E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® A NASDAQ Traded Company - Symbol HBNC INVESTOR PRESENTATION | JANUARY 27, 2021

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Forward-Looking Statements This presentation may contain forward-looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in the presentation materials should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include risk factors relating to the banking industry and the other factors detailed from time to time in Horizon’s reports filed with the Securities and Exchange Commission (the “SEC”), including those described in Horizon’s Annual Report on Form 10-K for the year ended December 31, 2019, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020, other subsequent filings with the SEC. Further, statements about the effects of the COVID-19 pandemic on our business, operations, financial performance, and prospects may constitute forward-looking statements and are subject to the risk that the actual impacts may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable, and in many cases beyond our control, including the scope and duration of the pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on our customers, third parties, and us. Undue reliance should not be placed on the forward-looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward- looking statement to reflect the events or circumstances after the date on which the forward-looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law. Non-GAAP Measures Certain non-GAAP financial measures are presented herein. Horizon believes they are useful to investors and provide a greater understanding of Horizon’s business without giving effect to non-recurring costs and non-core items. For each non-GAAP financial measure, we have presented comparable GAAP measures and reconciliations of the non-GAAP measures to those GAAP measures in the Appendix to this presentation. Please see slides 38-49. Important Information 2

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Corporate Overview 3

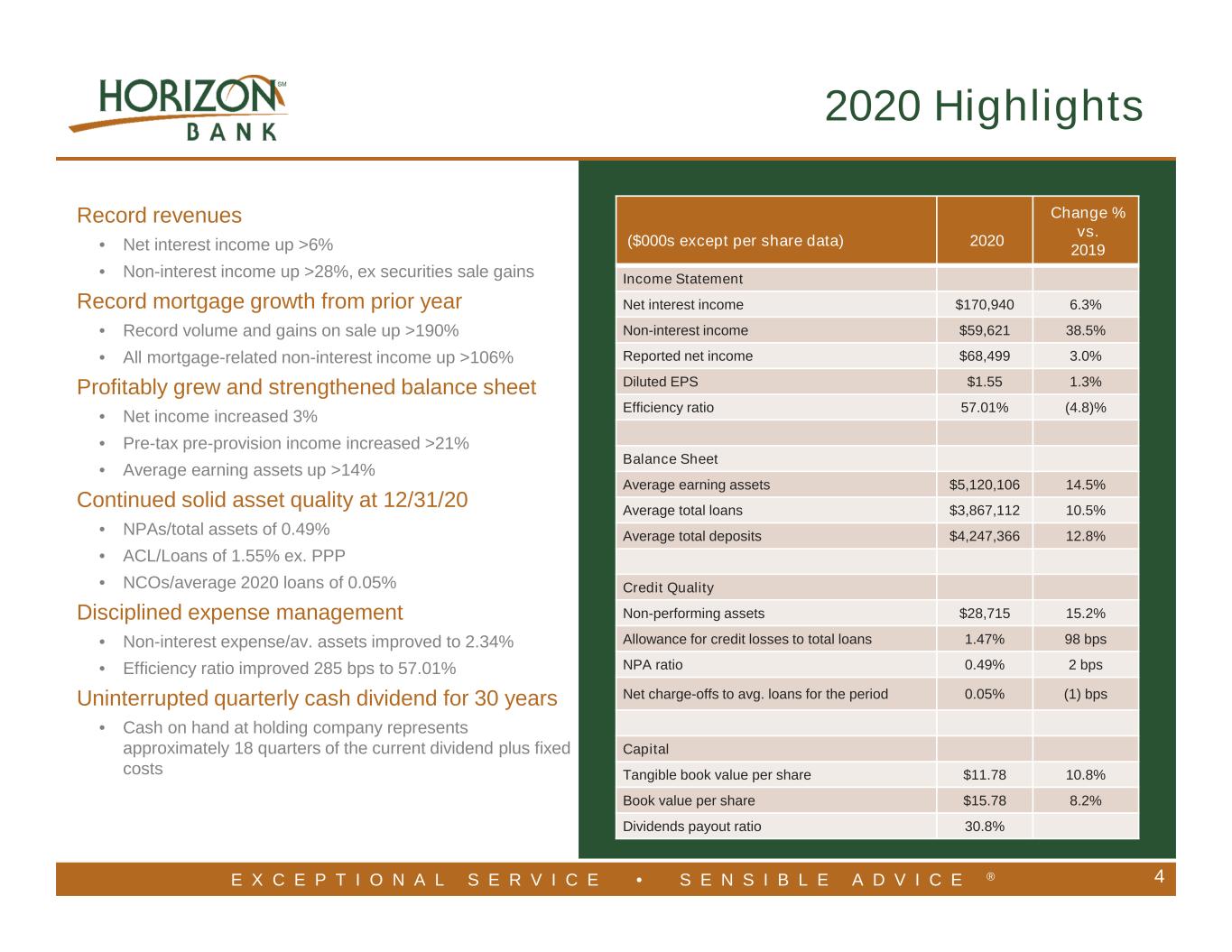

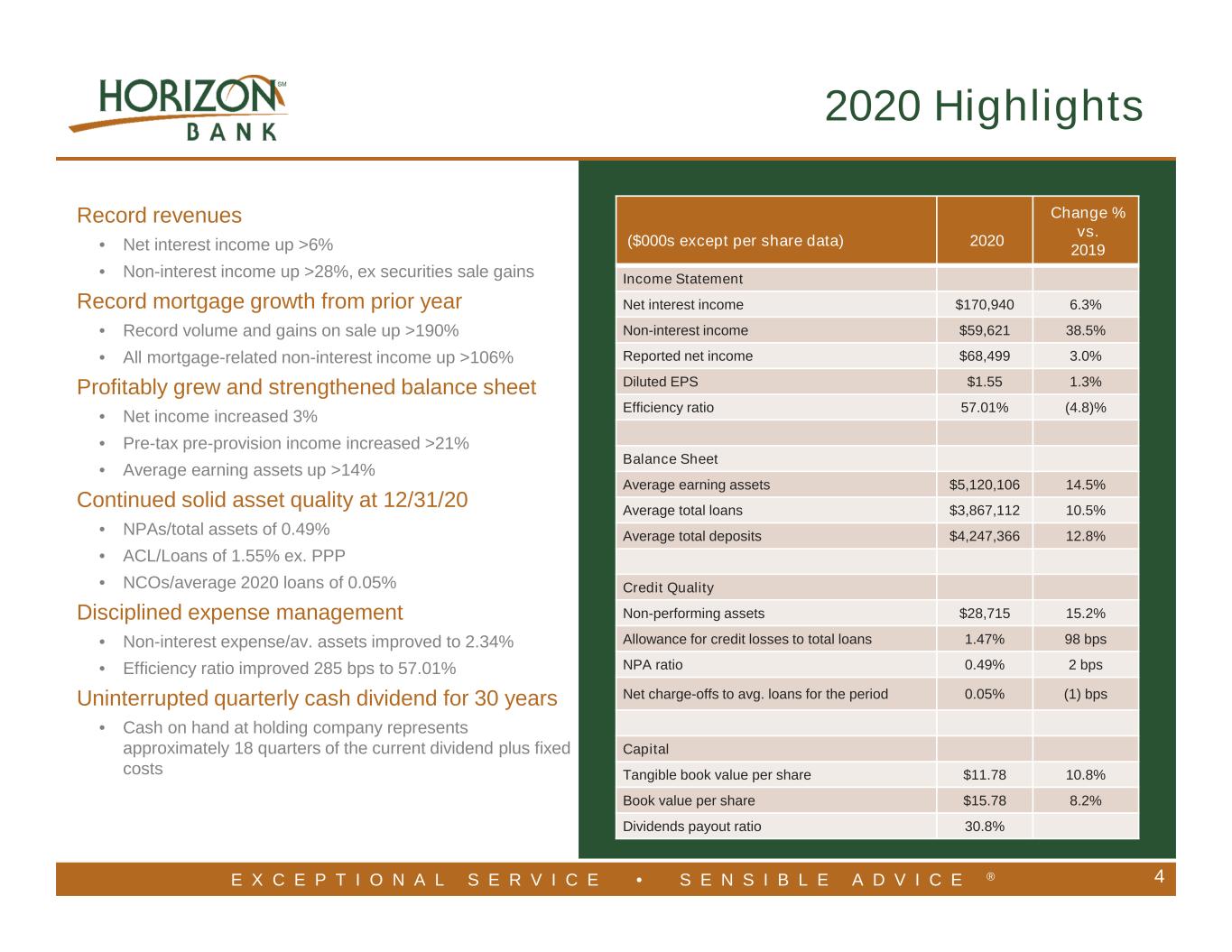

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 4 2020 Highlights ($000s except per share data) 2020 Change % vs. 2019 Income Statement Net interest income $170,940 6.3% Non-interest income $59,621 38.5% Reported net income $68,499 3.0% Diluted EPS $1.55 1.3% Efficiency ratio 57.01% (4.8)% Balance Sheet Average earning assets $5,120,106 14.5% Average total loans $3,867,112 10.5% Average total deposits $4,247,366 12.8% Credit Quality Non-performing assets $28,715 15.2% Allowance for credit losses to total loans 1.47% 98 bps NPA ratio 0.49% 2 bps Net charge-offs to avg. loans for the period 0.05% (1) bps Capital Tangible book value per share $11.78 10.8% Book value per share $15.78 8.2% Dividends payout ratio 30.8% Record revenues • Net interest income up >6% • Non-interest income up >28%, ex securities sale gains Record mortgage growth from prior year • Record volume and gains on sale up >190% • All mortgage-related non-interest income up >106% Profitably grew and strengthened balance sheet • Net income increased 3% • Pre-tax pre-provision income increased >21% • Average earning assets up >14% Continued solid asset quality at 12/31/20 • NPAs/total assets of 0.49% • ACL/Loans of 1.55% ex. PPP • NCOs/average 2020 loans of 0.05% Disciplined expense management • Non-interest expense/av. assets improved to 2.34% • Efficiency ratio improved 285 bps to 57.01% Uninterrupted quarterly cash dividend for 30 years • Cash on hand at holding company represents approximately 18 quarters of the current dividend plus fixed costs

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 5 • 31 Years of Banking & Public Accounting Experience • 11 Years with Horizon as CFO Executive Vice President of Horizon • 35 Years of Banking Experience • 10 Years with Horizon, 2 years as Chief Commercial Banking Officer • 41 Years of Banking Experience • 21 Years as President or CEO of Bank • 42 Years of Banking Experience • 2 Years as President • 19 Years as Senior Mortgage and Retail Credit Officer Craig M. Dwight Chairman & CEO James D. "Jim" Neff President Dennis J. Kuhn EVP & Chief Commercial Banking Officer Mark E. Secor EVP & Chief Financial Officer • 30 Years of Banking and Operational Experience • 19 Years as Senior Bank Operations Officer Kathie A. DeRuiter EVP & Senior Operations Officer • 28 Years of Corporate Legal Experience and 9 years of General Counsel Experience • 3 Years as SVP and General Counsel Todd A. Etzler EVP & Corporate Secretary & General Counsel SEASONED LEADERSHIP • Executive team has collectively >200 total years’ banking experience • Horizon’s middle management team on average has >25 years of banking experience • Horizon’s employees understand the value of work Seasoned Management Team • 25 Years of Banking Experience • 3 Years with Horizon as Senior Commercial Credit Officer Lynn M. Kerber EVP & Commercial Credit Officer

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 6 2002 - 2007 Organic M&A • St. Joseph, MI • South Bend, IN • Elkhart, IN • Merrillville, IN • Anchor Mortgage • Alliance Financial 2008 - 2013 Organic M&A • Kalamazoo, MI • Indianapolis, IN • American Trust • Heartland Bancshares 2014 - 2020 Organic M&A • Carmel, IN • Ft. Wayne, IN • Grand Rapids, MI • Columbus, OH(1) • Noblesville, IN • Holland, MI • 1st Mtg. • Summit • Peoples • Farmers • LaPorte • CNB • Bargersville • Lafayette • Wolverine • Salin 11 14 Organic Expansions M&A (1) Columbus location closed February 2018. A History of Profitable Growth Extensive and Diligent M&A Expertise Supplements Organic Growth $0.7 $0.8 $0.9 $1.1 $1.2 $1.3 $1.3 $1.4 $1.4 $1.5 $1.8 $1.8 $2.1 $2.7 $3.1 $4.0 $4.2 $5.2 $5.9 $5 $7 $7 $7 $7 $8 $9 $9 $10 $13 $20 $20 $18 $21 $24 $33 $53 $67 $68 - 10 20 30 40 50 60 70 80 - 1.00 2.00 3.00 4.00 5.00 6.00 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Total Assets ($B) Net Income ($M)

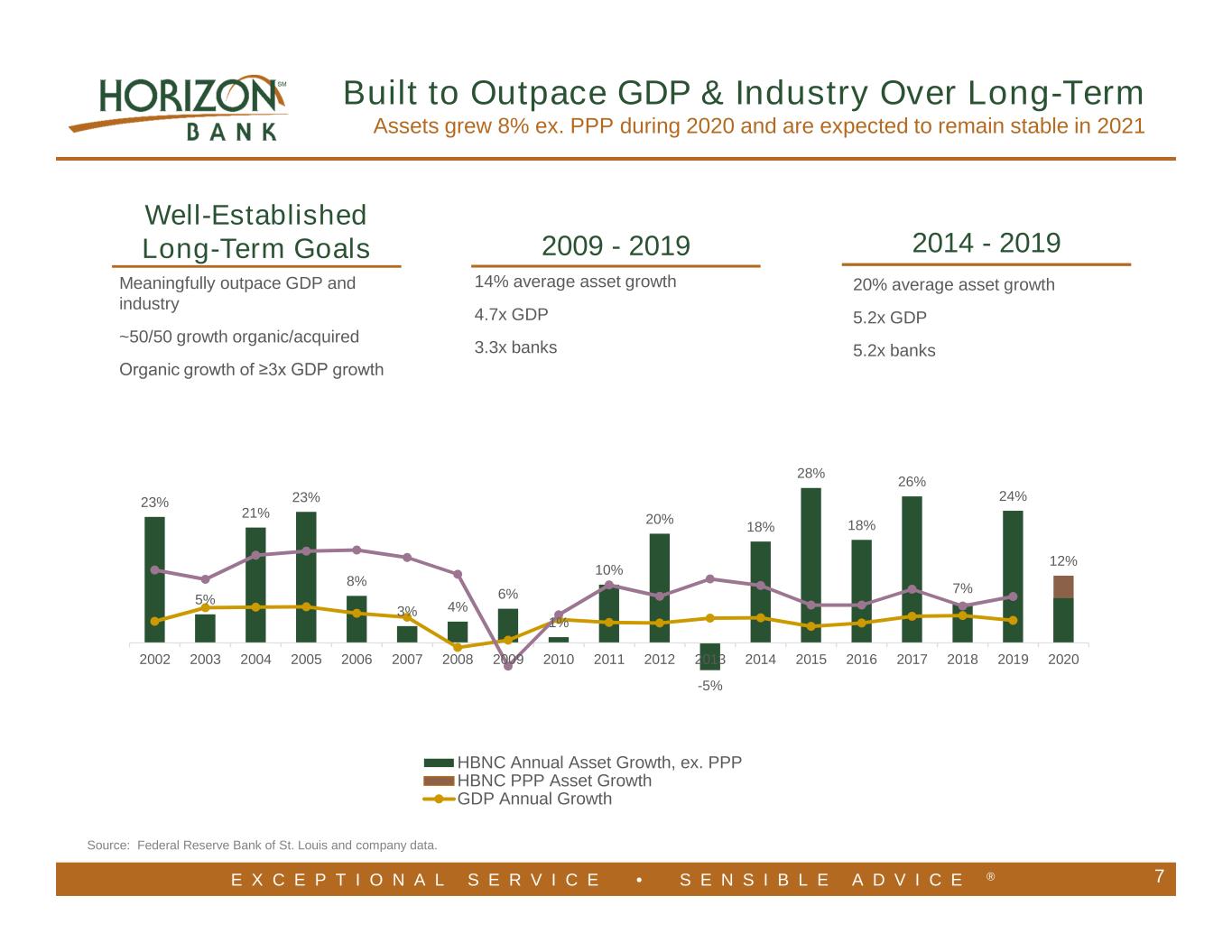

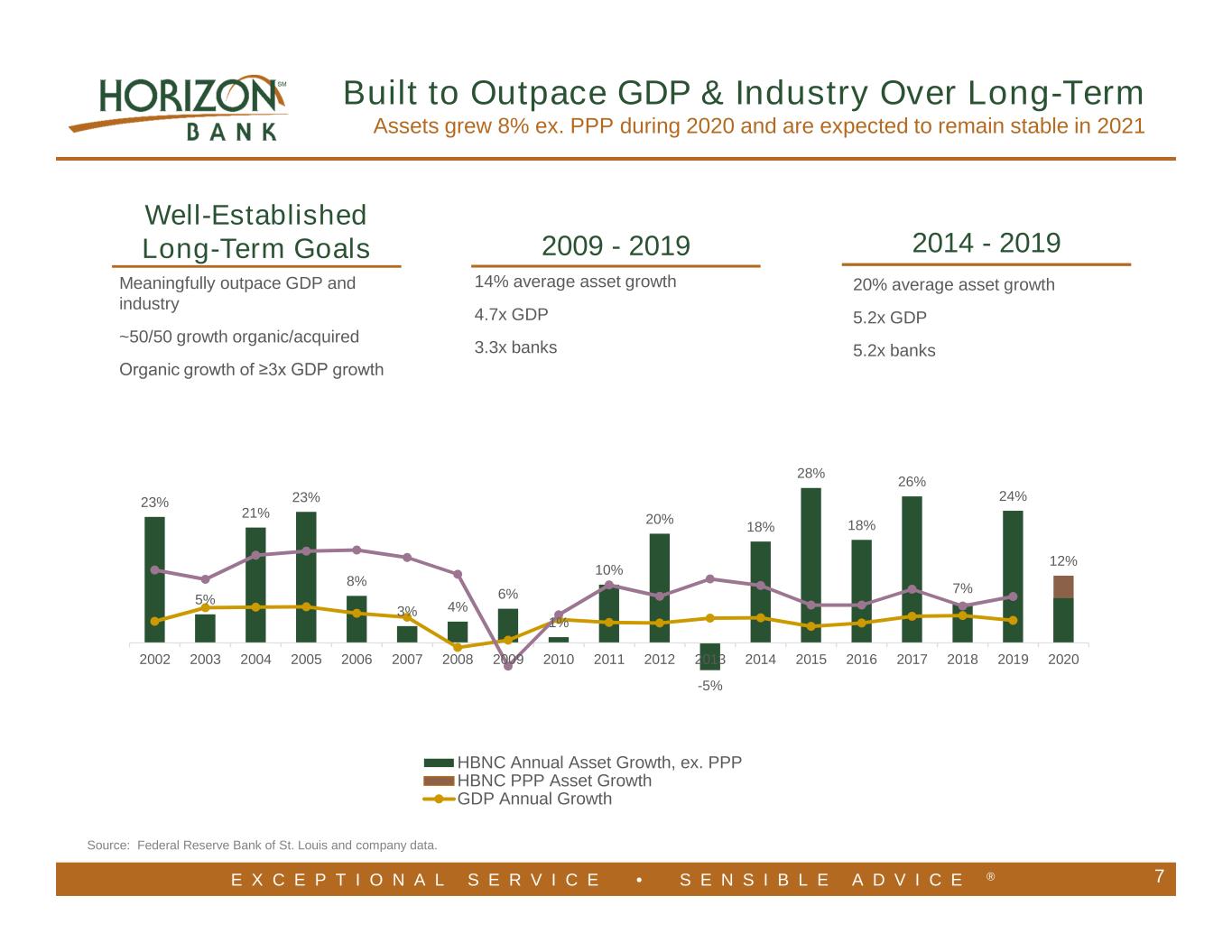

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 7 Well-Established Long-Term Goals Meaningfully outpace GDP and industry ~50/50 growth organic/acquired Organic growth of ≥3x GDP growth 2009 - 2019 2014 - 2019 Source: Federal Reserve Bank of St. Louis and company data. Built to Outpace GDP & Industry Over Long-Term Assets grew 8% ex. PPP during 2020 and are expected to remain stable in 2021 14% average asset growth 4.7x GDP 3.3x banks 20% average asset growth 5.2x GDP 5.2x banks 23% 5% 21% 23% 8% 3% 4% 6% 1% 10% 20% -5% 18% 28% 18% 26% 7% 24% 12% 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 HBNC Annual Asset Growth, ex. PPP HBNC PPP Asset Growth GDP Annual Growth

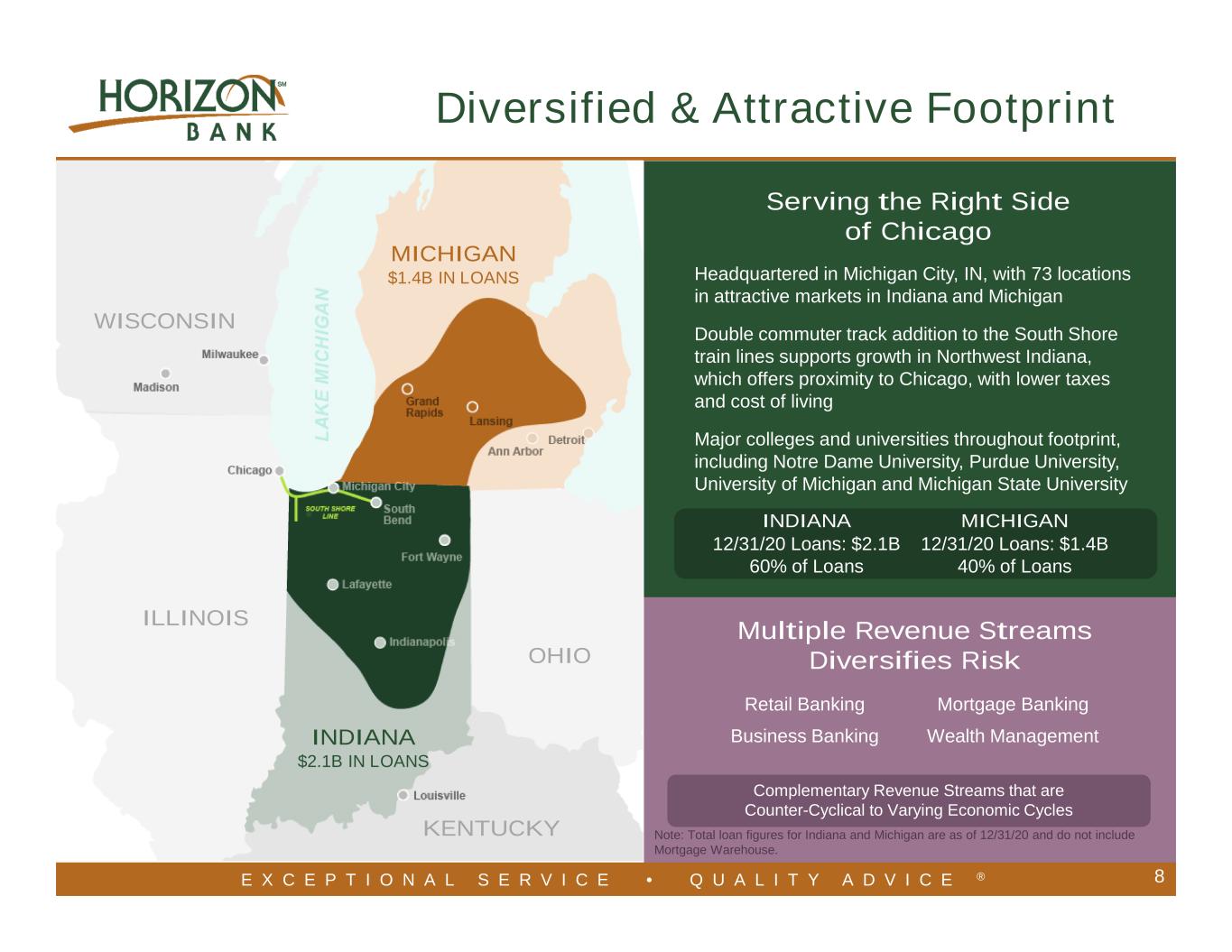

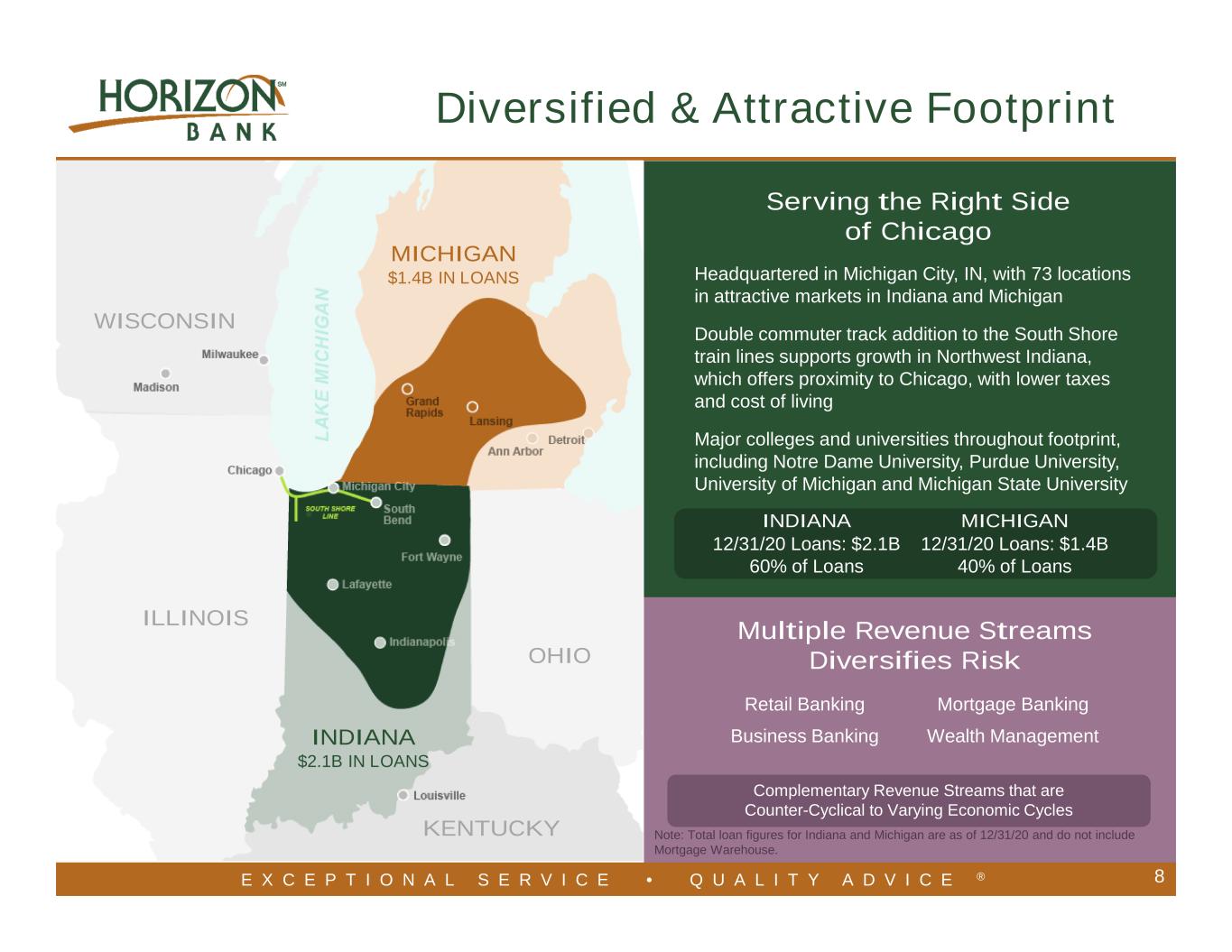

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 8 Multiple Revenue Streams Diversifies Risk Diversified & Attractive Footprint E X C E P T I O N A L S E R V I C E • Q U A L I T Y A D V I C E ® 8 Retail Banking Business Banking Mortgage Banking Wealth Management Complementary Revenue Streams that are Counter-Cyclical to Varying Economic Cycles Serving the Right Side of Chicago Headquartered in Michigan City, IN, with 73 locations in attractive markets in Indiana and Michigan Double commuter track addition to the South Shore train lines supports growth in Northwest Indiana, which offers proximity to Chicago, with lower taxes and cost of living Major colleges and universities throughout footprint, including Notre Dame University, Purdue University, University of Michigan and Michigan State University Note: Total loan figures for Indiana and Michigan are as of 12/31/20 and do not include Mortgage Warehouse. INDIANA 12/31/20 Loans: $2.1B 60% of Loans MICHIGAN 12/31/20 Loans: $1.4B 40% of Loans OHIO ILLINOIS WISCONSIN KENTUCKY MICHIGAN $1.4B IN LOANS INDIANA $2.1B IN LOANS

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 9 Michigan City, IN / La Porte, IN (Legacy) Indianapolis, IN (Growth) Northwest Indiana (Growth) Lafayette, IN (Growth) Southwest Michigan* (Growth) $1.1B Deposits $680M Deposits $548M Deposits $322M Deposits$413M Deposits 8 Branches 9 Branches 10 Branches 7 Branches8 Branches • Similar culture and economic base to legacy markets in Northern Indiana • Grand Rapids one of the most attractive markets in the Midwest • Purdue University collaborates with contiguous cities of Lafayette and West Lafayette • Subaru expanding facilities • Double commuter track addition to the South Shore train lines • High cost of living in Chicago • Population density of Chicago • Greater Indianapolis area exhibits strong growth • Over $500M in new investment and 4,000 new jobs created in 2019 • Significant manufacturing, healthcare, and education industries • Over $1.5B in public and private investments since 2012 • Double commuter track addition to the South Shore train lines Source: S&P Global Market Intelligence. Note: Core market demographics reflect MSA data. *Southwest Michigan defined as the MSAs of Niles, Grand Rapids-Kentwood and Kalamazoo-Portage. Demographic data weighted by HBNC deposits. Attractive & Stable Midwest Markets Top 5 Markets by Deposits Michigan City, IN La Porte, IN Indianapolis, IN Northwest Indiana Southwest Michigan* Lafayette, IN Median HHI $53,255 $65,306 $74,285 $58,856 $59,404 ’20 – ’25 HHI Growth 6.8% 11.2% 11.5% 11.8% 10.9% ’20 – ’25 Pop. Growth 0.12% 3.81% 0.08% 1.02% 3.86%

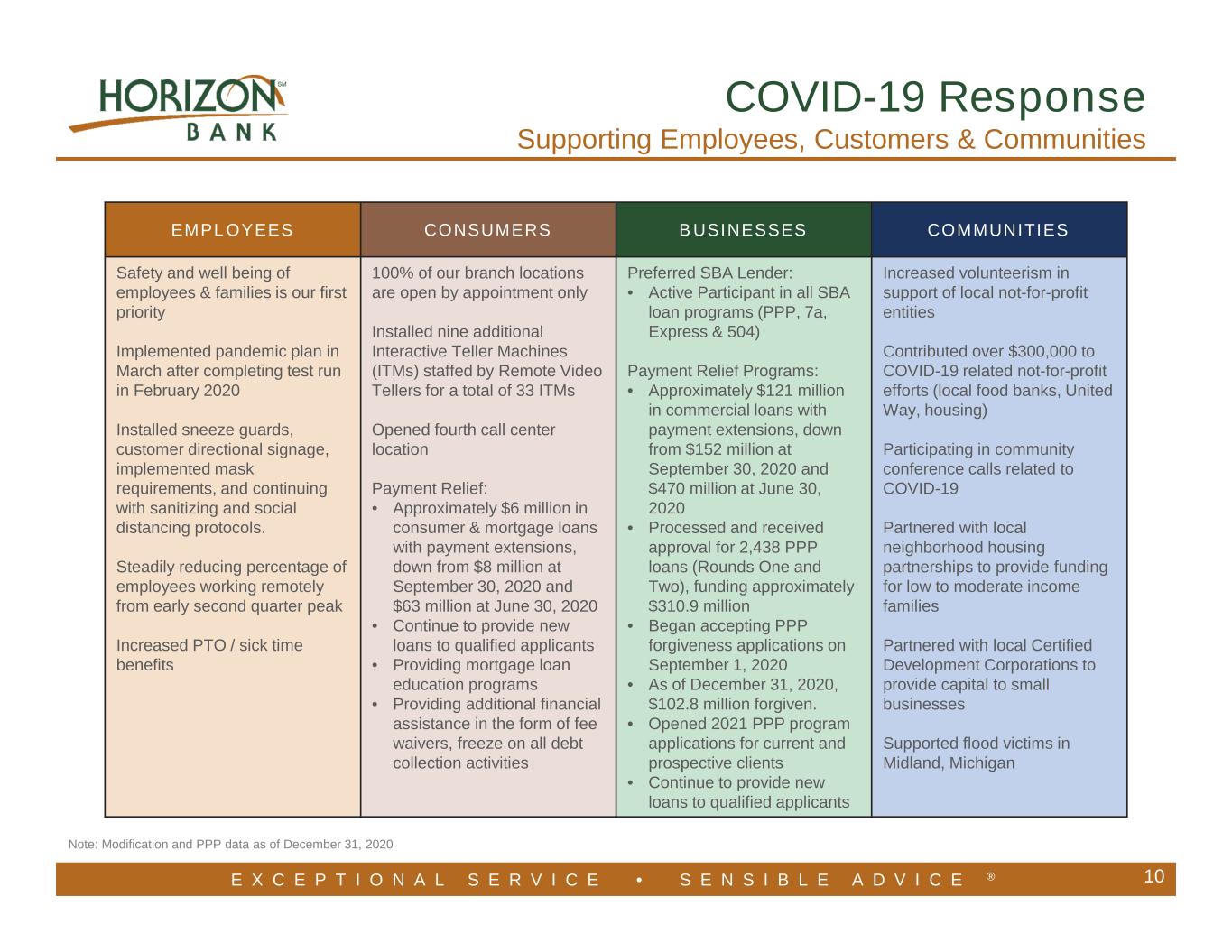

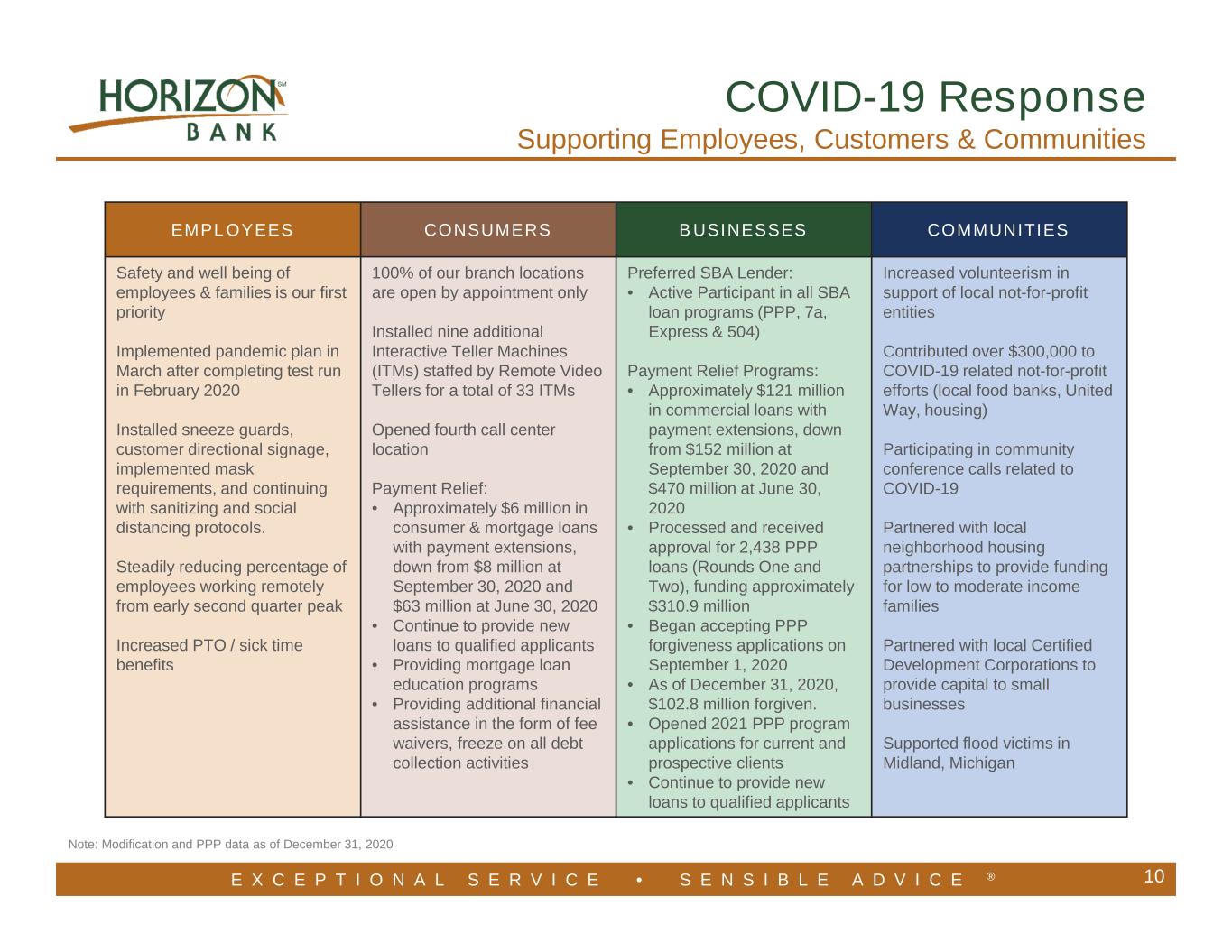

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® EMPLOYEES CONSUMERS BUSINESSES COMMUNITIES Safety and well being of employees & families is our first priority Implemented pandemic plan in March after completing test run in February 2020 Installed sneeze guards, customer directional signage, implemented mask requirements, and continuing with sanitizing and social distancing protocols. Steadily reducing percentage of employees working remotely from early second quarter peak Increased PTO / sick time benefits 100% of our branch locations are open by appointment only Installed nine additional Interactive Teller Machines (ITMs) staffed by Remote Video Tellers for a total of 33 ITMs Opened fourth call center location Payment Relief: • Approximately $6 million in consumer & mortgage loans with payment extensions, down from $8 million at September 30, 2020 and $63 million at June 30, 2020 • Continue to provide new loans to qualified applicants • Providing mortgage loan education programs • Providing additional financial assistance in the form of fee waivers, freeze on all debt collection activities Preferred SBA Lender: • Active Participant in all SBA loan programs (PPP, 7a, Express & 504) Payment Relief Programs: • Approximately $121 million in commercial loans with payment extensions, down from $152 million at September 30, 2020 and $470 million at June 30, 2020 • Processed and received approval for 2,438 PPP loans (Rounds One and Two), funding approximately $310.9 million • Began accepting PPP forgiveness applications on September 1, 2020 • As of December 31, 2020, $102.8 million forgiven. • Opened 2021 PPP program applications for current and prospective clients • Continue to provide new loans to qualified applicants Increased volunteerism in support of local not-for-profit entities Contributed over $300,000 to COVID-19 related not-for-profit efforts (local food banks, United Way, housing) Participating in community conference calls related to COVID-19 Partnered with local neighborhood housing partnerships to provide funding for low to moderate income families Partnered with local Certified Development Corporations to provide capital to small businesses Supported flood victims in Midland, Michigan 10 Note: Modification and PPP data as of December 31, 2020 COVID-19 Response Supporting Employees, Customers & Communities

