mirage, 8.375%, 2011 | 215,000 | 207,475 | |||||

MGM Mirage, 6.75%, 2013 | 200,000 | 172,500 | |||||

MGM Mirage, 5.875%, 2014 | 195,000 | 157,950 | |||||

Pinnacle Entertainment, Inc., 7.5%, 2015 | 320,000 | 244,800 | |||||

Station Casinos, Inc., 6.5%, 2014 | 530,000 | 304,750 | |||||

Station Casinos, Inc., 6.875%, 2016 | 380,000 | 207,575 | |||||

Trump Entertainment Resorts Holdings, Inc., | 405,000 | 252,113 | |||||

Wynn Las Vegas LLC, 6.625%, 2014 | 130,000 | 118,950 | |||||

| $ | 3,139,551 | ||||||

General Merchandise - 0.5% | |||||||

Buhrmann U.S., Inc., 7.875%, 2015 | $ | 195,000 | $ | 217,889 | |||

Industrial - 1.6% | |||||||

Blount, Inc., 8.875%, 2012 | $ | 205,000 | $ | 205,000 | |||

JohnsonDiversey, Inc., 9.625%, 2012 | EUR | 70,000 | 106,946 | ||||

JohnsonDiversey, Inc., “B”, | $ | 400,000 | 404,000 | ||||

| $ | 715,946 | ||||||

Insurance - Property & Casualty - 0.3% | |||||||

USI Holdings Corp., 9.75%, 2015 (n) | $ | 160,000 | $ | 137,600 | |||

15-HYVA

Portfolio of Investments (unaudited) — continued

| Issuer | Shares/Par | Value ($) | |||||

BONDS - continued | |||||||

Machinery & Tools - 0.6% | |||||||

Case New Holland, Inc., 7.125%, 2014 | $ | 280,000 | $ | 274,400 | |||

Major Banks - 1.1% | |||||||

Bank of America Corp., | $ | 225,000 | $ | 210,796 | |||

JPMorgan Chase & Co., | 325,000 | 304,733 | |||||

| $ | 515,529 | ||||||

Medical & Health Technology & Services - 7.9% | |||||||

Biomet, Inc., 10%, 2017 | $ | 160,000 | $ | 170,800 | |||

Biomet, Inc., 11.625%, 2017 | 310,000 | 328,600 | |||||

Community Health Systems, Inc., | 490,000 | 493,063 | |||||

Cooper Cos., Inc., 7.125%, 2015 | 220,000 | 211,200 | |||||

DaVita, Inc., 7.25%, 2015 | 395,000 | 384,138 | |||||

HCA, Inc., 6.375%, 2015 | 445,000 | 369,350 | |||||

HCA, Inc., 9.25%, 2016 | 765,000 | 787,950 | |||||

Psychiatric Solutions, Inc., 7.75%, 2015 | 200,000 | 198,000 | |||||

U.S. Oncology, Inc., 10.75%, 2014 | 325,000 | 322,563 | |||||

Universal Hospital Services, Inc., | 155,000 | 155,000 | |||||

Universal Hospital Services, Inc., FRN, | 45,000 | 42,075 | |||||

VWR Funding, Inc., 10.25%, 2015 (p) | 135,000 | 124,538 | |||||

| $ | 3,587,277 | ||||||

Metals & Mining - 4.5% | |||||||

Arch Western Finance LLC, 6.75%, 2013 | $ | 175,000 | $ | 171,500 | |||

FMG Finance Ltd., 10.625%, 2016 (n) | 320,000 | 372,800 | |||||

Freeport-McMoRan Copper & Gold, Inc., | 580,000 | 611,900 | |||||

Freeport-McMoRan Copper & Gold, Inc., FRN, 5.882%, 2015 | 305,000 | 308,007 | |||||

Peabody Energy Corp., 5.875%, 2016 | 225,000 | 210,375 | |||||

Peabody Energy Corp., 7.375%, 2016 | 175,000 | 174,563 | |||||

PNA Group, Inc., 10.75%, 2016 | 160,000 | 188,000 | |||||

| $ | 2,037,145 | ||||||

Municipals - 0.4% | |||||||

Regional Transportation Authority, IL, “A”, MBIA, 4.5%, 2035 | $ | 215,000 | $ | 199,468 | |||

Natural Gas - Distribution - 0.9% | |||||||

AmeriGas Partners LP, 7.125%, 2016 | $ | 200,000 | $ | 185,500 | |||

Inergy LP, 6.875%, 2014 | 235,000 | 218,550 | |||||

| $ | 404,050 | ||||||

Natural Gas - Pipeline - 2.1% | |||||||

Atlas Pipeline Partners LP, 8.125%, 2015 | $ | 155,000 | $ | 152,288 | |||

Atlas Pipeline Partners LP, | 140,000 | 138,950 | |||||

Deutsche Bank (El Paso Performance-Linked Trust, CLN), 7.75%, 2011 (n) | 255,000 | 256,895 | |||||

