A NASDAQ Traded Company - Symbol HBNC Responding to Unprecedented Public Health and Economic Challenges April 29, 2020

Important Information 2

Horizon’s Response to these Unprecedented Times 3

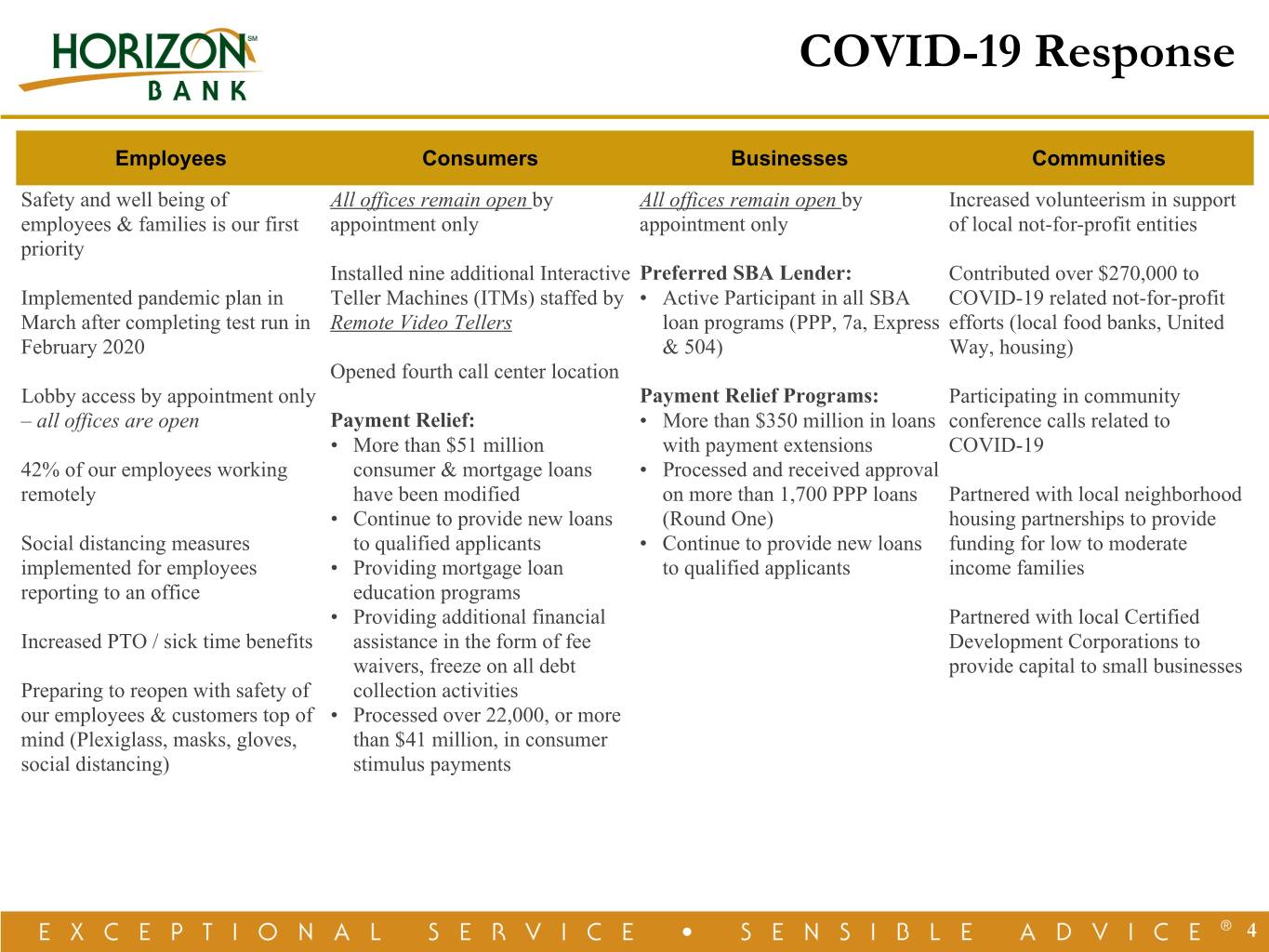

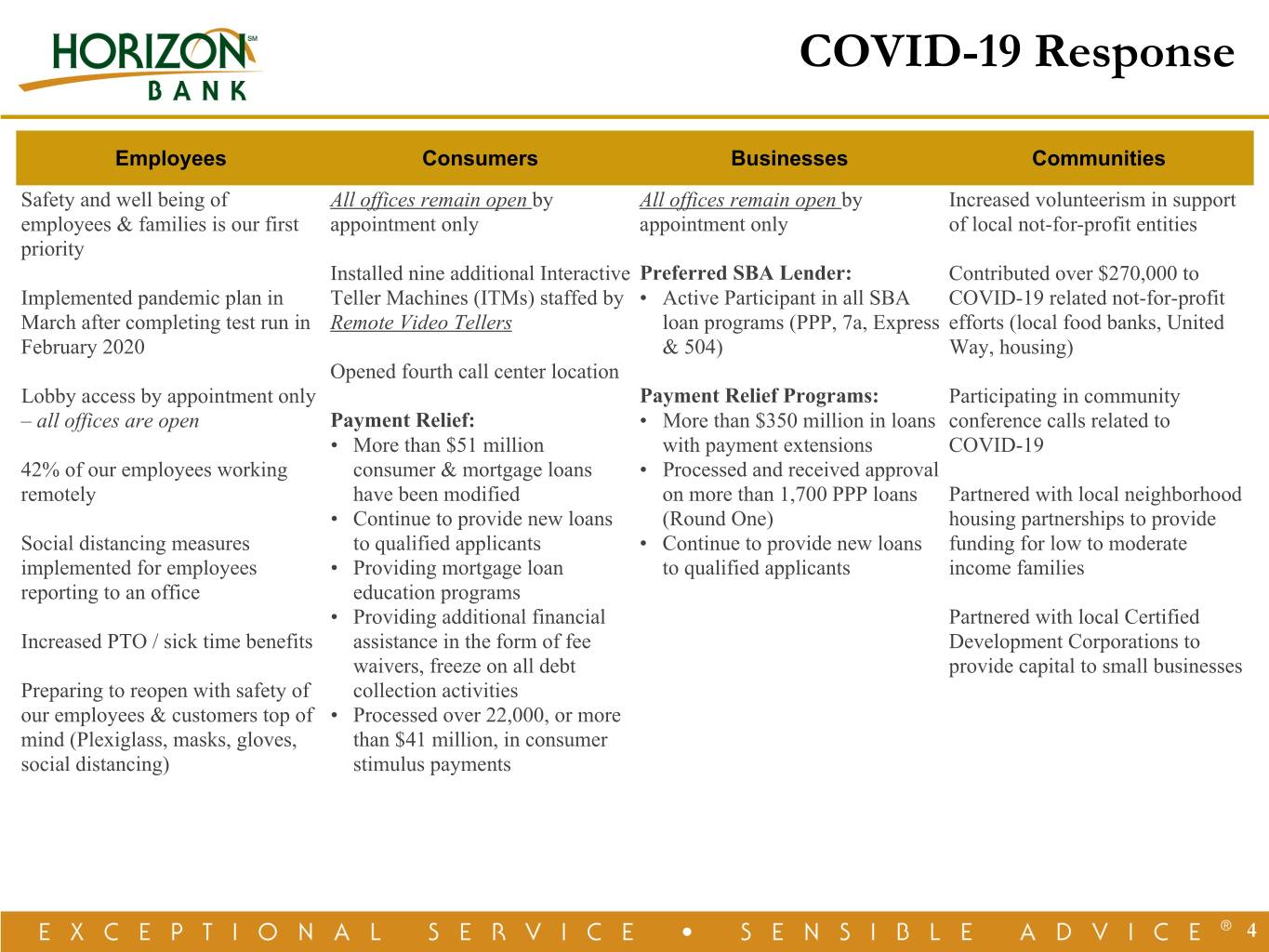

COVID-19 Response Employees Consumers Businesses Communities Safety and well being of All offices remain open by All offices remain open by Increased volunteerism in support employees & families is our first appointment only appointment only of local not-for-profit entities priority Installed nine additional Interactive Preferred SBA Lender: Contributed over $270,000 to Implemented pandemic plan in Teller Machines (ITMs) staffed by • Active Participant in all SBA COVID-19 related not-for-profit March after completing test run in Remote Video Tellers loan programs (PPP, 7a, Express efforts (local food banks, United February 2020 & 504) Way, housing) Opened fourth call center location Lobby access by appointment only Payment Relief Programs: Participating in community – all offices are open Payment Relief: • More than $350 million in loans conference calls related to • More than $51 million with payment extensions COVID-19 42% of our employees working consumer & mortgage loans • Processed and received approval remotely have been modified on more than 1,700 PPP loans Partnered with local neighborhood • Continue to provide new loans (Round One) housing partnerships to provide Social distancing measures to qualified applicants • Continue to provide new loans funding for low to moderate implemented for employees • Providing mortgage loan to qualified applicants income families reporting to an office education programs • Providing additional financial Partnered with local Certified Increased PTO / sick time benefits assistance in the form of fee Development Corporations to waivers, freeze on all debt provide capital to small businesses Preparing to reopen with safety of collection activities our employees & customers top of • Processed over 22,000, or more mind (Plexiglass, masks, gloves, than $41 million, in consumer social distancing) stimulus payments 4

Chicago: High Taxes High Cost of Living Low Credit Rating High Population Density Indiana and Michigan… The Right Side of Chicago 5

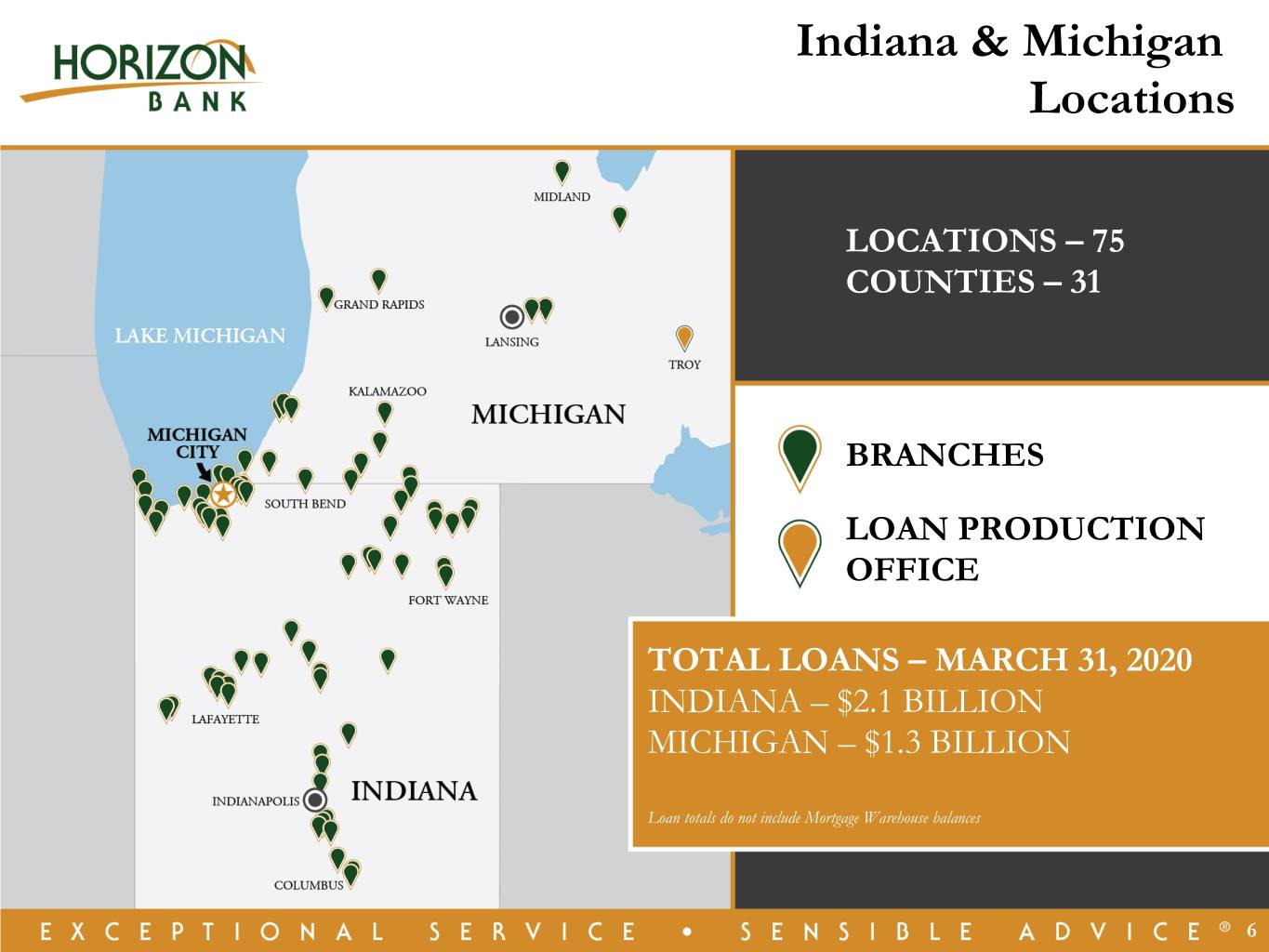

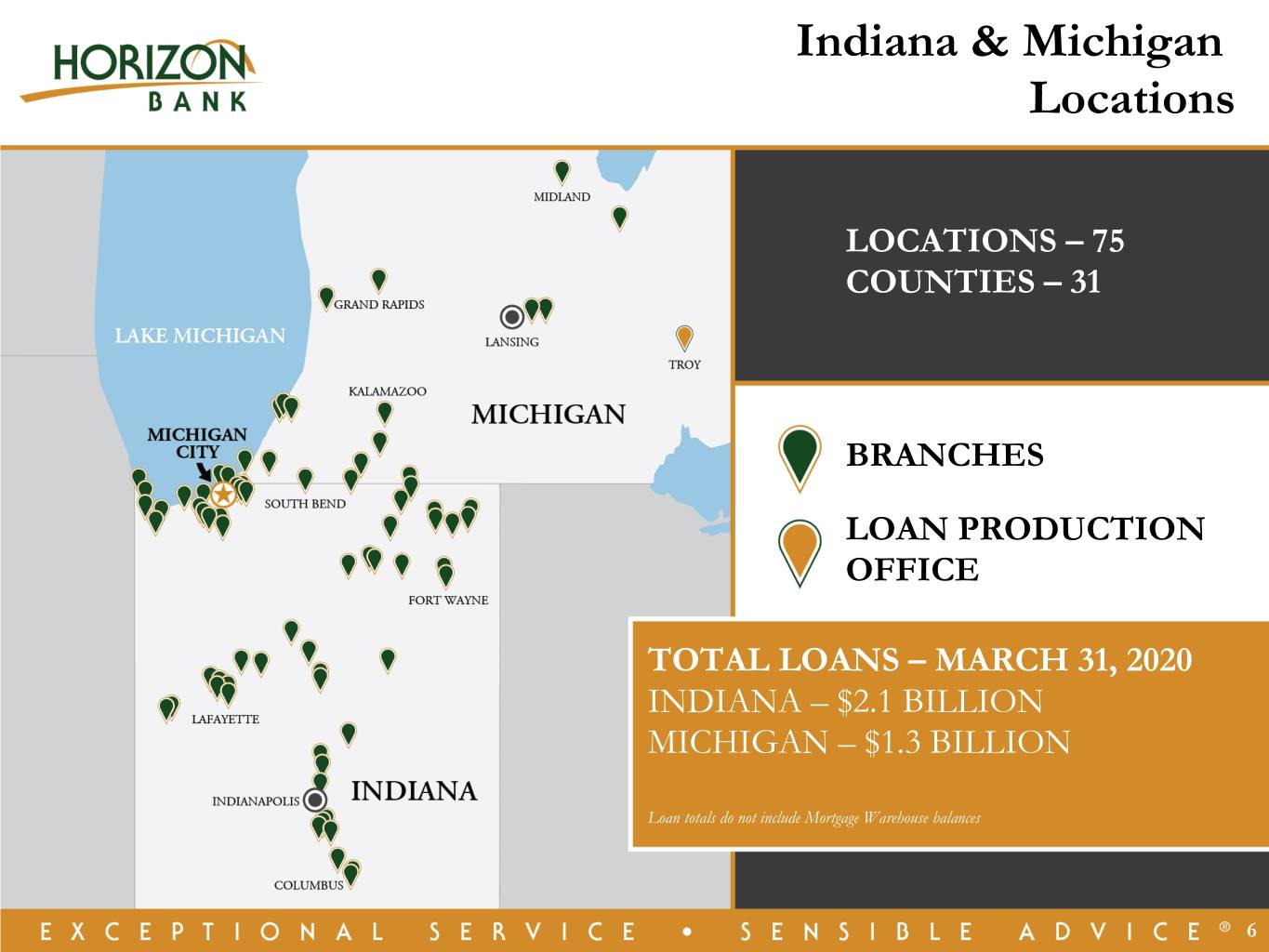

Indiana & Michigan Locations LOCATIONS – 75 COUNTIES – 31 BRANCHES LOAN PRODUCTION OFFICE TOTAL LOANS – MARCH 31, 2020 INDIANA – $2.1 BILLION MICHIGAN – $1.3 BILLION Loan totals do not include Mortgage Warehouse balances 6

Horizon Positioned Well Going Into this National Health & Economic Emergency 7

Seasoned Leadership 8

Multi-Delivery Channels Meeting Customers Needs 9

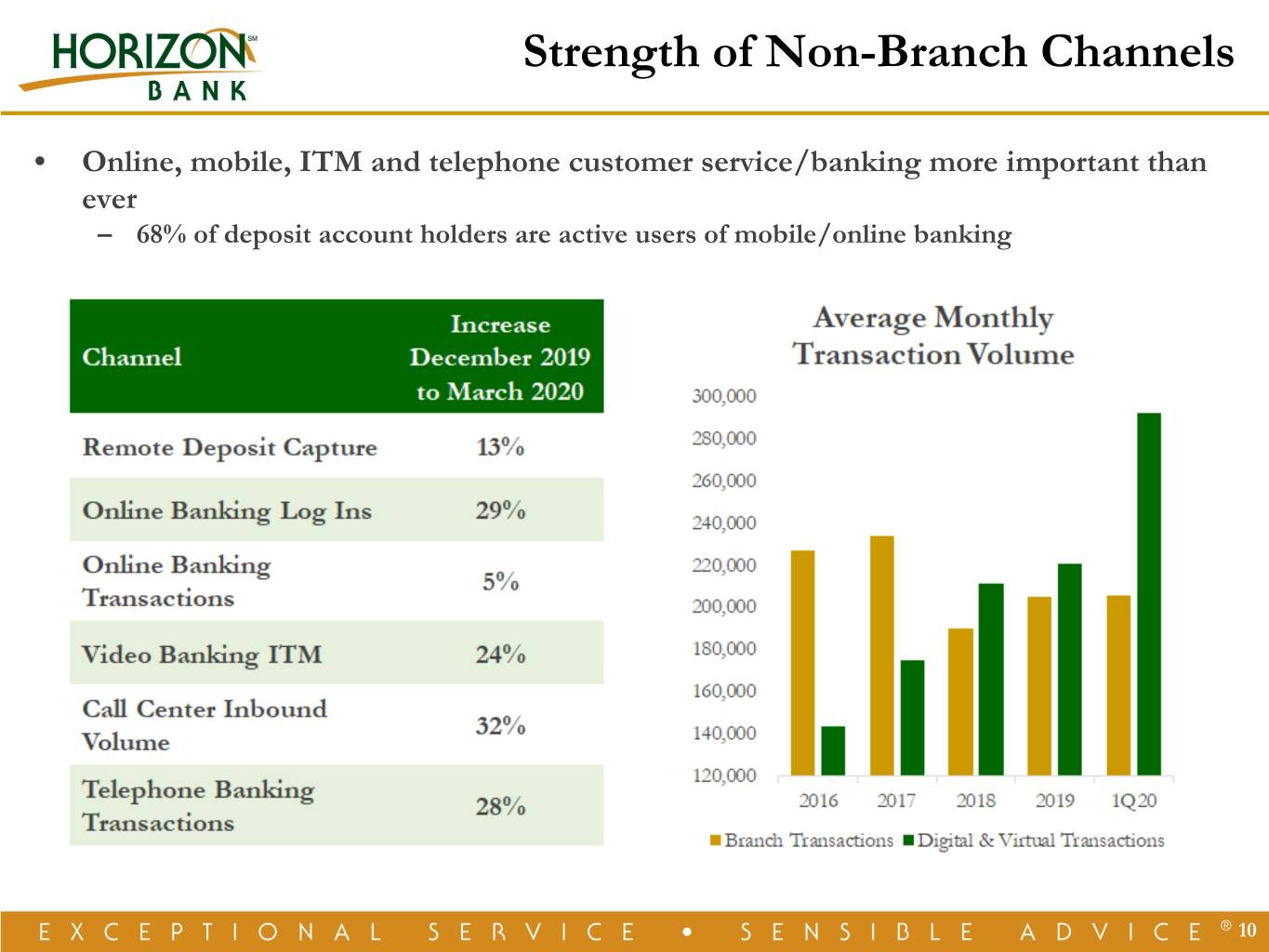

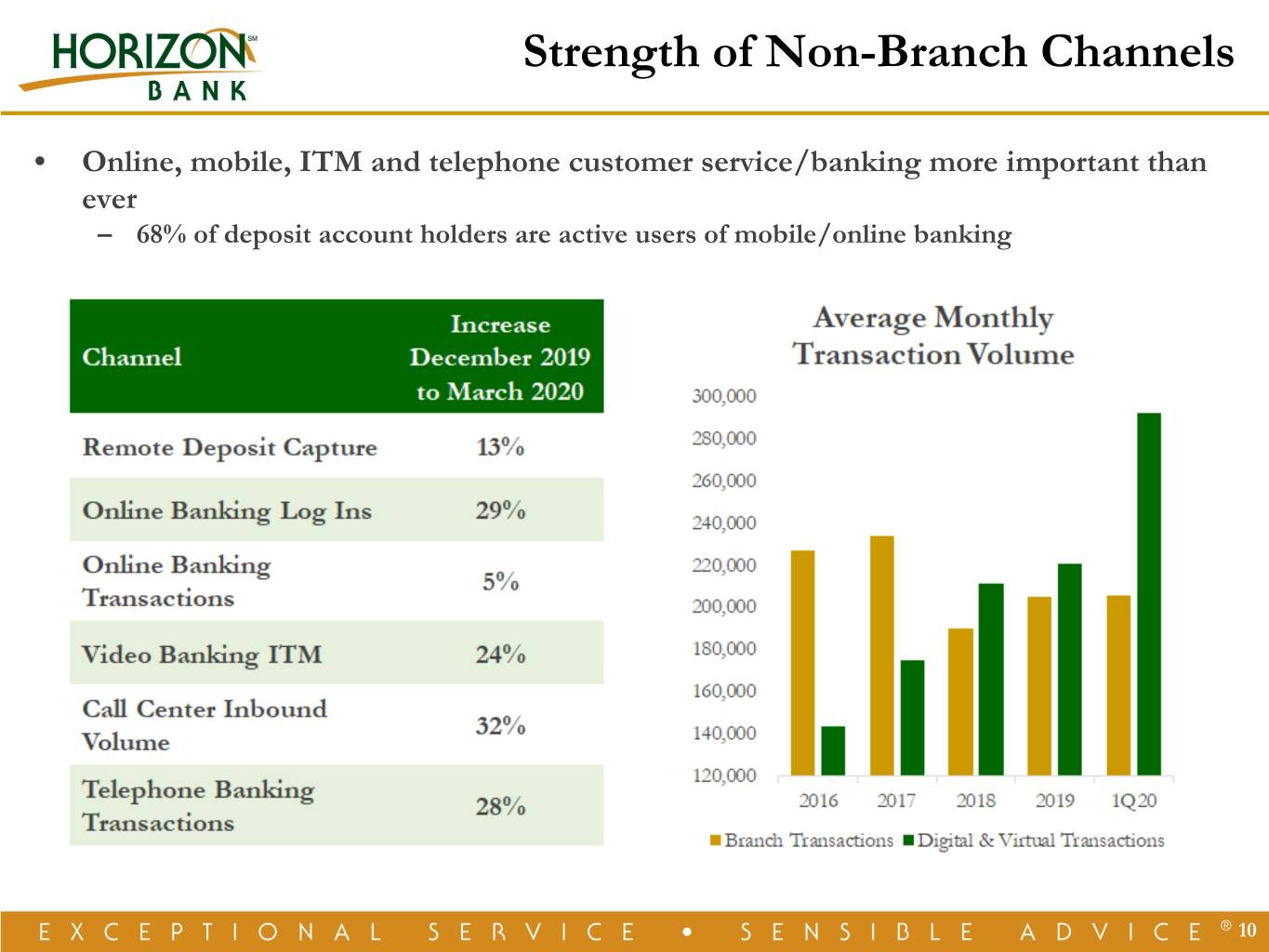

Strength of Non-Branch Channels • Online, mobile, ITM and telephone customer service/banking more important than ever – 68% of deposit account holders are active users of mobile/online banking 10