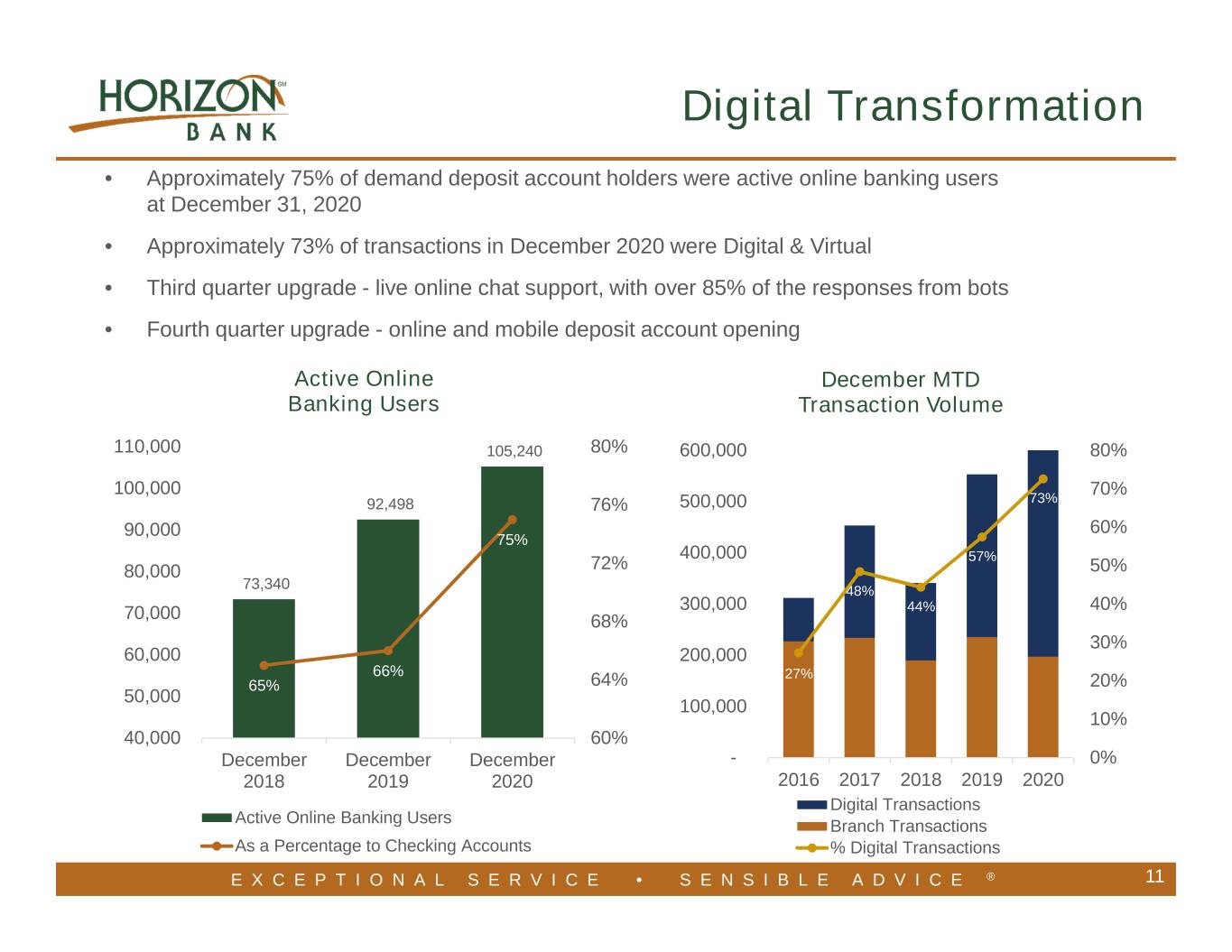

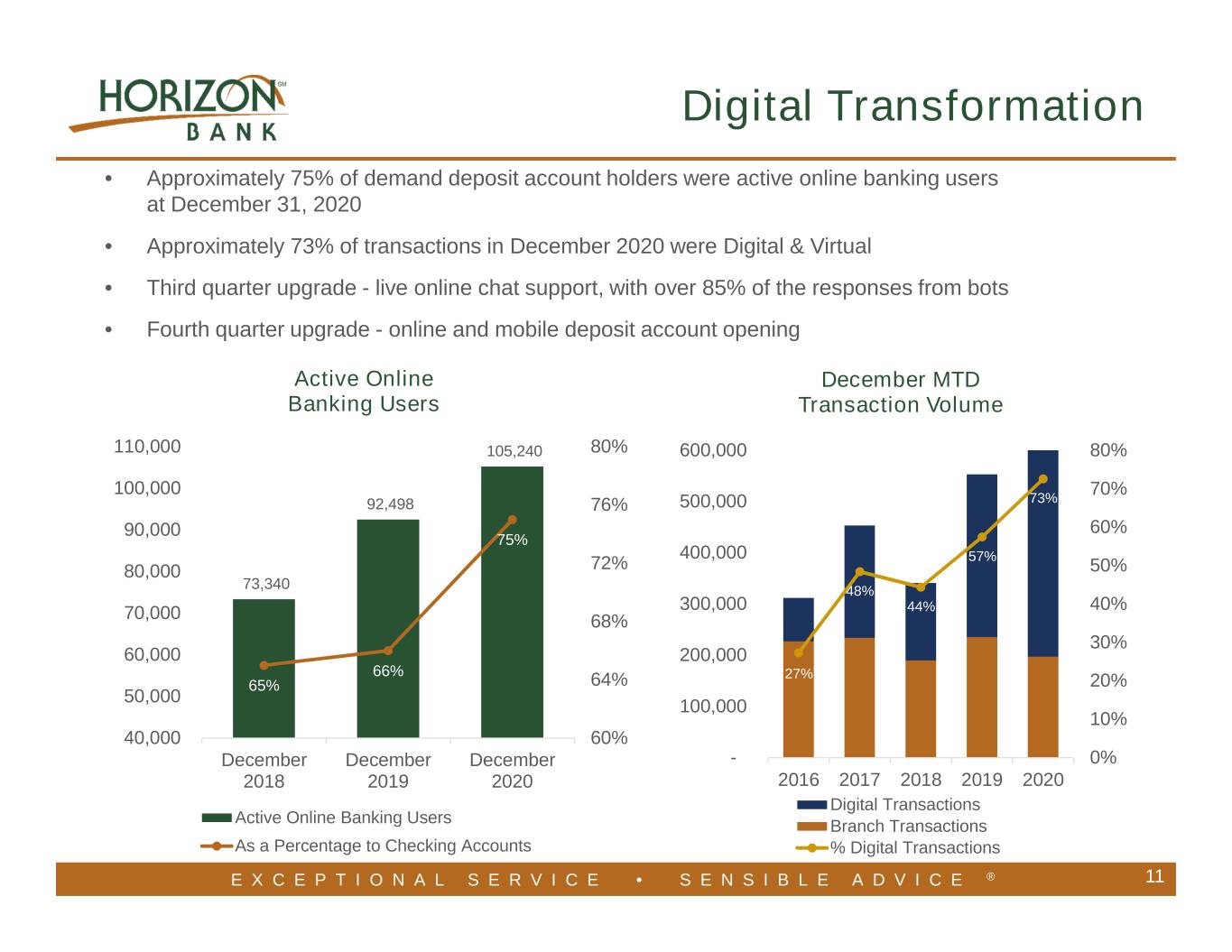

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 73,340 92,498 105,240 65% 66% 75% 60% 64% 68% 72% 76% 80% 40,000 50,000 60,000 70,000 80,000 90,000 100,000 110,000 December 2018 December 2019 December 2020 Active Online Banking Users Active Online Banking Users As a Percentage to Checking Accounts 11 • Approximately 75% of demand deposit account holders were active online banking users at December 31, 2020 • Approximately 73% of transactions in December 2020 were Digital & Virtual • Third quarter upgrade - live online chat support, with over 85% of the responses from bots • Fourth quarter upgrade - online and mobile deposit account opening 27% 48% 44% 57% 73% 0% 10% 20% 30% 40% 50% 60% 70% 80% - 100,000 200,000 300,000 400,000 500,000 600,000 2016 2017 2018 2019 2020 December MTD Transaction Volume Digital Transactions Branch Transactions % Digital Transactions Digital Transformation

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 12 Financial Highlights

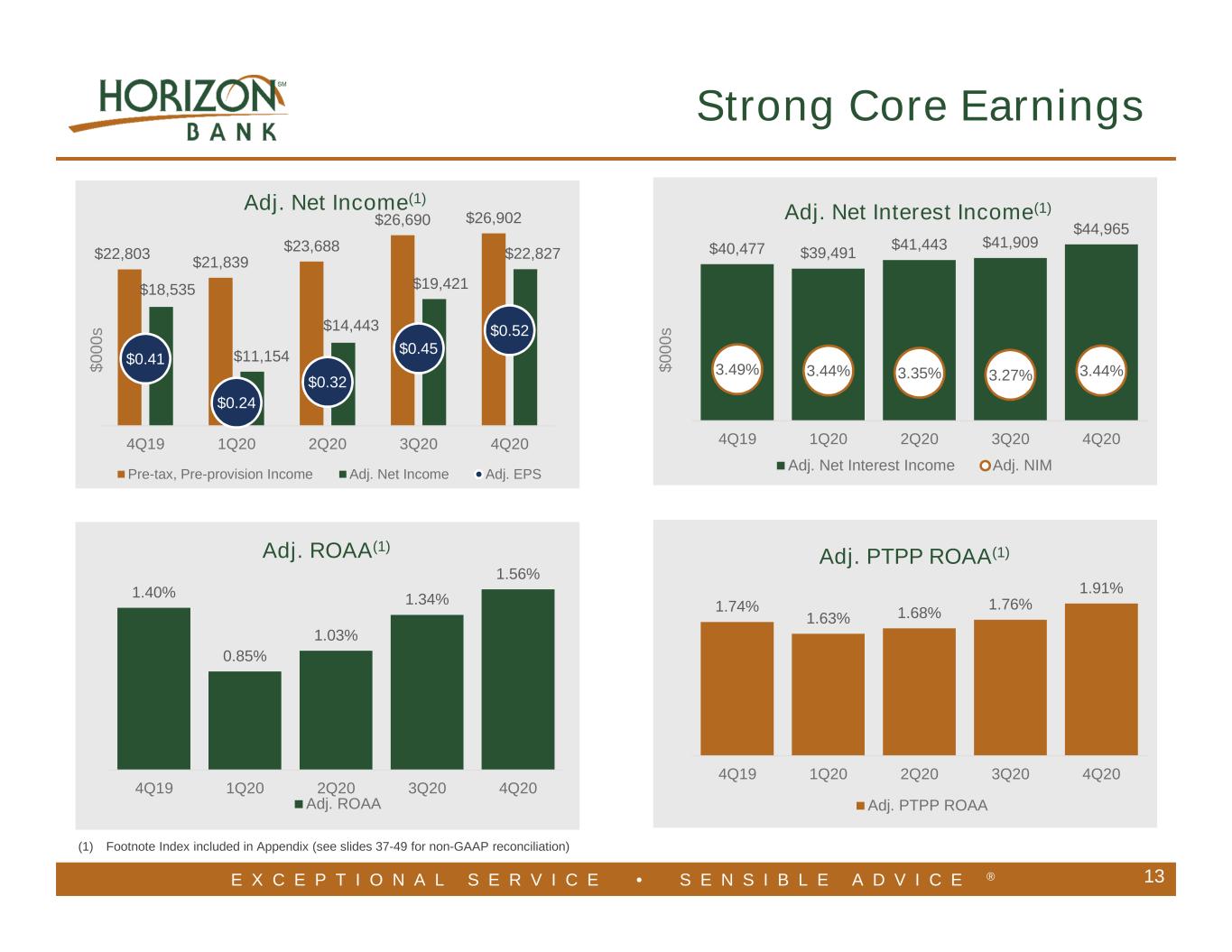

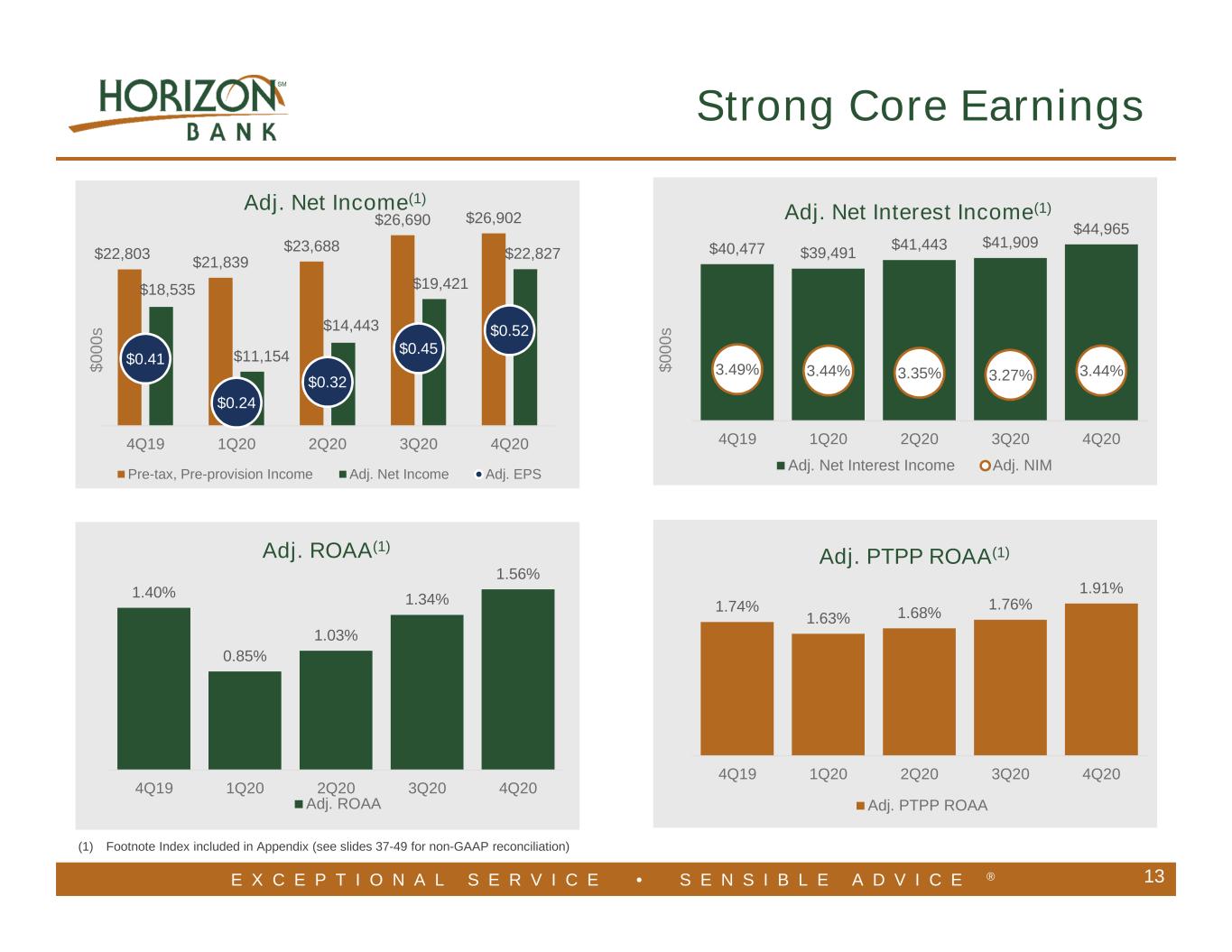

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 13 $ 0 0 0 s $22,803 $21,839 $23,688 $26,690 $26,902 $18,535 $11,154 $14,443 $19,421 $22,827 $0.41 $0.24 $0.32 $0.45 $0.52 4Q19 1Q20 2Q20 3Q20 4Q20 Adj. Net Income(1) Pre-tax, Pre-provision Income Adj. Net Income Adj. EPS 1.74% 1.63% 1.68% 1.76% 1.91% 4Q19 1Q20 2Q20 3Q20 4Q20 Adj. PTPP ROAA(1) Adj. PTPP ROAA $40,477 $39,491 $41,443 $41,909 $44,965 3.49% 3.44% 3.35% 3.27% 3.44% 4Q19 1Q20 2Q20 3Q20 4Q20 Adj. Net Interest Income(1) Adj. Net Interest Income Adj. NIM $ 0 0 0 s (1) Footnote Index included in Appendix (see slides 37-49 for non-GAAP reconciliation) 1.40% 0.85% 1.03% 1.34% 1.56% 4Q19 1Q20 2Q20 3Q20 4Q20 Adj. ROAA(1) Adj. ROAA Strong Core Earnings

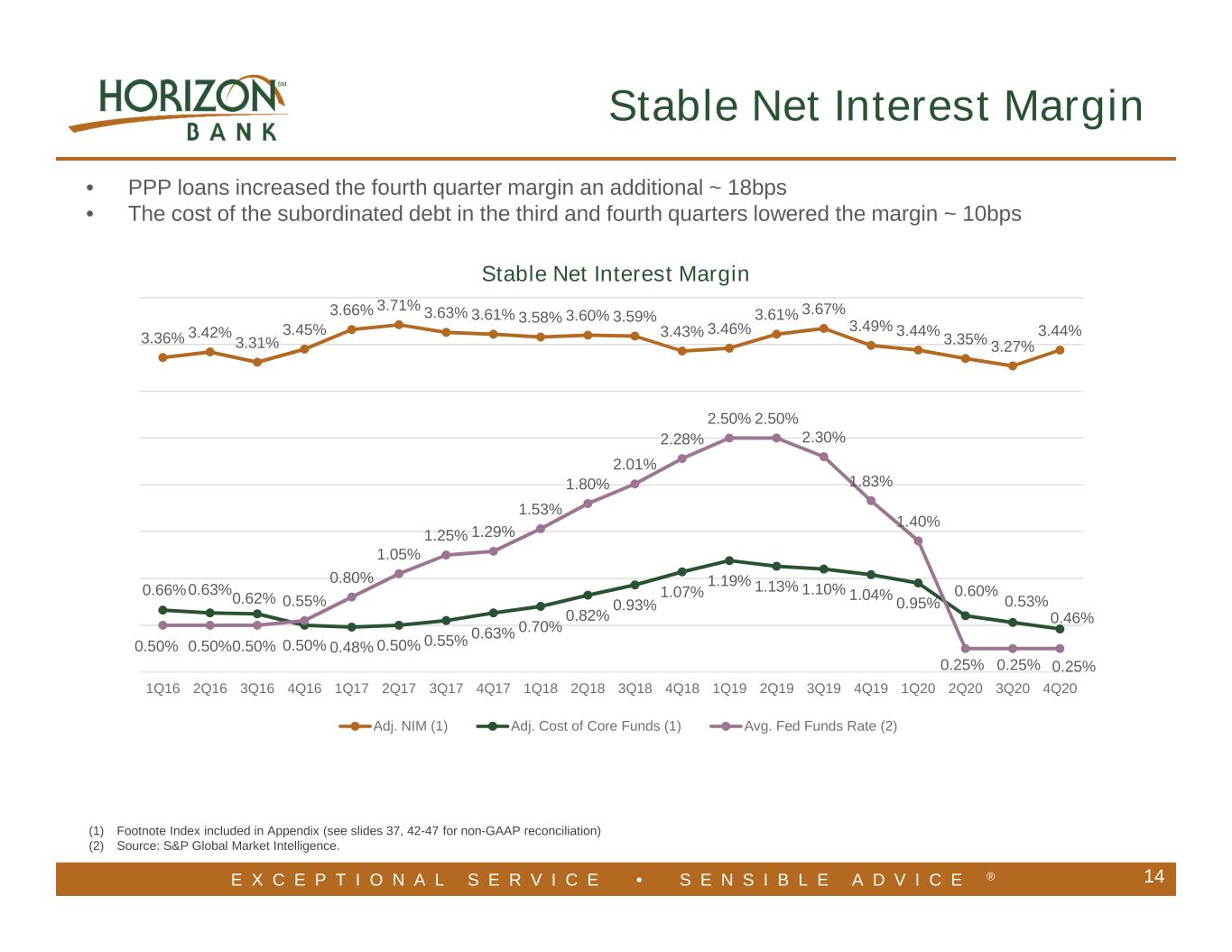

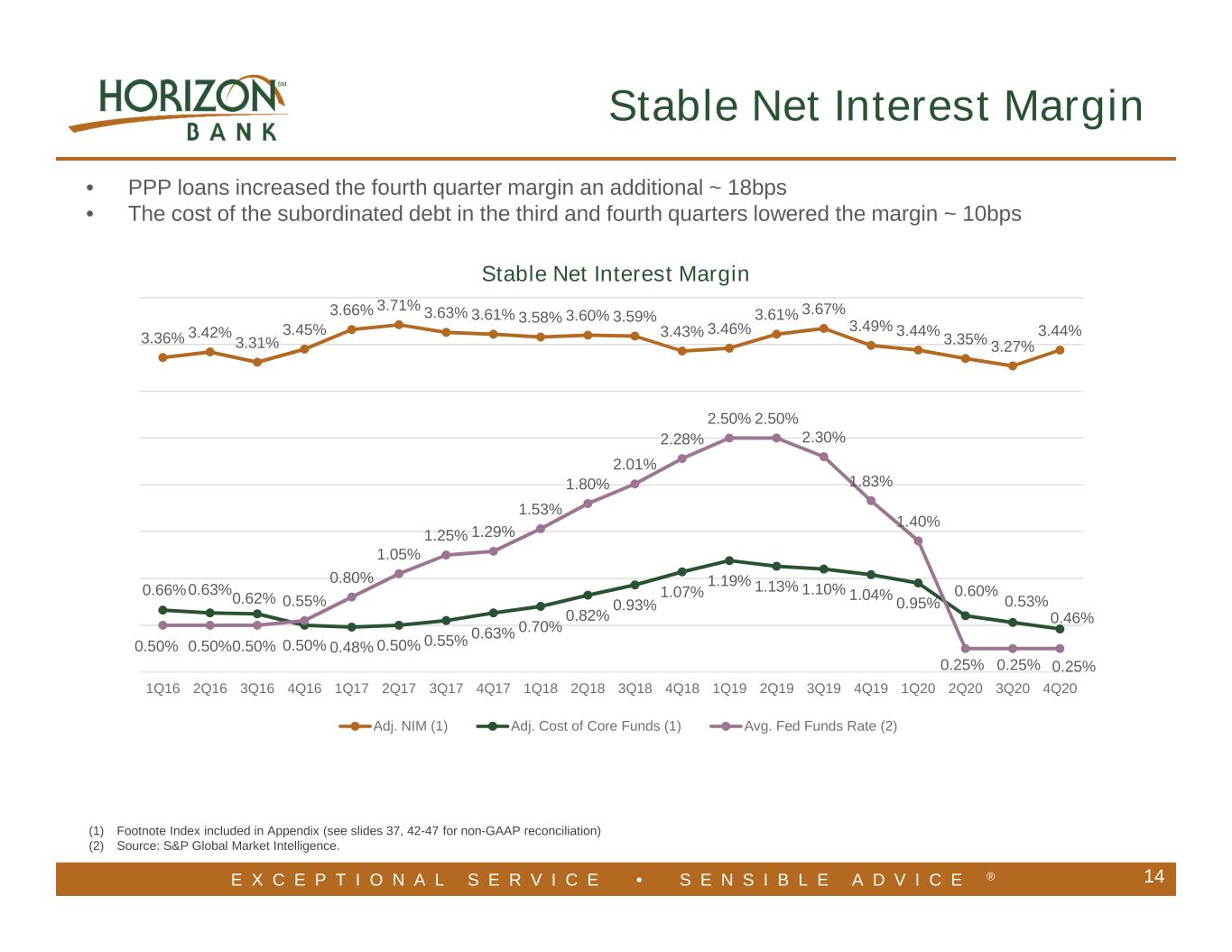

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 3.36% 3.42% 3.31% 3.45% 3.66% 3.71% 3.63% 3.61% 3.58% 3.60% 3.59% 3.43% 3.46% 3.61% 3.67% 3.49% 3.44% 3.35% 3.27% 3.44% 0.66%0.63% 0.62% 0.50% 0.48% 0.50% 0.55% 0.63% 0.70% 0.82% 0.93% 1.07% 1.19% 1.13% 1.10% 1.04% 0.95% 0.60% 0.53% 0.46% 0.50% 0.50%0.50% 0.55% 0.80% 1.05% 1.25% 1.29% 1.53% 1.80% 2.01% 2.28% 2.50% 2.50% 2.30% 1.83% 1.40% 0.25% 0.25% 0.25% 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Stable Net Interest Margin Adj. NIM (1) Adj. Cost of Core Funds (1) Avg. Fed Funds Rate (2) • PPP loans increased the fourth quarter margin an additional ~ 18bps • The cost of the subordinated debt in the third and fourth quarters lowered the margin ~ 10bps 14 (1) Footnote Index included in Appendix (see slides 37, 42-47 for non-GAAP reconciliation) (2) Source: S&P Global Market Intelligence. Stable Net Interest Margin

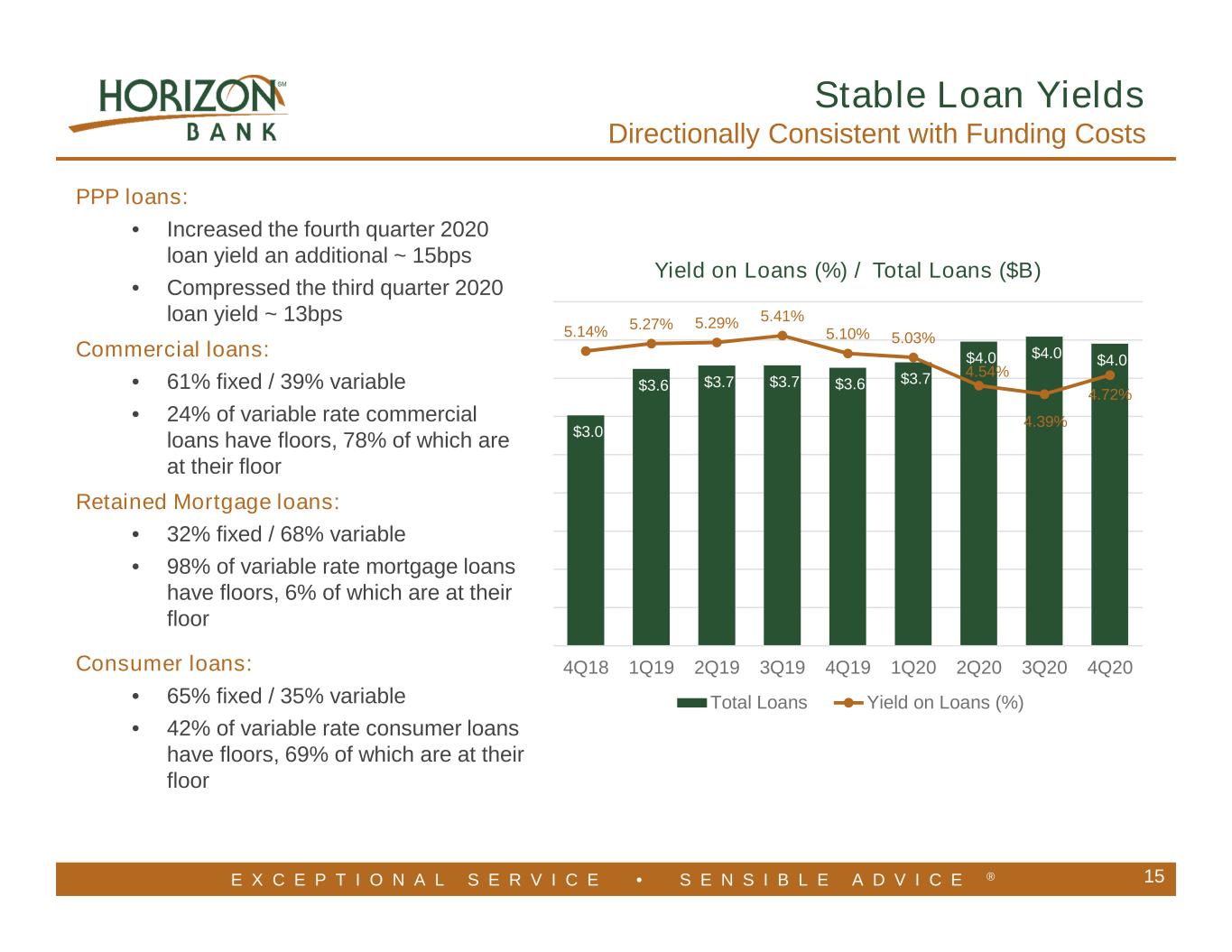

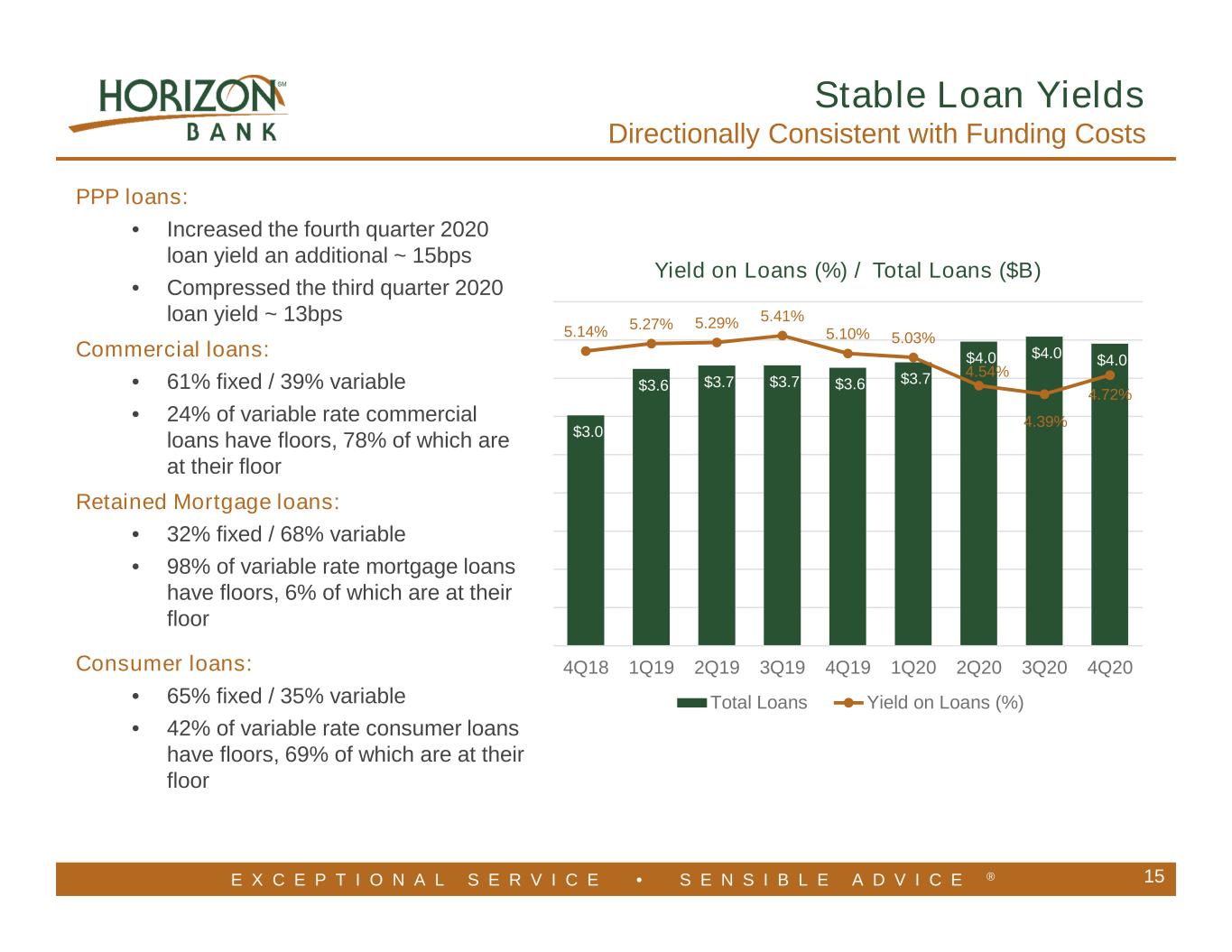

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® PPP loans: • Increased the fourth quarter 2020 loan yield an additional ~ 15bps • Compressed the third quarter 2020 loan yield ~ 13bps Commercial loans: • 61% fixed / 39% variable • 24% of variable rate commercial loans have floors, 78% of which are at their floor Retained Mortgage loans: • 32% fixed / 68% variable • 98% of variable rate mortgage loans have floors, 6% of which are at their floor Consumer loans: • 65% fixed / 35% variable • 42% of variable rate consumer loans have floors, 69% of which are at their floor 15 Stable Loan Yields Directionally Consistent with Funding Costs $3.0 $3.6 $3.7 $3.7 $3.6 $3.7 $4.0 $4.0 $4.0 5.14% 5.27% 5.29% 5.41% 5.10% 5.03% 4.54% 4.39% 4.72% 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 Yield on Loans (%) / Total Loans ($B) Total Loans Yield on Loans (%)

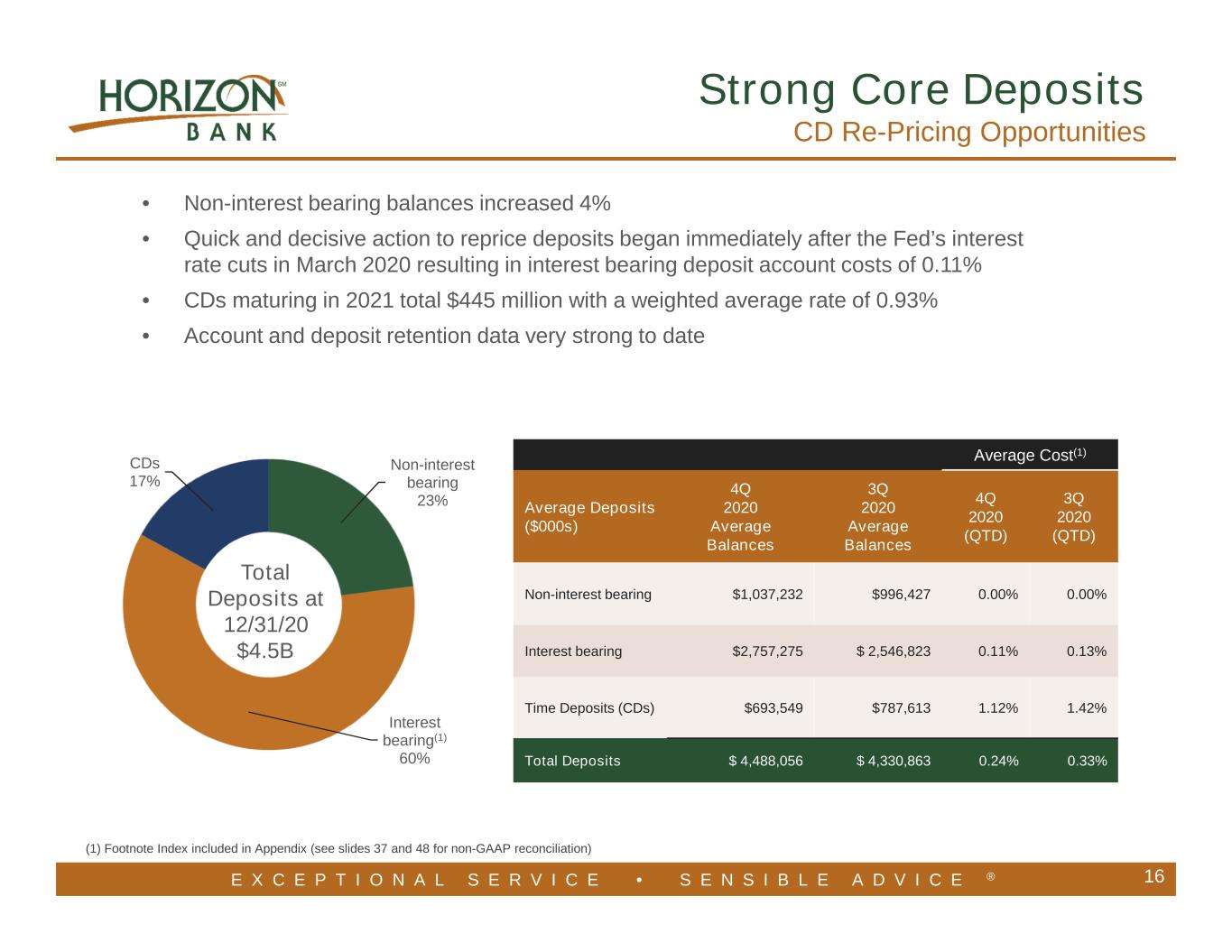

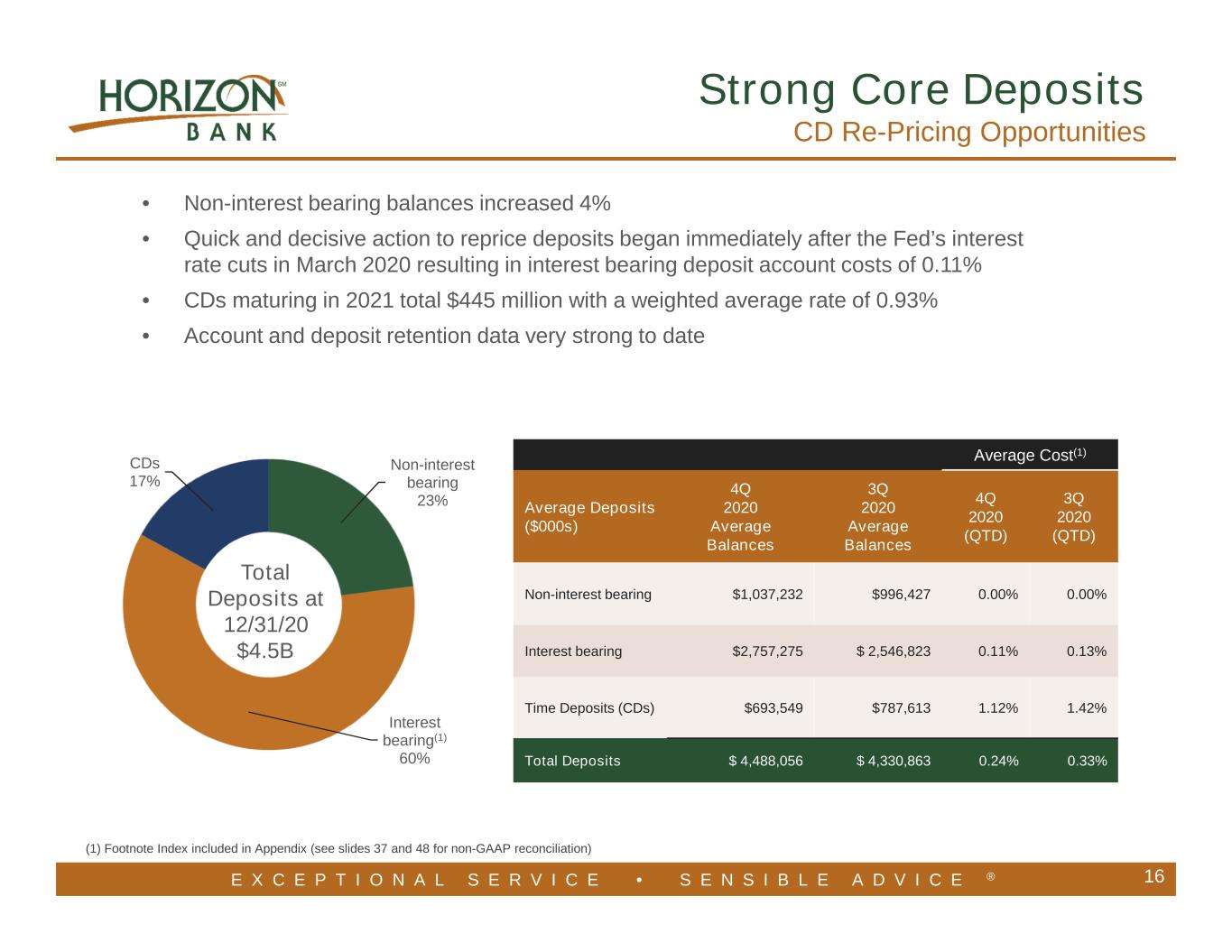

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Non-interest bearing 23% Interest bearing(1) 60% CDs 17% 16 • Non-interest bearing balances increased 4% • Quick and decisive action to reprice deposits began immediately after the Fed’s interest rate cuts in March 2020 resulting in interest bearing deposit account costs of 0.11% • CDs maturing in 2021 total $445 million with a weighted average rate of 0.93% • Account and deposit retention data very strong to date Average Cost(1) Average Deposits ($000s) 4Q 2020 Average Balances 3Q 2020 Average Balances 4Q 2020 (QTD) 3Q 2020 (QTD) Non-interest bearing $1,037,232 $996,427 0.00% 0.00% Interest bearing $2,757,275 $ 2,546,823 0.11% 0.13% Time Deposits (CDs) $693,549 $787,613 1.12% 1.42% Total Deposits $ 4,488,056 $ 4,330,863 0.24% 0.33% (1) Footnote Index included in Appendix (see slides 37 and 48 for non-GAAP reconciliation) Strong Core Deposits CD Re-Pricing Opportunities Total Deposits at 12/31/20 $4.5B