El Paso Corp., 7.25%, 2018 | 140,000 | 137,900 | |||||

Transcontinental Gas Pipe Line Corp., | 55,000 | 57,200 | |||||

Williams Partners LP, 7.25%, 2017 | 205,000 | 205,000 | |||||

| $ | 948,233 | ||||||

Network & Telecom - 3.8% | |||||||

Cincinnati Bell, Inc., 8.375%, 2014 | $ | 315,000 | $ | 304,763 | |||

Citizens Communications Co., | 225,000 | 232,875 | |||||

Nordic Telephone Co. Holdings, | 205,000 | 200,900 | |||||

Qwest Capital Funding, Inc., | 355,000 | 344,350 | |||||

| Issuer | Shares/Par | Value ($) | |||||

BONDS - continued | |||||||

Network & Telecom - continued | |||||||

Qwest Corp., 7.875%, 2011 | $ | 95,000 | $ | 95,000 | |||

Qwest Corp., 8.875%, 2012 | 300,000 | 306,000 | |||||

Windstream Corp., 8.625%, 2016 | 215,000 | 214,463 | |||||

| $ | 1,698,351 | ||||||

Oil Services - 0.9% | |||||||

Basic Energy Services, Inc., | $ | 290,000 | $ | 282,025 | |||

GulfMark Offshore, Inc., 7.75%, 2014 | 110,000 | 110,825 | |||||

| $ | 392,850 | ||||||

Printing & Publishing - 3.2% | |||||||

American Media Operations, Inc., | $ | 8,181 | $ | 6,586 | |||

American Media Operations, Inc., “B”, | 225,000 | 181,125 | |||||

Dex Media West LLC, 9.875%, 2013 | 119,000 | 107,100 | |||||

Dex Media, Inc., | 300,000 | 214,500 | |||||

Dex Media, Inc., | 425,000 | 303,875 | |||||

Idearc, Inc., 8%, 2016 | 395,000 | 248,356 | |||||

Nielsen Finance LLC, 10%, 2014 | 230,000 | 231,725 | |||||

Nielsen Finance LLC, | 40,000 | 27,500 | |||||

Quebecor World, Inc., 6.125%, 2013 (d) | 105,000 | 38,325 | |||||

R.H. Donnelley Corp., 8.875%, 2016 | 175,000 | 105,000 | |||||

| $ | 1,464,092 | ||||||

Retailers - 0.4% | |||||||

Couche-Tard, Inc., 7.5%, 2013 | $ | 120,000 | $ | 118,500 | |||

Sally Holdings LLC, 10.5%, 2016 | 45,000 | 42,863 | |||||

| $ | 161,363 | ||||||

Specialty Stores - 0.3% | |||||||

Payless ShoeSource, Inc., 8.25%, 2013 | $ | 160,000 | $ | 140,000 | |||

Steel - 0.3% | |||||||

Evraz Group S.A., 8.875%, 2013 (z) | $ | 140,000 | $ | 140,168 | |||

Supermarkets - 0.4% | |||||||

Stater Brothers Holdings, Inc., | $ | 165,000 | $ | 163,763 | |||

Telecommunications - Wireless - 1.7% | |||||||

Alltel Corp., 7%, 2012 | $ | 238,000 | $ | 242,760 | |||

MetroPCS Wireless, Inc., 9.25%, 2014 | 255,000 | 245,438 | |||||

Wind Acquisition Finance S.A., | 250,000 | 262,500 | |||||

| $ | 750,698 | ||||||

Transportation - Services - 0.3% | |||||||

Hertz Corp., 8.875%, 2014 | $ | 160,000 | $ | 146,400 | |||

Utilities - Electric Power - 5.8% | |||||||

Dynegy Holdings, Inc., 7.5%, 2015 | $ | 125,000 | $ | 115,313 | |||

Edison Mission Energy, 7%, 2017 | 340,000 | 317,900 | |||||

Mirant North America LLC, | 240,000 | 237,900 | |||||

NRG Energy, Inc., 7.375%, 2016 | 965,000 | 908,306 | |||||

Reliant Energy, Inc., 6.75%, 2014 | 75,000 | 76,500 | |||||

Reliant Energy, Inc., 7.875%, 2017 | 340,000 | 332,350 | |||||

Sierra Pacific Resources, 8.625%, 2014 | 110,000 | 115,300 | |||||

Texas Competitive Electric Holdings LLC, | 525,000 | 514,500 | |||||

| $ | 2,618,069 | ||||||

Total Bonds | $ | 40,031,440 | |||||

16-HYVA

Portfolio of Investments (unaudited)— continued

| Issuer | Shares/Par | Value ($) | |||||

FLOATING RATE LOANS (g)(r) - 6.0% | |||||||

Aerospace - 0.5% | |||||||

Hawker Beechcraft Acquisition Co., Letter of Credit, 4.69%, 2014 | 10,085 | $ | 9,448 | ||||