Multiple Revenue Streams Diversifies Risk Retail Banking Business Banking Mortgage Banking Wealth Management Complementary Revenue Streams that are Counter-Cyclical to Varying Economic Cycles 11

Financial Results, Capital & Liquidity By Mark E. Secor EVP & Chief Financial Officer 12

Strong Financial Performance • Footnote Index included in Appendix 13

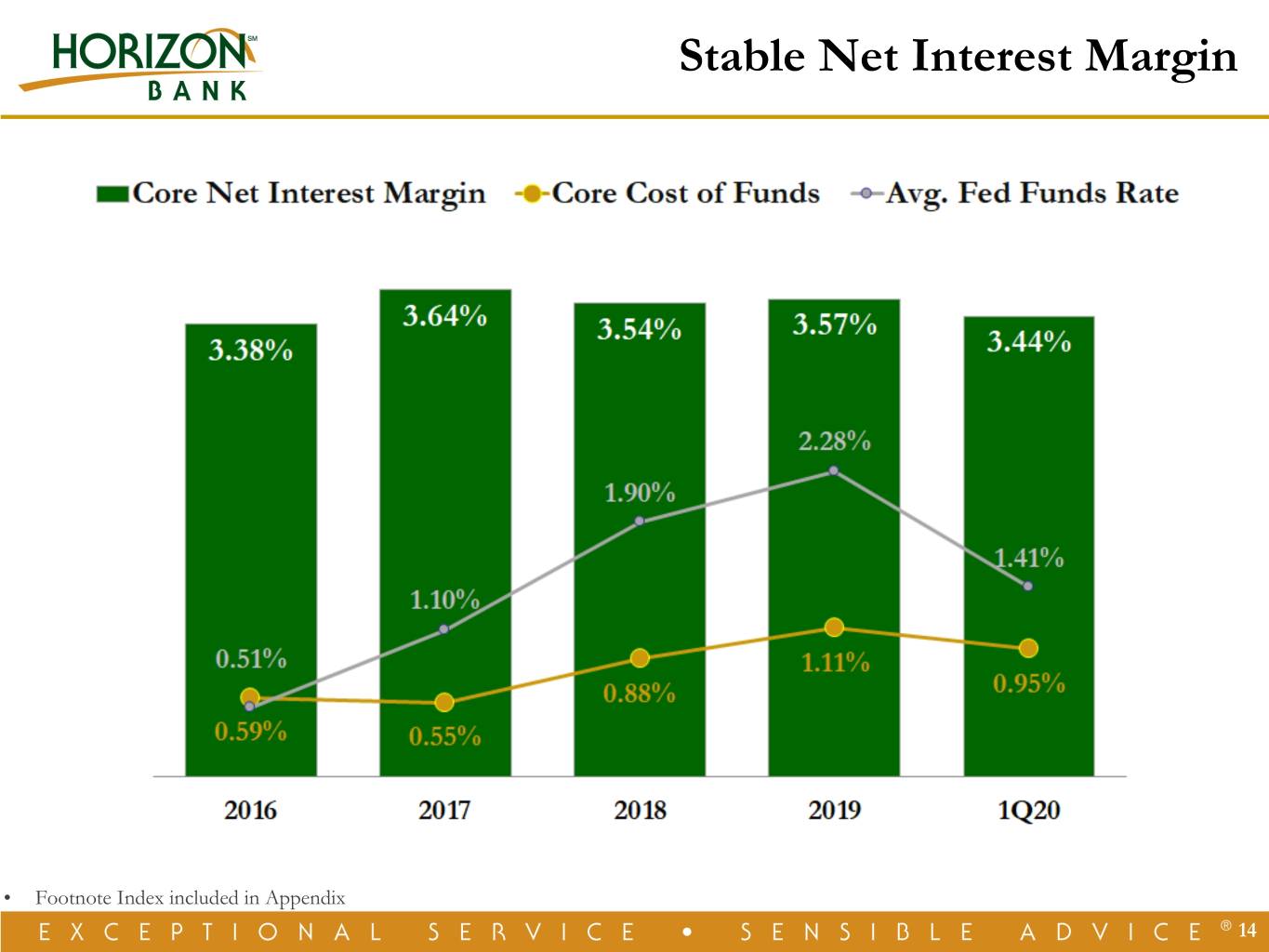

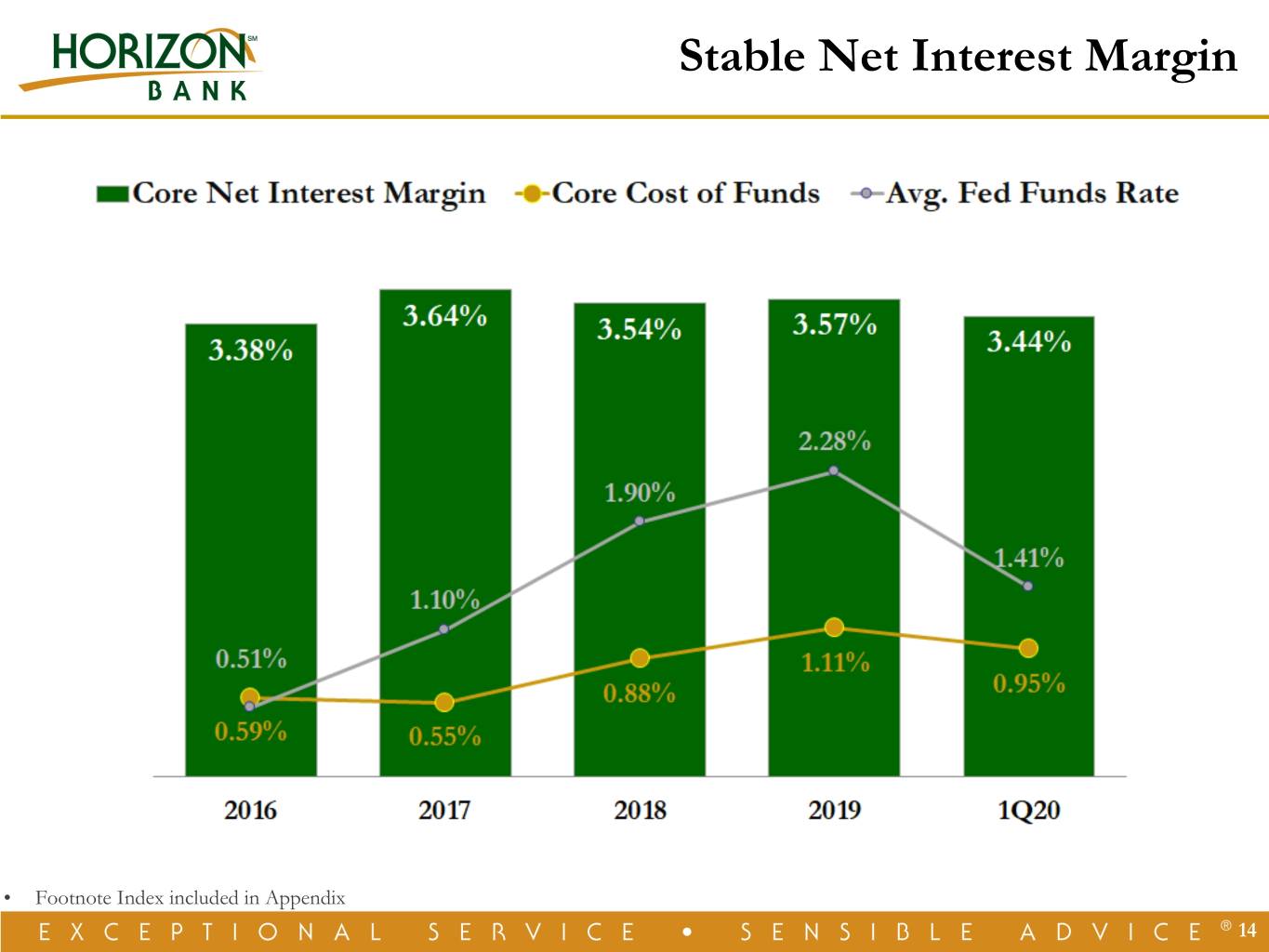

Stable Net Interest Margin • Footnote Index included in Appendix 14

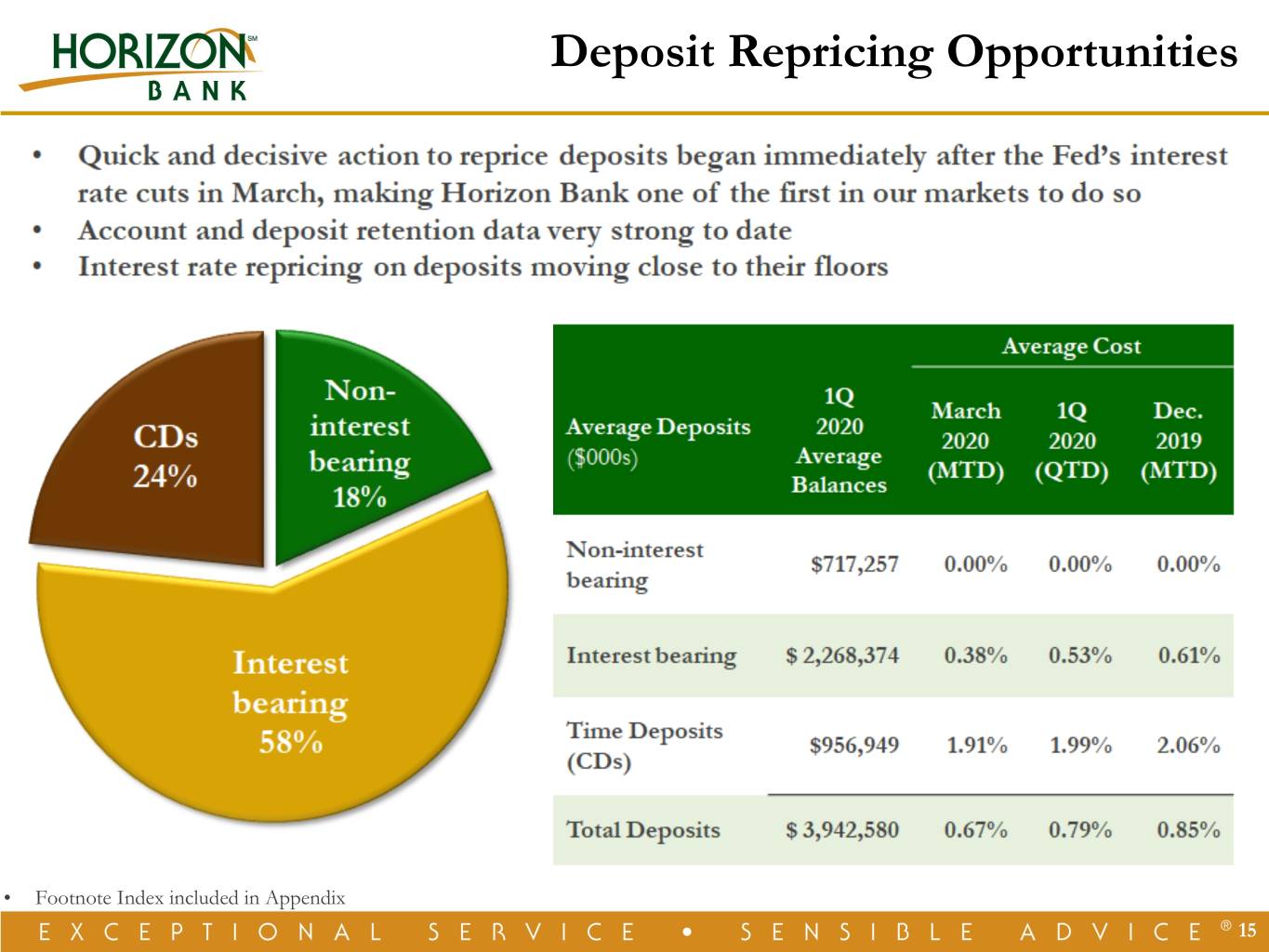

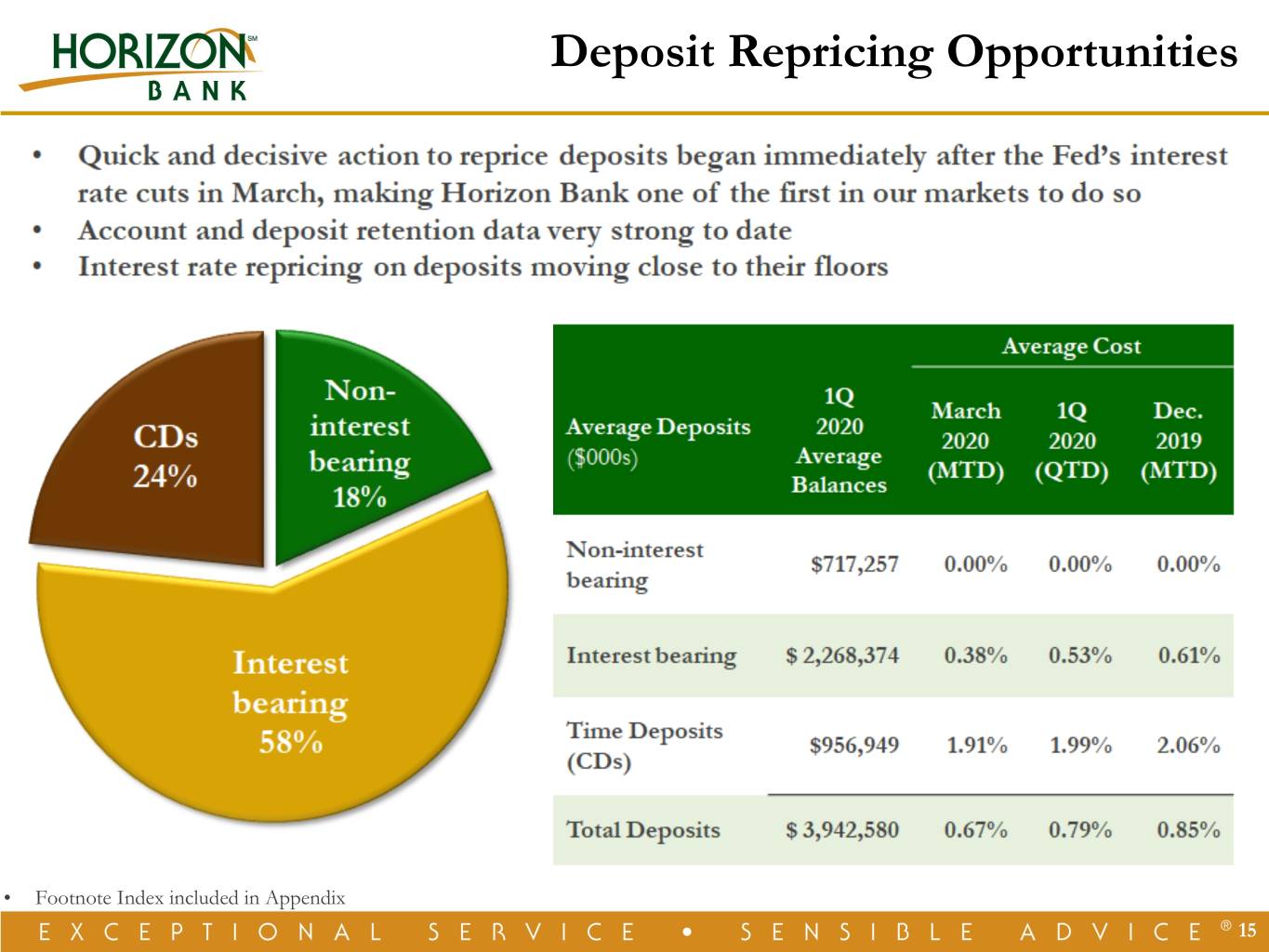