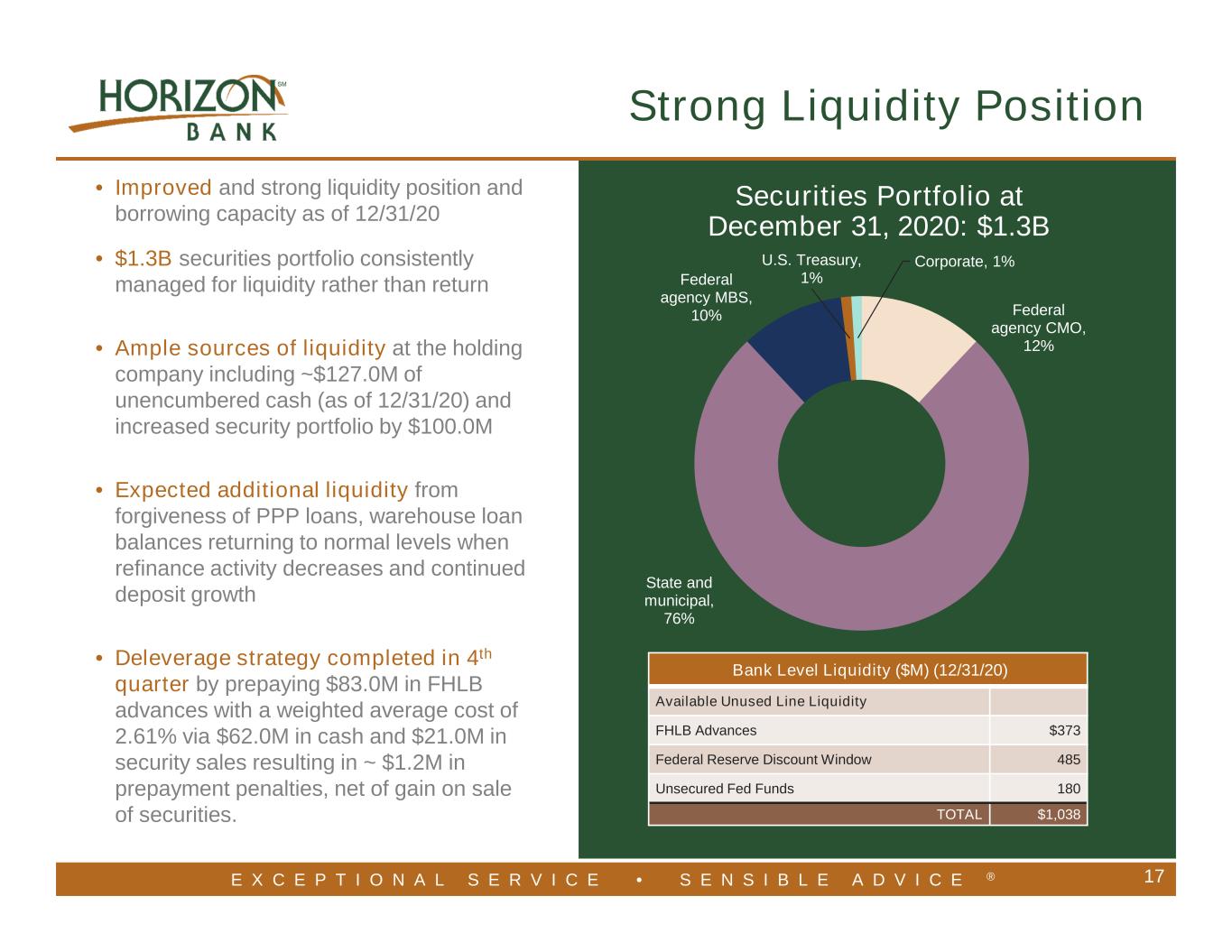

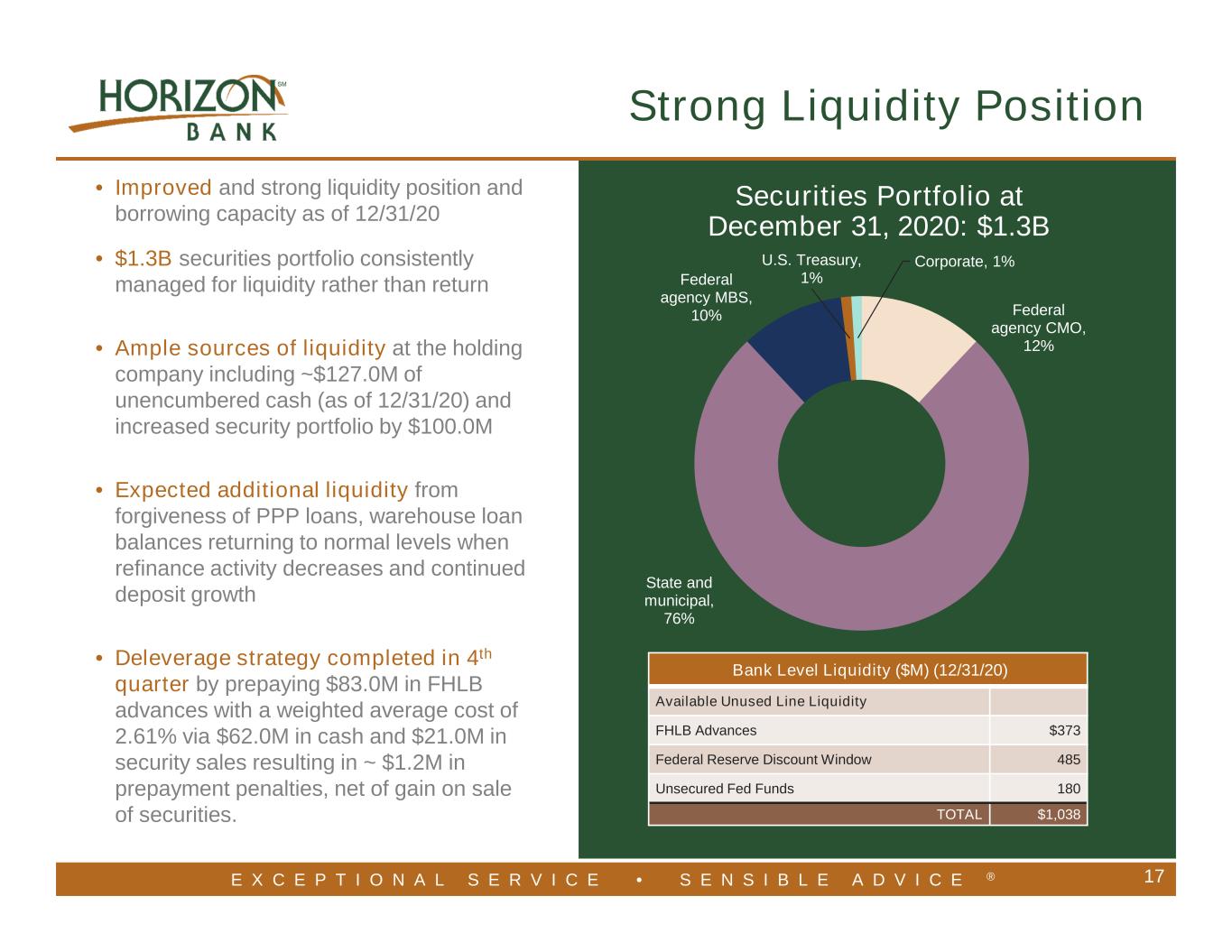

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Federal agency CMO, 12% State and municipal, 76% Federal agency MBS, 10% U.S. Treasury, 1% Corporate, 1% 17 • Improved and strong liquidity position and borrowing capacity as of 12/31/20 • $1.3B securities portfolio consistently managed for liquidity rather than return • Ample sources of liquidity at the holding company including ~$127.0M of unencumbered cash (as of 12/31/20) and increased security portfolio by $100.0M • Expected additional liquidity from forgiveness of PPP loans, warehouse loan balances returning to normal levels when refinance activity decreases and continued deposit growth • Deleverage strategy completed in 4th quarter by prepaying $83.0M in FHLB advances with a weighted average cost of 2.61% via $62.0M in cash and $21.0M in security sales resulting in ~ $1.2M in prepayment penalties, net of gain on sale of securities. Strong Liquidity Position Securities Portfolio at December 31, 2020: $1.3B Bank Level Liquidity ($M) (12/31/20) Available Unused Line Liquidity FHLB Advances $373 Federal Reserve Discount Window 485 Unsecured Fed Funds 180 TOTAL $1,038

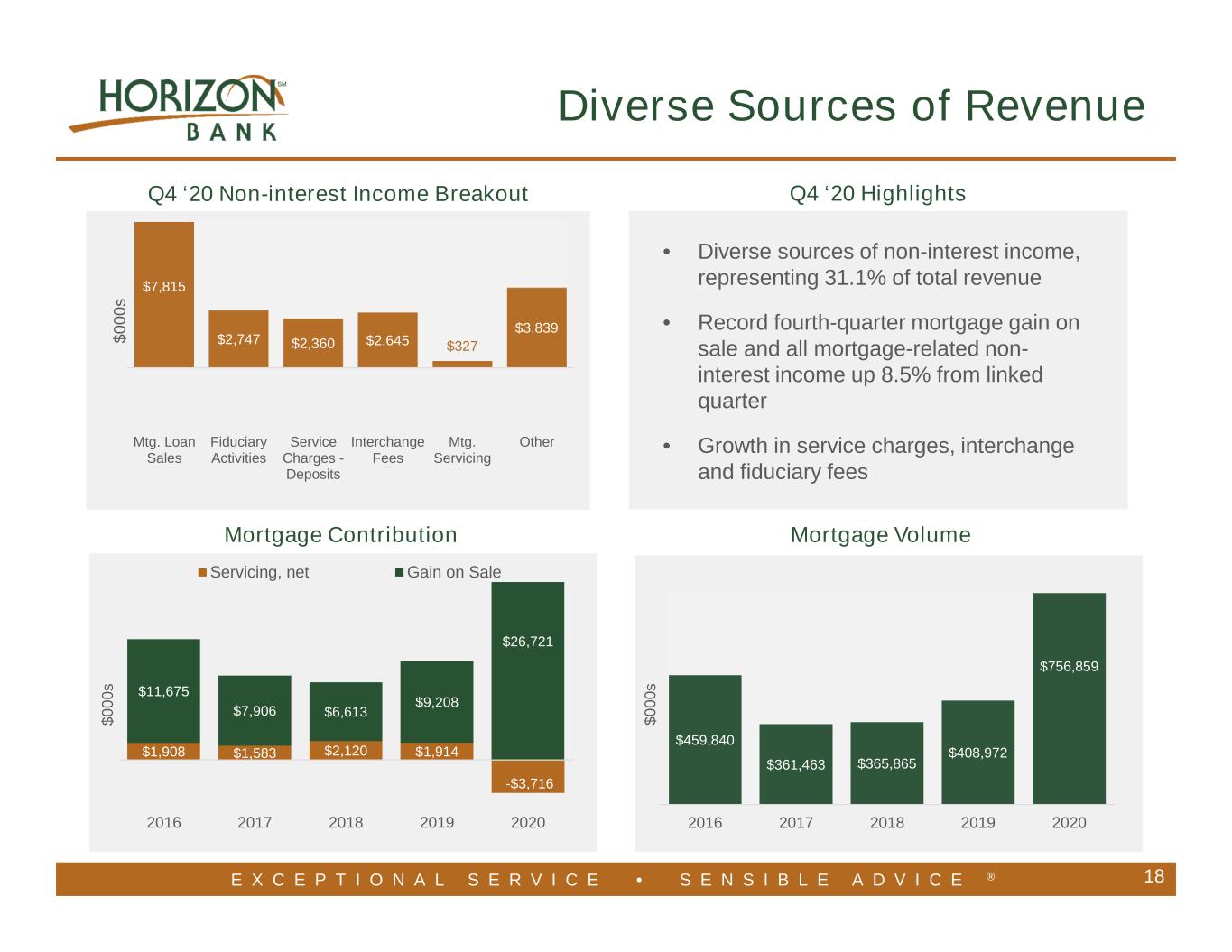

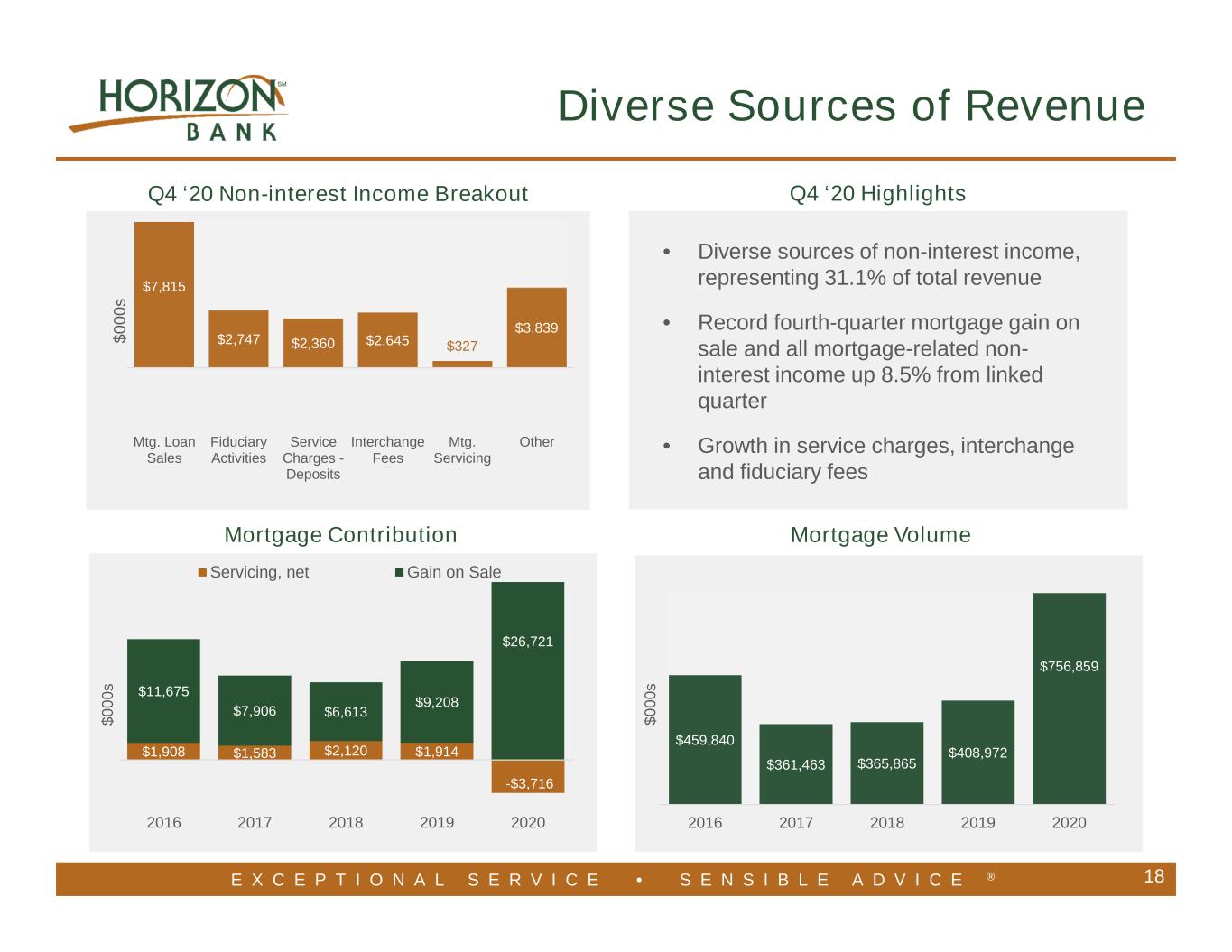

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® $7,815 $2,747 $2,360 $2,645 $327 $3,839 Mtg. Loan Sales Fiduciary Activities Service Charges - Deposits Interchange Fees Mtg. Servicing Other $ 0 0 0 s 18 $459,840 $361,463 $365,865 $408,972 $756,859 2016 2017 2018 2019 2020 $ 0 0 0 s $1,908 $1,583 $2,120 $1,914 -$3,716 $11,675 $7,906 $6,613 $9,208 $26,721 2016 2017 2018 2019 2020 Servicing, net Gain on Sale $ 0 0 0 s Mortgage Contribution Q4 ‘20 Non-interest Income Breakout Q4 ‘20 Highlights • Diverse sources of non-interest income, representing 31.1% of total revenue • Record fourth-quarter mortgage gain on sale and all mortgage-related non- interest income up 8.5% from linked quarter • Growth in service charges, interchange and fiduciary fees Diverse Sources of Revenue Mortgage Volume

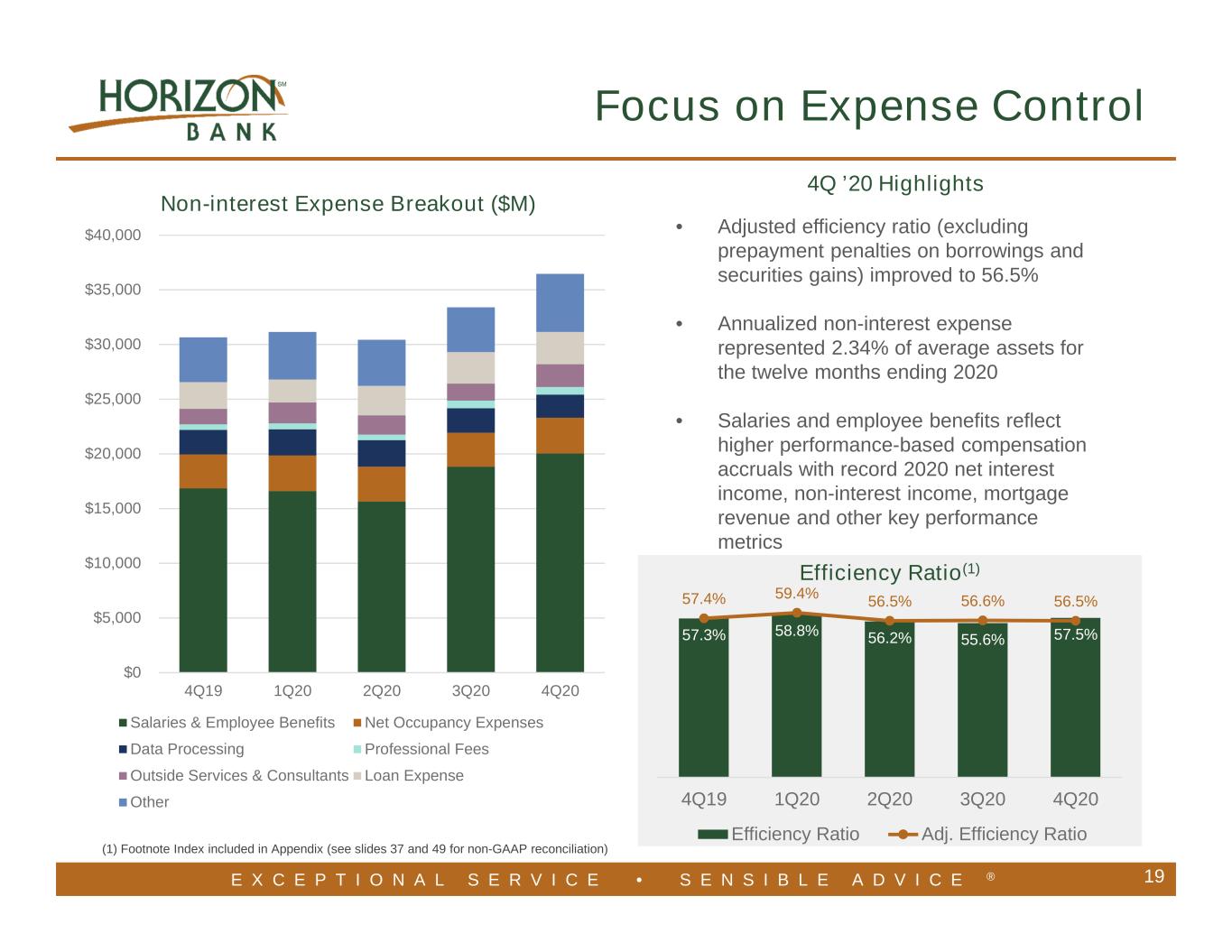

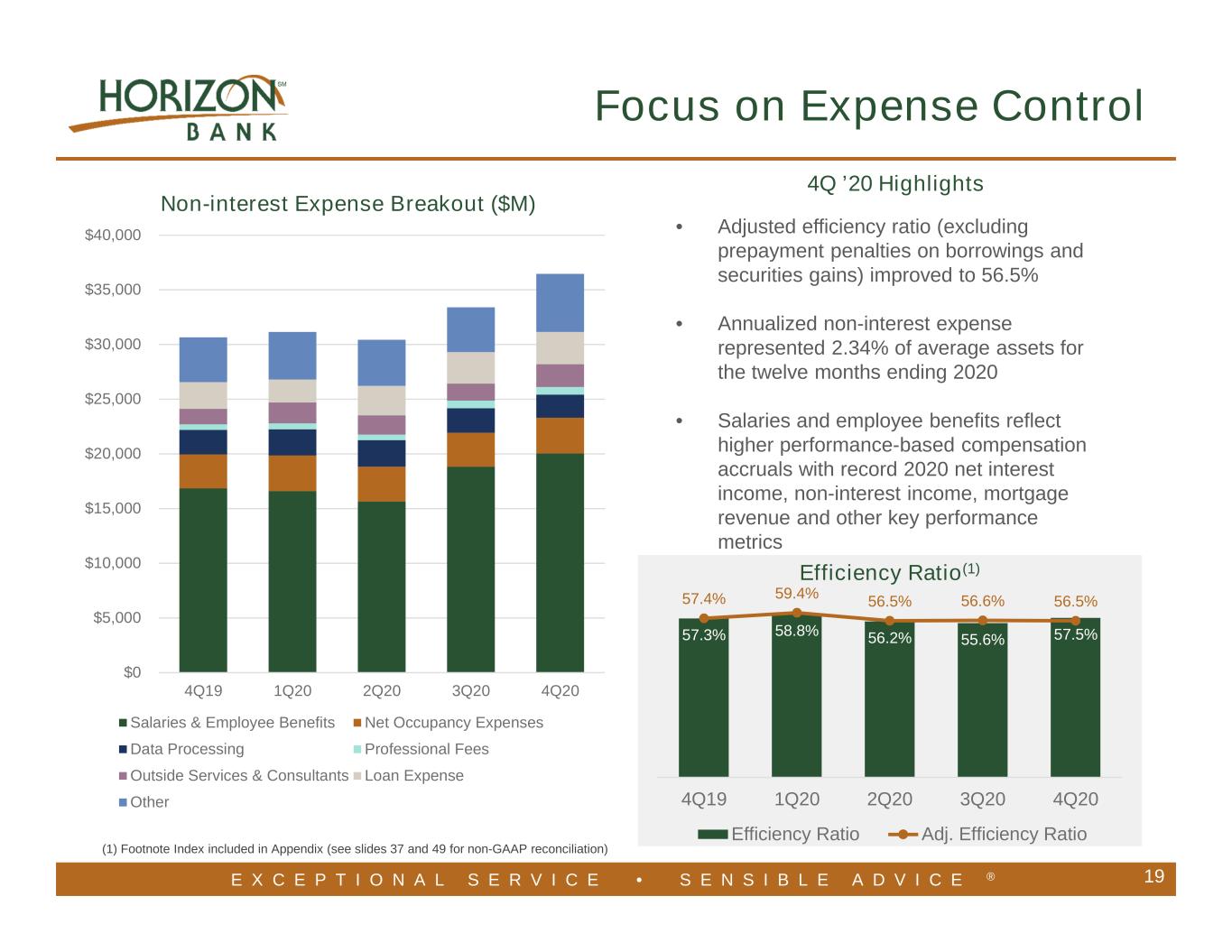

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® • Adjusted efficiency ratio (excluding prepayment penalties on borrowings and securities gains) improved to 56.5% • Annualized non-interest expense represented 2.34% of average assets for the twelve months ending 2020 • Salaries and employee benefits reflect higher performance-based compensation accruals with record 2020 net interest income, non-interest income, mortgage revenue and other key performance metrics 19 Efficiency Ratio(1) 4Q ’20 Highlights (1) Footnote Index included in Appendix (see slides 37 and 49 for non-GAAP reconciliation) Focus on Expense Control 57.3% 58.8% 56.2% 55.6% 57.5% 57.4% 59.4% 56.5% 56.6% 56.5% 4Q19 1Q20 2Q20 3Q20 4Q20 Efficiency Ratio Adj. Efficiency Ratio $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 4Q19 1Q20 2Q20 3Q20 4Q20 Non-interest Expense Breakout ($M) Salaries & Employee Benefits Net Occupancy Expenses Data Processing Professional Fees Outside Services & Consultants Loan Expense Other

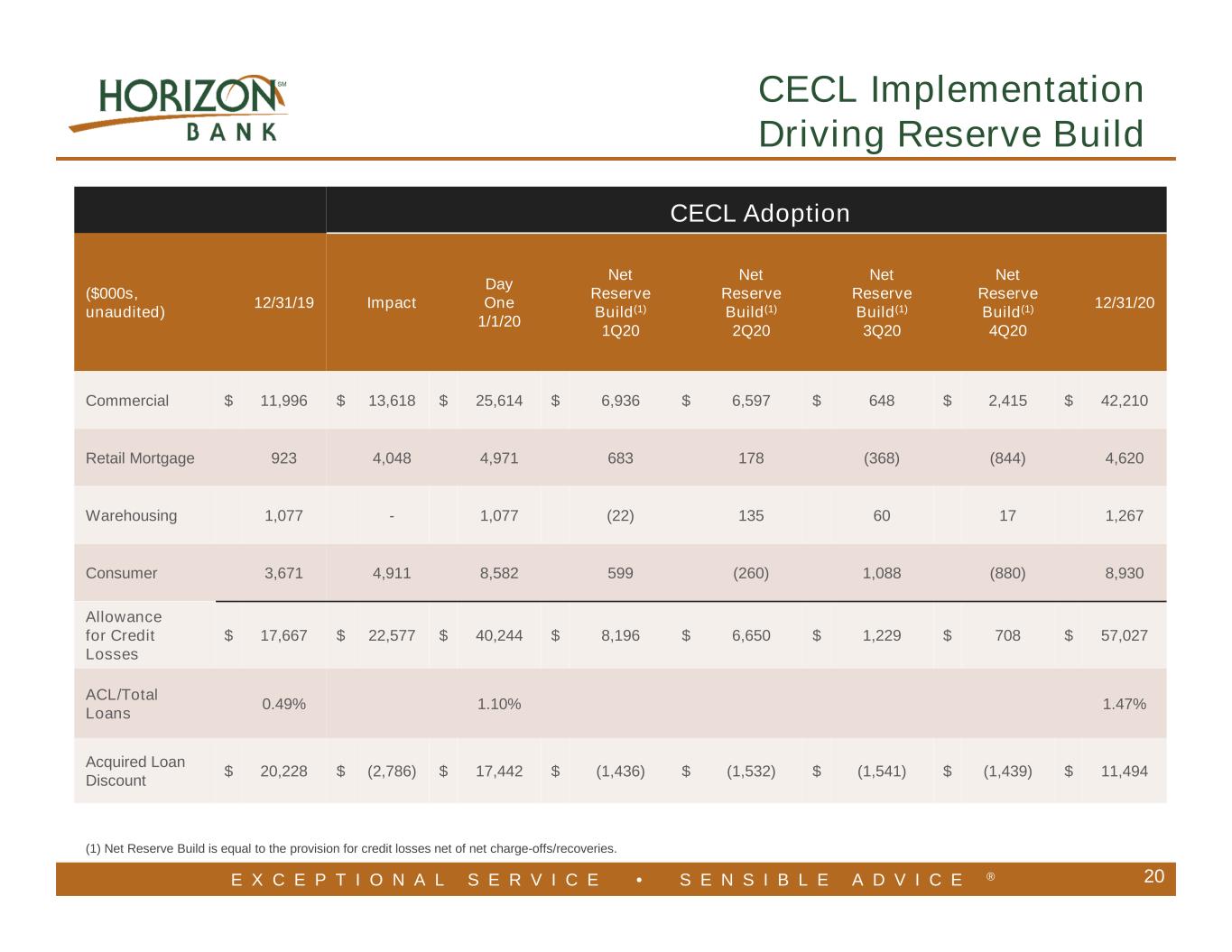

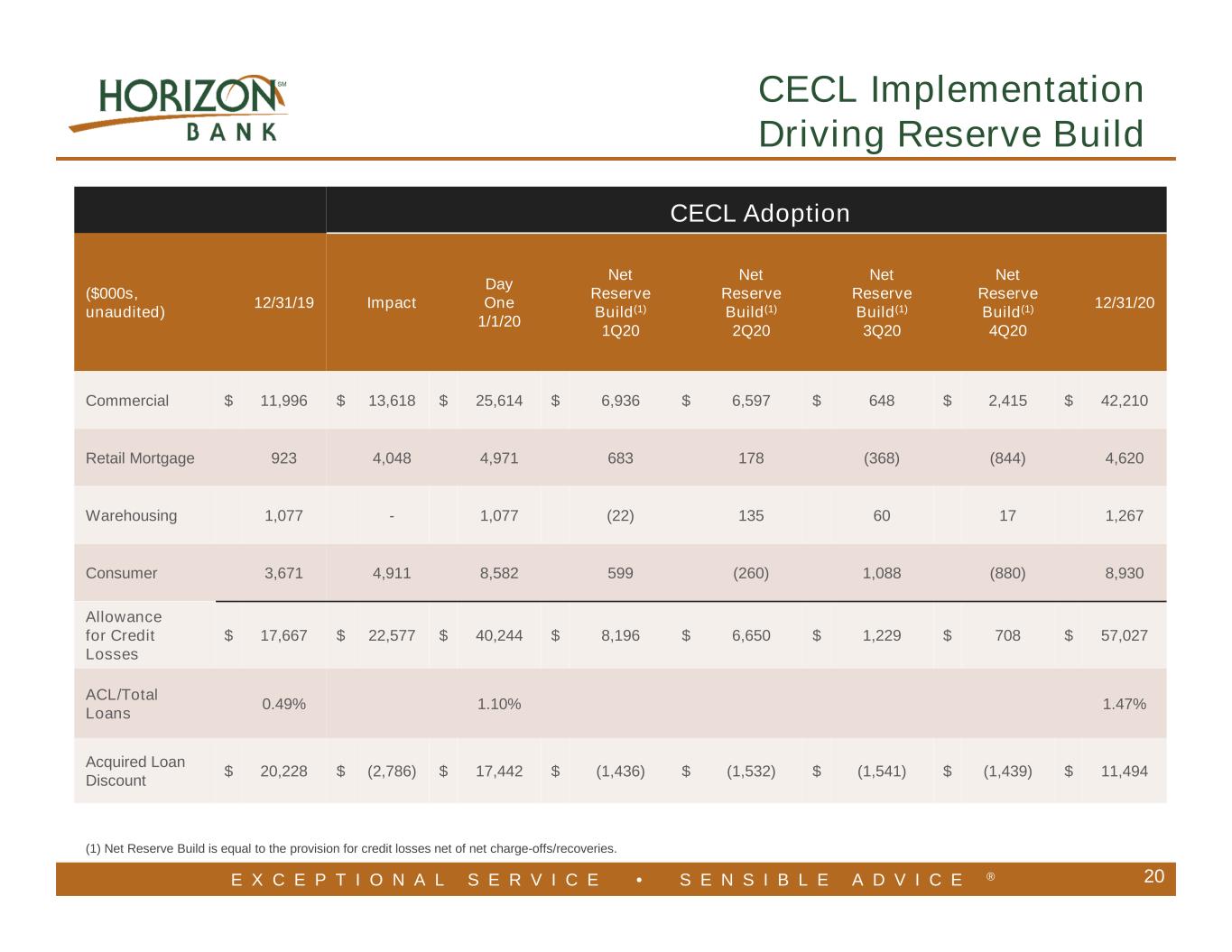

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 20 CECL Adoption ($000s, unaudited) 12/31/19 Impact Day One 1/1/20 Net Reserve Build(1) 1Q20 Net Reserve Build(1) 2Q20 Net Reserve Build(1) 3Q20 Net Reserve Build(1) 4Q20 12/31/20 Commercial $ 11,996 $ 13,618 $ 25,614 $ 6,936 $ 6,597 $ 648 $ 2,415 $ 42,210 Retail Mortgage 923 4,048 4,971 683 178 (368) (844) 4,620 Warehousing 1,077 - 1,077 (22) 135 60 17 1,267 Consumer 3,671 4,911 8,582 599 (260) 1,088 (880) 8,930 Allowance for Credit Losses $ 17,667 $ 22,577 $ 40,244 $ 8,196 $ 6,650 $ 1,229 $ 708 $ 57,027 ACL/Total Loans 0.49% 1.10% 1.47% Acquired Loan Discount $ 20,228 $ (2,786) $ 17,442 $ (1,436) $ (1,532) $ (1,541) $ (1,439) $ 11,494 (1) Net Reserve Build is equal to the provision for credit losses net of net charge-offs/recoveries. CECL Implementation Driving Reserve Build

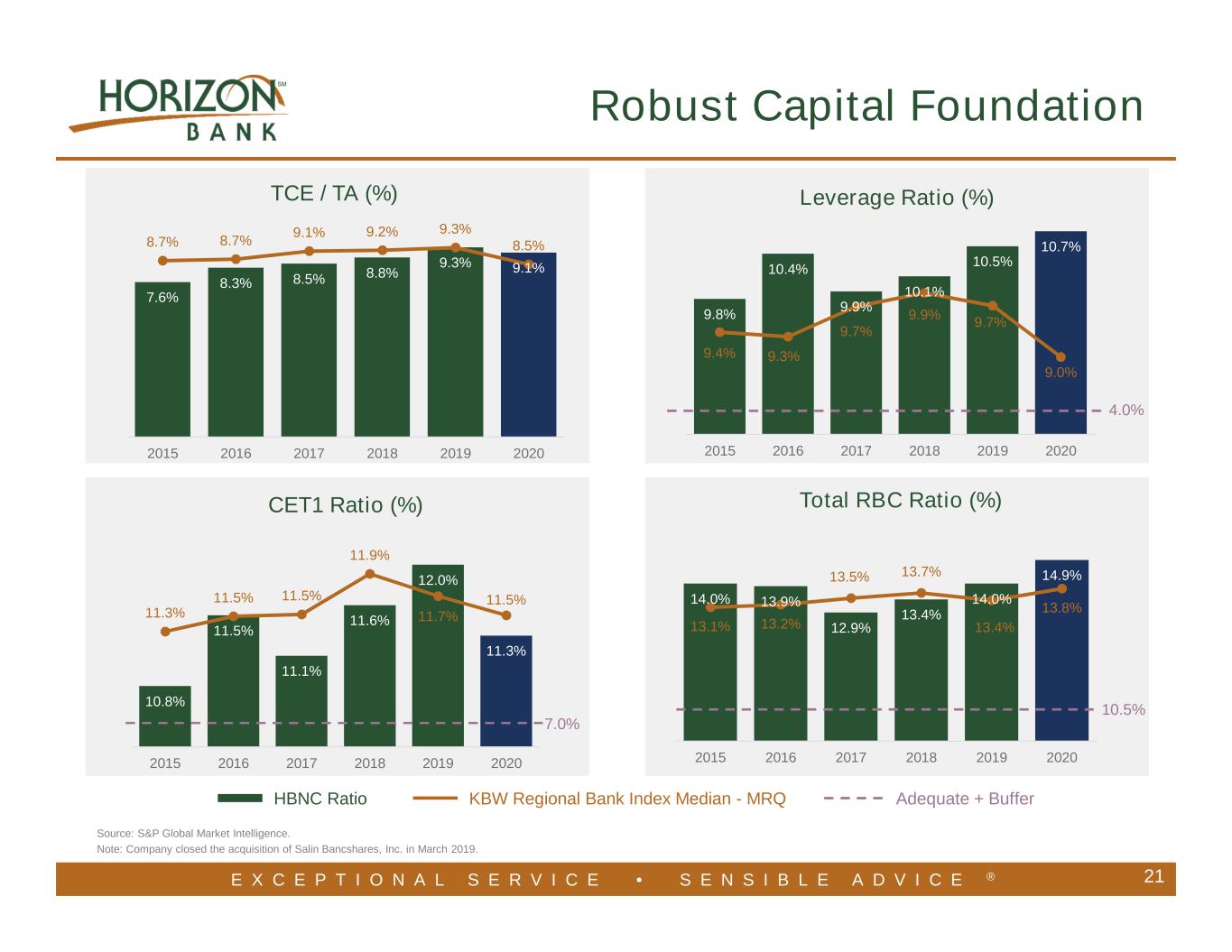

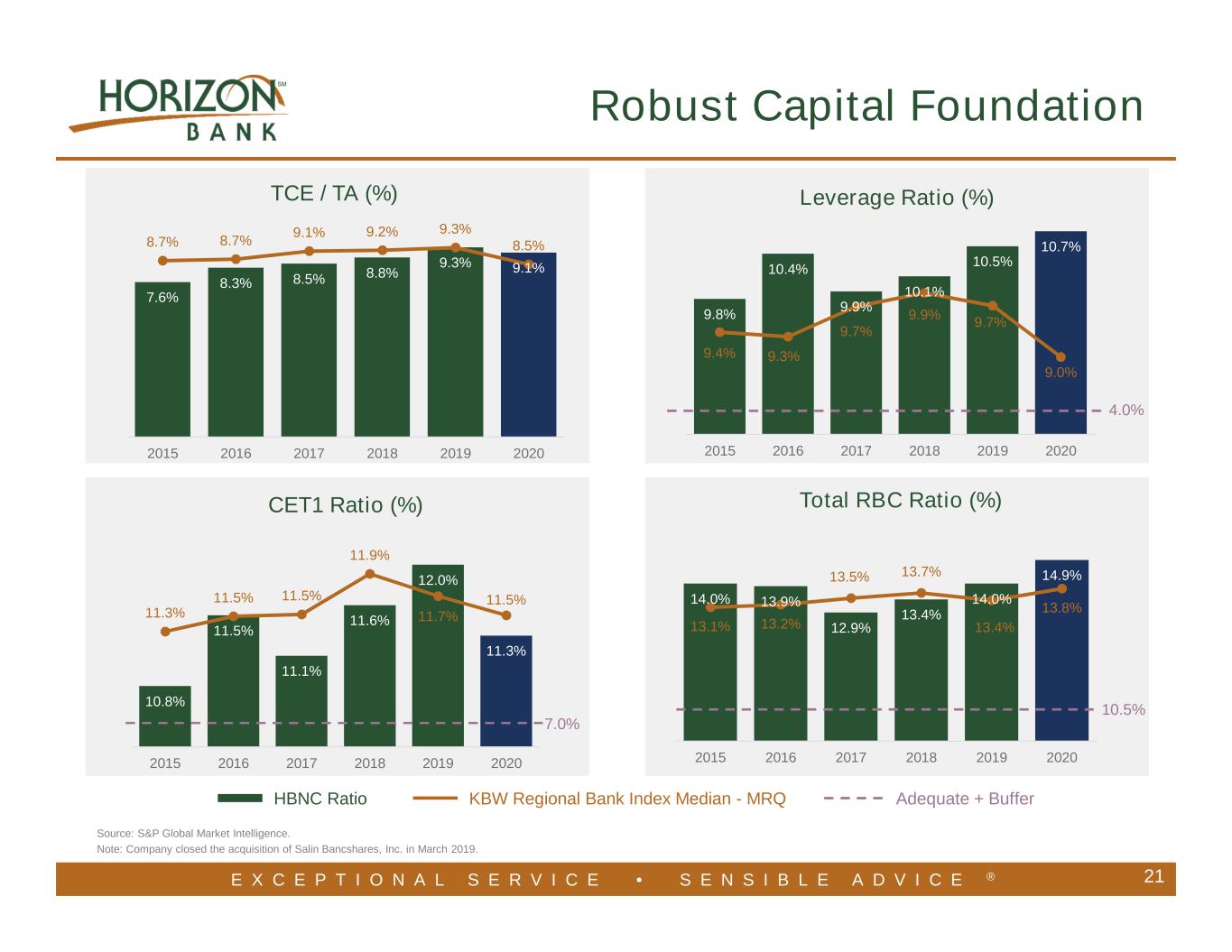

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 10.8% 11.5% 11.1% 11.6% 12.0% 11.3% 11.3% 11.5% 11.5% 11.9% 11.7% 11.5% 2015 2016 2017 2018 2019 2020 9.8% 10.4% 9.9% 10.1% 10.5% 10.7% 9.4% 9.3% 9.7% 9.9% 9.7% 9.0% 2015 2016 2017 2018 2019 2020 14.0% 13.9% 12.9% 13.4% 14.0% 14.9% 13.1% 13.2% 13.5% 13.7% 13.4% 13.8% 2015 2016 2017 2018 2019 2020 Source: S&P Global Market Intelligence. Note: Company closed the acquisition of Salin Bancshares, Inc. in March 2019. 21 TCE / TA (%) Leverage Ratio (%) Total RBC Ratio (%) 4.0% Adequate + Buffer 7.0% KBW Regional Bank Index Median - MRQ Robust Capital Foundation 10.5% HBNC Ratio 7.6% 8.3% 8.5% 8.8% 9.3% 9.1% 8.7% 8.7% 9.1% 9.2% 9.3% 8.5% 2015 2016 2017 2018 2019 2020 CET1 Ratio (%)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Loan Portfolio Review 22