Hawker Beechcraft Acquisition Co., Term Loan, 4.8%, 2014 | 250,954 | 235,113 | |||||

| $ | 244,561 | ||||||

Automotive - 1.2% | |||||||

Federal-Mogul Corp., Term Loan B, | 187,893 | $ | 156,890 | ||||

Ford Motor Co., Term Loan B, | 392,244 | 315,658 | |||||

Mark IV Industries, Inc., Second Lien Term Loan, 11.42%, 2011 | 169,464 | 68,633 | |||||

| $ | 541,181 | ||||||

Broadcasting - 0.5% | |||||||

Young Broadcasting, Inc., Term Loan, | 182,093 | $ | 163,884 | ||||

Young Broadcasting, Inc., Term Loan B-1, | 67,169 | 60,452 | |||||

| $ | 224,336 | ||||||

Computer Software - 0.5% | |||||||

First Data Corp., Term Loan B-1, | 241,834 | $ | 221,671 | ||||

Forest & Paper Products - 0.1% | |||||||

Abitibi Consolidated, Inc., Term Loan, 11.5%, 2009 | 65,619 | $ | 65,701 | ||||

Gaming & Lodging - 0.3% | |||||||

Green Valley Ranch Gaming LLC, Second Lien Term Loan, 5.89%, 2014 (o) | 248,868 | $ | 156,787 | ||||

Medical & Health Technology & Services - 0.9% | |||||||

Community Health Systems, Inc., Delayed Draw Term Loan B, 2014 (q) | 8,611 | $ | 8,106 | ||||

Community Health Systems, Inc., Term Loan B, 4.86%, 2014 | 168,339 | 158,465 | |||||

HCA, Inc., Term Loan B, 5.05%, 2013 | 240,438 | 225,481 | |||||

| $ | 392,052 | ||||||

Printing & Publishing - 0.5% | |||||||

Idearc, Inc., Term Loan B, 4.79%, 2014 | 23,068 | $ | 18,390 | ||||

Tribune Co., Term Loan B, 2014 (o) | 286,550 | 215,271 | |||||

| $ | 233,661 | ||||||

Specialty Stores - 0.2% | |||||||

Michaels Stores, Inc., Term Loan B, | 91,676 | $ | 76,034 | ||||

Telecommunications - Wireless - 0.3% | |||||||

ALLTEL Communications, Inc., Term Loan B-2, 2015 (o) | 126,672 | $ | 125,754 | ||||

Utilities - Electric Power - 1.0% | |||||||

Calpine Corp., DIP Term Loan, | 202,032 | $ | 192,829 | ||||

Texas Competitive Electric Holdings LLC, Term Loan B-3, 6.26%, 2014 | 262,052 | 242,153 | |||||

| $ | 434,982 | ||||||

Total Floating Rate Loans | $ | 2,716,720 | |||||

COMMON STOCKS - 1.9% | |||||||

Automotive - 0.0% | |||||||

Oxford Automotive, Inc. (a) | 53 | $ | 0 | ||||

| Issuer | Shares/Par | Value ($) | |||||

COMMON STOCKS - continued | |||||||

Cable TV - 0.7% | |||||||

Cablevision Systems Corp., “A” (a) | 2,100 | $ | 47,460 | ||||

Comcast Corp., “A” | 11,300 | 214,361 | |||||

Time Warner Cable, Inc. (a) | 2,800 | 74,144 | |||||

| $ | 335,965 | ||||||

Consumer Goods & Services - 0.0% | |||||||

Central Garden & Pet Co. (a) | 2,300 | $ | 10,465 | ||||

Electronics - 0.1% | |||||||

Intel Corp. | 2,300 | $ | 49,404 | ||||

Energy - Integrated - 0.1% | |||||||

Chevron Corp. | 500 | $ | 49,565 | ||||

Forest & Paper Products - 0.0% | |||||||

Louisiana-Pacific Corp. | 2,600 | $ | 22,074 | ||||

Gaming & Lodging - 0.2% | |||||||

MGM Mirage (a) | 1,300 | $ | 44,057 | ||||

Pinnacle Entertainment, Inc. (a) | 2,400 | 25,176 | |||||

| $ | 69,233 | ||||||

Major Banks - 0.1% | |||||||

Bank of America Corp. | 1,200 | $ | 28,644 | ||||

JPMorgan Chase & Co. | 600 | 20,586 | |||||

| $ | 49,230 | ||||||

Printing & Publishing - 0.0% | |||||||

Golden Books Family Entertainment, Inc. (a) | 21,250 | $ | 0 | ||||

Real Estate - 0.2% | |||||||

Host Hotels & Resorts, Inc., REIT | 5,000 | $ | 68,250 | ||||

Telephone Services - 0.2% | |||||||

Windstream Corp. | 7,600 | $ | 93,784 | ||||

Utilities - Electric Power - 0.3% | |||||||

Reliant Energy, Inc. (a) | 6,100 | $ | 129,747 | ||||

Total Common Stocks | $ | 877,717 | |||||

PREFERRED STOCKS - 0.8% | |||||||

Brokerage & Asset Managers - 0.8% | |||||||

Merrill Lynch Co., Inc., 8.625%, (Identified Cost, $380,625) | $ | 15,225 | $ | 353,220 | |||