Deposit Repricing Opportunities • Footnote Index included in Appendix 15

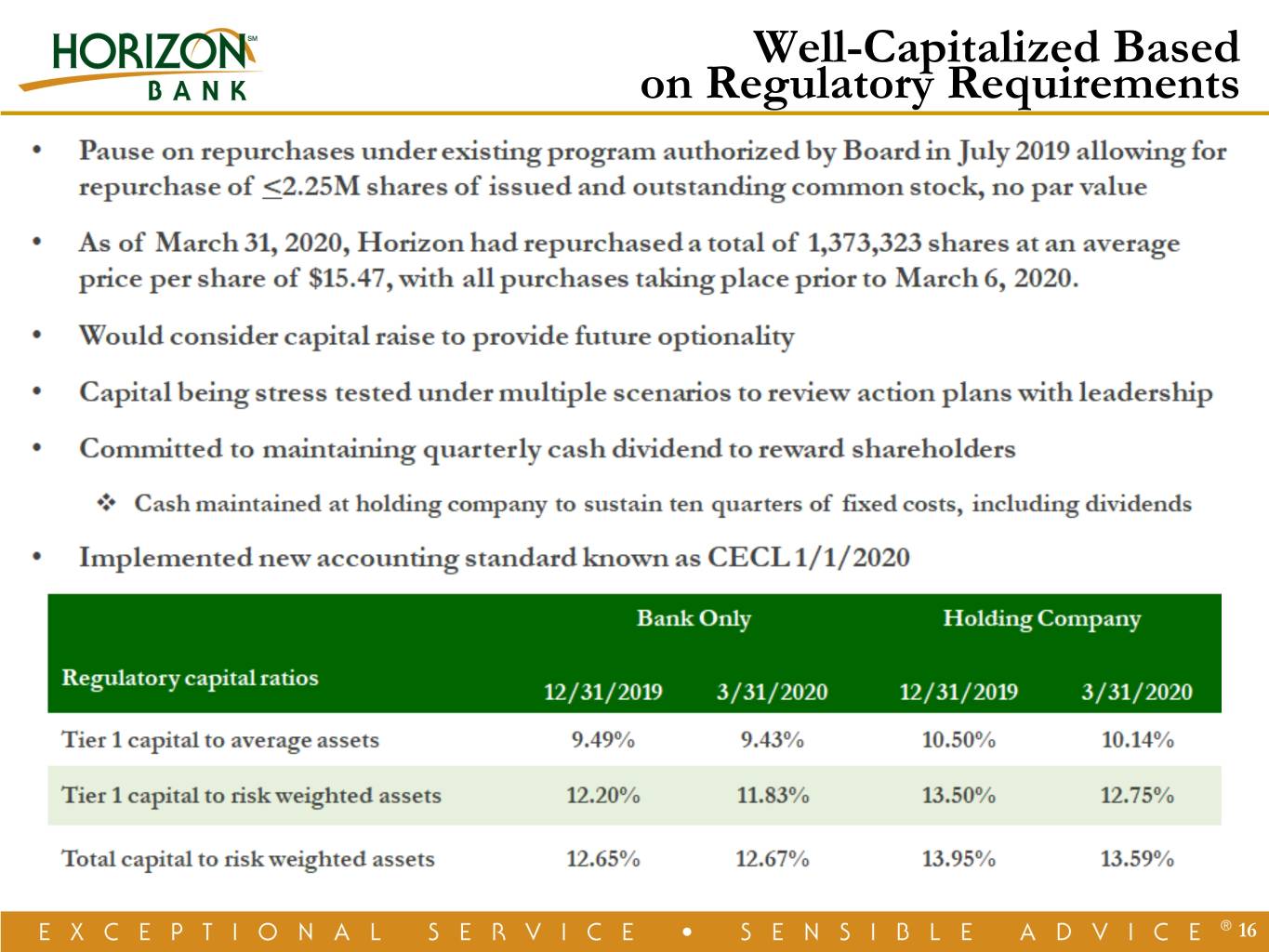

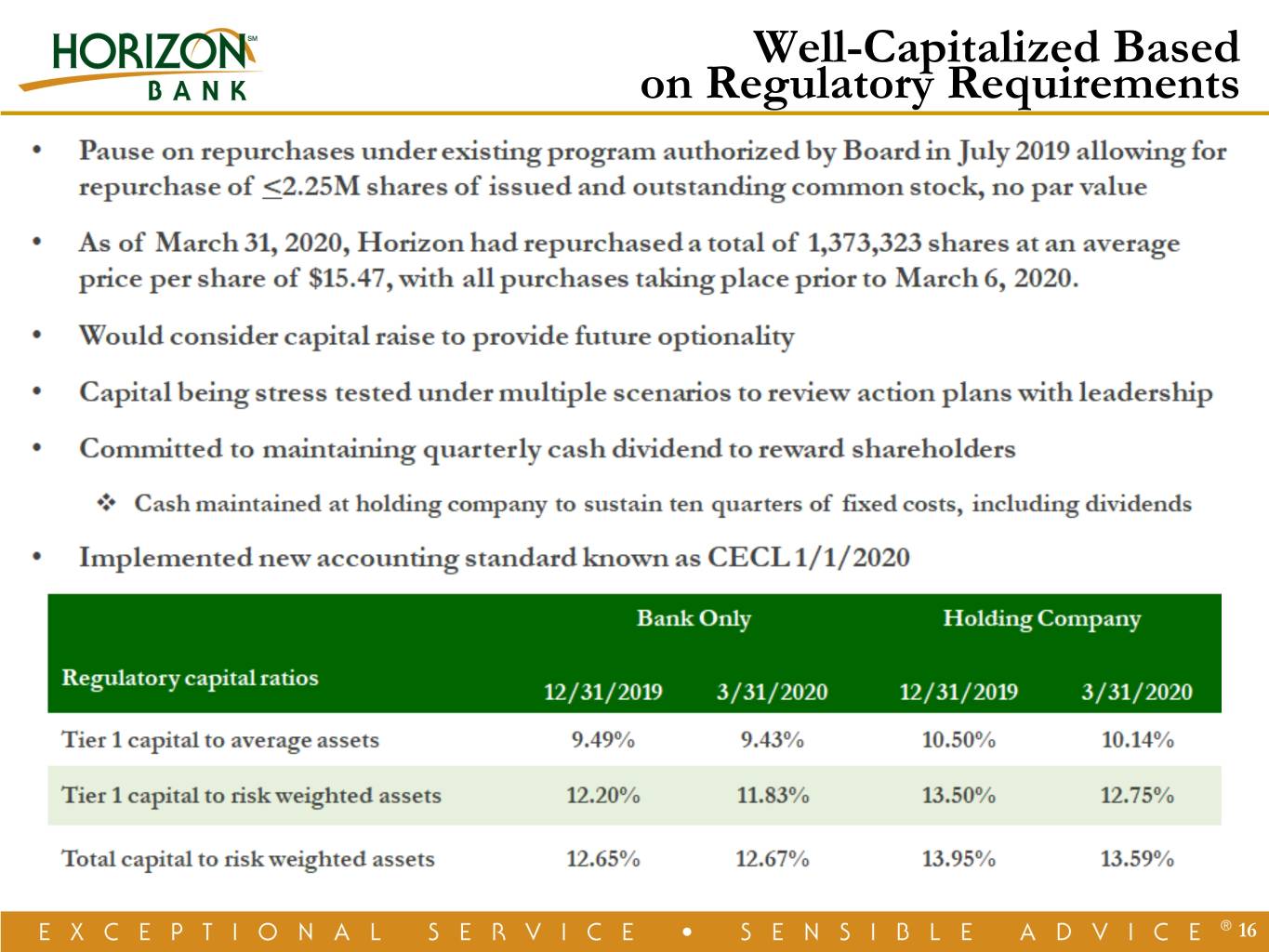

Well-Capitalized Based on Regulatory Requirements 16

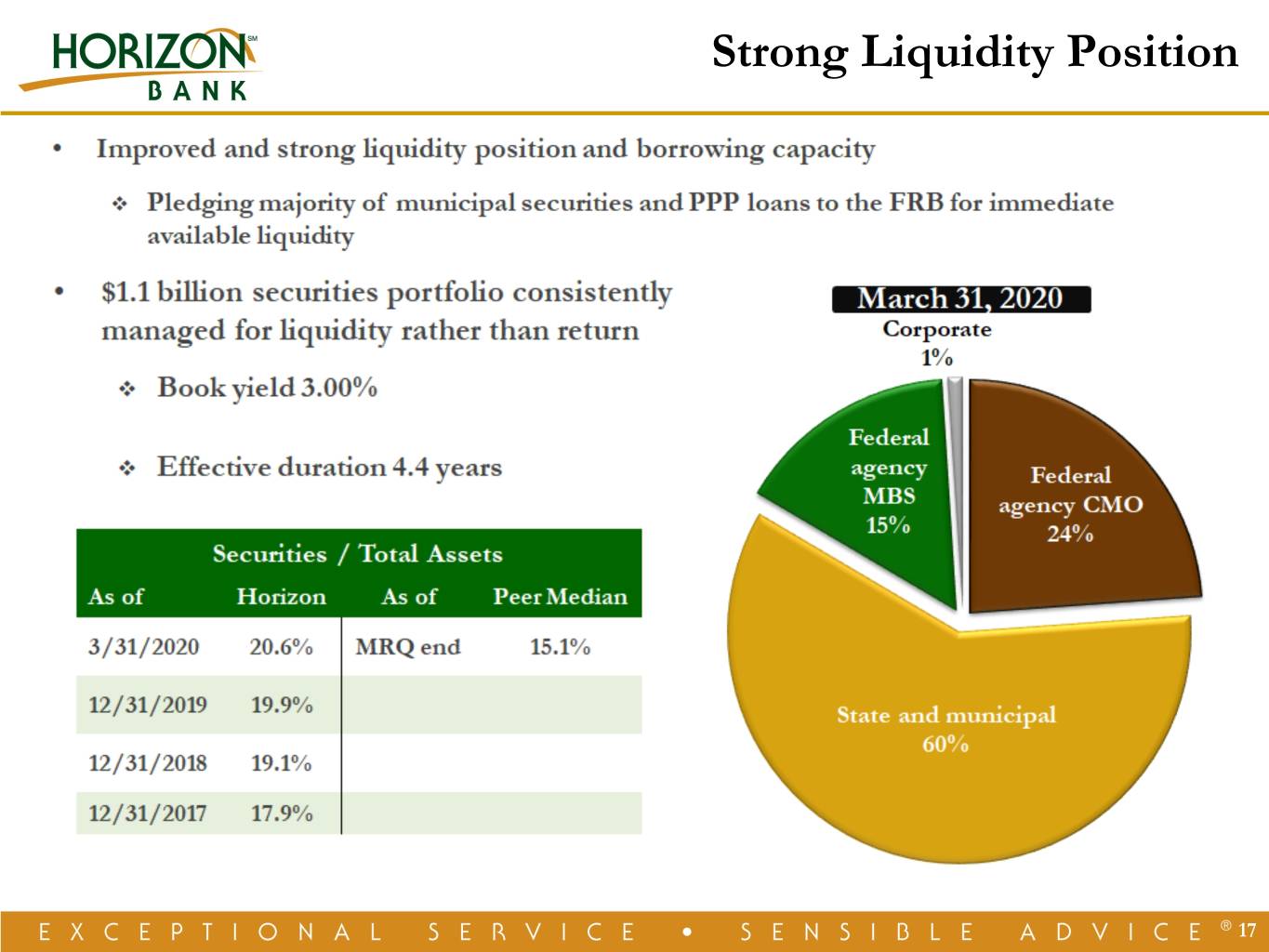

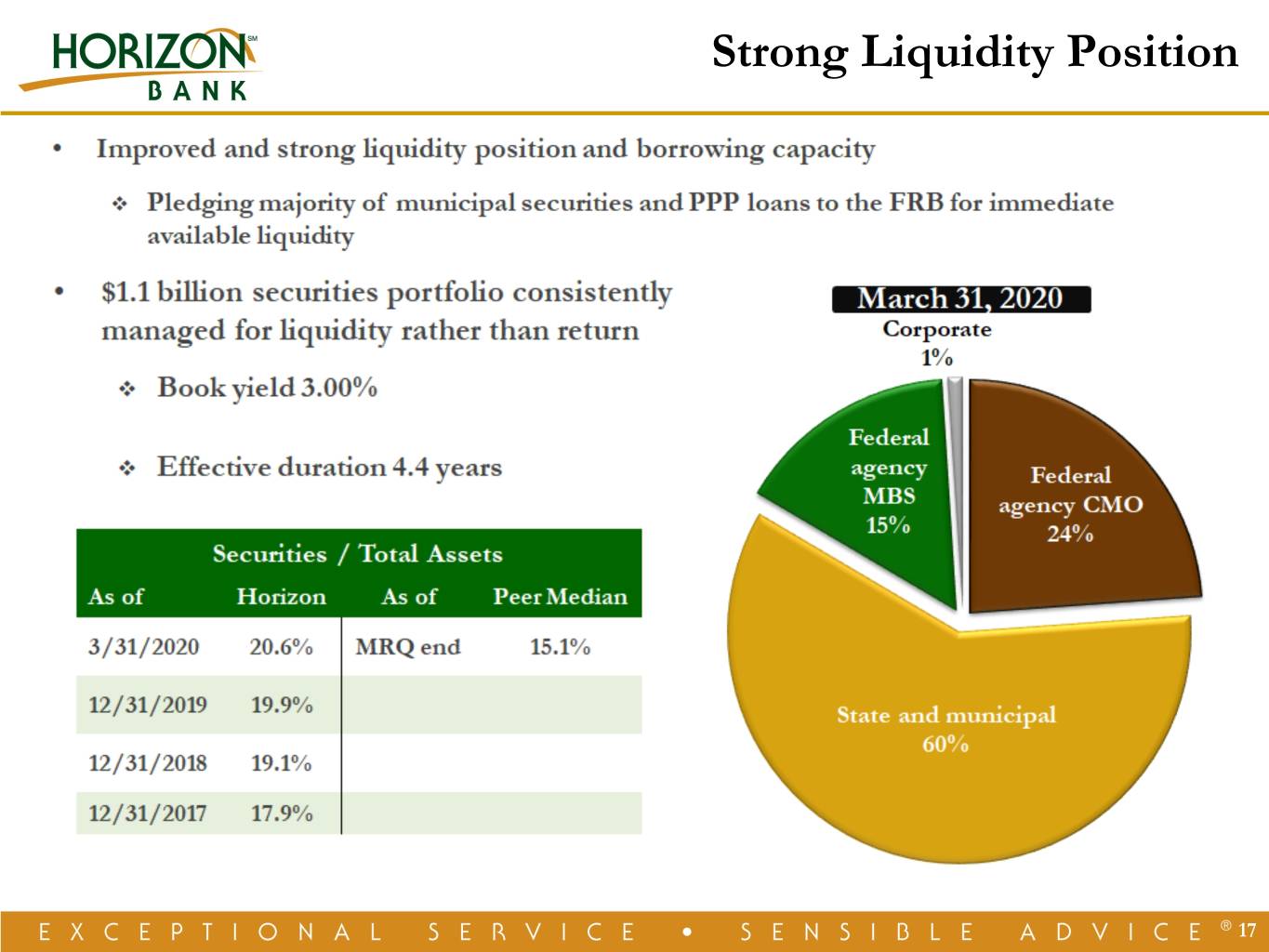

Strong Liquidity Position 17

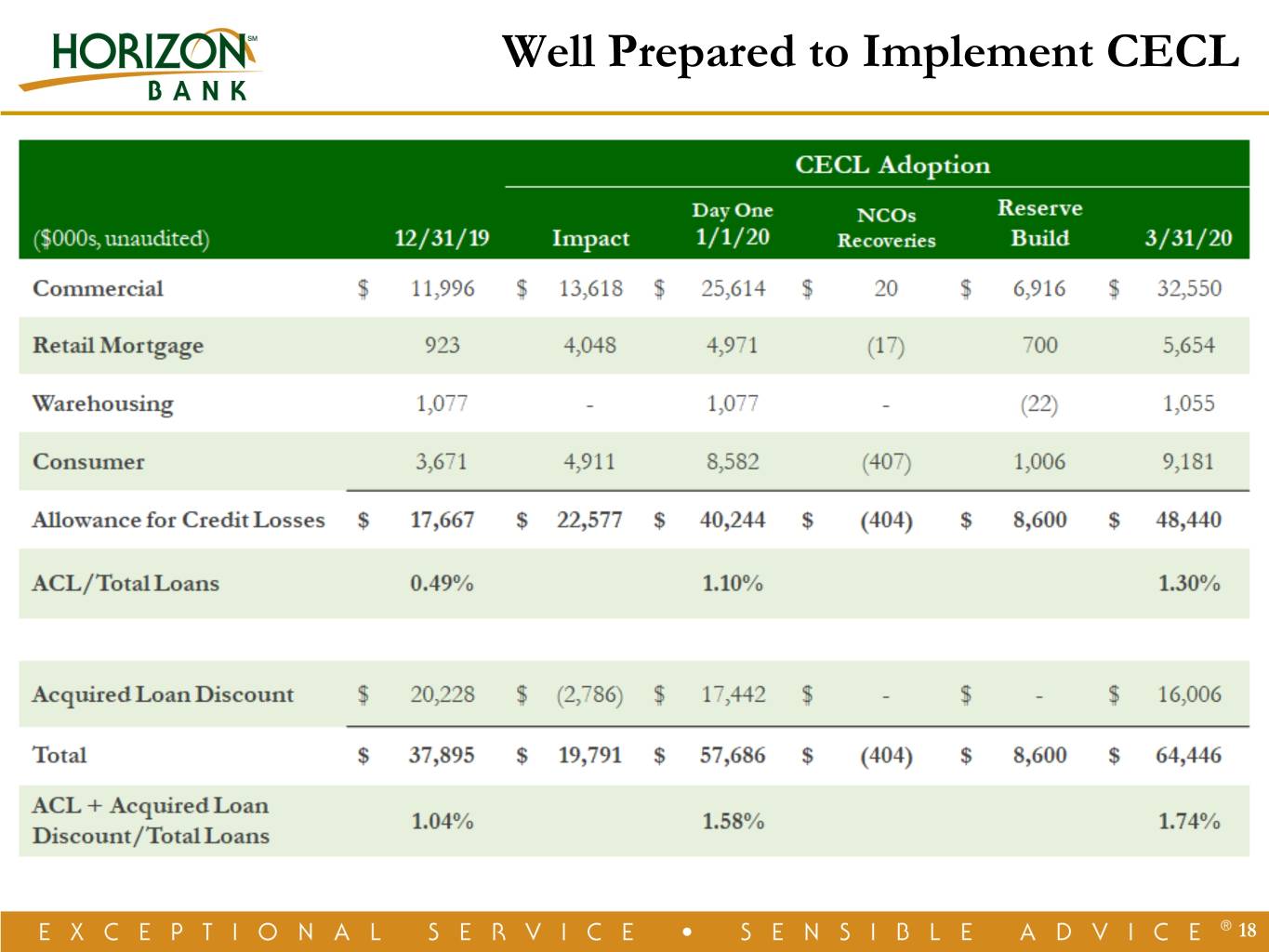

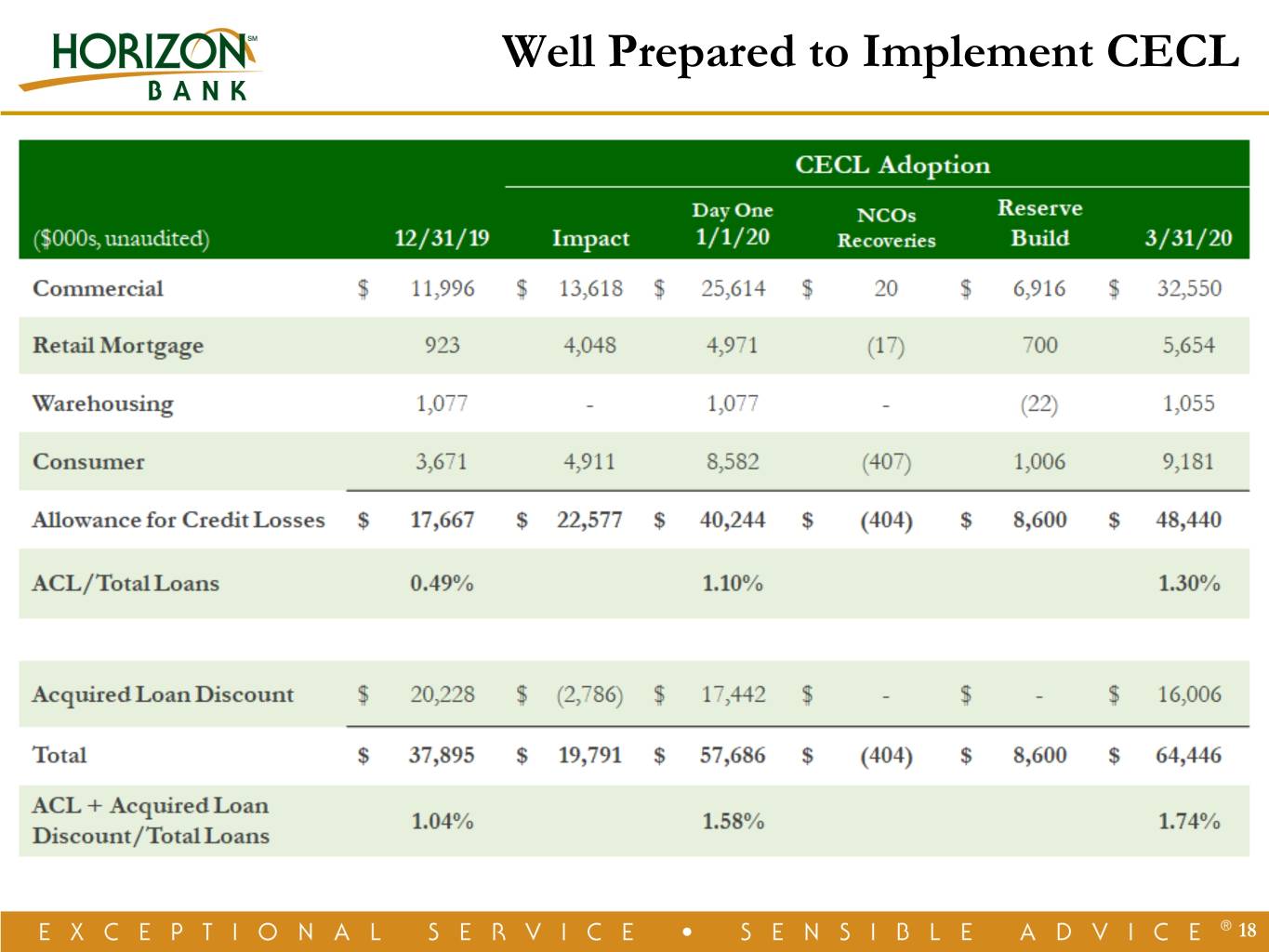

Well Prepared to Implement CECL 18

Asset Quality & Mix By James D. Neff, President & Dennis J. Kuhn, EVP Chief Commercial Banking Officer 19