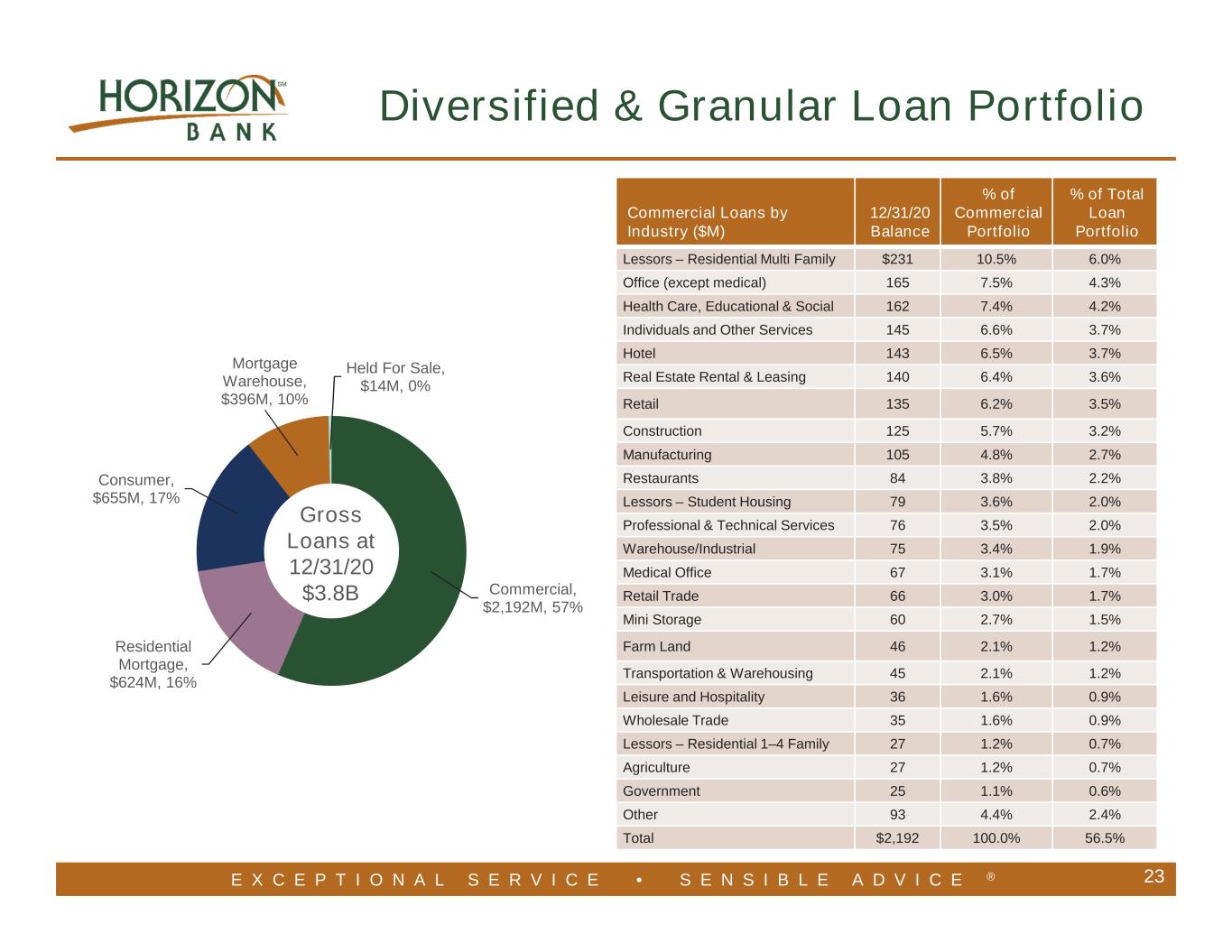

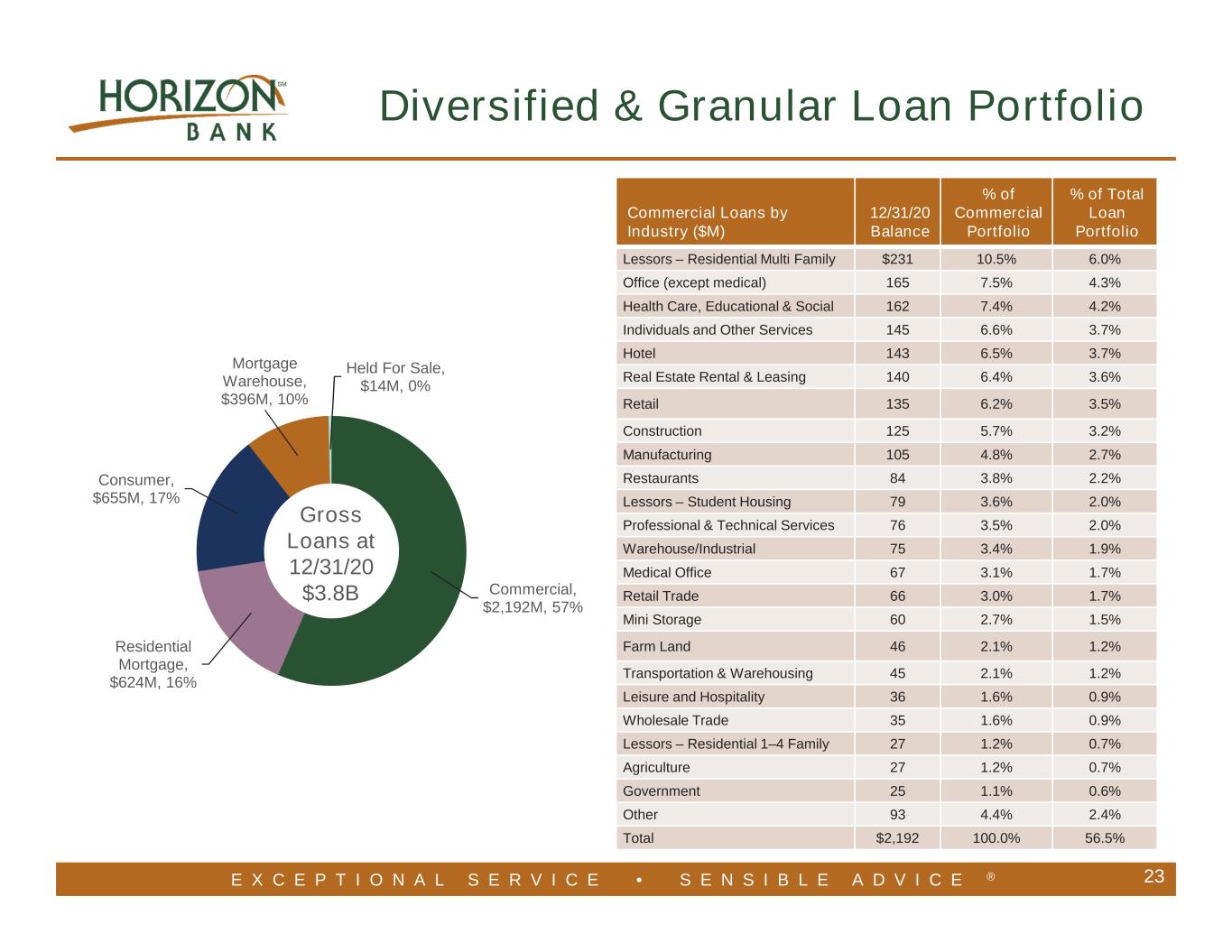

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® Commercial, $2,192M, 57% Residential Mortgage, $624M, 16% Consumer, $655M, 17% Mortgage Warehouse, $396M, 10% Held For Sale, $14M, 0% 23 Gross Loans at 12/31/20 $3.8B Diversified & Granular Loan Portfolio Commercial Loans by Industry ($M) 12/31/20 Balance % of Commercial Portfolio % of Total Loan Portfolio Lessors – Residential Multi Family $231 10.5% 6.0% Office (except medical) 165 7.5% 4.3% Health Care, Educational & Social 162 7.4% 4.2% Individuals and Other Services 145 6.6% 3.7% Hotel 143 6.5% 3.7% Real Estate Rental & Leasing 140 6.4% 3.6% Retail 135 6.2% 3.5% Construction 125 5.7% 3.2% Manufacturing 105 4.8% 2.7% Restaurants 84 3.8% 2.2% Lessors – Student Housing 79 3.6% 2.0% Professional & Technical Services 76 3.5% 2.0% Warehouse/Industrial 75 3.4% 1.9% Medical Office 67 3.1% 1.7% Retail Trade 66 3.0% 1.7% Mini Storage 60 2.7% 1.5% Farm Land 46 2.1% 1.2% Transportation & Warehousing 45 2.1% 1.2% Leisure and Hospitality 36 1.6% 0.9% Wholesale Trade 35 1.6% 0.9% Lessors – Residential 1–4 Family 27 1.2% 0.7% Agriculture 27 1.2% 0.7% Government 25 1.1% 0.6% Other 93 4.4% 2.4% Total $2,192 100.0% 56.5%

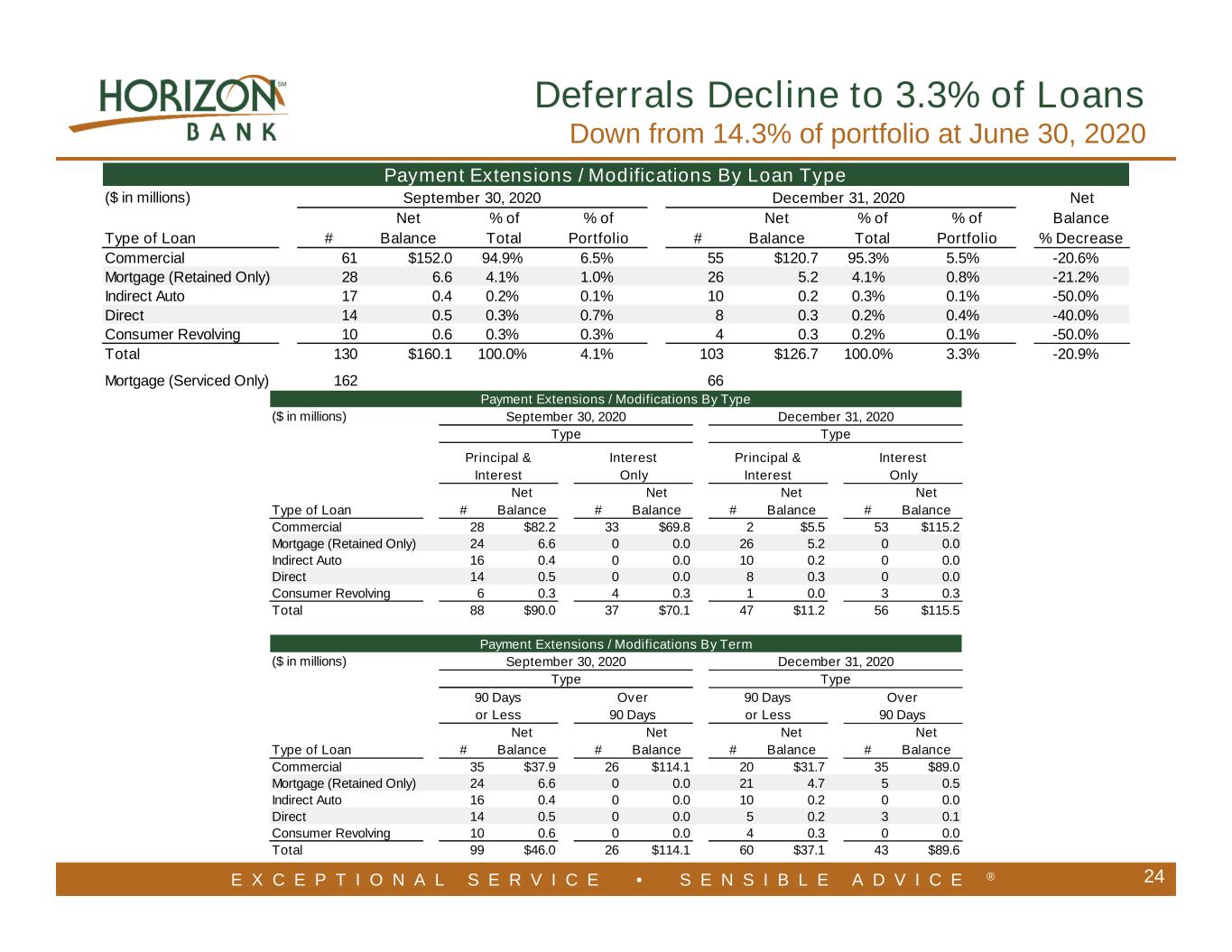

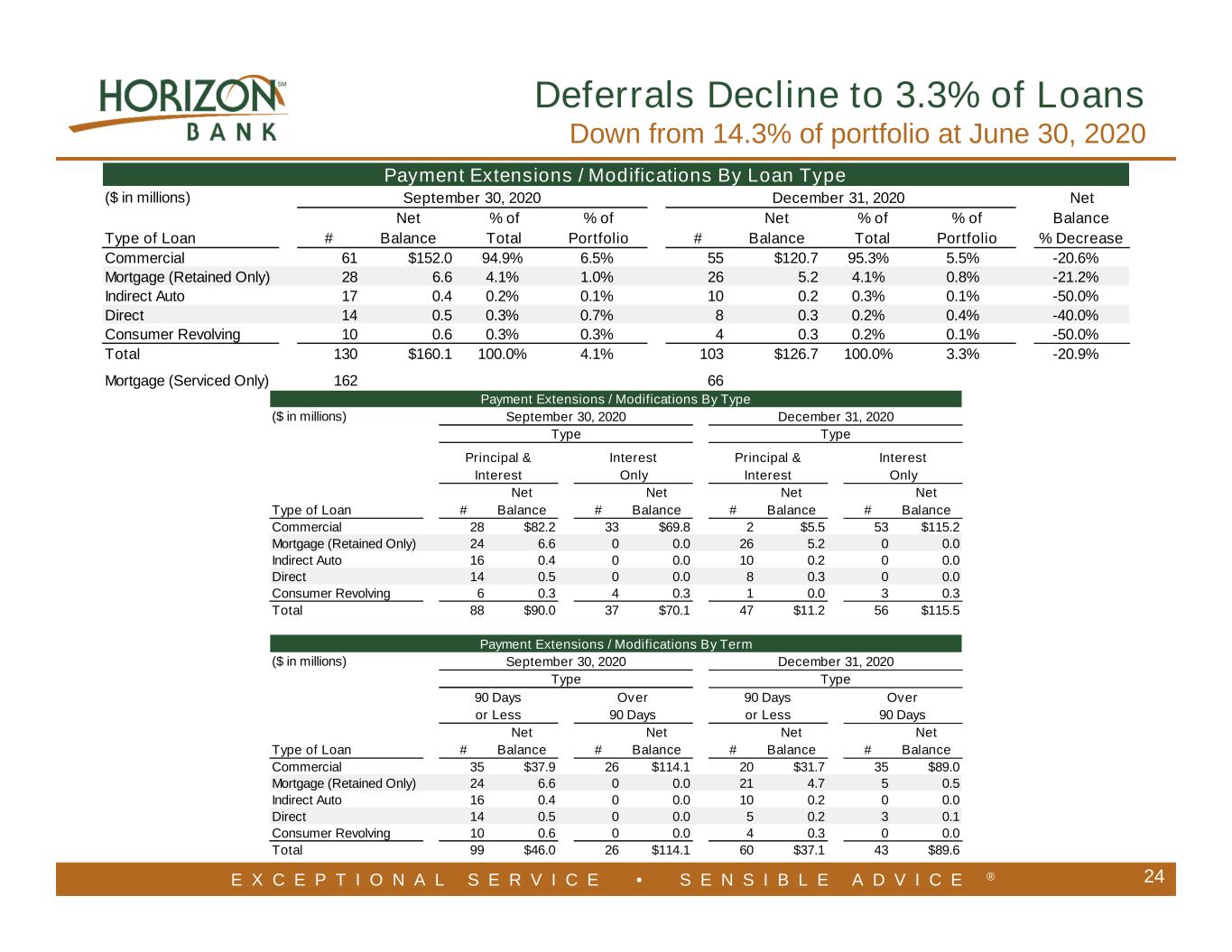

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 24 Deferrals Decline to 3.3% of Loans Down from 14.3% of portfolio at June 30, 2020 ($ in millions) Net Type of Loan # Net Balance % of Total % of Portfolio # Net Balance % of Total % of Portfolio Balance % Decrease Commercial 61 $152.0 94.9% 6.5% 55 $120.7 95.3% 5.5% -20.6% Mortgage (Retained Only) 28 6.6 4.1% 1.0% 26 5.2 4.1% 0.8% -21.2% Indirect Auto 17 0.4 0.2% 0.1% 10 0.2 0.3% 0.1% -50.0% Direct 14 0.5 0.3% 0.7% 8 0.3 0.2% 0.4% -40.0% Consumer Revolving 10 0.6 0.3% 0.3% 4 0.3 0.2% 0.1% -50.0% Total 130 $160.1 100.0% 4.1% 103 $126.7 100.0% 3.3% -20.9% Mortgage (Serviced Only) 162 66 Payment Extensions / Modifications By Loan Type September 30, 2020 December 31, 2020 ($ in millions) Type of Loan # Net Balance # Net Balance # Net Balance # Net Balance Commercial 28 $82.2 33 $69.8 2 $5.5 53 $115.2 Mortgage (Retained Only) 24 6.6 0 0.0 26 5.2 0 0.0 Indirect Auto 16 0.4 0 0.0 10 0.2 0 0.0 Direct 14 0.5 0 0.0 8 0.3 0 0.0 Consumer Revolving 6 0.3 4 0.3 1 0.0 3 0.3 Total 88 $90.0 37 $70.1 47 $11.2 56 $115.5 ($ in millions) Type of Loan # Net Balance # Net Balance # Net Balance # Net Balance Commercial 35 $37.9 26 $114.1 20 $31.7 35 $89.0 Mortgage (Retained Only) 24 6.6 0 0.0 21 4.7 5 0.5 Indirect Auto 16 0.4 0 0.0 10 0.2 0 0.0 Direct 14 0.5 0 0.0 5 0.2 3 0.1 Consumer Revolving 10 0.6 0 0.0 4 0.3 0 0.0 Total 99 $46.0 26 $114.1 60 $37.1 43 $89.6 90 Days or Less Over 90 Days 90 Days or Less Over 90 Days Type Type Principal & Interest Interest Only Principal & Interest Interest Only Payment Extensions / Modifications By Term September 30, 2020 December 31, 2020 Type Type Payment Extensions / Modifications By Type September 30, 2020 December 31, 2020

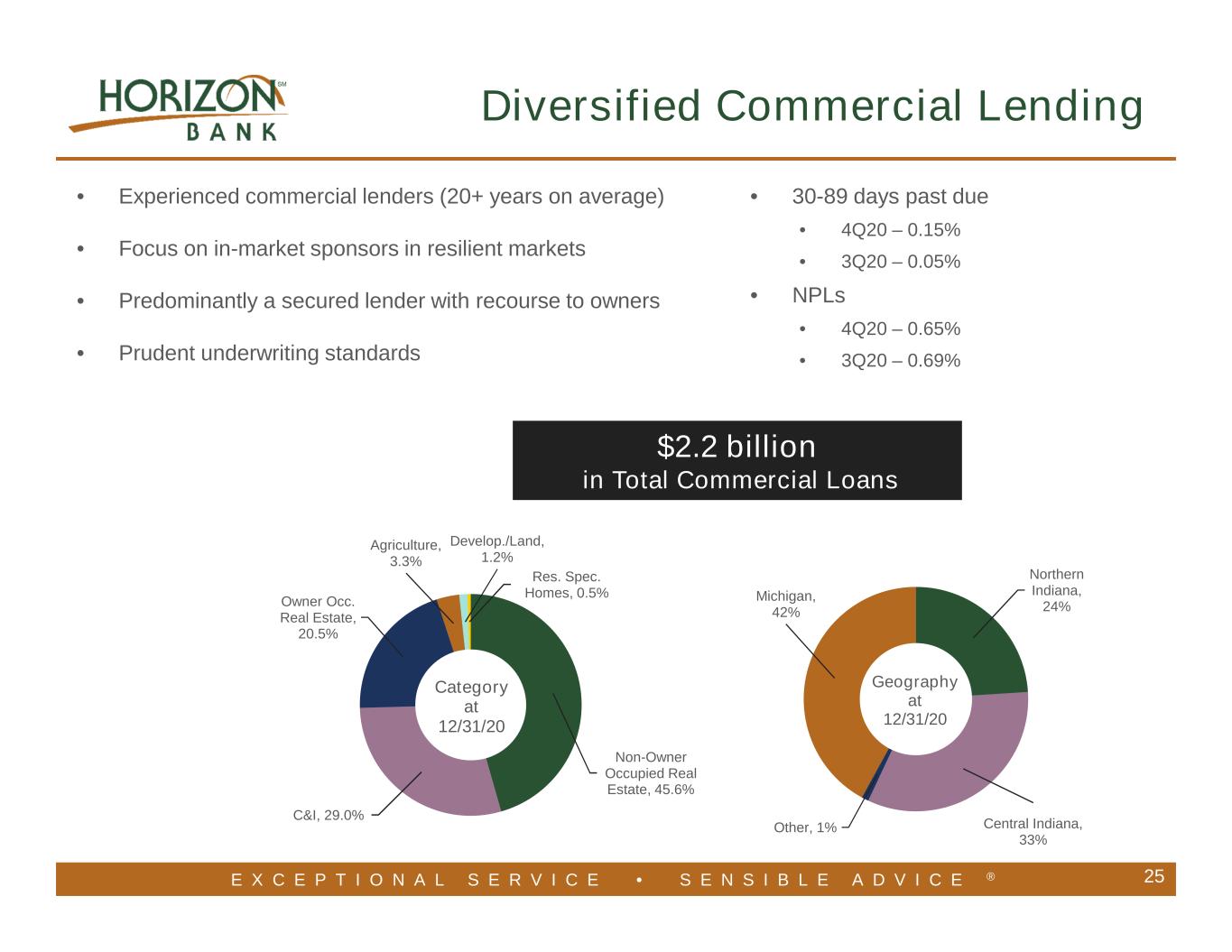

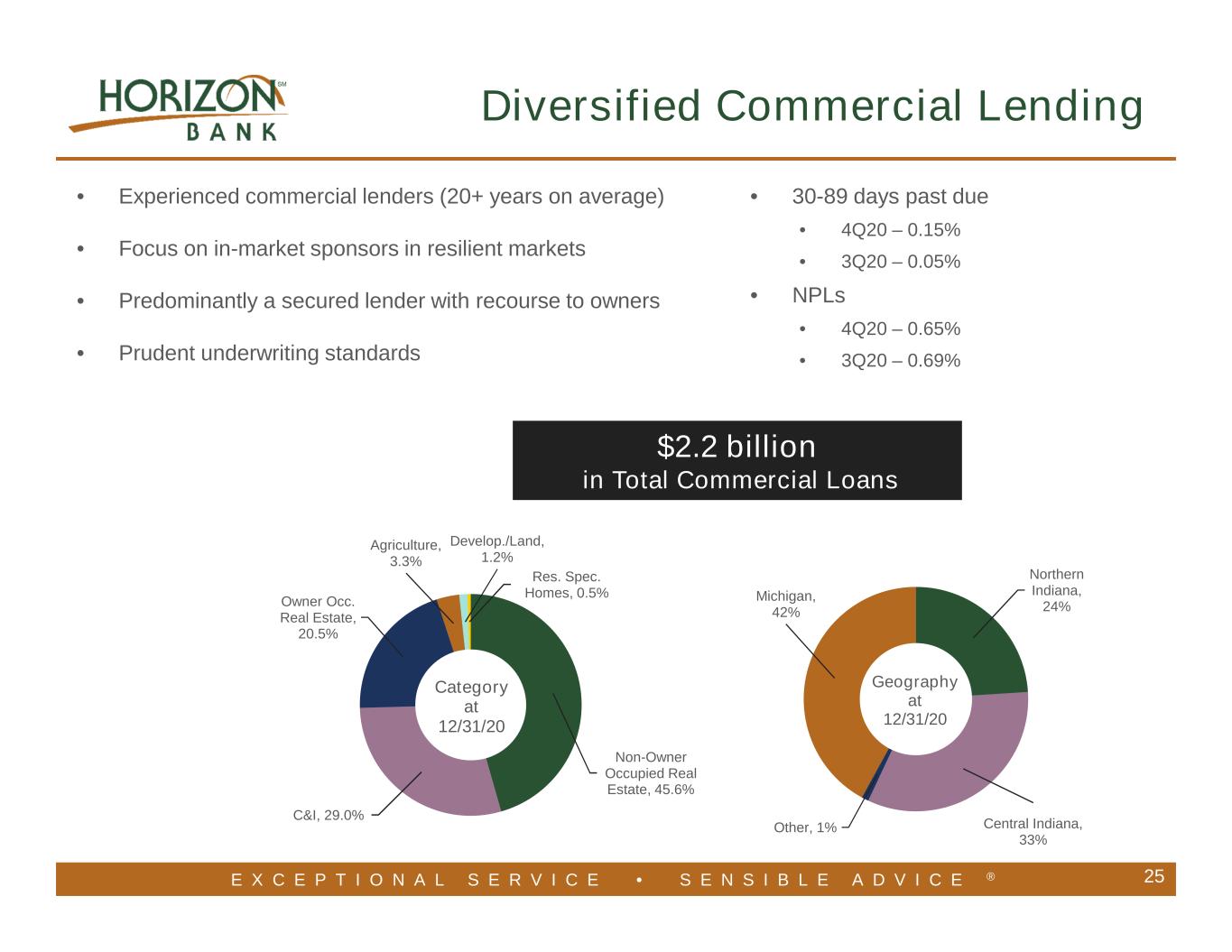

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® • Experienced commercial lenders (20+ years on average) • Focus on in-market sponsors in resilient markets • Predominantly a secured lender with recourse to owners • Prudent underwriting standards Northern Indiana, 24% Central Indiana, 33% Other, 1% Michigan, 42% Geography at 12/31/20 Non-Owner Occupied Real Estate, 45.6% C&I, 29.0% Owner Occ. Real Estate, 20.5% Agriculture, 3.3% Develop./Land, 1.2% Res. Spec. Homes, 0.5% Category at 12/31/20 Geography at June 30, 2020 $2.2 billion in Total Commercial Loans Diversified Commercial Lending 25 • 30-89 days past due • 4Q20 – 0.15% • 3Q20 – 0.05% • NPLs • 4Q20 – 0.65% • 3Q20 – 0.69%

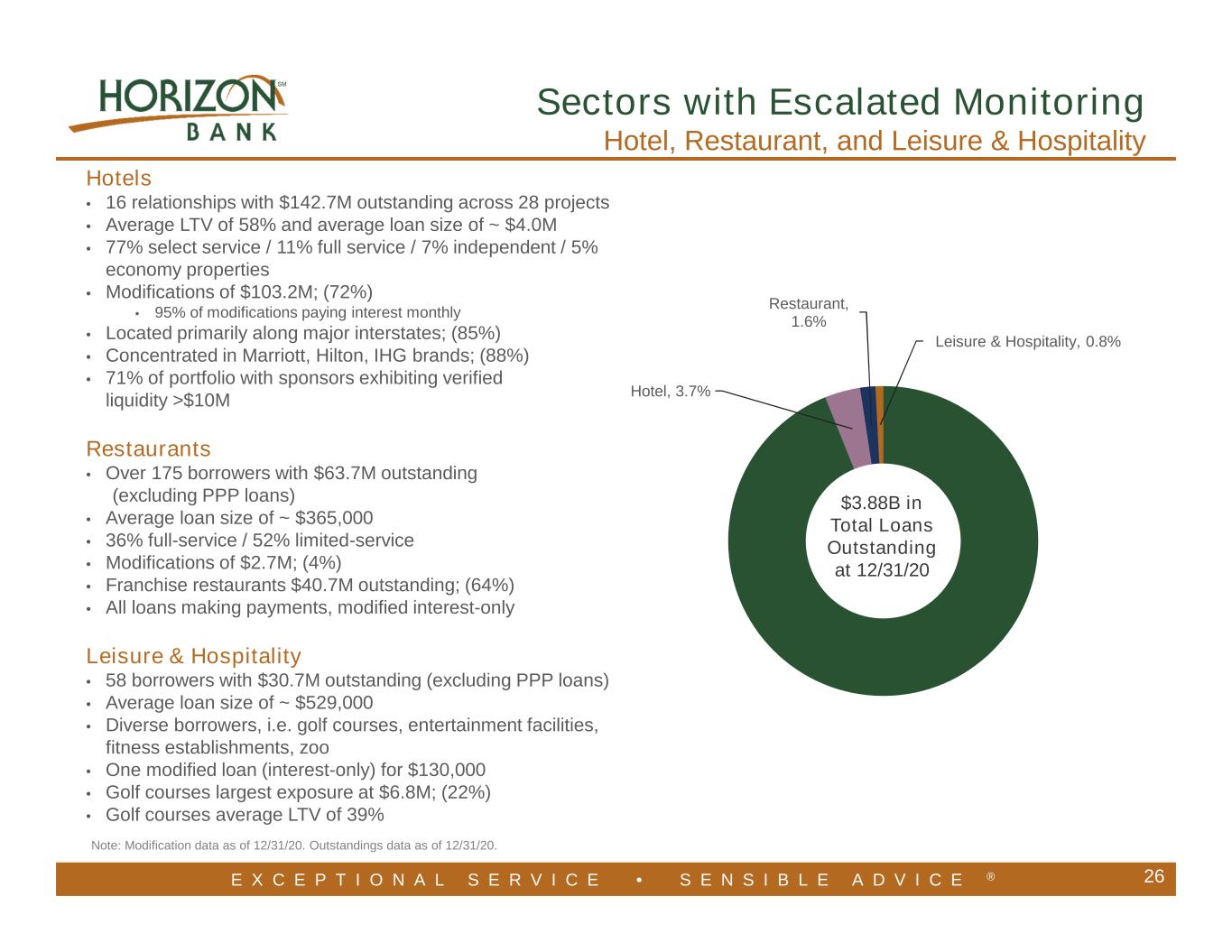

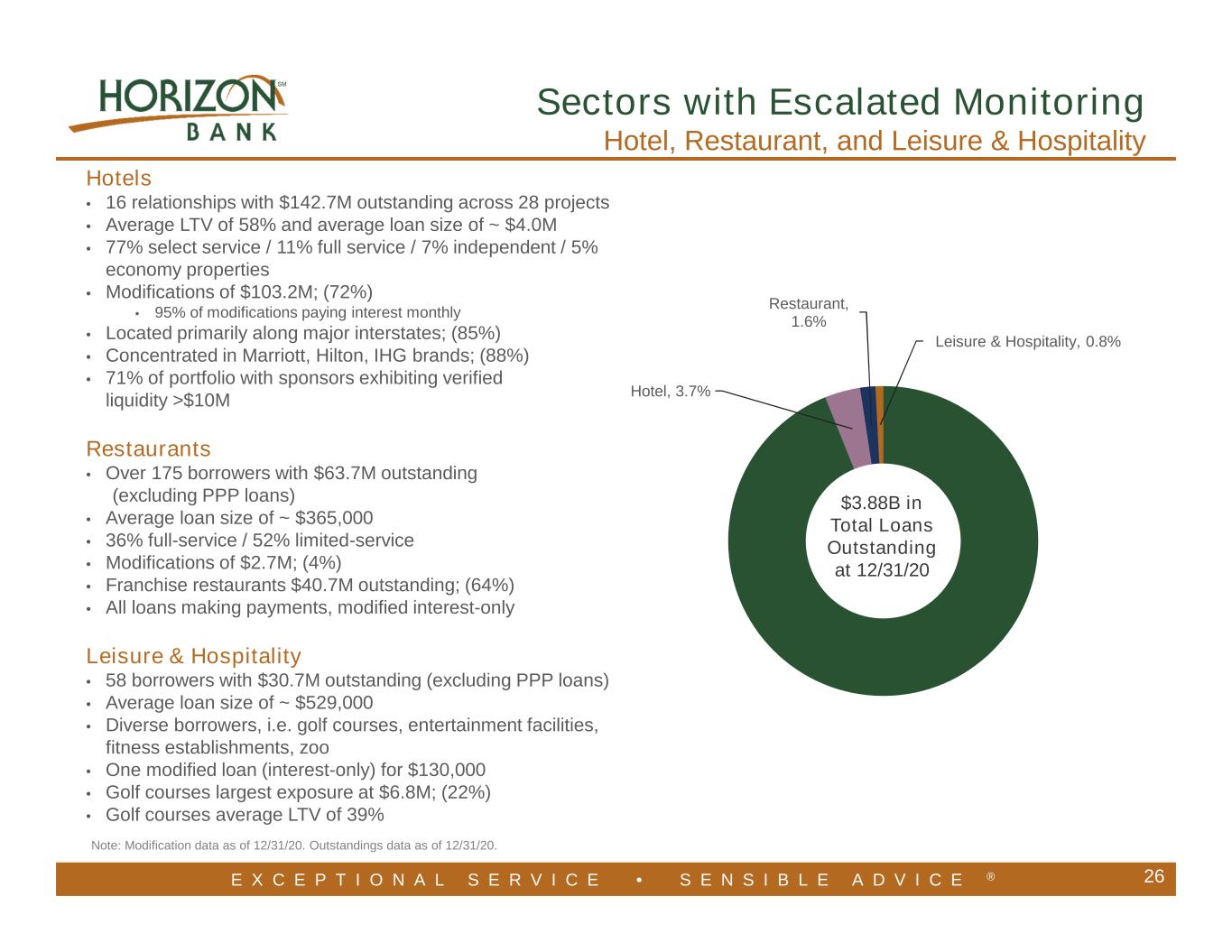

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 26 Hotels • 16 relationships with $142.7M outstanding across 28 projects • Average LTV of 58% and average loan size of ~ $4.0M • 77% select service / 11% full service / 7% independent / 5% economy properties • Modifications of $103.2M; (72%) • 95% of modifications paying interest monthly • Located primarily along major interstates; (85%) • Concentrated in Marriott, Hilton, IHG brands; (88%) • 71% of portfolio with sponsors exhibiting verified liquidity >$10M Restaurants • Over 175 borrowers with $63.7M outstanding (excluding PPP loans) • Average loan size of ~ $365,000 • 36% full-service / 52% limited-service • Modifications of $2.7M; (4%) • Franchise restaurants $40.7M outstanding; (64%) • All loans making payments, modified interest-only Leisure & Hospitality • 58 borrowers with $30.7M outstanding (excluding PPP loans) • Average loan size of ~ $529,000 • Diverse borrowers, i.e. golf courses, entertainment facilities, fitness establishments, zoo • One modified loan (interest-only) for $130,000 • Golf courses largest exposure at $6.8M; (22%) • Golf courses average LTV of 39% Hotel, 3.7% Restaurant, 1.6% Leisure & Hospitality, 0.8% Note: Modification data as of 12/31/20. Outstandings data as of 12/31/20. Sectors with Escalated Monitoring Hotel, Restaurant, and Leisure & Hospitality $3.88B in Total Loans Outstanding at 12/31/20

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 27 HOTEL SECTOR E X C E P T I O N A L S E R V I C E • Q U A L I T Y A D V I C E ® 27 FAVORABLE LOCATIONS Majority are located near major interstate highways or resort communities, which have rebounded faster than hotels located in metropolitan areas 95% of modified Hotel loans making interest payments monthly ALL HOTELS OPEN All hotel loans in Horizon’s portfolio are open for business, with occupancy rates ranging 22% - 55% Strong brands including Marriott, Hilton, IHG, Wyndham, Choice Hotels and independent brands Borrowers are long-time operators that have managed through multiple economic cycles and most have liquid resources available to them . INDIANA MICHIGAN OHIO ILLINOIS WISCONSIN KENTUCKY 16 Relationships 28 Projects $143M Outstanding 3.7% of Total Loans