SHORT-TERM OBLIGATIONS - 1.1% | |||||||

Toyota Motor Credit Corp., at | 494,000 | $ | 494,000 | ||||

Total Investments | $ | 44,473,097 | |||||

OTHER ASSETS, | 675,468 | ||||||

NET ASSETS - 100.0% | $ | 45,148,565 | |||||

17-HYVA

Portfolio of Investments (unaudited) — continued

Derivative Contracts at 6/30/08

Forward Foreign Currency Exchange Contracts at 6/30/08

| Type | Currency | Contracts to Deliver/ Receive | Settlement Date Range | In Exchange For | Contracts at Value | Net Unrealized Appreciation (Depreciation) | ||||||||||||

| Appreciation | ||||||||||||||||||

| BUY | EUR | 47,850 | 8/25/08 | $ | 74,323 | $ | 75,154 | $ | 831 | |||||||||

| Depreciation | ||||||||||||||||||

| SELL | EUR | 107,762 | 8/25/08 | $ | 167,321 | $ | 169,251 | $ | (1,930 | ) | ||||||||

Swap Agreements at 6/30/08

| Expiration | Notional Amount | Counterparty | Cash Flows to Receive | Cash Flows to Pay | Value | |||||||||

| Credit Default Swaps | ||||||||||||||

| 6/20/09 | USD | 200,000 | JPMorgan Chase Bank | 4.10% (fixed rate) | (1) | $ | (30,804 | ) | ||||||

| 6/20/09 | USD | 100,000 | JPMorgan Chase Bank | 4.80% (fixed rate) | (1) | $ | (14,792 | ) | ||||||

| 6/20/12 | USD | 200,000 | Morgan Stanley Capital Services, Inc. | 3.76% (fixed rate) | (2) | $ | (53,953 | ) | ||||||

| 6/20/12 | USD | 100,000 | Morgan Stanley Capital Services, Inc. | 4.15% (fixed rate) | (2) | $ | (25,998 | ) | ||||||

| 6/20/13 | USD | 200,000 | Goldman Sachs International (a) | 5.0% (fixed rate) | (3) | $ | (44,927 | ) | ||||||

| $ | (170,474 | ) | ||||||||||||

| (1) | Variable account to pay notional amount upon a defined credit event by Abitibi Consolidated, Inc., 8.375%, 4/01/15. |

| (2) | Variable account to pay notional amount upon a defined credit event by Bowater, Inc., 6.5%, 6/15/13. |

| (3) | Variable account to pay notional amount upon a defined credit event by Station Casinos, Inc., 6.0%, 4/01/12. |

| (a) | Net unamortized premiums received by the variable account amounted to $33,974. |

At June 30, 2008, the variable account had sufficient cash and/or other liquid securities to cover any commitments under these derivative contracts.

See portfolio footnotes and notes to financial statements.