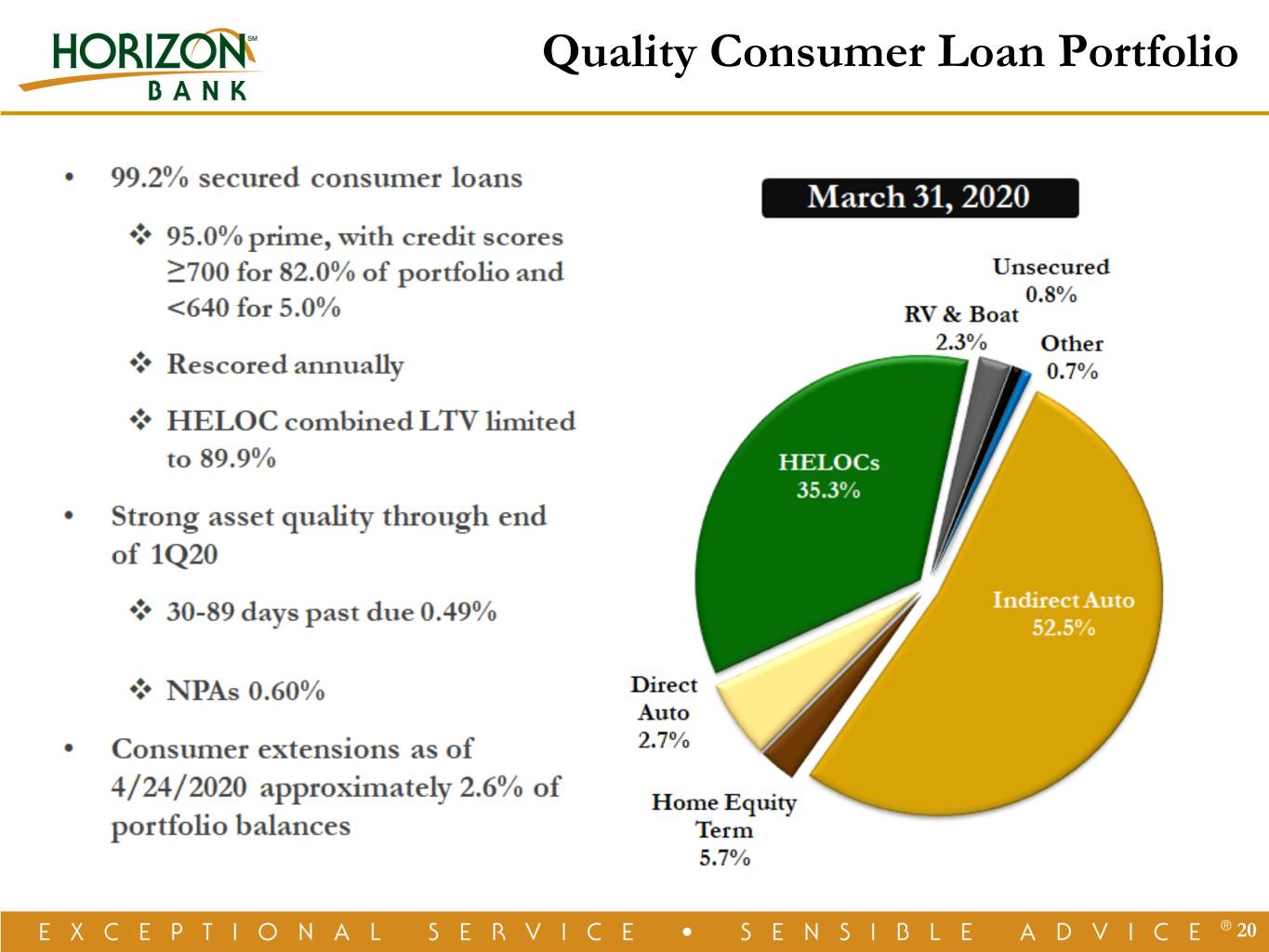

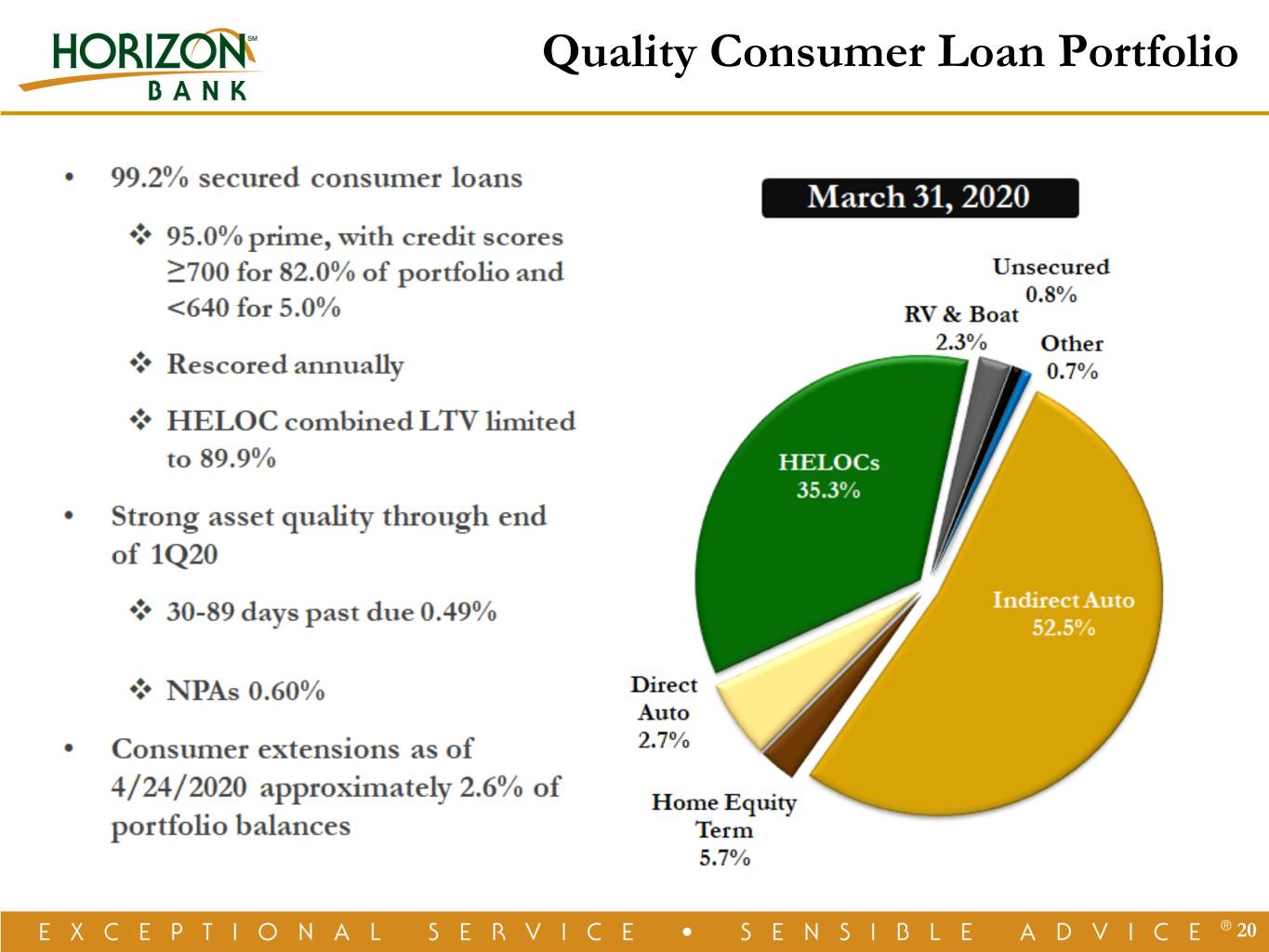

Quality Consumer Loan Portfolio 20

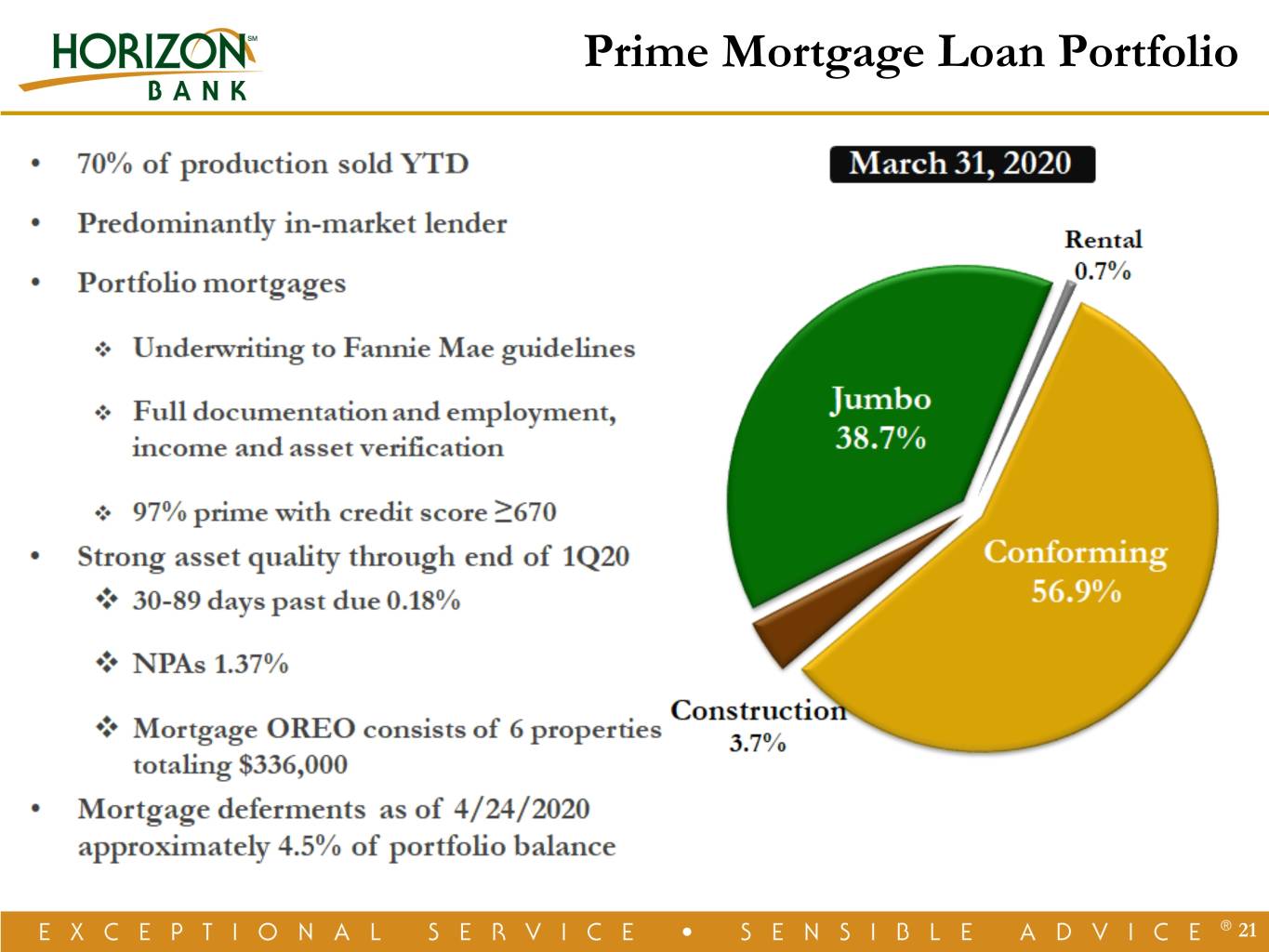

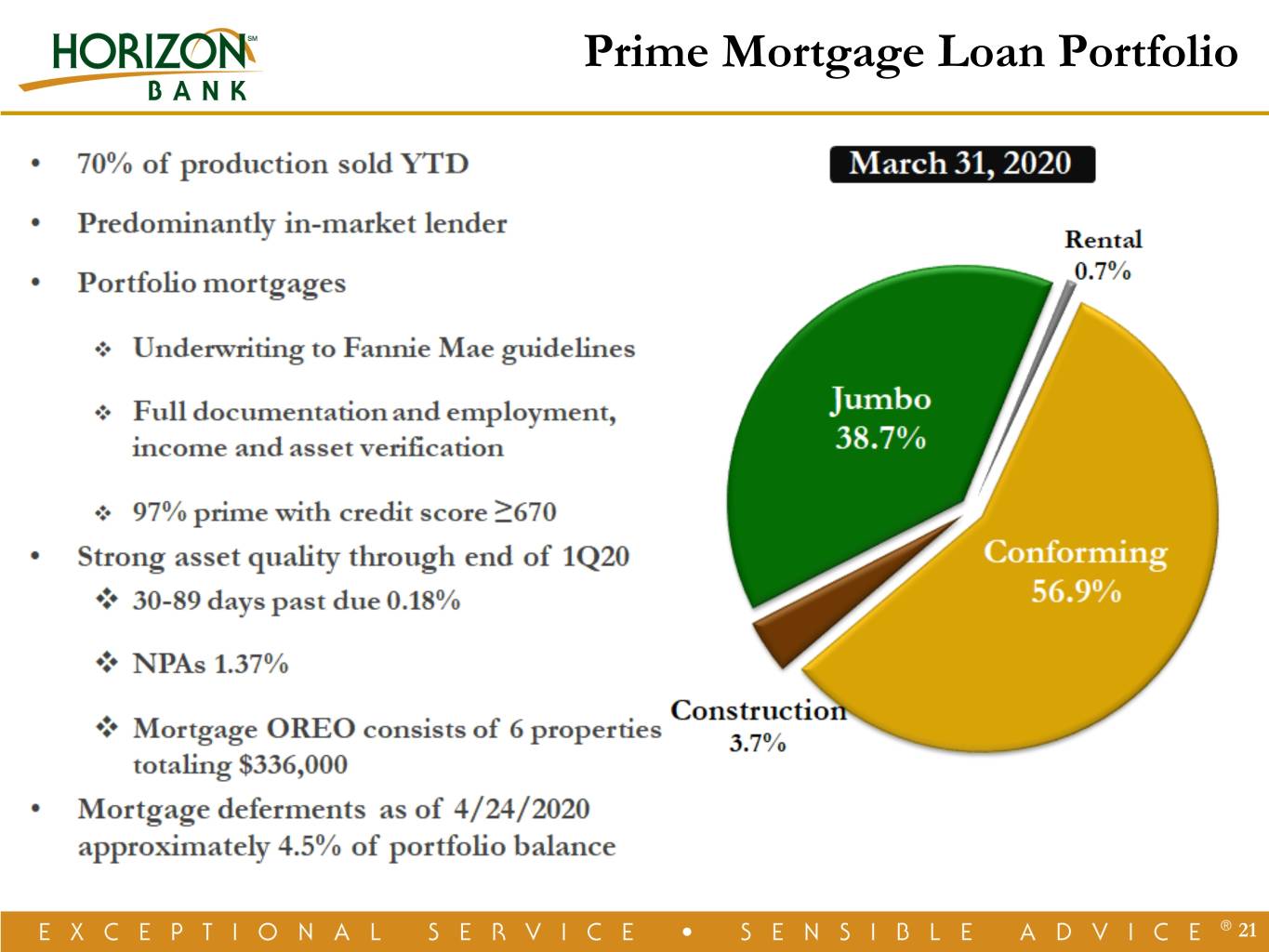

Prime Mortgage Loan Portfolio 21

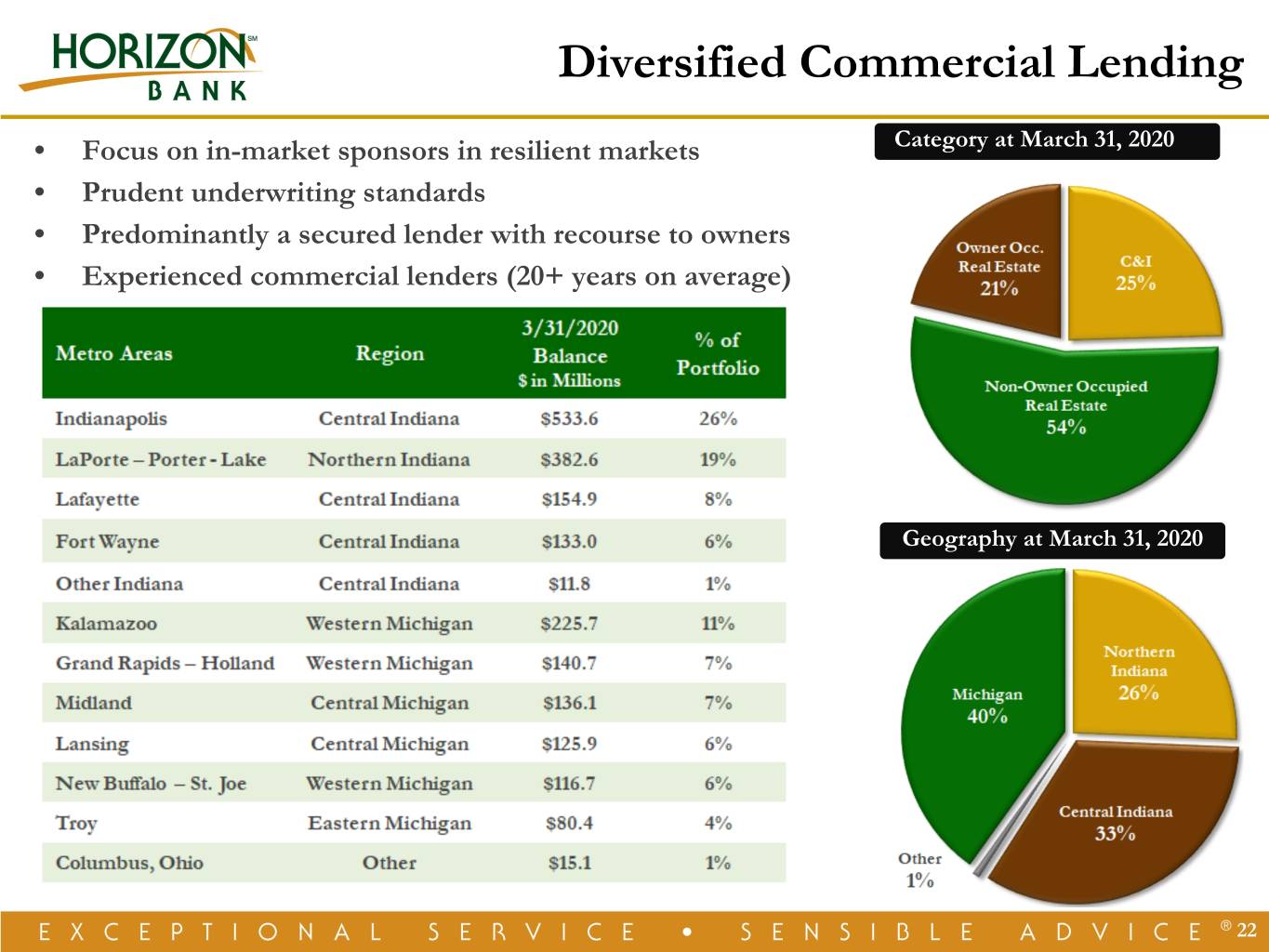

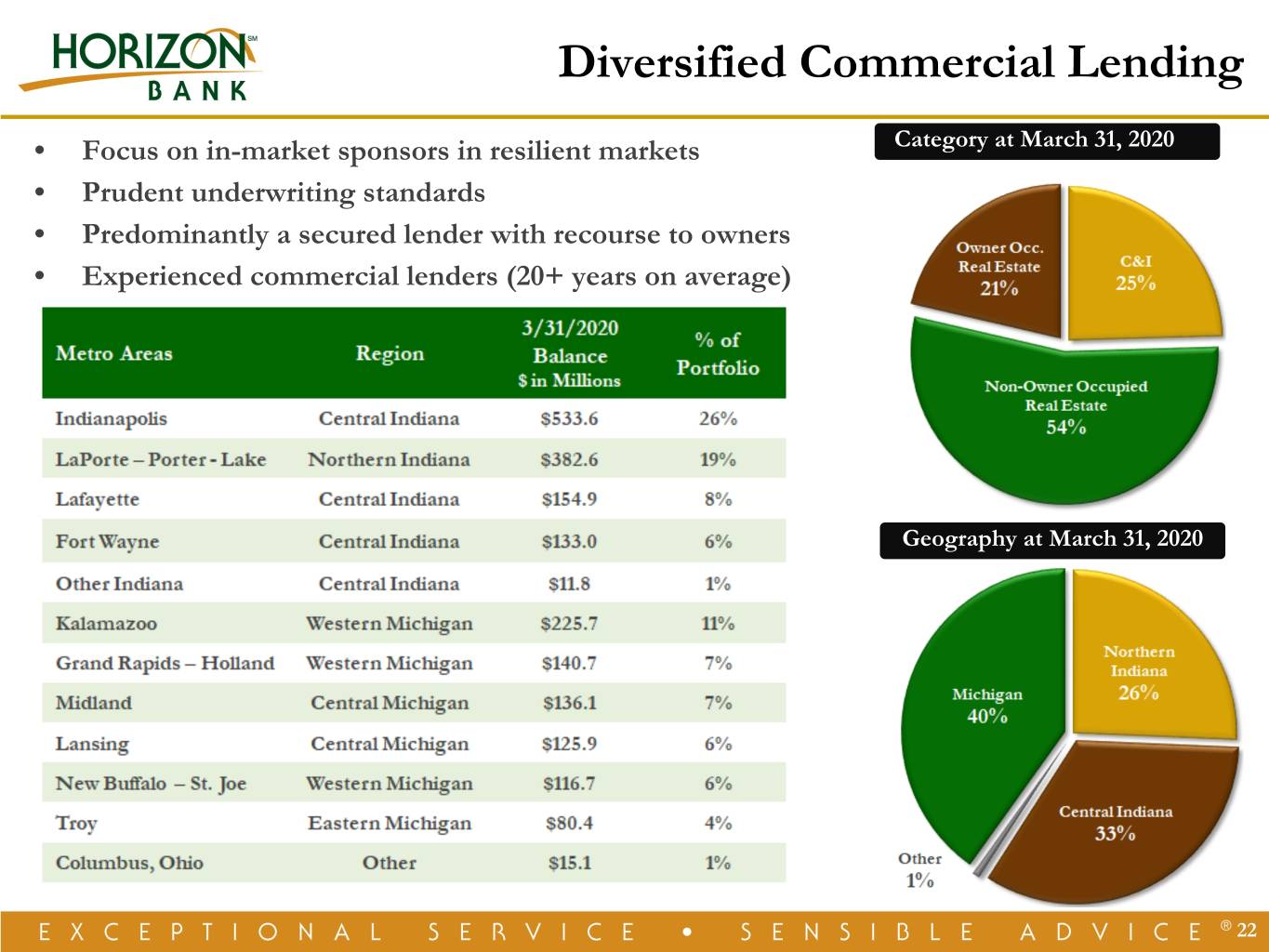

Diversified Commercial Lending • Focus on in-market sponsors in resilient markets Category at March 31, 2020 • Prudent underwriting standards • Predominantly a secured lender with recourse to owners • Experienced commercial lenders (20+ years on average) Geography at March 31, 2020 22

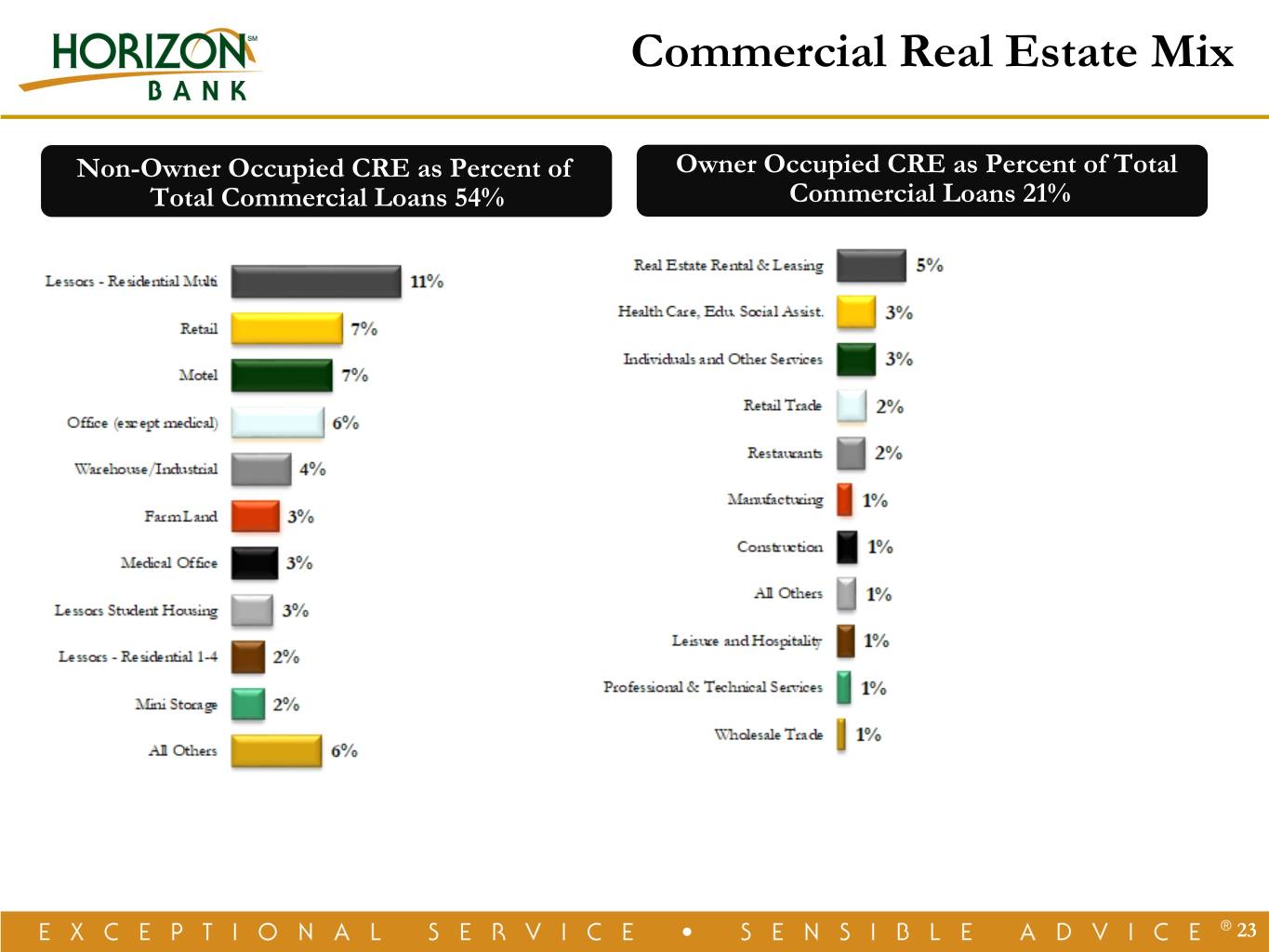

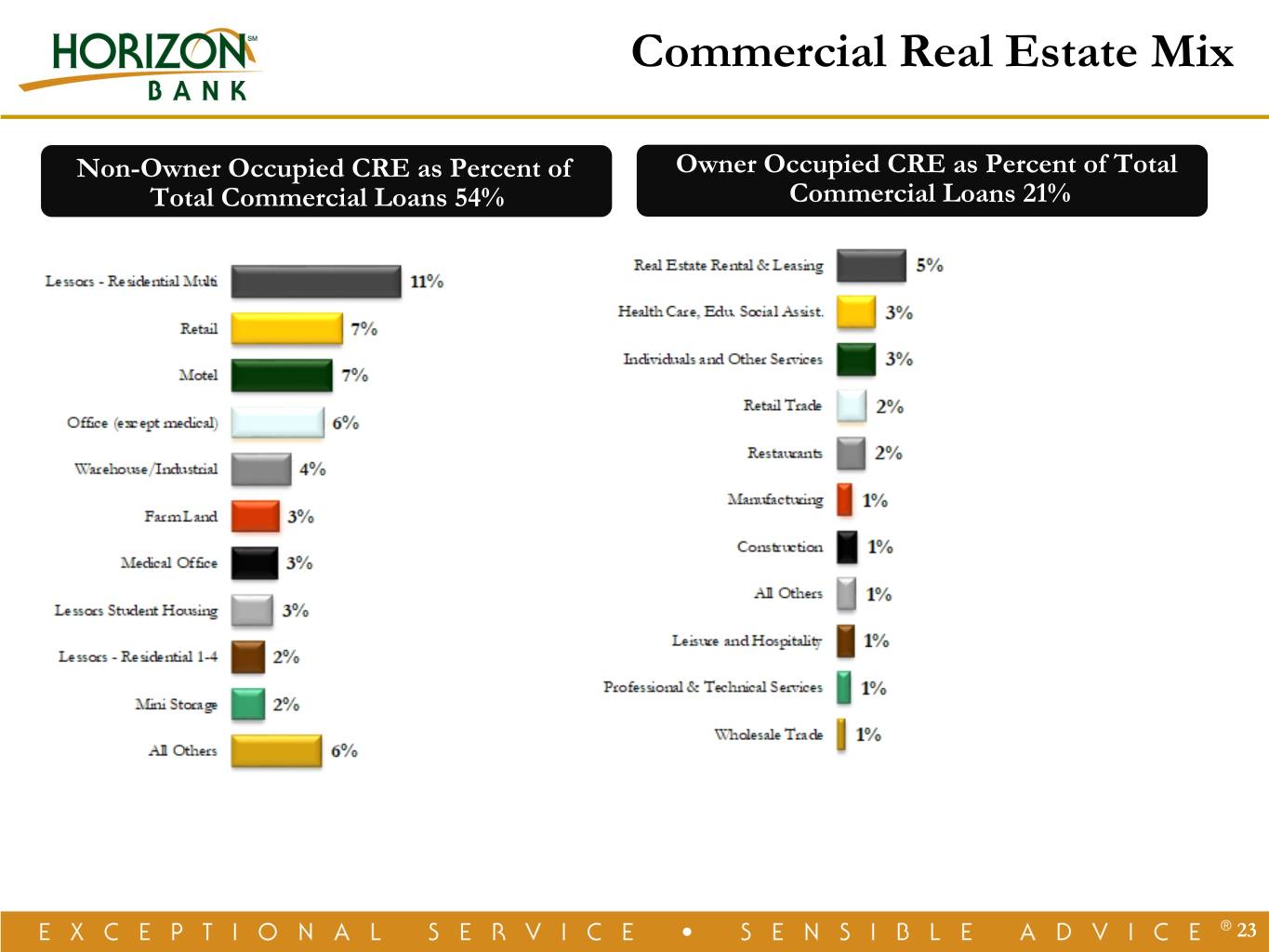

Commercial Real Estate Mix Non-Owner Occupied CRE as PercentDe ofce mber 31,O wner2017 Occupied CRE as Percent of Total Total Commercial Loans 54% Commercial Loans 21% 23

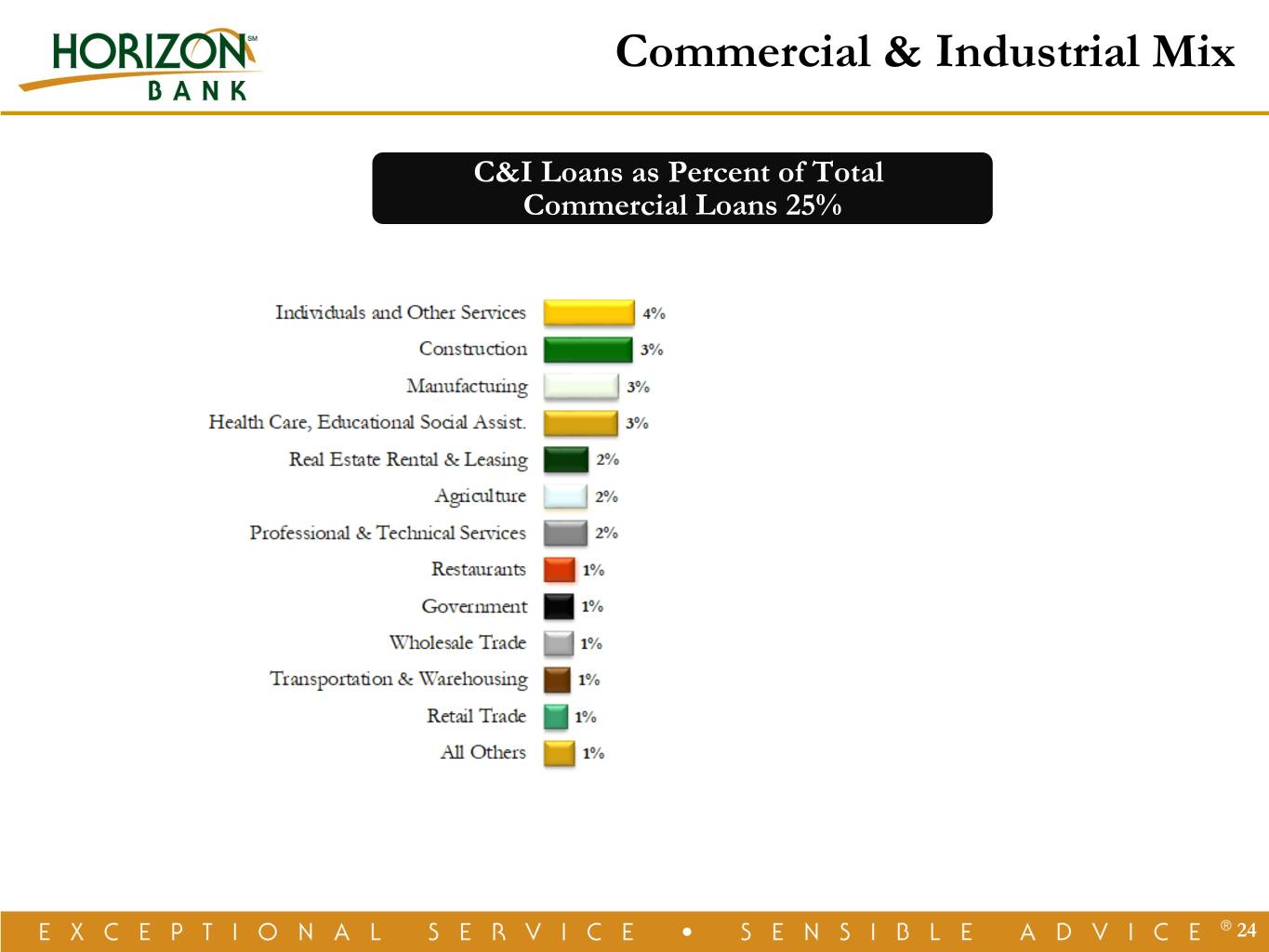

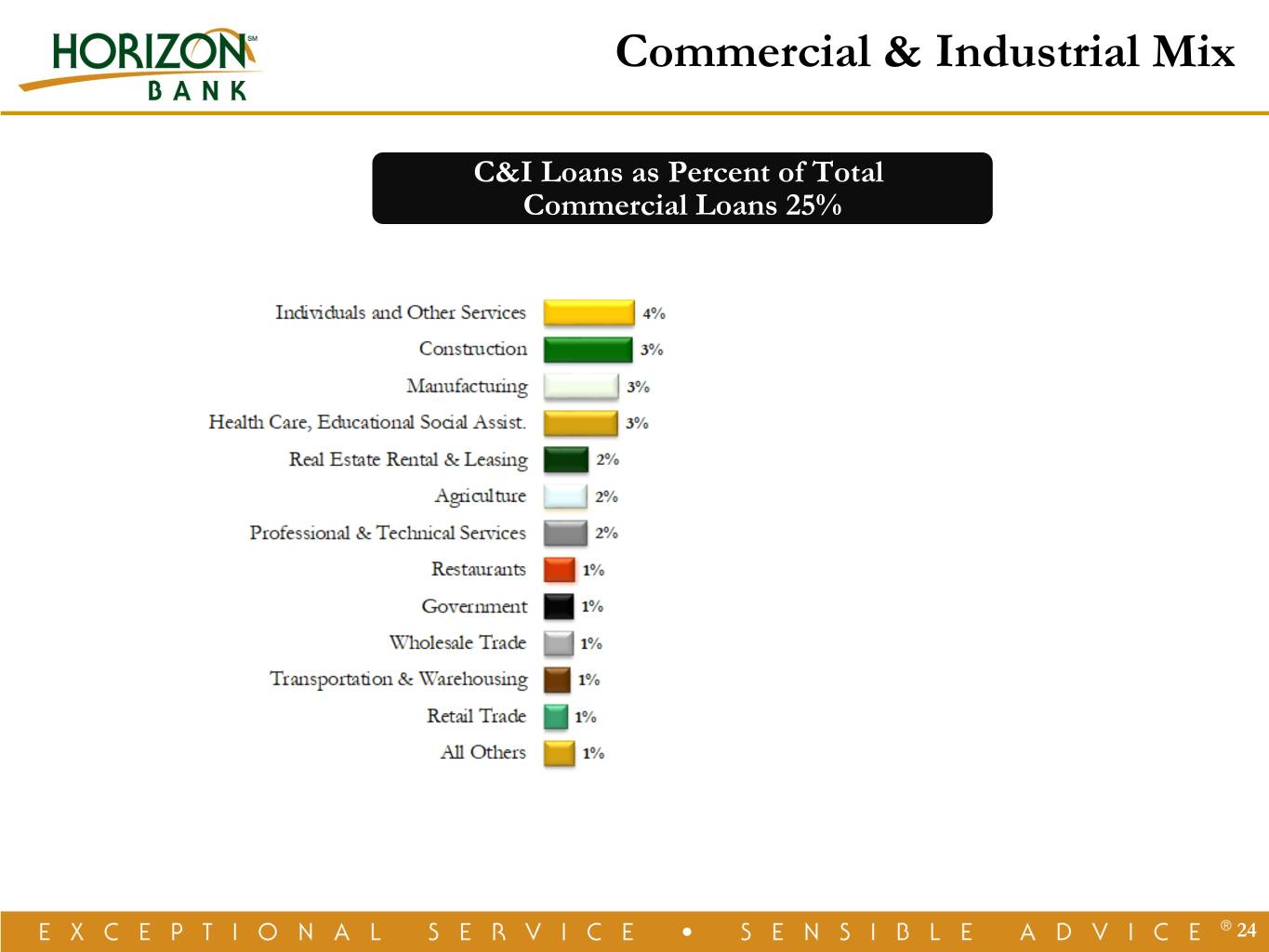

Commercial & Industrial Mix C&I Loans as Percent of Total Commercial Loans 25% 24