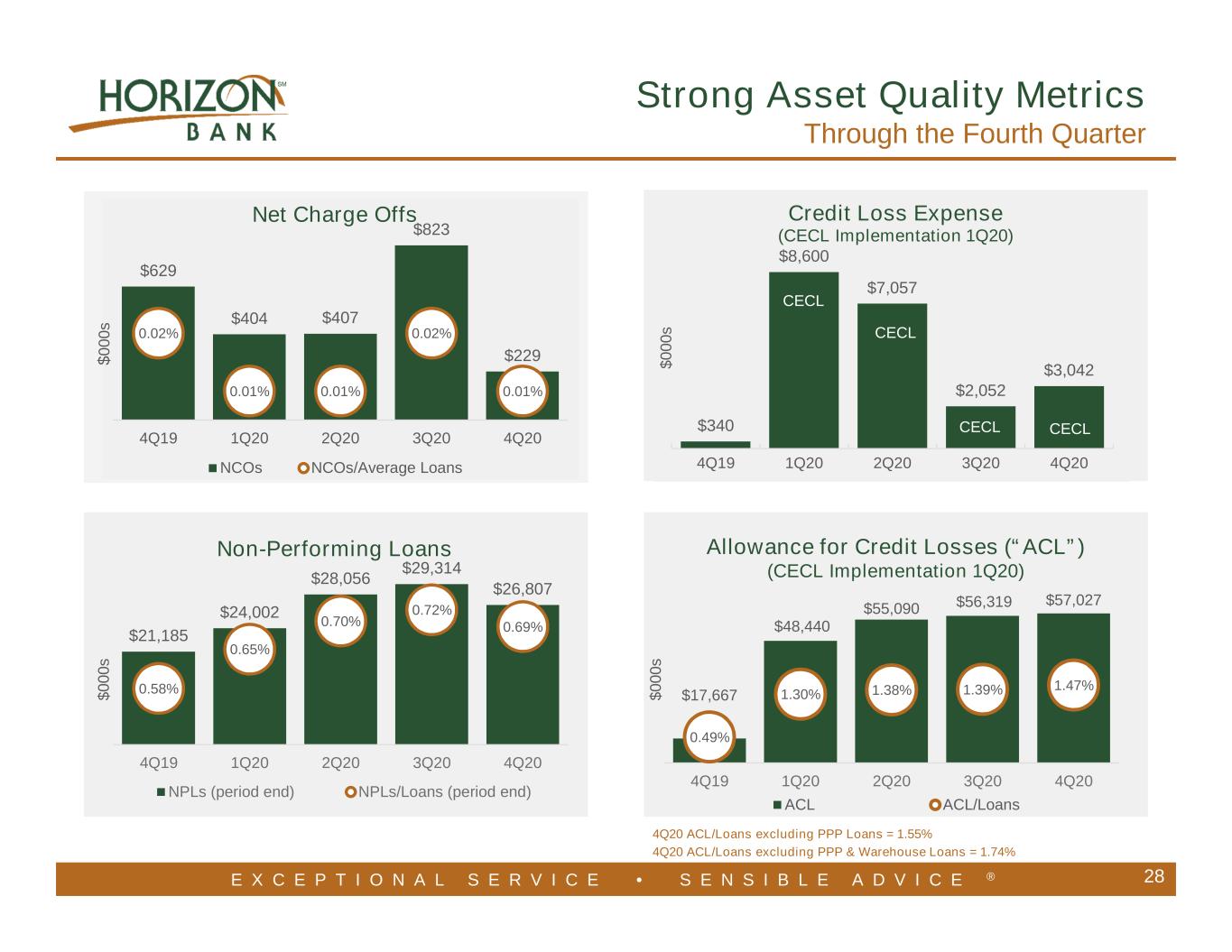

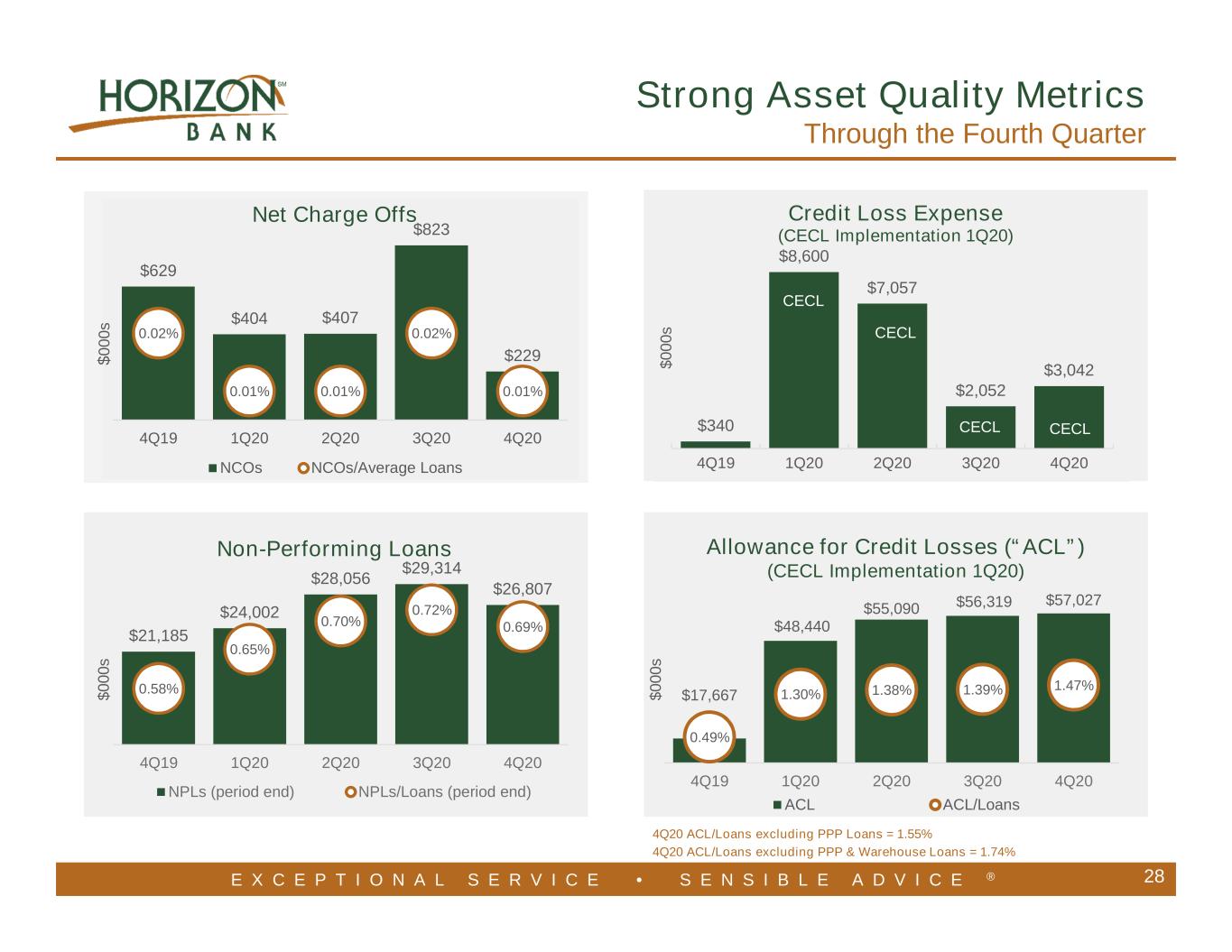

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® $629 $404 $407 $823 $229 0.02% 0.01% 0.01% 0.02% 0.01% 4Q19 1Q20 2Q20 3Q20 4Q20 Net Charge Offs NCOs NCOs/Average Loans $ 0 0 0 s $21,185 $24,002 $28,056 $29,314 $26,807 0.58% 0.65% 0.70% 0.72% 0.69% 4Q19 1Q20 2Q20 3Q20 4Q20 Non-Performing Loans NPLs (period end) NPLs/Loans (period end) $ 0 0 0 s $340 $8,600 $7,057 $2,052 $3,042 4Q19 1Q20 2Q20 3Q20 4Q20 $ 0 0 0 s 28 CECL CECL $17,667 $48,440 $55,090 $56,319 $57,027 0.49% 1.30% 1.38% 1.39% 1.47% 4Q19 1Q20 2Q20 3Q20 4Q20 ACL ACL/Loans CECL Strong Asset Quality Metrics Through the Fourth Quarter Allowance for Credit Losses (“ACL”) (CECL Implementation 1Q20) $ 0 0 0 s Credit Loss Expense (CECL Implementation 1Q20) CECL 4Q20 ACL/Loans excluding PPP Loans = 1.55% 4Q20 ACL/Loans excluding PPP & Warehouse Loans = 1.74% CECL

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 29 Key Franchise Highlights Seasoned management team – over 200 years combined banking experience Geographic diversification & exposure – strong market share in core footprint Stable Midwest markets with balanced industrial bases and growth opportunities High quality balance sheet with strong liquidity – approximately $1.6 billion of cash and securities as of 12/31/20 Robust capital position 13.9% Tier 1 and 14.9% Total RBC as of 12/31/20 Diversified loan portfolio and complementary counter-cyclical revenue streams Historical run rate demonstrates strong core operating earnings 30-year unbroken quarterly cash dividend record, with strong cash position at the holding company that represents approximately 18 quarters of the current dividend plus fixed costs

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 30 Appendix

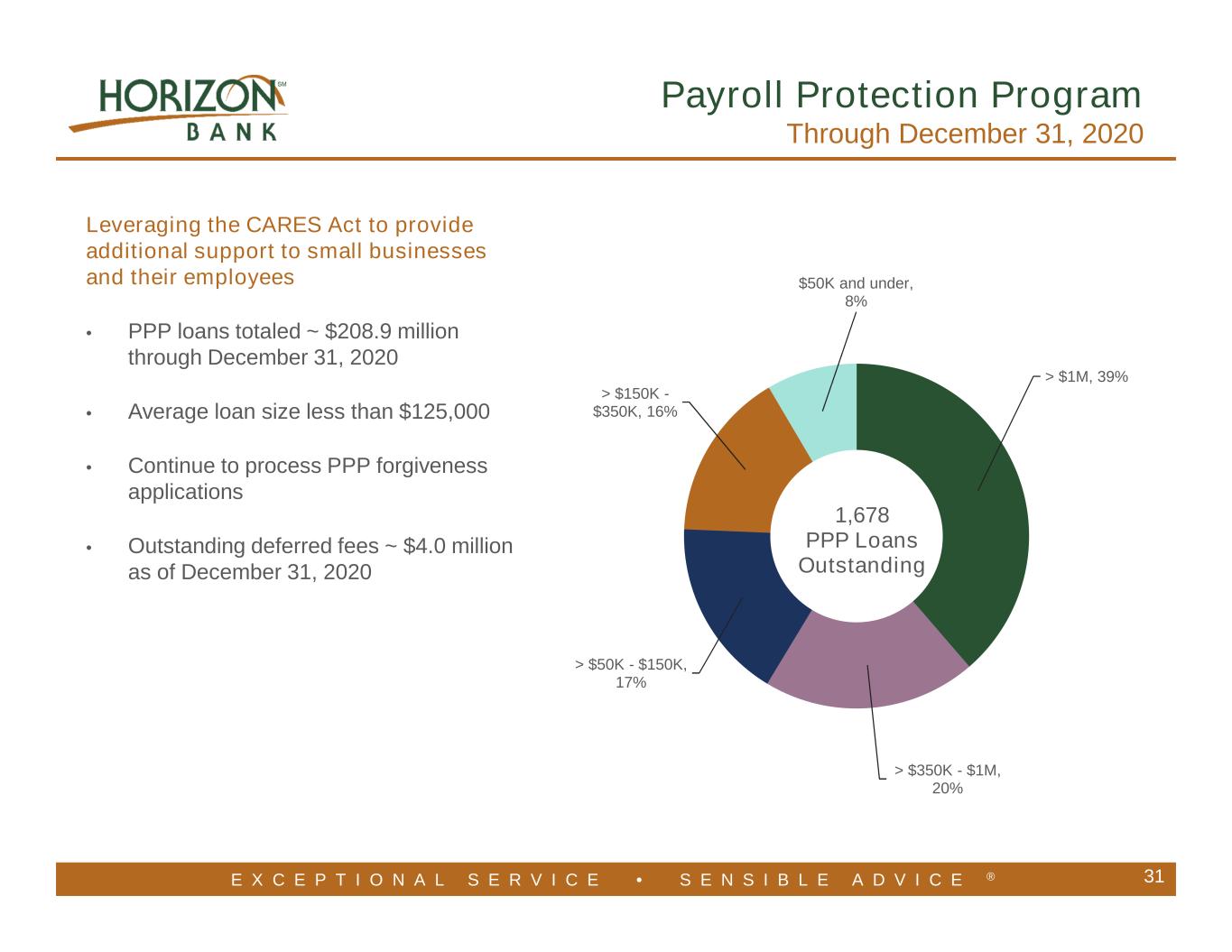

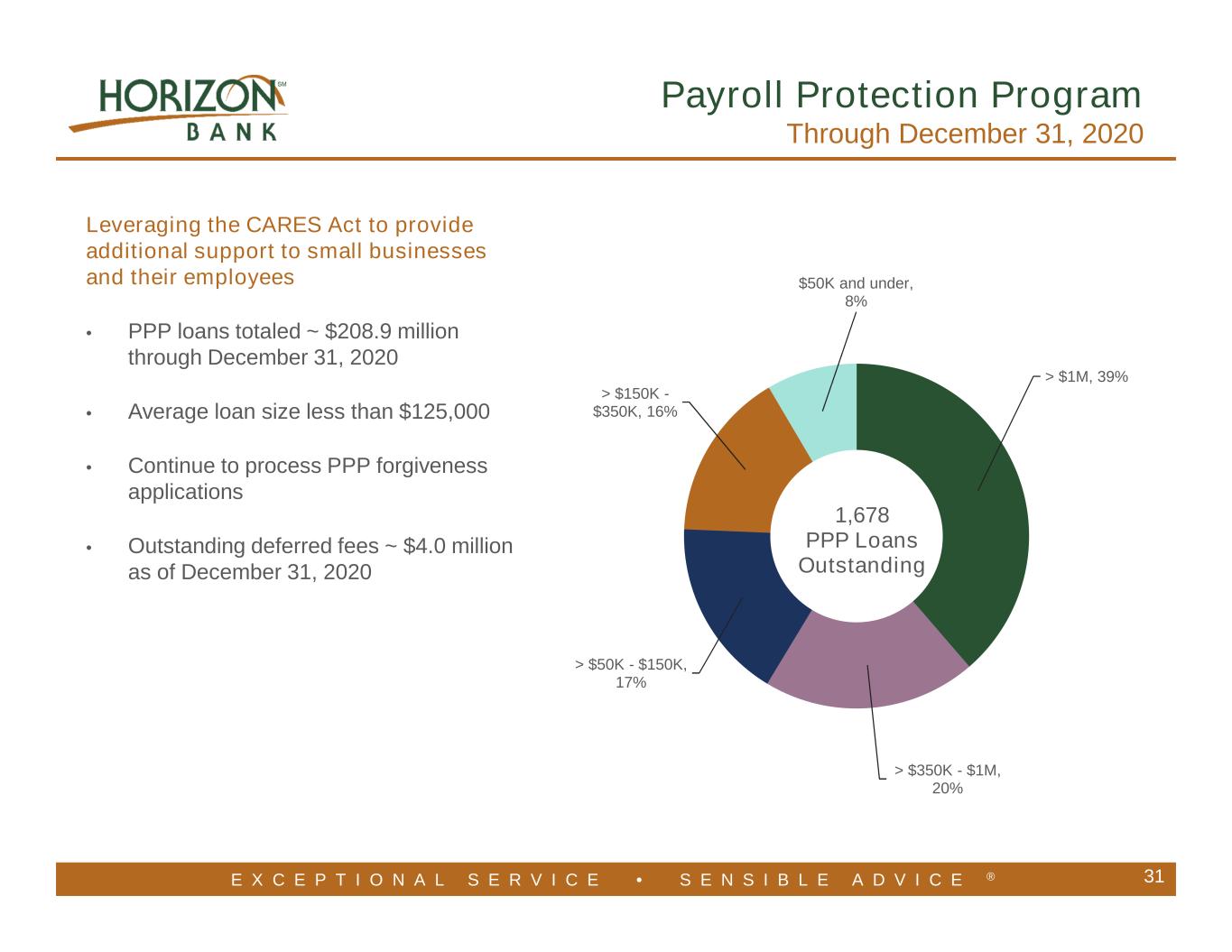

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 31 Leveraging the CARES Act to provide additional support to small businesses and their employees • PPP loans totaled ~ $208.9 million through December 31, 2020 • Average loan size less than $125,000 • Continue to process PPP forgiveness applications • Outstanding deferred fees ~ $4.0 million as of December 31, 2020 > $1M, 39% > $350K - $1M, 20% > $50K - $150K, 17% > $150K - $350K, 16% $50K and under, 8% 1,678 PPP Loans Outstanding Payroll Protection Program Through December 31, 2020

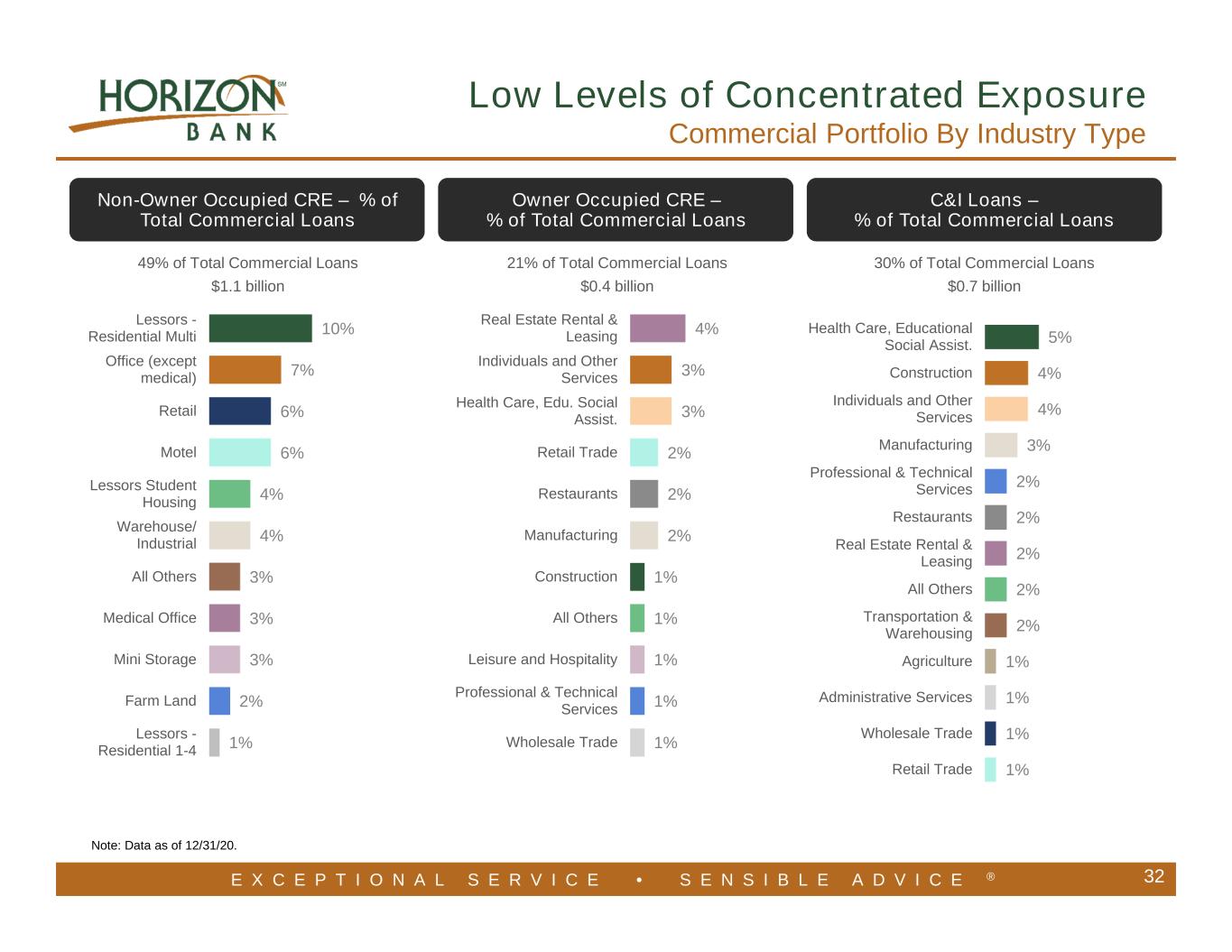

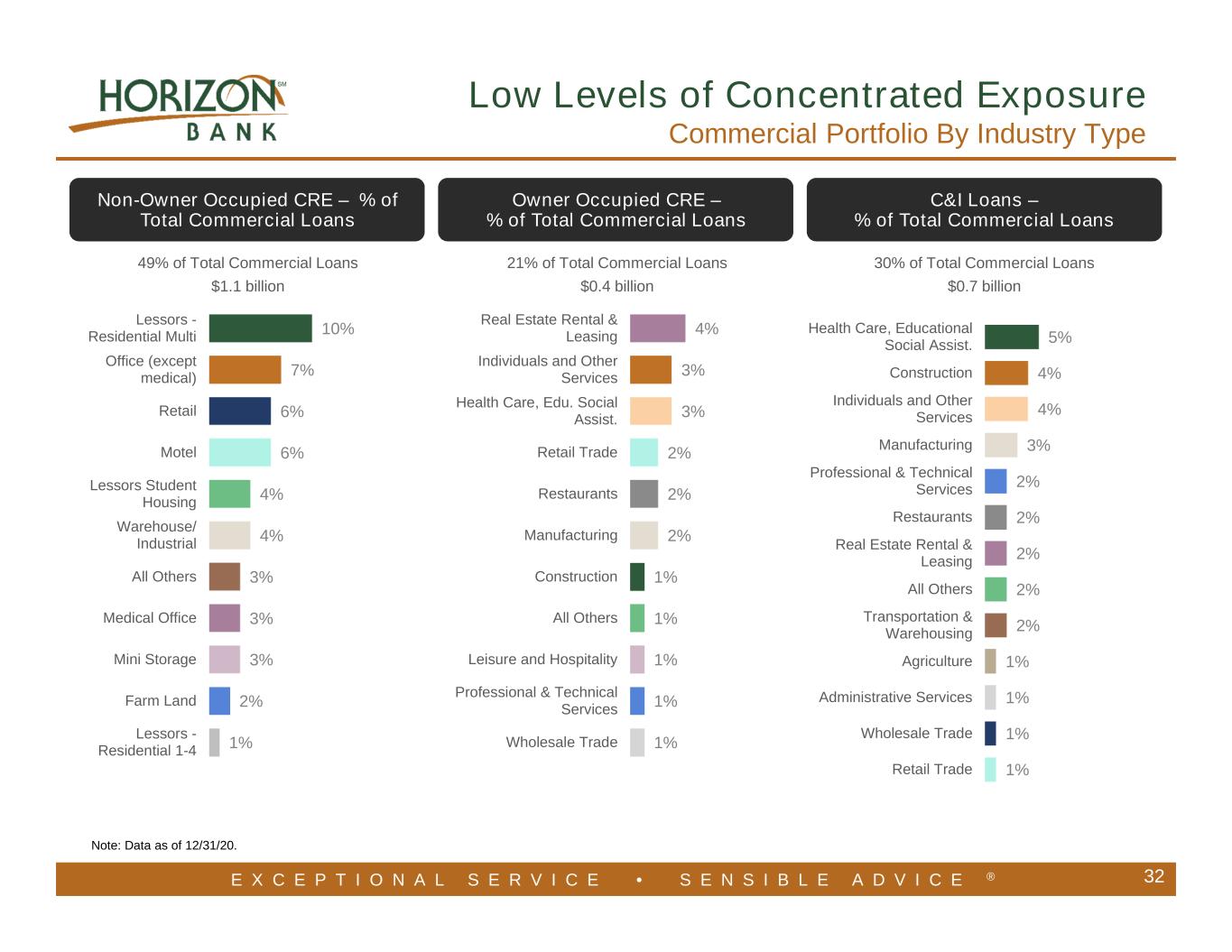

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 1% 2% 3% 3% 3% 4% 4% 6% 6% 7% 10% Lessors - Residential 1-4 Farm Land Mini Storage Medical Office All Others Warehouse/ Industrial Lessors Student Housing Motel Retail Office (except medical) Lessors - Residential Multi 1% 1% 1% 1% 1% 2% 2% 2% 3% 3% 4% Wholesale Trade Professional & Technical Services Leisure and Hospitality All Others Construction Manufacturing Restaurants Retail Trade Health Care, Edu. Social Assist. Individuals and Other Services Real Estate Rental & Leasing 1% 1% 1% 1% 2% 2% 2% 2% 2% 3% 4% 4% 5% Retail Trade Wholesale Trade Administrative Services Agriculture Transportation & Warehousing All Others Real Estate Rental & Leasing Restaurants Professional & Technical Services Manufacturing Individuals and Other Services Construction Health Care, Educational Social Assist. 32 Non-Owner Occupied CRE – % of Total Commercial Loans Owner Occupied CRE – % of Total Commercial Loans 49% of Total Commercial Loans $1.1 billion 21% of Total Commercial Loans $0.4 billion C&I Loans – % of Total Commercial Loans 30% of Total Commercial Loans $0.7 billion Note: Data as of 12/31/20. Low Levels of Concentrated Exposure Commercial Portfolio By Industry Type

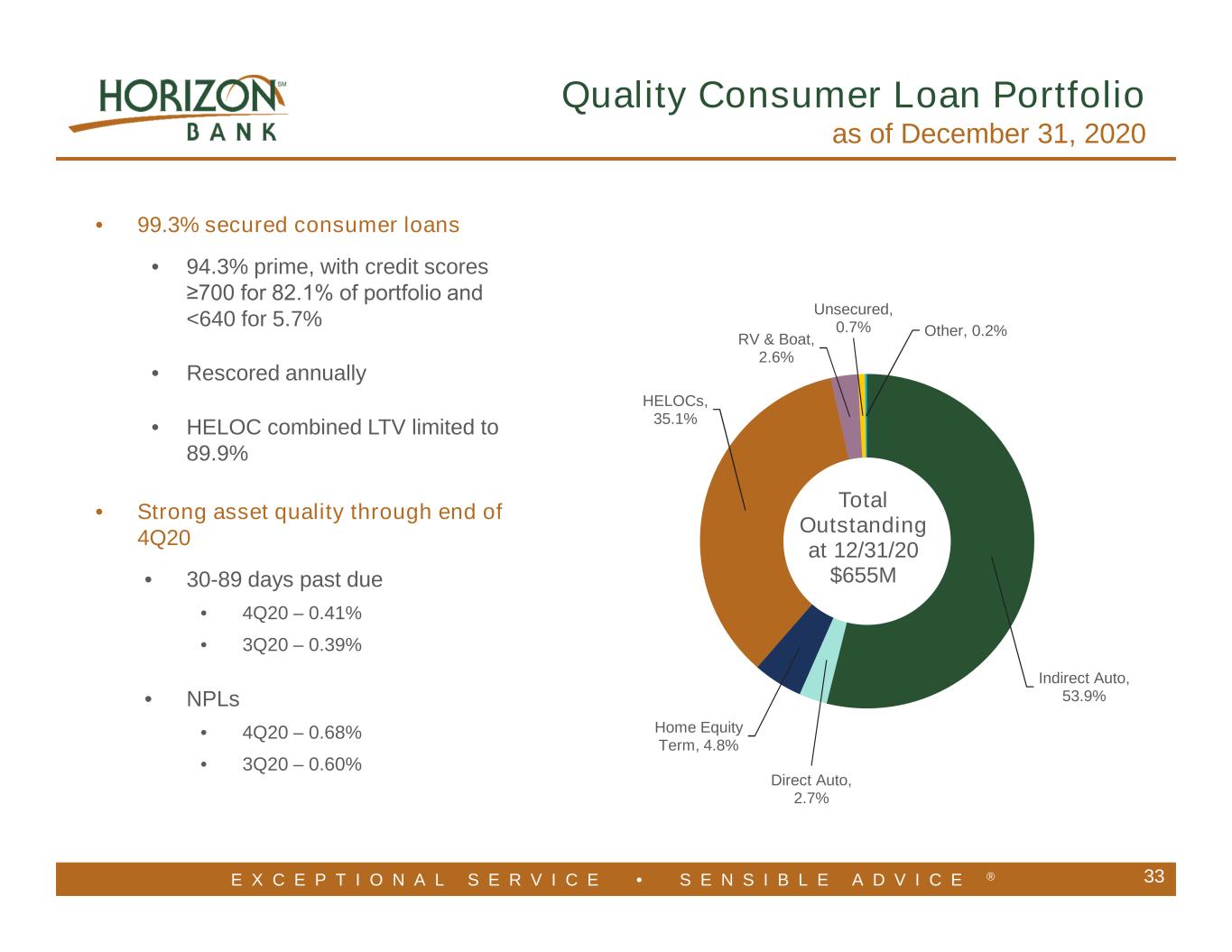

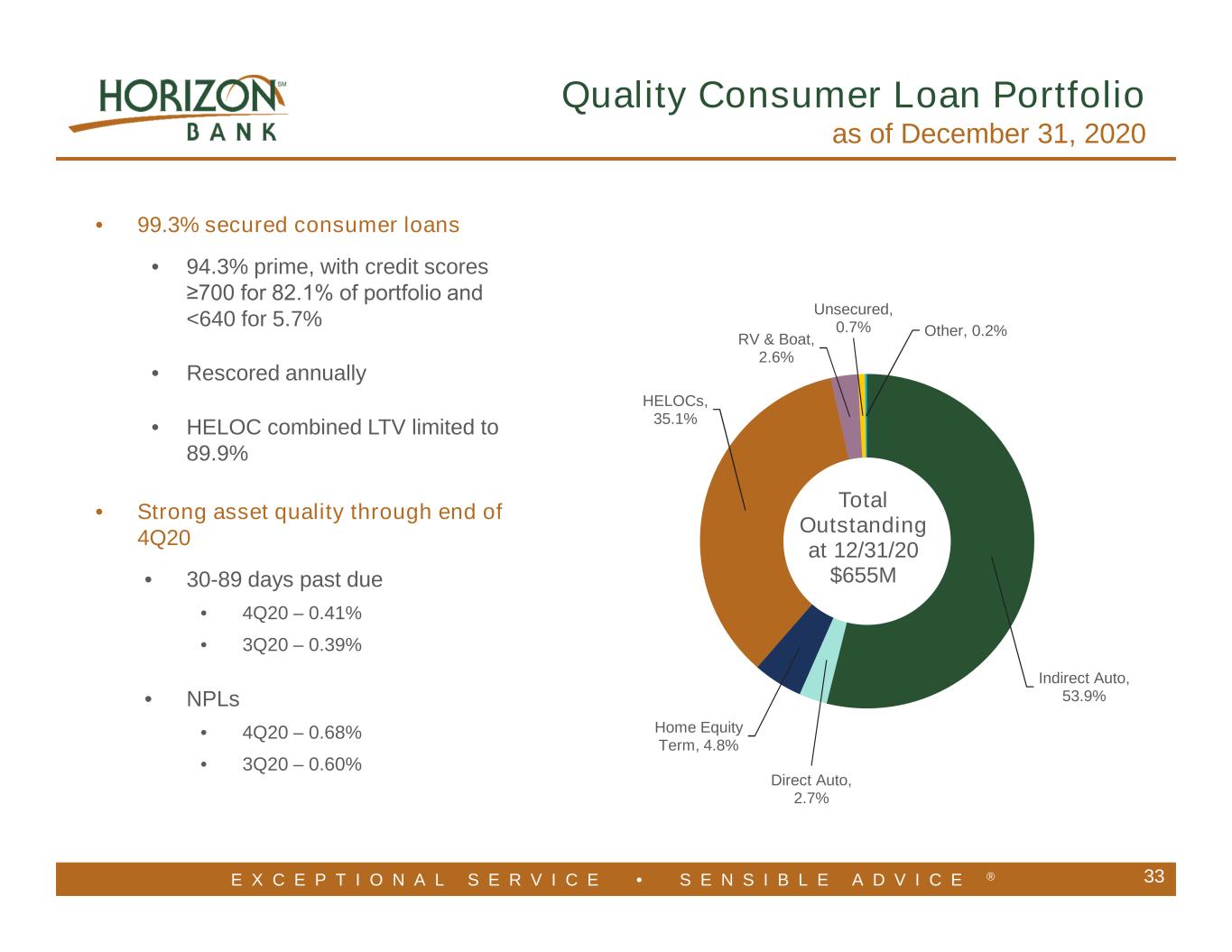

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 33 • 99.3% secured consumer loans • 94.3% prime, with credit scores ≥700 for 82.1% of portfolio and <640 for 5.7% • Rescored annually • HELOC combined LTV limited to 89.9% • Strong asset quality through end of 4Q20 • 30-89 days past due • 4Q20 – 0.41% • 3Q20 – 0.39% • NPLs • 4Q20 – 0.68% • 3Q20 – 0.60% Indirect Auto, 53.9% Direct Auto, 2.7% Home Equity Term, 4.8% HELOCs, 35.1% RV & Boat, 2.6% Unsecured, 0.7% Other, 0.2% Total Outstanding at 12/31/20 $655M Quality Consumer Loan Portfolio as of December 31, 2020

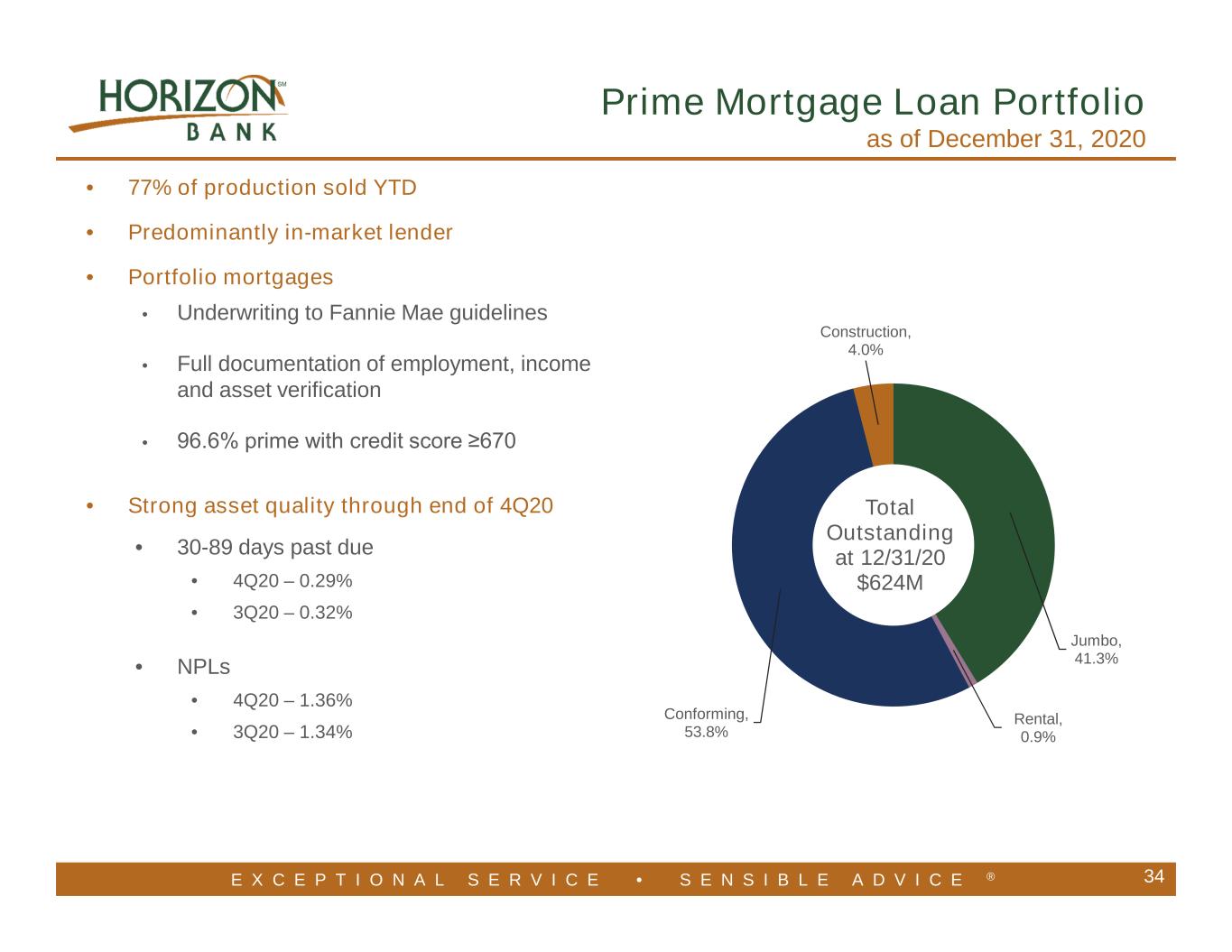

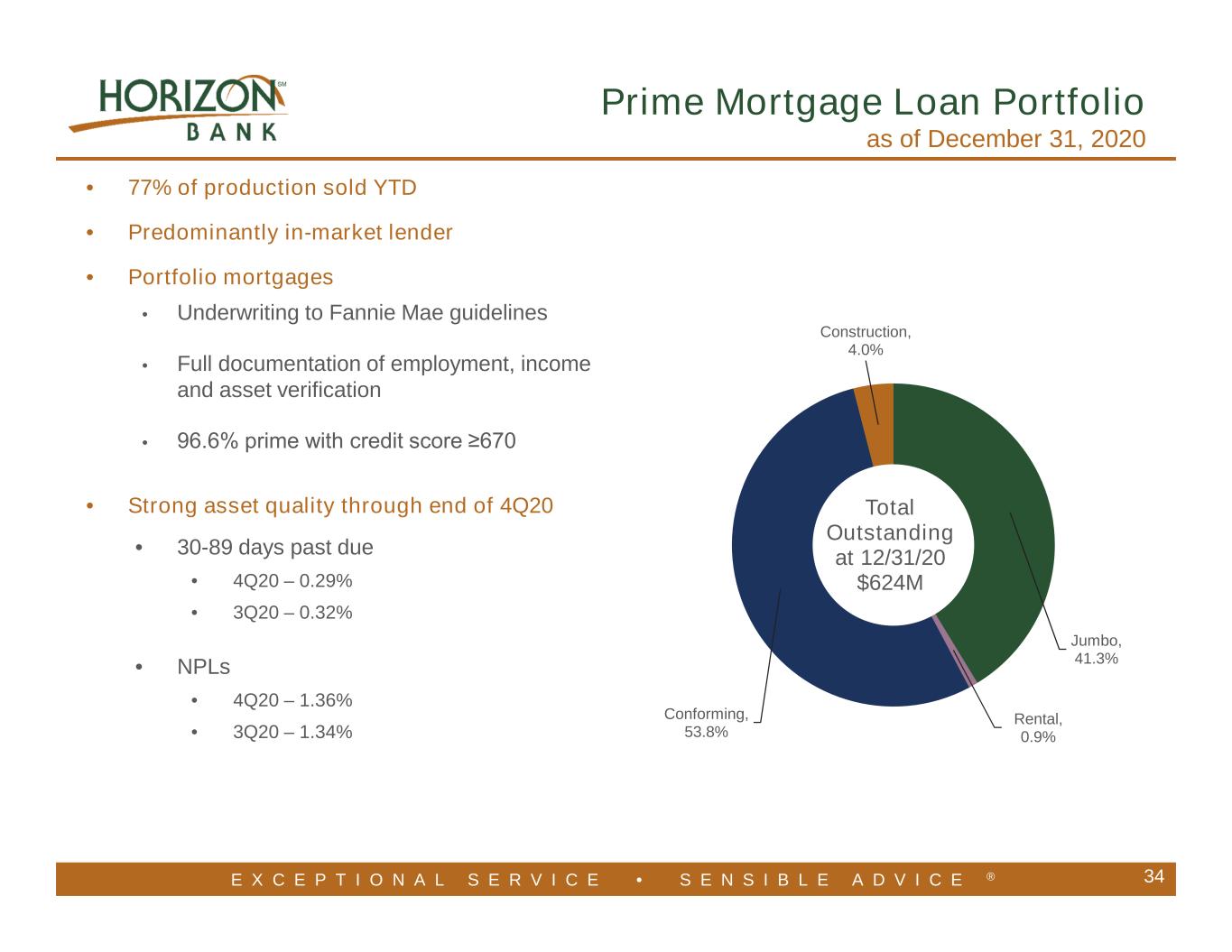

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 34 Jumbo, 41.3% Rental, 0.9% Conforming, 53.8% Construction, 4.0% Total Outstanding at 12/31/20 $624M • 77% of production sold YTD • Predominantly in-market lender • Portfolio mortgages • Underwriting to Fannie Mae guidelines • Full documentation of employment, income and asset verification • 96.6% prime with credit score ≥670 • Strong asset quality through end of 4Q20 • 30-89 days past due • 4Q20 – 0.29% • 3Q20 – 0.32% • NPLs • 4Q20 – 1.36% • 3Q20 – 1.34% Prime Mortgage Loan Portfolio as of December 31, 2020