18-HYVA

Portfolio of Investments (unaudited) — June 30, 2008

Money Market Variable Account

| Issuer | Shares/Par | Value ($) | ||||

CERTIFICATES OF DEPOSIT - 20.2% | ||||||

Financial Institutions - 3.0% | ||||||

Swedbank AB, NY, | $ | 1,280,000 | $ | 1,280,000 | ||

Major Banks - 11.9% | ||||||

Bank of Scotland PLC, NY, | $ | 1,250,000 | $ | 1,250,000 | ||

Barclays Bank PLC, NY, | 1,250,000 | 1,250,000 | ||||

BNP Paribas, NY, 3.65%, due 7/16/08 | 1,350,000 | 1,350,000 | ||||

Societe Generale, NY, | 1,295,000 | 1,295,000 | ||||

| $ | 5,145,000 | |||||

Other Banks & Diversified Financials - 5.3% | ||||||

DEPFA Bank PLC, NY, | $ | 1,280,000 | $ | 1,280,000 | ||

Rabobank Nederland N.V., NY, | 993,000 | 993,000 | ||||

| $ | 2,273,000 | |||||

Total Certificates of Deposit, | $ | 8,698,000 | ||||

COMMERCIAL PAPER (y) - 65.5% | ||||||

Alcoholic Beverages - 3.0% | ||||||

Anheuser-Busch Company, Inc., | $ | 1,288,000 | $ | 1,288,000 | ||

Automotive - 3.0% | ||||||

Toyota Motor Credit Corp., | $ | 1,283,000 | $ | 1,283,000 | ||

Toyota Motor Credit Corp., | 5,000 | 5,000 | ||||

| $ | 1,288,000 | |||||

Brokerage & Asset Managers - 5.9% | ||||||

Merrill Lynch & Co., Inc., | $ | 1,293,000 | $ | 1,273,314 | ||

Morgan Stanley, | 1,294,000 | 1,275,884 | ||||

| $ | 2,549,198 | |||||

Conglomerates - 3.0% | ||||||

United Technologies Corp., | $ | 1,288,000 | $ | 1,288,000 | ||

Energy - Integrated - 2.1% | ||||||

ConocoPhillips, 2.3%, due 7/01/08 (t) | $ | 901,000 | $ | 901,000 | ||

Financial Institutions - 11.7% | ||||||

American Express Credit Corp., | $ | 13,000 | $ | 13,000 | ||

American Express Credit Corp., | 1,283,000 | 1,275,117 | ||||

American General Finance Corp., | 11,000 | 11,000 | ||||

American General Finance Corp., | 1,284,000 | 1,277,059 | ||||

Cargill, Inc., 2.35%, due 7/30/08 (t) | 1,280,000 | 1,277,577 | ||||

General Electric Capital Co., | 1,200,000 | 1,197,499 | ||||

| $ | 5,051,252 | |||||

Food & Beverages - 5.9% | ||||||

Archer Daniels Midland Co., | $ | 1,290,000 | $ | 1,287,234 | ||

Coca-Cola Co., 2.03%, due 7/10/08 (t) | 1,266,000 | 1,265,358 | ||||

| $ | 2,552,592 | |||||

| Issuer | Shares/Par | Value ($) | ||||

COMMERCIAL PAPER (y) - continued | ||||||

Forest & Paper Products - 3.0% | ||||||

Mcgraw-Hill Cos., Inc., | $ | 1,289,000 | $ | 1,287,953 | ||

Insurance - 1.0% | ||||||

Prudential Funding LLC, | $ | 425,000 | $ | 422,905 | ||

Major Banks - 11.5% | ||||||

Abbey National North America LLC, | $ | 270,000 | $ | 269,752 | ||

Abbey National North America LLC, | 1,010,000 | 999,594 | ||||

Bank of America Corp., | 420,000 | 419,971 | ||||

Bank of America Corp., | 647,000 | 644,383 | ||||

JPMorgan Chase & Co., | 1,289,000 | 1,287,138 | ||||

Natexis Banques Populaires U.S. Financial Co., LLC, 2.6%, due 7/14/08 | 1,330,000 | 1,328,751 | ||||

| $ | 4,949,589 | |||||

Medical Equipment - 3.2% | ||||||

Pfizer, Inc., 2.68%, due 8/06/08 (t) | $ | 1,380,000 | $ | 1,376,302 | ||

Network & Telecom - 3.0% | ||||||

AT&T, Inc., 2.18%, due 7/31/08 (t) | $ | 1,277,000 | $ | 1,274,680 | ||

AT&T, Inc., 2.35%, due 7/01/08 (t) | 14,000 | 14,000 | ||||

| $ | 1,288,680 | |||||

Other Banks & Diversified Financials - 9.2% | ||||||

Calyon North America, Inc., | $ | 207,000 | $ | 206,902 | ||

Citigroup Funding Inc., | 361,000 | 359,313 | ||||

Citigroup Funding, Inc., | 922,000 | 916,468 | ||||

Dexia Delaware LLC, | 1,275,000 | 1,271,088 | ||||

Svenska Handelsbanken AB, | 735,000 | 734,486 | ||||

UBS Finance Delaware LLC, | 482,000 | 481,467 | ||||

| $ | 3,969,724 | |||||

Total Commercial Paper, | $ | 28,213,195 | ||||

U.S. GOVERNMENT AGENCIES - 4.2% | ||||||

Fannie Mae, 2.5%, due 8/20/08, | $ | 1,798,000 | $ | 1,791,757 | ||

REPURCHASE AGREEMENTS - 10.0% | ||||||

Merrill Lynch, 2.50%, dated 6/30/08, due 7/01/08, total to be received $4,295,298 (secured by various U.S. Treasury and Federal Agency obligations and Mortgage Backed securities in a jointly traded account), at Cost | $ | 4,295,000 | $ | 4,295,000 | ||

Total Investments, | $ | 42,997,952 | ||||

OTHER ASSETS, | 45,314 | |||||

NET ASSETS - 100.0% | $ | 43,043,266 | ||||

See portfolio footnotes and notes to financial statements.