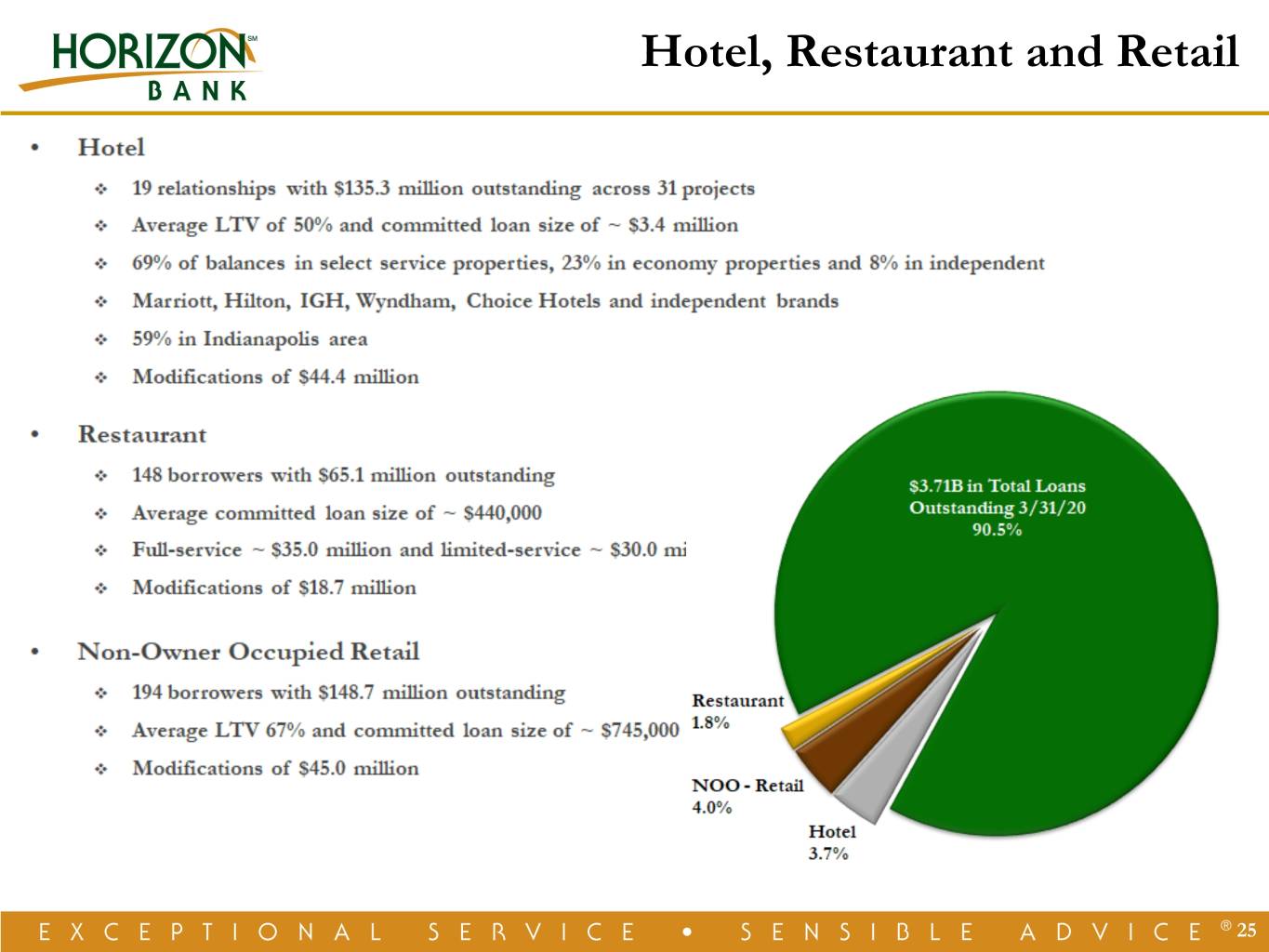

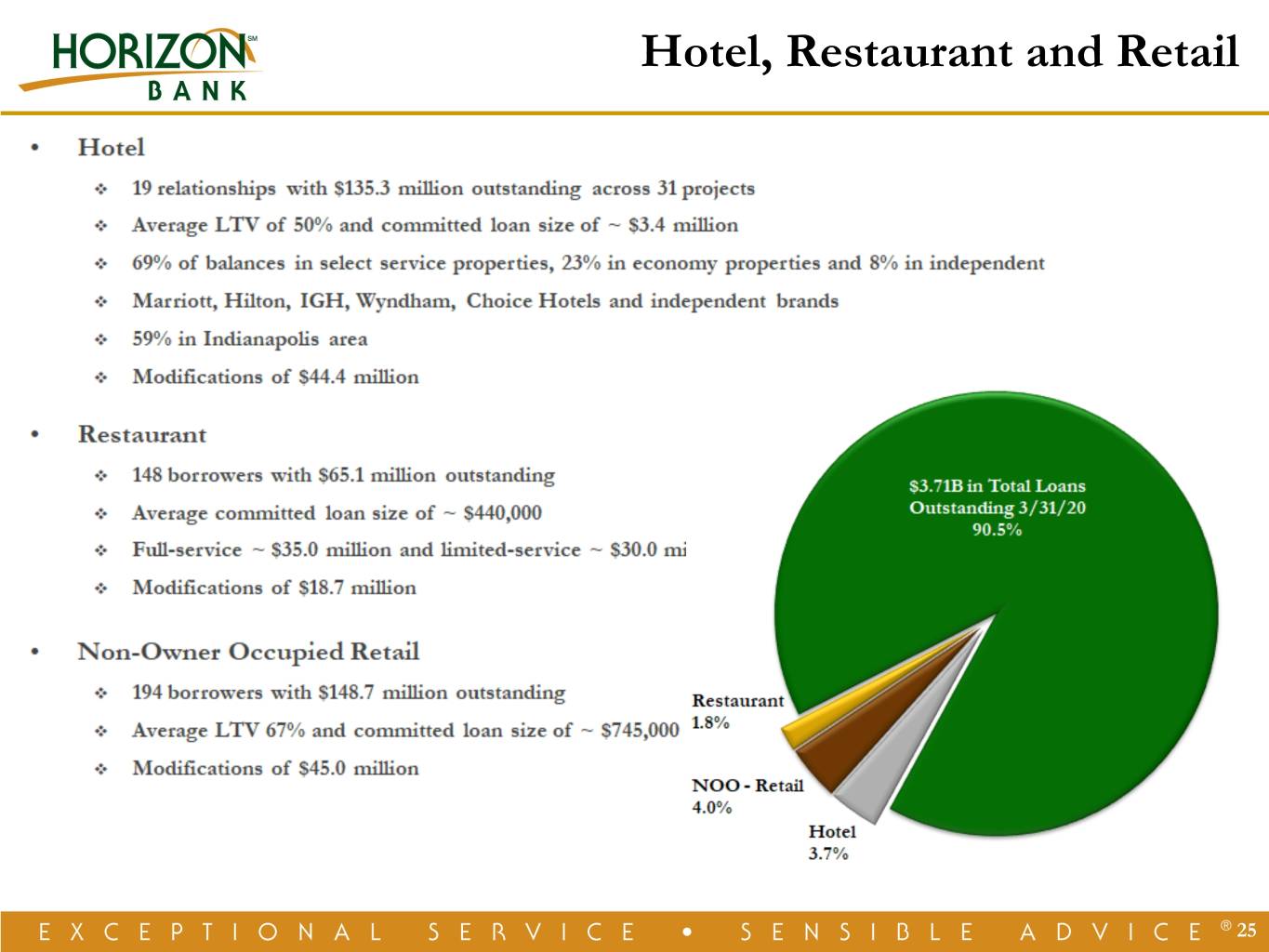

Hotel, Restaurant and Retail 25

Payroll Protection Program Round One 75% of PPP loans in amounts ≤ $150,000 26

Stakeholders Interests are Well Balanced Employee Shareholder Customer Community 27