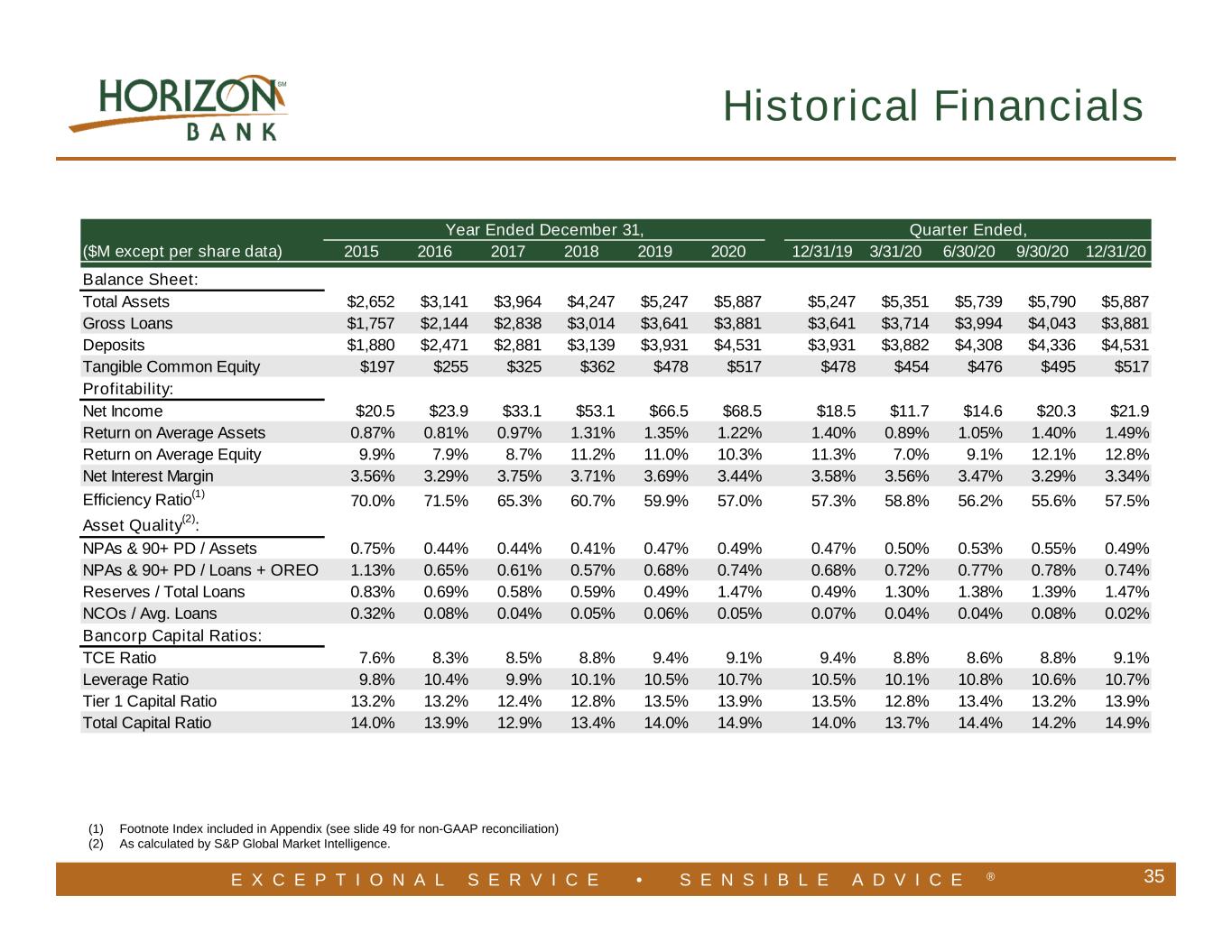

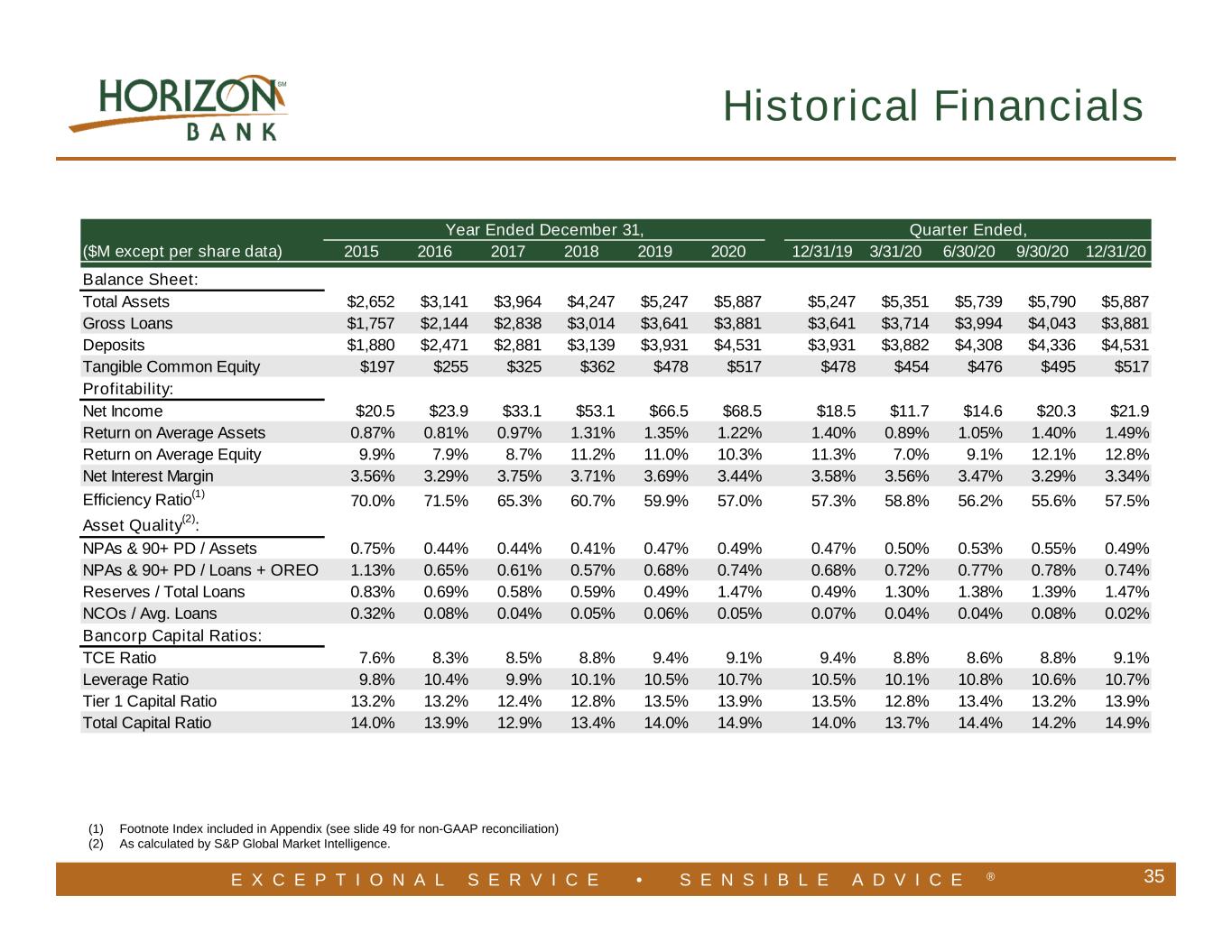

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 35 (1) Footnote Index included in Appendix (see slide 49 for non-GAAP reconciliation) (2) As calculated by S&P Global Market Intelligence. Historical Financials ($M except per share data) 2015 2016 2017 2018 2019 2020 12/31/19 3/31/20 6/30/20 9/30/20 12/31/20 Balance Sheet: Total Assets $2,652 $3,141 $3,964 $4,247 $5,247 $5,887 $5,247 $5,351 $5,739 $5,790 $5,887 Gross Loans $1,757 $2,144 $2,838 $3,014 $3,641 $3,881 $3,641 $3,714 $3,994 $4,043 $3,881 Deposits $1,880 $2,471 $2,881 $3,139 $3,931 $4,531 $3,931 $3,882 $4,308 $4,336 $4,531 Tangible Common Equity $197 $255 $325 $362 $478 $517 $478 $454 $476 $495 $517 Profitability: Net Income $20.5 $23.9 $33.1 $53.1 $66.5 $68.5 $18.5 $11.7 $14.6 $20.3 $21.9 Return on Average Assets 0.87% 0.81% 0.97% 1.31% 1.35% 1.22% 1.40% 0.89% 1.05% 1.40% 1.49% Return on Average Equity 9.9% 7.9% 8.7% 11.2% 11.0% 10.3% 11.3% 7.0% 9.1% 12.1% 12.8% Net Interest Margin 3.56% 3.29% 3.75% 3.71% 3.69% 3.44% 3.58% 3.56% 3.47% 3.29% 3.34% Efficiency Ratio (1) 70.0% 71.5% 65.3% 60.7% 59.9% 57.0% 57.3% 58.8% 56.2% 55.6% 57.5% Asset Quality (2) : NPAs & 90+ PD / Assets 0.75% 0.44% 0.44% 0.41% 0.47% 0.49% 0.47% 0.50% 0.53% 0.55% 0.49% NPAs & 90+ PD / Loans + OREO 1.13% 0.65% 0.61% 0.57% 0.68% 0.74% 0.68% 0.72% 0.77% 0.78% 0.74% Reserves / Total Loans 0.83% 0.69% 0.58% 0.59% 0.49% 1.47% 0.49% 1.30% 1.38% 1.39% 1.47% NCOs / Avg. Loans 0.32% 0.08% 0.04% 0.05% 0.06% 0.05% 0.07% 0.04% 0.04% 0.08% 0.02% Bancorp Capital Ratios: TCE Ratio 7.6% 8.3% 8.5% 8.8% 9.4% 9.1% 9.4% 8.8% 8.6% 8.8% 9.1% Leverage Ratio 9.8% 10.4% 9.9% 10.1% 10.5% 10.7% 10.5% 10.1% 10.8% 10.6% 10.7% Tier 1 Capital Ratio 13.2% 13.2% 12.4% 12.8% 13.5% 13.9% 13.5% 12.8% 13.4% 13.2% 13.9% Total Capital Ratio 14.0% 13.9% 12.9% 13.4% 14.0% 14.9% 14.0% 13.7% 14.4% 14.2% 14.9% Year Ended December 31, Quarter Ended,

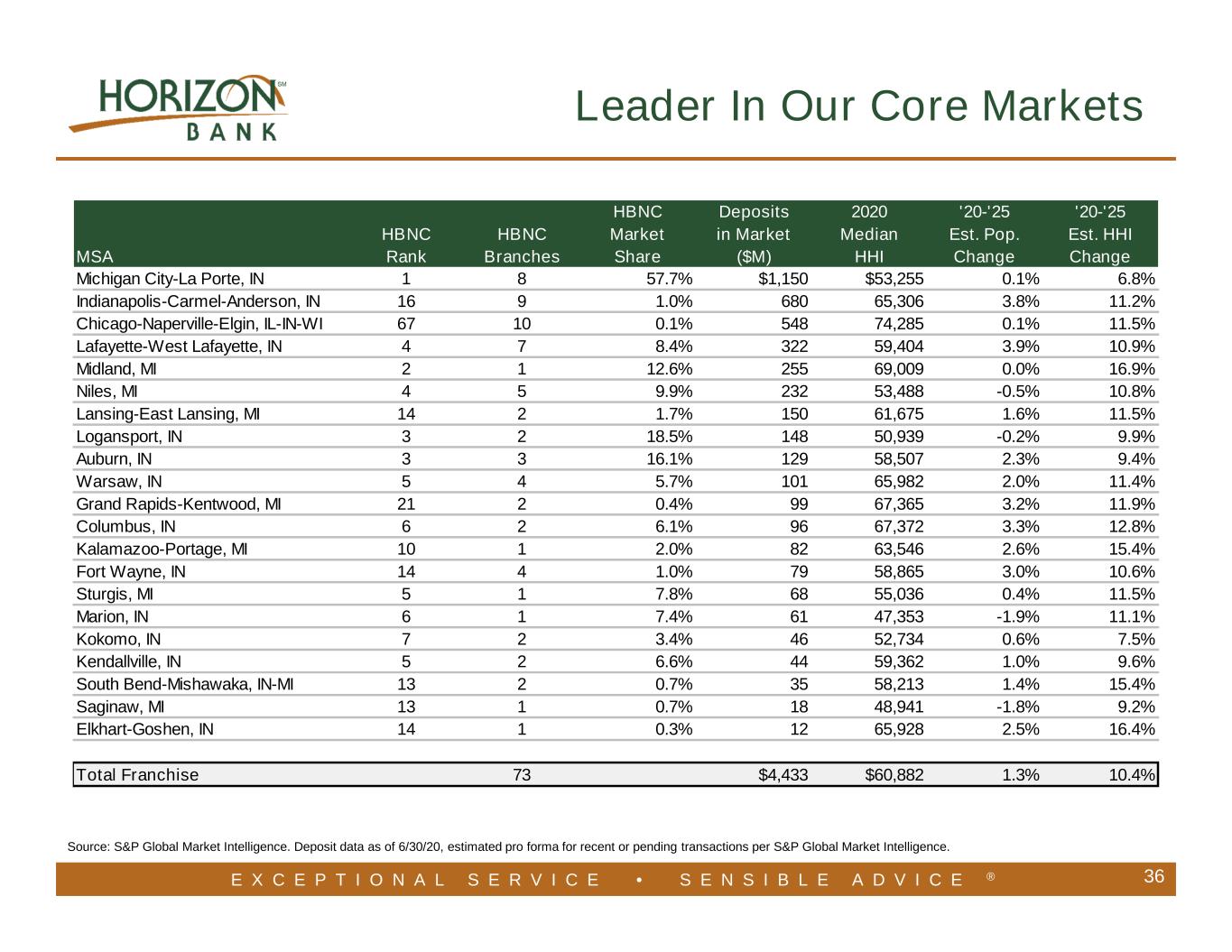

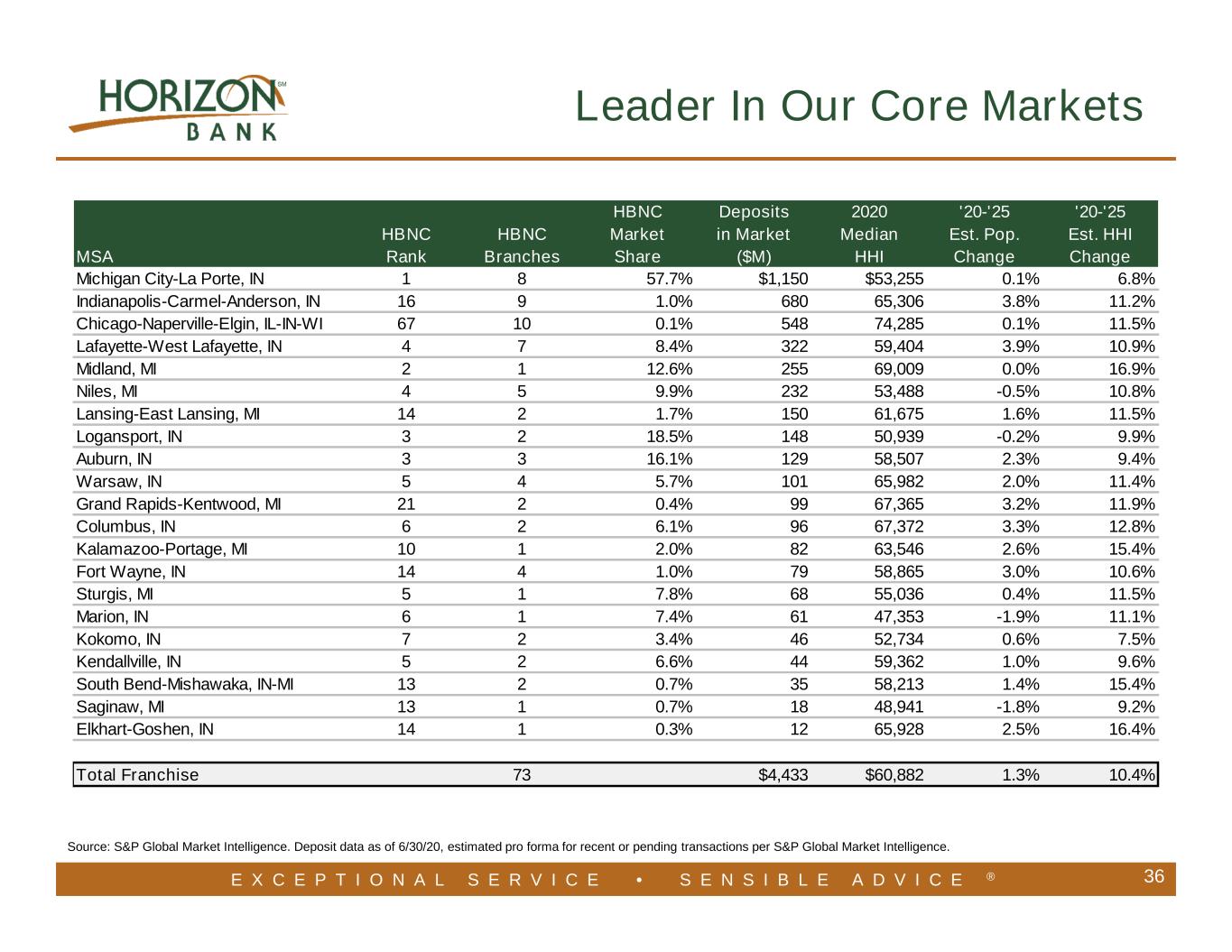

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 36 Source: S&P Global Market Intelligence. Deposit data as of 6/30/20, estimated pro forma for recent or pending transactions per S&P Global Market Intelligence. Leader In Our Core Markets MSA HBNC Rank HBNC Branches HBNC Market Share Deposits in Market ($M) 2020 Median HHI '20-'25 Est. Pop. Change '20-'25 Est. HHI Change Michigan City-La Porte, IN 1 8 57.7% $1,150 $53,255 0.1% 6.8% Indianapolis-Carmel-Anderson, IN 16 9 1.0% 680 65,306 3.8% 11.2% Chicago-Naperville-Elgin, IL-IN-WI 67 10 0.1% 548 74,285 0.1% 11.5% Lafayette-West Lafayette, IN 4 7 8.4% 322 59,404 3.9% 10.9% Midland, MI 2 1 12.6% 255 69,009 0.0% 16.9% Niles, MI 4 5 9.9% 232 53,488 -0.5% 10.8% Lansing-East Lansing, MI 14 2 1.7% 150 61,675 1.6% 11.5% Logansport, IN 3 2 18.5% 148 50,939 -0.2% 9.9% Auburn, IN 3 3 16.1% 129 58,507 2.3% 9.4% Warsaw, IN 5 4 5.7% 101 65,982 2.0% 11.4% Grand Rapids-Kentwood, MI 21 2 0.4% 99 67,365 3.2% 11.9% Columbus, IN 6 2 6.1% 96 67,372 3.3% 12.8% Kalamazoo-Portage, MI 10 1 2.0% 82 63,546 2.6% 15.4% Fort Wayne, IN 14 4 1.0% 79 58,865 3.0% 10.6% Sturgis, MI 5 1 7.8% 68 55,036 0.4% 11.5% Marion, IN 6 1 7.4% 61 47,353 -1.9% 11.1% Kokomo, IN 7 2 3.4% 46 52,734 0.6% 7.5% Kendallville, IN 5 2 6.6% 44 59,362 1.0% 9.6% South Bend-Mishawaka, IN-MI 13 2 0.7% 35 58,213 1.4% 15.4% Saginaw, MI 13 1 0.7% 18 48,941 -1.8% 9.2% Elkhart-Goshen, IN 14 1 0.3% 12 65,928 2.5% 16.4% Total Franchise 73 $4,433 $60,882 1.3% 10.4%