19-MMVA

Portfolio of Investments (unaudited) — June 30, 2008

Total Return Variable Account

| Issuer | Shares/Par | Value ($) | |||

COMMON STOCKS - 57.1% | |||||

Aerospace - 3.0% | |||||

Lockheed Martin Corp. | 22,560 | $ | 2,225,757 | ||

Northrop Grumman Corp. | 13,010 | 870,369 | |||

Raytheon Co. | 1,230 | 69,224 | |||

United Technologies Corp. | 17,010 | 1,049,517 | |||

| $ | 4,214,867 | ||||

Alcoholic Beverages - 0.6% | |||||

Diageo PLC | 34,196 | $ | 628,562 | ||

Heineken N.V. | 3,700 | 188,137 | |||

| $ | 816,699 | ||||

Apparel Manufacturers - 0.6% | |||||

NIKE, Inc., “B” | 13,140 | $ | 783,275 | ||

Automotive - 0.6% | |||||

Harley-Davidson, Inc. | 5,250 | $ | 190,365 | ||

Johnson Controls, Inc. | 21,570 | 618,628 | |||

| $ | 808,993 | ||||

Biotechnology - 0.5% | |||||

Amgen, Inc. (a) | 5,370 | $ | 253,249 | ||

Genzyme Corp. (a) | 6,250 | 450,125 | |||

| $ | 703,374 | ||||

Broadcasting - 1.0% | |||||

Omnicom Group, Inc. | 15,100 | $ | 677,688 | ||

Walt Disney Co. | 21,020 | 655,824 | |||

WPP Group PLC | 11,250 | 108,388 | |||

| $ | 1,441,900 | ||||

Brokerage & Asset Managers - 1.8% | |||||

Deutsche Boerse AG | 2,490 | $ | 279,483 | ||

Franklin Resources, Inc. | 5,860 | 537,069 | |||

Goldman Sachs Group, Inc. | 5,930 | 1,037,157 | |||

Invesco Ltd. | 7,640 | 183,207 | |||

Legg Mason, Inc. | 1,810 | 78,862 | |||

Merrill Lynch & Co., Inc. | 13,830 | 438,549 | |||

| $ | 2,554,327 | ||||

Business Services - 1.0% | |||||

Accenture Ltd., “A” | 12,770 | $ | 519,994 | ||

Automatic Data Processing, Inc. | 6,780 | 284,082 | |||

Fidelity National Information Services, Inc. | 7,890 | 291,220 | |||

Visa, Inc., “A” | 2,990 | 243,117 | |||

Western Union Co. | 2,200 | 54,384 | |||

| $ | 1,392,797 | ||||

Cable TV - 0.2% | |||||

Time Warner Cable, Inc. (a) | 10,430 | $ | 276,186 | ||

Chemicals - 1.0% | |||||

3M Co. | 3,100 | $ | 215,729 | ||

PPG Industries, Inc. | 16,700 | 958,079 | |||

Rohm & Haas Co. | 3,300 | 153,252 | |||

| $ | 1,327,060 | ||||

Computer Software - 0.8% | |||||

Oracle Corp. (a) | 53,740 | $ | 1,128,540 | ||

Synopsys, Inc. (a) | 1,300 | 31,083 | |||

| $ | 1,159,623 | ||||

Computer Software - Systems - 1.3% | |||||

Hewlett-Packard Co. | 8,780 | $ | 388,164 | ||

International Business Machines Corp. | 12,330 | 1,461,475 | |||

| $ | 1,849,639 | ||||

Construction - 0.5% | |||||

Masco Corp. | 13,940 | $ | 219,276 | ||

Pulte Homes, Inc. | 15,800 | 152,154 | |||

| Issuer | Shares/Par | Value ($) | |||

COMMON STOCKS - continued | |||||

Construction - continued | |||||

Sherwin-Williams Co. | 3,770 | $ | 173,156 | ||

Toll Brothers, Inc. (a) | 5,820 | 109,009 | |||

| $ | 653,595 | ||||

Consumer Goods & Services - 0.6% | |||||

Clorox Co. | 7,050 | $ | 368,010 | ||

Procter & Gamble Co. | 8,560 | 520,534 | |||

| $ | 888,544 | ||||

Containers - 0.0% | |||||

Smurfit-Stone Container Corp. (a) | 710 | $ | 2,890 | ||

Electrical Equipment - 1.1% | |||||

Danaher Corp. | 4,000 | $ | 309,200 | ||

General Electric Co. | 11,380 | 303,732 | |||

W.W. Grainger, Inc. | 7,040 | 575,872 | |||

WESCO International, Inc. (a) | 7,150 | 286,286 | |||

| $ | 1,475,090 | ||||

Electronics - 1.0% | |||||

Flextronics International Ltd. (a) | 21,340 | $ | 200,596 | ||

Intel Corp. | 44,860 | 963,593 | |||