Appendix 28

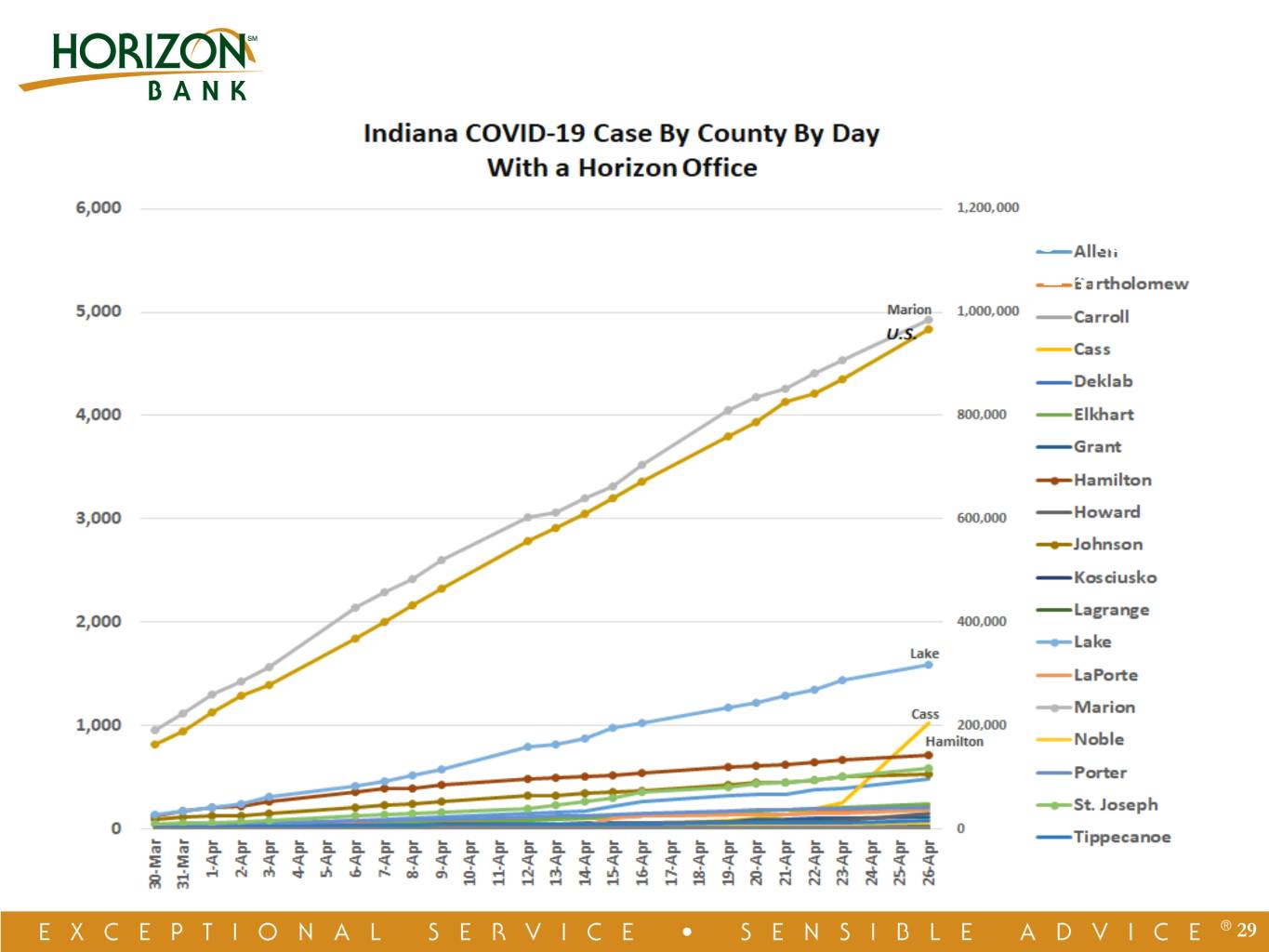

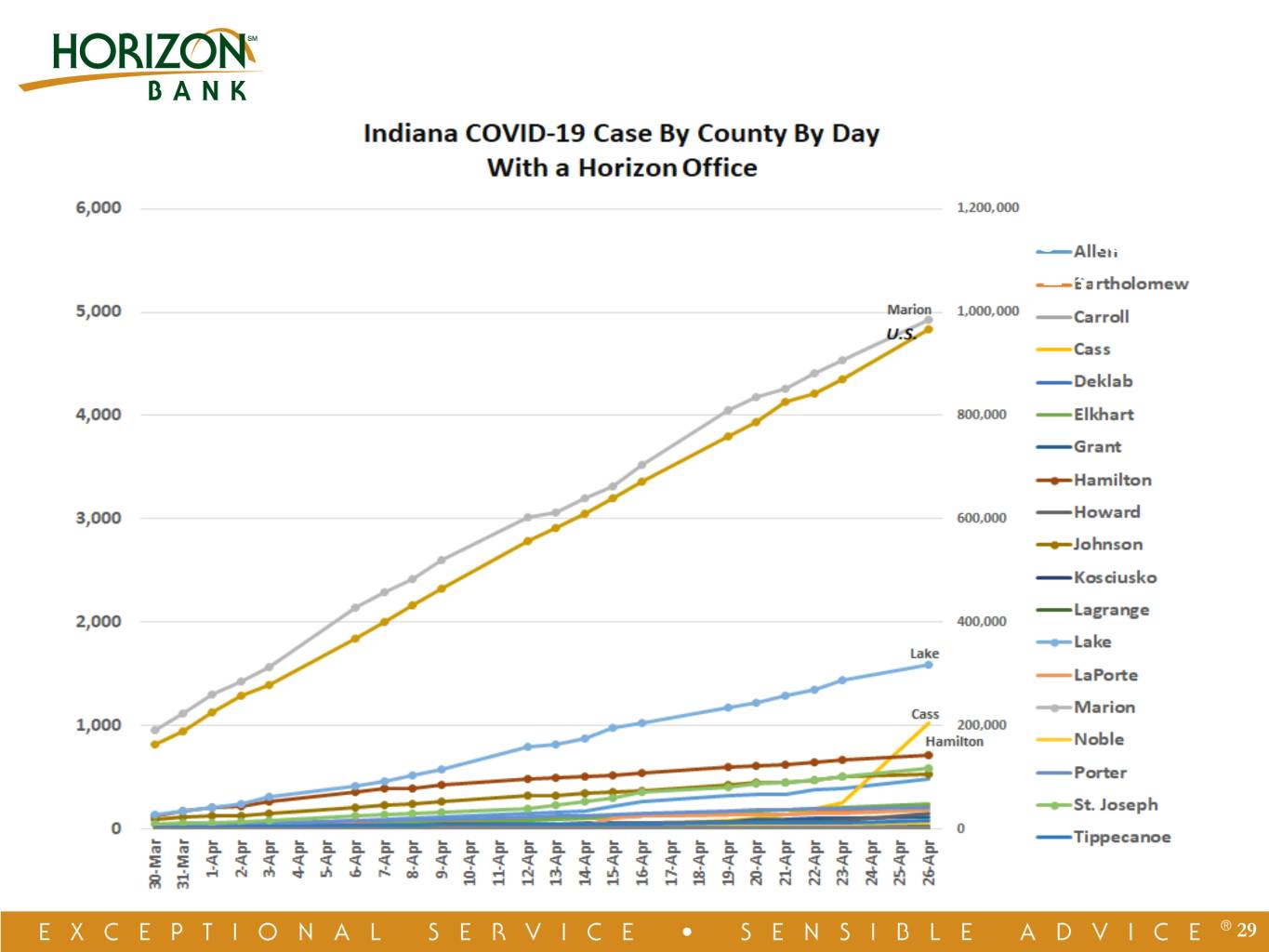

LOCATIONS – 75 COUNTIES – 31 29

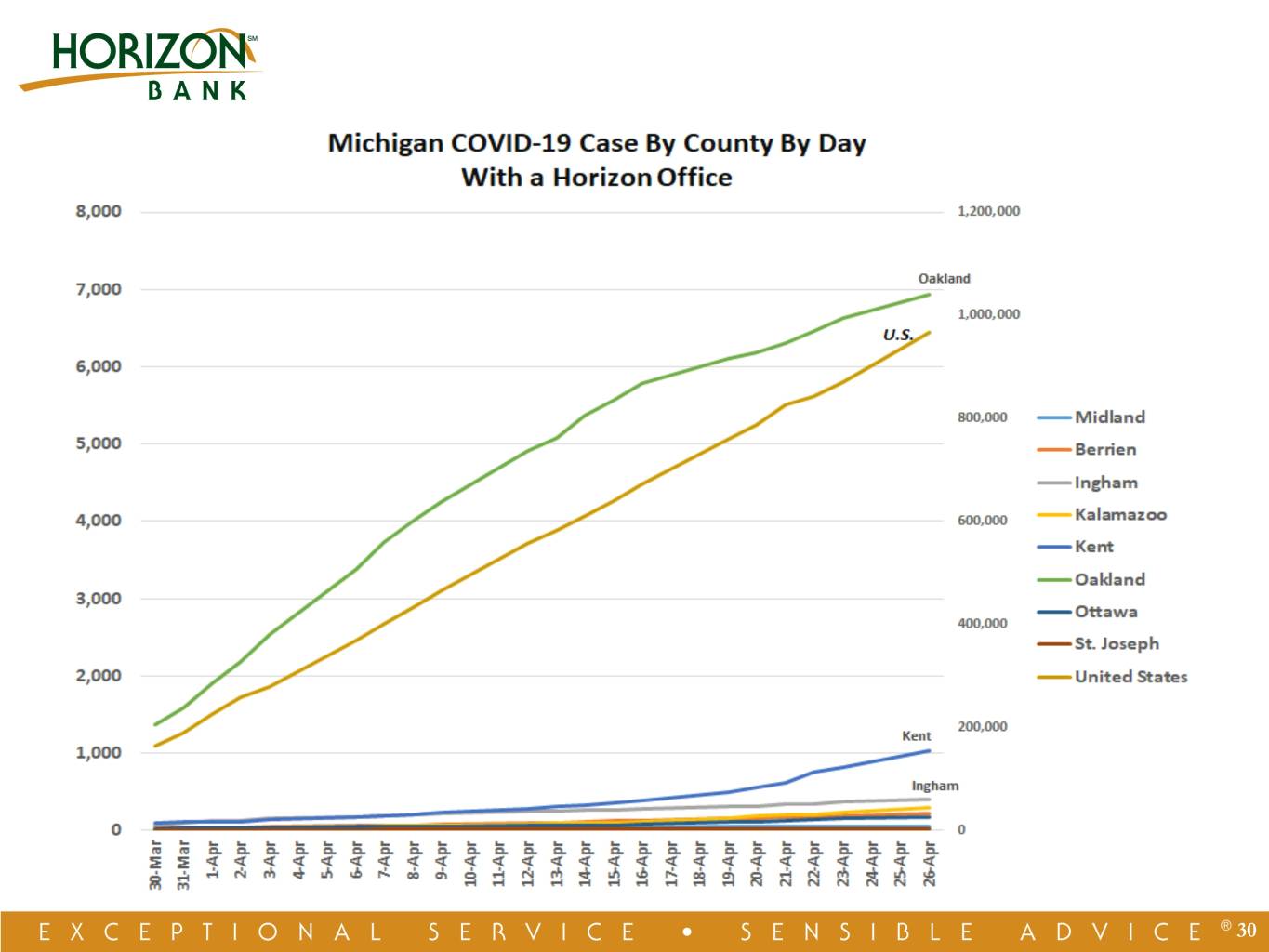

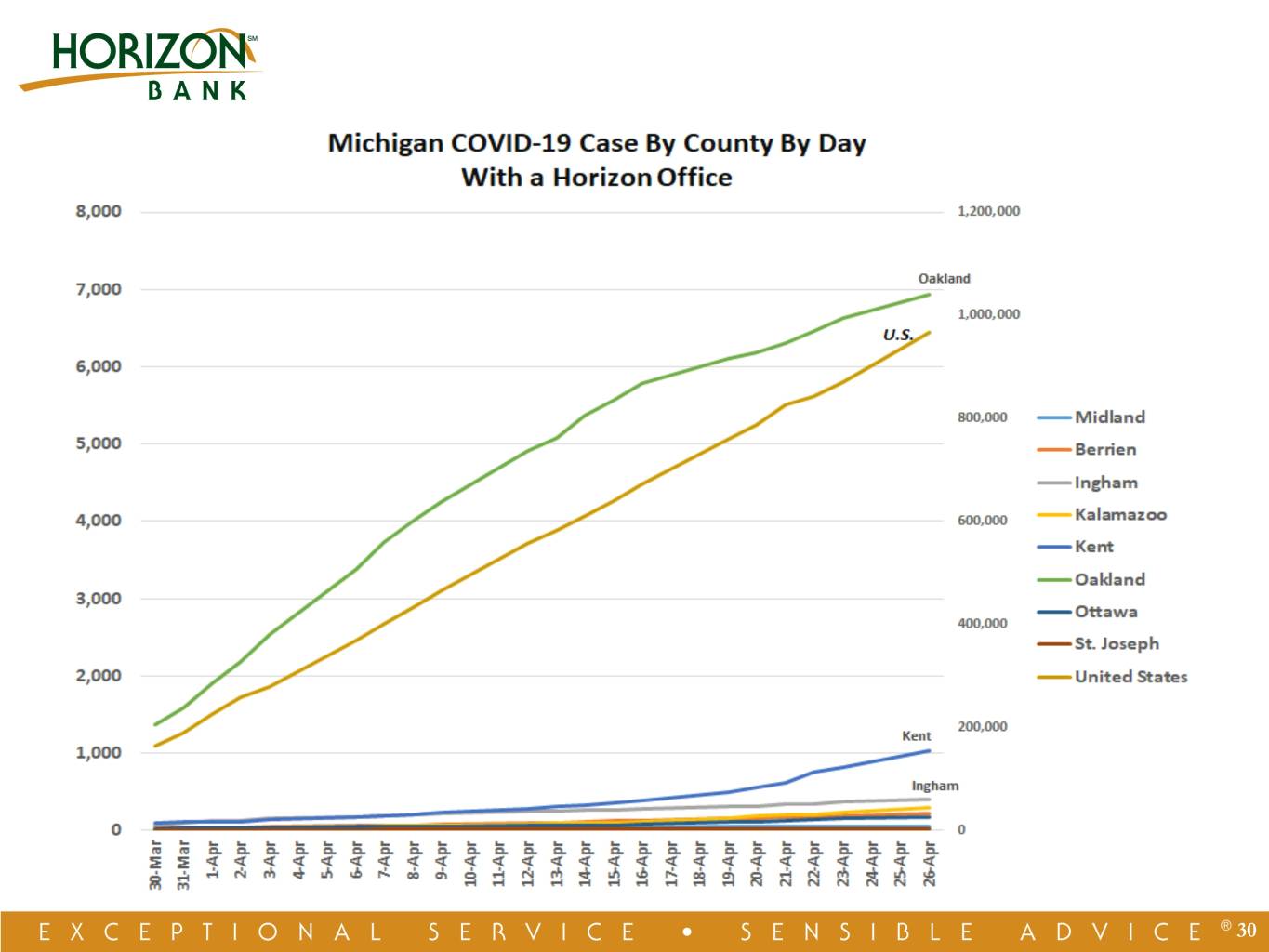

LOCATIONS – 75 COUNTIES – 31 30

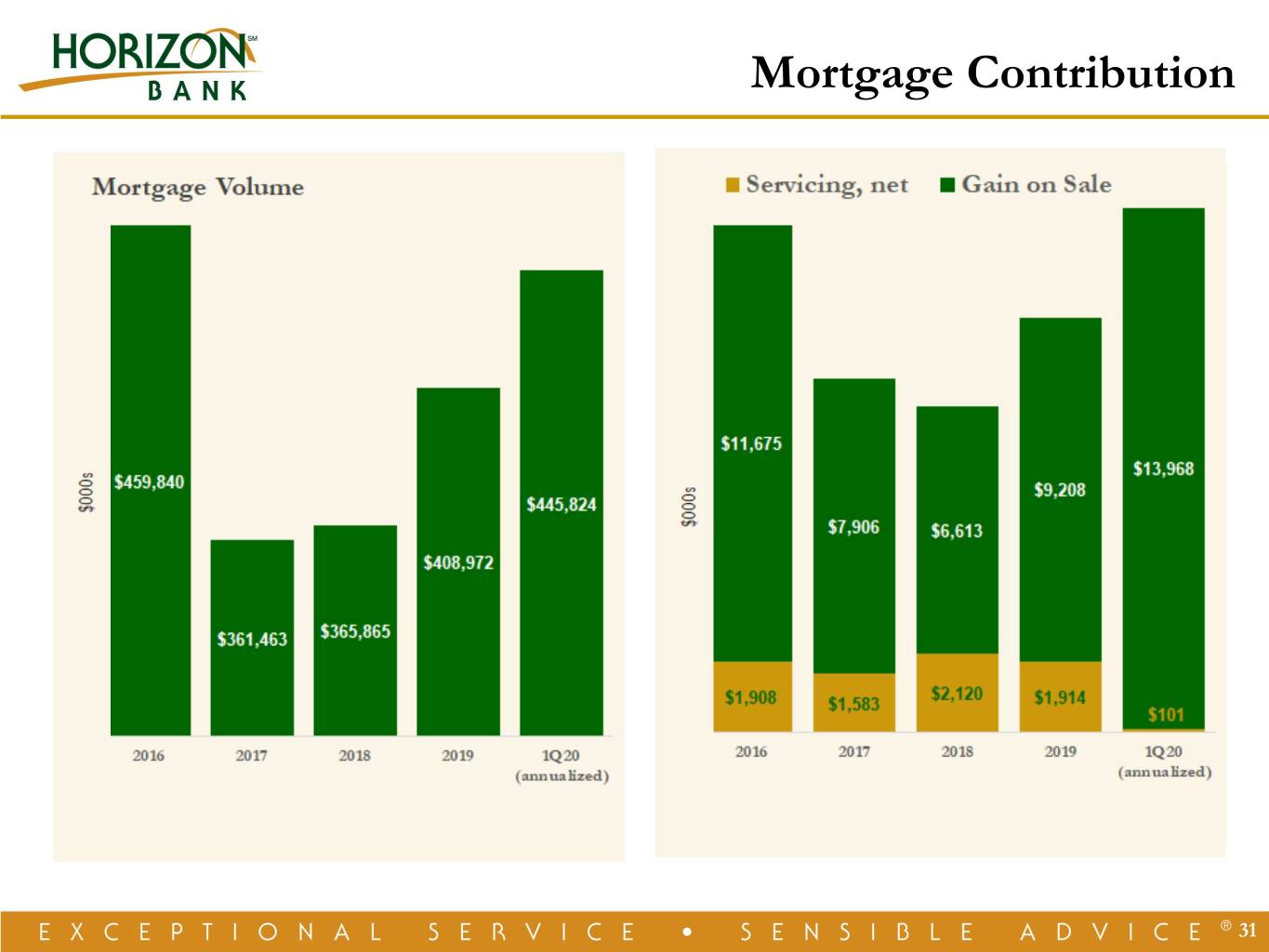

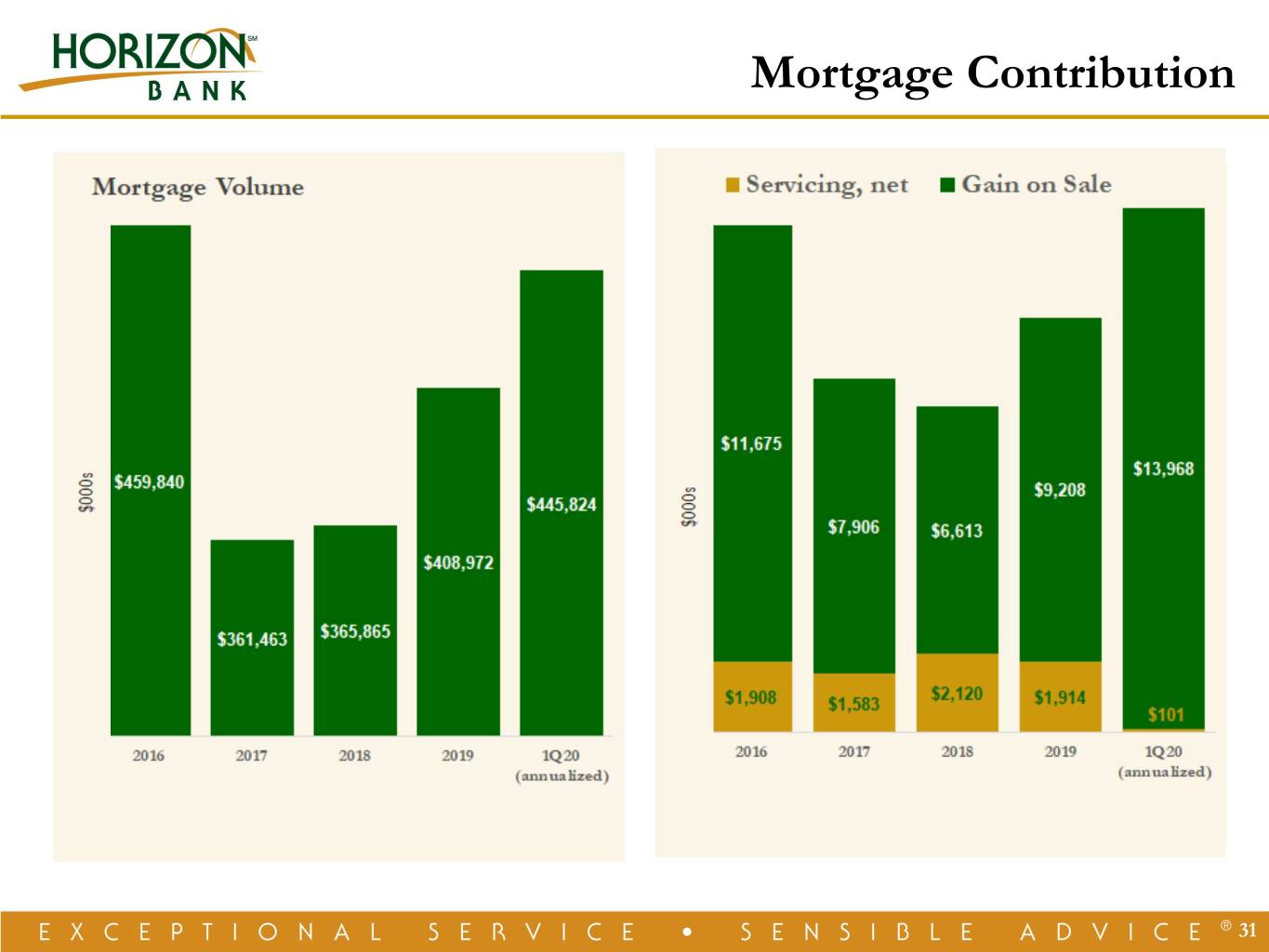

Mortgage Contribution 31

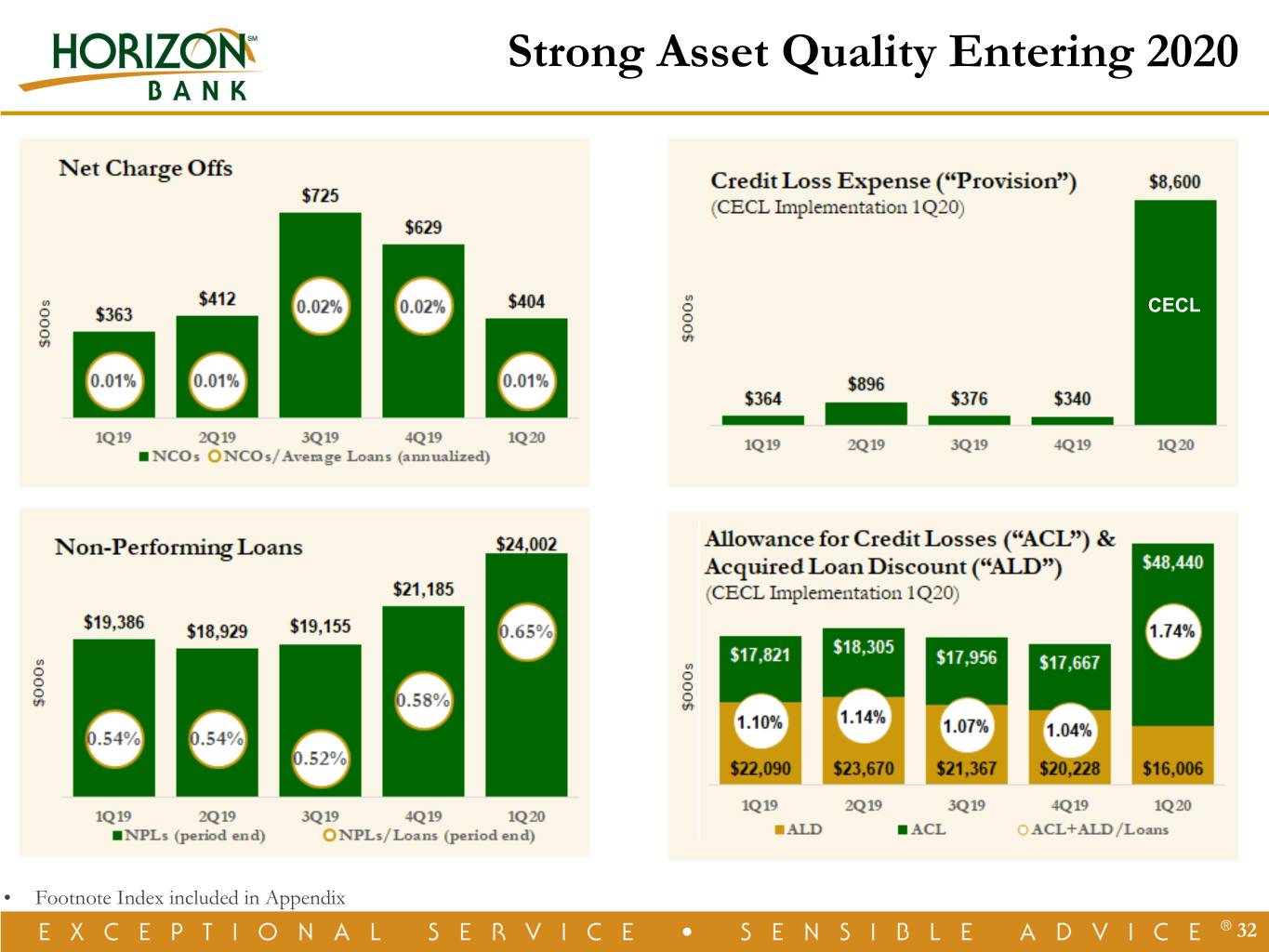

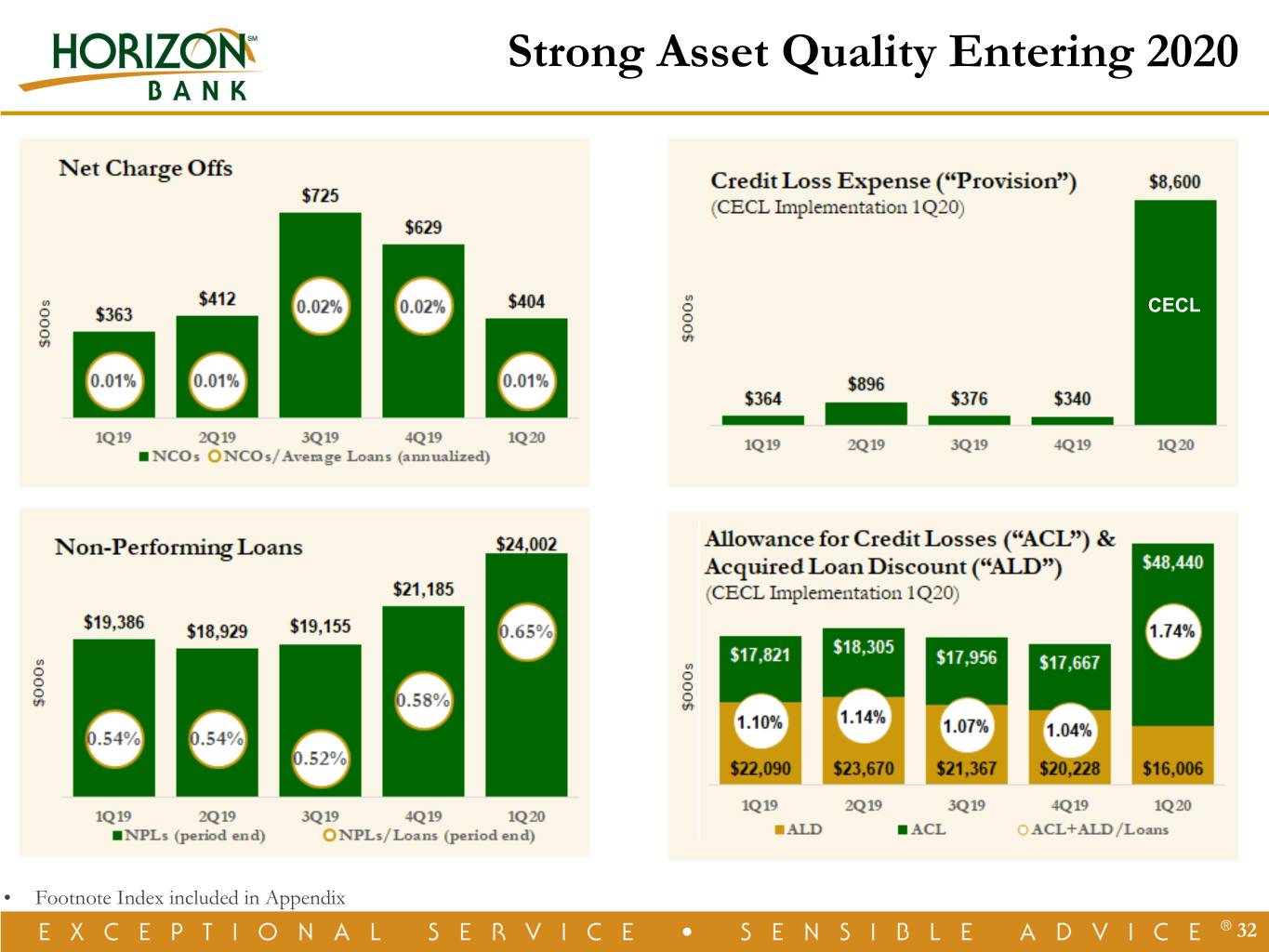

Strong Asset Quality Entering 2020 CECL CECL • Footnote Index included in Appendix 32