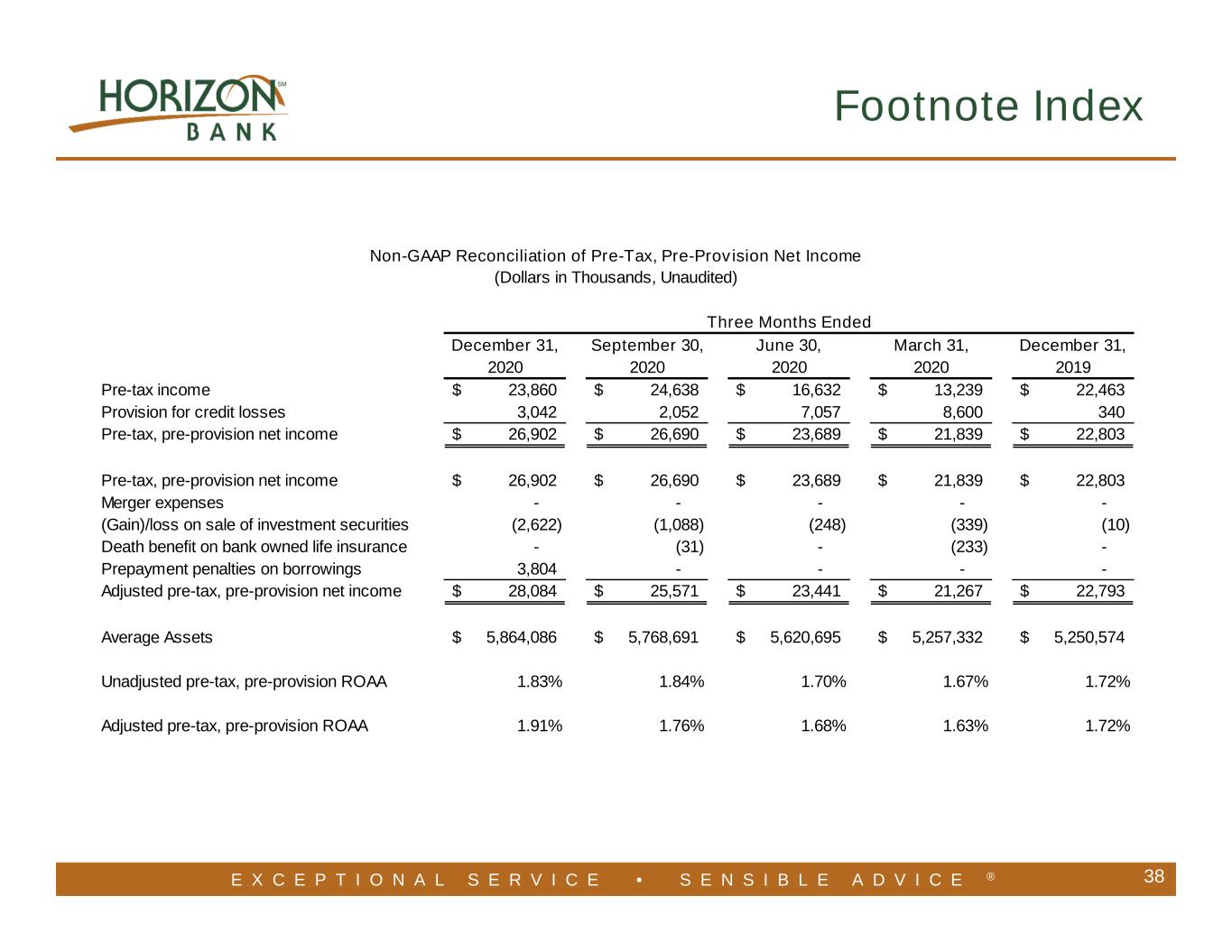

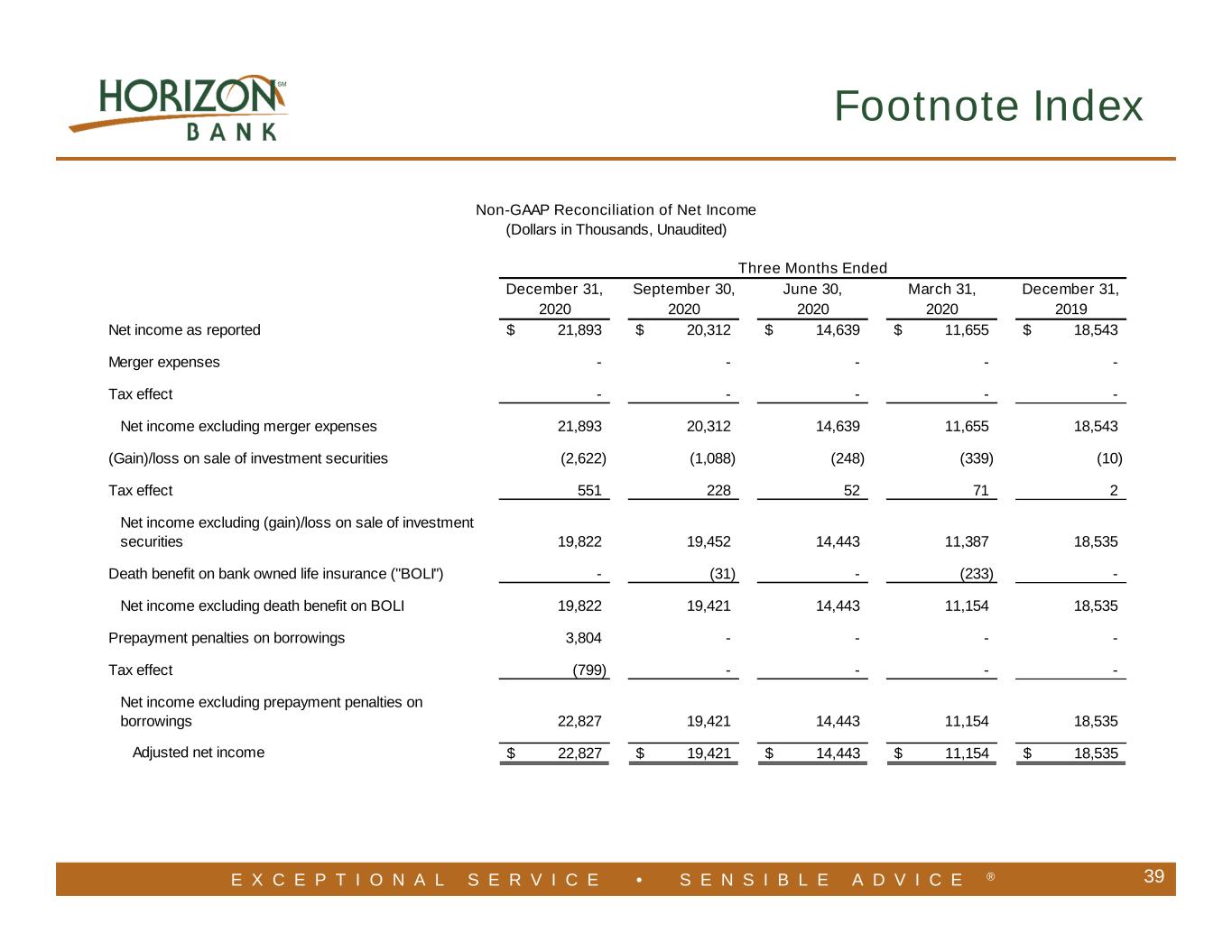

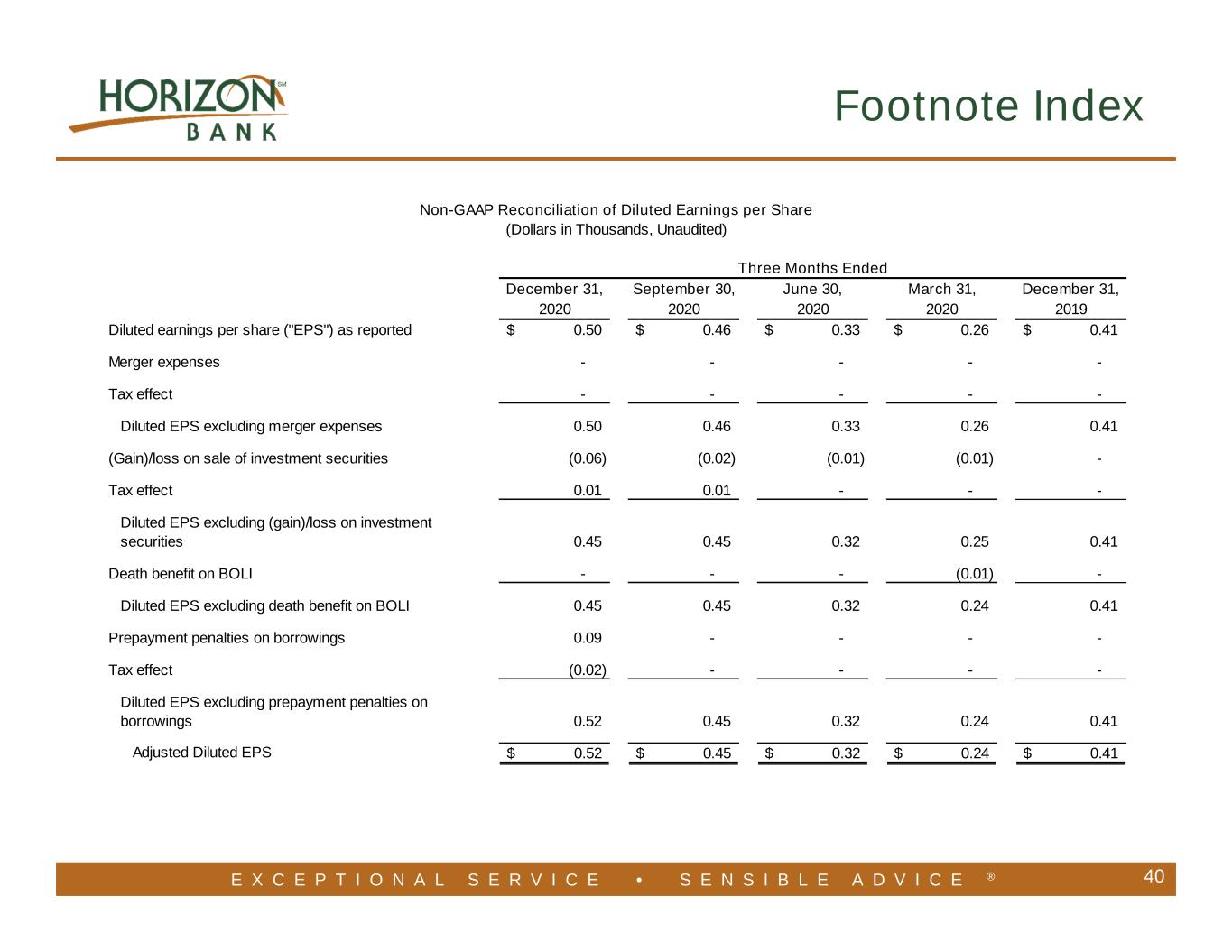

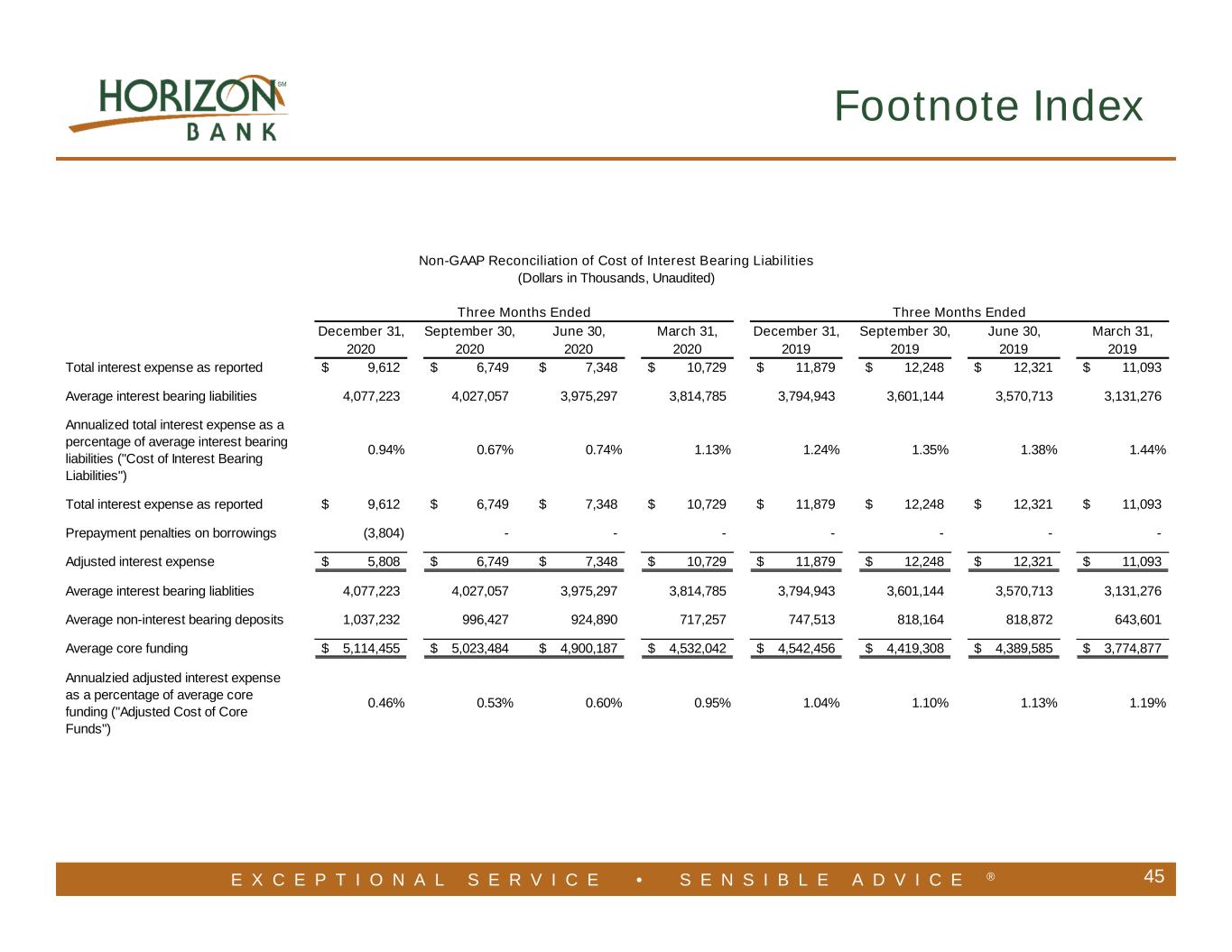

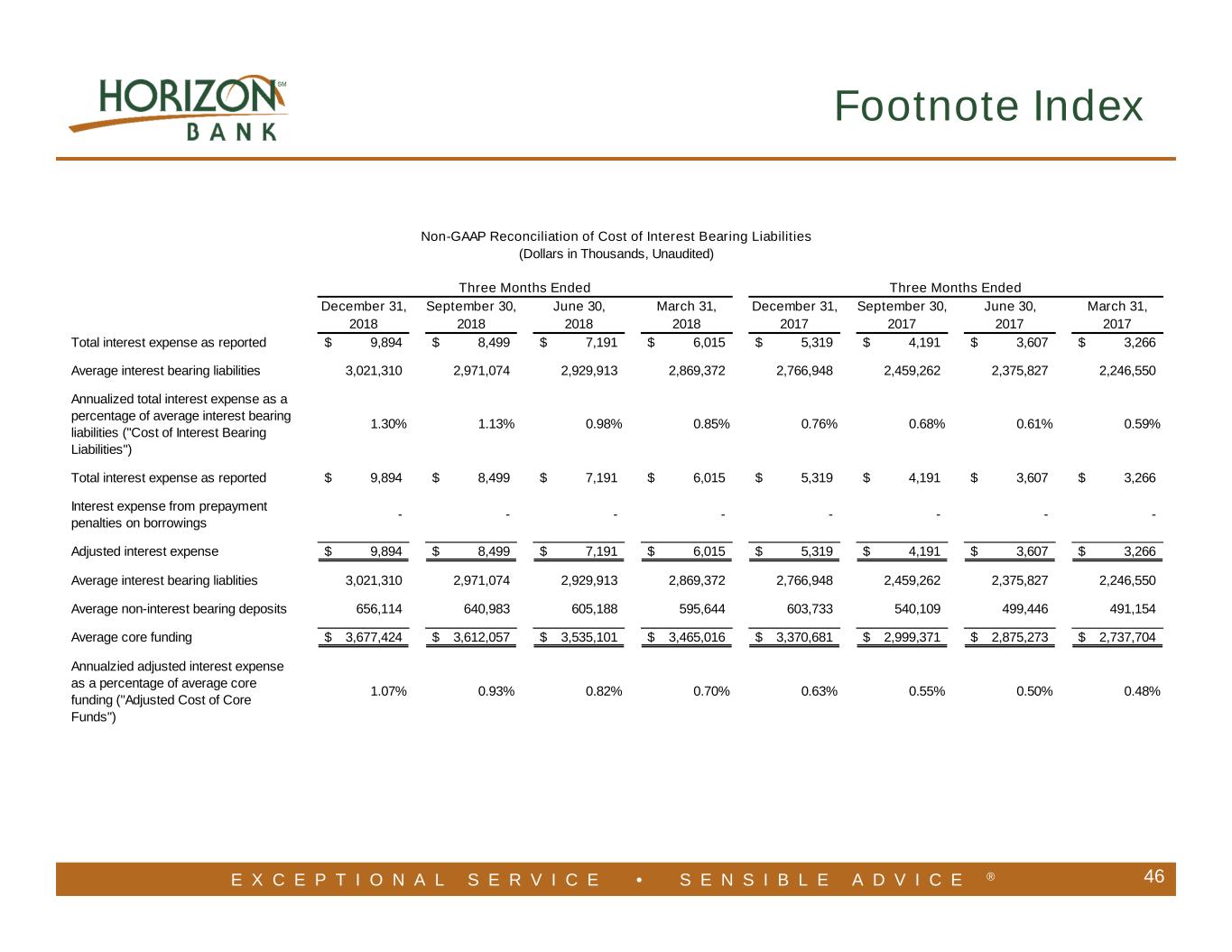

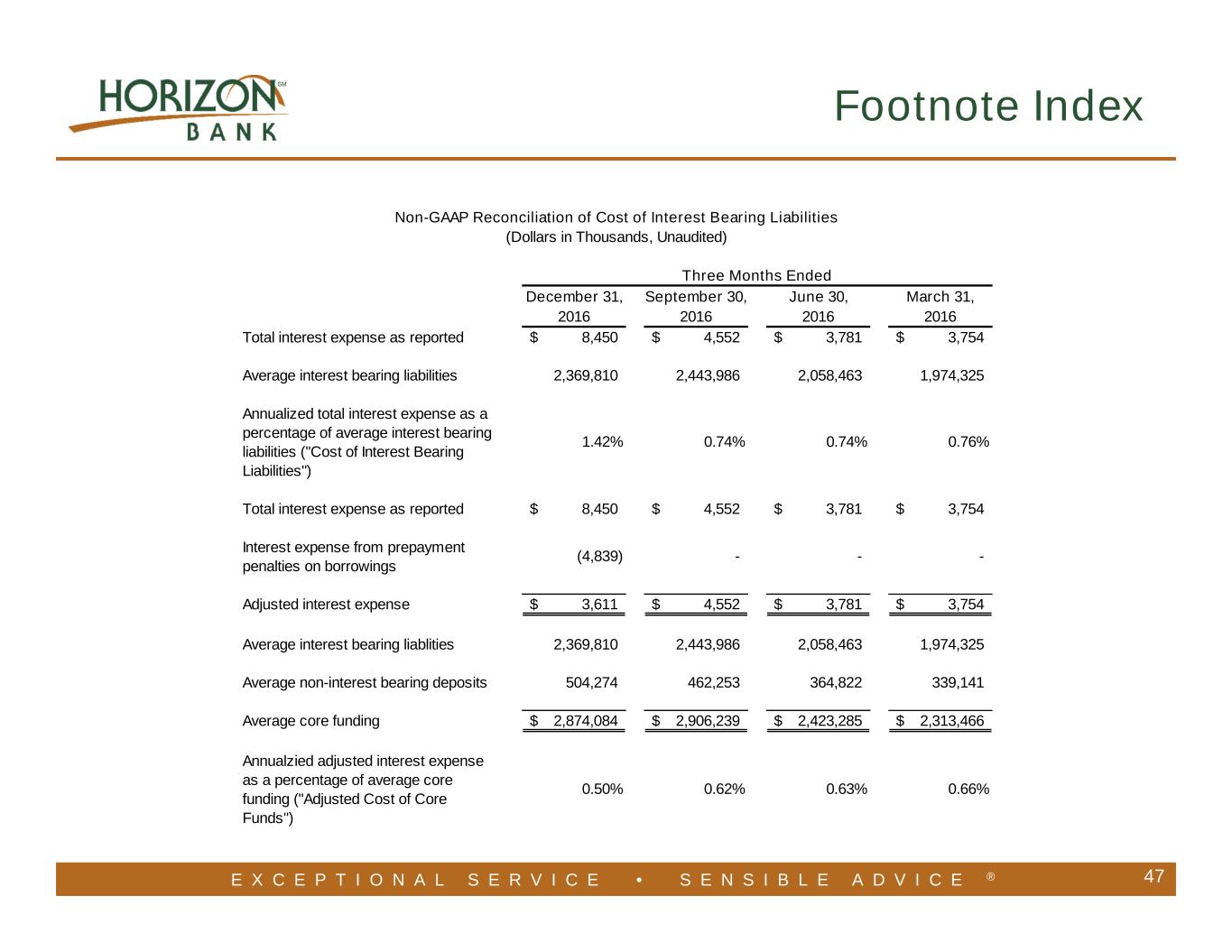

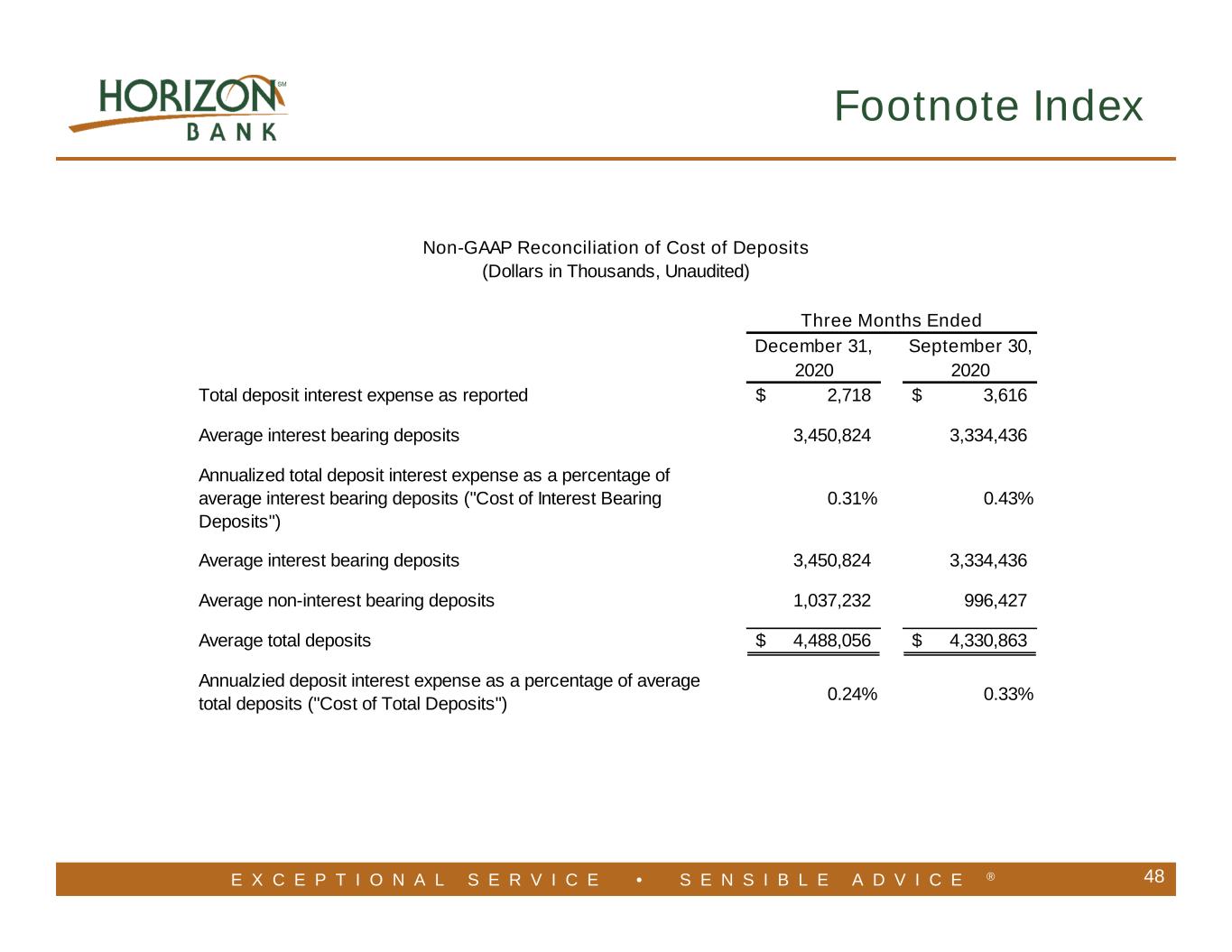

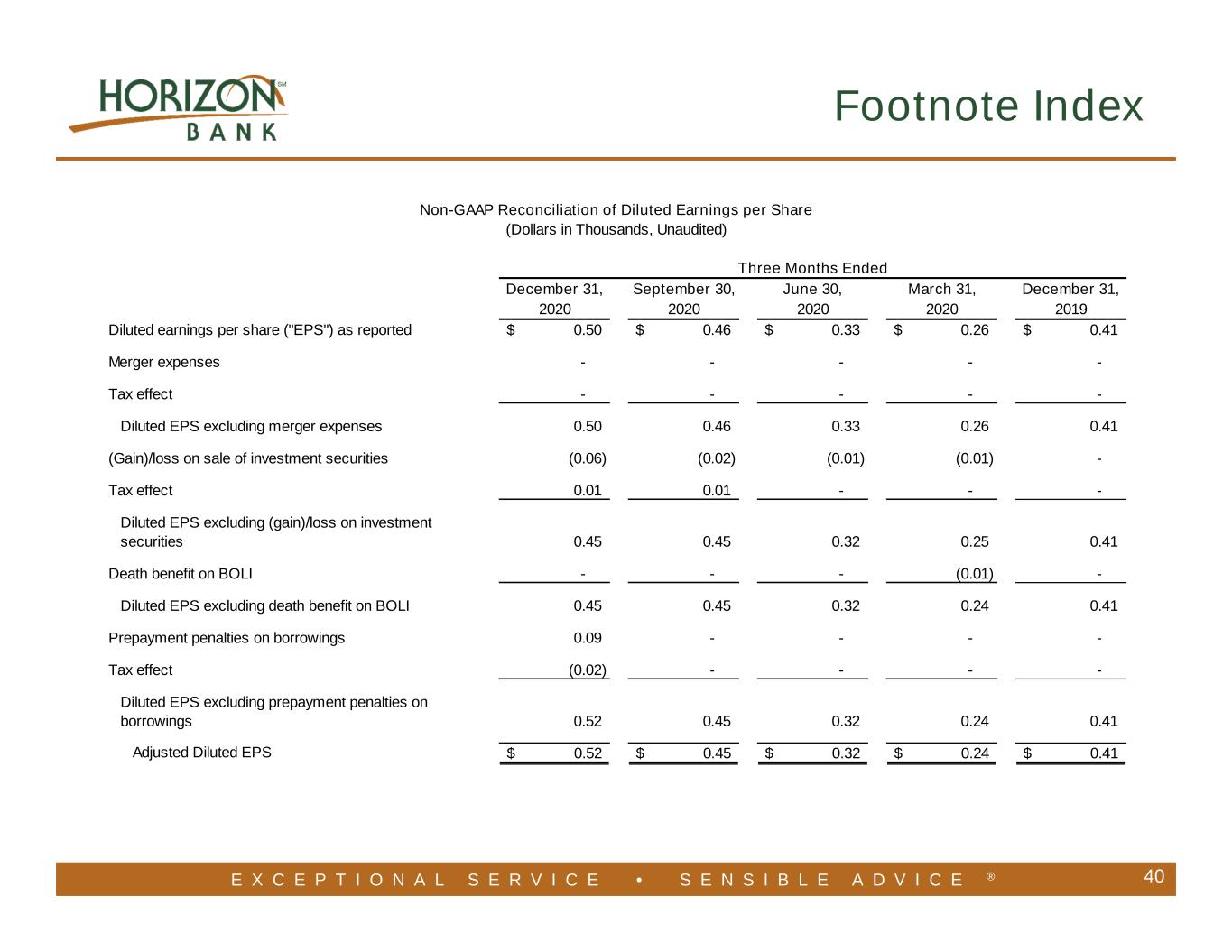

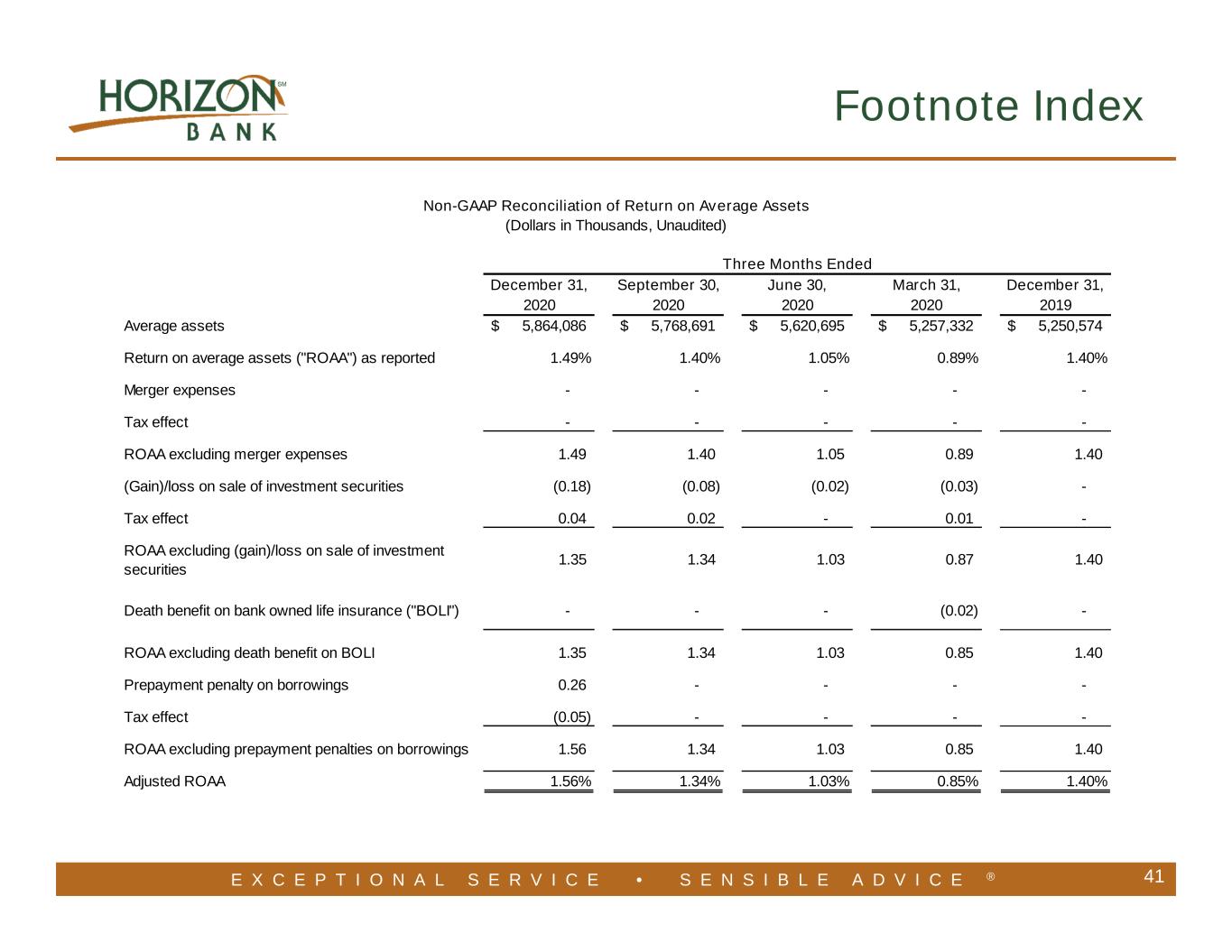

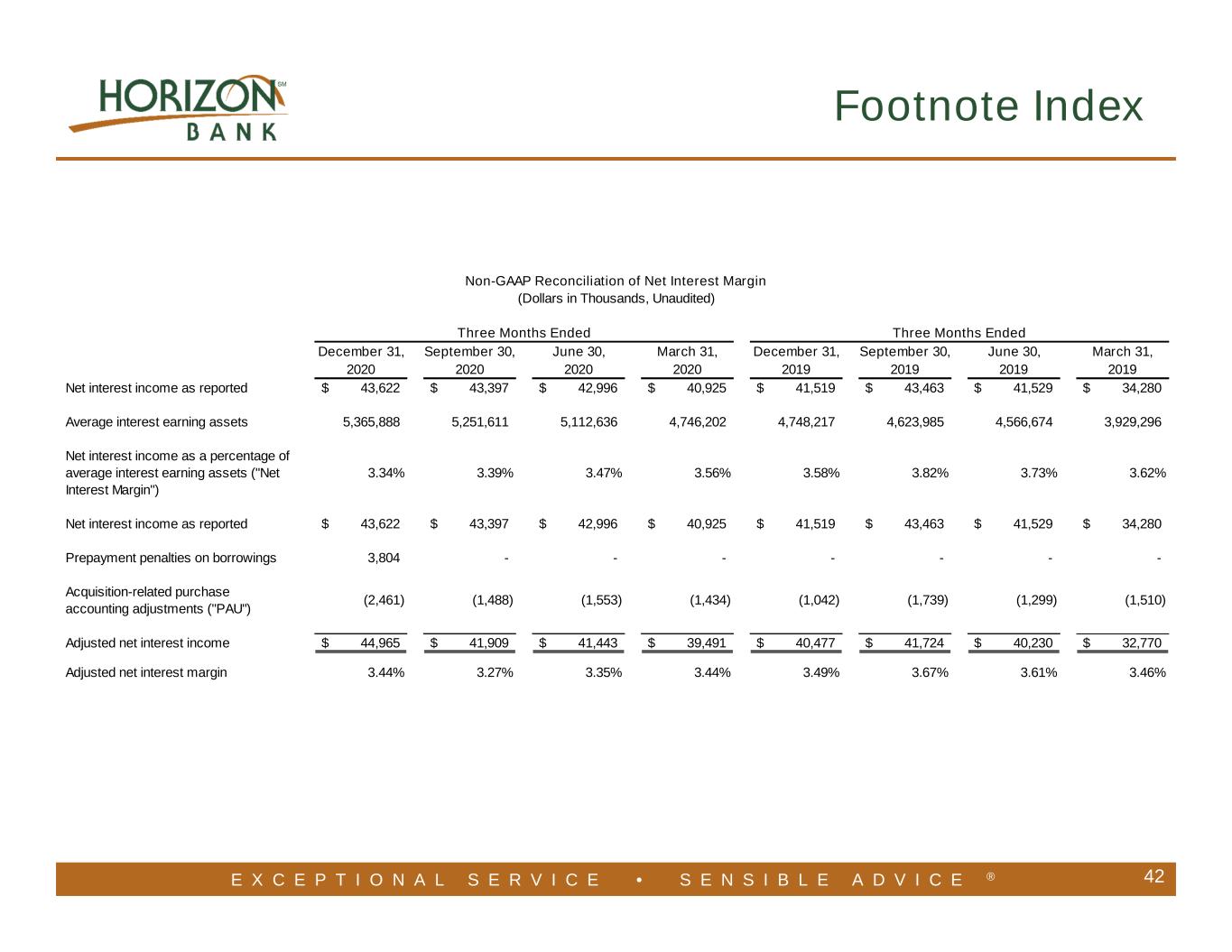

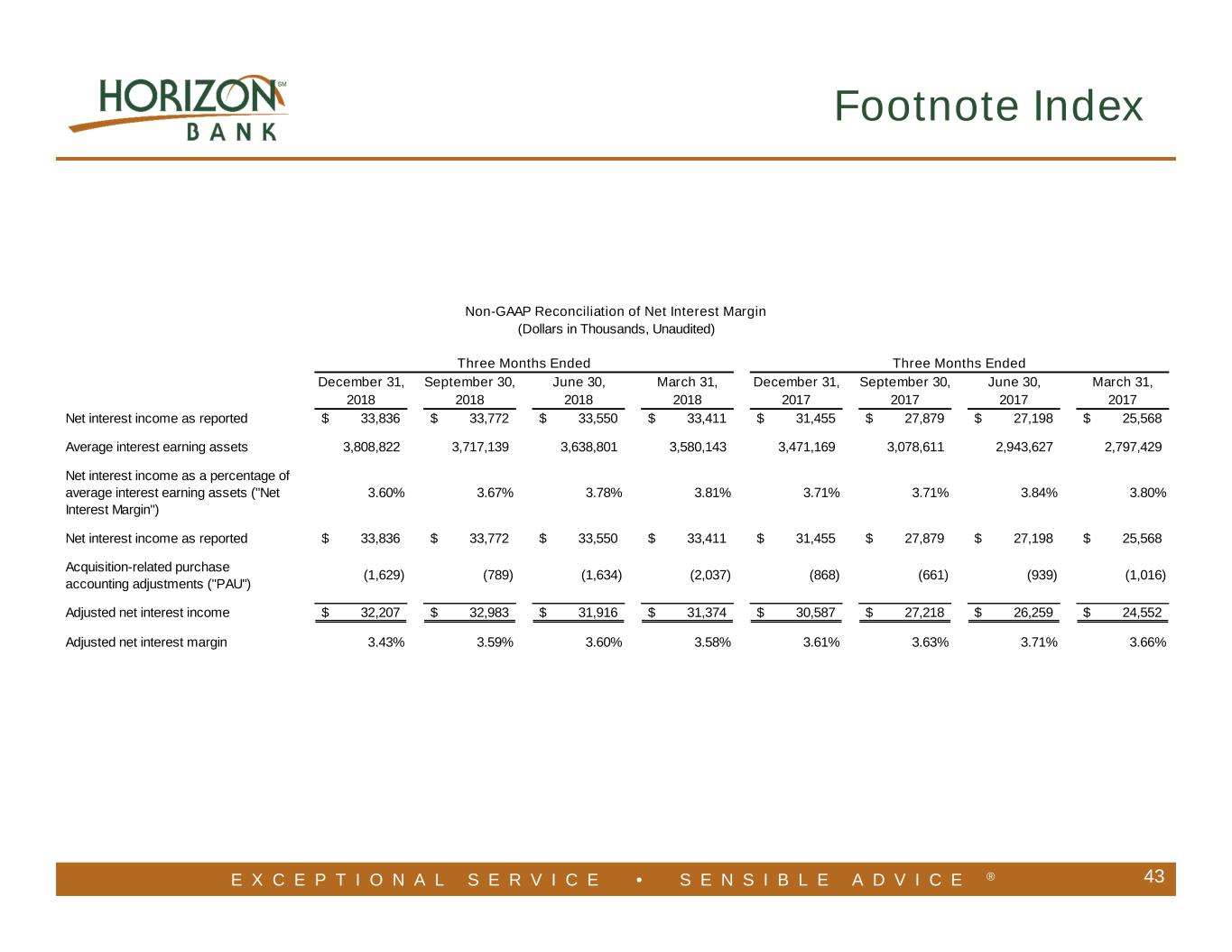

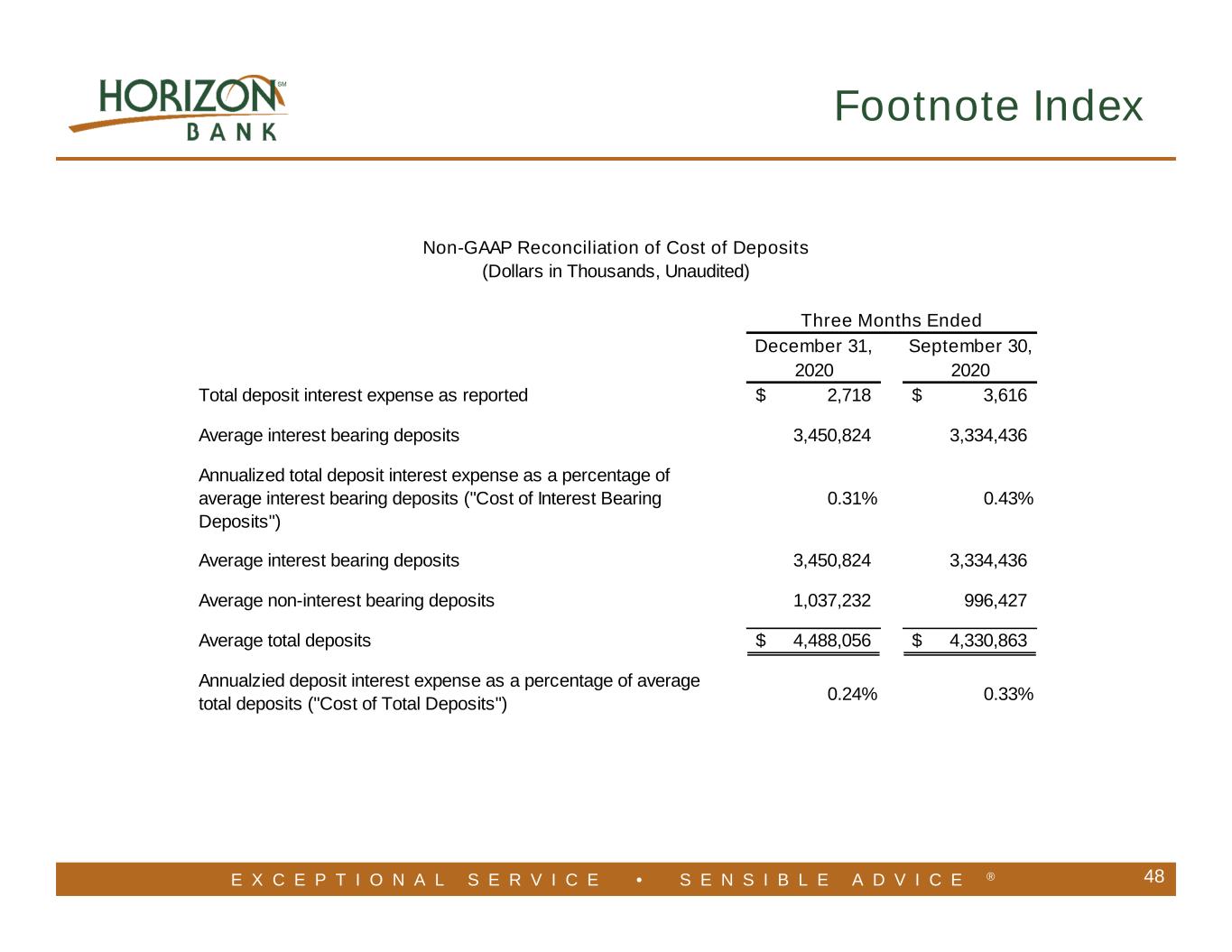

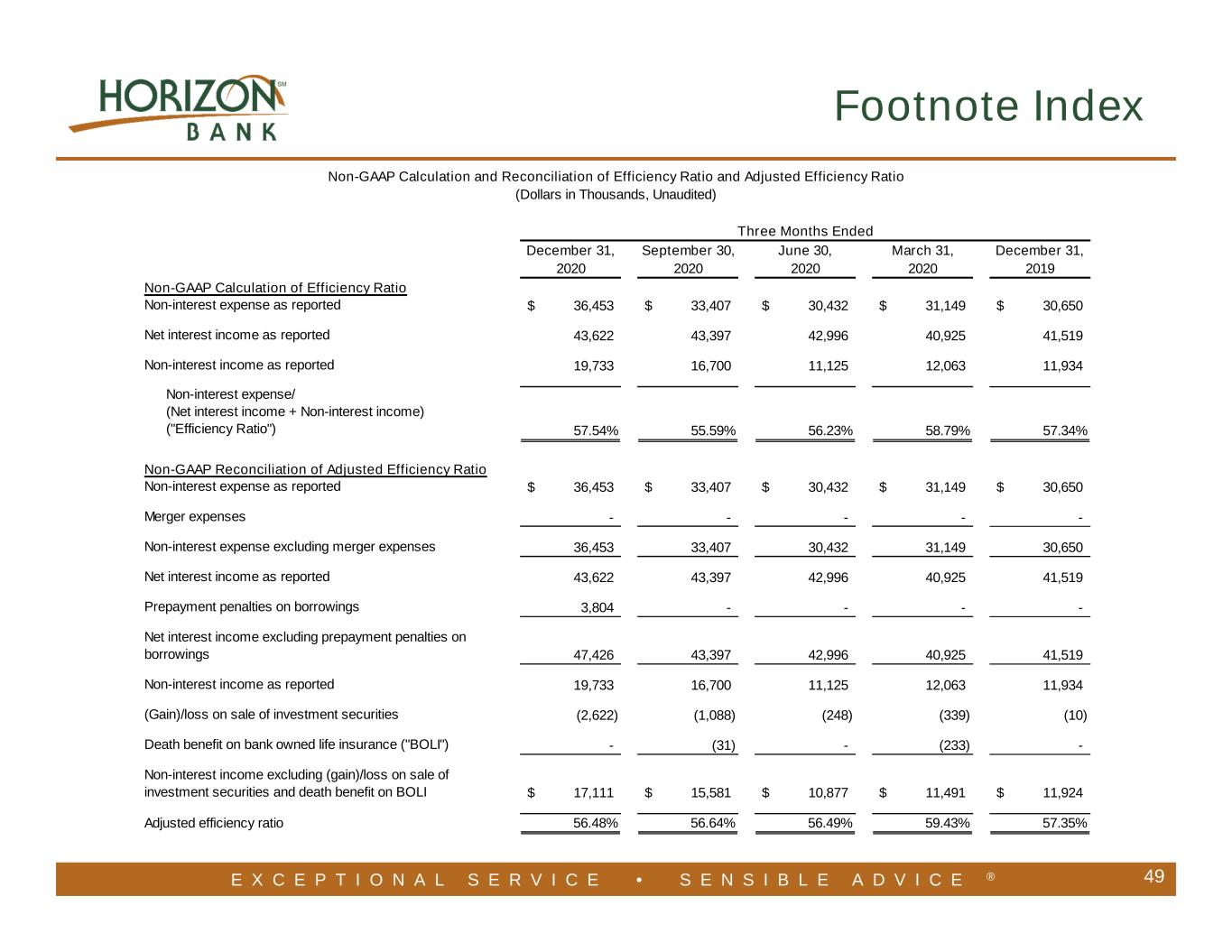

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 37 Slide 13 • Adjusted net income and adjusted diluted EPS excludes one-time merger expenses, (gain)/loss on sale of securities and death benefit on bank owned life insurance, net of tax. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) • Pre-tax, pre-provision income excludes income tax expense and credit loss expense. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) • Adjusted net interest income and adjusted net margin exclude acquisition-related purchase accounting adjustments. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) • Adjusted ROAA and Adjusted pre-tax, pre-provision ROAA excludes one-time merger expenses, (gain)/loss on sale of securities and death benefit on bank owned life insurance, net of tax. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 14 • Adjusted net interest income and adjusted net interest margin excludes prepayment penalties on borrowings and acquisition-related purchase accounting adjustments. Adjusted cost of core funds includes average balances of non- interest bearing deposits and excludes prepayment penalties on borrowings. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 16 • Average cost of average total deposits includes average balances of non-interest bearing deposits. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slide 19 • Adjusted efficiency ratio excludes one-time merger expenses, (gain)/loss on sale of securities and death benefit on bank owned life insurance. (See further in the Appendix for a reconciliation of these non-GAAP amounts to their GAAP counterparts.) Slides 38-49 Use of Non-GAAP Financial Measures • Certain information set forth in the presentation materials refers to financial measures determined by methods other than in accordance with GAAP. Horizon believes these non-GAAP financial measures are helpful to investors and provide a greater understanding of our business without giving effect to purchase accounting impacts, one-time acquisition and other non-recurring costs and non-core items. These measures are not necessarily comparable to similar measures that may be presented by other companies and should not be considered in isolation or as a substitute for the related GAAP measure. Footnote Index

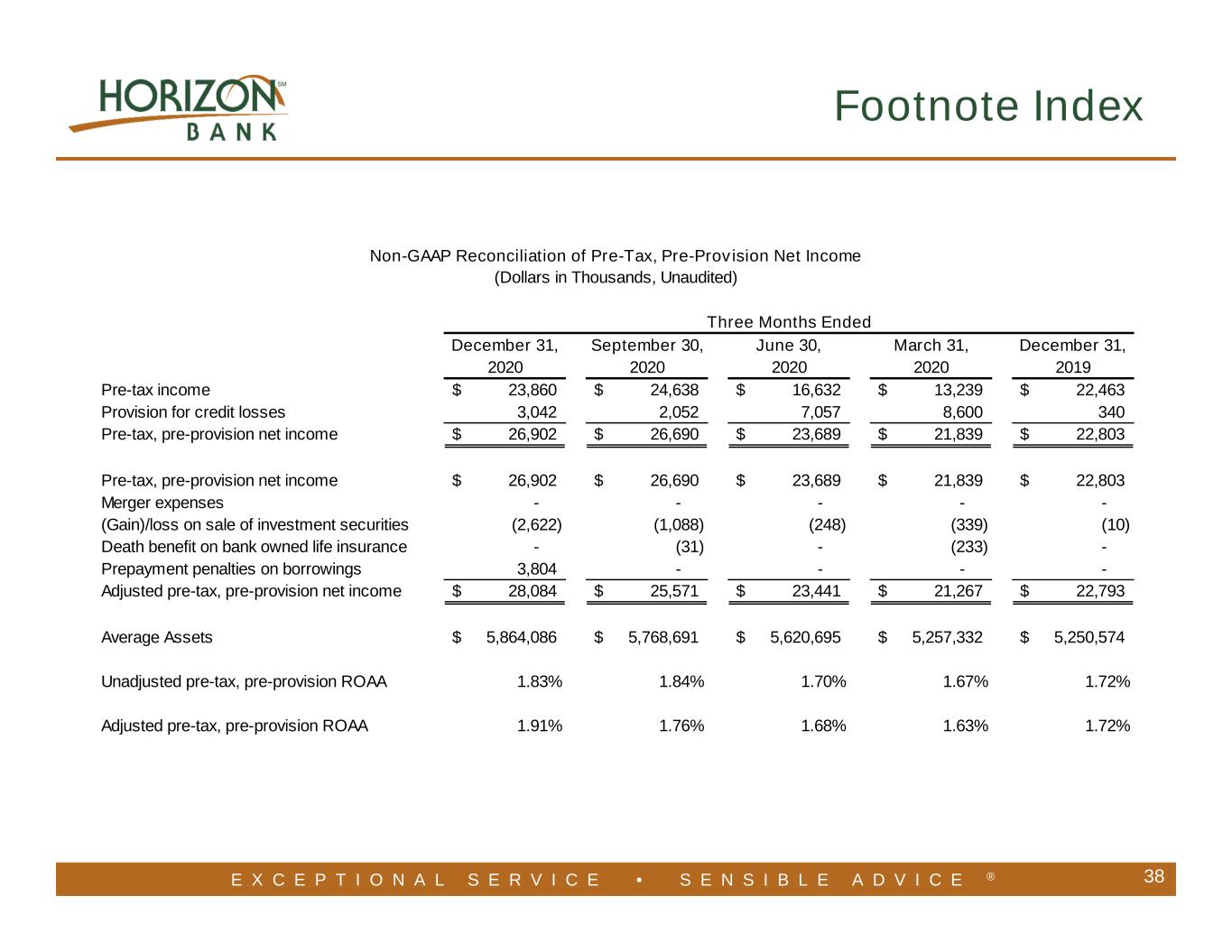

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 38 Footnote Index December 31, September 30, June 30, March 31, December 31, 2020 2020 2020 2020 2019 Pre-tax income 23,860$ 24,638$ 16,632$ 13,239$ 22,463$ Provision for credit losses 3,042 2,052 7,057 8,600 340 Pre-tax, pre-provision net income 26,902$ 26,690$ 23,689$ 21,839$ 22,803$ Pre-tax, pre-provision net income 26,902$ 26,690$ 23,689$ 21,839$ 22,803$ Merger expenses - - - - - (Gain)/loss on sale of investment securities (2,622) (1,088) (248) (339) (10) Death benefit on bank owned life insurance - (31) - (233) - Prepayment penalties on borrowings 3,804 - - - - Adjusted pre-tax, pre-provision net income 28,084$ 25,571$ 23,441$ 21,267$ 22,793$ Average Assets 5,864,086$ 5,768,691$ 5,620,695$ 5,257,332$ 5,250,574$ Unadjusted pre-tax, pre-provision ROAA 1.83% 1.84% 1.70% 1.67% 1.72% Adjusted pre-tax, pre-provision ROAA 1.91% 1.76% 1.68% 1.63% 1.72% Three Months Ended Non-GAAP Reconciliation of Pre-Tax, Pre-Provision Net Income (Dollars in Thousands, Unaudited)

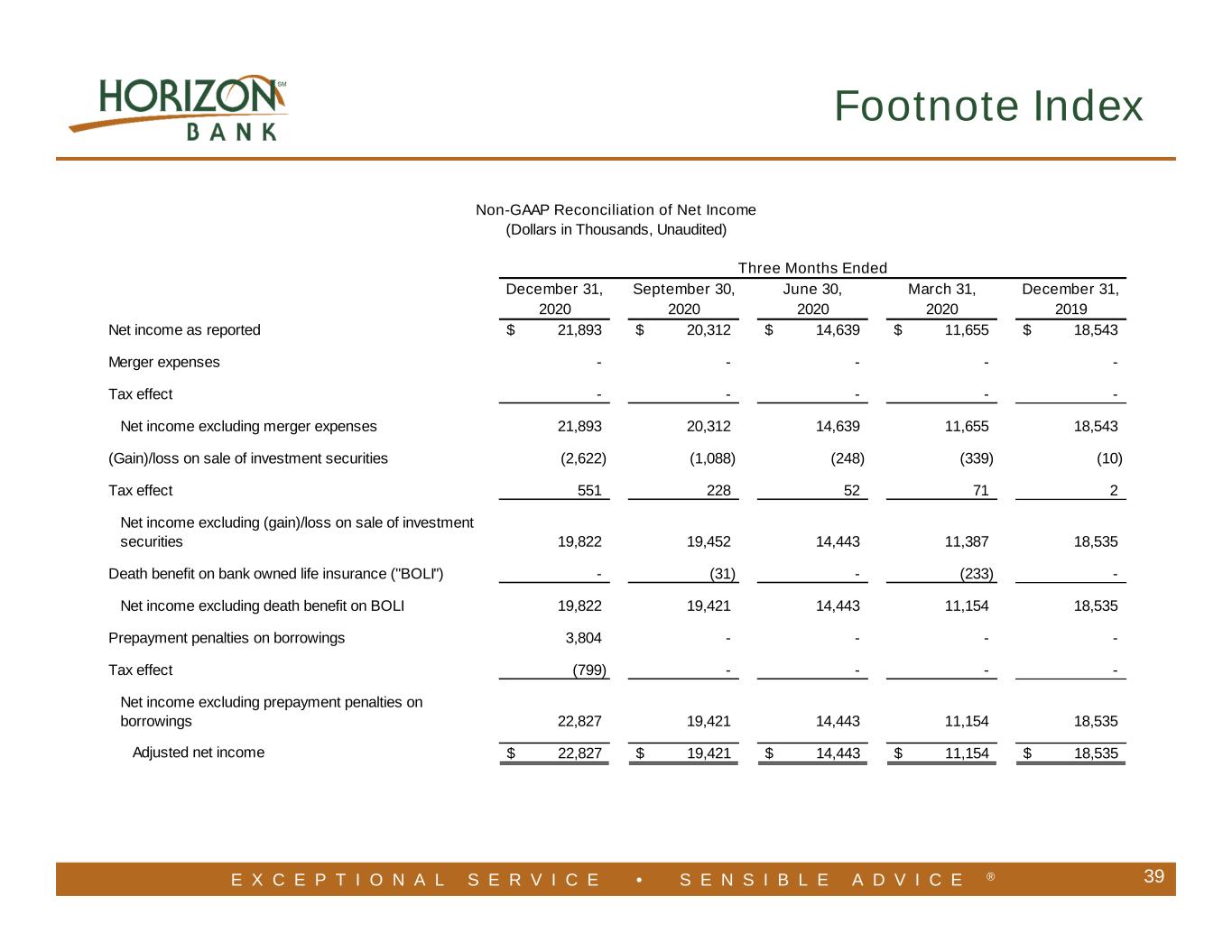

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 39 Footnote Index December 31, September 30, June 30, March 31, December 31, 2020 2020 2020 2020 2019 Net income as reported 21,893$ 20,312$ 14,639$ 11,655$ 18,543$ Merger expenses - - - - - Tax effect - - - - - Net income excluding merger expenses 21,893 20,312 14,639 11,655 18,543 (Gain)/loss on sale of investment securities (2,622) (1,088) (248) (339) (10) Tax effect 551 228 52 71 2 Net income excluding (gain)/loss on sale of investment securities 19,822 19,452 14,443 11,387 18,535 Death benefit on bank owned life insurance ("BOLI") - (31) - (233) - Net income excluding death benefit on BOLI 19,822 19,421 14,443 11,154 18,535 Prepayment penalties on borrowings 3,804 - - - - Tax effect (799) - - - - Net income excluding prepayment penalties on borrowings 22,827 19,421 14,443 11,154 18,535 Adjusted net income 22,827$ 19,421$ 14,443$ 11,154$ 18,535$ Non-GAAP Reconciliation of Net Income (Dollars in Thousands, Unaudited) Three Months Ended

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 40 Footnote Index December 31, September 30, June 30, March 31, December 31, 2020 2020 2020 2020 2019 Diluted earnings per share ("EPS") as reported 0.50$ 0.46$ 0.33$ 0.26$ 0.41$ Merger expenses - - - - - Tax effect - - - - - Diluted EPS excluding merger expenses 0.50 0.46 0.33 0.26 0.41 (Gain)/loss on sale of investment securities (0.06) (0.02) (0.01) (0.01) - Tax effect 0.01 0.01 - - - Diluted EPS excluding (gain)/loss on investment securities 0.45 0.45 0.32 0.25 0.41 Death benefit on BOLI - - - (0.01) - Diluted EPS excluding death benefit on BOLI 0.45 0.45 0.32 0.24 0.41 Prepayment penalties on borrowings 0.09 - - - - Tax effect (0.02) - - - - Diluted EPS excluding prepayment penalties on borrowings 0.52 0.45 0.32 0.24 0.41 Adjusted Diluted EPS 0.52$ 0.45$ 0.32$ 0.24$ 0.41$ Three Months Ended Non-GAAP Reconciliation of Diluted Earnings per Share (Dollars in Thousands, Unaudited)

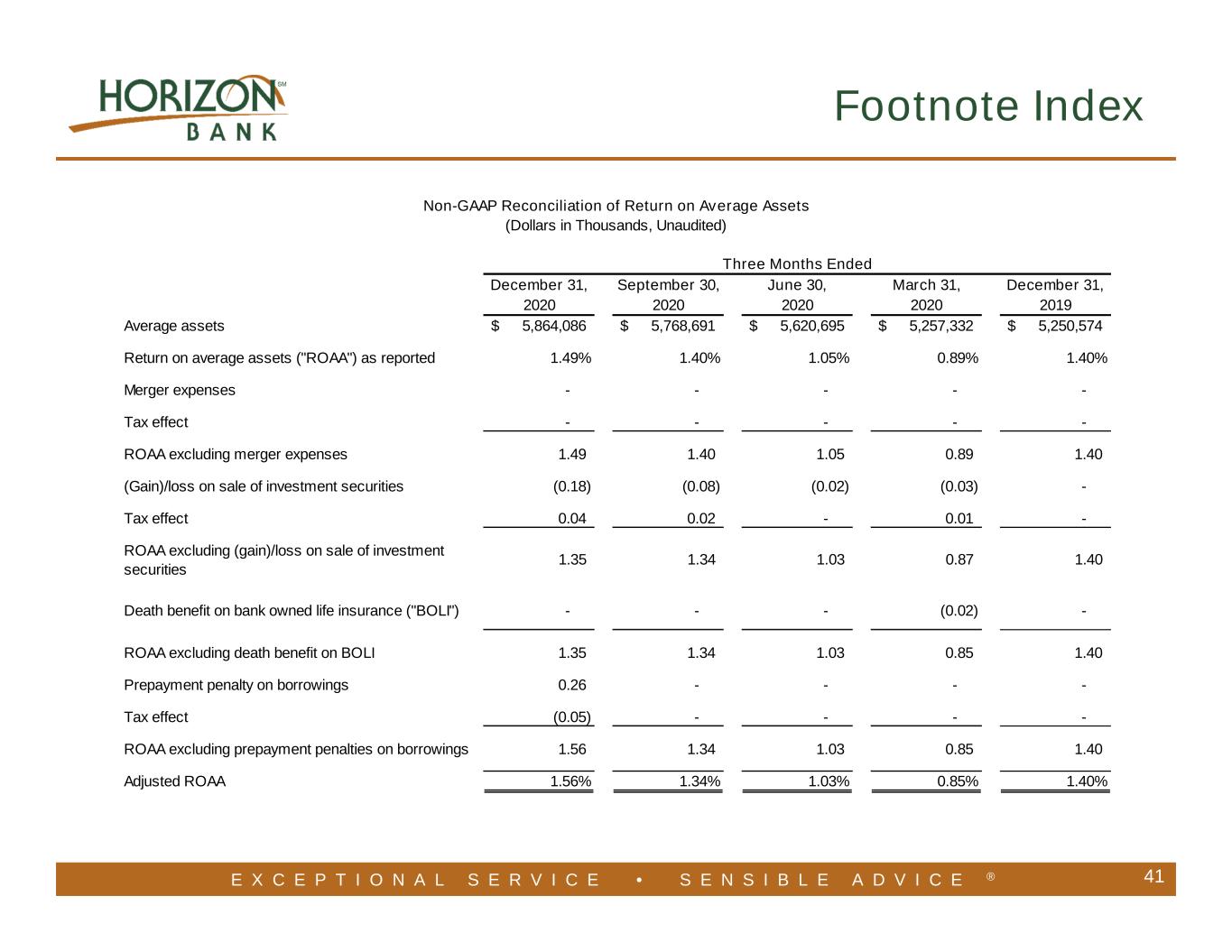

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 41 Footnote Index December 31, September 30, June 30, March 31, December 31, 2020 2020 2020 2020 2019 Average assets 5,864,086$ 5,768,691$ 5,620,695$ 5,257,332$ 5,250,574$ Return on average assets ("ROAA") as reported 1.49% 1.40% 1.05% 0.89% 1.40% Merger expenses - - - - - Tax effect - - - - - ROAA excluding merger expenses 1.49 1.40 1.05 0.89 1.40 (Gain)/loss on sale of investment securities (0.18) (0.08) (0.02) (0.03) - Tax effect 0.04 0.02 - 0.01 - ROAA excluding (gain)/loss on sale of investment securities 1.35 1.34 1.03 0.87 1.40 Death benefit on bank owned life insurance ("BOLI") - - - (0.02) - ROAA excluding death benefit on BOLI 1.35 1.34 1.03 0.85 1.40 Prepayment penalty on borrowings 0.26 - - - - Tax effect (0.05) - - - - ROAA excluding prepayment penalties on borrowings 1.56 1.34 1.03 0.85 1.40 Adjusted ROAA 1.56% 1.34% 1.03% 0.85% 1.40% Non-GAAP Reconciliation of Return on Average Assets (Dollars in Thousands, Unaudited) Three Months Ended