Samsung Electronics Co. Ltd., GDR | 454 | 133,123 | |||

SanDisk Corp. (a) | 4,600 | 86,020 | |||

| $ | 1,383,332 | ||||

Energy - Independent - 2.4% | |||||

Apache Corp. | 11,500 | $ | 1,598,500 | ||

Devon Energy Corp. | 10,220 | 1,228,035 | |||

EOG Resources, Inc. | 2,240 | 293,888 | |||

Sunoco, Inc. | 4,240 | 172,526 | |||

| $ | 3,292,949 | ||||

Energy - Integrated - 6.5% | |||||

Chevron Corp. | 10,475 | $ | 1,038,387 | ||

ConocoPhillips | 4,200 | 396,438 | |||

Exxon Mobil Corp. | 32,772 | 2,888,196 | |||

Hess Corp. | 13,180 | 1,663,184 | |||

Marathon Oil Corp. | 18,450 | 957,002 | |||

TOTAL S.A., ADR | 24,370 | 2,078,030 | |||

| $ | 9,021,237 | ||||

Engineering - Construction - 0.0% | |||||

North American Energy Partners, Inc. (a) | 1,800 | $ | 39,024 | ||

Food & Beverages - 2.7% | |||||

General Mills, Inc. | 17,050 | $ | 1,036,129 | ||

Hain Celestial Group, Inc. (a) | 600 | 14,088 | |||

Kellogg Co. | 16,000 | 768,320 | |||

Nestle S.A. | 25,190 | 1,140,027 | |||

PepsiCo, Inc. | 12,360 | 785,972 | |||

| $ | 3,744,536 | ||||

Food & Drug Stores - 1.4% | |||||

CVS Caremark Corp. | 23,864 | $ | 944,298 | ||

Kroger Co. | 8,930 | 257,809 | |||

Safeway, Inc. | 13,140 | 375,147 | |||

Walgreen Co. | 11,770 | 382,643 | |||

| $ | 1,959,897 | ||||

Furniture & Appliances - 0.2% | |||||

Jarden Corp. (a) | 13,140 | $ | 239,674 | ||

Gaming & Lodging - 0.6% | |||||

Royal Caribbean Cruises Ltd. | 24,780 | $ | 556,807 | ||

Wyndham Worldwide | 14,000 | 250,740 | |||

| $ | 807,547 | ||||

20-TRVA

Portfolio of Investments (unaudited) — continued

| Issuer | Shares/Par | Value ($) | |||

COMMON STOCKS - continued | |||||

General Merchandise - 0.8% | |||||

Macy’s, Inc. | 40,460 | $ | 785,733 | ||

Wal-Mart Stores, Inc. | 6,260 | 351,812 | |||

| $ | 1,137,545 | ||||

Health Maintenance Organizations - 0.6% | |||||

UnitedHealth Group, Inc. | 10,760 | $ | 282,450 | ||

WellPoint, Inc. (a) | 10,180 | 485,179 | |||

| $ | 767,629 | ||||

Insurance - 4.4% | |||||

Allstate Corp. | 35,260 | $ | 1,607,503 | ||

Aon Corp. | 2,110 | 96,933 | |||

Aspen Insurance Holdings Ltd. | 3,600 | 85,212 | |||

Chubb Corp. | 3,370 | 165,164 | |||

Conseco, Inc. (a) | 25,300 | 250,976 | |||

Genworth Financial, Inc., “A” | 55,810 | 993,976 | |||

Hartford Financial Services Group, Inc. | 8,910 | 575,319 | |||

Max Capital Group Ltd. | 10,700 | 228,231 | |||

MetLife, Inc. | 27,810 | 1,467,534 | |||

Principal Financial Group, Inc. | 2,500 | 104,925 | |||

Prudential Financial, Inc. | 2,690 | 160,701 | |||

Travelers Cos., Inc. | 8,540 | 370,636 | |||

| $ | 6,107,110 | ||||

Machinery & Tools - 1.1% | |||||

Eaton Corp. | 4,900 | $ | 416,353 | ||

Ingersoll-Rand Co. Ltd., “A” (a) | 9,040 | 338,367 | |||

Kennametal, Inc. | 8,390 | 273,095 | |||

Timken Co. | 13,500 | 444,690 | |||

| $ | 1,472,505 | ||||

Major Banks - 4.4% | |||||

Bank of America Corp. | 40,458 | $ | 965,732 | ||

Bank of New York Mellon Corp. | 36,484 | 1,380,190 | |||

JPMorgan Chase & Co. | 40,872 | 1,402,318 | |||

PNC Financial Services Group, Inc. | 13,710 | 782,841 | |||

State Street Corp. | 13,560 | 867,704 | |||

SunTrust Banks, Inc. | 9,310 | 337,208 | |||

UnionBanCal Corp. | 3,500 | 141,470 | |||

Wachovia Corp. | 11,500 | 178,595 | |||

| $ | 6,056,058 | ||||

Medical & Health Technology & Services - 0.1% | |||||