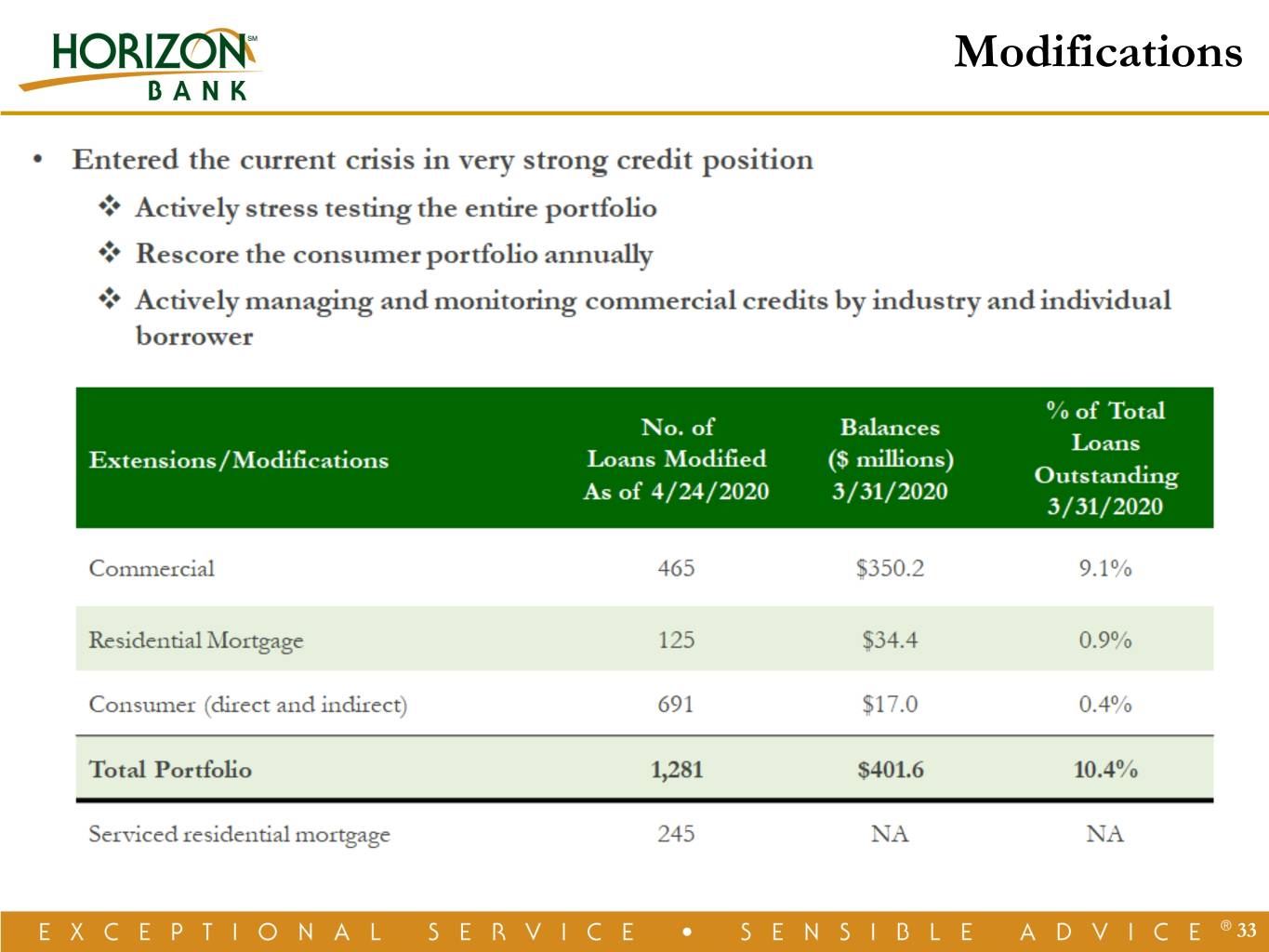

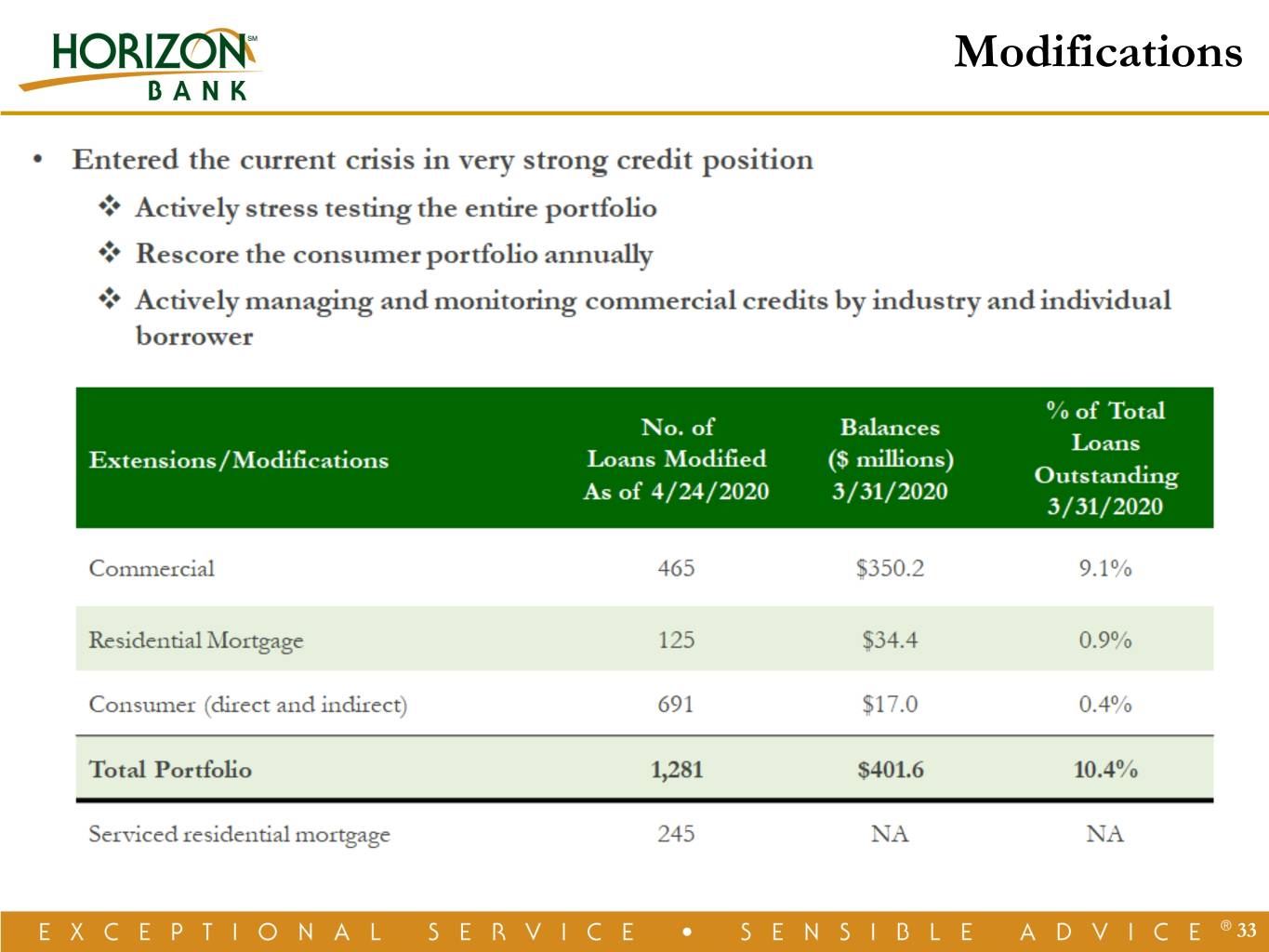

Modifications 33

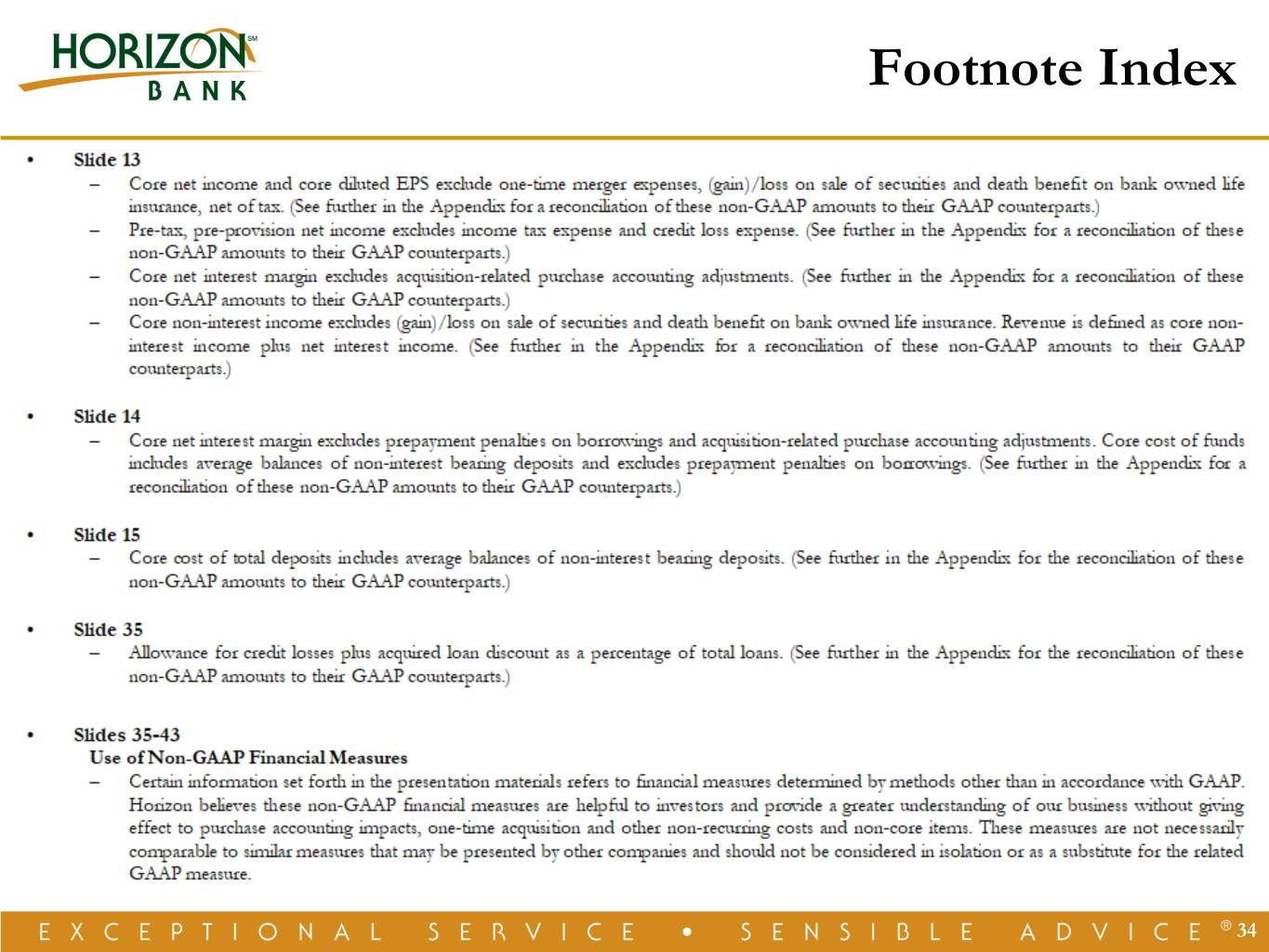

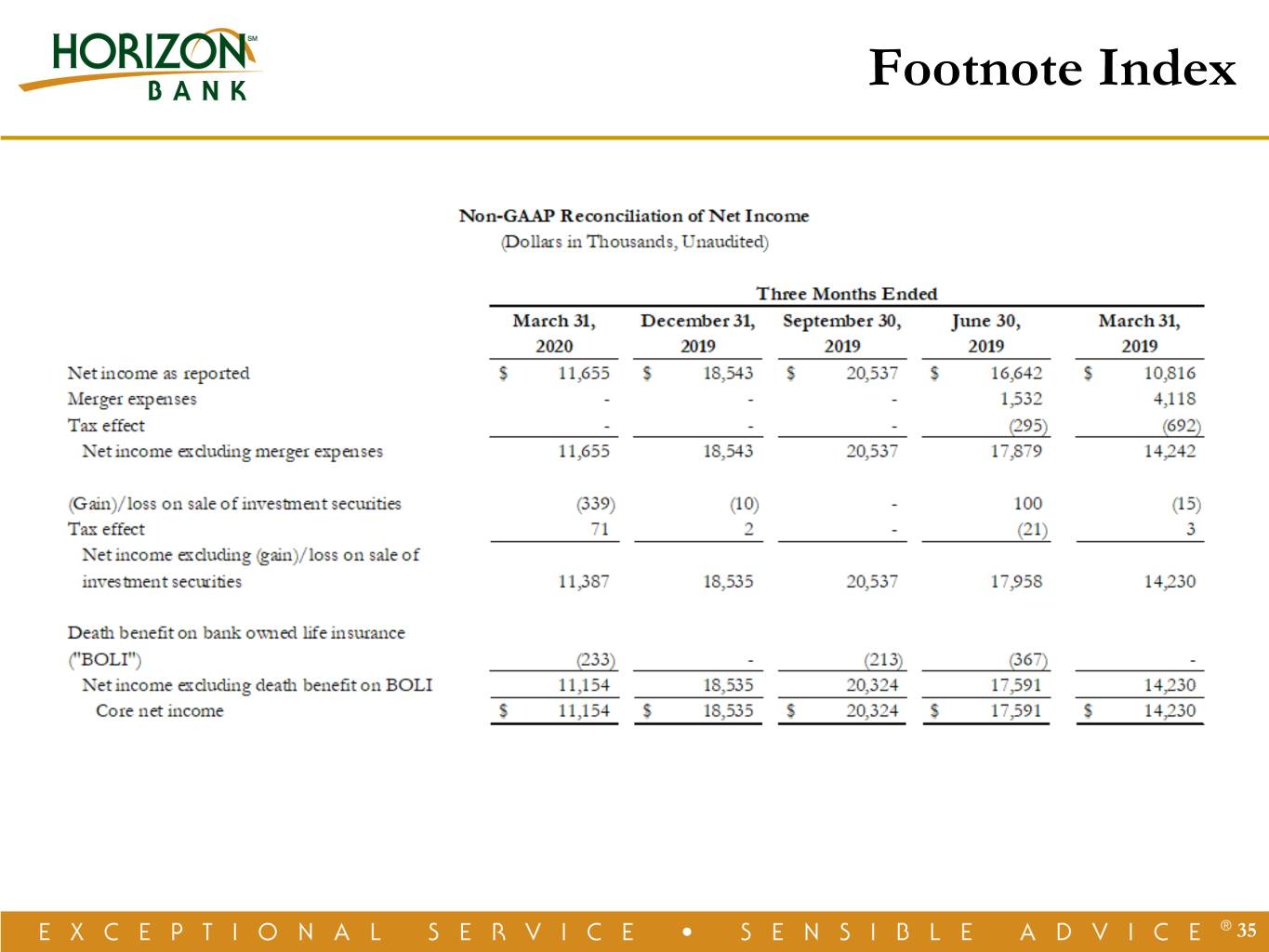

Footnote Index 34

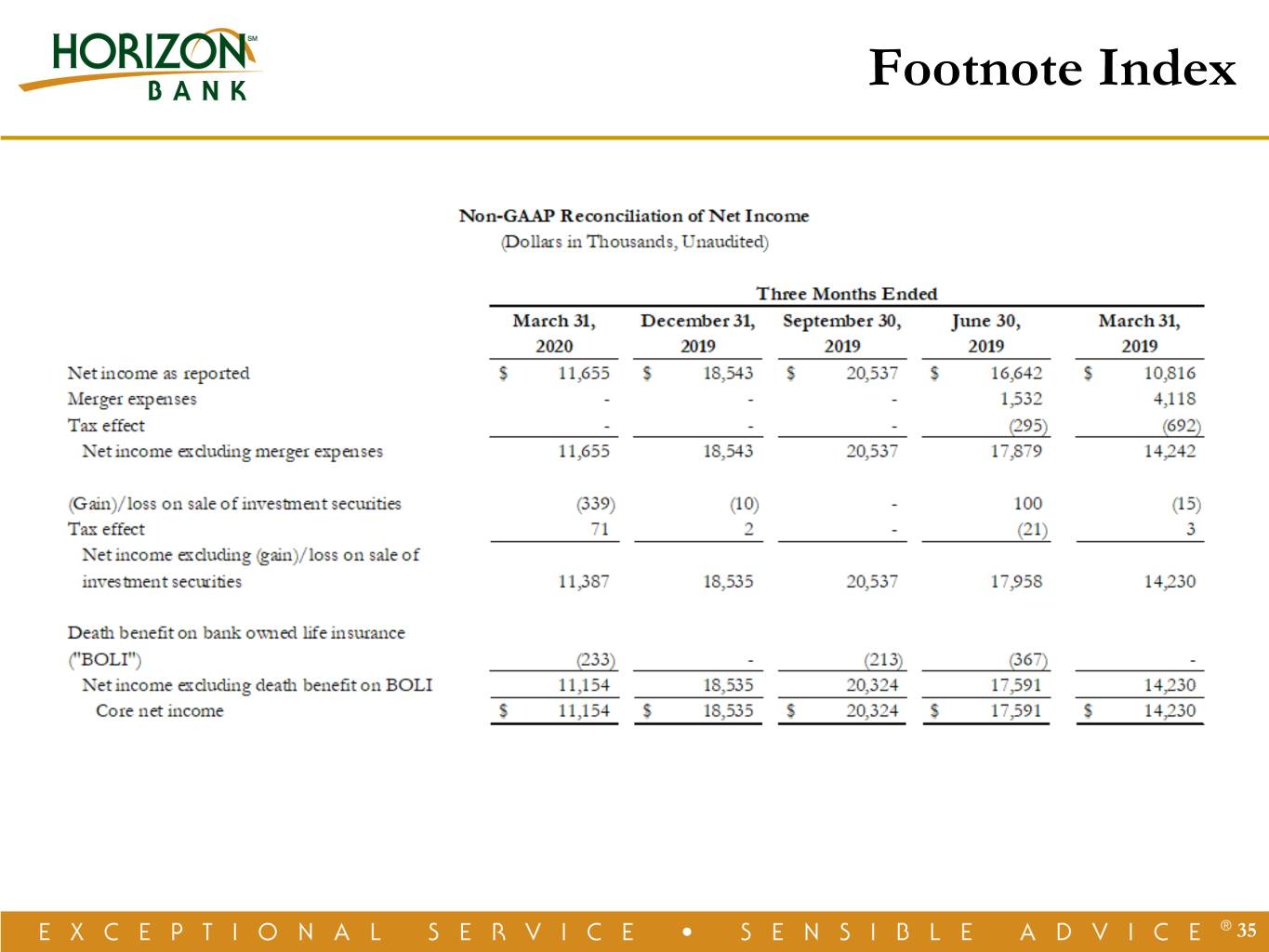

Footnote Index 35

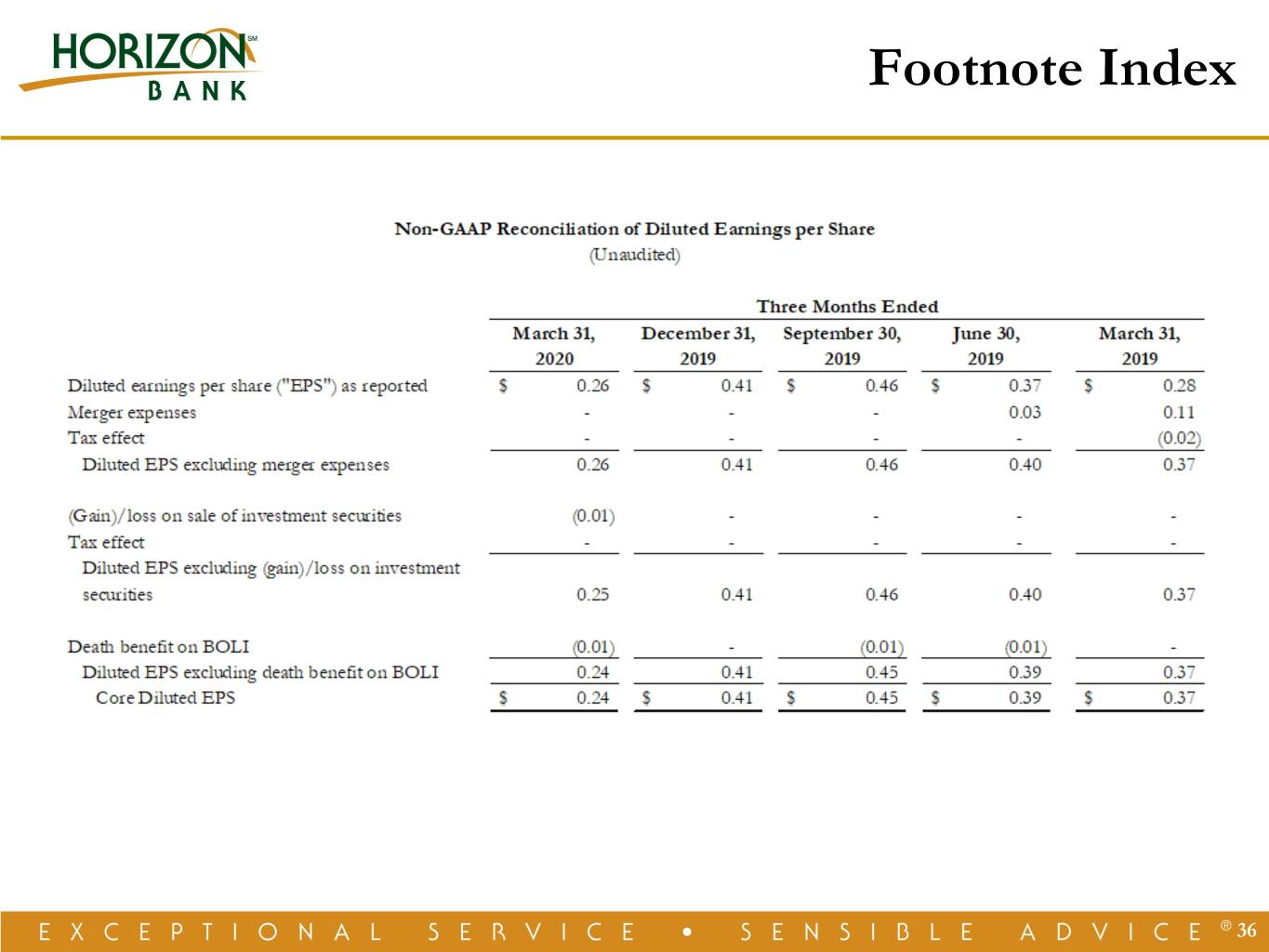

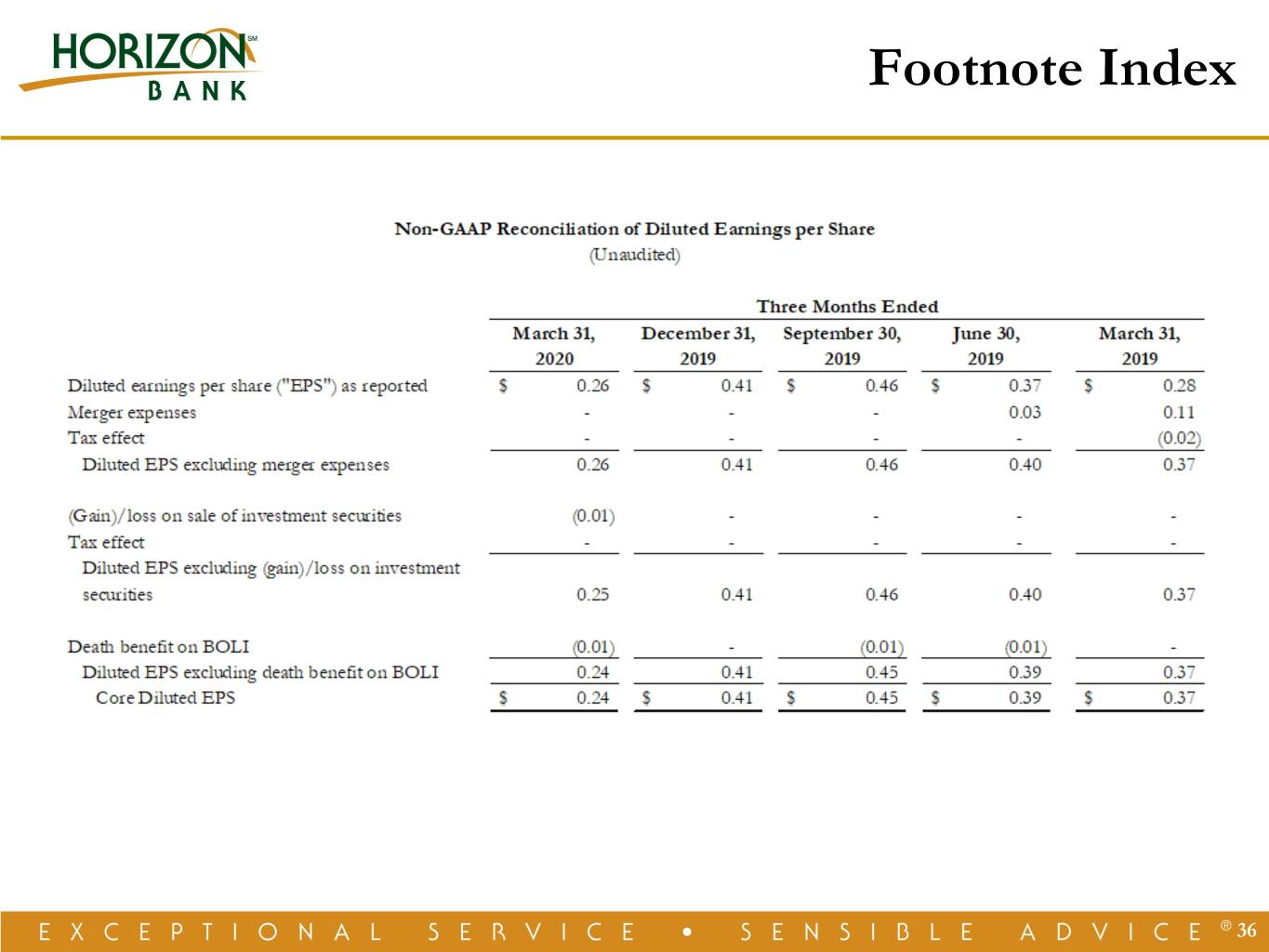

Footnote Index 36

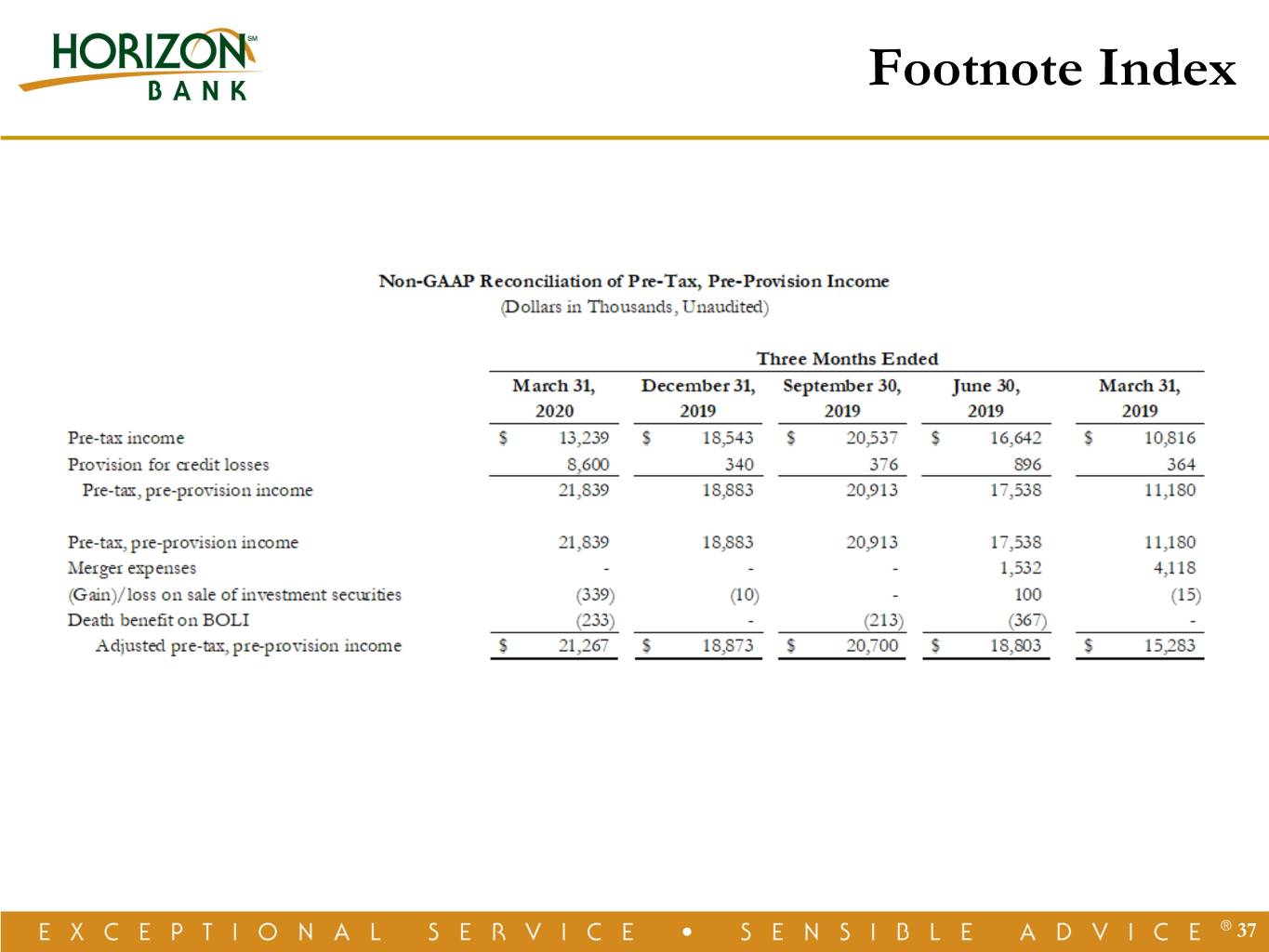