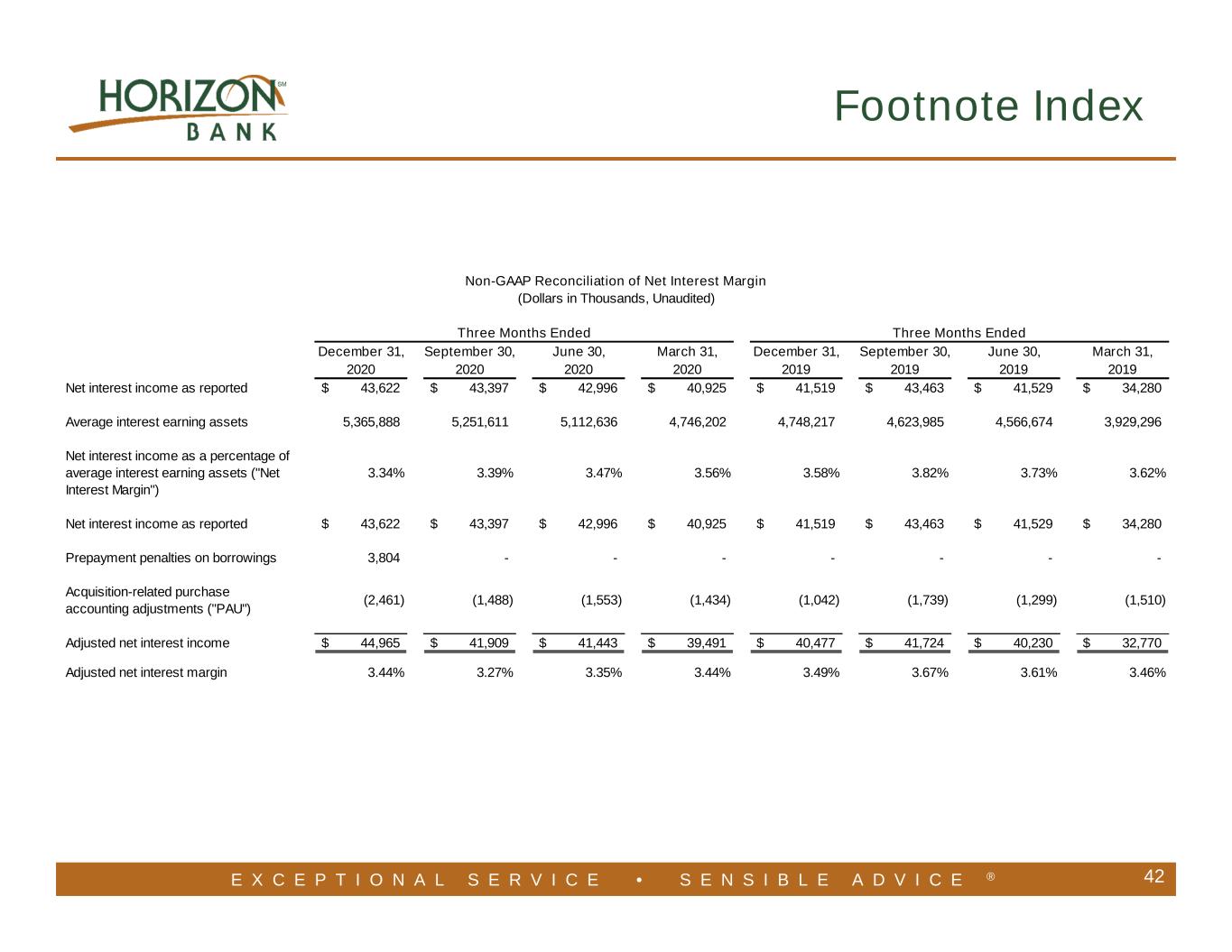

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 42 Footnote Index December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2020 2020 2020 2020 2019 2019 2019 2019 Net interest income as reported 43,622$ 43,397$ 42,996$ 40,925$ 41,519$ 43,463$ 41,529$ 34,280$ Average interest earning assets 5,365,888 5,251,611 5,112,636 4,746,202 4,748,217 4,623,985 4,566,674 3,929,296 Net interest income as a percentage of average interest earning assets ("Net Interest Margin") 3.34% 3.39% 3.47% 3.56% 3.58% 3.82% 3.73% 3.62% Net interest income as reported 43,622$ 43,397$ 42,996$ 40,925$ 41,519$ 43,463$ 41,529$ 34,280$ Prepayment penalties on borrowings 3,804 - - - - - - - Acquisition-related purchase accounting adjustments ("PAU") (2,461) (1,488) (1,553) (1,434) (1,042) (1,739) (1,299) (1,510) Adjusted net interest income 44,965$ 41,909$ 41,443$ 39,491$ 40,477$ 41,724$ 40,230$ 32,770$ Adjusted net interest margin 3.44% 3.27% 3.35% 3.44% 3.49% 3.67% 3.61% 3.46% Three Months EndedThree Months Ended Non-GAAP Reconciliation of Net Interest Margin (Dollars in Thousands, Unaudited)

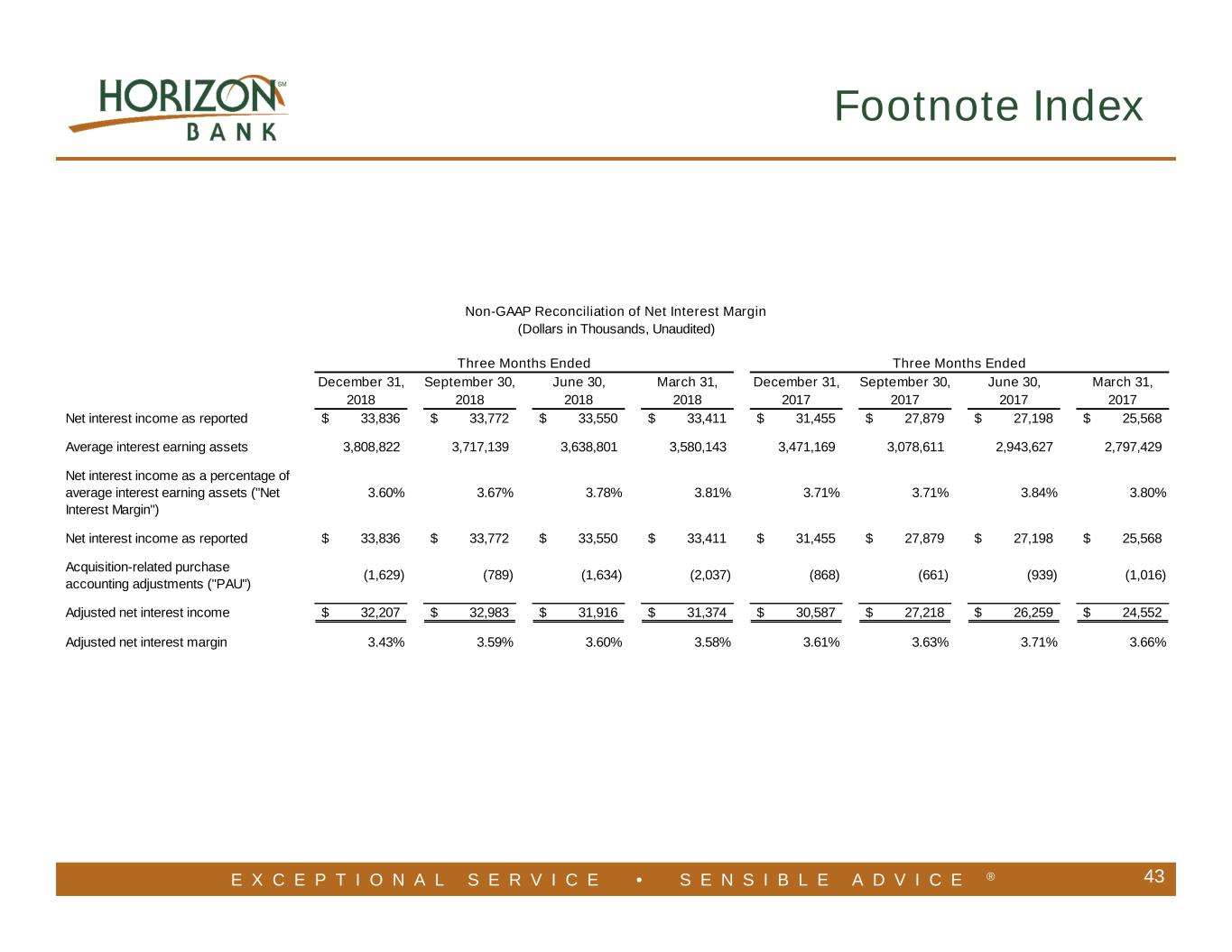

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 43 Footnote Index December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2018 2018 2018 2018 2017 2017 2017 2017 Net interest income as reported 33,836$ 33,772$ 33,550$ 33,411$ 31,455$ 27,879$ 27,198$ 25,568$ Average interest earning assets 3,808,822 3,717,139 3,638,801 3,580,143 3,471,169 3,078,611 2,943,627 2,797,429 Net interest income as a percentage of average interest earning assets ("Net Interest Margin") 3.60% 3.67% 3.78% 3.81% 3.71% 3.71% 3.84% 3.80% Net interest income as reported 33,836$ 33,772$ 33,550$ 33,411$ 31,455$ 27,879$ 27,198$ 25,568$ Acquisition-related purchase accounting adjustments ("PAU") (1,629) (789) (1,634) (2,037) (868) (661) (939) (1,016) Adjusted net interest income 32,207$ 32,983$ 31,916$ 31,374$ 30,587$ 27,218$ 26,259$ 24,552$ Adjusted net interest margin 3.43% 3.59% 3.60% 3.58% 3.61% 3.63% 3.71% 3.66% Three Months EndedThree Months Ended Non-GAAP Reconciliation of Net Interest Margin (Dollars in Thousands, Unaudited)

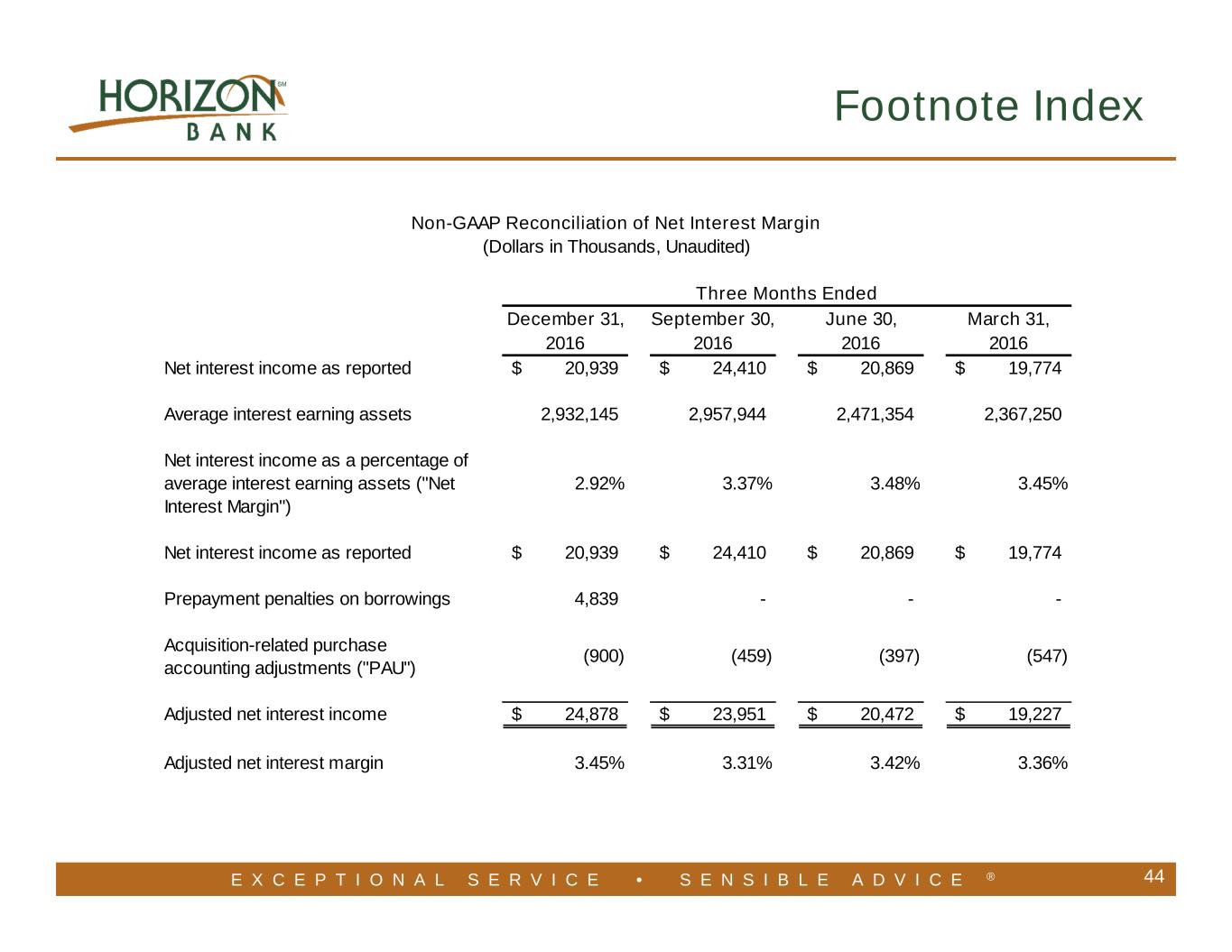

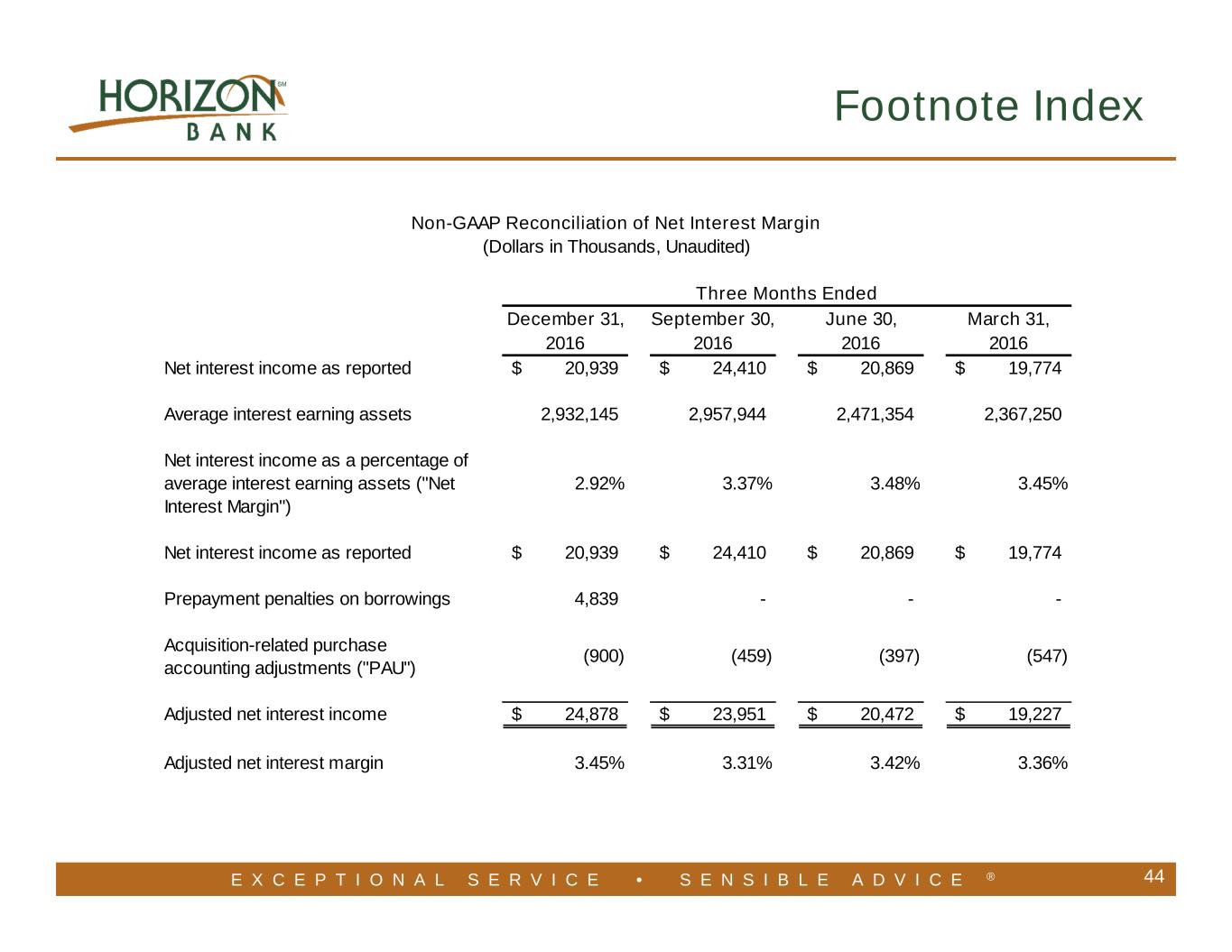

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 44 Footnote Index December 31, September 30, June 30, March 31, 2016 2016 2016 2016 Net interest income as reported 20,939$ 24,410$ 20,869$ 19,774$ Average interest earning assets 2,932,145 2,957,944 2,471,354 2,367,250 Net interest income as a percentage of average interest earning assets ("Net Interest Margin") 2.92% 3.37% 3.48% 3.45% Net interest income as reported 20,939$ 24,410$ 20,869$ 19,774$ Prepayment penalties on borrowings 4,839 - - - Acquisition-related purchase accounting adjustments ("PAU") (900) (459) (397) (547) Adjusted net interest income 24,878$ 23,951$ 20,472$ 19,227$ Adjusted net interest margin 3.45% 3.31% 3.42% 3.36% Three Months Ended Non-GAAP Reconciliation of Net Interest Margin (Dollars in Thousands, Unaudited)

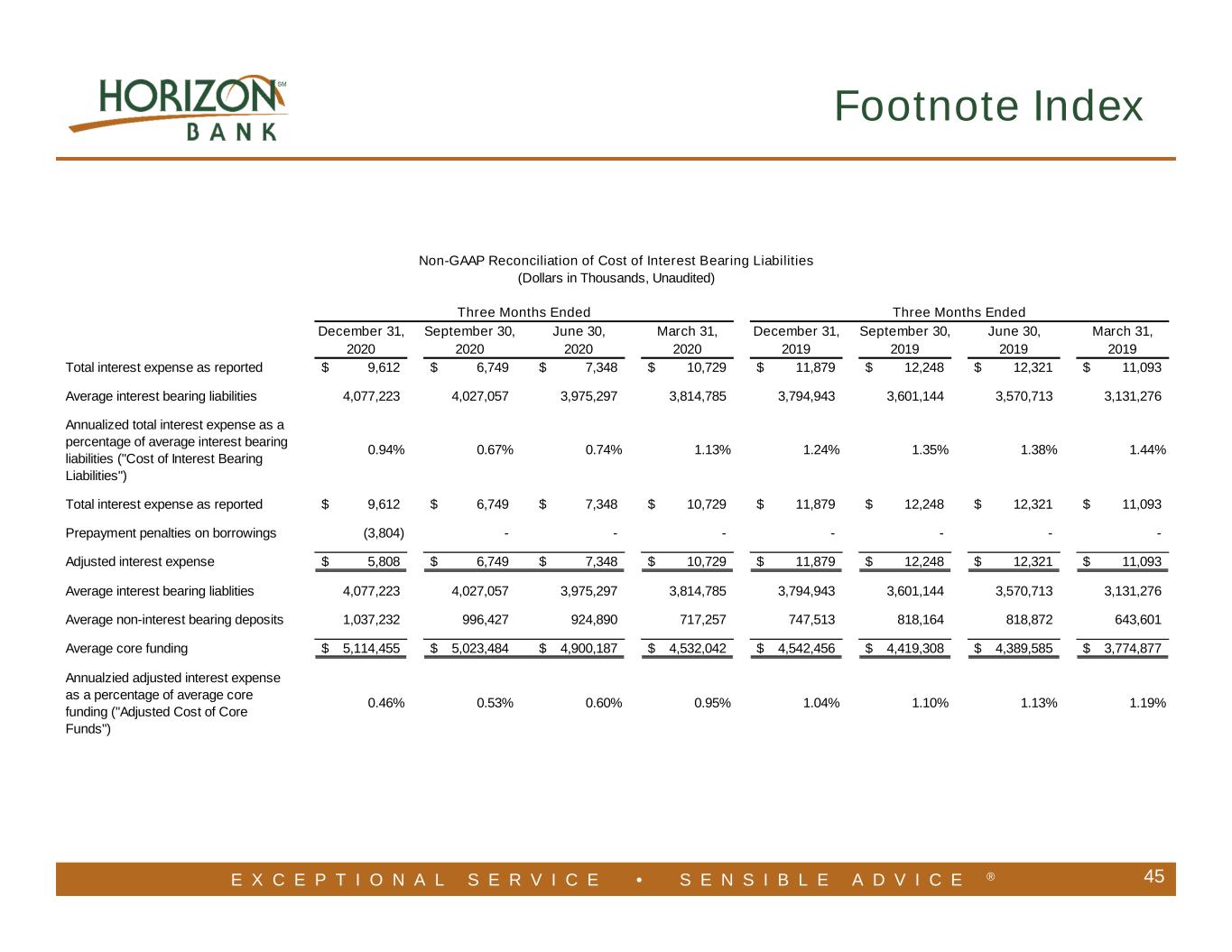

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 45 Footnote Index December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2020 2020 2020 2020 2019 2019 2019 2019 Total interest expense as reported 9,612$ 6,749$ 7,348$ 10,729$ 11,879$ 12,248$ 12,321$ 11,093$ Average interest bearing liabilities 4,077,223 4,027,057 3,975,297 3,814,785 3,794,943 3,601,144 3,570,713 3,131,276 Annualized total interest expense as a percentage of average interest bearing liabilities ("Cost of Interest Bearing Liabilities") 0.94% 0.67% 0.74% 1.13% 1.24% 1.35% 1.38% 1.44% Total interest expense as reported 9,612$ 6,749$ 7,348$ 10,729$ 11,879$ 12,248$ 12,321$ 11,093$ Prepayment penalties on borrowings (3,804) - - - - - - - Adjusted interest expense 5,808$ 6,749$ 7,348$ 10,729$ 11,879$ 12,248$ 12,321$ 11,093$ Average interest bearing liablities 4,077,223 4,027,057 3,975,297 3,814,785 3,794,943 3,601,144 3,570,713 3,131,276 Average non-interest bearing deposits 1,037,232 996,427 924,890 717,257 747,513 818,164 818,872 643,601 Average core funding 5,114,455$ 5,023,484$ 4,900,187$ 4,532,042$ 4,542,456$ 4,419,308$ 4,389,585$ 3,774,877$ Annualzied adjusted interest expense as a percentage of average core funding ("Adjusted Cost of Core Funds") 0.46% 0.53% 0.60% 0.95% 1.04% 1.10% 1.13% 1.19% Three Months EndedThree Months Ended Non-GAAP Reconciliation of Cost of Interest Bearing Liabilities (Dollars in Thousands, Unaudited)

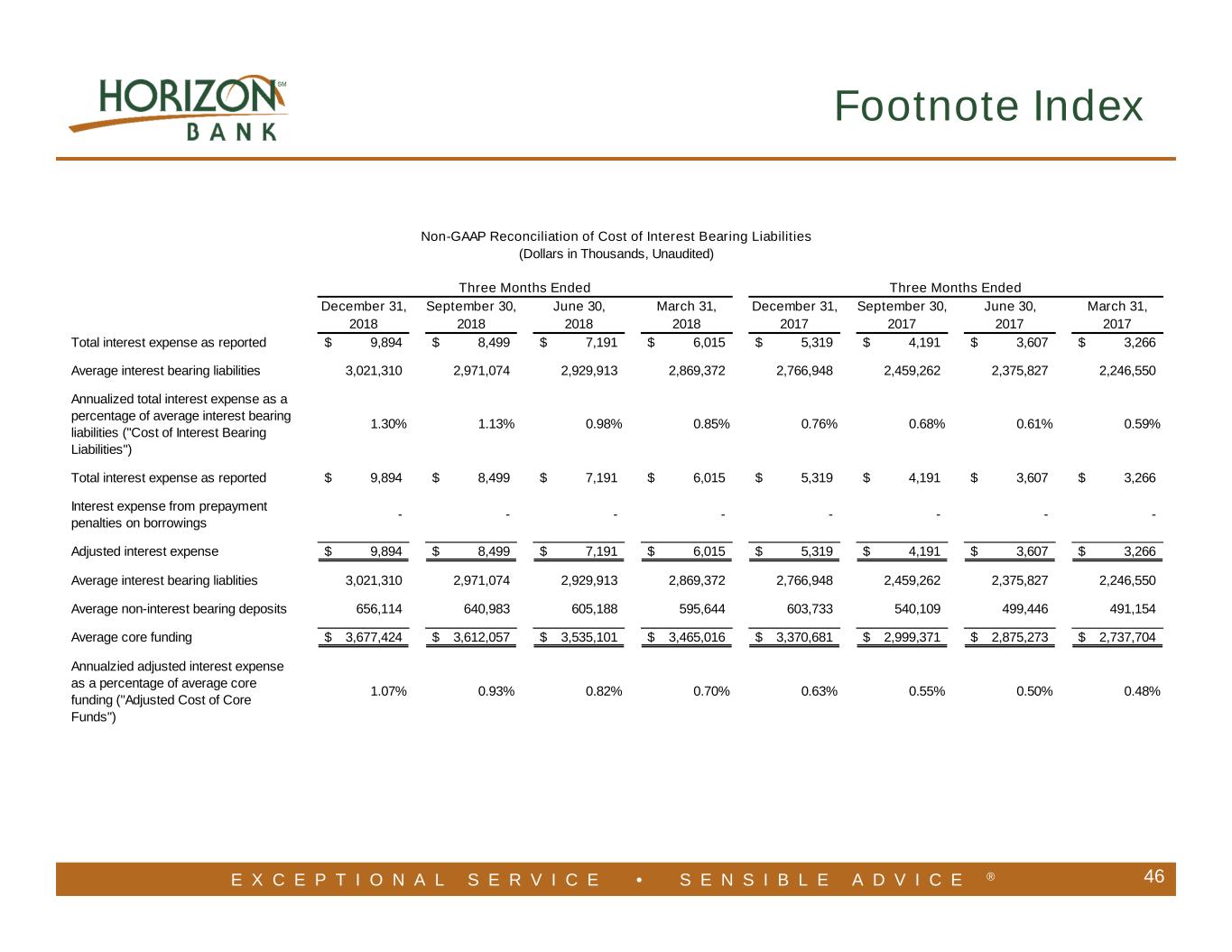

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 46 Footnote Index December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, 2018 2018 2018 2018 2017 2017 2017 2017 Total interest expense as reported 9,894$ 8,499$ 7,191$ 6,015$ 5,319$ 4,191$ 3,607$ 3,266$ Average interest bearing liabilities 3,021,310 2,971,074 2,929,913 2,869,372 2,766,948 2,459,262 2,375,827 2,246,550 Annualized total interest expense as a percentage of average interest bearing liabilities ("Cost of Interest Bearing Liabilities") 1.30% 1.13% 0.98% 0.85% 0.76% 0.68% 0.61% 0.59% Total interest expense as reported 9,894$ 8,499$ 7,191$ 6,015$ 5,319$ 4,191$ 3,607$ 3,266$ Interest expense from prepayment penalties on borrowings - - - - - - - - Adjusted interest expense 9,894$ 8,499$ 7,191$ 6,015$ 5,319$ 4,191$ 3,607$ 3,266$ Average interest bearing liablities 3,021,310 2,971,074 2,929,913 2,869,372 2,766,948 2,459,262 2,375,827 2,246,550 Average non-interest bearing deposits 656,114 640,983 605,188 595,644 603,733 540,109 499,446 491,154 Average core funding 3,677,424$ 3,612,057$ 3,535,101$ 3,465,016$ 3,370,681$ 2,999,371$ 2,875,273$ 2,737,704$ Annualzied adjusted interest expense as a percentage of average core funding ("Adjusted Cost of Core Funds") 1.07% 0.93% 0.82% 0.70% 0.63% 0.55% 0.50% 0.48% Non-GAAP Reconciliation of Cost of Interest Bearing Liabilities (Dollars in Thousands, Unaudited) Three Months Ended Three Months Ended

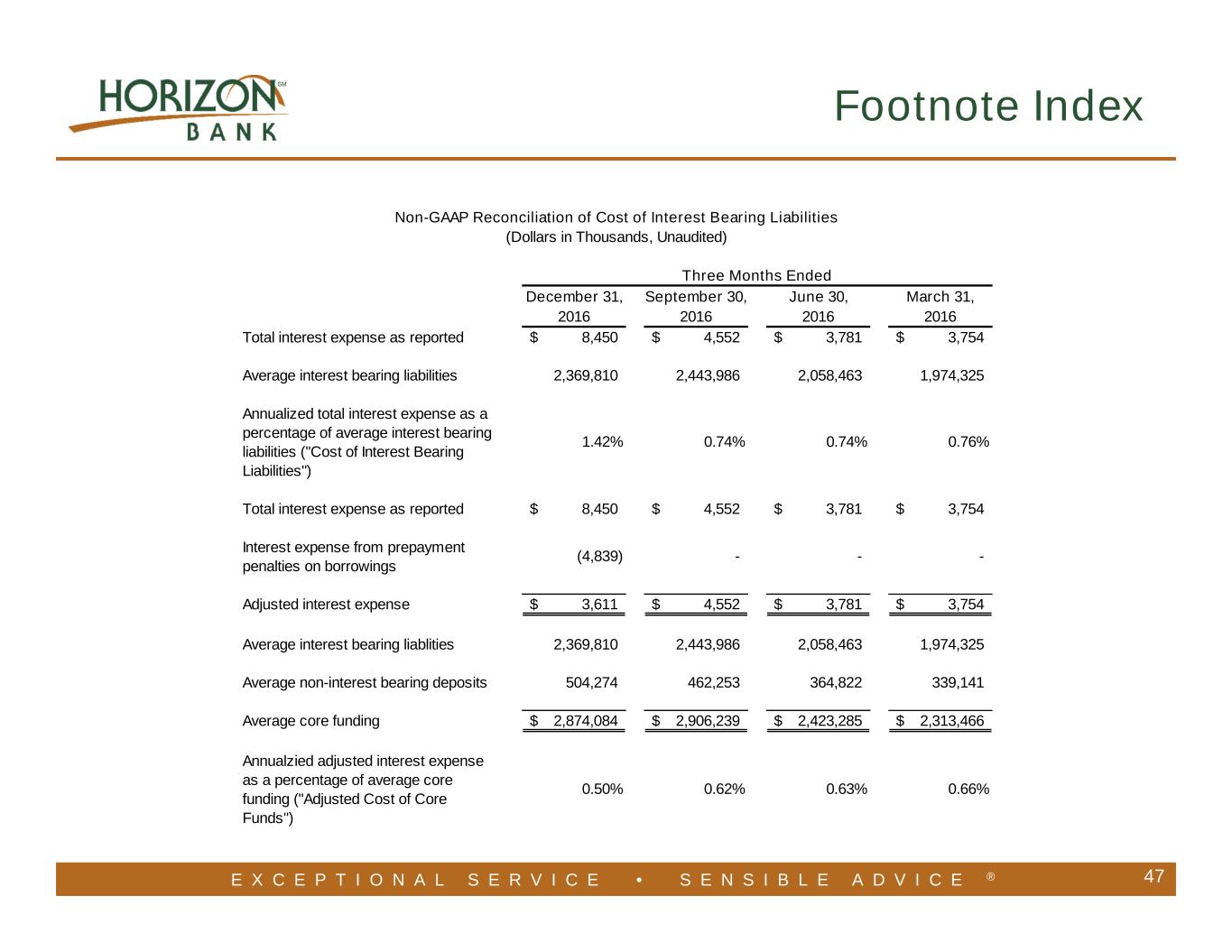

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 47 Footnote Index December 31, September 30, June 30, March 31, 2016 2016 2016 2016 Total interest expense as reported 8,450$ 4,552$ 3,781$ 3,754$ Average interest bearing liabilities 2,369,810 2,443,986 2,058,463 1,974,325 Annualized total interest expense as a percentage of average interest bearing liabilities ("Cost of Interest Bearing Liabilities") 1.42% 0.74% 0.74% 0.76% Total interest expense as reported 8,450$ 4,552$ 3,781$ 3,754$ Interest expense from prepayment penalties on borrowings (4,839) - - - Adjusted interest expense 3,611$ 4,552$ 3,781$ 3,754$ Average interest bearing liablities 2,369,810 2,443,986 2,058,463 1,974,325 Average non-interest bearing deposits 504,274 462,253 364,822 339,141 Average core funding 2,874,084$ 2,906,239$ 2,423,285$ 2,313,466$ Annualzied adjusted interest expense as a percentage of average core funding ("Adjusted Cost of Core Funds") 0.50% 0.62% 0.63% 0.66% Three Months Ended Non-GAAP Reconciliation of Cost of Interest Bearing Liabilities (Dollars in Thousands, Unaudited)

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 48 Footnote Index December 31, September 30, 2020 2020 Total deposit interest expense as reported 2,718$ 3,616$ Average interest bearing deposits 3,450,824 3,334,436 Annualized total deposit interest expense as a percentage of average interest bearing deposits ("Cost of Interest Bearing Deposits") 0.31% 0.43% Average interest bearing deposits 3,450,824 3,334,436 Average non-interest bearing deposits 1,037,232 996,427 Average total deposits 4,488,056$ 4,330,863$ Annualzied deposit interest expense as a percentage of average total deposits ("Cost of Total Deposits") 0.24% 0.33% Three Months Ended Non-GAAP Reconciliation of Cost of Deposits (Dollars in Thousands, Unaudited)

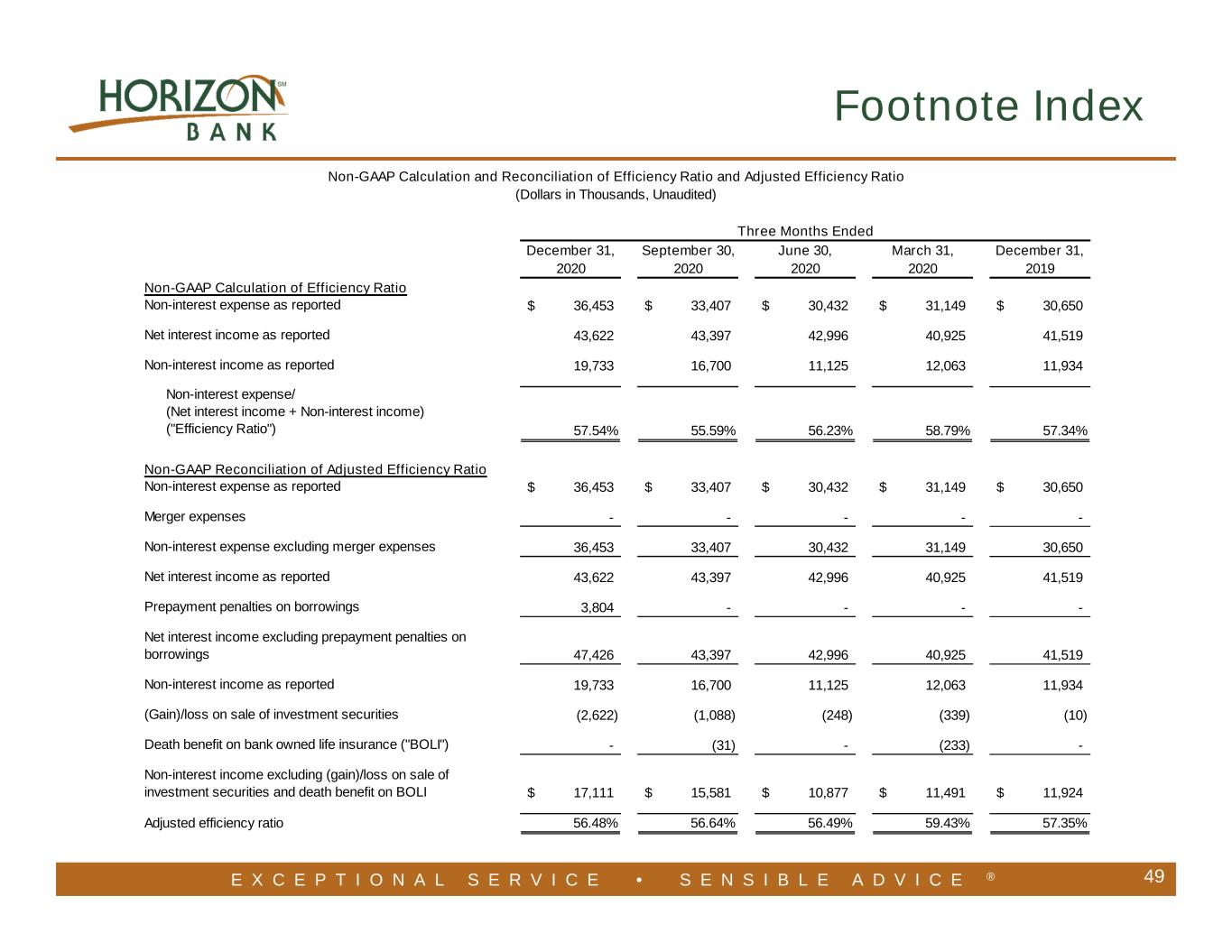

E X C E P T I O N A L S E R V I C E • S E N S I B L E A D V I C E ® 49 Footnote Index December 31, September 30, June 30, March 31, December 31, 2020 2020 2020 2020 2019 Non-GAAP Calculation of Efficiency Ratio Non-interest expense as reported 36,453$ 33,407$ 30,432$ 31,149$ 30,650$ Net interest income as reported 43,622 43,397 42,996 40,925 41,519 Non-interest income as reported 19,733 16,700 11,125 12,063 11,934 Non-interest expense/ (Net interest income + Non-interest income) ("Efficiency Ratio") 57.54% 55.59% 56.23% 58.79% 57.34% Non-GAAP Reconciliation of Adjusted Efficiency Ratio Non-interest expense as reported 36,453$ 33,407$ 30,432$ 31,149$ 30,650$ Merger expenses - - - - - Non-interest expense excluding merger expenses 36,453 33,407 30,432 31,149 30,650 Net interest income as reported 43,622 43,397 42,996 40,925 41,519 Prepayment penalties on borrowings 3,804 - - - - Net interest income excluding prepayment penalties on borrowings 47,426 43,397 42,996 40,925 41,519 Non-interest income as reported 19,733 16,700 11,125 12,063 11,934 (Gain)/loss on sale of investment securities (2,622) (1,088) (248) (339) (10) Death benefit on bank owned life insurance ("BOLI") - (31) - (233) - Non-interest income excluding (gain)/loss on sale of investment securities and death benefit on BOLI 17,111$ 15,581$ 10,877$ 11,491$ 11,924$ Adjusted efficiency ratio 56.48% 56.64% 56.49% 59.43% 57.35% Non-GAAP Calculation and Reconciliation of Efficiency Ratio and Adjusted Efficiency Ratio (Dollars in Thousands, Unaudited) Three Months Ended