DaVita, Inc. (a) | 3,340 | $ | 177,454 | ||

Medical Equipment - 0.7% | |||||

Advanced Medical Optics, Inc. (a) | 11,790 | $ | 220,945 | ||

Boston Scientific Corp. (a) | 17,150 | 210,774 | |||

Cooper Cos., Inc. | 3,540 | 131,511 | |||

Zimmer Holdings, Inc. (a) | 5,000 | 340,250 | |||

| $ | 903,480 | ||||

Metals & Mining - 0.1% | |||||

Century Aluminum Co. (a) | 2,920 | $ | 194,151 | ||

Natural Gas - Distribution - 0.6% | |||||

Sempra Energy | 14,510 | $ | 819,090 | ||

Natural Gas - Pipeline - 0.8% | |||||

El Paso Corp. | 18,560 | $ | 403,494 | ||

Williams Cos., Inc. | 17,030 | 686,479 | |||

| $ | 1,089,973 | ||||

Network & Telecom - 0.2% | |||||

Cisco Systems, Inc. (a) | 1,810 | $ | 42,101 | ||

Nokia Corp., ADR | 9,600 | 235,200 | |||

| $ | 277,301 | ||||

| Issuer | Shares/Par | Value ($) | |||

COMMON STOCKS - continued | |||||

Oil Services - 0.7% | |||||

Halliburton Co. | 7,380 | $ | 391,657 | ||

Helix Energy Solutions Group, Inc. (a) | 2,400 | 99,936 | |||

Nabors Industries Ltd. (a) | 2,000 | 98,460 | |||

Noble Corp. | 5,460 | 354,682 | |||

| $ | 944,735 | ||||

Other Banks & Diversified Financials - 0.8% | |||||

American Express Co. | 9,770 | $ | 368,036 | ||

Assured Guaranty Ltd. | 2,500 | 44,975 | |||

East West Bancorp, Inc. | 5,500 | 38,830 | |||

New York Community Bancorp, Inc. | 7,370 | 131,481 | |||

Sovereign Bancorp, Inc. | 49,900 | 367,264 | |||

UBS AG (a) | 5,657 | 117,137 | |||

| $ | 1,067,723 | ||||

Pharmaceuticals - 3.5% | |||||

Abbott Laboratories | 2,310 | $ | 122,361 | ||

GlaxoSmithKline PLC | 7,830 | 173,186 | |||

Johnson & Johnson | 17,630 | 1,134,314 | |||

Merck & Co., Inc. | 27,910 | 1,051,928 | |||

Merck KGaA | 2,020 | 286,939 | |||

Pfizer, Inc. | 6,760 | 118,097 | |||

Roche Holding AG | 1,800 | 323,500 | |||

Wyeth | 35,070 | 1,681,957 | |||

| $ | 4,892,282 | ||||

Railroad & Shipping - 0.5% | |||||

Burlington Northern Santa Fe Corp. | 4,800 | $ | 479,472 | ||

Norfolk Southern Corp. | 3,350 | 209,945 | |||

| $ | 689,417 | ||||

Specialty Chemicals - 0.3% | |||||

Air Products & Chemicals, Inc. | 3,770 | $ | 372,702 | ||

Praxair, Inc. | 700 | 65,968 | |||

| $ | 438,670 | ||||

Specialty Stores - 0.5% | |||||

Advance Auto Parts, Inc. | 1,360 | $ | 52,809 | ||

Nordstrom, Inc. | 2,200 | 66,660 | |||

PetSmart, Inc. | 5,300 | 105,735 | |||

Staples, Inc. | 17,120 | 406,600 | |||

| $ | 631,804 | ||||

Telecommunications - Wireless - 0.2% | |||||

Rogers Communications, Inc., “B” | 1,760 | $ | 68,418 | ||

Vodafone Group PLC, ADR | 8,849 | 260,692 | |||

| $ | 329,110 | ||||

Telephone Services - 2.2% | |||||

AT&T, Inc. | 50,744 | $ | 1,709,565 | ||

Embarq Corp. | 21,200 | 1,002,124 | |||

TELUS Corp. | 2,080 | 84,802 | |||

Verizon Communications, Inc. | 7,000 | 247,800 | |||

| $ | 3,044,291 | ||||

Tobacco - 1.6% | |||||

Altria Group, Inc. | 6,520 | $ | 134,051 | ||

Lorillard, Inc. (a) | 5,640 | 390,062 | |||

Philip Morris International, Inc. | 33,710 | 1,664,937 | |||

| $ | 2,189,050 | ||||

Trucking - 0.2% | |||||

United Parcel Service, Inc., “B” | 4,510 | $ | 277,230 | ||

Utilities - Electric Power - 3.4% | |||||

American Electric Power Co., Inc. | 11,150 | $ | 448,565 | ||

CMS Energy Corp. | 6,980 | 104,002 | |||

Dominion Resources, Inc. | 8,434 | 400,531 | |||

DPL, Inc. | 5,920 | 156,170 | |||

21-TRVA