Footnote Index 37

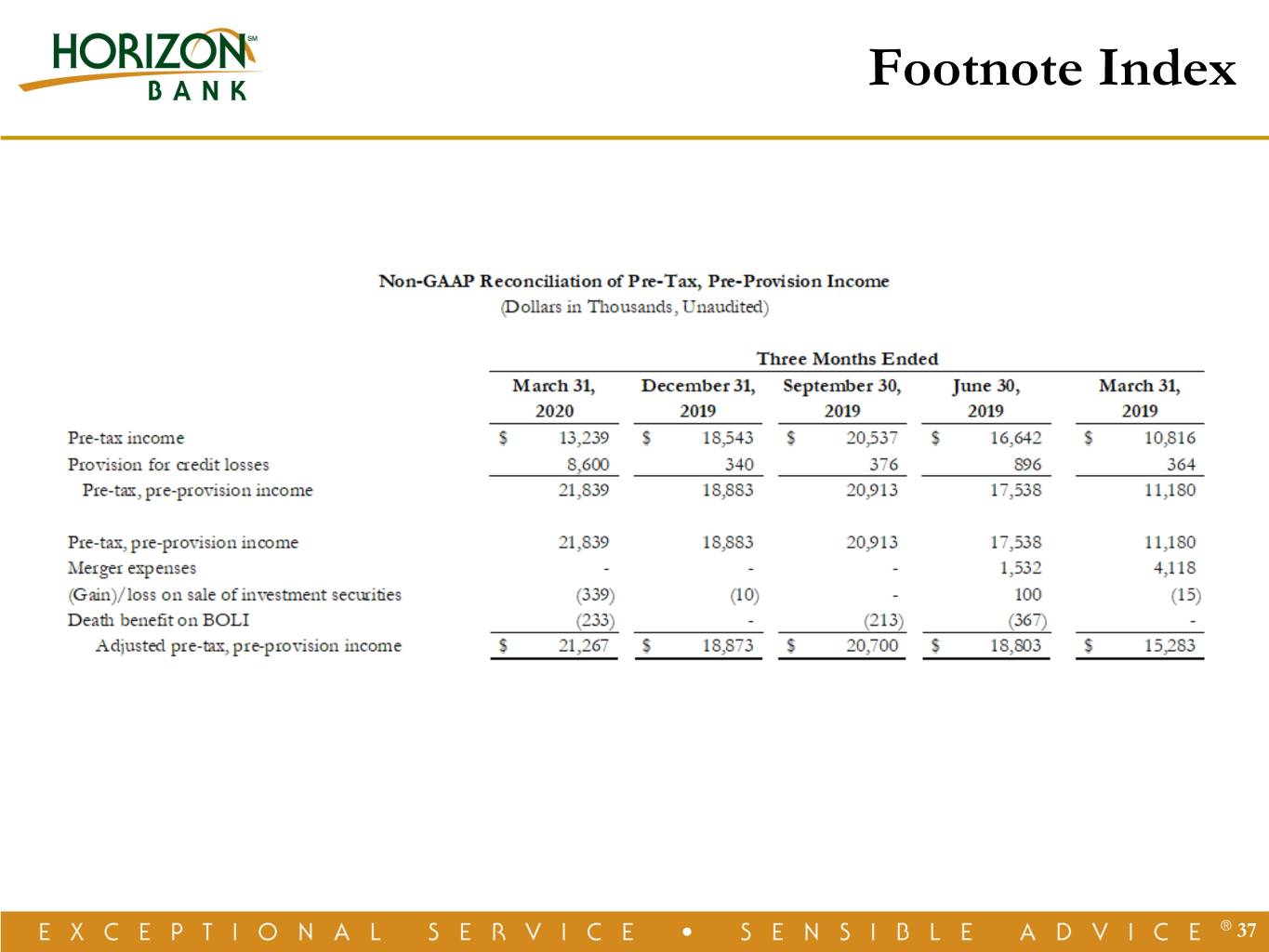

Footnote Index 38

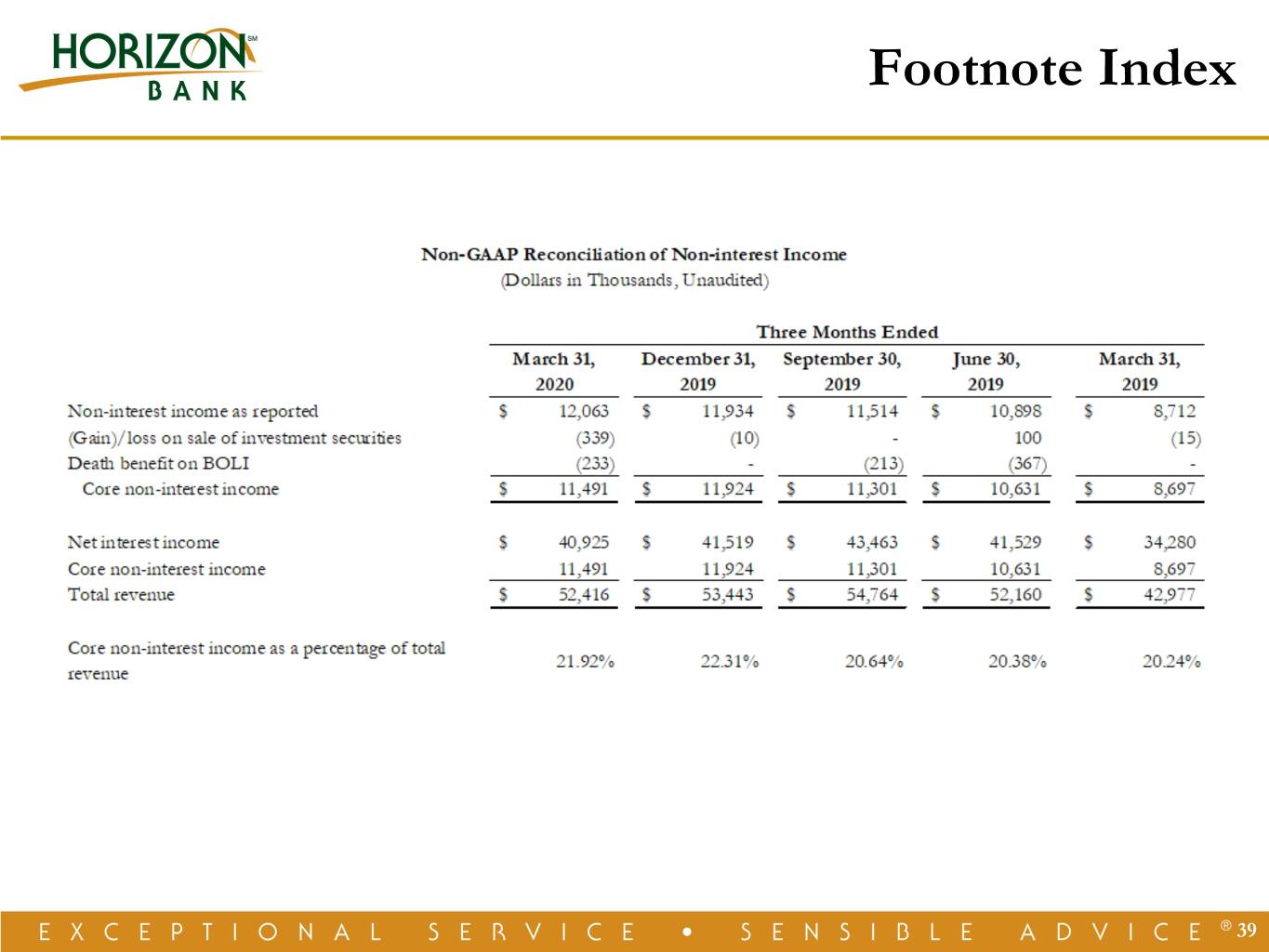

Footnote Index 39

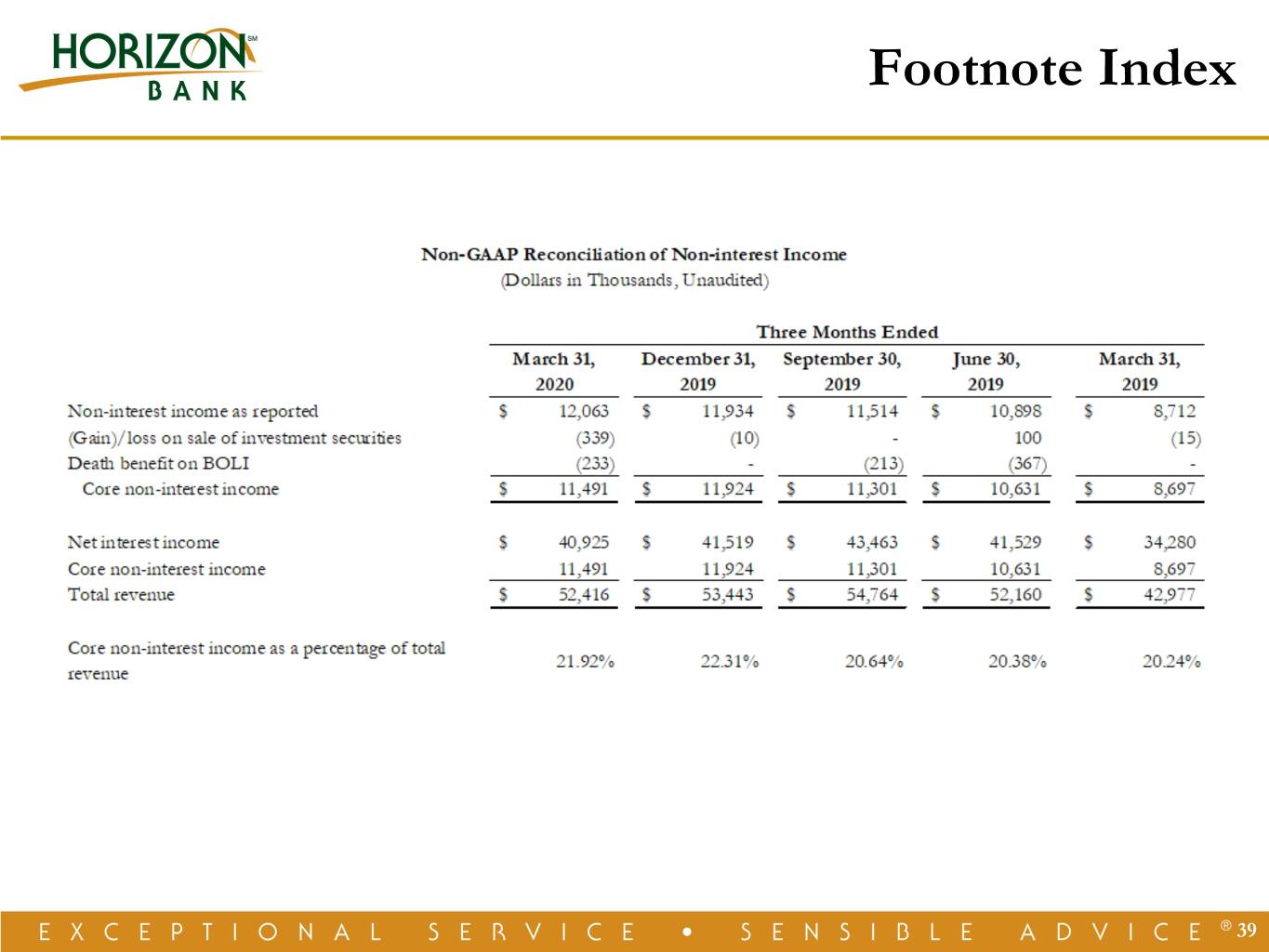

Footnote Index 40

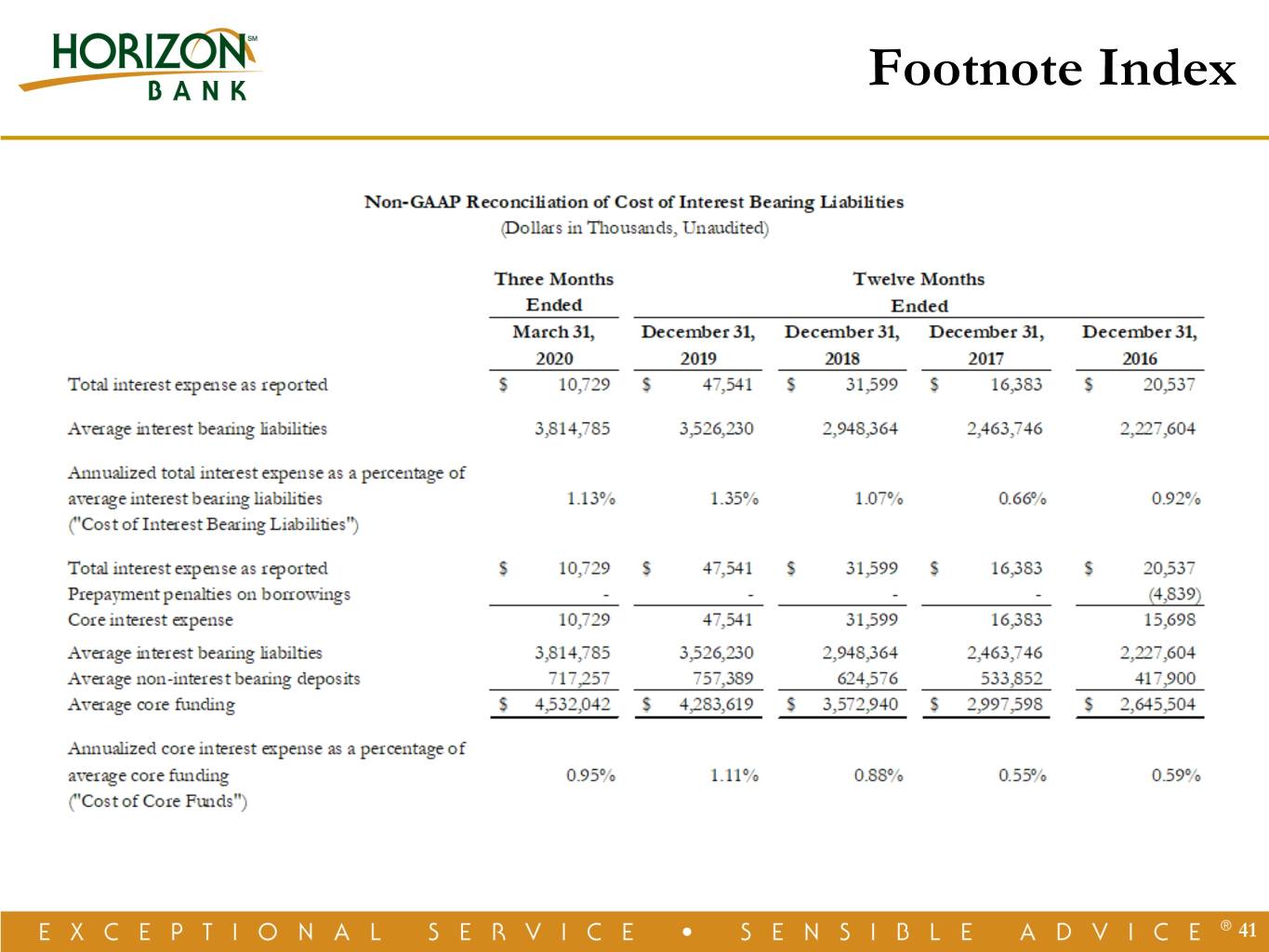

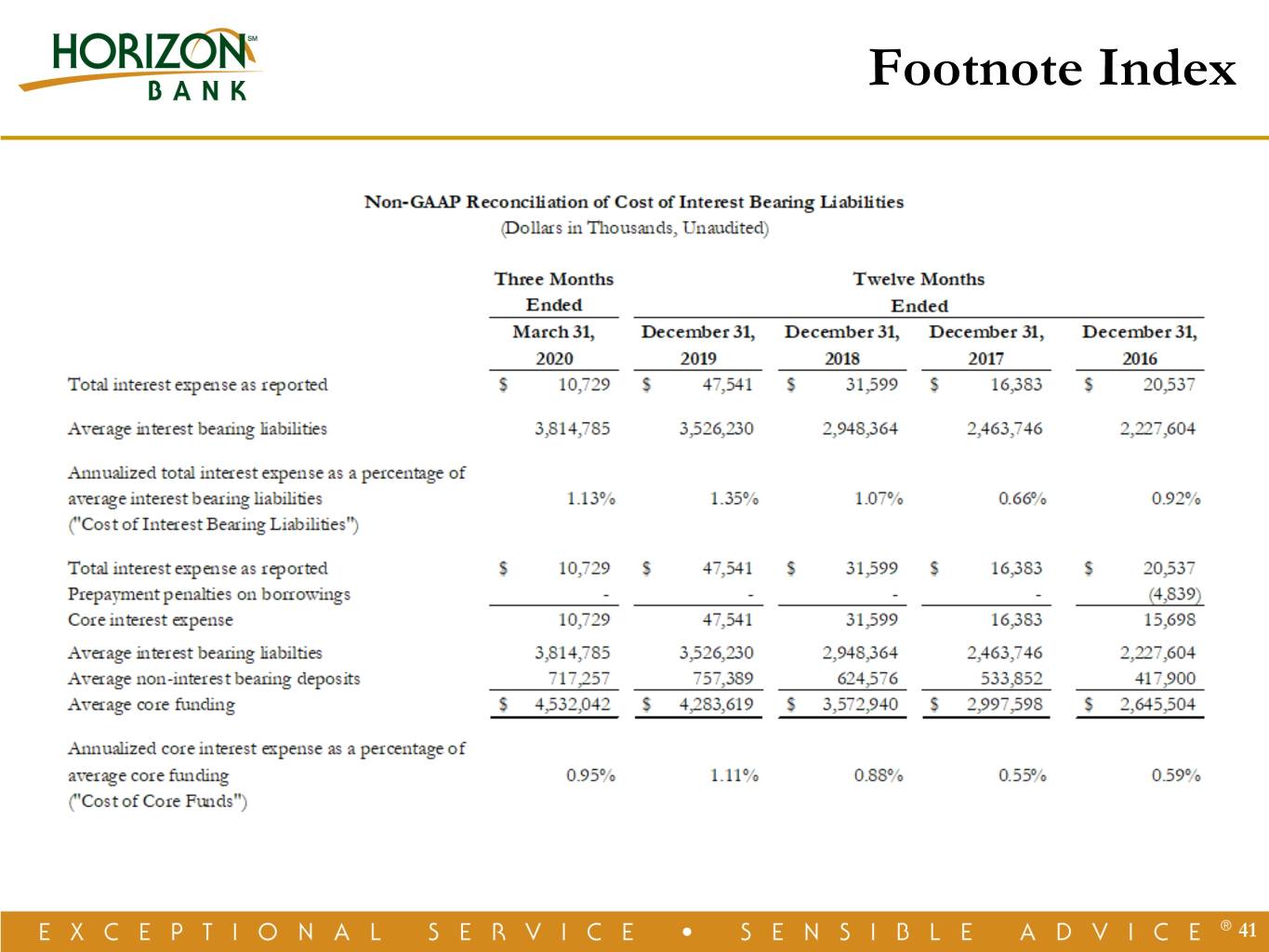

Footnote Index 41

Footnote Index 42

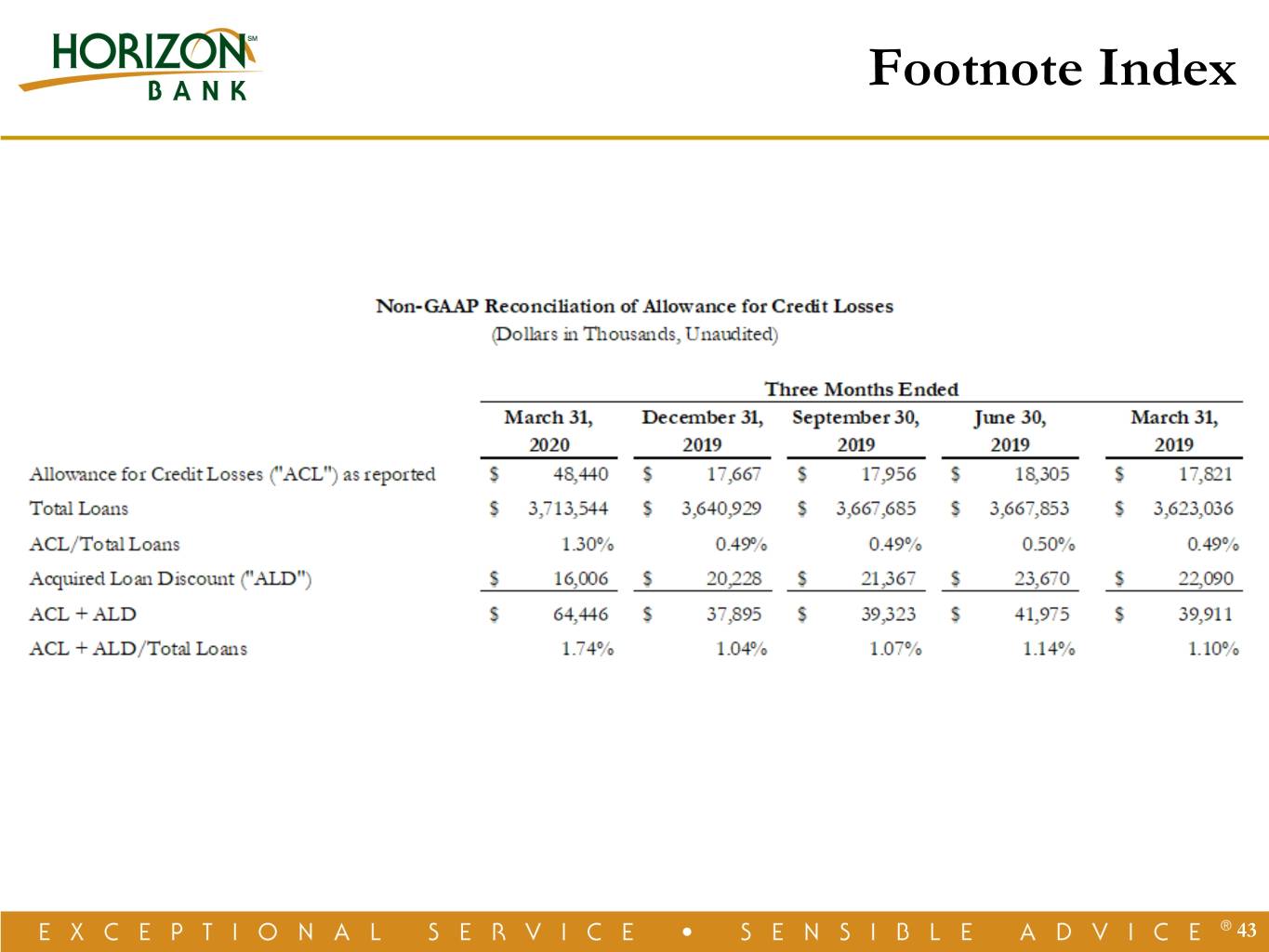

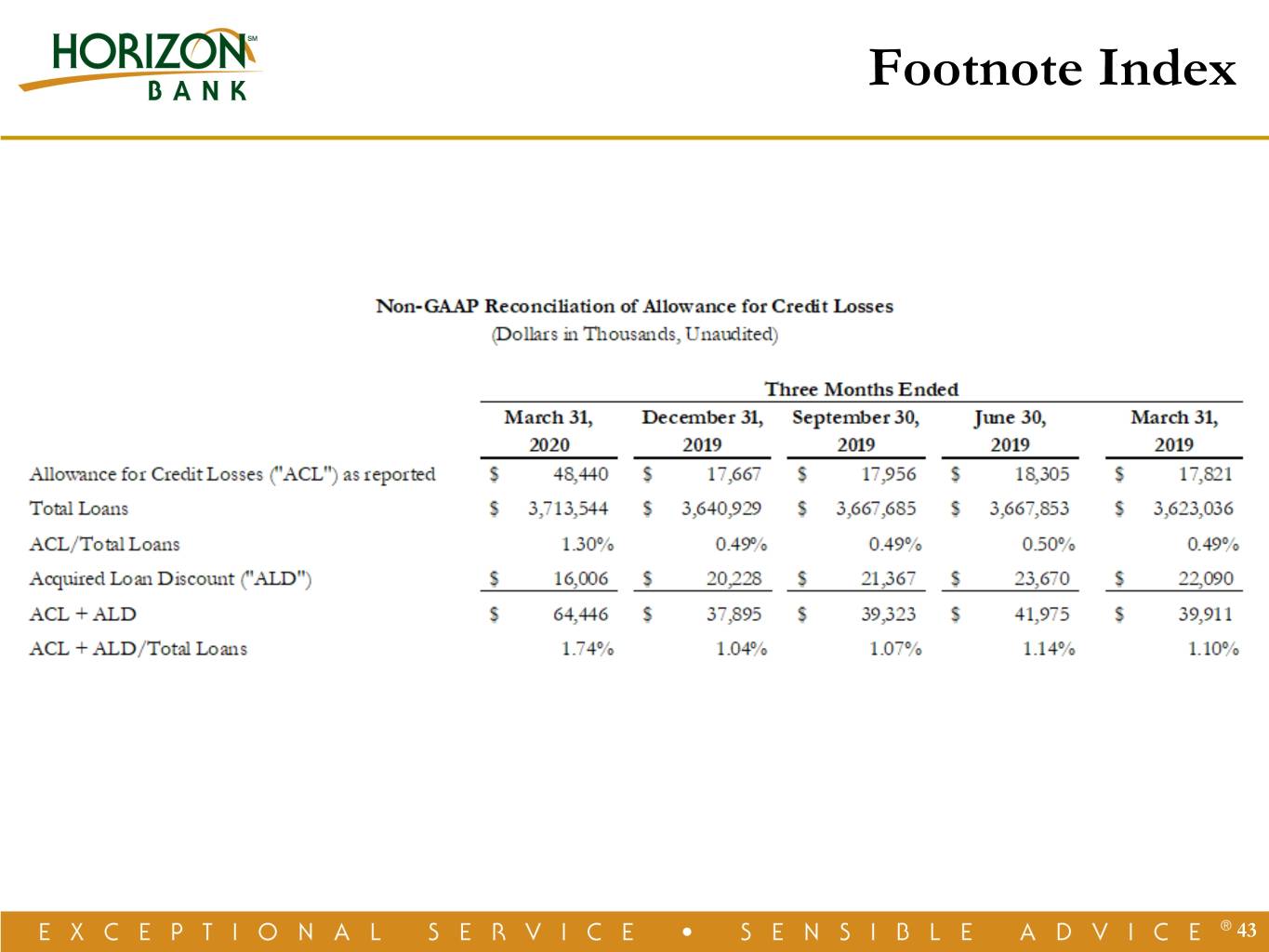

Footnote Index 43